- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-07-2022

- WTI fades bounce off one-week low below six-week-old resistance line, 100-SMA.

- Eight-day-old support line, fortnight-long horizontal area restrict short-term downside.

- Bulls need validation from $100.70 to retake control.

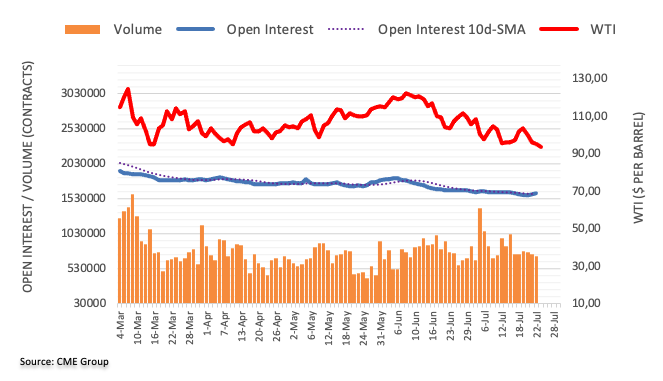

WTI crude oil prices drop back to $95.50 during Tuesday’s Asian session, after posting the first positive daily closing in four the previous day.

In doing so, the black gold retreats from the 50-SMA while recalling the bears. The downside bias also takes clues from the sluggish MACD and steady RSI.

However, an upward sloping trend line from July 14, around $92.80 by the press time, restricts the quote’s immediate weakness. Also acting as the downside filter is the two-week-old horizontal area near $91.60-80.

Should the WTI bears keep reins past $91.60, the odds of witnessing a slump towards the monthly low of $88.34, also the lowest level since February, can’t be ruled out.

Meanwhile, the upside break of the 50-SMA level, close to $96.15 at the latest, isn’t an open invitation to the WTI buyers as a convergence of the 100-SMA and a downward sloping resistance line from mid-June appear a tough nut to crack around $98.00.

Even if the quote manages to cross the $98.00 hurdle, the previous weekly high around $100.70 could test the upside momentum before giving control to the bulls.

WTI: Four-hour chart

Trend: Further weakness expected

- GBP/JPY is expected to display more gains after overstepping the critical hurdle of 165.00.

- The BOJ minutes are expected to remain extremely dovish.

- Pound bulls are performing well despite the downbeat Retail Sales data.

The GBP/JPY pair has displayed selling pressure in the early Tokyo session as investors are awaiting the release of the Bank of Japan (BOJ) minutes of July’s monetary policy. However, the upside remains favored as the minutes are expected to remain extremely dovish. Broadly, the asset has turned sideways in a 164.29-165.08 range after a sheer upside move from Monday’s low near 163.00.

It is worth noting that BOJ Governor Haruhiko Kuroda kept its interest rate policy unchanged last week. The BOJ is continued with its ultra-loose monetary policy in order to keep the inflation rate above the desired levels. However, its inability in elevating its wage rates is becoming a major hurdle and the inflation rate is above 2% seldom on the support of soaring price pressures.

What interesting would be in observing the BOJ minutes are the economic indicators, which will help in determining the economic situation of Japan.

On the UK front, pound bulls are performing against yen despite the weaker Retail Sales data on Friday. The annual economic data landed at -5.8%, lower than the expectations of -5.3% and the prior release of -4.7%. The investing community should be aware of the fact that higher price pressures are driving Retail Sales for now. And, a release of lower Retail Sales indicates that the overall demand is extremely weak.

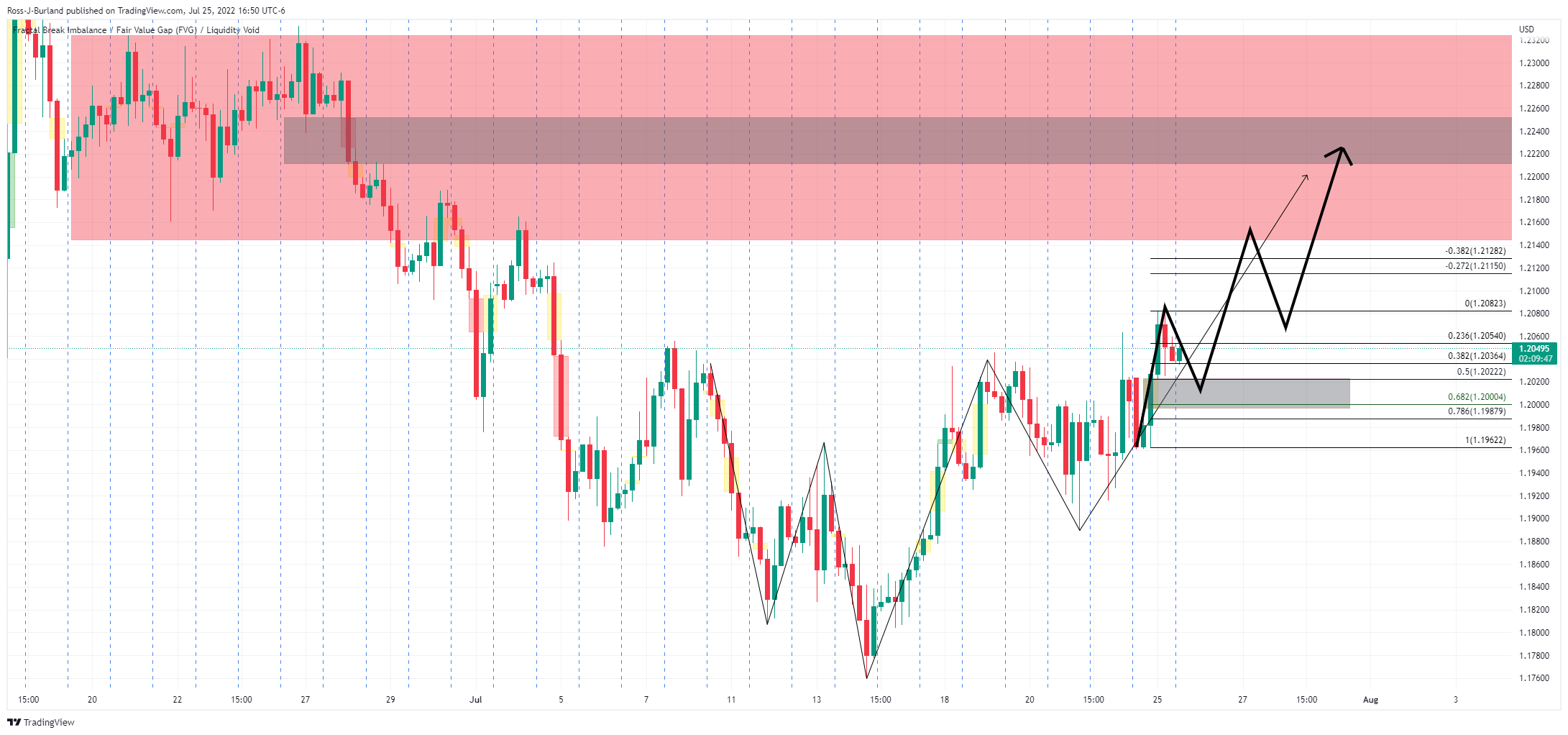

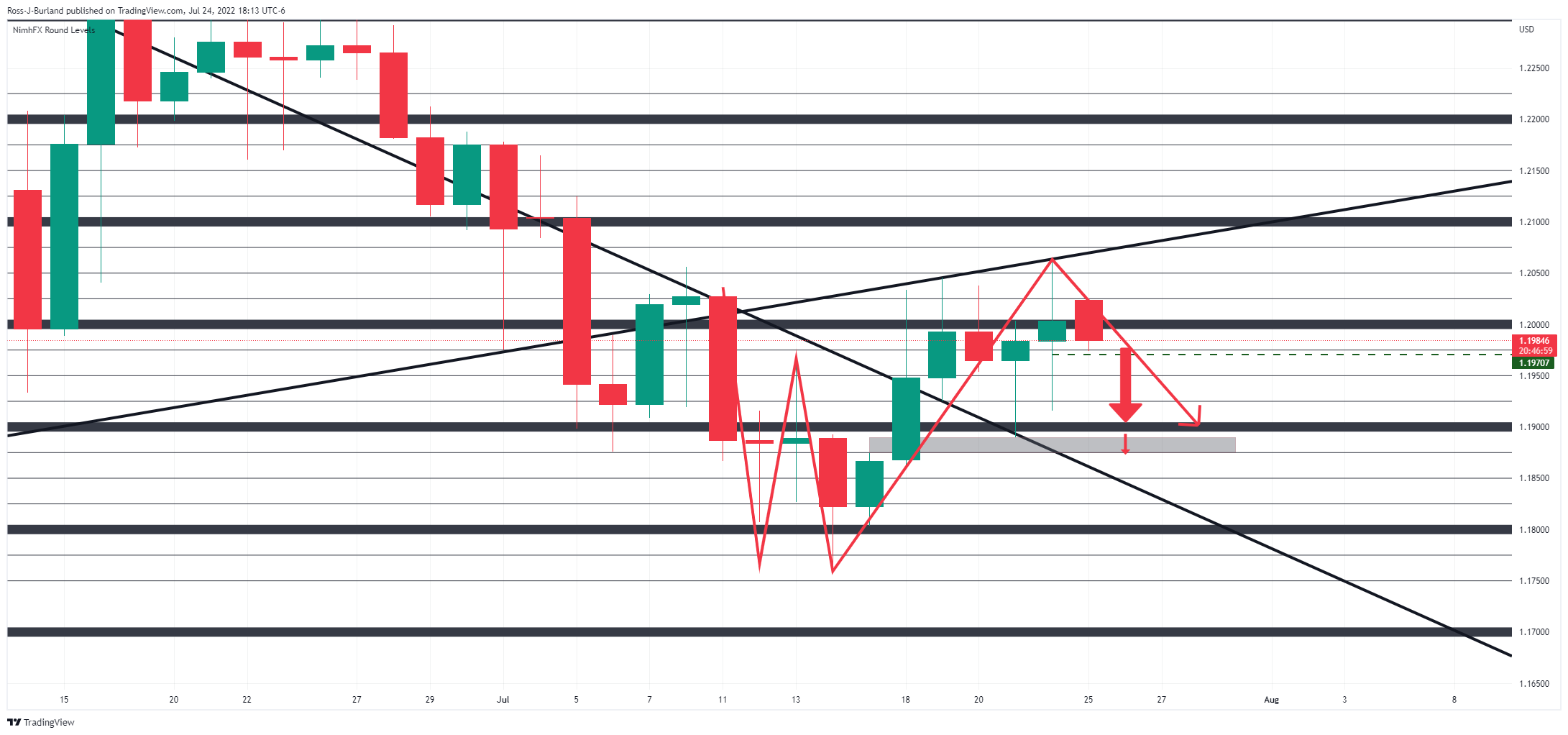

- GBP/USD bulls are in control with eyes on the 1.22 areas.

