- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-11-2022

- USD/CAD is struggling around the immediate hurdle of 1.3340 amid an absence of a potential trigger.

- The market mood has turned quiet as the United States economy is celebrating Thanksgiving Day.

- A decline in oil prices led by rising Covid-19 infections in China has impacted the Canadian Dollar.

The USD/CAD pair is displaying topsy-turvy moves just like another typical Friday session. The Lonnie asset is struggling around 1.3340 after witnessing a recovery move from below 1.3320. A bullish reversal cannot be claimed yet as it passes through various filters. No doubt, the trading activity is low on account of Thanksgiving Day but the market mood is still solid.

The USD Index (DXY) is auctioning like a dead cat amid the unavailability of any potential trigger ahead due to the light economic calendar. However, the hangover of less-hawkish commentary from Federal Open Market Committee (FOMC) minutes will continue to impact US Dollar ahead. Meanwhile, the 10-year US Treasury yields have dropped below 3.69%.

The long-term US yields are expected to remain on the tenterhooks as the Federal Reserve (Fed) is expected to shift to a lower interest rate hike for its December monetary policy meeting. Commentary from Fed policymakers as per FOMC minutes indicate that financial risks in the United States economy are accelerating led by extreme policy tightening.

Therefore, a slowdown in the rate hike pace would reduce those risks and would also present an opportunity to observe the impact of efforts made by the Fed to bring down inflationary pressures.

On the Canadian Dollar front, investors are awaiting the release of the Gross Domestic Product (GDP) for the third quarter, which will release on Tuesday. On a quarterly basis, the GDP data is expected to decline to 0.4% from the prior release of 0.8%. This might be delightful for the Bank of Canada (BOC) as a slowdown in the economy is necessary to cool down the ultra-hot inflation.

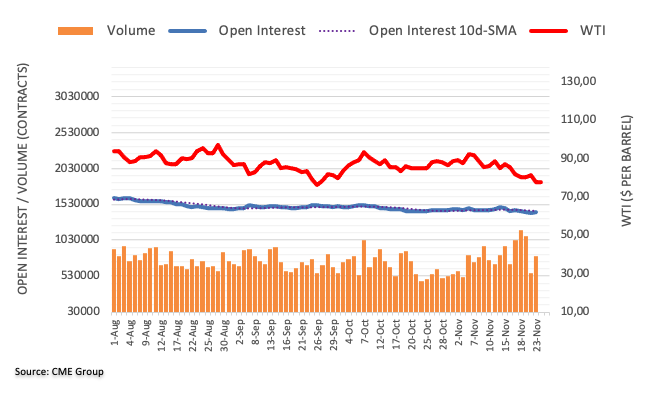

Meanwhile, oil prices have stabilized around the critical hurdle of $78.00 after a perpendicular downfall. This doesn’t present a reversal situation but an inventory distribution that could lead to further weakness. Rising infections of Covid-19 in China have resulted in a significant decline in economic projections. It is worth noting that Canada is a leading exporter of oil to the United States and a decline in oil prices is impacting the Canadian Dollar.

- Bears are lurking at 1.2150/00 on the daily chart.

- A correction eyes to 1.1959 and then the trendline support.

GBP/USD continued to climb on Thursday and reached the 1.2150s before moving lower into a consolidating during Thanksgiving where liquidity is thinner than usual. The US Dollar continues to extend its losses on Thursday after the minutes from the Federal Reserve's November meeting supported the view that the central bank would downshift and raise rates in smaller steps from its December meeting.

The minutes of the Nov. 1-2 meeting showed officials were largely satisfied they could now move in smaller steps, with a 50 basis point rate rise likely next month after four consecutive 75 basis point increases. In other key statements, the minutes showed that a slower pace of rate hikes would better allow the FOMC to assess progress toward its goals given the uncertain lags around monetary policy. A few participants said slowing the pace of rate hikes could reduce the financial system risks; others that slowing should await more progress on inflation.

The dollar index DXY, which measures the greenback against six major peers, was down 0.2% at 105.87, after sliding 1.1% on Wednesday. As Reuters noted, ''the Fed has taken interest rates to levels not seen since 2008 but slightly cooler-than-expected US consumer price data has stoked expectations of a more moderate pace of hikes.'' Consequently, the US Dollar index slide 5.2% in November, putting it on track for its worst monthly performance in 12 years.

Meanwhile, it is potentially going to be a quiet end to the week with a vacant calendar and half-day markets on Wall Street. This leaves the focus on busier times ahead. Net short GBP speculators’ positions fell back for a third consecutive week as the UK's fundamentals remain sour. A hefty 75 bps rate hike from the BoE this month failed to support the pound in the spot market, given the Bank’s gloomy UK economic forecasts and that sentiment is likely here to stay. A reversal in the US Dollar could be harmful to the pound and a potentially over-prescribed long in the spot market.

GBP/USD technical analysis

Bears are lurking at 1.2150/00 on the daily chart and there are prospects of a correction if the resistance holds over the coming days with eyes to 1.1959 and then the trendline support.

- The EUR/JPY rises as the Asian session begins after losing 0.53% on Thursday.

- EUR/JPY Price Analysis: After breaking below the rising wedge, a fall toward 142.50s is on the cards.

The Euro (EUR) fell sharply against the Japanese Yen (JPY), on Thursday, amidst an improved market sentiment, which usually benefits the shared currency. However, traders seeking safety bolstered the latter, sending the EUR/JPY sliding toward the 50-day Exponential Moving Average (EMA) around 144.15. At the time of writing, the EUR/JPY is trading at 144.19, below its opening price by 0.08%.

EUR/JPY Price Analysis: Technical outlook

From a daily chart perspective, the EUR/JPY remains neutral-to-upward biased. However, it should be noted that the rising wedge formed in the EUR/JPY chart was broken on Thursday, which could exacerbate a fall toward the November 11 daily low at 142.54. Another factor to consider is the Relative Strength Index (RSI) turned bearish; hence the EUR/JPY path of least resistance is downward biased.

The EUR/JPY first support would be the 50-day Exponential Moving Average (EMA) at 144.15. A breach of the latter will expose the 144.00 figure, followed by the November 15 daily low at 143.35, ahead of the 142.54 targets. As an alternate scenario, the EUR/JPY first resistance would be the 145.00 mark, which, once cleared, will expose the 146.00 figure. Break above will send the EUR/JPY climbing towards the November 9 swing high at 147.11.

EUR/JPY Key Technical Levels

- Quiet market mood on account of Thanksgiving Day has turned the Aussie asset sideways.

- An establishment of the AUD/USD pair above 0.6700 has strengthened the Australian Dollar.

- The 200-EMA at 0.6847 is expected to be smashed by the major sooner.

The AUD/USD pair is displaying back-and-forth moves in a 10-pips range in the early Asian session. The Aussie asset has turned sideways after printing a fresh weekly high at 0.6778 amid a quiet market mood on account of Thanksgiving Day.

Meanwhile, the USD Index (DXY) is still in the hangover of ‘less-hawkish’ cues from the Federal Open Market Committee (FOMC) minutes. The US Dollar is hovering below the critical hurdle of 106.00 amid the risk appetite theme.

On a daily scale, the Aussie asset has confidently established above the horizontal support plotted near July 14 low around 0.6700. The next hurdle for the Aussie asset is the 200-period Exponential Moving Average (EMA) at 0.6847, which has remained a major ceiling.

The 20-period EMA at 0.6616 is scaling higher, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is focusing on shifting into the bullish range of 60.00-80.00, which will trigger a bullish momentum.

Going forward, a break above Thursday’s high at 0.6778 will extend the three-day winning streak, which will drive the asset toward the round-level resistance at 0.6800, followed by the 200-EMA at 0.6847.

On the flip side, the Australian Dollar could lose strength if the Aussie asset drops below Monday’s low at 0.6585. This will drag the major towards October 4 high at 0.6548 and November 2 high at 0.6493.

AUD/USD hourly chart

- Gold price is marching towards $1,760.00 as Fed is set to ditch the 75 bps rate hike regime.

- The US Dollar is prone to decline toward a three-month low at 105.34 amid an upbeat market mood.

- Economists at ANZ Bank consider the Gold rally an exaggerated one as the inflation rate is well above 2% target.

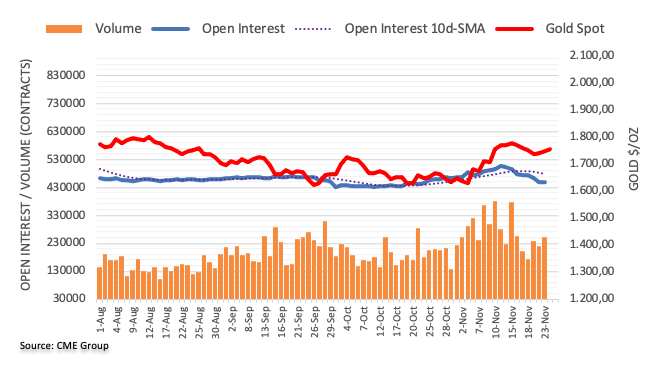

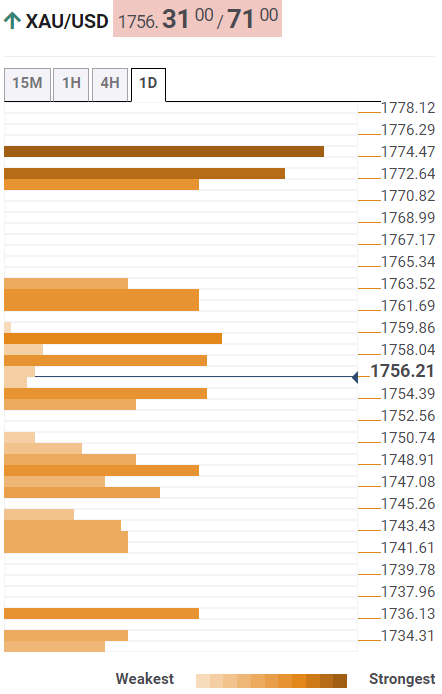

Gold price (XAU/USD) has attempted a recovery after declining to near $1,754.00 in the early Tokyo session. The precious metal remained sideways on Thursday due to less volume as United States markets were closed on account of Thanksgiving Day. Considering the optimism in the overall market, the gold price is expected to continue its upside journey toward the crucial hurdle of $1,760.00.

The USD index (DXY) displayed back-and-forth moves below the round-level resistance of 106.00. The US Dollar is prone to test a three-month low at 105.34 as the Federal Reserve (Fed) is set to ditch the bigger rate hike culture in its December monetary policy meeting. Meanwhile, S&P500 futures added some gains in the holiday session amid an upbeat market mood.

The Federal Open Market Committee (FOMC) minutes have cleared that the majority of Fed policymakers are in favor of decelerating the current interest rate hike pace. This may keep gold prices in a comfort zone. However, ANZ Bank shares a contrary opinion on the same. They believe that softer-than-expected US inflation triggered a sell-off in the US Dollar, helping Gold prices to recover. That is unlikely to last as inflation at 7.7% is well above the central bank’s target of 2%. “It is not enough for the Fed to be confident that inflation is on track to move back to 2% sustainably.

