- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-07-2022

- Silver remains firmer inside a three-day-old symmetrical triangle.

- Firmer RSI, sustained trading above 50-HMA favor buyers.

- A two-week-old triangle formation adds to the trading filters.

Silver (XAG/USD) picks up bids to extend the previous day’s run-up towards the $19.00 during Wednesday’s Asian session, around $18.67 by the press time.

In doing so, the bright metal justifies the upside break of the 50-HMA amid firmer RSI (14), not overbought, inside an immediate triangle formation established since Monday.

That said, the quote’s further upside aim for the stated triangle’s resistance line, at $18.70 at the latest.

Should the XAG/USD cross the $18.70 hurdle, a two-week-old descending trend line near $18.85, will challenge the metal buyers before giving them control. It’s worth noting that the $19.00 may act as an extra challenge for the bulls.

On the contrary, the 50-HMA adds strength to the nearby triangle’s support at $18.55 and restricts the quote’s short-term downside.

Also acting as the key challenge for the XAG/USD bears is an upward sloping trend line from July 13, at $18.34 by the press time.

To sum up, silver consolidates recent losses inside a short-term triangle. However, the metal’s further upside appears limited unless crossing the $18.85 hurdle.

Silver: Hourly chart

Trend: Further upside expected

- US Dollar Index grinds higher after rising the most in 12-days the previous day.

- Risk-aversion wave joins hawkish expectations from the Fed to underpin USD dollar demand.

- Equities, yield curve also contribute to the DXY’s strength amid mixed data, Eurozone recession fears.

- US Durable Goods Orders also become important to watch, Fed is the key.

US Dollar Index (DXY) seesaws around 107.25 during Wednesday’s Asian session, after posting the biggest daily jump in a fortnight the previous day. The greenback’s run-up could be linked to the escalated risk-off mood, as well as cautious sentiment ahead of the Federal Open Market Committee (FOMC) meeting. It’s worth noting that the recently mixed US data also contributes to the DXY strength of late.

Fears of recession intensified after the International Monetary Fund (IMF) cut its global growth forecast (once again) this year, to 2.9% from 3.6% forecast in April. The Washington-based organization also raised concerns over more economic hardships amid a full cut-off of Russian gas to Europe and a 30% drop in Russian oil exports, both of which are looming.

It should be noted that the disappointing results from the global retailer Walmart also contributed to the recession fears. Furthermore, the widening difference between the 2-year and the 10-year bond coupons, recently to the most since the year 2000, also portrayed the traders’ rush to the risk-aversion.

Talking about the data, the US CB Consumer Confidence fell for a third consecutive month in July, to 95.7 from 98.4 prior. Further, the US New Home Sales dropped to 0.59M for June versus 0.66M expected and 0.642M previous readout. On the same line, Richmond Fed Manufacturing Index rose to the highest level since April, to 0 from -13 expected and -9 prior (revised up from -11).

Amid these plays, Wall Street closed in the red but the S&P 500 Futures prints mild gains amid the pre-Fed consolidation, not to forget recent hopes of Sino-American peace as US President Joe Biden prepares to talk to China amid deteriorating relations.

That said, the US Dollar Index is likely to witness the pre-Fed inaction while the US Durable Goods Orders for June, -a 0.4% forecast compared to 0.8% prior, could try to entertain traders. It’s worth observing that the US central bank is expected to announce 75 basis points (bps) of a rate hike but some of the traders also highlight the case for the 100 bps move, making the event more interesting amid recession fears.

Also read: Fed Preview: Powell to reignite dollar rally with promise to crush inflation, whatever the cost

Technical analysis

A two-month-old ascending trend line defends DXY bulls unless the quote drops below 106.30. The recovery moves, however, need validation from 107.50. Given the quote's successful trading beyond the short-term key support line, as well as firmer RSI and bullish MACD, the US Dollar is expected to stretch the latest run-up.

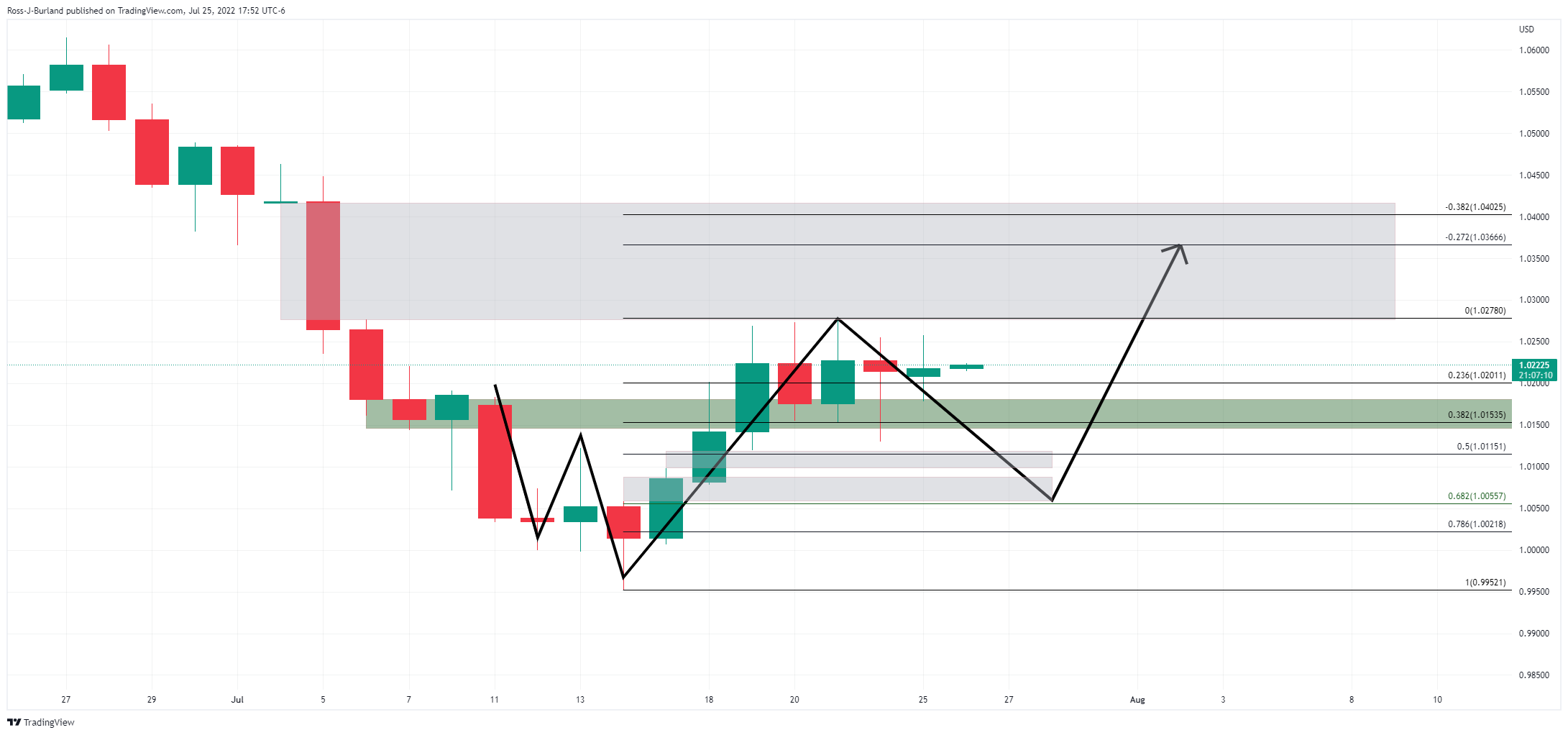

- USD/CAD bulls take control into the mid point of the broadening formation on the 4-hour time frame.

- The markets will be looking to the Fed for direction at this juncture.

USD/CAD is flat for the session so far in Asia ahead of the Tokyo open. The price has been moving higher over the course of the past few session mitigating some of the imbalance in price left behind from the prior sell-of. However, the focus is now on the Federal Reserve interest rate decision today.

The two-day Federal Open Market Committee started on Tuesday with the central bank widely expected to hike rates 75 bp to 2.50%. WIRP suggests only around 15% odds of a 100 bp move. ''With the recent weakness in the data, there is simply no need to go bigger this week,'' analysts at Brown Brothers Harriman argued.

''Updated macro forecasts and Dot Plots won’t come until the September meeting. Another 75 bp hike on September 21 is about 50% priced in. A 25 bp hike is fully priced in for November 2 but after that, one last 25 bp hike is only partially priced in. The swaps market paints a similar picture, with 175 of tightening priced in over the next 6 months that would see the policy rate peak near 3.5%. After that, an easing cycle is priced in for the subsequent 6 months.''

Fed Chair Jerome Powell may well also retain optionality by leaving the door open to additional 75bp rate increases and investors will be keeping a close eye on the Fed's forward guidance.

''Yes, the US economic data have been weakening but we do not think a recession is imminent,'' the analysts at BBH said. ''When all is said and done, we believe the US economy remains the most resilient. However, we expect a period of consolidation ahead for the dollar until the US economic outlook becomes clearer.'' Additionally, there is a high bar to compel directional USD moves with at least 75bps priced in already. ''The potential for more hikes is likely to keep an upward bias on front end rates and the curve flatter,'' analysts at TD Securities argued.

USD/CAD technical analysis

In the prior analysis, USD/CAD Price Analysis: Bears are moving in with eyes on a test of 1.2800, the broadening formation was identified as follows:

Since the analysis, the price has moved in on the midpoint of the range:

At this juncture, the bulls could move in from a discount if the price continues to correct the latest bullish impulse and in a continuation towards the mitigation of the price imbalance above en route to the upper end of the broadening formaiton.

- USD/JPY is likely to deliver more gains after surpassing the critical hurdle of 137.00.

- A rate hike announcement by the Fed will escalate the Fed-BOJ policy divergence.

- A significant drop in Walmart earnings and US Consumer Confidence indicate weaker retail demand.

