- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 04-01-2022

- GBP/USD seesaws near two-month high, inside bearish chart pattern.

- 50-SMA adds strength to the rising wedge’s support around 1.3465.

- Wedge’s resistance, seven-week-old horizontal line guard short-term upside.

- RSI, MACD join sustained trading beyond the key SMA to favor bulls.

GBP/USD keeps the previous day’s pullback from a two-month high of around 1.3530 during the inactive initial Asian session on Wednesday.

The cable pair refreshed the multi-day top the previous day while justifying MACD rebound and firmer RSI line. However, a 12-day-old rising wedge challenges the buyers.

Even so, the sellers may wait for a confirmation of the bearish chart pattern before taking a fresh entry. The 50-SMA level around 1.3465 increases hardships for the bear’s arrival.

In a case where the quote drops below 1.3465, the 200-SMA level near 1.3330 will offer an intermediate halt during the expected south-run targeting December 2021 low of 1.3160.

On the flip side, GBP/USD buyers can aim for the wedge’s resistance line and multi-day-old horizontal hurdle surrounding 1.3610 during further advances.

Following that, November’s high of 1.3697 and October's peak surrounding 1.3835 will be in focus.

GBP/USD: Four-hour chart

Trend: Further upside expected

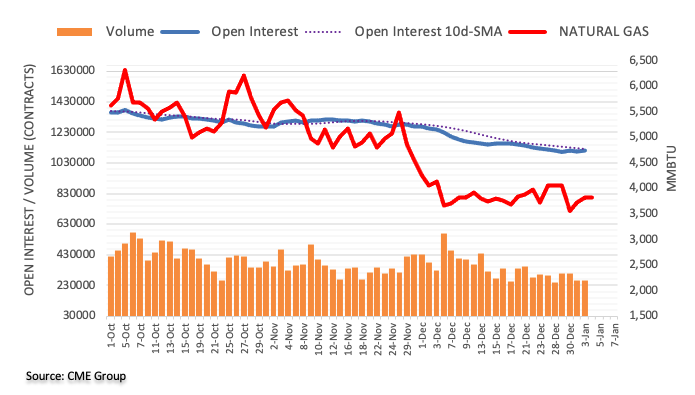

- WTI crude oil seesaws around six-week top after a two-day uptrend.

- API stocks marked surprise draw for the latest week, OPEC+ held 400K bpd policy.

- USD pullback adds to the bullish bias ahead of the key data/events.

WTI crude oil prices grind higher surrounding $77.00 during Wednesday’s Asian session.

The black gold rose to the fresh high since November 26 the previous day during the two-day uptrend, backed by likely positives from the Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, as well as a jump in the API stockpile draw. It should be noted, however, that cautious sentiment ahead of the US ADP Employment Change for December and Federal Open Market Committee (FOMC) Meeting Minutes, not to forget the official inventory data from the US Energy Information Administration (EIA) probe the oil bulls.

That said, the latest industry inventory figures from the American Petroleum Institute (API) dropped more than double the previous draw of 3.09M to -6.432M for the week ended on December 31.

On a different page, the OPEC group matched wide market expectations to go ahead with the 400,000 Barrels Per Day (BPD) output hike. “World oil markets are widely expected to remain prone to geopolitics in 2022, with ‘saber-rattling’ over the persistent Russia-Ukraine standoff and ongoing Iranian nuclear negotiations likely to be closely monitored by OPEC+,” said CNBC after the verdict.

Elsewhere, the US ISM Manufacturing PMI dropped to the lowest in 11 months in December, 58.7 versus 60.0 forecast and 61.1 prior, whereas November’s JOLTS Jobs Openings came in lower than the upwardly revised previous reading of 11.091M to 10.562M.

The downbeat US data joined the market’s firmer sentiment, amid hopes of less severe virus contagion, joined downbeat US inflation expectations to probe the US dollar bulls and favor oil buyers the previous day. the US inflation expectations, as per 10-Year Breakeven Inflation Rate numbers from the Federal Reserve Bank of St. Louis (FRED) eased from a six-week high to 2.57% at the latest, which in turn tamed Fed rate-hike chatters.

That said, the US data and risk catalysts are likely to direct short-term oil moves. While the US ADP and FOMC Minutes are the keys for clear direction, weekly prints of the EIA Crude Oil Stocks Change for the week ended on December 31, expected -3.4M versus -3.576M prior, will also be important to watch.

Technical analysis

Although RSI conditions challenge further upside, WTI bulls remain hopeful until witnessing a clear downside past the 100-DMA level of $74.55. Alternatively, the late November’s swing high, close to $79.00, and the $80.00 threshold restricts short-term advances.

- EUR/USD remains pressured around two-week low despite the latest sideways grind.

- Steady RSI backs bearish moving average crossover, break of 12-day-old support.

- Weekly horizontal line tests intraday sellers, bulls need 200-SMA break for conviction.

EUR/USD stays depressed around 1.1285 near a fortnight low amid the initial Asian session on Wednesday, following a two-day south-run.

In doing so, the major currency pair justifies the bearish cross of the 50-HMA under 200-HMA, as well as a clear downside break of an upward sloping trend line from December 19, currently around 1.1305.

Given the steady RSI line baking the aforementioned bearish technical catalysts, the latest grind to the south may continue.

However, a horizontal area comprising lows marked since December 19, around 1.1275-70 may challenge the EUR/USD sellers before directing them to the year 2021 low near 1.1185.

Adding to the downside filters are the levels surrounding 1.1230 and the 1.1200 threshold.

Meanwhile, the corrective pullback may aim for the previous support line near 1.1305 but may remain elusive until crossing the 200-HMA level close to 1.1325.

Following that, a run-up towards 1.1360 and December’s high around 1.1385 can’t be ruled out.

EUR/USD: Hourly chart

Trend: Further weakness expected

- The NZD/JPY marches firmly upwards gains 0.98%.

- Central bank policy divergence between the RBNZ and the BoJ favors the NZD.

- NZD/JPY Price Forecast: The double-bottom in the daily chart targets 80.00.

The NZD/JPY pair surges as the New York session ends, trading at 78.65 at the time of writing. Risk-sensitive currencies like the New Zealand dollar advanced against safe-haven peers, sharply against the low-yielder Japanese yen, as market participants’ mood deteriorated as the Wall Street’s session progressed.

Despite the aforementioned, NZD bulls keep in control. The NZD/JPY is a pure risk-sentiment play. However, it coincides with central bank divergence between the Reserve Bank of New Zealand (RBNZ) and the Bank of Japan (BoJ) at the time of writing.

In November’s meeting, the RBNZ decided to raise interest rates by 25 basis points, leaving the bank rate at 0.75% while eyeing the Official Cash Rate (OCR) at 2.60% by the end of 2023. Contrarily, the BoJ would keep rates unchanged for the foreseeable future, and although the emergency pandemic stimulus was scaled back, they extended it for smaller firms until March of 2022.

Market mood

The challenge for NZD/JPY traders would be the assessment of the risk sentiment, which is greatly influenced by China. The Omicron variant and the Covid-zero policy maintained by China could undermine appetite for riskier assets, so in that event, the Japanese yen might appreciate.

Therefore, it is recommended for NZD/JPY traders to keep an eye to global equities, Chinese developments, and the Volatility Index (VIX) for clues that would help them position themselves, depending on the risk-market mood.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY daily chart shows a double-bottom formation. Furthermore, at press time, the “neckline” of the chart pattern confluences with the 200-day moving average (DMA) around the 77.96-78.03 range, which NZD bulls are likely to defend as the double-bottom targets 80.00.

To the upside, the NZD/JPY first resistance would be 79.50. A breach of the latter paves the way for further upside. The following line of defense for JPY bulls would be the double-bottom target at 80.00, followed by November 5, 2021, a daily high at 81.34.

