- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-11-2022

- WTI holds lower ground at weekly low after the biggest daily fall in two months.

- Clear downside break of multi-month-old ascending trend line, bearish MACD signals favor sellers.

- Buyers remain off the table below 200-DMA, corrective bounce needs validation from $81.30.

WTI crude oil remains bearish around $77.50 during early Thursday, after falling the most since late September the previous day.

The black gold’s weakness could be linked to the downside break of an ascending trend line from December 2021, around $78.80 by the press time.

Also keeping the WTI sellers hopeful are the downbeat MACD signals and the confirmations of the “double top” bearish chart formation, by a clear concurrence of the $81.30 horizontal support.

Considering the aforementioned catalysts, the downward trajectory monthly low surrounding $75.30 is on the cards but the nearly oversold RSI (14) may challenge the oil bears afterward.

In a case where WTI bears fail to retreat from $75.30, the early December 2021 peak near $73.20 may act as an intermediate halt during the likely slump toward the previous yearly trough near $62.35.

Meanwhile, the multi-month-old previous support line near $78.80 will precede the $80.00 threshold to restrict the short-term upside of the energy benchmark.

Following that, the 11-week-old horizontal area, also forming part of the “Double top” bearish formation near $81.30, could challenge the commodity buyers before directing them to the 61.8% Fibonacci retracement level of December 2021 to March 2022 upside, close to $86.90.

WTI: Daily chart

Trend: Bearish

- A formation of an ascending triangle indicates a consolidation ahead.

- Overlapping of the 50-EMA with the cross dictates a sheer contraction in volatility.

- Oscillation in the 40.00-60.00 range by the RSI (14) indicates that investors are awaiting a potential trigger.

The AUD/JPY pair is struggling to overstep the immediate hurdle of 94.00 in the early Asian session. The cross is displaying a lackluster performance broadly due to the absence of key triggers for decisive action. Meanwhile, the market sentiment is extremely positive as US yields are facing immense pressure led by rising odds of a slowdown in the rate hike pace by the Federal Reserve (Fed).

On Thursday, Japanese markets will open after a close on Wednesday on account of Thanksgiving Day. Therefore, volatility could be immense as investors will look to manage their positions accordingly.

On an hourly scale, the cross is auctioning in an Ascending Triangle chart pattern, which indicates a sheer decline in volatility. The horizontal resistance of the above-mentioned chart pattern is placed from November 18 high at 94.10 while the upward-sloping trendline is plotted from Monday’s low at 93.19.

The 50-period Exponential Moving Average (EMA) at 93.87 is overlapping with the asset’s price, which indicates a consolidation ahead.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which states the unavailability of a potential trigger for making an informed decision.

For an upside move, the asset is needed to violate Wednesday’s high at 94.14, which will send the cross towards November 16 high at 94.66 and the round-level resistance of 95.00.

Alternatively, a breakdown of the chart pattern if the asset drops below Tuesday’s low at 93.57, will expose the cross for further downside towards Monday’s low at 93.19 followed by November 11 low at 92.60.

AUD/JPY hourly chart

-638048435366431458.png)

- AUD/USD picks up bids to reverse the pullback from weekly high.

- Softer US data, FOMC Minutes triggered weighed on the US Dollar, cautious optimism also favored Aussie pair bulls.

- Downbeat PMIs from Australia, China’s Covid woes gained little attention.

- Thanksgiving holiday, light calendar can allow buyers to take a breather.

AUD/USD remains on the buyer's radar despite the latest inaction around 0.6730-40 during Thursday’s Asian session. The reason could be linked to the broad-based US Dollar selling and the market’s cautious optimism.

The US Dollar Index (DXY) dropped the most in a fortnight the previous day after the latest Federal Open Market Committee (FOMC) Meeting Minutes signaled that the policymakers discussed the need of slowing down the interest rate hikes. Additionally weighing on the Greenback were chatters over the “sufficiently restrictive” level of the Federal Reserve’s (Fed) interest rates, as indicated in the Fed Minutes.

It should be noted that the softer US PMIs for November and strong Jobless Claims figures also acted as a negative catalyst for the AUD/USD pair. The preliminary readings of the US S&P Global Manufacturing PMI for November eased to 47.6 from 50.0 expected and 50.4 prior whereas the Services PMI also followed the suit while declining to 46.1 compared to 47.9 market forecasts and 47.8 previous readings. Overall, the S&P Global Composite PMI for November dropped to 46.3 versus 47.7 expected and 48.2 prior readouts.

That said, the United States Weekly Jobless Claims rose the most since June, to 240K versus 225K expected and 223K prior, which in turn favored the sentiment and drowned the US Dollar.

Alternatively, strong prints of the US Durable Goods Orders, up 1.0% in October versus 0.4% marked expectations and downwardly revised 0.3% prior, joined China’s covid woes and downbeat prints of Australia’s S&P Global PMIs for November to challenge the AUD/USD bulls. However, the market’s concentration on the Fed Minutes and hopes of overcoming the Coronavirus woes appeared to have favored the Aussie pair buyers.

Amid these plays, Wall Street closed in the positive territory while the US Treasury yields were downbeat and drowned the US Dollar.

Moving on, an absence of major data/events and a holiday in the US could allow the AUD/USD pair to consolidate some of its latest gains. On the same line could be the COVID-19 fears emanating from China and dovish bias at the Reserve Bank of Australia (RBA). However, the bulls are likely to keep the reins amid the receding hopes of the Fed’s aggressive rate hikes.

Technical analysis

A clear upside break of the 100-SMA and a one-week-old descending trend line, respectively near 0.6695 and 0.6590, keep the AUD/USD pair buyers directed toward the monthly high surrounding 0.6800.

- USD/CHF is expected to decline further to near 0.9400 as traction has shifted in favor of the risk-on profile.

- Less-hawkish cues from FOMC minutes have weakened the US Dollar and yields.

- A situation of robust consumer demand and weak real income could force households to bank upon higher borrowings.

The USD/CHF pair is hovering around 0.9423 in the early Asian session after two consecutive ultra-bearish sessions. Bears have snapped a six-day recovery in the past two trading sessions led by soaring investors’ risk appetite. Less-hawkish cues from Federal Open Market Committee (FOMC) minutes triggered a sell-off in the Greenback.

The major is expected to deliver more weakness and may slide to near the round-level support of 0.9400 as upbeat market sentiment is here to stay. The FOMC minutes indicate that the period of bigger rate hike announcements is over and a slowdown in the rate hike pace is necessary to observe the efforts made by central banks in achieving price stability.

Less-hawkish commentary from Federal Reserve (Fed) policymakers on interest rates guidance has weakened the US Dollar Index (DXY). The US Dollar has declined to near 106.10 and is expected to test the previous week’s low at 105.34. As the option of the fifth consecutive 75 basis points (bps) rate hike by the Fed is getting out of the picture, the returns generated by US Treasury bonds are losing their glory. The long-term US Treasury yields have dropped below 3.70%. Meanwhile, US markets are closed on Thursday on account of Thanksgiving Day.

Also, upbeat US Durable Goods Orders failed to support the US Dollar. The economic data improved by 1.0% vs. the expectations and the prior release of 0.4%. A situation of robust consumer demand and weak real income could force households to bank upon higher borrowing, which could lead to higher delinquency costs for the credit providers.

On the Swiss franc front, Swiss National Bank (SNB) Chairman Thomas J. Jordan cleared that monetary policy is still expansionary and ''we have most likely to adjust monetary policy again.'' The Swiss central bank is entitled to bring the inflation rate in the 0-2% range and in response to that current monetary policy is restrictive enough to perform the job.

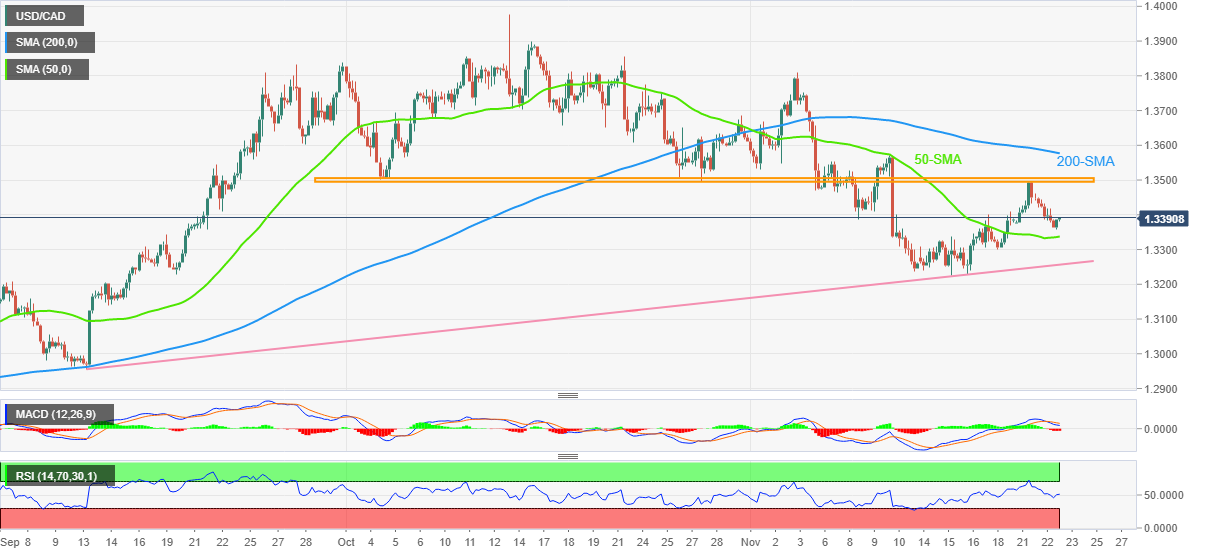

- USD/CAD bears ignited on FOMC minutes and eye 1.3300.

