- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-09-2011

Federal Reserve officials tomorrow will probably announce a program for monetary easing that will do little to help 14 million unemployed Americans find work. The Federal Open Market Committee will decide to replace short-term Treasuries in its $1.65 trillion portfolio with long- term bonds. Fed will reduce longer-term yields by about 0.1 percentage point by announcing a swap of $300 billion to $400 billion in Treasuries, selling securities with one to three years remaining maturity, and purchasing mostly those with seven to 12-year maturity.

FTSE 5,364 +104.15 +1.98%, CAC 2,984 +44.05 +1.50%, DAX 5,572 +155.77 +2.88% European stocks climbed as Greece described its debt talks with the European Union and the International Monetary Fund as “productive” and investors speculated the Federal Reserve will provide more stimulus. EON AG and RWE AG (RWE), Germany’s biggest utilities, climbed more than 3.5 percent after a court suspended a nuclear-fuel tax. Barratt Developments Plc (BDEV) surged 5.7 percent after Citigroup Inc. advised buying the shares. The IMF said that the program carried out by the government had produced “impressive fiscal consolidation,” while EU economics spokesman Amadeu Altafaj told reporters in Brussels yesterday that the European Commission has not demanded more of Greece than was agreed to in the international aid program for the country.

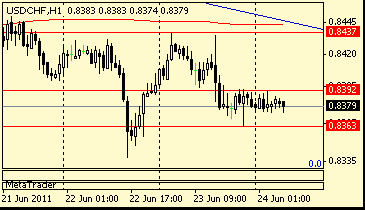

The Swiss franc fell against the dollar and the euro amid speculation the Swiss National Bank may tighten its target to limit the currency’s strength. Swiss central bank spokesman Walter Meier in Zurich declined to comment when asked about speculation that policy makers may adjust the franc ceiling against the euro. The franc weakened 0.6 percent to 1.2142 per euro at 10:24 a.m. in New York. It fell 0.6 percent to 88.77 centimes per U.S. dollar.The dollar rallied and Treasuries erased their decline after the International Monetary Fund predicted severe global growth repercussions if Europe fails to contain the sovereign debt crisis. IMF said the European Central Bank should lower interest rates if risks to growth persist. The ECB’s current benchmark rate is 1.5 percent. The euro was little changed at $1.3682. The shared currency traded at 104.77 yen, from 1.0482 yesterday, when it reached 103.96 yen, almost the least since 2001. German investor confidence fell to the lowest in more than 2 1/2 years in September as Europe’s debt crisis and a global slowdown damped the outlook for growth. Australia’s dollar was the biggest winner against the U.S. currency, rising 0.6 percent to $1.0280.

U.S. stocks rose, erasing an earlier drop, as speculation the Federal Reserve will do more to stimulate growth offset concern about the economic recovery. At the moment Dow 11,520.89 +119.88 +1.05%, Nasdaq 2,636.45 +23.62 +0.90%, S&P500 1,217.97 +13.88 +1.15%. All 10 groups in the Standard & Poor’s 500 Index rallied as gains were led by health-care and utility shares. Newmont Mining Corp. (NEM), the largest U.S. gold producer, added 5.4 percent as the metal climbed. PulteGroup Inc., the largest U.S. homebuilder by revenue, and Travelers Cos., the lone insurer in the Dow Jones Industrial Average, climbed at least 2.5 percent after analysts raised their recommendations for the companies.

Crude oil increased for the first time in three days after Greece described its debt talks as “productive” and on speculation the Federal Reserve will provide more stimulus to bolster economic growth. A U.S. Energy Department report tomorrow will probably show supplies dropped to an eight-month low, according to a Bloomberg News survey. Oil for October delivery rose 1.67 percent, to $87.13 a barrel on the New York Mercantile Exchange.

At 08:30 GMT there are data on the UK: minutes of the meeting of the Monetary Policy Committee (MPC) of the Bank of England and statistics for net borrowing of the public sector. Expected to increase significantly to 11.3V, against the previous month -2.0V. At 11:00 GMT Canada will publish the inflation data. It is expected that inflation will remain at the previous level. At 14:00 GMT there are data on existing home sales iin the U.S. It is planned to rise to small 4.78M against 4.67M in August. The most important and anticipated event of the week is a committee meeting FOMC, which will be held during Tuesday and Wednesday and 18:15 GMT will be published minutes of the meeting, which may clarify the prospects of support for the U.S. economy. The day ended publication of data on the GDP of New Zealand at 22:45 GMT.

