- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-02-2014

Gold $1,290.1 +2.60 +0.20%

ICE Brent Crude Oil $108.71 +0.08 +0.07%

NYMEX Crude Oil $100.36 +0.42 +0.42%

Hang Seng 21,962.98 +383.72 +1.78%

S&P/ASX 5,254.5 +32.40 +0.62%

Shanghai Composite 2,103.67 +17.60 +0.84%

S&P 1,819.75 +19.91 +1.11%

NASDAQ 4,191.05 +42.87 +1.03%

Dow 15,994.77 +192.98 +1.22%

FTSE 6,672.66 +81.11 +1.23%

CAC 4,283.32 +46.19 +1.09%

DAX 9,478.77 +188.91 +2.03%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3637 -0,05%

GBP/USD $1,6449 +0,30%

USD/CHF Chf0,8981 +0,17%

USD/JPY Y102,62 +0,36%

EUR/JPY Y139,94 +0,30%

GBP/JPY Y168,81 +0,67%

AUD/USD $0,9036 +0,97%

NZD/USD $0,8319 +0,65%

USD/CAD C$1,1007 -0,44%

02:00 China Trade Balance, bln January 25.6 24.2

02:00 China New Loans January 483 1100

06:00 Japan Prelim Machine Tool Orders, y/y January +28.1%

08:15 Switzerland Consumer Price Index (MoM) January -0.2% -0.2%

08:15 Switzerland Consumer Price Index (YoY) January +0.1% +0.1%

10:00 Eurozone Industrial production, (MoM) December +1.8% -0.2%

10:00 Eurozone Industrial Production (YoY) December +3.0% +1.8%

10:30 United Kingdom Bank of England Quarterly Inflation Report Quarter I

10:30 United Kingdom BOE Gov Mark Carney Speaks

15:30 Eurozone ECB President Mario Draghi Speaks

15:30 U.S. Crude Oil Inventories February +0.4

19:00 U.S. Federal budget January 53.2 -28.2

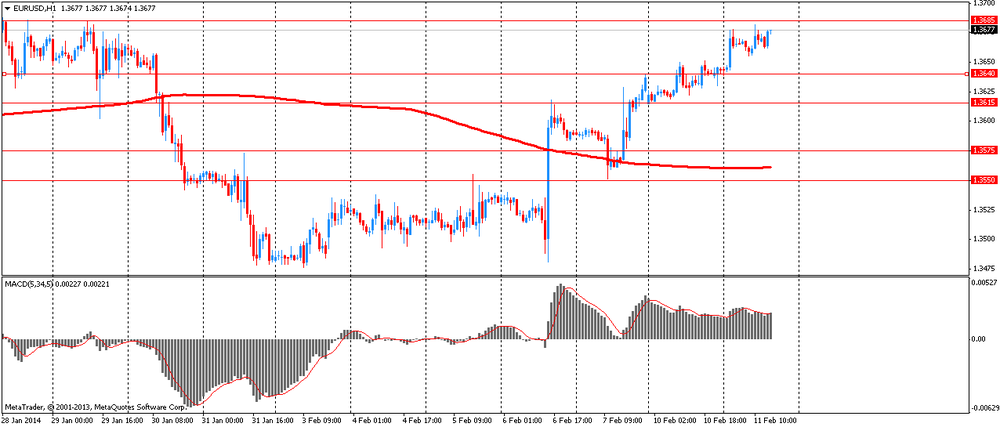

21:30 New Zealand Business NZ PMI January 56.4The euro exchange rate showed marked fluctuations against the dollar , but was unable to hold its positions and fell back to the lows of the session. The main focus of market participants was focused on the speech of Fed Chairman Janet Yellen . Speaking in the U.S. Congress with the semi-annual report on monetary policy , she noted that the situation in the labor market improved, but the economy still has a long recovery process. Yellen also supported the current policy of the FOMC and suggested that the Fed will continue at a moderate pace gradually curtail asset purchase program QE. She also noted that the achievement of targets will not mean automatic increase the federal funds rate . Rather, such progress would be to encourage the Central Bank to analyze the economic situation in order to determine at what stage the rate increase is justified. Yellen said that he sees " significant risks to the U.S. economic outlook " by the tension in the emerging markets , and did not consider politics QE factor that contributes to the formation of bubbles in the stock market , saying that the share price has risen from the average historical values only slightly .

