- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-11-2012

The euro traded close to a two-month low against the dollar as a draft policy makers’ report said Greece may require an extra $15 billion during the next two years and there are “very large risks.”

Europe’s shared currency traded at almost a one-month low against the yen after the report about the so-called troika as European leaders prepare to meet to seek a plan to maintain Greece’s solvency. Giving Greece a two-year extension to meet budget targets would ease the impact of austerity measures, the troika said.

The Australian dollar rallied after a bigger- than-estimated trade surplus in China improved prospects for commodity exports. China’s exports exceeded imports by $32 billion in October, the customs administration said Nov. 10, compared with a $27.3 billion trade surplus estimated by economists. China is Australia’s biggest trading partner.

The pound fell amid speculation the Bank of England’s latest growth and inflation projections may lead to more asset purchases. The Bank of England’s quarterly report is due in two days and may provide room for further asset purchases to boost growth. The central bank refrained from adding more stimulus at its most recent policy meeting, minutes from which are due next week.

European stocks fell to a two-week low as euro-area finance ministers met to discuss Greek aid and concern grew that impending U.S. tax increases and spending cuts will harm the world’s biggest economy.

National benchmark indexes fell in 12 of the 18 western- European markets today. France’s CAC 40 dropped 0.4 percent, while Germany’s DAX and the U.K.’s FTSE 100 were little changed.

Greece’s ASE sank 3.6 percent as Alpha Bank tumbled 14 percent to 1.56 euros. National Bank of Greece SA, the nation’s largest lender, lost 14 percent to 1.51 euros.

Plans to give Greece extra time to meet deficit-cutting targets would open up a financing gap of about 15 billion euros through 2014 and 17.6 billion euros in the two following years, the country’s creditors said. The so-called troika of the European Commission, ECB and International Monetary Fund supplied the estimates for tonight’s meeting of euro-area finance ministers in Brussels, according to a document obtained by Bloomberg News.

Telecom Italia climbed 4.2 percent to 72 euro cents. Italy’s former phone monopoly received interest from Sawiris, founder of Orascom Telecom Holding SAE, about an investment “through underwriting of new stock,” the Milan-based company said today. The offer is valued at more than 2 billion euros, said a person familiar with the matter, asking not to be identified because the discussions are confidential.

Banco Popular Espanol SA surged 4.6 percent to 1.17 euros as the Spanish bank said it plans to sell as much as 2.5 billion euros of discounted shares to close a capital shortfall.

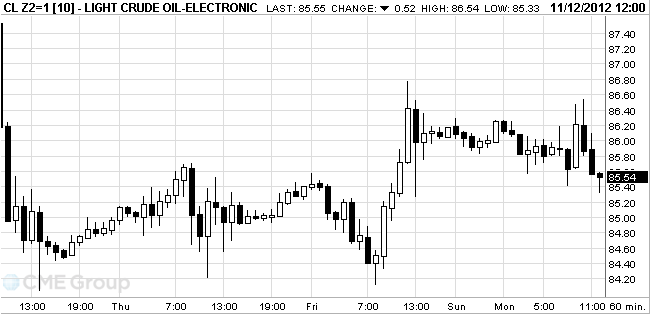

Oil fluctuated in New York as rising Chinese crude imports countered concern that an economic contraction in Japan will reduce fuel consumption.

Futures traded in a $1.05-a-barrel range after China’s net crude purchases rose to the highest level in five months in October. Price retreated after Japan said its economy shrank last quarter as overseas sales and consumer spending slumped.

China’s net crude imports rose to 5.52 million barrels a day in October, also the highest level since May, the General Administration of Customs said Nov. 10 in Beijing. Industrial production was up 9.6 percent in October from a year earlier, the National Bureau of Statistics said Nov. 9.

Japan’s gross domestic product fell an annualized 3.5 percent in the three months through September, after a revised 0.3 percent gain the previous quarter, the Cabinet Office said in Tokyo. A drop of 3.4 percent was the median estimate of economists.

The U.S., China and Japan are the world’s biggest oil- consuming countries, accounting for a combined 37 percent of world demand, according to BP’s Statistical Review of World Energy. The 27 members of the EU were responsible for 16 percent of global oil use in 2011, BP said.

Crude oil for December delivery traded in a range of $85,42 – $86,54 a barrel on the New York Mercantile Exchange. Prices are down 13 percent this year.