- The price is stalling on the bid on the short-term, however.

GBP/USD is offering mixed signals across the time frames, from bullish on the weekly to meanwhile bearish lower down on the 4-hour, but ultimately the bulls are in control. The following illustrates the prospects of a correction in the coming hours from which bulls might appear in droves for a continuation into the 1.22 areas.

GBP/USD weekly chart

The weekly chart's M-formation's neckline is a compelling target area for the bulls to aim for where it aligns with key Fibonaccis.

GBP/USD daily chart

Within the resistance area, there is a price imbalance on the daily chart which could lure the price in following the recent rally from the neckline of the W-formation.

GBP/USD H4 chart

The 4-hour chart has a price imbalance just below the recent lows as per the greyed-out area. A move into mitigating this where the 61.8% Fibo lies could be the next move on the cards before bulls fully engage.

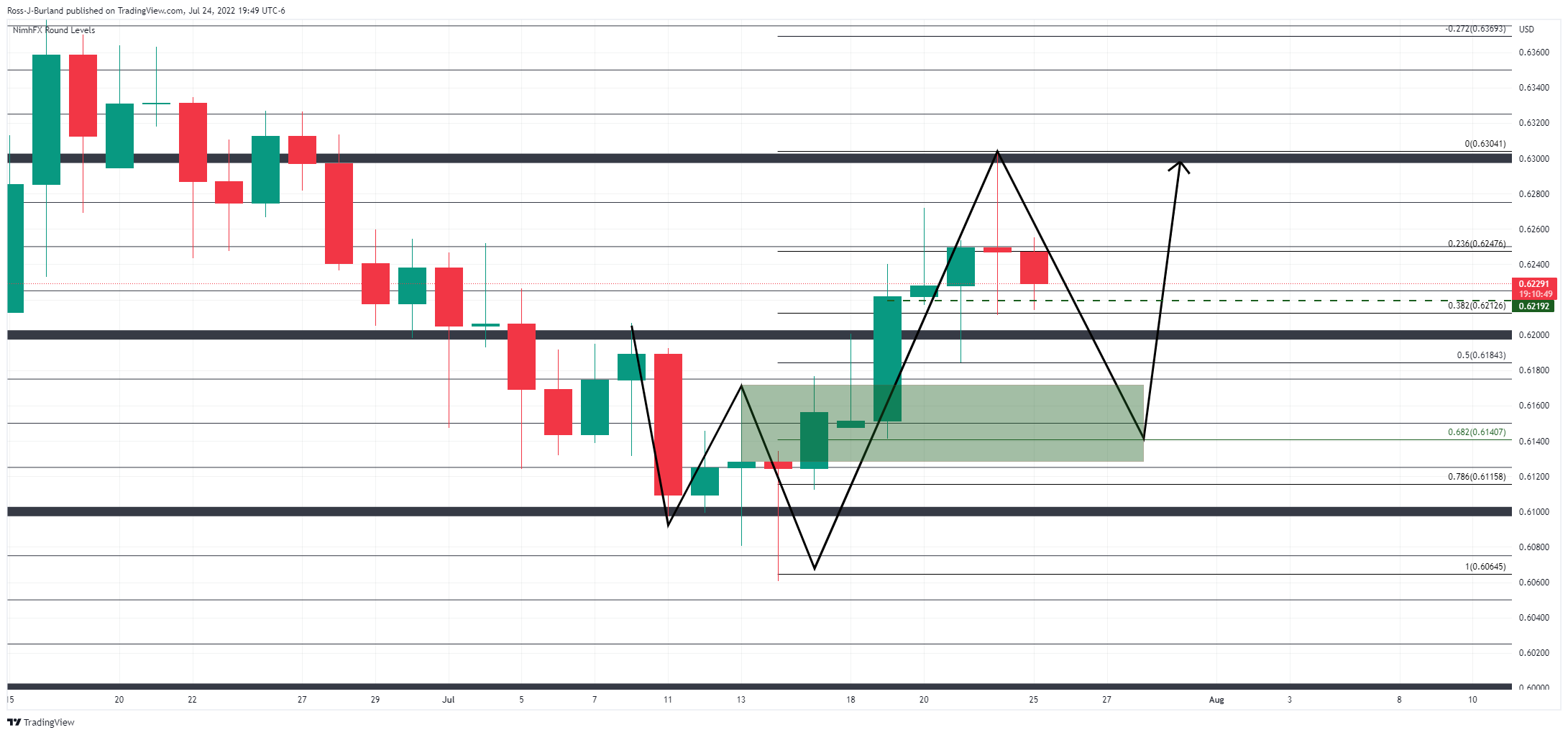

- NZD/USD bulls take a breather around monthly high, probes two-day uptrend.

- Fears of firmer US GDP, hawkish Fed challenge Kiwi pair buyers.

- Firmer sentiment, downbeat US data offered positive start to the key week.

- US Consumer Confidence for July will decorate calendar, risk catalysts are the key.

NZD/USD fades upside momentum as it takes rounds to 0.6260 during Tuesday’s Asian session. In doing so, the Kiwi pair remains near the monthly high flashed on Friday but snaps the two-day uptrend as traders await the key data/events amid a sluggish session.

The quote witnessed a softer start to the week comprising the Federal Open Market Committee (FOMC) meeting amid a light calendar and mixed concerns over the US economic conditions.

That said, Chicago Fed National Activity Index reprinted -0.19 in June, versus -0.03 forecast. Further, Dallas Fed Manufacturing Index for July slumped to the lowest levels since mid-2020 to -22.6 versus -12.5 expected and -17.7 prior.

Even so, two US Treasury officials, namely Ben Harris, Treasury Assistant Secretary for Economic Policy and Neil Mehrotra, Deputy Assistant Secretary for Macroeconomics raised hopes for a firmer US Gross Domestic Product (GDP). The officials wrote, per Reuters, that gross domestic income (GDI), which measures aggregate income -- wages, business profits, rental and interest income -- continued to rise in the first quarter at a 1.8% annual pace, while GDP fell.

Previously, US Treasury Secretary Janet Yellen talked down fears of the US recession while saying, “A second quarter GDP contraction would not signal recession because of underlying job market strength, demand and other indicators of economic health.”

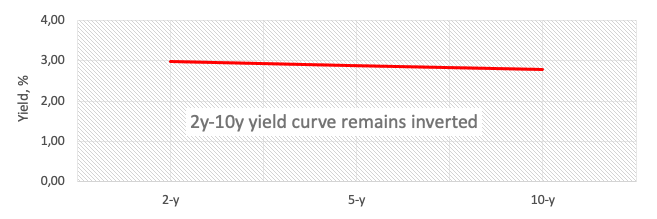

It’s worth noting that the inversion between the 10-year and the 2-year US Treasury yields, as well as the recently high inflation expectations, per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, highlight fears of recession and the Fed’s aggression.

Against this backdrop, Wall Street managed to close mixed, with Nasdaq posting mild losses versus the softer gains of the DJI30 and S&P 500. However, the US 10-year Treasury yields snapped a three-day downtrend and rose nearly 1.75% while regaining the 2.81% mark of late. It should be noted that the S&P 500 Futures drop 0.30% intraday by the press time.

Moving on, US CB Consumer Confidence for July, prior 98.7, appears to be the key for the pair traders to watch for the short-term directions. However, major attention will be given to the pre-Fed chatters and growth related talks will be crucial to watch for clear directions. Additionally important will be the US New Home Sales for June, Richmond Fed Manufacturing Index for July and House Price Index data for May.

Technical analysis

NZD/USD remains sidelined between the 21-DMA and the 50-DMA, respectively around 0.6195 and 0.6315.

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, rose for the second consecutive day by the end of Monday’s North American session. That said, the inflation gauge recently flashed the 2.36% mark, reversing the previous week’s losses of late.

The recovery in the long-term inflation expectations gain major should ideally help the US dollar as traders brace for this week’s Federal Open Market Committee (FOMC) meeting. However, the difference between the 2-year Treasury yields and the 10-year Treasury yields remain negative, known as the yield curve inversion, which in turn raises concerns over the US recession and challenges the USD bulls.

That said, the US 10-year Treasury yields snapped a three-day downtrend and rose nearly 1.75% while regaining the 2.81% mark of late. On the other hand, the 2-year Treasury yields marked the 3.01% figures at the latest.

It should be noted that the two US Treasury officials, namely Ben Harris, Treasury Assistant Secretary for Economic Policy and Neil Mehrotra, Deputy Assistant Secretary for Macroeconomics, recently raised hopes for a firmer US Gross Domestic Product (GDP). Earlier, US Treasury Secretary Janet Yellen talked down fears of the US recession earlier while saying, “A second quarter GDP contraction would not signal recession because of underlying job market strength, demand and other indicators of economic health.”

Also read: EURUSD price steadies above 1.0200 with eyes on US Consumer Confidence, Fed

- Silver remains pressured for the third consecutive day inside short-term symmetrical triangle.

- Bearish MACD signals, sustained trading below 100-SMA keep sellers hopeful.

- Mid-month high, 61.8% FE act as extra filters to trade.

Silver price (XAG/USD) remains depressed at around $18.40 inside a two-week-old symmetrical triangle. That said, the bright metal recently approaches the stated triangle’s support line.

Given the bearish MACD signals and the quote’s successful trading below the 100-SMA, XAG/USD is likely to witness further downside.

That said, the triangle’s lower line, around $18.25, appears the immediate support to watch for the metal traders.

Following that, the $18.00 threshold and the 61.8% Fibonacci Expansion (FE) of July 05-20 moves, near $17.80, could challenge silver bears.

In a case where the XAG/USD prices remain weak past $17.80, the odds of witnessing a south-run towards the June 2020 low near $16.95 can’t be ruled out.

Alternatively, the aforementioned triangle’s upper line, around $18.90, precedes the $19.00 round figure, also comprising the 100-SMA, which restricts the XAG/USD pair’s short-term upside moves.

If the silver buyers keep reins past $19.00, the mid-July swing high near $19.40 and the $20.00 psychological magnet will be on their radars afterward.

Overall, silver remains pressured around a multi-month low but the short-term triangle may restrict immediate moves.

Silver: Four-hour chart

Trend: Further weakness expected

- USD/CHF is juggling in a 0.9633-0.9648 range as focus shifts to Fed policy.

- A divergence in US Retail Sales data and the US Durable Goods Orders data may impact the DXY.

- The Fed will most likely dictate a consecutive 75 bps rate hike.

The USD/CHF pair is auctioning in a minute range of 0.9633-0.9648 from the late New York session after failing to cross the critical hurdle of 0.9660. The asset is expected to keep juggling ahead as investors are awaiting the announcement of the interest rate decision by the Federal Reserve (Fed), which is due on Wednesday.

