- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-02-2014

The euro exchange rate has risen sharply against the U.S. dollar after the European Central Bank announced new measures easing monetary policy , and gave no solid hints that it may soon be done that has not met the expectations of some investors who had expected a rate cut .

The euro was due to the fact that after the rate cut at the November meeting, it was expected that this is not enough , and some form of monetary easing will be offered or promised in the future. The absence of this has led to a reduction in rates in the euro's decline .

During a press conference following the decision of the Governing Council of the ECB to leave rates at 0.25 % , Mario Draghi reiterated his commitment to " transparency policy " and retention rates at current or lower levels for a long period of time.

ECB chief said that economic growth in the euro area was restored , as expected , but inflation will remain low for a long period before they reach the target level of 2%. The Governing Council will continue to " closely monitor the situation " and is ready to take " drastic measures" if required.

Moreover, Draghi said the uncertainty in emerging markets as a risk for the economic recovery of the eurozone. He also noted separately weak domestic demand and slow structural reforms in some EU countries as risks.

British pound retreated from lows against the dollar after the Bank of England left interest rates at 0.5% as expected . Program of asset purchases was also left on the 375 billion accompanying statement was not, but the head of the Central Bank Governor Mark Carney said earlier that he was not going to raise rates earlier, and that the target level of unemployment rate in the 7.0 % is not a factor that triggers the policy tightening . It is expected that the minutes of the meeting reflect the increased emphasis on the bank's inflation. Recall that the inflation report last month reflected the value at the target of 2.0 % for the first time in the last 4 years.

Little impact on the currency also had a report that showed that the rise in house prices in the UK slowed slightly in the last month , and confirmed the average forecast of experts. This was stated in the report of Halifax. According to figures for January house price index rose by 7.3 per cent per annum, compared with an increase of 7.5 percent in December. In monthly terms, the house price index rose 1.1 percent in January , while offsetting the 0.5 percent decline in the previous month , which was revised downward from -0.6 percent. Expectations were at the level of 0.4 percent.

Stocks in Europe rose for a second day as the European Central Bank held interest rates at a record low and companies including Daimler AG and Volvo AB posted earnings that beat estimates.

The Stoxx Europe 600 Index added 1.5 percent to 322.77 at the close of trading, for its biggest advance since Dec. 19. The benchmark has fallen 1.7 percent so far this year amid a selloff in emerging-market currencies, signs of slowing economic growth in China and reduced stimulus from the Federal Reserve.

The ECB kept its key interest rate at 0.25 percent today, as forecast by all except four of 66 economists in a Bloomberg survey. Speaking after the announcement, ECB President Mario Draghi reiterated that the bank will take action if the outlook for inflation worsens or money-market turbulence resumes.

Inflation in the 18-nation euro area unexpectedly slowed to 0.7 percent last month, matching the slowest rate since 2009 and less than half the ECB’s goal of just under 2 percent.

In the U.S., a Labor Department report showed jobless claims dropped by 20,000 to 331,000 in the period ended Feb. 1. The median forecast of economists surveyed by Bloomberg called for a decrease to 335,000.

National benchmark indexes climbed in every western-European market today. Germany’s DAX gained 1.5 percent, France’s CAC 40 added 1.7 percent and the U.K.’s FTSE 100 advanced 1.6 percent.

Daimler climbed 2.6 percent to 62.48 euros. The third-largest maker of luxury vehicles said earnings before interest and taxes from ongoing operations rose to 2.53 billion euros ($3.42 billion) from 1.74 billion euros a year earlier. That beat the 2.37 billion-euro average estimate of 15 analysts compiled by Bloomberg. Revenue gained 7.6 percent to 32.1 billion euros on demand for the new Mercedes-Benz CLA coupe and revamped flagship S-Class sedan.

Volvo advanced 4.6 percent to 89.40 kronor. The world’s second-biggest truckmaker reported fourth-quarter operating profit of 3.08 billion kronor ($471 million), exceeding analysts’ projections for 2.04 billion kronor. Volvo also said it will fire 4,400 employees, extending a previously announced reduction of 2,000 jobs. The majority of the cuts will take place in 2014.

