- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-11-2022

Japan's Gross Domestic Product which is released by the Cabinet Office shows the following:

Japanese GDP Annualised SA (QoQ) Q3 P: -1.2% (exp 1.2%; R previous 4.6%) -GDP SA (QoQ) Q3 P: -0.3% (exp 0.3%; R previous 1.1%).

More to come

The yen is a little pressured on the day but less affected by the data directly. USDJPY trades at 140.12 and flat on the release.

About Japan GDP

The Gross Domestic Product released by the Cabinet Office shows the monetary value of all the goods, services and structures produced in Japan within a given period of time. GDP is a gross measure of market activity because it indicates the pace at which the Japanese economy is growing or decreasing. A high reading or a better-than-expected number is seen as positive for the JPY, while a low reading is negative.

- Gold price struggles around a three-month high, after posting a bearish candlestick.

- Federal Reserve officials challenge United States inflation-led optimism.

- Jitters surrounding China also test Gold prices amid a light calendar.

- Downside risk appears escalating amid the US Dollar rebound.

Gold price (XAUUSD) remains depressed at around $1,770 while justifying the previous day’s bearish candlestick formation, as well as sluggish market conditions, during Tuesday’s Asian session.

The yellow metal’s latest weakness could also be linked to the mixed comments from the US Federal Reserve (Fed) officials, as well as fears surrounding China. It should be noted, however, that a light calendar also offers trading filters for the Gold price.

Federal Reserve officials challenge optimism over the Gold price

Having promoted the easy rate hikes and teased pivot talks in the last week, the US Federal Reserve policymakers began the week on a mixed footing as Vice-Chair Lael Brainard favored 50 bps rate hike but also stated, “We have additional work to do.” Earlier on Monday, Federal Reserve Governor Christopher Waller also promoted the ideal of a 0.50% rate hike while also warning against the market’s perception of the pivot. Such comments from the US Federal Reserve officials tame optimism surrounding future policy moves and renewed the US Dollar's strength.

Headlines from China also tease Gold price downside

China is the largest customer of bullion and hence the latest mixed headlines from the dragon nation probe the Gold price. Recently, US President Joe Biden and his Chinese counterpart Xi Jinping talked face-to-face for the first time in three years and tried to promote healthy competition, which in turn should have favored the Gold price. However, the thorny issue surrounding Taiwan soured the optimism surrounding the event.

Elsewhere, China’s easing of some of the Covid restrictions and help to the real-estate sector joins the jump in the daily coronavirus numbers to challenge the Gold traders.

US Treasury yields are the key

Given the US Treasury yields’ rebound underpinning the US Dollar’s comeback, the Bond coupons will be crucial to watch for clear directions, especially amid mixed updates and a light calendar. Should the bond bears keep fearing recession and hold control, the Gold price is likely to remain firmer. That said, the benchmark US 10-year Treasury yields remain unchanged near 3.86% by the press time.

US inflation expectations are important too

It’s worth noting that an increase in the New York Federal Reserve’s (Fed) inflation expectations appeared to have renewed the US bond selling and hence headlines surrounding price pressure should also be watched for near-term Gold price directions. As a result, today’s US Producer Price Index (PPI) for October, expected 8.3% YoY versus 8.5% prior, should be watched carefully to aptly forecast the near-term Gold price moves.

Technical analysis

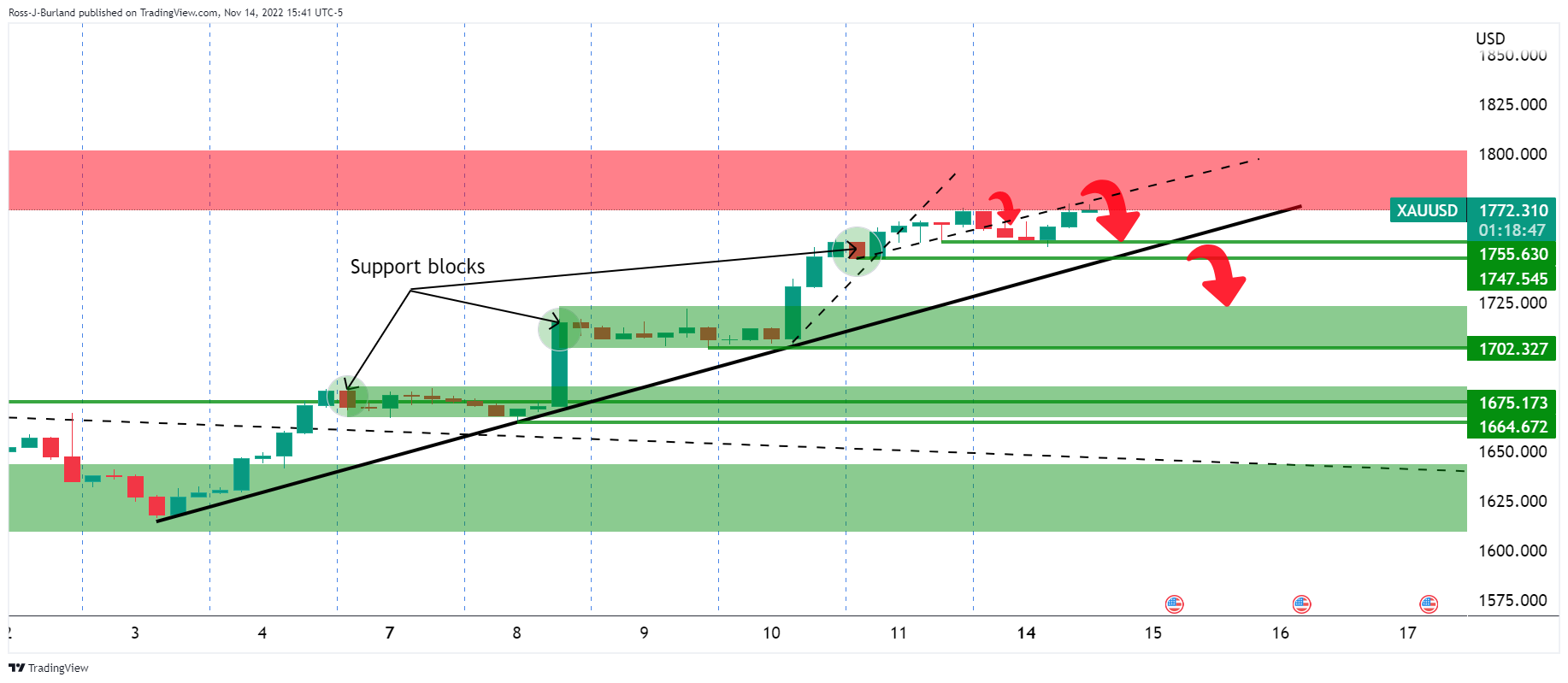

Gold price justifies the previous day’s bearish Doji candlestick, as well as the oversold conditions of the Relative Strength Index (RSI), located at 14, while printing mild losses.

That said, the Gold price could approach September’s high surrounding $1,735 during further downside, as the Moving Average Convergence and Divergence (MACD) also appears to ease the bullish bias.

However, the previous resistance line from late April, around $1,703 at the latest, could challenge the further downside of the Gold price.

Alternatively, a daily closing beyond the previous day’s high near $1,775 could recall the bullion buyers.

Even so, a convergence of the 200-DMA and multiple levels marked since mid-May, around $1,805-08, appears a tough nut to crack for the Gold price to cross before convincing the buyers.

Gold price: Daily chart

Trend: Further downside expected

- The downside momentum could get pause due to Harami Cross formation near the long-term trendline.

- Risk impulse has turned quiet which has shifted the DXY into the rangebound territory.

- Contrary to candlestick formation, a bearish range shift by the RSI (14) indicates more weakness ahead.

The USDCHF pair has attempted a pullback move after testing the previous week’s low around 0.9414 in the late New York session. The asset is displaying rangebound moves as the US dollar index (DXY) has turned sideways on a relatively quiet market mood.

The upside in the DXY has been capped due to lower chances for the continuation of 75 basis points (bps) rate hike by the Federal Reserve (Fed), while the downside is restricted due to anxiety ahead of the US midterm elections outcome. S&P500 futures have rebounded in Tokyo after a bearish Monday, which might bring the risk-on mood back into traction.

-638040665644513617.png)

On a daily scale, the asset has displayed a perpendicular fall after failing to sustain above the critical resistance of 1.0100. The major has dropped sharply to near the upward-sloping trendline placed from the 6 January 2021 low at 0.8758.

A sheer decline in the pair has turned the 50-and 200-period Exponential Moving Averages (EMAs) at 0.9830 and 0.9645 respectively towards the downside. This indicates that the short- and long-term trend is bearish now.

Adding to that, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00 for the first time in 15 months, which indicates more weakness ahead.

-638040665876193407.png)

On Monday, the asset formed a Harami Cross candlestick pattern that indicates a pause in the downside direction. A broad market profile could either be a continuation of the downside momentum or a reversal due to a loss in the downside momentum. Investors need to perform actively at this stage as it could be a make-or-a-break situation ahead.

Should the asset drop below Friday’s low around 0.9400, the Swiss franc bulls will drag the pair towards January 31 high at 0.9343, followed by March 31 low around 0.9200.

On the flip side, a break above the psychological resistance of 0.9500 will drive the asset toward the 200-EMA at 0.9645. A breach above the 200-EMA will send the asset toward the round-level resistance at 0.9700.

- EURUSD could be on the verge of a downside correction, but only time will tell.

