- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-09-2011

not sure if there's consensus to intervene in national policies.

Five central banks announced a coordinated plan Thursday to pump dollars into Europe's financial system in an effort to boost liquidity across the eurozone. The European Central Bank, along with the Federal Reserve, the Bank of England, the Bank of Japan and the Swiss National Bank will hold three dollar auctions for U.S. dollars, with a three-month maturity, through the end of the year. The coordinated move is aimed at providing U.S. dollars to struggling European banks that need the currency to fund loans and repay debt. All of the auctions will carry a fixed rate and be conducted as "repurchase operations against eligible collateral."

Among the economic data today, it is worth noting recently published statistics on CPI for August and Initial Jobless Claims last week. The number of IJC rose to 428K as an average forecast 408K. Also CPI rose to the level of 3.8% y/y against an average forecast of +3.6%. Were later released positive data on Industrial Production in the U.S. in August: the forecast drops in the last reporting period to 0.1% the actual value was equal to 0.2% compared to the previous month. But all of these rather weighty economic data had no significant effect on the market against the background of the main news of the day - the plan to increase liquidity across the eurozone.

- long period of low rates could cause new imbalances;

- eurobonds would be no solution for current debt crisis;

- there exists no simple, quick solution for debt crisis.

Crude oil increased, shoew session high above $90 a barrel, after the European Central Bank announced it will lend euro-area banks dollars to help tame the region’s credit crisis.

Data:

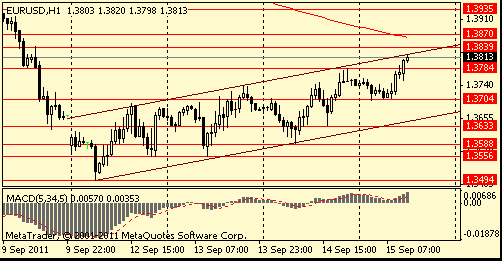

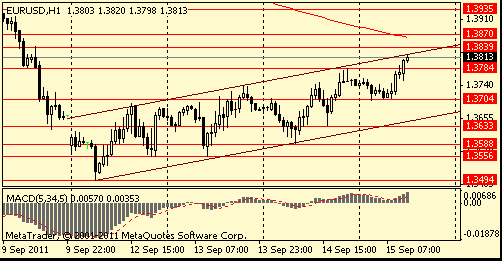

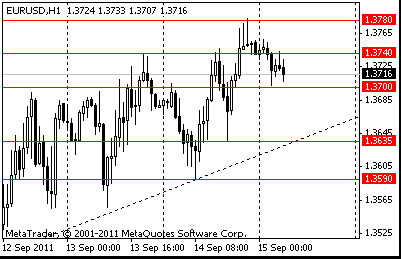

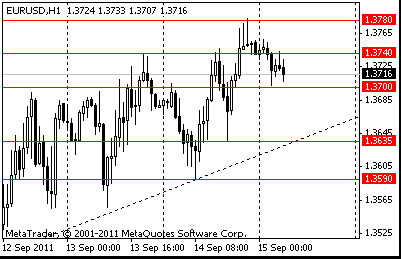

EUR/USD

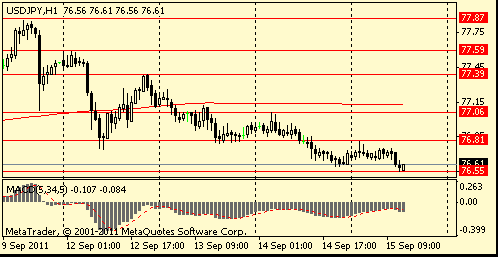

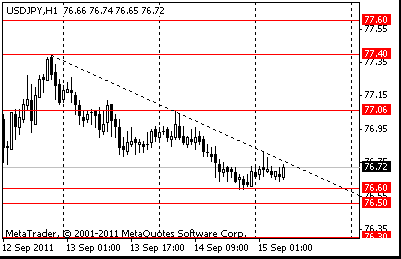

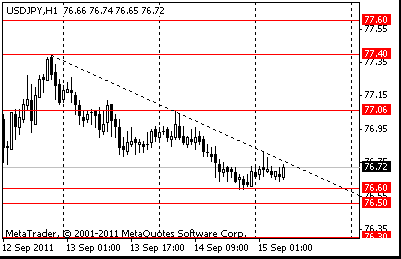

Resistance 3: Y77.40 (high of american session on Sep 12)

