- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-11-2022

- AUD/USD sellers take a breather around one-week low, pausing four-day downtrend.

- Reserve Bank of Australia’s latest Meeting Minutes, statements from officials favor AUD/USD bears but pre-event anxiety test downside moves.

- China-linked fears, altered expectations for Federal Reserve’s next move exert downside pressure on the risk-barometer pair.

- RBA Governor Philip Lowe’s dovish remarks could add strength to the bearish bias.

AUD/USD seesaws around 0.6600 as bears await more clues to extend the four-day downtrend during early Tuesday.

In doing so, the Aussie pair awaits the scheduled speech from the Reserve Bank of Australia’s (RBA) Governor Philip Lowe. the fresh COVID-19 fears and bearish bias at the Australian central bank keep the bears hopeful.

Reserve Bank of Australia Governor Philip Lowe could favor AUD/USD sellers

Ever since the Reserve Bank of Australia (RBA) disappointed markets with a smaller rate hike in October, the bearish bias for the AUD/USD mounted. Adding strength to the downside fears were the latest comments from the RBA policymakers and the Minute Statement of the Aussie central bank’s recent meeting.

In his latest comments, Reserve Bank of Australia (RBA) Deputy Governor Michele Bullock said, “We have already raised rates aggressively.” On the same line were the latest statements from the RBA Minutes stating, “No pre-set path -considered 50bps hike, saw stronger case for 25bps in November.”

It should be noted that the RBA surprised markets by announcing a 25 basis points (bps) of a rate hike in October and maintained the same pace of interest rate increase during the latest monetary policy.

Given the latest updates from the Reserve Bank of Australia, Governor Philip Lowe is less likely to turn hawkish and hence the AUD/USD bears have a hope to keep the reins.

Coronavirus woes also tease the Aussie bears

Considering Australia’s trade ties with China, a fresh jump in the Covid numbers from the major customer weighs on the AUD/USD prices of late. “China's capital warned on Monday that it was facing its most severe test of the COVID-19 pandemic, shutting businesses and schools in hard-hit districts and tightening rules for entering the city as infections ticked higher in Beijing and nationally,” said Reuters. It should be noted that China reported the highest daily coronavirus numbers since April as per the latest readings of 26,824.

United States-China optimism probe AUD/USD sellers

After the previous week’s meeting between United States President Joe Biden and his Chinese counterpart Xi Jinping, officials from the Washington and Beijing appear to braced for a more cordial relations going forward. In this regard, the Wall Street Journal (WSJ) reported that China is turning to an old friend in corporate America to bolster communications with the United States, as President Xi Jinping tries to stabilize the bilateral relationship while gearing up for greater competition between the two powers. It’s worth noting, however, that the Sino-American tussles over Taiwan and the latest controls on technology from the Washington seem to challenge the optimism surrounding the friendship among the world’s top two economies.

Federal Reserve bets are also important

Other than RBA Governor Lowe and the COVID-19 updates, also the likely ties between the United States and China, concerns surrounding the United States Federal Reserve’s (Fed) next move also appear as the key catalyst to watch for the AUD/USD pair traders.

Recently firmer prints of the US Retail Sales and Producer Price Index (PPI) for October underpinned the hawkish bets on the Fed’s next move. However, Atlanta Federal Reserve President Raphael Bostic and Cleveland Fed President Loretta Mester appeared less hawkish in their latest speeches. That said, downbeat prints of the Chicago Fed National Activity Index for October, to -0.05 compared to 0.17 prior, also challenged the US Dollar bulls.

AUD/USD technical analysis

The AUD/USD pair’s first daily closing below the 10-Day Moving Average (DMA) in 13 days joins receding bullish bias of the Moving Average Convergence and Divergence (MACD) indicator, as well as a retreat of the Relative Strength Index (RSI) placed at 14, to keep the bears hopeful.

That said, an upward sloping support line from November 03, close to 0.6570 by the press time, lures the AUD/USD bears ahead of multiple supports marked near the 38.2% Fibonacci retracement levels of the Aussie pair’s August-October downturn, around 0.6540.

It’s worth noting that the late October’s swing high near 0.6520 appears the last defense of the AUD/USD pair buyers before directing the quote towards the 23.6% Fibonacci retracement level surrounding 0.6400.

Alternatively, the 10-DMA and the 100-DMA restrict short-term AUD/USD upside near 0.6655 and 0.6690 in that order. Adding strength to the 0.6655 hurdle is the 50% Fibonacci retracement level.

Even if the quote crosses the 0.6690 hurdle, the 0.6700 round figure and 61.8% Fibonacci retracement near 0.6770, also known as the Golden Ratio, becomes necessary to convince the AUD/USD pair buyers.

Overall, AUD/USD is on the bear’s radar but the road to the south is a bumpy one.

AUD/USD: Daily chart

Trend: Limited downside expected

- Loonie trimmed losses after the USD/CAD tested the 1.3495 two-week high.

- US Dollar was underpinned by risk aversion amidst growing concerns over China’s Covid-19 outbreak.

- Federal Reserve officials favor slowing rate hikes pace, but pausing is not an option.

- USD/CAD Price Analysis: Rejection at the head-and-shoulders neckline to exacerbate a fall toward 1.3300.

The Loonie (CAD) weakened against the US Dollar (USD) as market sentiment shifted sour on renewed fears over China’s Covid-19 outbreak, causing the death of three, sparking a flight to safety, while Covid cases topped April’s 2022 number. Additional factors like sliding crude Oil prices due to increasing production rumors, and overall US Dollar strength, weighed on the Loonie. Hence, the USD/CAD rallied towards the head-and-shoulders neckline, registering a new two-week high at 1.3495 before retracing to current exchange rates. At the time of writing, the USD/CAD trades at 1.3452.

Loonie weakens on sour sentiment due to China’s Covid-19 outbreak

Wall Street finished Monday’s session in the red. Increasing cases in China spurred risk aversion on speculations that Chinese authorities could reinstate restrictions. Covid-19 cases jumped in Beijing, while schools moved back to online education until further notice. It should be noted that Chinese authorities relaxed quarantine times for inbound travelers, cheered by investors, with equities extending their gains. Nevertheless, last week’s news, with Beijing, reporting more than 20,000 cases, weighed on risk-perceived currencies like the Loonie. Therefore, the USD/CAD edged toward the head-and-shoulders chart pattern neckline at around 1.3495.

Crude oil prices tumbled, weighing on the CAD

Additionally, the Loonie dropped, weighed by falling crude Oil prices, notably Western Texas Intermediate (WTI), on an article published by the Wall Street Journal (WSJ). The report cited delegates saying that Saudi Arabia is looking to boost Oil production by 500K BPD ahead of the Russian oil embargo imposed by European countries. Later, the Saudi Energy Minister Prince Abdulaziz bin Salman, denying those affirmations, commented, “if there is a need to take further measures by reducing production to balance supply and demand, we always remain ready to intervene.”

USD/CAD trimmed some of its earlier gains on those comments, retreating from 1.3495 towards 1.3431 before consolidating around 1.3450s ahead of Tuesday’s Asian session.

Federal Reserve officials underpinned the US Dollar

Elsewhere, Federal Reserve officials continued to express their commitment to cubing inflation toward their 2% goal. Still, they said that the pace of hikes could moderate as soon as the December meeting. However, St. Louis Fed President James Bullard spooked investors, saying rates are not “sufficiently restrictive” and adding that he expects the Federal Funds rate (FFR) to peak at around 5% to 5.25%. Echoing some of his comments was San Francisco’s Fed President Mary Daly, saying that policymakers need to be mindful of the lags of monetary policy. She added that she sees rates peaking at least at around 5%.

Of late, Cleveland’s Fed President Loretta Mester added herself to the chorus of officials that won’t slow down the rhythm of interest rate hikes while emphasizing that the “I don’t think we’re anywhere near to stopping,” pushing back against pausing.

Even though the US Dollar strengthened on those comments, the USD/CAD remained comfortably around the 1.3300-1.3400 range before climbing to new two-week highs

USD/CAD Price Analysis: Technical outlook

The USD/CAD daily chart portrays the head-and-shoulders chart pattern remains in play, albeit the pair edged toward the neckline around 1.3495. Once the price hit that threshold, Loonie buyers stepped in, dragging the USD/CAD lower, toward 1.3450s. At the same time, the Relative Strength Index (RSI) turned flat, at bearish territory, suggesting that even though the USD/CAD edged higher, sellers remain in charge.

Therefore, the USD/CAD first support would be 1.3400. Break below will expose the November 21 low at 1.3373, followed by the psychological 1.3300 mark. On the flip side, the USD/CAD key resistance levels are the head-and-shoulders neckline around 1.3500, followed by the 50-day Exponential Moving Average (EMA) at 1.3559, followed by 1.3600.

- AUD/NZD is showing some signs of a reversal above 1.0800 ahead of RBA Lowe’s speech.

- The RBNZ is expected to hike its OCR by 75 bps to 4.25%.

- A bigger rate hike announcement by RBNZ will widen RBNZ-RBA policy divergence ahead.

The AUD/NZD pair is displaying an inventory accumulation phase in a range of 1.0810-1.0830 in the early Tokyo session. The asset is showing topsy-turvy moves as investors have shifted their focus toward the speech from Reserve Bank of Australia (RBA) Governor Philip Lowe. While the interest rate decision by the Reserve Bank of New Zealand (RBNZ) on Wednesday will be the crucial trigger for the cross ahead.

For making an informed decision, investors are awaiting the speech from the RBA policymaker. The speech will provide interest rate guidance to combat the historic surge in inflationary pressures. The inflation rate reached 7.3% in the third quarter, which forced the Australian central bank to lift its price growth guidance to 8.0%. However, the RBA continued its rate hike pace at 25 basis points (bps) to keep economic prospects solid along with the agenda of bringing price stability.

On the kiwi front, the announcement of the monetary policy by the Reserve Bank of New Zealand (RBNZ) will escalate RBNZ-RBA policy divergence. RBNZ Governor Adrian Orr has already announced five consecutive 50 basis points (bps) rate hikes to 3.5% and has no intention to pause rate hikes amid mounting price pressures.

A Reuters poll on RBNZ’s rate hike projections claims an increment in the Official Cash Rate (OCR) by 75 bps this time. An occurrence of the same will push the OCR to 4.25% and extremely diverge from RBA’s policy structure.

The move could strengthen the New Zealand Dollar ahead but will leave less room for more rate hikes by the Reserve Bank of New Zealand. Also, this will shift more responsibilities on economic dynamics to play ahead.

- NZD/USD bears are in play but a move to 0.6130 cannot be ruled out.