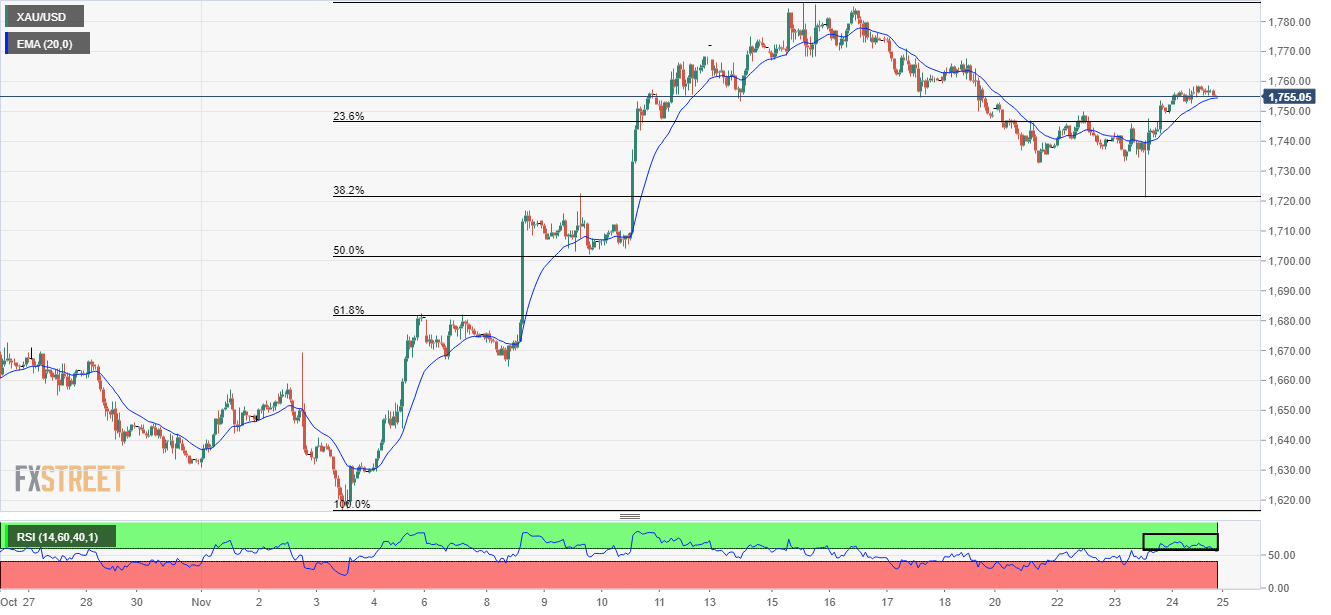

Gold technical analysis

On an hourly scale, Gold price has displayed a steep recovery after testing the 38.2% Fibonacci retracement (plotted from November 3 low at $1,616.69 to November 15 high at $1,758.88) at $1,722.00. The precious metal is looking for support around the 20-period Exponential Moving Average (EMA) at $1,754.65.

Meanwhile, the Relative Strength Index (RSI) (14) is declining into the 40.00-60.00 range, which indicates that Gold price is losing bullish momentum. However, it doesn’t claim a bearish reversal.

Gold hourly chart

- The Australian Dollar registers decent losses vs. the Japanese Yen amidst an upbeat sentiment.

- The lack of catalyst and price action trapped within 93.00-94.00 keeps the AUD/JPY sideways.

- AUD/JPY Price Analysis: RSI’s turning bearish could open the door for a fall to 93.00.

The Australian Dollar (AUD) edges lower against the Japanese Yen (JPY) after traveling throughout the day within the 94.00-93.11 range on Thursday, hoovering below the 50 and 100-day Exponential Moving Averages (EMAs). As the Asian Pacific session begins, the AUD/JPY is trading at 93.70, below its opening price by 0.20%.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart portrays the cross, consolidated within the 93.00-94.00 range, for the last six days. Even though the 50 and 100-day Exponential Moving Averages (EMAs) around 93.87 and 94.28, respectively, above the spot price, suggest the cross is downward biased, a flat slope confirms a neutral bias.

Short term, the AUD/JPY 1-hour chart portrays the 50, 100, and 200-EMAs seesawing around the price action. On Thursday, the AUD/JPY dived sharply below the Exponential Moving Averages (EMAs), opening the door for lower prices. Investors should be aware that the Relative Strength Index (RSI) crossed below the 50-midline to bearish territory, showing that sellers are gathering momentum.

Therefore, the AUD/JPY first support would be the daily pivot point at 93.63. The break below will expose the S1 daily pivot at 93.25, followed by this week’s low at 93.11. In the event of breaking upwards, the AUD/JPY first resistance would be the 200-EMA at 93.84, which, once cleared, would expose the 94.00 figure.

AUD/JPY Key Technical Levels

- NZD/USD has sensed a marginal selling pressure as NZ Retail Sales have dropped to 0.4% vs. 0.5% as projected.

- NZ Retail Sales has landed higher against its prior release but might not delight RBNZ policymakers.

- The RBNZ sees interest rates peaking around 5.5% by September 2023.

The NZD/USD pair has shown a marginal impact of a decline in New Zealand Retail Sales data against the consensus. The Kiwi asset has slipped below 0.6260 after auctioning sideways in the early Tokyo session. The NZ Retail Sales data for the third quarter has landed at 0.4% vs. the expectations of 0.5% but has remained significantly higher than the prior release of -2.3%.

A positive Retail Sales figure might be supportive of the New Zealand Dollar but won’t delight the Reserve Bank of New Zealand (RBNZ). The central bank is putting its blood and sweat to curtail inflationary pressures. The price rise index displayed a historic surge in the third quarter and a decline in consumer demand could bring a slowdown in inflation.

A rise in Retail Sales is not going to incentivize manufacturers and service providers to look for a halt in price growth or a decline. This may put more pressure on RBNZ Governor Adrian Orr to continue with extremely restrictive policy measures.

This week, the RBNZ hiked its Official Cash Rate (OCR) by 75 basis points (bps). Earlier, the central bank was hiking its OCR by a 50 bps rate. This has pushed its OCR to 4.25%. As price pressures have not displayed any sign of exhaustion nor a peak has been found yet, the regime of an ‘extreme hawkish’ stance will continue further. Also, the RBNZ has provided a peak for interest rates at 5.5% by September 2023.

Meanwhile, the US dollar index (DXY) is displaying a sideways performance as trading activity remained light on Thursday due to the holiday on account of Thanksgiving Day. The risk profile is still positive and has not displayed signs of caution yet.

The quarterly release of Retail Sales has been released as follows:

- New Zealand Q3 s/adj real retail sales +0.4 pct Q/Q.

- New Zealand Q3 s/adj actual retail sales +4.9 pct YoY.

New Zealand retail sales volumes rose a seasonally adjusted 0.4 percent in the third quarter, data from Statistics New Zealand showed on Friday, putting sales 4.9 percent higher on the year.

NZD/USD remains stagnant at 0.6265 in thin holiday trade at the start of the Asian session.

''As we have stated in recent days, we do think higher interest rates and the RBNZ’s hawkish stance are, on balance, a positive for the Kiwi, but newspapers are awash with recession talk, and that of course brings with it the risk that negative sentiment starts to feed on itself,'' analysts at ANZ Bank explained.

''The big global uncertainty is; how does the USD treat the prospect of the Fed slowing down the pace of hikes, but potentially higher terminal rate? Does that feed bearish sentiment, or help USD carry? So there is still uncertainty.''

About New Zealand Retail Sales

The quarterly release of Retail Sales by the Statistics New Zealand directly reflects on the country’s consumer spending. Stronger sales could drive inflation higher, leading the Reserve Bank of New Zealand (RBNZ) to hike interest rates so as to maintain its inflation-containment mandate. Thus, the indicator impacts the New Zealand dollar significantly. A better-than-expected print tends to be NZD bullish. The data is published about a month and a half after the quarter ends.

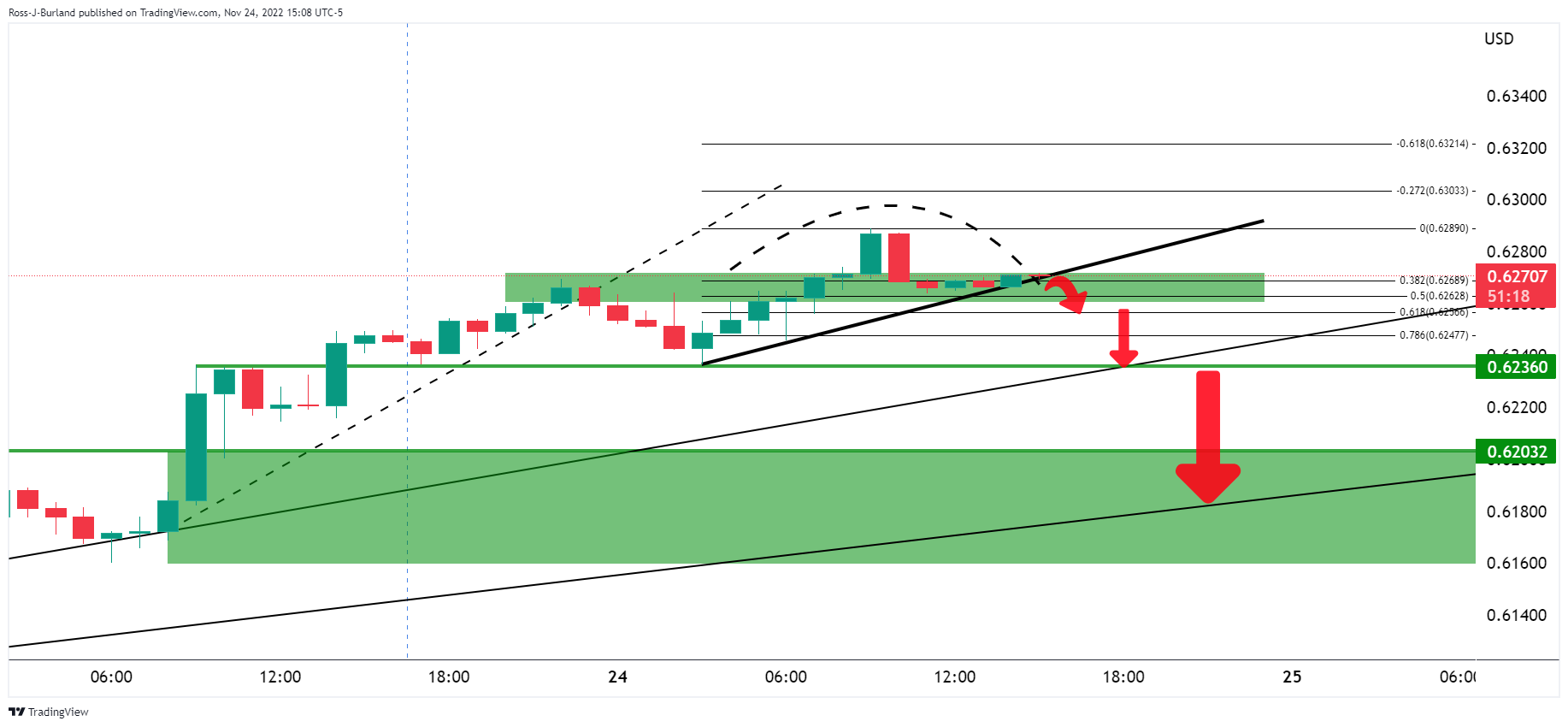

- NZD/USD bears could be about to make their moves.

- Bulls eye a run to test 0.6300 while above 0.6250.

