- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-02-2014

Gold $1,274.8 +4.50 +0.35%

NYMEX Crude Oil $100.00 +0.22 +0.22%

ICE Brent Crude Oil $108.42 -1.15 -1.05%

Hang Seng 21,579.26 -57.59 -0.27%

S&P/ASX 5,211.1 +55.60 +1.08%

Shanghai Composite 2,086.07 +36.16 +1.76%

S&P 1,799.84 +2.82 +0.16%

NASDAQ 4,148.17 +22.31 +0.54%

Dow 15,801.79 +7.71 +0.05%

FTSE 6,591.55 +19.87 +0.30%

CAC 4,237.13 +8.95 +0.21%

DAX 9,289.86 -12.06 -0.13%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3644 +0,05%

GBP/USD $1,6400 -0,09%

USD/CHF Chf0,8966 -0,07%

USD/JPY Y102,25 0,00%

EUR/JPY Y139,52 +0,06%

GBP/JPY Y167,68 -0,09%

AUD/USD $0,8948 -0,11%

NZD/USD $0,8265 -0,28%

USD/CAD C$1,1055 +0,16%

02:00 Japan Bank holiday

02:01 United Kingdom BRC Retail Sales Monitor y/y January +0.4% +0.8%

02:30 Australia National Australia Bank's Business Confidence January 6

02:30 Australia House Price Index (QoQ) Quarter IV +1.9% +3.2%

02:30 Australia House Price Index (YoY) Quarter IV+7.6% +8.6%

02:30 Australia Home Loans December +1.1% +0.9%

04:00 China Trade Balance, bln January 25.6 24.2

04:00 China New Loans January 483 1100

12:00 United Kingdom BOE Deputy Governor Andrew Bailey Speaks

16:00 U.S. FOMC Member Charles Plosser Speaks

17:00 U.S. Wholesale Inventories December +0.5% +0.5%

17:00 U.S. JOLTs Job Openings December 4001

17:00 U.S. Federal Reserve Chair Janet Yellen Testifies

23:00 Canada Annual Budget 2014

23:30 U.S. API Crude Oil Inventories February +0.4

01:30 Australia Westpac Consumer Confidence February -1.7%

01:50 Japan Core Machinery Orders December +9.3% -3.7%

01:50 Japan Core Machinery Orders, y/y December +16.6% +17.4%

01:50 Japan Tertiary Industry Index December +0.6% -0.2%

The euro exchange rate rose slightly against the U.S. dollar, which is likely due to the expectations of tomorrow's speech by Fed Yellen . According to analysts , it will not deviate from the course indicated by Bernanke in December, and will be a key promise of continuity rather than innovation .

As for today's events , a small influence on the bidding had data from the research center Sentix, which showed that investor confidence in the eurozone unexpectedly improved in February, the index of investor sentiment rose by 1.4 points to 13.3 points. The result was higher than the projected decline to 10.3 points. The improvement was mainly due to the increase in assessment of the current situation in February. Current situation index rose to 1.8 from 0.8 in January and was positive for the first time since August 2011 . At the same time , investors' expectations have risen only slightly in February to 25.5 from 25.3 in January.

The Canadian dollar was down against the U.S. dollar, which has been partly due to the Report on Canada. As it became known , in Canada the number of Housing Starts fell by 3.7 % m / m to an average of 180,248 units in January . January was the result of lower than forecast analysts expecting 184,000 bookmarks.

CMHC report showed that urban bookmarks new foundations fell by 2.7 % last month to 163,158 units. Bookmark urban apartment fell by 6% to 102,289 units, while single urban Bookmarks rose by 3.4% to 60,869 units.

CMHC said that the city grew on the prairies Bookmark and Ontario , and fell in Atlantic Canada , Quebec and British Columbia.

Rural Share of new foundations were estimated at a seasonally adjusted annual rate of up to 90 170 units.

" These past two months is actually quite healthy , given the harsh winter in some parts of the country , and are roughly in line with the demand associated with population growth ," said CIBC.

