- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-07-2022

- DXY struggles to overcome recent losses at multi-day low ahead of the key data.

- “Technical recession” in the US, inflation expectations make data interesting to watch.

- Fed’s preferred inflation gauge for July, second-tier activity numbers will be crucial for intraday direction.

US Dollar Index (DXY) licks its wounds near the 1.5-month low during Friday’s Asian session. That said, the greenback’s gauge versus the six major currencies dropped during the last two days before recently taking rounds to 106.20.

Easing fears of the Fed’s aggressive rate hike, backed by the US Q2 Gross Domestic Product (GDP) release, appear to drown the US dollar of late. On the same line are the US central bank’s neutral rate chatters and Fed Chairman Jerome Powell’s hopes of recovery.

After witnessing challenges for further rate hikes, as signaled by Fed’s Powell, the DXY players should have traced the Flash readings of the US Q2 GDP that marked the “technical recession” by declining for the second consecutive time to weigh on the greenback. That said, the first estimations of the US Q2 GDP printed -0.9% Annualized figure versus 0.5% expected and -1.6% prior. Further, the US Initial Jobless Claims also rose more than expected by 253K, with 256K during the week ended on July 22.

Elsewhere, US policymakers, including Fed’s Powell and Treasury Secretary Janet Yellen, tried to shrug off the “technical recession” after the US Q2 GDP dropped for the second consecutive time and teased the concept. The same probes the central bankers pushing for more rate hikes to tame inflation. Furthermore, talks between US President Joe Biden and his Chinese Counterpart Xi Jinping also went mostly okay and exerted downside pressure on the DXY.

Above all, heavy gains of the Wall Street benchmarks and the downside of the Treasury yields seemed to have drowned the US Dollar Index.

On the contrary, inflation expectations data, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED), refreshed the monthly high to 2.48% and renewed fears of higher Fed rates during the late Thursday, which in turn teased DXY buyers.

Hence, the Fed’s preferred inflation gauge, namely the Core Personal Consumption Expenditure (PCE) Price Index, expected 0.5% MoM for July versus 0.3% prior, will be important to watch for fresh impulse.

Technical analysis

A daily closing below the two-month-old ascending trend line, around 106.55 by the press time, directs DXY bears towards June’s peak of 105.79.

- AUD/USD bulls tale control and have the 0.7000s clocked.

- There is a bullish bias on the time frames with 0.7005 eyed for the session ahead.

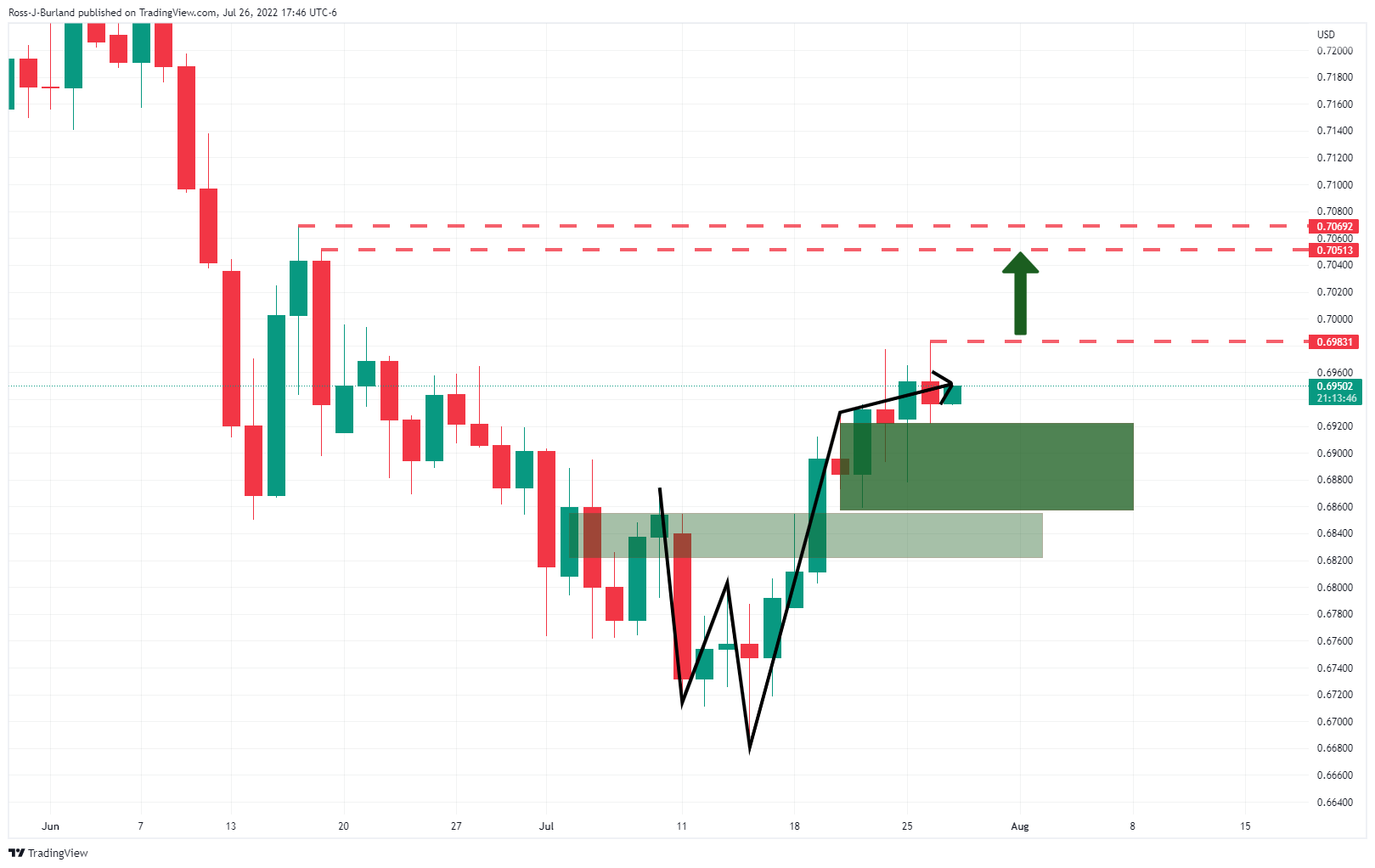

As per the prior analyses, AUD/USD Price Analysis: Bulls eye a break of 0.6980 or face a move lower, and, AUD/USD bulls cheer a less hawkish outcome at the Fed, the bulls stay in control.

AUD/USD, daily & H4 chart, prior analyses

From a 4-hour perspective, below, the price had almost completely mitigated the price imbalance between 0.7003 and 0.7013 which left the scope for a bearish correction, prior to the next bullish impulse.

AUD/USD live market

The price is playing out according to the above analysis as per the 4-hour chart above. If 0.7005 gives, then 0.7013 and the 0.7050s will be eyed.

From an hourly perspective, as per the chart above, the broadening formation is worth acknowledging and currently favours the upside.

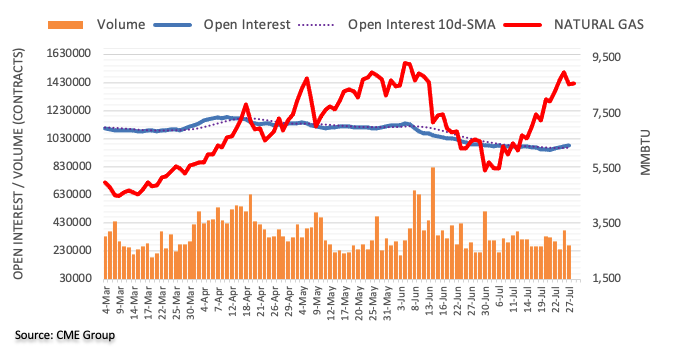

- WTI picks up bids to reverse pullback from weekly high.

- Convergence of 21-DMA, three-week-old triangle’s upper line challenges buyers.

- Sellers should wait for a sustained break of 1.5-month-old support line.

WTI crude oil prices pare recent losses around $96.50 during Friday’s Asian session. In doing so, the black gold again tried to cross a three-week-long symmetrical triangle after the previous day’s failed attempt.

Also keeping the commodity buyers hopeful is the quote’s sustained trading beyond the descending trend line from June 14, as well as the bullish MACD signals and firmer RSI (14).

Even so, the WTI buyers need a daily closing beyond the $98.00 comprising the stated triangle’s upper line and the 21-DMA, to keep reins.

Following that, a run-up towards the highs marked during July 19 and 08, respectively near $100.70 and $102.80, will be in focus.

It should be noted that the month-start low of $103.11 could act as the last defense for WTI bears.

Meanwhile, pullback moves need to break the previous resistance line from mid-June, near $95.80 to tease sellers.

Even so, the triangle’s bottom around $94.80 and multiple supports near $91.60 could test the commodity’s further downside before directing it to the recent low near $88.35.

WTI: Daily chart

Trend: Further recovery expected

- USD/JPY has found offers around 134.50 as the DXY is expecting more downside ahead of US PCE.

- Yen bulls have been infused fresh blood on higher consensus for employment data.

- Fed’s preferred inflation tool may elevate to 6.7% vs. 6.3% recorded earlier.

The USD/JPY pair has faced strong hurdles around 134.50 after attempting a mild recovery from a monthly low of around 134.20. The asset extended its downside move on Thursday after violating the critical support of the July 22 low at 135.57. A sheer downside move in the asset is backed by broader weakness in the US dollar index (DXY) and higher consensus for Japanese employment data, which is due on Friday.

Japan’s unemployment rate may trim to 2.5% vs. the prior release of 2.6%. Also, the Jobs/Applicants ratio is expected to increase to 1.25 from the former figure of 1.24. An occurrence of the same will strengthen Tokyo further.

The release of the downbeat US Gross Domestic Product (GDP) data has resulted in a laborious job for Federal Reserve (Fed) policymakers. The deadly combination of a solid labor market and upbeat economic data were major drivers of confident Fed policymakers.

The strength of economic catalysts was empowering the Fed for tightening monetary policy unhesitatingly. Now, less-than-expected hawkish guidance by the Fed and vulnerable US economic data are responsible for the vulnerable performance of the DXY. The DXY has tumbled to near 106.00 and is likely to surrender the cushion sooner rather than later.

In today’s session, the release of the US Personal Consumption Expenditure (PCE) data will be the show-stopper event. Fed’s preferred inflation indicator to judge the extent of price pressures in the economy is seen at 6.7%, higher than the former figure of 6.3%. This will keep the need for more policy tightening measures at elevated levels.