-637769329376649764.png)

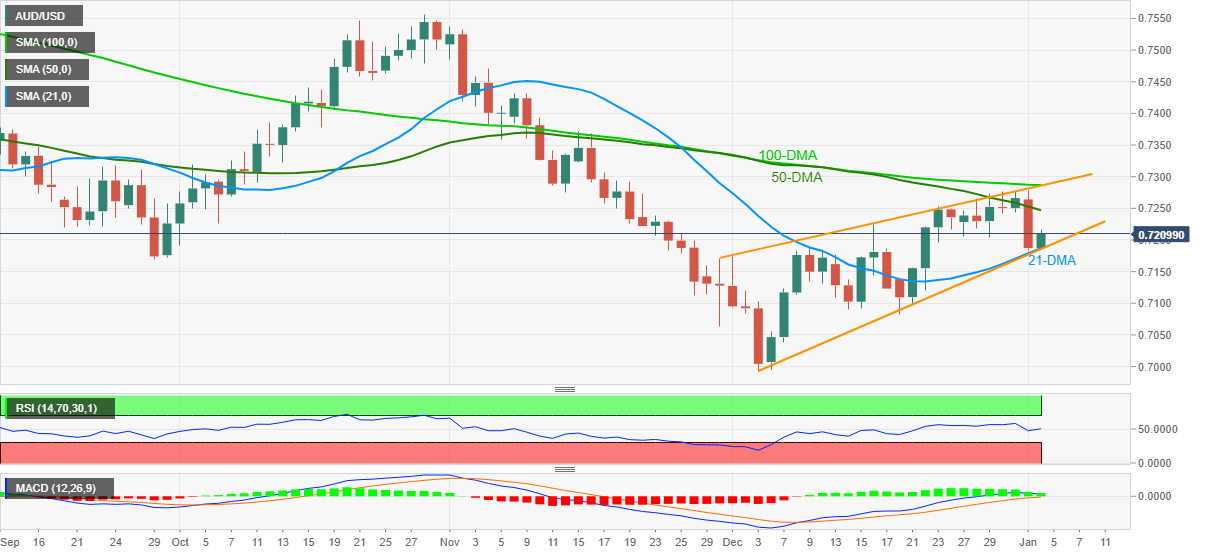

- AUD/USD grinds higher after positing the biggest daily gains in two weeks, also bouncing off fortnight low.

- Virus infections increase but WHO finds another evidence of less severity, gold prices, Aussie PMIs helped bulls to take chance.

- US ISM Manufacturing PMI, JOLTS Job Openings came in softer, inflation expectations eased too.

- US ADP Employment Change, FOMC Minutes will be the key.

AUD/USD retreats towards 0.7200, around 0.7235 by the early Wednesday morning in Asia while fading the previous day’s corrective pullback. The Aussie pair cheered cautious optimism in the markets, as well as upbeat data at home and softer US figures to consolidate Monday’s heavy losses.

Among the positives were the comments from World Health Organization (WHO) official that again tried to placate fears over the South African covid variant, Omicron. "We are seeing more and more studies pointing out that Omicron is infecting the upper part of the body. Unlike other ones, the lungs who would be causing severe pneumonia," WHO Incident Manager Abdi Mahamud told Geneva-based journalists per Reuters.

On the same line was the zero infections in West Australia for the first time in nearly a week. However, Aussie national count refreshed record top infection with close to 53,000 cases a day.

It’s worth noting that a jump in the global vaccinations also keeps policymakers hopeful of overcoming the pandemic, which in turn favored the riskier assets like gold, equities and AUD/USD.

That said, gold rose 0.74% to $1,814 while Wall Street benchmarks also tried to remain positive even as Nasdaq dropped 1.3% and S&P 500 stepped back from record top. Further, the US 10-year Treasury yields refreshed a six-week high before easing to 1.65% by the end of Tuesday’s North American session.

Talking about data, Australia’s Commonwealth Bank Manufacturing PMI surged to 57.7 in December versus the earlier forecast of 57.4. For the US, the ISM Manufacturing PMI dropped to the lowest in 11 months in December, 58.7 versus 60.0 forecast and 61.1 prior, whereas November’s JOLTS Jobs Openings came in lower than the upwardly revised previous reading of 11.091M to 10.562M.

Also, the US inflation expectations, as per 10-Year Breakeven Inflation Rate numbers from the Federal Reserve Bank of St. Louis (FRED) eased from a six-week high to 2.57% at the latest, which in turn tamed Fed rate-hike chatters and helped AUD/USD to rebound. Additionally probing the Fed hawks were comments from Minneapolis Fed President and 2022 voting FOMC member Neil Kashkari, who said on Monday that he now sees two rate hikes in 2022, versus the money market bets of three rate lifts.

Alternatively, cautious sentiment ahead of this week’s key data docket from the US and steadily rising covid cases join the news of a new virus variant that spreads faster than Omicron challenging the market sentiment and AUD/USD prices.

For the day, AUD/USD traders should pay attention to the risk catalysts ahead of the US ADP Employment Change for December and Federal Open Market Committee (FOMC) Meeting Minutes. While the anticipated easing in the ADP may help the Aussie pair to keep the latest rebound, the hawkish tone of the policymakers in the FOMC Minutes will be enough to keep the quote weak.

Read: US ADP December Preview: Suddenly its inflation, not jobs

Technical analysis

The AUD/USD pair’s failure to keep the bounce off 100-SMA joins bearish MACD signals and RSI retreat to favor sellers. However, confirmation of the monthly rising wedge and a downside break of 200-SMA becomes necessary for the bears to take an entry, which in turn highlights the 0.7170 level as the key support.

Alternatively, further advances may aim for 0.7250 but a six-week-old horizontal area restricts short-term upside around 0.7280. Adding to the upside filter is the stated wedge’s upper line near 0.7285.

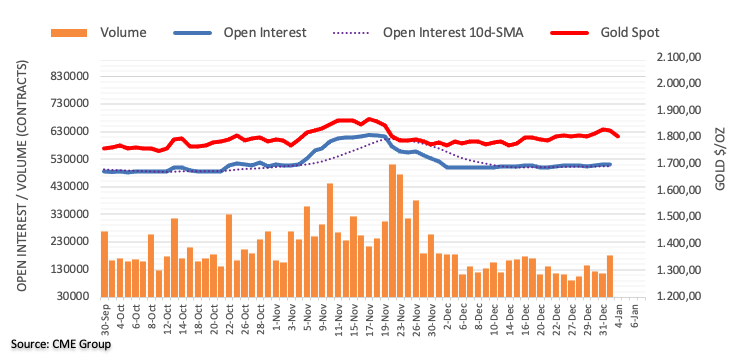

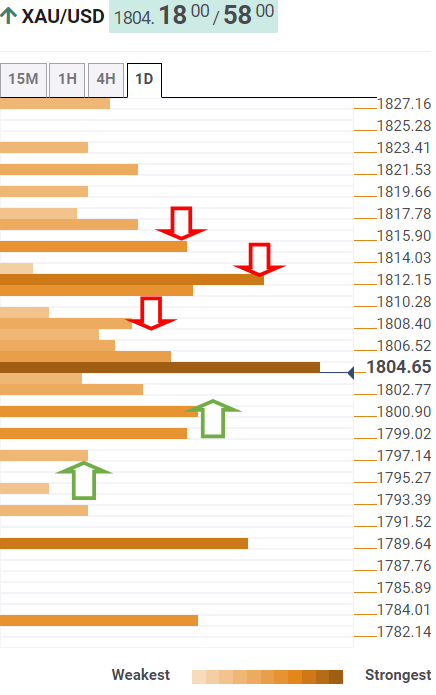

- XAU/USD bulls step in with eyes on the $1,820s eyed.

- The price is in a consolidation area, with $1,808 on the downside in focus.

- Traders are awaiting key US data this week, while the stock market cheers a positive start.

The price of gold (XA/USD) is firmly bid at $1,815 and rises 0.75% following a rise from $1,798.51 to a high of $1,816.81. The US dollar was offered at the end of the European session which helped the precious metal to rally from the lows of the day to test a 61.8% Fibonacci retracement of the hourly drop which leaves XAU/USD consolidating into the Wall Street close.

In this regard, US stocks were on fire again with the Dow Jones Industrial Average hitting yet another closing record on Tuesday at 36,799.65 points. US data was firm to start the year creating positive vibes amongst traders returning from the holiday season eager for gains.

US data in focus

Investors are betting on a strong recovery as the covid fears abate which sent a wobble into the tech sectors, weighing on the Nasdaq that ended down 1.4% in its biggest decline since December. The S&P 500 was mostly unchanged.

US data showed demand for workers was historically high again in November, with a record 4.5 million Americans quitting their jobs as labour shortages continue to strain employers, though the impact of the latest virus wave has yet to show.

This week's US Nonfarm Payrolls will be key in this regard and the pace of that momentum in terms of US growth. however, remains at the helm of the Federal Reserve. The minutes of the last meeting will be released on Wednesday.

