- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-09-2011

The euro rose against the majority of its most-traded counterparts as optimism increased that area leaders will work to avoid a default in Greece and contain the region’s debt crisis.

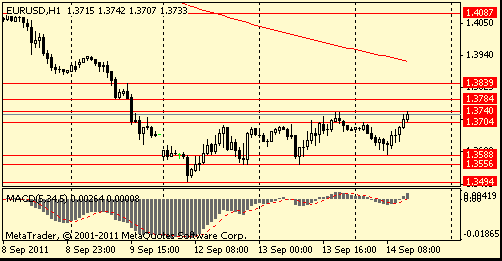

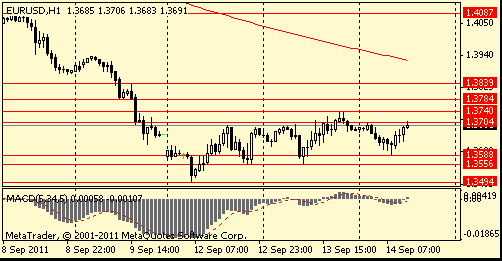

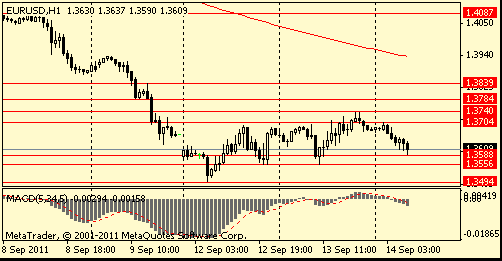

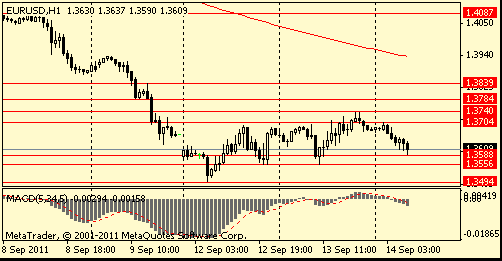

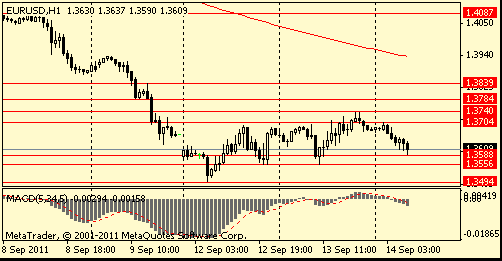

EUR/USD $1.3700, $1.3800, $1.3900, $1.4000

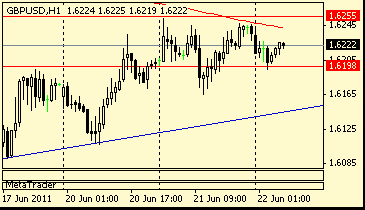

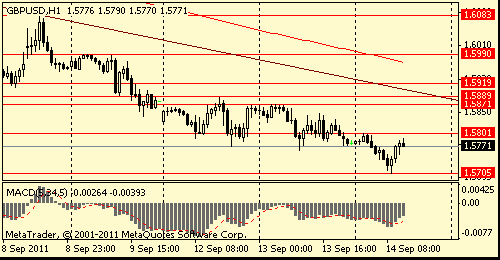

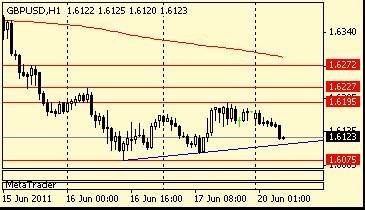

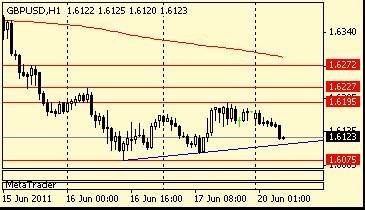

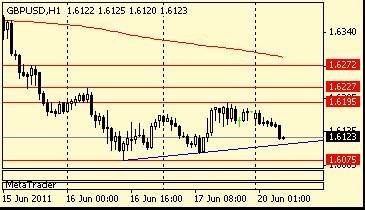

GBP/USD $1.5600

AUD/USD $1.0300, $1.0350

- have difficult challenges ahead, growth weaker than thought and US still has imbalances.

- US has huge interest in help solving debt problems.

"Markets will continue to be volatile for now. Deleveraging is the key to ending financial market volatility."

expected to hold steady in August. Energy prices are expected to decline further in the month, while food prices are seen rising modestly. The

core PPI is expected to rise 0.2%.

