- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-09-2011

Since the early U.S. session, the dollar rose against major currencies due to the decrease in major U.S. stock indices have reached an intraday lows, amid growing concern leaders are divided over how to handle Greece’s debt crisis.

European stocks declined, snapping the biggest three-day rally in 16 months, amid concern that holders of Greek bonds will suffer larger losses than previously agreed upon.

FTSE 100 5,218 -76.42 -1.44%, CAC 40 2,996 -27.76 -0.92%, DAX 5,578 -50.02 -0.89%

Man Group Plc (EMG) sank the most in almost three years as the world’s biggest hedge fund said assets under management will decrease. Cairn Energy Plc (CNE) slid 6.5 percent after abandoning an exploration well. Deutsche Boerse AG (DB1), the operator of the Frankfurt stock exchange, lost 4 percent as the European Union proposed a financial-transactions tax.

- SNB Balance Sheet Vulnerable To FX, Gold Price Changes

- SNB Isn't Mandated By Government To Make A Profit

- Profit Not A Yardstick For Monetary Policy Performance

Dow 11,258.31 +67.62 +0.60%, Nasdaq 2,550 +2.93 +0.12%, S&P 500 1,178 +2.60 +0.22%.

Alcoa Inc. and DuPont Co. dropped more than 1.5 percent, leading declines in the Dow Jones Industrial Average. Bank of America Corp. and JPMorgan Chase & Co. lost at least 0.7 percent, as financial shares tumbled. Amazon.com Inc. rose 3.1 percent after unveiling its Kindle Fire tablet computer.

Oil fell in New York, heading for the biggest quarterly drop since 2008, on concern that Europe’s debt crisis will linger and on increases in U.S. crude and fuel stockpiles.

Futures dropped as much as 2.1 percent as German Chancellor Angela Merkel signaled policy makers may review Greece’s second bailout after inspectors rule on whether the country is meeting the terms of its current package. U.S. crude oil supplies climbed 1.92 million barrels to 341 million last week, the Energy Department said today.

Crude oil for November delivery declined $1.16, or 1.4 percent, to $83.29 a barrel at 11:09 a.m. on the New York Mercantile Exchange. Prices climbed 5.3 percent yesterday, the biggest gain since May 9. Now the contract traded at $83.21 a barrel.

Gold may decline in New York as prices that declined for three consecutive weeks encouraged investors to hold off from making purchases.

Gold slumped 9.6 percent last week, extending its longest weekly losing streak since January, in part caused by investors selling the metal to cover losses in other markets. German Chancellor Angela Merkel signaled that Greece’s bailout may need to be renegotiated.

The panic displayed over the past few days has dissipated to a great extent, though there certainly hasn’t been a stampede back into gold. Instead, the market remains hesitant and gold continues to consolidate

Gold for December delivery fell $5.10, or 0.3 percent, to $1,647.40 an ounce by 7:57 a.m. on the Comex in New York. Prices dropped to $1,535 on Sept. 26, the lowest since July 8.

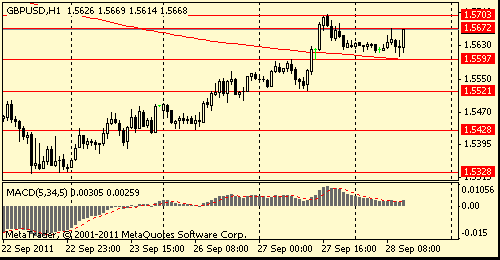

GBP/USD $1.5550, $1.5600, $1.5775, $1.5920

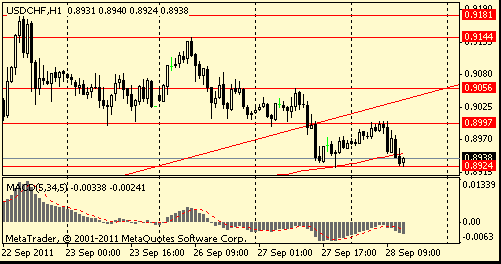

USD/CHF Chf0.8850

AUD/USD $1.0000, $0.9900, $0.9850

AUD/JPY Y78.00

Data:

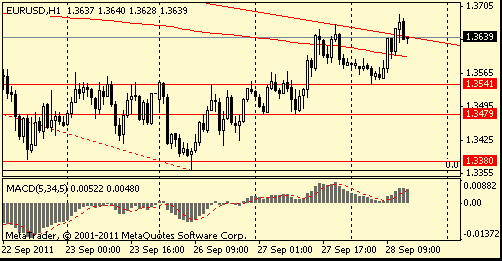

EUR/USD

Bids $1.3640, $1.3620, $1.3600/95, $1.3575/70

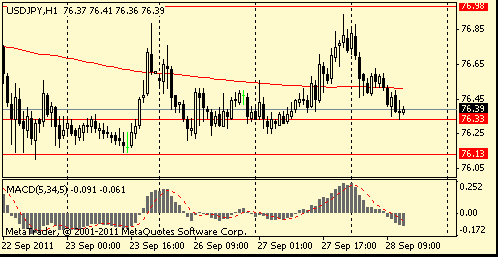

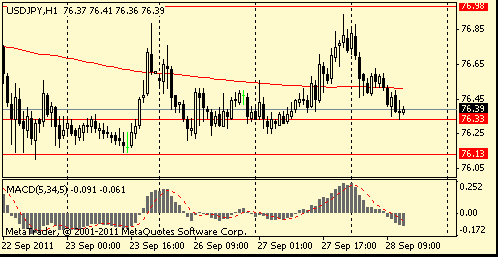

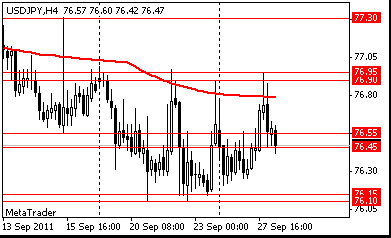

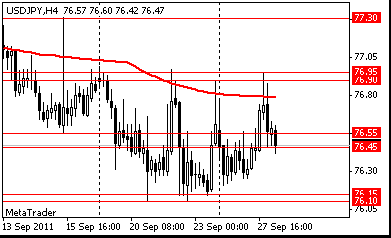

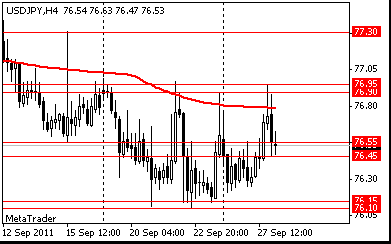

Resistance 3: Y77.60 (Sep 12 high)

Resistance 3: Chf0.9140 (Sep 26 high)

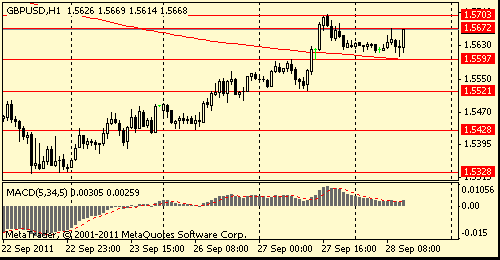

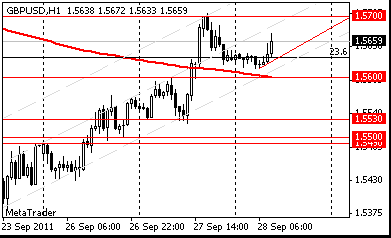

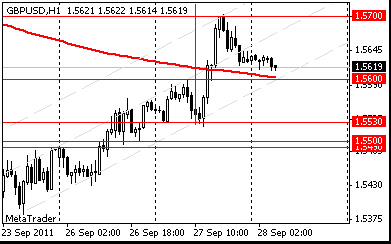

Resistance 3: $ 1.5750 (area of Sep 19-21 high)