As per the prior analysis, NZD/USD Price Analysis: The Bird is in full flight, whereby the bulls were creeping higher in Asian trade despite the ground it had already made since the central bank events in the week, fresh highs were made as follows:

NZD/USD prior analysis

NZD/USD update

While the trendline broke, the support held and the price moved higher. At this juncture, the bulls need to commit in the upper quarter of the 0.62 area. However, the tweezer top is a bearish candle stick combination pattern that shows sellers are in the market.

The price is now testing the next trendline support a break there opens the risk of a move to the downside to test below 0.6250 and with eyes on 0.6236 prior lows and trendline before 0.6200:

With that being said, it would be unusual for the market to simply melt without a revisit to the peak formation as distribution takes a while to play out, usually as per the following topping scenario on the 15-minute chart:

NZD/USD M15 chart

- The US Dollar remains offered, except against the Swiss Franc, as the USD/CHF rises.

- USD/CHF: A daily close above 0.9425 will pave the way toward a 0.9500 test.

The US Dollar (USD) stages a mild recovery against the Swiss Franc (CHF) following the release of the Federal Reserve (Fed) November meeting minutes, which showed policymakers’ desire to moderate interest-rate increases. Therefore, the USD/CHF tanked on Wednesday, but the story differed on Thursday. At the time of writing, the USD/CHF is trading at 0.9434 after traveling from its daily low of 0.9387.

USD/CHF Price Analysis: Technical outlook

The USD/CHF daily chart depicts Thursday’s price action forming a hammer, a candlestick that appears as a reversal pattern. Nevertheless, as with most technical analysis tools, that’s just one piece of the puzzle, as it will need further confirmation from Friday. The Relative Strength Index (RSI) shows sellers are in charge, but its slope aims upward, signaling that they might be losing momentum. If the USD/CHF achieves a daily close above Wednesday’s 0.9425, that could open the door for a re-test of 0.9500. Otherwise, sellers outweigh buyers could pressure the major towards 0.9400 before testing the November low at 0.9356.

In the near term, the USD/CHF 4-hour chart portrays the major as downward biased once it cleared an upslope trendline on November 22, exacerbating a drop below 0.9500. On its way toward a new weekly low below 0.9400, the USD/CHF surpassed the 50-Exponential Moving Average (EMA) alongside the daily pivot point at 0.9460. However, the USD/CHF S1 daily pivot at 0.9381 probed rigid support to break, and the major climbed back above 0.9400 toward the current spot price.

Therefore, the USD/CHF first resistance would be the daily pivot at 0.9460, followed by the 50-EMA at 0.9484, ahead of the psychological 0.9500 mark. As an alternative scenario, the USD/CHF first support would be 0.9400, followed by the S1 pivot level at 0.9381, ahead of November’s low at 0.9356.

USD/CHF Key Technical Levels

What you need to take care of on Friday, November 25:

The greenback extended its weekly decline on Thursday, settling near its lows against most of its major rivals. Activity pared after London’s close, as US markets were closed due to the Thanksgiving holiday.

Generally speaking, the mood was upbeat as Asian and European indexes closed in the green. However, some worrisome headlines may soon trigger a flip in investors’ sentiment. On the one hand, tensions between Russia and the EU continue and are on their way to escalate, as European Commission President Ursula von der Leyen announced they are working full speed on a 9th sanctions package on Moscow.

On the other hand, China reported record coronavirus contagions in the country, while a state-run news channel reported that Beijing and other cities are going back into lockdown. Financial markets may turn risk-averse on renewed concerns that Chinese restrictions could interrupt global commerce, trigger fresh supply-chain issues, and result in another inflationary spiral.

EUR/USD hovers around 1.0400, while GBP/USD trades in the 1.2110 price zone. AUD/USD extended its weekly rally and stands at around 0.6760, while USD/CAD eased to the 1.3330 price zone. Finally, USD/JPY edged south and trades at around 138.40.

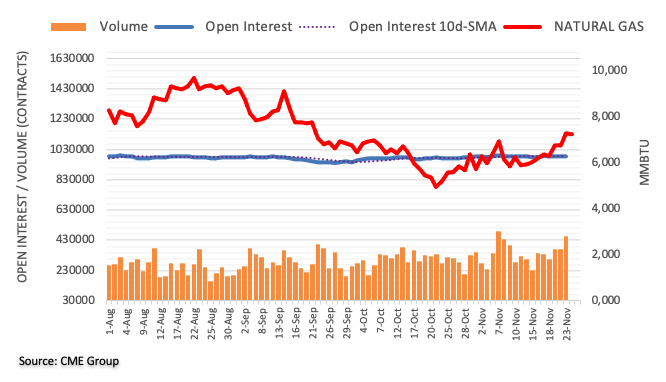

Spot gold consolidates around $1,755 a troy ounce, and WTI settled at $78 a barrel.

Like this article? Help us with some feedback by answering this survey:

- US Dollar weakened across the board on dovish-tilted Federal Reserve minutes.

- Mixed economic data from the United States keeps the US Dollar pressured.

- XAG/USD Price Analysis: Remains upward after conquering the 200-DMA, eyeing $22.00.

Silver price retraces after hitting a weekly high of $21.67, after climbing sharply on Wednesday, following the release of the Federal Reserve’s (FED) November meeting minutes, which weakened the US Dollar (USD). Also, factors like China’s Covid-19 crisis failed to trigger a flight to safety into the white metal. Hence, the XAG/USD trades at $21.47 a troy ounce.

On Thursday, Wall Street is closed in observance of the Thanksgiving holiday. The last meeting minutes of the Federal Reserve showed that “A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate,” giving the green light to investors seeking riskier assets. However, caution is warranted, as policymakers expressed “uncertainty” about how high rates need to go after emphasizing that inflation in the United States (US) remains “too high.”

Regarding Wednesday’s US economic calendar, S&P Global PMIs witnessed most indices moving into contractionary territory, another headwind for the US Dollar, while the Initial Jobless Claims for the last week jumped above forecasts, signaling that the labor market is easing.

On the positive side, US Durable Good Orders for October surprisingly rose, while the University of Michigan (UoM) Consumer Sentiment for November portrayed Americans are optimistic about the economy. The University of Michigan poll updated inflation expectations, with one-year ticking down to 5%, while for a 5-10 year horizon, were unchanged at 3%.

Back to price action, the US Dollar Index (DXY), a gauge of the buck’s value vs. its peers, drops by 0.21% at 105.875, extending its losses to three days. US Treasury yields, mainly the 10-year benchmark, followed suit, falling three bps at 3.663%.

Silver Price Forecast (XAG/USD): Technical outlook

Albeit Silver price retreated from weekly highs, it remains above the trendsetter 200-day Exponential Moving Average (EMA) at $21.37, sought as support by the white metal buyers. The XAG/USD bias remains upwards, and it could resume its uptrend if buyers reclaim $22.00. if that scenario plays out, the XAG/USD following resistance would be November 15 high at $22.24, followed by the June 6 high at $22.51. Otherwise, the XAG/USD first support would be the 200-day EMA at $21.37, followed by the psychological $21.00 mark.

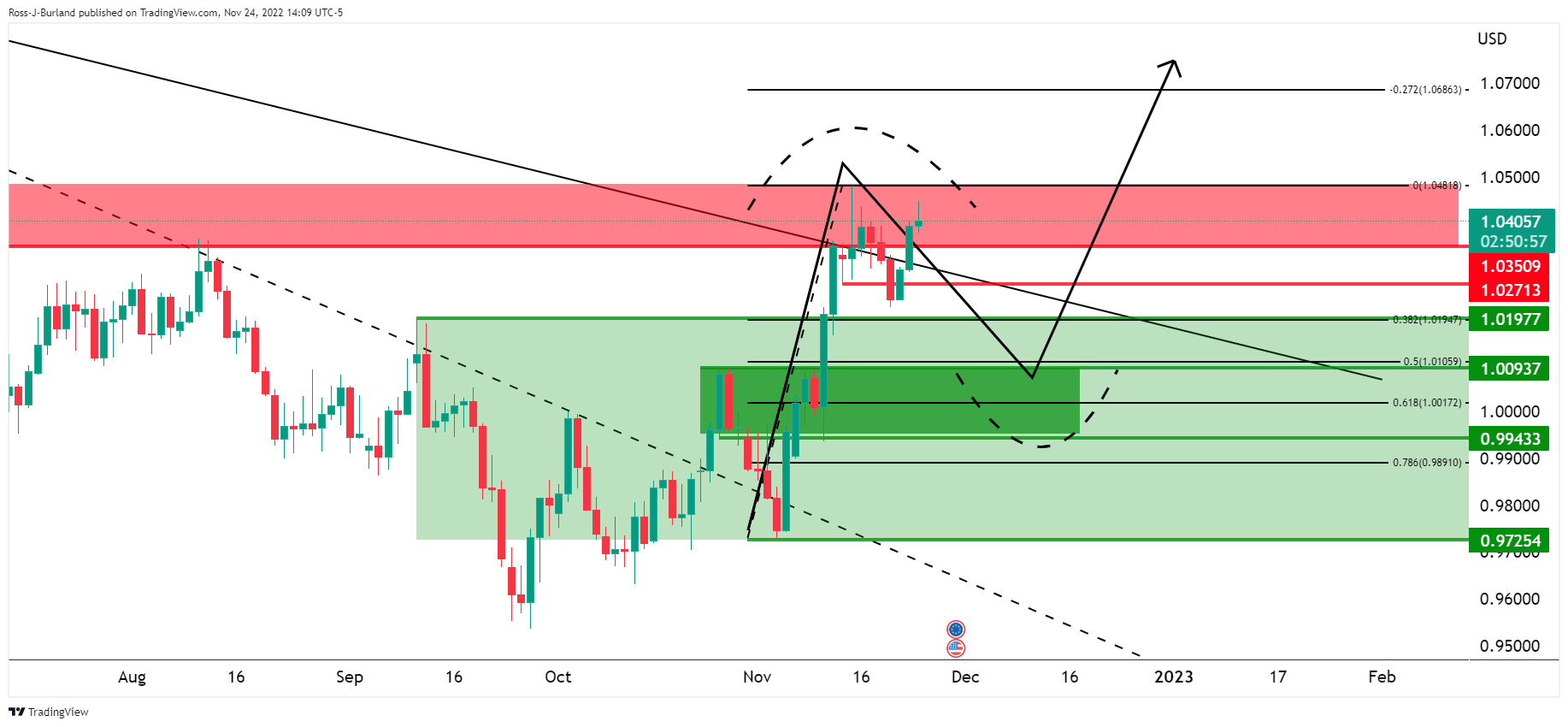

- This could be the Euro's final attempt while below 1.0450.

- A breach there, however, opens the risk of a move into the support quarter of the 1.04 area.

- A break of 1.0500 could be significant bullish development with the risk of a move to 1.0600.

EUR/USD was last up 0.1% at 1.0405, and has stuck to a range of between 1.0381 and 1.0448 while US markets are closed on Thursday for Thanksgiving and liquidity will likely be thinner than usual until Asia and Frankfurt crossover on Friday.

The euro held onto gains after the minutes of the European Central Bank's October meeting showed policymakers feared that inflation may be getting entrenched. This leaves the divergence between the Federal Reserve and the ECB thinner and may favour an upside bias for the euro for the medium term. In this regard, The U. Dollar has extended losses on Thursday after the minutes from the Federal Reserve's November meeting supported the view that the Fed will start to relax the pace of rate hikes into smaller increments, starting as soon as the next meeting in mid-December.