On a broader note, the asset has remained in the grip of bears as the US dollar index (DXY) has remained vulnerable over the past week. The DXY has established below the critical support of 107.00 and is likely to deliver more downside as the Federal Reserve (Fed) is not expected to remain ambitious this time.

Softer earnings from big tech boys and a decline in overall demand due to soaring price pressures are going to weaken Fed policymakers in making a bold announcement. However, maintenance of the status quo looks imminent.

Apart from the Fed policy, the US Durable Goods Orders data will also fetch investors’ sight. The economic data is expected to display a vulnerable performance as a downward shift to -0.2% vs. 0.8% signals a huge deviation.

It is worth noting that July’s Retail Sales print remained at 1%, significantly higher than the consensus and former print. A huge divergence between Retail Sales data and US Durable Goods Orders data indicates that soaring energy bills and costly food products were responsible for higher former economic data and overall demand is vulnerable.

On the Swiss franc front, the release of Real Retail Sales will hog the limelight. Earlier, the economic data landed at -1.6%. The economic catalyst is expected to remain higher as soaring energy bills and prices of food products will elevate Real Retail Sales. However, a slippage in the economic data will indicate a major slump in the overall demand. This may weaken the Swiss franc bulls ahead.

- EUR/JPY begins the week on the right foot, up by 0.49%.

- EUR/JPY Price Analysis: Short term is downwards-to-neutral, and a break below 139.47 would tumble the cross towards 138.00.

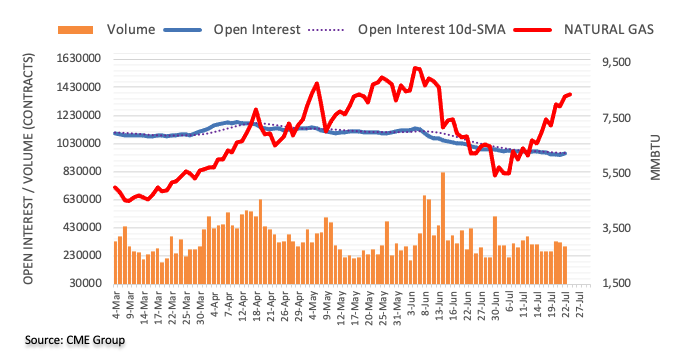

The EUR/JPY recovers some ground lost last Friday but faces solid resistance at the confluence of the 20 and 50-day EMA around 139.72-74, amidst a risk-off impulse. Sentiment shifted sour on Russia’s Gazprom reducing natural gas flows by half to 20% through Nord Stream 1 pipeline, alongside the Federal Reserve tightening policy by 75 bps late in the week, keeps investors on their toes. At the time of writing, eh EUR/JPY is trading at 139.63.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY is neutral-to-upward biased, as illustrated by the daily chart. Buyers unable to reclaim the July 21 high at 142.32 left the pair exposed to selling pressure. Further, oscillators like the Relative Strenght Index (RSI) at 48.74 shifted downwards, meaning that Monday’s correction might be a better entry price for EUR/JPY sellers, as they aim to drag prices lower, with their first target being the 100-day EMA at 137.35.

EUR/JPY 1-hour chart

The EUR/JPY hourly chart illustrates the pair as downwards-to-neutral. On Monday, the EUR/JPY buyers could not break above the 200-hour EMA at 139.97 three times. On their third attempt, EUR/JPY sellers stepped in and tumbled the price towards 139.41. Nevertheless, the downtrend lost steam; since then, it settled above the daily pivot point at 139.47.

Therefore, the EUR/JPY first support would be the daily pivot. Once broken, the cross next support would be the S1 daily pivot at 138.587, followed by the July 24 daily low at 138.71, and then the 138.00 mark.

EUR/JPY Key Technical Levels

- EURUSD stays inside weekly trading range after a softer start to the key week.

- Bulls and bears jostle as German IFO, US activity/sentiment numbers both came in downbeat.

- Fears of economic slowdown in the bloc probe Euro bulls while pre-Fed anxiety, firmer equities challenge greenback’s upside.

- US CB Consumer Confidence for July will be important to watch for fresh impulse.

EURUSD price remains sidelined at around 1.0220, keeping the one-week-old trading range, as traders await fresh clues after a sluggish start to the key week. That said, the major currency pair trades between 1.0130 and 1.0280 in the last week with eyes on Wednesday’s Federal Open Market Committee (FOMC). It’s worth noting that the mildly positive performance of the Wall Street and downbeat economics from the US and Eurozone restricted the quote’s latest moves.

Recently, two US Treasury officials, namely Ben Harris, Treasury Assistant Secretary for Economic Policy and Neil Mehrotra, Deputy Assistant Secretary for Macroeconomics raised hopes for a firmer US Gross Domestic Product (GDP). The officials wrote, per Reuters, that gross domestic income (GDI), which measures aggregate income -- wages, business profits, rental and interest income -- continued to rise in the first quarter at a 1.8% annual pace, while GDP fell.

It’s worth noting that US Treasury Secretary Janet Yellen talked down fears of the US recession earlier while saying, “A second quarter GDP contraction would not signal recession because of underlying job market strength, demand and other indicators of economic health.”

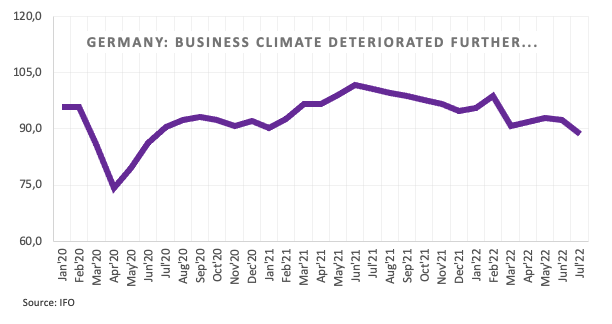

On the other hand, downbeat prints of the German IFO Sentiment data for July pushed IFO Economist Klaus Wohlrabe to mention, “Germany is on brink of recession.” It should be noted that the German IFO Business Climate Index slumped to 88.6 in July versus market forecasts of 90.5 and the previous monthly print of 92.2.

Not only the German figures but the US data was also downbeat as Chicago Fed National Activity Index reprinted -0.19 in June, versus -0.03 forecast. Further, Dallas Fed Manufacturing Index for July slumped to the lowest levels since mid-2020 to -22.6 versus -12.5 expected and -17.7 prior.

Amid these plays, Wall Street managed to close mixed, with Nasdaq posting mild losses versus the softer gains of the DJI30 and S&P 500. However, the US 10-year Treasury yields snapped a three-day downtrend and rose nearly 1.75% while regaining the 2.81% mark of late.

Moving on, a light calendar in Europe may keep the EURUSD price inside the aforementioned trading range. However, today’s US CB Consumer Confidence for July, prior 98.7, appears to the key for the pair traders to watch. Also important will be the US New Home Sales for June, Richmond Fed Manufacturing Index for July and House Price Index data for May. Above all, the pre-Fed chatters and growth related talks will be crucial to watch for clear directions.

Technical analysis

EUR/USD dribbles between the 10-DMA and the 21-DMA, respectively around 1.0160 and 1.0230. That said, the recently firmer RSI and MACD signals hint at the pair’s further upside.

- USD/CAD is minutely higher than weekly lows at around 1.2830, downside looks likely ahead.

- The Fed is expected to announce a consecutive rate hike by 75 bps.

- Oil prices have rebounded firmly as the DXY has extended losses.

The USD/CAD pair has displayed a less-confident rebound after testing its weekly lows at 1.2835 in early Tokyo. The asset displayed a steep fall on Monday after sensing tough hurdles at around 1.2940. On a broader note, the asset has turned into a balancing mode, which covers a wide range of 1.2835-1.2940 and is likely to display a downside break as the overall has remained bearish.

The responsiveness of weakness in the USD/CAD pair seems higher than the US dollar index (DXY), which indicates that the Canadian dollar is also extremely strong and is dragging the asset swiftly. A rebound move has been witnessed in the DXY, however, the asset will remain on the back foot as pre-anxiety of investors ahead of the Federal Reserve (Fed) monetary policy has cooled off.

Odds of a rate hike by 100 basis points (bps) are not in sight as the long-run inflation expectations have trimmed and the US economic data is displaying a bumpy ride ahead. This will compel Fed chair Jerome Powell, not to get too much ambitious and follow a status-quo structure rather than going all in.

On the loonie front, higher-than-expected Retail Sales have failed to support the loonie bulls. It is worth noting that the economic data was highly contaminated by a whopping 8.1% inflation rate. Higher Consumer Price Index (CPI) has driven the economic data vigorously. Apart from that, the rate hike of 1% by the Bank of Canada (BOC) indicates that the inflation situation is beyond the control of the administration for now.

Meanwhile, the oil prices have rebounded firmly on a weaker DXY. The black gold has picked bids around $92.60, however, the overall structure is still bearish as the US economy may report an increment in employment generation at a minimal rate. Google has halted its recruitment process for the past two weeks and Ford is planning for retrenchment of 8k jobs ahead.

Foreign secretary Liz Truss will promise on Tuesday to bring in "tough and decisive action" to limit strike action by trade unions if she becomes Britain's next prime minister, the latest salvo in a divisive fight to lead the Conservative Party, per Reuters. The news conveyed comments from a statement as the UK PM race intensifies.

Key comments

We need tough and decisive action to limit trade unions’ ability to paralyze our economy.

I will do everything in my power to make sure that militant action from trade unions can no longer cripple the vital services that hard-working people rely on.

GBP/USD bulls take a breather

GBP/USD grinds higher around 1.2050, after refreshing the monthly peak with 1.2086 the previous day.

“US Treasury officials said on Monday overall income and jobs figures suggested the economy was in good health and not in a recession, even if data due this week shows gross domestic product falling for a second consecutive quarter,” reported Reuters.

Key quotes

Ben Harris, Treasury assistant secretary for economic policy and Neil Mehrotra, deputy assistant secretary for macroeconomics, wrote that gross domestic income (GDI), which measures aggregate income -- wages, business profits, rental and interest income -- continued to rise in the first quarter at a 1.8% annual pace, while GDP fell.

They said while second quarter GDI data will not be available until the end of August, some GDI components, including employee compensation, proprietors income and rental income, show increases for the quarter. Tax receipts also suggest strong corporate income growth, the officials added.

Their comments came a day after U.S. Treasury Secretary Janet Yellen said a second quarter GDP contraction would not signal recession because of underlying job market strength, demand and other indicators of economic health.

FX implications

EUR/USD remains unfazed by the news as it takes rounds to 1.0220 after a sluggish start to the week.

