- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-02-2014

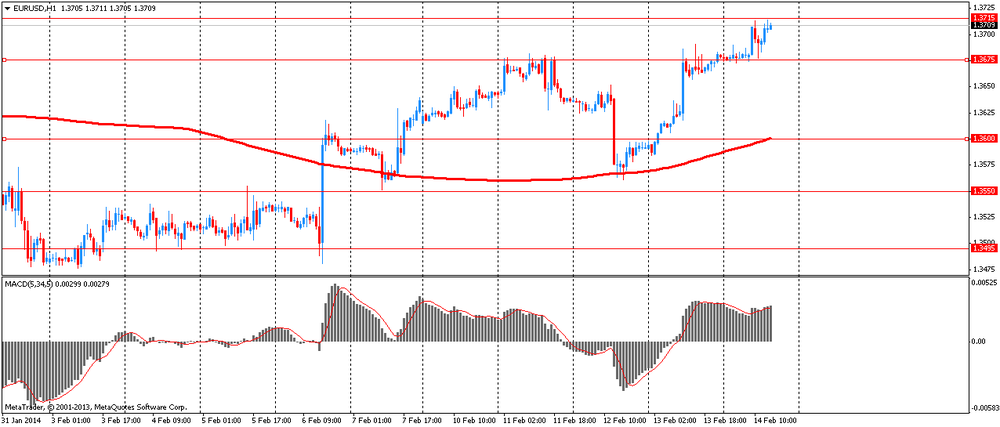

Rate of the euro retreated from the maximum values against the dollar, which was achieved after the release of Eurozone GDP , but continues to trade with a slight increase . Pressure on the currency was the U.S. data , which showed that import prices rose a second straight month in January by 0.1 percent after increasing 0.2 percent in December. In January, higher non-fuel prices offset lower fuel prices . Export prices also rose in January by 0.2 percent after rising 0.4 percent in December . January's growth was accompanied by higher non-fuel prices , while the increase in December was due to rising fuel prices . Despite the increase , the overall import prices decreased by 1.5 percent for the year ending in January.

In addition , the decline was due to the publication of the preliminary results of the study, which were presented to Thomson-Reuters and the Michigan Institute . They showed that in February, U.S. consumers feel about the economy and how it was recorded last month. According to preliminary February consumer sentiment index remained at the final reading of 81.2 in January . It is worth noting that according to the average estimates of experts , the index was down compared to the January to reach a value of 80.6 .

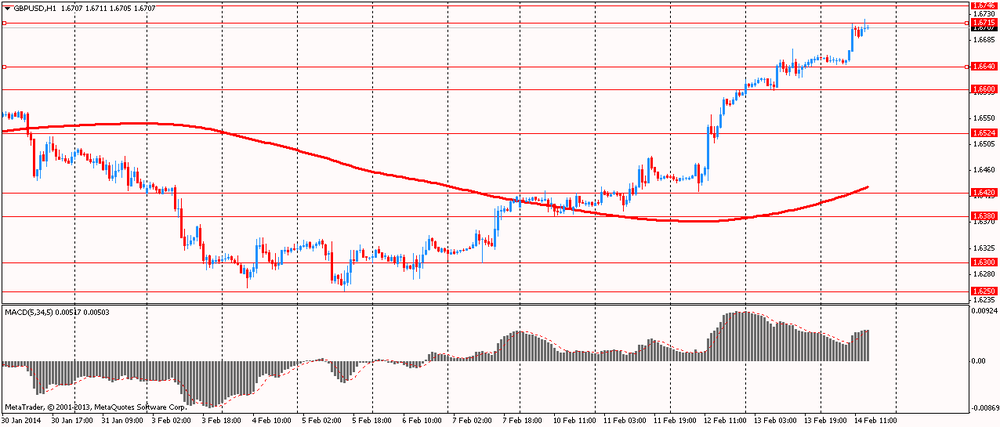

Pound was up against the U.S. dollar , reaching maximum values in nearly two years . Most of the rally pound associated with expectations that the Central Bank will raise rates sooner than previously thought. Strategists note that departure from the Bank of England " transparency policy " allowed to revise forecasts for rate increase for shorter periods . However, next week is expected to publish the IFA protocol , which will reflect a unanimous vote, and the CPI at the target level of 2% as a reminder that needed a lot of time ( experts remain forecast Q3 . 2015 with increasing risk in the 1st half of 2015 ) . In the labor market , the focus will be price increases on wages as a leading indicator of future inflation . Anemic wage growth may also reduce rate hike expectations .