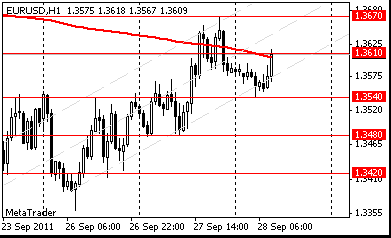

Resistance 3: $ 1.3800 (Sep 21 high)

GBP/USD $1.5550, $1.5600, $1.5775, $1.5920

USD/CHF Chf0.8850

AUD/USD $1.0000, $0.9900, $0.9850

AUD/JPY Y78.00

The yen rose against most of its major counterparts as EU’s worsening debt crisis and speculation that a report today will show U.S. durable goods orders fell last month, bolstered demand for the safest assets.

The euro headed for its biggest monthly decline against the yen in more than a year after the Financial Times reported yesterday that some euro-area countries want private creditors to take bigger writedowns on their Greek bond holdings. The euro held a three-day advance against the dollar.

Greek Prime Minister George Papandreou won parliamentary backing late yesterday for a property tax to meet deficit- reduction targets required to avoid default. Germany still privately anticipates that the Mediterranean nation will default on its debt as early as this year, Bild reported Chancellor Angela Merkel. France’s statistics office confirmed today that gross domestic product was unchanged in the second quarter from the preceding period. That’s in line with the initial estimate reported last month.

EUR/USD: on asian session the pair gain dropped.

GBP/USD: on asian session the pair hold at narrow range.

USD/JPY: on asian session the pair gain.

Focus today Troika to return to Athens to continue inspection/review. Finnish parliament vote on the amendment to the EFSF framework

agreement at 1100GMT. Later U.S. Durable Goods Orders August and U.S. EIA Crude Oil Stocks change.

- FSA Should advise banks not exacerbate markt fragility

- Some bank capital raising could worsen wider economy

- Banks capital build up shouldn't constrain lending

- Unlikely banks can use earnings rise to boost capital

- Facing the biggest challenge in Union's history

- World wondering if we have will to prop up euro

- Situation is serious but we have solutions

- Need to come together for European renewal

- Cites anger of nationalism, states turning inwards.

Hang Seng 17,992 -138.07 -0.76%

S&P/ASX 4,040 +34.94 +0.87%

Shanghai Composite 2,392 -22.99 -0.95%

The dollar and the yen declined as stocks rallied around the world on optimism European leaders are close to an agreement to contain the region’s debt crisis, damping demand for refuge.

The euro gained for a third day versus the dollar after German Chancellor Angela Merkel said her nation would help Greece meet the terms of its bailout agreement and Greek Prime Minister George Papandreou won support in parliament for an expansion to the region’s rescue fund.

EUR/USD: the pair rose.

GBP/USD: the pair rose and showed new weekly high at $1.5700

USD/JPY: yestherday the pair hold Y76.25-Y76.90.

Focus today Troika to return to Athens to continue inspection/review. Finnish parliament vote on the amendment to the EFSF framework

agreement at 1100GMT. Later U.S. Durable Goods Orders August and U.S. EIA Crude Oil Stocks change.

HSBC Holdings Plc (HSBA), Europe’s No. 1 lender by market value, gained 3.6 percent in Hong Kong after a report the European Central Bank may restart covered-bond purchases and take further measures to ease monetary conditions. Canon Inc. (7751), a camera maker that depends on Europe for about a third of its sales, surged 4.3 percent in Tokyo. BHP Billiton Ltd. (BHP), the world’s biggest mining company, jumped 4.1 percent in Sydney after crude and copper prices advanced.

European stocks climbed the most in 16 months amid speculation policy makers will increase efforts to contain the region’s sovereign-debt crisis. Financial markets are looking for stronger leadership from policy makers to help Greece overcome the current debt crisis.

National benchmark indexes rallied in all 18 western European markets today. Germany’s DAX Index soared 5.3 percent, France’s CAC 40 rose 5.7 percent and the U.K.’s FTSE 100 advanced 4 percent.