The minutes of the Nov. 1-2 meeting showed officials were largely satisfied they could now move in smaller steps, with a 50 basis point rate rise likely next month after four consecutive 75 basis point increases. In other key statements, the minutes showed that a slower pace of rate hikes would better allow the FOMC to assess progress toward its goals given the uncertain lags around monetary policy. A few participants said slowing the pace of rate hikes could reduce the financial system risks; others that slowing should await more progress on inflation.

The dollar index DXY, which measures the greenback against six major peers, was down 0.2% at 105.87, after sliding 1.1% on Wednesday. As Reuters noted, ''the Fed has taken interest rates to levels not seen since 2008 but slightly cooler-than-expected US consumer price data has stoked expectations of a more moderate pace of hikes.'' Consequently, the US Dollar index slide 5.2% in November, putting it on track for its worst monthly performance in 12 years.

Meanwhile, analysts at Rabobank are more pessimistic about the eurozone than what recent price action might otherwise say for the euro. ''The current economic outlook is more vulnerable given the impact of higher energy prices. By the ECB’s next policy meeting, Germany may already be in recession. As has been in the case in the UK in recent months, there is no guarantee that the EUR will respond favourably to higher rates if the economic backdrop appears grim. Although we see the risk of recession in the US next year, the outlook is not as severe as in Europe. ''

EUR/USD technical analysis

The euro is potentially topping out at this juncture, as per the daily chart.

While there is another push into the peak formation, this could be its final attempt while below 1.0450. A breach there, however, opens the risk of a move into the support quarter of the 1.04 area for the end of the week. A break of 1.0500 could be significant bullish development with the risk of a move to 1.0600.

- The inverted head-and-shoulders chart pattern on the GBP/JPY daily chart remains intact.

- From the daily chart perspective, the GBP/JPY is upward biased.

- GBP/JPY Price Analysis: After breaking below 168.00, it exacerbated a fall towards 167.00 and beyond.

The British Pound (GBP) is losing ground against the Japanese Yen (JPY) on Thursday, even though sentiment improved after the US Federal Reserve (Fed) agreed to slow the pace of rate increases. Hence, Asian and European stocks rallied, but the JPY had the upper hand in the FX space. At the time of writing, the GBP/JPY is trading at 167.71 after hitting a daily high of 168.29.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart illustrates the pair as upward biased, even though a head-and-shoulders chart pattern emerged and remains intact. On Wednesday, the cross climbed nearby the pattern’s right shoulder, but sellers leaning below 169.00 sent the GBP/JPY tumbling towards 168.00 and beyond. Of note, the Relative Strength Index (RSI) remains above the 50-midline, but buyers are losing momentum as the slope turns down.

Short term, the GBP/JPY 4-hour chart shows the cross broke below the bottom-trendline of a rising wedge, signaling that sellers are moving in. However, unless the GBP/JPY tumbles below the 200-Exponential Moving Average (EMA) at 167.18 and the S1 daily pivot at 167.00, risks will remain skewed to the upside. On the other hand, if the GBP/JPY reclaims 168.00, the inverted head-and-shoulders chart pattern could be invalidated if the cross pierces 169.00.

