- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-09-2011

Makes no change in rates (FF again targeted 0%-1/4%) with mid-'13 assurance; no change in IOER.

The U.S. dollar declined against its major counterparts on the eve of announcement of results of meeting FOMC, which plans to adopt new stimilus to support economic growth. Some market participants expect a decision on the third round of the quantitative easing QE3.

The pound has stopped falling, caused by the publication of the Bank of England Minutes, and showed growth over the past few hours.

The Canadian dollar fell to January’s lows as weak statistics about inflation.

Gold declined in New York on speculation further stimulus measures by the Federal Reserve will cut demand for the metal as a protection of wealth.

Gold for December delivery fell $12.90, or 0.7 percent, to $1,796.20 an ounce on the Comex in New York.

Futures also rose as a Chinese leading indicator climbed in July, adding to evidence that the world’s second-biggest economy is withstanding Europe’s debt crisis and faltering U.S. growth. South Korea’s unemployment rate fell to a three-year low as the economy’s expansion boosted hiring in the service sectors. China and South Korea are the world’s second and ninth biggest oil consuming countries, according to the U.S. Energy Department.

Oil for October delivery rose 0.78 percent, to $87.60 a barrel on the New York Mercantile Exchange.

At 12:30 GMT will be released Canadian data on retail sales base. Expected to increaseby 0.2% compared with a fall of 0.1% in the previous month.

At the same time, will be published weekly statistics on applications for unemployment benefits in the U.S.. It is expected a slight decline in this rate to 417K compared with the previous 428K.

USD/JPY Y77.00

EUR/JPY Y105.00, Y104.00

GBP/USD $1.6000

USD/CHF Chf0.8950

AUD/USD $1.0250, $1.0320, $1.0400

Before the opening of the market S & P futures rose (+0.06%) and reached 1196.70, NASDAQ futures lost 0.03% to reach 2295.75 points and the futures Dow fell (-0.25%) and reached 11307.00.

Stocks fell yesterday as concern that Greece wasn’t closer to receiving more financial aid offset speculation the Fed will act to stimulate growth.

Caterpillar Inc. and Citigroup Inc. paced declines among companies most-dependent on economic growth. Oracle Corp. (ORCL) climbed 4.3 percent after the software maker reported profit that topped analysts’ estimates. Adobe Systems Inc. (ADBE), the largest maker of graphic-design software, jumped 7 percent after its sales forecast exceeded projections.

The October WTI oil contract traded at $ 86.26 per barrel (-0.76%).

Prior to the regular session price of gold fell to $ 1803.40 per troy ounce (-0.32%).

08:30 United Kingdom PSNCR, bln August 11.8

08:30 United Kingdom PSNB, bln August 15.9

08:30 United Kingdom Bank of England Minutes

The Dollar advanced for the third time in four days amid speculation the Federal Reserve will announce further stimulus measures for the world’s biggest economy following a two-day policy meeting.

The pound slid most of its major peers after minutes of the Bank of England’s most-recent meeting showed policy makers said growth in the second half of 2011 may be “materially weaker” than projected in August. The central bank kept its key rate at a record low of 0.5 percent in September and left bond purchases at 200 billion pounds ($314 billion).

Canada’s dollar fell for a third straight day as slowing economic growth concern discouraged demand for higher-yielding assets.The International Monetary Fund cut Canada’s economic growth forecast yesterday to 2.1 percent for this year from 2.9 percent

EUR/USD: the pair fell to $1.3605.

GBP/USD: the pair fell to $1.5700.

USD/JPY: the pair holds Y76.20-Y76.30.

At 1300GMT, THE IMF releases ITS Global Financial Stability Report, in Washington.

More US data is released at 1300GMT, with the release of the August Existing Home Sales data.

The day's main event is at 1815GMT, when the FOMC monetary policy announcement is made, following a two-day meet.

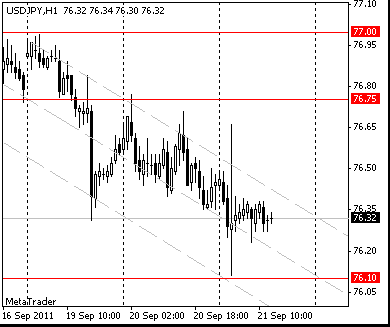

Resistance 2: Y77.00 (area of Sep 16-19 high)

Resistance 1: Y76.75 (Sep 20 high)

The current price: Y76.32

Support 1:Y76.10 (session low)

Support 2:Y75.65 (FIBO 200 % Y76.31-Y77.00)

Support 3:Y75.00 (psychological mark)

Comments: the pair holds in daily range.

