- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-09-2011

"Volatility remains high as gold is attracting more day and high-frequency traders. As a result, gold is losing safe-haven status and some investors are liquidating positions to increase cash and/or put funds into US Treasuries."

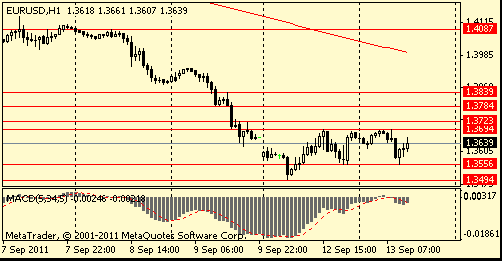

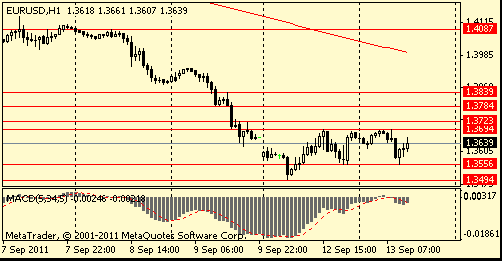

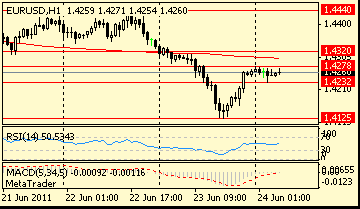

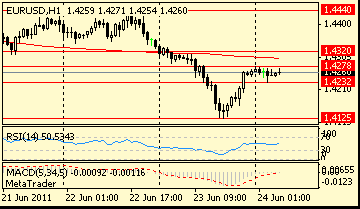

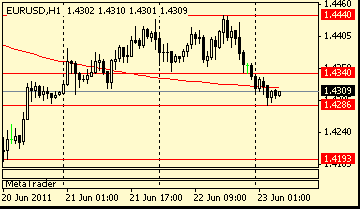

MS' analistes have revised their euro forecast significantly lower and now expect the euro to declined to $1.30 by year-end and $1.25 in Q1 2012 (versus prior forecast of $1.36 and $1.38 respectively, before stabilizing in the second half of next year.

Crude oil rose on speculation a report tomorrow will show stockpiles dropped in the U.S., the biggest oil consuming country.

Crude retreated from its session high after the International Energy Agency cut global oil demand forecasts for this year and next as the economic recovery falters.

Currently crude oil for october delivery is at $89.06 per barrel (+0.91%).

rising risk of sharp investment reversals out of emerging markets

shocks to emerging market growth prospects may spark major capital flight

EUR/USD $1.3800, $1.4000USD/JPY Y76.65, Y77.00, Y77.25, Y77.55, Y78.50

EUR/JPY Y108.30

AUD/USD $1.0375, $1.0550

- No rift in German govt over Greece aid

- Must avoid developments getting out of control

Data:

US data starts at 1230GMT with the Import/Export Price Index. Increases in import prices may be moderate due to only a small change in petroleum costs, and smaller increases in items like foods and motor vehicles. Export prices should benefit from favorable exchange rates and demand for

agricultural products. Finally, at 1800GMT, the US Treasury is expected to post a $130.0 bn budget gap in August.

Bids $1.3635/30, $1.3600, $1.3585/80, $1.3550

- with the global economic outlook worsening, the bank should arguably make even more asset purchases.

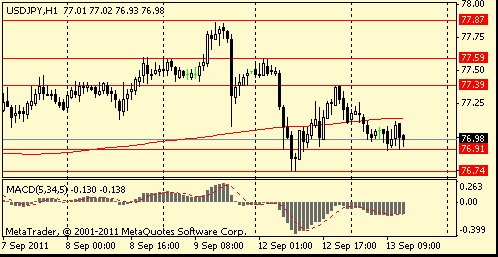

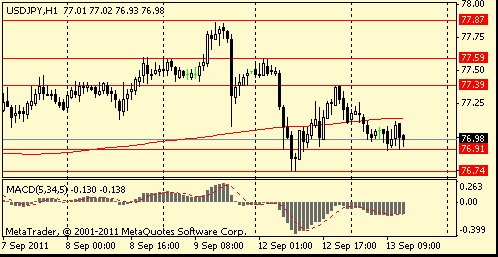

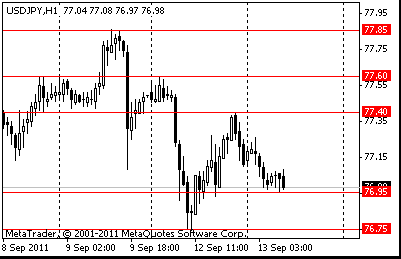

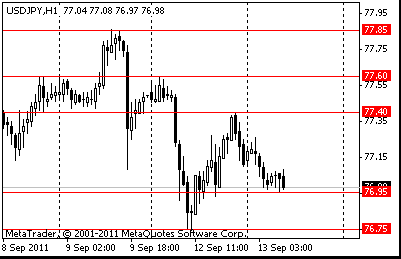

Resistance 3: Y77.85/90 (Sep 9 high)