The USD/JPY pair is displaying a subdued performance in the early Tokyo session after a perpendicular upside move on Tuesday. The asset remained in the grip of bulls as the announcement of interest rate decision by the Federal Reserve (Fed) will escalate the Fed-Bank of Japan (BOJ) policy divergence further. Broadly, the asset is extremely strong and is likely to deliver more gains after overstepping the critical hurdle of 137.00.

As per the market consensus, the Fed will paddle up the cost of capital by 75 basis points (bps). The laborious job of Fed policymakers to trim demand by elevating interest rates and to elevate supply for restoration of modest prices without dragging the economy into recession is getting heated now. Retail demand has taken the bullet as the US Consumer Confidence has dropped to lowest since February 2021 to 95.7 and giant retail-chain operator Walmart has reported weak earnings.

Meanwhile, the US dollar index (DXY) has established above the immediate hurdle of 107.00 and is likely to extend gains on hawkish Fed policy. Apart from the Fed policy, the release of the US Durable Goods Orders will remain in focus. The economic data is seen plunging to -0.2% from the prior release of 0.8%. A slippage in the aforementioned economic data indicates that the overall demand in the US economy is currently dominated by higher energy and food bills.

On the Tokyo front, the continuation of an ultra-loose monetary policy by the BOJ will keep the yen bulls in the negative trajectory. No doubt, the weaken yen has resulted into a significant increase in exports and eventually contributing meaningfully into the corporate earnings. But, for a long-term prospective, weaker yen may not be fruitful for the economy.

- NZD/USD picks up bids to pare the biggest daily loss in two weeks.

- Downside break of a fortnight-old ascending trend line, RSI retreat joins easing bullish bias of MACD to favor sellers.

- Bulls need to cross 0.6280 to retake control.

NZD/USD consolidates the biggest daily fall in 12 days around 0.6240 during Tuesday’s Asian session. Even so, the kiwi pair stays on the bear’s radar inside a three-month-old falling wedge bullish chart pattern.

That said, the quote’s clear downside break of the two-week-old previous support line joins the RSI (14) retreat and recently easy MACD to keep sellers hopeful.

During the NZD/USD pair’s further weakness, the 21-DMA surrounding 0.6195 could restrict the short-term declines, a break of which could direct the bears towards the recent multi-month low of 0.6060.

However, a downward sloping support line from mid-May, around 0.6025 by the press time, could challenge the pair sellers afterward.

Alternatively, the support-turned-resistance line, around 0.6260, guards the quote’s immediate upside ahead of the stated wedge’s resistance line, at 0.6280 at the latest.

In a case where NZD/USD remains firmer past 0.6280, it confirms the falling wedge bullish chart pattern and renews the upside momentum.

It’s worth noting that the monthly peak surrounding 0.6300 and the mid-June swing high of 0.6395 could act as the checking points for the Kiwi pair buyer’s return.

NZD/USD: Daily chart

Trend: Further weakness expected

- The AUD/JPY trimmed some of its Monday’s gains and formed a doji as indecision keeps traders at bay.

- From a long-term perspective, the AUD/JPY is neutral biased.

- In the near term, the AUD/JPY is neutral-upwards and might aim towards the 95.70s area.

The AUD/JPY remained in a choppy trading session, courtesy of a dampened market mood, which increased appetite for safe-haven peers like the Japanese yen, while the Australian dollar awaits crucial data, with inflation figures about to be released on Wednesday, around 01:30 GMT. Nevertheless, the AUD/JPY still recorded minimal losses of 0.07%, but as the Asian session opens, it is trading at 95.08.

AUD/JPY Price Analysis: Technical Outlook

The AUD/JPY daily chart illustrates that Tuesday’s price action formed a dragonfly-doji, meaning buyers/sellers are unsure about the pair’s direction. Helped by the daily moving averages, the AUD/JPY is upward biased, but the uptrend appears to be losing steam, as buyers have been unable to challenge the YTD highs of around 96.88 since June 9. Contrarily, sellers have stepped in and recorded a correction of 5.63% from YTD highs, but the cross-currency aimed towards the 95.00 area and has been unable to crack below July 1 low at 91.42. Hence, the AUD/JPY is neutral biased.

AUD/JPY 1-hour chart

In the near term, the AUD/JPY is also neutral biased. Nevertheless, due to recent price action, it is slightly tilted to the upside, supported by the hourly EMAs, lying below the exchange rate. Besides, the Relative Strength Index (RSI) is in bullish territory and aiming higher, signaling buyers’ momentum is increasing.

Therefore, the AUD/JPY first resistance would be the confluence of the July 26 high and the R1 daily pivot point around 95.27-35. Once cleared, the AUD/JPY’s next resistance would be the July 21 daily high and the R2 pivot at 95.60, followed by the July 20 high at 95.76.

AUD/JPY Key Technical Levels

- AUD/NZD is aiming to recapture a six-week high at 1.1168 on higher estimates of Australian CPI.

- Australian inflation for Q2CY22 is seen higher at 6.2% vs. 5.1% reported earlier.

- The RBNZ will measure the performance of its monetary policy decisions through economic parameters.

The AUD/NZD pair is advancing sharply to recapture a six-week high at 1.1168 as a higher consensus for Australian Inflation will compel the Reserve Bank of Australia (RBA) to tighten its policy further. On a broader note, the cross has displayed a sheer upside move after a corrective move to Monday’s low at 1.1053.

In the early Tokyo session, investors have turned sidelines as the extent of the jump in the inflation rate will demonstrate a clear picture of the economic situation and the headwinds the households are facing due to price pressures.

As per the market consensus, the Australian Consumer Price Index (CPI) for the second quarter of CY2022 is seen at 6.2%, higher than the prior release of 5.1%. No doubt, the price pressures are hurting the paychecks of households in Australia and the overall demand would be going through a tough phase. To combat the sky-rocketing inflation rate, the RBA has already elevated its Official Cash Rate (OCR) by a consecutive 50 basis points (bps). Officially, the RBA’s OCR has been elevated to 1.35%.

On the kiwi front, Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr said on Tuesday that it is undertaking a review of its recent performance in conducting monetary policy, as per Reuters. The central bank will scrutiny the condition of inflation and employment catalysts, which will help them to identify the performance of the monetary policy decisions.

- USD/CHF remains pressured after recalling the bears the previous day.

- Market sentiment deteriorates amid recession fears, pre-Fed anxiety.

- Fed is expected to announce 75 bps rate hike, Powell’s speech will be important.

- Swiss ZEW Survey data, US Durable Goods Orders are additional catalysts to watch for fresh impulse.

USD/CHF remains on the back foot around 0.9625-20 during Tuesday’s Asian session, following the seller’s re-entry from 0.9667 the previous day. Despite the broad US dollar strength, the pair manages to stay heavy due to the Swiss Franc’s (CHF) safe-haven nature.

The US dollar cheered the risk-off mood on Tuesday, after a dismal start to the week, as the market’s fears of economic slowdown joined the cautious mood ahead of the Federal Open Market Committee (FOMC) meeting.

The fears of economic slowdown intensified after the International Monetary Fund (IMF) cut its global growth forecast (once again) this year, to 2.9% from 3.6% forecasted in April. The Washington-based organization also raised concerns over more economic hardships amid a full cut-off of Russian gas to Europe and a 30% drop in Russian oil exports, both of which are looming. It should be noted that the disappointing results from the global retailer Walmart also contributed to the recession fears.

Elsewhere, the US CB Consumer Confidence fell for a third consecutive month in July, to 95.7 from 98.4 prior. Further, the US New Home Sales dropped to 0.59M for June versus 0.66M expected and 0.642M previous readout. On the same line, Richmond Fed Manufacturing Index rose to the highest level since April, to 0 from -13 expected and -9 prior (revised up from -11).

It should be noted that worsening US-China relation, recently over the South China Sea issue, also pushes US President Joe Biden to arrange a virtual meeting with his Chinese counterpart Xi Jinping, on Thursday. The same adds strength to the risk-off mood.

While portraying the mood, Wall Street closed in the red and the US Treasury yields remain mostly pressured. However, the difference between the 2-year and the 10-year bond coupons widened the most since the year 2000 and highlighted the rush towards risk-safety.

Looking forward, Switzerland’s ZEW Survey – Expectations for July, expected -81.6 versus -72.7 prior, will precede the US Durable Goods Orders for June, -0.4% forecast compared to 0.8% prior, to entertain USD/CHF traders. However, major attention will be given to the Fed’s ability to tame the inflation woes and also avoid the recession.

The US central bank is expected to announce 75 basis points (bps) of a rate hike but some of the traders also highlight the case for the 100 bps move, making the event more interesting.

Also read: Fed Preview: Powell to reignite dollar rally with promise to crush inflation, whatever the cost

Technical analysis

The 100-DMA and an upward sloping trend line from March 31, respectively around 0.9610 and 0.9590, appear tough nuts to crack for the USD/CHF bears. Recovery moves, however, need validation from a convergence of the 21-DMA and the 50-DMA, near 0.9700 by the press time.

That said, USD/CHF bears keep reins amid downbeat MACD signals and mostly steady RSI (14).

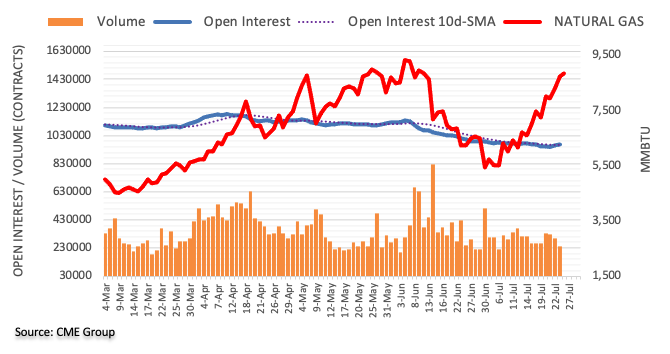

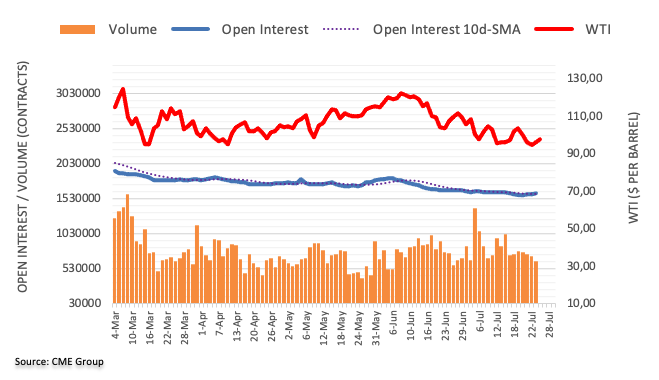

- The US crude oil benchmark lost some 0.83% on Tuesday, weighed by oil’s news aiming to increase supply.

