- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-09-2018

| Raw materials | Closing price | % change |

| Oil | $72.13 | -0.21% |

| Gold | $1,199.20 | -0.49% |

| Index | Change items | Closing price | % change |

| Nikkei | +93.53 | 24033.79 | +0.39% |

| SHANGHAI | +25.68 | 2806.81 | +0.92% |

| ASX 200 | +6.40 | 6192.30 | +0.10% |

| FTSE 100 | +3.93 | 7511.49 | +0.05% |

| DAX | +11.23 | 12385.89 | +0.09% |

| CAC 40 | +33.63 | 5512.73 | +0.61% |

| DJIA | -106.93 | 26385.28 | -0.40% |

| S&P 500 | -9.59 | 2905.97 | -0.33% |

| NASDAQ | -17.10 | 7990.37 | -0.21% |

| Pare | Closed | % change |

| EUR/USD | $1,1742 | -0,20% |

| GBP/USD | $1,3163 | -0,10% |

| USD/CHF | Chf0,96511 | +0,01% |

| USD/JPY | Y112,68 | -0,24% |

| EUR/JPY | Y132,30 | -0,44% |

| GBP/JPY | Y148,336 | -0,33% |

| AUD/USD | $0,7257 | +0,14% |

| NZD/USD | $0,6661 | +0,30% |

| USD/CAD | C$1,3043 | +0,70% |

Major US stock indexes finished trading in negative territory, affected by the collapse of the conglomerate sector and the financial sector.

The focus of investors' attention is also data on the housing market and the results of the Fed meeting. The Commerce Department reported that sales of new single-family homes in the US rose more than expected in August after two direct monthly decreases, but the main trend still indicates a weakening of the housing market amid rising mortgage rates and higher housing prices . The report showed that sales of new buildings recovered 3.5 percent to a seasonally adjusted level of 629,000 units. The pace of sales in July was revised to 608,000 units from 627,000 units. Sales in June were also much weaker than previously reported. Economists predicted that sales of new homes rose to 630,000 units.

As for the Fed meeting, as expected, the Central Bank raised interest rates by another 0.25% and signaled its intention to continue raising rates next year. This rate increase was the third this year and the eighth since the Fed began tightening policies in late 2015. In addition, for the first time in a decade, the rate exceeded the level of inflation according to the Fed's preferred index of prices for personal consumption expenditure, which in July rose by 2%.

Most of the components of DOW finished trading in the red (22 of 30). Outsider were shares of American Express Company (AXP, -1.69%). The leader of growth was the shares of International Business Machines Corporation (IBM, + 1.81%).

Almost all S & P sectors recorded a decline. The largest drop was shown by the sector of conglomerates (-1.1%). The services sector grew most (+ 0.3%).

At closing:

Dow 26,385.28 -106.93 -0.40%

S & P 500 2,905.97 -9.59 -0.33%

Nasdaq 100 7,990.37 -17.10 -0.21%

Greenback ticked higher on Wednesday afternoon and the Dollar index was seen to be 0.20% higher, slowly bouncing from two-month lows reached earlier in the week.

Investors are focusing on today's FOMC monetary policy decision, with the Fed seen hiking the fed fund rate to 2.25%. Just like every quarter, this decision will be accompanied by fresh inflation and economic projections and, we will see a new version of the so-called dot plot. As the rate hike has already been priced in, market participants will pay attention mainly to new projections and the dot plot.

The Central Bank appears to be ready to continue to tighten monetary policy, despite the ongoing trade war and flattening yield curve. Many maturities of the bond yield have risen to fresh cycle highs this week, with the 10-year bond yield jumping above 3.1% and the 2-year yield trading near 2.85%.

However, the greenback failed to capitalise on rising yields and traders have been selling the US Dollar recently. Moreover, stock markets are ignoring rising yields and US indices are trading at record highs.

Volatility is expected to be high after the decision, especially if the Fed confirms the rate hiking bias on the dot plot. Should the dollar index jump above 94.50, we could see a bigger relief rally targeting the 95.00 level. On the other hand, if the Fed sounds dovish today, the greenback could decline to new swing lows below 93.80.