These are from the December 14-15 Federal Open Market Committee meeting in which Fed Chair Powell confirmed the Fed's intention to begin tapering QE and lift interest rates in 2022. Traders will be paying close attention to the language for clues to when a rate hike could fall as it gears up for a potential rate hike as potentially soon as this quarter to deal with rising inflation.

Meanwhile, ahead of Friday's pivotal December labour market report, Wednesday's ADP employment report will give Wall Street a peak as to how many new jobs were created last month. traders will be looking for an outsized number that could nudge up the current consensus estimate of +422K for December NFP.

As for Omricon, the news could not get much better for markets that tend to err on the more positive side of cautionary optimism. Early laboratory studies have shown the more transmissible variant replicates less efficiently once inside the lung tissue. Scientists are using the word “milder” with much trepidation to describe the illness conferred by the Omicron variant of SARS-Cov-2.

However, it is widely accepted that even if the variant is milder, the sheer number of people it infects might lead to more hospitalisations overall, with healthcare workers having to isolate due to testing positive. Nevertheless, with angst surrounding the omicron variant having sparked a safe-haven bid in gold, it could be vulnerable to some downside if the covid bid is unsound in the CTA space.

Meanwhile, analysts at TD Securities stated that higher gold prices are inconsistent with global markets pricing in a 70% probability for a Fed rate hike in March, which places a cap on prices. ''Participants remain focused on the central bank's exit, but the virus' spread threatens both demand and supply-side forces, which could affect the US growth outlook, suggesting that the Fed may want to remain cautious until the Omicron wave this winter subsides.''

Gold technical analysis

The price is moving into a phase of consolidation while trapped between the support and resistance in the 4-hour chart. There is some mitigation likely on the card to the downside with $1,808 eyed and the same could be said of the upside into $1,821.

- The yen got broadly battered on Tuesday amid a sharp rise in global developed market bond yields.

- The pair is now eyeing a break above key trendline resistance and a move to 84.50.

AUD/JPY surged nearly 1.5% on Tuesday, its largest one-day move since October, and has in recent trade moved above the 84.00 level for the first time since early November. With Monday’s stumble that saw the pair drop momentarily back below the 83.00 level now well in the rear-view mirror, AUD/JPY is looking to break above a resistance trendline that has been capping the price action going back to 8 December, so for nearly one-month. At current levels, the pair trades about 0.5% higher on the week. A clean break above this trendline and the 84.00 level would open the door to a move to the next area of resistance around 84.50. Longer-term bulls will likely be betting on an eventual move back to Q4 2021 highs around 86.00.

In terms of the drivers of Tuesday’s strength, the first thing to note is that Monday’s drop never really made that much sense at the time anyway. Recall, that the pair dropped under 83.00, its worst decline in over a month, despite gains in strongly risk-on market conditions in global equity, bond and commodity markets. FX markets seem to have recognised the error of their ways on Tuesday and, amid a continued surge in long-term global developed market yields (including in Australia), have sent the yield-sensitive yen decisively lower. After all, if global bond, equity and commodity markets are moving to price in a rosier long-term economic outlook, it makes sense for AUD/JPY to move higher, not lower.

- GBP/USD has eased back from earlier session highs above 1.3550, but remains well supported above 1.3500.

- UK PM Boris Johnson again played down the need for tougher UK lockdowns, which may have helped sterling.

GBP/USD has eased back from earlier session highs above 1.3550 (the pair’s highest levels since early November) in recent trade and is back to roughly in line with where it opened on the year in the 1.3520s. That means it still trades higher by about 0.4% or over 50 pips on the day, having rallied from Asia Pacific levels in the 1.3475 area, with Monday’s dip abck towards the 50-day moving average in the 1.3420 area (at the time) now having proven to have been a good entry point for the short-term bullish speculators.

Technicians note support in the 1.3550 area (recent highs) and in the low 1.3400s (this week’s lows and the 50DMA). For now, it seems the pair’s bullish trend, which has seen it rally from lows under 1.3200 as recently as mid-December (a more than 2.5% rally), remains intact. Providing there isnt a sharp downturn for the pair in the coming days, GBP/USD’s 21DMA should cross to the north of its 50DMA, which may increase short to medium-term buying interest in the pair.

GBP/USD was primarily driven by risk appetite and USD flows on Tuesday. Regarding the former, risk appetite remains positive, as emphasises by the recent rallies in long-term developed market government bond yields to price in a more optimistic economic outlook for 2022 and beyond, which seemed to aid GBP on the day. Indeed, risk-sensitive sterling was the second-best performing G10 currency on the day after AUD, perhaps aided by the fact that UK PM Boris Johnson continues to signal that a tightening of lockdowns is not at present needed to curb Omicron transmission in the UK.

The pair was also given a helping during US hours following mixed US economic data (headline ISM manufacturing and JOLTS Job Openings disappointed). But the data has not been interpreted as broadly altering the prevailing narrative of that the US economy is in a state of strong growth, high inflation (though this is expected to ease in 2022) and a tight labour market. This story will receive further inputs later in the week in the form of the ISM Services PMI survey and the official December jobs report, but all arrows at this stage point towards the Fed pressing ahead tightening this year. Wednesday sees the release of the FOMC minutes, which are expected to contain a hawkish bias to reflect the hawkish policy announcement, with traders on the lookout for Quantitative tightening chatter. That suggests upside risks for the USD later this week.

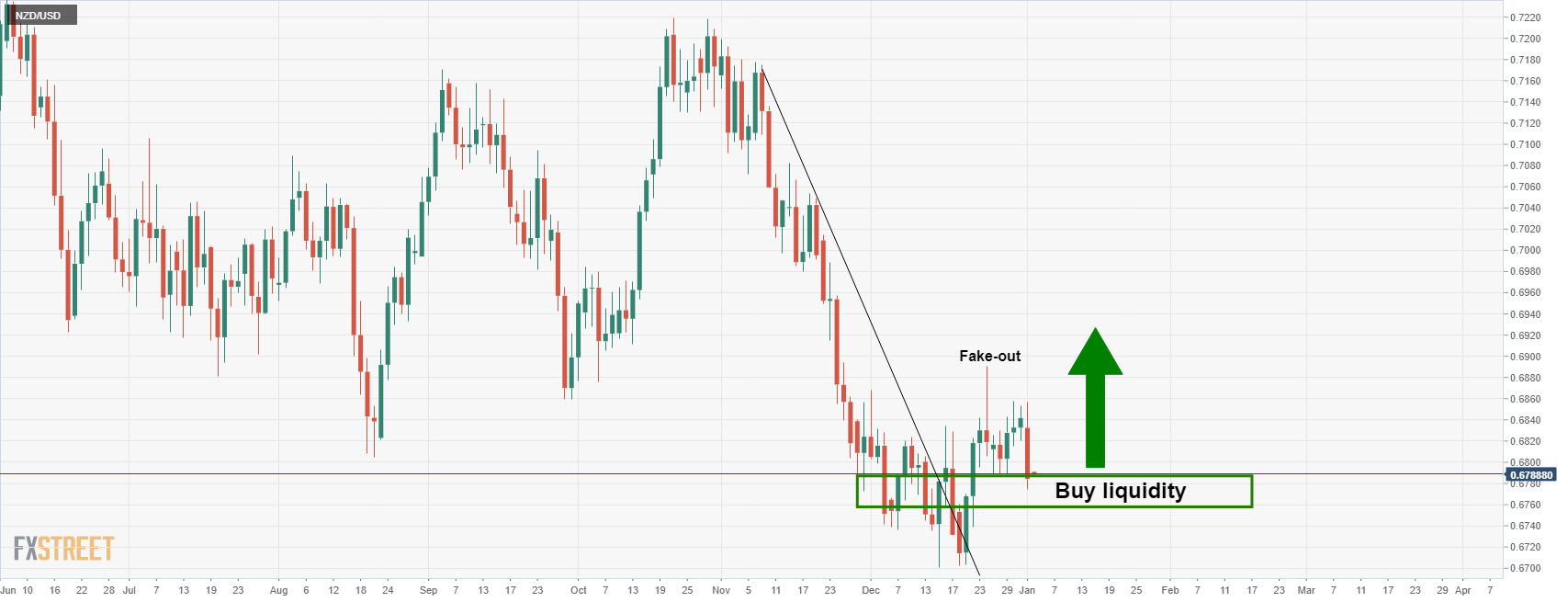

- The New Zealand dollar advances some 0.38% as the Wall Street end of the session approaches.

- US ISM Manufacturing PMI came worse than expected, but purchasers’ prices diminished 14.2 points.