- Beware eye the daily trendline support, but 0.5970s could come under pressure.

As per the prior analysis, NZD/USD Price Analysis: Bears move in from key highs for the week, the pair is pressured on the front side of the bearish micro trend which leaves the focus on the downside for the day ahead:

NZD/USD H1 charts

NZD/USD H1 zoomed in:

The price has been in a phase of distribution on the front side of a bullish dominant trend but there is the risk of a move lower:

NZD/USD M15 chart

The triangle is a bearish technical pattern and a break of structure below 0.6100 opens the risk of a move to the 0.5970s. If the pattern were to fail, however, then a move into the 0.6130s could be on the cards prior to the next move lower as per the daily chart:

NZD/USD daily chart

The M-formation is a topping pattern that would be expected to see the price rejected by the neckline.

US inflation expectations rose for the first time in two weeks as traders reassess the previously put bets on the Federal Reserve’s (Fed) next move.

That said, the inflation precursors, as per the 10-year and 5-year breakeven inflation rates per the St. Louis Federal Reserve (FRED) data, rebound from the lower levels since October 06 to 2.34% and 2.31% in that order as per the latest prints published on late Monday.

The revival in the US inflation precursor justifies the US Dollar’s latest run-up even if the Fed policymakers flashed mixed signals in their latest appearances.

US Dollar Index (DXY) rose the most in November the previous day, ended Monday around 107.80, even if Atlanta Federal Reserve President Raphael Bostic and Cleveland Fed President Loretta Mester appeared less hawkish.

While firmer inflation expectations keep the USD bulls hopeful, this week’s preliminary readings of the monthly activity data and the Federal Open Market Committee (FOMC) Meeting Minutes will be crucial for clear directions.

Also read: EUR/USD eyes 1.0200 as risk aversion underpins the US Dollar

- AUD/JPY is oscillating in a narrow range below 94.00 as investors are awaiting a speech from RBA’s Lowe.

- Mixed responses from the risk profile are also keeping the risk-sensitive assets on the sidelines.

- Japanese administration has announced fresh stimulus to support economic prospects.

The AUD/JPY pair is displaying a sideways performance in the early Asian session as investors are awaiting a speech from Reserve Bank of Australia (RBA) Governor Philip Lowe for making an informed decision. Mixed responses from the risk profile are also keeping the risk-sensitive assets on the sidelines.

The speech from RBA Governor will guide the likely monetary policy action ahead. Inflation pressures are displaying a historic surge led by significant price growth from service providers. The RBA is continuously hiking its Official Cash Rate (OCR) in each monetary policy.

Recently, the Australian central bank trimmed its rate hike pace to 25 basis points (bps). In response to that, RBA policymakers cited that interest rates have already been increased significantly and consideration of monetary policies on monthly intervals provides an edge to go parallel with the pace of other central banks in no time.

Apart from the interest rate guidance, investors will also focus on remarks about declining real estate prices. Rising interest obligations have compelled home buyers to postpone their demand, which is resulting in a vulnerable housing market.

On Monday, the risk barometer remained solid despite an unchanged monetary policy by the People’s Bank of China (PBOC). The PBOC kept its Prime Lending Rates (PLRs) stable, knowing the fact that Covid-19 infections are galloping and the real estate sector is extremely vulnerable. Investors should be aware of the fact that Australia is one of the leading trading partners of China and PBOC’s monetary policy stance has a significant impact on Aussie dollar.

On the Tokyo front, an announcement of fresh stimulus to support growth prospects could impact the Japanese yen. Japanese Finance Minister Shunichi Suzuki said in a statement on Monday, his government will guide economic and fiscal policy in a "responsible" manner. He urged a swift adoption of more spending measures, worth $207 billion, backed mostly by new debt issuance.

- USD/CHF seesaws near the highest levels in over a week.

- Risk aversion underpins the US Dollar’s haven demand.

- Coronavirus woes, Fed concerns weigh on the sentiment ahead of important data/events.

USD/CHF treads water around the weekly high near 0.9600, probing bulls after six-day advances, as traders seek fresh clues during Tuesday’s Asian session.

The major currency pair’s latest inaction could also be linked to the cautious mood ahead of Wednesday’s key data/events, as well as recently mixed signals from the US Federal Reserve (Fed) policymakers.

Fresh fears of the Coronavirus outbreak and remembrance of the Covid-led woes marked in early 2020s pushed traders towards the US Dollar in search of risk safety. Also likely to have favored the greenback are the firmer prints of the US Retail Sales and Producer Price Index (PPI) for October which underpinned the hawkish bets on the Fed’s next move.

Even so, Atlanta Federal Reserve President Raphael Bostic and Cleveland Fed President Loretta Mester appeared less hawkish in their latest speeches. That said, downbeat prints of the Chicago Fed National Activity Index for October, to -0.05 compared to 0.17 prior, also challenged the US Dollar bulls.

However, US Dollar Index (DXY) rose the most in November the previous day amid a surge in China’s Coronavirus cases and the first virus-linked deaths in Beijing since May.

Against this backdrop, Wall Street closed in the red and the US Treasury yields were firmer too, which in turn favored the US Dollar buyers and propelled the USD/CHF prices.

That said, a lack of major data/events and the market’s consolidation ahead of the key catalysts, scheduled for release on Wednesday, might challenge the USD/CHF pair buyers amid a likely sluggish Tuesday. It’s worth noting that hawkish comments from the Swiss National Bank (SNB) officials, published in the last week, also challenge the pair buyers of late. Though, the risk catalysts and the mood of traders will be crucial for near-term directions.

Technical analysis

Despite the latest inaction, the USD/CHF pair remains on the way to challenging the 200-DMA hurdle, around 0.9635 by the press time, unless dropping back below the downward-sloping trend line from November 04, close to 0.9400 at the latest.

- The formation of a symmetrical triangle indicates a consolidation ahead.

- Overlapping short-to-medium-term EMAs signals a volatility contraction.

- Quiet market mood is keeping the risk-perceived assets in a rangebound structure.

The GBPUSD pair turned sideways in the early Tokyo session after attempting a rebound below the critical support of 1.1800. The Cable is looking to extend its recovery above 1.1820 as risk-perceived currencies are gaining some traction in a quiet market mood.

Meanwhile, the US dollar index (DXY) is hovering around 107.80 after a bullish Monday. Apart from that, the 10-year US Treasury yields also rebounded to near 3.83% despite bleak chances of continuation of the 75 basis points (bps) rate hike structure by the Federal Reserve (Fed).

A formation of a Symmetrical Triangle on an hourly scale is indicating a volatility contraction. The upward-sloping trendline of the chart pattern is placed from November 14 low at 1.1710 while the downward-sloping trendline is plotted from November 15 high at 1.2029. A breakout of the same will result in wider ticks and heavy volume.

The 20-and 50-period Exponential Moving Averages (EMAs) are overlapping with each other, which signals a consolidation ahead.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into 40.00-60.00, which indicates the unavailability of a fresh trigger for decisive action ahead.

Going forward, a break above Friday’s high at 1.1950 will drive Cable towards November 15 high at 1.2029, followed by the round-level resistance at 1.2100.

On the flip side, a drop below Monday’s low at 1.1780 will drag the asset toward November 14 low at 1.1710. A slippage below November 14 low will expose the asset to the horizontal support plotted from October 27 high at 1.1646.

GBPUSD hourly chart

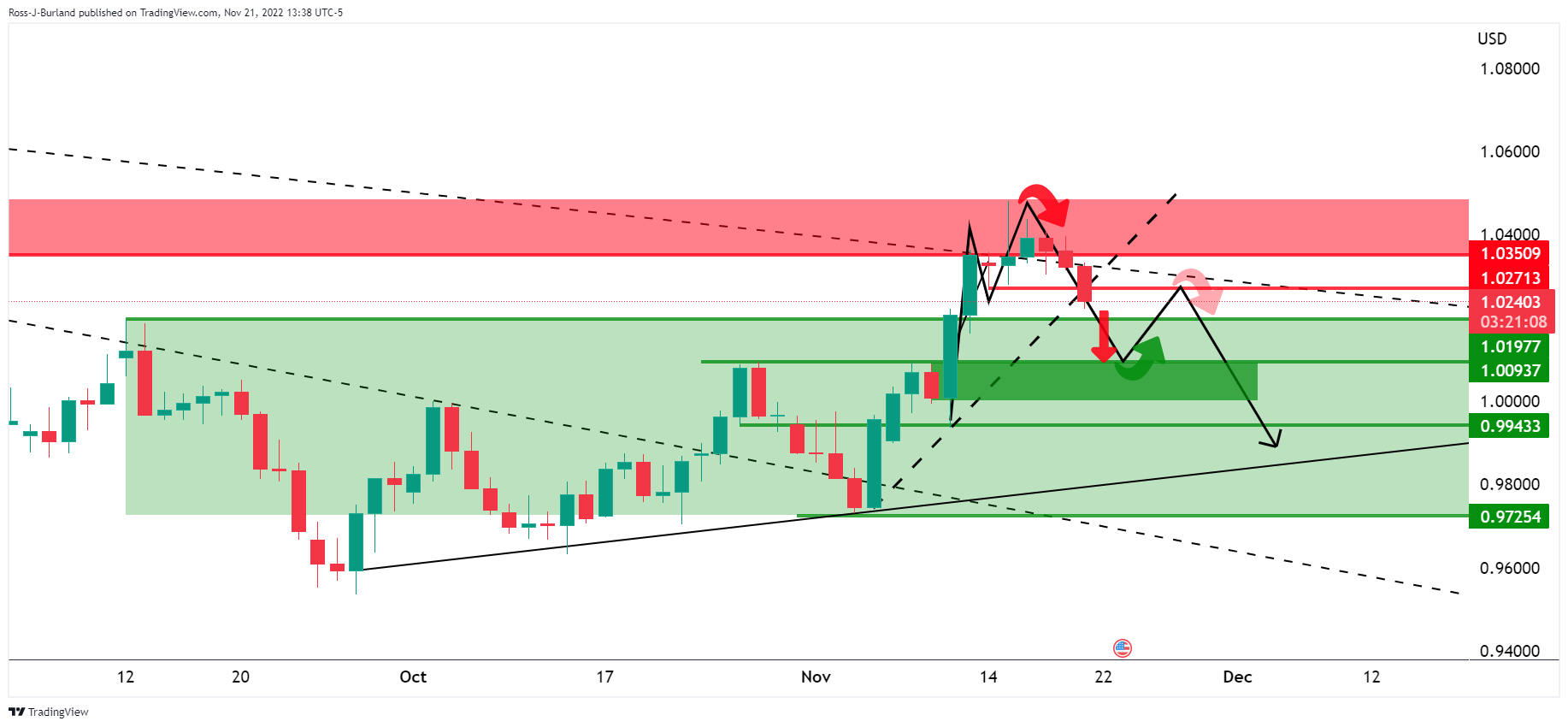

- EUR/USD holds lower ground near one-week low after breaking a fortnight-old support line.