The Canadian dollar fell sharply against the U.S. dollar after data showed that Canadian supply industry in the manufacturing sector fell unexpectedly in December , showing the biggest monthly decline in eight months , amid weak demand for aircraft , vehicles and metals. This was reported by Statistics Canada on Friday .

Industrial sales fell 0.9 % on a monthly basis to 49.87 billion Canadian dollars ( $ 45.55 billion ) , while market expectations were at 0.3% growth . In volume terms, the shipments index fell 1.9 % , the largest decline during the year.

Meanwhile, data on industrial supplies for November were revised downward and now showed that sales rose by only 0.5 % per month, or half the original estimates an increase of 1.0%.

European stocks advanced, heading for their biggest weekly gain this year, as better-than-forecast euro-area economic growth and U.S. consumer-confidence reports outweighed worse-than-estimated U.S. industrial output data.

The Stoxx Europe 600 Index gained 0.5 percent. The benchmark gauge rose 2.5 percent this week as comments by Federal Reserve Chair Janet Yellen fueled optimism the U.S. economy can withstand reduced monthly bond purchases.

“Despite weaker industrial production, we see investors remain calm,” said Kai Fachinger, who oversees about $700 million as portfolio manager at Robeco SAM AG in Zurich. “For the moment, underlying sentiment remains positive. Also, macroeconomic news out of Europe was good today, so that provides a bit of a cushion.”

The euro-area economy expanded faster in the final quarter of 2013 than economists forecast, led by Germany and France, data from the European Union’s statistics office in Luxembourg showed. Gross domestic product in the euro zone rose 0.3 percent after a 0.1 percent increase in the third quarter, beating the median forecast of 0.2 percent.

Preliminary data showed that U.S. consumer confidence was unchanged in February. The Thomson Reuters/University of Michigan index remained at 81.2 this month, the same as in January. The median estimate of economists called for a drop to 80.2.

Factory production in the U.S. unexpectedly declined in January by the most since May 2009, according to Federal Reserve figures published today in Washington.

The 0.8 percent decrease at manufacturers followed a revised 0.3 percent gain the prior month that was weaker than initially reported. The median forecast of economists called for a 0.1 percent advance. Total industrial production dropped 0.3 percent.

National benchmark indexes advanced in 17 of the 18 western-European markets today.

FTSE 100 6,661.98 +2.56 +0.04% CAC 40 4,336.07 +23.27 +0.54% DAX 9,649.65 +52.88 +0.55%

Italy’s FTSE MIB added 1.7 percent to the highest level since July 2011 as Prime Minister Enrico Letta resigned, possibly clearing the way for a new government led by his chief rival Matteo Renzi.

ThyssenKrupp climbed 4 percent to 20.50 euros. Adjusted earnings from continuing operations before interest and taxes more than doubled to 247 million euros ($338 million) in the fiscal first quarter, exceeding the 218.7 million-euro average of estimates.

A gauge of European mining companies posted the best performance of the 19 industry groups in the Stoxx 600 as gold headed for its biggest weekly advance since October and silver was set for its longest rally since March 2008.

Fresnillo, which produces gold and silver in Mexico, climbed 5.5 percent to 973 pence. Polymetal International Plc gained 3.6 percent to 659.5 pence.

Hikma Pharmaceuticals Plc increased 4.6 percent to 1,301 pence after the maker of generic drugs raised its full-year revenue growth forecast to about 23 percent from a previous prediction of about 20 percent.

Ladbrokes Plc added 2.8 percent to 149.7 pence after UBS AG raised the U.K. operator of betting shops to buy from neutral, citing recent declines in the share price. Ladbrokes has fallen 16 percent so far this year.

Schindler declined 1.4 percent to 131.50 Swiss francs after the company said net profit in 2013 fell to 463 million francs ($519 million) from 730 million francs a year earlier. Schindler also said sales rose 8.4 percent in local currencies to 8.81 billion francs, beating analyst estimates of 8.76 billion francs.

Oil prices declined moderately today as weak U.S. economic data could compensate for the increase , which was connected to supply disruptions in Libya and Angola.

Experts note that an unexpected drop in U.S. retail sales surge in January and weekly claims for unemployment insurance caused doubts about the accelerating growth in the world's largest economy and undermined expectations of increasing global oil demand growth this year.

" Prices have fallen during today's session , as the weaker outlook for demand in the United States and the decline in producer prices in China have reduced investor interest in buying ," said Kas Kamal , an analyst at Sucden.

