- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-09-2011

- SNB Already Holds Shares As Part Of Its Investment Holdings

- Emerging Mkts Are Robust, But Not Isolated From Industrialized Economies

- Central Bank Expects Jobless Rate To Rise In Switzerland

- CHF Strenght Is Affecting Margins Of Ever More Swiss Companies

European stocks climbed for the fourth time in five days as U.S. employment and growth data exceeded forecasts and German lawmakers backed an enhanced euro- region rescue fund.

BNP Paribas SA and UBS AG (UBSN) led gains in banking shares, rallying more than 3 percent. Hennes & Mauritz AB (HMB) surged 6.8 percent after Europe’s second-largest clothing retailer reported earnings that beat estimates. Swatch Group AG (UHR) led luxury-goods makers lower as a Bloomberg survey showed most global investors predict Chinese growth will slow to less than 5 percent by 2016.

The Stoxx Europe 600 Index climbed 0.7 percent to 228.9 at 4:43 p.m. in London after swinging between gains and losses at least 15 times. The measure is heading for its worst quarter since 2008, having fallen 16 percent amid concern global economic growth is slowing and policy makers are struggling to contain the European debt crisis. The gauge has dropped 3.6 percent this month following a 10 percent slump in August.

National benchmark indexes climbed in 16 of the 18 western European markets. Germany’s DAX and France’s CAC 40 advanced 1.1 percent. The U.K.’s FTSE 100 declined 0.4 percent as mining companies fell.

U.S. stocks rose, sending the Standard & Poor’s 500 Index higher for the fourth time in five days, as economic data eased concern about a slowdown and Germany approved changes to a European bailout fund.

U.S. stocks slid yesterday, halting a three-day rally for the S&P 500, on concern that European leaders are divided over how to handle Greece’s debt crisis. A four-day rout last week erased $1 trillion from U.S. equities amid concern Greek insolvency is inevitable and Europe can’t contain the damage.

Dow 11,170.86 +159.96 +1.45%, Nasdaq 2,495 +3.33 +0.13%, S&P 500 1,162.24 +11.18 +0.97%

Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) climbed 3.3 percent as European lenders soared. General Electric Co. and Hewlett-Packard Co. gained at least 2.8 percent as jobless claims fell more than forecast and the U.S. economy grew more than estimated in the second quarter. Advanced Micro Devices Inc. (AMD) slid 12 percent after cutting its forecasts.

Spot gold and silver prices rose for the second time in three days as equities rallied and the dollar dropped, increasing the appeal of the precious metals as alternative investments.

Gold for immediate delivery rose $3.08, or 0.2 percent, to $1,611.88 an ounce at 10:33 a.m. New York time. Earlier, the price dropped as much as 1.6 percent.

Before today, the metal slumped 16 percent from a record $1,921.15 on Sept. 6 as sovereign-debt woes in Europe drove equities and commodities lower.

Gold futures for December delivery fell $2, or 0.1 percent, to $1,616.10 on the Comex in New York, swinging between losses and gains.

Oil rose in New York as the U.S. government reported that the economy grew faster than previously estimated in the second quarter and German lawmakers approved an expanded European bailout fund.

Futures gained as much as 3.3 percent after the increase in gross domestic product beat economists’ expectations. Consumer spending also rose more than expected in the quarter and jobless claims dropped last week. Germany’s lower house of parliament agreed to extend the European Financial Stability Facility endorsed by Chancellor Angela Merkel.

Crude for November delivery gained $2.46, or 3 percent, to $83.67 a barrel at 9:55 a.m. on the New York Mercantile Exchange after tumbling 3.8 percent yesterday amid concern that Europe’s debt crisis would trigger another global recession.

New York futures are down 5.8 percent this month and dropped 12 percent since the end of June, the biggest quarterly loss since the last three months of 2008.

Brent oil for November settlement rose $1.75, or 1.7 percent, to $105.56 a barrel on the London-based ICE Futures Europe exchange.