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or an investment advice by TeleTrade. Indiscriminate reliance on illustrative or informational materials may lead to losses.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.9 million barrels from the previous week. At 396.0 million barrels, U.S. crude oil inventories are about 2% below the five year average for this time of year.

Total motor gasoline inventories increased by 1.5 million barrels last week and are about 8% above the five year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories decreased by 2.2 million barrels last week and are about 3% below the five year average for this time of year. Propane/propylene inventories increased by 1.6 million barrels last week and are about 10% below the five year average for this time of year. Total commercial petroleum inventories increased last week by 4.5 million barrels last week

Sales of new single-family houses in August 2018 were at a seasonally adjusted annual rate of 629,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.5 percent above the revised July rate of 608,000 and is 12.7 percent above the August 2017 estimate of 558,000.

The median sales price of new houses sold in August 2018 was $320,200. The average sales price was $388,400.

The seasonally-adjusted estimate of new houses for sale at the end of August was 318,000. This represents a supply of 6.1 months at the current sales rate.

U.S. stock-index futures edged higher on Wednesday, as bank stocks gained ahead of the announcement of the Federal Reserve's latest monetary-policy decision.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 24,033.79 | +93.53 | +0.39% |

| Hang Seng | 27,816.87 | +317.48 | +1.15% |

| Shanghai | 2,806.82 | +25.68 | +0.92% |

| S&P/ASX | 6,192.30 | +6.40 | +0.10% |

| FTSE | 7,505.70 | -1.86 | -0.02% |

| CAC | 5,496.83 | +17.73 | +0.32% |

| DAX | 12,350.08 | -24.58 | -0.20% |

| Crude | $71.81 | | -0.65% |

| Gold | $1,198.60 | | -0.54% |

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 213.4 | 2.76(1.31%) | 1500 |

| ALCOA INC. | AA | 41.4 | 0.16(0.39%) | 1236 |

| Amazon.com Inc., NASDAQ | AMZN | 1,976.95 | 2.40(0.12%) | 31583 |

| American Express Co | AXP | 109.28 | -0.59(-0.54%) | 197 |

| Apple Inc. | AAPL | 222.18 | -0.01(-0.00%) | 126654 |

| AT&T Inc | T | 33.78 | 0.02(0.06%) | 13966 |

| Barrick Gold Corporation, NYSE | ABX | 11.19 | 0.01(0.09%) | 88715 |

| Boeing Co | BA | 368 | 0.77(0.21%) | 1163 |

| Chevron Corp | CVX | 123 | -0.37(-0.30%) | 520 |

| Cisco Systems Inc | CSCO | 48.66 | 0.19(0.39%) | 1660 |

| Citigroup Inc., NYSE | C | 73.75 | 0.24(0.33%) | 15579 |

| Facebook, Inc. | FB | 164.88 | -0.03(-0.02%) | 54579 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.45 | -0.04(-0.28%) | 9397 |

