- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-11-2022

- WTI remains pressured around the monthly low, extends Friday’s losses.

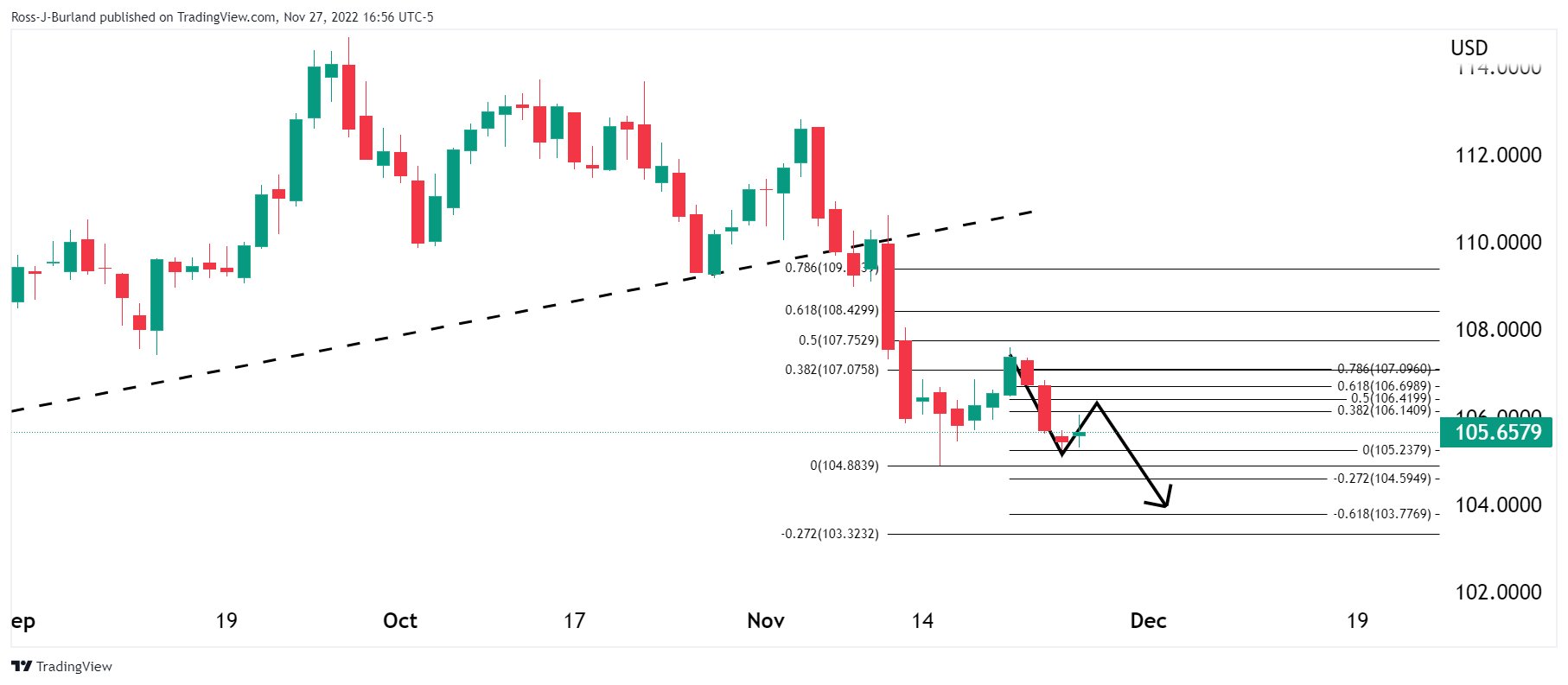

- Six-week-old descending trend line can test the bears on the way to sub-$70.00 area.

- Double top confirmation adds strength to the bearish bias.

- Buyers need to cross $81.30 to retake control.

WTI crude oil price stays depressed as it flirts with $76.00 during early Monday. In doing so, the black gold drops for the second consecutive day while highlighting mid-November’s confirmation of the double-top bearish chart pattern.

Even so, the nearly oversold Relative Strength Index (RSI), placed at 14, highlights a downward-sloping support line from October 18, close to $74.30, as immediate key support.

Following that, a south-run towards the theoretical target for the “Double Top” confirmation, near $69.80, can’t be ruled out. It’s worth noting that the $70.00 round figure may act as a buffer during the anticipated fall.

On the flip side, recovery moves may initially need to cross a two-week-old resistance line near $79.60 to convince the short-term buyers.

However, a horizontal line around $81.30 appears crucial for WTI crude oil buyers as it holds the key to their conviction.