- Bulls could be on the verge of a meanwhile scalp with 1.3375 eyed.

The Canadian dollar bounced back on Wednesday against the greenback and all the other G10 currencies despite the drop in oil prices. USD/CAD ended the US session offered at 1.3350 after falling from a high of 1.3440 on the day. The Federal Open Market Committee minutes were dovish and this weighed on the US Dollar, propelling the greenback forward.

USD/CAD prior analysis

The pair has broken the trendline this month and had corrected back into the resistance making prospects of a downside continuation as illustrated on the following hourly chart also:

USD/CAD update

After the FOMC minutes, the price dropped to the first target of 1.3350:

There is further downside potential on a convincing close below here to 1.3300:

However, a correction could be in order first of all with 1.3375 as a possible resistance area.

- GBP/JPY tumbled after testing 169.00, the head-and-shoulders right shoulder, so the pattern is still in play.

- Short term, the GBP/JPY might consolidate around 168.00-169.00.

- GBP/JPY Price Analysis: Break below 168.00 could pave the way toward 167.00.

The British Pound (GBP) climbed and tested the head-and-shoulders right shoulder but retreated after sellers stepped in just below the 169.00 figure, exacerbating a fall toward the 168.10 area. Hence, the GBP/JPY is trading at 168.16, registering minuscule losses of 0.04% as the Asian session begins.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart remains neutral-to-upward biased. Failure to break above the right shoulder kept the pattern intact; hence, further downside is expected. However, the GBP/JPY must clear the November 23 daily low of 167.69, which would exacerbate a fall towards the head-and-shoulders neckline around 165.30/50. Even though the Relative Strength Index (RSI) is in bullish territory, its slope is flat, closer to the 50-midline. So, if the cross drops below 168.00, the RSI could give a sell signal, exacerbating a fall toward the neckline and beyond.

Short term, the GBP/JPY 4-hour chart depicts the cross advancing steadily on smaller chunks, registering a fresh daily high for the last eight days. On Wednesday, after hitting a daily high of 168.99, the cross plunged 90 pips as sellers stepped in on the top-trendline of an ascending channel. That said, the GBP/JPY is trading below Thursday’s daily pivot point, so the path of least resistance is downwards.

The GBP/JPY first support would be the confluence of the S1 pivot and the upslope trendline around 167.63. Once cleared, the next demand area will be the confluence of the 200-Exponential Moving Average (EMA) and the S2 daily pivot at 167.01.

GBP/JPY Key Technical Levels

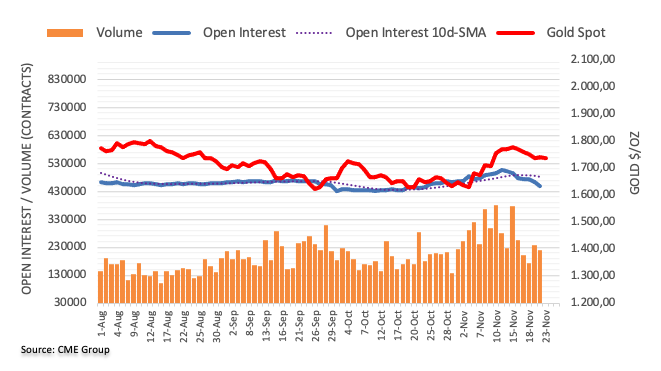

- Gold price grind higher following a rebound from the key support.

- Federal Reserve Minutes appeared dovish as policymakers discussed softer interest rate hikes, pivot point.

- Softer United States statistics also weighed on the US Dollar, as well as propelled Gold prices.

- China-linked market fears, Thanksgiving Holiday can allow XAU/USD to pare recent gains.

Gold price (XAU/USD) consolidates the recent gains at around $1,750 during Thursday’s Asian session, after posting the biggest daily jump in a fortnight. In doing so, the precious metal struggles for clear directions amid a lack of major data/events, as well as a Thanksgiving holiday in the United States.

Gold price cheers softer US Dollar as Federal Reserve Minutes spot ‘pivot’ discussions

Gold price benefited from the softer US Dollar as the US Dollar Index (DXY) marked the biggest daily slump in two weeks as the Federal Reserve (Fed) officials discussed the need of slowing down the interest rate hikes. That said, the Greenback’s gauge versus the six major currencies refreshed a one-week low following the latest Federal Open Market Committee (FOMC) Meeting Minutes, defensive near 106.15 at the latest.

In addition to the debate over the softer interest rate hikes, the “sufficiently restrictive” level of the Federal Reserve’s (Fed) interest rates also fuelled the US Dollar and favored the Gold price buyers.

United States statistics also fuelled the Gold price advances

Mostly downbeat statistics from the United States also weighed on the US Dollar and favored the Gold price to rise further. The preliminary readings of the US S&P Global Manufacturing PMI for November eased to 47.6 from 50.0 expected and 50.4 prior whereas the Services PMI also followed the suit while declining to 46.1 compared to 47.9 market forecasts and 47.8 previous readings. Overall, the S&P Global Composite PMI for November dropped to 46.3 versus 47.7 expected and 48.2 prior readouts.

Additionally, the United States Weekly Jobless Claims rose the most since June, to 240K versus 225K expected and 223K prior, which in turn favored the sentiment and drowned the US Dollar while fueling the Gold price.

Alternatively, the US Durable Goods Orders increased by 1.0% in October versus 0.4% marked expectations and downwardly revised 0.3% prior.

Risk catalysts, Thanksgiving Day in United States may test XAU/USD bulls

Be it the market’s cautious optimism due to the expectations of softer interest rates or the downbeat statistics from the United States, not to forget the below-mentioned technical details, the Gold price has more positives to cheer about. However, China’s Covid woes could join the likely inaction on the floor, due to the Thanksgiving Day holiday in the US, to allow the bullion buyers to take a breather. Even so, downbeat prints of the United States Treasury bond yields and firmer closing of Wall Street benchmarks keep Gold buyers hopeful.

Gold price technical analysis

Gold price defends the bounce off a convergence of the 100-day and 21-day Exponential Moving Average (EMA), despite the latest retreat.

That said, bullish signals from the Moving Average Convergence and Divergence (MACD) indicators also keep the Gold buyers hopeful of piercing the 200-day EMA hurdle, currently around $1,760.

However, a downwards-sloping resistance line from early July, around $1,778 by the press time, could challenge the Gold price upside.

Alternatively, a convergence of the aforementioned EMAs, around $1,724, restricts the Gold price downside, a break of which could direct the XAU/USD sellers toward the $1,700 threshold.

In a case where Gold price remains bearish past $1,700, July’s low near $1,680 could limit the bullion’s further downside.

Overall, the Gold price remains on the buyer’s radar but further upside appears limited.

Gold price: Daily chart

Trend: Limited upside expected

- Upbeat market sentiment has strengthened the Pound Sterling.

- A breakout of a VCP results in wider ticks formation and heavy volume.

- The formation of a Rising Channel indicates that the broader trend is towards the north.

The GBP/USD pair is displaying a sideways performance in the early Tokyo session after a juggernaut rally to near 1.2080. The Cable witnessed an immense buying interest after sustaining above the round-level resistance of 1.1900. A significant improvement in investors’ risk appetite strengthened the Pound Sterling.

Meanwhile, the US dollar index (DXY) has dropped 106.00 despite a firmer jump in the US Durable Goods Order data. It seems that less-hawkish cues on interest rate guidance from the Federal Open Market Committee (Fed) minutes have impacted the US Dollar. Investors should know that US markets are closed today on account of Thanksgiving Day.

On a daily scale, the Cable has delivered a breakout of a Volatility Contraction Pattern (VCP) that results in the formation of wider ticks and heavy volume. Broadly, a Rising Channel formation satisfies the condition of a long-term upside trend. Also, advancing the 20-period Exponential Moving Average (EMA) at 1.1738 adds to the upside filters.

Adding to that, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates that the upside momentum is active.

Going forward, the mighty 200-period EMA at 1.2110 could be a hurdle for the Pound Sterling bulls.

For further upside, the asset is required to establish firmly above the psychological resistance of 1.2000. But for a run-up, the Cable is needed to overstep the 200-EMA at 1.2110 firmly, which will drive GBP/USD towards the round-level resistance of 1.2200, followed by August 2 high at 1.2280.

On the flip side, a drop below Monday’s low at 1.1780 will drag the asset toward November 14 low at 1.1710. A slippage below November 14 low will expose the asset to the horizontal support plotted from October 27 high at 1.1646.

GBP/USD daily chart

- NZD/USD is looking to print a fresh three-month high above 0.6250 amid multiple tailwinds.

- Widened RBNZ-Fed policy divergence, positive market sentiment, and a weak US Dollar have supported the Kiwi Dollar.

- A significant improvement in US Durable Goods Orders has failed to support the US Dollar.

The NZD/USD pair is on the edge of refreshing its three-month high above 0.6250 ahead. The presence of multiple tailwinds such as risk-on profile, widened Reserve Bank of New Zealand (RBNZ)-Federal Reserve (Fed) policy divergence, and weak US Dollar Index (DXY) have strengthened the Kiwi Dollar against the Greenback.

The risk profile is extremely upbeat as plenty of Fed policymakers are expecting a slowdown in the rate hike pace ahead. Positive market sentiment empowered the S&P500 to carry forward its upside momentum on Wednesday. Meanwhile, the US dollar index (DXY) slipped firmly to near 106.10 despite a robust increase in demand for Durable Goods.

The US Durable Goods Orders data landed at 1%, significantly higher than the estimates and the prior release of 0.4%. This has indicated that consumer demand is still solid despite accelerating interest rates and higher inflation rates.