The Swiss franc rose against the U.S. dollar on the background of the earlier report , which showed that the unemployment rate remained stable at a seasonally adjusted at 3.2 percent in January . Similarly, the unadjusted unemployment rate remained unchanged at 3.5 percent .

In late January , there were about 153,260 people as unemployed , which is 3,823 more than compared to the previous month . Unemployment rose by 5102 , compared with the corresponding period last year.

Unemployment among young people aged 15 to 24 years increased by 52 persons to 20 533 people . Nevertheless, the unemployment rate fell by 674 people compared to last year.

The euro exchange rate rose slightly against the U.S. dollar, which is likely due to the expectations of tomorrow's speech by Fed Yellen . According to analysts , it will not deviate from the course indicated by Bernanke in December, and will be a key promise of continuity rather than innovation .

As for today's events , a small influence on the bidding had data from the research center Sentix, which showed that investor confidence in the eurozone unexpectedly improved in February, the index of investor sentiment rose by 1.4 points to 13.3 points. The result was higher than the projected decline to 10.3 points. The improvement was mainly due to the increase in assessment of the current situation in February. Current situation index rose to 1.8 from 0.8 in January and was positive for the first time since August 2011 . At the same time , investors' expectations have risen only slightly in February to 25.5 from 25.3 in January.

The Canadian dollar was down against the U.S. dollar, which has been partly due to the Report on Canada. As it became known , in Canada the number of Housing Starts fell by 3.7 % m / m to an average of 180,248 units in January . January was the result of lower than forecast analysts expecting 184,000 bookmarks.

CMHC report showed that urban bookmarks new foundations fell by 2.7 % last month to 163,158 units. Bookmark urban apartment fell by 6% to 102,289 units, while single urban Bookmarks rose by 3.4% to 60,869 units.

CMHC said that the city grew on the prairies Bookmark and Ontario , and fell in Atlantic Canada , Quebec and British Columbia.

Rural Share of new foundations were estimated at a seasonally adjusted annual rate of up to 90 170 units.

" These past two months is actually quite healthy , given the harsh winter in some parts of the country , and are roughly in line with the demand associated with population growth ," said CIBC.

The Swiss franc rose against the U.S. dollar on the background of the earlier report , which showed that the unemployment rate remained stable at a seasonally adjusted at 3.2 percent in January . Similarly, the unadjusted unemployment rate remained unchanged at 3.5 percent .

In late January , there were about 153,260 people as unemployed , which is 3,823 more than compared to the previous month . Unemployment rose by 5102 , compared with the corresponding period last year.

Unemployment among young people aged 15 to 24 years increased by 52 persons to 20 533 people . Nevertheless, the unemployment rate fell by 674 people compared to last year.

European stocks were little changed as L’Oreal SA and Nokia Oyj rallied, offsetting worse-than-forecast reports on industrial production in France and Italy.

The Stoxx Europe 600 Index gained less than 0.1 percent to 325.16 at 4:30 p.m. in London. The benchmark climbed 0.8 percent last week, posting its first increase in three weeks, as investors bet the Federal Reserve will delay a third cut to bond purchases after U.S. jobs data missed estimates.

“We’re seeing a return to the status quo, with numbers out of France and Italy showing there’s still a euro zone divided into two speeds,” said John Plassard, vice president at Mirabaud Securities LLP in Geneva. “Without significant macroeconomic data out of the U.S. or any big company earnings, markets are set to be calm.”

Data showed December industrial production fell 0.3 percent in France and 0.9 percent in Italy, both missing estimates.

National benchmark indexes advanced in nine of the 18 western European markets today.

FTSE 100 6,584.71 +13.03 +0.20% CAC 40 4,234.82 +6.64 +0.16% DAX 9,288.46 -13.46 -0.14%

L’Oreal (OR) gained 4.4 percent to 128.95 euros. Nestle has signaled to the L’Oreal management its intention to reduce its stake in the company, people with knowledge of the matter said. While talks have been on and off for some time, preparations have picked up close to April’s expiry of restrictions on Nestle’s stake imposed by a shareholder agreement with the Bettencourt family, the largest shareholder.