During the question and answer session in Congress Yellen had to touch on rates and QE minimize the likely impact on the process of weakening labor market and the recent disappointing performance report NFP. She admitted that the January employment data did not meet its forecasts , but urged not to jump to hasty conclusions.

Yellen recalled abnormal frosts , which could adversely affect the performance report. "I think we need to understand slowly significance of these figures," on the eve of the March Fed meeting, she said, adding that the only significant change projections will determine the pace of change in folding QE.

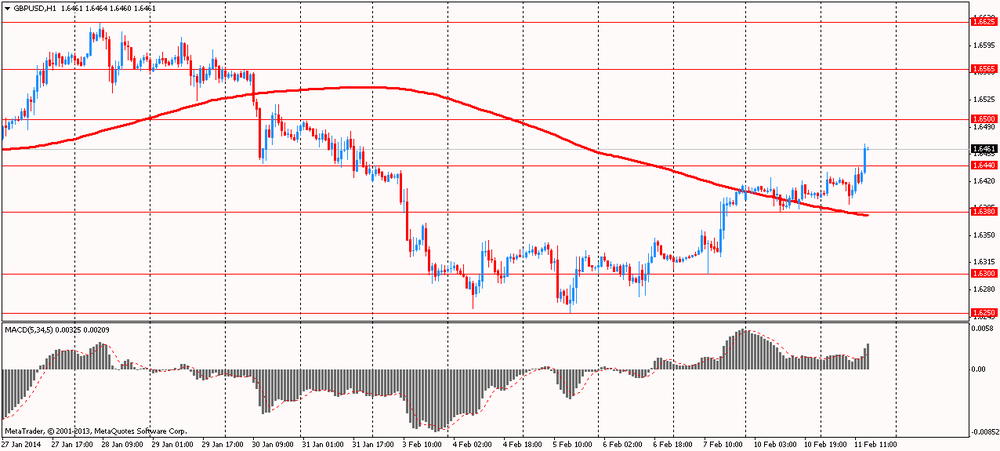

Pound retreated from a session high against the U.S. dollar , but continues to trade with a moderate increase . The main growth driver was the increase in the forecast for economic growth of the Confederation of British Industry , which referred to the fact that the economy gain strength in business investment on the background of low borrowing costs and ready to grow this year in net trade . However , CBI has expressed concern about the political uncertainty at a time as a nation enters into a long campaign. Lobbying business projects will grow by 2.6 percent this year , compared with the November forecast of 2.4 per cent , reflecting stronger than expected economic performance in late 2013 .

For 2015 CBI expects expansion of 2.5 percent , it is slightly smaller compared to the forecast of 2.6 per cent in November. Forecasts are generally in accordance with a wide range of estimates of forecasters . It is expected that in the quarterly measurement of gross domestic product growth at 0.6 percent this year , and will be recorded quarterly growth rates ranging from 0.6 percent to 0.7 percent in 2015.

Besides a couple of words influenced Fed chief Janet Yellen .

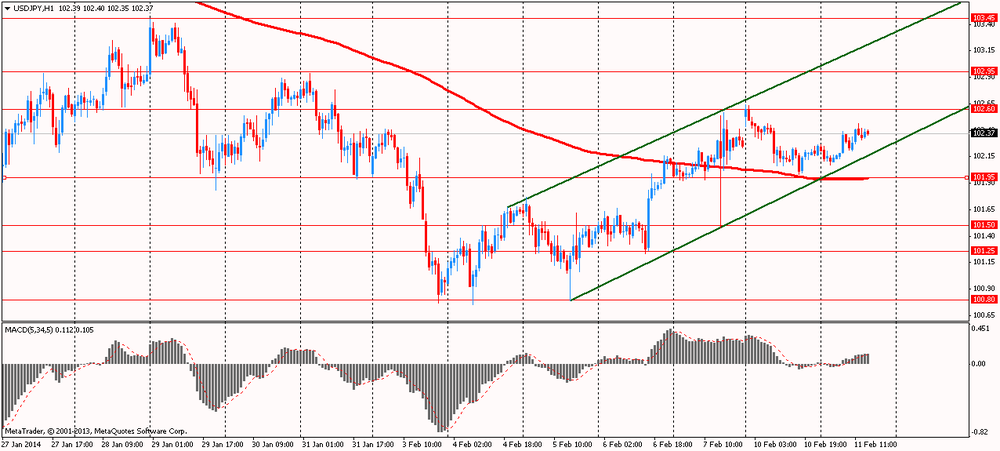

The yen fell against the dollar , reaching with almost two-week low . Experts note that the demand for USD / JPY pair has returned thanks Yellen . As announced today , Fed Chairman Janet Yellen , speaking in the U.S. Congress with its first semi-annual report on monetary policy , the labor market situation has improved , but the economy still has a long recovery process. Thus, the market received mixed signals , resulting in market volatility .