The returns on US Treasury bonds have dropped further as the minutes of the Federal Open Market Committee (FOMC) dictated that a slowdown in the rate hike pace would allow Fed chair Jerome Powell to judge progress on their goals. The 10-year US Treasury yields have dropped below 3.70%.

On the New Zealand front, investors are still in a hangover of 75 basis points (bps) rate hike and consideration of the full percent rate in its monetary policy meeting on Wednesday. It seems that the battle against a historic surge in inflation is demanding more blood and sweat from RBNZ Governor Adrian Orr. The RBNZ has pushed its Official Cash Rate (OCR) to 4.25%, which has widened the RBNZ-Fed policy divergence.

“Canadian inflation remains high and broad-based and more interest-rate increases will be needed to cool the overheating economy,” said Bank of Canada (BOC) Governor Tiff Macklem in a testimony at the House of Commons late Wednesday, reported Reuters.

Additional comments

We expect our policy rate will need to rise further.

How much further policy rates would need to rise will depend on how monetary policy is working to slow demand.

Inflation in Canada remains high and broad-based, reflecting large increases in both goods and services prices.

We have yet to see a generalized decline in price pressures.

Canadian economy is still in excess demand and it’s overheated.

Higher interest rates are beginning to weigh on growth.

Effects of higher rates will take time to spread through the economy.

Expect growth will stall in the next few quarters; once we get through this slowdown, growth will pick up.

We are trying to balance the risks of under- and over-tightening.

The tightening phase will come to an end, and we are getting closer, but we are not there yet.

with inflation so far above our target we are particularly concerned about the upside risks.

BOC balance sheet peaked in March 2021 at CAD575bn, as of last week it was around CAD 415bn, a drops of around 28%.

There is a risk that inflation in Canada is more embedded, more entrenched; also some possibilities that inflation could come down faster.

Expecting to see businesses pass on input price decreases as quickly to consumers as they did with increases on the way up.

USD/CAD bears take a breather

USD/CAD remains sidelined, actually bouncing off the intraday low to 1.3355, despite the hawkish comments from BOC’s Macklem.

Also read: USD/CAD tumbles toward 1.3350 after the Fed released dovish minutes

- EUR/USD dribbles around one-week high after crossing short-term key hurdle.

- Nearly overbought RSI conditions could challenge bulls around monthly peak.

- 50-SMA, resistance-turned-support line restrict immediate downside amid bullish MACD signals.

EUR/USD bulls take a breather around a one-week high near 1.0400 during Thursday’s Asian session, following a two-day uptrend. Even so, the major currency pair remains on the way to the monthly top, as well as appears capable of crossing it, on crossing the short-term key hurdles, now nearby supports.

Not only a successful break of a one-week-old descending trend line and the 50-SMA but bullish MACD signals also keep the EUR/USD buyers hopeful of approaching the monthly high near 1.0480, as well as the 1.0500 threshold.

Though, nearly overbought conditions of the RSI (14) could challenge the quote’s further advances.

If the pair remains firmer past 1.0500, late June’s peak surrounding 1.0615 will gain the EUR/USD buyer’s attention before highlighting the June month’s high of 1.0786.

Alternatively, the 50-SMA level, close to 1.0340, precedes the previous resistance line from November 15, around 1.0280, to restrict short-term EUR/USD downside.

Even if the EUR/USD pair drops below 1.0280, an ascending trend line from October 04, close to 1.0220, should be eyed closely as a clear break of which won’t hesitate to direct the bears toward the 200-SMA support near the parity level.

EUR/USD: Four-hour chart

Trend: Further upside expected

- US Dollar weakened on the release of dovish Federal Reserve November minutes.

- The Canadian Dollar strengthened due to a soft US Dollar.

- USD/CAD Price Analysis: To resume its downtrend towards the head-and-shoulders target of 1.3030.

The US Dollar (USD) extended its losses vs. the Canadian Dollar (CAD), as Wall Street ended Wednesday's session in the green after the release of dovish Federal Reserve (Fed) November monetary policy minutes. Policymakers agreed to slow down the pace of rate hikes, so investors shifted to risk-perceived assets in the FX space, particularly the Canadian Dollar. At the time of writing, the USD/CAD is trading at 1.3349.

Federal Reserve minutes a headwind for the US Dollar

On Wednesday, the Federal Reserve revealed its latest minutes, which showed that officials are ready to begin hiking rates on smaller sizes after lifting rates by 75 bps four times in 2022. It should be noted that officials are unaware of where the Federal Funds rate (FFR) would peak, though most expressed that 5% could be the peak for some participants.

Mixed US economic data, another factor spurring USD weakness

Data-wise, S&P Global PMIs revealed for the US showed that the economy is slowing faster than expected, with Manufacturing, Services, and Composite Indices lying in contractionary territory. Aside from this, Consumer Sentiment remained positive, according to a University of Michigan (UOM) survey, at 56.9, above estimates but below the preliminary reading of November. Inflation expectations remained unchanged.

Earlier, the US economic docket featured Initial Jobless Claims for the last week, which jumped above expectations, flashing that the labor market is easing. At the same time, US Durable Good Orders for October rose sharply by 1% MoM, against 0.4% estimates, as consumers' resilience kept manufacturing activity from slowing down.

Of late, the Bank of Canada (BoC) Governor Tiff Macklem said that they expect rates to rise further. Macklem added that inflation in Canada remains high and broadens, reflecting increases in goods and services.

USD/CAD Price Analysis: Technical outlook

The USD/CAD resumed its downtrend after testing the head-and-shoulders neckline on Monday, though failure to crack it kept the chart pattern in play. Before the release of the Fed minutes, the USD/CAD registered a daily high of 1.3440 before diving toward its low of 1.3344. That said, the USD/CAD path of least resistance is downwards.

Therefore, the USD/CAD first support is 1.3300. Break below will expose the 100-day Exponential Moving Average (EMA) at 1.3264, followed by 1.3200.