EUR/USD $1.3500, $1.3600, $1.3725, $1.3870, $1.3900

USD/JPY Y75.50, Y75.75, Y76.00, Y76.85, Y77.25, Y77.30, Y77.50

GBP/USD $1.5500

AUD/USD $1.0100, $1.0160, $1.0200, $1.0350

AUD/JPY Y80.00, Y75.00

Federal Reserve officials tomorrow will probably announce a program for monetary easing that will do little to help 14 million unemployed Americans find work, according to economists in a Bloomberg News survey.

As expect, the Federal Open Market Committee will decide to replace short-term Treasuries in its $1.65 trillion portfolio with long- term bonds.

Stock futures maintained gains after a report showing builders began work on fewer homes than forecast in August. Housing starts dropped 5 percent to a three-month low 571,000 annual rate, Commerce Department figures showed today in Washington. The median forecast in a survey called for a 590,000 pace.

06:00 Germany PPI (August) -0.3%

06:00 Germany PPI (August) Y/Y 5.5%

09:00 Germany ZEW economic expectations index (September) -43.3

The euro snapped two days of declines against the dollar as gains in European stocks boosted sentiment toward the currency on signs that talks aimed at staving off a Greek debt default were making progress.

The 17-nation currency erased a drop against the yen as Greece resumed talks with creditors as well as European Union and International Monetary Fund officials.

Standard & Poor’s cut its credit rating for Italy, which has Europe’s second-largest debt load, to A from A+ yesterday. The firm said Italy’s net general government debt is the highest among A rated sovereigns, and now expects it to peak later and at a higher level than it previously anticipated.

Italy follows Spain, Ireland, Portugal, Cyprus and Greece as euro-region countries having their credit ratings cut this year. The European Central Bank last month started buying Italian and Spanish government bonds after the region’s debt crisis pushed their yields to euro-era records.

Fed policy makers may decide to replace some of the short- term Treasuries in the Fed’s $1.65 trillion portfolio with longer-maturity debt in a bid to lower borrowing costs, according to economists at Wells Fargo & Co., Barclays Plc and Goldman Sachs Group Inc.

The euro pared declines against the dollar after data showed Germany’s investor confidence fell less than economists expected this month.

The ZEW Center for European Economic Research in Mannheim said its index of investor and analyst expectations, which aims to predict developments six months in advance, declined to minus 43.3 in September from minus 37.6 last month, the lowest since December 2008. Economists expected a drop to minus 45, according to the median estimate in a survey.

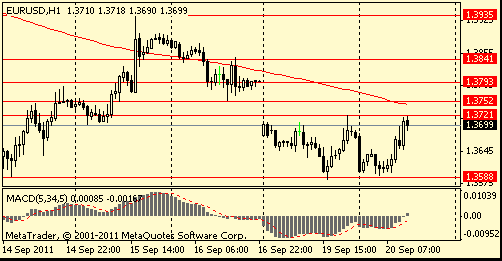

EUR/USD: the pair become stronger above $1.3700.

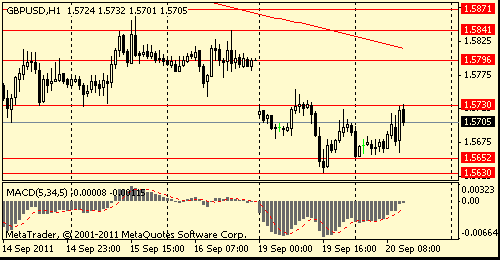

GBP/USD: the pair become stronger above $1.5700.

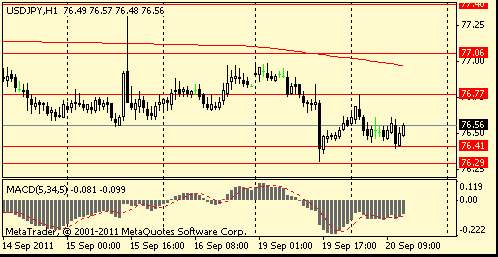

USD/JPY: the pair holds Y76.40-Y76.60.

US data released at 1230GMT includes August housing starts and building permits. The pace of housing starts is expected to slow further to a 580,000 annual rate after falling in the previous month. Weak new home sales and the high inventory level of unsold existing homes continue to restrain new home building.

At 1300GMT, the IMF releases its World Economic Outlook, with revised economic forecasts, with many expecting a downgrade of GDP

forecasts.