| General Electric Co | GE | 11.25 | -0.02(-0.18%) | 237184 |

| General Motors Company, NYSE | GM | 33.65 | 0.10(0.30%) | 5672 |

| Google Inc. | GOOG | 1,189.39 | 4.74(0.40%) | 3047 |

| Intel Corp | INTC | 45.87 | -0.04(-0.09%) | 20271 |

| International Business Machines Co... | IBM | 151.41 | 2.50(1.68%) | 36027 |

| Merck & Co Inc | MRK | 70.39 | -0.26(-0.37%) | 2047 |

| Microsoft Corp | MSFT | 114.75 | 0.30(0.26%) | 19079 |

| Nike | NKE | 82.51 | -2.28(-2.69%) | 189352 |

| Pfizer Inc | PFE | 43.64 | -0.15(-0.34%) | 287 |

| Tesla Motors, Inc., NASDAQ | TSLA | 301.11 | 0.12(0.04%) | 11061 |

| Verizon Communications Inc | VZ | 53.17 | 0.12(0.23%) | 4607 |

| Visa | V | 149.75 | 0.17(0.11%) | 873 |

| Wal-Mart Stores Inc | WMT | 95.47 | 0.37(0.39%) | 214 |

| Walt Disney Co | DIS | 114 | 0.37(0.33%) | 3713 |

Downgrades before the market open

DowDuPont (DWDP) downgraded to Neutral from Buy at Nomura; target $76

Upgrades before the market open

IBM (IBM) upgraded to Buy from Neutral at UBS; target raised to $180 from $160

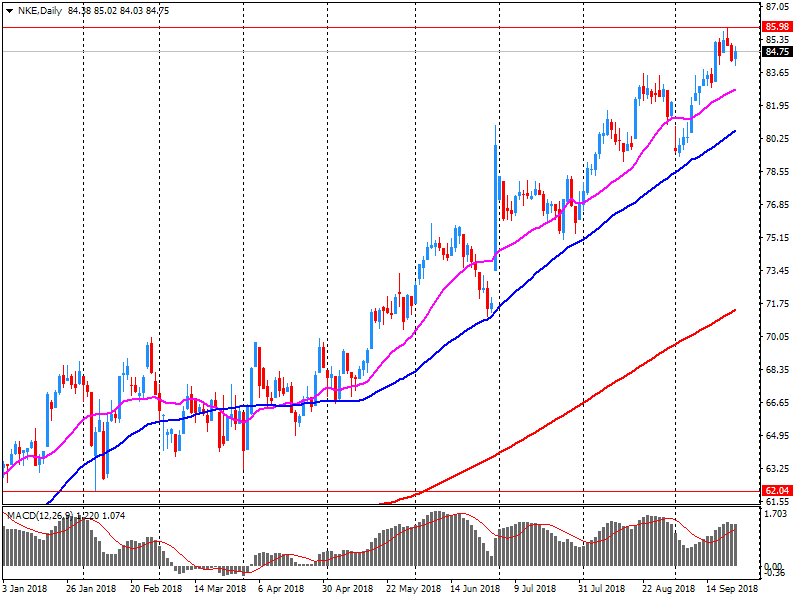

NIKE (NKE) reported Q1 FY 2019 earnings of $0.67 per share (versus $0.57 in Q1 FY 2018), beating analysts' consensus estimate of $0.63.

The company's quarterly revenues amounted to $9.948 bln (+9.7% y/y), generally in-line with analysts' consensus estimate of $9.918 bln.

NKE fell to $82.70 (-2.46%) in pre-market trading.

Retail sales volumes growth eased slightly in the year to September but remained broadly in line with the long-run average. That's according to the latest CBI monthly Distributive Trades Survey.

The survey of 117 firms showed that sales volumes were in line with average for the time of year and are set to remain so again next month. Orders placed on suppliers were unchanged in the year to September and are expected to remain broadly flat next month.

Within the retail sector, growth in sales volumes was reported in the durable household goods, hardware & DIY, non-store (i.e. internet and mail order), and other normal goods sub-sectors. Meanwhile, sales volumes fell for the non-specialised (i.e. department stores), footwear & leather, chemists and recreational goods sub-sectors.

Year-on-year internet sales volumes expanded at a broadly average pace - for the third month running - in the year to September and are expected to grow at a similar pace again next month.

-

Growth Risk Have Yet To impact Hard Data

-

Gross mortgage lending for the total market in August was £24.1bn, some 1.2 per cent lower than a year earlier.

-

The number of mortgage approvals by the main high street banks in August rose by 0.7 per cent compared to the same month a year earlier. Within this, remortgaging approvals were 9.2 per cent higher than for the same period a year earlier. There was a fall in house purchase and other secured borrowing of 4.3 per cent and 2.1 per cent respectively.

-

Credit card spending was 7.6 per cent higher than a year earlier, with outstanding levels on card borrowing growing by 5.8 per cent over the year. Outstanding overdraft borrowing was 7.2 per cent lower compared to the same time last year.

-

Personal deposits grew by 1.2 per cent in the last 12 months. Deposits held in instant access accounts were 4.3 per cent higher than a year earlier.

The U.S. Federal Reserve is largely expected to raise the interest rate by 25 basis points to a corridor of 2% to 2.25% on Wednesday, hence the flat EUR/USD at 1.1766 in London morning trading. The Fed's monetary policy tightening is likely to end next year, says UniCredit, which means "most of the dollar's strength is behind us." The Fed could remove the word "accommodative" from Wednesday's statement, but most analysts think this is unlikely. Even if it does, "we would not expect this change to trigger any strong dollar buying," UniCredit says - via WSJ.