- NZD/USD has a neutral-bearish bias, but failure to break above 0.6830 would open the door for further losses.

The New Zealand dollar edges slightly up during the New York session, clinging to the 0.6800 figure at the time of writing. The market sentiment is mixed, though the NZD has risen in tandem with other risk-sensitive currencies like the AUD and the GBP against the greenback, despite higher US Treasury yields, with the 10-year benchmark note at 1.66%, up to three basis points in the day.

In the meantime, an absent New Zealand economic docket, spurred by holidays in New Zealand, kept the NZD/USD pair leaning on US economic data. Meanwhile, the US economic docket featured the US Institute for Supply Management (ISM) Manufacturing PMI for December in its final reading, which came at 58.7 vs. 60 estimated by analysts, worse than expected.

Despite being poor data, the decline came at the expense of “sharp declines in delivery times and prices were key drivers of the decline and signal at least some welcome improvement in terms of diminishing inflationary pressure,” as commented by Wells Fargo analysts. Further, the analysts noted that “the biggest message from today’s report is that the prices paid component plunged 14.2 points in December.”

Therefore, once the data crossed the wires, the NZD/USD spiked to 0.6820, facing strong selling pressure and returning to the 0.6800 figure almost immediately. Rallies in the NZD/USD could be viewed as opportunities for USD bulls to position themselves as long as US T-bond yields keep rising.

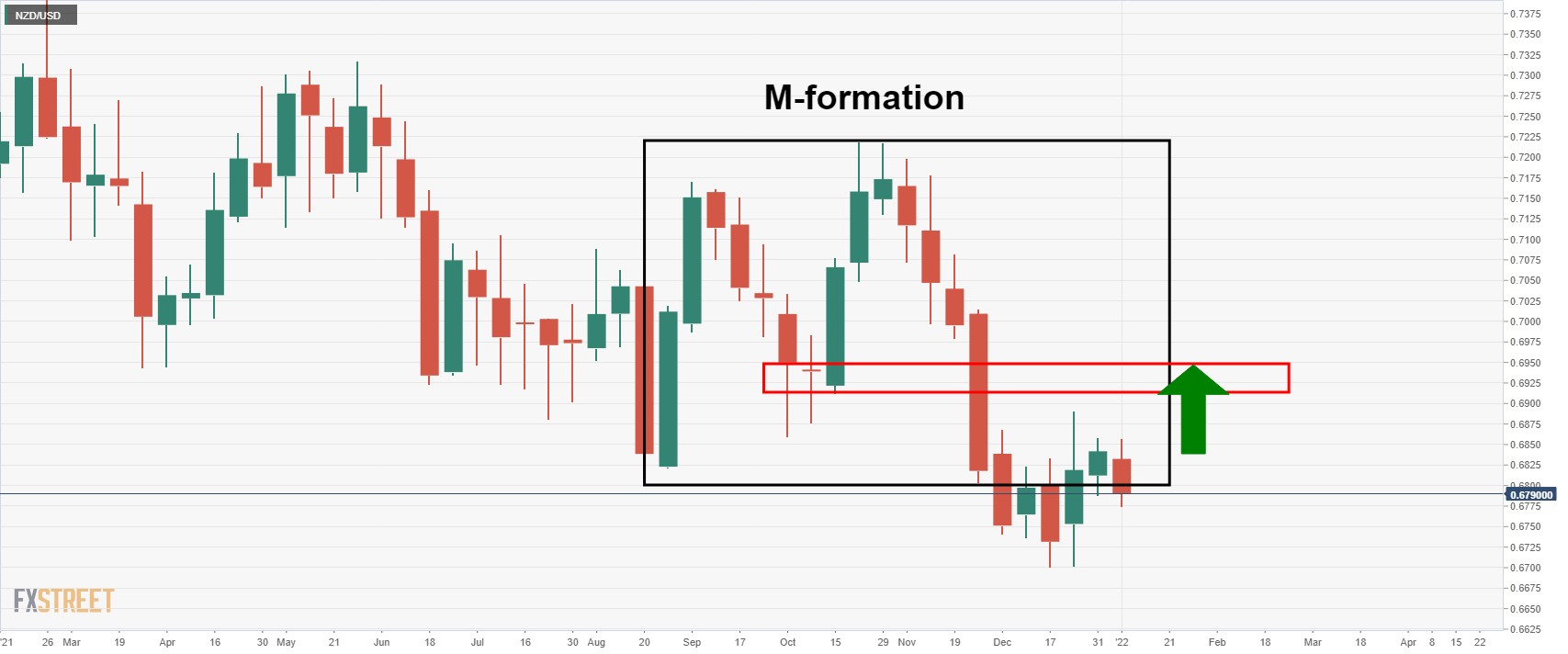

NZD/USD Price Forecast: Technical outlook

The NZD/USD 1-hour chart shows that the pair has a neutral-bearish bias, as the hourly simple moving averages (SMAs) remain above the spot price.

During the New York session, the NZD/USD upward move faced strong resistance around the 0.6820 area, retreating to the 0.6800-10 area, as NZD bulls would not be able to sustain the trend, despite poor US economic data, with the ISM Manufacturing PMI for December, falling short of expectations.

To the upside, NZD/USD’s first resistance would be the R1 daily pivot at 0.6836. A decisive break of the latter would expose the January 3 daily high at 0.6856, followed by the R2 daily pivot at 0.6888.

On the other hand, failure to break the abovementioned would open the door for USD bulls to enter fresh bets vs. the NZD, as the bond yield differential shrank as Federal Reserve tightening expectations have increased since December 2021 last monetary policy meeting.

The first support would be 0.6800. A breach of that level would expose the January 4 daily low at 0.6764, followed by the December 22 swing low at 0.6740.

- AUD/USD bears eye a run to test 0.71 the figure for the coming days.

- Bears need to break 0.7180 for a fast run to 0.7150 support.

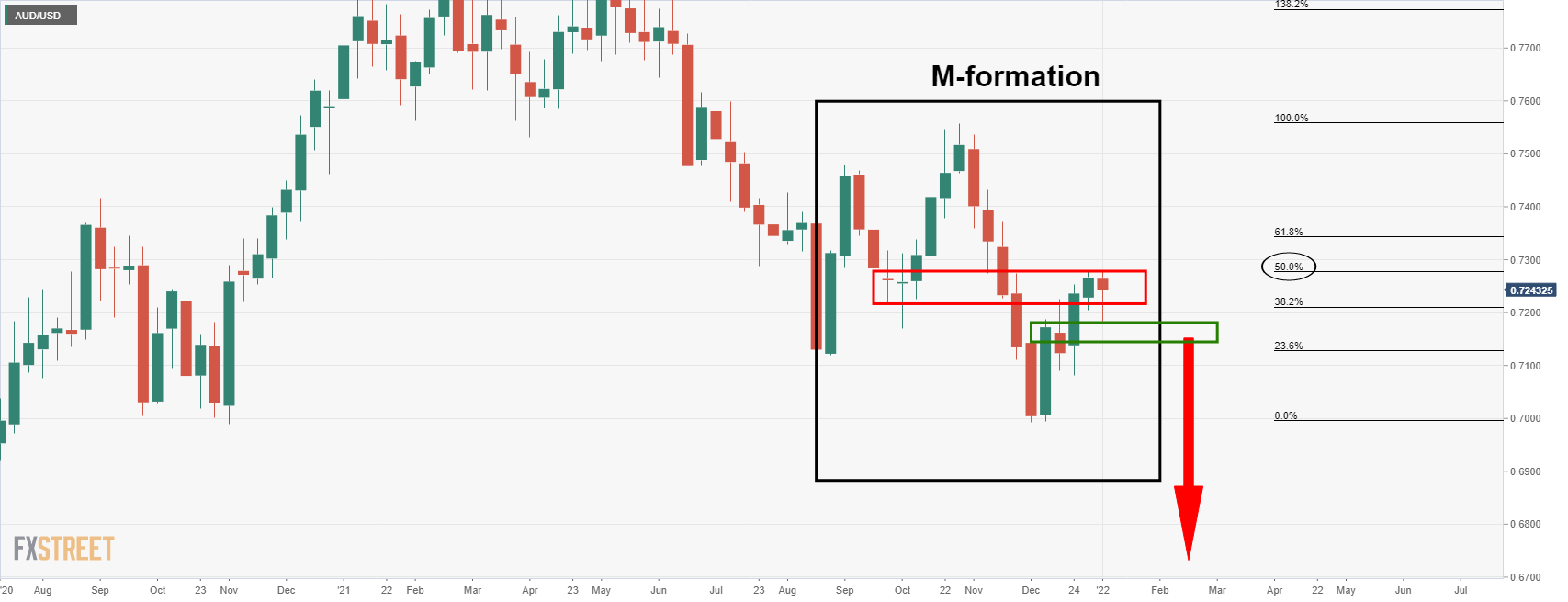

AUD/USD is correcting in a weekly and daily move that may have run its course. The following illustrates the market imbalances and structures in a top-down analysis from a bearish perspective.

