- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-09-2011

ECB's Weidmann sees German GDP +0.5% In 3Q

By the time the closing European stock markets, and growth of major benchmark indexes, the dollar, pound and franc rebounded

European stocks rose for a second day as foreign governments and central banks urged policy makers in Europe to intensify efforts to contain the region’s debt crisis following meetings with the International Monetary Fund.

Allianz SE and Axa SA, Europe’s biggest insurers, jumped the most in more than a year. Deutsche Bank AG led lenders higher amid speculation the European Central Bank may cut interest rates and as executives called for a U.S.-style Troubled Asset Relief Program in Europe. Fresnillo Plc tumbled 6.9 percent as silver had the biggest three-day drop since 1980.

Bank of America Corp. and JPMorgan Chase & Co. jumped more than 1.9 percent, as European Central Bank policy makers are said to consider restarting covered-bond purchases along with further measures to ease monetary conditions. Berkshire Hathaway Inc. Class B shares jumped 5.9 percent as the company plans a stock buyback. Apple Inc. lost 1.4 percent after an analyst said the company is cutting orders for iPad parts.

Gold for December delivery fell as much as $104.80, or 6.4 percent, to $1,535 an ounce, the lowest since July 8, and was at $1,619.30 by 9:57 a.m. on the Comex in New York.

Oil declined for the fourth straight day in New York, reversing an earlier gain of 1.3 percent. Crude for November delivery slipped $1.12, or 1.4 percent, to $78.73 a barrel at 10:33 a.m. on the New York Mercantile Exchange.

Oil began to recover last few hours and now the price of November futures on the New York Mercantile Exchange at $ 79.24 a barrel.

In the middle of the day in the U.S. at 13:00 GMT S&P/CS Composite-20 HPI y/y and 14:00 GMT - CB Consumer Confidence, on which is expected to increase to 46.4 against 44.5 in August.

End the day - Fed's Lockhart speech at 16:30 GMT.

U.S. stock futures rose on speculation European leaders will act to prevent the region’s debt crisis from getting worse.

Shanghai Composite -1.64%, FTSE +0.96%, CAC +2.31%, DAX +2.78%.

Data:

ECB council members Ewald Nowotny from Austria and Luc Coene from Belgium have already said the bank may look at stepping up efforts to boost growth as soon as next month.

The official said ECB policy makers haven’t decided on the size of the potential new covered-bond purchase program.

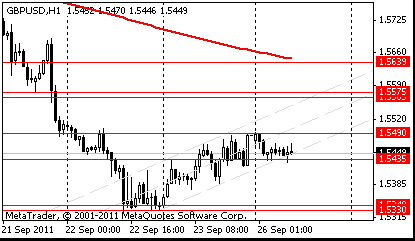

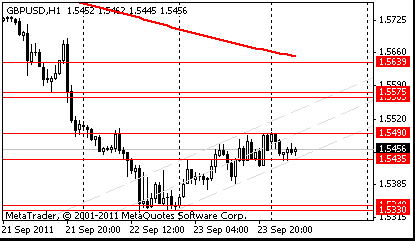

GBP/USD: the pair grown above $1.5500.

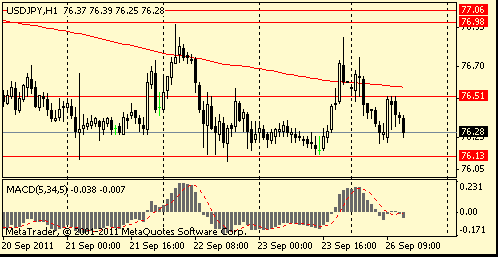

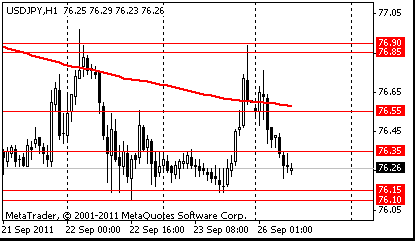

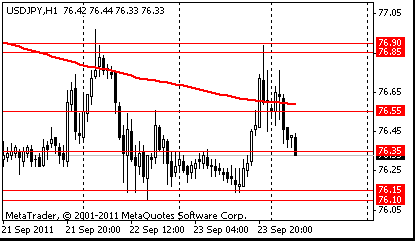

USD/JPY: on european session the pair was in Y76.20-Y76.50 range.

- сan't exclude further downward revision of ECB forecasts;

- at end of day, expect agreement between Greece, troika.

Resistance 3: Y77.30 (Sep 15 high)

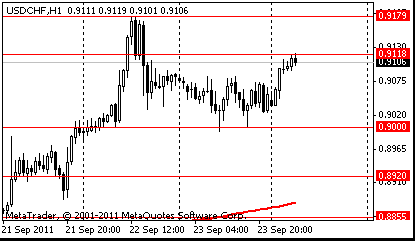

Resistance 3:Chf0.9350 (high of March and April)

Resistance 3: $ 1.5630 (Sep 19 low)

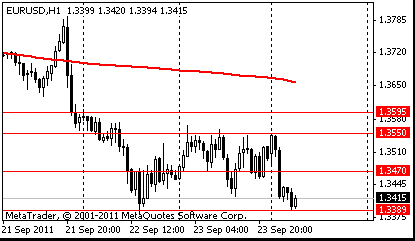

Resistance 3: $ 1.3600 (area of Sep 19-20 low and Sep 22 high)

European stocks climbed as finance ministers and central bankers urged policy makers in Europe to intensify efforts to contain the region’s debt crisis.

