- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-10-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Trimmed Mean CPI q/q | Quarter III | -0.1% | 0.3% |

| 00:30 (GMT) | Australia | CPI, q/q | Quarter III | -1.9% | 1.5% |

| 00:30 (GMT) | Australia | Trimmed Mean CPI y/y | Quarter III | 1.2% | 1.1% |

| 00:30 (GMT) | Australia | CPI, y/y | Quarter III | -0.3% | 0.7% |

| 07:45 (GMT) | France | Consumer confidence | October | 95 | 93 |

| 09:00 (GMT) | Switzerland | Credit Suisse ZEW Survey (Expectations) | October | 26.2 | |

| 12:30 (GMT) | U.S. | Goods Trade Balance, $ bln. | September | -83.11 | |

| 14:00 (GMT) | Canada | Bank of Canada Rate | 0.25% | 0.25% | |

| 14:00 (GMT) | Canada | Bank of Canada Monetary Policy Report | |||

| 14:30 (GMT) | U.S. | Crude Oil Inventories | October | -1.001 | |

| 23:50 (GMT) | Japan | Retail sales, y/y | September | -1.9% | -7.7% |

“There will not be sufficient doses of Covid-19 vaccines for the entire population before the end of 2021,” a European Commission official told diplomats from EU states in a closed-door meeting on Monday, Reuters reported, citing a person who attended this meeting. Another official confirmed the statement. An EU Commission spokesman was not immediately available for comment, Reuters added.

FXStreet reports that the złoty is now approaching 4.60 against the euro again. This brings the złoty almost back to the low seen in March. Economists at ABN Amro expect a weak zloty in the near-term and a modest recovery next year.

“For the coming months, we expect that investors will continue to shy away from the złoty. Investors are concerned about the double-dip in the eurozone and the second wave of COVID-19. The eurozone is an important export market for Poland. Poland is also battling this second wave of COVID-19. So there is not much relative strength. It is likely that investors will try to test the previous low in the złoty versus the euro (high in EUR/PLN just above 4.63).”

"Next year, we expect a vaccine for COVID-19. As a result, the global economy is set to recover. We also expect the Polish economy to recover and even to outperform the economy of the eurozone. Investors will likely focus on relative growth performance and yield spreads again. All of this is positive for the złoty. Furthermore, we think that the Polish central bank will unlikely cut rates into negative territory. The ECB has a negative deposit rate and when investor sentiment improves, the difference in official rates starts to play a role again. Therefore, this will probably support the złoty.”

“Even though we expect the currency to recover next year, it is unlikely that the złoty will rally sharply. The strained political relationship with the EU remains negative for the złoty. All in all, we expect a weak złoty in the near-term and a modest recovery next year. Our new forecast for the end of this year in EUR/PLN is 4.6 (was 4.4) and end of next year 4.3 (was 4.25).”

FXStreet notes that while the COVID-19 crisis is weakening eurozone banks, there are many stabilizing mechanisms such as funding at -1%, government aid to companies and households, corporate cash reserves or banks’ high capital level. The way eurozone banks' share prices have reacted to the crisis seems very excessive and there is no reason to fear credit rationing, according to analysts at Natixis.

“There are actually a number of reassuring factors. Banks can obtain funding at -1% through TLTROs and therefore generate a positive carry on their assets, including on government bonds. Government aid (guaranteed loans, tax cuts, short-time working, etc.) is limiting the rise in bankruptcies and in unemployment. Many companies have not used the loans drawn down in 2020 and have kept them in cash, they will therefore be able to repay them easily. Banks had very high capital levels at the beginning of the crisis. The pessimism about euro-zone banks must therefore be put into perspective.”

FXStreet notes that emerging markets currencies could benefit in the short-term if the US election result is not contested but growth and macro policy are key for capital inflows and for the longer-term fortunes of emerging markets FX. CNY strength is set to continue, while the INR may see upside from strong capital inflows, economists at HSBC report.

“In the short-term, risk appetite could play a part: if the election is not contested and the outcome is known sooner rather than later, then EM FX should benefit, otherwise the USD may strengthen amid risk aversion.”

“The pertinent issues heading into 2021 will probably relate to the growth and macro policy settings that will shape whether capital inflows can return. EM growth indicators have been improving lately but the pace from hereon could slow. China’s import growth is currently the strongest (or contracting the least) among EM and G3 (United States, Eurozone and Japan) economies. This is benefiting some Asian economies and could increasingly be felt by others.”

