- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-09-2011

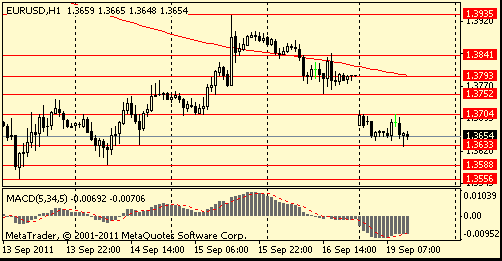

Overnight high at $1.3706 a nearby objective and stops a risk above there with offers visible at $1.3720.

All eyes on Japan's gov't Tuesday as that country returns from a three-day weekend, the gov't expected to announce plans to help businesses deal with a strong yen. Source says among the steps being considered a measures to increase subsidies to companies that build new plants in Japan rather than sending manufacturing overseas to lower priced manufacturing regions

The euro weakened to almost a seven-month low against the dollar after European officials failed last week to offer a plan to halt the region’s debt crisis as Greece struggles to avoid default.

The dollar rose against all its major counterparts except the yen as Treasury two-year yields fell to a record before the Federal Reserve begins its two-day meeting tomorrow.

The yen rallied to within 0.5 percent of its record against the greenback on refuge demand before European Union and International Monetary Fund officials judge whether the Greek government is eligible for its next aid payment.

Today, Barack Obama presented a plan for collecting additional taxes amounting to $ 1.5 trillion over the next 10 years. Obama proposes to reduce the federal deficit by about $ 3 trillion within a decade, that is, the additional tax revenues to provide half the estimated amount of abbreviations. In particular, president wants to increase the tax burden on millionaires and billionaires who pay relatively less tax than the middle class.

After the Obama's plan publication U.S. stock indexes began to rise and fall in the dollar as a result of lower demand for safe-heaven currencies.

U.S. stocks dropped sharply Monday, following a global sell-off, as investors fret over the European debt crisis. After the Obama’s speech, announced the measures expected to reduce the deficit, the market began to recover.

Dow 11,323.74 -185.35 -1.61%; Nasdaq 2,597 -25.50 -0.97%; S&P 500 1,197.71 -18.30 -1.50%.

The greatest losses are in the financial sector (- 3.1%) and basic materials sector (-2.4%).

Oil fell to a one-week low in New York on speculation fuel demand will falter as economic growth in the U.S. weakens and the debt crisis in Europe worsens. OPEC Secretary-General Abdalla El-Badri said today that global demand for oil is rising less than expected.

Oil for October delivery on the New York Mercantile Exchange fell as much as $1.61 to $86.35 a barrel, the lowest price since Sept. 12, and was at $86.85.

Currently S&P future -1.6%, Nasdaq futures -1.5%.

The 17-nation currency slid against most of its 16 major peers before European Union and International Monetary Fund officials speak today with Greek Finance Minister Evangelos Venizelos to judge whether his government is eligible for its next aid payment.

The U.S. currency rose as Asian stocks fell, spurring demand for the safest assets.

The Australian dollar dropped against the greenback before the Reserve Bank is due to release tomorrow the minutes of this month’s policy meeting.

The dollar rallied before the Federal Open Market Committee gathers tomorrow for a two-day meeting.

The committee may decide to replace some of the short-term Treasury securities in the Federal Reserve’s $1.65 trillion portfolio with long-term debt in a bid to lower rates on everything from mortgages to car loans, according to economists at Wells Fargo & Co., Barclays Capital Inc. and Goldman Sachs Group Inc. Some analysts dub the maneuver “Operation Twist” because it would bend long-term yields lower.

Australia’s dollar snapped two days of gains versus the greenback on concern the RBA will signal interest-rate cuts in its September meeting minutes to be released tomorrow, curbing demand for the South Pacific nation’s currency.

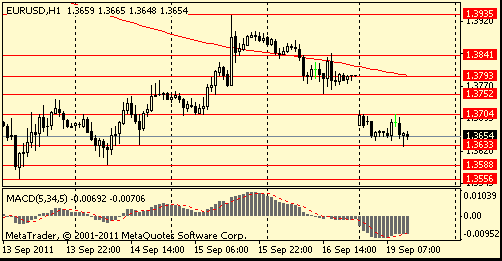

EUR/USD: holds $1.3630-$ 1.3700.