The FOMC begins its two-day monetary policy meeting, a meeting expended from 1-day to 2, for the members to explore further

exceptional measures available to the Fed.

EUR/USDOffers $1.3790/805, $1.3750/55, $1.3720/30

Bids $1.3675/70, $1.3650, $1.3625/20, $1.3600, $1.3590/80, $1.3560/50, $1.3495

Resistance 3: Y77.60 (Sep 8 and 12 high)

Resistance 3: Chf0.8925 (Sep 12 high)

Resistance 3: $ 1.5840 (Sep 16 high)

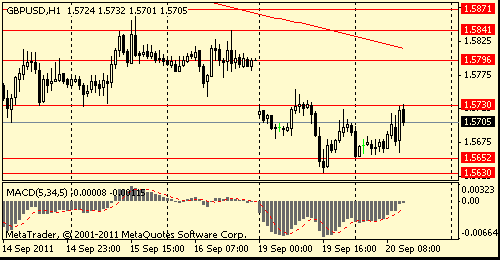

Resistance 1: $ 1.5730 (session high, high of asian and american session on Sep 19))

Current price: $1.5707

Support 1 : $1.5650 (area of high of the end of Dec 2010, first half of Jan 2011, session low)

Support 2 : $1.5575 (Dec 3'2010 low)

Support 3 : $1.5525/30 (Dec 2 and 15'2010)

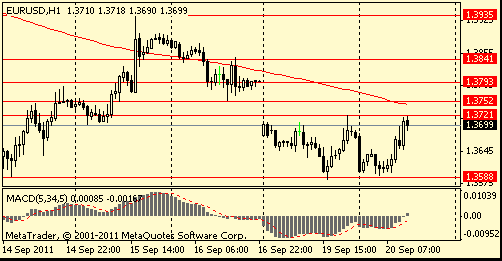

Resistance 3: $ 1.3840 (high of american session on Sep 16)Resistance 2: $ 1.3750 (Sep 16 low)

Resistance 1: $ 1.3720 (Sep 19 high, session high)

Current price: $1.3699

Support 1 : $1.3650 (inntraday low)

Support 2 : $1.3590 (session low, Sep 19 low)

Support 3 : $1.3555/60 (area of Sep 12-13 lows)

Comments: the pair restored. Strong resistance - $1.3620.

The dollar gained most of its major peers before the Federal Reserve’s policy meeting today.

Australia’s currency rose as high as $1.0243 after the Reserve Bank of Australia released minutes of its most recent meeting saying the central bank is “well placed” under current policy settings.

EUR/USD: on asian session the pair fell, but restored later.

GBP/USD: on asian session the pair fell, but restored later.

USD/JPY: the pair was under pressure.

Canadian data at 1230GMT includes the release of the August Leading indicator and July Wholesale sales.

US data released at 1230GMT includes August housing starts and building permits. The pace of housing starts is expected to slow further to a 580,000 annual rate after falling in the previous month. Weak new home sales and the high inventory level of unsold existing homes continue to restrain new home building.

At 1300GMT, the IMF releases its World Economic Outlook, with revised economic forecasts, with many expecting a downgrade of GDP

forecasts.

The FOMC begins its two-day monetary policy meeting, a meeting expended from 1-day to 2, for the members to explore further

exceptional measures available to the Fed.

The dollar rose against all its major counterparts except the yen as Treasury two-year yields fell to a record before the Federal Reserve begins its two-day meeting tomorrow.

The yen rallied to within 0.5 percent of its record against the greenback on refuge demand before European Union and International Monetary Fund officials judge whether the Greek government is eligible for its next aid payment.

Yesterday, Barack Obama presented a plan for collecting additional taxes amounting to $ 1.5 trillion over the next 10 years. Obama proposes to reduce the federal deficit by about $ 3 trillion within a decade, that is, the additional tax revenues to provide half the estimated amount of abbreviations. In particular, president wants to increase the tax burden on millionaires and billionaires who pay relatively less tax than the middle class.

After the Obama's plan publication U.S. stock indexes began to rise and fall in the dollar as a result of lower demand for safe-heaven currencies.

EUR/USD: the pair showed low $1.3590, then retreated and closed session on $1.3690.

GBP/USD: in first half of day the pair hold $1.5685/95 area. Then showed low $1.5630. The Pair finished session $1.5690.

USD/JPY: yesterday the pair was under pressure and showed low at Y76.30.

Two events will dominate Tuesday's calendar; the ongoing Greek/Troika discussions and the first day of the 2-day FOMC meet.

However, the ZEW survey will also be much anticipated (09:00 GMT).

Canadian data at 1230GMT includes the release of the August Leading indicator and July Wholesale sales.

US data released at 1230GMT includes August housing starts and building permits. The pace of housing starts is expected to slow further to a 580,000 annual rate after falling in the previous month. Weak new home sales and the high inventory level of unsold existing homes continue to restrain new home building.

At 1300GMT, the IMF releases its World Economic Outlook, with revised economic forecasts, with many expecting a downgrade of GDP

forecasts.

The FOMC begins its two-day monetary policy meeting, a meeting expended from 1-day to 2, for the members to explore further

exceptional measures available to the Fed.

EUR/USD $1.3500, $1.3600, $1.3725, $1.3870, $1.3900

USD/JPY Y75.50, Y75.75, Y76.00, Y76.85, Y77.25, Y77.30, Y77.50

GBP/USD $1.5500

AUD/USD $1.0100, $1.0160, $1.0200, $1.0350

AUD/JPY Y80.00, Y75.00

Esprit Holdings Ltd. (330), a clothing retailer with 83 percent of its sales in Europe, tumbled 20 percent in Hong Kong.

BHP Billiton Ltd. (BHP), the world’s biggest mining company, dropped 1.7 percent in Sydney as crude and metal prices sank. Asian financial shares slumped, paced by Westpac Banking Corp. in Sydney.

Industrial & Commercial Bank of China Ltd. slid 4.2 percent in Hong Kong on speculation China won’t loosen measures to control inflation.

Asian stocks fell today after finance chiefs from the euro region said last week that the 18-month debt crisis leaves no room for tax cuts or extra spending to spur an economy on the brink of stagnation. Economic reports on Germany this week are forecast to show a decline in investor confidence and a slowdown in manufacturing in Europe’s largest economy.

Greece’s ability to avoid default hangs in the balance as international monitors assess whether Prime Minister George Papandreou can meet the conditions of rescue loans.

European stocks slid, halting a four-day rally for the Stoxx Europe 600 Index, as investors speculated that Greece may not receive an aid payment that would help it avoid default.

Deutsche Bank AG (DBK) led banks lower after Germany’s ruling party lost another regional election. Mining companies and oil producers fell as base metals and crude oil dropped, while Michelin & Cie. declined after Morgan Stanley downgraded the tiremaker.

The benchmark Stoxx 600 dropped 2.3 percent to 224.96 at the 4:30 p.m. close in London, paring last week’s 2.5 percent advance. The gauge has declined 23 percent from this year’s peak on Feb. 17 as the region’s growing debt crisis added to concern that the economic recovery is at risk.

Stocks rallied around the world last week after Germany and France said Greece will remain a euro member and the European Central Bank announced coordinated measures with the Federal Reserve to ensure the region’s lenders have sufficient U.S. dollars.

National benchmark indexes declined in every western European market. France’s CAC 40 Index fell 3 percent, the U.K.’s FTSE 100 Index dropped 2 percent and Germany’s DAX Index lost 2.8 percent.

European Union and International Monetary Fund inspectors hold a teleconference today with Greece’s Finance Minister, Evangelos Venizelos, to judge whether the government is eligible for an aid payment due in October.

Separately, German Chancellor Angela Merkel’s party lost a regional election in Berlin, the last of seven state ballots this year in which voters have punished the governing coalition parties for their handling of the sovereign-debt crisis.

Societe Generale (GLE) SA, which was downgraded by Moody’s on Sept. 14, sank 6.7 percent to 17.69 euros. Credit Suisse Group AG declined 6.2 percent to 21.31 euros.

Lloyds Banking Group Plc slumped 6.7 percent to 33.42 pence as the bank said Finance Director Tim Tookey will leave the U.K.’s largest mortgage lender to join Friends Life, the insurer being built by Resolution Ltd., Clive Cowdery’s acquisition firm.

Michelin sank 6 percent to 45.53 euros after Morgan Stanley lowered its recommendation for the world’s second-largest tiremaker to “underweight” from “overweight.”

Temenos Group AG (TEMN) dropped 7.4 percent to 14.35 francs after Morgan Stanley downgraded the banking-software maker to “equal weight” from “overweight.”

U.S. stocks pared losses after the Greek Finance Ministry said a “productive and substantive discussion took place” during a conference call with international regulators about the country’s financial bailout.

Earlier losses came amid concern Greece would fail to meet the requirements of international aid from the European Union and the International Monetary Fund needed for the country to avoid default.

EU and International Monetary Fund inspectors held a teleconference this evening in Athens with Finance Minister Evangelos Venizelos and other officials to judge whether the government is eligible for an aid payment due next month and on track for a second rescue package approved by EU leaders on July 21.

Greece said “a productive and substantive discussion took place” during the call.

Tomorrow morning, the teams of technical experts already in Athens “will further elaborate on some data and the conference call will be repeated tomorrow at the same time,” the Greek Finance Ministry said in an e-mailed statement.

Resistance 2: Y77.00 (area of Sep 16-19 high)

Resistance 1: Y76.75 (session high)

The current price: Y76.50

Support 1:Y76.30 (Sep 19 low)

Support 2:Y75.95 (Aug 19 low)

Support 3:Y75.60 (FIBO 200 % Y77.00-Y76.30)

Comments: the pair under pressure. Below Y76.30.

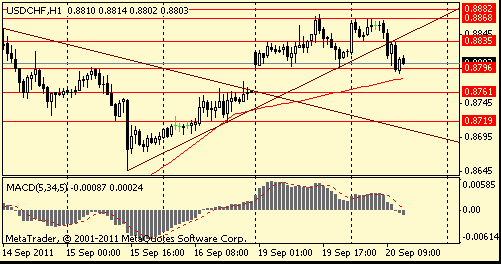

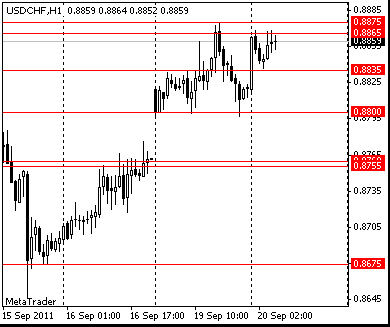

Resistance 2: Chf0.8925 (Sep 12 high)

Resistance 1: Chf0.8865/75 (area of Sep 19-26 high)

The current price: Chf0.8859

Support 1: Chf0.8835 (session low)

Support 2: Chf0.8800 (Sep 19 low)

Support 3: Chf0.8755/60 (area of Sep 13-14 low)

Resistance 3: $1.5755 (Sep 19 high)

Resistance 2: $1.5725 (high of Asian and American sessions on Sep 19)

Resistance 1: $1.5685 (session high)

Current price: $1.5673

Support 1 : $1.5650 (area of Dec 2010)

Support 2 : $1.5575 (Dec 3’2010 low)

Support 3 : $1.5525/30 (Dec 2 and 15’2010 low)

Comments: the pair is still under pressure. Below $1.5650 losses are possible to $1.5575.

Resistance 2: $ 1.3770/80 (Sep 14 high, area of Sep 16 low)

Resistance 1: $ 1.3705 (Sep 15 low,session high)

Сurrent price: $1.5670

Support 1 : $1.3590 (session low,Sep 19 low)

Support 2 : $1.3555/60 (area of Sep 12-13 low)

Support 3 : $1.3500 (Sep 12 low)

Comments: the pair is trading along an downtrend. Below $1.3555 losses are possible to $1.3500 are possible.

Hang Seng 18,918 (537.36) -2.76%

Shanghai Composite 2,438 (44.55) -1.79%

FTSE 5,260 (108.85) -2.03%

CAC 2,940 (91.08) -3.00%

DAX 5,416 (157.60) -2.83%

Dow 11,401.01 -108.08 -0.94%

Nasdaq 2,612.83 -9.48 -0.36%

S&P 500 1,204.09 -11.92 -0.98%

10 Year Yield 1.94% -0.14 -

Oil $86.10 +0.40 +0.47%

Gold $1,782.20 +3.30 +0.19%

05:00 Japan Leading Economic Index July 103.2 106

05:00 Japan Coincident Index July 108.8 109.0

06:00 Germany Producer Price Index (MoM) August +0.7% +0.1%

06:00 Germany Producer Price Index (YoY) August +5.8% +5.8%

09:00 Germany ZEW Survey - Economic Sentiment September -37.6 -45.0

12:30 U.S. Housing Starts, y/y August 0.604 0.590

12:30 U.S. Building Permits, m/m August 0.601 0.590

12:30 Canada Leading Indicators, m/m 0 0.2% 0.2%

12:30 Canada Wholesale Sales, m/m July +0.2% +0.6%

22:45 New Zealand Current Account Quarter II -0.10 -0.69

23:50 Japan Trade Balance August 0.073 -0.300

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.