“In terms of currencies, those in Asia have been relatively resilient over the past month and this should not change before and after the US election. Their relatively stronger fundamentals should keep them supported.”

“The CNY continues to be resilient, even though China’s 3Q GDP grew by 4.9% YoY, which was slower than expected. We think that the CNY’s trend appreciation is not yet over, but there could be a brief period of consolidation in the near-term. We also think the INR is well placed to strengthen further supported by strong capital inflows, despite the slow growth environment.”

FXStreet notes that S&P 500 has seen a sharp sell-off and a close below the 63-day average at 3391 would see the ‘head & shoulders’ base negated to reassert a sideways and likely choppy range into the US election. Meanwhile, the VIX has completed a base to warn of a more concerted move higher and likely lower for the market itself, with next resistance seen at 36.20, per Credit Suisse.

“A poor start to the week has seen a sharp sell-off for a conclusive break of the 38.2% retracement of the September/October rally at 3420, but with the index for now managing to hold on a closing basis its rising 63-day average, now seen at 3391. Despite this though support from the ‘neckline’ to the ‘head & shoulders’ base has been removed and whilst resistance at 3466 caps, the immediate risk is seen lower.”

“A close below 3391 is needed to confirm the base has indeed been neutralized to reassert the sideways range from the early September peak. We would then see support next at 3365 ahead of the late September price gap, starting at 3324 and stretching down to 3298/93.”

“Near-term resistance is seen at 3415, then 3440/41. Above 3466 is needed to reassert a positive tone again, with resistance then at 3516/18.”

“The VIX has completed a base to warn of a more concerted move higher, with resistance then seen next at 36.20.”

The Conference

Board announced on Tuesday its U.S. consumer confidence fell 0.4 points to 100.9

in October from 101.3 in September.

Economists had

expected consumer confidence to come in at 102.0.

September’s

consumer confidence reading was revised down from originally estimated 101.8.

The survey

showed that the expectations index dropped from 102.9 last month to 98.4 this

month. Meanwhile, the present situation index increased from 98.9 in September

to 104.6.

“Consumer

confidence declined slightly in October, following a sharp improvement in

September,” noted Lynn Franco, Senior Director of Economic Indicators at The

Conference Board. “Consumers’ assessment of current conditions improved while

expectations declined, driven primarily by a softening in the short-term

outlook for jobs. There is little to suggest that consumers foresee the economy

gaining momentum in the final months of 2020, especially with COVID-19 cases on

the rise and unemployment still high.”

S&P

reported on Tuesday its Case-Shiller Home Price Index, which tracks home prices

in 20 U.S. metropolitan areas, rose 5.2 percent y-o-y in August, following a revised

4.1 percent y-o-y surge in July. (originally a 3.9 percent y-o-y climb). This

was the biggest annual advance in house prices since August 2018.

Economists had

expected an advance of 4.2 percent y-o-y.

Phoenix (+9.9

percent y-o-y), Seattle (+8.5 percent y-o-y) and San Diego (+7.6 percent y-o-y)

recorded the highest y-o-y advances among the 19 cities (excluding Detroit) in August.

All 19 cities reported greater price gains in the year ending August versus the

year ending July.

Meanwhile, the

S&P/Case-Shiller U.S. National Home Price Index, which measures all nine

U.S. census divisions, jumped 5.7 percent y-o-y in August, following a 4.8

percent y-o-y increase in the previous month.

“A trend of

accelerating increases in the National Composite Index began in August 2019 but

was interrupted in May and June, as COVID-related restrictions produced

modestly-decelerating price gains”, noted Craig J. Lazzara, Managing Director

and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “We

speculated last month that the accelerating trend might have resumed, and

August’s results easily bear that interpretation. The last time that the

National Composite matched August’s 5.7% growth rate was 25 months ago, in July

2018. If future reports continue in this vein, we may soon be able to conclude

that the COVID-related deceleration is behind us.”

FXStreet notes that USD/CHF has moved into a tight range just above its key 0.9000/8999 2020 lows, however, analysts at Credit Suisse stay directly bearish and look for a break in due course.

“USD/CHF remains in its short-term range of the past few days, maintaining a bearish ‘outside day’ from Thursday. With daily MACD also still firmly below zero, our core bias stays lower, with short-term support at the mid-September and recent range lows at 0.9049/37.”