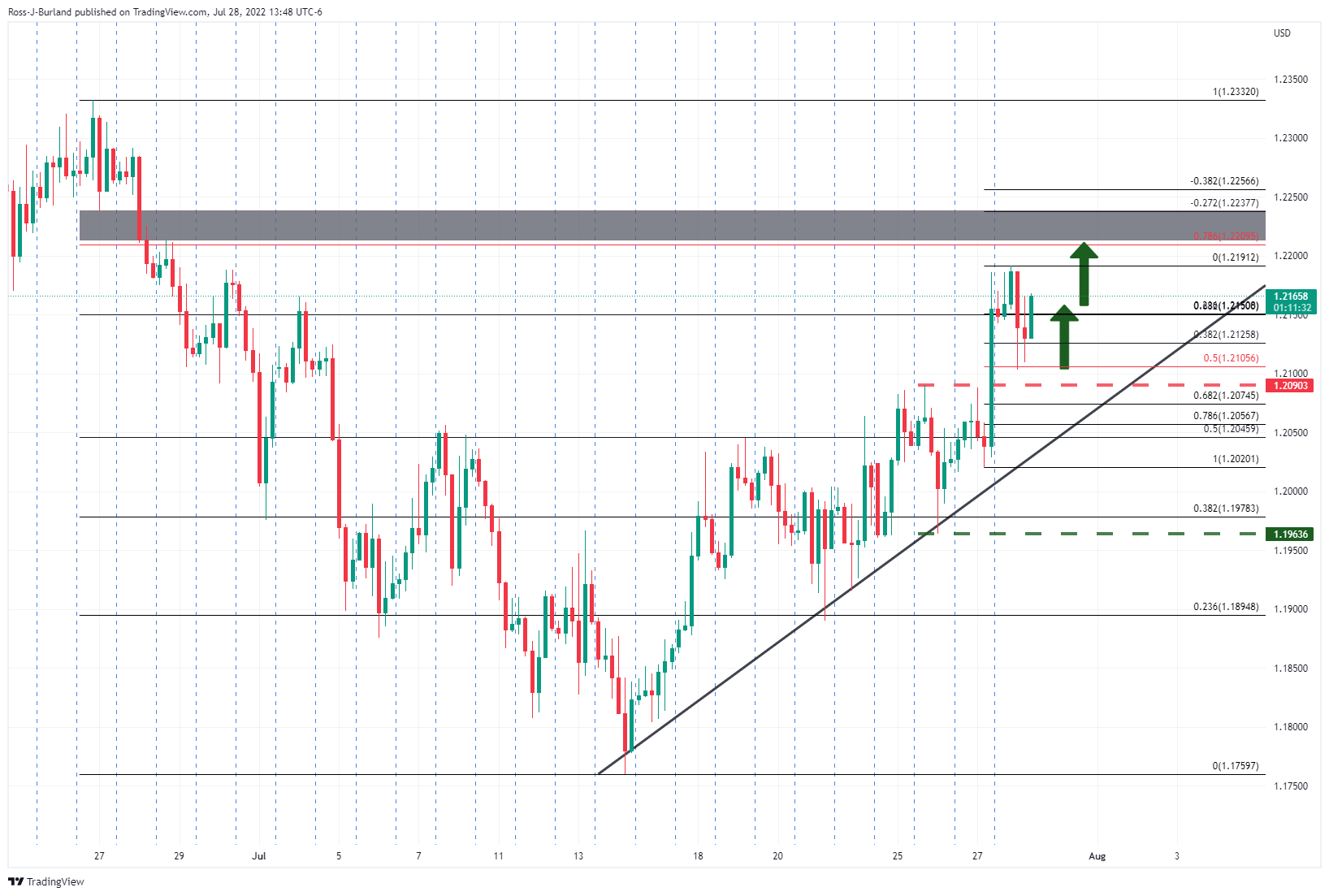

- GBP/USD buyers struggle to keep reins around one-month high.

- UK politics gain major attention as the first Conservative Party hustings favor Truss.

- US fell into a “technical recession” and pushed back the Fed hawks, exerting downside pressure on the USD.

- US Core PCE Price Index eyed for fresh impulse amid firmer inflation expectations.

GBP/USD seesaws near the one-month high as bulls and bears jostle ahead of the key US data, as well as due to the mixed signals, during Friday’s Asian session.

That said, the Cable pair rose during the last two consecutive days on broad US dollar weakness. It’s worth noting that the political jitters in the UK and Brexit woes, as well as the US dollar’s consolidation ahead of the key US inflation data, are likely weighing on the GBP/USD prices.

The market’s expectations of no more aggressive rate hikes from the Fed, backed by the US Q2 Gross Domestic Product (GDP) release, appear to favor the US dollar weakness. On the same line are the US central bank’s neutral rate chatters and Fed Chairman Jerome Powell’s hopes of recovery.

It should be noted that the Flash readings of the US Q2 GDP printed -0.9% Annualized figure versus 0.5% expected and -1.6% prior. With the second consecutive negative GDP print, the US fall into a “technical recession”, which in turn probes the Fed hawks and exerts downside pressure on the US dollar.

However, inflation expectations data, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED), refreshed the monthly high to 2.48% and renewed fears of higher Fed rates during the late Thursday, which in turn weighed on the GBP/USD prices.

At home, the first of 12 political hustings for Conservative Party leadership didn’t go well in favor of Rishi Sunak as policymakers accused him of stabbing Boris Johnson. On the other hand, Liz Truss gets an uncomfortable question on the monarchy, per Sky News. Furthermore, a survey from the British Chambers of Commerce (BCC) mentioned that a survey found that quarter of 2600 exporters had suffered a fall in exports and another 46% reported no change, reported The Guardian.

Against this backdrop, the Wall Street benchmarks closed positive but the Treasury yields slumped and the US Dollar Index (DXY) refreshed its multi-day low while extending the post-Fed losses.

Moving on, the Fed’s preferred inflation gauge, namely the Core Personal Consumption Expenditure (PCE) Price Index, expected 0.5% MoM for July versus 0.3% prior, will be important to watch for fresh impulse.

Technical analysis

A clear upside break of the 1.5-month-old descending trend line, now support around 1.2075, favors the GBP/USD buyers to aim for the 50-DMA hurdle surrounding 1.2225.

- NZD/USD is moving higher into the next critical US data.

- The US dollar has been bleeding out following poor US data and the Fed.

NZD/USD is trading at 0.6291 and a touch higher in early Asia ahead of the Tokyo equities open. The pair has benefitted from a friendlier environment in the commodities and equities space following the Federal Reserve meeting on Wednesday and a statement that left the futures markets tied to Fed policy expectations tilted towards a more moderate increase for the next meeting.

The Fed has led to a softer US dollar which is now treading water around the lower quarter of the 106 area as per DXY, an index that measures the greenback vs. a basket of major currencies. Markets were also digesting the weaker US growth data following on from the Fed chairman's relatively dovish comments the prior day. On Thursday, the US Gross Domestic Product was reported to have fallen at a 0.9% annualized rate last quarter, the Commerce Department said in its advance estimate of GDP. Economists polled by Reuters had forecast GDP rebounding at a 0.5% rate.

For the end of the week, US inflation and wages data will be pivotal, analysts at ANZ Bank say – ''any signs of weakness will likely only exacerbate the recent rally in rates and top out DXY.''

Domestically, the second quarter labour market data are released next Wednesday (3 August). The analysts at ANZ Bank said that they anticipate that the data will confirm the ongoing labour market tightening seen in timely indicators, survey data, and anecdotes.

''We expect unemployment declined to 2.8% in Q2 (vs. 3.2% in Q1). And while we can’t discount that typical HLFS volatility could see unemployment come in above our expectation, risks are skewed towards a still-lower number.''

They explained that the tight labour market is turning into an increasingly intense headache for the Reserve Bank of New Zealand.

''The gaping chasm between labour demand and supply is likely to be a key driver of persistently too-high domestic inflation pressure over the next year. We expect ongoing 50bp hikes will bring the OCR to 4% by year-end. That’s consistent with market pricing, but a stronger-than-expected jobs report could see a market reaction nonetheless.''

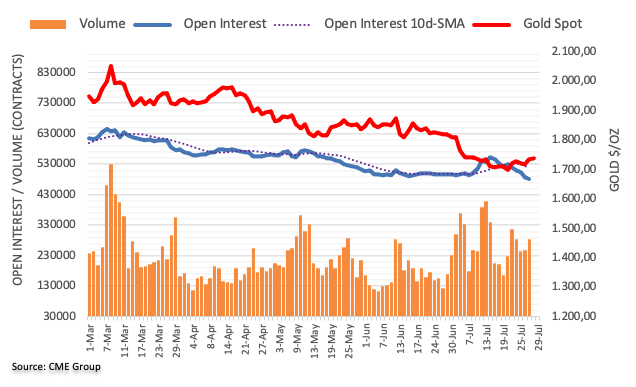

- Silver price extends its weekly rally after bottoming around $18.00.

- XAGUSD soars on falling US Treasury yields which undermine the greenback.

- The US economy taps into recessionary territory as GDP shrank by 0.9%.

Silver price rallied for three consecutive days, gaining almost 9% in the week courtesy of traders’ upbeat mood, on the perception of a Fed “dovish” tilt, spurring lower US treasury yields and weakening the US dollar. Alongside the previously mentioned, a dismal US GDP reading for the second quarter decreased bets that the US Federal Reserve would keep tightening at its current pace as the stagflationary scenario worsens. At the time of writing, XAGUSD is trading at $19.91.

XAGUSD soars on falling US Treasury yields which undermine the greenback

US equity futures rise on the back of positive US corporate earnings. In the meantime, falling US Treasury yields, led by the 10-year note rate slashing 12 bps, yielding just 2.671%, bolstered the appetite for the white metal.

On Thursday, the US Department of Commerce revealed that US GDP for Q2 shrank at a 0.9% YoY pace after declining 1.6% in the first quarter, meaning that the US is in a technical recession. At the same time, the US Department of Labor reported that Initial Jobless Claims for the week ending on July 23 rose by 256K, higher than forecasts but lower than the previous week’s 261K.

During the day, the greenback weakened, undermined by falling US bond yields. The US Dollar Index is losing 0.24% and sits at 106.206 after hitting a daily high at 106.975.

On Wednesday, the Federal Reserve hiked 75 bps the Federal funds rate (FFR). In the monetary policy statement, the Fed acknowledged that the economy is slowing, but it also emphasized its commitment to bringing inflation down to its 2% target. Nevertheless, money market futures pared back further rate hikes by the Fed, as they are pricing in less than 100 bps of tightening, foreseeing the FFR to finish around 3.25%.

Also read: Gold Price Forecast: XAUUSD conquers $1,750 as US Q2 GDP shrinks, flashing a recession

What to watch

The US economic docket will feature the Personal Consumption Expenditures (PCE) on its headline and core readings. Later, the University of Michigan (UoM) Consumer Sentiment for July’s final reading will be revealed.

Silver (XAGUSD) Key Technical Levels

- AUD/JPY has moved to 94.00 as yen bulls lose momentum ahead of employment data.

- Japan’s jobless rate may trim to 2.5% vs. 2.6% reported earlier.

- The downbeat aussie Retail Sales data may keep the antipodean on the back foot.

The AUD/JPY pair has witnessed a firmer recovery after printing a low of 93.57 on Thursday. The risk barometer has rebounded after sensing a loss of momentum. The downside move in the cross exhausted as investors turned cautious ahead of the Japanese employment data.

On Thursday, the commentary from Bank of Japan (BOJ) Deputy Governor Masayoshi Amamiya strengthened the Japanese yen. BOJ policymaker supported the monetary policy easing and its continuation to support the wage rates as the catalyst will remain a key driver to keep inflation rate above 2%.