Also at 1230GMT, US Treasury Secretary Tim Geithner gives the 30 minute interview on CNBC.

US data continues at 1400GMT, when business inventories are expected to rise 0.6% in July, as factory inventories were already reported up 0.5%, while wholesale inventories rose 0.8% in the month.

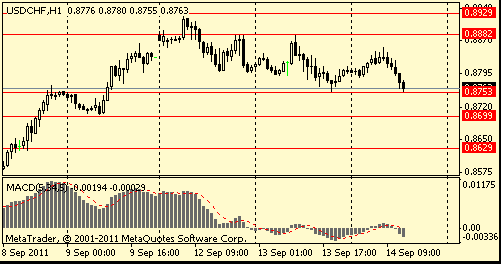

Resistance 3: Chf0.9000 (Apr 19-20 high)

Resistance 3: $ 1.5920 (area of Sep 6-8 low)

Resistance 3: $ 1.3790 (low of european session on Sep 9)

The euro weakened versus the yen for a fifth day before Greek Prime Minister George Papandreou holds a conference call with German Chancellor Angela Merkel and French President Nicolas Sarkozy today.

Spain is scheduled to auction securities maturing in 2019 and 2020 tomorrow. Italy sold 3.9 billion euros ($5.3 billion) of five-year notes yesterday at an average yield of 5.6 percent, up from 4.93 percent at the previous auction. Demand dropped to 1.28 times the amount on offer, from 1.93 times.

expected to hold steady in August. Energy prices are expected to decline further in the month, while food prices are seen rising modestly. The

core PPI is expected to rise 0.2%.

Also at 1230GMT, US Treasury Secretary Tim Geithner gives the 30 minute interview on CNBC.

US data continues at 1400GMT, when business inventories are expected to rise 0.6% in July, as factory inventories were already reported up 0.5%, while wholesale inventories rose 0.8% in the month.

EUR/USD $1.3700, $1.3800, $1.3900, $1.4000

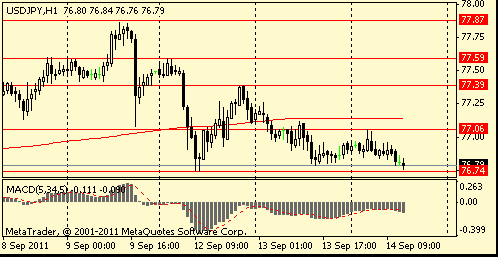

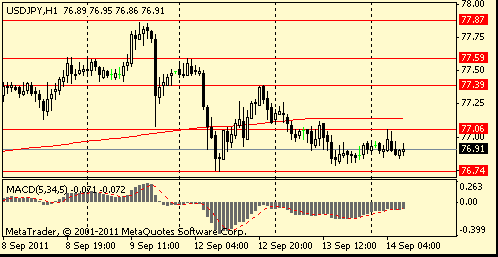

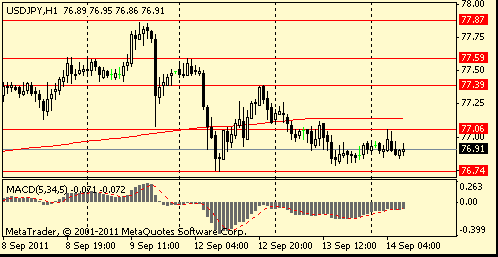

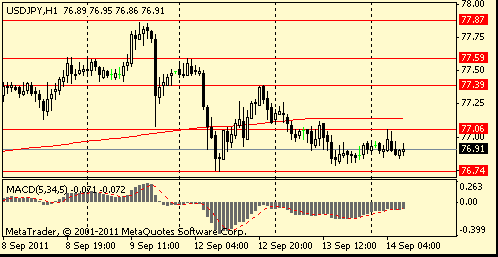

USD/JPY Y76.00, Y76.80, Y77.15, Y77.25, Y78.00

GBP/USD $1.5600

AUD/USD $1.0300, $1.0350

US data starts at 1230GMT with both PPI and Retail Sales.Retail sales are expected to rise 0.3% in August, as vehicle sales were down only slightly after seasonal adjustment and AAA reported only a slight rise in gasoline prices after larger declines in June and July. Nonauto retail sales are forecast to rise 0.3%. Producer prices are

expected to hold steady in August. Energy prices are expected to decline further in the month, while food prices are seen rising modestly. The

core PPI is expected to rise 0.2%.