- Sentiment shifted sour, augmenting appetite for safe-haven assets to the detriment of commodity prices.

- According to the Department of Treasure, previous releases from SPR and foreign partners brought gasoline prices down by “40 cents per gallon.”

The US crude oil benchmark, WTI, slides for the first time in the week, down some 0.83%, and is trading at $95.58 BPD at the time of writing. A risk-off mood, dented appetite for the black gold. US companies reporting earnings, and one of the biggest US retailers, blaming high inflation as one of the factors that spurred a slash in profits, kept investors on their toes.

WTI falls on recession fears as the WH taps the SPR reserves

Alongside the abovementioned, on Monday, prices spiked on news that Russia’s Gazprom slashed natural gas flows to Europe from 40 to 20%, as Moscow reported that the missing turbine was on its way to maintenance but had not been installed. WTI reacted upwards to the announcement and closed around $96.26 BPD.

Sources cited by Reuters said, “The announcement revived fears that Russia, despite its cynical denial, will not shy away from using its energy as a weapon in order to gain concessions in its war against Ukraine and ... could probably expect short-term success.”

On Tuesday, earlier in the North American session, EU countries agreed to reduce gas use for the following winter, which was cheered by oil bears, further pushing prices lower. Furthermore, the White House (WH) announced it would sell 20 million barrels from the Strategic Petroleum Reserve. The WH said it would repurchase oil “in future years, likely after 2023.”

Linked to the previously mentioned, the Department of Treasure said that the previous releases from the SPR, alongside releases of crude oil from foreign partners, helped reduce gasoline prices by “about 40 cents per gallon.”

WTI Daily chart

WTI Key Technical Levels

- The upward-sloping trendline from 1.1760 has acted as a major cushion for the asset.

- Pound bulls have comfortable defended the 200-EMA at 1.1990.

- A decisive break of 60.00 by the RSI (14) will trigger the upside momentum.

The GBP/USD pair is auctioning in a tight range of 1.2016-1.2042 from the late New York session as investors’ focus has shifted to the interest rate decision by the Federal Reserve (Fed). The cable has turned sideways after a responsive buying action to near Monday’s low at 1.1960. A responsive buying action indicates upbeat liquidity channelization after the market participants find the asset a value bet.

The cable is firmly marching towards the three-week high at around 1.2100 after sensing an offers absorbing structure around the upward-sloping trendline plotted from July 14 low at 1.1760.

Also, the pound bulls have comfortably defended the 200-period Exponential Moving Average (EMA) at 1.1990, which signals the strength of the asset. Meanwhile, the cable has reclaimed the 50-EMA at 1.2025, which signals that the short-term term is positive now.

The Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, which seeks a potential trigger. A decisive break of 60.00 will trigger the upside momentum.

An upside break of Tuesday’s average price at 1.2054 will drive the asset to a three-month high at around 1.2100. A breach of the latter will expand the upside potential of the cable to July 4 high at 1.2165.

On the flip side, the greenback bulls may make a comeback if the asset drops below Monday’s low at 1.1960. An occurrence of the same will drag the asset towards Friday’s low at 1.1916 followed by July 13 low at 1.1828.

GBP/USD hourly chart

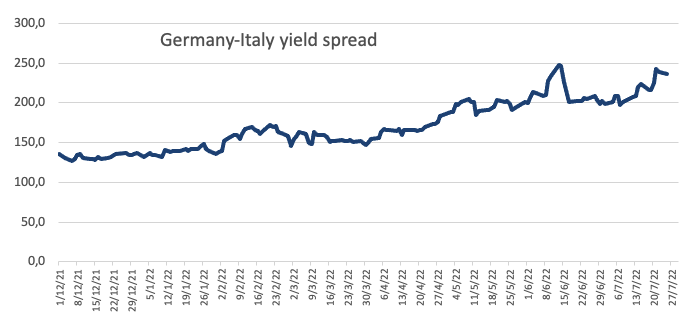

- EUR/USD pares the biggest daily loss in two weeks.

- IMF’s economic forecasts highlight fears of recession in the bloc due to energy crisis.

- US Durable Goods Orders, housing data could entertain traders ahead of FOMC.

- Fed is expected to announce a 0.75 bps rate hike, Powell’s speech will be crucial.

EUR/USD licks its wounds around 1.0125-30 as bears take a breather after the biggest daily slump in 12 days. The quote dropped the most in two weeks amid escalated fears of economic slowdown in the old continent, mainly due to the Russia-linked energy crisis. Also weighing on the pair could be the US dollar’s run-up ahead of today’s US Durable Goods Orders for June and the Federal Open Market Committee (FOMC) meeting.

The European policymakers have a plan to tame the energy consumption during the next six months and avail additional sources to battle reduced gas supplies from Moscow. However, there isn’t any immediate solution to the energy crisis that pushes the old continent towards recession.

It’s worth noting that the International Monetary Fund (IMF) cut the global growth forecast once again this year, from 3.6% in their April review to 2.9%. The Washington-based organization also highlights a scenario of more economic hardships amid a full cut-off of Russian gas to Europe and 30% drop in Russian oil exports. Not only the IMF, but the global rating agency Moody’s also raised concerns over the bloc’s economic health considering the latest problems over the Russian gas supplies to Europe.

On a different page, global retail benchmark Walmart’s disappointing results and downbeat profit forecasts also weigh on the market sentiment.

In the case of data, the US CB Consumer Confidence fell for a third consecutive month in July, to 95.7 from 98.4 prior. Further, the US New Home Sales dropped to 0.59M for June versus 0.66M expected and 0.642M previous readout. On the same line, Richmond Fed Manufacturing Index rose to the highest level since April, to 0 from -13 expected and -9 prior (revised up from -11).

Against this backdrop, equities closed in the red and the US Treasury yields remain mostly pressured. However, the difference between the 2-year and the 10-year bond coupons widened the most since the year 2000 and highlighted the rush towards risk-safety.

Looking forward, EUR/USD may witness a lackluster session ahead of the Fed’s monetary policy meeting announcements, which in turn raise expectations of witnessing a corrective pullback. However, the hope of 0.75% rate hike and likely hawkish comments from Fed Chair Jerome Powell could keep the pair bears hopeful.

Also read: Fed Preview: Powell to reignite dollar rally with promise to crush inflation, whatever the cost

Technical analysis

EUR/USD pair’s U-turn from the 21-DMA, around 1.0200 by the press time, directs the major currency pair towards the 1.0070-65 horizontal support area before challenging the recent multi-month low around 0.9950.

- AUD/USD keeps pullback from five-week high, sidelined of late.

- Fears of economic slowdown, concerns surrounding China weigh on sentiment.

- Equities drop, yield curve inversion widened the most since 2000.

- Australia’s Q2 CPI, FOMC Meeting will be in focus for fresh impulse.

AUD/USD remains sidelined at around 0.6940 during the initial hours of Wednesday’s Asian session, after reversing from the monthly peak the previous day. The Aussie pair’s recent moves could be linked to the market’s risk-off mood amid recession concerns. Also weighing on the quote are the fears surrounding crucial consumer China, as well as the cautious mood ahead of important Q2 Consumer Price Index (CPI) data from Australia and the Federal Open Market Committee (FOMC) meeting.

Market’s fears of economic slowdown magnified after the International Monetary Fund (IMF) cut the global growth forecast once again this year, from 3.6% in their April review to 2.9%. The Washington-based organization also cut China’s 2022 GDP growth forecast to 3.3% from 4.4% in April by citing covid-19 lockdowns and the property sector crisis. It should be noted that the disappointing results from the global retailer Walmart also contributed to the recession fears.

Elsewhere, the US criticized Beijing’s approach to the South China Sea and renewed geopolitical tussles among the world’s top two economies. On the same line were chatters that Russia is up for shutting down gas supplies to Europe.

Talking about the data, the US CB Consumer Confidence fell for a third consecutive month in July, to 95.7 from 98.4 prior. Further, the US New Home Sales dropped to 0.59M for June versus 0.66M expected and 0.642M previous readout. On the same line, Richmond Fed Manufacturing Index rose to the highest level since April, to 0 from -13 expected and -9 prior (revised up from -11).

Amid these plays, equities closed in the red and the US Treasury yields remain mostly pressured. However, the difference between the 2-year and the 10-year bond coupons widened the most since the year 2000 and highlighted the rush towards risk-safety.

Moving on, Australia’s Q2 CPI, expected 1.8% versus 2.1% prior, will be crucial for the AUD/USD traders amid the Reserve Bank of Australia’s (RBA) readiness for heavier rate hikes. Following that, the Fed’s ability to convince markets of its ability to tame inflation and still keep the growth prospects intact will be crucial to watch. That said, the US central bank is expected to announce a 0.75% rate hike.

Also read: Australian CPI Preview: Why inflation is set to exceed estimates, and where AUD/USD could go

Technical analysis

Sustained trading below the 21-DMA level surrounding 0.6850 appears necessary for the AUD/USD bears to retake control. Alternatively, a downward sloping resistance line from mid-April, near 0.6950, precedes the monthly peak of 0.6983 to restrict short-term advances of the pair. That said, MACD and RSI (14) hint at the pair’s further upside.

- Gold price is displaying a lackluster performance as investors await Fed policy for further guidance.