It is worth noting that the Japanese economy has failed to return to the pre-pandemic growth levels led by lower demand and inflation rates. To accelerate the same, the BOJ is keep buying the Japan Government Bonds (JGBs) and is focused to deploy helicopter money in the economy.

Apart from that, higher consensus for Japanese employment data also strengthened the yen bulls. The jobless rate may trim to 2.5% vs. the prior release of 2.6%. Also, the Jobs/Applicants ratio is expected to increase to 1.25 from the former figure of 1.24.

Meanwhile, the aussie bulls are likely to remain in the hangover of the downbeat Retail Sales for a little longer. The Australian Retail Sales data landed at 0.2%, significantly lower than the expectations of 0.5% and the prior release of 0.9%. The economic data was highly likely to remain upbeat as a higher inflation rate is resulting in more payouts by the households.

Although the US economy fell into “technical recession” the previous day, inflation expectations data, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED), refreshed the monthly high by the end of Thursday’s North American session.

That said, the inflation gauge recently jumped to the 2.48% mark during the three-day uptrend while refreshing the monthly peak.

It should be noted that the Flash readings of the US Q2 GDP printed -0.9% Annualized figure versus 0.5% expected and -1.6% prior. With the second consecutive negative GDP print, the US fall into a “technical recession”, which in turn probes the Fed hawks and exerts downside pressure on the US dollar.

However, the recent jump in the US inflation expectations ahead of the Fed’s preferred inflation gauge, namely the Core Personal Consumption Expenditure (PCE) Price Index, for July, could underpin the US dollar’s rebound from a 1.5-month low.

Also read: Forex Today: Technical recession is not a recession?

- USD/CAD remains pressured around 1.5-month low, bears approach descending support line from mid-June.

- Bearish MACD signals, downbeat RSI joins daily closing below 100-day EMA to favor sellers.

- Buyers need validation from monthly horizontal resistance, sellers could aim for 200-day EMA.

USD/CAD stays depressed around a seven-week low near 1.2800 during Friday’s Asian session. In doing so, the Loonie pair sellers keep reins around the short-term key support line.

It’s worth noting, however, that the quote’s first daily closing below the 100-day EMA since early June joins the downbeat RSI (14), not oversold, as well as bearish MACD signals, to hint at the pair’s further declines.

Hence, the USD/CAD bears await a clear downside break of the descending support line from June 14, at 1.2790 by the press time, to excel.

Following that, the 200-day EMA level near 1.2750 and the 61.8% Fibonacci retracement of April-July upside, near 1.2715, will be in focus before directing the sellers towards a three-month-long support line, near 1.2615 at the latest.

On the contrary, a confluence of the 100-day EMA and 50% Fibonacci retracement level guards the quote’s recovery moves around 1.2815.

Also acting as a strong upside hurdle for the USD/CAD buyers is a horizontal area established from June 30, close to 1.2940.

USD/CAD: Daily chart

Trend: Further weakness expected

- USD/CHF is aiming to recapture monthly lows around 0.9500 as poor US GDP data has weakened DXY.

- A slump in economic activities and retail demand mark as the beginning of a recession in an economy.

- In today’s session, the US PCE and Swiss Real Retail Sales data will remain in limelight.

The USD/CHF pair has displayed a less-confident reversal after hitting a low of 0.9540 in the late New York session. The further downside remains warranted as the asset is likely to carry forward its three-day losing streak after a downbeat US Gross Domestic Product (GDP) data, released on Thursday. A downside move would drag the asset towards its monthly low at 0.9504.

The US Bureau of Economic Analysis reported the annualized GDP for the second quarter at -0.9%, which has been improved from the prior release of -1.6% but remained lower than the consensus of 0.5%. Back-to-back downbeat performance on the retail demand and productivity front in the US economy is raising concerns for the Federal Reserve (Fed).

A slump in economic activities and retail demand marks the beginning of a recession in an economy. The resurgence of recession and a picture-clear interest rate extent by the Fed till the end of 2022 has weakened the US dollar index (DXY).

In today’s session, the US Personal Consumption Expenditure (PCE) inflation data carries utmost importance. The economic data is likely to release at 6.7%, higher than the former figure of 6.3%. This indicates that the price pressures are not going to find a peak in the nearest future and the Fed will be blamed further for their higher responsive action towards the soaring interest rates.

However, the Swiss franc economy will report the annual Real Retail Sales data. Earlier, the economic data landed at -1.6% and this time the economic catalyst is expected to remain higher as soaring energy bills and prices of food products will elevate the end figure. However, a slippage in the economic data will indicate a major slump in the overall demand. This may weaken the Swiss franc bulls ahead.

- EUR/USD fails to overcome recent losses and remains sidelined around 21-day EMA hurdle.

- US dollar stays pressured near three-week low as “technical recession” push back Fed hawks.

- Germany’s inflation data, European gas crisis probe pair buyers.

- German/Eurozone GDP, Eurozone CPI precede US Core PCE Inflation to direct short-term moves.

EUR/USD dribbles around 1.0200, after paring most of the daily losses, as traders await the key data from Eurozone and the US. Even so, the bulls remain pressured during Friday’s initial Asian session amid recession fears, following the negative daily close of the previous day.

The major currency pair’s latest rebound could be attributed to the US dollar’s slump amid the market’s expectations of no more aggressive rate hikes from the Fed. The US Q2 Gross Domestic Product (GDP) release could be linked to the same, in addition to the US central bank’s neutral rate chatters and Chairman Powell’s hopes of recovery.

On Thursday, the Flash readings of the US Q2 GDP printed -0.9% Annualized figure versus 0.5% expected and -1.6% prior. Further, the US Initial Jobless Claims also rose more than expected by 253K, with 256K during the week ended on July 22.

It’s worth noting that the various US policymakers, including Fed’s Powell and Treasury Secretary Janet Yellen, tried to shrug off the “technical recession” after the US Q2 GDP dropped for the second consecutive time and teased the concept. The same probes the central bankers pushing for more rate hikes to tame inflation.

On the contrary, Germany’s inflation data flashed mixed signals as the Consumer Price Index (CPI) dropped to 7.5% YoY versus 7.6% prior but the Harmonised Index of Consumer Prices (HICP) climbed to 8.5% yearly, versus 8.2% prior in July. Additionally, the European Commission reported, "In July 2022, the Economic Sentiment Indicator (ESI) plummeted in both the EU (-4.2 points to 97.6) and the euro area (-4.5 points to 99.0), falling below its long-term average.”

Other than the data, fears of economic slowdown in the old continent, due to the gas crisis, also probed the EUR/USD bulls.

Amid these plays, the Wall Street benchmarks closed positive but the Treasury yields slumped and the US Dollar Index (DXY) refreshed its multi-day low while extending the post-Fed losses.

Moving on, the initial readings of German and Eurozone GDP for the second quarter (Q2) of 2022, as well as Eurozone Consumer Price Index (CPI) for July, will be important ahead of the Fed’s preferred inflation gauge, namely the Core Personal Consumption Expenditure (PCE) Price Index, for July.

Also read: Eurozone Inflation Preview: Signs of peak inflation, not yet

Technical analysis

21-day EMA around 1.0230 keeps restricting short-term EUR/USD up-moves but the gradual firming of the RSI (14) line hints at the quote’s further upside. That said, two-week-old horizontal support near 1.0120 challenges sellers.

- Safe-haven peers rallied vs. most G8 currencies, including the euro.

- EUR/JPY plunged more than 200 pips on Thursday and lost 1.70%.

- EUR/JPY Price Analysis: It might aim towards 135.30 once sellers reclaim 136.85.

EUR/JPY nosedived below the 100-day EMA on Thursday, spurred by dismal US economic data, reporting that Q2 GDP shrank for the second straight month, tapping the economy into a “technical recession.” Traders in the equity markets ignored the news, but in the FX space, safe-haven peers flourished. The EUR/JPY is trading at 136.91, slightly up 0.02% as the Asian session begins.

EUR/JPY Price Analysis: Technical outlook

From a daily chart perspective, the EUR/JPY shifted to neutral-downward biased. Even though the EUR/JPY 200-day EMA sits at 133.67 below the exchange rate, the break of the 100-day is significant. Nevertheless, EUR/JPY sellers need to reclaim the July 8 daily low at 136.85, which might be achieved as the Relative Strength Index (RSI) is in bearish territory, with enough room before reaching oversold levels. Once that level is cleared, it would pave the way for a EUR/JPY move towards 136.00.

EUR/JPY 1-hour chart

The EUR/JPY hourly chart depicts sellers losing steam, as the Relative Strength Index (RSI) is in oversold conditions. The cross-currency bottomed around 163.37, which would be the first support level, as EUR sellers take a breather. EUR/JPY traders should be aware that the pair might print a leg-up towards the confluence of the daily pivot and the 50% Fibonacci retracement around the 137.45-55 area before resuming downwards towards the EUR/JPY sellers’ target at 135.30.

EUR/JPY Key Technical Levels

- AUD/USD is scaling towards 0.7000 firmly as the DXY is likely to surrender the cushion of 106.00.

- A downbeat performance on the US GDP front has weakened the DXY further.

- Investors will keep an eye on the US PCE inflation measure for further guidance.

The AUD/USD pair is marching towards the psychological resistance of 0.7000 swiftly after concluding the corrective move to near 0.6960 in the late New York session. The asset attempted to establish above 0.7000 on Thursday, however, the downbeat Australian Retail Sales data weakened the aussie bulls and dragged the asset.

The Australian Retail Sales data landed at 0.2%, significantly lower than the expectations of 0.5% and the prior release of 0.9%. Investors should be aware of the fact that the inflation rate has remained firmer in the Australian economy. The Australian Bureau of Statistics, on Wednesday, reported the inflation rate for Q2CY22 at 6.1%. The investing community is aware of the fact that higher energy bills and costly food products have resulted in higher payouts for households.

Therefore, the Retail Sales data should have soared dramatically but a vulnerable performance from the economic data indicates that the overall demand from the retail participants has remained extremely lower. An occurrence of the same pushed aussie on the back foot.

On the dollar front, the US dollar index (DXY) is likely to renew its monthly print as poor US Gross Domestic Product (GDP) has acted as the last nail in the coffin. The annualized GDP for the second quarter improved to -0.9% from the prior release of -1.6% but remained lower than the consensus of 0.5%. The DXY is likely to surrender the cushion of 106.00 as poor GDP data has hurt DXY buyers’ sentiment.

Going forward, investors will focus on the Federal Reserve (Fed)’s preferred Personal Consumption Expenditure (PCE) Price Index inflation indicator to judge the extent of price pressures in the economy. The economic data is seen at 6.7%, higher than the former figure of 6.3%.