AUD/USD daily chart

As illustrated, the price is attempting to rally from the trendline support within the rising channel. However, if the bulls fail to break the resistance through 0.7250, the focus could quickly shift back to the downside and bears will be looking for a downside continuation and break of 0.70 the figure as per the weekly chart:

AUD/USD Weekly chart

As illustrated, the price has met the M-formation's neckline which would be expected to act as resistance. This also has a confluence with the 50% mean reversion of the weekly bearish impulse. 0.7150 support is key in guarding against a downside continuation towards and through the weekly lows of 0.6995.

AUD/USD H1 charts

Meanwhile, from a nearer term outlook, the bears are stepping in following a recent surge to the upside that has mitigated almost all of the prior imbalance from the bearish impulse. With that being said, the bulls will be keen to mitigate all of the imbalance to towards 0.7253 which could play out as follows:

Or...

Should the bears have already gathered enough sell liquidity, then the price can easily deteriorate from here which leaves the 61.8% Fibo as the last defence ahead of a restest of the hourly lows at the dynamic trendline support near 0.7180. If that breaks, then sell stops around 0.7150 could be quickly tested exposing 0.71 the figure for a test in the coming days.

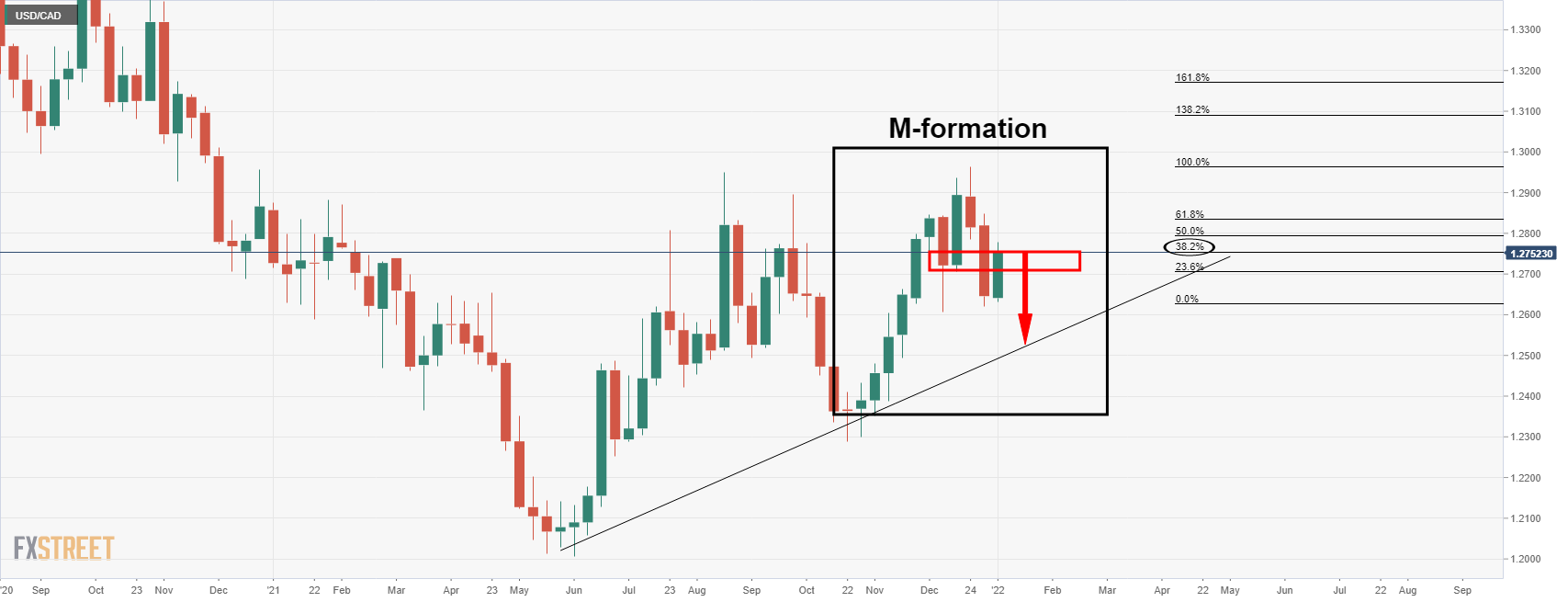

- USD/CAD has risen back to the 1.2700 level in recent trade after bouncing at the 50DMA in the 1.2660s.

- Strength in oil prices post-optimistic OPEC+ meeting has underpinned the loonie, as has a generally more risk-on FX market tone.

USD/CAD has risen back to the north of the 1.2700 level again having found support in recent trade just above its 50-day moving average at 1.2664. The pair is still trading with reasonable losses on the day of around 0.3% or just over 30 pips, as FX markets adopt a significantly more risk-on posture on Tuesday. That compares to Monday’s more defensive/risk-off bias that saw USD/CAD rally as high as 1.2780, with the 21-day moving average, which as at the time close to 1.2790, coming in to provide resistance. From a technical perspective, USD/CAD is currently locked between a 1.2660-1.2780ish range, with weekly extremes at either end of this range combined with the 50 and 21DMAs likely to act as support and resistance and make a breakout more difficult.

Oil prices hit fresh multi-week highs on Tuesday, with WTI pushing above $77.50 earlier in the session, providing support for the loonie. OPEC+’s decision to press ahead with a 400K barrel per day output hike in February amid an upbeat take on the outlook for demand seemed to instil some optimism in oil markets. There is clearly potential for more gains on the cards as market participants bid economically sensitive stocks and long-term yields higher in a vote of confidence in the economic outlook for 2022 and beyond. That suggests downside risks for USD/CAD, so bears might be looking for a test of December lows in the low-1.2600s at some point in the coming days/weeks.

But this might be a tall order as FX strategists have been noting upside risks to the dollar this week. Wednesday’s December Fed meeting minutes are likely to include hawkish chatter about the potential for quantitative tightening in 2022 once rate hikes are underway. Meanwhile, further US data later this week (ISM services PMI and the official jobs report) are unlikely to alter the prevailing narrative that the US economy is in a state of strong growth, high inflation (though this is expected to ease in 2022) and seeing a very tight labour market.

What you need to know on Wednesday, January 5:

The greenback kept advancing on Tuesday, posting the most notorious advance against the yen. USD/JPY jumped to 116.36, its highest since January 2017, as the dollar surged alongside US government bond yields. Demand for the American currency receded with Wall Street’s opening, with the dollar ending the day unevenly across the FX board.

US indexes were mixed, with the DJIA reaching a record high and holding on to gains, but the Nasdaq Composite shedding roughly 300 points. The S&P posted an all-time high but ended the day with modest losses.

US Treasury yields continued to advance. The yield on the 10-year note hit 1.686%, holding around 1.66% at the end of the day.

The OPEC+ announced its next meeting for early February, agreed to stick to its current policy of increasing 400,000 bpd. Crude oil prices edged higher, flirting with their recent highs but retreating some ahead of the close. WTI settled at $77.00 a barrel.

Gold recovered and retained its gains by the end of the day, closing the day at around $1,814.80 a troy ounce.

The GBP/USD pair jumped to 1.3556, holding on to gains and currently trading at around 1.3550 after UK PM Boris Johnson said in a news conference that, given that the country is not seeing the same numbers in intensive care, the UK has a chance to ride out this Omicron wave without shutting down.

EUR/USD advanced as demand for the greenback reversed, but it was unable to hold on to gains and settled at around 1.1290. Commodity-linked currencies posted gains vs the dollar, with AUD/USD now trading at around 0.7240 and USDCAD changing hands at 1.2700.