Alcatel-Lucent jumped 9.2 percent, the most since Oct. 31, to 3.31 euros. The Paris-based company posted net income of 134 million euros, compared with a 1.56 billion-euro loss a year earlier. It also got a binding offer from China Huaxin for its business that sells telecommunications equipment and services. Alcatel will keep a 15 percent stake in the unit.

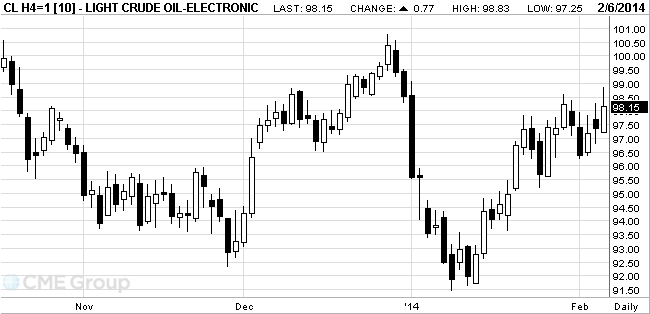

West Texas

Intermediate crude advanced for a third day as applications for

Prices

climbed as much as 1.5 percent. Jobless claims dropped by 20,000 to

WTI for

March delivery rose 93 cents, or 1 percent, to $98.31 a barrel at 10:45 a.m. on

the New York Mercantile Exchange. The volume of all futures traded was 13

percent more than the 100-day average.

Brent for March settlement gained 68 cents, or 0.6 percent, to $106.93 a barrel on the London-based ICE Futures Europe exchange. Volume of all futures traded was 9.1 percent above the 100-day average.The European crude was at a premium of $8.62 to WTI on the ICE exchange. The spread closed at $8.87 yesterday.

Gold prices decline after rising early in the session on the background of recovery in stock markets and data applications for unemployment in the United States .

Publish controversial U.S. macroeconomic statistics , keeping investors uncertain about the stability of economic growth. The number of jobs in the private sector in January was increased by the slowest pace since August 2013 , but the growth of non-manufacturing sector accelerated.

Recent data from the U.S. Labor Department showed that the number of applications for unemployment benefits dropped significantly last week , indicating a marked improvement in the labor market . According to the report , the seasonally adjusted number of initial claims for unemployment benefits fell for the week ending February 1 , 20 thousand , thus reaching the level of 331 thousand Many experts expect that the number of complaints dropped to 334 thousand from 348 thousand , which originally reported last week.

Now investors are waiting for coming in Friday 's official employment report in the U.S..

Activity in the physical markets decreased in the absence of Chinese buyers , who will return to work on Friday after the New Year celebration .

The cost of the April gold futures on the COMEX today rose to $ 1267.50 per ounce and then fell to $ 1252.50 per ounce.

U.S. stock-index futures rose, as a report indicated applications for unemployment benefits fell for the first time in three weeks.

Global markets:

Nikkei 14,155.12 -25.26 -0.18%

Hang Seng 21,423.13 +153.75 +0.72%

FTSE 6,506.36 +48.47 +0.75 %

CAC 4,146.52 +28.73 +0.70 %

DAX 9,161 +44.68 +0.49 %

Crude oil $98.73 (+1.39%)

Gold $1266.60 (+0.29%).

USD/JPY Y100.70, Y101.05, Y101.50, Y101.75/80, Y102.00, Y102.35, Y102.50, Y102.75, Y103.40/50

EUR/USD $1.3300, $1.3350, $1.3385, $1.3425, $1.3475, $1.3500, $1.3515, $1.3530, $1.3550, $1.3570, $1.3585

AUD/USD $0.8800/10, $0.8860, $0.8900/10, $0.8950

EUR/GBP stg0.8200, stg0.8300, stg0.8400

USD/CAD Cad1.1050, Cad1.1140, Cad1.1175

GBP/USD $1.6340, $1.6400

USD/CHF Chf0.9050, Chf0.9095

EUR/CHF Chf1.2175, Chf1.2300

AUD/JPY Y89.50, Y91.00, Y93.50

NZD/USD NZ$0.8165, NS$0.8200

Data

00:00 China Bank holiday

00:30 Australia Retail sales (MoM) December +0.7% +0.5% +0.5%

00:30 Australia Retail Sales Y/Y December +4.6% +5.7%

00:30 Australia NAB Quarterly Business Confidence Quarter IV 5 Revised From 3 8

00:30 Australia Trade Balance December 0.08 Revised From -0.12 -0.27 0.47

06:45 Switzerland SECO Consumer Climate Quarter IV -5 0 2

07:00 Switzerland Trade Balance December 2.11 2.41 0.5

08:00 United Kingdom Halifax house price index January -0.6% +0.4% +1.1%

08:00 United Kingdom Halifax house price index 3m Y/Y January +7.5% +7.3% +7.3%

11:00 Germany Factory Orders s.a. (MoM) December +2.4% +0.3% -0.5%

11:00 Germany Factory Orders n.s.a. (YoY) December +6.8% +7.9%

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.25% 0.25% 0.25%

Rate of the euro fell sharply against the U.S. dollar , while losing all positions receive immediately after the announcement of the ECB rate decision . Note that the ECB decided to leave the refinancing rate at around 0.25 %. Now market participants' attention shifted to the press conference the head of the ECB , Mario Draghi , which is scheduled for 13:30 GMT. It is expected that it will affect their comments deflation problem in the region.

Meanwhile, add that to the announcement of the decision at a rate little impact on the euro was a report on Germany, which showed that the number of manufacturing orders unexpectedly fell in December , while orders from the euro zone have increased significantly , potentially signals of recovery. According to the data , the results of December promzakazy fell by 0.5% ( seasonally adjusted ), which was followed after increasing 2.4% in November ( revised up from 2.1 %). I also add that many experts expected increase in the number of orders by 0.3%. Earlier this week, an industry group VDMA also reported a disappointing year for the completion of the major machine builders , but some experts still predict an increase in total orders .

Pound retreated from a session low against the dollar, however, continues to trade slightly lower . Pound had little support that the Bank of England left interest rates at 0.5% as expected . Program of asset purchases was also left on the 375 billion accompanying statement was not, but the head of the Central Bank Governor Mark Carney said earlier that he was not going to raise rates earlier, and that the target level of unemployment rate in the 7.0 % is not a factor that triggers the policy tightening . It is expected that the minutes of the meeting reflect the increased emphasis on the bank's inflation. Recall that the inflation report last month reflected the value at the target of 2.0 % for the first time in the last 4 years.

Little impact on the currency also had a report that showed that the rise in house prices in the UK slowed slightly in the last month , and confirmed the average forecast of experts. This was stated in the report of Halifax. According to figures for January house price index rose by 7.3 per cent per annum, compared with an increase of 7.5 percent in December. In monthly terms, the house price index rose 1.1 percent in January , while offsetting the 0.5 percent decline in the previous month , which was revised downward from -0.6 percent. Expectations were at the level of 0.4 percent.

EUR / USD: during the European session, the pair fell to $ 1.3488

GBP / USD: during the European session, the pair fell to $ 1.6270 , and then recovered to $ 1.6287

USD / JPY: during the European session, the pair traded in a narrow range

At 13:30 GMT the euro area will be held monthly press conference of the ECB. At 13:30 GMT , Canada and the United States declares its trade balance for December. Also this time, the U.S. will announce data on changes in the level of labor productivity in the non-manufacturing sector for the 4th quarter and change the level of cost of labor for the 4th quarter .

European stocks rose for a second day as investors awaited the European Central Bank’s rate decision and companies including Daimler AG and Volvo (VOLVB) AB beat earnings forecasts. U.S. stock-index futures and Asian shares advanced.

The Stoxx Europe 600 Index added 1 percent to 321.15 at 10:43 a.m. in London. The benchmark has fallen 2.2 percent so far this year amid a selloff in emerging-market currencies, signs of slowing economic growth in China and slowing stimulus from the Federal Reserve.