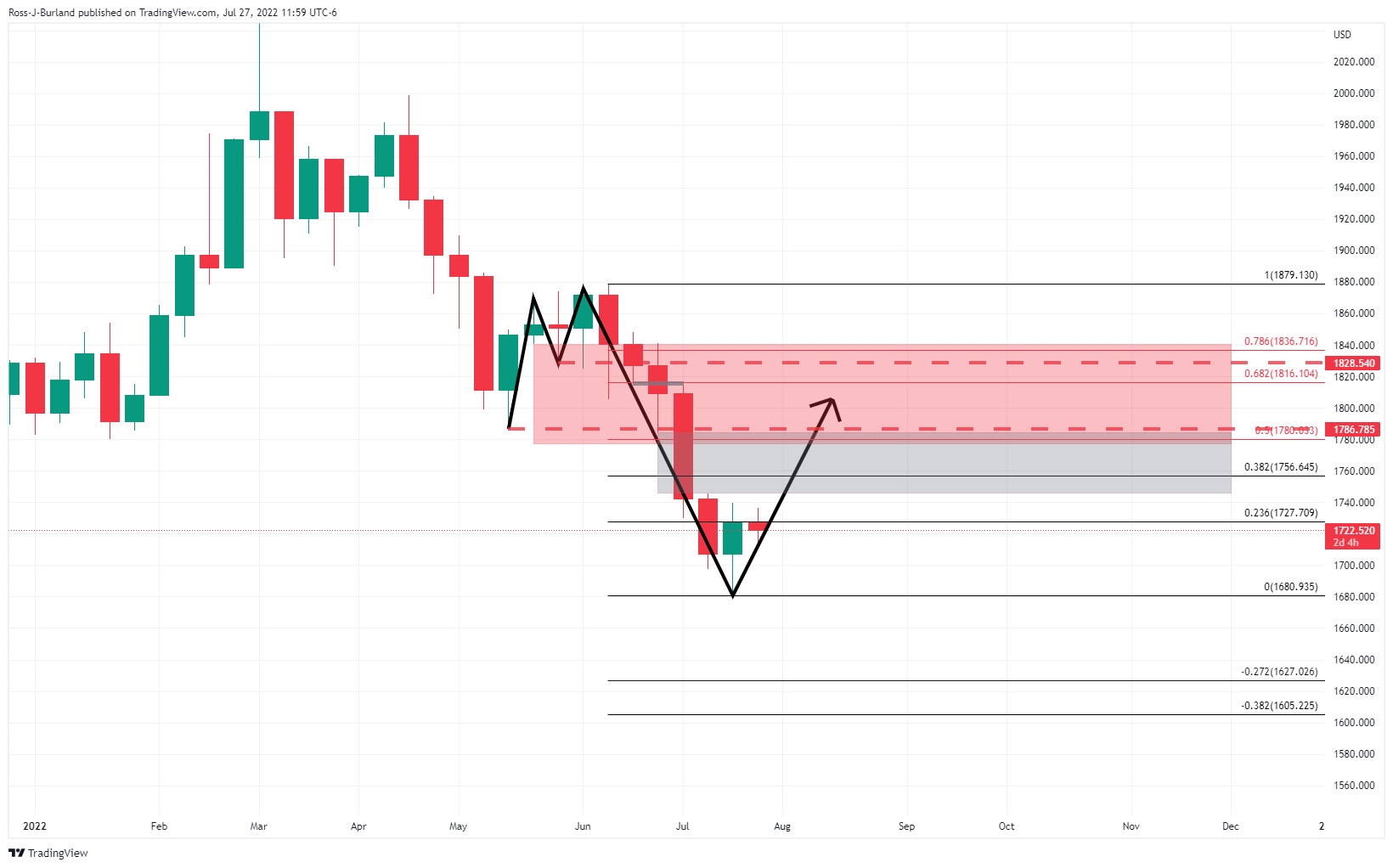

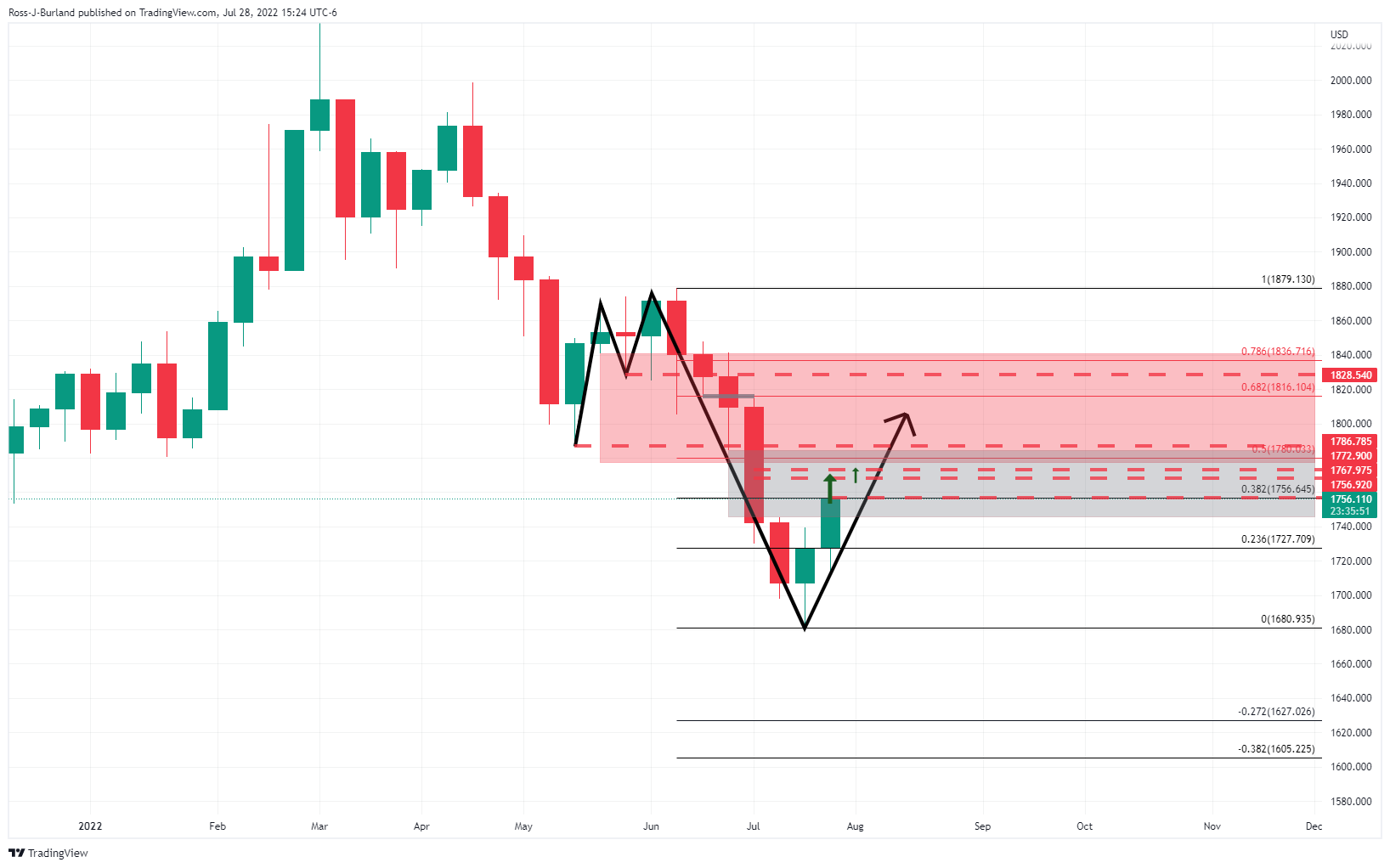

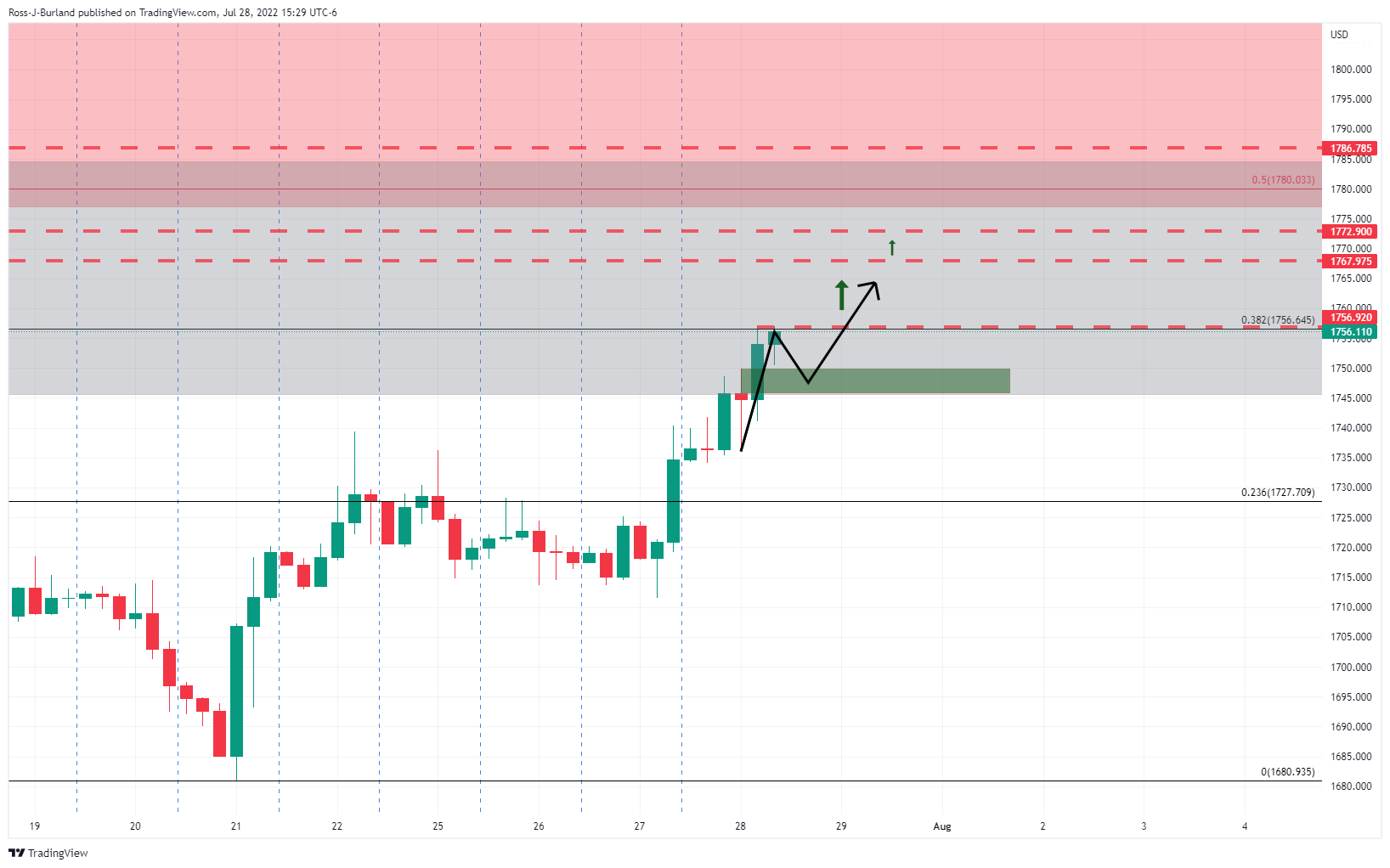

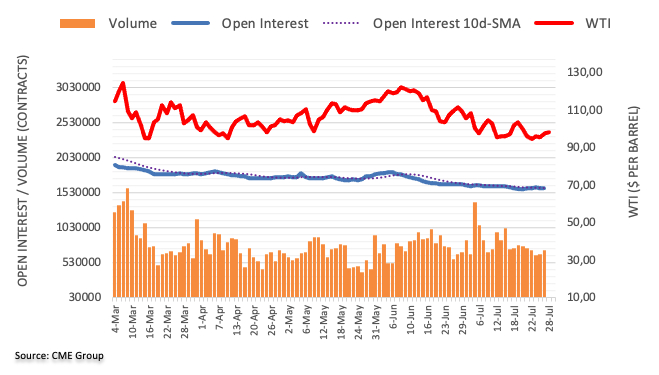

- Gold is firm into the close of the US forex session as the US dollar sheds some points.