- Bears will await the Asian highs and lows and a set up for the day ahead.

The US Dollar gained against the euro on Monday but has been unable to take off as investors are still in two minds about whether there is going to be a slower pace of Federal Reserve interest rate hikes going forward.

The US Dollar got a boost when Christopher Waller crossed the wires and said Friday's inflation report was "just one data point," and that markets are "way out in front". This has been the theme that is gathering pace in the opening sessions.

DXY daily chart

The daily chart in the US Dollar is showing signs of a corrective nature which opens risk for the downside in the euro as follows:

EURUSD H1 chart

Bears will be reluctant to make their move in the face of caution around the Fed sentiment, but the resistance is compelling for a move to the downside on the hourly chart. The price needs to form a topping formation below the trendline, with a break of structure, 1.0320.

EURUSD daily chart

Correction in the making?

EURUSD weekly chart

The price is on the front side of the major trend but the back side of the recent trend and this leaves the focus on a move towards 1.0500 following a correction that could be imminent.

Early Tuesday morning in Asia, at 00:30 GMT, the Reserve Bank of Australia (RBA) will release the minutes of the latest monetary policy meeting held in November.

The Australian central bank surprised markets by announcing a softer rate hike of 0.50% versus 0.75% in its latest meeting, which in turn raised expectations that the pivot is already established. The same could be confirmed from the latest comments of the RBA officials and make it important for the policy hawks to step back.

As a result, today’s RBA Minutes will be closely observed for the details on the latest decision which surprised traders and triggered talks of easy rate hikes moving forward. Also important inside the Minutes statement, especially for the AUDUSD pair traders, will be the economic outlook and the central bankers’ optimism towards overcoming the recession fears.

Westpac is on the same line and said,

the RBA’s November meeting minutes will provide more color around the Board’s 25bp rate hike decision, particularly the 25bp versus 50bp debate (if any?). However, the scope for fresh revelations is limited by what we have already seen since the last meeting, including speeches by Lowe and Bullock and the quarterly statement.

How could the minutes affect AUD/USD?

AUD/USD portrays the market’s indecision as it remains sidelined after pausing a bearish Doji candlestick at the two-month high the previous day.

That said, the Aussie pair’s further upside hinges on how the RBA Minutes manage to keep the bulls happy even after promoting the 50 bps rate hike. That being said, talks over the economic transition and neutral rate, as well as surrounding employment conditions, will also be crucial to watch for short-term AUDUSD forecast ahead of this week’s Australia Wage Price Index for the third quarter (Q3), up for publishing on Wednesday.

Technically, the bearish candlestick formation joins overbought RSI (14) and a failure to provide a daily closing beyond the 100-DMA, around 0.6700 by the press time, to keep AUDUSD sellers hopeful. However, the quote’s further downside needs validation from July’s low near 0.6680.

Key Notes

AUDUSD Forecast: Bulls happily adding at lower levels

AUDUSD subdued after Federal Reserve official’s commentary, as RBA minutes loom

About the RBA minutes

The minutes of the Reserve Bank of Australia meetings are published two weeks after the interest rate decision. The minutes give a full account of the policy discussion, including differences of view. They also record the votes of the individual members of the Committee. Generally speaking, if the RBA is hawkish about the inflationary outlook for the economy, then the markets see a higher possibility of a rate increase, and that is positive for the AUD.

- Federal Reserve policymakers are committed to tackling inflation in the United States, bolstering the US Dollar.

- Australia’s Consumer Confidence improved, Aussie Dollar traders eye RBA minutes.

- AUDUSD Price Analysis: The inverted head-and-shoulders pattern remains in play, targets 0.6870.

The Australian Dollar (AUD) is almost flat as the North American session winds down after two Fed officials emphasized the Federal Reserve’s (Fed) commitment to tackle inflation at around 7.7% YoY, bolstering the US Dollar (USD). However, both policymakers acknowledged that it would be “appropriate” to slow the pace of interest-rate increases, spurring a risk-on impulse. Nevertheless, sentiment shifted sour. At the time of writing, the AUDUSD is trading at 0.6700.

Fed officials compromised to bring inflation to Fed’s target

Wall Street finished Monday’s session in the red. Fed Vice-Chair Lael Brainard said that the Federal Reserve might slow the pace of interest-rate increases and said she favors a 50 bps hike in December. Brainard added that the Central Bank would not pause or ease monetary conditions, adding that “we have additional work to do.” Earlier, Fed Governor Christopher Waller echoed Brainard’s comments and commented that the Fed could moderate the size of interest-rate increases to 50 bps at their December meeting or the one after that. Although it was a hawkish statement, and the USD was bolstered, the AUD clung to its last week’s gains, as shown by the AUDUSD hitting a daily low at 0.6663 before challenging the 0.6700 figure.

Data-wise, the United States (US) calendar featured the New York Fed inflation expectations, with one and three-year horizons expanding by 5.9% and 3.1%, from 5.4% and 2.9%, respectively. The jump in inflation expectations is attributed to high gasoline prices.

Australia’s Consumer Confidence improved, but the AUDUSD remains subdued

Aside from this, Australia’s economic docket features the ANZ-Roy Morgan Consumer Confidence, which rose 2.7% after declining 10.4% over the previous six weeks. Delving into the report, Weekly Inflation expectations dropped 0.3% though they remained elevated at around 6.5%. Traders did not react to the data, as the AUDUSD was in choppy trading as the Asian session began.

RBA’s monetary policy minutes eyed

The Reserve Bank of Australia’s (RBA) November monetary policy meeting minutes would be revealed after the Central Bank lifted the Overnight Cash Rate (OCR) 25 bps to 2.85%. Some analysts expect that the RBA will return to a faster pace of tightening after September’s inflation report increased by 7.3%. However, the RBA upgraded its inflation forecast, and now they see inflation at around 8%.

AUDUSD Price Analysis: Technical outlook

The AUDUSD remains neutral-to-upward biased. It should be noted that an inverted head-and-shoulders remains in play, though the Aussie Dollar is struggling to reclaim the 100-day Exponential Moving Average (EMA) at 0.6697. Once the latter is cleared, the uptrend towards the inverted head-and-shoulders pattern target at 0.6870 is on the cards, but critical resistance levels need to be surpassed, like the 0.6800 figure.

- AUDJPY has sensed a buying interest of around 93.50 ahead of RBA minutes/Japan’s GDP.

- The RBA minutes will dictate the reasoning behind announcing a 25 bps rate hike in November.

- BOJ’s Kuroda sees a recovery in the economy as the impact of supply constraints and the pandemic eases.

The AUDJPY pair has witnessed an intermittent pullback after dropping to near 93.50 in early Asia. A short-term relief cushion around 93.50 doesn’t seem long-lasting citing price action and volatility ahead. The release of the Reserve Bank of Australia (RBA) policy minutes and Japan’s Gross Domestic Product (GDP) would bring wild gyrations into the asset.

The release of the RBA minutes will clarify the rationale behind the announcement of the 25 basis points (bps) despite a historic surge in the inflation rate. For the third quarter, the headline inflation soared to 7.3% vs. the projections of 7.0% and the prior release of 6.3%. Therefore, think thanks were expecting that RBA Governor Philip Lowe will return to the 50 bps rate hike regime. The absence of exhaustion in the inflationary pressures can be cared for by aggressive policy tightening measures.

Later this week, investors will focus on the employment data, which will release on Thursday. As per the projections, the Australian economy has added 15k jobs in October month vs. the former release of 0.9k. The jobless rate is seen unchanged at 3.5%.

On the Tokyo front, investors are looking for the release of the Gross Domestic Product (GDP) data. Analysts at ING believe that the third quarter GDP is expected to grow 0.5% QoQ, seasonally adjusted, which is a slower pace than the previous quarter. Reopening effects still led the overall growth but higher inflation and the weak yen partially offset the recovery.”

Meanwhile, positive commentary from Bank of Japan (BOJ) Governor Haruhiko Kuroda failed to fuel sheer optimism in Japanese yen. BOJ Governor is of the view that the economy is likely to recover as the impact of supply constraints and the pandemic eases. The tight labor market will drive wages and the inflation rate to grow around 3% this fiscal year.

Japan’s Finance Ministry is up for releasing the first version of the third quarter (Q2) Gross Domestic Product (GDP) figures for 2022 at 23:50 GMT on Monday, early Tuesday morning in Asia.

Market consensus bears the burden of the global supply chain blockade, mainly due to the Russia-Ukraine tussle, which in turn weighs on the GDP forecasts suggesting a 0.30% QoQ figure versus 0.9% prior. The details mention that the Annualized GDP is expected to have eased 1.1% from 3.5% in previous readings.

Considering the Bank of Japan’s (BOJ) defense of the easy money policies, today’s Japanese GDP data appears the key to the USDJPY pair buyers, especially due to the latest rebound.

Ahead of the event, Westpac mentioned,

Despite the ongoing rebound in consumption, materially weaker trade will likely see GDP growth slow notably in Q3 (market forecst: 0.3% QoQ).

How could it affect USD/JPY?

Considering the risks to Asia’s major economy highlighted by the BOJ policymakers, in the latest meeting, any further weakness in the GDP figures will push the Japanese central bank towards further easing. However, the policymakers are already conveyed their easy-money policy during the times when the major central banks were rushing towards higher rates. Hence, today’s Japanese GDP numbers, even if provide a positive surprise, might not be able to renew the Japanese Yen’s (JPY) strength unless being extremely high.