- Lower Consumer Confidence and weak Walmart’s earnings show indicate a slowdown in retail demand.

- The Fed will hopefully elevate its interest rates by 75 bps.

Gold price (XAU/USD) is displaying back and forth moves in a narrow range of $1,713.92-1,721.97 as investors are awaiting the announcement of the fourth consecutive interest rate decision by the Federal Reserve (Fed). The precious metal has displayed a complete volatility contraction, which indicates that now the monetary policy announcement is the only trigger that will fetch auctions in the asset.

The Fed is expected to elevate its interest rates by 75 basis points (bps). This will step up the cost of capital to 2.25-2.50%.

On Tuesday, the release of the US Consumer Confidence failed to bring a significant impact on gold prices. The economic data has decreased consecutively for a third month to 95.7 after the June figure of 98.4. Apart from that, US giant retail chain operator Walmart reported downbeat earnings.

The underperformance of Consumer Confidence and softer earnings by retail giant indicate that retail demand has been hit dramatically by soaring price pressures. No doubt, the US Retail Sales data remained upbeat after landing at 1%, higher than the expectations of 0.6% but they were highly contaminated by runaway inflation.

Gold technical analysis

On an hourly scale, the gold price is auctioning in a descending triangle pattern. The downward-sloping trendline of the volatility contraction pattern is placed from July 22 high at $1,739.37. While the horizontal support is placed from July 22 low at $1,712.94. The above-mentioned chart pattern indicates a volatility squeeze, which will be followed by an expansion in volumes and candlesticks’ range.

The gold prices are overlapping with the 50-period Exponential Moving Average (EMA) at $1,719.42, which signals a consolidation ahead.

Also, the Relative Strength Index (RSI) (14) has shifted into a 40.00-60.00 range, which signals that the asset is awaiting potential a trigger for a decisive move.

Gold hourly chart

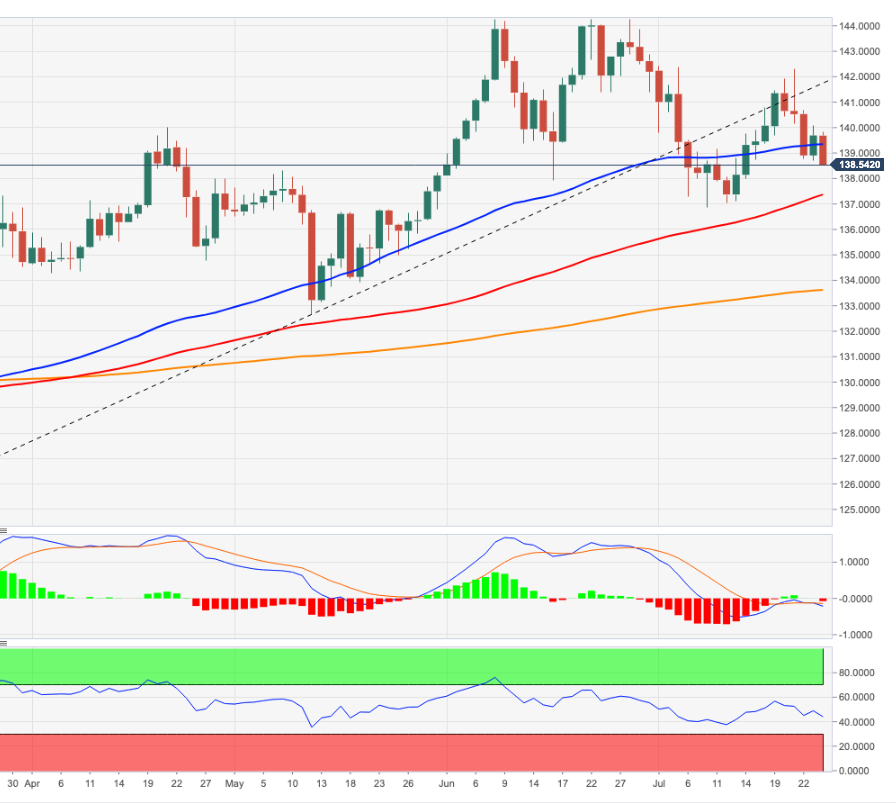

- The EUR/JPY erased Monday’s gains and is down 0.30% in the week.

- A risk-off impulse weighed on the shared currency, while safe-haven peers got bid, like the yen.

- EUR/JPY Price Analysis: In the short-term, tilted to the downside, it might break below 138.00.

The EUR/JPY tumbles from around the confluence of the 20 and 50-day EMA around 139.767-72 and breaks below the 139.00 thresholds, refreshing two-week lows around 138.13 in the mid-North American session. At 138.55, the EUR/JPY is set to finish Tuesday’s session with losses of 0.76%.

Investors’ mood shifted sour ahead of the US Federal Reserve monetary policy meeting, courtesy of US companies missing earnings, while others blame inflation and missing earnings due to currency fluctuations, which weighed on the EUR/JPY.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart depicts the pair as neutral-to-upward biased but under some selling pressure. EUR/JPY bore stepped in around the confluence of the 20 and 50-day EMA and sent the pair tripping down almost 200 pips, but once the dust settled, it bounced off to current price levels. On the downside, the EUR/JPY’s first support would be the 100-day EMA at 137.44 before giving way to sellers on its way to July’s 8 low at 136.85. Upwards, EUR/JPY buyers need to reclaim the 20 and 50-day EMA area around 139.46-80 to regain control.

EUR/JPY 1-hour chart

The EUR/JPY hourly chart depicts the pair as downward biased after opening near the daily highs at 139.61. the cross consolidated around 139.32-60 before nose-diving towards its daily low close to 138.00. However, as the Asian session began, the EUR/JPY is trading below the daily pivot, located at 138.83. If EUR/JPY buyers reclaim the July 26 low at 138.71, that will pave the way for further upside. Nevertheless, the cross-currency pair path of least resistance is downwards.

Therefore, the EUR/JPY first support would be 138.00. Break below will expose the S1 daily pivot at 137.78, followed by the July 12 low at 137.14, and then the July 8 low at 136.85.

EUR/JPY Key Technical Levels

- NZD/USD bears are looking for the 0.61 area in a 1-3 month view.

- All eyes will be on the Fed on Wednesday as the next catalyst.

At 0.6231, NZD/USD is lower by some 0.45% and has fallen from a high of 0.6280 to a low of 0.6224 on the day. The bears have been in charge during a risk-off day amid lower Us stocks and profit warnings from Walmart. Across the pond, the gas woes crippled the euro and send a bid on the US dollar.

''With more key earnings results today and the Federal Open Market Committee tomorrow, volatility is likely going to stay elevated,'' analysts at ANZ Bank said. ''Focus will be on the Fed’s language and whether it is showing any concerns around the recent spate of disappointing survey data.''

The two-day FOMC started on Tuesday and the Fed is widely expected to hike rates 75 bp to 2.50%. WIRP suggests only around 15% odds of a 100 bp move. ''With the recent weakness in the data, there is simply no need to go bigger this week,'' analysts at Brown Brothers Harriman argued.

''Updated macro forecasts and Dot Plots won’t come until the September meeting. Another 75 bp hike on September 21 is about 50% priced in. A 25 bp hike is fully priced in for November 2 but after that, one last 25 bp hike is only partially priced in. The swaps market paints a similar picture, with 175 of tightening priced in over the next 6 months that would see the policy rate peak near 3.5%. After that, an easing cycle is priced in for the subsequent 6 months.''

However, investors will be keeping a close eye on the Fed's forward guidance as it grapples with high inflation and the potential for a recession. ''Yes, the US economic data have been weakening but we do not think a recession is imminent,'' the analysts at BBH said. ''When all is said and done, we believe the US economy remains the most resilient. However, we expect a period of consolidation ahead for the dollar until the US economic outlook becomes clearer.''

Meanwhile, analysts at Rabobank said that they expect the USD to remain well bid on the back of safe haven demand despite speculation that the market may have over-estimated the extent of Fed policy tightening in the coming months.

''In our view, USD strength is likely to push NZD/USD back towards its recent lows in the 0,61 area on a 1 to 3-month view. We expect USD strength to turn around on a 6-month view allowing NZD/USD to recover to the 0.64 regions.''

What you need to take care of on Wednesday, July 27:

Risk aversion took over financial markets on Tuesday, benefiting the greenback the most. Several factors dented the market’s mood.

Germany reported that Gazprom, the Russian gas giant, is delivering pretty much 20% of its usual natural gas provision. EU countries agreed to reduce gas use for next winter, aiming to cut gas use by 15% in the upcoming six months. Meanwhile, Moscow reported that the missing turbine for the pipeline is on its way after maintenance, but it still has not been installed.

Additionally, speculative interest was paying attention to US bond yields. The yield curve is the most inverted since 2000. 2-year Treasuries are yielding 3.03%, while the 10-year note yields 2.76%. An inverted curve is usually a sign of an upcoming recession.

The International Monetary Fund (IMF) cut the global growth forecast once again this year, from 3.6% in their April review to 2.9%. The organism also warned that downside risks from overheated inflation and the Ukraine war could push the world economy to the edge of a global recession. The World Economic Outlook also showed that in the case Russia complete cut gas to Europe and a drop in the country’s oil export would slow growth further in 2023.

The EUR was again among the weakest USD rivals, with EUR/USD flirting with 1.0100. GBP/USD held above 1.2000, while the AUD/USD settled at 0.6935. The USD/CAD pair advanced amid weaker oil prices, trading near 1.2890.

Save-haven currencies saw little activity, with USD/CHF steady around 0.9620 and USD/JPY now trading at 136.75.

Spot gold remained within familiar level, although near the lower end of its latest range. The bright metal changes hands at $1,717 a troy ounce.

Crude oil prices edged lower, partially due to the dismal mood but also because of a US decision to sell additional 20 million barrels of oil from its Strategic Petroleum Reserve. The barrel of WTI finished the day trading at $94.90 a barrel.