GBP/USD: the pair restored from morning low in area $1.5750. But returned back to $1.5700 area later.

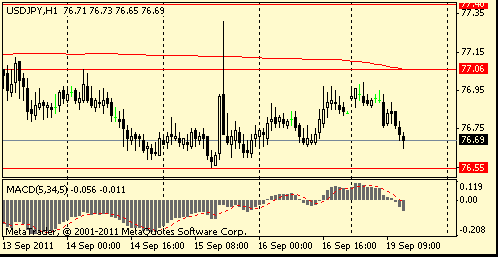

USD/JPY: the pair decreased in Y76.60 area.

Resistance 3: Y77.60 (Sep 8 and 12 high)

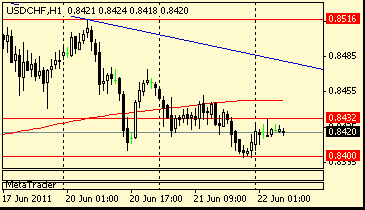

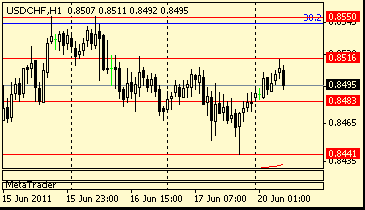

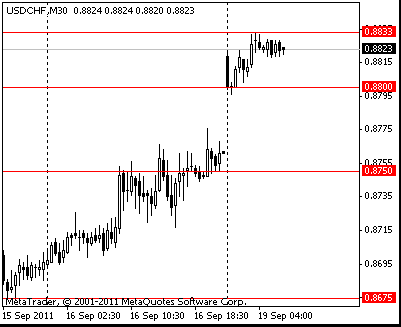

Resistance 3:Chf0.8930 (Sep 12 high)

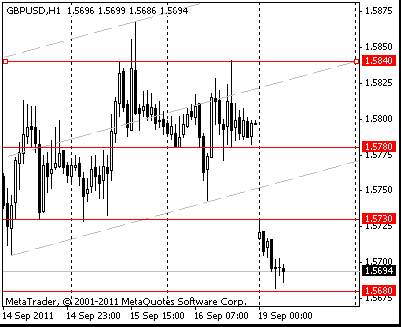

Resistance 3: $ 1.5840 (Sep 16 high)

Resistance 3: $ 1.3790 (close price of the last week, МА(200) for Н1)

Can't alter basic EMU design; must keep no-bailout rule.

Currently the pair at $1.3633. Next support seen into $1.3620 with stops below. A break here to expose $1.3600/1.3590 support area, with stops mixed in on a break of $1.3595. Further demand then noted between $1.3580/60.

USD/JPY Y77.00

EUR/JPY Y105.00, Y104.00

GBP/USD $1.6000

USD/CHF Chf0.8950

AUD/USD $1.0250, $1.0320, $1.0400

- Uncertainty always erodes growth prospectsEurope's debt crisis could undermine world growthBank recapitalization best way to restore confidence

- Repeats that inflation risks have also changed

- Must keep monitoring all developments very closely

- Bank of finland: outlook for world economy has eroded rapidly

- Declining confidence portends very weak economy near-term

- Must restore confidence in politicians to make decisions

The 17-nation currency slid against most of its 16 major peers before European Union and International Monetary Fund officials speak today with Greek Finance Minister Evangelos Venizelos to judge whether his government is eligible for its next aid payment.

The Australian dollar dropped against the greenback before the Reserve Bank is due to release tomorrow the minutes of this month’s policy meeting.

Australia’s dollar snapped two days of gains versus the greenback on concern the RBA will signal interest-rate cuts in its September meeting minutes to be released tomorrow, curbing demand for the South Pacific nation’s currency.

EUR/USD: on asian session the pair fell, but restored later.

GBP/USD: the pair showed low below $1.5700, the rose to $1.5740 area.

USD/JPY: the pair the began the week with losses against US dollar.