- US yields are under pressure following the Fed and gold bulls are back in play.

At $1,756.64, gold prices continue to rise on Thursday even as the US dollar attempted a comeback. However, bond yields remain on the backfoot following the Federal Reserve's dovish tilt on Wednesday. At the time of writing, XAU/USD is 1.25% higher after climbing from a low of $1,734.18 to reach $1,757.06 the high of the day.

Bad news was good news for US stocks on Thursday stocks, which have extended their bullish recovery following disappointing US growth data that has added to the dovish sentiment surrounding the path of rate hike expectations from the Fed. US second quarter Gross Domestic Product came in weaker than expected, declining 0.9% in SAAR terms (exp: +0.4%, prev: -1.6%). However, while technically, this meets the two-quarters of negative growth definition of a recession, analysts at ANZ bank argue that the details were a little stronger than the headline number suggests.

''A lot of the weakness came from inventories which subtracted 2%pts from the headline figure. Personal consumption growth was positive, rising 1%, but still underwhelming expectations (exp: 1.2%, prev: 1.8%). Private fixed investment was weak, declining 3.9%.'' However, ''all up'', the analysts say, ''it was still a disappointing report, even when accounting for the outsized influence of the inventories number (which the Fed may be inclined to disregard as noise). This will only fuel the current concern markets have about a slowdown in US economic activity.''

Meanwhile, the analysts noted that ''Initial Claims were weaker than expected, at 256k. But that came as last week’s number was revised higher. Overall, claims are still at levels that are too low to suggest a deterioration in the labour market is imminent – a key ingredient for a fundamental recession in the US.''

The US dollar was higher following the data, although the bears moved in later in the session and the DXY is currently trading at the lows of the day. DXY has fallen from a high of 106.975 to a low of 106.059. Nevertheless, bond yields dropped, bullish for gold since it offers no interest. The US 10-year note was last seen paying as low as 2.649%, down by over 3.8%.

Meanwhile, the bar for CTA short covering in gold is declining, analysts at TD Securities argued. ''Given the slowing trend in data, Chair Powell's forward guidance tying another "unusually large" 75bp hike to data placed a high bar for another jumbo-sized hike, which gave a green light for a short squeeze in risk assets associated with pervasively negative sentiment.''

The analysts agued that ''as a short covering rally ensues across global markets, the likelihood for a CTA buying program in gold has risen, given that prices need only close north of $1780/oz to spark a change in trend signals.''

However, the analysts continue to caution that gold markets are faced with a massive amount of complacent length held by prop traders, which still hold the title as the dominant speculative force in gold.

''We have yet to see capitulation in gold, suggesting the pain trade is still to the downside and that the recent rally will ultimately fade when faced with a wall of offers.''

Gold technical analysis

As per the pre-Fed analysis, the price of gold is running higher:

From a 4-hour perspective, the price needs to break above $1,756 for a run to $1,768 and beyond:

- GBP/JPY sank close to 250 pips on Thursday, erasing Wednesday’s gains.

- The GBP/JPY daily chart is neutral-biased, but a double-top tilts the bias downwards.

- GBP/JPY Price Analysis: If sellers reclaim 163.00, a dive towards 161.00 is on the cards.

The GBP/JPY erases Wednesday’s gains and tanks more than 250 pips as traders assess the US Federal Reserve commentary, but also due to the US Advanced GDP for the Q2 contracting, meaning that the country is in a “technical recession.” In the FX space, investors flew towards safe-haven assets, with the Japanese yen being the best performer, appreciating the most vs. the greenback since March 2020. At the time of writing, the GBP/JPY is trading at 163.50.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart depicts the pair as neutral biased, once it cleared on its way south, the 20 and 50-day EMAs. Additionally, a double-top formed, and even though Thursday’s low broke below the neckline, sellers lost steam, giving way to some buying pressure. However, if GBP/JPY sellers reclaim 163.00, they will challenge the July 12 low at 161.82, followed by the double-top target at 159.50.

GBP/JPY 1-hour chart

The GBP/JPY further cemented the neutral bias, with price action stuck between the 163.00-166.00 range. However, Thursday’s price action tilted the tendency downwards, as the GBP/JPY exchange rate tumbled below all the hourly EMAs. Therefore, the GBP/JPY is neutral-to-downward biased.

That said the GBP/JPY first support would be the 163.00 figure. The break below will expose the S1 daily pivot at 162.17, followed by the S2 pivot point at 160.92.

GBP/JPY Key Technical Levels

What you need to take care of on Friday, July 29:

Thursday was another volatile day, with financial markets struggling for direction. The dollar remained under pressure during Asian trading hours, resurged during the European session and came again under pressure in the American afternoon.

The greenback’s intraday advance could be attributed to renewed recession-related fears following the release of tepid European data. The EUR/USD pair traded between 1.0113 and 1.0233 to finally settle at 1.0180.

The US published the second quarter Gross Domestic Product, which showed that the economy entered a technical recession after contracting by 0.9% in the three months to June and following a 1.6% contraction in Q1. However, stock markets ignored the news. US indexes soared and reached fresh multi-week highs, where they stand early in the Asian session.

Different US authorities diminished the relevance of the negative figure. Federal Reserve chief Jerome Powell anticipated it on Wednesday, saying that a disappointing GDP figure should be taken with a pinch of salt. US Treasury Secretary Janet Yellen said on Thursday that the Q2 contraction demonstrates the economy's move to more sustainable growth. Finally, President Joe Biden noted that Chair Powell and several other high-level banking executives claim that the US is not in a recession.

Also, Biden spoke with Chinese President Xi Jinping as part of US efforts to deepen lines of communication, responsibly manage differences, and address issues of mutual interest. There was no mention of tariff reduction.

Safe-haven assets were the best performers against the greenback. USD/CHF plunged to 0.944, while USD/JPY bottomed at 134.19, both trading nearby. Gold soared and now changes hands at $1,755 a troy ounce.

The GBP/USD pair maintained the bullish momentum and reached 1.2190, now hovering around 1.2165. Commodity-linked currencies posted modest intraday losses, helped by soaring equities. AUD/USD quotes at 0.6980 while USD/CAD is at 1.2820.

Crude oil prices eased, and WTI settled at $97 a barrel.

Cardano Price Prediction: Was ADA's post-FOMC euphoric rally a bull trap?

Like this article? Help us with some feedback by answering this survey:

- GBP/USD bulls moving back in for another attempt at the 1.22 area.

- The US dollar remains pinned to the floor following the dialled-down Fed monetary policy pricing in markets.

GBP/USD is trading at 1.2160 and around flat on the day following a surge after the Federal Reserve meeting on Wednesday and a statement that left the futures markets tied to Fed policy expectations tilted towards a more moderate increase for the next meeting. This resulted in the softer US dollar which is now treading water around the lower quarter of the 106 area as per DXY, an index that measures the greenback vs. a basket of major currencies.

Domestically, there has been no UK data but investors are second-guessing the Bank of England's next move. The Old Lady meets on August 4. and markets are pricing the central bank to continue its tightening cycle with the possibility of a larger 50-bp increase. Nevertheless, dosued in political and economic woes, sterling has been one of the laggard this year despite The Old Lady being out of the traps with policy tightening relatively early. Relative to other G10 currencies, GBP is holding in the middle of the pack in terms of its performance in the year to date, improving only as the euro sinks towards the bottom of the pack.

''GBP has been trading under a cloud of negative sentiment for large swaths of this year,'' analysts at Rabobank noted. ''It was notable in May that the BoE’s (as expected) rate hike failed to stop the pound from falling as the market latched on to the Bank’s downside growth revision.''

''Around this time the OECD forecast that the UK would see no growth in 2023, a little worse than our house forecast of 0.2%. The BoE, like most other central banks, it committed to reigning in inflation, even at the cost of growth. However, the absence of the latter has provided a strong headwind for the pound.''

Meanwhile, the US dollar has been pushed and pulled this week in the build-up to the Fed outcome, juggled between the bears and bulls depending on risk sentiment. The weakness in the euro has benefitted the US dollar due to the gas woes in Europe and poor business sentiment from Germany on Monday. Additionally, an overall gloomy outlook for world growth as forecasted by the International Monetary fund has helped to buoy the greenback for its safe haven allure.

However, it has been all about the Fed since Wednesday and the DXY has been trading on the backfoot since since the US central bank raised interest rates by 75 basis points, as was widely anticipated, while comments from Fed Chair Jerome Powell spurred hopes for a slower hiking path.

On Thursday, the US Gross Domestic Product was reported to have fallen at a 0.9% annualized rate last quarter, the Commerce Department said in its advance estimate of GDP. Economists polled by Reuters had forecast GDP rebounding at a 0.5% rate.

GBP/USD technical analysis

The pound is attempting to claim the 1.22 area following a pullback to the 50% mean reversion of the 4-hour bullish impulse. There is a weekly price imbalance (greyed area on the chart above) that has a confluence with the 78.6% Fibonacci retracement level that could captivate the bulls in the near future.

The US president Joe Biden spoke following today's early reading that showed the US economy contracted for the two quarters through June and yesterday's Federal Reserve interest rate decision and statement that has resulted in futures markets tied to Fed policy expectations tilting towards a more moderate increase for the next meeting.

Biden, says that Fed Powell and many significant banking personnel say we are not in a recession and that strong data, that prospect for passing the chips bill and other factors don't 'sound like a recession'. However, he acknowledged that growth is expected to be slower compared to last year.

Gross Domestic Product fell at a 0.9% annualized rate last quarter, the Commerce Department said in its advance estimate of GDP on Thursday. Economists polled by Reuters had forecast GDP rebounding at a 0.5% rate.

While Biden and others say the US is not in a recession, the second straight quarterly decline in GDP meets the standard definition of a recession. However, the Dow Jones Transport Average index viewed as a bellwether for health of the economy, was up 2.7%. This suggests that investors are taking a nuanced view about whether the US economy is headed for a significant downturn.

Meanwhile, the greenback has fallen since the Fed raised interest rates by 75 basis points on Wednesday, as was widely anticipated, while comments from Fed Chair Jerome Powell spurred hopes for a slower hiking path.