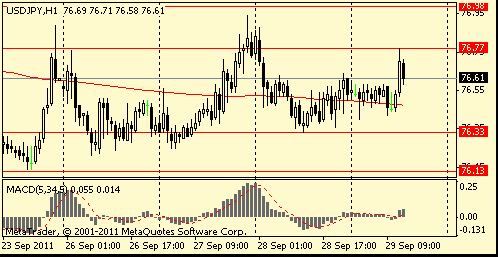

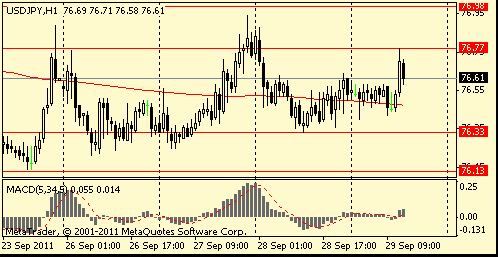

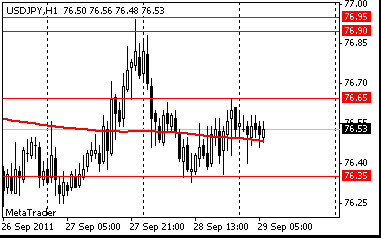

USD/JPY Y76.00, Y76.50, Y76.60, Y76.75, Y77.00, Y77.10

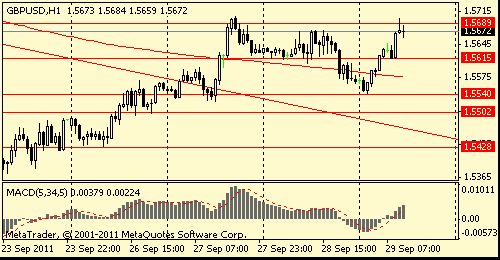

GBP/USD $1.5600, $1.5800

EUR/GBP stg0.8710

AUD/USD $0.9900, $1.0000, $1.0100

USD/CHF Chf0.9000

Data:

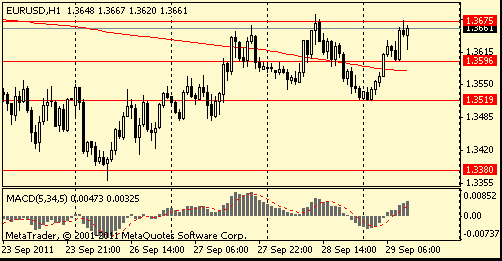

EUR/USD

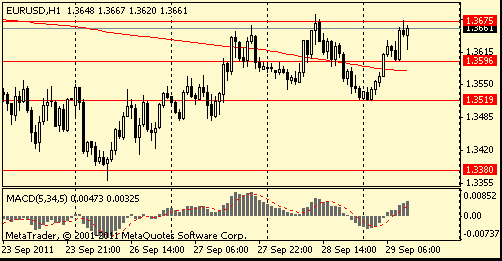

Bids $1.3600, $1.3590/80, $1.3550, $1.3500/480

Resistance 3: Y77.30 (Sep 15 high)

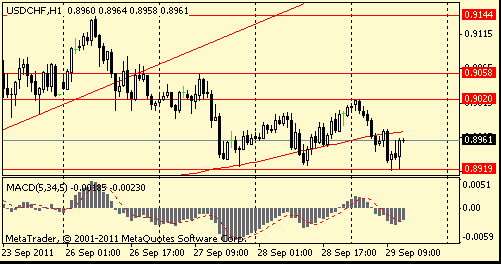

Resistance 3: Chf0.9140 (Sep 26 high)

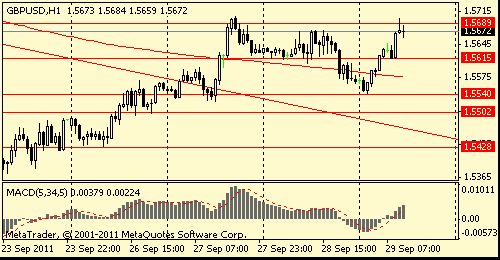

Resistance 3: $ 1.5800 (Sep 16 close price)

Resistance 3: $ 1.3800 (Sep 21 high)

European stocks are mixed before a vote in Germany on expanding the remit of the euro region’s rescue fund.

Company news:

Shares of Hennes & Mauritz AB climbed 4.2% as company reported earnings that fell less than analysts expected.

USD/JPY Y76.00, Y76.50, Y76.60, Y76.75, Y77.00, Y77.10

GBP/USD $1.5600, $1.5800

EUR/GBP stg0.8710

AUD/USD $0.9900, $1.0000, $1.0100

USD/CHF Chf0.9000

The euro rose toward a one-week high versus the dollar amid speculation German lawmakers will approve the expansion of a bailout fund for debt-stricken euro- area nations to help contain the sovereign-debt crisis.

The 17-nation currency strengthened against 12 of its 16 major counterparts as German Chancellor Angela Merkel attempts to win the backing of her coalition to expand the powers of the European Financial Stability Facility. The vote in Berlin on changes to the EFSF would allow the fund to buy the bonds of distressed member states and offer emergency loans to governments, raising Germany’s guarantees to 211 billion euros from 123 billion euros. The main opposition Social Democrats and Greens have said they will vote with Merkel’s government, assuring passage.

EUR/USD: on asian session the pair gain.

GBP/USD: on asian session the pair gain.

USD/JPY: on asian session the pair hold Y76.50.

Focus today German lower house votes on 'EFSF' ratification from 0700GMT, Italy medium-long BTP bond auctions for up to E9.0bln. Later Eurozone Economic sentiment index September and Business climate indicator September

In American session Canada Raw Material Price Index August and Industrial product prices August

U.S. Initial Jobless Claims Week of September and Final GDP Quarter II

Hang Seng Closed

S&P/ASX 4,008 -31.22 -0.77%

Shanghai Composite 2,365 -26.72 -1.12%

The euro advanced to a one-week high against the dollar after the European Commission refuted reports that euro-area nations are pushing for private Greek bondholders to accept larger writedowns.

German Chancellor Angela Merkel said she’s waiting for a report from a team of officials from the European Union, European Central Bank and International Monetary Fund on Greece’s progress before deciding whether a second financing package for the country agreed on July 21 needs to be revised.

Since the U.S. session, the dollar rose against major currencies due to the decrease in major U.S. stock indices have reached an intraday lows, amid growing concern leaders are divided over how to handle Greece’s debt crisis.

EUR/USD: the pair fell.

GBP/USD: the pair fell.

USD/JPY: the pair hold Y76.35-Y76.65.

Focus today German lower house votes on 'EFSF' ratification from 0700GMT, Italy medium-long BTP bond auctions for up to E9.0bln. Later Eurozone Economic sentiment index September and Business climate indicator September

In American session Canada Raw Material Price Index August and Industrial product prices August

U.S. Initial Jobless Claims Week of September and Final GDP Quarter II

Nikkei 225 8,616 +5.70 +0.07%, Hang Seng 18,011 -119.49 -0.66%, S&P/ASX 200 4,040 +34.96 +0.87%, Shanghai Composite 2,392 -22.99 -0.95%

Esprit Holdings Ltd. (330), a clothier that counts Europe as its biggest market, surged 12 percent in Hong Kong. Oki Electric Industry Co. climbed 9.2 percent in Tokyo after the Nikkei newspaper reported the electronics maker may post its first profit in seven years. CSR Corp., China’s biggest train maker, fell 1.7 percent in Shanghai on speculation the government will slow rail expansion following another accident.

Еuropean stocks declined, snapping the biggest three-day rally in 16 months, amid concern that holders of Greek bonds will suffer larger losses than previously agreed upon.

FTSE 100 5,218 -76.42 -1.44%, CAC 40 2,996 -27.76 -0.92%, DAX 5,578 -50.02 -0.89%

Man Group Plc (EMG) sank the most in almost three years as the world’s biggest hedge fund said assets under management will decrease. Cairn Energy Plc (CNE) slid 6.5 percent after abandoning an exploration well. Deutsche Boerse AG (DB1), the operator of the Frankfurt stock exchange, lost 4 percent as the European Union proposed a financial-transactions tax.

U.S. stocks declined, halting a three-day rally for the Standard & Poor’s 500 Index, amid growing concern that European leaders are divided over how to handle Greece’s debt crisis.

All 10 industry groups in the S&P 500 fell at least 0.6 percent, with companies most-tied to economic growth dropping the most. Dow Chemical Co. (DOW) and Alcoa Inc. (AA) slid at least 4.9 percent as commodities tumbled. Morgan Stanley and Bank of America Corp. (BAC) lost more than 4.9 percent, pacing declines among financial shares. Amazon.com Inc. (AMZN) rose 2.5 percent after the company launched its Kindle Fire tablet computer, taking aim at Apple Inc.’s bestselling iPad.