Oil experts, however , remain optimistic about global growth in oil demand .

Recall that the report presented today in China showed that consumer prices rose 2.5 percent in January compared with the previous year , registering the same rate of increase as in December. Experts expect that consumer prices will rise by 2.4 percent. On a monthly basis , consumer price inflation accelerated to 1 percent from 0.3 percent a month earlier. For the entire 2013 , inflation was 2.6 percent , well below the government's target of 3.5 per cent .

At the same time , it was reported that producer prices fell by 1.6 percent year on year , compared with a decline of 1.4 percent in December. The rate of decline matched economists' expectations and remain in negative territory for almost two years. On a monthly basis , producer prices fell 0.1 percent in January , while fixing the first drop in the past six months.

On the dynamics of trade also influenced appeal of the International Energy Agency (IEA ) to the Organization of Petroleum Exporting Countries (OPEC) to increase oil production.

Oil stocks in developed countries fell to a 5-year low amid strong demand , and oil prices since the beginning of the year increased by 9 %. In order to cool slightly overheated market , the IEA and OPEC asked to increase production quotas .

Current daily limit supply by OPEC countries - 30 million barrels per day , the actual daily volume of deliveries in January amounted to 29.94 million barrels per day

During the last three months of 2013 oil reserves in the group of OECD countries declined by 1.5 million daily barrels , so quickly reserves are not depleted in 1999.

One of the leaders to increase demand for oil was U.S. . And, as analysts predict this trend will continue for some time .

The other day , OPEC and U.S. Energy Information Administration raised its forecast for global oil demand in 2014. The IEA raised its forecast to a record 92.6 million barrels per day , down 1.3 million barrels a day more than last year .

Traders also respond to data from the U.S. Department of Energy , under which oil reserves rose by 11.1 million barrels over the past four weeks.

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 99.92 a barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture fell 46 cents to $ 108.25 a barrel on the London exchange ICE Futures Europe.

Gold prices today rose markedly , reaching a three-month high at the same time , and showing its biggest weekly gain in the past six months, as a series of weak U.S. data , which were released this week , have raised concerns about economic growth and put pressure on dollar .

Spot gold prices rose to a high of $ 1,320.90 an ounce, the highest since November 7. For the week, prices rose by 4 per cent , showing the largest increase since mid-August .

" Gold continues to trade very well , punching with one key resistance level after another ," said BofA Merrill Lynch analyst Michael Widmer . " From a fundamental point of view , we can assume that gold will continue its upward trend ."

The technical picture has improved over the past few sessions and prices were above its 200 -day moving average , the last time was registered in August 2012 .

However, some traders noted that the 14 - day relative strength index (RSI) for the spot price of gold was at 73.7 . An index value above 70 indicates that the market is overbought .

Add that with the beginning of the year prices rose by almost 9 percent , after falling 28 percent in 2013 on doubts about the recovery of the U.S. economy , as well as turmoil in emerging markets, which put pressure on some markets .

However , analysts remain cautious about the medium-term prospects for gold. Many expect the U.S. economy to recover and the dollar will start its rally , which would put pressure on gold , which is generally regarded as a safe haven in times of trouble .

We add that the current rise in gold prices has also helped improve sentiment among investors that directly affected the fund SPDR Gold Trust - stocks rose by 7.5 tons to 806.35 tons , registering the largest inflow since late December .

Physical demand , meanwhile, can be reduced in marked increase in prices and the possibility of another fall that keeps buyers at bay.

The cost of the April gold futures on the COMEX today rose to $ 1316.60 per ounce for ounce.

U.S. stock-index futures were little changed, before data that may show weakening industrial-output growth and consumer confidence.

Global markets:

Nikkei 14,313.03 -221.71 -1.53%

Hang Seng 22,298.41 +132.88 +0.60%

Shanghai Composite 2,115.85 +17.45 +0.83%

FTSE 6,658.07 -1.35 -0.02%

CAC 4,329.18 +16.38 +0.38%

DAX 9,641.13 +44.36 +0.46%

Crude oil $99.66 (-0.69%)

Gold $1315.80 (+1.21%).