Europe keeps reporting record coronavirus contagions, as the Union is in the middle of the peak of the Omicron wave. The number of deaths and hospitalizations is still low, but there’s some disruption in day-to-day activity amid the mandate to isolate those suffering the illness. Meanwhile, France announced the discovery of a new coronavirus variant, IHU, with has more variants than Omicron.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto market forms multiple bear traps, bullish reversals incoming

Like this article? Help us with some feedback by answering this survey:

- The growth stock-heavy Nasdaq 100 index is sharply underperforming on Tuesday amid a sharp rise in long-term US rates.

- The yield rally reflects a pumping of economic optimism that is lifting “value” and “cyclical” stocks, helping the Dow higher.

- The net result for the S&P 500 is that it has dipped back under 4800 again.

The main news in US equities on Tuesday is rotation from growth stocks into value. The tech-heavy Nasdaq 100 index, which is seen by many as a proxy for growth, has come under heavy selling pressure on Tuesday, dropping around 2.0% from around 16.5K to the 16.15K area. The valuation of so-called growth stocks, which include many big tech names, is disproportionately dependent on expectations for future earnings growth rather than current earnings. Thus, growth stock valuations are disproportionately negatively exposed to a rise in long-term interest rates, which increases the opportunity cost of betting on future earnings growth as opposed current earnings.

And an increase in long-term interest rates is exactly what is being seen on Tuesday. US 30-year yields are up 6bps to around 2.07%, their highest level in months, while 10s are up just nuder 4bps to above 1.65% and near Q4 2021 highs. As a result, big names like Apple, which surpassed $3T in market capitilisation on Monday (the first stock to do so), is down 1.3% on Tuesday, Amazon is down 2.2%, Microsoft is down 2.4%, Alphabet is down 0.7%, Facebook is down 1.2% and Tesla is down 4.7%.

The increase in long-term yields this week which has seen US 10s rally 15bps and 30s 17bps in just two days is a reflection of a sharp increase in optimism about the outlook for the US economy in not just 2022, but the years beyond. That means stocks more exposed to the health of the economic cycle (as their valuation disproportionately depends on current earnings) have been performing well. The Dow, seen by some as a proxy for so-called “value” or “cyclical” stocks as it gives a higher weighting to financial, industrial, material and energy names, is up 0.6%.

The net result for the S&P 500 is that it is down about 0.2% and trading close to the 4780 level, having printed record intra-day highs just under 4820 earlier in the session. Mixed US economic data has largely been ignored and has not been interpreted as broadly altering the prevailing narrative that the US economy is in a state of strong growth, high inflation (though this is expected to ease in 2022) and a tight labour market. This story will receive further inputs later in the week in the form of the ISM Services PMI survey and the official December jobs report, but all arrows at this stage point towards the Fed pressing ahead tightening this year. Wednesday seen the release of the FOMC minutes, which are expected to contain a hawkish bias to reflect the hawkish policy announcement, with traders on the lookout for Quantitative tightening chatter.

- The British pound surged in the New York session up 1.03%.

- The GBP/JPY Tuesday’s upward move stalled near the R3 daily pivot.

- The GBP/JPY has an upward bias as GBP bull’s eye the 2021 year-high.

In the New York session, the British pound rallied against the Japanese yen, trading at 157.08 at the time of writing. A risk-on market mood spurred demand for risk-sensitive currencies like the GBP to the detriment of safe-haven peers like the JPY.

Since the overnight session, the cross-currency was seesawing around the daily pivot point at 155.42, then rallied sharply, breaking the R1, and R2 daily pivot levels, stalling at 157.43, 8-pips short of the R3 daily pivot at 157.51.

In the meantime, the daily moving averages (DMAs) reside below the 153.00 figure, with the 50-DMA being the closest to the spot. At the same time, the 100-DMA is about to cross over the 200-DMA, which would be another bullish signal that could send the GBP/JPY rallying towards the 2021 year-high at 158.22.

Upwards, the path of least resistance for the GBP/JPY as witnessed by the price action first resistance level would be 157.50. A breach of the latter would expose crucial supply zones, like 158.00, followed by the 2021 high at 158.22.

On the other hand, the cross-currency first support level would be the May 28 daily high, previous resistance-turned-support at 156.06, followed by June 23, 2021, daily high at 155.15, followed by the psychological 155.00

GBP/JPY Daily chart

-637769200467369064.png)

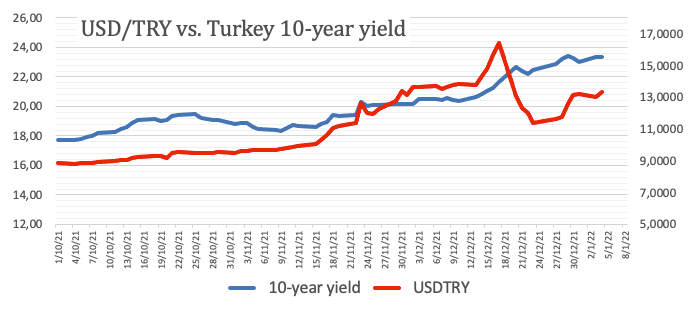

- USD/TRY bears are stepping in at a critical level of resistance on the daily chart.

- TRY could find further stability as we approach planned elections scheduled for no later than mid-2023.

The price has hit a crossroads according to the technical structure of the market and recent price action. The following illustrates this from a daily perspective taking into consideration the prior volumes of transactions conducted just below 14 the figure and the confluence of the 38.2% Fibonacci retracement level as follows:

USD/TRY Daily chart

-637769183713608855.png)

As illustrated in the above chart, the price has made a classic bearish impulse followed by a decelerating correction into a key zone of resistance. The price action has been driven by central banking fundamentals and uncertainties in that regard persist due to the unprecedented course of action by Turkish officials combatting the highest levels of inflation since 2002, (Turkey's consumer price inflation jumped to 36.08 per cent year-on-year in December 2021, up from 21.31 per cent in the previous month).

Most central banks raise interest rates to help cool inflation but Turkey has gone the other way. In a speech on Monday, he said Turkey was "going through a transformation in economy and rising to the next league".

Given that Tayyip Erdogan prioritises exports over currency stability, there is going to be more volatility and inflation risks ahead as the central bank is unlikely to act. Mr Erdogan overhauled the central bank's leadership last year. The bank has already slashed rates to 14 per cent from 19 per cent since September despite the central bank's official inflation target being just 5 per cent.

The further Erdogan digs a hole for himself, the lira could find further stability as we approach planned elections scheduled for no later than mid-2023. The economic turmoil has already started to hit President Erdogan's opinion poll ratings as Erdogan's scheme to curb the lira's weakness has been seen to fail.

- Spot silver jumped back above $23.00 on Tuesday despite a sharp upside in US real yields.

- Precious metals seemingly took advantage of a weakening dollar (against most of its G10 peers) after underwhelming US data.

Despite a continued sharp rise in US real yields that would typically be a negative for precious metals given the increased opportunity cost associated with non-yielding assets, spot silver (XAG/USD) prices have gained ground on Tuesday. Spot prices have in recent trade rebounded back to the north of the $23.00 per troy ounce level after finding support in the $22.60s in the late European morning. Buyers came in ahead of last week’s $22.60 low and the 21-day moving average at $22.55. Short-term silver bulls will now be eyeing a test of recent highs in the $23.40 area which happen also to coincide with the 50DMA at $23.39.

Silver and other precious metals (like gold) have gained ground on Tuesday as they take advantage of dollar weakness (USD is lower against all G10 currencies aside from the euro and yen, which is keeping the DXY flat). US data seems to have net-net weighed on the buck on Tuesday after the ISM manufacturing survey showed activity slowing in December and inflationary pressures as a result of supply chain snags subsiding substantially. Meanwhile, the headline JOLTs Job Opening figure also missed expectations and there appear to be some bets mark participants making bets that this will alleviate some pressure on the Fed to tighten so aggressively this year.

The JOLTs survey did indicate a record number of people quitting their job in November, however, which is seen as one of the best indicators of a hot labour market (people confident they can “do better” than their current job). Meanwhile, the most dovish (historically) Fed member Neil Kashkari said he now sees two rate hikes in 2022, having not long ago wanted the Fed to wait into 2024 before hiking. Real yields seem to be getting the message that economic conditions, despite today’s minor data blips, still warrant some Fed tightening and the Fed seems ready to eagerly oblige.