WTI: Four-hour chart

Trend: Bearish

Reserve Bank of Australia's governor, Philip Lowe expects rising rental pressure over the next year and he worries about the housing supply as the population grows. He said demand is too strong relative to supply.

Additional comments

Fiscal settings not noticeably impacting monetary policy.

Unsure about the labour market, price response to supply shock.We have better chance than many of pulling off an economic soft landing.

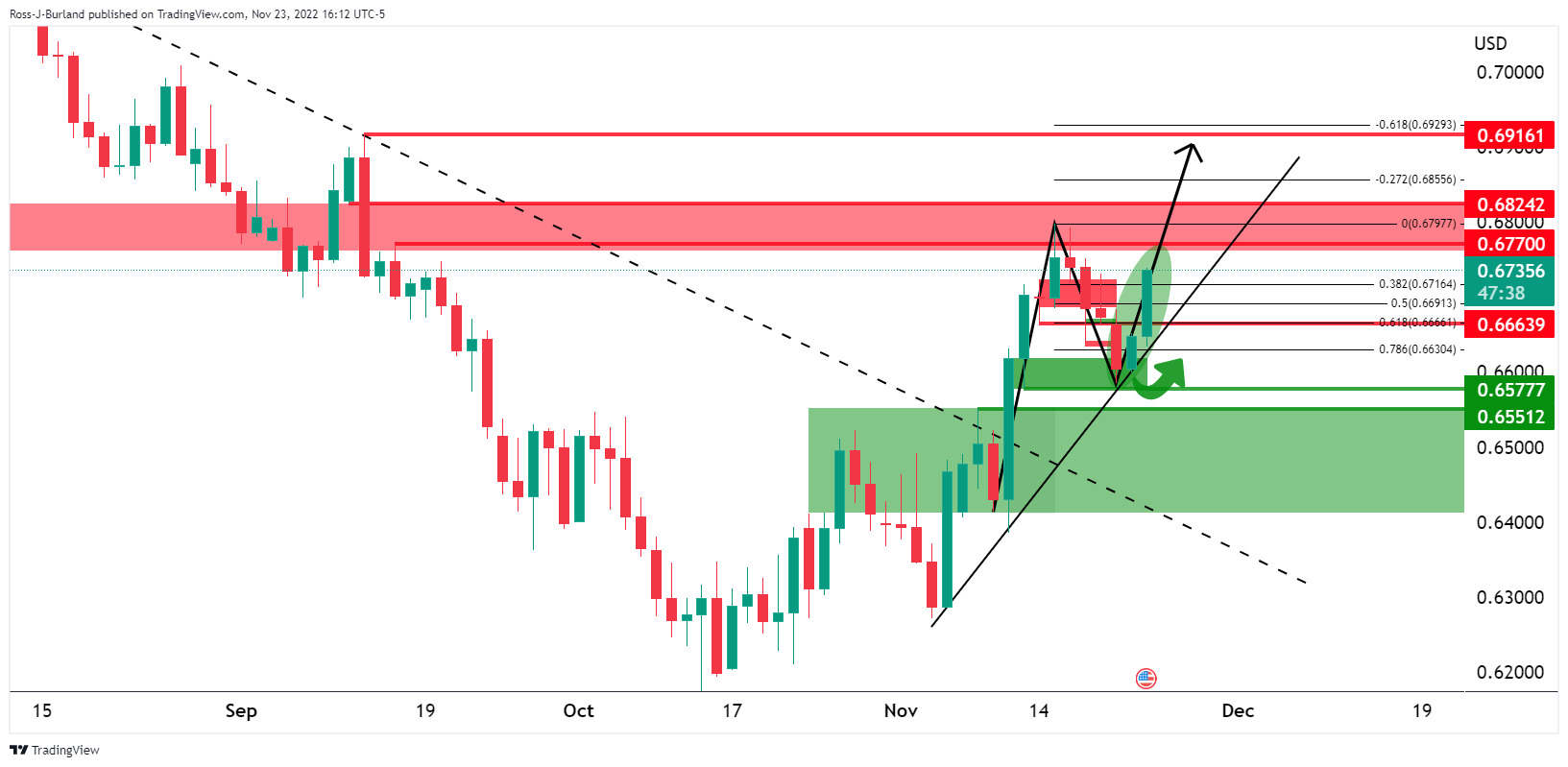

AUD/USD update

The bulls need to commit at the 0.6700 area following failures at 4-hour resistance near the neckline of the M-formation.

Retail Sales Overview

Early Monday in the Asia-Pacific region, the market sees preliminary readings of Australia's seasonally adjusted Retail Sales for October month at 00:30 GMT. Market consensus suggests a softer MoM print of 0.6%, suggesting the lack of sustained improvement in economic activity.