USD/JPY Y101.00, Y101.50, Y101.80, Y102.00, Y102.40-50, Y103.00

EUR/USD $1.3500, $1.3550, $1.3625, $1.3710, $1.3720-25, $1.3770

GBP/USD $1.6600, $1.6650, $1.6700

EUR/GBP stg0.8100, stg0.8200, stg0.8280, stg0.8300, stg0.840

USD/CHF Chf0.9150

EUR/NOK Nok8.3516

AUD/USD $0.8900, $0.8950, $0.9000, $0.9025, $0.9040-45, $0.9100

NZD/USD $0.8200

USD/CAD C$1.0900, C$1.0940, C$1.0950-55, C$1.0990, C$1.1000, C$1.1135-50

06:30 France GDP, q/q (Preliminary) Quarter IV -0.1% +0.2% +0.3%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.2% +0.6% +0.8%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.3% +0.3% +0.4%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.1% +1.3% +1.4%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.1% -0.1% +0.1%

10:00 Eurozone Trade Balance s.a. December 16.0 14.5 13.7

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.2% +0.3%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV -0.4% +0.4% +0.5%

The euro rose to almost three-week high against the U.S. dollar after the rate of economic growth in Germany, France and the euro area slightly exceeded expectations. Eurozone economic growth accelerated in the fourth quarter, more than expected , according to preliminary estimates by Eurostat . Gross domestic product grew by 0.3 percent on a quarterly measurement that was faster than the growth of 0.1 percent posted in the third quarter and above economists' forecast of 0.2 percent . GDP grew the third consecutive quarter in late 2013 . In annual terms the economy grew by 0.5 percent , breaking the trend of declining by 0.3 percent in the third quarter . Projected growth of 0.4 percent. For the entire 2013 , GDP fell by 0.4 percent in the euro area and rose by 0.1 percent in the 28 countries of the European Union.

German growth accelerated in the fourth quarter , due to the positive contribution of foreign trade and investment , according to preliminary data from the Federal Statistical Office . Gross domestic product grew by 0.4 per cent compared with the previous quarter ago , while it was expected that he would remain stable at 0.3 percent.

According to preliminary calculations consistent growth in exports of goods and services was significantly higher than import growth . In terms of the expenditure side , government spending remained at the level of the previous quarter , while household spending on final consumption was slightly lower . Positive contribution was recorded in part of fixed capital formation , which was significantly higher in the sector of machinery and equipment , and construction. Nevertheless , stocks declined significantly , which slowed economic growth. Calendar adjusted GDP increased by 1.4 percent year on year , which is also faster than the growth of 0.6 per cent , which is seen in the third quarter and higher than economists expected 1.3 percent growth.

The French economy grew at the end of 2013 after stagnating in the third quarter , helped by the improvement in external demand , data showed the European statistical office Insee. Gross domestic product grew by 0.3 percent in the fourth quarter , after zero growth in the third quarter . The expenditure breakdown of GDP shows that as household spending and government spending accelerated in the fourth quarter , to 0.5 percent and 0.4 percent respectively. Investment rose for the first time since the end of 2011 , 0.6 percent in the fourth quarter . Exports grew by 1.2 per cent , 1.6 per cent drop changing ago quarter . Meanwhile, import growth slowed to 0.5 percent from 0.8 percent.

The Australian dollar rose after the publication of positive inflation data from China. Today, the National Bureau of Statistics in Beijing stated that in January consumer price index rose at the same pace as in December , by 2.5 % compared with the same period a year earlier. Producer price index fell by 1.6% in line with expectations . Recall that China is the largest trading partner of Australia and New Zealand .

EUR / USD: during the European session, the pair rose to $ 1.3714

GBP / USD: during the European session, the pair rose to $ 1.6722

USD / JPY: during the European session, the pair dropped to Y101.71

At 13:30 GMT , Canada will release the change in volume production shipments in December. In the U.S. at 13:30 GMT will import price index for January to 14:15 GMT - capacity utilization , change in industrial production for January to 14:55 GMT - consumer sentiment index from the University of Michigan in February.

European stocks advanced, extending their weekly gain, as investors awaited U.S. consumer confidence data, and a report showed the euro-area economy grew faster in the fourth quarter than anticipated. U.S. stock-index futures and Asian shares were little changed.

The Stoxx Europe 600 Index gained 0.4 percent to 332.64 at 10:24 a.m. in London.

The euro-area economy expanded more in the final quarter of 2013 than forecast, led by Germany and France, data from the European Union’s statistics office in Luxembourg showed today. Gross domestic product in the euro zone rose 0.3 percent after a 0.1 percent increase in the third quarter, beating the median forecast of 0.2 percent in a Bloomberg News survey.

ThyssenKrupp climbed 3.7 percent to 20.43 euros. Adjusted earnings from continuing operations before interest and taxes more than doubled to 247 million euros ($338 million) in the fiscal first quarter, exceeding the 218.7 million-euro average of 10 estimates compiled by Bloomberg.

