- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-09-2011

"U-Mich consumer survey data show the mood of Americans remains dark so far this month, but not as dark as in August. Low mtg rates and Pres Obama's jobs plan perhaps lifted the index. But expectations remained very sour. Expectations at 47.0 was the lowest since the early 80s and infl expectations edged up."

"Michigan consumer sentiment details continued to look pretty weak and some of that reflects downbeat ideas on personal finances, income expectations, and the labor market.

Currently: Dow +25.2 11,458.38 +0.22%, Nasdaq +5.91 2,612.98 +0.23%, S&P+1.65, 1,210.76 +0.14%.

U.S. stocks were little changed Friday, as investors take a breather and await news from a meeting of European finance ministers in Poland.

Stocks started the day modestly higher, but erased those gains to hang close to the breakeven line.

Financial stocks were dragging on stocks, with shares of Bank of America (, Fortune 500), Morgan Stanley (MS), Wells Fargo (WFC) and JPMorgan Chase (JPM) down about 2%.

Oil slipped, trimming its fourth straight weekly gain and longest winning streak since July, on concern that European plans to solve the region’s debt crisis may founder, threatening economic growth.

"in Sept consumer sentiment, Current Conditions pushed the number up. The main factor was a jump in Buying Conditions for Household Durables, mainly because of fewer consumers saying it was a 'bad time to buy'." CS's recession probability estimate is 35% currently, based on high unemploy claims, lower stocks and depressed consumer expectations.

U.S. stock-index futures declined, indicating that the benchmark Standard & Poor’s 500 Index will snap a four-day advance, as European Union finance ministers met in Poland to find ways to control the debt crisis.

"We would not be surprised if FOMC decides to buy 30y bonds and possibly even expand their balance sheet. These policies could end badly. Too much liquidity in the 1970s had quite devastating effect. This directly led to the debilitating inflation spike in 1978 to 1980."

08:00 EU(17) Current account (July) adjusted, bln -12.9

09:00 EU(17) Trade balance (July) adjusted, bln -2.5

The euro fell, halting a two-day gain versus the dollar and yen, on concern issues of collateral required by some nations to take part in another Greek bailout will hinder agreement at a meeting of European officials today.

European Central Bank President Jean-Claude Trichet pressed euro-area governments to take decisive action at today’s meeting to halt the crisis and show “unity of purpose.” His comments, made late yesterday, came as the challenges in stem the debt crisis was highlighted by disputes over collateral for Greek loans and German objections to altering European treaties.

The euro jumped the most in a month yesterday after the ECB said it will coordinate with the Federal Reserve and other central banks to conduct three separate dollar liquidity operations to ensure lenders have enough of the currency through the end of the year.

The Dollar Index, which measures the greenback against the currencies of six major U.S. trading partners, trimmed a weekly decline as concern the world’s largest economies are slowing fuels demand for the safest assets.

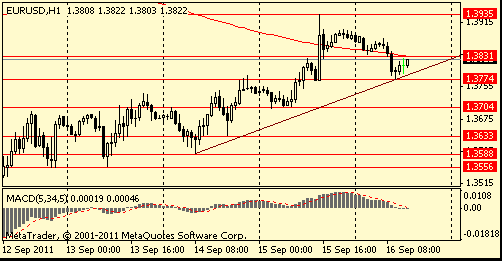

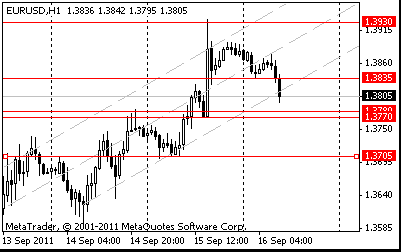

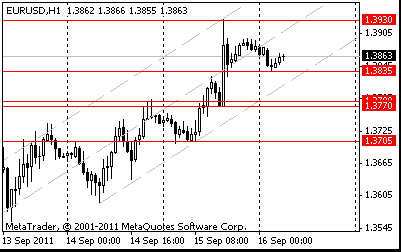

EUR/USD: the pair decreased below $1.3800.

