- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 30-09-2011

- sees 2012 GDP between 2%-3%; inflation around 2%

- slow growth, low wages will bring prices down in 2012

Allianz SE and Axa SA led a gauge of insurers to the biggest jump since March 2009. Societe Generale (GLE) SA, France’s second-largest bank, and KBC Groep NV, Belgium’s biggest lender by market value, climbed more than 20 percent. Lundin Petroleum AB soared 44 percent after increasing its estimate of recoverable resources for an oil prospect.

The 17-nation euro headed for its biggest monthly decline against the yen in more than a year after data showed German retail sales fell by more than economists forecast and U.S. consumer spending slowed in August. New Zealand’s dollar extended its second week of losses against its U.S. counterpart after Standard & Poor’s joined Fitch Ratings in cutting the nation’s credit ratings. The Swiss franc strengthened against the euro even after the central bank said it will prevent currency gains.

Equities trimmed declines after consumer companies that sell necessities reversed declines and U.S. data showed business activity and consumer confidence topped projections. Companies most tied to economic growth had the biggest declines among 10 groups in the S&P 500. American Express Co. fell 2.2 percent, while General Electric Co. (GE) lost 2.4 percent. Micron Technology Inc. (MU) slid 12 percent after reporting an unexpected loss on weak demand for personal computers.

The S&P 500 retreated 0.8 percent to 1,151.13 at 12:01 p.m. New York time, after falling as much as 1.7 percent earlier. The Dow Jones Industrial Average lost 39.88 points, or 0.4 percent, to 11,114.10.

Very choppy trade in Dec COMEX gold futures, recently up $3.30 cents at $1,620.60. Short-covering and quarter-end position squaring

seen, but the upside is capped by a firmer US dollar index. Strong chart support seen at this week's low of $1,535.00. Overnight high of

$1,642.50 serving as near-term resistance.

Oil fell, heading for its largest quarterly decline in New York since the 2008 financial crisis, as signs of slowing growth in China, the U.S. and Germany heightened concerns that fuel demand will suffer. West Texas Intermediate futures have fallen 15 percent this quarter, the biggest drop since the three months ended Dec. 31, 2008. Chinese manufacturing fell for a third month, according to data from HSBC Holdings Plc, while Germany’s Federal Statistics office said retail sales declined the most in more than four months in August. U.S. consumer spending slowed in August as incomes declined, the Commerce Department said today. WTI’s discount to Brent oil narrowed for a sixth day, the longest streak since March 2010. Crude for November delivery on the New York Mercantile Exchange fell as much as $1.59, or 1.9 percent, to $80.55 a barrel and was at $80.64 at 1:52 p.m. London time. WTI is down 9.2 percent this month. Brent oil for November settlement fell $1.57 to $102.38 a barrel on the ICE Futures Europe exchange in London. Prices are down 9 percent this quarter.

"Chi PM report was very strong, with impressive gains in production (63.9 from 57.8), new orders (65.3 from 56.9), and employment (60.6 from 52.1)." Barclays call for mfg ISM to remain above 50.

USD/JPY Y75.50, Y75.75, Y76.00, Y76.50, Y77.00, Y77.25, Y77.50

EUR/JPY Y106.00

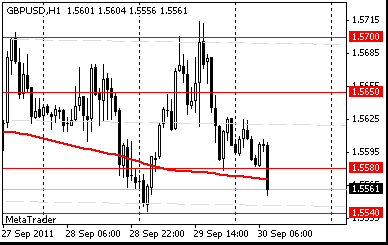

GBP/USD $1.5600

USD/CHF Chf0.9105

AUD/USD $0.9830, $0.9950, $1.0000

U.S. stock-index futures fell after reports from China and Germany added to concern the global economy is slowing.

In Germany, retail sales declined the most in more than four years in August as concerns about the economic impact of Europe’s sovereign debt crisis sapped consumers’ willingness to spend. Sales, adjusted for inflation and seasonal swings, slumped 2.9 from July, when they rose 0.3 percent, the Federal Statistics Office in Wiesbaden said. That’s the biggest drop since May 2007. Economists forecast a 0.5 percent decline, according to the median of estimates survey.

U.S. futures extended their losses after European inflation unexpectedly accelerated to the fastest in almost three years. The euro-area inflation rate jumped to 3 percent this month from 2.5 percent in August, the European Union’s statistics office said. That’s the biggest annual increase in consumer prices since October 2008.