The focus now shifts to the US Federal Reserve. The central bank is widely anticipated to hike the funds rate by 75 bps, although there is a chance of a 100 bps movement. The latter has become increasingly unlikely since the latest Fed meeting, as economic growth keeps deteriorating. Policymakers may not risk a recession to tame inflation.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Gepetto's guilty pleasure

Like this article? Help us with some feedback by answering this survey:

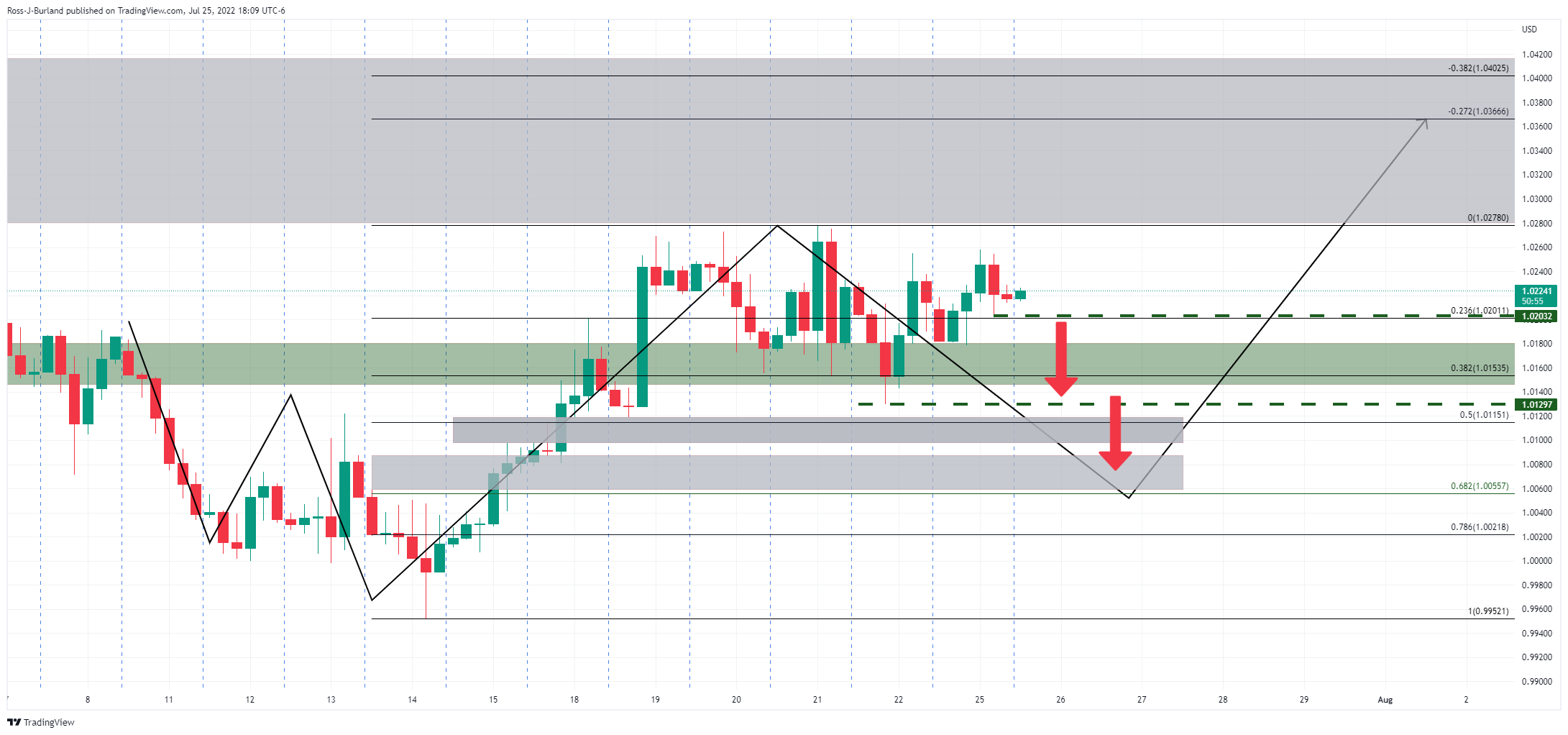

- EUR/USD bears are taking on a critical territory to the downside.

- The euro is out of favour as the US dollar picks up the safe haven flows ahead of the Fed.

At 1.0122, EUR/USD is lower on the day by some 0.90% at the time of writing, trying to establish a grounding, however, in the recent hour of the New York session. The pair has been pressured from a high of 1.0250 amid a risk-off tone stemming from both sides of the pond.

In the US, risk appetite was squashed on Wall Street. Profit warnings by Walmart and fears of an inflation-led recession in the US economy have sapped flows from stocks and sent them towards US debt instead and the US dollar. At the same time, the International Monetary Fund sliced its outlook for global growth this year which is supportive of the greenback.

Meanwhile, the euro has been hit this week by a poor business sentiment survey in Germany in the wake of the gas crisis. Eurozone growth risks have risen sharply as Russia announced another cut in natural gas shipments. On Monday, Russian energy giant Gazprom said gas flows to Germany through the Nord Stream 1 pipeline would fall to 33 million cubic metres per day from Wednesday, or half of the current flow, which was already at only 40% capacity. Subseqent Kremlin-related commentary has resulted in European Union countries approving a weakened emergency plan to curb their gas demand as they brace for further Russian reductions in supply.

Fed eyed as the next catalyst

The two-day Federal Open Market Committee starts today and the Fed is widely expected to hike rates 75 bp to 2.50%. WIRP suggests only around 15% odds of a 100 bp move. ''With the recent weakness in the data, there is simply no need to go bigger this week,'' analysts at Brown Brothers Harriman argued.

''Updated macro forecasts and Dot Plots won’t come until the September meeting. Another 75 bp hike on September 21 is about 50% priced in. A 25 bp hike is fully priced in for November 2 but after that, one last 25 bp hike is only partially priced in. The swaps market paints a similar picture, with 175 of tightening priced in over the next 6 months that would see the policy rate peak near 3.5%. After that, an easing cycle is priced in for the subsequent 6 months.''

However, investors will be keeping a close eye on the Fed's forward guidance as it grapples with high inflation and the potential for a recession. ''Yes, the US economic data have been weakening but we do not think a recession is imminent,'' the analysts at BBH said. ''When all is said and done, we believe the US economy remains the most resilient. However, we expect a period of consolidation ahead for the dollar until the US economic outlook becomes clearer.''

As for the European Central Bank, it raised all three of its main policy rates last Thursday, hiking the main refinancing rate from 0.0% to 0.5%, the marginal lending facility rate from 0.25% to 0.75%, and the deposit facility rate from -0.5% to 0.0%. This was the first rate increase in 11 years and the biggest since 2000 and surprised most economists, who had anticipated only a 25-basis-point move. However, despite the ECB’s hawkish surprise last week, the euro remains pressured due to the gas crisis which will make it difficult for the ECB to hike aggressively and can keep the euro hamstrung in the wake of a firmer US dollar.

EUR/USD technical analysis

The euro is being sent lower to the bottom of the broadening formation's lower boundary and into a price imbalance on the daily chart, as per the greyed areas between 1.0120 and 1.0058. This meets a 61.8% Fibonacci retracement of the prior bullish rally where bulls may look to step in again. On the upside, there is a significant price imbalance between 1.0276 and 1.0416 should the bulls manage to get back in control again.

- GBP/JPY barely slides 0.06% in a choppy trading session.

- Sentiment remains negative, thus putting a lid on GBP/JPY gains.

- GBP/JPY Price Analysis: Tuesday’s price action is shrinking, and a bullish-harami is forming in the daily chart, opening the door for further upside.

GBP/JPY slides and erases Monday’s gains due to downbeat market sentiment in the financial markets, triggered by US Walmart blaming inflation as the principal reason to rip its profit forecasts. Meanwhile, Russia reduced gas flows through Nord Stream 1, and EU countries agreed to use less natural gas for the next winter, reigniting recession fears in the bloc. At the time of writing, the GBP/JPY is trading at 164.39.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY is neutral-to-upward biased, and sellers’ failure on Tuesday to achieve a daily close below the 20 and 50-day EMAs at 164.05 and 163.68, respectively, opened the door for further gains. Despite the previously mentioned, buyers need to further lift the GBP/JPY exchange rate above the three-month-old upslope support trendline-now-resistance around 165.00 to cement the case for a rally to 166.00. Otherwise, GBP/JPY sellers would remain hopeful of dragging prices below 163.00 if they would like to regain control.

GBP/JPY 1-hour chart

The GBP/JPY hourly char portrays the cross-currency pair as neutral biased. On Tuesday, the pair’s price action shrank between the boundaries of Monday, meaning that a bullish-harami chart pattern is forming in the daily chart, which would open the door for further gains. Nevertheless, on its way up, the GBP/JPY’s first resistance would be the 100-hour EMA at 164.54. Break above will expose the 200-hour EMA at 164.76, followed by the July 25 daily and weekly high at 165.08.

On the flip side, the GBP/JPY first support would be the 20-day EMA at 164.39. Once cleared, the next support would be the intersection of the 20-hour EMA and the daily pivot around 164.15, followed by 164.00.

GBP/JPY Key Technical Levels

- GBP/USD bulls move in during the midday NY session.

- The price is meeting a key level of 4-hour resistance.

- Eyes will move from gas woes in Europe to the Fed for the next catalyst.

At 1.2031, GBP/USD is lower on the day by some 0.16% at the time of writing, recoupling the losses from the 1.1963 lows scored at the start of the New York session. The pair has been pressured from a high of 1.2090 amid a risk-off tone stemming from both sides of the Atlantic.

In the US, risk appetite was reigned in on Wall Street as the retail sector is weighed by profit warnings by Walmart which is re-energising the fears of an inflation-led recession in the US economy. However, US government bonds rose with the dollar as the International Monetary Fund sliced its outlook for global growth this year.

Across the pond, equally supportive of the safe haven US dollar in wake of the most recent Kremlin-related commentary, the euro has been pressured. European Union countries have approved a weakened emergency plan to curb their gas demand as they brace for further Russian reductions in supply.