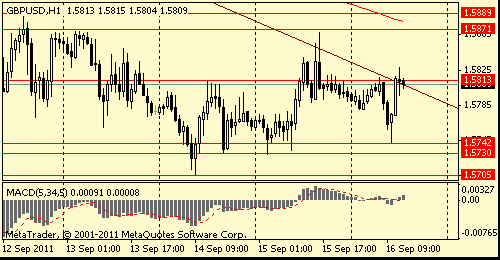

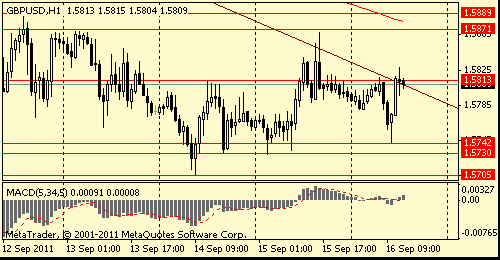

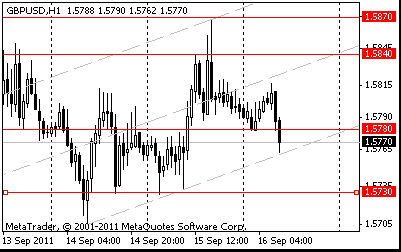

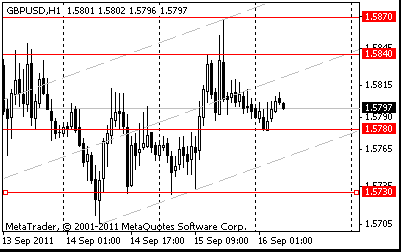

GBP/USD: the pair showed low in $1.5740 area then restored above $1.5800. Later decrease renewed.

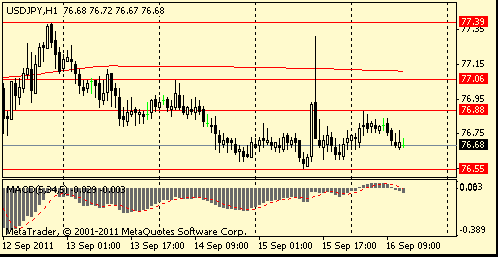

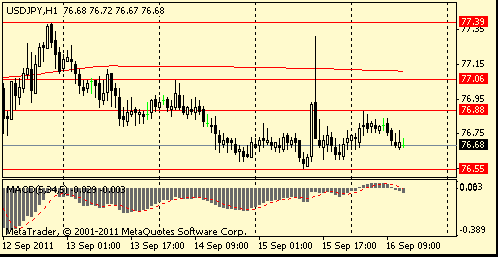

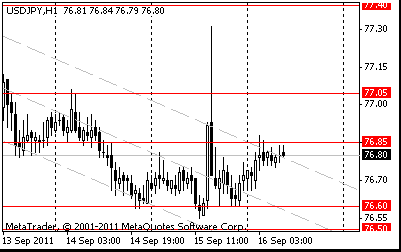

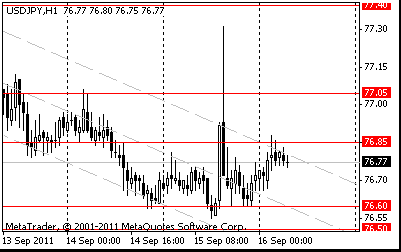

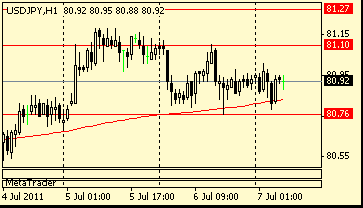

USD/JPY: the pair holds Y76.65-Y76.90.

In second half of the day focus will be on following data:

13:00 GMT Jul Tsy TICS.

13.55 GMT Sep prelim Rtrs-UMich consumer sentiment. Est56.5

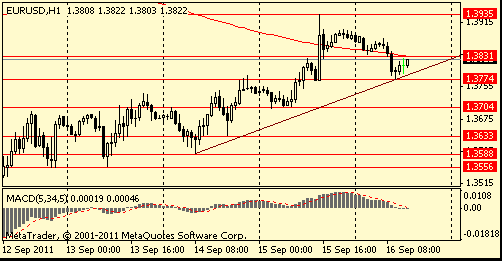

EUR/USD

Resistance 2: Y77.05 (Sep 14 high)

Resistance 1: Y76.90 (session high)

Current price: Y7668

Support 1:Y76.50/60 (Sep 2 low, average line of down channel)

Support 2:Y76.25/30 (Aug 1 low)

Support 3:Y75.95 (Aug 19 low)

Comments: in the morning the pair rose to Y76.80 area. The immediate support - Y76.50/60. Below losses are possible to Y76.30. The immediate resistance - Y76.90. Above growth is possible to Y77.05.