Technically, the USDJPY pair’s daily closing below the 100-DMA support, now immediate resistance around 140.85, keeps the pair directed towards an upward-sloping support line from late May, close to 136.80 at the latest.

Key Notes

USDJPY reclaims 140.00, after dropping to multi-month lows at around 138.00s

About the Japanese Q3 GDP

The Gross Domestic Product released by the Cabinet Office shows the monetary value of all the goods, services and structures produced in Japan within a given period of time. GDP is a gross measure of market activity because it indicates the pace at which the Japanese economy is growing or decreasing. A high reading or a better than expected number is seen as positive for the JPY, while a low reading is negative.

- NZDUSD struggles to extend the week-start pullback from a two-month high.

- The two-day-old symmetrical triangle, weekly support line restrict immediate moves.

- Oscillators favor bears but 0.6070 limited short-term declines.

- Monthly top, September’s high add to the upside filters.

NZDUSD struggles to keep bears on the board, after their fresh entry the previous day, as the quote seesaws near 0.6100 during Tuesday’s initial Asian session. In doing so, the Kiwi pair remains inside a symmetrical triangle formation established since the last Friday.

Given the bearish MACD signals and the downbeat RSI (14), not oversold, the NZDUSD bears are likely to keep the reins.

However, a clear downside break of the stated triangle’s support line around 0.6070 at the latest appears necessary. That said, the 50-HMA adds strength to the stated support levels.

Should the quote breaks the 0.6070 support confluence, the odds of witnessing a slump toward November 08 peak surrounding the 0.60000 psychological magnet can’t be ruled out.

However, an ascending trend line from November 03, close to 0.5890 by the press time, will challenge the NZDDUSD bears afterward.

Alternatively, an upside clearance of the triangle’s upper line, around 0.6120 at the latest, isn’t an open invitation to the NZDUSD bulls as the monthly high could probe the upside momentum around 0.6130.

Additionally, tops marked in September around 0.6165 also challenge the pair’s north-run.

NZDUSD: Daily chart

Trend: Limited downside expected

- GBPUSD has sensed pressure around 1.1800, following the footprints of the sideways DXY.

- UK Autumn Statement will deliver further clarity on closing the fiscal gap.

- British jobless claims may decline by 12.6k vs. an expansion of 25.5k reported earlier.

The GBPUSD pair declined in the early Asian session after sensing selling pressure while attempting to surpass the immediate hurdle of 1.1800. The Cable has turned sideways after a vertical rally as a market impulse has turned quiet ahead of the US midterm elections outcome.

S&P500 is facing immense pressure ahead of the midterm elections outcome. A majority win of Republicans for the House of Representatives will slow down the execution of expansionary policies ahead as they would be required confirmation from the former too before execution. Also, it will trigger political uncertainty in the economy.

The US dollar index (DXY) is auctioning in a chartered territory after registering a fresh three-month low of around 106.30.

This week, all eyes will remain on the contents of the UK Autumn Budget Statement from Chancellor Jeremy Hunt. The bifurcation of GBP 54bln into spending cuts and tax rises and dismantling of the ‘mini budget’ announced two months earlier by then UK PM Liz Truss will remain in focus. UK Chancellor warned earlier that everyone needs to sacrifice a bit by paying higher taxes to support the economy.

Support for energy bills from the government would be scaled down but support could be there for the low-income group.

Analysts at Danske Bank believe that “While we expect the Autumn Statement to deliver further clarity on closing the fiscal gap, we broadly expect a muted reaction in GBP.”

But before that, investors will keep an eye on the UK employment data, which will release on Tuesday. The jobless claims are expected to display a withdrawal of 12.6k against claims executed in the prior release. The Unemployment Rate is seen as stable at 3.5%.

UK Prime Minister (PM) “Rishi Sunak will announce a significant rise in the national living wage and give eight million households cost of living payments worth up to £1,100 as he prioritizes support for the poorest over universal measures,” per The Times.

The news also adds, “The Times has been told that the prime minister and Jeremy Hunt, his chancellor, will accept an official recommendation to increase the living wage from £9.50 an hour to about £10.40 an hour — a rise of nearly 10 percent. The move will benefit 2.5 million people. One government source suggested that the increase could be even higher.”

Earlier in the day, UK Chancellor Jeremy Hunt was cited drawing lines for the new windfall tax on electricity generators, per the Financial Times (FT). “Jeremy Hunt is preparing a raid on electricity generators with a new tax on their “excess returns” as he tries to find money to pay for an inflation-linked rise in benefits and pensions while extending help for households with energy bills,” mentioned the news.

GBPUSD remains pressured

With the dicey markets and the Cable pair trader’s anxiety ahead of the key UK employment report, GBPUSD remains depressed around 1.1750, keeping the previous day’s pullback from the 11-week high.

- USDCAD grinds higher after bouncing off the 100-DMA.

- Downbeat RSI, MACD conditions favor bears but multiple hurdle before 1.3200 challenge further downside.

- 50-DMA, monthly resistance line add to the upside filters.

USDCAD treads water around 1.3315, after bouncing off the two-month low surrounding the 100-DMA during early Tuesday morning in Asia.

That said, a clear downside break of the support-turned-resistance line from early August, around 1.3400 by the press time, keeps sellers hopeful.

Also keeping sellers hopeful are the downbeat Relative Strength Index (RSI), (located at 14), as well as the bearish MACD signals.

However, a daily closing below 1.3315 becomes necessary for the USDCAD bears to aim for the early September swing high, surrounding 1.3200.

Alternatively, the aforementioned resistance line, previous support near 1.3400, precedes the 50-DMA hurdle surrounding 1.3530 to challenge USDCAD bulls.

In a case where the USDCAD pair manage to stay firmer past 1.3530, a downward-sloping resistance line from October 13, close to 1.3730, will act as the last defense of the pair bears.

Following that, a run-up toward refreshing the yearly high, currently around 1.3980, can’t be ruled. Also acting as an upside filter is the 1.4000 psychological magnet.

Overall, USDCAD is likely to recover but the upside move appears tepid.

USDCAD: Daily chart

Trend: Limited recovery expected

- EURUSD is facing barricades around 1.0350 amid the unavailability of any potential trigger.

- Fed Brainard supported the view of trimming the rate hike pace due to a steep fall in October inflation report.

- Going forward, Eurozone GDP will be of utmost importance.

The EURUSD pair is sensing a capped upside around 1.0350 in the Tokyo session. Quite market mood due to the absence of a potential trigger has shifted the currencies into the rangebound structure. On a broader note, the asset is displaying topsy-turvy moves in a 1.0271-1.0350 range from Monday’s trading session.

The upside in the US dollar index (DXY) is restricted due to rising odds for a slowdown in the pace of rate hikes by the Federal Reserve (Fed). While anxiety ahead of the US midterm elections is providing some cushion to the mighty DXY at the downside.

Chances of shifting hands of stewardship for the US House of Representatives to Republicans weighed pressure on S&P500. A majority win of Republicans will not be in favor of expansionary policies to be announced later as those policies will have to go through Republicans’ confirmation before execution.

A rebound move in the 10-year US Treasury yields remained marginal to near 3.87% as the CME FedWatch tool claims that the chances of a fifth consecutive rate hike by 75 basis points (bps) in December monetary policy are extremely low.

Also, Fed Vice Chair Lael Brainard supported the view of reducing the pace of policy tightening. He cited that “It will soon be appropriate for the Federal Reserve to reduce the pace of its interest rates hikes”, in an interview with Bloomberg.

On the Eurozone front, the Gross Domestic Product (GDP) data will be of utmost importance. As per the consensus, the annual Gross Domestic Data (GDP) is expected to remain stable at 2.1%. The economy is facing the turbulence of soaring inflation, energy crisis, and supply chain bottlenecks due to Russia-Ukraine tensions. Therefore, a stable GDP data might be supportive for the shared currency.

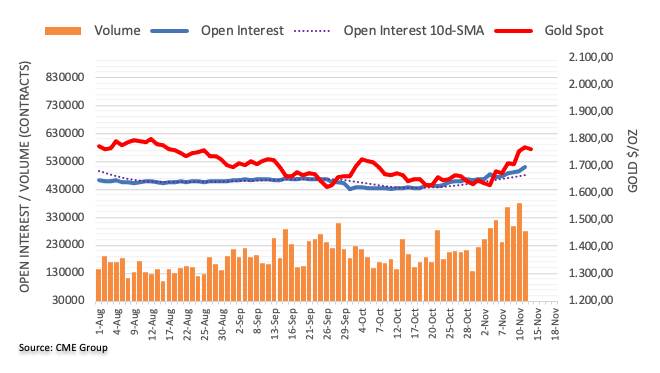

- Gold could be on the verge of a move into the recent length built in November's rally.

- Bears are lurking at critical resistance as Monday establishes a fresh corrective high.

Despite a firmer US Dollar, the Gold price edged higher on Monday to a fresh three-month high even as US yields moved higher following Friday's US Consumer Price Index miss vs. the expectations. The yellow metal continues to garner demand based on traders betting that the Federal Reserve would ease off on big interest rate hikes following Friday's inflation data.

Despite a hawkish Federal Reserve meeting, whereby the Fed Chair, Jerome Powell, pushed back against the market's reaction to a dovish statement by arguing that the terminal rate could be higher than first anticipated, commodity prices have been staging a rally off year-to-date lows. There are a number of components to the switch in sentiment, including speculation that China will ease its restrictive zero-Covid policies. There had been growing speculation, due to a series of less inflationary outcomes in the US data of late, that a Fed pivot was on the horizon.