- Hawkish comments from the ECB policymakers battled softer German PPI to favor confuse traders.

- Worsening Covid conditions in China, indecision over Fed’s next move and US data favored the US Dollar.

- Risk catalysts are the key ahead of Wednesday’s key data, FOMC Minutes.

EUR/USD struggles around mid-1.0200s after breaking a short-term key support during three-day downtrend in the last. The pair bears take a breather around a one-week low amid a lack of major data/events during Tuesday’s Asian session but broad US Dollar demand and breaking of the previously important support keeps sellers hopeful.

That said, the US Dollar Index (DXY) rose the most in November the previous day as market’s sentiment soured amid fresh fears of the Coronavirus. Adding strength to the greenback’s safe haven demand were mixed signals from Eurozone data and the European Central Bank (ECB) policymakers. Furthermore, anxiety ahead of this week’s preliminary readings of the monthly activity data and the Federal Open Market Committee (FOMC) Meeting Minutes.

China reported a jump in the daily Covid cases and two virus-led deaths on Monday, which in turn raised doubts on the Chinese government’s easing of activity controls. The same renews the virus woes that drowned global markets previously.

Elsewhere, ECB Chief Economist Philip Lane favored further rate hikes and expected the likely recession to be short-lived. On the same line, Government Council member Robert Holzmann favored 75 basis points (bps) of rate hike for December whereas policymaker Mario Centeno raised doubts on such a move.

It should be noted that Cleveland Federal Reserve (Fed) Bank President Loretta Mester appeared less hawkish whereas the previous US data raised expectations of a 75 bps move from the Fed and favored the US Dollar bulls.

Elsewhere, the Chicago Fed National Activity Index fell to -0.05 compared to 0.17 prior whereas Germany’s Producer Price Index (PPI) for October eased to 34.5% versus 41.5 expected and 45.8% prior.

Amid these plays, Wall Street closed in the red and the US Treasury yields were firmer too, which in turn favored the US Dollar buyers and weigh on the EUR/USD prices.

Moving on, Eurozone Consumer Confidence for November, expected -26 versus -27.6 prior will be important for fresh impulse but major attention should be given to the risk catalysts ahead of a busy Wednesday.

Technical analysis

A clear downside break of a two-week-old ascending trend line and the 10-Day Moving Average (DMA), currently around 1.0285, directs EUR/USD bears towards September’s peak surrounding 1.0200.

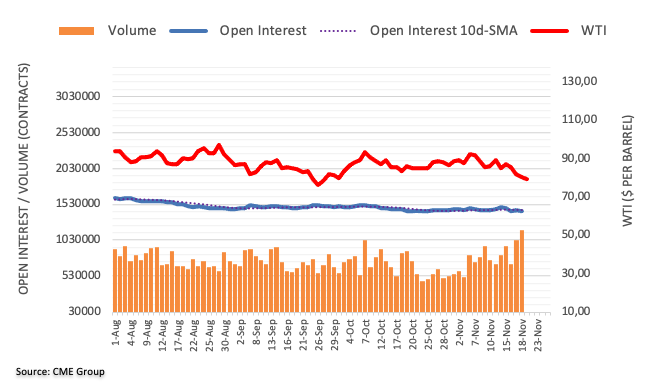

“Central banks are snapping up gold this year, but it is uncertain which ones are behind most of that shopping spree, fueling speculation that China is a big player,” reported Nikkei Asia.

The news quotes multiple analysts to also mention, “Seeing how Russia has been hit by monetary sanctions by the West, China and some other countries must be hurrying to reduce dependence on the dollar.”

Key quotes

Central banks bought a net 399.3 tonnes of gold in the July-September period, more than quadrupling on the year, according to the November report by industry group the World Gold Council. The latest amount marks a steep jump from 186 tonnes in the preceding quarter and 87.7 tonnes in the first quarter, while the year-to-date total alone surpasses any full year since 1967.

Buyers such as the central banks of Turkey, Uzbekistan and India reported purchases of 31.2 tonnes, 26.1 tonnes and 17.5 tonnes, respectively. The problem is that such specified buying adds up only to roughly 90 tonnes -- meaning it is unclear who bought the remaining roughly 300 tonnes net.

“China likely bought a substantial amount of gold from Russia,” said market analyst Itsuo Toshima.

China has made similar moves in the past. After staying mum since 2009, Beijing stunned the market in 2015, disclosing it had boosted gold holdings by about 600 tonnes. It has not reported any activity since September 2019.

The People's Bank of China likely bought a portion of the Central Bank of the Russian Federation's gold holdings of over 2,000 tonnes, Toshima said.

China has been unloading U.S. bonds. It sold $121.2 billion in U.S. debt , the equivalent of roughly 2,200 tonnes of gold, between the end of February -- immediately after Russia's first attack on Ukraine -- and the end of September, according to the U.S. Treasury Department.

Chinese imports of gold from Russia surged in July, soaring more than eightfold on the month and roughly 50 times the year-earlier level, according to China's customs authorities.

Central banks generally do not unload their gold holdings in the market, meaning the more they buy the precious metal, the stronger support this will give its price.

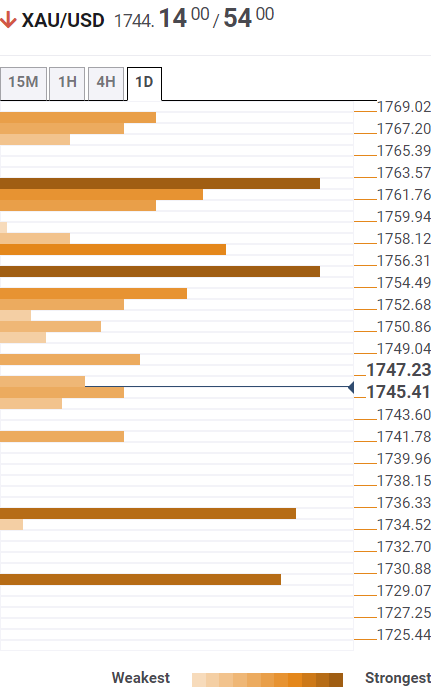

Gold remains pressured

The news should have favored the Gold price but the metal stays depressed at around $1,740 by the press time.

Also read: Gold Price Forecast: XAUUSD sees an establishment below $1,740 as DXY extends rally

- Gold price is likely to shift its business below $1,740.00 amid the risk-off market mood.

- The US Treasury yields have rebounded despite less-hawkish commentary from Fed’s Mester.

- Fed’s Mester has supported the view of a slowdown in the rate hike pace ahead.

Gold price (XAUUSD) is oscillating below the critical support of $1,740.00 in the early Asian session. The precious metal is declining gradually amid a global correction in risk-perceived assets. Weaker economic projections due to a significant fall in consumer spending have raised concerns. S&P500 dropped on Monday amid anxiety ahead of the release of the US Durable Goods orders data.

The US dollar index (DXY) has reached near the round-level resistance of 108.00 as investors turned risk-averse due to the absence of a key trigger for decisive action. Meanwhile, the 10-year US Treasury yields have rebounded to 3.83% despite a less-hawkish commentary from Cleveland Federal Reserve (Fed) Bank President Loretta Mester. Fed policymaker is of the view that it makes sense to slow down the pace of rate hikes a bit in an interview with CNBC.

He further added that “We have had some good news on the inflation front, but need more and sustained good news”. However, he doesn’t see any pause in the rate hike cycle yet.

Going forward, the show-stopper event this week will be the US Durable Goods Orders data. The economic catalyst is seen stable at 0.4%.

Gold technical analysis

On a four-hour scale, the gold price has dropped below the 23.6% Fibonacci retracement (placed from November 3 low at $1,616.39 to November 15 high at $1,786.55) at $1,746.67. The asset has dropped below the 20-and 50-period Exponential Moving Averages (EMAs) at $1,751.40 and $1,746.67 respectively, which adds to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold four-hour chart

- USD/JPY recovered the 142.00 psychological level as buyers piled around the 140.00 figure.

- If the USD/JPY clears 143.00, a rally to the 50-day EMA is on the cards.

- USD/JPY Price Analysis: Upward biased, though buyers lack momentum, as shown by the RSI.

The USD/JPY bounces from below the 100-day Exponential Moving Average (EMA) and advances sharply above the 142.00 psychological level for the first time after dropping to three-month lows of 137.65 in the last week. Factors like sentiment, a buoyant US Dollar (USD), and reclaiming the 100-day EMA bolstered the USD/JPY. Hence, the USD/JPY is trading at 142.03, above its opening price by 1.21%, after hitting a daily low of 140.15.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart portrays the pair as neutral-to-upward biased once buyers reclaimed the 100-day EMA. Of note, on its way north, the Relative Strength Index (RSI) aims upwards, accelerating towards the 50-midline, which, once crossed, suggests that buyers are in charge. USD/JPY key resistance levels in the daily chart are November 11, high at 142.48, followed by the psychological 143.00 figure, ahead of the 50-day EMA at 145.07.

On the other hand, the USD/JPY first support would be the 142.00 mark. A breach of the latter will expose the 100-day EMA at 141.01, followed by September 22 swing low at 140.34, ahead for the MTD low of 137.65.