- Inventory distribution near monthly highs indicates aussie bulls are gearing up for more highs.

- Ascending 50- and 200- EMAs add to the upside filters.

- A violation of 60.00 by the RSI (14) will strengthen the aussie bulls.

The AUD/USD pair has carry-forwarded its back and forth move structure in the Tokyo session after remaining lackluster in New York. The asset is oscillating in a narrow range of 0.6950-0.6963 and is likely to give a decisive break ahead.

After correcting from its monthly high of 0.6977, the major has rebounded sharply and is forming an inventory distribution structure. A formation of an above-mentioned structure near monthly highs indicates initiation of longs by the market participants who prefer to enter into an auction after the establishment of a bias.

The 50-and 200-period Exponential Moving Averages (EMAs) at 0.6952 and 0.6926 are advancing sharply, which indicates that the long-term trend is bullish.

Meanwhile, the Relative Strength Index (RSI) (14) has sifted in a 40.00-60.00 range, which signals a consolidation ahead. Also, the asset is looking for a potential trigger for a decisive move.

A decisive move above Monday’s high at 0.6965 will drive the asset towards the psychological resistance at 0.7000. A breach of the latter will infuse fresh blood and the asset may record a high of June 16 high at 0.7069.

On the flip side, a steep fall below the round-level support of 0.6800 will strengthen the greenback bulls. This may decline the pair towards July 13 low at 0.6724, followed by July 14 low at 0.6680.

AUD/USD hourly chart

-637943830958543091.png)

- USD/JPY rises 0.02% for the second straight day as the Asian session begins.

- Russia’s Gazprom reducing natural gas flows to Europe, alongside the FOMC meeting looming, shifted sentiment sour.

- USD/JPY Price Analysis: Neutral biased, but a break below 134.74 to tumble the pair lower; otherwise, buyers eyeing 137.00.

The USD/JPY trims some of last Friday’s losses and edges up 0.42% as the New York session winds down. At the time of writing, the USD/JPY is trading at 136.65, below the 20-day EMA, as the Asian session takes over amidst a negative market sentiment.

USD/JPY rose on bad US data and mood

Investors’ mood dampened on news that Russia’s Gazprom halted one engine at the Nord Stream 1 pipeline, declining gas flows to 20%. The USD/JPY might remain choppy trading ahead of the US Federal Reserve Open Market Committee monetary policy meeting, where Powell & co. are expected to hike 75 bps the Federal funds rate (FFR).

Money market futures STIRs have fully priced in a 0.75% increase. Regarding a whole 1% hike, odds are at a 10% chance. Nevertheless, traders would lean onto the US 10-year Treasury yield reaction due to its close correlation with the USD/JPY.

On Monday, US economic data led by the Chicago National Activity Index further reinforced a recessionary scenario, tumbling for a second straight month to -0.9. Additionally, the Dallas Fed Manufacturing Index for July plunged -22.6 from -17.7 in June.

On the Japanese side, the Bank of Japan (BoJ) welcomed two new members, Takata and Tamure. In his first speech as a BoJ member, Takata said that the bank can keep monetary policy easy but is facing new challenges such as dwindling bank margins and the impact on market functions. In the meantime, Tamura said that Japan might soon see a positive cycle with wages increasing alongside inflation. He added that if that occurred, we would begin discussing an exit to easy policies.

What to watch

On Tuesday, the Japanese calendar will reveal the Bank of Japan's last monetary policy minutes. On the US front, the docket will feature US Consumer Confidence and New Home Sales.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart depicts the pair is upward-to-neutral biased, despite sliding below the 20-day EMA at 136.85. To shift the bias to neutral, or neutral-to-bearish, USD/JPY sellers need to reclaim the July 1 low at 134.74. Once cleared, the major would drop towards the 50-day EMA at 133.83.

- NZD/USD bulls stay in charge ahead of a busy week.

- The Fed is the showdown event among a number of key data.

In a slow start to the week, NZD/USD is up towards the end of the New York session, higher by 0.27% on the day after rising from a low of 0.6214 to a high of 0.6279. The US dollar was pressured vs. a basket of rival and major currencies on Monday as investors moved to the sidelines.

The Fed is widely expected to raise interest rates by 75 basis points at the conclusion of its policy meeting on Wednesday. However, the concerns are stemming from recent data that is showing that the world's largest economic power could be headed for a recession. On Friday, data showed that the US Composite PMI Output Index fell far more than expected to 47.5 this month from a final reading of 52.3 in June.

''The Kiwi gained overnight in uneven market conditions,'' analysts at ANZ Bank said. ''Data over the rest of the week may prove to be pivotal for medium-term levels for the NZD,'' the analysts advise. ''How hawkish the FOMC is, along with US data on wages and inflation, may set the tone for DXY. And domestically, ANZBO is likely to be very important for getting a read on how the Reserve Bank of New Zealand’s hikes are feeding into price pressures and activity.''

In the US, traders will be paying attention to the advance reading for second-quarter Gross Domestic Product, for one. If this were to show negative growth, the US will be showing a traditional definition of recession. We then have the Fed's preferred inflation measure which will be released in the form of Personal Consumption Expenditures, PCE.

- AUD/JPY begins the week on the right foot and rises almost 1%.

- Investors’ mood turned sour late in the New York session due to US corporate earnings and Gazprom reducing gas flows in NS 1.

- AUD/JPY Price Analysis: Break below 95.00 would tumble the pair to 93.80s; otherwise, a challenge at 97.00 is on the cards.

AUD/JPY erases last Friday’s losses due to a risk-sensitive appetite in the FX space and edges up by 0.90%. The cross-currency pair began trading around 94.20 and dived to its daily low at 93.89 before rallying sharply above the 95.00 figure. At the time of writing, the AUD/JPY is trading at 95.07.

Sentiment deteriorated, and US equities finished with losses. Gazprom reduced NatGas flows through the Nord Stream 1 pipeline to 20%, painting a complex picture in the EU and fueling recession worries in the block area. The US Federal Reserve Interest Rate decision would keep traders’ moods fragile as the US central bank prepares to raise rates by 75 bps on Wednesday.

AUD/JPY Price Analysis: Technical outlook

From the daily chart perspective, the AUD/JPY is upward-to-neutral biased. Failure to record a fresh daily high above 96.88 keeps the cross with its current bias but is also subject to selling pressure, as sellers stepped in around the 95.30 area. Failure to reclaim a daily close above the latter would leave the pair vulnerable to selling pressure. Otherwise, an AUD/JPY rally towards the YTD high of around 97.00 is on the cards.

AUD/JPY 1-hour chart

During the last hour, the AUD/JPY consolidated around the R1 daily pivot, unable to break above 95.20. The AUD/JPY hit a daily high at 95.18 in a goodish momentum bounce provided by the Relative Strength Index (RSI). However, the rally appears to be losing steam, as the RSI’s shifted horizontally around 63 and slid below RSI’s 7-hour SMA as buying interest fades.

Therefore, the AUD/JPY is neutral biased. But as mentioned above, failure at 95.00 would be gladly welcomed by sellers. Hence, the AUD/JPY first support would be the 100-hour EMA at 95.04. Break below will expose the confluence of the 20 and 50-hour EMA around 94.70-77, followed by the 200-hour EMA at 94.48. Once cleared, the next support would be the July 25 low at 93.89.