“A clear break below 0.9049/37 would further reinforce our bearish bias and open up a move back to the current year low and psychological inflection point at 0.9000/8999, which we also think will be eventually broken over the medium-term. The next major support below here is seen at the 50% retracement of the entire 2015/17 upmove at 0.8875.”

U.S. stock-index futures rose on Tuesday, as stocks attempted to rebound from a drastic sell-off a day earlier, supported by upbeat quarterly earnings reports from several big companies, which offset worries about growing coronavirus cases in the United States and some European countries and a stalled U.S. fiscal stimulus talks.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,485.80 | -8.54 | -0.04% |

Hang Seng | 24,787.19 | -131.59 | -0.53% |

Shanghai | 3,254.32 | +3.20 | +0.10% |

S&P/ASX | 6,051.00 | -104.60 | -1.70% |

FTSE | 5,785.46 | -6.55 | -0.11% |

CAC | 4,776.73 | -39.39 | -0.82% |

DAX | 12,145.79 | -31.39 | -0.26% |

Crude oil | $38.67 | +0.29% | |

Gold | $1,905.40 | -0.02 |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 165.04 | -1.12(-0.67%) | 17654 |

ALCOA INC. | AA | 13.05 | 0.05(0.38%) | 1172 |

Amazon.com Inc., NASDAQ | AMZN | 3,225.05 | 18.01(0.56%) | 35833 |

American Express Co | AXP | 97.33 | 0.45(0.46%) | 6711 |

AMERICAN INTERNATIONAL GROUP | AIG | 33.4 | 2.14(6.85%) | 36575 |

Apple Inc. | AAPL | 115.39 | 0.34(0.30%) | 701189 |

AT&T Inc | T | 27.33 | -0.05(-0.18%) | 52318 |

Boeing Co | BA | 160.5 | -0.33(-0.21%) | 73715 |

Caterpillar Inc | CAT | 159.31 | -3.89(-2.38%) | 43940 |

Chevron Corp | CVX | 71.06 | 0.12(0.17%) | 10851 |

Cisco Systems Inc | CSCO | 37.8 | 0.13(0.35%) | 26238 |

Deere & Company, NYSE | DE | 235 | 0.75(0.32%) | 1273 |

Exxon Mobil Corp | XOM | 33.36 | 0.01(0.03%) | 99585 |

Facebook, Inc. | FB | 278.26 | 1.15(0.42%) | 107366 |

FedEx Corporation, NYSE | FDX | 278.5 | 0.88(0.32%) | 5571 |

Ford Motor Co. | F | 8.07 | 0.04(0.50%) | 322452 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.35 | -0.01(-0.06%) | 23139 |