European stocks rose, with the Stoxx Europe 600 Index climbing for a fifth day, as Federal Reserve Chairman Janet Yellen said more work is needed to restore the labor market to health.

Carmakers posted the biggest gain among 19 industry groups in the Stoxx 600 after Goldman Sachs Group Inc. boosted its growth forecasts for auto sales in western Europe.

The Stoxx 600 advanced 1.2 percent to 329.29 at 4:30 p.m. in London, taking its five-day gain to 3.7 percent. The gauge lost 5.5 percent from its six-year high on Jan. 22 through Feb. 4 amid concern about the Fed’s bond-buying cuts, China’s economic slowdown and volatility in developing markets.

Yellen testified before the House Financial Services Committee as investors weigh the pace of stimulus reductions. While growth has picked up, “the recovery in the labor market is far from complete,” Yellen said today in the text of her remarks. She repeated the Fed’s outlook for further reductions in “measured steps” and that asset purchases are not on a “pre-set course.”

The Fed said in December that it would start cutting the monthly pace of asset purchases. It announced a $10 billion reduction that month, followed by a cut of the same size in January to $65 billion.

Data on Feb. 6 showed U.S. jobless claims dropped for the first time in three weeks. A government report the next day indicated payrolls rose by a less-than-projected 113,000 jobs in January and the unemployment rate unexpectedly fell to the lowest level in more than five years.

National benchmark indexes advanced all western-European markets except Greece today.

FTSE 100 6,672.66 +81.11 +1.23% CAC 40 4,283.32 +46.19 +1.09% DAX 9,478.77 +188.91 +2.03%

PSA Peugeot Citroen advanced 4.5 percent to 12.02 euros after Goldman Sachs added the company to its conviction-buy list. Bayerische Motoren Werke AG rose 2.6 percent to 84.16 euros after the New York-based bank recommended buying the stock. Nokian Renkaat Oyj (NRE1V) climbed 3.7 percent to 33.50 euros after HSBC Holdings Plc and SEB AB raised their ratings on the biggest tiremaker in the Nordic region.

Michelin, Europe’s largest tiremaker, climbed 3.6 percent to 83.93 euros. The company will stick with its earnings targets for 2015 as it predicts volume will rise this year and first-half spending on supplies will drop. The manufacturer will probably achieve its 1 billion-euro ($1.4 billion) cost-savings goal for 2016, Chief Executive Officer Jean-Dominique Senard said. Michelin will raise its dividend 4.1 percent to 2.50 euros a share, the company said.

Hexagon AB (HEXAB) rallied 6.4 percent to 224 kronor. The world’s largest maker of measuring instruments reported fourth-quarter net income of 104.1 million euros, exceeding the 98.2 million euros posted in the same period last year and beating analysts’ estimates. The Stockholm-based company also proposed increasing its dividend to 31 euro cents a share from 28 cents a year earlier.

ICAP Plc (IAP) increased 3.7 percent to 413.9 pence. Goldman Sachs raised its recommendation on the world’s largest broker of transactions between banks to neutral from sell after the stock dropped 13 percent from its Jan. 15 high through yesterday.

Barclays fell 4 percent to 263.9 pence. The U.K.’s second-largest lender by assets said its investment-bank unit had a pretax loss of 329 million pounds ($539 million) in the last three months of 2013, compared with a profit of 760 million pounds in the year-earlier period. The company said it will raise bonuses by 10 percent and cut jobs.

Prices for Brent crude moderately increased , being in the neighborhood of $ 109 per barrel, while WTI oil prices exceeded the $ 100 a barrel as investors analyzed the comments of the Federal Reserve System Janet Yellen that the U.S. central bank will continue to reduce program asset purchase .

In his first public comments as Fed chief Yellen also said that the recent volatility in global financial markets does not pose a significant risk to the U.S. economic outlook .