USD/JPY Key Technical Levels

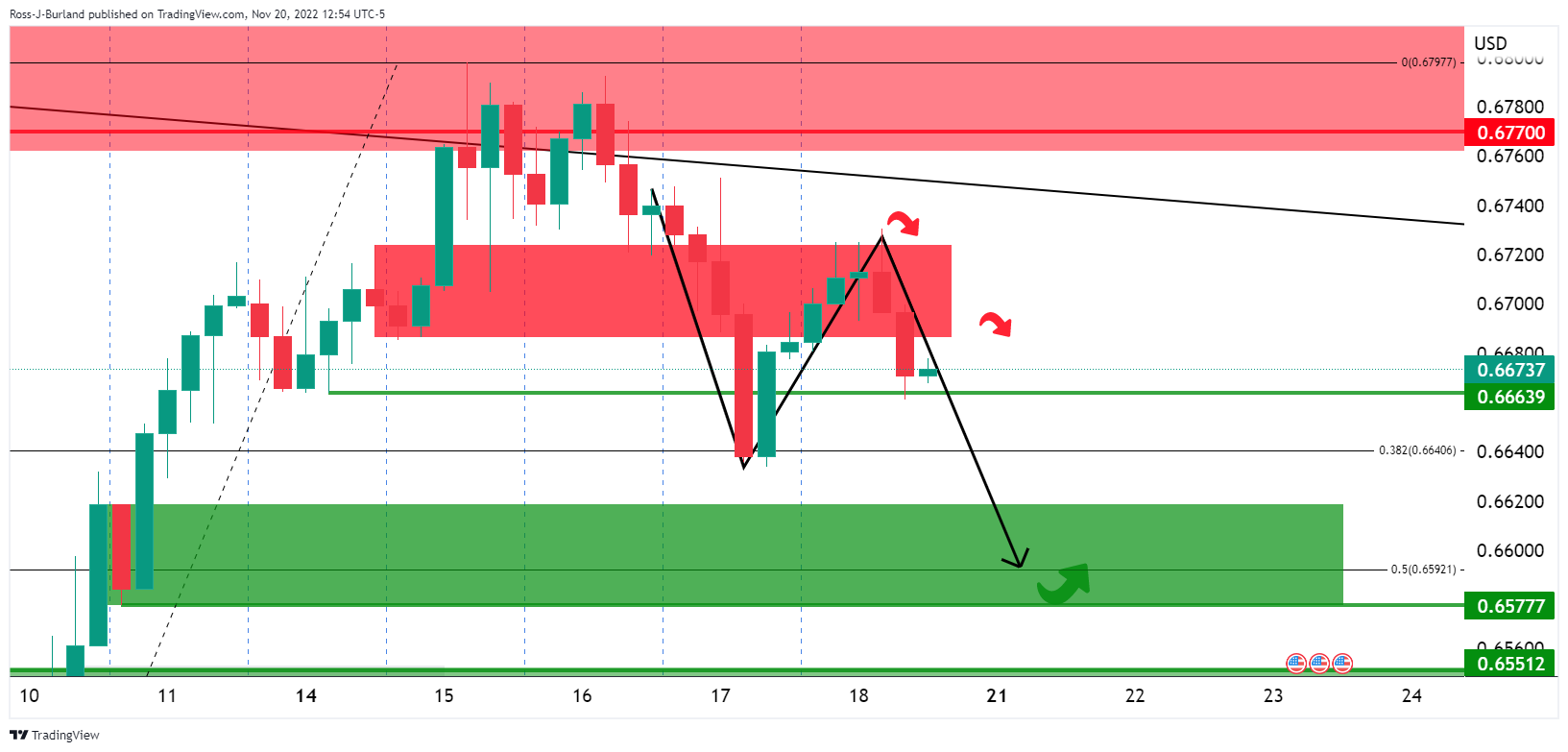

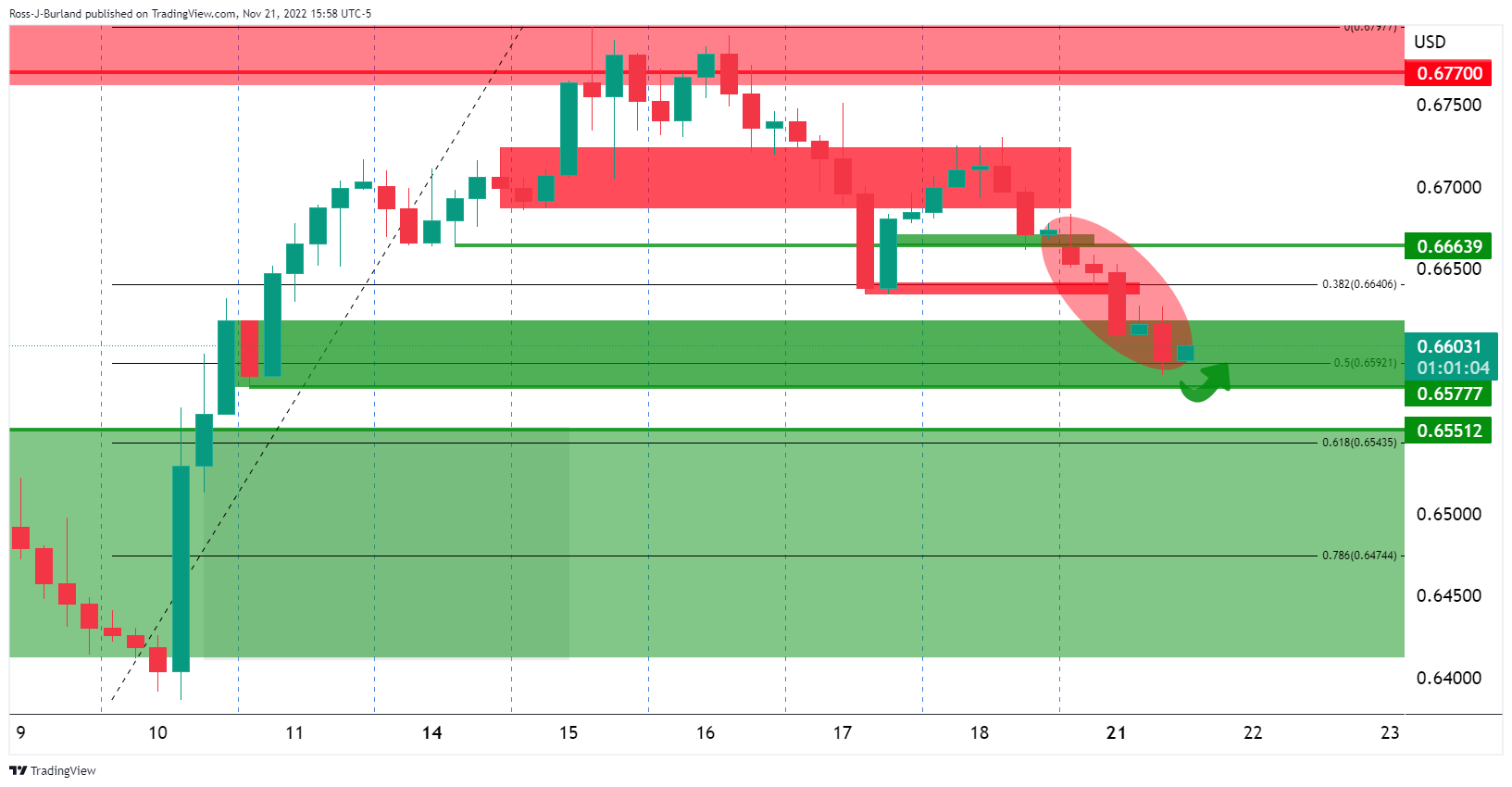

- AUD/USD is correcting into daily support with eyes on 0.6550.

- Price remains in bullish territories while on the back side of the bearish trend.

As per the prior analysis, AUDUSD Price Analysis: Bears eye a breakout to the downside for the opening sessions, the price has indeed moved lower as the following illustrates.

AUD/USD prior analysis

The hourly M-formation was compelling and argued for a downside continuation having already corrected into the bearish impulse and resistance. The AUDUSD H4 chart looked like this:

AUDUSD update

The four-hour chart shows the price meeting the 50% mean reversion of the following daily chart's prior bullish impulse:

The price has been attempting to break higher on the back side of the bear trendline but it has met resistance and is now correcting into daily support with eyes on 0.6550.

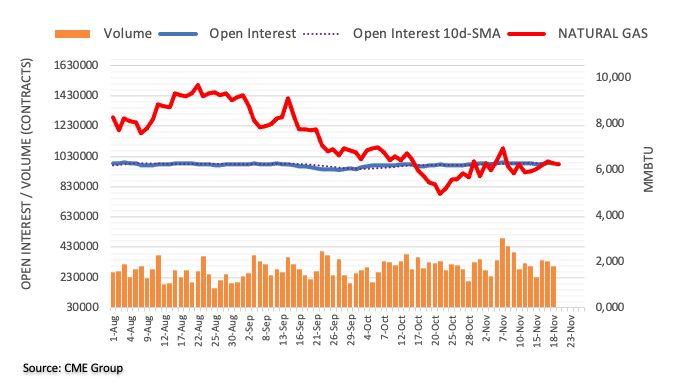

- Albeit plunging below $76.00, WTI stages a comeback, trimming earlier losses to 0.51%

- Saudi officials denied news that OPEC considered increasing oil production.

- WTI Price Analysis: A candlestick hammer in the daily chart can propel oil prices higher.

Western Texas Intermediate (WTI) remains negative during the North American session after hitting a daily low of $75.30 per barrel on rumors that the Organization of the Petroleum Exporting Countries (OPEC) was considering an increase in its oil production, as reported by the Wall Street Journal (WSJ). Another factor that weighed on crude oil demand was China’s Covid-19 outbreak, causing three deaths in the last week, augmenting speculations that China’s oil need will diminish. Therefore, WTI exchanges hand at $79.88 per barrel.

According to OPEC delegates cited by the WSJ, Saudi Arabia considered boosting crude oil output by 500,000 barrels ahead of the oil embargo imposed on Russian oil. Once the headline crossed wires, WTI slashed 3.6% of its value, collapsing towards its daily low of $75.30, before recovering some ground as the Saudi Energy Minister Prince Abdulaziz bin Salman, denying those affirmations

Prince Abdulaziz bin Salman said, “if there is a need to take further measures by reducing production to balance supply and demand, we always remain ready to intervene.”

Aside from this, China’s Covid-19 cases are increasing to levels last seen in April 2022, according to Goldman Sachs. Sentiment shifted sour on fears that Chinese authorities reimposing lockdowns could slow down the global economy, weighing, and denting crude oil’s demand.

Oil traders should be aware that OPEC and its allies (OPEC+)will meet on December 4 to lay the ground for January 2023, one day before the Russian oil embargo and G7 oil price cap begins.

Also read:

- Saudi Arabia eyes OPEC+ production increase – WSJ

- Saudi Energy Minister Abdulaziz: The current OPEC+ deal continues to the end of 2023

WTI Price Analysis: Technical outlook

WTI daily chart suggests that oil prices fell short of the 2022 YTD low of around $74.30 PB and are staging a comeback, nearly $80.00 PB. Notably, Monday’s price action formed a massive hammer candlestick, suggesting that WTI could rally in the near term, but firstly, buyers need to reclaim $80.00.

If that scenario plays out, WTI’s first resistance would be October’s 18 swing low-turned-resistance at $82.10, followed by the 50-day Exponential Moving Average (EMA) at $85.72 and the 100-day EMA at $89.51. On the flip side, WTI’s key support levels are the September 26 daily low at $76.28, the November 21 swing low at $75.30, and the YTD low of $74.30.