Nokia advanced 2.7 percent to 5.38 euros. The company agreed with HTC Corp. collaborate after ending a patent-infringement dispute. HTC will pay royalties to Nokia to end the row, the two partners said without disclosing financial terms.

Fresnillo Plc, a producer of gold and silver, jumped 8.8 percent to 862.5 pence. Gold rose for a fourth day in the longest rally since October, as Chinese buyers returned from a holiday. Separately, data from the China Gold Association showed consumption in world’s second-biggest economy surged 41 percent to a record in 2013.

Telekom Austria AG advanced 3.2 percent to 6.72 euros, its highest price since August 2012. Erste Group Bank AG raised the company part-owned by Carlos Slim’s America Movil SAB to hold from reduce, citing a potential for profit-">ArcelorMittal (MT) slid 3.2 percent to 12.09 euros after Bank of America Corp. cut the world’s biggest steelmaker to neutral from buy, citing “tepid European economic growth.

Prices for Brent crude fell slightly , but will continue to be near five-week high above $ 109 a barrel as investors await comments regarding future policy the U.S. Federal Reserve . The new head of the Federal Reserve System, Janet Yellen first appearance before Congress this week, and markets expect to hear that monetary policy will remain accommodative . Economists suggest that Yellen continue gradual narrowing of asset purchases , but on condition that the economy will improve.

This view was reinforced by disappointing data on employment in the United States, which showed that job growth was the weakest in three years and suggested that U.S. economic growth is losing momentum .

" Oil is rising on expectations that the restriction of asset purchases will not be accelerated ," said Eugene Weinberg , head of commodities research Commerzbank. But Weinberg said that oil prices could get close to the top of its range for some time , namely, up to $ 100 per barrel (WTI), and up to $ 110 per barrel (Brent).

I also add that the price of Brent crude oil have been under some pressure from the news that production on the UK Buzzard oilfield returned to normal - 200 thousand barrels per day or more, after his fourth trip in 2014 last week.

Chinese economic data , which will be released this week, may also be favorable for oil if it will point to a more rapid growth in the world 's second largest oil consumer . Some analysts who follow oil prices , saying that the upward momentum in the market can be sustained .

Experts also note that the weakening of political tensions around Iran's nuclear program may affect the price of oil , as production from OPEC may increase if Tehran will reach a final agreement with the world powers .

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 100.27 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture fell 44 cents to $ 109.10 a barrel on the London exchange ICE Futures Europe.

Gold prices rose significantly today , as weak employment data in the U.S., which were presented at the end of last week , raised the question about the economic recovery , and a slowdown in stimulus from the Federal Reserve .

Add that after this report , the attention of many market participants begin to switch to tomorrow's presentation of a new chapter of the Federal Reserve Janet Yellen , from which experts expect to hear that the policy will remain the same for a long time .

" Gold is approaching the level of $ 1280 per ounce , and receives some support from a weaker dollar , but market participants cautious as he expected statements Yellen ," said analyst Robin Bhar Societe Generale . "Some of the " soft " economic reports on the U.S. may mean that the Fed will pause attenuation at the March meeting , but everything depends on the data flow between now and then ." Recall that the next meeting of the Federal Committee on open market operations the Fed is scheduled for March 18-19 .

Today, spot gold prices rose by 0.6 percent , after rising 1.9 percent the previous week , recording its biggest weekly gain since Jan. 3 .

It is also worth noting that one of the reports submitted showed that consumer demand in China, which is the world's largest consumer of gold , reached 1,000 tons in 2013. Nevertheless , it is expected that demand will fall slightly this year from 2013 reached record levels. We also add that gold production in China in 2013 also reached a record level - 428.16 tons, making the country the biggest earner in the world for the seventh consecutive year.

The cost of the April gold futures on the COMEX today rose to $ 1274.30 per ounce for ounce.

U.S. stock futures fell, before Federal Reserve Chairman Janet Yellen delivers her first report on monetary policy tomorrow.