- EUR/USD falls due to weaker than expected EU economic data, facing strong headwinds with the energy crisis, and slower economic growth.

- US GDP in the second quarter showed signs of contraction, meaning the US is in a “technical recession.”

- Inflation in Germany tops around 8.6% YoY, while the EU’s economic sentiment plunges.

The EUR/USD drops from daily highs above 1.0200, trimming some of Wednesday’s gains. On Wednesday, the market perceived a slightly “dovish” tilt of Fed Chair Jerome Powell as that, so most G8 currencies rallied vs. the greenback. Additionally, the US economy getting into a “technical recession,” as the US Department of Commerce reported, would keep the greenback pressured.

The EUR/USD is trading at 1.0170 after hitting a daily high at 1.0234, but tumbled on worst-than-expected EU Economic sentiment & Consumer confidence figures, plunging towards the daily low of 1.0114, before bouncing on dismal US economic data.

EUR/USD, unable to capitalize on a soft US Dollar, could fall further

Sentiment remains positive and would likely end in that way. Data from the US Department of Commerce showed that US GDP in the second quarter shrank 0.9%, less than the forecasted 0.4% growth. That said, alongside money market futures pricing a less “hawkish” Fed than previously estimated, with odds of a 75 bps rate hike in September at 78%.

At the same time, the US Department of Labor reported that the US Initial Jobless Claims for the week ending on July 23 increased by 256K, more than the 253K estimated. Nevertheless, fell compared to the week ending on July 16, which printed 261K.

Elsewhere, the US Dollar Index is almost flat at 106.473 after reaching a daily high at 106.975. US Treasury yields are also down, led by the US 10-year benchmark note coupon diving ten bps, sitting at 2.680%.

In the Europe session, inflation in Germany rose unexpectedly in June, with the HICP increasing by 8.5%, higher than estimations and smashing the previous figure of 8.3%. In non-harmonized estimations, inflation in Germany fell slightly to 7.5%, from the prior reading of 7.6%.

Earlier, the EU Economic sentiment plunged to 99 in July, lower than estimations of 102. In the same tone, the EU Consumer confidence tumbled -27.0 vs. -23.8 in June.

What to watch

On Friday, the EU economic docket will feature Eurozone, France, Italy, and Spain’s GDP Growth and inflation readings. That is alongside Germany’s employment data and GDP Growth. On the US front, the calendar will feature the core and headline PCE Price Index for June, the Chicago PMI, and the University of Michigan Consumer Sentiment for July.

EUR/USD Key Technical Levels

- NZD/USD climbed almost 0.20% on Thursday after Fed’s hike and dismal US GDP data.

- Money market futures expectations of a Fed’s 75 bps rate hike in September lie at a 78% chance.

- NZD/USD Price Analysis: Buyers reclaiming 0.6308 would pave the way for further gains; otherwise, a move towards 0.6200 is on the cards.

The NZD/USD rises after the release of mediocre US GDP data that shows the US economy is in a technical recession after the Federal Reserve increased rates by 75 bps on Wednesday. Market players speculate that the Fed tilted “dovish,” which appears premature, as Fed Chair Powell reiterated that they are committed to bringing inflation down to 2%.

Nevertheless, the NZD/USD is trading at 0.6272 after diving in the early Asian session and hitting the daily low at 0.6250, but buyers stepping in lifted the pair just shy of reaching 0.6300.

NZD/USD advances due to upbeat sentiment on bad US GDP print

Investors’ moods shifted positively in the last couple of hours. The US Bureau of Economic Analysis reported that GDP for the second quarter in its Advance estimate contracted by 0.9%, missing estimations of a 0.4% growth. That said, money market futures have scaled back Fed tightening, and odds of a 75 bps rate hike in September lie at 78%.

In the meantime, the US Dollar Index is almost flat at 106.481 after reaching a daily high at 106.975. US Treasury yields are also down, led by the US 10-year benchmark note coupon diving ten bps, sitting at 2.680%. These aforementioned factors are a tailwind for the New Zealand dollar, though it has barely blinked, as some analysts see the current reaction as a “misreading” of what the Fed is doing and will do.

Analysts at BBH said that the Fed “… noted that spending and production are softer while job gains remain robust. Lastly, the statement noted that balance sheet reduction is proceeding at its announced pace. All of this was pretty much as expected. There was no hint of a pause or that the Fed is even thinking about a pause.”

They added, “The initial market response was that the Fed had pivoted. We wholeheartedly disagree.”

Aside from this, US Initial Jobless Claims for the week ending on July 23 increased by 256K, higher than estimations but lower than the previous week’s 261K.

What to watch

The New Zealand economic docket will feature the ANZ Consumer Confidence for July, foreseen at 79. On the US front, the calendar will feature the core and headline PCE Price Index for June, the Chicago PMI, and the University of Michigan Consumer Sentiment for July.

NZD/USD Price Analysis: Technical outlook

The NZD/USD remains neutral-to-downward biased, despite jumping in two-volatile trading sessions, namely Wednesday and Thursday. If NZD/USD buyers break above the 50-day EMA at 0.6307, the next resistance would be the June 16 daily high at 0.6395. Otherwise, the NZD/USD first support would be 0.6200, which, once cleared, would open the door for a test of the 20-day EMA at 0.6192.

The US economy contracted at a 0.9% annualized rate in the second quarter, according to official data released on Thursday. Analysts at Wells Fargo point out it is undeniable that the economy is cooling. They believe broad activity is not yet consistent with a contraction that is typically thought of as a recession.

Key Quotes:

“We are forecasting recession, but we do not have it starting until early next year. The strength of the labor market today is the best argument against those saying we are already in recession.”

“Even if skeptics can be convinced that in this particular instance, back-to-back quarters of negative GDP growth does not constitute a recession, it is undeniable that the economy is cooling. Based on the available data, we believe broad activity is not yet consistent with a contraction that is typically thought of as recession.”

“We expect tight monetary policy alongside still-high inflation to tip the U.S. economy into a mild recession by Q1-2023. Our latest July forecast pulled forward the timing of that downturn, and if conditions continue to deteriorate, it may warrant further reconsideration. Another potential consideration in the context of today's report is that an argument could be made that tighter monetary policy is already having a demonstrable slowing effect on growth; if that succeeds in cooling inflation, it might make the Federal Reserve's job a little easier.”

- USD/CHF faced solid resistance around the 100-day EMA and plummeted 70 pips from its highs.

- The USD/CHF might fall towards 0.9500 unless buyers reclaim the 200-hour EMA at 0.9665.

The USD/CHF extends its weekly losses and falls for the third consecutive day, tumbling below the 100-day EMA and beneath 0.9600, on worst than estimated US GDP figures that showed the US economy is in a technical recession. At the time of writing, the USD/CHF is trading at 0.9576.

USD/CHF Price Analysis: Technical outlook

The USD/CHF price action on Wednesday sent the pair sliding under the 100-day EMA at 0.9610 and recorded a daily close below 0.9600. However, USD/CHF buyers lifted the pair as sentiment shifted sour. Nevertheless, solid resistance above, like the 61.8% Fibonacci retracement at 0.9644 and the 100-day EMA, were difficult ceiling levels to overcome, and sellers outweighed buyers. Hence, the USD/CHF plunged 70 pips from its daily highs.

USD/CHF 1-hour chart

The USD/CHF hourly chart depicts the pair as downward biased. The major tumbled below the 100, 50, and 20-hour EMAs, but the fall was capped around the S1 daily pivot, around 0.9562. If USD/CHF buyers want to regain control, they will need a decisive break above the 200-hour EMA at 0.9665; otherwise, sellers are in charge.

Therefore, the USD/CHF first support will be the S1 pivot point at 0.9562. A breach of the latter will expose the S2 daily pivot at 0.9536, which, once cleared, will leave the major vulnerable to fall towards 0.9500.

USD/CHF Key Technical Levels

On Wednesday, the Federal Reserve raised the key interest rate by 75 basis points, as expected. Analysts at the Research Department at BBVA stick with our forecast that the Fed will take the fed funds rate to a 3.25-3.50% by the end of this year, shifting to a 50 bps hike in September, followed by two consecutive 25 bps hikes in November and December.

Key Quotes:

“We stick with our forecast that the Fed will take the fed funds rate to a 3.25-3.50% target range by the end of this year, which will imply a shift to slow the pace of rate increases to a 50 bps hike in September, followed by two consecutive 25 bps hikes in November and December.”

“We continue to expect the fed funds rate to peak at 3.75-4.00% in 1H23 as we anticipate that core inflation will still show signs of stickiness by then. Yet, the path for monetary policy in 2023 and beyond is becoming much more uncertain as risks to the outlook will likely become more two-sided. Increased odds of a recession in 2023 will make the Fed's job more challenging. Uncertainty around the Fed steps in 2023 will rise, but for the time being, the most likely scenario is still that the Fed will have the need to stick to the series of additional rate hikes that seem more plausible for the median of Fed officials in the latest update of the Summary of Economic Projections (SEP).”

- USD/MXN is falling for the fifth consecutive day.

- Losses seem limited while above 20.30; dollar to strengthen above 20.55.

The USD/MXN is falling for the fifth consecutive day. The decline found support again around the 20.30 area that also capped the downside earlier in July. The mentioned zone is the key support and a consolidation below would clear the way for the 55-day Simple Moving Average at 20.15. The next support stands at 20.00.

The 20.30 area also contains an uptrend line from the June low, reinforcing the importance of this crucial area.

Technical indicators offer no clear signs. Momentum and the RSI are flatting. Price remains below the 20-day Simple Moving Average (20.54) that is still heading north. The bearish bias still prevails in the short term but shows a lack of strength.

A recovery above 20.55 should improve the outlook for the greenback. The next key resistance is seen at 20.70, that last defense to a new test of 20.90. A daily close above the last one would expose 21.00.

USD/MXN Daily chart

-637946222722358294.png)

Chinese President Xi Jinping told US President Joe Biden on Thursday that they firmly oppose Taiwan's independence and the interference of external forces, Chinese state media reported.

"Those who play with fire will only get burnt," Xi told his American counterpart during the phone call, as per Reuters. "Hope the US side can see this clearly."

Market reaction

This headline doesn't seem to be having a significant impact on risk perception. As of writing, the US Dollar Index was up 0.15% on the day at 106.62 and Wall Street's main indexes were rising between 0.15% and 0.55%.

- USD/CAD hit a six-week low at 1.2794 but recovered some ground, eyeing a break above 1.2850.

- The US BEA revealed that the GDP for the second quarter contracted less than the first quarterfinal reading.

- USD/CAD remains positive due to a solid US dollar and falling oil prices.

The USD/CAD bounces from weekly highs and rises towards the 50-day EMA at 1.2853 after dismal US economic data flashes that the US is in a “technical” recession after the Fed hiked 75 bps its interest rate on Wednesday and conceded that production and spending are “softening.”

The USD/CAD is trading at 1.2833 after refreshing six-week lows at 1.2794 but rebounded and hit a daily high just above the 100-hour EMA at 1.2869 before reaching current exchange rate levels.