In a CNBC interview, Federal Reserve Bank of Cleveland President Loretta Mester said it makes sense to slow down a bit the pace of rate hikes.

Key comments

Can now be very deliberate in setting policy.

Need to be more judicious in balancing risks.

Not anywhere near to stopping rate hikes though.

We've had some good news on inflation front, but need more and sustained good news.

Am very grateful we've seen some encouraging signs on inflation.

We are beginning to see our actions working.

Question is how do we calibrate policy to get back to 2% inflation goal.

Getting back to 2% will take some time, we need to do more work.

I don't think market expectations of fed funds rate is really off.

I do think we need to get into restrictive territory, right now we are just barely there.

Rate path will depend on the economy.

We are moving into a different cadence on policy, letting data guide us.

I will be listening to my contacts, as their feedback is more forward looking.

I think we can slow down from 75 at dec meeting.

But we need to let economy tell us going forward the pace of hikes after that.

If we don't see meaningful progress on inflation next year, we will need to react.

Journey back to 2% will have some pain involved.

If we don't see meaningful progress on inflation next year, we will need to react.

Journey back to 2% will have some pain involved.

Very much monitoring balance sheet runoff impact on financial market functioning.

We have said we will be flexible on balance sheet if conditions change; so far no reason to change.

I don't have a recession in my forecast.

But with below-growth trend, there are risks an unexpected shock could send us into recession.

But right now the focus is on getting inflation down.

US dollar update

The US Dollar DXY dropped to a fresh low of 106.28 on Friday, extending the post-CPI dump into a fresh layer of potential support. On Monday, the greenback as measured by the DXY index is up 0.85% at the time of writing at 107.87. The catalyst for the move can be partly put down to a risk-off start to the week due to fresh COVID-19 curbs in China that have fuelled worries over the global economic outlook.

Further to earlier comments, San Francisco Federal Reserve President Mary Daly said on Monday that she is not prepared to say what hike the Fed should do at December Federal Open Market Committee.

Further comments

Not taking anything off the table for Dec.

At some point, it will be right for Fed to slow the rate hike pace.

Can hike beyond 5% if inflation data doesn’t cool.

US Dollar update

The US Dollar advanced against most major currencies on Monday due to fresh COVID-19 curbs in China fuelled worries over the global economic outlook and boosting the greenback, which is seen as a safe haven in times of stress:

-

US Dollar bulls bounce back to life, eye 50% mean reversion and beyond

What you need to take care of on Tuesday, November 22:

The American Dollar edged higher on Monday, helped by a negative shift in the market’s sentiment. Risk aversion dominated financial markets after China’s National Health Commission reported two deaths of Covid-19 patients in Beijing, while the country reported over 26,000 new contagions on Sunday. Stay-at-home orders were issued in different regions, spurring concerns about a potential global economic setback amid the country’s strict covid policy.

The EUR/USD pair trades not far above a daily low of 1.0222, while GBP/USD barely holds above the 1.1800 figure. Germany published the October Producer Price Index (PPI), which unexpectedly contracted by 4.2% MoM. The annual figure was up by 34.5%, well below the previous 45.8%. It is the first sign of easing inflation in the EU.

European Central Bank (ECB) Executive Board member Philp Lane was on the wires and said that any recession in the Union would be mild and short-lived. He also noted that the ECB would hike rates again in December, progressing towards the levels needed. Government Council member Robert Holzmann said if the current situation persists, they will go for a 75 bps hike in December. Finally, ECB policymaker Mario Centeno noted that many conditions exist for rate increases to be less than 75 basis points in December.

Commodity-linked currencies ended the day with losses against the greenback. The AUD/USD pair trades around 0.6600, while USD/CADstands at 1.3440, down from an intraday high of 1.3416.

The Japanese yen was among the weakest US Dollar rivals, ending the day at around 142.05. In the meantime, the USD/CHF pair recovered to the 0.9590 price zone.

Gold fell for a fourth consecutive day, settling at around $1,738 a troy ounce. Crude oil prices, on the other hand, plunged ahead of the US opening amid market talks suggesting some OPEC members were considering a production increase of up to 500,00 barrels per day. The news was later denied by the Saudi Energy Minister, who said the current OPEC+ deal would continue until the end of 2023. Crude oi prices trimmed early losses and finished the day pretty much unchanged, with WTI now trading at $80 a barrel.

The week will be mostly light regarding macroeconomic releases, focusing on the FOMC Meeting Minutes to be out on Wednesday.

Like this article? Help us with some feedback by answering this survey:

- NZD/USD bears move in on paring back in global risk appetite.

- Fed minutes will shed light on the FOMC's deliberations.

NZD/USD is pressured at the start of this week due to a stronger US dollar that is bouncing back from a number of red days following a period of accumulation at the depths of November's sell-off. At the time of writing, DXY, an index that measures the US Dollar vs. a basket of currencies is higher by 0.77% and has sent the Kiwi down to a low of 0.6087 from the day's high of 0.6169.

The catalyst for the move can be partly put down to a risk-off start to the week due to fresh COVID-19 curbs in China that have fuelled worries over the global economic outlook.

- China doctors have made a stark warning to Pres. Xi

''The Kiwi slipped overnight amid a broad paring back in global risk appetite as equities nudged lower and the USD regained some of its lost safe-haven appeal,'' analysts at ANZ Bank explained. ''There didn’t seem to be a lot behind the moves, with little data or news to digest. But we suspect we could be in for a bit of volatility in coming days, with the RBNZ MPS due tomorrow, followed by a handful of global PMI data prints, and then the Fed minutes.''

''The MPS could be the real wildcard, even if the market gets the 75bp hike analysts are looking for, and that’s because there is a very wide range of views around where the RBNZ might project the OCR to peak (currently 4.1%). This is likely to be what determines where key short-end swap rates go, and by extension and correlation, where the Kiwi goes.''

FOMC minutes eyed

For the week ahead, the Fed minutes will shed light on the FOMC's deliberations regarding the expected downshift in the pace of rate increases. ''With that said, policymakers will also emphasize that the terminal rate is likely edging higher vs prior expectations as the labor market remains overly tight. In terms of the data, we look for the mfg PMI to recede modestly, staying above the 50 level in November,'' analysts at TD Securities said.

- EUR/USD bears are lurking below 1.0300 and eye a fast break below support.

- The bulls are gathering at 4-hour support in the meanwhile.

EUR/USD is under pressure at the start of the week and the highs appear to be locked in following a break of structure at 1.0270 as the following technical analysis will show with 1.0200 in focus:

EUR/USD weekly chart

The weekly chart sees the price attempting to break the dominant trendline resistance, but so far, the bulls are lacking conviction. A pullback is underway and there are prospects of a correction to the support structure.

EUR/USD daily chart

The daily charts show that the price is cracking the structure of 1.0270 on the backside of the micro trendline that has been broken. This gives rise to a downside continuation into support.

EUR/USD H4 chart

The 4-hour chart sees the price collected at support already. A correction could play out in the meantime for the restest of the counter trendline.

EURUSD H1 chart

The hourly chart shows a large imbalance of bids and offers below the current support structure that will likely be mitigated quickly in a sharp drop below the current support.

- Silver Price forms a candlestick hammer in the daily chart after hitting a two-week low at around $20.50s.

- The Relative Strength Index on the hourly chart crossed the 50-midline, bolstering XAG.

- If XAG/USD breaks above $20.90s, Silver will rally toward $21.00; otherwise, it will consolidate around $20.50.

Silver Price prolongs its losses after rallying to a multi-month high around $22.25, and plunges below the 200-day Exponential Moving Average (EMA), as broad US Dollar (USD) strength weighs on the white metal. Hence, the XAG/USD is trading at $20.85, beneath its opening price by 0.56%, after hitting a daily high of $21.00 a troy ounce.

Silver Price Analysis: Technical outlook

From a technical perspective, the XAG/USD is neutral-to-upward biased, as shown by the daily chart. On Monday, the XAG/USD broke below the October 4 swing high of $21.24, exacerbating a fall below the $21.00 mark. Even though the white metal achieved a fresh two-week low of $20.58, the Silver Price is forming a hammer, meaning that buyers stepped in around $20.50 as they prepare to assault the 200-day ENA at $21.41.

In the near term, the XAG/USD hourly chart portrays Silver bottoming around the S2 daily pivot around $20.60, further supported by the Relative Strength Index (RSI), crossing above the 50-midline. At the same time, the XAG/USD tests the confluence of a resistance trendline and the 50-hour EMA around $20.92, which, once cleared, will expose the $21.00 psychological price level.

That said, the XAG/USD first resistance would be the previously mentioned confluence, followed by $21.00, the intersection of the R1 daily pivot, and the 100-hour EMA at $21.20. On the flip side, the XAG/USD first support would be the S1 pivot at $20.76, followed by the S2 daily pivot at $20.57.

Silver Key Technical Levels

- US Dollar bulls emerge at key support and eye a 50% mean reversion.

- Risk-off tones are benefiting the safe haven US Dollar ahead of key data and FOMC minutes.

The US Dollar, as measured by the DXY index, is up 0.85% at the time of writing. The index, which measures the US Dollar vs. a basket of currencies, is correcting a small portion of the November sell-off and is on track for a break above 108 the figure having made a high of 107.993 so far. The catalyst for the move can be partly put down to a risk-off start to the week due to fresh COVID-19 curbs in China that have fuelled worries over the global economic outlook.

- China doctors have made a stark warning to Pres. Xi

Boosting the US Dollar, the new cases and warnings by health officials to the government have cast doubt on hopes that the government could soon ease its tough restrictions.

The rebound in the greenback follows the sharp selloff over the last few weeks that saw the Dollar Index DXY fall by as much as 4.7% in November. Speculators’ net long USD index positions have declined in a moderate fashion at the same time a drop occurred in the spot market that followed the softer-than-expected print for US CPI inflation data. Additionally, net EUR long positions continued to grow and are now three times larger than their levels in mid-October. This gives room for corrections in the euro that support the prospects of a recovery in the US Dollar that remains up 12% for the year.

FOMC minutes eyed

For the week ahead, the Fed minutes will shed light on the FOMC's deliberations regarding the expected downshift in the pace of rate increases. ''With that said, policymakers will also emphasize that the terminal rate is likely edging higher vs prior expectations as the labor market remains overly tight. In terms of the data, we look for the mfg PMI to recede modestly, staying above the 50 level in November,'' analysts at TD Securities said.

US Dollar technical analysis

The DXY index has started to correct the prior bearish daily impulse and is headed towards a 50% mean reversion of the last leg of the M-formation. If, however, the resistance of the counter-trendline and neckline of the M-pattern hold, the downside will remain in focus and a test of 104.70 could play out.