Data:

EUR/USD

Bids $1.3475/70, $1.3450, $1.3415/00

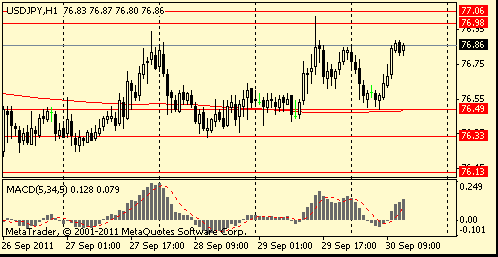

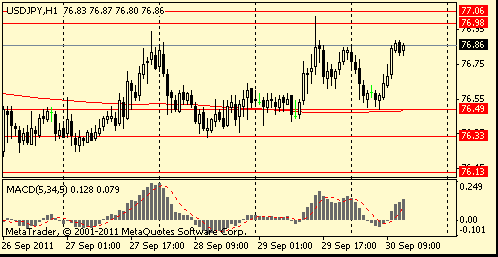

Resistance 3: Y77.60 (Sep 12 high)

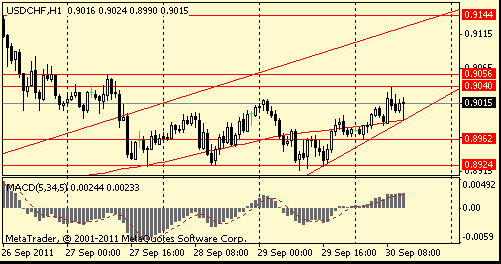

Resistance 3: Chf0.9140 (Sep 22 high)

Resistance 3: $ 1.5750 (area of Sep 19-21 high)

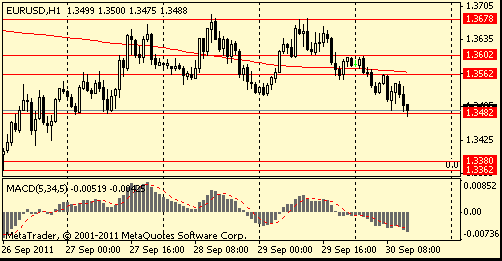

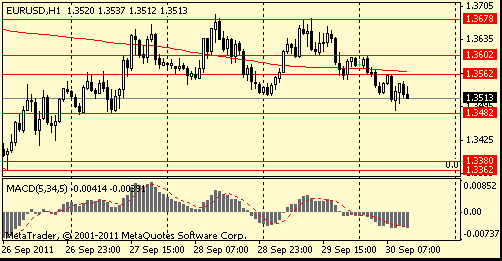

Resistance 3: $ 1.3680 (area of Sep 27-29 high)

The vote in Berlin on changes to the EFSF allows the fund to buy the bonds of distressed member states and offer emergency loans to governments, raising Germany’s guarantees to 211 billion euros from 123 billion euros.

Gains in the euro were tempered after Italy’s borrowing costs rose at a government debt sale today. Italy’s five-year credit-default swaps were at 472 basis points today, showing traders see a 34 percent chance for the nation’s nonpayment, compared with 4.6 percent for the U.S.

The yen weakened as U.S. equity futures rose, spurring demand for higher-yielding assets.

EUR/USD: at first half of Thursday the pair rose, but then fell at $1.3550.

GBP/USD: at first half of Thursday the pair rose, but then fell at $1.5580.

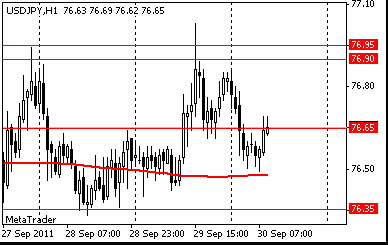

USD/JPY: the pair rose and showed new weekly high Y77.03

Focus today Italy T-bill redemption for E8.0bln, German upper house Bundestrat votes on reform of the EFSF , Austria assembly to give final approval to EFSF. Afternoon data includes Chicago PMI as well as Michigan sentiment at 1345GMT and 1355GMT respectively. End of month and the dollar widely expected to be

in demand at the fixings, though the signal versus the euro said to be weak.

USD/JPY Y75.50, Y75.75, Y76.00, Y76.50, Y77.00, Y77.25, Y77.50

EUR/JPY Y106.00

GBP/USD $1.5600

USD/CHF Chf0.9105

AUD/USD $0.9830, $0.9950, $1.0000

USD/JPY Y75.50, Y75.75, Y76.00, Y76.50, Y77.00, Y77.25, Y77.50

EUR/JPY Y106.00

GBP/USD $1.5600

USD/CHF Chf0.9105

AUD/USD $0.9830, $0.9950, $1.0000

The vote in Berlin on changes to the EFSF allows the fund to buy the bonds of distressed member states and offer emergency loans to governments, raising Germany’s guarantees to 211 billion euros from 123 billion euros.