Brent oil for December settlement climbed 48 cents, or 0.4 percent, to $109.88 a barrel on the London-based ICE Futures Europe exchange.

Gold continues to go after the most successful week in late August because of concerns that the U.S. recession may begin, if Congress does not agree on reducing the budget deficit.

Precious metal rising in price while the dollar is under pressure from fears about threatening the U.S. financial crisis. If the White House and Congress agree, at the beginning of next year, will come into force automatically spending cuts and tax increases, estimated at $ 600 billion, which could push the U.S. economy into recession.

Euro holds above a two-month low against the dollar as Greece's ruling coalition won enough votes in parliament to approve the budget for 2013.

Today, the euro zone finance ministers meet in Brussels to discuss Greece's selection of a new portion of loans. According to German Finance Minister Wolfgang Schaeuble, the "troika" of international creditors are unlikely to present a full report on Monday on Greece.

On the physical market, jewelers reduced purchases, speculators and investors are waiting for the new price increase. Importers in India also stopped buying, because due to the weakening rupee, local prices increased to a maximum of seven weeks. The festive season, with rising demand for gold will culminate this week during festivals Dhanteras and Diwali, but the wedding season will last until December.

December futures price of gold on COMEX today rose to 1738.30 dollars per ounce.

- France attitude on Greece positive,constructive

- Must take decisive steps on Greece today

- Should see growth if we resolve Greek problem

- France making big efforts to reduce deficits

U.S. stock futures advanced amid a surge in takeover activity.

Global Stocks:

Nikkei 8,676.44 -81.16 -0.93%

Hang Seng 21,430.3 +45.92 +0.21%

Shanghai Composite 2,079.27 +10.21 +0.49%

FTSE 5,790.28 +20.60 +0.36%

CAC 3,418.28 -5.29 -0.15%

DAX 7,187.22 +23.72 +0.33%

Crude oil $85.81 -0.30%

Gold $1734.80 +0.23%

Walt Disney (DIS) was upgraded to Buy at Citigroup

McDonald's (MCD) was initiated with Buy at Davenport

Johnson & Johnson (JNJ) was downgraded to Hold at Jefferies

Caterpillar (CAT) was downgraded to a Neutral at JPMorgan.

EUR/USD $1.2700, $1.2750, $1.2800, $1.2850, $1.2870

USD/JPY Y79.00, Y79.70, Y80.00

GBP/USD $1.5900, $1.6000, $1.6100

AUD/USD $1.0300, $1.0365, $1.0400Data

00:30 Australia Home Loans September +1.8% +1.1% +0.9%

00:30 Australia National Australia Bank's Business Confidence October 0

02:30 Japan BOJ Governor Shirakawa Speaks -

06:00 Japan Prelim Machine Tool Orders, y/y October -2.8% -6.7%

11:00 Eurozone Eurogroup Meetings

The euro traded near a two-month low against the dollar ahead of the meeting of European politicians, whose aim is to discuss a plan to maintain the solvency of Greece, and holding it in the euro area.

Note that the single currency was little changed compared to most other major currencies.

Japan's currency weakened after early data showed that the economy declined in the third quarter at the fastest pace since the earthquake last year. Japan's gross domestic product fell an annualized 3.5% in the three months to September, following a revised 0.3% rise the previous quarter. Analysts had expected a fall of 3.4%.

Also the head of the Bank of Japan Governor Masaaki Shirakawa said that the bank is ready to continue the policy of aggressive monetary easing to fight deflation.

The Australian dollar rose against all major currencies after a bigger-than-expected surplus in the trade balance in China has improved the prospects of export commodities. According to reports, China's exports exceeded imports by $ 32 billion in October, compared with $ 27.3 billion last month.

EUR/USD: during the European session, the pair set a minimum level of $ 1.2695, and then recovered, and is now trading around $ 1.2723

GBP/USD: during the European session, the pair rose to $ 1.5910, but then fell sharply to $ 1.5863

USD/JPY: during the European session the pair fell slightly, setting all-time low at Y79.38

At 21:45 GMT New Zealand will report relative changes in the level of food prices in October. Also today in Canada is celebrated on Memorial Day and Veterans Day in the United States.