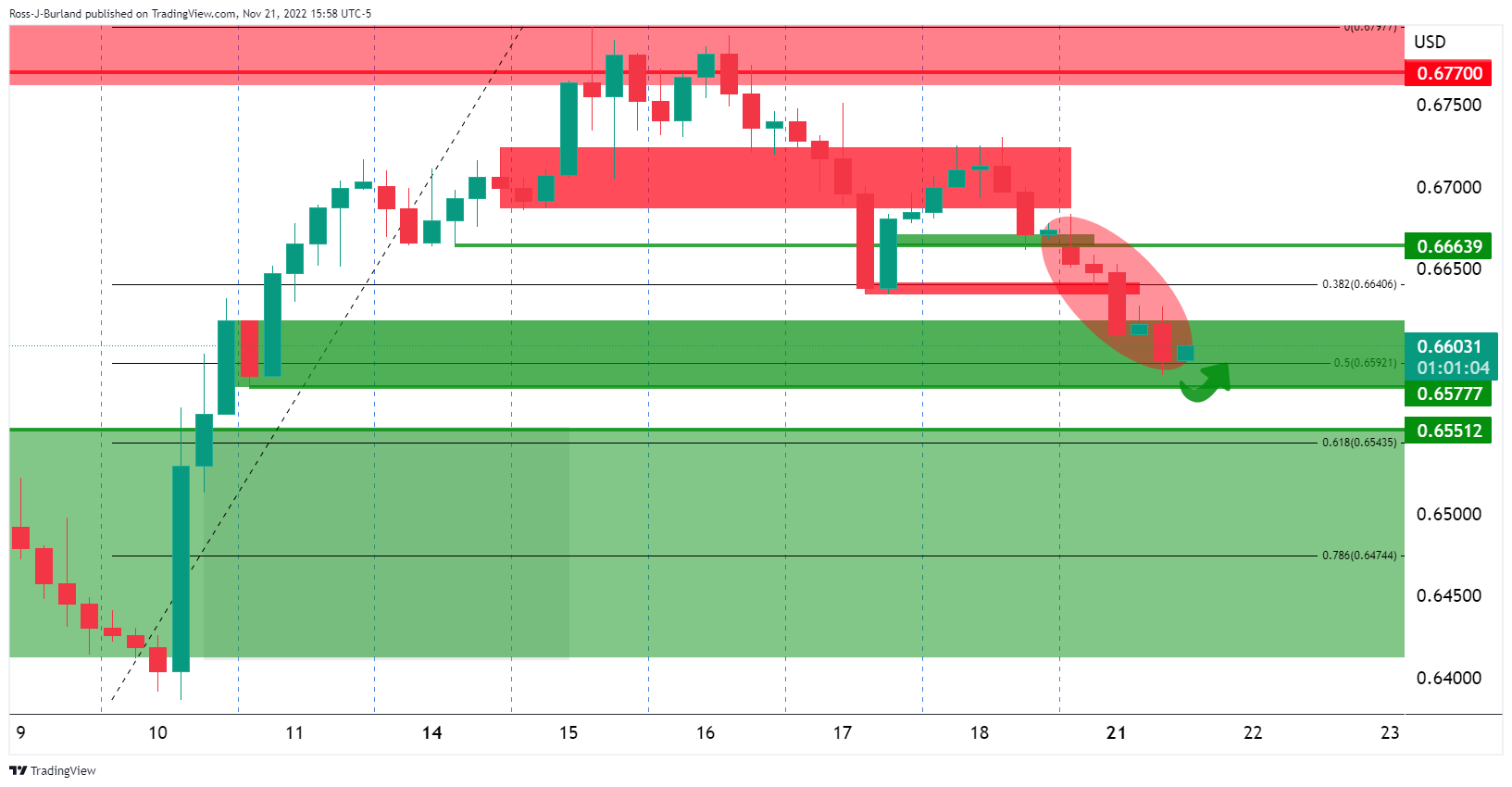

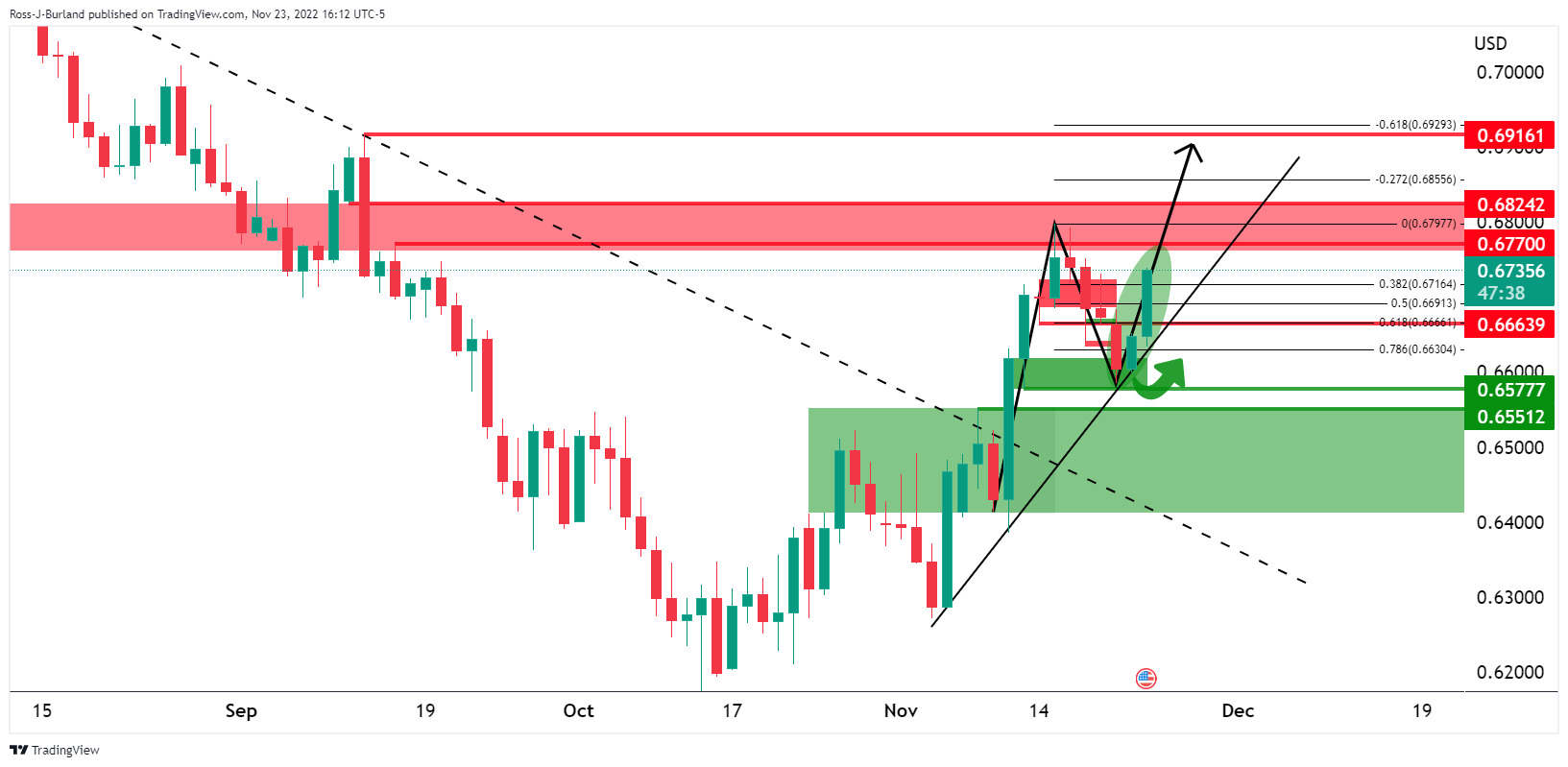

- AUD/USD remains on the front side of the daily trendline with the 0.6900s eyed.

- FOMC minutes help the bulls out and keep US Dollar on the backfoot.

As per the prior analysis, AUD/USD Price Analysis: Bulls are lurking in daily support, 0.6570/50, the market shot higher from the anticipated support and has reached 0.6738 on the back of some dovish Federal Open Market Committee minutes.

The following illustrates how the price action has opened prospects of a move higher to test 0.6750 and then 0.6850 and 0.6900 for an onward bullish cycle for the rest of the year.

AUD/USD prior analysis

The four-hour chart showed the price meeting the 50% mean reversion of the following daily chart's prior bullish impulse:

AUD/USD update

AUD/USD has moved higher as forecasted and is set to extend the bullish rally while on the front side of the daily trendline with the 0.6900s eyed.

Reuters reported that New Zealand's central bank governor said on Thursday that the central bank cash rate was officially contractionary as it tries to bring down inflation.

"We are sorry that New Zealanders are being buffeted by significant shocks and inflation is above target. As we've said before, inflation is no one's friend and causes economic costs," Reserve Bank of New Zealand governor Adrian Orr told a committee at parliament.

NZD/USD update

The Kiwi is higher having made a fresh high for the current upswing, and regaining a 0.6250 area while it was approaching its strongest levels in nearly three months. The Reserve Bank of New Zealand delivered a supersized 75 basis point rate hike to get ahead of inflation.

That hike was the largest since the RBNZ introduced the OCR in 1999 and brought the policy rate to a 14-year high of 4.25%. Meanwhile, in the statement, it was explained that the central bank's board expects the cash rate to peak at 5.5% in September 2023 according to its latest forecasts. Additionally, a dovish set of Federal Reserve minutes helped.

What you need to take care of on Thursday, November 24:

The Greenback came under selling pressure on Wednesday and finished the day sharply down against all of its major rivals. The American Dollar got hit by poor growth-related data and dovish US FOMC Meeting Minutes.

The document showed that most participants agreed that, despite the risk to the inflation outlook remaining skewed to the upside, a slower pace of interest rate hikes would be appropriate soon. Furthermore, they believe the monetary policy is approaching a “sufficiently restrictive” level. The US Dollar fell further as an immediate reaction to the news, while US indexes picked up an upward pace. Chances of a 50 bps hike rose to 79% following the release and according to Fedwatch, while the terminal rate is now seen at 5.03%.

S&P Global published the preliminary estimates of its November PMIs. The EU figures were better than anticipated but remained within contraction levels. US indexes, however, disappointed big, triggering the first bout of dollar selling. EUR/USD trades near the 1.0400 figure ahead of the close.

The GBP/USD pair hovers around 1.2050, holding on to most of its intraday gains. UK S&P Global PMIs were better than anticipated but signal persistent economic contraction in the country. Market is paying little attention to Brexit-related headlines, but it seems the issue is making yet another comeback. Finally, the UK Supreme Court rules against Scotland’s bid to hold a new independence referendum.

Commodity-linked currencies benefited from the upbeat tone of global stocks. Asian and European indexes closed in the green, while US indexes gained upward momentum after FOMC Meeting Minutes. AUD/USD trades around 0.6730 while USD/CAD declined towards the 1.3360 price zone.

Safe-haven currencies were among the best performers against the US Dollar. USD/CHF is down to 0.9420, while USD/JPY trades around 139.45. Spot gold remained subdued for most of the day, jumping above the $1,750 mark late in the US afternoon, retaining its intraday gains.

Crude oil prices, on the other hand, edged lower, with WTI trading at around $77.80 a barrel. The black gold fell despite the US Energy Information Administration reporting inventories of oil were down by 3.7 million barrels over the week ended November 18. Speculations of upcoming sluggish demand, particularly due to the COVID situation in China, weighed on oil prices.

The US celebrates Thanksgiving on Thursday, which means action across financial markets will be limited heading into the weekend.

How SBF bought FTX's one-way ticket to bankruptcy, leaving crypto markets in shambles

Like this article? Help us with some feedback by answering this survey:

- Gold bulls jump into action around a dovish FOMC minute.

- Thanksgiving holidays around the corner are holding up the bid.

Gold had rallied to a high of $1,753 on the back of a dovish set of Federal Open Market Committee minutes but has since come off to test below $1,750 again and is oscillating between the range of the move. Thanksgiving holidays are upon us which likely means there are fewer participants around the event.

Nevertheless, the minutes show that a substantial majority of participants at the November meeting judged a slowing in the pace of the interest rate hikes would likely still be appropriate. In other key statements, the minutes showed that a slower pace of rate hikes would better allow the FOMC to assess progress toward its goals given the uncertain lags around monetary policy. A few participants said slowing the pace of rate hikes could reduce the financial system risks; others that slowing should await more progress on inflation.

Prior to the event, the US PMI data had given the US Dollar bears a head start before the FOMC minutes were released. A slew of US economic data (including durable goods orders, PMIs, claims, new home sales, and final Michigan sentiment), for the most part, was solid but the emphasis was put on the shocking result in the US Manufacturing PMI that missed expectations by a mile:

- US: S&P Global Manufacturing PMI drops to 47.6 in November vs. 50 expected

The US Dollar index, as a consequence, has fallen more than 1% toward 106, the lowest since mid-August, as traders raise bets of only a 50 bps rate hike by the Fed in December.

US Dollar H1 chart

Gold technical analysis

The price has shot higher into resistance and the bulls will look for a discount on the backside of the trendline for a higher price ahead. With the Thanksgiving holidays, markets have fewer participants and hence there is little in the way of a follow-through so far.

- The Euro appreciated as the US Dollar weakened on the release of the Federal Reserve November minutes.