Gains in the euro were tempered after Italy’s borrowing costs rose at a government debt sale today. Italy’s five-year credit-default swaps were at 472 basis points today, showing traders see a 34 percent chance for the nation’s nonpayment, compared with 4.6 percent for the U.S.

The yen weakened as U.S. equity futures rose, spurring demand for higher-yielding assets.

EUR/USD: at first half of Thursday the pair rose, but then fell at $1.3550.

GBP/USD: at first half of Thursday the pair rose, but then fell at $1.5580.

USD/JPY: the pair rose and showed new weekly high Y77.03

Focus today Italy T-bill redemption for E8.0bln, German upper house Bundestrat votes on reform of the EFSF , Austria assembly to give final approval to EFSF. Afternoon data includes Chicago PMI as well as Michigan sentiment at 1345GMT and 1355GMT respectively. End of month and the dollar widely expected to be

in demand at the fixings, though the signal versus the euro said to be weak.

Nikkei 225 8,701 +85.58 +0.99%, Hang Seng Closed, S&P/ASX 4,008 -31.22 -0.77%, Shanghai Composite 2,365 -26.72 -1.12%

Mitsubishi UFJ Financial Group Inc. (8306), Japan’s largest lender, gained 2.3 percent in Tokyo on optimism the German vote will ease concerns about the global financial system. Canon Inc. (7751), the world’s biggest camera maker, gained 1.6 percent after orders for U.S. capital goods unexpectedly climbed. BHP Billiton Ltd. (BHP), the world’s No. 1 mining company, fell 1.4 percent in Sydney after copper futures extended declines.

European stocks climbed for the fourth time in five days as U.S. employment and growth data exceeded forecasts and German lawmakers backed an enhanced euro- region rescue fund.

The Stoxx Europe 600 Index climbed 0.7 percent to 228.9 at 4:43 p.m. in London after swinging between gains and losses at least 15 times. The measure is heading for its worst quarter since 2008, having fallen 16 percent amid concern global economic growth is slowing and policy makers are struggling to contain the European debt crisis. The gauge has dropped 3.6 percent this month following a 10 percent slump in August.

National benchmark indexes climbed in 16 of the 18 western European markets. Germany’s DAX and France’s CAC 40 advanced 1.1 percent. The U.K.’s FTSE 100 declined 0.4 percent as mining companies fell.

FTSE 100 5,197 -20.79 -0.40%, CAC 40 3,028 +32.03 +1.07%, DAX 5,640 +61.16 +1.10%.

BNP Paribas SA and UBS AG (UBSN) led gains in banking shares, rallying more than 3 percent. Hennes & Mauritz AB (HMB) surged 6.8 percent after Europe’s second-largest clothing retailer reported earnings that beat estimates. Swatch slumped 5.8 percent to 325 Swiss francs. Burberry Group Plc (BRBY) declined 8.3 percent to 1,201 pence. Luxury-goods makers fell as the Bloomberg survey showed most global investors predict Chinese growth will slow to less than half the pace sustained since the government began dismantling Mao Zedong’s communist economy three decades ago.

Mining companies retreated with base metals. Fresnillo Pc, the world’s largest primary silver producer, slid 4.7 percent to 1,511 pence. Rio Tinto Group, the second-biggest mining company, lost 3.1 percent to 2,962 pence.

U.S. stocks rose, rebounding from an earlier loss, as lower-than-estimated claims for unemployment benefits and a vote by German lawmakers to expand a European bailout fund helped offset losses by technology and consumer companies. Greek bonds surged.

The Standard & Poor’s 500 Index rose 0.8 percent to 1,160.38 at 4 p.m. New York time, after recovering from a 1 percent decline earlier. The Stoxx Europe 600 Index advanced 0.7 percent as banks rallied. The euro appreciated 0.4 percent to $1.3559 and rose versus 15 of 16 major peers. The Greek two-year yield tumbled 453 basis points to 65.24 percent. Natural gas slid 1.4 percent as the U.S. reported a rise in supplies, while oil climbed.

The S&P 500 rallied as much as 2.2 percent early in the trading day, after the U.S. economy grew at a 1.3 percent pace in the second quarter, faster than previously estimated, and applications for jobless benefits dropped by a more-than- forecast 37,000 to 391,000, the fewest since April, according to government data. German Chancellor Angela Merkel gained support from lawmakers to expand the European Financial Stability Facility’s firepower.

U.S. stocks declined, halting a three-day rally for the Standard & Poor’s 500 Index, amid growing concern that European leaders are divided over how to handle Greece’s debt crisis.