Anglo American, which runs the world’s biggest platinum producer and Africa’s largest iron ore miner, added 1.4 percent to 1,554.5 pence. The company posted underlying earnings for 2013 of $2.7 billion, beating analyst estimates of $2.38 billion. Full-year sales rose 1 percent to $33.06 billion, while the net loss narrowed to $961 million from a loss of $1.49 billion in 2012.

Schindler declined 3.9 percent to 128.10 Swiss francs after the company said profit in 2013 fell to 463 million francs ($519 million) from 730 million francs a year earlier. Schindler also said sales rose 8.4 percent in local currencies to 8.81 billion francs, beating analyst estimates of 8.76 billion francs.

FTSE 100 6,664.74 +5.32 +0.08%

CAC 40 4,331.36 +18.56 +0.43%

DAX 9,654.66 +57.89 +0.60%

USD/JPY Y101.00, Y101.50, Y101.80, Y102.00, Y102.40-50, Y103.00

EUR/USD $1.3500, $1.3550, $1.3625, $1.3710, $1.3720-25, $1.3770

GBP/USD $1.6600, $1.6650, $1.6700

EUR/GBP stg0.8100, stg0.8200, stg0.8280, stg0.8300, stg0.840

USD/CHF Chf0.9150

EUR/NOK Nok8.3516

AUD/USD $0.8900, $0.8950, $0.9000, $0.9025, $0.9040-45, $0.9100

NZD/USD $0.8200

USD/CAD C$1.0900, C$1.0940, C$1.0950-55, C$1.0990, C$1.1000, C$1.1135-50

A gauge of Asian stocks outside Japan climbed, headed for its biggest weekly gain in more than four months, as health-care and information technology companies advanced. Stocks in Tokyo tumbled after the yen strengthened.

Nikkei 225 14,313.03 -221.71 -1.53%

S&P/ASX 200 5,356.26 +48.15 +0.91%

Shanghai Composite 2,115.85 +17.45 +0.83%

Shandong Weigao Group Medical Polymer Co. jumped 5.3 percent in Hong Kong to lead health-care companies higher.

Tencent Holdings Ltd. rose to a record after Jefferies Hong Kong Ltd. boosted its target price on Asia’s largest Internet company by market value.

Kirin Holdings Co. fell 9.2 percent after the Japanese beverage maker forecast profit that missed analysts’ estimates.

01:30 China PPI y/y January -1.4% -1.6% -1.6%

01:30 China CPI y/y January +2.5% +2.4% +2.5%

The Dollar Index was set for the lowest close in more than a month as a winter storm swept across the U.S. and amid signs of weakness in retail sales, manufacturing and employment. Retail sales in the U.S. fell 0.4 percent in January after a revised 0.1 percent drop the prior month, according to the Commerce Department. The median forecast of 86 economists surveyed by Bloomberg called for no change.

The yen strengthened versus all of its major counterparts as Japanese equity declines boosted demand for the perceived safety of the currency.

Australia’s dollar rallied after consumer prices increased in China, the nation’s biggest trading partner. Data in China showed consumer prices increased 2.5 percent in January from a year earlier, compared to a 2.4 percent increase estimated by economists in a Bloomberg News survey. The producer price index fell 1.6 percent, in line with economists’ forecasts.

New Zealand’s dollar rose versus most of its major peers as Asian stocks extended gains and food prices in the nation rebounded. In New Zealand, food prices increased 1.2 percent in January from the prior month, when it slid 0.1 percent, Statistics New Zealand reported today in Wellington.

China is the biggest trading partner of both Australia and New Zealand.

EUR / USD: during the Asian session, the pair traded in the range of $1.3670-90

GBP / USD: during the Asian session, the pair traded in the range of $1.6640-60

USD / JPY: on Asian session the pair fell to Y101.65

Friday sees a full data calendar to start the week, with the release of the main euro area flash GDP numbers for the fourth quarter the stand out feature. Also Friday. ratings agency Moody's could issue a review on Italy, while DBRS could issue an update on the UK. The European data calendar kicks off at 0630GMT, with the release of the French Q4 GDP data, followed by the German Q4 data at 0700GMT. French data continues at 0730GMT, with the release of the Bank of France retail trade data, the fourth quarter employment numbers and the Q4 job creation data. At 0800GMT, the Spanish January final HICP numbers will cross the wires. There is further data scheduled for release at 1000GMT, including the Italian flash Q4 GDP data and the Eurozone December trade balance.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.