Resistance 3: Chf0.9000 (Apr 19-20 high)

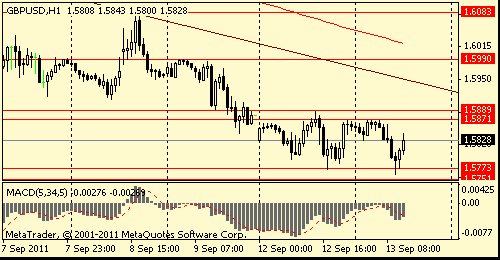

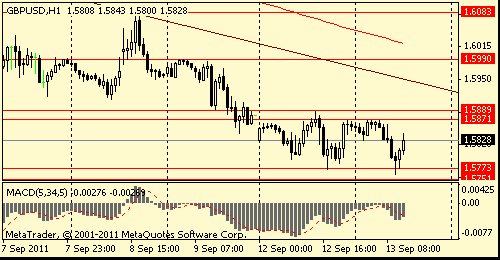

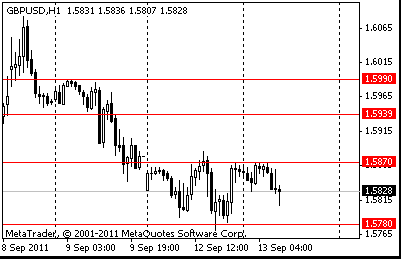

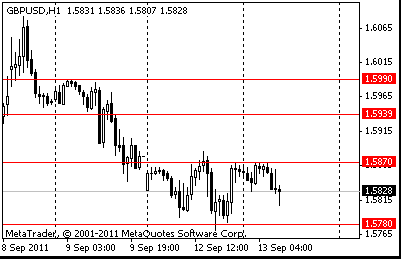

Resistance 3: $ 1.5990 (Sep 9 high)

Resistance 3: $ 1.3840 (high of american session on Sep 9)

EUR/USD $1.3800, $1.4000USD/JPY Y76.65, Y77.00, Y77.25, Y77.55, Y78.50

EUR/JPY Y108.30

AUD/USD $1.0375, $1.0550

IEA cuts avg 2012 global demand fcst by 400 kbd to 90.7 mbd;

IEA trims 2011 avg non-OPEC supply fcst 200 kbd to 52.8 mbd;

IEA trims 2012 avg non-OPEC supply fcst 200 kbd to 53.8 mbd;

August global oil supply rose 1.0 mbd m/m to 89.1 mbd;

August OPEC crude output rose 165 kbd m/m to 30.26 mbd.

Data:

UK data at 0830GMT includes inflation and trade data as well as CLG House Prices. Consumer Price Inflation is expected to show price increases persisting at well over double the 2% official target. The BoE has said it expects CPI to approach a 5% annual rate once rising utility bills take their toll but that is not expected to be seen until the September data are released next month. Median forecasts for Tuesday look for CPI to come in at 0.6% m/m, 4.5% y/y with core-CPI at 0.6% m/m, 3.1% y/y. Trade is due out the same day and could well reflect the clear drop off in demand and orders from overseas seen in the recent Markit/CIPS PMI survey of the sector.

US data starts at 1230GMT with the Import/Export Price Index. Increases in import prices may be moderate due to only a small change in petroleum costs, and smaller increases in items like foods and motor vehicles. Export prices should benefit from favorable exchange rates and demand for

agricultural products.The two earliest monthly indexes for consumer confidence include the IBD/TIPP Economic Optimism Index for September at

1400GMT and could provide a strong hint about the direction of the preliminary Reuters/University of Michigan Consumer Sentiment Index on

Friday. Finally, at 1800GMT, the US Treasury is expected to post a $130.0 bn budget gap in August.

IEA monthly oil market report is due, at 0800GMT.

UK data at 0830GMT includes inflation and trade data as well as CLG House Prices. Consumer Price Inflation is expected to show price increases persisting at well over double the 2% official target. The BoE has said it expects CPI to approach a 5% annual rate once rising utility bills take their toll but that is not expected to be seen until the September data are released next month. Median forecasts for Tuesday look for CPI to come in at 0.6% m/m, 4.5% y/y with core-CPI at 0.6% m/m, 3.1% y/y. Trade is due out the same day and could well reflect the clear drop off in demand and orders from overseas seen in the recent Markit/CIPS PMI survey of the sector.