Fed eyed as the next catalyst

Meanwhile, central bank reaction functions will come back to the fore as the Federal Reserve is widely expected to raise interest rates by 75 basis points on Wednesday. However, investors will be keeping a close eye on the central banks' forward guidance as it grapples with high inflation and the potential for a recession. With that being said, like most other G10 central banks, both Fed and the Bank of England have made it clear that forcing down inflation is its primary goal, even at the cost of growth.

The BoE said in June it was ready to act forcefully if needed and Governor Andrew Bailey has said a half percentage-point increase in interest rates is now on the table, as well as the typical quarter-point move. The MPC's next scheduled announcement on August 4. Nevertheless, according to a Reuters poll, 54% of respondents anticipate only a 25 basis point hike while 45% think we will see a 50 bps hike. This is in contrast to the prior hawkish sentiment being priced into the pound by markets.

GBP/USD technical analysis

As per the prior analysis, GBP/USD Price Analysis: Bulls set a medium-term target in the 1.22 area, the price has fallen to mitigate the imbalance identified in the 4-hour time frame but has since found its footing. A break of 1.2090 will now be needed to see the price continue on its northerly trajectory. First, the bulls need to clear the neckline of the 4-hour M-formation:

- The three major US equity indices plunge between 0.44% and 1.79%.

- Sentiment shifted after Walmart blamed “high inflation” as it rips its profit outlook for the second half of 2022.

- The US Dollar Index rises above 107.000, while the US 10-year T-note yield is flat at around 2.79%.

US equities slumped after jumping from YTD low levels, but a dampened market sentiment, alongside July’s Federal Reserve monetary policy decision looming, kept investors uneasy on Tuesday.

At the time of writing, the S&P 500 sits at 3,920.79, falling 1.16%, while the tech-heavy Nasdaq slumps by 1.79%, at 11,572.09, and the Dow Jones Industrial average slides 0.44% to 31,850.33

Sector-wise, the leading sectors are Health, up by 1.02%, followed by Utilities and Real Estate, each recording gains of 0.64 % and 0.25%, respectively. The biggest losers were Consumer Discretionary, Communication Services, and Technology, plummeting 3.09%, 1.88%, and 1.36% each.

Shares fell due to Walmart cutting its earnings forecast, complaining about double-digit food prices and elevated energy prices. Additionally, the US Federal Reserve monetary policy decision is looming, and Europe’s escalating energy crisis re-ignited recession fears amongst traders, which turned to safe-haven assets, namely the greenback.

The US Dollar Index (DXY), a measurement of the greenback’s value against some currencies, rallies 0.62% to 107.132, while the 10-year US Treasury yield is almost flat, yielding 2.792%.

in the commodities complex, WTI drops 1.13%, exchanging hands at $95.60 BPD. Meanwhile, precious metals like gold (XAU/USD) drop 0.11%, trading at $1717.15 a troy ounce.

SP 500 Chart

Key Technical Levels

- AUD/USD tumbles due to downbeat sentiment and a stronger greenback.

- US Consumer confidence deteriorates further, while housing data reveals that prices are slumping.

- AUD/USD Price Analysis: Neutral to downward biased, could test the 20-day EMA in the near term.

The AUD/USD slides for the first time in the week, retracing from last week’s high around 0.6983, falling below the 50-day EMA at 0.6969, amidst a dampened market mood, courtesy of US companies complaining about high prices while traders prepare for July’s FOMC meeting.

The AUD/USD is trading at 0.6935, after hitting a 0.6983 daily high, but tumbled as sentiment deteriorated during the day, reaching a daily low at 0.6921, before settling at current price levels.

AUD/USD capped by deteriorated sentiment ahead of Fed’s decision

Several factors worth mentioning weighed on market sentiment. Walmart cut its profit outlook in the year ahead and mentioned double-digit inflation in food prices as one of the reasons, dragging US equities lower. That, alongside EU countries agreeing to reduce gas consumption while Russia reduces gas flows to Europe, increased the chances of the bloc getting into a recession.

In the meantime, a light US calendar, led by the CB Consumer Confidence, dropped to its lowest level since February 2021, from 98.7 to 95.7. Lyn Franco, senior director of economic indicators at the Conference Board, said, “Concerns about inflation -- rising gas and food prices, in particular -- continued to weigh on consumers.” Furthermore, she added, “looking ahead, inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months.”

Earlier, housing data showed that prices are falling nationwide, as the Federal Housing Financial Agency revealed. Meanwhile, the Richmond Fed Manufacturing Index for July stood at 0, better than June’s -11, while the Dallas Fed Services Index in July recovered some ground to -10.9 vs. -12.4 in June.

What to watch

The Australian economic docket will feature CPI figures, awaited to increase more than the RBA’s forecast, as TDS analysts wrote. “Our headline forecast implies the peak is likely to exceed the RBA’s 7% year-end target, warranting at least a 50bps Aug policy rate hike. We see upside risks to our forecast.”

On the US front, the US economic docket will feature the Durable Good Orders, Retail Inventories, and Pending Home Sales ahead of the FOMC monetary policy decision.

AUD/USD Price Analysis: Technical outlook

The AUD/USD is neutral-to-downward biased, despite having broken the 20-day EMA. Tuesday’s price action tested the 50-day EMA but tripped down as sellers stepped in around that area, which also intersects with a four-month-old downslope trendline, acting as resistance. Hence, the AUD/USD fell, but it was capped by the Relative Strength Index (RSI) resilience to cross below its 7-day RSI’s SMA, which would trigger a selling signal that could send the AUD/USD lower.

The AUD/USD first resistance would be 0.7000. A breach of the latter could pave the way for further gains, and the target could be the 100-day EMA at 0.7130. On the other hand, if the AUD/USD resumes downwards, its first support would be 0.6900. Once cleared, the next stop would be the 20-day EMA at 0.6842.

The European Central Bank Pablo Hernández de Cos is crossing the wires and has said that there are risks to the eurozone inflation outlook that remain on the upside and have intensified, ‘, particularly in short term’.

de Cos has stated that the risks include lasting deterioration of the economy in the eurozone, and persistently high energy & food prices.

''The ECB stands ready to adjust all instruments to ensure inflation stabilises at 2% medium-term target.''

Meanwhile, the comments follow the last meeting where the ECB announced its new Transmission Protection Instrument (TPI), which will let it buy bonds from indebted countries such as Italy to cap any excessive rise in their borrowing costs, helping limit financial fragmentation within the eurozone.

At 1.1027 vs. the greenback, the euro is under pressure as the week moves along with the prospect of another Russian gas supply cut. Russia said on Monday it would cut gas flows to Germany via the Nord Stream 1 pipeline to 33 million cubic metres per day (bpd) from Wednesday. That is half of the current flow, which is already only 40% of normal capacity. Additionally, risk-off sentiment has sent a bid into the US dollar, while US equities are pulled lower following a profit warning from retail giant WalMart which said it would slash prices to reduce inventory. EUR/USD is down 0.89% at the time of writing.

- The USD/JPY is trendless as investors await the Federal Reserve monetary policy decision.

- Sentiment remains downbeat, keeping FX majors in choppy trading ranges.

- USD/JPY Price Analysis: The USD/PY is upward biased, long term, but in the near-term is range-bound.

The USD/JPY is subdued during the North American session as investors brace for the Federal Reserve monetary policy decision, to be revealed on Wednesday, with traders expecting a 75 bps rate hike to the Federal funds rate. On Tuesday, the USD/JPY reached a daily low at 136.27. But the pair edged higher and hit a daily high around 136.84 before settling around 136.64 at the time of writing.

USD/JPY Price Analysis: Technical outlook

From a technical perspective, the USD/JPY in the long term is upward biased. Nevertheless, the sudden drop below the 20-day EMA at 136.85 keep sellers hopeful of driving prices further down towards the rising-wedge target profit at 133.50. On the other hand, if USD/JPY buyers achieve a daily close above 137.00, that would keep them in play for a re-test of the YTD high at 139.38.

USD/JPY 1-hour chart

The USD/JPY hourly chart depicts the major as neutral-to-upward biased. The Relative Strength Index (RSI) is seesawing around the 50-midline, portraying the previously mentioned, as traders prepare for the Fed. If the USD/JPY breaks to the upside, the first resistance would be the R1 daily pivot at 136.98. Break above will expose the 100-hour EMA at 137.16, followed by the R2 pivot point at 137.33. On the flip side, the USD/JPY first support would be the S1 pivot point at 136.08. Once cleared, the USD/JPY could tumble towards the confluence of the July 22 low and the S2 daily pivot at 135.57.

USD/JPY Key Technical Levels

The euro will likely weaken further against the Swiss franc over the next weeks, according to anañysts at TD Securities. They consider the EUR/CHF cross could target 0.95 over the next 1-2 months, while it remains under 0.9890.

Key Quotes:

“Despite the ECB (European Central Bank) delivering a 50bp 'surprise' hike alongside an anti-fragmentation tool, the decision in totality appears to be more of a faux-flex and likely marked peak hawkishness. While adopting a "meeting by meeting" approach to rate decisions might introduce more policy optionality in the curve, it seems the ECB was reluctant to commit to being as aggressive going forward. They also seemed to confirm that more policy aggression now is borrowing from tightening in the future.”

“Data is only going to get worse from here and Germany is likely to be at the heart of it. We believe the EZ is headed for recession in H2 (unlike the ECB), so the capacity for aggressive hikes amid weak growth and an impending energy crisis is constrained. The latter will receive significant focus given shortage concerns.”

“We think the SNB (Swiss National Bank) is willing to allow FX strength to help offset import price inflation. That, alongside a more supportive current account backdrop (unlike the implosion in the EZ) allows the CHF to be used to diversify away from well-populated USD longs. Indeed, we are concerned that the USD may be on a tactical pause.”

Conference Board’s consumer confidence indicators dropped in July for the third consecutive month. According to analysts at Wells Fargo, point out high inflation, rising interest rates and volatile financial markets weighed on consumer confidence.