Also at 1230GMT, US Treasury Secretary Tim Geithner gives the 30 minute interview on CNBC.

US data continues at 1400GMT, when business inventories are expected to rise 0.6% in July, as factory inventories were already reported up 0.5%, while wholesale inventories rose 0.8% in the month.

Mitsubishi UFJ Financial Group Inc., Japan’s largest lender by market value, advanced 2.5 percent.

Fanuc Corp., the world’s biggest maker of machine-tool controls, gained 2.3 percent, recovering part of a 15 percent loss last week.

Elpida Memory Inc. led chip-related companies higher on signs semiconductor prices have bottomed.

The Nikkei 225 rose 1 percent to 8,616.55, rebounding from the lowest level since April 2009 yesterday. The broader Topix gained 1.2 percent to 749.82 after Trichet signaled support for the banking system, saying: “We have the weaponry to provide what is necessary.”

While Italian officials have had talks with Chinese counterparts about potential investment in the euro region’s third-largest economy, the purchase of Italian bonds by China was not the focus of the discussion, an Italian official said on condition of anonymity.

Japanese banks gained on speculation the ECB will prevent Europe’s sovereign debt crisis from spreading to the financial sector. Mitsubishi UFJ advanced 2.5 percent to 331 yen. Smaller Sumitomo Mitsui Financial Group Inc. climbed 1.2 percent to 2,105 yen.

Among decliners, Nintendo Co. sank 5.1 percent to 12,320 yen after analysts said the company will probably sell fewer 3-D handheld game players than it’s targeting because price cuts and new accessories will fail to make up for a lack of hit titles.

European stocks close: FTSE 5,174 +44.63 +0.87%, CAC 2,895 +40.12 +1.41%, DAX 5,166 +94.03 +1.85%.

European stocks rose for the first time in three days, with the benchmark Stoxx Europe 600 Index rebounding from a two-year low, as banking shares advanced.

Today national benchmark indexes rose in every western-European market except Greece, Iceland and Norway.

Societe Generale SA and Deutsche Bank AG jumped more than 8 percent. Chief Executive Officer os Societe Generale said that the bank has sufficient capital and liquidity, and that its balance sheet is solid.

Deutsche Boerse AG jumped 3 percent after news that NYSE Euronext and Deutsche Boerse plan to make about 200 million euros, or half of the proposed cost cuts from their combination.

Despite choppy trade, US stocks scored strong gains today. The effort made for the market's first back-to-back advance of the month.

Caution related to precarious fiscal and financial conditions in Europe initially kept stocks in check this morning, but before long bank stocks and other financial issues began to bounce, providing an impetus for the broad market to make its way higher. Although the move encountered challenges from sellers, stocks showed resilience by staging a gradual climb to close near session highs. Stocks were helped by headlines that suggested BRIC countries are in talks to purchase eurozone debt.

For the second straight session the Nasdaq outperformed its counterparts. Its strength came as semiconductor stocks extended their prior session climb, taking the Philadelphia Semiconductor Index 2% higher to its best level in one month.

Industrial stocks were the best performers in the broad market. As a group, they climbed 2.0%.

Energy stocks and consumer staples stocks lagged all session. The two sectors settled with gains of 0.3% and 0.2%, respectively. Best Buy (BBY 23.35, -1.61) was one of the poorest individual names following disappointing quarterly earnings results, which caused many analysts to reconsider the retailer's business structure.

Resistance 3: Y77.60 (Sep 8 and 12 high)

Resistance 3: Chf0.9000 (Apr 19-20 high)

Resistance 3: $ 1.5920 (area of Sep 6-8 low)

Resistance 3: $ 1.3790 (low of european session on Sep 9)

Shanghai Composite 2,471 -26.45 -1.06%

FTSE 5,174 +44.63 +0.87%

CAC 2,895 +40.12 +1.41%

DAX 5,166 +94.03 +1.85%

Dow 11,105.85 +44.73 +0.40%

Nasdaq 2,532 +37.06 +1.49%

S&P 1,172.87 +10.60 +0.91%

10 Year Yield 1.99% +0.06 --

Oil $89.94 +1.75 +1.98%

Gold $1,840.00 +9.90 +0.54%

00:30 Australia Westpac Consumer Confidence (Sep) 8.1% -3.5%

04:30 Japan Industrial Production (YoY) (Jul) -3.0% -2.8%

04:30 Japan Industrial Production (MoM) (Jul) 0.4%

14:30 United States EIA Crude Oil Stocks change (Sep 9) -4M

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.