S&P/ASX 4,082 -67.89 -1.64%

Shanghai Composite 2,441 -41.72 -1.68%

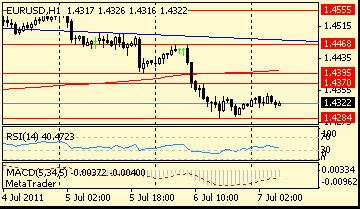

On Monday the euro touched its lowest level since 2001 against the yen as speculation German Chancellor Angela Merkel is preparing for a Greek default curbed demand for the 17-nation currency.

Merkel’s government is debating how to shore up German banks in the event that Greece fails to meet the budget-cutting terms of its aid package and is unable to get a bailout-loan payment, three officials said Sept. 9.

BNP Paribas SA, Societe Generale and Credit Agricole SA, France’s largest banks by market value, led European equity declines after two people with knowledge of the matter said Moody’s Investors Service may cut their credit ratings as soon as this week because of their Greek holdings.

On Tuesday the euro fell toward its weakest level in a decade against the yen on speculation Greece is nearing default and as Italy’s borrowing costs rose at a sale of 3.9 billion euros ($5.3 billion) of bonds.

The 17-nation currency reversed yesterday’s gain versus the dollar amid uncertainty China will buy Italian assets.

On Wednesday the euro rose against the majority of its most-traded counterparts as optimism increased that area leaders will work to avoid a default in Greece and contain the region’s debt crisis.

On Thursday five central banks announced a coordinated plan Thursday to pump dollars into Europe's financial system in an effort to boost liquidity across the eurozone. The European Central Bank, along with the Federal Reserve, the Bank of England, the Bank of Japan and the Swiss National Bank will hold three dollar auctions for U.S. dollars, with a three-month maturity, through the end of the year. The coordinated move is aimed at providing U.S. dollars to struggling European banks that need the currency to fund loans and repay debt. All of the auctions will carry a fixed rate and be conducted as "repurchase operations against eligible collateral."

On Friday the euro fell, halting a two-day gain versus the dollar, after European finance ministers meeting in Poland ruled out efforts to prop up the region’s economy and gave no indication of providing added support for lenders.

The pound fell for a fourth week against the dollar on speculation a deteriorating economic outlook will spur the Bank of England to introduce additional monetary stimulus.

Mitsubishi UFJ Financial Group Inc. climbed 4.6 percent, leading gains among Japan’s largest lenders.

Canon Inc., a maker of cameras and copiers that counts on Europe for almost a third of its sales, rose 4.3 percent.

Olympus Corp. jumped 7.4 percent after Citigroup Inc. started coverage of the optical-equipment maker with a “buy” rating.

The Nikkei 225 gained 2.3 percent to 8,864.16 at the 3 p.m. close in Tokyo, the biggest advance since March 30. The broader Topix rose 2.2 percent to 768.13 today after central banks took joint action to ensure liquidity to Europe’s lenders.

The Topix rebounded 1.6 percent this week as the leaders of Europe’s biggest economies expressed support for keeping Greece in the union and speculation built that China will help the region’s most indebted nations.

German stocks rose for a fourth day, extending the biggest weekly rally in two years, as speculation mounted that policy makers will provide more support to contain the region’s debt crisis.

Daimler AG led gains on the benchmark DAX Index (DAX), rallying 3.4 percent. EON AG climbed 3.5 percent after JPMorgan Chase & Co. advised buying the shares of Germany’s biggest utility.

The DAX climbed 65.27, or 1.2 percent, to 5,573.51 at the 5:30 p.m. close in Frankfurt. The gauge surged 7.4 percent this week, its largest jump since July 2009. The measure has still plunged 26 percent from this year’s peak on May 2 as the debt crisis spread from Greece to the larger economies of Italy, Spain and France.

Daimler rallied 3.4 percent to 36.40 euros.

EON climbed 3.5 percent to 15.62 euros as JPMorgan upgraded the shares to “overweight” from “neutral,” citing a peak in German political risk, the gas market tightening and details on cost cutting increasing investors’ confidence.

SMA Solar Technology AG (S92) slumped 7.3 percent to 56.13 euros as Jefferies Group Inc. downgraded its recommendation on the shares to “hold” from “buy.”

U.K. stocks gained for a fourth day as European officials met in Poland to discuss how they can expand the new bailout fund for the euro area.