10-year TIPS yields are above -0.95% on Tuesday, having surged from under -1.10% as recently as last Friday as traders bet on higher long-term interest rates (that will be closer to long-term inflation) as economic optimism prevails over Omicron-related pessimism. Indeed, it very much seems at this stage that Omicron is significantly milder than prior strains and its associated economic damage is far less. The rally in real yields suggests that Tuesday’s bounce in silver and gold may prove nothing more than a dead-cat bounce. If Fed tightening combined with a strong US economy in 2022 does push nominal 10-year yields above 2.0% but keep inflation expectations in check in the mid-2s%, then that means 10-year real yields are headed back towards 0.0%. That suggests substantial downside for precious metals like silver from current levels. Medium-term bears will be looking for XAG/USD to test recent lows in the $21.00s in the coming weeks.

- The single currency slides for the second consecutive day, down some 0.04%.

- US Treasury yields extend their weekly rally, with the 10-year closing to the 1.70% threshold.

- EUR/USD has a downward bias in the near term, as the upward move stalled around the hourly 50, 100, and 200-SMAs, retreating below the 1.1300 figure.

The EUR/USD extends its losses to two days, trading at 1.1292 at the time of writing. The greenback continues to benefit against the low-yielder euro by rising US Treasury yields, led by the 10s, the 20s, and 30s, rising between 5 to 7.5 basis points, sitting at 1.682%, 2.1180%, and 2.090%, respectively.

That said, the buck rebounded after dipping during the London fix, as low as 96.03, flat during the day, at 96.24. Despite the lack of movement of the greenback, market participants begin to position for at least three-rate hikes as portrayed by US money market futures, expecting the first lift-off once the bond-taper ends by March of 2022.

Minneapolis Fed Kashkari (FOMC 2022 voting member) eyes two rate hikes in 2022

European Central Bank Governing Council Member and Head of the Banque of France Francois Villeroy and Minneapolis Fed President Neil Kashkari crossed the wires in the last couple of hours. In the case of Francois Villeroy de Galhau, he said that inflation in France is “now close to its peak and in the euro area.” Additionally said that “we believe that supply difficulties and energy pressures should gradually subside over the course of the year.” His remarks came after Fresh France HICP showed an increase of 3.4% in the annual base inflation, a 13-year high.

In the meantime, Neil Kaskari said that he nows sees two rate hikes in 2022. He expects the first rate hike to be met after the April 2022 economic data is released, signaling his support for a May rate hike.

EUR/USD Price Forecast: Technical outlook

The EUR/USD 1-hour chart shows that bears are in control, as portrayed by the simple moving averages (SMAs) residing above the spot price. Indeed the aforementioned stalled the upward move from 1.1276 up to 1.1320s, as EUR bulls failed to capitalize good macroeconomic data, hurt by technical indicators, alongside the interest rate differentials between the Federal Reserve and the ECB.

On the downside, the first support would be the January 3 daily low at 1.1280. A break under that level could send the pair tumbling towards the S1 daily pivot at 1.1259, intersection with an upslope trendline drawn from the November cycle lows up to the December ones.

- EUR/GBP bears are on the verge of a test of the critical weekly support area.

- Covid risks abate which is helping to keep GBP elevated.

EUR/GBP is on the verge of a downside extension as it takes on critical support in the lows of the day near 0.8335. The pair has fallen some 0.4% from a high of 0.8395 on the day so far. The pound, often regarded as a risk currency, has benefited from a risk-on environment at the start of the week as full markets return.

Omricon variant risks abate

One of the main contributors to the risk-on mood, helping to keep stocks elevated around the world, is down to the improved sentiment surrounding covid-19 and the Omricon variant. Early laboratory studies show the more transmissible variant replicates less efficiently once inside the lung tissue. Plus, will we need second boosters, and how to manage COVID at home.

In the UK specifically, no new measures are needed in Britain to fight the variant, which is "plainly milder" than earlier forms of the coronavirus, Prime Minister Boris Johnson said at the start of the week. This has given the pound a much-needed boost.

"The way forward for the country as a whole is to continue with the path that we are on," he told broadcasters. "Of course, we will keep all measures under review, but the mixture of things that we are doing at the moment is I think the right one."

UK data mixed

meanwhile, Britain’s manufacturers have suffered a fall in export demand. The weight of Covid risks and lockdowns as well as the uncertainties surrounding Brexit are impacting. This was according to fresh data that shows supply chain disruption and staff shortages held back the economy in December.

IHS Markit and the Chartered Institute of Procurement and Supply (Cips) showed growth in UK factory output was limited last month. According to the survey of 650 manufacturers, a key measure of for the Bank of England for early warning signs from the economy, inflows of new work from overseas dropped for the fourth month in a row. Meanwhile, the Final December Manufacturing PMI came in at 57.9 vs. 57.6 preliminary. Final services and composite PMIs will be reported Thursday as the next key gauge.

''We may have to wait until January to get a cleaner read on the U.K. economy but we see headwinds ahead from Brexit (still!), energy shortages, and both fiscal and monetary tightening,'' analysts at Brown Brothers Harriman explained.

Brexit saga continues

As for Brexit, Between January 4 and January 6, there are very important meetings to begin the legal process against the UK which is going to be a weight to the pound.

Moreover, the City AM reported today that ''many British businesses may “give up importing” as a result of new strict rules that came into force on Saturday, on 1 January, a former senior civil servant in charge of Brexit planning has warned.''

''Philip Rycroft, who was permanent secretary at the Department for Exiting the European Union (DExEU) between 2017 and 2019, said the changes that came into play on January 1 will cause 'teething problems, with some sectors hit harder than others.

With the introduction of new barriers to trade with the bloc, Rycroft said businesses may decide it 'is simply not worth the hassle'.''

Additionally, the row regarding fishing rights continues. This will now be likely be referred to a court, where a negative ruling could result in retaliatory measures such as tariffs. This will not go down well in the land of GBP forex as uncertainties will remain. ''While the matter appeared to have been somewhat settled with the issuance of additional fishing licenses to the EU, reports suggest French fishermen are still waiting for 73 of them to be handed out by the UK,'' analysts at Brown Brothers Harriman explained.

EZ inflation data eyed

The biggest event for the eurozone will be the inflation readings. ''Like in Germany, both energy prices and re-weighting issues are likely to weigh on December's inflation figures,'' analysts at TD Securities explained.

''We think underlying core price momentum is a bit stronger than the consensus, though, yielding a stronger core inflation figure. For headline inflation, we expect a bigger drag from energy prices than the consensus.''

EUR/GBP technical analysis

Meanwhile, from a technical standpoint, the price is on the verge of a test of critical weekly support:

Things to note as per Reuters ''Buzz'' analysis:

- Seasonal pattern: EUR has only closed up in Jan 5 times in last 20-years;

- Cross could also complete a fifth consecutive bear week;

- Increasing bearish momentum and lower RSI readings confirming latest drop;

- Next significant support from 2020 and 2019, 0.8282 and 0.8278 respectively;

- Upside squeeze point a long way off at 0.8598;

UK PM Boris Johnson said in a news conference in Downing Street that, given that we are not seeing the same numbers in intensive care, we have a chance to ride out this Omicron wave without shutting down. Johnson noted that the UK is in the midst of the fastest growth of Covid-19 cases that has ever been seen and that the battle with Covid-19 is over, meaning now is a moment for utmost caution. However, we can find a way to live with the virus, he said, adding that while the weeks ahead will be tough, if we all play our part, the disruptions caused can be less severe than locking down.

Johnson said the government is identifying hospital trusts that might need military staffing support (given high numbers of staff in self-isolation after testing positive) and is recommending to his cabinet that the UK continue with plan B. Further restrictions will depend on when Omicron peaks and how it bows through, Johnson said. His chief scientific advisor Patrick Valance said that up until now, Omicron has largely been an infection of the young and the effect is unknown as it moves up the age brackets.

Market Reaction

UK PM Johnson's decision not too toughen restrictions was widely expected and thus has not triggered any reaction in GBP.

The central bank of Denmark presented its December numbres. Analysts at Danske Bank point out the Danmarks Nationalbank (DN) resumed intervention with the second highest monthly purchases ever.

Key Quotes:

“The big news in today's release was the significant FX intervention that took place in December. It was the second highest monthly FX intervention purchase on record only surpassed by the rally into DKK in January 2015. We have been arguing that DKK strength in December and subsequent need for FX intervention was mainly due to year-end tightness in the DKK money market. The size of the inflow to the FX reserve means it was likely coupled with investor rebalancing flows.”

“The large inflow to the FX reserve will likely fuel speculation that another unilateral rate cut is coming in Denmark. However, we do not want to rush to conclusion.”