GBP/JPY Key Technical Levels

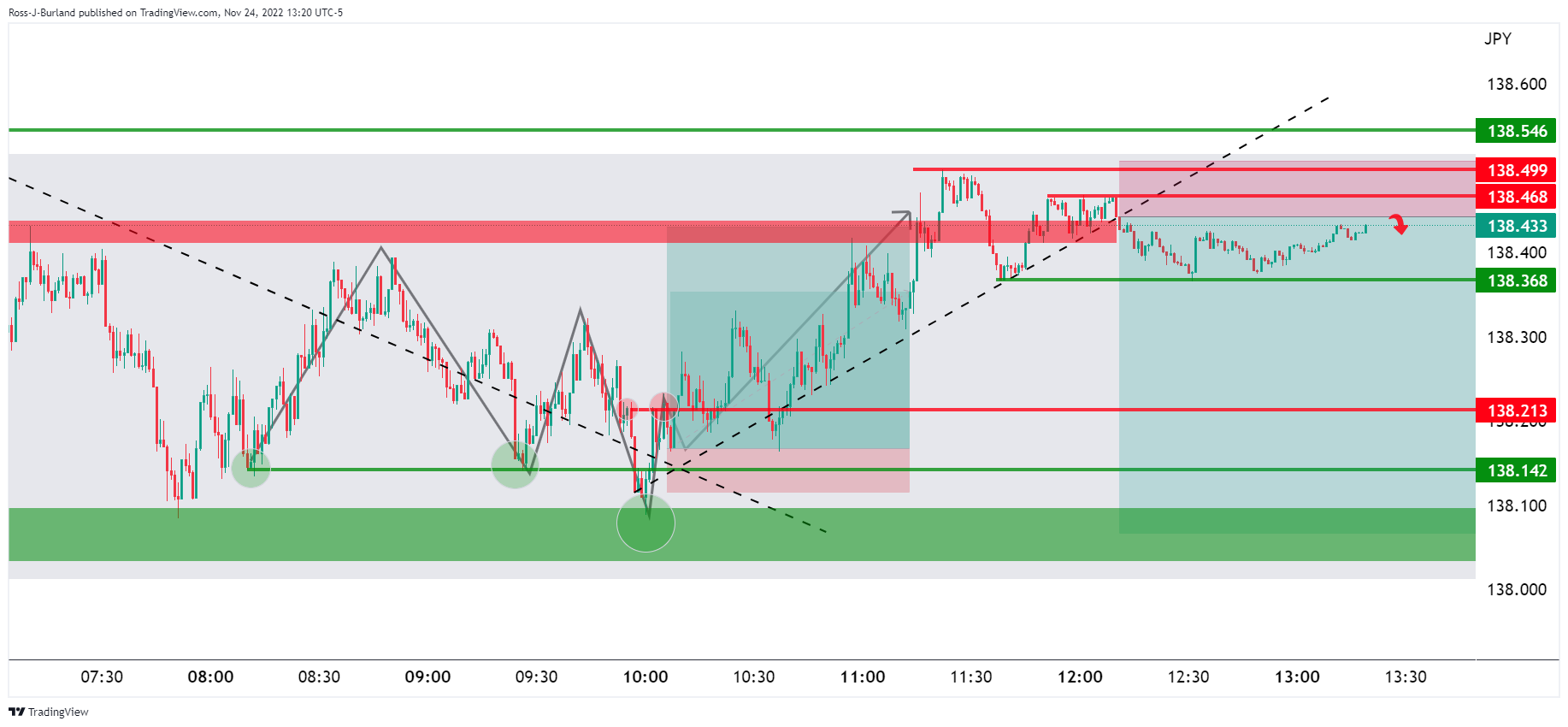

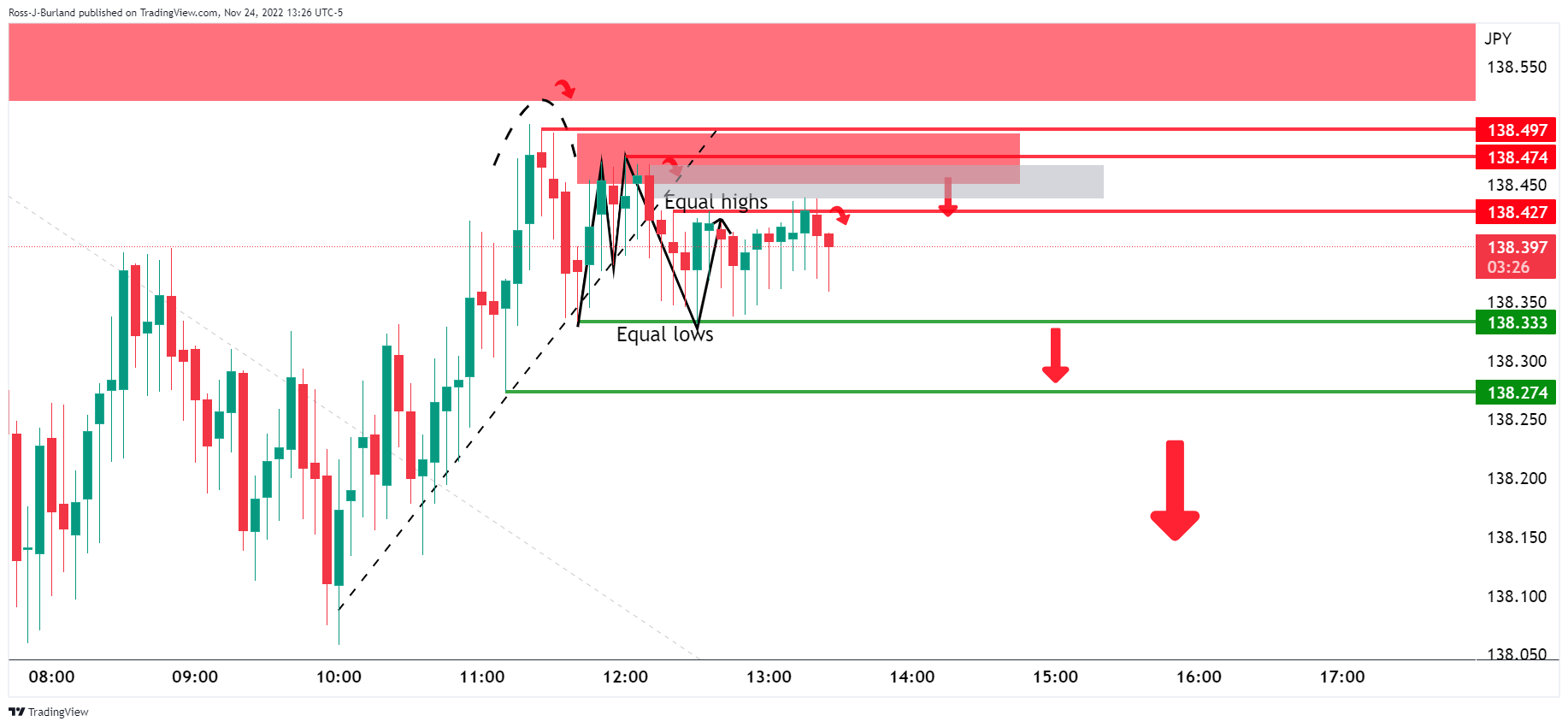

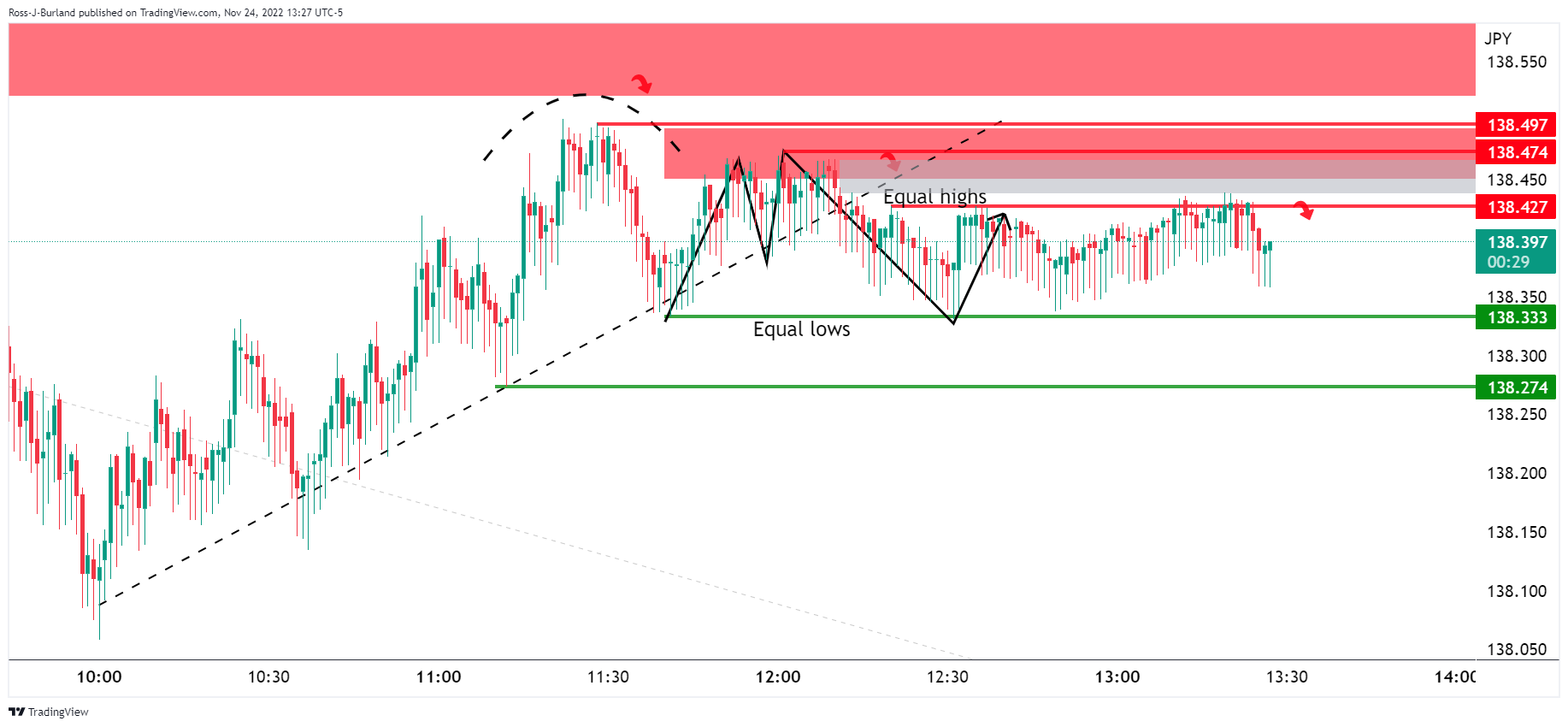

- USD/JPY bears are lurking for low-hanging fruit.

- A break of recent lows opens risk of a downside move to 138.00.

With US markets closed on Thursday for Thanksgiving, liquidity will likely be thinner than usual which means in the absence of traders, sideways choppy price action is in play. However, that is not to say there have not been opportunities in the New york session as the following illustrates:

USD/JPY M1 chart

As seen, the price at the start of the session broke a trendline resistance and established equal lows around 138.15 before violating those and subsequently moving higher, all the while remaining on the back side of the counter trendline.

There is a similar scenario playing out for the downside, as shown above, although the volumes in forex have petered out being so late in the day, so there is a lack of momentum. Nonetheless, the setup is as follows:

USD/JPY H1 chart

USD/JPY M15 chart

The price recently broke onto the backside of the trendline and that usually would be followed by a correction from below resistance.

USD/JPY M5 chart

There is low hanging fruit for the bears below recent consolidation lows and the sideways channel.

USD/JPY M1 chart

The minute chart shows the price trapped in a sideways chop but a violation of the recent equal highs points to prospects of a test of the price imbalance for mitigation. This could be the trigger for a stronger move to the downside and a test of equal lows. A break there opens the risk of a move into 138.00 the figure. However, until volumes return, in Asia and Frankfurt, sideways price action is the name of the game.

- The minutes of the Federal Reserve’s last meeting laid the ground for moderate rate hikes.

- US Dollar consequently weakened across the board against most G8 currencies.

- The Australian Dollar was bolstered by RBNZ’s hawkish commentary and a risk-on impulse.

- AUD/USD is on its way to hitting the inverted head-and-shoulders target at 0.6870.

The Australian Dollar (AUD) extended its gains for three straight days and reclaimed the 0.6700 figure on Thursday, courtesy of the November Federal Reserve minutes, which plunged the US Dollar (USD) against most G8 currencies. Therefore, the AUD/USD is trading at 0.6764, after hitting a daily low of 0.6726, in a light trading session, in observance of the Thanksgiving holiday in the United States (US).

Sentiment remains positive, as shown by European equities finishing in the green. The release of the Federal Reserve Open Market Committee (FOMC) minutes weighed on the US Dollar as officials agreed to slow the pace of rate hikes. Minutes were dovish tilted, as policymakers saw growth risks are skewed to the downside. In fact, Fed officials acknowledged a 50-50 chance of a recession in the United States.

Nevertheless, investors should be aware that policymakers expressed “uncertainty” about how high rates need to go and would be data-dependent. That said, caution is warranted, as the Federal Reserve would continue to increase borrowing costs.

Data-wise, the US economic docket on Wednesday was packed. S&P Global PMIs for November flashed signs of recession, mainly the Manufacturing Index, dropping to 47.6 vs. 50.4 on the previous reading. Later, the Consumer sentiment report released by the University of Michigan (UOM) printed 56.9, showing that Americans remain slightly optimistic about the economy. Inflation expectations were mainly unchanged.

US Initial Jobless Claims for the last week exceeded estimates, showing that the labor market is easing. At the same time, US Durable Good Orders beat forecasts, signaling consumers’ resilience amidst high inflation and higher borrowing costs.

On the Australian side, Covid-19 cases in China would likely keep the Australian Dollar (AUD) contained. However, the AUD was bolstered by hawkish comments by the Reserve Bank of New Zealand (RBNZ), which lifted rates by 75 bps on Wednesday. Investors should remember that the Reserve Bank of Australia (RBA) minutes showed that officials are open to either pausing the tightening cycle or returning to more significant interest rate hikes depending on incoming data.

AUD/USD Price Analysis: Technical outlook

The AUD/USD daily chart shows the major resumed its uptrend, after testing the 50% Fibonacci retracement at 0.6596, on Monday. Once the Australian Dollar buyers reclaimed 0.6700, they briefly tested the November high of 0.6797, which, once cleared, could send the AUD/USD toward the inverted head-and-shoulders chart pattern target of 0.6870. As an alternative scenario, the AUD/USD first support would be 0.6700, followed by the 100-day Exponential Moving Average (EMA) at 0.6687 and the 38.2% Fibonacci level at 0.6644.

- Federal Reserve’s dovish tilted November minutes weighed on the US Dollar and bolstered the Canadian Dollar.

- US S&P Global PMIs dived into a recessionary territory, meaning that the US economy is decelerating fast.

- USD/CAD Price Analysis: Downward biased, eyeing the head-and-shoulders target at 1.3030.

The Canadian Dollar (CAD) continued its advance against the US Dollar (USD), courtesy of several factors, principally the US Federal Reserve (Fed) minutes perceived as slightly dovish, with the board ready to slow the pace of rate hikes. That, alongside a gloomy economic outlook in the United States (US) with PMIs entering the recessionary territory, weighed on the USD. At the time of writing, the USD/CAD is trading at 1.3338, below its opening price by 0.17%

US Dollar remains soft on Fed officials ready to moderate hikes

Sentiment remains upbeat, amidst low volume trading conditions, on the observance of the Thanksgiving holiday in the US. On Wednesday, the Federal Reserve Open Market Committee (FOMC), revealed November’s minutes, which expressed that “A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate,” giving the green light to investors seeking riskier assets. Nevertheless, traders should be aware that policymakers expressed “uncertainty” about how high rates need to go and would be data-dependent.

The same minutes reported that recessionary risks have increased, with odds at a 50% chance that the US economy would tap into a recession, as officials acknowledged that growth risks are skewed to the downside.

Aside from this, a slew of mixed economic data from the United States on Wednesday witnessed the S&P Global PMIs Manufacturing, Services, and Composite Indices for November entered the recessionary territory. Later, the University of Michigan (UOM) Consumer Sentiment remained positive at 56.9, below the preliminary reading but above estimates. Inflation expectations were mainly unchanged.

Earlier, the Initial Jobless Claims for the last week exceeded estimates, showing that the labor market is easing. At the same time, US Durable Good Orders beat forecasts, signaling consumers’ resilience amidst a period of high inflation and higher borrowing costs.

Meanwhile, the US Dollar Index (DXY), a gauge of the buck’s value against a basket of peers, is down b 0.23%, at 105.857, closing to the 200-day Exponential Moving Average (EMA) at 105.272. If the 200-day EMA is broken, that will exacerbate a test of the 100.000 figure.

Shifting our focus towards Canada, Bank of Canada (BoC) Governor Tiff Macklem appeared at the parliament, testifying on the October Monetary Policy Report. Macklem did not comment on anything new. He stressed the need to balance the risk of over and under-tightening. He said that they expect rates to rise further and added that inflation in Canada remains high and broadening, reflecting increases in goods and services prices

USD/CAD Price Analysis: Technical outlook

The USD/CAD resumed its downtrend after testing the head-and-shoulders neckline on Monday, though failure to crack it kept the chart pattern in play. The aftermath of the November Fed minutes release left the USD/CAD trading below 1.3400. Nevertheless, the lack of liquidity due to the US holidays kept the USD/CAD trading sideways. However, the USD/CAD path of least resistance is downwards.

Therefore, the USD/CAD first support is 1.3300. The break below will expose the 100-day Exponential Moving Average (EMA) at 1.3264, followed by 1.3200.

Data due next week includes Eurozone inflation data. Analysts at Wells Fargo expect data to show price growth slowed in November but is still elevated. They see the European Central Bank tightening monetary policy through the end of 2022 and EUR/USD slipping back below parity.

Key Quotes:

“Europe has seen persistent inflationary pressures, and next week, we expect those pressures to still be reflected in November CPI data. To that point, headline inflation is currently 10.7% year-over-year; however, we expect November data to show price growth slowed over the course of the month, but remains elevated. While energy prices have come down and supply chain disruptions have eased, natural gas supply disruptions have kept inflation well above the European Central Bank's (ECB) target range.”

“Policymakers have communicated interest rates are likely to rise in the near future, and while we believe additional tightening is likely, the ECB is unlikely to deliver the amount of tightening priced by financial markets. In that sense, we expect the euro to slip back below parity as markets adjust to a more gradual pace of tightening.”

“Eurozone inflation is likely to remain above the ECB's target for all of 2023, only starting to head on a downward trajectory in a few months' time.”

Ahead of the next US official employment report, due next week, analysts at Wells Fargo, look for job growth to moderate further in November and the subsequent month. They point out that wage data will also be crucial for the Federal Reserve.

Key Quotes:

“Nonfarm payrolls rose 261K in October, topping expectations again. Yet beneath the surface, there were some signs in the data that cracks are emerging in the labor market. Technical factors related to the birth-death model appear to be flattering the headline nonfarm payroll numbers. Employment, as measured by the household survey, fell by 328K in October, and the labor force participation rate again tumbled back to where it was when the year began.”