Global markets:

Nikkei 14,718.34 +255.93 +1.77 %

Hang Seng 21,579.26 -57.59 -0.27 %

Shanghai Composite 2,086.07 +41.57 +2.03 %

FTSE 6,581.51 +9.83 +0.15%

CAC 4,245.52 +17.34 +0.41%

DAX 9,308.69 +6.77 +0.07%

Crude oil $99.65 (-0.23%)

Gold $1275.90 (+0.80%).

06:45 Switzerland Unemployment Rate January 3.2% 3.2% 3.2%

07:45 France Industrial Production, m/m December +1.2% Revised From +1.3% -0.1% -0.3%

07:45 France Industrial Production, y/y December +1.5% +0.5%

09:30 Eurozone Sentix Investor Confidence February 11.9 10.3 13.3

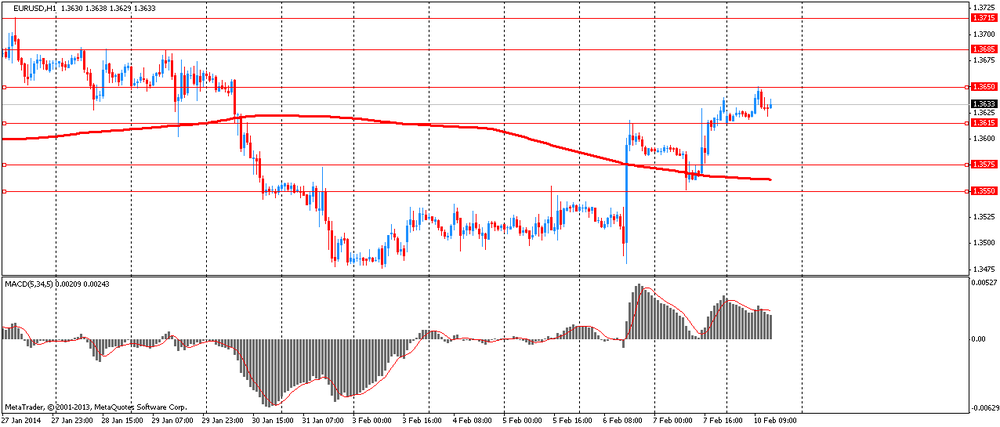

The euro / dollar failed to gain a foothold on the heights reached and pulled back from 11 -day high , as the pair virtually ignored the study of confidence of European investors Sentix. As revealed on Monday monthly survey research center Sentix, investor confidence in the eurozone unexpectedly improved in February . Investor sentiment index rose by 1.4 points to 13.3 points. The result was higher than the projected decline to 10.3 points. The improvement was mainly due to the increase in assessment of the current situation in February. Current situation index rose to 1.8 from 0.8 in January and was positive for the first time since August 2011 . At the same time , investors' expectations have risen only slightly in February to 25.5 from 25.3 in January.

The euro kept data on industrial production in France. Industrial production in France increased at a slower pace in December , with growth rates gave way to the forecasts of economists showed on Monday, the latest data statistical office Insee. Industrial production grew by 0.5 percent in December compared with the same month last year. Economists had expected a more rapid increase of 1 per cent . In November, production recorded a growth of 1.7 percent.

Industrial production fell by 0.3 percent compared to November , when it was recorded an increase of 1.2 percent. Expectations were reducing by 0.1 percent . During the three months ended in December , production increased by 0.3 percent compared with the previous three-month period . Industrial production grew by 0.5 per cent in quarterly terms.

In Insee also noted that production in the French manufacturing sector expanded by 0.9 percent year on year in December. On a monthly measurement of industrial production remained unchanged after rising 0.2 percent in November.

The yen strengthened against the euro and the dollar in anticipation of tomorrow's presentation of the new Federal Reserve Chairman Janet Yellen . Chapter Fed on Tuesday will deliver to Congress for the first time after its official accession to the post of head of the Federal Reserve and is expected to confirm the Fed's intention to continue to decline in the quantitative easing program unabated.