Given the recently mixed Aussie data and the Reserve Bank of Australia’s (RBA) cautious mood, not to forget the challenges to sentiment from China, today’s Aussie Retail Sales appear the key for the AUD/USD traders.

In his latest comments, RBA Governor Philip Lowe mentioned that demand is too strong in comparison to supply.

Ahead of the data, Westpac said,

Australia October retail sales should begin to exhibit a clearer impact from interest rate rises, though it will likely be mild (Westpac forecast: 0.2%).

How could it affect AUD/USD?

AUD/USD remains pressured towards 0.6700 after beginning the week’s trading with a downside gap, holds lower ground near 0.6720 by the press time. Covid and political fears emanating from China appear to exert downside pressure on the Aussie pair as of late.

That said, the likely easy economics from Australia may add losses to the AUD/USD prices amid recently sluggish comments from RBA officials. The pair’s downside, however, appears limited as traders may wait for Friday’s speech of RBA Governor Philip Lowe and the US jobs report for clear directions. Even so, the risk-aversion wave may join the Aussie Retail Sales to please the intraday sellers if the outcome is softer.

Technically, a convergence of the 100-Day Moving Average (DMA) and an upward-sloping support line from November 04, around 0.6690, restricts the short-term AUD/USD downside.

Key Notes

AUD/USD slides towards 0.6700 on China Covid concerns, Aussie Retail Sales eyed

AUD/USD Price Analysis: Bulls could be tested at 0.6750 resistance

About Australian Retail Sales

The Retail Sales released by the Australian Bureau of Statistics is a survey of goods sold by retailers based on a sampling of retail stores of different types and sizes and it's considered an indicator of the pace of the Australian economy. It shows the performance of the retail sector over the short and mid-term. Positive economic growth anticipates bullish trends for the AUD, while a low reading is seen as negative or bearish.

- USD/CHF is marching towards 0.9500 as China’s anti-Covid restrictions protest hits the risk aversion theme.

- The 10-year US Treasury yields are failing to cross 3.70% as the Fed is expected to halt the 75 bps rate hike culture.

- An unchanged US GDP data may not delight the Fed policymakers.

The USD/CHF pair has attempted a recovery after dropping to near the crucial support of 0.9440 in the early Asian session. The attempted recovery seems to have some wings as rising protests from individuals against anti-Covid locking measures have triggered the risk aversion theme in the global market.

The asset has advanced near 0.9480, at the time of writing, and is expected to remain in the grip of bulls as the US Dollar index (DXY) is showing some strength. The USD Index has accelerated to near 106.23 and is aiming to test a two-day high at 106.42. Road protests toward Covid-19 curbs by households in China have triggered a risk of a severe decline in economic prospects, which has improved the appeal for safe-haven assets.

The 10-year US Treasury yields are still below 3.70% as the Federal Reserve (Fed) is looking to halt the bigger rate hike culture to reduce financial risks and to observe the progress made by efforts from Fed policymakers till now.

Going forward, the preliminary United States Gross Domestic Product (GDP) data will be crucial for further guidance. The economic data for the third quarter is seen as stable at 2.6%. This might keep reins in the US Dollar but won’t Fed chair Jerome Powell in his mission of achieving price stability. Sustainability in growth rates despite strict policy measures indicates that retail demand is robust, which won’t let inflation come down as required.

On the Swiss franc front, investors are also awaiting Tuesday’s GDP data. On a quarterly basis, the economic data is seen unchanged at 0.3%. While, on an annual basis, the growth rates are expected to decline to 1.0% vs. the prior release of 2.8%.

- EUR/USD begins the week’s trading with a downside gap.

- Concerns surrounding Russian oil price cap, China’s Covid conditions weigh on the prices.

- ECB’s Makhlouf teases smaller interest rate hikes in 2023.

- Risk catalysts are the key ahead of inflation numbers, Fed Chair Powell’s speech and the US jobs report.

EUR/USD remains pressured around 1.0380, after beginning the week’s trading with a downside gap, as the risk-off mood underpins the US Dollar’s demand during Monday’s Asian session. Also likely to have weighed on the quote could be the downbeat comments from European Central Bank Governing Council Member Gabriel Makhlouf, as well as anxiety ahead of the key Eurozone inflation data and the US Nonfarm Payrolls (NFP) for November.

“The European Central Bank will likely increase interest rates by smaller increments next year if further hikes are needed,” said ECB’s Makhlouf on Sunday, per Reuters. The Irish central bank Chief Mokhlouf also added that he thinks by the second half of next year we'll see it (inflation) lower.