- Federal Reserve officials agreed to slow the rate hikes, weakening the US Dollar.

- EUR/USD Price Analysis: Daily close above 1.0400 can exacerbate a rally to 1.0500.

The Euro (EUR) jumped against the US Dollar (USD) following the release of the Federal Reserve (Fed) monetary policy minutes showed that policymakers agreed to slow the pace of rate hikes at the Federal Reserve’s (Fed) November meeting. At the time of writing, the EUR/USD is volatile, trading at around 1.0396, testing the 200-day Exponential Moving Average (EMA) at 1.0396.

Remarks of the Federal Reserve Open Market Committee (FOMC) November minutes

As mentioned above, Fed officials agreed to slow the rate hikes spurred US Dollar weakness, as the EUR/USD advanced towards its daily high of 1.0400. Furthermore, policymakers expressed that monetary policy is approaching a “sufficiently restrictive” level, acknowledging that the Federal Funds rate (FFR) peak is more important than the rate itself.

Regarding inflation, Fed policymakers agreed that there were few signs of easing inflationary pressures, though they emphasized that inflation risks were skewed to the upside.

Officials expressed a high level of uncertainty about the peak of the FFR. However, several predicted interest rates would peak at a higher level, as the Federal Reserve Chairman Jerome Powell expressed at the monetary policy press conference.

In the meantime, money market interest-rate futures odds for a 50 bps hike increased to 79% in the December meeting after the release of the FOMC minutes.

The US Dollar Index (DXY), a gauge of the greenback’s value against a basket of six currencies, extended its losses to almost 1%, down at 106.161, while US Treasury bond yields retreated.

EUR/USD Price Analysis: Technical outlook

The EUR/USD is upward biased, as shown by the 1-hour chart, after breaking above the 100 and 200-Exponential Moving Averages (EMAs). Additionally, on its way north, the EUR/USD cleared the R1, R2 and is testing the R3 daily pivot point at around 1.0400. If the Euro clears the latter, the major could rally towards 1.0500.

Hence, the EUR/USD first resistance would be the November 16 daily high at 1.0438, ahead of the R4 pivot level at 1.0440, followed by the R5 pivot point at 1.0490 ahead of the psychological 1.0500 mark.

There is volatility in the markets following the Fed minutes that show a substantial majority of the board sees slowing hikes soon.

Key notes

Fed says rate peak to be higher than previously expected.

Uncertain lags, magnitudes reasons cited for Fed slowdown.

Few participants: slowing pace reduces financial risks.

Few officials: Advantageous to wait before slowing pace.

Full statement

As a consequence of the dovishness, US stocks are higher, Gold is up and the US Dollar is bleeding out, supporting the commodity complex such as the Canadian dollar.

- US Dollar remains offered across the board against most G8 currencies.

- A broken rising wedge in the USD/JPY 4-hour chart targets a fall towards 138.00.

The USD/JPY prolonged its losses to two consecutive days and cleared the 100-day Exponential Moving Average (EMA), cementing the case of the USD/JPY bias turning neutral-to-downwards, albeit remained trading above the 200-day EMA. Hence, the USD/JPY is trading at 139.83, below its opening price by 0.96%.

USD/JPY Price Analysis: Technical outlook

Once the USD/JPY dropped below the 100-day EMA, the bias shifted neutral downwards, though it should be noted that crucial support levels lie below the spot price. If Japanese Yen (JPY) buyers would like to extend their gains, they need to clear the three-month low of 137.65, which would exacerbate a fall toward a six-month-old upslope support trendline of around 136.70.

Short term, the USD/JPY 4-hour chart broke a rising wedge, a continuation pattern formed after a first leg-down. That said, the USD/JPY is comfortably trading around the S3 daily pivot. Therefore, the USD/JPY first support would be the 139.00 psychological level, followed by the S4 daily pivot level at 138.87, ahead of the November 15 low at 137.65.

USD/JPY Key Technical Levels

- NZD/USD perched near the highs of the week ahead of FOMC.

- US Dollar is under pressure amid poor PMIs while NZD is supported by a hawkish RBNZ.

NZD/USD rallied to a high of 0.6236 on Wednesday, from a low of 0.6123 and was approaching its strongest levels in nearly three months after the Reserve Bank of New Zealand delivered a supersized 75 basis point rate hike to get ahead of inflation.

That hike was the largest since the RBNZ introduced the OCR in 1999 and brought the policy rate to a 14-year high of 4.25%. Meanwhile, in the statement, it was explained that the central bank's board expects the cash rate to peak at 5.5% in September 2023 according to its latest forecasts.

The members of the board had considered a 100Bp rate rise which fuelled the rally in the bird. Stubbornly high inflation and near-record-low unemployment in New Zealand supported the case for a more aggressive move. Finance Minister Grant Robertson said before the event that the country was well-positioned to withstand a global recession due to robust growth and a stable financial system.

The projected peak of 5.5% was well above consensus which led to the two-year swap rates to surge 29 basis points to 5.285%, the biggest daily jump since 2009. Analysts at ANZ Bank have revised their forecasts higher, now expecting an additional 50 bp increase in April and a 25 bp one in May, which would take the peak to 5.75%.

FOMC minutes eyed

Meanwhile, the US Dollar sold off on Wednesday in the early New York trade on the back of PMI's that are giving the bears a head start before the FOMC minutes are released. The overall data, for the most part, was solid but the emphasis was put on the shocking result in the US Manufacturing PMI that missed expectations by a mile:

-

US: S&P Global Manufacturing PMI drops to 47.6 in November vs. 50 expected

In the prior statement, it read "In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments."

This statement gave rise to volatility in markets as investors positioned for a softer approach from the Fed which Chair Jerome Powell pushed back against in his presser by suggesting that there will likely be a higher terminal rate. Therefore, the minutes will be scrutinised for clarity in this regard. ''We expect the November FOMC meeting minutes to shed further light on the FOMC's deliberations regarding the expected downshift in the pace of rate increases in upcoming meetings,'' analysts at TD Securities said.

''But above all, we look for the minutes to place a lot of emphasis on the likelihood that the terminal rate will need to end up higher than anticipated initially. The Fed still needs to grind down the labour market to align wage and household spending growth with rates more consistent with the inflation target.''

- USD/CAD is pressured below 1.3440/50 and trendline resistance.

- FOMC minutes are eyed for direction in the US Dollar.

The Canadian dollar weakened on Wednesday against the greenback and all the other G10 currencies as oil prices fell. USD/CAD is up 0.3% having travelled between a low of 1.3356 and a high of 1.3440 on the day so far ahead of a parliamentary appearance by Bank of Canada Governor Tiff Macklem and the Federal Open Market Committee minutes.

The Loonie was pressured despite US dollars moving lower that followed a slew of US economic data (including durable goods orders, PMIs, claims, new home sales, and final Michigan sentiment). The data, for the most part, was solid but the emphasis was put on the shocking result in the US Manufacturing PMI that missed expectations by a mile:

US: S&P Global Manufacturing PMI drops to 47.6 in November vs. 50 expected

Nevertheless, the price of oil has blown off to the downside on Wednesday as China continues to struggle with rising Covid-19 infections, imposing mass testing and lockdown measures, lowering economic growth and cutting demand for oil from the world's No.1 importer. At the same time, the European Union readies to impose a price cap on Russian oil exports. Additionally, a report showed a larger-than-expected drop in US inventories.

Besides the FOMC minutes, Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers will appear before the House of Commons Standing Committee on Finance at 4:30 p.m. ET (2130 GMT).

FOMC minutes eyed

The PMI data today has given the US Dollar bears a head start before the FOMC minutes are released. Firstly, the recent cooler-than-expected US Consumer Price data has already created sentiment for a Fed pivot and investors' hopes that the central bank may be in a position to moderate its pace of hikes. In the prior statement, it read "In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments."

This statement gave rise to volatility in markets as investors positioned for a softer approach from the Fed which Chair Jerome Powell pushed back against in his presser by suggesting that there will likely be a higher terminal rate. Therefore, the minutes will be scrutinised for clarity in this regard. ''We expect the November FOMC meeting minutes to shed further light on the FOMC's deliberations regarding the expected downshift in the pace of rate increases in upcoming meetings,'' analysts at TD Securities said.

''But above all, we look for the minutes to place a lot of emphasis on the likelihood that the terminal rate will need to end up higher than anticipated initially. The Fed still needs to grind down the labour market to align wage and household spending growth with rates more consistent with the inflation target.''

In such a scenario, this could put a bid into the US Dollar that has been downtrodden ahead of the event. Nevertheless, USD/CAD is on the backside of a trend and below a topping pattern daily charts as the following illustrate:

USD/CAD technical analysis

The pair has broken the trendline this month and has corrected back into the resistance with prospects of a downside continuation as illustrated on the following hourly chart also:

- A softer US Dollar is weighing on the USD/CHF, down by almost 1%.

- A bearish-engulfing candle pattern exacerbated a fall of 200 pips in the USD/CHF.

- Short term, the USD/CHF is downward biased and might test 0.9300.

The USD/CHF dives sharply, extending its losses to two straight days, after reaching a new two-week high of 0..9600, nearby the 200-day Exponential Moving Average (EMA) at 0.9628. Failure to reclaim the former exacerbated a 200-pip fall. Therefore, the USD/CHF is trading at 0.9430, losing almost 1%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF daily chart portrays the formation of a bearish-engulfing candle chart pattern formed with Monday and Tuesday’s USD/CHF price action. On Wednesday, the major continued its downward path, after printing a daily high of 0.9533, right at the 23.6 % Fibonacci retracement, defended by sellers, as shown by the USD/CHF plunging 100 pips. Even though the Relative Strength Index (RSI) followed suit, it turned flat in bearish territory, opening the door for consolidation.

In the short term, the USD/CHF collided with the 50-period Exponential Moving Average (EMA) around 0.9488, and a downslope trendline was drawn since the beginning of November. Hence, the US Dollar (USD) buyers unable to break above 0.9500 exposed the pair to selling pressure.

Therefore, the USD/CHF first support will be the 0.9400 figure, followed by the November 15 swing low at 0.9356. A decisive break will expose the 0.9300 figure. Upwards, the USD/CHF key resistance level lie at 0.9500, which, once cleared, could open the door towards 0.9600 and beyond.

USD/CHF Key Technical Levels

- GBP/USD exchanges hands above its opening price by 1.50%.

- US S&P Global PMIs flashed that the economy is slowing faster than expected.

- Consumer sentiment in the US remains positive, while inflation expectations eased.

- Durable Good Orders in the United States exceeded forecasts, showing consumers resilience.

The Pound Sterling is rallying back above 1.2000 after the release of mixed economic data out of the United States (US), weighed on the US Dollar (USD). At the same time, a risk-on impulse keeps European and US equities trading with gains ahead of the release of the Federal Reserve’s (Fed) last meeting minutes. At the time of writing, the GBP/USD is trading at 1.2051 after hitting a daily low of 1.1872.

US economic data was mixed, undermining the US Dollar

Data released from the US came mixed, undermining the US Dollar. The University of Michigan (UoM) Consumer sentiment came at 56.9, above estimates but below the preliminary reading of November. Delving into the report, 1-year inflation expectations were lowered from 5.1% to 4.9%, while the 5-10 year horizon remained unchanged at 3.0%. Meanwhile, US New Home Sales surprisingly jumped to 632K from 570K, even though higher mortgage rates, nearly 7%, were sparked by the Federal Reserve tightening monetary conditions,

Earlier, S&P Global reported that October’s Manufacturing, Services, and Composite PMIs for the US, are flashing a recession, remaining each at 47.6, 46.1, and 46.3, respectively. The biggest plunge was observed in the Manufacturing index, diving from 50.4 in the previous reading and below estimates of 50.

Before Wall Street opened, the US Department of Commerce revealed that Durable Good Orders in October rose by 1%, vs. 0.4% estimates, smashing September’s 0.3% figure while excluding transportation, the so-called core Durable Good Orders, climbed 0.5% above forecasts. At the same time, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the week ended November 19 increased to 240K, above estimates of 225K, amidst a period of high-tech companies laying off workers.

That said, the GBP/USD jumped from around 1.1950 to its new three-month high at 1.2080, a level last seen on August 17, 2022. The US Dollar Index, a gauge of the buck’s value against six peers, dives 0.72%, down to 106.374.

Data revealed during the European session showed that the UK S&P Global/CIPS PMIs were unchanged, at contractionary territory, further cementing the case of an economic contraction. After the Bank of England (BoE) revealed its latest monetary policy report, policymakers expressed that the UK was already in a recession.

What to watch

Traders’ focus shifts to the release of the Federal Reserve Open Market Committee (FOMC) minutes of the November meeting. Analysts are searching for clues about how high policymakers expect rates to go, how many participants support that view, and how many support a slowdown in rate increases.

GBP/USD Key Technical Levels

Bank of England (BoE) Chief Economist Huw Pill said on Wednesday that further policy action will likely be required to ensure that inflation returns sustainably to the 2% target, as reported by Reuters.

Pill further added that he does not anticipate raising bank rate to levels priced by markets ahead of the November monetary policy report.

Market reaction

These comments don't seem to be having a noticeable impact on the Pound Sterling's market valuation. As of writing, GBP/USD was trading at 1.2055, where it was up 1.43% on a daily basis.

- Mexican peso rises again versus US dollar.

- USD/MXN tests critical support around 19.25/30.

- Upside remains limited while under 19.55/60.

The USD/MXN is falling on Wednesday for the second day in a row, amid a weaker US Dollar and ahead of the release of the FOMC minutes. The pair is pulling back after the upside was capped by the 19.60 horizontal resistance and the 20-day Simple Moving Average at 19.55.

Recently USD/MXN bottomed at 19.32, the lowest level in six days. So far the pair has been able to remain above the critical support area around 19.25/30. Below that area, the next target is seen at 19.00/05, with an intermediate resistance at 19.15.

Technical indicators are turning south again. RSI is moving to the downside but far from the 30 level. Price holds below key moving averages. A consolidation between 19.30 and 19.60 over the next sessions seems likely.

The Dollar needs to break and hold above 19.60 in order to improve the outlook. A daily close above would point to more gains, toward the next barrier at 19.80.

USDMXN daily chart

-638048160542577806.png)

Gold remains capped by the 200-Day Moving Average (DMA) at $1,801. A move above here is needed to open up further gains toward the $1,877 June high, strategists at Credit Suisse report.

Beak back below the 55DMA at $1,685 to inject fresh downside momentum

“A break back below the 55DMA at $1,685 is needed to inject fresh downside momentum into the market again, with next supports seen at the recent YTD low at $1,614, before the 50% retracement of the whole 2015/2020 upmove seen at $1,560.”

“Above the 200DMA at $1,801 is needed to open the door for a potential rise toward the $1,877 June high, as well as reassert a broad consolidation phase.”

- Consumer confidence rise above expectations in November.

- New Home Sales jump unexpectedly 7.5% in October.

- S&P Global Composite falls more than expected in November.

- EUR/USD soars to its highest level since Friday amid a weaker Dollar.

The EUR/USD is trading around the 1.0375 zone, at the highest level since Friday boosted by a weaker US Dollar and ahead of the FOMC minutes. The Greenback lost momentum following the release of economic reports.

The pair made a clear break above 1.0350 and gained strength. If it continues to rise, the next resistance area is seen at 1.0400. On the flip side, a slide under 1.0320 should weaken the current intraday bullish bias.

Dollar down after US data

The Greenback is losing ground across the board as US yields tumble. The DXY is falling by 0.83%. The US 10-year yield fell to 3.70% while the 2-year dropped to 4.47%.

Earlier on Wednesday, economic data showed an increase to multi-week highs in jobless claims, offset by a bigger-than-expected increase in Durable Goods Orders. More recently, the November preliminary PMI S&P Global showed a decline in the Composite index to 46.3 from 48.3, below the 47.7 of market consensus. New Home Sales jumped 7.5%, surpassing expectations. The University of Michigan Consumer Sentiment Index recovered from 54.7 to 56.8, above the 55 expected.

Later on Wednesday, the Federal Reserve will release the minutes of its latest meeting. Market participants will look for clues about a potential slowdown in rate hikes. “We look for the minutes to place a lot of emphasis on the likelihood that the terminal rate will need to end up higher than anticipated initially. The Fed still needs to grind down the labor market to align wage and household spending growth with rates more consistent with the inflation target”, said analysts at TD Securities.

On Thursday, Wall Street will remain close due to Thanksgiving Day. In Japan, the Jibun Bank Manufacturing PMI and the Leading Index are due.

Technical levels

- October’s upbeat data from the United States bolstered the US Dollar as Gold edges lower.

- US Durable Good Orders came better than expected amidst a gloomy economic outlook.

- The labor market in the US continued to ease, as shown by Initial Jobless Claims.

- Short term, XAU/USD is neutral biased but would turn upwards if it reclaims $1750.

Gold Price registers minuscule gains of 0.19% following the release of economic data from the United States (US), on the busiest day of the current week calendar, which failed to underpin the US Dollar (USD), ahead of the release of the Federal Reserve (Fed) monetary policy meeting minutes at around 18:00 GMT. At the time of writing, the XAU/USD is trading at $1741 after hitting a daily high of $1745.77.

Durable Good Orders rose sharply, underpinning the US Dollar

Sentiment is mixed as Wall Street fluctuates between gainers and losers. Data reported by the US Department of Commerce (DoC) revealed that Durable Good Orders in October jumped by 1% compared to September’s 0.3%, showing consumers’ resilience amidst a time of high inflation, elevated borrowing costs, and a deteriorated economic outlook. Delving into the report, core Durable Orders, which exclude transportation and aircraft, rose 0.5% MoM for the same period, well above September’s -0.9% contraction, and expectations of coming unchanged.

The US labor market begins to ease

At the same time, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the week ending on November 19 increased to 240K above estimates of 225K, amidst a period of high-tech companies laying off workers. Meanwhile, continuing claims climbed by 48K to 1.55 million in the week ended November 12, the highest since March, flashing signs that the labor market is easing.

The XAU/USD seesawed on data, hitting a daily low of $1725.23 before rallying towards the daily high at $1747.69 and stabilizing around current spot prices. In the meantime, the US Dollar Index (DXY), a gauge of the US Dollar value vs. six currencies, extended its losses, down by 0.51%, at 106.600.

Federal Reserve officials committed to tame inflation, as traders eye FOMC minutes

Elsewhere, Federal Reserve officials commented that the central bank’s primary goal is to bring inflation to 2%, though acknowledging that borrowing costs should moderate. On Tuesday, the Cleveland Fed President Loretta Mester said, “Maintaining price stability is a critical objective that will be accomplished using all available means.” On Monday, Mester commented that she Is open to moderate rate hikes, though she emphasized that a pause is off the table. She echoed some of the comments made by San Francisco Fed President Mary Daly’s saying that the Federal Funds rate (FFR) needs to peak at around 5%.

Later in the day, the US economic calendar will reveal the Federal Reserve Open Market Committee (FOMC) minutes from the November meeting, which analysts will scrutinize. They are searching for clues about how high policymakers expect rates to go, how many participants support that view, and how many support a slowdown in rate increases.