The dollar index suspended its five-day decline, even after January in the U.S. was created only 113 thousand jobs , and the unemployment rate fell to 6.6 % compared to 6.7% in December , said Friday the Ministry of Labour . Economists had expected an increase of the number of non-agricultural jobs in the 185 thousand unemployment fell to its lowest level since October 2008 .

EUR / USD: during the European session, the pair rose to $ 1.3650 , then dropped to $ 1.3622

GBP / USD: during the European session, the pair fell to $ 1.6381

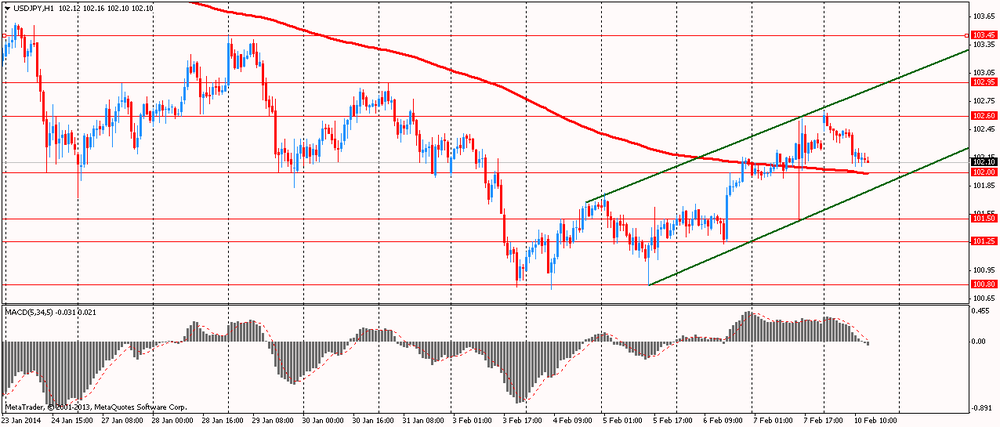

USD / JPY: during the European session, the pair dropped to Y102.06

At 13:15 GMT will be released in Canada by Housing Starts in January . At 15:00 GMT the U.S. will release the share of overdue mortgage payments for the 4th quarter . At 17:50 GMT to make a speech , Deputy Governor of the Bank of Canada John Murray .

EUR/USD

Offers $1.3700/10, $1.3680, $1.3650

Bids $1.3600, $1.3575/70, $1.3555/45, $1.3525/20, $1.3500

GBP/USD

Offers $1.6577, $1.6545/55, $1.6520

Bids $1.6380, $1.6365-50, $1.6330/20, $1.6300

AUD/USD

Offers $0.9050, $0.9000, $0.8980, $0.8935/40

Bids $0.8900, $0.8850, $0.8820, $0.8800

EUR/GBP

Offers stg0.8400/05, stg0.8370/80, stg0.8325/30

Bids stg0.8270/65, stg0.8250/40, stg0.8225/20

EUR/JPY

Offers Y140.50, Y139.95/00, Y139.55/60

Bids Y139.00, Y138.50, Y138.00

USD/JPY

Offers Y102.90/00, Y102.75/80, Y102.60/70, Y102.40/50

Bids Y102.00, Y101.55/50, Y101.00, Y100.80

European stocks were little changed as L’Oreal SA and Nokia Oyj rallied, offsetting worse-than-forecast reports on industrial production in France and Italy. U.S. index futures fell, while Asian shares rose.

The Stoxx Europe 600 Index gained 0.2 percent to 325.68 at 9:55 a.m. in London. The benchmark climbed 0.8 percent last week, posting its first increase in three weeks, as investors bet the Federal Reserve will delay a third cut to bond purchases after U.S. jobs data missed estimates. Standard & Poor’s 500 Index futures slipped 0.2 percent, while the MSCI Asia Pacific Index added 0.6 percent.

Data showed December industrial production fell 0.3 percent in France and 0.9 percent in Italy, both missing estimates.

L’Oreal gained 4.8 percent to 129.40 euros. Nestle has signaled to the L’Oreal management its intention to reduce its stake in the company, people with knowledge of the matter said. While talks have been on and off for some time, preparations have picked up close to April’s expiry of restrictions on Nestle’s stake imposed by a shareholder agreement with the Bettencourt family, the largest shareholder.