EUR/USD

Offers $1.2820, $1.2800/10, $1.2760, $1.2730

Bids $1.2690, $1.2665-50, $1.2630/20

GBP/USD

Offers $1.600/10, $1.5980/85, $1.5940/50

Bids $1.5880, $1.5850, $1.5820, $1.5805/00

AUD/USD

Offers $1.0500, $1.0470/90, $1.0460, $1.0445/50

Bids $1.0385/80, $1.0360, $1.0350, $1.0300

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8040, stg0.8031, stg0.8020

Bids stg0.7970/60, stg0.7945/40

EUR/JPY

Offers Y102.20, Y102.00, Y101.75/80, Y101.60, Y101.45/50

Bids Y100.80, Y100.50, Y100.20, Y100.00

USD/JPY

Offers Y80.15/20, Y79.95/00, Y79.85/90

Bids Y79.25/20, Y79.10, Y79.00, Y78.80

Trading in Europe in different directions, and a slight change in the indices. The focus of the market is Greece, but which last week approved the budget for 2013 with a small surplus (1.1%), excluding debt service. If the country does not receive the next tranche of aid, it is threatened with default this week.

German Chancellor Angela Merkel and the chairman of the Foreign Affairs Committee Bundestag Ruprecht Polenz supported the creation of a free trade area between the EU and the U.S.. The German government intends to ensure that the authorities in Washington as soon as possible to discuss this issue.

FTSE 100 5,781.64 +11.96 +0.21%

CAC 40 3,418.57 -5.00 -0.15%

DAX 7,179.81 +16.31 +0.23%

Telecom Italia Shares rose 3%. According to press reports, Orascom Telecom Holding SAE is planning to acquire a minority stake in the Italian telephone operator.

The capitalization of the Swiss phone company Swisscom AG rose by 1%. After JPMorgan Chase & Co. increased Swisscom recommendation on the shares to "overweight" from "neutral."

Quotes HSBC Holdings added 0.4%, Credit Agricole shares were down 1.5%.

EUR/USD $1.2700, $1.2725, $1.2775, $1.2800, $1.2850, $1.2900

USD/JPY Y79.00, Y79.30, Y79.40, Y80.00, Y80.50

EUR/JPY Y103.25

GBP/USD $1.6000, $1.6030, $1.6050, $1.6100, $1.5910

EUR/GBP stg0.8000

GBP/CHF Chf1.5230

USD/CHF Chf0.9425

AUD/USD $1.0400, $1.0425, $1.0430, $1.0445

Asian stocks fell, with the regional benchmark index headed for its lowest close in a month, after Japan’s economy shrank at the fastest pace since last year’s earthquake, overshadowing an acceleration in China’s exports.

Nikkei 225 8,676.44 -81.16 -0.93%

S&P/ASX 200 4,448.03 -13.99 -0.31%

Shanghai Composite 2,079.27 +10.21 +0.49%

Yokohama Rubber Co. sank 6.3 percent after posting quarterly earnings that missed analysts’ estimates and as the price of rubber fell to a two-month low following the Japanese data.

QBE Insurance Group Ltd. sank 8.3 percent, the most in 11 months, after Australia’s No. 1 insurer by market value said it will issue debt due to losses from U.S. super storm Sandy.

Li & Fung Ltd., a supplier of clothes and toys to Wal-Mart Stores Inc., climbed 1.3 percent as China’s exports grew at the fastest rate since May.

The euro fell to a two-month low against the dollar and to the weakest level in nearly a month against the yen since the fall of French industrial production adds speculation that Europe's economic prospects are deteriorating. The data showed that the amount of French industrial production fell by 2.7%, compared to the previous month, while the average forecast was at 1%. We also learned that business confidence in the second-largest economy of the euro area reached a three-year low last month.

The single currency was headed for a weekly decline against the yen and the dollar, as Greek lawmakers prepared to vote on November 11 for the next year's budget. The euro recovered some losses, even in spite of the fact that the index of U.S. consumer confidence rose to a five-year maximum.

The yen reached 79.08 per dollar, which is the strongest level since Oct. 18, but also showed an increase against most other major currencies. Note that the currency is generally stronger in times of political, financial and economic turmoil, and the latest data on the trade surplus means that the country has to rely on foreign creditors. But, despite this growth rate still declined, approaching with up to the opening level of the day.

The dollar index (DXY) rose 0.3% to 81.035, after an early increase to the level of 81.087, which is a two-month high.