Sold E1.25bn vs target E750m-E1.25b

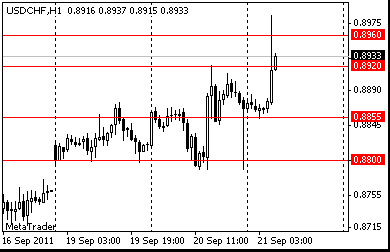

Resistance 2: Chf0.9000 (area of Apr 18-19 high)

Resistance 1: Chf0.8960 (area Apr 14-15 high)

The current price: Chf0.8933

Support 1: Chf0.8920 (Sep 20 high)

Support 2: Chf0.8855 (session low)

Support 3: Chf0.8800 (area Sep 19-20 low)

Comments: the pair rises. Above resistance Chf0.8960.

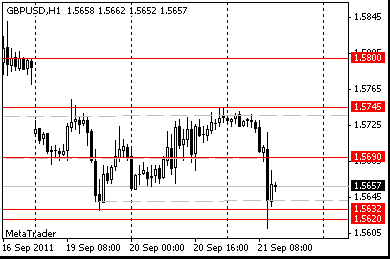

Resistance 2: $ 1.5745 (area of Sep 19-20 high)

Resistance 1: $ 1.5690 (average line of the channel, low of Asian session on Sep 19)

The current price: $1.5665

Support 1 : $1.5620/30 (session low)

Support 2 : $1.5575 (Dec 3’2010 low)

Support 3 : $1.5525/30 (Jan 11 low)

Comments: the pair restored after falling. Further resistance $1.5690.

Resistance 2: $ 1.3840 (high of American session on Sep 16)

Resistance 1: $ 1.3750 (Sep 16 high)

The current price: $1.3693

Support 1 : $1.3650 (low of American session on Sep 20 )

Support 2 : $1.3590 (Sep 19 low)

Support 3 : $1.3555/60 (area of Sep 12-13 low)

Comments: the pair was restored. Below resistance $1.3750

EUR/USD $1.3500, $1.3600, $1.3680, $1.3690, $1.3800, $1.3900

USD/JPY Y75.85, Y75.95, Y76.40, Y76.45, Y76.65, Y76.70, Y77.50, Y77.75, Y78.00

EUR/JPY Y103.30, Y107.70, Y108.50

GBP/USD $1.5700, $1.5500

AUD/USD $1.0100, $1.0270, $1.0345, $1.0350, $1.0375, $1.0400, $1.0420

- UK finances underline current challenging times

- Growth lower than OBR March forecasts

- Tax receipts continue to grow

- Spending growth so far at rate OBR forecast

- Data shows welcome, substantial borrowing reduction

Hang Seng 18,804 -211.11 -1.11%

S&P/ASX 4,072 +31.55 +0.78%

Shanghai Composite 2,513 +65.61 +2.68%

The dollar rallied and Treasuries erased their decline after the International Monetary Fund predicted severe global growth repercussions if Europe fails to contain the sovereign debt crisis. IMF said the European Central Bank should lower interest rates if risks to growth persist. The ECB’s current benchmark rate is 1.5 percent.

The euro was little changed at $1.3682. The shared currency traded at 104.77 yen, from 1.0482 yesterday, when it reached 103.96 yen, almost the least since 2001. German investor confidence fell to the lowest in more than 2 1/2 years in September as Europe’s debt crisis and a global slowdown damped the outlook for growth.

Australia’s dollar was the biggest winner against the U.S. currency.

EUR/USD: in first half of day the pair hold $1.3680. Then pair rises to $1.3720 on American session.

GBP/USD: the pair rises and finished session $1.5730.

USD/JPY: yestherday pair was under pressure and finished session Y76.45.

Focus today is set squarely on this morning#'s release of BOE MPC .

After UK statistic from Canada - Consumer Price Index.

After Canada releases focus will turn toward this evening's FOMC announcement.

BHP Billiton Ltd. (BHP), the world’s biggest mining company, dropped 2.1 percent in Sydney as crude and metal prices tumbled.

Rio Tinto Group, the second-largest miner by sales, fell 1.9 percent, extending losses yesterday.

Sony Corp. (6758) slumped 4.1 percent, leading exporters’ shares lower after Japanese markets resumed trading following yesterday’s public holiday.

China Unicom (Hong Kong) Ltd., the nation’s No. 2 mobile phone carrier, rose 3.9 percent in Hong Kong after boosting subscribers.