Friday's US consumer prices rose 0.4% for the month of October, up 7.7% over the year. This was down from 8.2% year over year in September and 0.2 percentage points below consensus, as was the ex-food and energy reading of 6.3%. This was a welcome report and the market reaction included a 5.5% surge in the S&P 500 and a 26 basis point drop in the 2-year Treasury yield that sent gold through the roof and the greenback off a cliff. Gold traders had already been focused on the rise in money manager short positioning over the last months leading to substantial short covering beyond the $1,720 resistance.

Fed speakers eyed

Meanwhile, risk events for the week ahead will lie with the Fed speakers, US Retail Sales, Chinese activity data, and updates with regard to the COVID noise in Chinese markets. As for Fed speakers, the US Dollar was thrown a lifeline by Fed's Christopher Waller who crossed the wires before the open and said Friday's inflation report was "just one data point," and that markets are "way out in front".

- Will need to see a run of CPI reports to take a foot off the brake.

- Positive that goods prices came down with some moderation in services, but it needs to continue.

- US policy rate is "not that high" given level of inflation.

- Rate hikes so far has not "broken anything.

- The US housing market needed to slow down.

- Signal was to pay attention to the endpoint not the pace of rate increases, and until inflation slows the endpoint is "a ways out".

Consequently, the US Dollar was bid at the start of the week: US Dollar bulls could start to emerge in the opening sessions:

On the other side of the spectrum, Fed Vice Chair Lael Brainard said on Monday that it will soon be appropriate for the Fed to reduce the pace of its interest rate hikes.

A slew more speakers are slated and analysts at TD Securities said ''Fed speakers are likely to push back on the overly dovish market reaction after the October CPI report. Officials will make clear that following the positive news on the inflation front, there must be further evidence of sustained monthly core inflation that is more in line with their 2% target. And given the persistent strength of the labor market, this may take a while.''

As for US Retail Sales, the analysts at TDS said, ''we look for retail sales to accelerate in October, following a largely sideways move in September. Spending was likely boosted by a significant increase in auto sales and the first gain in gasoline station sales in four months. Importantly, control group sales likely rose firmly, while those for bars/restaurants probably retreated following two months of expansions.''

Gold technical analysis

As per the start of the week's pre-open analysis, Gold, The Chart of the Week: XAUUSD bears licking their lips, watching for lower timeframe distribution, the yellow metal bears are lurking with the price on the backside of the now broken trendlines (counter trendlines):

- Broad US Dollar strength keeps most G8 currencies weakening, except for the NZD.

- Vice-Chair Brainard boosted hopes that the Federal Reserve might slow its pace of interest-rate increases.

- The New Zealand Dollar (NZD) traders focus shifts on housing data, to be released around 21:30 GMT.

The New Zealand Dollar (NZD) advances in the North American session, even though Fed speaking bolstered the US Dollar (USD), a late intervention of the Federal Reserve (Fed) Vice Chair Brainard turned sentiment positive. Therefore, the NZDUSD is trading at 0.6113, above its opening price by 0.49%.

Federal Reserve’s Vice-Chair Brainard shifted sentiment positively

US equities turned green. Fed Vice-Chair Lael Brainard said that the Fed would soon reduce the pace of rate hikes and supports a 50 bps interest-rate increase. Nevertheless, she emphasized that the US central bank would not ease and acknowledged that “we have additional work to do.” Echoing her comments was Fed Governor Christopher Waller, who said that the Fed “still got a ways to go” in tightening monetary conditions. He added that the US Central Bank could moderate to 50 bps increases in December or following that meeting and cautioned Fed officials are not close to pausing.

Data-wise, the New York Fed survey of consumer inflation expectations in October rose to 5.9% in a one-year horizon, while the 3-year jumped to 3.1%. Increases in inflation expectations reflect high gasoline prices.

Meanwhile, the US Dollar Index advances 0.27%, up at 106.710, failing to underpin the USD against the NZD.

Aside from this, on Monday’s Asian session, New Zealand’s calendar revealed that the services and Composite Performance of Services (PSI) jumped by 1.5 points, exceeding the previous month’s reading from 55.9 to 57.4, while the latter edged lower to 53.1 from 54.1

What to watch

The New Zealand economic docket will feature REINZ housing data. On the US front, the October Producer Price Index (PPI) and Fed speakers like Patrick Harker, Lisa Cook, and Michael Barr.

NZDUSD Key Technical Levels

- USDCAD is on the brink of a move higher as the US Dollar firms.

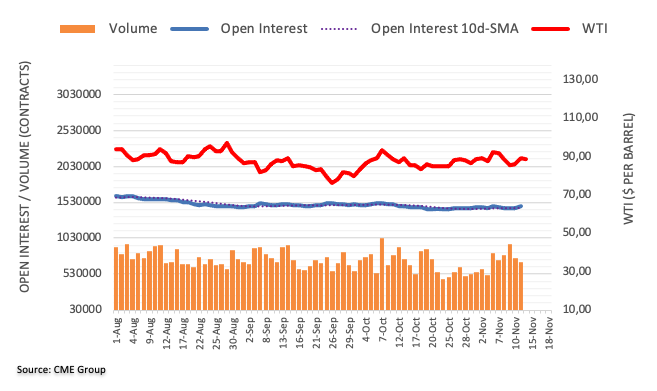

- WTI pressured on Covid cases in China, denting CAD.

USDCAD is making tracks on the upside on Monday, partly as oil prices fall and the greenback rallies against a basket of major currencies. The US Dollar is accumulating as investors kept their focus on the Federal Reserve's interest rate hiking path. Ahead of the open, a Fed member poured cold water over the US consumer Price Index upside surprise, arguing it was too soon to call for a pivot.

At the time of writing, USDCAD is trading at 1.3286, up 0.27% on the day having traded between a low of 1.3239 and 1.3309 so far. The US Dollar index, DXY, is up some 0.2% having climbed from a low of 106.41 and reached a high of 107.27 so far, supported by comments from Federal Reserve Governor Christopher Waller. He crossed the wires and said Friday's inflation report was "just one data point," and that markets are "way out in front".

Key comments

- Will need to see a run of CPI reports to take a foot off the brake.

- Positive that goods prices came down with some moderation in services, but it needs to continue.

- US policy rate is "not that high" given level of inflation.

- Rate hikes so far has not "broken anything.

- The US housing market needed to slow down.

- Signal was to pay attention to the endpoint not the pace of rate increases, and until inflation slows the endpoint is "a ways out".

Meanwhile, both US and Canadian government bond yields have been mixed following the Remembrance and Veterans Day holidays on Friday. In this regard, we will have the Canadian inflation data for October, due on Wednesday. This could offer clues on the Bank of Canada's policy outlook. Money markets expect the central bank to raise interest rates by at least 25 basis points at its Dec. 7 policy announcement.

Elsewhere, the price of oil has been falling since the start of the day. The reports of surging new Covid-19 infections in China, even after the country relaxed some of its quarantine policies last week, have dented the market's stability. West Texas Intermediate crude is down some 3.3% falling from a high of $89.82 to a low of $85.68. The drop came, as Reuters reports, following the news agency's report that ''new Covid-19 infections were surging in Beijing and other cities even as the country, the world's No.1 oil importer last week relaxed some of the Zero-Covid policies that shut-down major cities for weeks at a time, cutting in demand, while the new policies are seen as supportive for the country's economy.''

USDCAD weekly chart

The M-Formation is a compelling bullish feature, but there could still be some downside to come.

A break of the support opens up the way to dynamic trendline support.

What you need to take care of on Tuesday, November 15:

The American Dollar enjoyed some temporal demand at the beginning of the week but quickly resumed its decline ahead of the US opening, ending the day near its recent lows against most major rivals. Market players saw the greenback’s near-term appreciation as an opportunity to sell it, reflecting that the tie has changed.

Global stocks struggled to extend last week’s rally, but most indexes posted gains, while US government bond yields ticked modestly higher.

Market players struggled to digest negative news coming from China, as the country keeps reporting record coronavirus contagions in Beijing and other big cities. The government has a zero-covid policy, which may lead to stricter lockdowns and the interruption of global shipments. The country will release some first-tier macroeconomic figures on Tuesday, which may lead the market’s sentiment, at least throughout the Asian session.

On the other hand, there are growing hopes tensions between Russia and Ukraine could soon ease after Moscow retreated and Ukrainian President Volodymyr Zelenskyy noted the country is ready for peace. However, the news should be taken with a pinch of salt, as it seems pretty unlikely Russia will back from the separatist regions.

Meanwhile, US President Joe Biden met his Chinese counterpart Xi Jinping during the G20 summit in Bali. The versions of the outcome differ according to national sources. On the one hand, US President Biden said they are not looking for conflict and will not be a new Cold War. On the other, Chinese media reported that President Xi warned his US counterpart about crossing a “red line” on Taiwan. Both Presidents said they wanted to find the right direction and manage their differences.

The EURUSD pair trades a few pips below Friday’s high at 1.0363 while GBPUSD battles to regain the 1.1800 level. The Australian Dollar reached a fresh November high in the 0.6720 area and is poised to extend its advance. The USDCAD pair, on the other hand, ticked north and trades around 1.3290 amid the poor performance of oil. Crude oil prices were sharply down amid Chinese news, with WTI trading at around $86.10 a barrel.