“We look for job growth to moderate further in November and the subsequent months. Layoffs, according to initial jobless claims and the JOLTS report, remain low, but discharges are only half the net hiring equation. Demand for additional workers appears to be slipping. Job openings, hiring plans, PMI employment sub-components and consumers' views of the labor market have all deteriorated since the spring. Beyond the headline, the average hourly earnings data also will be crucial for Federal Reserve policymakers. It will take more than normalizing supply chains to return inflation to 2%, and slower wage growth is another important piece of the puzzle.”

- US Dollar remains under pressure after FOMC minutes.

- Limited trading activity as Wall Street remains close.

- GBP/USD heads for the highest close in three months.

The GBP/USD rose further during the American session and hit at 1.2152, the highest level since mid-August. It is up rising for the third consecutive day. While the Pound holds to recent gains, the US Dollar is under pressure.

Cable has risen more than 300 pips since Tuesday as the UK leaves behind the chaotic September and October. Price has approached the 200-day Simple Moving Average that stands at 1.2180. The last time the GBP/USD closed above was back in September 2021.

The short-term bias favors the upside although some overbought readings are seen. The 1.2030 zone has become the initial support followed by 1.1960. A sharp correction, could reach the 1.1700 without changing the upside bias.

The US Dollar continues to slide following the FOMC minutes released on Wednesday. Expectations that the US central bank might slow the pace of rate hikes after four 75 basis points hikes weighed on the Greenback and boosted Treasuries. The Fed will likely continue to raise rates as inflation remains elevated and far from the target.

On Thursday, price action is limited on Thanksgiving Day. Wall Street is closed and Friday will see a shortened session.

Technical levels

The average monthly performance of the Euro against the Dollar for the last 20 years shows that the EUR/USD pair has usually risen in December, economists at Société Générale report.

Danger of falling over on an icy sidewalk in January

“The last 20 Decembers have seen EUR/USD rising on 16 occasions, making it the Euro’s best month by some distance. Part of the reason may be that Euro sentiment has been negative more often than not, over that period. The average position in the FX markets market, for example, has been short Euros over that period. This means that there is frequently pressure to cover short Euro positions into the end of the year.”

“January is usually the Euro’s worst month, perhaps because the bearish sentiment doesn’t go away. This year, with a massive Dollar-bullish consensus taking EUR/USD lower, short-covering pressures may be even bigger than usual.”

“The danger is that the conditions for a January EUR/USD wobble are very easy to imagine. US consumers, still supported by strong balance sheets, don’t stop spending, and the Fed is forced to remain hawkish in the New Year. Winter arrives in Europe and concerns about energy supplies grow. Russian missile attacks on Ukraine raise fears of a bloody stalemate. That kind of news after a strong Euro rebound is exactly the kind of icy sidewalk that even a careful currency strategist could fall over on!”

- US Dollar weakened due to the dovish tone of the Federal Reserve’s last meeting minutes.

- US S&P Global PMIs dropped to contractionary territory, a headwind for the USD.

- According to the University of Michigan Consumer Sentiment poll, inflation expectations in the United States remained unchanged.

- Gold Price Analysis: Upward biased, needing to clear $1800 to extend the uptrend.

Gold Price advanced steadily on Thursday amidst thin liquidity conditions courtesy due to the observance of the Thanksgiving holiday in the United States (US), with Wall Street and the bond market closed. Factors like Federal Reserve (Fed) policymakers agreeing to moderate interest-rate increases and a risk-on mood keep the US Dollar (USD) on the defensive. Therefore, XAU/USD is trading at $1756 a troy ounce at the time of writing.

Federal Reserve minutes a headwind for the US Dollar

On Wednesday, the Federal Reserve revealed its latest minutes, which showed that officials are ready to begin hiking rates on smaller sizes after lifting the Federal Funds rate (FFR) by 75 bps four times in 2022. Even though the minutes are slightly dovish, investors should know that Federal Reserve officials are uncertain how high rates will end, with most policymakers expressing that 5% could be the peak for some participants.

US S&P Global PMI tumbled to recessionary territory, triggering USD weakness

On Wednesday, S&P Global PMIs revealed for the United States showed that the economy is slowing faster than expected, with Manufacturing, Services, and Composite Indices lying in contractionary territory. Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said that “business conditions across the US worsened in November” and added that “according to the preliminary PMI survey findings, with output and demand falling at increased rates, consistent with the economy contracting at an annualized rate of 1%.”

US consumer sentiment remained positive

At the same time, the University of Michigan (UOM) Consumer Sentiment for November, on its final reading, came at 56.9, above expectations but below the 59.9 preliminary reading. The same report updated American expectations for inflation, with one-year estimated to rise hit 4.9%, while the 5-10 year estimates remained unchanged at 3%.

Mixed US economic data pressured the US Dollar

Earlier, the US economic docket featured Initial Jobless Claims for the last week, which jumped above expectations, flashing that the labor market is easing. At the same time, US Durable Good Orders for October rose sharply by 1% MoM, against 0.4% estimates, as consumers’ resilience kept manufacturing activity from slowing down.

Aside from this, US Treasury yields extended their losses, with the 10-year T-bond yield dropping six bps, down to 3.70%, a tailwind for the Gold price, undermining the USD. Meanwhile, the US Dollar Index (DXY), a gauge of the buck’s value against a basket of rivals, stumbles 0.36%, at 105.705.

Gold Price Analysis (XAU/USD): Technical outlook

From a daily chart perspective, XAU/USD is neutral-upward biased. However, Gold stays below the “trendsetter” 200-day Exponential Moving Average (EMA), used as confirmation for bullish/bearish bias in the long term. So if XAU buyers want to regain control, they need to clear $1800, so they can pose a threat to send XAU/USD rallying towards the June 17 swing high at $1857 ahead of the psychological $1900 figure. Otherwise, the XAU/USD will be exposed to selling pressure, opening the door for a fall to the 100-day EMA at $1711.51, ahead of the $1700 mark.

The US Dollar Index is close to testing the recent intra-day low from 15th November at 105.34. However, economists at MUFG believe that the USD sell-off does not have too much further to go.

FOMC minutes fail to provide conviction for higher terminal rate

“The release of the FOMC minutes last night in our view failed to provide enough conviction to the belief expressed by Fed Chair Powell that the terminal rate for the fed funds would need to be higher than the September media dot implied (4.625%).”

“The US Dollar will remain vulnerable to speculation of an end to the tightening cycle. The 2s10s continues to invert and is indicative of a growing belief that inflation risks are receding but with the Fed not in a position to pause. But the escalation of covid infections to record high levels in China and recession in Europe also mean there are limits to the scale of USD selling that should mean this long Dollar squeeze does not have too much further to go.”

Bank of England (BOE) policymaker Catherine Mann said on Thursday that price and wage dynamics in the UK were not consistent with the 2% inflation target but noted that they were not observing a wage-price spiral, as reported by Reuters.

"The BOE has communicated effectively that rates need to rise and that market expectations before the November meeting were too high," Mann added.

Market reaction

GBP/USD preserves its bullish momentum and trades near 1.2150 after these comments, rising 0.8% on a daily basis.

Brent Oil dropped 3.4% on Wednesday. A break under the September low of $84.06 would intensify downside pressure, strategists at MUFG Bank report.

Lower oil prices alleviate the negative terms of trade shock on EUR, GBP and JPY

“Weak growth is a possible factor but in addition, the speculation of a Saudi-led push for a production increase could still be weighing on crude oil prices.”

“Lower crude oil prices and still low natural gas prices alleviate considerably the negative terms of trade shock on the Euro, Pound and Japanese Yen.”

“A close in Brent below the September low of $84.06 would be a technically bearish signal.”

- Japanese yen among top performs on Thursday amid lower bond yields.

- US Dollar still affected by the FOMC minutes.

- USD/JPY is about to post the lowest daily close in almost three months.

The USD/JPY is hovering around 138.15/20, holding a bearish tone on the back of a weaker Dollar but also amid a stronger Japanese yen. The pair bottomed at 138.04, the lowest since November 15, before bouncing modestly to the upside.

As long as USD/JPY remains under 138.50, more losses seem likely. The immediate support is the 138.00 zone followed then by the November low at 137.65. The pair is on its way toward the lowest daily close since August 26, another bearish sign.

Dollar under pressure

The US Dollar has been under pressure since Wednesday. The FOMC minutes added to the negative tone. Expectations that the Fed might slow the pace of interest rate hikes as soon as the next meeting, December 13/14 weighed on the Dollar and boosted Treasuries. The US 10-year yield fell to as low as 3.68% approaching the monthly low. The DXY is falling by 0.35%, trading at 105.75, headed toward the lowest daily close since mid-August.

The decline in bond yields boosted the Japanese yen across the board. The currency is among the top performers on a quiet session. Wall Street is closed due to a holyday in the US (Thanksgiving Day).

No economic data is due in the US for the rest of the week. In Japan, on Friday, the Tokio Consumer Price Index will be released. It will be a shortened session in Wall Street that will resume normal activity on Monday.

Technical levels

GBP/USD extends gains through the 1.20 area. Economists at Scotiabank expect Cable to test the 1.22/1.23 region.

Resistance at 1.2050/00 turns into support

“Solid intraday trends are backing up a positive longer-term technical picture for the GBP.”

“Clear and sustained Cable gains through the 1.2000/50 zone this week put the Pound on course for an extension higher to test the 1.22/1.23 area.”

“The GBP’s 200-day MA stands at 1.2192 and figures as important resistance for the next few days ahead.”

“Support is 1.2000/50, former resistance.”

- EUR/USD rises for the third session in a row and trespasses 1.0400.

- Further gains could challenge the monthly peak around 1.0480.

EUR/USD flirts with the multi-month resistance line around 1.0450 amidst the continuation of the upside momentum on Thursday.

A close above the key 200-day Simple Moving Average, today at 1.0391, is needed to shift the pair’s outlook to positive and thus allow for extra gains to potentially visit the November high at 1.0481 (November 15).

Above the latter, the pair could aim for a move to the round level at 1.0500.

EUR/USD daily chart

- The index succumbs to the selling pressure and breaches 106.00.

- A deeper pullback opens the door to the November low near 105.30.

DXY keeps the downtrend well and sound in the second half of the week, this time dropping well south of the 106.00 support.

In case the selling pressure accelerates, the dollar could shed further ground and dispute the November low at 105.34 (November 15). This area of contention appears underpinned by the proximity of the always relevant 200-day SMA, today at 105.27

While above the 200-day SMA, the outlook for the index should remain constructive.

DXY daily chart

USD/CAD peeled off steadily yesterday, losing around 90 pips into the close to retest the low-1.33s. A dip below here would open up the room for further losses, economists at Scotiabank report.

Intraday charts reflect firm USD selling pressure

“Spot’s turn lower from Monday’s high/retest of the head and shoulders breakdown at 1.3495 looks a little more emphatic now, with steady losses pushing the USD back to the low 1.33s.”

“Intraday charts reflect firm USD selling pressure on USD gains above 1.34 yesterday and we look for better selling pressure on modest gains to curb the USD today and perhaps into tomorrow.”

- EUR/JPY adds to the corrective downside and breaches 144.00.

- The continuation of the leg lower could revisit 142.50.

EUR/JPY corrects further south and briefly tests the 143.60 region on Thursday, or multi-session lows.