General Electric Co | GE | 7.41 | 0.03(0.41%) | 505401 |

General Motors Company, NYSE | GM | 35.8 | -0.02(-0.06%) | 16626 |

Goldman Sachs | GS | 201.15 | 0.01(0.01%) | 2358 |

Google Inc. | GOOG | 1,598.00 | 7.55(0.47%) | 3161 |

Hewlett-Packard Co. | HPQ | 18.4 | 0.15(0.82%) | 541 |

Home Depot Inc | HD | 277 | 0.96(0.35%) | 2220 |

Intel Corp | INTC | 45.98 | -0.74(-1.58%) | 505048 |

International Business Machines Co... | IBM | 112.35 | 0.13(0.12%) | 9201 |

International Paper Company | IP | 45.3 | 0.01(0.02%) | 226 |

Johnson & Johnson | JNJ | 144.25 | 0.28(0.19%) | 5094 |

JPMorgan Chase and Co | JPM | 101.21 | -0.03(-0.03%) | 20353 |

Merck & Co Inc | MRK | 79.98 | 1.14(1.45%) | 34697 |

Microsoft Corp | MSFT | 211.39 | 1.31(0.62%) | 246719 |

Nike | NKE | 128.43 | 0.06(0.05%) | 7948 |

Pfizer Inc | PFE | 37.83 | -0.09(-0.24%) | 324432 |

Procter & Gamble Co | PG | 141.7 | 0.40(0.28%) | 498 |

Starbucks Corporation, NASDAQ | SBUX | 89.9 | 0.24(0.27%) | 56410 |

Tesla Motors, Inc., NASDAQ | TSLA | 419.75 | -0.53(-0.13%) | 194671 |

The Coca-Cola Co | KO | 49.9 | 0.10(0.20%) | 11381 |

Twitter, Inc., NYSE | TWTR | 49.41 | 0.41(0.84%) | 48257 |

UnitedHealth Group Inc | UNH | 324.12 | 1.06(0.33%) | 1059 |

Verizon Communications Inc | VZ | 57.75 | -0.06(-0.10%) | 4403 |

Visa | V | 193.6 | 0.53(0.27%) | 5217 |

Wal-Mart Stores Inc | WMT | 142.15 | -0.01(-0.01%) | 8028 |

Walt Disney Co | DIS | 124.38 | 0.32(0.26%) | 4330 |

Yandex N.V., NASDAQ | YNDX | 58.97 | -0.16(-0.27%) | 9687 |

The U.S.

Commerce Department reported on Tuesday that the value of new factory orders climbed

1.9 percent m-o-m in September, following an unrevised 0.4 percent m-o-m advance

in August.

That marked the fifth consecutive month of gains in factory orders.

Economists had

forecast a 0.5 percent m-o-m increase.

According to the report, orders for transportation equipment went up 4.1 percent and led the increase. Meanwhile, total factory orders excluding transportation, a volatile part of the overall reading, rose 0.8 percent m-o-m in September (compared to an upwardly revised 1.0 percent m-o-m jump in August), while orders for nondefense capital goods excluding aircraft, a measure of business spending plans, increased also 1.0 percent m-o-m (compared to an upwardly revised 2.1 percent m-o-m surge in the previous month).

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:00 | Eurozone | Private Loans, Y/Y | September | 3% | 3.1% | |

| 09:00 | Eurozone | M3 money supply, adjusted y/y | September | 9.5% | 9.6% | 10.4% |

| 11:00 | United Kingdom | CBI retail sales volume balance | October | 11 | 1 | -23 |

| 12:30 | U.S. | Durable goods orders ex defense | September | 0.9% | 3.4% | |

| 12:30 | U.S. | Durable Goods Orders ex Transportation | September | 1% | 0.4% | 0.8% |

| 12:30 | U.S. | Durable Goods Orders | September | 0.4% | 0.5% | 1.9% |

GBP traded mixed against its rivals in the European session on Tuesday with declines versus NZD and CAD, with gains versus USD and CHF, and flat versus JPY, EUR and AUD.

Talks between the UK and the EU over a Brexit trade deal continue. The EU’s chief negotiator Michel Barnier said yesterday that he would be in London until Wednesday to negotiate a deal with the UK, after which the talks will switch to Brussels. The European Commission said today that both sides are engaging intensively to try and reach a deal. However, analysts see that the pound is unlikely to get much should the agreement be reached.

Sentiment also remains impacted by the growing number of coronavirus infections and worries over tightened COVID-19 lockdown measures and their implications on economic growth, as well as the possibility of the imposition of negative interest rates by the BoE.

In addition, market participants received disappointing data from the Confederation of British Industry (CBI), which showed that the UK retail sales balance plunged to -23 in October from +11 in September. That was the lowest reading since June. Economists had forecast the reading to decrease to 1. Retail sales volumes are expected to decline at a similar pace in November (-26). The report also revealed that orders placed on suppliers dropped steeply (balance of -39, from -14) and are seen to decrease at an even faster rate in the year to November (-48).

FXStreet reports that based on experience working with diverse asset owners, the Morgan Stanley Institute for Sustainable Investing and Morgan Stanley Investment Management have developed a four-part framework tailored to help asset owners develop, implement and maintain a dynamic sustainable investing strategy.

“Organizations should first define the reasons why they want to integrate sustainability factors into their investment processes. All key internal stakeholders, including senior leadership and investment teams, should be engaged in defining the investment philosophy.”

“Investors can choose the approaches that best reflect their investment philosophy. Restriction screening: Avoiding investments in certain sectors or specific issuers, based on values or risk-based criteria. ESG integration: Considering ESG criteria alongside financial analysis to identify risks and opportunities throughout the investment process. Thematic investments: Investing focused on certain themes and sectors positioned to solve global sustainability-related challenges. Impact investing: Allocating to funds or enterprises structured to deliver a specific and measurable set of positive social and/or environmental impacts alongside market-rate financial returns. Company/issuer engagement: Aiming to drive improvement in ESG activities or outcomes through proxy voting or active dialogue with invested companies/issuers.”