On the other hand, spot gold remained strong, with XAUUSD now hovering around $1,773 a troy ounce.

The USDJPY is up, a few pips below the 140.00 threshold, while USDCHF is down, hovering around 0.9410.

FTT price barely holds $1 as Binance's CZ hints at a new proof of reserve mechanism

Like this article? Help us with some feedback by answering this survey:

- Federal Reserve members stressed the need to prolong rate hikes, even though at a slower pace, bolstering the US Dollar.

- The Swiss Franc continues to strengthen against the US Dollar.

- Based on data, SNB Governor Thomas J. Jordan said they could hike in December.

- USDCHF Price Analysis: To continue weakening once it clears 0.9370.

The USDCHF extends some of last week’s losses, courtesy of the Federal Reserve’s official hawkish commentary, which spurred risk aversion in the financial markets. Therefore, global equities dropped while the safe-haven status of the US Dollar rose. At the time of writing, the USDCHF is trading at 0.9410, registering decent losses of 0.18%.

Vice-Chair Brainard sees appropriate slowing the pace of rate hikes

US equities dwindled following remarks by two Federal Reserve (Fed) board members. During the weekend, Christopher Waller said that the Fed “still has ways to go” regarding tightening monetary conditions. He added that the Central Bank is not close to pausing and that it could moderate the size of interest-rate increases to 50 bps at their December meeting or the one after that, reiterating that the US central bank is not close to pausing.

Of late, the Fed Vice-Chair Lael Brainard commented that it’s appropriate to slow the pace of rate hikes, though emphasized that “we(Fed) have additional work to do.” Brainard added that it would take some time for the cumulative tightening “to flow through” the economy. She said that October’s CPI print might suggest that the Fed’s favorite gauge for inflation, the Core PCE, “might be also showing a little bit of reduction.”

On the Swiss Franc side, the Swiss National Bank (SNB) Chairman of the Governing Board, Thomas J. Jordan, crossed newswires. He said that Swiss growth is foreseen to be weaker in 2023 than in the current year and added that unemployment would not prevent additional rate hikes. Jordan said inflation has broadened and predicts a “great probability” that the SNB would need to tighten conditions. Regarding the December meeting, he said that the Central Bank could hike, but it will depend on data.

Therefore, the USDCHF is expected to lean on US and Switzerland’s economic data alongside monetary policy. However, speculations for a Fed pivot would likely keep the US Dollar on the defensive, propelling the Swiss Franc prospects for a stronger Swissy. Hence, the USDCHF could test August’s monthly lows at around 0.9370 before extending its fall to the YTD low at 0.9091.

USDCHF Price Analysis: Technical outlook

From a technical perspective, the USDCHF free fall will likely continue after dropping below the 200-day Exponential Moving Average (EMA) at 0.9617. Also, once the USDCHF tumbles below the August 11 daily low at 0.9379, that could open the door towards testing the YTD low at 0.9091. Of note, the Relative Strength Index (RSI) is oversold, but due to the strength of the downtrend, it could fall towards 20, marked by “some” analysts, as the most extreme oversold condition.

Therefore, the USDCHF key support levels lie at 0.9400, followed by the August 11 low at 0.9379. A Break below will expose the April 12 swing low at 0.9286, ahead of the February 21 daily low at 0.9150.

- AUDUSD bears are lurking at a key area of resistance.

- US Dollar showing signs of accumulation in lower time frames.

As per the start of the week's pre-open analysis: AUDUSD Price Analysis: A deceleration opens risk of a break to 0.6650 and below, the price continues to decelerate on Monday.

So far, AUDUSD has stuck to a 0.6663 / 0.6716 range and is flat on the day so far:

AUDUSD H1 chart

The bears are pressing below 0.6750 and 0.6700 is under pressure. A break of 0.6650/40 opens the risk of a significant bearish correction.

AUDUSD daily chart

The daily chart's W-formation is a significant feature for the week ahead. This is a reversion pattern whereby the price would be expected to move into the neckline of the formation in due course. The Fibonacci scale has the 61.8% ratio aligned with the neckline on the way down below the first target as being the 38.2% Fibo below 0.66 the figure.

The trajectory will depend on the US Dollar which is currently showing all of the signs of accumulation on the hourly chart:

- Federal Reserve officials and risk aversion underpin the US Dollar.

- The Japanese Yen fails to gain traction after BoJ’s Kuroda comments.

- The USDJPY is forming a bullish harami, which could exacerbate a test of 142.50.

After diving more than 5% in the last week, the USDJPY is staging a comeback, bouncing off the last week’s lows around 138.00 and climbing over 150 pips. Factors, like Federal Reserve’s policymaker hawkish commentary, triggered a risk-off impulse, as depicted by US equities falling. At the time of writing, the USDJPY is trading at 140.28, above its opening price by 1.10%.

US Dollar underpinned by Federal Reserve commentary

Sunday’s hawkish commentary by Federal Reserve (Fed) Governor Christopher Waller shifted sentiment sour. Waller commented that the Fed “still has ways to go” lifting interest rates and added that the Central Bank could moderate the size of interest-rate increases to 50 bps at their December meeting or the one after that, reiterating that the US central bank is not close to pausing.

Meanwhile, the Fed Vice-Chair Lael Brainard is crossing newswires, saying that the most recent CPI suggests that Core Personal Consumption Expenditures (PCE) could also show a reduction. She added that it would be appropriate to slow the pace of hikes, and further rate hikes would be data-dependent.

The US Dollar Index, a gauge of the greenback’s value against a basket of peers, extended its gains by 0.36%, up at 106.807, after falling to three-month lows at 106.281. in the meantime, the US 10-year Treasury yield edged down one bps at 3.865%, capping the USDJPY rally around the current exchange rates.

Japanese economy picking up, says BoJ Kuroda

Aside from this, in the Asian session, the Bank of Japan (BoJ) Governor Haruhiko Kuroda said the economy was picking up and reiterated that monetary policy conditions would remain at ease to support the US economy. Kuroda added that the BoJ is watching the impact of raw material inflation and monitoring the effects of the FX market.

USDJPY Price Analysis: Technical outlook

The USDJPY is neutral biased, even though it cleared the 100-day Exponential Moving Average (EMA) at 140.79, exposing the USDJPY to selling pressure. Of note, the Relative Strength Index (RSI) exited from oversold conditions, suggesting that sellers are losing momentum. Also, USDJPY’s last two days’ price action is forming a bullish-harami pattern.

If the USDJPY clears the 100-day EMA, the next resistance would be the psychological 141.00 figure. Once cleared, the following resistance would be November’s 11 daily high at 142.48, followed by the 50-day EMA at 145.37.

Swiss National Bank Chairman Thomas Jordan who hinted recently that further interest rate hikes were on the way from the central bank, saying "determined action" is required to check rising prices has said in trade today there is a "great probability" that the SNB will need to tighten monetary policy further as inflation is likely to remain elevated for a while.

He also said the nominal appreciation of the Swiss franc is helping guard against inflationary pressure. Jordan had said last week the SNB was prepared to take "all measures necessary" to bring inflation back down to its 0-2% target range and that current monetary policy was not restrictive enough to do the job.

Key quotes

In 2023, see swiss growth weaker than this year.

Inflation in Switzerland is likely to remain elevated for a while, though lower than in other advanced economies.

See limited second-round wage effects in Switzerland.

SNB still has credibility in eyes of businesses that inflation will moderate.

USDCHF update

Meanwhile, USDCHF's downside is decelerating and the M-formation could be a significant feature for the week ahead as a reversion pattern that is kicking in at a 150% range expansion of the first week of business conducted in November:

It will soon be appropriate for the Federal Reserve to reduce the pace of its interest rates hikes, Fed Vice Chair Lael Brainard said on Monday.

"I do think there is very strong agreement among committee members about the need to show resolve," Brainard said in an interview with Bloomberg in Washington.

"But we do have, and I think this is really important, we do have very full discussions among committee members...(about) how much restraint, for how long, what data do we look at...So I think there's healthy discussions and I do believe that it's going to be very important to have those different perspectives informing our policy deliberations."

Key comments

"Very cognizant" of potential spillovers, risks from coordinated central bank tightening.

Spillovers may create real risks for some countries, including commodity importers, those with funding mismatches.

Retail markups now are high, multiple times the increase in average hourly earnings.

Expect retail margins to fall, contribute to disinflation.

Regarding ethics, the Fed has taken very rapid action to put in place processes to catch potential issues sooner.

Focus on "broad and inclusive" employment central to fed's work.

Employment outcomes for different demographic groups now similar to where they were pre-pandemic.

Fed's mandate is "very much around" keeping inflation expectations anchored at 2%.

Fed has shown "resolve" in attacking inflation, and will continue.

Not sure whether early retirees are likely to return to the workplace or not.

"Would be great" to see a return of workers, otherwise will need to restrain demand.

Taking lags and cumulative impact of policy into account will let the fed better see how its policy is playing out.

Exactly what the rate path looks like is difficult to see right now.

Important to remember that real incomes on aggregate have fallen during high inflation.

Fed "has a 2% inflation target" and that is what policy will be designed to achieve.

Fed will be balancing considerations but is focused on achieving 2% goal.

Treasury yield curve is now above 1% in real terms.

A variety of estimates around the lag of monetary policy, from many quarters to only 2 or 3.

Very strong agreement" among committee members to show resolve against inflation.

Fed does have "very full discussions" about policy, and weight given to different data points.