Reuters reports that San Francisco Federal Reserve President Mary Daly said on Monday the real-world impact of the U.S. central bank's interest rate hikes is likely greater than what its short-term rate target implies.

In prepared remarks for an address to the Orange County Business Council in California, Daly said some researchers have found "the level of financial tightening in the economy is much higher than what the (federal) funds rate tells us."

Key notes

Compared to the current target rate, she added, "financial markets are acting like it is around 6%."

Daly said "it will be important to remain conscious of this gap between the federal funds rate and the tightening in financial markets. Ignoring it raises the chances of tightening too much."

Daly said the next stage for the Fed will be "in many ways more difficult." She added that officials will need to be "mindful" of their choices and said "adjusting too little will leave inflation too high.

"Although one month of data does not a victory make, the latest inflation report had some encouraging numbers, including a long-awaited decline in goods price inflation," she added.

Real-world impact of fed rate hikes likely higher than what current rate target implies.

Financial markets priced like fed funds rate at 6%, not 3.75%-4.00%.

Fed must be mindful of risk of tightening policy too much.

Fed has more work to do when it comes to rate hikes.

Fed policy is in modestly restrictive territory.

US dollar updated

The US Dollar, as measured by the DXY index, is up 0.85% at the time of writing. The index, which measures the US Dollar vs. a basket of currencies, is correcting a small portion of the November sell-off and is on track for a break above 108 the figure having made a high of 107.993 so far.

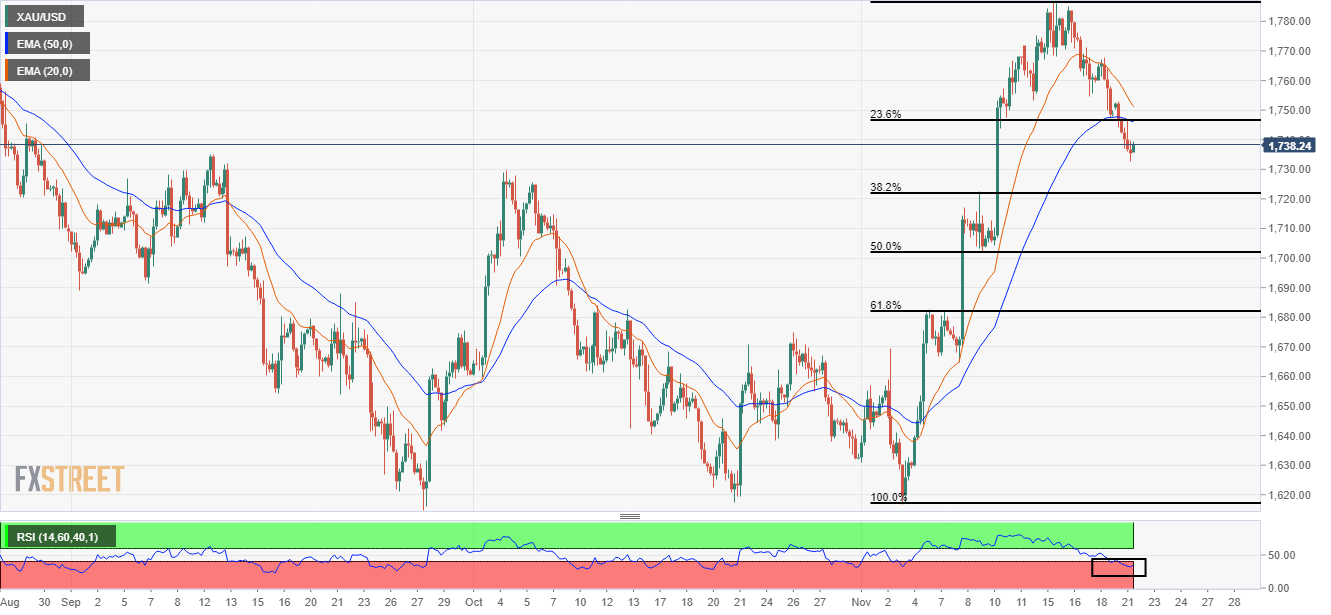

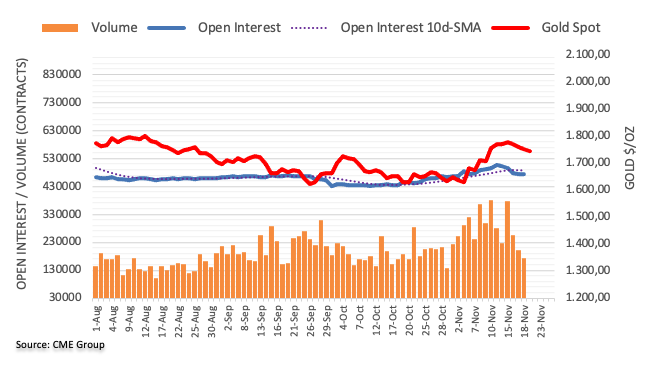

- Gold Price drops close to 0.80% on a strong US Dollar.

- Last week Federal Reserve’s hawkish commentary still weighed on investors’ mood.

- Gold Price Forecast: Supported around $1727, if broken, will expose the 100-DMA.

Gold Price grinds lower amidst a risk-off impulse, which triggered a flight to safe-haven assets. The US Dollar (USD) remains underpinned by investors’ concerns that the recent Covid-19 outbreak in China could spur authorities to reimpose restrictions. Therefore, the precious metals segment is down, as shown by the XAU/USD trading at $1735, below its opening price by 0.87%.

Buoyant US Dollar weighs on Gold Prices on sour sentiment

Sentiment remains negative, as shown by Wall Street posting losses between 0.32% and 1.08%. The financial markets narrative has not changed since October’s Consumer Price Index (CPI) report from the United States (US), which cooled down, while the Producer Price Index (PPI) followed suit. Even though both reports showed that prices are stabilizing, speculations that the Federal Reserve (Fed) might pause hiking rates were used to spur a rally in equities, which weighed on the US Dollar. However, last week’s solid US Retail Sales data increased the likelihood that the Fed would continue tightening conditions.

In that regard, US Federal Reserve officials continued to express their commitment to bringing inflation toward their 2% goal, but they said that the pace of hikes could moderate as soon as the December meeting. However, St. Louis Fed President James Bullard spooked investors, saying rates are not “sufficiently restrictive” and adding that he expects the Federal Funds rate (FFR) to peak at around 5% to 6%. Echoing some of his comments was Atlanta’s Fed President Raphael Bostic, adding that he supports slowing the rhythm of interest-rate increases and foresees 75 to 100 bps additional tightening to the FFR.

Data-wise, the US economic calendar featured the Chicago National Activity index falling to negative territory in October, to -0.05 from 0.17 in September, which triggered to reaction in the XAU/USD. In the meantime, the US Dollar Index, a measure of the buck’s value against its peers, extends its gains by 0.93%, at 107.967, registering a fresh one-week high.

Elsewhere, US Treasury bond yields are extending their gains, particularly the 10-year benchmark note rate yielding 3.818%, underpinning the USD. Another headwind for Gold Prices is Real yields, which are calculated by the US 10-year nominal yield minus inflation expectations for the same period, which remains positive at 1.71% as of last Friday’s close.

Ahead into the week, the US docket will feature Fed regional manufacturing indices alongside further Fed speaking.

Gold (XAU/USD) Price Forecast: Technical outlook

Gold Price remains neutral-to-upward biased, comfortably above the $1700 psychological level, though the Relative Strength Index (RSI) slope aims downward, accelerating towards its midline. If RSI’s central line is crossed, it will exacerbate XAU/USD’s fall towards the 100-day Exponential Moving Average (EMA) at $1711, ahead of the abovementioned $1700 figure. XAU/USD key resistance levels lie at $1750, followed by November’s high of $1786, ahead of the $1800 mark.

Following earlier rumors, Saudi Energy Minister Abdulaziz bin Salman Al-Saud said the current OPEC+ deal continues to the end of 2023.

Key notes

The current cut of 2 million bpd will be maintained until the end of 2023.

If additional measures are required to balance supply and demand, we will be ready to intervene.

Energy market update

Meanwhile, a sour note amid growing fears that China could reinstate its strict zero-COVID policy has weighed on risk appetite at the start of the week. Due to the rising infections in China, Goldman Sachs has slashed its forecast for Brent crude oil prices in the fourth quarter to US$100 per barrel from its prior US$110 estimate.

"China's Covid cases are at Apr-22 highs, yet, the new policy reaction function is unknown. However, the logic of exponential virus spread, means further lockdowns will likely be required, if full reopening is not feasible. Therefore, we cautiously lower our expectations for China demand by 1.2 mb/d in 4Q22, equivalent to the effective cut recently implemented by OPEC+, the group's first successful preemptive curtailment," the investment bank explained.

"The net impact is a c.1.5 mb/d loosening of 4Q22 balances, lowering our 4Q22 Brent forecasts by $10/bbl, to $100/bbl. Markets have instead priced a c.2 mb/d softening over the next 3 months, as these fundamental developments occurred during a seasonally low liquidity period."

- AUD/USD plunges below 0.6600 as sentiment dampened.

- Recently, China’s Covid-19 outbreak kept investors worried about speculations that the Government would reimpose restrictions.

- Traders’ focus turns to Reserve Bank of Australia Governor Philippe Lowe speaking on Tuesday.

The Australian Dollar (AUD) fell for the fourth straight day in a risk-off mood after news broke that the latest China Covid-19 outbreak caused three deaths during the weekend, as authorities eased some restrictions. Hence, speculators seeking safety bolstered the US Dollar (USD) amid growing concerns about reimposing lockdowns. The AUD/USD is trading at 0.6590 after hitting a daily high of 0.6683.

Sentiment bolstered the US Dollar on safe-haven flows

Wall Street denotes investors’ worries about China being hit by a Covid outbreak, extending its losses in the day. A light economic calendar in the United States (US) witnessed the Chicago National Activity index falling to negative territory in October, to -0.05 from 0.17 in September. Although the US October CPI and PPI reports were softer-than-expected, a solid US Retail Sales report increased the chances that the Fed will continue tightening monetary conditions.

During the last week, a slew of Federal Reserve (Fed) officials expressed the need to ease the pace of interest rate hikes but mentioned that they’re not pausing. St. Louis Fed President James Bullard said rates are not “sufficiently restrictive” and foresees the Federal Funds rate (FFR) to peak at around 5% to 6%.

The Atlanta Fed President Raphael Bostic noted that the supports slowing the rhythm of interest-rate increases and foresees 75 to 100 bps additional tightening to the FFR.

