- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-09-2011

New lows for the day around $0.9720 as risk tickets remain under pressure with the Dow down almost 500 points. Pair on track to retest support at $0.9535 that are lows going back to last December

By the early U.S. session, The dollar jumped and currencies of commodity exporters tumbled on concern global growth is stalling after the Federal Reserve said yesterday it saw “significant downside risks” to the U.S. economy. The Dollar Index climbed to a seven-month high as the Fed’s statement stoked concern the global economy is headed for a recession and currency volatility surged to a 16-month high. The euro reached a fresh decade-low against the yen after region’s services and manufacturing contracted

During the U.S. session, the dollar has reduced its rapid growth and is currently the major currencies traded mixed against the dollar. The market is characterized by high volatility.

European stocks tumbled to a two- year low as the Federal Reserve signaled “significant downside risks” to the world’s largest economy and Moody’s Investors Service downgraded three U.S. banks.

National benchmark indexes retreated in all of the 18 western European markets. Germany’s DAX Index declined 5 percent and France’s CAC 40 dropped 5.3 percent. The U.K.’s FTSE 100 slid 4.7 percent, the most since March 2009.

Logitech International SA (LOGN), the world’s biggest maker of computer mice, plunged 12 percent after cutting its forecasts for the second time in two months. Rio Tinto Group, the world’s second-largest mining company, sank the most in more than two years as copper fell for a fifth day. LVMH Moet Hennessy Louis Vuitton SA (MC) and Burberry Group Plc (BRBY) led luxury stocks lower.

- european banking crisis more likely than before;

- risk of recession unless leaders restore confidence;

- ECB bond purchases "unquestionably legitimate".

- Need To Recapitalize Vulnerable EU Banks

U.S. stocks continue to fall.

To date, the Dow 10,770.95 -353.89 -3.18%, Nasdaq 2,473.15 -65.04 -2.56%, S & P 500 1,133.31 -33.45 -2.87%.

All sectors of S & P500 index showed a fall. The largest decline in the sector conglomerates and the basic materials sector - 5.1% and 5.0% respectively.

Gold prices on Thursday demonstrated a tangible negative trend due to the fact that the rise of the dollar against global currencies has reduced the demand for the metal as an investment alternative, according to data exchanges. With increasing dollar demand for gold as a more reliable asset was under pressure.

The price of gold futures on the New York Mercantile Exchange fell to $1732.10 per ounce (-4.2%).

Oil fell to the lowest price in more than four weeks in New York after the U.S. Federal Reserve cited “significant downside risks” to the economic outlook in the world’s biggest crude-consuming nation.

The Fed’s decision not to implement an outright third round of so-called quantitative easing “leads investors to take their money out of the risky assets like oil

Analyst says that the oil market is on downside momentum with serious lack of risk appetite. In addition to the weak macroeconomic data, we have to acknowledge the lack of oil demand from the U.S. and emerging markets, amid ongoing concerns about growth.

To date, the November crude oil futures Nymex WTI price fell by 4.88% and reached $ 81.73 a barrel.

In Japan, a national holiday - Autumnal Equinox Day.

At 08:30 GMT there are data on the volume of UK mortgage lending by the BBA. It is predicted that the data in August, virtually unchanged - 33.2K 33.4K against in July.

At 09:00 GMT, Switzerland showed quarterly report on inflation from the Swiss National Bank Q3.

On this day in the U.S. will be important meetings - September meeting the IMF will begin at 14:00 GMT. And at 15:00 GMT start the second day meeting of leaders of big twenty G20. At 17:30 GMT a speech a member of the FOMC William Dudley.

- expect reformed EFSF to be operational in second half of Oct

- underlying state of most of europe economically healthy.

Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) retreated at least 2.4 percent, pacing losses in financial shares.

The benchmark gauge yesterday had its biggest decline in one month on the Federal Reserve’s assessment that market turmoil caused by Europe’s sovereign-debt crisis is taking a toll on the U.S. economy. Stocks also fell as Moody’s Investors Service downgraded three U.S. banks.

Global stocks extended declines today on data that China’s manufacturing may shrink for a third month in September, the longest contraction since 2009, after a preliminary index of purchasing managers showed measures of export orders and output declined.