Key Quotes:

“The third consecutive monthly decline in consumer confidence to 95.7 in July came with somewhat unsettling developments in the details, with the present situation index falling by the most in 12 months and the expectations component hitting its lowest since 2013.”

“As optimism has faltered, so too has consumers' assessment of the labor market. The so-called labor differential, which is the difference in those reporting jobs as “plentiful” less those who report jobs as “hard to get”, slid to its lowest reading in over a year to 37.8%.”

“Most data in the July confidence report moved in the wrong direction. While lower confidence does not always lead spending lower, the recent loss of momentum doesn't bode well for consumption. It's the directional move and rate of change in confidence that is more important than the absolute level, and the overall consumer confidence index is now 12.9 points lower than where it was just three months ago. That sharp move lower may provide an added headwind to spending.”

The US Dollar is likely to remain well bid on the back of safe haven demand despite speculation that the market may have over-estimated the extent of Federal Reserve policy tightening in the coming months, warn analysts at Rabobank. They see the NZD/USD pair moving back to the 0.61 area in the short-term and then moving toward 0.64.

Key Quotes:

“The outlook for the NZD in the coming months is likely to influenced by what the RBNZ may have got right. Since the RBNZ was quick to tighten policy relative to its peers, it may reach peak interest rates ahead of other central banks. This could have negative implications for the NZD vs some of its peers.”

“In addition to higher interest rates, stuttering Chinese growth and New Zealand’s energy import needs are likely to be headwinds to growth. Imports of crude oil have stopped since refining was stopped in the Marsden refinery, and this has shifted demand to more expensive downstream products. In June petroleum and products imports reached a new high.”

“FX volatility has been heightened in recent months and we expect this to continue. We expect the USD to remain well bid on the back of safe haven demand despite speculation that the market may have over-estimated the extent of Fed policy tightening in the coming months. In our view, USD strength is likely to push NZD/USD back towards its recent lows in the 0,61 area on a 1 to 3 month view. We expect USD strength to turn around on a 6 month view allowing NZD/USD to recover to the 0.64 region. We see scope for AUD/NZD to trend higher to 1.12 in the coming months.”

- US Dollar strengthens across the board as FOMC meeting kicks off.

- Risk aversion weighs on the Canadian dollar.

- USD/CAD finds support again at the 1.2815/30 area.

The USD/CAD rebounded sharply after hitting 1.2814, the lowest level in six weeks. It printed a fresh daily high at 1.2888, boosted by a stronger US Dollar across the board.

Dollar wakes up

After falling for three consecutive days, the dollar is up across the board. It woke up the day the FOMC began its two-day meeting, amid a deterioration in market sentiment. The Fed is expected to hike rates by 75bp, as it did in June. “In doing so, the Committee would bring the policy stance to its estimate of neutral. We also look for Chair Powell to retain optionality by leaving the door open to additional 75bp rate increases”, said analysts at TD Securities.

On Wall Street the Dow Jones is falling by 0.66% and the Nasdaq is declining by 1.75%. Crude oil prices are losing more than 0.50% after being unable to hold onto gains. The DXY is up 0.65%, back above 107.00.

Technical outlook

The decline of the USD/CAD found support at 1.2815 and rebounded above 1.2850 like what happened back late in June. A daily close clearly below 1.2845 should open the doors to more losses.

The pair's rebound could point that a short-term bottom is in place. Near 1.2900 is the immediate resistance, followed by the 1.2945/50 area that also contains the 20-day moving average.

Technical levels

- Gold price remains in choppy trading conditions as investors await Fed’s 75 bps rate hike.

- US corporate earnings weigh on mood as they complain about inflation as the main reason for cutting or missing profits.

- Gold Price Forecast (XAUUSD): Downward biased but will remain sideways ahead of the FOMC meeting.

Gold price turned negative during the day, after hitting a daily high at around $1728, but so far slid amidst downbeat investors’ market mood as they brace for the July FOMC monetary policy meeting. At the time of writing, XAUUSD is trading at $1718.46, down 0.05%.

US companies complain about inflation and a higher US dollar, headwinds for gold

Several factors, like Walmart cutting its profit outlook, blamed on double-digit food prices and elevated energy prices, and the IMF cut its global growth outlook for 2022 and 2023, weighed on sentiment. Also, EU countries agreed to reduce their gas use by 15%, alongside reduced gas flows in the Nord Stream 1 pipeline, adding fuel to the already battered mood. Traders seeking safety propelled the greenback higher. The US Dollar Index, a gauge of the buck’s value vs. a basket of its peers, gains 0.54%, up at 107.060.

Global bond yields followed suit, edged higher, but pared some gains. The US 10-year benchmark note drops three bps and sits at 2.761%. Worth noting that the yield curve inversion between 2s and 10s had further deepened towards -0.253%. However, the US 3-month 10-year yield curve has bear flattened to 0.228%, about to flag recession.

In the meantime, a light US economic calendar ahead of Chair Powell and Co. meeting witnessed the release of the CB Consumer Confidence, which dropped to its lowest level since February 2021. Lyn Franco, senior director of economic indicators at the Conference Board, said American “Concerns about inflation -- rising gas and food prices, in particular -- continued to weigh on consumers.” Furthermore, she added, “looking ahead, inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months.”

At the same time, the S&P/Case-Shiller Home Price YoY for May missed expectation by 0.5%, while the US House Price Index for May, trailed April’s reading to 18.3%, lower than the 18.9%.

What to watch

On Wednesday, the US economic docket will feature the Durable Good Orders, Retail Inventories, and Pending Home Sales ahead of the FOMC monetary policy decision.

Gold Price Forecast (XAUUSD): Technical outlook

Gold price remains downward biased, despite holding above the $1700 price level. The daily EMAs above the spot price, and buyers failing to reclaim the May 16 low-turned-resistance at $1787.03, would keep the bias intact. Additionally, the Relative Strength Index (RSI) at 35.80 but aiming lower suggest the yellow metal price is skewed to the downside.

Upwards, a break above the 20-day EMA at $1741.87 would open the door for challenging $1750. On the flip side, a break below $1700 would send the precious metal towards $1681.

- EUR/USD loses further ground and approaches 1.0100.

- The greenback reverses the initial decline and surpasses 107.00.

- US CB’s Consumer Confidence came at 95.7 in July.

Sellers quickly returned to the European currency and dragged EUR/USD to fresh multi-session lows in the vicinity of 1.0100 on Tuesday.

EUR/USD offered ahead of FOMC

EUR/USD rapidly abandoned the area around 1.0250 to retreated nearly 15 cents after EU countries decided to reduce the gas consumption in the next winter, all following the decision by Russian giant Gazprom to cap the supply of gas to the old continent to around 20%.

The decision sparked recession fears in the euro area at the time when the IMF cut the growth prospects for 2023 and several major banks now see the region entering recession at some point in Q4.

Absent releases in the euro area, the US Consumer Confidence tracked by the Conference Board eased to 95.7 in July, while New Home Sales contracted 8.1% MoM in June, or .59M units. Earlier in the session, the FHFA’s House Price Index rose 1.4% in May from a month before.

What to look for around EUR

EUR/USD remains under pressure in the pre-FOMC and threatens to revisit the 1.0100 region amidst the sudden resumption of the demand for the greenback.

Renewed market chatter surrounding the likelihood of an economic slowdown in the euro area in the medium term seems to have resurfaced and weigh on the European currency ahead of the upcoming FOMC event on Wednesday.

In the meantime, the price action around the European currency closely follows increasing speculation of a probable recession in the euro area, dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

Key events in the euro area this week: Germany GfK Consumer Confidence (Wednesday) – EMU Final Consumer Confidence, Economic Sentiment, Germany Flash Inflation Rate (Thursday) – Germany Unemployment Change, Unemployment Rate, Flash Q2 GDP, EMU Flash Inflation Rate, Advanced Q2 GDP (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of monetary conditions. Performance of the economic recovery post-pandemic in the region. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is losing 0.84% at 1.0131 and faces initial contention at 1.0116 (weekly low July 26) seconded by 1.0000 (psychological level) and finally 0.9952 (2022 low July 14). On the upside, a breakout of 1.0278 (weekly high July 21) would target 1.0446 (55-day SMA) en route to 1.0615 (weekly high June 27).

“Ukraine and Russia signed two separate agreements in Istanbul to resume grain exports from three Ukrainian ports. However, the agreements were already called into question again just one day after they were signed because of a Russian missile attack on the port of Odessa,” writes Carsten Fritsch, Analyst Energy, Agriculture, Precious Metals at Commerzbank.

Additional Quotes:

“The wheat price on CBOT fell by almost 6% to around 760 US cents per bushel in the September contract, which was the lowest closing level for the most actively traded contract since the beginning of February. The European wheat price on Euronext in Paris (also expiring in September) closed down 7% at just over EUR 325 per ton. The most actively traded contract (December maturity) fell in the meantime to a 5-month low of just over EUR 310 per ton.”

“The agreement was called into question just one day after it was signed because of a Russian missile attack on the port of Odessa. Russia had committed itself in the agreement not to attack the ships and the ports. Accordingly, wheat prices rose again at the beginning of the week. This shows how fragile the hope is that there will be a quick and smooth resumption of grain exports from Ukraine. This is necessary for wheat prices to fall sustainably.”

Analysts at TD Securities (TDS) offered a brief preview of this week's key central bank event risk - the highly anticipated FOMC monetary policy decision on Wednesday.

Key Quotes:

“With markets pricing in 78bp of hikes in July, investors will focus on what the Fed does after reaching neutral. The potential for more hikes given a sticky inflation backdrop is likely to put upward pressure on front end rates and flattening pressure on the curve. We remain long 2y TIPS BEs and long 30y real rates to position for still high near-term inflation and great fears of recession.”

“A heavy US-centric week with the Fed decision and top-tier data releases including ECI, core PCE, and real GDP. We think FX markets are waiting to see how these event risks unfold to establish a directional view on the broad USD. We do not get the sense that this meeting carries a great deal of weight despite our expectation for a 75bp hike. And, with markets about 50/50 priced for a 75bp hike in September, we think focus will be placed on the activity data between now and then.”

- AUD/USD retreated from over a one-month high amid the emergence of fresh USD buying.

- The risk-off mood benefitted the safe-haven buck and weighed on the risk-sensitive aussie.

- Traders now eye US consumer confidence data for some impetus ahead of Australian CPI.

The AUD/USD pair is seen retreating further from over a one-month high, around the 0.6980-0.6985 region touched this Tuesday. The emergence of fresh US dollar buying turned out to be a key factor exerting downward pressure and dragged spot prices back closer to the 0.6900 mark during the early North American session.

The market sentiment remains fragile amid growing worries about a possible global recession. This, along with the pre-Fed nervousness, tempered investors' appetite for perceived riskier assets. This was evident from a weaker tone around the equity markets, which boosted demand for the safe-haven US dollar and weighed on the risk-sensitive aussie.

The global flight to safety, meanwhile, triggered a steep intraday slide in the US Treasury bond yields, which might cap the USD and lend support to the AUD/USD pair. Investors might also prefer to wait on the sidelines ahead of this week's heavyweight US macro data and the highly anticipated FOMC monetary policy decision on Wednesday.

A rather busy week in terms of important US economic releases kick starts with the Conference Board's Consumer Confidence Index on Tuesday. The focus, however, would remain on the outcome of a two-day FOMC policy meeting. The Fed is expected to hike interest rates by another 75 bps and leave the door open for further policy tightening.

Heading into the key central bank event risk, traders would take cues from the quarterly consumer inflation figures from Australia, scheduled during the Asian session on Wednesday. This week's US economic docket also highlights the release of Durable Goods Orders on Wednesday and the Advance Q2 GDP report on Thursday.

This, along with the US Personal Consumption Expenditures (PCE report) - the Fed's preferred inflation gauge - due on Friday will influence the USD and provide a fresh impetus to the AUD/USD pair. In the meantime, traders might refrain from placing aggressive bets, warranting caution before confirming that the recent move up has run out of steam.

Technical levels to watch

- EUR/USD quickly breaches the 1.0200 region to multi-day lows.

- The continuation of the decline could expose another test of parity.

EUR/USD breaks below the prevailing consolidation and threatens to revisit the 1.0100 zone on Tuesday.

If the pair breaches the 1.0100 region, then the next support of note is seen at the parity level, which is expected to hold the downside ahead of a potential drop to the 2022 low at 0.9952 (July 14).

In the meantime, the pair is expected to remain under downside pressure while below the 5-month support line around 1.0490.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0984.

EUR/USD daily chart

- GBP/USD witnessed a dramatic intraday turnaround from a three-week high touched on Tuesday.

- The risk-off mood, recession fears revived demand for the safe-haven USD and exerted pressure.

- The UK political drama undermined the British pound and contributed to the intraday pullback.

The GBP/USD pair is seen extending its intraday retracement slide from a three-week top touched earlier this Tuesday and continued losing ground through the mid-European session. The downward trajectory dragged spot prices to a fresh daily low, around the 1.1970-1.1965 region in the last hour.

Investors remain concerned about a possible global recession, which was evident from a generally weaker tone around the equity markets. This assisted the safe-haven US dollar to stage a goodish rebound from the vicinity of a multi-week low touched the previous day, which, in turn, exerted downward pressure on the GBP/USD pair.

Furthermore, UK politics was seen as another factor that added to negative sentiment surrounding the British pound and further contributed to the pair's intraday turnaround. The combination of factors, to a larger extent, overshadowed the prospects for a 50 bps rate hike move by the Bank of England at the upcoming meeting in August.

The global flight to safety, meanwhile, triggered a fresh leg down in the US Treasury bond yields, which might cap gains for the USD and offer some support to the GBP/USD pair. Traders might also refrain from placing aggressive bets ahead of the highly-anticipated FOMC policy decision on Wednesday and heavyweight US macro data.

A rather busy week in terms of important US economic releases kick starts with the Conference Board's Consumer Confidence Index on Tuesday. The focus, however, would remain on the outcome of a two-day FOMC meeting. The Fed is expected to hike interest rates by another 75 bps and leave the door open for further policy tightening.

This week's US economic docket also features the release of Durable Goods Orders on Wednesday and the Advance Q2 GDP report on Thursday. Apart from this, the Personal Consumption Expenditures (PCE report) - the Fed's preferred inflation gauge - due on Friday will influence the USD and provide a fresh impetus to the GBP/USD pair.

Technical levels to watch

“DXY is up for the first time after three straight down days and trading back above 107. We are not yet ready to change our strong dollar call. However, we expect a period of consolidation ahead for the dollar until the U.S. economic outlook becomes clearer,” explains Win Thin, Global Head of Currency Strategy at BBH.

Additional Quotes:

“The two-day FOMC starts today and the Fed is widely expected to hike rates 75 bp to 2.50%. WIRP suggests only around 15% odds of a 100 bp move. With recent weakness in the data, there is simply no need to go bigger this week. Updated macro forecasts and Dot Plots won’t come until the September meeting.

Another 75 bp hike September 21 is about 50% priced in.”

“A 25 bp hike is fully priced in for November 2 but after that, one last 25 bp hike is only partially priced in. The swaps market paints a similar picture, with 175 of tightening priced in over the next 6 months that would see the policy rate peak near 3.5%. After that, an easing cycle is priced in for the subsequent 6 months.”

- DXY reverses three daily pullbacks in a row and regains 107.00.

- There are no resistance levels of note until the 2022 top past 109.00.

DXY picks up extra pace and advances to 2-day highs north of the 109.00 yardstick on Tuesday.

There seems to be strong contention in the 106.00 neighbourhood for the time being, while the next barrier on the upside is not seen before the YTD high near 109.40 (July 14). In case sellers push harder, the index carries the potential to drop further and retest the post-FOMC peak at 105.78 (June 15).

Despite the ongoing downside, the near-term outlook for DXY is seen constructive while above the 5-month support line near 103.70.

In addition, the broader bullish view remains in place while above the 200-day SMA at 99.25.

DXY daily chart

- EUR/JPY resumes the selling bias and breaks below 139.00.

- A deeper decline should face the 100-day SMA near 137.30.

EUR/JPY quickly fades Monday’s advance and regains downside momentum well below the 139.00 mark on Tuesday.

Further losses remain in store for the cross while below the 4-month resistance line near 141.70. Against that, the next temporary support comes at the 100-day SMA at 137.34 ahead of the July low at 136.85 (July 8).

In the longer run, the constructive stance in the cross remains well underpinned by the 200-day SMA at 133.59.

EUR/JPY daily chart

The shared currency, so far, hasn't reacted to growing market concerns about gas supply and rising gas prices, explains Kit Juckes, Macro Strategist at Societe Generale.

Key Quotes:

“Gazprom announced yesterday the flow through Nord Stream 1 will be cut to 20% of capacity in the next day or two, for an indeterminate time. Prices at the Netherland virtual trading point have risen to EUR 182/MWh, close to post-March highs. The euro hasn't over-reacted to this news, however. Maybe that reflects a willingness to wait and see how temporary the supply reduction will be, though the uncertainty about supplies in the months ahead will hurt growth because Europe's leaders will need to curb demand regardless of what transpires. Maybe also, euro shorts are finally big enough, after another increase last week, to cushion the currency.”

Analysts at TD Securities offer a brief preview of the Australian quarterly consumer inflation data, due for release during the Asian session on Wednesday.

Key Quotes:

“We expect outsized headline/ underlying CPI prints vs consensus. The magnitude of the increases for the main drivers of Australia CPI inflation are: 1) Housing 3.2% q/q; 2) Food 2.25% q/q; 3) Transport 2.3% q/q; 4) Household Services 1.65% q/q & 5) Recreation 1.2% q/q. Our headline forecast implies the peak is likely to exceed the RBA's 7% year-end target warranting at least a 50bps Aug policy rate hike. We see upside risks to our forecast.”

- Gold price struggles to preserve its modest intraday gains amid the emergence of some USD buying.

- The prospects for a more aggressive major central banks also acted as a headwind for the metal.

- The downside seems limited ahead of this week’s key US macro releases and the FOMC decision.

Gold price attracted some selling near the $1,728 region on Tuesday and retreated to the lower end of its daily range during the first half of the European session. The XAUUSD was last seen trading just below the $1,720 level, nearly unchanged for the day.

The US dollar staged a goodish rebound from the vicinity of its lowest level since July 5 touched the previous day, which, in turn, acted as a headwind for the dollar-denominated gold. This, along with the prospects for a more aggressive move by major central banks to curb soaring inflation, was seen as another factor weighing on the non-yielding yellow metal.

That said, growing fears about a possible global recession continue weighing on investors' sentiment and offer some support to the safe-haven gold. The flight to safety is triggering a fresh leg down in the US Treasury bond yields, which could keep a lid on any meaningful gains for the greenback and help limit losses for the precious metal, at least for the time being.

Investors might also be reluctant to place aggressive bets ahead of the heavyweight US macro data and the key central bank event risk. A rather busy week kicks off with the release of the Conference Board's US Consumer Confidence Index on Tuesday. The focus, however, will remain on the outcome of a two-day FOMC meeting, scheduled to be announced on Wednesday.

The US central bank is widely expected to hike interest rates by 75 bps and leave the door open for further hikes. The outlook, along with Fed Chair Jerome Powell's remarks, will influence the USD price dynamics. This week's US economic docket also highlights the release of Durable Goods Orders data on Wednesday and the Advance Q2 GDP report on Thursday.

Apart from this, traders will take cues from the US Personal Consumption Expenditures (PCE report) - the Fed's preferred inflation gauge - scheduled for release on Friday. This, in turn, will play a key role in driving gold price in the near term and help investors to determine the next leg of a directional move.

Technical levels to watch

Citing people familiar with the matter, Reuters reports that the European Union (EU) member countries have reached an agreement on regulation for emergency gas cuts this winter.