Gold Price Analysis (XAU/USD): Technical outlook

After dropping to a new two-week low of around $1725.23, testing the August 22 swing low of $1727.90, XAU/USD is staging a comeback, as the spot price is back above $1740. Traders should be aware that the Relative Strength Index (RSI) shifted flat, though as it stays in bullish territory, a resumption of the uptrend Is on the cards.

If XAU/USD buyers reclaim $1750, the Gold Price might return to trade within the $1750-$1760 area before launching an assault to $1800. On the flip side, failure to do it will expose XAU/USD’s to a fall toward the 100-day Exponential Moving Average (EMA) at $1711.24, followed by a test of the $1700 figure.

There is clearly a change in tone in the US Dollar in the air. History suggests the early stages of US recessions are typically associated with USD weakness, economists at Scotiabank report.

CHF and JPY have tended to benefit in periods of US recessions

“On average (looking at the last five US recessions of 1981, 1990, 2001, 2007 and 2020) the USD declines a little more than 2% in the first three months of US recessions, with losses contained to 0.5% on average over a six-month view. This suggests to us that mild USD rebounds versus G3 currencies remain a sell in the next few months.”

“The USD’s role as a safe-haven has evolved over time and its linkage to risk appetite has strengthened in the post-Great Financial Crisis environment, our long-run correlation studies indicate. That may limit pressure on the exchange rate in the coming recession to some extent. But history suggests that the more ‘usual’ havens– that is to say, strong external account currencies, such as the CHF and JPY – have tended to benefit in periods of US recessions.”

“A situation where US yields decline and commodity prices ease, both developments which are conceivable under a recession scenario, should be favourable for the JPY (as these conditions would imply less onerous yield spreads and an improvement in Japan’s weak terms of trade) even considering Japan’s weakened trade balance (and recently diminished haven status).”

- New Home Sales in the US rose unexpectedly in October.

- US Dollar Index stays deep in negative territory at around 106.50.

Sales of new single‐family houses rose by 7.5% in October to a seasonally adjusted annual rate of 632,000, the data published jointly by the US Census Bureau and the Department of Housing and Urban Development showed on Wednesday.

This reading followed September's contraction of 11% and came in much better than the market expectation for a decrease of 3.8%.

Market reaction

This data failed to help the US Dollar, which came under heavy selling pressure on disappointing PMI figures, find demand. As of writing, the US Dollar Index was down 0.55% on the day at 106.55.

- The index loses the grip further and targets 106.00.

- US Flash Manufacturing PMI is expected at 47.6 in November.

- Markets’ attention will be on the release of the FOMC Minutes.

The greenback accelerates losses and trades in 4-day lows near 106.30 when tracked by the USD Index (DXY) on Wednesday.

USD Index looks at FOMC Minutes

The index extends the recent breakdown of the 107.00 mark and drops to new lows in the proximity of 106.00 on the back of persevering appetite for the risk complex and rising prudence prior to the publication of the FOMC Minutes.

On the latter, market participants will closely follow the release of the Minutes of the November event, where the centre of the debate is expected to be around any debate surrounding the next steps by the Fed when it comes to future interest rate hikes.

In the US docket, the flash Manufacturing PMI is seen at 47.6 in November and 46.1 when it comes to the Services gauge.

What to look for around USD

The dollar faltered just ahead of the 108.00 barrier and sparked a so far 2-day corrective move to the area below the 107.00 yardstick pari passu with the recovery in the risk-linked galaxy.

While hawkish Fedspeak maintains the Fed’s pivot narrative in the freezer, upcoming results in US fundamentals would likely play a key role in determining the chances of a slower pace of the Fed’s normalization process in the short term.

Key events in the US this week: MBA Mortgages Applications, Building Permits, Durable Goods Orders, Initial Jobless Claims, Flash Manufacturing/Services PMIs, Final Michigan Consumer Sentiment, New Home Sales, FOMC Minutes (Wednesday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.59% at 106.51 and the breakdown of 105.34 (monthly low November 15) would open the door to 105.22 (200-day SMA) and finally 104.63 (monthly low August 10). On the other hand, the next up barrier comes at 107.99 (weekly high November 21) followed by 109.18 (100-day SMA) and then 110.63 (55-day SMA).

- US S&P Global Services PMI fell more than expected in early November.

- US Dollar struggles to find demand following the disappointing PMI surveys.

The business activity in the US service sector continued to contract at an accelerating pace in early November with the S&P Global Services PMI dropping to 46.1 from 47.8 in October. This print missed the market expectation of 47.9.

"In line with weak demand, new business fell at a solid pace in November," S&P Global elaborated. "The second successive monthly decrease in new orders was the sharpest seen since May 2020."

"On the price front, input costs rose at a slower pace midway through the fourth quarter," the publication further read. "The increase in cost burdens was the softest in almost two years, as firms noted lower prices for some key inputs."

Market reaction

The US Dollar stays under heavy selling pressure after this data and the US Dollar Index was last seen losing 0.6% on the day at 106.52.

The Riksbank is set to announce its Interest Rate Decision on Thursday, November 24 at 08:30 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of five major banks for the upcoming central bank's meeting.

Riksbank meets is expected to hike rates by 75 basis points to 2.50%. At the last meeting, the bank delivered a hawkish surprise and hiked rates 100 bps to 1.75%.

ING

“Given that the ECB has continued with its 75 bps rate hikes – and the Riksbank has been vocal about staying out in front of the eurozone’s interest rate policy – we expect further aggressive tightening by Swedish policymakers. Remember this is Riksbank’s last meeting before February, and we, therefore, expect a 75 bps hike on Thursday. We’d expect the new interest rate projection published alongside the decision to pencil in at least another 25 bps worth of tightening early next year, but ultimately there are limits to how far it can go given the fragile housing market.”

Danske Bank

“We expect Riksbank to hike its policy rate by 75 bps, which is largely priced in the markets already.”

TDS

“We now look for the Riksbank to deliver a 75 bps hike despite signaling for a 50 bps increase in Sep, as core CPIF has surged and major CBs have hiked more than the Bank expected. While markets see ~50% odds of a 100 bps hike, we think a 50 bps move is more likely, as headline CPIF is much lower than the Bank's forecast.”

Swedbank

“We expect the Riksbank to raise by 75 bps to 2.5%. We also expect its new rate path to show another hike of 25 bps in the first half of 2023. But in reality, we think it will raise more than that – namely, 50 basis points – at the February meeting to a level of 3%. The decision to stop reinvesting securities at the start of next year isn’t likely to change. In other words, monetary policy is getting tighter.”

Nordea

“We expect the Riksbank to increase the policy rate by 75 bps to 2.50%, but our conviction is low. October core CPI, large rate hikes by ECB and Fed, few Riksbank meetings and higher foreign inflation would be the main drivers for a 75 bps hike. A 50 bps hike is the Riksbank’s guidance from September and an obviously possible outcome. The bond purchase amounts should in our view be phased out completely in Q1 2023. The Riksbank could decide to continue purchases in smaller amounts in order to ‘keep readiness’ for future interventions.”

- US S&P Global Manufacturing PMI dropped below 50 in early November.

- US Dollar Index extended its daily slide after the data.

Business activity in the US manufacturing sector contracted in early November with the S&P Global Manufacturing PMI dropping to 47.6 from 50.4 in October. This reading came in weaker than the market expectation of 50.

"Contributing to the decrease in the headline figure was a renewed fall in output and a sharper decline in new orders," S&P Global explained in its publication.

Commenting on the survey, "in this environment, inflationary pressures should continue to cool in the months ahead, potentially markedly, but the economy meanwhile continues to head deeper into a likely recession," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Market reaction

The US Dollar Index fell sharply with the initial reaction to this data and was last seen losing 0.6% on the day at 106.50.

- Japanese yen gains momentum during the American session amid lower US yields.

- US data mixed: jobless claims at monthly highs while Durable Goods Orders rise above expectations.

- USD/JPY extends retreat from above 142.00, eyes 140.50/60.

The USD/JPY is falling for the second day in a row on Wednesday before more US data and the FOMC minutes. The pair continues to pull back after hitting on Monday the highest level in two weeks above 142.00. Recently the pair printed a fresh daily low at 140.50 and it remains near the lows, with a bearish bias.

USD/JPY looking at 140.50

The outlook for the dollar suffered a deterioration on Wednesday, with price under the 20-Simple Moving Average in four hours chart. Still USD/JPY remains above the 140.50/60 key support area. A break lower would point to more losses.

If the pair manages to remain above 140.50, the greenback could recover strength. On the upside, the immediate resistance is seen at 141.50 followed by 142.05/10.

Yen up as US yields drop

Economic data from the US showed a bigger-than-expected increase in jobless claims while Durable Goods Orders rose above expectations. The Dollar fell after the data.

Next on the calendar is the November preliminary PMI S&P Global. Later, during the second half of the American session, the Federal Reserve will release the minutes of its latest meeting. Market participants will look for clues about the next moves of the Fed. The next FOMC meeting is December 13 and 14. Recent comments from Fed officials warrant another rate hike but it could be smaller than 75 bps.

US bond yields are falling ahead of the data and the minutes, supping the Japanese yen across the board that is not being affected by risk appetite. In Wall Street, the Dow Jones is rising by 0.25% and the Nasdaq by 0.16%.

Technical levels

NZD/USD is testing the top of its recent range at 0.6203/05. A close above there would expose the 200-day Moving Average (DMA) at 0.6302, analysts at Credit Suisse report.

Only above 200 DMA would mark firmer medium-term upside

“We continue to expect an eventual break above the last week’s highs at 0.6203/05, above which would open the door to the 200 DMA at 0.6302. Should a convincing break above here be achieved, this would suggest further medium-term strength, with the next firm resistance seen at the August highs at 0.6456/68.”