“Institutions may opt to first introduce sustainability considerations when existing investment mandates roll over or there’s new cash to invest. They might also consider a dedicated strategy consisting of one or multiple asset classes that mirror the overall asset allocation, which can help build proof-of-concept internally.”

“Appropriate governance forms the operational backbone for supporting implementation and for defining, communicating and meeting sustainable investing goals. A set of formalized and documented sustainable investing goals – including the use of an annual sustainability report or website – can also help align key stakeholders. Beyond governance and communication, asset owners must identify the needed resources – employees, skill-sets, data and tools – to support a dynamic sustainable investing strategy for the long term.”

Merck (MRK) reported Q3 FY 2020 earnings of $1.74 per share (versus $1.51 per share in Q3 FY 2019), beating analysts’ consensus estimate of $1.43 per share.

The company’s quarterly revenues amounted to $12.551 bln (+1.2% y/y), beating analysts’ consensus estimate of $12.213 bln.

MRK rose to $79.80 (+1.22%) in pre-market trading.

Pfizer (PFE) reported Q3 FY 2020 earnings of $0.72 per share (versus $0.75 per share in Q3 FY 2019), beating analysts’ consensus estimate of $0.71 per share.

The company’s quarterly revenues amounted to $12.131 bln (-4.3% y/y), missing analysts’ consensus estimate of $12.298 bln.

PFE fell to $37.86 (-0.16%) in pre-market trading.

Raytheon Technologies (RTX) reported Q3 FY 2020 earnings of $0.58 per share (versus $1.27 per share in Q3 FY 2019), beating analysts’ consensus estimate of $0.50 per share.

The company’s quarterly revenues amounted to $15.047 bln (+32.3% y/y), roughly in line with analysts’ consensus estimate of $15.157 bln.

RTX rose to $61.00 (0.31%) in pre-market trading.

FXStreet reports that economists at MUFG Bank are becoming increasingly confident that the lift the pound would derive from a Brexit deal being confirmed is likely to be modest. Monday was a good example of some good news failing to provide much lift at all for GBP as the cable closed at 1.3024.

“The decision of Michel Barnier to remain in negotiations in London through tomorrow was viewed as a positive sign by the UK government yet it failed to register in the FX markets. The offsetting macro-economic news is such that investors remain wary of buying the pound as risks of a renewed downturn after the Q3 rebound increase.”

Increased restrictions and high frequency data from the UK continue to show risks of a renewed downturn in GDP growth in Q4. Increased QE by the BoE at its next meeting on 5 November is now highly likely but it will be the minutes that will be key for the pound in gauging whether appetite amongst the MPC for negative rates next year is increasing.”

“The risk of negative rates is growing and that for a currency like the pound is significant. We have no example of negative rates in a country running a current account deficit, a budget deficit that is larger than most other major advanced economies and where inflation is by no means low. It certainly points to potential for a greater currency impact than in countries like Japan, Switzerland or the eurozone.”

Caterpillar (CAT) reported Q3 FY 2020 earnings of $1.34 per share (versus $2.66 per share in Q3 FY 2019), beating analysts’ consensus estimate of $1.17 per share.

The company’s quarterly revenues amounted to $9.881 bln (-22.6% y/y), beating analysts’ consensus estimate of $9.780 bln.

CAT fell to $160.99 (-1.35%) in pre-market trading.

Advanced Micro (AMD) reported Q3 FY 2020 earnings of $0.41 per share (versus $0.18 per share in Q3 FY 2019), beating analysts’ consensus estimate of $0.31 per share.

The company’s quarterly revenues amounted to $2.801 bln (+55.5% y/y), beating analysts’ consensus estimate of $2.563 bln.

The company also issued upside guidance for Q4 FY 2020, projecting revenues of $2.90-3.10 bln versus analysts’ consensus estimate of $2.62 bln.

AMD fell to $79.78 (-2.98%) in pre-market trading.

The

Confederation of British Industry (CBI) reported on Tuesday its latest survey

of retailers showed retail sales volume balance stood at -23 in the year to September,

down sharply from 11 in September. That was the lowest reading since June.

Economist had

forecast the reading to decrease to 1.

Retail sales

volumes are expected to decline at a similar pace in November (-26).