USD/JPY Y76.00, Y76.50, Y76.65, Y76.80

GBP/USD $1.5500, $1.5600

EUR/JPY Y100.00

New Zealand’s dollar fell for a sixth day versus the greenback and yen after a report showed the country’s trade deficit was wider than estimated, adding to signs of a slowdown in the South Pacific nation.

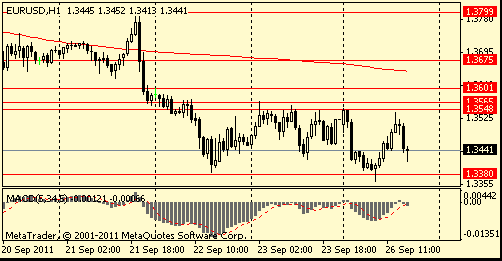

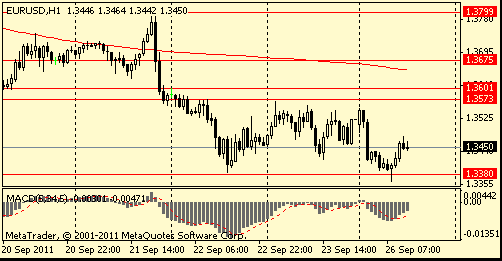

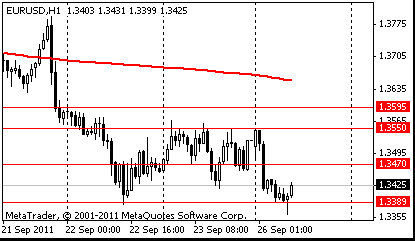

EUR/USD: on asian session the pair dropped, but later restored.

GBP/USD: on asian session the pair hold $1.5430-$1.5460 .

USD/JPY: on asian session the pair dropped.

US data kicks off at 1330GMT with the release of the Capital Goods Index for the Sept 23 week. a 1400GMT, the New Home Sales data is released, followed at 1430GMT, with the release of the Retail Trade Index for the Sept 24 week. The pace of new home sales is expected to fall to a 295,000 annual rate in August after falling slightly in July,as Hurricane Irene held back sales in the affected region. Also at

1430GMT, the US Sept Dallas Fed Manufacturing Outlook Survey is released. Finally, at 1900GMT, Minneapolis Federal Reserve Bank

President Narayana Kocherlakota sits on a panel on sovereign debt in Chicago.

- Global Environment 'Clearly Disinflationary'

- Global Risks Dominating Any Stg Price Effects

- Inflation Expectations 'Pretty Well Anchored'

- Denies MPC Took Part In Currency Wars

- Should not expand toolkit of ECB beyond current scope

- Insolvency not scenario of Greece authorities or ECB

- Too much talk about Greece insolvency; bad for markets

- At end of day, expect agreement between Greece, troika

- must await result

- From what we hear, Ireland and Portugal fully on track

On results of week the dollar has grown against all major currencies except for yen. The American currency for last five trading sessions has grown on 2.07 % against euro, has grown on 1.89 % against pound and has lost 0.12 % against yen. The most growth has shown the American dollar against next currencies: the Canadian, Australian and New Zealand dollars for a week lost more than on 5 %.

On Monday the euro weakened to almost a seven-month low against the dollar after European officials failed last week to offer a plan to halt the region’s debt crisis as Greece struggles to avoid default.

The dollar rose against all its major counterparts except the yen as Treasury two-year yields fell to a record before the Federal Reserve begins its two-day meeting.

The yen rallied to within 0.5 percent of its record against the greenback on refuge demand before European Union and International Monetary Fund officials judge whether the Greek government is eligible for its next aid payment.

On Tuesday the Swiss franc fell against the dollar and the euro amid speculation the Swiss National Bank may tighten its target to limit the currency’s strength. Swiss central bank spokesman Walter Meier in Zurich declined to comment when asked about speculation that policy makers may adjust the franc ceiling against the euro. It fell 0.6 percent to 88.77 centimes per U.S. dollar.

The dollar rallied and Treasuries erased their decline after the International Monetary Fund predicted severe global growth repercussions if Europe fails to contain the sovereign debt crisis. IMF said the European Central Bank should lower interest rates if risks to growth persist. The ECB’s current benchmark rate is 1.5 percent.

On Wednesday the dollar climbed to a seven-month high after the Federal Open Market Committee said there are “significant downside risks” to the economic outlook.

The euro advanced versus the yen as Greece said it will accelerate budget cuts to keep emergency loans flowing.