Elsewhere, the US Dollar Index (DXY), a measure of the buck’s value against a basket of six currencies, climbs sharply by 0.80%, at 107.823, a headwind for the Australian Dollar.

Aside from this, an absent Australian economic calendar leaves AUD/USD traders leaning on market sentiment, battered by China‘s news. It should be noted that the People’s Bank of China (PBoC) kept the Loan Prime Rate (LPR) unchanged at 3.65%, while Iron Ore prices added another piece of the puzzle that is weighing on the Australian Dollar.

Ahead into the week, the Reserve Bank of Australia (RBA) Governor Philip Lowe will cross wires on Tuesday, delivering a speech at the Annual Committee for Economic Development of Australia Dinner. He is expected to reiterate the RBA’s commitment to tame inflation, though it is not likely to rock the boat. On the US front, the economic calendar will feature the Richmond Fed Manufacturing Index alongside further Fed speaking.

AUD/USD Key Technical Levels

USD/CHF has maintained its rejection from 0.9372/55. A sustained close below here remains needed to confirm weakness over the next month, according to economists at Credit Suisse.

200DMA at 0.9629 ideally holds any further upside

“USD/CHF has extended its rejection of the key support zone at 0.9372/55. Whilst this development stays in line with improving near-term momentum and we see scope to extend this recovery for now, our broader bias remains negative, and we continue to look for an eventual turn back lower.”

“Immediate support is found at 0.9500/9496 and then at 0.9475/71, though a stable close below the major support zone at 0.9372/55 remains seen as needed to confirm weakness over the next month and open the door to 0.9322/12.”

“A close above the 200-day average at 0.9629 would raise a question mark over our broader bearish bias, with next resistance above here then seen at 0.9683/9700.”

AUD/USD has not followed through on the recent break above 0.6725. However, analysts at Credit Suisse see the current pause as a correction ahead of further upside.

Near-term consolidation now seen as likely

“Our bias is for the current pause to extend short term. However, with medium-term MACD still rising and with a small top in the USD in place, we think the risk remains pointed to the upside over the next one month.”

“We continue to look for an eventual and sustained close above 0.6725 and then above the recent high at 0.6797 after this pause, which would then be seen to expose the 200 -day average at 0.6943.”

“Immediate support is seen at the 13-day exponential average at 0.6607 and then below at 0.6577, though below the recent low and the neckline to the recent base at 0.6552/47 remains needed to raise thoughts of a more significant near-term move lower.”

- GBP/USD drops below 1.1900, eyeing 1.1800, blamed on risk aversion.

- Amidst a light calendar, Federal Reserve commentary to give direction to the GBP/USD.

- GBP/USD to consolidate around 1.1800-1.2000 amid the lack of catalyst.

The Pound Sterling (GBP) strumbled sharply below the 1.1900 figure in the North American session amid risk aversion as China’s Covid-19 crisis worsens, reporting its first related death in six months, increasing worries of lockdowns in the second largest economy. In the last week, hawkish Federal Reserve (Fed) rhetoric weighed on investors, which lifted global equities from their yearly lows. At the time of writing, the GBP/USD is trading at 1.1816, beneath its opening price by 0.60%.

Risk aversion weighed on the British Pound

Equities remain downbeat, hit hard by China’s Covid-related news that three people died during the weekend, sparking fears that authorities could reimpose strict measures to curb the outbreak. The economic docket in the United States (US) revealed the Chicago National Activity index fell into negative territory in October, to -0.05 from 0.17 in September. Aside from this, even though US October CPI and PPI reports were softer-than-expected, a solid US Retail Sales report increased the chances that the Fed will continue tightening monetary conditions.

In the meantime, the US Dollar Index, a greenback gauge against a basket of currencies, jumped 0.62%, at 107.646 was a headwind for the GBP/USD.

On the United Kingdom (UK) side, the Office for Budget Responsibility (OBR) foresees a drop of 1.4% in GDP for 2023, worst than the estimated 1.8% growth in March. Meanwhile, expectations that the Bank of England (BoE) would tighten monetary policy

What to watch

Ahead in the week, the UK economic docket Is light, awaiting S&P Global/CIPS PMIs on Wednesday. Across the pond, the US calendar will feature further Fed speaking.

GBP/USD Price Analysis: Technical outlook

After rallying towards fresh three-month highs above 1.2000, the GBP/USD retraces toward testing the September 13 swing high-turned-support at 1.1738. However, until GBP sellers clear the 1.1800, the major might consolidate in the 1.1800-1.2000, awaiting a fresh catalyst.

GBP/USD key resistance levels lie at 1.1900, followed by the 1.2000 psychological level. On the flip side, the GBP/USD first support would be the 1.1800 mark, which, once cleared, would expose the abovementioned 1.1738, followed by the 100-day Exponential Moving Average (EMA).

EUR/USD slide edges under 1.03 support zone. Economists at Scotiabank believe that the pair could extend its slump to 1.0100/05.

Risk of EUR/USD rally extending towards the low 1.05 removed for now

“Loss of support around 1.0310 has condemned the EUR to some short-term (at least) weakness and removed the risk of its rally extending towards the low 1.05 for now.”

“We still think better EUR support will emerge on dips but that could mean near 1.02 or – at worst – nearer more solid, short-term support at 1.0100/05.”

“Resistance is 1.0300/05.”

- The selling pressure remains well and sound around EUR/USD.

- The dollar trades in multi-session highs when tracked by the DXY.

- The Chicago Fed National Activity Index worsened in October.

Bears keep controlling the mood in the risk complex and keep EUR/USD depressed in the 1.0250 region at the beginning of the week.

EUR/USD drops to 2-week lows

EUR/USD maintains the corrective downside well in place for yet another session and threatens to challenge the key support around the 1.0200 neighbourhood sooner rather than later.

Indeed, in quite an uneventful session, the greenback extends the recent bounce backed by the recent hawkish message from some Fed speakers, which lent renewed oxygen to both the buck and yields, while at the same time mitigated the optimism around a potential Fed’s pivot.

Earlier in the calendar, German Producer Prices contracted 4.2% MoM in October and rose 34.5% vs. the same month of 2021. In the US data space, the Chicago Fed National Activity Index dropped to -0.05 in October (from 0.17).

What to look for around EUR

EURUSD sees its downside exacerbated to the area of 2-week lows on the back of the resumption of the bid bias in the greenback.

In the meantime, the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. In addition, markets repricing of a potential pivot in the Fed’s policy remains the exclusive driver of the pair’s price action for the time being.

Back to the euro area, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: Flash EMU Consumer Confidence (Tuesday) EMU, Germany Advanced PMIs (Wednesday) – Germany IFO Business Climate, ECB Accounts (Thursday) – Germany Final Q3 GDP Growth Rate, GfK Consumer Confidence (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.69% at 1.0251 and a breach of 1.0021 (100-day SMA) would target 0.9935 (low November 10) en route to 0.9730 (monthly low November 3). On the other hand, the next hurdle emerges at 1.0406 (200-day SMA) ahead of 1.0481 (monthly high November 15) and finally 1.0500 (round level).

USD/CAD has extended its rejection from 1.3225/03. However, analysts at Credit Suise continue to look for an eventual break below this level.

Weakness to be eventually reasserted

“Whilst we see room for the recovery to extend further reinforced by daily MACD turning higher and daily RSI unwinding from oversold levels, this move higher is seen as a near-term correction within the broader bearish environment.”

“Our bias is for the weakness to be eventually reasserted, though with a break below 1.3298 needed to retest the still intact key support at 1.3225/03, a stable close below which would signal further setback to 1.3021/1.2986.”

“We look for the neckline to the recent top and the recent price high at 1.3493/1.3571 to ideally provide a better near-term ceiling to prevent a stronger recovery.”

According to the Wall Street Journal (WSJ), Saudi Arabia is eyeing an OPEC+ production increase ahead of the embargo and price cap on Russian oil.

An increase of up to 500,000 barrels a day is now under discussion for OPEC+’s December 4 meeting, the WSJ reported, citing delegates.

Market reaction

Crude oil prices came under heavy bearish pressure on this headline and the barrel of West Texas Intermediate (WTI) was last seen trading at $77.20, where it was down 3.6% on a daily basis.

USD/SGD has stayed within a relatively narrow range at either side of 1.37 over the past week. For the week ahead, economists at MUFG Bank see the pair within a range of 1.3638 and 1.3864 with slight upside bias

Still positive outlook

“For the week ahead, we continue to see elevated inflation amid subdued industrial production growth for October. Overall, these may provide near-term supports for the SGD for the coming week.”

“For USD/SGD, we see the pair within a range of 1.3638 and 1.3864 with slight upside bias.”

Economist at UOB Group Lee Sue Ann reviews the announcement of the UK’s Autumn Statement.

Key Takeaways

“Following weeks of speculation, UK Chancellor of the Exchequer Jeremy Hunt delivered his long-awaited Autumn Statement on Thu (17 Nov). Nicknamed the “memorial service for Trussonomics”, Hunt’s sweeping GBP55bn fiscal plan was based around 3 priorities – stability, growth and public services – as he sought to restore credibility under the new Prime Minister Rishi Sunak’s government.”

“Meanwhile, the independent Office for Budget Responsibility (OBR) now estimates that the UK economy is in recession and that GDP will contract by 1.4% in 2023, while inflation is predicted to hit 9.1% this year and 7.4% next year.”

“We maintain our view of a 50bps move at its 15 Dec monetary policy meeting. But we think the BOE still has a little way to go, given that Hunt as decided to delay much of the pain from the fiscal consolidation, which means that fiscal policy will do little to fight inflation.”

USD/JPY continues its rebound. Economists at Credit Suisse expect the pair to extend its rebound to the 13-day exponential average at 142.18/20.

Support seen at 139.63, then 138.63

“We see scope for a deeper recovery, whilst still maintaining our broader negative outlook. Resistance is seen at the falling 13-day exponential average at 142.18/20, which we look to try and cap on a closing basis. Above can see a deeper recovery back to the 38.2% retracement of the October/November fall at 143.12/17, but with fresh sellers expected here.”

“Below 139.63 is needed to ease the immediate upside bias. Big picture, we look for an eventual sustained move below 138.63 for a fall back to 137.69 and eventually what we expect to be much better support at the 200-day average at 133.48.”

- USD/CAD climbs to over a one-week high and draws support from a combination of factors.

- Bearish oil prices undermine the Loonie and act as a tailwind amid sustained USD buying.

- Sustained strength beyond the 1.3400 mark might have set the stage for additional gains.

The USD/CAD pair builds on last week's bounce from the 100-day SMA support, or a two-month low, and gains some follow-through traction on Monday. The pair maintains its bid tone through the early North American session and is currently trading near a one-and-half-week high, just below mid-1.3400s.