US data starts at 1230GMT with the Import/Export Price Index. Increases in import prices may be moderate due to only a small change in petroleum costs, and smaller increases in items like foods and motor vehicles. Export prices should benefit from favorable exchange rates and demand for agricultural products.The two earliest monthly indexes for consumer confidence include the IBD/TIPP Economic Optimism Index for September at 1400GMT and could provide a strong hint about the direction of the preliminary Reuters/University of Michigan Consumer Sentiment Index on Friday. Finally, at 1800GMT, the US Treasury is expected to post a $130.0 bn budget gap in August.

Japanese stocks fell for a second day, with the Nikkei 225 (NKY) Stock Average dropping to its lowest in almost two and a half years, as exporters and banks tumbled amid speculation Greece may be nearing default.

Sony Corp., which gets 21 percent of its sales in Europe, fell 3.4 percent as the yen’s advance to a 10-year high against the euro dimmed the earnings outlook.

European stocks slumped for a second day, dragging the benchmark regional gauge to its lowest level since July 2009, as speculation mounted that Germany is preparing for Greece to default.

BNP Paribas (BNP) SA, Societe Generale SA and Credit Agricole SA (ACA) tumbled at least 11 percent after two people with knowledge of the matter said Moody’s Investors Service may cut the banks’ ratings because of their Greek holdings. AXA SA (CS) and ING Groep NV (INGA) lost more than 8 percent as insurers posted the second biggest losses among 19 industry groups on the Stoxx Europe 600 Index.

Officials in Chancellor Angela Merkel’s government in Germany are debating how to shore up the country’s banks should Greece fail to meet the budget-cutting terms of its aid package, three coalition officials said on Sept. 9. BNP Paribas, Societe Generale and Credit Agricole may have their ratings cut by Moody’s this week because of their holdings of the Mediterranean nation’s debt, two people with knowledge of the matter said.

Prime Minister George Papandreou, vowing to avoid a default and keep Greece in the euro, approved new measures yesterday to help plug a budget gap as resistance builds at home and in Europe to extending more aid to the European Union’s most- indebted nation.

Charter International Plc rallied 6.6 percent to 857 pence after Colfax Corp. (CFX)’s U.K. unit said the company agreed to buy the U.K. engineering business for about 1.53 billion pounds ($2.4 billion).

U.S. stocks pared losses after the Financial Times reported that Italy was in talks with a Chinese investment firm to buy bonds, offsetting concern that Greece may default on its debt.

Chipmakers and banks in the Standard & Poor’s 500 Index rallied. NetLogic Microsystems Inc. (NETL) jumped 52 percent after Broadcom Corp. (BRCM) agreed to buy the semiconductor company for $3.7 billion in cash.

Resistance 3: Y77.85/90 (Sep 9 high)

Comments: the pair renewed falling. The immediate support - Y77.95/00. Below losses are possible to Y76.75/70. The immediate resistance - Y77.40. Above growth is possible to Y77.60.

Resistance 3: Chf0.8925/30 (Sep 12 high)

Resistance 3: $ 1.5990 (Sep 9 high)

Resistance 3: $ 1.3840 (high of american session on Sep 9)

FTSE 100 -85.03 -1.63% 5,129.62

CAC 40 -119.78 -4.03% 2,854.81

DAX -117.60 -2.27% 5,072.33

Dow +68.99 +0.63% 11,061.12

Nasdaq +27.10 +1.10% 2,495.09

S&P 500 +8.04 +0.70% 1,162.27

10 Year Yield 1.93% +0.02 --

Oil $88.15 -0.04 -0.05%

Gold $1,814.90 +1.60 +0.09%

01:30 Australia National Australia Bank's Business Confidence (Aug) -8 2

08:30 UK HICP (August) 0.4% 0.0%

08:30 UK HICP (August) Y/Y 4.5% 4.4%

08:30 UK HICP ex EFAT (August) Y/Y 3.1% 3.1%

08:30 UK Retail prices (August) - -0.2%

08:30 UK Retail prices (August) Y/Y - 5.0%

08:30 UK RPI-X (August) Y/Y 5.1% 5.0%

08:30 UK Trade in goods (July), bln -8.6 -8.9

08:30 UK Non-EU trade (July), bln -5.5 -5.7

12:30 USA Import prices (August) -0.5% 0.3%

12:30 USA Export prices (August) - -0.4%

19:00 USA Federal budget (August), bln -131.8 -129.4

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.