Canadian dollar recovered today suffered losses early in the day, after a report on the level of consumer confidence in the United States. Note that the currency is trading above parity with U.S. counterpart for a second day.

Asian stocks fell, with the regional benchmark index headed for the biggest two-day loss in two months, as companies cut forecasts and Australia’s central bank trimmed its national growth outlook. Shares pared losses after data added to signs China’s economy is bottoming.

Nikkei 225 8,757.6 -79.55 -0.90%

Hang Seng 21,353.1 -213.81 -0.99%

S&P/ASX 200 4,462.02 -21.80 -0.49%

Shanghai Composite 2,069.07 -2.44 -0.12%

Nexon Co., a developer of online games, slumped 16 percent in Tokyo after cutting its net-income forecast.

Emeco Holdings Ltd., a mining-equipment maker, plunged 17 percent in Sydney after reducing its profit target.

National Australia Bank Ltd., the nation’s fourth-biggest lender by market value, dropped 0.7 percent in Sydney.

Chinese developer Guangzhou R&F Properties Company Ltd. rose 1.6 percent in Hong Kong.

European stocks were little changed, after yesterday sliding the most in two weeks, as a selloff in auto manufacturers overshadowed results from Swiss Re Ltd. and Hermes International (RMS) SCA that beat analysts’ estimates.

PSA Peugeot Citroen SA (UG) and Valeo SA both lost more than 4.5 percent as analysts downgraded their shares. Swiss Re gained 1.9 percent after saying smaller losses from natural disasters helped net income surge in the third quarter. Hermes advanced 2 percent as sales rose because of increased demand in Asia.

The Stoxx Europe 600 Index fell 0.1 percent to 270.8 at 4:30 p.m. in London, after earlier climbing as much as 0.6 percent.

National benchmark indexes fell in 15 of the 18 western- European (SXXP) markets.

FTSE 100 5,776.05 -15.58 -0.27% CAC 40 3,407.68 -1.91 -0.06% DAX 7,204.96 -27.87 -0.39%

Greece’s ASE slumped 3.8 percent even as Prime Minister Antonis Samaras obtained a parliamentary majority for a package of austerity measures needed to release further financial aid from the European Union.

Stocks briefly declined after euro-area finance ministers were said to delay a decision on whether to provide further financial aid to Greece.

The ECB left its benchmark interest rate at a record low of 0.75 percent. Draghi reiterated that the central bank will buy the debt of countries that ask it to intervene in their bond markets.

The Bank of England held its key interest rate at a record low of 0.5 percent.

Peugeot dropped 6 percent to 4.47 euros after Citigroup Inc. lowered its recommendation for Europe’s second-biggest carmaker to sell from neutral, citing the company’s struggles with cash.

Valeo declined 4.7 percent to 33.16 euros after UBS AG downgraded France’s second-largest car-parts maker to neutral from buy, saying consensus estimates for European auto suppliers remained too high and all companies will face earnings downgrades.

Pirelli & Cie. lost 2.8 percent to 8.50 euros after brokerages including Exane BNP Paribas said the tiremaker may lower its forecasts. Exane projected sales of 6.1 billion euros ($7.8 billion) in 2012, rather than the current guidance of 6.4 billion euros.

Hermes gained 2 percent to 223.60 euros after the French maker of Birkin bags and silk scarves said third-quarter sales advanced 24 percent from a year earlier to 848.6 million euros. The average analyst’s estimates had called for 803.8 million euros. Excluding currency swings, sales rose 16 percent.

Siemens AG (SIE) added 1.8 percent to 80.27 euros after Europe’s largest engineering company announced that it plans to cut costs by 5 billion euros as it prepares for lower profit in 2013.

BTG Plc (BTG) soared 7.6 percent to 352.4 pence after the drugmaker reported first-half adjusted earnings per share of 5.6 pence, compared with 3.9 pence a year earlier. It reiterated its 2013 revenue forecast.

Major U.S. stock indexes retreated from highs, but still managed to finish in positive territory. For the week the index DOW fell 2,12%, Nasdaq fell 2,59%, S & P500 lost 2.43%.

Support indexes closing of short positions by market participants following the recent decline in anticipation of the weekend.

Positively reflected on the index published data on the index of consumer sentiment from Reuters / Michigan, which in November rose to its highest level in five years.