Elsewhere, Coronavirus fears in China joined the protest against the government’s Zero-Covid policy to add to the market’s woes. China reported an all-time high of COVID-19 daily cases with nearly 40,000 new infections on Saturday. The dragon nation has been using the stringent policy to limit the virus spread but the outcome hasn’t been a positive one so far. On the contrary, a deadly fire in a building was allegedly linked to the virus-linked lockdown measures and resulted in mass protests in Beijing and Shanghai.

Additionally, weighing on the EUR/USD prices could be the looming concerns over the bloc’s push for a price cap on Russian energy exports. That said, the talks among the members of the Group of Seven Nations (G7) and the European Union (EU) continue to drag on the Russian oil price cap. As per the latest updates, the $65 per barrel is the sticking point as discussions are likely to resume on Monday.

While portraying the mood, the S&P 500 Futures drop 0.30% intraday while the US 10-year Treasury yields remain unchanged near 3.69% by the press time.

It should be observed, however, that the prospect of the Fed’s slower pace of interest rate hikes weighed on the US Dollar during the last week.

Moving on, Wednesday’s monthly inflation data from the bloc and a speech from Fed Chair Jerome Powell will be crucial for the EUR/USD pair traders. Following that, November’s job reports from the US could direct the moves. Above all, chatters surrounding the central banks and China’s COVID-19 conditions will help predict the pair’s next momentum.

Technical analysis

A horizontal area comprising multiple levels marked since May 12, between 1.0375 and 1.0355, appears a tough nut to crack for the EUR/USD bears.

- AUD/JPY is seeking support around 93.50 after China’s anti-Covid locking protest hit the streets.

- Individuals in China have come out on the roads after frustrating by the prolonged zero-Covid policy.

- Aussie Retail Sales are expected to decline to 0.4% vs. 0.6% reported earlier on a monthly basis.

The AUD/JPY pair has recorded a gap-down opening around 93.50 as Covid-19 concerns in China have escalated the risk-off theme for trading partners of China. The cross has attempted a rebound after a dark open but is still under caution.

Individuals in China have come out on the roads after frustrating by the prolonged zero-Covid policy by the Chinese administration. The Chinese economy is recording fresh highs in the number of Covid-19 cases day after day. The economy recorded a high of 37,971 cases on November 26. Rising risks of civil protests against restrictions on the movement of men, materials, and machines have escalated the risk of further increment in Covid-19 cases.

Intensifying anti-locking protests have raised concerns about growth prospects in the Chinese economy. The country is already facing the risk of bleak demand and a vulnerable real estate sector. This has also impacted the Aussie dollar as Australia is a leading trading partner of China.

Meanwhile, investors are also awaiting the release of the Australian Retail Sales. The monthly economic data is seen lower at 0.4% vs. the prior release of 0.6%. This may add to the downside filters for the Aussie Dollar but will delight the Reserve Bank of Australia (RBA) as the central bank is highly focused to bring inflation down and a decline in retail demand could trim price growth.

On the Japan front, Tokyo’s inflation has outpaced forecasts to hit its fastest clip since 1982, an acceleration that suggests nationwide price growth will also quicken in November after months of yen weakness and elevated energy costs, as reported by Bloomberg. The headline Consumer Price Index (CPI) in Tokyo has escalated to 3.8% vs. the consensus of 3.6%. While core CPI has jumped to 2.5% against the projections of 2.1%.

- USD/CAD picks up bids to extend Friday’s recovery.

- Comments from Iraqi Official, concerns over Russian oil price cap weigh on the WTI.

- Covid woes challenge market sentiment and favor bulls even as hopes of Fed’s easy rate tease sellers.

- Risk catalysts, monthly job numbers from US, Canada will be crucial for the pair traders.

USD/CAD bulls attack the 1.3400 threshold while extending Friday’s corrective bounce during Monday’s Asian session. In doing so, the Loonie pair cheers the market’s risk-off mood, as well as softer prices of WTI crude oil, Canada’s main export item.

WTI crude oil remains pressured around $76.30, down for the third consecutive day, as bears cheer the market’s risk-off mood, as well as price-negative headlines from Iraqi official and relating to the Russian oil price cap.

“The OPEC+ meeting in December will take into account the condition and balance of the market,” Iraq's state news agency quoted Saadoun Mohsen, a senior official at the country's state oil marketer (SOMO), as saying on Saturday. Elsewhere, the talks among the members of the Group of Seven Nations (G7) and the European Union (EU) continue to drag on the Russian oil price cap. As per the latest updates, the $65 per barrel is the sticking point as discussions are likely to resume on Monday.

That said, the prospect of the Fed’s slower pace of interest rate hikes weighed on the US Dollar the previous week.