AUD/JPY Key Technical Levels

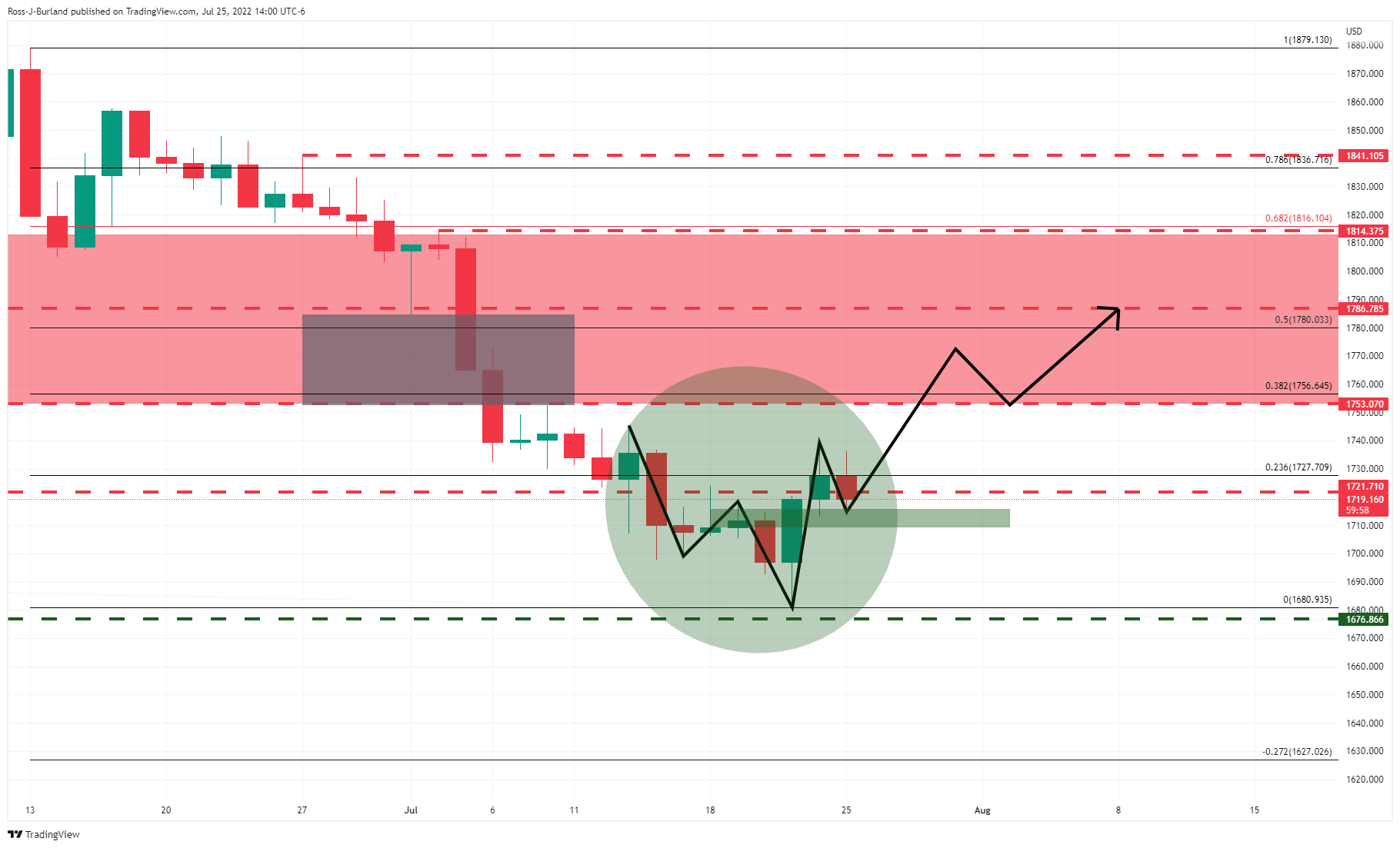

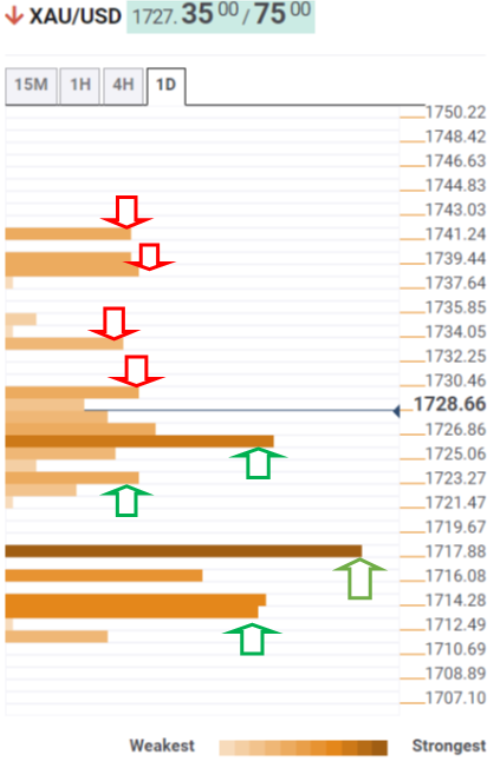

- Gold price is headed into a key area of support on a busy week ahead.

- It is a huge week for financial markets and gold will be sure to be in the spotlight around the key events.

- A 50% mean reversion level of around $1,780 could be in the offing if bulls commit through this critical week.

The gold price is down on the day by some 0.58% and falls from a high of $1,736.30 to a low of $1,714.80 despite a softer greenback. Meanwhile, traders are bracing for the showdown this week that will come in the form of the Federal Reserve ahead of some key US data points, such as the Fed's preferred inflation measure and fresh growth data towards the end of a very busy week.

All eyes are on the Fed

The Fed is expected to end its two-day meeting with another 75bps hike for the second-straight time. Expectations for a hike of 75 basis points from the Fed stand at about 75%, according to CME's Fedwatch tool with a 25% chance of a 100 basis point hike. Analysts at Brown Brothers Harriman said WIRP suggests only around 10% odds of a 100 bp move, noting that updated macro forecasts and Dot Plots won’t come until the September meeting.

''Another 75 bp hike on September 21 is only about 45% priced in, with a 50 bp move favoured then. A 25 bp hike is priced in for November 2 but after that, one last 25 bp hike is only partially priced in. The swaps market paints a similar picture, with 175 of tightening priced in over the next 6 months that would see the policy rate peak near 3.5%. Then, an easing cycle is priced in for the subsequent 6 months.''

Gold has been pressured in this environment as the yellow metal offers no yield. Nevertheless, analysts at TD Securities are of the mind that a CTA whipsaw would be the most obvious driver for additional short covering in the yellow metal.

The analysts say that prices would need to close north of $1,775 to spark a buying program. ''Ultimately, a behemoth position held by prop traders remains nearly twice its typical size, suggesting a substantial amount of pain will reverberate across gold markets if prices revert lower. We have yet to see capitulation in gold, suggesting the recent rally will ultimately fade when faced with a wall of offers.''

However, rising bond yields ahead of the Fed are contributing to a gap between the 2- and 10-year Treasury notes which observers would argue signal a looming recession in the US. Gold's allure as a safe haven asset could see higher prices, especially if the Fed were to start to dial back its hawkish rate hike path for the fear of crashing the economy.

Recent data has shown signs of an economic slowdown while inflation remains stubbornly high, with claims for jobless benefits rising to their highest in eight months. Moreover, on Friday, data showed that the US Composite PMI Output Index fell far more than expected to 47.5 this month from a final reading of 52.3 in June. This is showing that the world's largest economic power could be headed for a recession.

However, the greenback found some support from safe-haven flows late on Friday while investors' stepped aside from stocks on the back of some weak earnings reports. Meanwhile, to start the week, pre-Fed jitters are keeping the greenback off its highs. This makes the end of the week's data highly critical for the path of both the greenback and gold.

Key data ahead

Investors will eye the advance reading for second-quarter Gross Domestic Product, for one. If this were to show negative growth, the US will be showing a traditional definition of recession. We then have the Fed's preferred inflation measure which will be released in the form of Personal Consumption Expenditures, PCE.

Gold technical analysis

Meanwhile, the daily chart's W-formation has been pulling the gold price towards the neckline for a restest of the bull's commitments near $1,700 prior to what could turn out to be a full-on drive higher in the coming days. The greyed area on the chart above is a price imbalance that could be mitigated in the process and exposes the 50% mean reversion level around $1,780.

What you need to take care of on Tuesday, July 26:

The week started in risk-off mode, although the better performance of equities weighed on the greenback since the mid-European session. Earnings reports and hopes that the US Federal Reserve will refrain from innovating on monetary policy partially offset concerns about a global recession.

The EUR was among the worst performers, as tepid European data weighed on the shared currency. The latter also suffered from persistent tensions with Russia. The Nord Stream 1 pipeline is flowing at around 20% of its full capacity, and Europe will not have enough natural gas to make it throughout the winter. The pair trades around 1.0220, little changed for a second consecutive day.

The lack of news were good news for high-yielding currencies. The GBP/USD pair trades at around 1.2050, while AUD/USD nears July high at 0.6977. On the other hand, the USD/CAD pair is down to 1.2840.

The dollar advanced modestly against safe-haven rivals. USD/CHF stands at 0.9640 while USD/JPY trades around 136.60.

Gold price eased now, trading at around $1,717 a troy ounce. Crude oil prices were marginally higher, with WTI now trading at $96.60 a barrel.

The macroeconomic calendar had little to offer until next Wednesday. The US Federal Reserve monetary policy decision will top the first-tier event list, but preliminary GDPs and inflation figures for different economies will also be out.

LUNA prepares for a 20% move as lawsuits against Do Kwon and associates pile

Like this article? Help us with some feedback by answering this survey:

- The US crude oil benchmark snaps three days of consecutive losses and rises despite US data showing the US economy is slowing.

- A US recession and subsequent China’s Covid-19 lockdowns might weigh sharply on WTI price.

- Libya would increase its oil output from 860K to 1.2 million BPD amidst political turmoil.

Western Texas Intermediate (WTI) rises 1.40% on Monday as US equities gain, portraying an upbeat market mood, despite weaker than expected US economic data paints a gloomy scenario for the economy, reigniting recession fears. At the time of writing, WTI is exchanging hands at $96.65 per barrel.

Traders’ mood is positive, despite dismal US economic data flashing recession

Sentiment remains positive as investors await US corporate earnings reports. The Fed Chicago National Activity Index contracted for the second straight month. At the same time, the Dallas Fed Manufacturing Index also plunged, indicating that the US economy is in worse conditions than estimated. Consequently, as shown by the US Dollar Index, the greenback weakened, dropping 0.09%, a tailwind for WTI.

Fundamentally speaking, the narrative has not changed. Energy prices remain high, a US recession looms, and the Ukraine-Russia conflict extends for five months. US Monday’s data further increased traders’ worries regarding a recession and might cut fuel demand, a headwind for WTI prices.

Additionally to US factors, China’s Covid-19 zero-tolerance restrictions have taken their toll on oil prices. The second-largest economy narrowly missed a contraction in Q2 and grew by 0.4% YoY.

In the meantime, financial analysts remain skeptical about Libya’s output as the country deals with political uncertainty. Nevertheless, Libya’s National Oil Corporation said it would like to bring back 1.2 million BPD in two weeks from 860K. That, alongside EU countries imposing a cap on Russian oil, would keep the black gold prices volatile in the week ahead.

What to watch

In the week ahead, the US economic docket will feature the API Crude Oil Stock Change for July 22, on Tuesday, with the previous reading standing at 1.86M. On Wednesday, the EIA would unveil its gasoline and crude oil inventories alongside the US Federal Reserve monetary policy decision.

WTI Key Technical Levels

- EUR/USD holds in familiar territory ahead of the showdown event this week in the Fed.

- IFO German business sentiment is at its lowest in more than two years.

At 1.0223, EUR/USD is sideways at the start of the week ahead of the Federal Reserve interest rate decision on Wednesday. The US dollar, however, has been on the back foot for the main while traders weigh the implications of a rate hike and second guess what this will mean for the US economy that, according to recent data, could be on the cusp of a recession.

As recent as last Friday, data showed that the US Composite PMI Output Index fell far more than expected to 47.5 this month from a final reading of 52.3 in June. This is showing that the world's largest economic power could be headed for a recession. However, the greenback found some support from safe-haven flows late on Friday while investors' stepped aside from stocks on the back of some weak earnings reports. Meanwhile, to start the week, pre-Fed jitters are keeping the greenback off its highs.

The Fed is widely expected to raise interest rates by 75 basis points, but the worries are that a rate hike will close out pandemic-era support for the economy and with claims for jobless benefits rising to their highest in eight months, investors are treading cautiously in the build-up to the event. The Fed decision will be accompanied by the latest growth figures later in the week as well as the Fed's preferred inflation measure.

Meanwhile, the recent 50 basis point rate hike by the European Central Bank lifted the euro vs the greenback at the same time equities on Wall Street were on the front foot during solid earnings. However, the effect was shortened on the back of the latest earnings that were not so encouraging. Investors are eyeing the earnings season for signs of a worsening economy as well as the impact of a strong greenback on profits. Nevertheless, Martins Kazaks, who is the Latvian central bank governor who was speaking with Bloomberg News said that the ECB may not be done with big rate hikes, and this has dented the greenback today while US equities were modestly lower to start the week.

In domestic data on Monday, the IFO business sentiment survey showed on Monday that business morale in Germany has sunk more than expected in July to its lowest in more than two years. ''The collapse in the Ifo business climate (88.6 after 92.2) primarily reflects German companies' fear of a gas crisis,'' Commerzbank analysts said. ''Sooner or later, Putin might reduce gas deliveries again to make voters and politicians nervous so that they do not continue to support Ukraine militarily. Like the purchasing managers' index, the Ifo business climate now clearly points to a downturn in the German economy. How bad things end up is, unfortunately, primarily in Putin's hands.''

- GBP/USD bulls move in as traders get set for the Fed this week.

- UK politics are a potential weight for the pound going forward.

GBP/USD is higher in the midday New York session by some 0.37% after rallying from a low of 1.1960 to a high of 1.2086 on the day so far. The US dollar is down vs. a basket of rivals to start the week while traders get set for this week's showdown in the Federal Reserve interest rate decision.

The expectations of 75 basis points this Wednesday are throwing into question whether the US economy is able to sustain continued rate hikes at such a pace. A hike of that magnitude would effectively close out pandemic-era support for the economy and data of late has not been encouraging.

On Friday, the US Composite PMI Output Index fell far more than expected to 47.5 this month from a final reading of 52.3 in June indicating the US could be headed for a recession. However, the greenback found some support from safe-haven flows late on Friday while investors' stepped aside from stocks on the back of some weak earnings reports. Meanwhile, to start the week, pre-Fed jitters are keeping the greenback off its highs.

Domestically, net short GBP positions edged lower last week as per the latest positioning data shows as the pound finds itself caught up in political turmoil again. The UK will have a lame duck PM until September when a new leader will be announced and the uncertainty of a farm cloud over the currency and pound-denominated investments.

As analysts at Rabobank explained, ''it remains to be seen if the UK government, under new leadership can address the concerns that have been dogging GBP investors in terms of opportunity and growth for post-Brexit Britain. Presented with a worsening in the cost-of-living crisis, it is far from certain that a new PM in the UK will be able to substantially alter the gloomy tone that has been weighing on GBP all year.''

''Given our expectation that USD strength is likely to persist for around 6 months or so in view of risks to global growth, we foresee the potential for further sharp drops in the value of the pound,'' the analysts argued. ''We have revised lower our target for cable from 1.18 and see the potential for a dip to levels as low as 1.12 on a 1-to-3-month view.''

- GBP/JPY rallied 200 pips and hit a daily high at 165.08.

- The British pound got bolstered by an upbeat market mood, despite soft US data reigniting recession fears.

- GBP/JPY Price Analysis: To remain range-bound after fulfilling a double-bottom price target at 164.50.

The GBP/JPY erases last Friday’s losses and is gaining close to 1% on Monday, amidst an improved market mood with US equities rising, ahead of US mega-tech companies reporting earnings after US data further reinforces a recessionary scenario. At the time of writing, the GBP/JPY is trading at 164.70.

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY is still upward biased due to sellers being unable to keep prices below the 50-day EMA at 163.62. it is also worth noting that the Relative Strength Index (RSI) spiked from negative territory, and it’s about to break above the RSI’s 7-day SMA, around 52.41, which would exacerbate and open a move towards the July 21 high at 165.98. However, the GBP/JPY would be vulnerable to selling pressure unless the latter is achieved.

GBP/JPY 1-hour chart

The GBP/JPY 1-hour chart depicts the pair formed a double-bottom around the 163.00 area, bolstering the cross, which rallied close to 200-pips. On its way north, the GBP/JPY pierced the 100-hour EMA at 164.90 before retreating above the 200-hour EMA at 164.68. However, due to RSI about to enter overbought conditions and price action lacking the strength to pierce the 165.00 late in the New York session, it would keep the pair range bound.

The GBP/JPY’s first resistance would be the July 25 high at 165.08. Break above will expose the confluence of the July 21 high and the R2 pivot around 166.00. On the flip side, the GBP/JPY first support would be the R1 daily pivot point at 164.58. Once cleared, the next support would be the 163.97-164.12 area, followed by the daily pivot point at 163.79.

GBP/JPY Key Technical Levels

- The AUD/USD advances towards solid resistance around the 0.6970-90 area.

- Weak US economic activity and manufacturing data reported on Monday increase the chances of a US recession.

- AUD/USD Price Analysis: Downward biased, but if buyers reclaim 0.6970, a test of 0.7000 is on the cards.

The AUD/USD climbs during the North American session but faces solid resistance around the 50-day EMA around 0.6971, amidst an upbeat market mood, with US equities rising, except for the Nasdaq, down 0.44%. Softer US economic data further reinforces the recession scenario as the Fed tries to tame 40-year high inflation by hiking rates aggressively and is widely expected to lift the Federal funds rate (FFR) to 2.50% on Wednesday.

The AUD/USD is trading at 0.6959 after opening near the 0.6920 area. During the Asian session, the major tumbled to the daily low of 0.6878, but buying pressure overcame sellers and lifted the pair to the daily high around 0.6965, also shy of the confluence of the R1 pivot point and the 50-day EMA.

Dismal US data increased the likelihood of a recession

Earlier in the New York session, the Chicago Fed revealed its National Activity Index for June, which tumbled to -0.19 MoM, unchanged from the May reading. However, it’s worth noticing that the 3-month moving average shifted negatively for the first time, indicating deterioration. Late during the day, the Dallas Fed Manufacturing Index plummeted to -22.6 from -12.5 estimated in July.

Meanwhile, an absent Australian economic docket left traders adrift to market sentiment and US economic data. Nevertheless, throughout the week, AUD/USD traders will get some cues from Australia’s Q2 inflation report, which is expected to rise by 6.3%, to its highest since 1990. That would ramp up rate hike expectations by the Reserve Bank of Australia (RBA), with money market futures already pricing in a 75 bps rate hike.

What to watch

On Tuesday, the US economic docket will feature CB Consumer Confidence, New Home Sales, and the beginning of the two-day US FOMC monetary policy meeting.

AUD/USD Price Analysis: Technical outlook

Despite the ongoing correction, the AUD/USD is still downward biased, facing solid resistance on the confluence of the 50-day EMA and a four-month-old downslope trendline, around the 0.6971-85 area. Nevertheless, it’s worth noting that the Relative Strength Index (RSI) at 56.38 aims higher, opening the door for a potential test of 0.7000. But sellers remain in charge unless buyers step in and break resistance around 0.6970-85.

If the latter scenario plays out, the AUD/USD first resistance would be 0.7000. Break above will expose the 100-day EMA at 0.7133, followed by the 200-day EMA at 0.7153. On the other hand, the AUD/USD first support would be the 0.6900 figure. A breach of the latter will send the major sliding towards the 20-day EMA at 0.6840, followed by the 0.6800 mark.

Analysts at MUFG Bank forecast the USD/JPY pair to end the third quarter at 135 and the year at 131.00. However, in the short-term they see the pair likely to rise to 140.

Key Quotes:

“The dollar strengthened across the board as the Fed turned hawkish in response to an unexpected pickup in inflation, while the yen weakened due the divergence in monetary policy in Japan and other countries. The USD/JPY rose to touch 137, with 140 now in view given the Fed's unwaveringly hawkish stance should keep the dollar strong in the near term. However, the possibility of recession in the US could constrain a further widening of the interest rate differential between Japan and the US, which has been driving the USD/JPY's rise. We expect the USD/JPY's current rise to peak in Jul–Sep due to a slowdown in the US economy.”

“The interest rate differential in the intermediate sector, which tends to reflect the near-term outlook for monetary policy, has driven the USD/JPY higher since last year. The current level already looks strained, but we expect a narrowing of interest rate differentials would weigh on the USD/JPY if expectations of a decline US interest rates in anticipation of changes in the US economy becomes the mainstream view.”

“We expect the possibility of government intervention in the forex market to stop the yen from weakening will come into view if the USD/JPY passes 140. The last time Japanese authorities conducted yen-buying intervention was in June 1998, when the USD/JPY was above 140. The USD/JPY has been driven higher by the interest rate differential between Japan and the US. Now that this driver has started to lose momentum, we think growing concerns about intervention should act as an automatic brake on upside when the USD/JPY passes 140.”

- Gold turns negative as market sentiment deteriorates.

- XAU/USD slides below $1720, rejected again from above $1730.

- US Dollar recovers momentum, erases losses.

Gold prices failed to hold to gains on Monday, hit after Gazprom’s announcement that will slow flows on the Nord Stream 1 pipeline, triggering a decline in equity prices. XAUUSD printed a fresh daily low at $1714 during the American session.

Earlier on Monday, gold peaked at $1736, slightly below last week high and then lost momentum. It failed to hold above $1730 and then accelerated the decline after the US Dollar gained strength.

Gazprom’s announcement weighed in stocks and pushed energy prices to the upside. The dollar erased losses and turned positive. The DXY rose back above 106.50.

Market participants await the outcome of the FOMC meeting that will start on Tuesday. “We expect the FOMC to follow up June's large 75bp rate increase with a similar move in July, lifting the target range for the Fed Funds rate to 2.25%-2.50%. In doing so, the Committee would bring the policy stance to its estimate of the longer-run neutral level. We also look for Chair Powell to retain optionality by leaving the door open to additional 75bp rate increases”, explained an analyst at TD Securities.

Gold finds resistance

Last week, gold prices posted the first weekly gains after falling during five in a row. The rebound from the critical support area of 1675$ (2021 lows) found resistance at $1740.

From a very short-term perspective, XAUUSD is correcting lower and is testing the $1715 area. A break lower could open the doors to $1700. If it rises back above $1725, another test of $1740 could take place. The key resistance above is at $1750.

Technical levels

- Silver price begins the week heavy, creeps towards $18.40 ahead of the FOMC meeting.

- Weaker than expected data flagging further deterioration of the US economy underpins US Treasury yields.

- Silver Price Forecast (XAGUSD): Downward biased, to restest the $18.00 mark in the near term.

Silver price is retracing from daily highs near the $18.70 region towards the $18.40 area. A mixed market mood, spurred by the Federal Reserve Open Market Committee meeting looming, alongside US corporate earnings and US GDP preliminary readings, expected to expand but at the brink of confirming a technical recession in the US, keep Silver prices heavy.

XAGUSD began the week trading around $18.60, climbed steadily near the R1 daily pivot at $18.84, but dived below the S1 daily pivot and hit the daily low at $18.30, but had recovered some ground, meandering around the S1 pivot point at $18.40.

Despite weaker US data, safe-haven flows move towards the greenback

Late newswires confirmed that Gazprom has reduced the Natural Gas flows to 20% in the Nord Stream 1 pipeline, which triggered a jump in the UD Dollar Index to 106.420. In the meantime, US economic data further shows deterioration in the economy, as the US Dallas Fed Manufacturing Index collapsed -22.6 vs. -12.5 in July. That, alongside the US Chicago Fed National ACtivivity Indeed tumbling to -0.19 in June, keep recession fears lingering around investors’ minds. With the US Federal Reserve expected to hike 75 bps on Wednesday, the white metal is expected to accelerate its losses as higher US Treasury yields boost the appetite for the greenback.

Regarding the money market futures, expectations for a 75 bps interest rate rise by the Fed lie at a 75% chance, while estimations for a 100 bps increase are at 25%.

Talking about US Treasury yields, the 10-year benchmark note coupon edges up two and a half basis points, yielding 2.807%, while the US 2s-10s yield curve remains inverted for the sixteenth straight day, at -0.207%.