07:28 Germany PMI (September) flash 50.0

07:28 Germany PMI services (September) flash 50.3

07:58 EU(17) PMI (September) flash 48.4

07:58 EU(17) PMI services (September) flash 49.1

09:00 EU(17) Industrial orders (July) -2.1%

09:00 EU(17) Industrial orders (July) Y/Y 8.4%

10:00 UK CBI industrial order books balance (September) -9%

10:00 UK CBI industrial output balance (September) +9%

The dollar and yen jumped on concern global growth is stalling after the Federal Reserve said yesterday it saw “significant downside risks” to the U.S. economy, spurring demand for safer assets.

The Dollar Index climbed to a seven-month high as the Fed’s statement stoked concern the global economy is headed for a recession.

The euro fell to the weakest level since January versus the dollar and reached a fresh decade-low against the yen after euro-area services and manufacturing contracted this month, adding to concern the region’s debt crisis is deepening.

Australia’s dollar slid below parity with the greenback for the first time in six weeks and New Zealand’s currency slumped.

EUR/USD: the pair decreased in $ 1.3450 area.

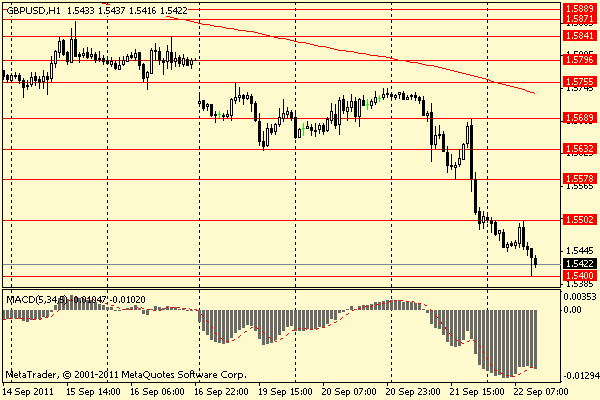

GBP/USD: the pair showed low in $ 1.5400 area.

USD/JPY: the pair showed low Y76.10 area then receded.

Resistance 2: Y76.95/05 (area of Sep 16-19 high and session high)

Resistance 1: Y76.55 (intraday high)

Current price: Y76.39

Support 1:Y76.10 (area of Sep 21 and session lows)

Support 2:Y75.90 (area of historical low)

Support 3:Y75.00 (psychological mark)

Comments: the pair remains in area of historical lows.

Resistance 2: Chf0.9200 (psychological level)

Resistance 1: Chf0.0.9160 (session high)

Current price: Chf0.9142

Support 1: Chf0.9000 (low of european session)

Support 2: Chf0.8885 (low of american session on Sep 21)

Support 3: Chf0.8800 (area of low on Sep 19-20)

Comments: the pair continues to update session high. The immediate strong resistance - Chf0.9350.

Resistance 2: $ 1.5565/75 (low of european session on Sep 21)

Resistance 1: $ 1.5490 (Sep 21 low)

Current price: $1.5423

Support 1 : $1.5400 (session low)

Support 2 : $1.5340 (low of Dec’2010)

Support 3 : $1.5300/95 (low of Sep’2010)

Comments: the pair remains under pressure. Strong supports are in area $1.5340 and futher on $1.5300.

Resistance 2: $ 1.3570 (high of european session)

Resistance 1: $ 1.3500 (Sep 12 low)

Current price: $1.3466

Support 1 : $1.3450 (session low)

Support 2 : $1.3430 (low of February)

Support 3 : $1.3380 (area of close prices of days in Dec’2010)

Comments: the pair continues to decrease. Strong supports are in area $1.3430 and then on $1.3380.

rate down to extended lows of $1.5416. Support now seen at $1.5410/00

USD/JPY Y76.00, Y77.00

GBP/USD $1.5500, $1.5725, $1.5785, $1.5850

AUD/USD $0.9920, $0.9915

EUR/JPY Y103.50

USD/CHF Chf0.9000, Chf0.8850

Hang Seng 18,028 -796.58 -4.23%

S&P/ASX 3,965 -106.90 -2.63%

Shanghai Composite 2,453 -60.06 -2.39%

The Dollar climbed to a seven-month high after the Federal Open Market Committee said there are “significant downside risks” to the economic outlook.