The cross reversed the strong rebound soon after trespassing the 146.00 mark on Wednesday and sparked quite a marked reversal. That said, further weakness could now motivate EUR/JPY to slip back to the November low at 142.54 (November 11) sooner rather than later.

In the longer run, while above the key 200-day SMA at 138.68, the positive outlook is expected to remain unchanged.

EUR/JPY daily chart

Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group see USD/CNH keeping the side-lined trading between 7.0600 and 7.2100 for the time being.

Key Quotes

24-hour view: “Our view for USD to weaken yesterday was incorrect as it soared to a high of 7.1837 before quickly falling back down. The sharp but short-lived swings have resulted in a mixed outlook. We expect USD to trade between 7.1200 and 7.1650 today.”

Next 1-3 weeks: “We continue to hold the same view as from last Friday (18 Nov, spot at 7.1460) where USD has likely moved into a consolidation phase. We expect USD to trade sideways for now, likely to be between 7.0600 and 7.2100.”

Steady gains in the EUR/USD since Tuesday leave the pair trading relatively firmly. Economists at Scotiabank note that EUR/USD is on the cusp of a further push higher.

EUR/USD nears 200-Day Moving Average test

“Short-term trading patterns are positive, with the EUR gaining steadily from its early week low and accelerating higher yesterday after regaining the 1.03 zone.”

“EUR/USD is on the cusp of retesting the mid-Nov high (1.0479) on the short-term chart and we continue to think that gains should extend to the low 1.05 (retracement resistance point) following the break above long term trend resistance. More significant, however, is the fact that the EUR is poised to regain (conclusively) its 200DMA, which it last saw in Jun 2021. Pushing through this benchmark would be hugely supportive from a market point of view.”

European Central Bank (ECB) Governing Council member Isabel Schnabel said on Thursday that they will probably need to raise interest rates further into restrictive territory, as reported by Reuters.

Key takeaways

"In the current environment, there is a risk that monetary and fiscal policies may pull in opposite directions."

"We continue to stand ready to counter fragmentation in financial markets that is not justified."

"Incoming data so far suggest that the room for slowing down the pace of interest rate adjustments remains limited."

"The new macroeconomic environment requires a different mix of monetary and fiscal policies."

"The largest risk for central banks remains a policy that is falsely calibrated on the assumption of a fast decline in inflation."

Market reaction

These comments failed to trigger a noticeable market reaction and EUR/USD was last seen trading at 1.0410, where it was up 0.15% on the day.

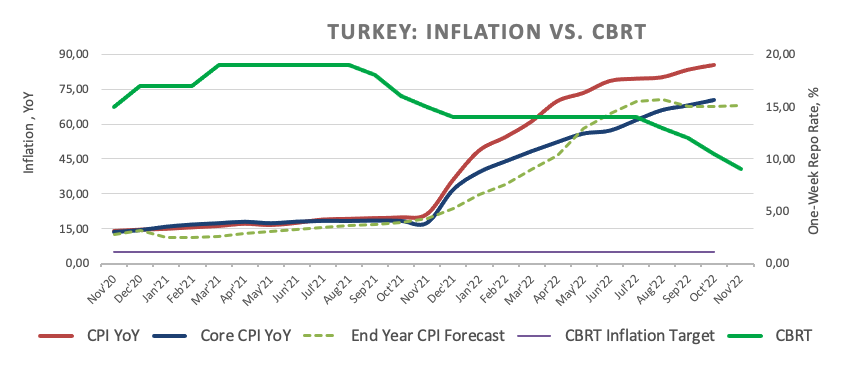

USD/TRY remains stuck in a narrow range at around 18.60. Economists at TD Securities expect the pair to jump toward to 27 by the first quarter of 2023.

CBRT ends easing with a final cut

“The CBRT cut the policy repo by 150 bps to 9.00%, in line with our forecasts and the consensus. With rates achieving 'single-digit' levels, the CBRT has called the end of easing.”

“Today's decision cuts ex-ante real rates further to -76.5%. While inflation is likely to be at or close to the peak, monetary policy in Turkey will remain excessively expansionary for the foreseeable future.This suggests persistent inflationary and negative currency pressures.”

“We still expect USD/TRY to blow up to around 27 (from 18.63) in Q1 2023. We also expect rates to be hiked in emergency mode next year, with a likely peak of around 40%.”

The accounts of the European Central Bank's (ECB) October policy meeting revealed on Thursday that a few members of the Governing Council expressed a preference for increasing the policy rate by 50 basis points (bps) rather than 75, per Reuters.

Additional takeaways

"The view was widely shared that the inflation outlook continued to worsen."

"These developments indicated an increasing risk that inflation might become entrenched."

"ECB now needed to show equal determination when inflation was above the target, countering far too high inflation and preventing it from becoming entrenched, irrespective of a deteriorating outlook."

"Wage growth was accelerating, it could still be considered moderate."

"Weakening in economic activity would not suffice to curb inflation to a significant extent."

"Governing Council should continue normalising and tightening monetary policy, whereas it might want to pause if there was a prolonged and deep recession."

"Although wage growth was accelerating, it could still be considered moderate."

"75 basis points hike was supported by a very large majority."

"It was noted that market participants were pricing in an increase of this size."

Market reaction

The ECB's publication failed to trigger a noticeable market reaction and EUR/USD was last seen trading sideways at around 1.0400.

EUR/SEK broke out above a multi-month trend line resulting in a move towards 11.10 in October. Economists at Société Générale expect the pair to advance nicely towards 11.10, then 11.26.

Upward momentum prevails

“Currently a phase of pullback is underway however the pair has so far successfully defended that support line at 10.68/10.63.”

“Daily MACD has entered positive territory denoting prevalence of upward momentum.”

“Holding above 10.68/10.63, the up move could persist gradually towards 11.10 and projections of 11.26.”

See – EUR/SEK: Krona to weaken over the coming quarters – Danske Bank

- USD/TRY reverses the recent weakness after the CBRT move.

- The central bank cut the interest rate by 150 bps, as expected.

- The CBRT said that the easing cycle is now terminated.

The Turkish lira gives away some of its previous gains and prompts USD/TRY to advance to the 18.6300 region on Thursday.

USD/TRY up on CBRT rate cut

USD/TRY sets aside two daily pullbacks in a row and regains upside momentum on the back of the resumption of the bearish note around the Turkish lira.

Indeed, sellers put the lira under pressure after the Turkish central bank (CBRT) cut the One-Week Repo Rate by 150 bps to 9.00% at Thursday’s event, matching estimates.

The central bank announced that the easing cycle that started back in August is now over. It is worth recalling that the CBRT reduced the policy rate from 14.00% in July to 9.00% in November, fulfilling President Erdogan’s pledge of having single-digits interest rate by end of the year.

There were no changes to the CBRT’s statement, which still contemplates the inflation target at 5%.

On the latter, consumer prices tracked by the headline CPI rose more than 85% in the year to October and the government expects it to recede to around 65% by year end.

Earlier in the calendar, Capacity Utilization in Türkiye eased to 75.9% in November and the Manufacturing Confidence receded to 97.9 in the same month.

What to look for around TRY

USD/TRY remains side-lined above/around the 18.6000 region amidst omnipresent intervention in the FX markets.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating and real interest rates remain entrenched well in the negative territory

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth via transforming the current account deficit into surplus, always following a lower-interest-rate recipe.

Key events in Türkiye this week: Capacity Utilization, Manufacturing Confidence, CBRT Interest Rate Decision (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.13% at 18.6262 and faces the next hurdle at 18.6503 (all-time high November 3) followed by 19.00 (round level). On the downside, a break below 18.3642 (monthly low November 7) would expose 18.2077 (100-day SMA) and finally 17.8590 (weekly low August 17).

European currencies are strengthening amid a favourable backdrop. Nonetheless, economists at ING do not expect a smooth ride as energy prices are set to rise.

Enjoying an ideal mix for now

“European currencies are enjoying a strong rally, as lower energy prices (crude was hit by the EU oil price cap proposal) and higher-than-expected PMIs yesterday had already offered some support to European sentiment before the Fed delivered some dovish minutes.”

“We remain doubtful that it will be a smooth ride to recovery for European currencies, and our commodities team continues to see upside risks for energy prices into the new year despite recent developments.”

Further downside could drag USD/JPY to retest the 137.70 region in the next few weeks, note Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “While we expected a lower USD yesterday, we did not expect a break of the strong support at 140.30. However, USD cracked 140.30 and plunged to a low of 139.15. Impulsive downward momentum indicates further decline. The level to watch is at 138.50, followed by 137.70. The latter level is unlikely to come into view today. Resistance is at 139.80, followed by 140.30.”

Next 1-3 weeks: “After USD soared above 142.00, we indicated on Tuesday (22 Nov, spot at 141.80) that upward momentum is building. However, we were of the view that USD has to break and hold above 142.50 before further gains are likely. USD did not challenge 142.50 but instead, dropped below our ‘strong support’ level of 140.30 yesterday. The sharp and swift drop has shifted the risk to the downside towards 137.70. On the upside, the ‘strong resistance’ at 140.80 is likely to come under challenge, at least for the next 1 to 2 days.”

EUR/USD is gaining traction above the 200-Day Moving Average (DMA) at 1.0393. Analysts at Société Générale expect the pair to target 1.0630/90 on a move above the 1.0480 mark.

Weekly low at 1.0220 provides support

“EUR/USD is attempting a break beyond the 200DMA denoting possibility of continuation in bounce.”

“Beyond 1.0480, next potential hurdles are at projections of 1.0570 and 1.0630/1.0690.”

“The low formed this week at 1.0220 is near term support.”

See: EUR/USD may extend its rally to 1.0500/1.0550 in the near term – ING

NZD/USD closed above 0.62 for the first time since 25 August. Economists at DBS Bank expect the pair to struggle at the 0.6270 resistance.

RBNZ says overnight cash rate needs to hit 5.5%

“The Reserve Bank of New Zealand delivered the 75 bps hike expected by consensus. With the official cash rate at 4.25% and above the 4.1% terminal rate projected in August, the RBNZ now sees more hikes to 5.5% in 2023.”

“Unlike the US, inflation has yet to show signs of peaking in New Zealand. RBNZ reckoned CPI inflation could rise further to 7.5% over the next couple of quarters from 7.2% in September. RBNZ also played down the 11.5% fall in house prices from its November 2021 peak, citing the 15% rise in household wealth since end-2020. However, the central bank did not mind a recession to return inflation to its 1-3% target.”

“Kiwi may find resistance at its 50% Fibonacci retracement level of around 0.6270.”

USD/ZAR has broken below 17.00. Economists at Société Générale expect the pair to trend lower toward 15.00 over the coming months.

An initial rebound is expected

“An initial rebound is expected however the channel limit at 17.27 and recent pivot high of 17.55 are likely to be near term hurdles.”

“Failure to hold 16.85 can extend the decline towards 16.65 and perhaps even towards the 200-Day Moving Average near 16.40/16.35. This could be a crucial support zone.”

“We see the Rand strengthening towards 15.00/USD over the next 12 months.”

Riksbank has hiked by 75 basis points as expected. However, economists at Danske Bank expect the Swedish Krona to weaken in the coming months.

Slightly dovish tilt

“The 75 bps hike to 2.50% and a the slightly higher rate path was bang in line Overview of macro forecasts with our expectations. They will also end QE reinvestments as of year-end. The revised rate path is still somewhat shy of market expectations, and hence somewhat dovish.”