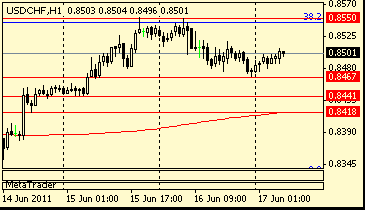

Resistance 3:Chf0.8850 (Sep 14 high)

balance of economic risks on the downside

Resistance 3: $ 1.5920 (FIBO 23.6 % $1.5705-$ 1.6618)

Resistance 3: $ 1.4020 (FIBO 50 % $1.3495-$ 1.4548)

- see Germany GDP growth near +3.0% in 2011

The common currency rose this week as euro-area finance ministers prepare to meet today in Wroclaw, Poland. ECB President Jean-Claude Trichet pressed euro-area governments to take decisive action to halt the debt crisis and show “unity of purpose” at today’s gathering.

The ECB said yesterday it will lend dollars to banks in the region in a series of three-month loans. The Frankfurt-based organization said it will coordinate with the Federal Reserve and other central banks to conduct three separate dollar liquidity operations to ensure lenders have enough of the currency through the end of the year.

EUR/USD: the pair bargains fell on asian session.

GBP/USD: the pair fell to area of Sep 12-13 low on $1.5760-$ 1.5780.

USD/JPY: the pair becomes stronger to Y76.80 area.

The meeting of Europe's Economic and Financial Affairs Council (ECOFIN) takes place in Poland from today, including US Treasury

Secretary Tim Geithner. European data starts at 0600GMT with ACEA new car registrations data. Data continues at 0800GMT with the ECB current account data for July. EMU data then continues at 0900GMT with Q2 labour costs and the July trade balance.

Among the economic data today, it is worth noting recently published statistics on CPI for August and Initial Jobless Claims last week. The number of IJC rose to 428K as an average forecast 408K. Also CPI rose to the level of 3.8% y/y against an average forecast of +3.6%. Were later released positive data on Industrial Production in the U.S. in August: the forecast drops in the last reporting period to 0.1% the actual value was equal to 0.2% compared to the previous month. But all of these rather weighty economic data had no significant effect on the market against the background of the main news of the day - the plan to increase liquidity across the eurozone.

EUR/USD: the pair showed low at $1.3705. Then rose and reached high at $1.3930.

GBP/USD: in first half of day the pair fell to $1.5730. Then rose to $1.5870.

USD/JPY: the pair updated high in area of Y77.30. Then fell and finished session in Y76.60 area.

The meeting of Europe's Economic and Financial Affairs Council (ECOFIN) takes place in Poland from today, including US Treasury

Secretary Tim Geithner. European data starts at 0600GMT with ACEA new car registrations data. Data continues at 0800GMT with the ECB current account data for July. EMU data then continues at 0900GMT with Q2 labour costs and the July trade balance.

Toyota Motor Corp., the world’s biggest carmaker by market value, gained 2.1 percent.

Sumitomo Metal Industries Ltd., Japan’s No. 3 steelmaker, jumped 3.8 percent after Credit Suisse Group AG raised its stock price estimate.

Elpida Memory Inc. paced chipmakers higher after saying it may shift some production overseas to combat the yen’s appreciation.

European stocks rallied as Germany and France said Greece will remain a member of the euro and the European Central Bank announced coordinated measures with the Federal Reserve to ensure banks have enough dollars.

National benchmark indexes climbed in all 18 western European markets, except Greece and Ireland. Germany’s DAX Index (DAX) advanced 3.2 percent, the U.K.’s FTSE 100 gained 2.1 percent and France’s CAC 40 climbed 3.3 percent.

Bank shares rose after the ECB said it will lend the U.S. currency to euro-area banks.

BNP Paribas (BNP), France’s biggest bank, soared 13 percent to 30.50 euros, the largest advance since May 2010. Credit Agricole surged 5.9 percent to 5.52 euros and Italy’s Intesa Sanpaolo SpA (ISP) rose 10 percent to 1.05 euros.

UBS AG (UBSN) slid 11 percent, the most since March 2009, after Switzerland’s biggest bank announced a $2 billion trading loss.