Nokia advanced 3.7 percent to 5.44 euros. The company and HTC Corp. have agreed to collaborate after ending a patent-infringement dispute. HTC will pay royalties to Nokia to end the row, the companies said without disclosing financial terms.

ArcelorMittal slid 1.5 percent to 12.31 euros after Bank of America Corp. cut the world’s biggest steelmaker to neutral from buy, citing “tepid European economic growth.”

FTSE 100 6,579.39 +7.71 +0.12%

CAC 40 4,242.37 +14.19 +0.34%

DAX 9,322.92 +21.00 +0.23%

USD/JPY Y101.50, Y102.00, Y102.50, Y103.00, Y104.50

EUR/USD $1.3470, $1.3525, $1.3530, $1.3550, $1.3575, $1.3600, $1.3650

AUD/USD $0.8850, $0.8900, $0.8925, $0.9000

AUD/JPY Y90.10, Y90.50

USD/CAD Cad1.0875, Cad1.0995, Cad1.1040, Cad1.1100, Cad1.1150

Asian stocks rose, with the regional benchmark index heading for its longest stretch of gains this year, after jobs data spurred the biggest two-day rally for U.S. equities since October and the yen weakened.

Nikkei 225 14,718.34 +255.93 +1.77%

S&P/ASX 200 5,222.15 +55.62 +1.08%

Shanghai Composite 2,086.07 +41.57 +2.03%

Toyota Motor Corp., the world’s biggest carmaker, climbed 1.6 percent to pace gains among Japanese exporters.

Rio Tinto Group, the world’s second-largest mining company, advanced 1.6 percent in Sydney as copper futures rose a third day.

Genting Singapore Plc and partner Landing International Development Ltd. rose after announcing plans to build a casino on South Korea’s Jeju island.

05:00 Japan Consumer Confidence January 41.3 43.9 40.5

05:00 Japan Eco Watchers Survey: Current January 55.7 55.5 54.7

05:00 Japan Eco Watchers Survey: Outlook January 54.7 54.0 49.0

The dollar gained to the highest level in more than a week against the yen as investors bet the Federal Reserve will press on with a reduction in stimulus before Chairman Janet Yellen speaks to U.S. lawmakers tomorrow.

The Bloomberg Dollar Spot Index halted a five-day slide, even after a Feb. 7 report indicated employment growth last month in the world’s biggest economy was less than analysts expected. The Labor Department said last week hiring in the U.S. rose by 113,000 in January, fewer than the 180,000 gain that was the median forecast of economists surveyed by Bloomberg News and following a 75,000 increase the prior month. Unemployment fell to 6.6 percent, the least since October 2008, from 6.7 percent in December.

The yen weakened against most major peers as Japan’s finance ministry said the nation’s current-account deficit widened to a record in December. The December deficit pushed Japan’s 2013 current-account surplus down to about 3.3 trillion yen, reducing the balance that allows Japan to be less reliant on foreign capital and makes the yen a haven from financial turmoil.

The euro snapped an advance from last week before data today that may show factory production in France declined. In France, industrial production probably fell 0.2 percent in December from the previous month, when it rose 1.3 percent, according to the median estimate by economists surveyed by Bloomberg before today’s report.

EUR / USD: during the Asian session, the pair traded in the range of $1.3615-30

GBP / USD: during the Asian session, the pair traded in the range of $1.6395-15

USD / JPY: during the Asian session, the pair rose to Y102.65

At 0645GMT, the Swiss January unemployment data is set for release and is seen unchanged at 3.5%. French data kicks off at 0730GMT, when the French December Bank of France business survey is set for publication, followed at 0745GMT by the release of the December industrial output data. Italian December industrial output data will be released at 0900GMT, seen flat on month and higher by 0.9% on year. At 0930GMT, the EMU February sentiment index will cross the wires. The last scheduled European release comes at 1100GMT, when the December leading indicator crosses the wires.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.