Monetary tightening has become apparent in house prices flattening or falling.

Housing services in inflation not likely to peak until next year.

Her comments follow Fed's Christopher Waller who sparked a bid into the US Dollar at the start of the week when he said, Friday's inflation report was "just one data point," and that markets are "way out in front". He added ''will need to see a run of CPI reports to take a foot off the brake. ''

DXY is in a phase of accumulation for the start of the week as per the hourly chart above.

The USDCAD is seen moving to the upside over the next quarters, although at a slower pace after the recent decline of the US Dollar, according to analysts from Danske Bank. They forecast USDCAD at 1.36 in a month, and at 1.39 in a six-month horizon.

Key Quotes:

“Similar to other central banks that have lead the global tightening cycle Bank of Canada has also slowed down its hiking pace amid weaker growth prospects. With BoC having hiked policy rates to 3.75% and with signs of slowing growth and not least housing market we maintain a final 50bp hike for the December meeting which we expect will mark the final hike of this cycle.”

“In terms of spot we regard relative rates and the global environment as supportive of USD/CAD. The cross will remain highly sensitive to markets pricing Fed pivot and China optimism – in either direction – leaving the potential of big spot moves in the months ahead.”

“In light of the recent drop in the broad USD, we lower our USD/CAD profile but maintain an upward slowing trajectory.”

Analysts at Danske Bank continue to see the EURUSD pair with a bearish bias over the next months. They forecast the pair at 1.00 in a month and at 0.95 in a six-month horizon.

Key Quotes:

“The large negative terms-of-trade shock to Europe vs US, a further cyclical weakening among trading partners, the coordinated tightening of global financial conditions, broadening USD strength and downside risk to the euro area makes us keep our focus on EUR/USD moving still lower (targeting 0.93) – a view not shared by the consensus.”

“The key risk to shift EUR/USD towards 1.15 is seeing global inflation pressures fade and industrial production increase. However, ‘transitory’ has substantially lost credibility and European industrial production continues to be weak. This will continue as manufacturing PMIs heads below 50. The upside risk also include a renewed focus on easing Chinese credit policy and a global capex uptick but neither appear to be materialising, at present.”

- The USDCAD marches firmly toward 1.3300 following Fed official hawkish remarks.

- Federal Reserve Waller said the Fed could hike 50 bps in December or after that meeting.

- The US Dollar got bolstered by Waller’s remarks, while US Treasury yields rose.

- The Loonie is at the expense of Canadian CPI and GDP data throughout the week.

The USDCAD slightly recovers after losing for two consecutive days. The pair bounced around the 100-day Exponential Moving Average (EMA) at 1.3229, following hawkish remarks by Fed officials on Sunday. Even though factors like China’s easing Covid-19 conditions added to investors’ optimism, Fed’s Waller remarks, suggesting further tightening, spurred risk aversion. At the time of writing, the USDCAD is trading at 1.3280, up by 0.20%.

US Dollar bolstered by Fed policymaker remarks

Risk aversion is the name of the game on Monday. Sunday remarks by Federal Reserve (Fed) Governor Christopher Waller triggered a risk-off impulse. Waller said that the Fed “still has ways to go” hiking rates and commented that the US central bank could moderate the size of interest-rate increases to 50 bps at their December meeting or the one after that, reiterating that the US central bank is not close to pausing.

The US Dollar (USD), underpinned by Waller’s remarks, edged higher, as shown by the USDCAD, bottoming at around 1.3250 and climbing toward its daily high at 1.3306.

Canadian CPI and GDP data will influence Loonie’s direction

Meanwhile, on the Canadian front, the Bank of Canada (BoC) Governor Tiff Macklem said that inflation is too high and that lower-income Canadians will be “disproportionally” affected by the economic slowdown. Aside from this, the Loonie would be at the expense of the Canadian Consumer Price Index (CPI) on Wednesday, with investors expecting CPI to edge higher to 7.0% YoY in October.

Ahead in the week, the US economic docket will feature the Fed Vice-Chair Lael Brainard, October’s Producer Price Index (PPI), and the NY Empire State Manufacturing Index. On the Canadian front, New Motor Vehicle Sales, and Manufacturing/Wholesale Sales MoM for September, will shed some light ahead of Q3 GDP.

USDCAD Price Analysis: Technical outlook

From a technical perspective, the USDCAD is neutral-to-downward biased, though it would be “firmly” cemented if CAD buyers clear the 100-day EMA, as the head-and-shoulders chart pattern remains in play. The head-and-shoulders target is 1.3033, ahead of the 200-day EMA at 1.2979.

If the USDCAD clears the 1.3300 figure, a test of the November 11 daily high at 1.3360 is on the cards. Otherwise, the major could fall towards the 100-day EMA, ahead of the 1.3200 figure. A breach of the latter will expose the 1.3100 figure ahead of the head-and-shoulders chart pattern target.

Investors will likely remain on the defensive regarding Brazil taking into account the transition to a new government after Lula's triumph, according to analysts from Rabobank. They see USDBRL at 5.30 by year-end.

Key Quotes:

“Externally, US consumer price positively surprised and increased less than consensus in October, suggest inflation is colling down. The CPI core index also came below the expected. On Friday, China announced measures to relax some measures against Covid. Among the main measures announced, the Chinese government reduced the period of mandatory quarantine for travellers entering the country. And from now on, people who have had contact with carriers of the Covid-19 virus will be isolated for only 5 days, two less than previously required.”

“We still believe the Fed will remain hawkish, the USD will keep its safe haven status, and domestically the transition to a new government will feed defensive positions. We still see the USDBRL at 5.30 by end-22.”

- Dollar’s recovery loses momentum, even as US yields rebound.

- EURUSD stabilizes around 1.0300, holds firm onto recent gains.

- More US inflation data due on Tuesday.

The EURUSD pair erased intraday losses after climbing back to the 1.0330 zone. Earlier the pair bottomed at 1.0270 but then the Greenback lost momentum across the board, triggering the rebound.

EURUSD holds onto recent gains

After an impressive two-day rally, EURUSD stabilized around 1.0300. So far the correction has been limited and the bias continues to point to the upside, despite overbought readings. While under 1.0350/60, gains seem limited.

The Dollar pulled back during the American session even as US yields moved higher. The US 10-year stands at 3.89% and the 2-year at 4.43%. Equity prices in Wall Street are moving off highs.

EURUSD holds onto most of recent gains that followed the release of the October US Consumer Price Index that boosted expectations of a less aggressive Federal Reserve. On Tuesday, the Producer Price Index is due and could impact markets. More signs of a slowdown in inflation could weigh further on the dollar, while the contrary could prompt a steep correction of the dollar.

“The market is now leaning into this week’s slew of scheduled Fed commentary with the risk that the collective tone will remain hawkish. Over the weekend, the Fed’s Waller suggested that “the market seems to have gotten way out in front over this one CPI report”. Strong resistance awaits in the EUR/USD1.03.50/70 area. We see risk that parity will be hit again before this area is breached”, explained analysts at Rabobank.

In the Eurozone, data released on Monday showed a bigger than expected increase in Industrial Production. On Tuesday, data to be released includes Q3 employment, GDP and confidence.

Technical levels

The Federal Reserve Bank of New York's monthly Survey of Consumer Expectations showed on Monday that the US consumers' one-year inflation expectation rose to 5.9% in October from 5.4% in September.

Additional takeaways

"Expected inflation three years from now rises to 3.1% in October vs Sept 2.9%."

"Expected inflation five years from now rises to 2.4% in October vs Sept 2.2%."

"Year-ahead gasoline price marks record one month expected jump, hits 4.8% in October."

"Expected year-ahead home price change steady at 2% in October."

"Year-ahead expected household income rise hits record 4.3% in October."

"Expected unemployment level year from now highest since April 2020."

Market reaction

The US Dollar Index showed no immediate reaction to this publication and it was last seen gaining 0.45% on the day at 106.90.

According to Reuters, last week the USD suffered the biggest weekly decline since the era of freefloating exchange rates began over 50 years ago. Nonetheless, economists at Rabobank expect the EURUSD to return to parity.

New dawn or false dawn?

“The market’s focus on peak inflation is misplaced with the issue for the Fed more likely to be about the persistence of price pressures. This implies that once Fed rates do reach their peak level, that they will then stay higher for longer. This suggests that the USD could hold on to most of this year’s gains for longer.”

“By the ECB’s next policy meeting, Germany may already be in recession. As has been in the case in the UK in recent months, there is no guarantee that the EUR will response favourably to higher rates if the economic backdrop appears grim. Although we see the risk of recession in the US next year, the outlook is not as severe as in Europe.”

“Strong resistance awaits in the EURUSD 1.03.50/70 area. We see risk that parity will be hit again before this area is breached.”

- Pound under pressure at the beginning of an important week.

- EURGBP approached last week high near 0.8830.

- Consolidation above 0.8830 could open the doors for 0.8900.

The Pound is among the worst performers across the G10 space on Monday. EURGBP broke above 0.8800 and climbed to 0.8813, reaching the highest level since Thursday.

EURGBP gains momentum

The cross remains near the top supported by a weaker Pound across the board. While GBPUSD trades at daily lows under 1.1730, EURUSD is moving toward daily highs above 1.0330.

Economic data from the Eurozone showed an increase in Industrial Production of 0.9% in September, above the 0.5% expected. On Tuesday, employment and GDP data are due.