Resistance 2: Y77.05 (Sep 14 high)

Resistance 1: Y76.80 (session high)

Current price: Y76.61

Support 1:Y76.50/60 (Sep 2 low, session low)

Support 2:Y76.25/30 (Aug 1 low)

Support 3:Y75.95 (Aug 19 low)

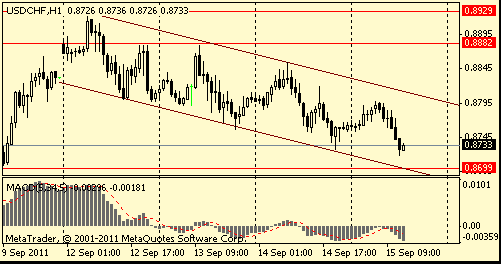

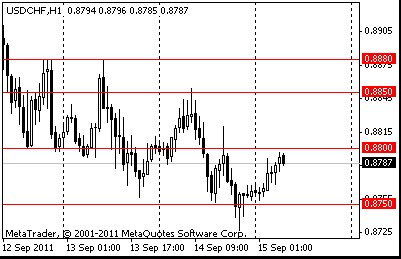

Resistance 3:Chf0.8880 (high of american session on Sep 12, Sep 13 high)

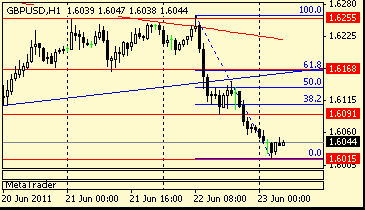

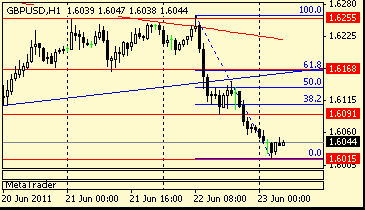

Resistance 3: $ 1.5920 (area of Sep 6-7 low)

Resistance 3: $ 1.3940 (high of american session on Sep 9)

EUR/USD $1.3750, $1.3760, $1.3800, $1.3925

The euro declined against the dollar on concern that the risk of a Greek default is increasing borrowing costs for other European countries.

- longer term inflation expectations 3.5% vs 3.2% in May

EMU data at 0900GMT should see final August HICP data remain unrevised, while Q2 employment data is due at the same time. Then later, at 1840GMT, ECB President Jean-Claude Trichet is due to host a gala dinner of the Eurofi Financial Forum 2011.

Resistance 3: Y77.60 (Sep 8 and 12 high)

Resistance 3:Chf0.8880 (high of american session on Sep 12, Sep 13 high)

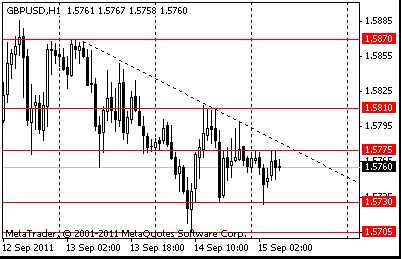

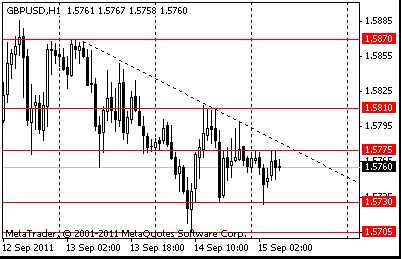

Resistance 3: $ 1.5870 (area of Sep 12-13 lows)

Resistance 3: $ 1.3840 (high of american session on Sep 9)

Hang Seng 19,045 +14.90 +0.08%

Shanghai Composite 2,485 +13.52 +0.55%

Dow 11,246.13 +140.28 +1.26%

Nasdaq 2,573 +40.40 +1.60%

S&P 500 1,189 +15.81 +1.35%

10 Year Yield 2.01% +0.02

Oil $88.95 +0.04 +0.04%

Gold $1,815.80 -10.70 -0.59%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.