In September, households have been less optimistic concerning their future financial situation: the corresponding balance has lost 5 points and deviated from its long term average. Household's balance of opinion on their past personal situation has been stable and stands below its long term average.

The share of households considering it is a suitable time to make major purchases has been virtually stable. The corresponding balance stands above its long term average since January 2016.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1883 (2914)

$1.1858 (2910)

$1.1845 (605)

Price at time of writing this review: $1.1765

Support levels (open interest**, contracts):

$1.1725 (2175)

$1.1685 (1839)

$1.1641 (3899)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 15 is 88019 contracts (according to data from September, 25) with the maximum number of contracts with strike price $1,1900 (5162);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3273 (2446)

$1.3255 (1710)

$1.3240 (654)

Price at time of writing this review: $1.3174

Support levels (open interest**, contracts):

$1.3130 (1144)

$1.3098 (425)

$1.3062 (966)

Comments:

- Overall open interest on the CALL options with the expiration date October, 15 is 29567 contracts, with the maximum number of contracts with strike price $1,3335 (2955);

- Overall open interest on the PUT options with the expiration date October, 15 is 34163 contracts, with the maximum number of contracts with strike price $1,2800 (2491);

- The ratio of PUT/CALL was 1.15 versus 1.13 from the previous trading day according to data from September, 25.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

On Tuesday, US Trade Representative said that the negotiators "do not seem to be in time," to include Canada in the trade deal the US concluded with Mexico last month.

The Trump administration hopes to inform Congress of a plan for a new North American trade agreement by Sunday, which will allow Mexican President to sign it until November 30.

"There is still a fair distance between us, there are very big problems," Mr.Lighthizer said at the Concordia summit in New York.

"The deal will be concluded if Canada is not late, although she would like to be in agreement," he added. "Canada does not make concessions in areas that we consider important," Lighthizercontinued.

Both sides will almost certainly not be able to meet the deadline (this weekend) to include Canada in the new North American trade agreement.

President Donald Trump said he wants to change the name of the North American Free Trade Agreement to the USMC pact and warned Canada that if the country does not agree with his demands, he will refuse the "C" in the new title.

"They called the NAFTA treaty, we will call it the trade agreement between the US and Mexico, and we will get rid of the NAFTA name," Trump told reporters last month.

"We will see if we want to accept Canada into a treaty or simply make a separate deal with Canada if they want to conclude it," he added.

In the September ANZ Business Outlook Survey headline business confidence bounced 12 points to a net 38% of respondents reporting they expect general business conditions to deteriorate in the year ahead. Firms' perceptions of their own activity prospects lifted 4 points to a net 8% expecting an improvement, still well below the long-term average of +27%. By industry, retail expectations dropped 11 points to be by far the least positive about their own activity (-13%), while services is the most optimistic sector, consistent with a large contribution to GDP growth over the June quarter.

Goods exports rose $366 million (9.9 percent) to $4.1 billion.

Goods imports rose $675 million (14 percent) to $5.5 billion, the third-highest total on record, and the fourth-consecutive month with values over $5 billion.

The monthly trade balance was a deficit of $1.5 billion (37 percent of exports), the largest monthly deficit on record.

Meat and edible offal led the export rise in August 2018, up $137 million (43 percent) to $457 million:

-

Sheep meat (lamb and mutton) rose $83 million (55 percent) in value and 42 percent in quantity.

-

Beef rose $45 million (31 percent) in value and 23 percent in quantity.

-

Meat and edible offal exported in the year ended August 2018 rose 19 percent in value and 7.9 percent in quantity from the August 2017 year.

Milk powder, butter, and cheese rose $80 million (17 percent) to $540 million:

-

Milk fats including butter rose $63 million (63 percent) in value, and 55 percent in quantity.

-

Milk powder rose $20 million (11 percent) in value to $205 million. Quantity fell 2.0 percent.

-

Logs, wood, and wood articles rose $74 million (18 percent) to $477 million, led by a rise in untreated logs, up $58 million (22 percent) to $317 million.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.