In the UK, employment data will be reported Tuesday. The unemployment rate is expected to remain steady at 3.5%. On Wednesday, October CPI is due, with the headline expected to rise to 10.7% from 10.1%.

The key event will be the Autumn Budget statement on Thursday. “Markets await Chancellor Hunt’s Autumn Statement on Thursday. Hunt faces a delicate balance of trying to shore up UK policy credibility to reassure markets and the GBP, whilst making spending cuts and revenue enhancements that do not weaken already soft support for the Conservatives even further”, said analysts at Scotiabank.

Technical levels

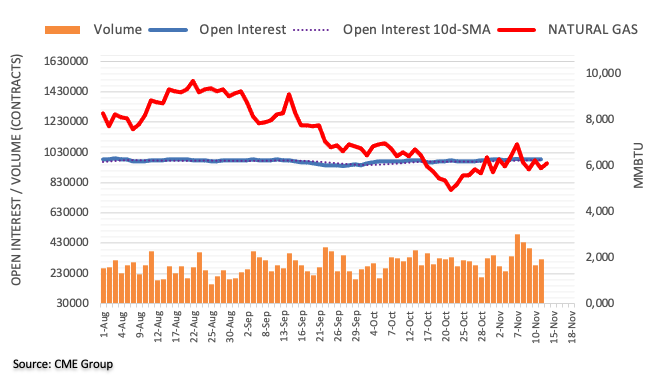

Gold capitalized on risk flows and the broad-based US Dollar weakness last week and gained over 5%. In the absence of high-impact macroeconomic data releases this week, the risk perception is likely to continue to impact the US Dollar's valuation and Gold price's action.

Risk flows are likely to continue to weigh on US Dollar

“October Industrial Production and Retail Sales figures from China will be released on Tuesday. Investors, however, are likely to ignore these data and stay focused on developments surrounding the Covid restrictions. In case China continues to ease its rules, Gold price should stretch higher on improving demand outlook.”

“On Wednesday, the US Census Bureau will publish the October Retail Sales data. The Federal Reserve Bank of Philadelphia’s Manufacturing Survey and the US Department of Labor’s weekly Initial Jobless Claims data will be the last data of the week from the US on Thursday.

Since the above-mentioned data releases don’t have the potential to move the markets in a significant way, participants will keep a close eye on Fedspeak and the overall risk perception.”

“In case global equity indexes preserve the bullish momentum, XAUUSD could capitalize on the broad US Dollar weakness.”

Japan will release third quarter (Q3) Gross Domestic Product (GDP) figures on Monday, November 14 at 23:50 GMT and as we get closer to the release time, here are forecasts from economists and researchers of four major banks regarding the upcoming growth data.

Growth is expected at 1.2% SAAR vs. 3.5% in Q2 and expected at 0.3% quarter-on-quarter vs. 0.9% in Q2.

Standard Chartered

“We expect GDP growth to have slowed to 0.3% QoQ (seasonally adjusted) from 0.9% in the previous quarter when the growth rebound was boosted by pent-up demand. We expect GDP to continue to expand, albeit at a slow pace, reflecting a gradual recovery from the pandemic impact. Also, weaker global growth due to China’s zero-COVID policy and the prolonged Russia-Ukraine war likely weighed on Japan’s exports. That said, easing supply bottlenecks in the auto sector and an improving COVID-19 situation may have supported growth. Japan’s job market has also remained resilient, likely supporting consumption, but limited wage growth likely weighed on consumption growth.”

ING

“Third quarter GDP in Japan is expected to grow 0.5% QoQ, seasonally adjusted, which is a slower pace than the previous quarter. Reopening effects still led the overall growth but higher inflation and the weak yen partially offset the recovery.”

Wells Fargo

“Japan is expected to report slower economic growth for Q3. Third-quarter GDP growth is forecast to slow to 1.2% QoQ annualized, reflecting a sharp slowdown in consumer spending even as investment spending is expected to continue rising at a steady clip. Against this relatively subdued economic backdrop, the BoJ appears unlikely to adjust its monetary policy stance for the time being, while the government is also pursuing another fiscal stimulus package to help consumers deal with higher living costs, while also supporting growth in the quarters ahead.”

SocGen

“We forecast real GDP growth of +0.3% QoQ (annualised, +1.2% QoQ) for 3Q22. Growth is expected to slow somewhat from the previous quarter due to downward pressure from the rapid spread of the novel coronavirus pandemic. A substantial increase in imports will also significantly depress growth in 3Q22.”

- GBPUSD dived from last week’s highs at around 1.1850s.

- Federal Reserve’s Waller: Could hike 50 bps at December’s meeting or the next one.

- After Waller’s remarks, the US Dollar rose, and the GBPUSD tumbled below 1.1800.

- The GBP would remain choppy trading ahead of the UK’s budget release on Thursday.

The Pound Sterling tumbled from around last week’s highs above 1.1800 against the US Dollar (USD) after a Federal Reserve (Fed) official stated that a move of 50 bps is on the radar for the next meeting or the one after that. Therefore a risk-off impulse capped the GBP rally, bolstering the USD. At the time of writing, the GBPUSD is trading at 1.1734, below its opening price by 0.80%.

Fed's Waller hawkish remarks boosted the US Dollar

Amidst the lack of US economic data in the calendar, investors are leaning on Fed officials speaking, particularly on Christopher Waller. Waller said that the Fed “still has ways to go” hiking rates and commented that the US central bank could moderate the size of interest-rate increases to 50 bps at their December meeting or the one after that, and reiterated that the Fed is not close to pausing.

The market reacted negatively to the remarks, as the GBPUSD dropped below 1.1800, while the greenback bounced off, as shown by the US Dollar Index (DXY), rising 0.56%, at 107.031. Regarding US Treasury bond yields, following Friday’s holiday, the 10-year benchmark note rate reached a daily high at 3.904% before dipping towards 3.863%.

Meanwhile, the Pound Sterling is expected to trade choppy as investors await the UK’s budget on Thursday, as Chancellor Jeremy Hunt is expected to release a fiscally responsible package. Newswires reported that around 40% of the GBP 55 billion of savings would come from tax hikes and 60% from spending cuts.

According to the Scotiabank analysts, they spot key support at around 1.1550, but firstly, the GBPUSD needs to surpass 1.1625/35. On the upside, a break above 1.2045, it’s the first resistance level.

What to watch

On Tuesday, the UK economic calendar will release employment figures for September. On the US front, the New York Empire Manufacturing Index for November, the October Producer Price Index (PPI), and Fed speakers like Patrick Harker, Lisa Cook, and Michael Barr.

GBPUSD Price Analysis: Technical outlook

From a daily chart perspective, the GBPUSD is neutral-biased after rallying above the 100-day Exponential Moving Average (EMA). Notably, falling below the September 13 daily high at 1.1738 would open the door for further losses. Why? UK fundamental data would likely keep the GBP pressured so that the GBPUSD might test the 100-day EMA at 1.1652. Once cleared, the next support would be the psychological 1.1600 figure, followed by the October 5 daily high-turned-support at 1.1495.

US Dollar rebounds to start the week as risk rally fades. Nonetheless, economists at Scotiabank note that USD risk reversals reflect a clear weakening in broader USD bull sentiment.

Further gains in US equity markets to weigh on the broader USD tone

“We note that USD risk reversals reflect a clear weakening in broader USD bull sentiment – a view we concur with, given the USD’s overextended gains.”

“The USD may find itself a bit more susceptible to soft economic data in the near-term at least and may struggle to improve materially, even if policymakers maintain a hawkish outlook for rates.”

“Further gains in US equity markets are liable to weigh on the broader USD tone.”

- The index reclaims the area above the 107.00 mark on Monday.

- US yields tread water amidst a generalized absence of direction.

- Fed’s Vice Chair L.Brainard discusses the “Economic Outlook” later.

The USD Index (DXY), which tracks the greenback vs. a bundle of its main competitors, keeps the bid tone unchanged following the opening bell in Wall St. on Monday.

USD Index appears supported around 106.30

The index regains some poise after the sharp decline seen in the second half of the last week, which was particularly sparked in response to lower-than-expected US inflation figures for the month of October and rising speculation of a Fed’s pivot in its policy.

The dollar appears bid at the beginning of the week on the back of some respite in the risk rally and some profit taking following the recent broad-based advance in the risky assets.

Nothing in the US docket on Monday should leave Fed Brainard’s discussion on the “Economic Outlook” as the main event later in the session.

What to look for around USD

The index attempts a moderate bounce past the 107.00 yardstick and partially leaves behind the post-CPI bearish move to the 106.30/25 band on Monday.

In the meantime, investors’ repricing of a probable pivot in the Fed’s policy now emerges as a fresh and quite reliable source of weakness for the dollar, in line with a corrective decline in US yields across the curve.

Key events in the US this week: Producer Prices (Tuesday) - MBA Mortgage Applications, Retail Sales, Industrial Production, Business Inventories, NAHB Index, TIC Flows (Wednesday) - Building Permits, Initial Jobless Claims, Housing Starts, Philly Fed Index (Thursday) - CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: US midterm elections. Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.62% at 107.07 and faces the next up barrier at 109.08 (100-day SMA) seconded by 110.95 (55-day SMA) and then 113.14 (monthly high November 3). On the flip side, the breakdown of 106.28 (monthly low November 11) would open the door to 104.83 (200-day SMA) and finally 104.63 (monthly low August 10).