USD/CAD advances despite worst than expected US data

Sentiment remains mixed but fragile and could turn sour during the day, meaning upside action for the USD/CAD lies ahead. Shrinking US Q2 GDP data keeps US equities fluctuating from gaining to losing throughout the day. The US Department of Commerce reported that GDP dropped by 0.9% annually after declining 1.6% in the first quarter, meaning that the US is in a technical recession.

In the meantime, the US Department of Labor revealed that unemployment claims for the week ending on July 23 rose by 256K, higher than forecasts but lower than the previous week’s 261K.

Aside from this, the greenback’s rise and falling US crude oil prices keep the USD/CAD risks skewed to the upside. The US Dollar Index, a gauge of the greenback’s value vs. a basket of peers, climbs 0.04% to 106.504, while WTI exchanges hands at $97.99 BPD, down 0.02%.

What to watch on Friday

The Canadian economic docket will feature the GDP for May and June’s GDP preliminary reading. The US calendar will feature the core and headline PCE Price Index for June, alongside the Chicago PMI and the University of Michigan Consumer Sentiment for July, on its final release.

USD/CAD Key Technical Levels

US President Joe Biden will deliver his remarks on the Inflation Reduction of 2022.

Earlier in the day, the data published by the US Bureau of Economic Analysis (BEA) showed that the US economy contracted at an annualized rate of 0.9% in the second quarter. The US Dolar Index, which recovered toward 107.00 earlier in the day, retreated toward 106.50 during the American trading hours.

On Friday, the BEA will release the Personal Consumption Expenditures (PCE) Price Index data, the Fed's preferred gauge of inflation.

- Australian dollar pulls back versus greenback, still above FOMC levels.

- US dollar hit by lower US yields after economic data.

- AUD/USD retreats from 0.7000, and holds a bullish bias.

The AUD/USD printed a fresh daily low during the American session at 0.6954. It is attempting to recover momentum supported by an improvement in market sentiment and on the back of a weaker US dollar.

Between a weak dollar and… risk aversion?

Data released on Thursday showed the US economy contracted during the second quarter at an annualized rate of 0.9%, against expectations of a 0.5% expansion. It is the quarterly contraction in a row, so it points to the US economy falling into a technical recession.

“Insisting upon the precise definition of recession will be an even more fraught task in light of the unequivocal deterioration in economic activity reflected in today's 0.9% contraction in Q2 real GDP. Yet real consumer spending continued to forge ahead and the job market still has legs. It is too early call the end of this expansion, but the hour is fast approaching”, said analysts at Wells Fargo. The numbers triggered a rally in Treasuries and weighed on the US dollar. The US 10-year yield is at 2.66%, the lowest level since April.

After a negative opening, equity prices are up again in Wall Street, adding to yesterday’s strong gains. Initially, risk aversion gave some support to the dollar but later faded.

The AUD/USD still shows a bullish bias. A test of 0.7000 seems likely over the next session if it remains above 0.6950. Below the next support stands at 0.6910. A break lower would weaken the outlook suggesting a deeper correction ahead.

Technical levels

- Gold price advances more than 1%, recording back-to-back gains for the first time since July 21-22.

- The US Q2 GDP, on its preliminary reading, contracted, meaning the US is in a technical recession.

- The US economic calendar on Friday will update the Fed’s favorite inflation gauge, alongside the UoM Consumer Sentiment.

Gold Price breaks above the top of the $1700-$1720 range and rallies towards the $1750 area, where the non-yielding metal will face solid resistance, led by the July 8 daily high at $1752.46. At the time of writing, the XAUUSD is trading at $1753.62.

Gold rises on mixed sentiment and falling US bond yields

Global equities are mixed, though US stocks are trimming some of Wednesday’s gains, courtesy of the Federal Reserve’s slightly “dovish” tilt. Although the US Fed Chair Jerome Powell acknowledged that production and spending were slowing down, he reiterated that the Fed would continue hiking rates, opening the door for another “exceptionally” increase. After that, the US central bank would become data-dependent and could slow the pace of tightening.

Gold price reaction to that climbed from $1718.60 to $1738.28 and finished trading around $1733.10. On Thursday, the XAUUSD is gaining almost $20 and is up 1%.

In the meantime, the US Advance GDP for Q2 showed signs that the economy is further deteriorating. The US Department of Commerce revealed that GDP shrank at a 0.9% YoY pace after declining 1.6% in the first quarter, meaning that the US is in a technical recession. The report shows decreases in private inventory investment, residential fixed investment, and federal government spending. The positive is that, albeit contracting, it jumped from Q1’s -1.6% YoY print, helped by increases in exports and personal consumption expenditures (PCE).

At the same time, the US Department of Labor reported that Initial Jobless Claims for the week ending on July 23 rose by 256K, higher than forecasts but lower than the previous week’s 261K.

That said, gold regained some bullishness as a stagflation scenario in the US economy looms. However, XAUUSD traders should be aware of US Treasury yields and the US dollar reaction to forwarding data. At the time of writing, the US Dollar Index is rising 0.12%, at 106.598, while the US 10-year Treasury yield collapsed almost ten bps, at 2.685%, a tailwind for the yellow metal.

What to watch

On Friday, the US economic docket will feature the Fed’s favorite inflation gauge, the Personal Consumption Expenditures (PCE), on its headline and core readings. Also, investors need to be aware of the Employment Cost Index, which would shed some clues regarding the stickiness of inflation. Later in the day, the University of Michigan (UoM) Consumer Sentiment for July on its final reading will be revealed.

Gold (XAUUSD) Key Technical Levels

Citing eight sources familiar with the matter, Reuters reported on Thursday that the Organization of the Petroleum Exporting Countries (OPEC) and allies, collectively known as OPEC+, were planning to leave the oil output unchanged for September.

Sources also acknowledged that a modest output increase could be discussed amid calls from the United States for additional supply.

The group is scheduled to meet next Thursday, August 4.

Market reaction

Crude oil prices continue to fall after this report with the barrel of West Texas Intermediate losing 1.6% on the day at $96.50.

- The index regains the upside following GDP figures.

- The US economy is seen contracting 0.9% QoQ in Q2.

- Weekly Claims rose more than expected by 256K.

The greenback comes under pressure following the release of the flash Q2 GDP figures, although it manages well to keep the trade in the 106.50/60 band so far when tracked by the US Dollar Index (DXY).

US Dollar Index capped by 107.00

The greenback keeps the positive bias well in place following the post-GDP knee-jerk, as market participants continue to re-assess the recent interest rate hike by the Fed and comments from Chief Powell.

Indeed, the US economy is now seen contracting 0.9% in the April-June period, charting a second consecutive quarter in the contraction territory, and thus slipping back into a technical recession.

Additional data saw Initial Claims rise by 256K in the week to July 23

What to look for around USD

The index comes under downside pressure in the wake of the Fed meeting on Wednesday and now flirts with the 106.00 region.

Despite the knee-jerk, the constructive view in the dollar appears bolstered by the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

On the flip side, market chatter of a potential US recession could temporarily undermine the uptrend trajectory of the dollar somewhat.

Key events in the US this week: Flash Q2 GDP, Initial Claims (Thursday) – PCE Price Index, Personal Income, Personal Spending, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is up 0.19% at 106.66 and a break above 107.42 (weekly high post-FOMC July 27) would expose 109.29 (2022 high July 15) and then 109.77 (monthly high September 2002). On the other hand, initial support emerges at 106.05 (weekly low July 28) followed by 103.67 (weekly low June 27) and finally 103.41 (weekly low June 16).

Analysts at TD Securities (TDS) offered a brief preview of the monthly Canadian GDP report, which is expected to show that economy contracted by 0.2% in May. The backwards-looking data is scheduled for release on Friday and might fail to exert any meaningful pressure on the Canadian dollar.

Key Quotes:

“We look for industry-level GDP to decline by 0.1% in May, slightly above flash estimates, due to one-off headwinds to the goods-producing sector from auto retooling and construction. Services should fare much better, helped by the ongoing recovery for the travel sector, and we also expect flash estimates to confirm a moderate rebound (~0.3%) for activity in June.”

“Unless data surprises significantly to the downside, CAD is more deferent to broad USD and risk sentiment rather than lagging data. 1.2780/00 key support for USDCAD.”

“Canada is grinding out outperformance vs the US in a very consistent manner. We feel the 30y auction today may restore the supply-demand imbalance Canada currently finds itself in (relative to the US). Our bias for Canada to outperform the US is due for a pause here after solid gains on the trade. Canada is trading fairly in line with the US post that GDP print this morning, and we will see if that holds after our GDP release and the 30y auction.”

- USD/JPY remains under intense selling pressure on Thursday and slides to a one-month low.

- The selling bias picks up pace after the US Q2 GDP report confirmed a technical recession.

- Bearish traders now await a break below the 61.8% Fibo. level support, around mid-134.00s.

The USD/JPY pair witnessed heavy selling on Thursday and extends the previous day's post-FOMC decline from the 137.45 region. This marks the second successive day of a negative move and drags spot prices to a one-month low, around mid-134.00s during the early North American session.

The latest leg down follows the disappointing release of the Advance US GDP report, which showed that the world's largest economy contracted by 0.9% annualized pace during the second quarter. This comes after the 1.6% decline during the January-March period and confirms a technical recession.

The data adds to worries about an economic downturn and reaffirms expectations that the Fed could slow the pace of rate hikes. This is evident from a fresh leg down in the US Treasury bond yields, which results in the narrowing of the US-Japan rate differential and is benefitting the Japanese yen.

On the other hand, the US dollar surrenders a major part of its intraday gains in reaction to the weaker data. This is seen as another factor contributing to the heavily offered tone surrounding the USD/JPY pair, taking along some short-term trading stops near the 135.00 psychological mark.

From a technical perspective, the overnight sustained weakness below the 200-period SMA on the 4-hour chart was seen as a fresh trigger for bears. A subsequent fall below the 50% Fibonacci retracement level of the 131.50-139.39 strong move up on Thursday validates the negative outlook.

That said, bearish traders might now wait for some follow-through selling below the 134.50 region, or the 61.8% Fibo. level support, before placing fresh bets. A convincing break below should pave the way for an extension of the recent corrective slide from the 24-year high.

On the flip side, any meaningful recovery attempt might now confront resistance near the 135.00 mark. This is followed by the 50% Fibo. level, around the 135.45 region, above which a bout of short-covering has the potential to lift the USD/JPY pair back towards the 135.90-136.00 area.

The latter is closely followed by the 200-period SMA on the 4-hour chart, around the 136.15 region, and mid-136.00s (38.2% Fibo. level). Some follow-through buying would suggest that the downfall has run its course and shift the bias back in favour of bullish traders.

USD/JPY 4-hour chart

-637946127004783488.png)

Key levels to watch

European Central Bank (ECB) Governing Council member Ignazio Visco said on Thursday that the weak data give them the responsibility to act in a prudent way while progressively normalizing the policy stance, as reported by Reuters.

"We have to avoid strong measures," Visco added and noted that they don't have to worry about the exchange rate for the time being.

Market reaction

These comments don't seem to be having a significant impact on the shared currency's performance against its rivals. As of writing, the EUR/USD pair was down 0.4% on the day at 1.0160.

Economist at UOB Group Ho Woei Chen, CFA, assesses the recently published GDP figures in South Korea.

Key Takeaways

“South Korea’s GDP rose sequentially for the 8th consecutive quarter with the momentum picking up to 0.7% q/q from 0.6% in 1Q22 as stronger private consumption and government expenditure offset weaker exports and facilities investment.”

“Export and investment could continue to underperform in 2H22 due to factors including weaker global growth, elevated energy prices and accelerated rate hikes to temper runaway inflation. The Bank of Korea (BoK) is expected to continue raising its interest rate for the rest of this year.”

“As such, the strong consumption recovery in 2Q22 could be short-lived with COVID resurgence risks also adding to the growth headwinds. Government spending may also moderate as the new administration plans a tightening in fiscal rules.”

“South Korea’s economy expanded by 2.9% y/y in 1H22. Taking into consideration of the stronger than expected 2Q22 GDP and increased downside risks, we are maintaining our full-year GDP growth forecast for South Korea at 2.7%, with an expected slowdown to 2.8% y/y in 3Q and 2.1% in 4Q.”

- EUR/USD gives away post-FOMC gains and falters near 1.0230.

- There is a tough up barrier around the weekly high at 1.0280 so far.

EUR/USD could not sustain the earlier bull run and retreated to the area well below the 1.0200 support on Thursday.

For the pair to gather a more serious rebound, it needs to leave behind the recent highs around 1.0280 to allow for extra gains to test, initially, the interim hurdle at the 55-day SMA at 1.0435.

In the meantime, the pair is expected to remain under downside pressure while below the 5-month support line around 1.0470.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0969.

EUR/USD daily chart

- Initial Jobless Claims fell by 5,000 in the week ending July 16.

- US Dollar Index struggles to preserve its bullish momentum.

There were 256,000 initial jobless claims in the week ending July 23, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 261,000 and came in worse than the market expectation of 253,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 249,250, an increase of 6,250 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending July 16 was 1,359,000, a decrease of 25,000 from the previous week's unrevised level of 1,384,000," the DOL added.

Market reaction

The US Dollar Index continues to edge lower from daily highs and was last seen posting small gains at 106.55.

- GBP/USD defends the 1.2100 mark and stalls its intraday pullback from a nearly one-month low.

- A technical recession in the US forces the USD to trim a part of its gains and offers some support.

- The UK political/Brexit uncertainty warrants some caution before placing aggressive bullish bets.

The GBP/USD pair finds some support near the 1.2100 mark and stalls its intraday retracement slide from the 1.2200 neighbourhood, or a nearly one-month high touched earlier this Thursday. Spot prices recover a few pips during the early North American session following the release of the Advance US GDP report

According to the first estimate released by the US Bureau of Economic Analysis, the world's largest economy contracted by 0.9% annualized pace during the April-June period. The reading turns out to be worse than the 0.4% growth estimated and follows a 1.6% contraction in the previous quarter, confirming a technical recession. The US dollar is trimming a part of intraday recovery gains, which, in turn, assists the GBP/USD pair to bounce back closer to the mid-1.2100s.

The data, however, adds to growing market worries about a global economic downturn and continues to weigh on investors' sentiment. This is evident from a generally weaker tone around the US equity futures, which, along with an uptick in the US Treasury bond yields, could offer support to the safe-haven buck. Hence, it would be prudent to wait for sustained strength beyond the 1.2200 mark before positioning for any further appreciating move for the GBP/USD pair.

The downside, meanwhile, is likely to remain cushioned, at least for the time being, in the wake of rising bets for a 50 bps rate hike by the Bank of England at its upcoming policy meeting in August. The mixed fundamental backdrop further warrants some caution for aggressive traders amid the UK political uncertainty and Brexit woes.

Technical levels to watch

The US economy contracted at an annualized rate of 0.9% in the second quarter, the US Bureau of Economic Analysis' (BEA) first estimate showed on Thursday. This reading came in much worse than the market expectation for an expansion of 0.5%.

"The decrease in real GDP reflected decreases in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by increases in exports and personal consumption expenditures (PCE)," the BEA explained in its publication. "Imports, which are a subtraction in the calculation of GDP, increased."

Market reaction

With the initial reaction, the US Dollar Index lost its traction and erased a large portion of its daily recovery gains. As of writing, the index was up 0.15% on the day at 106.60.

Senior Economist at UOB Group Alvin Liew reviews the lates publication of inflation results in Singapore.

Key Takeaways

“Singapore’s headline CPI rose much faster than expected, at 1.0% m/m, 6.7% y/y in Jun (from 1.0% m/m, 5.6% y/y in May), fastest y/y print since Sep 2008. Core inflation (which excludes accommodation and private road transport) also rose at a faster clip, up by 4.4% y/y (from 3.6% in May), fastest since Nov 2008.”

“The sources of price pressures for core inflation were again broad-based including almost all the major categories. As for the headline CPI inflation, other than upside to the core CPI, both the accommodation costs and private transport costs were also the key drivers of overall price increases. Transport component continued to lead, contributing an outsized 3.4ppts to the 6.7% inflation print, followed by housing & utilities (1.3ppt) and food (1.2ppt). Communication cost was the only major component of CPI which saw a fall in prices, but its ‘contribution’ was fairly insignificant.”

“In its outlook, the MAS projected core inflation to peak in 3Q and ease towards end-2022, but the warnings on inflation developments remain on the upside, both on the external (‘upward pressure on Singapore’s import prices are expected to persist’) and domestic fronts (tight labour market conditions and businesses to pass higher costs to consumer prices here).”

“We now expect headline inflation to average 6.0% (up from previous forecast of 5.0%) and core inflation at 4.2% (up from previous forecast of 4.0%) in 2022. Our latest forecasts are at the top end of the official outlook for headline CPI (5.0-6.0%) but still exceeds the revised official core inflation forecast range (3.0-4.0%), and with the risks still tilted to the upside, as the MAS rightly highlighted the ‘risks to inflation from fresh shocks to global commodity prices, as well as domestic wage pressures’.”

- DXY fades the post-FOMC sharp pullback and approaches 107.00.

- Extra range bound seems probable for the time being.

DXY bounces off the 106.00 neighbourhood and manages to reverse Wednesday’s strong retracement on Thursday.

So far, the prevailing side-lined trading looks well contained by the 106.00 neighbourhood. If the index breaks above this pattern it could then attempt a move to the 2022 high near 109.40 (July 14). Bouts of extra weakness in the dollar carries the potential to drag the index to the 55-day SMA at 104.71.

The near-term outlook for DXY is seen constructive while above the 5-month support line near 103.90.

In addition, the broader bullish view remains in place while above the 200-day SMA at 99.38.

DXY daily chart

- EUR/GBP remains under heavy selling pressure for the fifth successive day on Thursday.

- The European gas crisis turns out to be a key factor weighing heavily on the shared currency.

- Resurgent USD demand exerts pressure on sterling, which might lend support to the cross.

The EUR/GBP cross is prolonging its recent sharp pullback from the 0.8585 region and losing ground for the fifth successive day on Thursday. The downward trajectory remains uninterrupted through the mid-European session and has now dragged spot prices to over a three-month low, around the 0.8345 region.

The shared currency's relative underperformance comes amid renewed worries over a halt of gas flows from Russia, which could trigger an energy crisis in the Eurozone. In fact, Russian energy group Gazprom said that flows through its main Nord Stream 1 pipeline to Germany had been cut to 20% of their normal levels from Wednesday because of maintenance. Though seems temporary, the supply reduction could drag the region's economy faster and deeper into recession.

On the economic data front, Destatis reported this Thursday that inflation in Germany, as measured by the Consumer Price Index (CPI), edged lower to 7.5% YoY in July from the 7.6% previous. The Harmonised Index of Consumer Prices (HICP), the European Central Bank's preferred gauge of inflation, meanwhile, climbed to 8.5% in the same period from 8.2% as against 8.1% expected. This, however, fails to impress the euro bulls or offer any support to the EUR/GBP cross.

Apart from this, political instability in Italy - ahead of elections in September - adds to concerns about the regions economic outlook and could further weigh on the euro. This supports prospects for a further near-term depreciating move for the EUR/GBP cross. The British pound, on the other hand, is pressured by resurgent US dollar demand and could help limit deeper losses. Nevertheless, the fundamental backdrop seems tilted firmly in favour of bearish traders.

Technical levels to watch

- Annual HICP in Germany jumped to 8.5% in July.

- EUR/USD stays under bearish pressures, closes in on 1.0100.

Inflation in Germany, as measured by the Consumer Price Index (CPI), declined to 7.5% on a yearly basis in July from 7.6% in June, Germany's Destatis reported on Thursday. This reading came in slightly higher than the market expectation of 7.4%.

The Harmonised Index of Consumer Prices (HICP), the European Central Bank's preferred gauge of inflation, climbed to 8.5% in the same period from 8.2%, compared to the market expectation of 8.1%.

Market reaction

The shared currency struggles to find demand after this report and the EUR/USD pair was last seen losing 0.85% on the day at 1.0117.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting assess the latest inflation figures in the Malaysian economy.

Key Takeaways

“Headline inflation breached the 3% level for the first time this year at 3.4% y/y in Jun (from 2.8% in May). It came in higher than ours and Bloomberg consensus of 3.2%. Price pressures broadened with more consumer price index (CPI) components recording larger price increases last month compared to the preceding month, led by food and transport components.”

“We expect CPI growth to jump above 4.0% in 2H22 after averaging 2.5% in 1H22. Our 2H22 inflation outlook largely rests on high commodity prices, year-ago low base effects, persistent currency weakness, changes in some staple food prices (i.e. chicken, eggs and cooking oil), and recovering domestic demand. The new targeted fuel subsidy mechanism, which is currently under pilot testing, will pose upside risks to our inflation outlook should it be implemented over the next few months. As such, our current full-year inflation forecast of 3.0% is subject to upward revision next month when the Jul CPI reading is released (vs. 2.5% in 2021, BNM est: 2.2%-3.2%).”

“The combination of factors including broadening second-round effects on inflation, firmer domestic economic recovery, and diminishing real interest rate gap with US continue to suggest a need for further policy normalisation. We expect Bank Negara Malaysia to deliver another 25bps rate hike at the next MPC meeting on 7-8 Sep, taking the Overnight Policy Rate (OPR) to 2.50%.”

US Q2 GDP Overview

Thursday's economic docket highlights the release of the Advance second-quarter US GDP report, at 12:30 GMT. Having contracted by 1.6% in the previous quarter, the world's largest economy is expected to return to growth and narrowly avoided a so-called 'technical' recession. GDP likely grew at a meagre 0.3% annualized pace during the April-June period, though some economists anticipate a drop in activity for the second successive quarter.

According to Valeria Bednarik, Chief Analyst at FXStreet, “Macroeconomic data points to heightened downward risks for the economy, particularly figures linked to the last half of the quarter, as spending retreated sharply.”