The report also revealed that orders placed on suppliers dropped steeply (balance of -39, from -14) and are seen to decrease at an even faster rate in the year to November (-48). Meanwhile, stock levels in relation to expected sales were seen as broadly adequate, after easing to their lowest level since March (+6, from +11). Stock levels are expected to remain similar next month (+8).

“The fall in retail sales in October is a warning sign of a further loss of momentum in the economy as coronavirus cases pick up and restrictions are tightened across many parts of the country,” noted Ben Jones, CBI Principal Economist. “It’s no surprise that sales have dipped despite no new direct restrictions on retail in England, as the evidence from earlier in the year suggests consumers become more cautious as case numbers rise. With footfall still down by one third, many retailers face a difficult run-up to the all-important Christmas period. It is vital that local authorities use their discretion over the new Tier 2 grant funding to target support in a way that helps keep town and city centers open for business.”

3M (MMM) reported Q3 FY 2020 earnings of $2.43 per share (versus $2.72 per share in Q3 FY 2019), beating analysts’ consensus estimate of $2.27 per share.

The company’s quarterly revenues amounted to $8.350 bln (+4.5% y/y), roughly in line with analysts’ consensus estimate of $8.380 bln.

MMM rose to $166.83 (+0.40%) in pre-market trading.

Reuters reports that European Union chief negotiator Michel Barnier resumed talks in London with his British counterpart on Tuesday as the two sides try to strike a last-minute trade agreement.

The United Kingdom left the EU in January but the two sides are trying to clinch a deal that would govern nearly a trillion dollars in annual trade before informal membership - known as the transition period - ends on Dec. 31.

There is very little time left to bridge significant gaps between Britain and the EU on sticking points in talks about a post-Brexit trade deal, Prime Minister Boris Johnson's spokesman said on Monday.

FXStreet reports that Lisa Shalett from Morgan Stanley points to the speed and durability of China’s economic turnaround.

“China’s economic balance continues to improve as domestic consumer and business demand makes up a greater percentage of spending. The country is less dependent on exports, which are now only 17% of GDP, down from 35% in 2007. We see room for more growth as per capita disposable income and consumption spending return to their long-term growth trend, after a vaccine is available. Vacation-related spending is still off by close to 60% currently in China.”

“China’s interest rate and currency dynamics remain attractive, suggesting a healthy backdrop for attracting foreign capital flows and protecting investor capital gains. China 10-year bonds are yielding nearly 3.2%, the widest premium in 15 years to the US 10-year Treasury, which yields less than 1%. For its part, the yuan, which China’s central bank generally keeps within a targeted range, is now at the strongest level since 2018, trading at 6.65 to the dollar. Such metrics point to the ongoing internationalization of the renminbi. Morgan Stanley & Co. strategists estimate that 10% of global reserves could be held in China’s currency by 2030.”

RTTNews reports that according to the report from statistical office INE, Spain's unemployment rate increased in the third quarter to the highest level since early 2018 as the coronavirus pandemic took its toll on the labor market.

The unemployment rate rose to 16.26 percent in the third quarter from 15.33 percent in the second quarter. This was the third consecutive rise and was also above economists' forecast of 15.9 percent.

The number of unemployed increased to 3.722 million from 3.368 million in the preceding quarter. At the same time, employment advanced by 569,600 to 19.176 million in the third quarter.

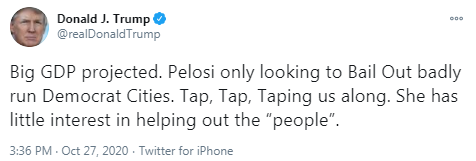

FXStreet reports that the FX market is looking beyond 2021 as USD fails to follow risk-off, economists at MUFG Bank brief.

“Around 440K new COVID-19 cases were reported last week in the US and there is evidence of infections spreading back to urban areas like New York. Restrictions remain more sporadic in the US than in Europe but at the current pace, tighter restrictions are inevitable which will reinforce a worsening economic outlook. US Q3 real GDP is likely to expand by over 30.0% on a SAAR Q/Q basis but if COVID-19 fuels more restrictions then the slowdown in Q4 will take GDP back down close to 1-2%.”

“Whoever wins the election next week, a large fiscal stimulus is coming and coupled with that we believe the Fed will persist with an aggressive easing stance for longer than is usual for the Fed.”

“We believe the consequences of a Biden victory for the equity markets are less clear than the consequences for the US dollar.”