It’s worth noting that the People’s Bank of China’s (PBOC) cutting of the Reserve Requirement Ratio (RRR) by 25 basis points (bps) effective from December 5 joins the Covid woes to also propel the USD/CAD prices.

China reported an all-time high of COVID-19 daily cases with nearly 40,000 new infections on Saturday. The dragon nation has been using the stringent policy to limit the virus spread but the outcome hasn’t been a positive one so far. On the contrary, a deadly fire in a building was allegedly linked to the virus-linked lockdown measures and resulted in mass protests in Beijing and Shanghai.

Amid these plays, the US Dollar Index (DXY) stays defensive around 106.30 while the US stock futures and US Treasury yields pare recent losses.

Moving on, the second-tier US data relating to employment may entertain the USD/CAD traders but major attention should be given to the aforementioned risk catalysts and the November month’s job report for the US and Canada.

Technical analysis

A two-week-old symmetrical triangle restricts short-term USD/CAD moves between 1.3430 and 1.3340.

British Prime Minister Rishi Sunak plans to promise on Monday to maintain or increase military aid to Ukraine next year, and to confront international competitors "not with grand rhetoric but with robust pragmatism", reported Reuters. The news is based on extracts released by UK PM Sunak’s office, per Reuters, ahead of his first major foreign policy speech, which he plans to deliver on Monday in London's financial district.

Key quotes

Under my leadership we won't choose the status quo. We will do things differently.

Priorities would be "freedom, openness and the rule of law".

Sunak indicated no change with the policy pursued by Johnson and Truss.

We will stand with Ukraine for as long as it takes. We will maintain or increase our military aid next year. And we will provide new support for air defence.

It means delivering a stronger economy at home - because it is the foundation of our strength abroad. And it means standing up to our competitors, not with grand rhetoric but with robust pragmatism.

Sunak has previously described China as a ‘systemic challenge’ and "the single biggest state threat to our economic security.

Also read: GBP/USD seeks support around 1.2060 amid quiet market mood, US ADP payrolls eyed

“The OPEC+ meeting in December will take into account the condition and balance of the market,” Iraq's state news agency quoted Saadoun Mohsen, a senior official at the country's state oil marketer (SOMO), as saying on Saturday.

Elsewhere, the talks among the members of the Group of Seven Nations (G7) and the European Union (EU) continue to drag on the Russian oil price cap. As per the latest updates, the $65 per barrel is the sticking point as discussions are likely to resume on Monday.

Additional comments

OPEC+'s October decision to reduce production by two million barrels per day (bpd) had played an important role in stabilising global markets.

The cut hadn’t reduced Iraq's exports.

Iraq's current production represents 11 percent of the group's total output of 43 million barrels per day (bpd).

Iraq expects a crude price range of at least $85-95 next year.

Oil markets are witnessing ‘severe fluctuations’ due to the repercussions of the pandemic, a slowing global economy and the war in Ukraine, making it harder to ensure price stability.

Market implications

The news should exert downside pressure on the WTI crude oil prices which dropped to $76.30 by the end of Friday’s trading session.

- GBP/USD is looking for a cushion around 1.2060 after a marginal selling pressure.

- Accelerating interest rates and weak economic projections have led to a decline in consensus for US ADP employment.

- Sterling reserve is under threat amid multiple headwinds ahead, as cited by Natixis.

The GBP/USD pair has sensed a marginal selling pressure at open and has dropped near the immediate support of 1.2060 in the early Asian session. The positive sentiment is still solid, therefore, recovery is highly expected in the Pound Sterling.

The US Dollar Index (DXY) has sensed some strength after dropping to near the round-level support of 106.00. Meanwhile, the 10-year US Treasury yields are failing to cross the 3.70% hurdle as the Federal Reserve (Fed) is highly expected to ditch the 75 basis points (bps) rate hike spell in its December monetary policy meeting. S&P500 remained subdued on Friday amid the absence of a potential trigger that could drive global markets.

This week, the market participants are preparing for the release of the US Nonfarm Payrolls (NFP) data. But before that, Wednesday’s Automatic Data processing (ADP) Employment data will provide meaningful cues to investors. As per the projections, the economic data is expected to decline to 200k vs. the prior release of 239k. As interest rates are accelerating dramatically and economic projections are facing heat, firms have ditched their recruitment process for the time being.

The bleak growth outlook for the shopping season while Christmas is expected to impact demand for employees in the United States economy. US businesses are hiring fewer seasonal workers this holiday shopping season, as stubborn inflation dims the outlook for retail sales as reported by Financial Times. Employers posted 8.2 percent fewer holiday openings this year than last year, according to jobs site Indeed FT further added.