The euro advanced versus the yen as Greece said it will accelerate budget cuts to keep emergency loans flowing.

New Zealand’s dollar weakened after data showed economic growth almost stalled.

Australia’s dollar slid below parity with the greenback after a survey said China’s manufacturing may slow.

EUR/USD: in first half of day the pair hold. Then pair decline to $1.3560 on American session.

GBP/USD: the pair was under pressure and closed at $1.5500

USD/JPY: yestherday the pair restored and showed high at Y76.75.

Focus today is set squarely on 07:58 Eurozone Purchasing Manager Index Manufacturing September

after 09:00 Eurozone Industrial New Orders s.a

10:00 United Kingdom CBI industrial order books balance

Then 12:30 Canada Retail Sales, m/m July and U.S. Initial Jobless Claims

Finished day at 14:00 U.S. Leading Indicators August

China Life Insurance Co., the nation’s biggest insurer by market value, rose 1.6 percent in Hong Kong after the Conference Board said its leading indicator index for the world’s second- largest economy rose 0.6 percent in July, citing a preliminary reading.

BHP Billiton Ltd. (BHP), the world’s largest mining company, climbed 0.9 percent in Sydney, reversing an earlier decline of as much as 0.5 percent.

Esprit Holdings Ltd. plunged 11 percent after Morgan Stanley listed it as one of the Asian companies most at risk from Europe’s debt crisis.

Stock gains were also limited today after the IMF said the world economy will expand 4 percent this year and next, revising down its June forecasts of 4.3 percent in 2011 and of 4.5 percent in 2012. The U.S. growth projection for 2011 was lowered to 1.5 percent from a 2.5 percent prediction in June.

European stocks retreated as officials said they plan to return to Athens next week after three days of consultations failed to produce a solution to the country’s debt crisis.

PSA Peugeot Citroen and Volkswagen AG (VOW) led a decline in automakers.

Deutsche Lufthansa AG (LHA) lost 5 percent as Deutsche Bank AG (DBK) downgraded Europe’s second-biggest airline. Stada Arzneimittel AG (SAZ) slumped 19 percent for the biggest drop in three years.

Bank of England officials considered ways of adding stimulus to the economy this month and most of them said an expansion of their 200 billion-pound ($313 billion) bond purchase program is “increasingly probable.” The nine-member Monetary Policy Committee voted 8-1 to maintain the current size of the bond plan and were unanimous in keeping the benchmark rate at a record low of 0.5 percent. The minutes of the Sept. 8 meeting show the decision on whether to expand stimulus was “finely balanced.”

National benchmark indexes retreated in 13 of the 18 western European markets. Germany’s DAX Index declined 2.5 percent, while the U.K.’s FTSE 100 lost 1.4 percent and France’s CAC 40 dropped 1.6 percent.

Peugeot, Europe’s second-largest carmaker, slid 5.7 percent to 17.04 euros and Volkswagen preferred shares slipped 2.6 percent to 111 euros. Bayerische Motoren Werke AG (BMW) and Daimler AG (DAI), the world’s biggest makers of luxury cars, declined 2.7 percent to 56.09 euros and 3.8 percent to 35.40 euros, respectively.

Fiat SpA (F) fell 6.2 percent to 4.04 as Moody’s Investors Service downgraded its corporate family rating. A gauge of auto- industry shares dropped 3.3 percent for the second-largest retreat among 19 industry groups in the Stoxx 600.

Deutsche Bank retreated 2.3 percent to 23.90 euros as Chief Financial Officer Stefan Krause said Germany’s biggest bank is “fighting” to meet its goal of 10 billion euros in operating pretax profit this year.

U.S. stocks slumped, giving the Standard & Poor’s 500 Index its biggest decline in a month, as the Federal Reserve announced plans to buy $400 billion of long- term debt and cited risks to the economic outlook.

Caterpillar Inc. and Dow Chemical Co. fell more than 5.1 percent, pacing losses among companies most-tied to the economy. Financial shares in the S&P 500 slid 4.9 percent as a group, to a two-year low, as Moody’s Investors Service cut its ratings on Bank of America Corp., Citigroup Inc. and Wells Fargo & Co.