“We see a weaker USD in 2021 no matter who wins but we are more confident of that under a Biden presidency.”

According to the report from European Central Bank, the annual growth rate of the broad monetary aggregate M3 increased to 10.4% in September 2020 from 9.5% in August, averaging 10.0% in the three months up to September. Economists had expected a 9.6% increase.

The components of M3 showed the following developments. The annual growth rate of the narrower aggregate M1, which comprises currency in circulation and overnight deposits, increased to 13.8% in September from 13.2% in August. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) increased to 1.4% in September from 0.4% in August. The annual growth rate of marketable instruments (M3-M2) increased to 12.5% in September from 8.2% in August.

Annual growth rate of adjusted loans to households stood at 3.1% in September, compared with 3.0% in August

Annual growth rate of adjusted loans to non-financial corporations stood at 7.1% in September, unchanged from previous month

CNBC reports that according to Nikko Asset Management’s John Vailm the Japanese currency will not likely strengthen significantly unless there’s a “negative shock”.

“It would take quite a shock to get (dollar- yen) down to say the 100 level, a negative shock. It’s been very steady in the 104 to 106 region for quite some time and seems like people are satisfied with that level,” said Vail.

Japan’s economic leadership is also very averse to a strong yen, Vail told CNBC.

Japan’s central bank governor Haruhiko Kuroda is “extremely against yen strength” while incumbent Finance Minister Taro Aso is also “very much against” a strong Japanese currency, he pointed out.

Furthermore, any appreciation in the Japanese currency is “not good” for the country’s exporters, the strategist said.

A stronger currency makes a country’s exports more expensive and less competitive in international markets.

FXStreet reports that the Senate is still projected to flip Democrat while the impact of record early voting is uncertain, per Standard Chartered.

“Biden’s lead in the average of polls has stabilised at 8ppt, one week before election day. This is a substantial lead, especially if we compare it to Hillary Clinton’s in 2016.”

“One of the most respected organisations – Project.FiveThirtyEight.com – says that out of 40,000 election scenario simulations, Biden wins the Electoral College in 87% of the outcomes. In fact, the range of possibilities suggests that Biden could win as many as 400 Electoral College votes. But again, the actual number of votes required to change that – just a few thousand, if allocated in key counties of key swing states – can dramatically alter the outcome, in a disproportionate manner.”

“Americans will also vote on 3 November for members of the House of Representatives (all seats) as well as about one-third of the Senate. Since the vote for the House is well correlated with popular vote intentions, it is widely expected that the Democrats will keep the House. For the Senate, projections of state-level polls have shown for weeks that the Democrats have a good chance to flip the Senate, with a projected tight 51-49 outcome”

During today's Asian trading, the euro rose against the US dollar and the yen, while traders wait for the meeting of the European Central Bank (ECB), which will be held this week.

Experts note that the ECB has sufficient grounds to increase the volume of monetary stimulus, taking into account the renewed increase in the incidence of COVID-19 in Europe. They do not expect the European Central Bank to announce any major steps at the end of Thursday's meeting, but expect to hear from ECB chief Christine Lagarde some signals that a new stimulus will be adopted before the end of this year.

Analysts believe that in December, the ECB may increase by another 500 billion euros the volume of the emergency asset purchase program, which currently amounts to 1.35 trillion euros.

The Bank of Japan will also hold a meeting this week, the results of which will be announced on Thursday. Experts do not expect him to change the main parameters of monetary policy at the upcoming meeting.

The ICE index, which tracks the US dollar against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell 0.07%.

Reuters reports that the U.N. Conference for Trade and Development (UNCTAD) said in a report that global foreign direct investment (FDI) plunged by 49% in the first half of 2020 from the same period a year ago and is on course to fall by up to 40% for the year, driven by fears of a deep recession.

FDI flows to European economies turned negative for the first time ever, falling to -$7 billion from $202 billion, while flows to the United States fell by 61% to $51 billion.

Global FDI fell as multinationals postponed investments to preserve cash, U.N. said.

"Global FDI flows for the first half of this year went down by close to half... It was more drastic than we expected for the whole year," James Zhan, director of UNCTAD's investment and enterprise division, told.

The flows are expected to decline by 30 to 40% this year and "moderately" in 2021, by 5 to 10%, Zhan said.