USDIDR gapped lower on Friday after being in a narrow range of about 15,650-15,750 over the past week. Economists at MUFG Bank expect the pair to trade within a 15,390-15,590 range this week.

USDIDR seen at 15,700 by the end of the year

“For the week ahead, we see a range of 15,390 to 15,590.”

“We currently forecast USDIDR at 15,700 at the end of the year. This comes as there may still be threats of Dollar strength in the coming months, even if we see slight downside risks to our forecast.”

S&P 500 has developed a steady rebound after failing to give a decisive break below graphical levels of 3,700/3,630. Economists at Société Générale expect the index to extend its bounce.

Defending 3,815 is essential for persistence in bounce

“Cross above last month high has resulted in a series of higher peaks and troughs highlighting short-term upside.”

“The index is expected to inch higher towards projections of 4,120/4,150 and perhaps even towards previous bearish gap near 4,218.”

“August high of 4320 could be an important resistance.”

“Defending 3,815, the 38.2% retracement of recent move is essential for persistence in bounce.”

While speaking at a press conference following his meeting with Chinese President Xi Jinping, United States (US) President Joe Biden said that he does not think there is any imminent attempt by China to invade Taiwan.

Key quotes

"The US is bringing together a broad coalition together, will meet climate targets."

"We're going to compete vigorously but looking to manage competition responsibly."

"One-China policy has not changed."

"There need not be a new cold war."

"Xi and I agreed that we would have top officials meet to discuss details of every issue that we raised."

"Xi was direct and straightforward, think he is willing to compromise on certain key issues."

Market reaction

These comments don't seem to be having an impact on the US Dollar's performance against its major rivals. As of writing, the US Dollar Index was up 0.55% on the day at 107.00.

Sterling is softer, in line with most of its peers, in the session. In the view of economists at Scotiabank, GBP caution is likely to prevail ahead of Autumn Statement on Thursday.

Key support is 1.1550

“Markets await Chancellor Hunt’s Autumn Statement on Thursday. Hunt faces a delicate balance of trying to shore up UK policy credibility to reassure markets and the GBP, whilst making spending cuts and revenue enhancements that do not weaken already soft support for the Conservatives even further.”

“Expect relatively narrow range-trading for the GBP on the crosses ahead of the fiscal update.”

“Cable gains look to have stalled on the short-term chart. Broader trends – bullish longer-term price signals and the break above the major bear trend in place since the start of the year – remain intact, however.”

“We spot support at 1.1625/35. Key support is 1.1550. Resistance is 1.2045 (50% Fibonacci retracement of the 2022 decline).”

"Inflation is too high around the world, rapid increases in interest rates are raising the costs of servicing debt," Bank of Canada (BOC) Governor Tiff Macklem said on Monday, as reported by Reuters.

Macklem further noted that lower-income households will be disproportionately affected by the slowdown in economic activity that is needed to rebalance demand and supply.

Market reaction

These comments don't seem to be having an impact on USDCAD's action. As of writing, the pair was trading at 1.3275, where it was up 0.15% on a daily basis.

Economist at UOB Group Ho Woei Chen reviews the latest inflation figures in the Chinese economy.

Key Takeaways

“Headline CPI inflation eased to just 2.1% y/y in Oct, lowest since Apr-May when the inflation was also at 2.1% y/y. Tightened COVID curbs took a toll on domestic demand as core inflation (excluding food & energy) remained at an 18-month low of 0.6% y/y.”

“Inflation had averaged 2.0% y/y in Jan-Oct with full-year 2022 inflation likely well-below our forecast of 2.2% (2021: 0.9%). We keep our 2023 inflation forecast at 2.8% given expectation that China will ease its zero-COVID policy and start to reopen its borders.”

“PPI dipped into deflation for the first time since Dec 2020, to -1.3% y/y in Oct. A high comparison base will likely keep PPI in deflation through 1H23 while uncertainties remain for global commodity price movements that could affect the costs for producers.”

“We continue to see full-year PPI averaging 4.0-4.5% for 2022 (2021: +8.1%) and expect the PPI to be flat in 2023 as we factor in weaker global demand and expected PPI deflation in 1H23.”

“The disinflation pressure will likely stay in place until China starts to ease its strict zero-COVID policy. The PBoC may further ease its monetary policy amid weaker outlook for the economy.”

Economists at ABN Amro have revised their ECB view. They now see the terminal rate higher, but with cuts by the end of 2023.

ECB to start cutting rates in the final quarter of 2023

“We now expect the ECB to raise its deposit rate to 2.50% by the end of 2023Q1. Previously, our base case was for the ECB to hike to a peak level of 2.0% in December 2022 and, subsequently, pause.”

“We now also expect the central bank to start cutting rates again in the final quarter of 2023.”

- Gold corrects from a nearly three-month high amid the emergence of some USD buying.

- Bets for less aggressive Fed rate hikes act as a tailwind and help limit any further losses.

- Any meaningful pullback might be seen as a buying opportunity and remain cushioned.

- The XAUUSD still seems poised to climb further towards the $1,800 psychological mark.

Gold kicks off the new week on a weaker note and reverses a major part of Friday's gains to its highest level since August 17. A goodish pickup in the US Treasury bond yields, bolstered by Federal Reserve Governor Christopher Waller's hawkish comments on Sunday, assists the US Dollar to stage a solid bounce from the post-US CPI slump to a nearly three-month low. This, in turn, is seen as a key factor exerting some downward pressure on the dollar-denominated commodity. That said, rising bets for smaller interest rate hikes by the US central bank help limit deeper losses for the non-yielding yellow metal, at least for the time being.

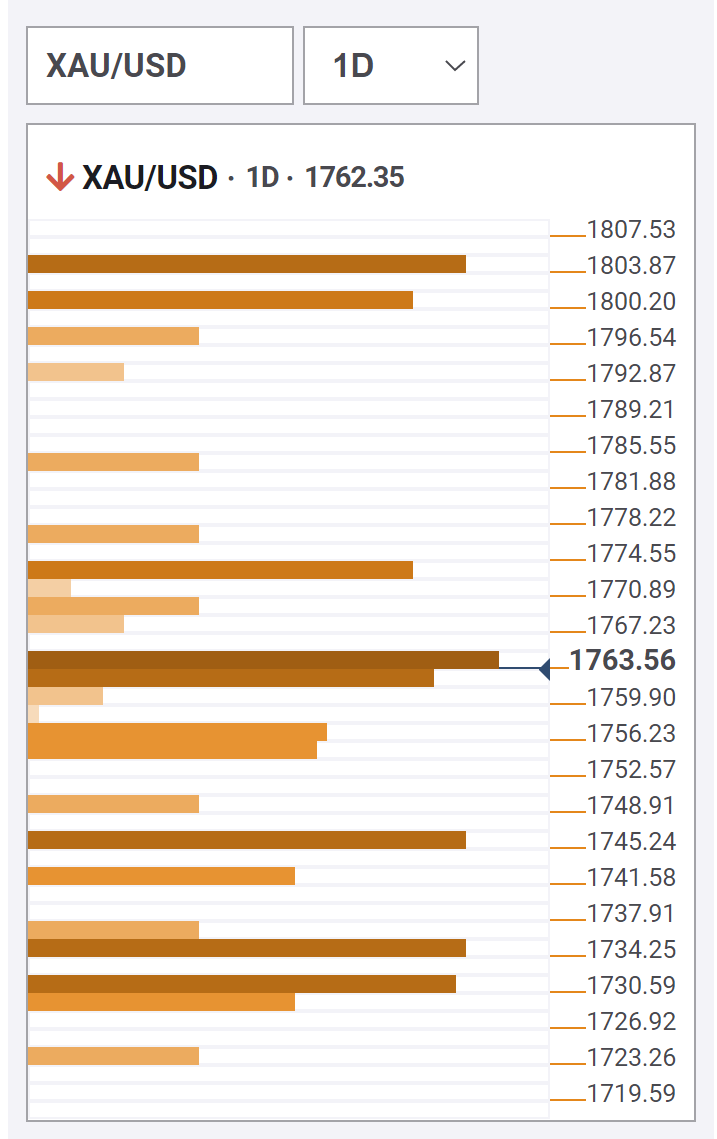

Gold Price: Key levels to watch

The Technical Confluence Detector shows that any subsequent slide is likely to find decent support near the $1,756-$1,753 region - comprising Fibonacci 61.8% 1-Day and Pivot Point 1-Day S1. A convincing break below could accelerate the fall towards the $1,745 area - Fibonacci 23.6% 1-Week and Bollinger Band 1-Day Upper. Some follow-through selling below the $1,741 region - Pivot Point 1-Day S1 - will expose the $1,734 zone - Pivot Point 1-Day S3 - and the $1,730 level - Previous Month High and SMA 100 1-Hour.

On the flip side, immediate resistance is pegged near the $1,774 region - Pivot Point 1-Month R2. A sustained strength beyond should allow bulls to reclaim the $1,800 psychological mark - Fibonacci 161.8% 1-Month. The latter should act as a pivotal point, which if cleared decisively should pave the way for an extension of the upward trajectory witnessed over the past two weeks or so.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- EURUSD’s rally seems to have met initial resistance around 1.0360.

- The surpass of this region opens the door to extra gains.

EURUSD comes under some marked downside pressure soon after hitting fresh peaks around 1.0360.

The continuation of the recovery looks the most likely scenario in the very near term. Against that, further upside could motivate the pair to trespass the August high at 1.0368 (August 10) and then target the always relevant 200-day SMA, today at 1.0432.