“The initial reaction is for a somewhat weaker SEK, which seems warranted given the slightly dovish rate path (compared to market pricing).”

“We don’t see anything in either monetary policy or the Riksbank’s communication here and now that changes the outlook for the SEK over the coming quarters, where we expect a further weakening.”

European Central Bank (ECB) Governing Council member Gabriel Makhlouf said on Thursday that “housing markets across the world responding to rising interest rates, early indications of reduced demand.”

Further comments

“Vulnerabilities accumulated during the period of low rates means the full impact of shocks are hard to foresee.”

“Undoubtedly risks of further asset price falls, potential episodes of market disruption as we tackle inflation.”

Market reaction

EUR/USD is clinging to gains above 1.0400, currently trading at 1.0425, 0.30% higher on the day.

- EUR/USD picks up pace and surpasses the 1.0400 barrier.

- The dollar remains offered following Wednesday’s FOMC Minutes

- German IFO Business Climate surprised to the upside in November.

The optimism around the European currency remains on the rise and now lifts EUR/USD back above the 1.0400 hurdle, or new multi-day highs.

EUR/USD up on weaker dollar, positive data

EUR/USD now advances for the third session in a row and flirts with the multi-month resistance line near 1.0450, just ahead of the November highs around 1.0480.

The combination of the weaker note in the greenback - which was exacerbated following the release of the FOMC Minutes on Wednesday – and the inactivity in the US markets due to the Thanksgiving Day holiday all collaborates with the upbeat sentiment in the risk complex and underpins the upside bias in spot.

Also adding to the pair’s uptick, the German Business Climate tracked by the IFO Institute improved to 86.3 in November (from 84.5). Later in the session, the ECB will publish its Accounts of the last event seconded by speeches by Board members De Guindos, Schnabel and Enria.

What to look for around EUR

EUR/USD trades on a firm note and manages to break above the 1.0400 barrier, as the dollar remains offered and the appetite for the risk assets looks firmer.

In the meantime, the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. In addition, markets repricing of a potential pivot in the Fed’s policy remains the exclusive driver of the pair’s price action for the time being.

Back to the euro area, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: Germany Final Q3 GDP Growth Rate, GfK Consumer Confidence (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.29% at 1.0425 and faces the next up barrier at 1.0481 (monthly high November 15) ahead of 1.0500 (round level) and finally 1.0614 (weekly high June 27). On the flip side, a breach of 1.0222 (weekly low November 21) would target 1.0026 (100-day SMA) en route to 0.9935 (low November 10).

The dovish tone seen in the FOMC Minutes weighed on the US Dollar. Economists at Commerzbank expect the EUR/USD to trade between 1.04 and 1.05.

Dollar under pressure again

“It should have been clear to many since the last Fed meeting at the beginning of November and the US inflation figures for October that the Fed would shift down a gear at some point with regard to the pace of interest rate hikes. But clearly many seemed to need the reminder from the Fed minutes to bring that back to mind. But perhaps some also got cold feet about entering the long Thanksgiving weekend in the US with a ‘too strong’ USD.”

“Obviously, the new comfort level (i.e. the new equilibrium price for the USD) is more likely to be between 1.04 and 1.05 against the backdrop of smaller Fed rate hikes in the near future. Which is why the Dollar's brief rally is already over.”

Germany’s central bank, the Bundesbank, said in a statement on Thursday, “macro-financial environment has deteriorated substantially and major downside risks remain.“

Additional takeaways

There are no signs of a severe slump in real estate prices or of overvaluations receding.

No need to release countercyclical buffers.

Energy crisis, a sharp economic slump and abruptly rising market rates could put the German financial system under pressure.

Rising costs raise future credit risk.

Related reads

- German IFO Business Climate Index improves to 86.3 in November vs. 85.0 expected

- EUR/USD Forecast: 1.0450 aligns as next hurdle for Euro

In light of the recent price action, AUD/USD is now poised to extra gains to the 0.6800 region, comment Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “The strong surge in AUD yesterday came as a surprise (we were expecting AUD to range trade). The overbought rally has room to extend but a clear break of 0.6800 is unlikely today. It is worth noting there is another resistance at 0.6770. On the downside, a breach of 0.6680 (minor support is at 0.6715) would indicate that AUD is not advancing further.”

Next 1-3 weeks: “Two days ago (22 Nov, spot at 0.6605), we highlighted that AUD is under mild downward pressure. However, we noted that it has to break and stay below 0.6570 before further decline is likely. Yesterday (23 Nov), AUD took out our ‘strong resistance’ level of 0.6690 as it surged to a high of 0.6739. The rapid rise has shifted the risk to the upside towards 0.6800. Overall, only a break of 0.6645 would indicate that the upside risk has faded.”

Bank of England (BoE) Deputy Governor Dave Ramsden said in a scheduled appearance on Thursday, “my bias is towards further tightening, but depends on the economy.”

Additional quotes

I am acutely conscious that our actions are adding to the difficulties caused to households by the current situation.

MPC must take the necessarysteps in terms of monetary policy to return inflation to achieve the 2%.

I favor a watchful and responsive approach to setting policy.

Although my bias is towards further tightening, if the economy develops differently to then i would consider the case for reducing bank rate.

Market reaction

The Pound Sterling is little moved on the BOE policymaker’s remarks, keeping its range at around 1.2075, still up 0.18% on a daily basis.

The US Dollar Index (DXY) stays on the back foot and continues to edge lower despite thin holiday trading. However, economists at ING do not expect DXY to trade sustainably under the 105 level.

USD embedding a good deal of Fed-related negatives now

“The degree of cautiousness manifested by Fed officials after the softer CPI figures means that markets may be reluctant to further revise their peak rate bets lower in the near term. This means that one-way traffic in FX, with the Dollar staying on a downtrend for longer, still appears unlikely.”

“The greenback has now absorbed a good deal of negatives when it comes to the Fed story, and in our view can still benefit from the deteriorating outlook outside of the US (especially in Europe and China) in the coming months.”

“While we don’t exclude the Dollar contraction to take DXY below 105.00, we struggle to see sub-105 levels holding for very long.”

- GBP/USD kicks off the week on the wrong footing amid resurgent US Dollar demand.

- Risk aversion weighs negatively on the Pound Sterling ahead of BoE-speak.

- GBP/USD buyers stay hopeful amid bullish RSI, eyes on 1.2128 rising wedge hurdle.

GBP/USD is consolidating the upside below 1.2100, having failed to sustain above the latter earlier in the Asian session this Thursday. The strength in the major can be mainly attributed to the broad-based weakness in the US Dollar following the dovish FOMC minutes and downbeat US S&P Global PMIs.

The greenback has failed to capitalize on a cautious market mood, courtesy of the record high covid cases in China and the resultant restrictions. The subdued trading on Thanksgiving Day is also adding to the weight on the US Dollar while keeping GBP/USD afloat.

The upside in the pair, however, appears capped on account of looming Brexit concerns. UK Prime Minister Rishi Sunak said that Britain will not pursue any post-Brexit relationship with the EU "that relies on alignment with EU laws”.

Looking forward, thin market conditions could exaggerate the moves in GBP/USD pair while traders will also closely follow the speeches from the Bank of England (BoE) policymakers in the day ahead.

From a short-term technical perspective, GBP/USD is gathering strength to clear out the critical resistance near 1.2200, which is the convergence of the rising wedge upper boundary and the bearish 21-Daily Moving Average (DMA).

The 14-day Relative Strength Index (RSI) has turned flat while above the midline, justifying the listless action in the pair, at the moment. Although bulls stay hopeful so long as the RSI holds above the 50.00 level.

Acceptance above the aforesaid key resistance will initiate a solid uptrend towards the 1.2250 psychological level.

GBP/USD: Daily chart

On the flip side, bears need a sustained move below the 1.2050 support area to negate the upbeat momentum. The downside will then open up toward the lower boundary of the rising wedge at 1.1784.

The next relevant cushion is seen at the confluence of the 21 and 100-Daily Moving Averages (DMA) at around 1.1660.

GBP/USD: Additional technical levels

EUR/USD has broken above 1.0400. The cuurency pair could extend its race higher to the 1.0500/50 area in the near term, in the opinion of analysts at ING.

Return towards parity likely in December

“EUR/USD may extend its rally to 1.0500/1.0550 in the near term, but we suspect the bullish trend may start to run out of steam as we approach year-end.”

“A return towards parity remains our base case for December.”

See: EUR/USD to see small fluctuations around the 1.03 level – Commerzbank

Following the release of the German IFO Business Survey, the institute’s Economist Klaus Wohlrabe said that “the German economy is sending signals of hope.”

Additional quotes

59.3% of companies surveyed complained about supply bottlenecks in November vs 63.8% in October.

46.8% of companies surveyed want to raise prices in the coming three months, pressure to increase prices is sinking continuously.

Industry export expectations rose just into positive territory.

Retailers and hospitality sectors showing small signs of hope, state support helps.

- EUR/USD may extend its rally to 1.0500/1.0550 in the near term – ING

- German IFO Business Climate Index came in at 86.3 in November.

- IFO Current Economic Assessment for Germany rose to 93.1 this month.

- November German IFO Expectations Index arrived at 80.0, beating estimates.

The headline German IFO Business Climate Index climbed to 86.3 in November versus the previous reading of 84.5 and the market consensus of 85.0.

Meanwhile, the Current Economic Assessment improved to 93.1 points in the reported month when compared to October's 84.2 and 93.8 expected.

The IFO Expectations Index – indicating firms’ projections for the next six months, rose to 80.0 in November from the last month’s 75.9 and against the estimates of 77.0.

Market reaction

EUR/USD shrugs off the upbeat German IFO survey. At the time of writing, the pair is trading at 1.0412, up 0.19% on the day.

About German IFO

The headline IFO business climate index was rebased and recalibrated in April after the IFO Research Institute changed the series from the base year of 2000 to the base year of 2005 as of May 2011 and then changed the series to include services as of April 2018. The survey now includes 9,000 monthly survey responses from firms in the manufacturing, service sector, trade and construction.

- The index adds to the weekly pullback and breaches 106.00.

- US markets will be closed due to the Thanksgiving Day holiday.

- The dollar remains depressed following FOMC Minutes.

The greenback loses ground for the third session in a row and breaks below the 106.00 support when gauged by the USD Index (DXY).

USD Index looks offered post-Minutes

The index trades in multi-day lows in the sub-106.00 zone amidst the tenacious improvement in the risk-associated universe and already approaches the November low near 105.30, just ahead of the critical 200-day SMA, today at 105.27.

In the meantime, the dollar remains offered in the current post-FOMC Minutes context, where participants agreed that a slower pace of future interest rate hikes could be appropriate to better assess the progress of the ongoing normalization of the Fed’s monetary conditions.

It is worth recalling, however, that FOMC members still see the ultimate level of the interest rates higher than previously thought.

What to look for around USD

The dollar extends the pronounced drop from Monday’s peaks around the108.00 barrier and already trades in the area below the 106.00 yardstick pari passu with the persistent recovery in the risk-linked galaxy.

While hawkish Fedspeak maintains the Fed’s pivot narrative in the freezer, upcoming results in US fundamentals would likely play a key role in determining the chances of a slower pace of the Fed’s normalization process in the short term.

Key events in the US this week: Thanksgiving Day holiday (Thursday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels