- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-02-2014

The euro has risen sharply against the U.S. dollar after a report by the Ministry of Labour employment was weaker than economists' expectations . The labor market showed a slight increase again in January , though a bit more than in December , increasing concerns about the economic recovery and may lead to the fact that the Federal Reserve will need to rethink its strategy .

Data from the Department of Labor showed that the seasonally adjusted number of people employed in non-agricultural sector grew in January at 113 thousand , compared with an increase of 75 thousand in December ( revised from 74 thousand). The January increase was significantly lower than the average increase in the period from August to November - at the level of 200 thousand jobs.

In addition, it was reported that the unemployment rate fell to 6.6 % last month from 6.7 % in December , as the number of Americans who worked and those that are part of the workforce , increased slightly . Economists had expected an increase of 185,000 jobs and 6.7 % unemployment .

Weak data on the growth of the number of employees in December , and signs of weakness in the housing sector and emerging markets have raised concerns that the beginning of 2014 may be disappointing , and the report for January even more intensified these concerns . Add that weak employment report could force the Fed to reconsider their plans for reducing the amount of bond-buying program . In the past month the Fed voted to reduce the rate of its monthly bond purchases by $ 10 billion , despite a disappointing report on the number of employees in December. Continue to reduce incentives may be challenged , given the other signs of slowing growth and continued low inflation .

Euro rate previously dropped against the U.S. dollar after the German Constitutional Court declared that transmits its decision to the ECB's operations in the open market of the EU Court of Justice . In the accompanying statement, the court said that the plan of the Central Bank for the purchase of bonds , " beyond the mandate of the ECB monetary policy and violates the powers of the participating countries , and violates the prohibition of monetary financing of the budget ." However , the court said that if the decision on the OMT program is adopted restrictive , it will match the German constitution . According to the court , the program OMT can obtain the status of a legitimate , if not undermine the principles of rescue programs EFSF and ESM. Thus, intended to exclude the possibility of reducing the Agreement on the European Stability Mechanism , as well as any unlimited Bank program.

The pound fell against the dollar earlier on the background report , which showed that the volume of production in the manufacturing sector rose in December by 0.3 percent , which was significantly less than forecasts at 0.6 percent. Meanwhile, the total volume of industrial production, which accounts for about 15 percent of the British economy grew by 0.4 percent in December from November . It is estimated that production would grow by 0.7 percent. We also add that in the fourth quarter , industrial output grew by 0.5 %, which was slightly below the initial assessment at the level of 0.7 % , which was published last month. However, lower growth in itself is not sufficient to cause a downward revision to the pace of economic growth in the 4th quarter , reported in the statistical agency .

European stocks advanced, following their biggest rally in seven weeks, as investors assessed a report that showed the U.S. economy created fewer new jobs last month than forecast.

The Stoxx Europe 600 Index increased 0.7 percent to 325.09 at the close of trading, taking its advance this week to 0.8 percent. The equity benchmark rallied 1.5 percent yesterday as the European Central Bank left interest rates at a record low. European stocks have still fallen 3.3 percent from their high on Jan. 22 amid a sell-off in emerging-market currencies and signs of slowing economic growth in China.

In the U.S., a Labor Department report in Washington showed that the unemployment rate unexpectedly slipped to 6.6 percent in January, its lowest in more than five years. The release also showed that employers in the world’s biggest economy increased their payrolls by 113,000 workers last month. That missed the median forecast of 92 economists in a Bloomberg survey for net hires of 180,000.

National benchmark indexes rose in every western-European market except Iceland today. The U.K.’s FTSE 100 gained 0.2 percent, while Germany’s DAX rose 0.5 percent. France’s CAC 40 added 1 percent. The volume of shares changing hands in companies listed on the Stoxx 600 was 8.3 percent greater than the 30-day average, data compiled by Bloomberg show.

Statoil added 5.7 percent to 157.50 kroner. Norway’s national oil company scaled back its spending plans for the three years through 2016 by 8 percent to about $20 billion a year in an attempt to increase its free cash flow. The company earlier reported a 27 percent drop in quarterly profit.

Aperam, the stainless-steel producer spun off by ArcelorMittal in 2011, jumped 13 percent to 15.39 euros. Ebitda in the fourth quarter amounted to $84 million, beating the $65.5 million that analysts had predicted.

Vedanta Resources Plc increased 4.3 percent to 857.5 pence after Bank of America Corp. raised the commodity producer to buy from neutral. The brokerage said that the share price already reflects concern the Indian rupee will continue to weaken. Vedanta mines iron ore in India and copper in Zambia.

ArcelorMittal advanced 0.8 percent to 12.50 euros. Earnings before interest, taxes, depreciation and amortization rose to $1.91 billion in the fourth quarter, from $1.56 billion a year earlier. That beat the average analyst estimate of $1.81 billion. The company also said earnings will continue to climb in 2014, forecasting full-year Ebitda of about $8 billion.

Daimler AG gained 1.7 percent to 63.54 euros as Chief Executive Officer Dieter Zetsche said he intends to increase the prices of some of the company’s vehicles because demand has outstripped supply.

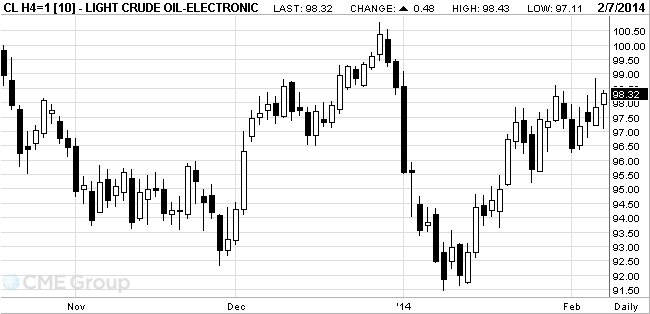

West Texas

Intermediate crude oil was little changed in early floor trading on the New

York Mercantile after rebounding from a decline of 0.7 percent.

WTI for

March delivery declined 11 cents to $97.73 a barrel at 9:04 a.m. The price

ranged from $97.11 to $98.14. The volume of all futures traded was 21 percent

more than the 100-day average.

Brent for

March settlement rose 37 cents, or 0.3 percent, to $107.56 on the ICE Futures

Europe exchange. The European benchmark crude was at a premium of $9.83 to WTI

on the ICE exchange, compared with $9.35 yesterday.

WTI

rebounded after the Labor Department reported payrolls in the

In

Gold prices rose after the release less positive than expected U.S. data on employment.

In January, the U.S. labor market for the second month in a row was recorded weak job growth . It can strengthen concerns about the economic recovery and may cause some investors to urge the U.S. Federal Reserve to rethink his strategy .

As reported on Friday, the U.S. Labor Department , the number of jobs outside agriculture in January rose by 113,000 adjusted for seasonal variations. Accelerated growth rate compared to December , but was below the average growth rate in the past year . December job growth was revised upward for 1000 to 75 000, and the November growth - also upwards of 33 000 to 274 000 .

Job growth in January was weak compared with the average growth in the period between August and November , when the index grows by more than 200,000 .

The U.S. Labor Department also reported that the unemployment rate in January fell to 6.6 % from 6.7 % in December. The number of employed Americans and labor also increased slightly .

Chinese buyers returned to the market on Friday after a week's absence, and the >

U.S. jobless rate declined while payrolls rose less than forecast, spurring debate on the outlook for stimulus cuts.

Globalmarkets:

Nikkei 14,462.41 +307.29 +2.17%

Hang Seng 21,636.85 +213.72 +1.00%

Shanghai Composite 2,044.5 +11.41 +0.56%

FTSE 6,581.33 +23.05 +0.35%

CAC 4,217.16 +29.06 +0.69%

DAX 9,291.61 +35.03 +0.38%

Crude oil $97.75 (-0.09%)

Gold $1266.50 (+0.74%).

USD/JPY Y101.00, Y101.25, Y101.45/50, Y102.00, Y102.25, Y102.50, Y103.00, Y104.00, Y105.00

EUR/USD $1.3400, $1.3430, $1.3450, $1.3500, $1.3525, $1.3550, $1.3600, $1.3650/55

AUD/USD $0.8750, $0.8850, $0.8875, $0.8900, $0.8940

EUR/GBP stg0.8150

USD/CAD Cad1.0980, Cad1.1050, Cad1.1080, Cad1.1150, Cad1.1200

GBP/USD $1.6300, $1.6400, $1.6450

USD/CHF Chf0.8950, Chf0.9000, Chf0.9150, $0.9200

NZD/USD NZ$0.8100

00:30 Australia RBA Monetary Policy Statement Quarter I

01:45 China HSBC Services PMI January 50.9 50.7

05:00 Japan Leading Economic Index December 111.1 111.9 112.1

05:00 Japan Coincident Index December 110.7 111.7

07:00 Germany Current Account December 21.6 23.5

07:00 Germany Trade Balance December 18.9 Revised From 17.8 17.3 18.5

08:00 Switzerland Foreign Currency Reserves January 435.2 437.7

08:15 Switzerland Retail Sales Y/Y December +4.2% +3.9% +2.3%

09:30 United Kingdom Industrial Production (MoM) December 0.0% +0.7% +0.4%

09:30 United Kingdom Industrial Production (YoY) December +2.5% +1.8%

09:30 United Kingdom Manufacturing Production (MoM) December 0.0% +0.6% +0.3%

09:30 United Kingdom Manufacturing Production (YoY) December +2.8% +1.5%

09:30 United Kingdom Trade in goods December -9.4 -7.7

11:00 Germany Industrial Production s.a. (MoM) December +1.9% +0.5% -0.6%

11:00 Germany Industrial Production (YoY) December +3.5% +2.6%

The euro exchange rate fell sharply against the U.S. dollar after the German Constitutional Court declared that transmits its decision on operations of the ECB on the open market of the EU Court of Justice . In the accompanying statement, the court said that the plan of the Central Bank for the purchase of bonds , " beyond the mandate of the ECB monetary policy and violates the powers of the participating countries , and violates the prohibition of monetary financing of the budget ." However , the court said that if the decision on the OMT program is adopted restrictive , it will match the German constitution . According to the court , the program OMT can obtain the status of a legitimate , if not undermine the principles of rescue programs EFSF and ESM. Thus, intended to exclude the possibility of reducing the Agreement on the European Stability Mechanism , as well as any unlimited Bank program .

Little impact on the bidding had data on industrial production in Germany . As it became known that the volume of German industrial production unexpectedly fell in December , signaling that Europe's largest economy remains vulnerable to weakness in the rest of the region . Production decreased by 0.6 % from November , when it rose 2.4%. Economists had forecast an increase of 0.5%. Production grew by 2.6% compared with a year earlier , adjusted for the number of working days. Ministry of Economy said that the prospects of industrial production in 2014 remain positive on the background of the " revival" of consumption and improving business confidence .

Pound is trading slightly higher against the dollar, despite the sharp decline earlier. Exerted pressure on the currency report , which showed that the volume of production in the manufacturing sector rose in December by 0.3 percent , which was significantly less than forecasts at 0.6 percent. Meanwhile, the total volume of industrial production, which accounts for about 15 percent of the British economy grew by 0.4 percent in December from November . It is estimated that production would grow by 0.7 percent. We also add that in the fourth quarter , industrial output grew by 0.5 %, which was slightly below the initial assessment at the level of 0.7 % , which was published last month. However, lower growth in itself is not sufficient to cause a downward revision to the pace of economic growth in the 4th quarter , reported in the statistical agency .

The yen fell against the dollar on the eve of today's publication of official statistics on the employment market in the United States . According to the median forecast of economists, the number of new jobs created in the U.S. economy is likely to grow to 185 thousand in January , compared to 75 thousand a month earlier, which was the smallest increase since January 2011 . The unemployment rate , according to the same projected to remain at 6.7 % , the lowest level since 2008.

Recall that the last published data on the number of new applications for unemployment benefits . The number of people who applied for benefits in the U.S. fell by 20,000 to 331,000 in the week ended Feb. 1. This suggests that the U.S. labor market continues to improve gradually .

EUR / USD: during the European session, the pair fell to $ 1.3551

GBP / USD: during the European session, the pair fell to $ 1.6299 , and then recovered to $ 1.6329

USD / JPY: during the European session, the pair rose to Y102.30

At 13:30 GMT , Canada will report on the unemployment rate and the change in the number of employed in January , while the U.S. will release data on unemployment and the change in the number of people employed in non-farm payrolls in January . At 15:00 GMT Britain to publish data on the change of the NIESR GDP in January .

European stocks rose, following their biggest gain in seven weeks, as investors awaited a report that may show U.S. employers hired workers at a faster pace last month. U.S. index futures and Asian shares also climbed.

The Stoxx Europe 600 Index increased 0.3 percent to 323.61 at 11:06 a.m. in London, taking its advance this week to 0.3 percent. The equity benchmark rallied 1.5 percent yesterday as the European Central Bank left interest rates at a record low.

“All eyes are on U.S. non-farm payrolls today, which could soften some of the recent growth worries and support stocks,” Thomas Lehr, an investment strategist at Credit Suisse Group AG in Zurich, said in a telephone interview. “It will be interesting to see the market’s reaction to very strong numbers, as it supports further tapering by the Fed, meaning the question remains what it will do to emerging markets.”

The Stoxx 600 has still fallen 3.7 percent from its high on Jan. 22 amid a sell-off in emerging-market currencies and signs of slowing economic growth in China.

U.S. Employment

In the U.S., a Labor Department report may show that employers in the world’s biggest economy added more than twice as many workers in January as in December. Payrolls probably rose by 185,000 workers, following a 74,000 gain in December, according to the median forecast of economists. The unemployment rate probably remained at 6.7 percent, its lowest in more than five years.

ArcelorMittal advanced 4.2 percent to 12.92 euros. Earnings before interest, taxes, depreciation and amortization rose to $1.91 billion in the fourth quarter, from $1.56 billion a year earlier. That beat the average analyst estimate of $1.81 billion. The company also said earnings will continue to climb in 2014, forecasting full-year Ebitda of about $8 billion.