Crude oil prices languish near the lowest level since September 28 amid concerns that the worsening COVID-19 situation in China will dent fuel demand. This, in turn, undermines the commodity-linked Loonie and acts as a tailwind for the USDCAD pair amid the ongoing US Dollar recovery from a three-month low.

From a technical perspective, sustained strength beyond the 23.6% Fibonacci retracement level of the corrective slide from over a two-year peak could be seen as a trigger for bullish traders. This, in turn, remains supportive of the intraday positive move and supports prospects for a further near-term appreciating move.

That said, oscillators on the daily chart - though have been recovering from the negative territory - are yet to confirm a bullish bias and warrants caution. Hence, any subsequent move up might attract some sellers near the 1.3500 psychological mark and remain capped near the 50-day SMA support breakpoint, around mid-1.3500s.

On the flip side, the 1.3400 resistance breakpoint now seems to protect the immediate downside. The next relevant support is pegged near the 1.3325 region. This is closely followed by the 1.3300 mark, which if broken might expose the 100 DMA support, currently around the 1.3255-1.3250 area, or the monthly low touched last week.

USD/CAD daily chart

Key levels to watch

- EUR/USD accelerates the decline and retargets 1.0200.

- The loss of 1.0200 exposes a probable drop to 1.0020.

EUR/USD adds to the ongoing retracement and loses ground for the third session in a row on Monday.

A deeper pullback could breach 1.0200 and thus pave the way for extra losses to the 100-day SMA around 1.0020. South of this level, a potential visit to the parity zone could return to the radar.

In the meantime, the 200-day SMA, today at 1.0406, continues to cap occasional bullish attempts.

EUR/USD daily chart

- Chicago Fed's National Activity Index fell into negative territory in October.

- US Dollar Index clings to strong daily gains above 107.50.

The Federal Reserve Bank of Chicago's National Activity Index (CFNAI) declined to -0.05 in October from 0.17 in September.

"The CFNAI Diffusion Index, which is also a three-month moving average, decreased to +0.13 in October from +0.25 in September," the publication further read. "Forty-five of the 85 individual indicators made positive contributions to the CFNAI in October, while 40 made negative contributions."

Market reaction

This data failed to trigger a noticeable market reaction. As of writing, the US Dollar Index was up 0.75% on the day at 107.77.

- DXY adds to the ongoing rebound and approaches 108.00.

- Further upside could see the 100-day SMA near 109.20 revisited.

DXY advances for the third session in a row and trades at shouting distance from the key barrier at 108.00 on Monday.

The continuation of the uptrend targets the temporary hurdle at the 100-day SMA, today at 109.18, prior to the resistance line around 109.70. The surpass of the latter could prompt gains to pick up pace in the short-term horizon.

While above the key 200-day SMA at 105.11, the outlook for the index should remain constructive. This region is also reinforced by the November low at 105.34 (November 15).

DXY daily chart

- USD/JPY surges past the 141.00 confluence and rises to over a one-week high on Monday.

- Strong follow-through USD buying remains supportive amid the Fed-BoJ policy divergence.

- The mixed technical setup warrants some caution before positioning for any further gains.

The USD/JPY pair gains strong positive traction on Monday and recovers further from its lowest level since August 29 touched last week. Spot prices climb to over a one-week high during the early North American session, with bulls now looking to build on the momentum further beyond the 142.00 mark.

The worsening COVID-19 situation in China and the imposition of fresh lockdowns fuel worries about a deeper economic downturn. This, in turn, boosts the US Dollar's status as the global reserve currency. This, along with a big divergence in the monetary policy stance adopted by the Federal Reserve and the Bank of Japan, provides an additional lift to the USD/JPY pair.

From a technical perspective, a sustained strength above the 141.00 confluence support breakpoint, turned resistance, was seen as a key trigger for intraday bulls. The said handle comprises the 100-day SMA and the 50% Fibonacci retracement level of the August-October rally. This should now act as a pivotal point and determine the near-term direction for the USD/JPY pair.

Meanwhile, oscillators on the daily chart - though have been recovering from lower levels - are still holding in the bearish territory. This warrants caution before positioning for a further appreciating move. Hence, any subsequent move-up is more likely to remain capped near the 142.45-142.50 resistance. That said, some follow-through buying should pave the way for additional gains.

The USD/JPY pair might then accelerate the recovery momentum towards reclaiming the 143.00 mark, above which bulls could aim to test the 38.2% Fibo. level, around the 143.50 region.

On the flip side, the 141.00 round figure now seems to protect the immediate downside ahead of the 140.80-140.75 region. The next relevant support is pegged near the 140.25-140.20 horizontal zone. This is closely followed by the 140.00 psychological mark. A convincing break below the latter will negate any near-term positive outlook and shift the bias back in favour of bearish traders.

USD/JPY daily chart

-638046331248292342.png)

Key levels to watch

GBP/USD strength has stalled. Nevertheless, analysts at Credit Suisse stay bullish for an eventual test of the key long-term 200-Day Moving Average, currently seen at 1.2216.

Move above 1.1952/58 needed to reassert an upward bias again

“We see scope for further consolidation and potentially a pullback also. With key resistance from the 55DMA and downtrend from February broken though, our bias remains to view this as a temporary pause only.

“Support is seen at 1.1762 initially, below which can see a retreat to next support at the 13DMA and price support at 1.1718/10, which we look to ideally hold. Should weakness extend, we would see scope for a test of the 1.1647 August high, but with fresh buyers expected to be seen here, if reached.”

“Above 1.1952/58 is needed to reassert an upward bias again for a test of what we see as more important resistance at the 200DMA of 1.2216, then potentially the 50% retracement of the 2021-2022 fall at 1.2298.”

Markets Strategist at UOB Group Quek Ser Leang notes a sustained move above 15,745 seems out of favour for the time being.

Key Quotes

“We expected USD/IDR to weaken further last week. However, USD/IDR rose to a high of 15,700. While overbought, the advance is not showing any signs of weakness just yet.”

“For this week, USD/IDR could rise above 15,745 but in view of the overbought conditions, it is unlikely to be able to maintain a foothold above this level (next resistance is at 15,810). Support is at 15,600, a breach of the next support at 15,550 would indicate that the current upward pressure has eased.”

- EURJPY fades Friday’s drop amidst erratic performance.

- Immediately to the upside comes the monthly highs near 147.00.

EURJPY resumes the upside above the key 145.00 mark at the beginning of the week.

If the corrective bounce becomes more serious, then the cross should face initial resistance at the so far November high at 147.11 (November 9). Above the latter, the door could open to a more meaningful move to the 2022 peak at 148.40 (October 21).

In the longer run, while above the key 200-day SMA at 138.47, the constructive outlook is expected to remain unchanged.

EUR/JPY daily chart

USD/CAD clings to gains above 1.3400. However, economists at Scotiabank expect the mid-1.24s to cap the advance.

Firm resistance seen at 1.3495

“Corrective USD gains have extended to near the mid-1.34 zone where we do think there is a reasonable technical case for the rebound to stall. This is where the 61.8% retracement of the sell-off from 1.3575 and short-term bull potential from the rebound from the low 1.32s converge.”

“There is firm resistance above the market at 1.3495 (bear breakdown point) should gains extend.”

EUR/USD remains capped as expected below the 200-Day Moving Average on a closing basis, currently seen at 1.0409. Analysts at Credit Suisse see scope for a deeper setback to the 38.2% retracement of the rally from September at 1.0120.

Resistance at 1.0409 is expected to cap for now

“EUR/USD remains capped as expected by key resistance from its falling long-term 200DMA, currently seen at 1.0409, and with a minor top now seen in place, we continue to see scope for a deeper setback from here.”

“Support is seen next at the rising 13DMA at 1.0211, a close below which would be seen to clear the way for a test of the October/November reaction highs at 1.0197/95. We continue to look for a floor here. Should weakness directly extend, this would raise the prospect of further weakness, with support then seen next at the 38.2% retracement of the September/November rally at 1.0120.”

“Resistance is seen at 1.0334 initially, with a close above the 200DMA at 1.0409 needed to clear the way for further strength back to the 1.0481 high and eventually the 38.2% retracement of the entire 2021-2022 fall at 1.0612/15.”

- AUD/USD drops to a one-week low on Monday amid strong follow-through USD buying.

- China’s COVID-19 woes, geopolitical risks boost demand for the safe-haven greenback.

- The setup supports prospects for a further near-term depreciating move for the major.

The AUD/USD pair extends last week's retracement slide from the vicinity of the 0.6800 mark, or over a two-month high and attracts some follow-through selling on Monday. The pair maintains its offered tone through the early North American session and is currently placed near a one-week low, just above the 0.6600 round-figure mark.

The US Dollar gains traction for the third straight day and builds on its bounce from the lowest level since August 12, which, in turn, is seen exerting downward pressure on the AUD/USD pair. The better-than-expected US Retail Sales data released last week cast doubts on the peak inflation narrative. Moreover, hawkish signals from several Fed officials suggest that the US central bank might still be far from pausing its policy-tightening cycle and acts as a tailwind for the greenback.

Apart from this, the prevalent cautious market mood provides an additional lift to the safe-haven buck. Investors remain concerned about headwinds stemming from the worsening COVID-19 situation in China and the imposition of fresh lockdowns in several financial hubs - including the capital Beijing and the economic centre Shanghai. Furthermore, fears of a potential escalation in the Russia-Ukraine conflict take its toll on the global risk sentiment and further weigh on the risk-sensitive Aussie.

Meanwhile, worries about a slowdown in economic activity contribute to the ongoing fall in copper prices, which is seen as another factor denting demand for the resources-linked Australian Dollar. Apart from this, speculations that the Reserve Bank of Australia (RBA) will stick to its dovish course favour the AUD/USD bears. Hence, a subsequent fall below the 0.6600 mark, towards testing the 0.6560-0.6550 strong horizontal support breakpoint, looks like a distinct possibility.

Technical levels to watch

China rising new daily Covid cases could pose a downside risk to Yuan. But economists at MUFG Bank expect the USD/CNY pair to move in the range of 7.00-7.15 in the near term.

Lack of direction, range bound

“While the ease of Covid policy is a positive development, the challenge actually become larger for both national and local governments in the near-term in terms of containing the rising outbreak of Covid cases around the country, as China’s health authorities stressed that the 20-point playbook of new Covid-19 policy ‘does not mean we can slacken our response or even simply end Covid-19 restrictions and lie flat’.”

“Renewed geopolitical concerns and the Dollar’s move driven by Fed’s potential rate hike pace would imply a volatile USD/CNY pair.”