On the United Kingdom front, a note from analysts at Natixis indicates that “Sterling’s reserve currency role is under threat, particularly since the Brexit referendum, led by relatively weak growth, the reduced appeal of the UK for corporate investment, awareness of the small size of the UK economy relative to its reserve currency status, a decline in labor force due to the departure of Europeans and the onset of a vicious circle where because pound sterling is less attractive, it depreciates, which in turn makes it less attractive still.”

- NZD/USD extends Friday’s pullback from three-month high, begins the week with a downside gap.

- Bearish MACD signals favor downside towards two-week-long horizontal support but further downside appears limited.

- 100-SMA, ascending trend line from early November offer strong challenge to sellers.

- Bulls need validation from 0.6270 to retake control.

NZD/USD holds lower ground near 0.6220, after beginning the week’s trading with a downside gap, as bears jostle with a short-term key support line during early Monday in Asia. In doing so, the Kiwi pair extend Friday’s pullback from the highest levels since early August.

That said, bearish MACD signals and failure to refresh the monthly-day high keep the NZD/USD sellers hopeful of breaking the 0.6220 immediate support.

However, multiple levels marked since November 15 could challenge the Kiwi pair’s further downside near 0.6200.

In a case where the quote breaks the 0.6200 key support, the odds of witnessing a slump toward the 100-SMA level surrounding 0.6080 can’t be ruled out. Even so, an upward-sloping support line from November 04, close to 0.6075 by the press time, could probe the NZD/USD bears afterward.

Meanwhile, recovery remains elusive unless the quote crosses a downward-sloping resistance line from November 24, near 0.6270 at the latest.

Following that, the monthly high of 0.6290 and the 0.6300 threshold may act as the upside filters before directing the bulls towards the early August highs near 0.6355 and the August month’s peak surrounding 0.6470.

NZD/USD: Daily chart

Trend: Further downside expected

- AUD/USD faces barriers to extending the weekly gains.

- China reports record Coronavirus cases, witnesses civil disobedience in Shanghai, Beijing.

- Prospects of Fed’s easy rate hikes favor Aussie pair buyers even as RBA’s lacks hawkish moves.

- Australia’s Retail Sales, Inflation data and comments from RBA Governor Lowe, Fed Chair Powell can entertain traders pre-NFP.

AUD/USD witnesses hardships in stretching the weekly gains beyond 0.6750 as it begins the key week on a back foot around 0.6720.

Coronavirus fears in China joined the protest against the government’s Zero-Covid policy to add to the market’s woes. Additionally, the Reserve Bank of Australia’s (RBA) mixed comments and the Aussie pair trader’s anxiety ahead of the key data/events also challenge the AUD/USD bulls. Even so, concerns surrounding easy rate hikes from the US Federal Reserve (Fed) allowed the pair buyers to remain hopeful ahead of crucial data and events.

China reported an all-time high of COVID-19 daily cases with nearly 40,000 new infections on Saturday. The dragon nation has been using the stringent policy to limit the virus spread but the outcome hasn’t been a positive one so far. On the contrary, a deadly fire in a building was allegedly linked to the virus-linked lockdown measures and resulted in mass protests in Beijing and Shanghai.

Also negative for the AUD/USD pair could be the downbeat China data publishing this weekend. China’s Industrial Profit dropped to -3.0% during the January to October period versus -2.3% marked for the January-September era. Additionally, the record high growth in the US Black Friday online shopping also acts as a negative barrier for the AUD/USD prices.

It’s worth noting that the prospect of the Fed’s slower pace of interest rate hikes weighed on the US Dollar the previous week even if the Reserve Bank of Australia (RBA) officials appeared not too hawkish. Also positive could be the People’s Bank of China’s (PBOC) cutting of the Reserve Requirement Ratio (RRR) by 25 basis points (bps) effective from December 5.

Looking forward, Australia’s Retail Sales for October, expected 0.4% versus 0.6% prior, will act as an immediate catalyst for the AUD/USD pair. However, major attention will be given to the risk catalysts like the Covid headlines and rate concerns ahead of the nation’s recently initiated monthly inflation data, comments from RBA Governor Philip Lowe and Fed Chair Jerome Powell, as well as Friday’s US employment report for November.

Technical analysis

Despite the latest struggle, a convergence of the 100-Day Moving Average (DMA) and an upward-sloping support line from November 04, around 0.6690, restricts the short-term AUD/USD downside.

- US Dollar bulls move in at the start of the week.

- Risk-off themes with China Covid dominates.

The US Dollar moved higher across the board on Friday in what was otherwise a quiet session following the US Thanksgiving holiday.