The S&P 500 lost 2.1 percent to 1,151.06 at 4 p.m. New York time, after rising as much as 0.8 percent earlier and rallying 4.1 over the previous three days. The Dow Jones Industrial Average fell 179.79 points, or 1.6 percent, to 11,010.90 today, with all 30 stocks retreating.

Resistance 2: Y77.90/95 (Sep 23 high)

Resistance 1: Y76.65 (session high)

The current price: Y76.54

Support 1:Y76.35 (session low)

Support 2:Y76.10/15 (area of Sep 21-23 low)

Support 3:Y75.90 (area of a historical low)

Comments: the pair bargains in range Y76.35-Y76.65.

Resistance 2: Chf0.9085 (Sep 23 high)

Resistance 1: Chf0.9020 (session high)

The current price: Chf0.8960

Support 1: Chf0.8925 (Sep 27-28 low)

Support 2: Chf0.8880/85 (Sep 13 low)

Support 3: Chf0.8800 (area of Sep 17-20 low)

Comments: the pair continues growth. In focus support on Chf0.8925.

Resistance 2: $ 1.5700 (Sep 27 high)

Resistance 1: $ 1.5650 (Sep 20 low)

The current price: $1.5630

Support 1 : $1.5580 (MA (200) H1)

Support 2 : $1.5540 (session low)

Support 3 : $1.5490/00 (Sep 23 high)

Comments: the pair is corrected in downtrend. In focus resistance at $1.5650

Resistance 2: $ 1.3690 (Sep 28 high)

Resistance 1: $ 1.3640 (Sep 21 low)

The current price: $1.3617

Support 1 : $1.3570 (MA (200) H1)

Support 2 : $1.3520 (session low)

Support 3 : $1.3480 (Sep 27 low)

Comments: the pair is corrected in downtrend. Below $1.3570.

Nikkei 225 8,616 +5.70 +0.07%

Hang Seng 18,011 -119.49 -0.66%

S&P/ASX 200 4,040 +34.96 +0.87%

Shanghai Composite 2,392 -22.99 -0.95%

FTSE 100 5,218 -76.42 -1.44%

CAC 40 2,996 -27.76 -0.92%

DAX 5,578 -50.02 -0.89%

Dow 11,010.90 -179.79 -1.61%

Nasdaq 2,492 -55.25 -2.17%

S&P 500 1,151.06 -24

10 Year Yield 2.00% -0.01 --

Oil $80.78 -0.43 -0.53%

Gold $1,614.40 -3.70 -0.23%

06:00 United Kingdom Nationwide house price index August -0.6% +0.2%

07:55 Germany Unemployment Change September -8К -9К

07:55 Germany Unemployment Rate s.a. September 7.0% 7.0%

08:30 United Kingdom Consumer credit, bln August 0.2 0.2

08:30 United Kingdom M4 money supply final August -0.1%

08:30 United Kingdom M4 money supply final, y/y August -1.1%

08:30 United Kingdo Mortgage Approvals August 49.2К 49.5К

09:00 Eurozone Economic sentiment index September 98.3 96.0

09:00 Eurozone Business climate indicator September 0.07 -0.12

12:30 Canada Raw Material Price Index August -1.2% -1.6%

12:30 Canada Industrial product prices, m/m August -0.3% -0.4%

12:30 U.S. Initial Jobless Claims Week of September 24 423К 420К

12:30 U.S. Final GDP Quarter II +1.0% +1.2%

12:30 U.S. кв/кв Quarter II +3.2%

14:00 U.S. Pending Home Sales (MoM) August -1.3% -1.6%

21:45 New Zealand Building Permits, m/m August +13.0% -1.5%

23:01 United Kingdom Gfk Consumer Confidence September -31 -33

23:30 Japan National Consumer Price Index, y/y August +0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y August +0.1%

23:30 Japan Tokyo-area CPI September +0.1%

23:30 Japan Tokyo Consumer Price Index, y/y September -0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September -0.2%

23:30 Japan Jobless Rate August 4.7% 4.7%

23:30 Japan Household spending Y/Y August -2.1% -2.6%

23:50 Japan Nationwide CPI August 0.0%

23:50 Japan Industrial Production (MoM) August +0.4% +1.5%

23:50 Japan Industrial Production (YoY) August -3.0% +1.1%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.