What to watch

On Tuesday, the US economic docket will feature CB Consumer Confidence, New Home Sales, and the beginning of the two-day US FOMC monetary policy meeting.

Silver Price Forecast (XAGUSD): Technical outlook

Silver price shows signs that the downtrend that accelerated since mid-April is losing steam, unable to crack the $18.00 barrier, which once cleared, would open the door for further losses, towards the June lows around $16.95. XAGUSD traders should notice that the Relative Strength Index (RSI) exited from oversold levels but is aiming lower, about to cross under the RSI’s 7-day SMA, opening the door for further downwards action.

Therefore, the XAGUSD’s first support would be the YTD low at $18.14. XAGUSD break below will expose $18.00, followed by a challenge of the $17.00, before refreshing 2-year lows around June 2020 lows at $16.95.

Russia’s Gazprom announced on Monday it will slow flows on the Nord Stream 1. The company is halting another turbine in the pipeline to Germany that is currently at 40%. On Wednesday the supply will fall to 33 million cubic meters per day, about half of the current.

European gas prices jumped following the announcement. The DAX turned negative and it was falling by 0.49%.

- Dallas Fed Manufacturing Index fell sharply again in July.

- US Dollar Index trims daily losses, rises to 106.50.

The headline General Business Activity Index of the Federal Reserve Bank of Dallas’s Manufacturing Survey plunged to -22.6 in July from -17.7 in June. This print missed the market expectation of -12.5 by a wide margin.

The New Orders sub-index dropped to -9.2 from -7.3, the Prices Paid for Raw Materials component fell to 38.4 from 57.5 and the Employment sub-index rose to 17.9 from 15.2.

Market reaction

The US Dollar continued to trim losses across the board after the report. The US Dollar Index was last seen posting small daily losses around 106.50.

Also read: Polestar (PSNY) stock falls sharply as news flow dries up

- The USD/CHF got a bid ahead of the FOMC meeting on mixed sentiment.

- From a medium-term perspective, the USD/CHF is upward biased; it could retest 0.9900.

- USD/CHF Price Analysis: A bearish flag emerged, which, once broken, would send the pair sliding towards 0.9580.

The USD/CHF stages a rebound from last week’s low and the 100-day moving average (DMA) at 0.9600 and edges higher on a mixed sentiment with US equities fluctuating as traders brace for the Federal Reserve monetary policy decision on Wednesday. At the time of writing, the USD/CHF is trading at 0.9652, slightly gaining 0.37%.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, the USD/CHF is still upward biased, as buyers stepped in around 0.9600 and lifted the exchange rate towards Monday’s daily high at 0.9660. Nevertheless, since June, the USD/CHF has been range-bound within the 0.9500-0.9900 area, so a break above the 50-DMA at 0.9698 would put in play a move towards the July 18 high at 0.9789 before challenging the 0.9900 mark.

USD/CHF 1-hour chart

The USD/CHF is still neutral-to-downward biased, with the hourly SMAs residing above the exchange rate. Oscillators, although showing positive readings, the RSI is about to cross under its 7-period SMA, which would open the door for further losses. USD/CHF traders should be aware that a bearish-flag formed, which once broken to the downside, would pave the way for a break below 0.9600.

If that scenario is about to play out, the USD/CHF first support would be the daily pivot at 0.9640. A breach of the latter would immediately expose the bottom trendline of the bearish flag. Once cleared, the next support would be 0.9600. A decisive break would expose the bearish-flag target around the 0.9575-80 area.

USD/CHF Key Technical Levels

- A combination of factors weighed on the JPY and assisted USD/JPY to gain traction on Monday.

- The widening US-Japan yield differential, the risk-on impulse undermined the safe-haven JPY.

- The USD languished near a two-week low and capped gains as the focus remains on the FOMC.

The USD/JPY pair attracted some buying near the 136.00 mark on the first day of a new week and reversed a part of Friday's losses to a two-week low. The pair, for now, seems to have snapped a two-day losing streak, though the intraday uptick lacked bullish conviction.

A goodish recovery in the global risk sentiment - as depicted by an intraday rally in the equity markets - undermined the safe-haven Japanese yen. The risk-on flow pushed the US Treasury bond yields higher and widened the US-Japan rate differential. This was seen as another factor that weighed on the JPY and extended some support to the USD/JPY pair.

That said, the emergence of fresh US dollar selling held back bulls from placing aggressive bets and kept a lid on any meaningful gains for the USD/JPY pair. The USD struggled to capitalize/preserve its modest intraday gains and languished near its lowest level since July 5, which, in turn, was seen as a key factor that acted as a headwind for spot prices.

The USD downfall, however, remained limited, at least for the time being, amid bets that the Fed would hike interest rates by another 75 bps at the end of a two-day meeting on Wednesday. In contrast, the Bank of Japan stuck to its ultra-easy policy settings last week and reiterated its commitment to continue buying the Japanese Government Bonds (JGB).

The big divergence in the monetary policy stance adopted by the two major central banks favours bullish trades and supports prospects for a further near-term appreciating move for the USD/JPY pair. Hence, any meaningful pullback might still be seen as a buying opportunity and is more likely to be short-lived ahead of the key central bank event risk.

Technical levels to watch

- EUR/USD reverses the initial pullback to 1.0180.

- ECB’s Kazaks favoured a “significant” hike in September.

- Germany’s Business Climate surprised to the downside in July.

The single currency regains composure and pushes EUR/USD back to the upper end of the familiar range near 1.0260 on Monday.

EUR/USD bid on USD-selling

EUR/USD extends the choppy performance so far at the beginning of the week amidst the continuation of the corrective downside in the greenback, which prompts the US Dollar Index (DXY) to retreat for the third session in a row.

The upbeat mood in the pair looks also underpinned by comments from ECB’s Board member Kazaks, who seemed to share the view of 150 bps rate hikes by June, at the time when he also advocated for a “significant” hike at the September event.

No reaction in the FX space after the German Business Climate measured by the IFO Institute grinded lower to 88.6 in July. In addition, IFO officials said the German economy remains close to a recession, a view fueled by high energy prices and potential shortages of gas in the next months. The same source added that companies see further deterioration in the index in the upcoming months.

In the US calendar, the Chicago Fed National Activity Index stayed unchanged at -0.19 in June, while the Dallas Fed Manufacturing Index is due later.

What to look for around EUR

EUR/USD managed to put further distance from sub-parity levels seen earlier in the month and approached the 1.0300 neighbourhood during last week.

The pair now looks side-lined as market participants continue to gauge the latest ECB announcements and appear cautious ahead of the upcoming FOMC event on Wednesday.

In the meantime, the price action around the European currency closely follows increasing speculation of a probable recession in the euro area, dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

Key events in the euro area this week: Germany IFO Business Climate (Monday) – Germany GfK Consumer Confidence (Wednesday) – EMU Final Consumer Confidence, Economic Sentiment, Germany Flash Inflation Rate (Thursday) – Germany Unemployment Change, Unemployment Rate, Flash Q2 GDP, EMU Flash Inflation Rate, Advanced Q2 GDP (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Effervescence around Italian politics following Draghi’s exit. Fragmentation risks amidst the ECB’s normalization of monetary conditions. Performance of the economic recovery post-pandemic in the region. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is gaining 0.25% at 1.0239 and a breakout of 1.0278 (weekly high July 21) would target 1.0452 (55-day SMA) en route to 1.0615 (weekly high June 27). On the flip side, immediate contention emerges at 1.0129 (low July 22) seconded by 0.9952 (2022 low July 14) and finally 0.9859 (low December 2002).

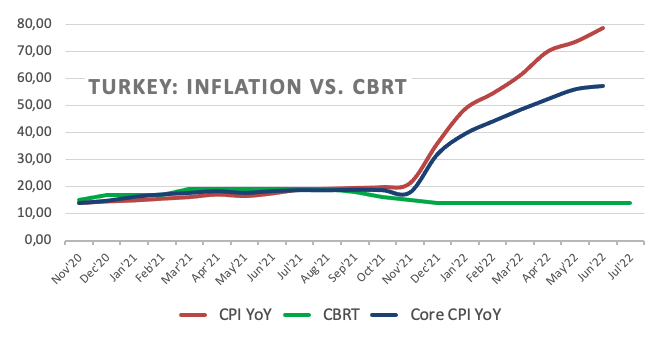

- USD/TRY starts the week on a positive note and approaches 18.00.

- Lack of investors’ confidence and rampant inflation weigh on the lira.

- Türkiye Capacity Utilization improved to 78.2% in July.

The selling pressure continues to hurt the Turkish lira and lifts USD/TRY to fresh 2022 highs around 17/85, an area last visited in December 2021.

USD/TRY now targets 18.00 and above

USD/TRY advances for the sixth consecutive session on Monday and gradually approaches the 18.00 neighbourhood, as market participants remain biased towards selling the lira in the current context of elevated inflation and the utter absence of any reaction from both the government and the Turkish central bank (CBRT).

The central bank once again left the One-Week Repo Rate unchanged at 14.00% at its meeting last week despite consumer prices rose nearly 80% in the year to June. Furthermore, the CBRT refrained from acting on rates since it cut the policy rate to 14% at the December 2021 meeting.

In the domestic calendar, Capacity Utilization ticked higher to 78.2% in July (from 77.6%) and Manufacturing Confidence eased to 103.7 also in July (from 106.4).

What to look for around TRY

The upside bias in USD/TRY remains unchanged and stays on course to revisit the key 18.00 zone. It is worth noting that the pair closed with gains in all the months so far this year.

In the meantime, the lira’s price action is expected to keep gyrating around the performance of energy prices, which appear directly correlated to developments from the war in Ukraine, the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent. In addition, there seems to be no Plan B to attract foreign currency in a context where the country’s FX reserves dwindle by the day.

Key events in Türkiye this week: Capacity Utilization, Manufacturing Confidence (Monday) – Economic Confidence Index (Thursday) – Trade Balance (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.73% at 17.8395 and faces the immediate target at 17.8436 (2022 high July 25) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.1903 (weekly low July 15) would pave the way for 16.7486 (55-day SMA) and finally 16.0365 (monthly low June 27).

“The collapse in the Ifo business climate (88.6 after 92.2) primarily reflects German companies' fear of a gas crisis. Like the purchasing managers' index, the Ifo business climate now clearly points to a downturn in the German economy”, notes Dr. Jörg Krämer, Chief Economist at Commerzbank Research in the latest Economic Briefing published on Monday.

Key Quotes:

“After Nord Stream 1 maintenance, Russia has resumed deliveries at 40% of the maximum pipeline volume. But Putin might reduce gas deliveries again sooner or later. Because that way he could make voters and politicians nervous so that they stop supporting Ukraine militarily and it becomes less difficult for Russia to prevail militarily.”