FXStreet reports that FX Strategists at UOB Group noted that cable remains neutral and is forecasted to navigate between 1.2900 and 1.3120 in the next weeks.

Next 1-3 weeks: “We highlighted yesterday that ‘upward momentum is beginning to ease’ and added, ‘GBP has to move and stay above 1.3120 within these 1 to 2 days or the odds for further GBP strength would diminish quickly’. GBP subsequently came close to breaching our ‘strong support’ level at 1.2990 (low of 1.2993) and closed on a soft note at 1.3022 (-0.13%). Upward momentum has deteriorated further and further GBP appears unlikely. GBP is more likely to consolidate and trade between 1.2900 and 1.3120 for now.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1916 (3335)

$1.1891 (4078)

$1.1871 (496)

Price at time of writing this review: $1.1825

Support levels (open interest**, contracts):

$1.1760 (1084)

$1.1735 (1063)

$1.1705 (1644)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 6 is 57781 contracts (according to data from October, 26) with the maximum number of contracts with strike price $1,1800 (4078);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3122 (2634)

$1.3083 (265)

$1.3058 (800)

Price at time of writing this review: $1.3020

Support levels (open interest**, contracts):

$1.2978 (826)

$1.2947 (276)

$1.2925 (245)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 32809 contracts, with the maximum number of contracts with strike price $1,3950 (3784);

- Overall open interest on the PUT options with the expiration date November, 6 is 25864 contracts, with the maximum number of contracts with strike price $1,2050 (2391);

- The ratio of PUT/CALL was 0.79 versus 0.79 from the previous trading day according to data from October, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

RTTNews reports that data from the National Bureau of Statistics showed that China's industrial profits increased for the fifth straight month in September.

Industrial profits grew 10.1 percent on a yearly basis but slower than the 19.1 percent increase posted in August.

The statistical office cited falling factory gate prices and rising raw material prices as major reason for the slowdown in industrial profits.

During January to September period, industrial profits declined 2.4 percent from the same period last year.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 40.36 | -2.68 |

| Silver | 24.23 | -1.34 |

| Gold | 1901.456 | 0.01 |

| Palladium | 2356.58 | -1.04 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -22.25 | 23494.34 | -0.09 |

| KOSPI | -16.9 | 2343.91 | -0.72 |

| ASX 200 | -11.4 | 6155.6 | -0.18 |

| FTSE 100 | -68.27 | 5792.01 | -1.16 |

| DAX | -468.57 | 12177.18 | -3.71 |

| CAC 40 | -93.52 | 4816.12 | -1.9 |

| Dow Jones | -650.19 | 27685.38 | -2.29 |

| S&P 500 | -64.42 | 3400.97 | -1.86 |

| NASDAQ Composite | -189.34 | 11358.94 | -1.64 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 09:00 (GMT) | Eurozone | Private Loans, Y/Y | September | 3% | |

| 09:00 (GMT) | Eurozone | M3 money supply, adjusted y/y | September | 9.5% | 9.6% |

| 11:00 (GMT) | United Kingdom | CBI retail sales volume balance | October | 11 | |

| 12:30 (GMT) | U.S. | Durable goods orders ex defense | September | 0.7% | |

| 12:30 (GMT) | U.S. | Durable Goods Orders ex Transportation | September | 0.4% | 0.4% |

| 12:30 (GMT) | U.S. | Durable Goods Orders | September | 0.4% | 0.5% |

| 13:00 (GMT) | U.S. | Housing Price Index, m/m | August | 1% | |

| 13:00 (GMT) | U.S. | Housing Price Index, y/y | August | 6.5% | |

| 13:00 (GMT) | U.S. | S&P/Case-Shiller Home Price Indices, y/y | August | 3.9% | 4.2% |

| 14:00 (GMT) | U.S. | Richmond Fed Manufacturing Index | October | 21 | |

| 14:00 (GMT) | U.S. | Consumer confidence | October | 101.8 | 102.5 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71172 | -0.26 |

| EURJPY | 123.793 | -0.29 |

| EURUSD | 1.18072 | -0.43 |

| GBPJPY | 136.475 | -0.07 |

| GBPUSD | 1.30157 | -0.22 |

| NZDUSD | 0.66711 | -0.23 |

| USDCAD | 1.31992 | 0.57 |

| USDCHF | 0.90751 | 0.39 |

| USDJPY | 104.83 | 0.13 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.