“Markets are stabilizing, partly in anticipation of the ECB,” Philippe Gijsels, chief strategy officer at BNP Paribas Fortis, said by telephone from Brussels. “The market may not be counting on immediate action, but it expects the ECB to at least say that they’re worried about emerging markets and that they’re ready to act.”

The ECB meets to discuss monetary policy today after a rout that has seen about $3 trillion erased from the value of equities worldwide this year. All except four of 66 economists in a survey said the central bank will leave its benchmark rate at a record low of 0.25 percent when it announces its decision at 1:45 p.m. Frankfurt time. President Mario Draghi will hold a press conference 45 minutes later.

The Bank of England will also probably keep its key rate at 0.5 percent when it meets today, survey showed.

Eighteen of the 19 industry groups in the Stoxx 600 advanced today, with auto-related companies leading gains.

Daimler rose 4.1 percent to 63.36 euros. The third-largest maker of luxury vehicles said earnings before interest and taxes from ongoing operations rose to 2.53 billion euros ($3.42 billion) from 1.74 billion euros a year earlier. That beat the 2.37 billion-euro average estimate of analysts. Revenue gained 7.6 percent to 32.1 billion euros on demand for the new Mercedes-Benz CLA coupe and revamped flagship S-Class sedan.

Volvo advanced 4.3 percent to 89.20 kronor. The world’s second-biggest truckmaker reported fourth-quarter operating profit of 3.08 billion kronor ($471 million), exceeding analysts’ projections for 2.04 billion kronor. Volvo also said it will fire 4,400 employees, extending a previously announced reduction of 2,000 jobs. The majority of the cuts will take place in 2014.

Alcatel-Lucent jumped 9.6 percent to 3.32 euros. The Paris-based company posted net income of 134 million euros, compared with a 1.56 billion-euro loss a year earlier. It also got a binding offer from China Huaxin for its business that sells telecommunications equipment and services. Alcatel will keep a 15 percent stake in the unit.

FTSE 100 6,507.21 +49.32 +0.76%

CAC 40 4,161.33 +43.54 +1.06%

DAX 9,217.95 +101.63 +1.11%

USD/JPY Y100.70, Y101.05, Y101.50, Y101.75/80, Y102.00, Y102.35, Y102.50, Y102.75, Y103.40/50

EUR/USD $1.3300, $1.3350, $1.3385, $1.3425, $1.3475, $1.3500, $1.3515, $1.3530, $1.3550, $1.3570, $1.3585

AUD/USD $0.8800/10, $0.8860, $0.8900/10, $0.8950

EUR/GBP stg0.8200, stg0.8300, stg0.8400

USD/CAD Cad1.1050, Cad1.1140, Cad1.1175

GBP/USD $1.6340, $1.6400

USD/CHF Chf0.9050, Chf0.9095

EUR/CHF Chf1.2175, Chf1.2300

AUD/JPY Y89.50, Y91.00, Y93.50

NZD/USD NZ$0.8165, NS$0.8200

Asian stocks rose, with the regional benchmark index poised for its second straight daily advance, as investors weighed earnings and U.S. data showing service-industries growth against a private jobs report that missed estimates.

Nikkei 225 14,155.12 -25.26 -0.18%

S&P/ASX 200 5,131.4 +61.09 +1.20%

Shanghai Composite closed

Mazda Motor Corp. gained 4.7 percent in Tokyo after the carmaker raised its full-year net-income forecast.

Sands China Ltd. jumped 6.9 percent in Hong Kong, leading a rebound for Macau casino operators.

Naver Corp., a provider of web portal services, surged 8 percent in Seoul after its fourth-quarter operating profit beat estimates.