Treasury 30-year bonds surged, pushing the yields below 3 percent for the first time since 2009, after the Fed said it will purchase longer-term debt and sell shorter maturities to sustain the economic recovery, confirming market speculation that the central bank was planning an “Operation Twist” similar to one of the central bank’s programs in the 1960s.

Fed Chairman Ben Bernanke said in an Aug. 26 speech that the central bank still has tools to stimulate the economy without signaling he will use them. He echoed comments of dissenting members of the Federal Open Market Committee who said then that U.S. economic data aren’t pointing to a recession.

The KBW Bank Index (BKX) declined 5.5 percent. Bank of America fell 7.5 percent to $6.38. Wells Fargo lost 3.9 percent to $23.71, and Citigroup slipped 5.2 percent to $25.52.

Bank of America and Wells Fargo had their long-term credit ratings downgraded by Moody’s, which cited a decreasing probability that the U.S. would support the lenders in an emergency. Citigroup’s short-term credit rating was cut.

Goldman Sachs Group Inc. (GS), the fifth-biggest U.S. bank by assets, closed below $100 for the first time since March 2009. The shares dropped 4.6 percent to $97.86. Morgan Stanley, the sixth-biggest U.S. bank by assets, sustained the biggest decline in the S&P 500 Financials Index as the stock fell 8.6 percent to $13.82.

Resistance 2: Y77.25 (Sep 1 high)

Resistance 1: Y76.95/00 (area of Sep 16-19 high)

Current price: Y76.75

Support 1:Y76.55 (Sep 15 low)

Support 2:Y76.30 (Sep 19 low)

Support 3:Y76.10 (Sep 21 low)

Comments: the pair continues to rise.

Resistance 2: $ 1.3690 (MA (200) for H1)

Resistance 1: $ 1.3600 (session high)

The current price: $1.3548

Support 1 : $1.3530 (session low)

Support 2 : $1.3500 (Sep 12 low)

Support 3 : $1.3445/50 (area of Jan 14-18 high)

Comments: the pair continues falling. Below $1.3530 immediate $1.3500.

Resistance 2: Chf0.9105 (Apr 11 high)

Resistance 1: Chf0.0.9060 (area of Apr 11 low)

Current price: Chf0.9026

Support 1: Chf0.8985 (intraday low)

Support 2: Chf0.8920/25 (area of Sep 12 and 20 high)

Support 3: Chf0.8885 (low of american session on Sep 21)

Comments: the pair shows growth, trying to be fixed above 0.9000.

Resistance 2: $ 1.5565/75 (low of european session on Sep 21)

Resistance 1: $ 1.5490 (Sep 21 low)

Current price: $1.5455

Support 1 : $1.5435 (Jan 3 low)

Support 2 : $1.5345/55 (area of Sep 2,6,10 and 14’2010 low)

Support 3 : $1.5295 (Sep 7’2010 low)

Comments: the pair continues to decrease. The immediate support $1.5435. The immediate resistance $1.5490

Nikkei 8,741 +19.92 +0.23%

Hang Seng 18,824 -190.63 -1.00%

Shanghai Composite 2,513 +65.21 +2.66%

FTSE 5,288 -75.30 -1.40%

CAC 2,936 -48.23 -1.62%

DAX 5,434 -137.88 -2.47%

Dow 11,124.84 -283.82 -2.49%

Nasdaq 2,538.19 -52.05 -2.01%

S&P 500 1,166.76 -35.33 -2.94%

10 Year Yield 1.88% -0.07 --

Oil $85.21 -1.71 -1.97%

Gold $1,788.60 -19.50 -1.08%

10:28 Germany PMI services (September) flash 50.5 51.1

10:58 EU(17) PMI (September) flash 48.4 49.0

10:58 EU(17) PMI services (September) flash 51.0 51.5

12:00 EU(17) Industrial orders (July) -1.2% -0.7%

12:00 EU(17) Industrial orders (July) Y/Y 10.5% 11.1%

13:00 UK CBI industrial order books balance (September) -5% +1%

15:30 Canada Retail sales (July) -0.3% 0.7%

15:30 Canada Retail sales excluding auto (July) 0.2% -0.1%

15:30 USA Jobless claims (week to 17.09) 424K 428K

17:00 USA Leading indicators (August) 0.1% 0.5%

23:30 USA M2 money supply (12.09), bln - +21.5

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.