Despite the current rise, the mood in the markets remains negative. The focus of the market is still the problem of the "fiscal cliff" in the U.S. and the possibility of deterioration of the crisis in Europe.

On the issue of "fiscal cliff in the U.S.", today spoke on the issue, U.S. President Barack Obama and the Republican Party of the United States, John Boehner.

Most of the components of the index DOW show a positive trend. Maximum loss carry stock Walt Disney Co. (DIS, -5.81%), which exerted pressure on the quarterly report published on the eve of the company.

More than other stocks rose Boeing Co (BA, +3.01%).

All sectors of the index S & P, except one, are in the black. In the red zone is only sector utilities (-0.5%). Leading sector of industrial goods (+0.5%) and the health sector (+0.5%).

To date:

Dow +3.92 12,814.55 +0.03%

Nasdaq +9.29 2,904.87 +0.32%

S & P +2.34 1,379.85 +0.17%

00:30 Australia Home Loans September +1.8% +1.1% +0.9%

00:30 Australia National Australia Bank's Business Confidence October 0

02:30 Japan BOJ Governor Shirakawa Speaks

The euro traded 0.3 percent from a two-month low before European finance chiefs meet today to seek a program to maintain Greek solvency. Euro-area finance ministers will meet at 5 p.m. in Brussels. While ministers probably won’t approve 31.5 billion euros ($40 billion) in fresh loans to Greece, the maturing of 5 billion euros of Greek bills on Nov. 16 won’t lead to an “accidental default,” a European official said last week.

The 17-nation euro remained lower versus the yen, following its biggest weekly loss in four months, even after Greek Prime Minister Antonis Samaras secured support from a majority of lawmakers for the 2013 budget needed to unlock international bailout funds. Samaras secured the vote on Greece’s 2013 budget with 167 lawmakers, setting up the next tranche of an international bailout. The nation’s fiscal plan, which forecasts a deficit of 5.2 percent of gross domestic product and a sixth year of contraction, is designed to regain the confidence of its euro- area and International Monetary Fund creditors.

The yen weakened against most of its major peers after data today showed Japan’s economy contracted in the third quarter at the fastest pace since last year’s record earthquake as exports slumped and consumer spending slid. In Japan, GDP fell an annualized 3.5 percent in the three months through September, after a revised 0.3 percent gain the previous quarter, the Cabinet Office said in Tokyo today. The median of 23 estimates in a Bloomberg News survey was for a 3.4 percent drop.

Australia’s dollar rose after a bigger-than-estimated trade surplus in China brightened prospects for commodity exports, and data today showed Australian home-loan approvals rose for a second month. China’s customs administration said Nov. 10 the nation’s exports exceeded imports by $32 billion in October, compared to a $27.3 billion trade surplus estimated by economists surveyed by Bloomberg. China is Australia’s biggest trading partner. In Australia, the number of loans granted to build or buy houses and apartments rose 0.9 percent in September from the previous month, when it grew by a revised 2.1 percent, the statistics bureau said in Sydney today.

EUR / USD: during the Asian session, the pair rose to $ 1.2730.

GBP / USD: during the Asian session the pair was trading around $ 1.5900.

USD / JPY: during the Asian session, the pair traded in the range of Y79.40-55.

With US markets closed for the Veterans' Day holiday, there is a very limited calendar Monday. UK data gets the ball rolling in Europe, with the release of the October CML Mortgage Approvals. At 1100GMT, the November OECD Leading Indicator will be released. With Greece having passed the latest budget and spending bills, attention turns to the Eurogroup meeting scheduled for today in Brussels, although it appears there will be no decisions on the disbursement of funds to Greece. At 1100GMT, the OECD leading indicator for the EMU for October will be released. As noted, US bond markets are closed, but the major stock markets, including the NYSE, are open. However, there are still possibilities that headlines could cross the wires regarding any possibile "fiscal cliff" negotiations, although Federal offices are officially closed.

00:30 Australia Home Loans September +1.8% +1.1% +0.9%

00:30 Australia National Australia Bank's Business Confidence October 0

02:30 Japan BOJ Governor Shirakawa Speaks -

06:00 Japan Prelim Machine Tool Orders, y/y October -2.8%

11:00 Eurozone Eurogroup Meetings -

21:45 New Zealand Food Prices Index, m/m October -0.9%

21:45 New Zealand Food Prices Index, y/y October -0.3%© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.