- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-09-2011

The yen traded at almost a post-war record high against the dollar amid speculation the Bank of Japan may intervene to curb the currency’s strength.

Before closing the currency trading the major currencies began to decline against the U.S. dollar.

Dow 10,745.63 +11.80 +0.11%, Nasdaq 2,476 +20.59 +0.84%, S&P 500 1,135.29 +5.73 +0.51%.

Alcoa Inc. (AA) and Caterpillar Inc. rallied at least 1 percent, pacing gains in companies most-tied to economic growth. Bank of America Corp. (BAC) and Morgan Stanley advanced more than 3.8 percent as financial stocks climbed.

Today the price of gold has fallen to the worst in the last seven weeks of performance, because investors sell the metal along with the leading stocks and other commodities on fears that the global economy will be unstable. But over the last few hours gold, as well as oil has risen due to the positive sentiment on the background to the meetings of financial leaders of the G20.

The price of gold futures on the New York Mercantile Exchange fell to $1682.10 per ounce (-3.42%).

Oil rose from a six-week low in New York as investors speculated the biggest weekly drop in almost two months is exaggerated, while central bankers from the Group of 20 pledged to address risks to the global economy.

Futures climbed as much as 1.6 percent after plunging 6.3 percent yesterday and dipping below $80 earlier today. Finance chiefs from the Group of 20 nations said they would address “heightened downside risks” from sovereign debt and slowing growth. Prices may fall next week on concern economic growth will slow in the U.S. and China.

Crude oil for November delivery climbed as much as $1.30 to $81.81 a barrel in electronic trading on the New York Mercantile Exchange and was at $81.42 at 9:22 a.m. London time. The contract yesterday dropped $5.41 to $80.51, the lowest settlement since Aug 9. Prices are down 7.4 percent this week

- on 1-yr tender: ECB showed it will act if needed

- German economic situation better than sentiment

- see risks that sentiment could spill into real econ

- German fall back into recession is unlikely

- German economy needs no economic stimulus measures

- German stimulus wld have little impact on EMU growth

- stimulus would hit trust in Germany as stab anchor

- undifferntiated call for more bank capital unhelpful

- no doubt efsf reforms will be implemented fully

USD/JPY Y75.00, Y76.00, Y77.00, Y78.30

GBP/USD $1.5650, $1.5720

AUD/USD $1.0000

EUR/CHF Chf1.2150, Chf1.2300

Equity futures trimmed losses as a European Central Bank official said policy makers may reintroduce 12-month loans to banks to ease funding strains.

Global stocks dropped today as a pledge by Group of 20 nations to tackle rising risks failed to ease concern the global economy is on the brink of another recession. Policy makers are “committed to a strong and coordinated international response to address the renewed challenges facing the global economy,” G-20 finance ministers and central bank governors said in a statement late yesterday in Washington.

The shared currency dropped versus its major peers, heading for a fourth weekly decline against the yen after Moody’s Investors Service downgraded the debt ratings of eight Greek banks. The euro strengthened earlier after Group of 20 finance ministers pledged to address risks to the global economy.

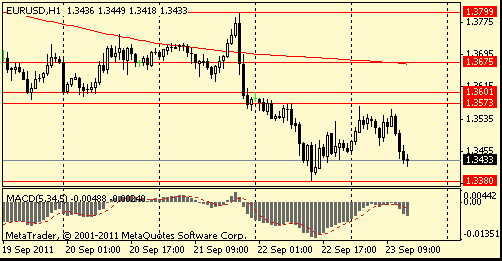

EUR/USD: the pair updated a session low and decreased in $1.3430 area.

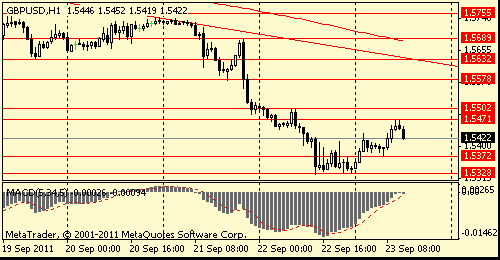

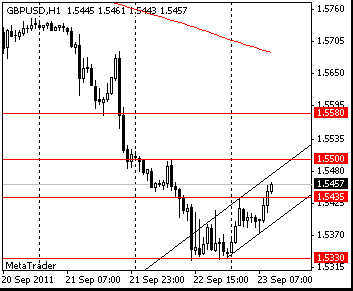

GBP/USD: the pair receded from a session high to $1.5400 area .

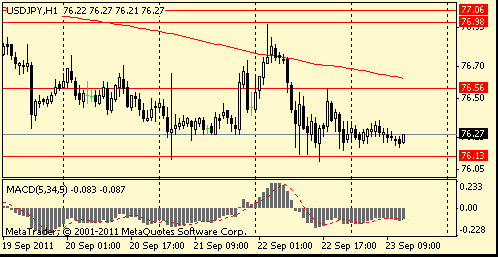

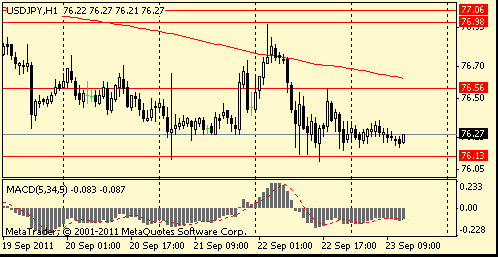

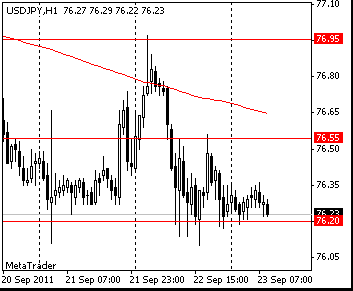

USD/JPY: the pair holds Y76.20-Y76.35.

Offers $1.3520/30, $1.3500, $1.3480/85, $1.3470

Bids $1.3435/25, $1.3400, $1.3380, $1.3350

Resistance 2: Y76.95/05 (area of Sep high 16-19)

Resistance 1: Y76.55 (high of american session on Sep 22)

Current price: Y76.27

Support 1:Y76.10 (Sep 21-22 low)

Support 2:Y75.90 (area of historical low)

Support 3:Y75.00 (psychological mark)

Comments: the pair remains in area of historical low.

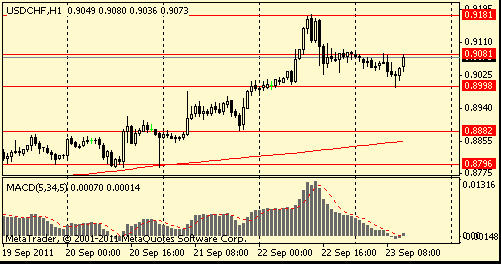

Resistance 2: Chf0.9180 (Sep 22 high)

Resistance 1: Chf0.0.9080 (area of session high)

Current price: Chf0.9075

Support 1: Chf0.9000 (area of session low and low of european session on Sep 22)

Support 2: Chf0.8880 (low of american session on Sep 21)

Support 3: Chf0.8800 (area of Sep 19-20 low)

Comments: the pair come nearer to session high which is the immediate resistance. Above growth is possible to $0.9180.

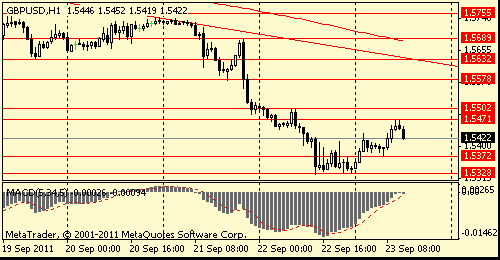

Resistance 2: $ 1.5500 (area of Sep 22 high)

Resistance 1: $ 1.5470 (session high)

Current price: $1.5422

Support 1 : $1.5370 (low of european session)

Support 2 : $1.5330 (area of Sep 22 low and session low)

Support 3 : $1.5235 (Jul 15’2010 low)

Comments: the pair receded from high reached today - currently the immediate resistance. The immediate support - $1.5370

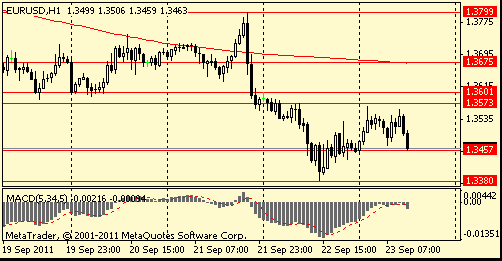

Resistance 2: $ 1.3600 (Sep 22 high)

Resistance 1: $ 1.3570 (session high, high of european session on Sep 22)

Current price: $1.3463

Support 1 : $1.3450 (area of session low)

Support 2: $ 1.3380 (Sep 22 low)

Support 3: $ 1.3240 (area of Jan 17-18 low)

Comments: the pair comes nearer to session low - the immediate support. Below loss may extend to $1.3380.

EUR/USD $1.3300, $1.3500, $1.3850

USD/JPY Y75.00, Y76.00, Y77.00, Y78.30

GBP/USD $1.5650, $1.5720

AUD/USD $1.0000

EUR/CHF Chf1.2150, Chf1.2300

The 17-nation currency trimmed earlier gains against the U.S. dollar after Moody’s Investors Service lowered the credit ratings on eight Greek banks by two levels.

The Australian and New Zealand dollars rose as Asian stocks pared declines before meetings of the International Monetary Fund and World Bank.

Moody’s today downgraded the long-term deposit and senior debt ratings of eight rated Greek banks by two levels.

EUR/USD: on asian session the pair restored.

GBP/USD: on asian session the pair restored.

USD/JPY: on asian session the pair holds Y76.20-Y76.35

Focus today is set squarely on G20 Meetings and FOMC Member Dudley Speaks.

After ECB President Trichet Speaks.

Hang Seng 17,611 -301.30 -1.68%

S&P/ASX 3,930 -34.91 -0.88%

Shanghai Composite 2,419 -23.81 -0.97%

National Bank of Greece SA (NBG), EFG Eurobank Ergasias SA (Eurobank), Alpha Bank AE (Alpha), Piraeus Bank SA (Piraeus), Agricultural Bank of Greece (ATE) and Attica Bank SA downgraded to Caa2 from B3. Emporiki Bank of Greece (Emporiki) and General Bank of Greece (Geniki) downgraded to B3 from B1.

The dollar and yen jumped on concern global growth is stalling after the Federal Reserve said it saw “significant downside risks” to the U.S. economy, spurring demand for safer assets.

The Dollar climbed to a seven-month high as the Fed’s statement stoked concern the global economy is headed for a recession.

The euro fell to the weakest level since January versus the dollar and reached a fresh decade-low against the yen after euro-area services and manufacturing contracted this month, adding to concern the region’s debt crisis is deepening.

Australia’s dollar slid below parity with the greenback for the first time in six weeks and New Zealand’s currency slumped.

EUR/USD: the pair decreased and showed new low in $1.3385. Then pair restored to $1.3450 on American session.

USD/JPY: yestherday the pair showed new low at Y76.10.

Focus today is set squarely on G20 Meetings and FOMC Member Dudley Speaks.

After ECB President Trichet Speaks.

HSBC Holdings Plc, plunged 3.6 percent in Hong Kong as the currency union’s risk watchdog said threats to the financial system have increased “considerably.”

BHP Billiton Ltd. , the world’s largest mining company, slumped 4 percent in Sydney as copper futures entered a bear market.

Toyota Motor Corp. declined 1.7 percent in Tokyo and South Korea’s Samsung Electronics Co., which makes close to 80 percent of its revenue overseas, dropped 2.8 percent in Seoul.

Banks dropped after the Federal Reserve’s warning of growing “strains in global financial markets” and the European Systemic Risk Board said threats to the financial system have increased “considerably” amid a worsening debt crisis in Europe. The International Monetary Fund said the sovereign-debt issue has generated as much as 300 billion euros ($410 billion) in credit risk for European banks.

Mitsubishi UFJ Financial Group Inc., Japan’s biggest lender by market value, lost 1.5 percent to 332 yen in Tokyo and HSBC, which receives more than half its revenue from Europe, sank 3.6 percent to HK$60.65.

European stocks tumbled to a two- year low as the Federal Reserve signaled “significant downside risks” to the world’s largest economy and Moody’s Investors Service downgraded three U.S. banks.

National benchmark indexes retreated in all of the 18 western European markets. Germany’s DAX Index declined 5 percent and France’s CAC 40 dropped 5.3 percent. The U.K.’s FTSE 100 slid 4.7 percent, the most since March 2009.

Logitech International SA (LOGN), the world’s biggest maker of computer mice, plunged 12 percent after cutting its forecasts for the second time in two months. Rio Tinto Group, the world’s second-largest mining company, sank the most in more than two years as copper fell for a fifth day. LVMH Moet Hennessy Louis Vuitton SA (MC) and Burberry Group Plc (BRBY) led luxury stocks lower.

BNP Paribas SA, France’s biggest bank, retreated 5.7 percent to 23.06 euros. Chief Executive Officer Baudouin Prot said the bank plans “significant” staff reductions at its investment-banking unit as the lender cuts total assets by about 10 percent. Societe Generale (GLE) SA, France’s second-largest by assets, slid 9.6 percent to 15.31 euros, the lowest since 1992.

Lloyds Banking Group Plc (LLOY), Britain’s biggest mortgage lender, lost 10 percent to 32.51 pence while Barclays Plc (BARC) sank 9.4 percent to 138.85 pence. Raiffeisen Bank International AG (RBI) fell 8.4 percent to 20.25 euros.

U.S. stocks slumped, giving the Dow Jones Industrial Average its biggest two-day decline since December 2008, amid investors’ concern that policy makers are running out of tools to avoid another global economic recession.

Main stock indexes Wall Street, the session on Thursday substantial losses after some time started to be traded mixed in a downtrend. Before the end of trading the indices showed gains, but failed to even partially offset the incurred losses during the day. Following the session the index lost more than 3%.

All sectors of the S & P closed today in the red zone. The maximum loss showed sector conglomerates and the basic materials sector - 6.8% and 6.7% respectively.

Shares of Goodrich gained 10% after the aircraft-components maker agreed to be acquired by blue-chip conglomerate United Technologies for $16.4 billion in cash. United Technologies fell 9.2%. FedEx slipped 8.2% after the package-delivery service reported fiscal first-quarter results that were higher than expected, but said it slightly reduced its earnings outlook as it looked to adjust its cost structure to match lower demand. Red Hat gained 3%. The software company reported better-than-expected fiscal second-quarter results.

Shares of Bank of America Corp. (BAC) fell by 5%, Citigroup Inc.(C) fell by 6.1%.

Resistance 2: Y76.95/05 (area of Sep 16-19 high)

Resistance 1: Y76.55 (Sep 22 high)

Current price: Y76.29

Support 1:Y76.20 (session low)

Support 2:Y75.90 (area of historical low)

Support 3:Y75.00 (psychological mark)

Comments: the pair remains in area of historical lows.

Resistance 2: Chf0.9180 (Sep 22 high)

Resistance 1: Chf0.0.9090 (area of session high)

The current price: Chf0.9050

Support 1: Chf0.9030 (American session of Sep 22 low)

Support 2: Chf0.8985 (European session of Sep 21 high)

Support 3: Chf0.8885 (American session of Sep 21 low)

Comments: the pair $0.9030-$ 0.9090.

Resistance 2: $ 1.3675 (MA (200) for H1)

Resistance 1: $ 1.3570 (session high)

The current price: $1.3530

Support 1 : $1.3500 (Sep 12 low)

Support 2 : $1.3445/50 (area of Jan 14-18 high)

Support 3: $ 1.3385 (Sep 22 low)

Comments: the pair corrected. Above $1.3570. Support on $1.3500.

Nikkei 8,560 -180.90 -2.07%

Hang Seng 17,912 -912.22 -4.85%

Shanghai Composite 2,443 -69.91 -2.78%

FTSE 5,042 -246.80 -4.67%

CAC 2,782 -154.14 -5.25%

DAX 5,164 -269.59 -4.96%

Dow 10,733.83 -391.01 -3.51%

Nasdaq 2,455.67 -82.52 -3.25%

S&P 500 1,129.56 -37.20 -3.19%

10 Year Yield 1.72% -0.16 --

Oil $80.22 -0.29 -0.36%

Gold $1,736.00 -5.70 -0.33%

5:00 Switzerland SNB Quarterly Bulletin

13:00 EU Belgium NBB Business Climate

Day 2 USA G20 Meetings

All Day USA IMF Meetings

17:30 USA FOMC Member Dudley Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.