All 10 industry groups in the S&P 500 fell at least 0.6 percent, with companies most-tied to economic growth dropping the most. Dow Chemical Co. (DOW) and Alcoa Inc. (AA) slid at least 4.9 percent as commodities tumbled. Morgan Stanley and Bank of America Corp. (BAC) lost more than 4.9 percent, pacing declines among financial shares. Amazon.com Inc. (AMZN) rose 2.5 percent after the company launched its Kindle Fire tablet computer, taking aim at Apple Inc.’s bestselling iPad.

The S&P 500 lost 2.1 percent to 1,151.06 at 4 p.m. New York time, after rising as much as 0.8 percent earlier and rallying 4.1 over the previous three days. The Dow Jones Industrial Average fell 179.79 points, or 1.6 percent, to 11,010.90 today, with all 30 stocks retreating.

Advanced Micro Devices Inc. (AMD) fell 14 percent, the most since 2008 on a closing basis, after the second-largest maker of processors for personal computers cut its forecasts for third- quarter sales and profits. Netflix Inc. (NFLX) retreated 11 percent after people with knowledge of the matter said Microsoft Corp. (MSFT) will offer online pay television service.

Resistance 2: Y77.85 (session high)

Resistance 1: Y76.65 (Sep 28 high)

The current price: Y76.55

Support 1:Y76.50 (session low, MA (200) H1)

Support 2:Y76.35 (Sep 28 low)

Support 3:Y76.10/15 (area of Sep 21-23 low)

Comments: the pair holds in range Y76.35-Y76.85.

Resistance 2: $ 1.5700 (area of Sep 27 and 29 high)

Resistance 1: $ 1.5625 (session low)

The current price: $1.5625

Support 1 : $1.5575/80 (MA (200) H1)

Support 2 : $1.5540 (Sep 29 low)

Support 3 : $1.5490/00 (Sep 23 high)

Comments: the pair holds in range $1.5540-$ 1.5700. The nearest resistance $1.5625

Resistance 2: $ 1.3630 (Sep 21 high)

Resistance 1: $ 1.3570 (MA (200) H1)

The current price: $1.3534

Support 1 : $1.3520 (Sep 29 low)

Support 2 : $1.3480 (Sep 27 low)

Support 3 : $1.3420/25 (Sep 23 low)

Comments: the pair bargains in downtrend. The further resistance at $1.3570.

Nikkei 225 8,701 +85.58 +0.99%

Hang Seng Closed

S&P/ASX 4,008 -31.22 -0.77%

Shanghai Composite 2,365 -26.72 -1.12%

FTSE 100 5,197 -20.79 -0.40%

CAC 40 3,028 +32.03 +1.07%

DAX 5,640 +61.16 +1.10%

Dow 11,152.77 +141.87 +1.29%

Nasdaq 2,481 -10.82 -0.43%

S&P 500 1,160.15 +9.09 +0.79%

10 Year Yield 1.96% -0.04 --

Oil $82.57 +0.43 +0.52%

Gold $1,621.60 +4.30 +0.27%

Resistance 2: Chf0.9060 (Sep 27 high)

Resistance 1: Chf0.9010/20 (area of session high and Sep 29 high)

Current price: Chf0.8989

Support 1: Chf0.8960 (session low)

Support 2: Chf0.8920 (area of Sep 27-29 low)

Support 3: Chf0.8880 (low of american session on Sep 21)

Comments: the pair tested Chf0,9000, but could not to be fixed above. In focus - area of resistance Chf0,9010/20.

06:00 Germany Retail sales, real adjusted August 0.0% -0.4%

06:45 France Consumer spending August +1.1% +0.2%

06:45 France Consumer spending, y/y August +2.2%

08:00 Italy Unemployment Rate August 8.0% 8.0%

09:00 Italy Prelim Consumer Price Index, m/m September +0.3% -0.1%

09:00 Italy Prelim Consumer Price Index, Y/Y September +2.8% +2.9%

09:00 Eurozone Harmonized CPI, y/y, preliminary September +2.5% +2.5%

09:00 Eurozone Unemployment Rate August 10.0% 10.0%

09:30 Switzerland KOF Leading Indicator September 1.61 1.46

12:30 Canada Gross Domestic Product (MoM) July +0.2% +0.3%

12:30 U.S. Personal Income, m/m August +0.3% +0.1%

12:30 U.S. Personal spending August +0.8% +0.2%

13:45 U.S. Chicago Purchasing Managers' Index September 56.5 56.0

13:55 U.S. Reuters/Michigan Consumer Sentiment Index September 57.8 57.9

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.