“Immediate support remains seen at the 13-Day Exponential Moving Average and recent lows at 0.6069/60, but we look for support at 0.6000/5983 to try to prevent any sharper move lower to avoid a lengthier consolidation.”

Softer-than-expected US inflation triggered a sell-off in the US Dollar, helping Gold prices to recover. That is unlikely to last, in the opinion of economists at ANZ Bank.

Fed rate hikes hang over Gold

“The recent Gold price rally was triggered by softer-than-expected US inflation for October. However, we believe the market reaction to the latest inflation print was exaggerated as inflation remains near 7.7%, which is well above the central bank’s target of 2%. Further, the month-on-month increase was still 0.4% for both September and October.”

“It is not enough for the Fed to be confident that inflation is on track to move back to 2% sustainably. Any hawkish comments from the Fed could reverse the recent bullish move in XAU/USD.”

“Retreating inflation and rising rates until early 2023 would keep real rates rising, leaving the backdrop challenging for non-yielding Gold.”

- AUD/USD lacks any firm intraday directional bias on Wednesday and oscillates in a range.

- The prevalent USD selling bias offers some support, though a softer risk tone caps gains.

- The mixed US data fails to provide any impetus as the focus remains on FOMC minutes.

The AUD/USD pair struggles to gain any meaningful traction and seesaws between tepid gains/minor losses through the early North American session on Wednesday. The pair is currently placed around mid-0.6600s, nearly unchanged for the day, as traders keenly await the release of the November FOMC meeting minutes.

In the meantime, the prevalent US Dollar selling bias continues to offer support to the AUD/USD pair. Investors seem convinced that the Federal Reserve will slow the pace of its policy-tightening cycle and have been pricing in a greater chance of a relatively smaller 50 bps rate hike in December. This, in turn, is seen as a key factor weighing on the Greenback.

The USD maintains its offered tone and fails to gain any respite from mixed US economic releases. The Weekly Initial Jobless Claims in the US rose to the highest since August and largely offset the upbeat US Durable Goods Orders data. That said, the cautious market mood helps limit losses for the safe-haven buck and keeps a lid on the risk-sensitive Australian Dollar.

From a technical perspective, the AUD/USD pair has managed to hold comfortably above the 0.6600 round figure. The said handle should protect the immediate downside and act as a pivotal point for intraday traders. A convincing break below will expose a strong resistance breakpoint, around the 0.6560-0.6550 area, which coincides with the 200-period Exponential Moving Average on the 4-hour chart.

Some follow-through selling will negate any near-term positive outlook and shift the bias in favour of bearish traders. The AUD/USD pair might then turn vulnerable to accelerate the fall towards the 0.6500 psychological mark. The downward trajectory could get extended towards the 0.6435 intermediate support before spot prices eventually drop to sub-0.6400 levels.

On the flip side, immediate resistance is pegged ahead of the 0.6700 mark, which if conquered should pave the way for additional gains. The AUD/USD pair might then climb to the 0.6740-0.6745 hurdle and make a fresh attempt to conquer the 0.6800 mark. The momentum could get extended towards a technically significant 200-day Simple Moving Average, currently around the 0.6845 region. The pair has also formed a harami Japanese candelstick pattern on the daily chart at the recent November 21-22 lows and if Wednesday's price provides bullish confirmation in the form of a green candlestick the short-term trend may flip bullish.

AUD/USD 4-hour chart

Key levels to watch

- EUR/USD adds to Tuesday’s advance and retests 1.0350.

- Next on the upside comes the key 200-day SMA near 1.0400.

EUR/USD advances for the second session in a row and climbs to 3-day highs around 1.0350.

The continuation of the rebound should initially target the key 200-day SMA, today at 1.0395. The surpass of this region is needed to challenge the so far November high at 1.0481 (November 15).

The pair’s outlook is expected to shift to positive above the 200-day SMA.

EUR/USD daily chart

- Initial Jobless Claims in the US rose by 17,000 in the week ending November 19.

- US Dollar Index struggles to gain traction, stays below 107.00.

There were 240,000 initial jobless claims in the week ending November 19, the weekly data published by the US Department of Labor (DOL) showed on Wednesday. This print followed the previous week's print of 223,000 and came in worse than the market expectation of 225,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.1% and the 4-week moving average was 226,750, an increase of 5,500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending November 12 was 1,551,000, an increase of 48,000 from the previous week's revised level," the DOL noted in its publication.

Market reaction

The US Dollar Index stays under modest bearish pressure after this data and was last seen losing 0.22% on the day at 106.90.

- Durable Goods Orders in the US rose more than expected in October.

- US Dollar Index stays in negative territory below 107.00 after the data.

Durable Goods Orders in the US rose by 1%, or by $2.8 billion, on a monthly basis in October to $277.4 billion, the monthly data published by the US Census Bureau revealed on Tuesday. This reading followed September's 0.3% expansion and came in better than the market expectation for an increase of 0.4%.

"Excluding transportation, new orders increased 0.5%," the publication further read. "Excluding defense, new orders increased 0.8%. Transportation equipment, up six of the last seven months, led the increase, $2.0 billion or 2.1% to $97.8 billion."

Market reaction

The US Dollar Index edged lower with the initial reaction and was last seen losing 0.3% on the day at 106.80.

- USD/CAD catches some bids on Wednesday and recovers a part of the overnight losses.

- A fresh leg down in oil prices undermines the Loonie and remains supportive of the move.

- Bets for less aggressive Fed rate hikes weigh on the USD and might cap gains for the pair.

- Traders now look to the US macro data for some impetus ahead of the key FOMC minutes.

The USD/CAD pair attracts some buying near the 1.3360-1.3355 area and stages a goodish bonce from the weekly low touched earlier this Wednesday. The pair reaches a fresh daily high near the 1.3425 region during the early North American session and for now, seems to have stalled this week's corrective slide from the vicinity of the 1.3500 psychological mark.

A fresh leg down in crude oil prices is seen undermining the commodity-linked loonie and turning out to be a key factor acting as a tailwind for the USD/CAD pair. An imminent price cap on Russian oil by the Group of Seven (G7) nations, along with worries that a new COVID-19 outbreak in China will hurdle fuel demand, weigh on the black liquid. Moreover, the Organisation for Economic Cooperation and Development (OECD) sees a deceleration in global economic expansion next year and further adding pressure on crude oil prices.

The US Dollar, on the other hand, remains depressed for the second straight day amid growing acceptance that the Fed will slow the pace of its policy tightening. In fact, the markets are currently pricing in a greater chance of a relatively smaller 50 bps Fed rate hike move in December. Furthermore, stable performance in the equity markets is seen as another factor weighing on the safe-haven greenback. This, in turn, might cap any further gains for the USD/CAD pair as the market focus remains glued to the FOMC meeting minutes.

Investors will look for clues about the Fed's policy outlook and future rate hike path. This will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to the USD/CAD pair. Heading into the key event risk, the US economic docket - featuring the releases of Durable Goods Orders, Weekly Initial Jobless Claims, flash PMIs and New Home Sales data - might produce short-term trading opportunities.

Technical levels to watch

GBP/USD pushes higher as momentum remains positive. Economists at Scotiabank believe that Cable could test the 1.21 in the near-term.

Short-term technical patterns remain GBP-positive

“Short-term technical patterns remain GBP-positive; Cable is edging out of the short-term consolidation pattern (bull wedge) than has formed over the past week, putting a test of the 1.21 zone (at least) on the near-term radar.”

“Intraday gains still face some tough resistance points – 1.1960 high tested twice last week and the 1.2025/30 peak from Nov 15th.”

“Support is (firm) at 1.1870/75 now.”

EUR/USD edges lower from 1.0350 test after mixed Eurozone PMIs. The pair needs to defend 1.03 in order to retain bullish momentum, economists at Scotiabank report.

Weakness below 1.03 will point to renewed losses

“The data were mixed but the aggregate Eurozone data were better than forecast and unchanged or slightly stronger than the Oct report. All data prints were below 50, suggesting economic contraction, but the data will not prevent further ECB tightening in Dec. Modest EUR dips are liable to remain supported, we expect.”

“The short-term uptrend remains intact but soft price action may see spot test support around the 1.0300 zone intraday; holding the figure zone should renew bullish momentum for a retest (and break) of 1.0350.”

“Weakness below 1.03 will point to renewed losses towards the low 1.02s at least.”

- GBP/USD scales higher for the second straight day and climbs to a fresh weekly high.

- Bets for less aggressive Fed rate hikes weigh on the USD and offer support to the pair.

- Better-than-expected UK PMI underpins the GBP and contributes to the positive move.

- Investors now look to US macro data for some impetus ahead of the key FOMC minutes.

The GBP/USD pair builds on the previous day's positive move and gains some follow-through traction for the second successive day on Wednesday. The pair maintains its bid tone through the early North American session and is currently placed near the weekly high, just below the mid-1.1900s.

A combination of factors keeps the US Dollar bulls on the defensive, which, in turn, is seen acting as a tailwind for the GBP/USD pair. Investors now seem convinced that the US central bank will slow the pace of its rate-hiking cycle and have been pricing in a greater chance of a relatively smaller 50 bps lift-off in December. This, along with a generally positive tone around the equity markets, continues to weigh on the safe-haven greenback.

The British Pound, on the other hand, draws support from reports that the UK government might look to pursue a Swiss-style relationship with the European Union. This comes on the back of expectations that the Bank of England will lift interest rates further to tame inflation. Furthermore, the flash UK PMIs showed that economic activity slowed less than expected in November, which is further underpinning the Sterling and pushing the GBP/USD pair higher.