"Yellen has clearly stated that it plans to continue to reduce incentives - said the chief market analyst at Price Futures Group Phil Flynn . - Investors are hoping that she is inclined to support incentives but Yellen destroyed these hopes . "

Note that the series of disappointing U.S. data prompted speculation that the Fed may refrain from further reduce the incentives that supported prices for oil and other commodities .

U.S. crude still close to six-week high , supported by expectations that the fall in distillate stocks for the previous week due to cold weather across the country. Stocks of distillates , including heating oil and diesel, are expected to have decreased by 2.3 million barrels for the week ending February 7. Oil reserves, however, are expected to rise by 3 million barrels. Recall that today will present data on stocks of the American Petroleum Institute , and tomorrow - the Energy Information Administration .

We add that the rise in prices for Brent was limited expectations of a further increase in Libyan production . Current production in the North African country is about 600,000 barrels per day , which is slightly above the average , which was celebrated in January.

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 100.15 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture rose 62 cents to $ 109.03 a barrel on the London exchange ICE Futures Europe.

Gold prices rose sharply , reaching at this three-month high , as investors heard that the new head of the U.S. Federal Reserve will continue the previous policy , which was held by Bernanke.

Fed Chairman Janet Yellen , speaking in the U.S. Congress with the semi-annual report on monetary policy , said that the situation on the labor market improved, but the economy still has a long recovery process.

It supported the current political course FOMC and suggested that the Fed will continue at a moderate pace gradually curtail asset purchase program QE. She also noted that the achievement of targets will not mean automatic increase the federal funds rate . Rather, such progress would be to encourage the Central Bank to analyze the economic situation in order to determine at what stage the rate increase is justified.

Yellen said that he sees " significant risks to the U.S. economic outlook " by the tension in the emerging markets , and did not consider politics QE factor that contributes to the formation of bubbles in the stock market , saying that the share price has risen from the average historical values only slightly .

Higher prices also helped that the dollar fell to its lowest level in almost two weeks against the euro and a basket of major currencies.

"Strengthening the prices should be seen as an opportunity to sell ," - said the head of commodity markets analyst Societe Generale Asia Mark Keenan .

We also learned that the mark-up on gold 99.99 fine on the Shanghai Gold Exchange fell to $ 7 per ounce to the spot price at $ 12 on Monday, as demand declined as prices rise .

In addition , we add that the Ministry of Commerce of India recommends to ease restrictions on imports of gold after 77 - percent drop in imports in January . Recall that India has imposed restrictions in the past year , including a record-breaking 10 - percent import duty to reduce the trade deficit .

Assets of the world's largest holder of gold investment institutions ETFs SPDR Gold Trust remained unchanged - at the level of 797.05 tons.

The cost of the April gold futures on the COMEX today rose to $ 1288.70 per ounce for ounce.

U.S. stock futures pared gains as Federal Reserve Chairman Janet Yellen said that while more work is needed to restore the labor market to health, the central bank would likely continue scaling back its bond buying.

Global markets:

Hang Seng 21,962.98 +383.72 +1.78%

Shanghai Composite 2,103.67 +17.60 +0.84%

FTSE 6,631.59 +40.04 +0.61%

CAC 4,255.22 +18.09 +0.43%

DAX 9,401.67 +111.81 +1.20%

Crude oil $100.17 (+0.11%)

Gold $1278.80 (+0.32%).

USD/JPY Y101.00, Y101.25, Y101.75-80, Y102.00, Y102.20, Y102.35-40, Y102.50-55, Y102.75

EUR/USD $1.3450, $1.3500, $1.3525, $1.3610, $1.3635, $1.3745

GBP/USD $1.6200, $1.6250, $1.6300, $1.6400

EUR/GBP stg0.8200, stg0.8235

USD/CHF Chf0.9000, Chf0.9055

AUD/JPY $0.8850, $0.8870-75, $0.8900, $0.9000

NZD/USD $0.8100, $0.8210

USD/CAD Cad1.0900, Cad1.0970, Cad1.1000

00:01 United Kingdom BRC Retail Sales Monitor y/y January +0.4% +0.8% +3.9%

00:30 Australia National Australia Bank's Business Confidence January 6 8

00:30 Australia House Price Index (QoQ) Quarter IV +2.4% Revised From +1.9% +3.2% +3.4%

00:30 Australia House Price Index (YoY) Quarter IV +8.0% Revised From +7.6% +8.6% +9.3%