Barclays Plc (BARC) climbed 3.4 percent, extending its biggest weekly advance since February 2010.

BG Group Plc (BG) rose amid speculation a Chinese oil producer may be interested in the company’s Brazilian business. Inmarsat Plc (ISAT) rallied 6.9 percent.

The FTSE 100 Index (UKX) increased 30.87, or 0.6 percent, to 5,368.41 at the 4:30 p.m. close in London, bringing this week’s advance to 3 percent. The FTSE All-Share Index also gained 0.6 percent today, while Ireland’s ISEQ Index rose 1.4 percent.

U.S. stocks advanced for a fifth straight day, giving the Standard & Poor’s 500 Index its longest rally since July, amid optimism that European leaders will make further progress on controlling the region’s debt crisis.

Macy’s Inc. (M) advanced 1.3 percent, pacing gains in retailers, as a report showed that confidence among U.S. consumers rose. Textron Inc. (TXT), Tyco International Ltd. (TYC) and Rockwell Collins Inc. (COL) rallied more than 3.8 percent after a report that United Technologies Corp. is lining up financing for an acquisition. Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) slumped at least 1.7 percent, driving financials lower.

The S&P 500 rose 0.2 percent to 1,211.31 at 2:23 p.m. New York time after slipping as much as 0.4 percent and rising 0.9 percent. The benchmark gauge was up 5 percent since Sept. 9, poised to snap a two-week decline. The Dow Jones Industrial Average added 57.97 points, or 0.5 percent, to 11,491.15.

European finance ministers ruled out efforts to prop up the faltering economy and gave no indication of providing aid for lenders to go along with yesterday’s liquidity lifeline from the ECB. Clashing with Geithner, finance chiefs from the euro region said the 18-month debt crisis leaves no room for tax cuts or extra spending to spur an economy on the brink of stagnation.

The Thomson Reuters/University of Michigan preliminary index of consumer sentiment climbed to 57.8 this month from 55.7 in August. The median estimate of economists called for a reading of 57. The group’s measure of consumer expectations six months from now dropped to the lowest level since May 1980.

Research In Motion Ltd. (RIMM) tumbled 20 percent to $23.76 after missing analysts’ estimates as sales of aging BlackBerry smartphone models slowed and the company shipped fewer PlayBook tablet computers than projected. The company is losing ground in that market to Apple Inc.’s iPhone and devices that use Google Inc.’s Android software. RIM has made little progress with its PlayBook in the tablet computer market, shipping just one device for every 46 iPads that Apple sold in the latest quarter.

Resistance 2: Y77.40 (Sep 12 high)

Resistance 1: Y77.00 (session high)

The current price: Y76.93

Support 1:Y76.85 (session low)

Support 2:Y76.50/60 (Sep 2 low)

Support 3:Y76.25/30 (Aug 1 low)

Comments: the pair holds Y76.85-Y77.00.

Resistance 2: Chf0.8880 (Sep 13 high)

Resistance 1: Chf0.8830/35 (session high)

Current price: Chf0.8820

Support 1: Chf0.8800 (session low)

Support 2: Chf0.8750/55 (area of Sep 13-14 low)

Support 3: Chf0.8675 (area of Sep 15 low)

Comments: the pair rises. In focus resistance Chf0.8830 and further Chf0.8880.

Resistance 2: $ 1.5780 (area of Sep 12-13 low)

Resistance 1: $ 1.5730 (session high)

Current price: $1.5694

Support 1 : $1.5680 (session low)

Support 2 : $1.5645 (area of Dec 1-2 2010 high)

Support 3 : $1.5575 (Dec 3rd 2010 low)

Comments: the pair holds in $1.5700 area. Below $1.5680 losses are possible to $1.5645.

Resistance 2: $ 1.3770/80 (Sep 14 high, area of Sep 16 low)

Resistance 1: $ 1.3705 (Sep 15 low, session high)

Current price: $1.3657

Support 1 : $1.3645 (session low)

Support 2 : $1.3590 (Sep 14 low)

Support 3 : $1.3555/60 (area of Sep 12-13 low)

Comments: the pair decreases. Below $1.3645 (immediate support) decrease is possible to $1.3590.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.