On Thursday the euro fell to the weakest level since January versus the dollar and reached a fresh decade-low against the yen after euro-area services and manufacturing contracted this month, adding to concern the region’s debt crisis is deepening.

Australia’s dollar slid below parity with the greenback for the first time in six weeks and New Zealand’s currency slumped.

On Friday the euro rose against the dollar and yen as global equities erased losses and as investors look to Group of 20 finance ministers meeting in Washington for further action.

The yen traded at almost a post-war record high against the dollar amid speculation the Bank of Japan may intervene to curb the currency’s strength.

BHP Billiton Ltd. (BHP), the world’s No. 1 mining company, slumped 3 percent in Sydney after crude oil and metal prices tumbled yesterday and today.

Korea Zinc Co., which produces gold and silver, plunged 15 percent in Seoul and Samsung Electronics Co., South Korea’s biggest exporter of consumer electronics, lost 4.1 percent.

Esprit Holdings Ltd. (330), a clothing retailer that gets most of its revenue in Europe, sank 4.6 percent in Hong Kong, taking its losses in the last two weeks to 58 percent.

The Asia Pacific index pared declines today after finance chiefs from the Group of 20 nations said they would address “heightened downside risks” from sovereign debt and a slowing global economy. The gauge briefly resumed losses after Moody’s Investors Service downgraded the long-term deposit and senior debt ratings of eight rated Greek banks by two levels.

European stocks last week fell to a two-year low after Fed statement, but increased slightly on Friday, stepping back from the lows after a meeting in connection with the G20 in Washington, politicians have reduced investor concern that the European debt crisis is spreading and the global economy is weakening.

For the week the London FTSE lost 5.62%, German DAX fell 6.48%

BNP Paribas (BNP) SA and Societe General SA led a rally in banks. Bayer AG (BAYN) climbed 7.1 percent as its Xarelto blood thinner-drug won European backing for use in irregular-heartbeat patients.

Despite Friday's relative calm on Wall Street, it was a brutal week for stocks, with investors losing faith in economies and political leaders around the world.

All three indexes fell by more than 5% for the week. The S&P 500 (SPX) was down 80 points, or 6.5% for the week, while the tech-heavy Nasdaq (COMP) dropped 139 points, or 5.6%. The Dow Jones industrial average closed the week down 738 points, or 6.4%, its worst weekly performance since October 2008.

In a subdued end to the calamitous week, U.S. stocks edged higher Friday afternoon, as investors tried to recover from Thursday's 3% slide. But the gains were limited as traders remained cautious amid worries about the global economy and Europe's debt crisis.

Home Depot Inc. (HD) and Intel Corp. (INTC) added at least 2 percent, pacing gains in companies most-tied to economic growth. Bank of America Corp. (BAC) rallied 4.1 percent, the most in the Dow, as the lender prepared more asset sales to bolster capital. Nike Inc. (NKE), the world’s largest sporting-goods maker, jumped 5.3 percent after profit topped analysts’ estimates and it raised a sales forecast. Newmont Mining Corp. (NEM) and Halliburton Co. (HAL) retreated more than 3.2 percent as gold and oil prices slumped.

Resistance 2: Y77.85/90 (Sep 23 high)

Resistance 1: Y76.55 (American session of Sep 22 high)

The current price: Y76.40

Support 1:Y76.35 (session low)

Support 2:Y76.10/15 (area of Sep 21-23 low)

Support 3:Y75.90 (area of historical low)

Comments: the pair fell. Losses below to last week low Y76.10.

Resistance 2: Chf0.9180 (Sep 22 high)

Resistance 1: Chf0.9120 (session high)

The current price: Chf0.9106

Support 1: Chf0.9000 (Sep 23 low)

Support 2: Chf0.8920 (Sep 20 high)

Support 3: Chf0.8855/60 (area of Sep 19-20 high)

Comments: the pair rose. In focus resistance on Chf0.9180.

Resistance 2: $ 1.5565/75 (European session of Sep 21 low)

Resistance 1: $ 1.5490 (session high)

The current price: $1.5450

Support 1 : $1.5435 (session low)

Support 2 : $1.5330/40 (Sep 22 low)

Support 3 : $1.5275 (Jul 16’2010 low)

Коментарии: the pair hold on $1.5450. Strong support at $1.5435.

Resistance 2: $ 1.3550 (session high)

Resistance 1: $ 1.3470 (Asian session of Sep 23 low)

The current price: $1.3398

Support 1 : $1.3390 (session low)

Support 2 : $1.3250 (Jan 17-18 low)

Support 3 : $1.3130 (Jan 12 high)

Comments: the pair fell on the last week low. Losses below to $1.3250.

08:00 Germany IFO - Business Climate September 108.7 107.0

08:00 Germany IFO - Current Assessment September 118.1 115.5

08:00 Germany IFO - Expectations September 100.1 97.4

08:00 Italy Consumer confidence September 100.3 98.5

14:00 U.S. New Home Sales August 298К 296К

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.