BNP Paribas and Societe Generale pushed a gauge of European lenders higher, soaring 14 percent to 30.05 euros and 17 percent to 20.50 euros, respectively. Credit Agricole SA (ACA) jumped 13 percent to 5.19 euros.

Austria’s Erste Group Bank AG (EBS) surged 8.3 percent to 20.54 euros while Deutsche Bank AG (DBK), Germany’s biggest lender, increased 13 percent to 28.29 euros.

Allianz SE (ALV) and Axa SA (CS), Europe’s biggest insurers, climbed 8 percent to 70.18 euros and 9.3 percent to 9.81 euros, respectively. Delta Lloyd NV (DL) climbed 11 percent to 11.40 euros. A gauge of insurance companies in the Stoxx 600 recorded the biggest two-day gain since October 2008.

Rio Tinto Group led a rally in raw-material shares, surging 7.8 percent, as metal prices rose.

MAN SE (MAN) rose the most in two years as European Union regulators cleared Volkswagen AG (VOW)’s takeover of the truckmaker.

Resistance 2: Y77.30 (Sep 15 high)

Resistance 1: Y77.90/95 (Sep 23 high)

The current price: Y76.54

Support 1:Y76.45 (session low)

Support 2:Y76.10/15 (area of Sep 21-23 low)

Support 3:Y75.90 (area of a historical low)

Comments: the pair bargains in range Y76.15-Y76.90.

Resistance 2: Y77.30 (Sep 15 high)

Resistance 1: Y77.90/95 (Sep 23 high)

The current price: Y76.54

Support 1:Y76.45 (session low)

Support 2:Y76.10/15 (area of Sep 21-23 low)

Support 3:Y75.90 (area of a historical low)

Comments: the pair bargains in range Y76.15-Y76.90.

Resistance 2: $ 1.5745 (Sep 20 high)

Resistance 1: $ 1.5700 (Sep 27 high)

The current price: $1.5618

Support 1 : $1.5600 (MA (200))

Support 2 : $1.5530 (Sep 27 low)

Support 3 : $1.5490/00 (Sep 23 high)

Comments: the pair is corrected in the uptrend. In focus support MA (200) $1.5600

Resistance 2: $ 1.3670 (Sep 27 high)

Resistance 1: $ 1.3610 (MA200)

The current price: $1.3554

Support 1 : $1.3540 (session low)

Support 2 : $1.3480 (Sep 27 low)

Support 3 : $1.3420 (Sep 23 low)

Comments: the pair is corrected in the uptrend. Below $1.3610.

Nikkei 225 8,374 -186.51 -2.18%

Hang Seng 17,240 -429.16 -2.43%

S&P/ASX 3,866 -37.46 -0.96%

Shanghai Composite 2,404 -28.80 -1.18%

FTSE 100 5,089 +22.56 +0.45%

CAC 40 2,859 +49.23 +1.75%

DAX 5,346 +149.00 +2.87%

Dow 11,043.86 +272.38 +2.53%

Nasdaq 2,517 +33.46 +1.35%

S&P 500 1,162.95 +26.52 +2.33%

10 Year Yield 1.90% +0.10 --

Oil $81.18 +0.94 +1.17%

Gold $1,623.60 +28.80 +1.81%

05:30 France GDP q/q Quarter II 0.0% 0.0%

05:30 France GDP Y/Y Quarter II +1.6% +1.6%

06:00 Germany Import prices August +0.8% -0.3%

06:00 Germany Import prices Y/Y August +7.5% +6.7%

08:30 United Kingdom BOE Credit Conditions Survey Quarter III

11:00 U.S. MBA Mortgage Applications September 0.6%

12:00 Germany CPI preliminary September 0.0% -0.1%

12:00 Germany CPI preliminary Y/Y September +2.4% +2.4%

12:30 U.S. Durable Goods Orders August +4.0% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation August +0.7%

12:30 U.S. Durable goods orders ex defense August +4.8%

14:30 U.S. EIA Crude Oil Stocks change -7.3

23:30 Japan Retail sales, y/y August +0.7% -0.6%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.