French President Nicolas Sarkozy and German Chancellor Angela Merkel said late yesterday they are “convinced” Greece will stay in the euro area after a phone conversation with Greek Prime Minister George Papandreou.

U.S. stocks rose for a fourth day as the European Central Bank and international policy makers coordinated to lend dollars to banks to tame the credit crisis, offsetting concern spurred by signs unemployment is worsening.

Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) added more than 3 percent as the ECB coordinated with the Federal Reserve and other central banks to provide liquidity to European lenders.

General Electric Co. (GE) and Chevron Corp. (CVX) advanced at least 2 percent, pacing gains in companies most-tied to the economy.

Netflix Inc. (NFLX) tumbled 19 percent as the online film- rental service cut its forecast for U.S. subscribers.

Stocks rallied as the ECB said it coordinated with the Fed, the Bank of England, the Bank of Japan and the Swiss National Bank to extend three-month loans to euro-area banks in an effort to ensure they have enough cash for the rest of the year. The announcement added to optimism after French and German leaders yesterday confirmed they will support Greece’s continued participation in the shared euro currency.

Operation Twist

In the U.S., a report showed industrial production unexpectedly rose in August. That helped temper concerns about other data pointing to a weakening recovery. Stock futures trimmed gains earlier as applications for U.S. unemployment benefits rose last week to the highest level since the end of June. Separate reports showed that manufacturing in the New York region contracted at a faster pace, while manufacturing in the Philadelphia region shrank for a second straight month.

All groups in the S&P 500 rose as gains were led by financial, energy and industrial shares.

Resistance 2: Y77.05 (Sep 14 high)

Resistance 1: Y76.85/90 (session high)

Current price: Y76.77

Support 1:Y76.50/60 (Sep 2 low, average line of down channel)

Support 2:Y76.25/30 (Aug 1 low)

Support 3:Y75.95 (Aug 19 low)

Comments: in the morning the pair rose to Y76.80 area. The immediate support - Y76.50/60. Below losses are possible to Y76.30. The immediate resistance - Y76.90. Above growth is possible to Y77.05.

Resistance 2: $ 1.5870 (area of Sep 12-13 high)

Resistance 1: $ 1.5820 (resistance line from Aug 29)

Current price: $1.5802

Support 1 : $1.5780 (session low)

Support 2 : $1.5730 (session low and low of american session on Sep 14)

Support 3 : $1.5705 (Sep 14 low)

Коментарии: the pair holds at $1.5800 area. The further growth is possible to $1.5820 area.

Resistance 2: Chf0.8800 (high of Sep 15)

Resistance 1: Chf0.8750 (area of Sep 13-14 low)

Current price: Chf0.8711

Support 1: Chf0.8675 (average line of down channel)

Support 2: Chf0.8630 (Sep 6-7 high)

Support 3: Chf0.8530 (Sep 7 low)

Comments: the pair is corrected. In focus support on Chf0.8675.

Resistance 2: $ 1.4020 (FIBO 50 % $1.3495-$ 1.4548)

Resistance 1: $ 1.3930 (a maximum on September, 15th)

Current price: $1.3865

Support 1 : $1.3835 (session low)

Support 2 : $1.3780 (Sep 15 low)

Support 3 : $1.3700 (Sep 14 high)

Comments: the pair retreated from high reached yesterday. The immediate resistance - $1.3930 and further $1.4020.

Nikkei 8,669 +150.29 +1.76%

Hang Seng 19,182 +136.06 +0.71%

Shanghai Composite 2,479 -5.77 -0.23%

FTSE 5,338 +110.52 +2.11%

CAC 3,046 +96.48 +3.27%

DAX 5,508 +168.05 +3.15%

Dow 11,427.12 +180.39 +1.60%

Nasdaq 2,607 +34.52 +1.34%

S&P 500 1,209 +20.42 +1.72%

10 Year Yield 2.08% +0.07

Oil $89.29 -0.11 -0.12%

Gold $1,791.70 +10.30 +0.58%

08:00 EU(17) Current account (July) adjusted, bln -5.8 -7.4

09:00 EU(17) Trade balance (July) unadjusted, bln - 0.9

09:00 EU(17) Trade balance (July) adjusted, bln 1.9 -1.6

13:00 USA TICS net flows (July), bln - -29.5

13:00 USA TICS net long-term flows (July), bln 22.5 3.7

13:55 USA Michigan sentiment index (September) preliminary 55.9 55.7

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.