Mitsubishi UFJ Financial Group Inc. (8306), Japan’s biggest lender by market value, declined 2.9 percent to 335 yen on concern Europe’s debt crisis may spill over into the banking system.

European stocks climbed as Greece described its debt talks with the European Union and the International Monetary Fund as “productive” and investors speculated the Federal Reserve will provide more stimulus.

EON AG and RWE AG (RWE), Germany’s biggest utilities, climbed more than 3.5 percent after a court suspended a nuclear-fuel tax.

Barratt Developments Plc (BDEV) surged 5.7 percent after Citigroup Inc. advised buying the shares. SAP AG (SAP) rose 2.3 percent.

The Federal Reserve, led by Chairman Ben S. Bernanke, will decide tomorrow to replace short-term Treasuries with long-term bonds, according to the majority of economists.

National benchmark indexes rose in every western-European market except Greece and Iceland today. The U.K.’s FTSE 100 Index advanced 2 percent, Germany’s DAX Index gained 2.9

The IMF said that the program carried out by the government had produced “impressive fiscal consolidation,” while EU economics spokesman Amadeu Altafaj told reporters in Brussels yesterday that the European Commission has not demanded more of Greece than was agreed to in the international aid program for the country.

S&P said Italy’s net general government debt is the highest among A-rated sovereigns, and the company expects it to peak later and at a higher level than it had estimated.

Resistance 2: Y77.00 (area of Sep 16-19 high)

Resistance 1: Y76.75 (Sep 20 high)

The current price: Y76.35

Support 1:Y76.10 (session low)

Support 2:Y75.65 (FIBO 200 % Y76.31-Y77.00)

Support 3:Y75.00 (psychological mark)

Comments: the pair holds in daily range.

Resistance 2: Chf0.9000 (area of Apr 18-19 high)

Resistance 1: Chf0.8960 (area Apr 14-15 high)

The current price: Chf0.8933

Support 1: Chf0.8920 (Sep 20 high)

Support 2: Chf0.8855 (session low)

Support 3: Chf0.8800 (area Sep 19-20 low)

Comments: the pair rises. Above resistance Chf0.8960.

Resistance 2: $ 1.5800 (the price of closing of the last week)

Resistance 1: $ 1.5745/50 (area of Sep 19-20 high)

The current price: $1.5735

Support 1 : $1.5720 (session low)

Support 2 : $1.5650 (low of the end on Dec 2010)

Support 3 : $1.5575 (Dec 3’2010 low)

Comments: the pair holds area of weekly high. The immediate resistance $ 1.5745/50

Resistance 2: $ 1.3840 (high of American session on Sep 16)

Resistance 1: $ 1.3750 (Sep 16 high)

The current price: $1.3720

Support 1 : $1.3650 (low of American session on Sep 20 )

Support 2 : $1.3590 (Sep 19 low)

Support 3 : $1.3555/60 (area of Sep 12-13 low)

Comments: the pair was restored. Below resistance $1.3750

Nikkei 8,721 -142.92 -1.61%

Hang Seng 19,015 +96.85 +0.51%

Shanghai Composite 2,448 +9.96 +0.41%

FTSE 5,364 +104.15 +1.98%

CAC 2,984 +44.05 +1.50%

DAX 5,572 +155.77 +2.88%

Dow 11,409.19 +8.18 +0.07%

Nasdaq 2,590 -22.59 -0.86%

S&P 500 1,202 -2.00 -0.17%

10 Year Yield 1.95% +0.01 -

Oil $86.76 -0.13 -0.15%

Gold $1,806.90 -2.20 -0.12%

08:30 United Kingdom PSNCR, bln August -5.6

08:30 United Kingdom PSNB, bln August 0.0 10.0

08:30 United Kingdom Bank of England Minutes 0

11:00 Canada Consumer Price Index m / m August +0.2% +0.1%

11:00 Canada The consumer price index, g / g August +2.7% +2.9%

11:00 Canada Bank of Canada Consumer Price Index Core, m/m August +0.2% +0.2%

11:00 Canada Bank of Canada Consumer Price Index Core, y/y August +1.6% +1.6%

14:00 U.S. Existing Home Sales August 4.67 4.75

14:30 U.S. EIA Crude Oil Stocks change неделя по 16 сентября -6.7

18:15 U.S. Fed Interest Rate Decision 0 0.00-0.25% 0.00-0.25%

22:45 New Zealand Gross Domestic Productб q/q Quarter II +0.8% +0.5%

22:45 New Zealand Gross Domestic Product, y/y Quarter II +1.5% +1.7%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.