Aperam (APAM), the stainless-steel producer spun off by ArcelorMittal in 2011, jumped 9.1 percent to 14.83 euros. Ebitda in the fourth quarter amounted to $84 million, beating the $65.5 million that analysts had predicted.

EMS-Chemie rose 3.3 percent to 331.75 Swiss francs as the chemical producer posted Ebitda of 424 million francs ($470 million) for 2013, beating the 413.5 million-franc average analyst projection. The company also said it will pay a dividend of 8.50 francs a share for 2013, exceeding the forecast of 8 francs. It also announced an extraordinary dividend of 2.50 francs.

FTSE 100 6,562.55 +4.27 +0.07%

CAC 40 4,193.82 +5.72 +0.14%

DAX 9,275.89 +19.31 +0.21%

USD/JPY Y101.00, Y101.25, Y101.45/50, Y102.00, Y102.25, Y102.50, Y103.00, Y104.00, Y105.00

EUR/USD $1.3400, $1.3430, $1.3450, $1.3500, $1.3525, $1.3550, $1.3600, $1.3650/55

AUD/USD $0.8750, $0.8850, $0.8875, $0.8900, $0.8940

EUR/GBP stg0.8150

USD/CAD Cad1.0980, Cad1.1050, Cad1.1080, Cad1.1150, Cad1.1200

GBP/USD $1.6300, $1.6400, $1.6450

USD/CHF Chf0.8950, Chf0.9000, Chf0.9150, $0.9200

NZD/USD NZ$0.8100

Asian stocks rose, with the regional benchmark index paring its sixth straight weekly loss, as U.S. jobless claims fell and investors weighed company earnings.

Nikkei 225 14,462.41 +307.29 +2.17%

S&P/ASX 200 5,166.53 +35.13 +0.68%

Shanghai Composite Closed

Honda Motor Co., a Japanese carmaker that gets almost half its revenue in North America, added 2.9 percent.

Sony Corp. climbed 4.1 percent in Tokyo after the electronics maker announced job cuts and a reorganization.

Aurora Oil & Gas Ltd. surged 56 percent in Sydney after Baytex Energy Corp., a Canadian producer of heavy crude oil, agreed to buy the company.

GS Engineering & Construction Corp. slumped 15 percent in Seoul after the contractor said it’s considering a share sale.

00:30 Australia RBA Monetary Policy Statement Quarter I

01:45

Nikkei 225 14,155.12 -25.26 -0.18%

S&P/ASX 200 5,131.4 +61.09 +1.20%

Shanghai Composite closed

FTSE 100 6,552.48 +94.59 +1.46%

CAC 40 4,188.88 +71.09 +1.73%

DAX 9,251.96 +135.64 +1.49%

Dow 15,628.46 +188.23 +1.22%

Nasdaq 4,057.12 +45.57 +1.14%

S&P 500 1,773.43 +21.79 +1.24%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3589 +0,43%

GBP/USD $1,6320 +0,07%

USD/CHF Chf0,9007 -0,31%

USD/JPY Y102,11 +0,66%

EUR/JPY Y138,74 +1,06%

GBP/JPY Y166,64 +0,73%

AUD/USD $0,8957 +0,55%

NZD/USD $0,8246 +0,40%

USD/CAD C$1,1069 -0,11%

00:30 Australia RBA Monetary Policy Statement Quarter I

01:45 China HSBC Services PMI January 50.9

05:00 Japan Leading Economic Index December 111.1 111.9

05:00 Japan Coincident Index December 110.7

07:00 Germany Current Account December 21.6

07:00 Germany Trade Balance December 17.8 17.3

08:00 Switzerland Foreign Currency Reserves January 435.2

08:15 Switzerland Retail Sales Y/Y December +4.2% +3.9%

09:30 United Kingdom Industrial Production (MoM) December 0.0% +0.7%

09:30 United Kingdom Industrial Production (YoY) December +2.5%

09:30 United Kingdom Manufacturing Production (MoM) December 0.0% +0.6%

09:30 United Kingdom Manufacturing Production (YoY) December +2.8%

09:30 United Kingdom Trade in goods December -9.4

11:00 Germany Industrial Production s.a. (MoM) December +1.9% +0.5%

11:00 Germany Industrial Production (YoY) December +3.5%

13:30 Canada Unemployment rate January 7.2%

13:30 Canada Employment January -45.9

13:30 U.S. Average workweek January 34.4 34.4

13:30 U.S. Average hourly earnings January +0.1% +0.2%

13:30 U.S. Nonfarm Payrolls January 74 185

13:30 U.S. Unemployment Rate January 6.7% 6.7%

15:00 United Kingdom NIESR GDP Estimate January +0.7%

20:00 U.S. Consumer Credit December 12.3 12.4

20:25 Canada Gov Council Member Macklem Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.