However, the greenback remained near multi-month lows on the prospect of the Federal Reserve moderating the pace of its policy tightening. With that being said, a risk-off start to the week could come of the protests in China and support the safe havens such as the US Dollar, yen and Treasuries.

Large violent, anti-government anti-lockdown protests have broken out in major Chinese cities. The BBC wrote that videos posted on social media appear to show hundreds of Wuhan residents taking to the streets, with some protesters pictured knocking down barricades and smashing metal gates.

US Dollar technical analysis

On the back side of the bullish trend, this price is making tracks to the downside. However, for the open, a bid in the US Dolar would be expected to see a deeper correction up the Fibonacci scale as follows:

In doing so, the price could be expected to move in towards 106.50 on a break of resistance as per the following hourly chart:

- Gold price is aiming to shift its business above the immediate hurdle of $1,750.00.

- The US Dollar has sensed support around 106.00 amid a quiet market mood.

- The preliminary GDP for the third quarter is seen unchanged at 2.6%., however, a decline would delight the Fed.

Gold price (XAU/USD) is focusing on establishing above the critical resistance of $1,750.00 in the early Asian session after a solid recovery from $1,746.00 witnessed late Friday. Broadly, the precious metal is looking to recapture the three-and-a-half-month high at $1,786.54 amid a broader strength in market mood.

Global markets remained subdued on Friday amid the unavailability of a potential trigger that indicates a situation of volatility contraction. This week, the markets are expected to display some meaningful moves, therefore a power-pack performance is expected from various assets. Meanwhile, the US Dollar Index (DXY) has attempted a recovery after dropping to near 106.00. The 10-year US Treasury yields have failed to cross the critical hurdle of 3.70%.

Going forward, the US Gross Domestic Product (GDP) data will be of utmost importance. The preliminary GDP for the third quarter is seen unchanged at 2.6%. As the Federal Reserve (Fed) is utterly dedicated to bringing price stability, a slower growth rate is highly recommended. A spell of improvement in the growth rates will continue to keep reign into inflation as it indicates robust demand from individuals, which doesn’t lead to a decline in price growth by the manufacturers and service providers.

Gold technical analysis

On an hourly scale, Gold price has displayed a steep recovery after testing the 38.2% Fibonacci retracement (plotted from November 3 low at $1,616.69 to November 15 high at $1,758.88) at $1,722.00 and has also crossed the 23.65 Fibo retracement at $1,746.50.

The precious metal has also crossed the 20-period Exponential Moving Average (EMA) at $1,753.17, which indicates that the short-term trend is solid again.

Meanwhile, the Relative Strength Index (RSI) (14) has rebounded after sensing support around 40.00, which signals that dips are explosively capitalized by the market participants.

Gold hourly chart

In China, large violent, anti-government anti-lockdown protests have broken out in major Chinese cities. In the cities of Shanghai, Wuhan, Guangzhou and Beijing protesters were heard chanting ''down with XI''.

The BBC wrote that videos posted on social media appear to show hundreds of Wuhan residents taking to the streets, with some protesters pictured knocking down barricades and smashing metal gates. There are reports that the police were using billy clubs and gas against protesters.

In spite of the stringent measures, China's case numbers last week hit all-time records since the pandemic began. Such a risk-off theme could mean a stronger US dollar in the open which could be a weight for the yuan and the Australian Dollar and could be prompting investors to shift toward haven assets such as the yen and Treasuries. Rising risks may also weaken demand for stocks.

- EUR/USD has been capped but bullish there are prospects while above 1.0300/1.0220.

- EUR/USD bulls need to get on the back side of the micro bearish trendline resistance.

EUR/USD remained close to the four-month high of 1.0481 touched in mid-November. For the week, the Euro was higher by 0.7% against the US Dollar that remains near multi-month lows on the prospects of the Federal Reserve moderating the pace of its policy tightening.

From a technical perspective, there could be some upside to come over the coming days on a break of 1.0450 while above 1.0220 as the following multi time frame analysis leans towards:

EUR/USD Weekly chart

The weekly chart shows that a breakout could be immature and while below 1.0480, the bias is for a downside correction into the support structure. A 50% mean reversion comes in near 1.0050.

EUR/USD daily charts

With that being said, an inverse head & shoulders could be in the making at this juncture. Bullish commitments around 1.0300/50 would be forming the right-hand shoulder of the bullish pattern. A Break of 1.0220, however, could likely leave the downside in favour.