00:30 Australia Home Loans December +1.4% Revised From +1.1% +0.9% -1.9%

10:00 United Kingdom BOE Deputy Governor Andrew Bailey Speaks

The euro exchange rate is moderately higher against the dollar , while investors expect the Fed speeches new head Janet Yellen . Based on the past comments and guesses analysts, we can assume that Yellen is likely to defend the current policy stance and remind you that the bar to change the incentive plan folding quite high , although dependent on the data. Immediately before Yellen will speak Philadelphia Fed President Charles Plosser , and it will probably pave the way in calling for a drastic reduction of bond purchases , while the unemployment situation remains favorable . Nevertheless , reducing the Fed's program is the focus of only a month later after it was launched . Submitted since economic data has not been unequivocally favorable. So this is the first performance for Yellen may become very active.

The British pound strengthened against the U.S. dollar , amid growth in retail sales . According to a survey released Tuesday by the British Retail Consortium (BRC), retail sales in the UK rose in January. BRC Retail Sales Monitor showed that overall retail sales rose by 5.4 percent compared with a year earlier.

Sales at stores that have been open a year or more , grew by 3.9 per cent per annum, said the BRC. Sales growth in same stores was much stronger than in December (0.4 percent ) , and is the highest since April 2011 , when sales growth was 5.2 percent . Sales growth in general in December was 1.8 percent, and it was with a maximum value in March 2010

Non-food sales rose 5.1 percent in the last quarter of 2013 , while sales of food rose by only 0.8 percent in Q4. Online non-food sales grew by 19 percent in January.

EUR / USD: during the European session, the pair rose to $ 1.3677

GBP / USD: during the European session, the pair rose to $ 1.6468

USD / JPY: during the European session, the pair rose to Y102.46

At 15:00 GMT indicates Fed chairman Janet Yellen . At 15:00 GMT the United States will vacancy rates and labor turnover from the Bureau of Labor Statistics for December. At 23:30 GMT , Australia will publish consumer confidence index from Westpac in February. At 23:50 GMT , Japan will release the change in orders for machinery and equipment, the index of activity in the services sector in December.

European stocks rose, with the Stoxx Europe 600 Index climbing for a fifth day, as investors awaited for Federal Reserve Chairman Janet Yellen to deliver her first testimony on monetary policy. Asian shares and U.S. stock-index futures also gained.

Yellen testifies before the House Financial Services Committee today as investors weigh the pace of stimulus reductions against data this week that may show retail sales in the world’s largest economy stalled while jobless claims declined. Her prepared remarks will be released at 8:30 a.m. Washington time and the hearing will begin at 10 a.m.

Yellen’s appearance before Congress comes after the Federal Open Market Committee said last month it will cut monthly bond purchases by $10 billion to $65 billion, citing labor-market indicators that “were mixed but on balance showed further improvement” and economic growth that has “picked up in recent quarters.” Policy makers next meet on March 18-19.

PSA Peugeot Citroen increased 2 percent to 11.74 euros after Goldman Sachs added the company to its conviction-buy list. Bayerische Motoren Werke AG rose 1.4 percent to 83.16 euros after the New York-based bank recommended buying the stock. Nokian Renkaat Oyj climbed 3.7 percent to 33.49 euros after HSBC Holdings Plc and SEB AB raised their ratings on the biggest tiremaker in the Nordic region.

Michelin, Europe’s largest tiremaker, climbed 1.9 percent to 82.55 euros. The company will stick with its earnings targets for 2015 as it predicts volume will rise this year and first-half spending on supplies will drop. The manufacturer will probably achieve its 1 billion-euro ($1.4 billion) cost-savings goal for 2016, Chief Executive Officer Jean-Dominique Senard said. Michelin will raise its dividend 4.1 percent to 2.50 euros a share, the company said.

L’Oreal SA slipped 2.4 percent to 125.95 euros after earlier jumping as much as 4.5 percent. The world’s largest cosmetics company agreed to buy back 8 percent of its shares from Nestle SA for 6 billion euros. The maker of Maybelline mascara also reported a 4.8 percent increase in 2013 earnings, matching analysts’ estimates.

Barclays fell 2.3 percent to 268.8 pence. The U.K.’s second-largest lender by assets said its investment-bank unit had a pretax loss of 329 million pounds ($539 million) in the last three months of 2013, compared with a profit of 760 million pounds in the year-earlier period. The company said it will raise bonuses by 10 percent and cut jobs.