“Beyond all the uncertainty, massively increased energy prices are already a reality for German companies. According to a survey by the DIHK business association, 16% of the manufacturing companies surveyed said they were responding to higher energy prices by scaling back their production or partially abandoning business segments.”

“Due to the extensive interest rate hikes in the USA, we expect the US economy to fall into recession in the first half of next year. If the economy of this important German trading partner shrinks, this will have a negative impact on companies in this country.”

“All in all, the German economy is probably already in a downturn. Unfortunately, how bad things end up is primarily in Putin's hands. If there were a complete halt to gas supplies, a deep recession would be inevitable.”

- A combination of factors prompted aggressive intraday selling around USD/CAD on Monday.

- Rebounding crude oil prices underpinned the loonie and exerted pressure amid a weaker USD.

- Recession fears could cap oil prices and limit the USD losses ahead of the key FOMC decision.

The USD/CAD pair witnessed an intraday turnaround from a multi-day high touched earlier this Monday and has now retreated nearly 100 pips from the vicinity of mid-1.2900s. The pair maintained its offered tone heading into the North American session and was last seen flirting with the 50-day SMA, around the 1.2855-1.2850 region.

A goodish recovery in the global risk sentiment - as depicted by a strong intraday rally in the equity markets - weighed on the safe-haven US dollar. In fact, the USD Index languished near its lowest level since July 5 touched on Friday, which, in turn, was seen as another factor that acted as a headwind for the USD/CAD pair on Monday.

A weaker USD, along with a positive tone, assisted crude oil prices to rebound over 4% from a one-week low touched earlier this Monday. This, in turn, underpinned the commodity-linked loonie and exerted additional downward pressure on the USD/CAD pair. That said, a combination of factors could help limit losses for spot prices.

Investors remain worried that a more aggressive tightening by major central banks could limit economic activity and pose challenges to global growth. This, along with the imposition of strict COVID-19 controls in China, has raised concerns about the fuel demand outlook and should cap gains for the black liquid.

Traders might also refrain from placing aggressive directional bets and prefer to wait on the sidelines ahead of the crucial FOMC monetary policy decision, scheduled to be announced on Wednesday. The Fed is widely expected to hike interest rates by 75 bps and hence, the focus would be on fresh clues about the future policy tightening path.

Market participants this week will also keep a close eye on important US macro data. A rather busy week kicks off with the release of the Conference Board's US Consumer Confidence Index on Tuesday. This, along with the Advance US Q2 GDP report on Thursday, will influence the USD and help determine the near-term trajectory for the USD/JPY pair.

Technical levels to watch

- GBP/USD jumped to a fresh multi-week high amid the emergence of fresh USD selling.

- A positive intraday turnaround in the risk sentiment weighed on the safe-haven buck.

- Brexit woes might cap gains for the British pound ahead of the crucial FOMC decision.

The GBP/USD pair attracted some dip-buying near the 1.1960 area on Monday and shot to a nearly three-week peak during the mid-European session. The pair was last seen trading around the 1.2065-1.2070 region, up over 0.50% for the day.

Friday's better-than-expected flash UK PMI prints reaffirmed market bets for a 50 bps rate hike by the Bank of England in August and continued acting as a tailwind for the British pound. On the other hand, a positive turnaround in the global risk sentiment - as depicted by a strong intraday rally in the equity markets - weighed on the safe-haven US dollar. In fact, the USD Index languished near its lowest level since July 5 touched on Friday, which, in turn, was seen as another factor that provided a goodish lift to the GBP/USD pair.

That said, growing concerns about a global economic downturn could keep a lid on any optimistic move in the markets. Apart from this, a goodish rebound in the US Treasury bond yields could offer support to the safe-haven greenback. Investors also remain worried that the UK government's controversial Northern Ireland Protocol Bill could trigger a trade war with the European Union amid the ongoing cost-of-living crisis. This could act as a headwind for sterling and further contribute to capping any meaningful upside for the GBP/USD pair.

Investors might also be reluctant to place directional bets and prefer to wait for the outcome of the crucial FOMC monetary policy meeting on Wednesday. The Fed is widely expected to hike interest rates by 75 bps, though recession fears could force the US central bank to slow the pace of its aggressive policy tightening path. This, in turn, suggests that the Fed's policy outlook would now play a key role in influencing the USD price dynamics and help investors to determine the near-term trajectory for the GBP/USD pair.

In the meantime, the broader market risk sentiment and the US bond yields would drive the USD demand amid absent relevant market moving economic releases from the US on Monday. Hence, it remains to be seen if the GBP/USD pair is able to capitalize on the positive move or meets with a fresh supply at higher levels. Nevertheless, acceptance above the 1.2045 horizontal resistance could be seen as a trigger for intraday traders and might have already set the stage for a further near-term appreciating move.

Technical levels to watch

- EUR/USD remains within a consolidative mood near 1.0250.

- Extra side-lined trade appears favoured in the near term.

EUR/USD fades the initial pessimism and refocuses on the upper end of the recent range near 1.0260.

The current consolidative mood carries the potential to extend further, at least until the FOMC meeting due later in the week. The upside should remain limited by the weekly high around 1.0280, while the low-1.0100s are expected to hold the downside for the time being.

In the meantime, the pair is expected to remain under downside pressure while below the 5-month support line around 1.0490.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0991.

EUR/USD daily chart

- DXY remains under pressure in the lower end of the range.

- Further weakness could see the post-FOMC top at 105.80 retested.

DXY extends the bearish mood and revisits the low-106.00s, where some initial support appears to have turned up so far on Monday.

Considering the ongoing price action, a break below the 106.00 zone should not be ruled out in the short-term horizon. Against that, the index carries the potential to drop further and retest the post-FOMC peak at 105.78 (June 15).

Despite the ongoing downside, the near-term outlook for DXY is seen constructive while above the 5-month support line near 103.60.

In addition, the broader bullish view remains in place while above the 200-day SMA at 99.18.

DXY daily chart

- EUR/JPY reverses three daily pullbacks and approaches 140.00.

- The 4-month resistance line in the mid-141.00s caps the upside.

EUR/JPY manages to regain some poise and flirts with the 140.00 region following three daily sessions with losses.

While below the 4-month resistance line near 141.50, further losses should remain in the pipeline and another drop to the July low at 136.85 (July 8) should not be ruled out.

In the longer run, the constructive stance in the cross remains well underpinned by the 200-day SMA at 133.56.

EUR/JPY daily chart

- AUD/USD reverses an intraday dip on Monday and climbs back closer to a one-month high.

- A positive risk tone undermines the safe-haven USD and benefits the risk-sensitive aussie.

- Traders might refrain from placing aggressive bets ahead of this week’s key data/event risks.

The AUD/USD pair attracts dip-buying near the 0.6880-0.6875 region on Monday and gains traction through the first half of the European session. The momentum lifts spot prices to the 0.6955 region in the last hour, back closer to a one-month high touched on Friday.

The US dollar struggles to preserve/capitalize on the modest intraday gains and is last seen hovering just above its lowest level since July 5. A positive turnaround in the risk sentiment undermines the safe-haven USD and offers some support to the risk-sensitive aussie.

That said, any meaningful upside still seems elusive amid worries about a global economic downturn, which should keep a lid on any optimistic moves in the markets. Investors might also refrain from placing aggressive bets and prefer to wait for this week's key data/event risk.

A rather busy week kicks off with the release of the Conference Board's US Consumer Confidence Index on Tuesday. This will be followed by Australian quarterly inflation figures on Wednesday. The focus, however, will remain on the outcome of a two-day FOMC monetary policy meeting.

The Fed is scheduled to announce its interest rate decision during the US session on Wednesday and is universally expected to hike benchmark interest rates by 75 bps. Investors, however, will look for fresh clues about the central bank's near-term policy outlook, which could play a key role in influencing the USD.

Apart from this, the Advance US Q2 GDP report on Thursday will provide a fresh impetus to the AUD/USD pair and help determine the next leg of a directional move. In the meantime, the broader market risk sentiment will be looked upon for short-term trading opportunities.

Technical levels to watch

“Rapid forex volatility is undesirable and forex must move stably reflecting fundamentals,” the Bank of Japan (BOJ) new board member Naoki Tamura said on Monday.

Further comments

He believes prices move on various factors, not just in response to monetary policy.

Negative rate policy has exerted a certain effect on the economy but there are questions on how much marginal effect the policy still has.

Japan's economy is on a recovery course but various risks exist such as covid, Ukraine war and overseas slowdown.

FX volatility affects economy, markets so BOJ could respond comprehensively, such as supporting economy with QQE, enhancing sustainability of YCC.

-

BOJ’s Tamura: Rapid FX volatility undesirable, FX must move stably reflecting fundamentals

The Bank of Japan (BOJ) newly appointed board member Hajime Takata said on Monday, the central bank will be able to keep the easy monetary policy but there are challenges.

Additional quotes

Dwindling bank margins, impact on market function are among the challenges.

Yield curve control has various impact on the economy and prices.

Need to take those into account as well when managing policy.

Current yield curve control is sustainable.

If there is a positive cycle, then easy policy exit will become focus of discussion.

Following the release of the German IFO Business Survey, the institute’s Economist Klaus Wohlrabe said that “companies expect significant deterioration in business in coming months.”

Additional quotes

High energy prices and gas shortages weigh on the economy.

Germany is on brink of recession.

In services sector, business climate has deteriorated significantly.

In the manufacturing sector, index fell sharply; pessimism about months ahead has reached its highest level since April 2020.

German economy is facing uncomfortable times.

Uncertainty among companies has increased significantly; they find it difficult to assess the future.

-

EUR/USD Weekly Forecast: All eyes on the Fed´s upcoming decision

- German IFO Business Climate Index came in at 88.6 in July.

- IFO Current Economic Assessment for Germany dropped to 97.7 this month.

- July German IFO Expectations Index arrived at 80.3, missing estimates.

The headline German IFO Business Climate Index plunged to 88.6 in July versus last month's 92.2 and the consensus estimates of 90.5.

Meanwhile, the Current Economic Assessment dropped to 97.7 points in the reported month as compared to June's 99.4 and 98.2 anticipated.

The IFO Expectations Index – indicating firms’ projections for the next six months, fell sharply to 80.3 in July from the previous month’s 85.5 reading and the market forecast of 83.0.

Market reaction

EUR/USD remains unfazed by the downbeat German IFO survey. At the time of writing, the pair is trading at 1.0194, down 0.14% on the day.

About German IFO

The headline IFO business climate index was rebased and recalibrated in April after the IFO research Institute changed series from the base year of 2000 to the base year of 2005 as of May 2011 and then changed series to include services as of April 2018. The survey now includes 9,000 monthly survey responses from firms in the manufacturing, service sector, trade and construction.

- GBP/USD bulls are yielding into bearish control below 1.2000.

- UK political jitters and recession fears weigh down on the spot.