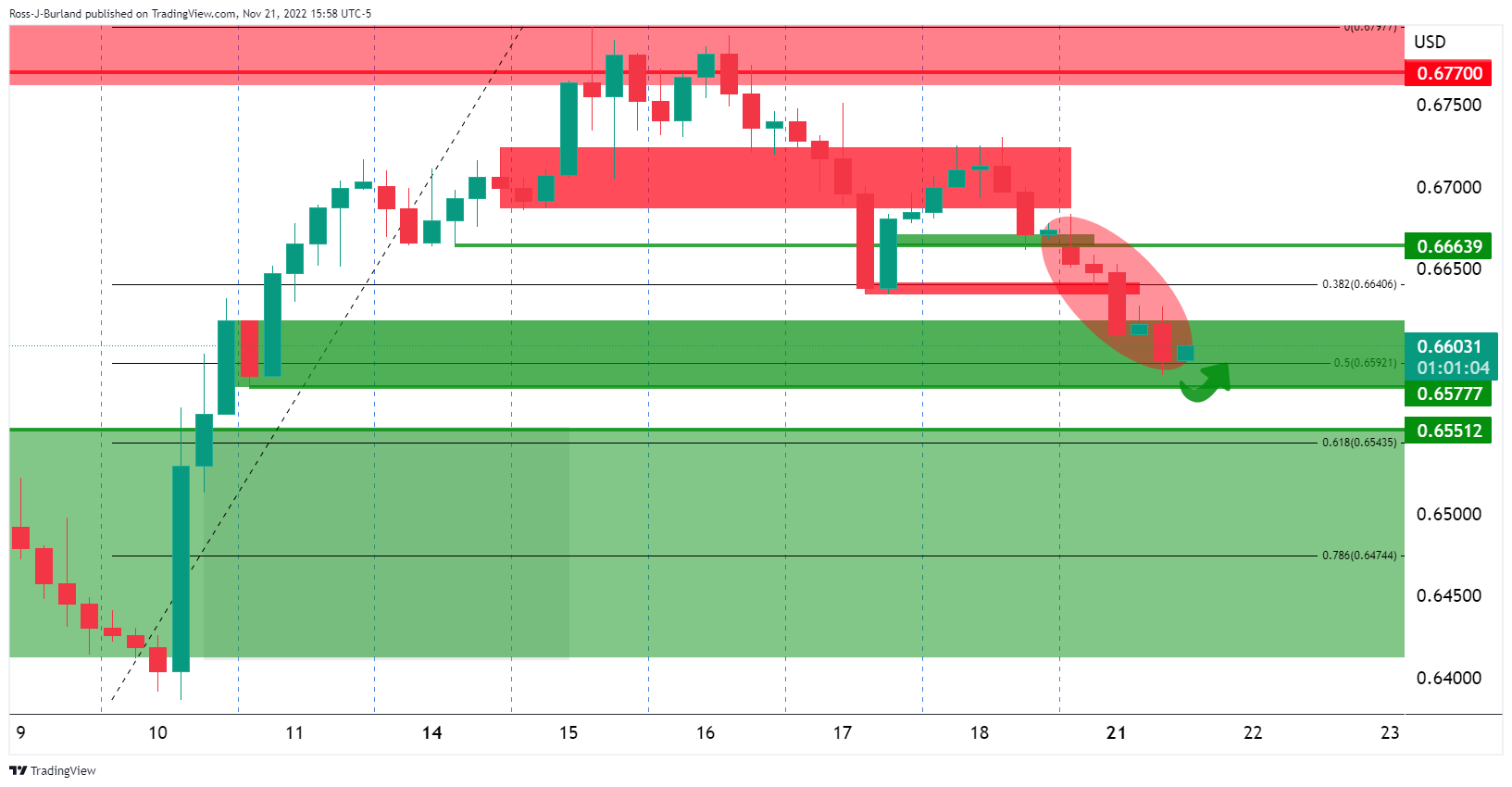

AUD/USD H4 charts

The bulls need to get on the back side of the micro bearish trendline resistance on the 4-hour and 1-hour charts:

EUR/USD H1 chart

- AUD/USD bulls meeting M-formation neckline resistance.

- The bulls need to commit at the 0.6700 area if there is to be a retest to the downside.

As per the prior analysis, AUD/USD Price Analysis: Bulls eye 0.6900s into year-end, the bias remains to the upside for the week ahead while being on the front side of the bullish trendline. AUD/USD reached a high of 0.6778 but has so far failed to break resistance.

The following illustrates the bias for a move towards 0.6900 for an onward bullish cycle for the rest of the year.

AUD/USD prior analysis

The four-hour chart showed the price meeting the 50% mean reversion of the following daily chart's prior bullish impulse:

AUD/USD remains on the front side of the daily trendline with the 0.6900s eyed:

AUD/USD H4 chart

The bulls need to commit at the 0.6700 area if there is to be a retest to the downside following failures at 4-hour resistance near the neckline of the M-formation.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.