FTSE 100 6,651.4 +59.85 +0.91%

CAC 40 4,270.49 +33.36 +0.79%

DAX 9,411.03 +121.17 +1.30%

USD/JPY Y101.00, Y101.25, Y101.75-80, Y102.00, Y102.20, Y102.35-40, Y102.50-55, Y102.75

EUR/USD $1.3450, $1.3500, $1.3525, $1.3610, $1.3635, $1.3745

GBP/USD $1.6200, $1.6250, $1.6300, $1.6400

EUR/GBP stg0.8200, stg0.8235

USD/CHF Chf0.9000, Chf0.9055

AUD/JPY $0.8850, $0.8870-75, $0.8900, $0.9000

NZD/USD $0.8100, $0.8210

USD/CAD Cad1.0900, Cad1.0970, Cad1.1000

A gauge of Asian stocks outside Japan rose, heading for its biggest advance since November, before Federal Reserve Chairman Janet Yellen delivers her first testimony on monetary policy.

Nikkei 225 Closed

S&P/ASX 200 5,254.5 +32.35 +0.62%

Shanghai Composite 2,103.67 +17.60 +0.84%

Zijin Mining Group Co., China’s biggest gold producer, jumped 8.1 percent in Hong Kong as the bullion’s price headed for the longest rally since August.

Australia & New Zealand Banking Group Ltd., Australia’s third-largest bank by market value, added 2.2 percent after posting a 13 percent jump in first-quarter cash profit.

Tata Motors Ltd. climbed 2.3 percent in Mumbai, rising for a sixth day, after India’s biggest automaker posted quarterly profit that beat analyst estimates.

00:00 Japan Bank holiday

00:01 United Kingdom BRC Retail Sales Monitor y/y January +0.4% +0.8% +3.9%

00:30 Australia National Australia Bank's Business Confidence January 6 8

00:30 Australia House Price Index (QoQ) Quarter IV +2.4% Revised From +1.9% +3.2% +3.4%

00:30 Australia House Price Index (YoY) Quarter IV +8.0% Revised From +7.6% +8.6% +9.3%

00:30 Australia Home Loans December +1.4% Revised From +1.1% +0.9% -1.9%

Australia’s dollar reached a four-week high after home prices and business sentiment climbed. “The Aussie dollar cracked above the 90 level on the back of the business confidence data, and generally, sentiment for the currency is becoming less negative,” said Mitul Kotecha, the Hong Kong-based global head of foreign-exchange strategy at Credit Agricole Corporate & Investment Bank SA. “The bias for the U.S. dollar is slightly weaker, and I think it looks like it’s going to be under pressure ahead of Yellen’s speech.”

The greenback fell against the yen before Federal Reserve Chairman Janet Yellen speaks to U.S. lawmakers today. Yellen will speak before Congress today for the first time since being sworn in as Fed chairman on Feb. 3. The Federal Open Market Committee said last month it will cut monthly bond purchases by $10 billion to $65 billion, citing labor-market indicators that “were mixed but on balance showed further improvement” and economic growth that has “picked up in recent quarters.” Policy makers next meet on March 18-19.

Data this week may show U.S. retail sales stalled and Chinese import growth slowed. Retail sales probably stagnated in January after a 0.2 percent gain the month before, according to the median estimate of economists surveyed by Bloomberg News before the U.S. Commerce Department reports the data on Feb. 13.

Japan’s financial markets are closed today for a national holiday.

EUR / USD: during the Asian session, the pair rose to $ 1.3680

GBP / USD: during the Asian session, the pair rose to $ 1.6430

USD / JPY: on Asian session the pair traded in the range of Y102.05-30

There is a full calendar on both sides of the Atlantic Tuesday, although largely dominated by central bank appearances over data. The standout feature is undoubtedly the first appearance on Capitol Hill of Janet Yellen as new Fed Chair. The European calendar kicks off at 0800GMT, with the release of the Belgian National Bank annual report. At 1130GMT, Euro-Working Group Chair ThomasWieser will speak on Europe's Financial Architecture, in Frankfurt. ECB Governing Council member Jens Weidmann is slated to speak on "From dentists to economists - the importance of a consistent monetary regulation of framework", in Karlsruhe, Germany, starting at 1500GMT.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.