00:00 China Bank holiday

00:30 Australia Retail sales (MoM) December +0.7% +0.5% +0.5%

00:30 Australia Retail Sales Y/Y December +4.6% +5.7%

00:30 Australia NAB Quarterly Business Confidence Quarter IV 5 Revised From 3 8

00:30 Australia Trade Balance December 0.08 Revised From -0.12 -0.27 0.47

The euro was near an 11-week low amid speculation slowing inflation will prompt the European Central Bank to reinforce its dovish stance when announcing an interest-rate decision today. The ECB will hold its benchmark interest rate at a record-low 0.25 percent today, a separate poll of economists shows. Official figures last week showed that consumer-price growth slowed in January to match the weakest pace since November 2009.

Overnight implied volatility on Europe’s common currency rose toward the highest since 2012. Premiums on overnight options for the euro against the dollar jumped to 17.8 percent, poised to close at the highest level since 2011.

Demand for the yen was curbed as Japanese stocks advanced, sapping demand for haven assets.

The Australian dollar rose to a three-week high after record exports to China fueled an unexpected trade surplus. The nation’s overseas shipments exceeded imports by A$468 million ($420 million) in December, the statistics bureau said today. Economists had forecast a shortfall of A$200 million. Australia’s exports to China jumped to A$94.5 billion in 2013, the most on record.

EUR / USD: during the Asian session the pair fell to $ 1.3520

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6300-30

USD / JPY: on Asian session the pair traded in the range of Y101.30-65

There is a full calendar on both sides of the Atlantic Thursday, with the policy decisions from both the ECB and MPC the stand out features. The European calendar gets underway at 1100GMT, with the release of the German December manufacturing orders data. At 1215GMT, German Chancellor Angela Merkel and Luxembourg Prime Minister Xavier Bettel hold a joint press conference in Berlin. The ECB's February policy decision is expected at 1245GMT, followed by President Mario Draghi's press conference at 1330GMT. Although consensus suggests the ECB will stand pat, the continued slide in core HICP could help nudge the Council into action, with some economists suggesting a possible cut of either 0.1% or 0.15% to the headline refi rate.

Nikkei 225 14,180.38 +171.91 +1.23%

S&P/ASX 200 5,070.31 -26.75 -0.52%

Shanghai Composite Closed

FTSE 100 6,457.89 +8.62 +0.13%

CAC 40 4,117.79 +0.34 +0.01%

DAX 9,116.32 -11.59 -0.13%

Dow 15,440.17 -5.07 -0.03%

Nasdaq 4,011.55 -19.97 -0.50%

S&P 500 1,751.64 -3.56 -0.20%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3531 +0,10%

GBP/USD $1,6308 -0,09%

USD/CHF Chf0,9035 0,00%

USD/JPY Y101,44 -0,19%

EUR/JPY Y137,27 -0,09%

GBP/JPY Y165,43 -0,28%

AUD/USD $0,8908 -0,17%

NZD/USD $0,8213 -0,34%

USD/CAD C$1,1081 +0,02%

00:00 China Bank holiday

00:30 Australia Retail sales (MoM) December +0.7% +0.5% +0.5%

00:30 Australia Retail Sales Y/Y December +4.6% +5.7%

00:30 Australia NAB Quarterly Business Confidence Quarter IV 5 Revised From 3 8

00:30 Australia Trade Balance December 0.08 Revised From -0.12 -0.27 0.47

06:45 Switzerland SECO Consumer Climate Quarter IV -5 0

07:00 Switzerland Trade Balance December 2.11 2.41

08:00 United Kingdom Halifax house price index January -0.6% +0.4%

08:00 United Kingdom Halifax house price index 3m Y/Y January +7.5% +7.3%

11:00 Germany Factory Orders s.a. (MoM) December +2.1% +0.3%

11:00 Germany Factory Orders n.s.a. (YoY) December +6.8%

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.25% 0.25%

13:30 Eurozone ECB Press Conference

13:30 Canada Trade balance, billions December -0.94 1.00

13:30 U.S. International Trade, bln December -34.3 -35.8

13:30 U.S. Initial Jobless Claims January 348 334

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter IV +3.0% +2.6%

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter IV -1.4% -0.5%

15:00 Canada Ivey Purchasing Managers Index January 46.3 51.3

22:30 Australia AiG Performance of Construction Index January 50.8

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.