“Downwards pressure on EUR/DKK spot has eased to start the year and if the need for intervening in FX markets has ended for now, DN will probably draw the same conclusion as us and stay put on interest rates. Hence, we stick to our view that DN will keep policy rates unchanged despite the sizeable FX intervention in December.”

“The biggest sequential drop in more than a decade for the prices paid component and shorter wait times for desperately needed supplies were the two primary drivers of the 2.4 point decline in the ISM manufacturing index to 58.7 in December”, explained analysts at Wells Fargo.

Key Quotes:

“The drop in December's ISM manufacturing index to 58.7 from 61.1 in November masks what we see as a still strong demand environment in the factory sector. Sharp declines in delivery times and prices were key drivers of the decline and signal at least some welcome improvement in terms of diminishing inflationary pressure and incremental strides with supply chain issues.”

“We still expect inflation to remain stubbornly high and above the Fed's target rate, but it will at least be slowing on a year-over-year basis.”

“The biggest message from today's report is that the prices paid component plunged 14.2 points in December. Not only was that the largest drop of any sub-component, it also marks the biggest monthly drop in the prices paid measure in over a decade. Make no mistake, at 68.2 prices are still rising, but it is no longer the scorching hot 82.4 reading seen in November.”

“Even though the primary drivers of the decline were in categories that will likely bring relief to the manufacturing sector, the headline decline was also driven to a much smaller extent by new orders and production, both of which slipped in December.”

- The USD/CHF slides some 0.32% in the New York session.

- The Swiss franc benefitted from weak US ISM Manufacturing PMI, gained some 50 pips.

- The USD/CHF has a neutral bias, as the DMAs remain horizontal, around the 0.9170-0.9220 area.

At the time of writing during the New York session, the USD/CHF slides, trading at 0.9159. A mixed-market mood, as portrayed by US stock indices fluctuating between gainers and losers, while the greenback gave back early gains, with its US Dollar Index grinding lower down some 0.16%, sitting at 96.06.

In the overnight session, the USD/CHF remained trading in a narrow range of 0.9170-0.9185 to react to poor US macroeconomic data, which showed that the Institute for Supply Management (ISM) Manufacturing PMI rose to 58.7, lower than the 60 estimated by analysts.

Market participants sold the US dollar, spurring a 50-pip drop in the pair, near the S1 daily pivot point at 0.9130.

In the meantime, US Treasury yields keep advancing, with the 10-year benchmark note up some four and a half basis points, at 1.675%, failing to underpin the USD/CHF, which benefitted from safe-haven flows.

USD/CHF Price Forecast: Technical outlook

The USD/CHF has a neutral bias, depicted by the daily moving averages (DMAs) with a horizontal slope residing around the spot price. However, an upslope trendline drawn from December 2020 cycle lows to the June 2021 swing lows provided support, as the downward move pierced the aforementioned, rebounded strongly towards the 200-DMA around 0.9171.

To the upside, the first resistance would be the 200-DMA. A breach of the latter would open the door for a confluence of the 50 and the 100-DMA around 0.9205-15 area, that once broken would open the door towards the December 15 cycle high 0.9294, and then the 0.9300 figure.

On the other hand, a decisive break under the 0.9150 figure would open the door for 0.9100, followed by the November 2 swing low at 0.9085 and then the psychological 0.9000.

-637769122175519634.png)

- US data below expectations, on Wednesday ADP and FOMC minutes.

- DXY turns positive again, holds above 96.00.

- USD/CAD holds a bearish tone but again rejected from under 1.2700.

The USD/CAD pair bottomed at 1.2666 and rebounded back above 1.2700, as the US dollar jumps from instance weakness to strength in a few minutes. Higher US yields continue to be a key driver of USD strength. At the same time, higher equity prices limit gains.

US still strong, data below expectations

The greenback remains with momentum amid higher US yields that reached again multi-month highs. Economic numbers from the US came in below expectations on Tuesday. The ISM Manufacturing Index came in at 58.7 in December below the 60.2 of markets consensus and under the 61.1 of the previous month. On Wednesday, the ADP employment report is due and later the Federal Reserve will release the minutes of the last FOMC meeting.

In Canada, economic figures showed the Industrial Product Price Index rose 0.8% in November, as expected; while the Raw Material Price Index decline unexpectedly 1%. A different report showed the Markit Manufacturing PMI dropped in December to 56.5 from 57.2, and against the 57.5 of market consensus. The numbers had o significant impact on the loonie.

The USD/CAD continues to move with a bearish bias, but again it was rejected from under 1.2700. A recovery above 1.2770 should negate the negative tone. A consolidation in the short term below 1.2680 should expose the recent low.

Analysts at Brown Brother Harriman point out that the Canadian dollar was the only major currency to post gains against the dollar in 2021, “but we may be in for a period of underperformance to start off 2022. For USD/CAD, a break above 1.2835 is needed to set up a test of the December high near 1.2965.”

Technical levels

According to Reuters, Bank of France head and ECB governing council member Francois Villeroy de Galhau said on Tuesday that inflation "is now close to its peak in our country (December showing first signs of stabilisation) and in the euro area". "While remaining very vigilant," he added, "we believe that supply difficulties and energy pressures should gradually subside over the course of the year".

His remarks come after the release of flash French HICP figures on Tuesday which showed YoY inflation remaining at 13-year highs of 3.4% in December. The French central bank thinks inflation will end 2022 under 2.0%.

Market Reaction

The euro has not reacted to Villeroy's latest remarks.

In a post on Medium, Minneapolis Fed President and 2022 voting FOMC member Neil Kashkari said on Monday that he now sees two rate hikes in 2022. That is a switch from his previous forecast for now rate hikes until 2024, he said in the post. He warned in the post that the costs of ending up in a high-inflation regime outweigh the costs of ending up in a low-inflation regime. He expects the threshold for first-rate hikes to be met after the April economic data is released, indicating his potential support for a May rate hike.

Market Reaction

Despite Kashkari, who will be a policy voter in 2022, being known as one of the most dovish Fed members, his "hawkish shift" has not impacted FX markets.

- The DXY has dipped back to near the 96.00 level in wake of the latest US data, erasing early gains.

- The latest ISM manufacturing report fell to 58.7 in December from 61.1 driven by a drop in prices paid.

The DXY has dipped into negative territory on the day in recent trade and is probing the 96.00 level in wake of the latest batch of US data. The index, which is a trade-weighted basket of major USD currency pairs, now trades about 0.15% lower on the day and is about 0.4% lower versus its earlier peaks near 96.50.

It’s latest decline has seen it slip back to the south of its 21-day moving average, which currently resides around the 96.20 level and the bears will be eyeing a test of last week’s lows in the 95.50s should the 96.00 level be broken. Support in the form of the 50DMA at 95.65 is notable, which the level having been associated with good buying interest in the recent past.

US data weighs on the DXY

The latest ISM manufacturing report fell to 58.7 in December from 61.1 in November, below the expected 60.0 and its lowest reading since January 2021. The decline was in part driven by a substantial drop in the prices paid subindex, which slumped to 68.2 from 82.4 in a sign of easing supply chain snags. That marked the lowest reading for the index since November 2020 and was the largest MoM drop in the index since March 2020. Elsewhere, the new orders remained robust above 60.0 and the employment index rose to 54.2 from 53.3, its highest reading since April, in a good omen for Friday’s employment report.

Meanwhile, the latest JOLTs report for November showed a fall to 10.562M job openings from more than 11M in October. However, the report showed a rise in quits in high-end, white-collar jobs, as well as in the hospitality sector, which well-known Fed watcher and chief US economist at SGH Macro said was consistent with increasing wage pressure at the higher ends of the employment spectrum.

The headline miss in the JOLTs report coupled with the deflationary signal encapsulated by the sharp drop in the prices paid ISM subindex seem to have been enough to weigh on the DXY intra-day. This may be because traders might interpret the data as indicating the US labour market isn’t as hot as assumed and that inflation may come down sooner rather than later as supply chains problems ease, combining to exert less pressure on the Fed to tighten monetary policy as swiftly.

- Gold rises on Tuesday despite higher US yields.

- XAU/USD manages to hold above 1800$, more gains could lead to a test of 1830$.

Gold prices are rising on Tuesday after strengthening during the American session even as US yields remain high. XAU/USD held above 1800$ and recently climbed to 1814$, reaching a fresh daily high. Gold is trimming Monday’s losses and is attempting to recover levels above 1815$.

If the bounce to the upside in gold continues, the next level to watch is the 1830$ resistance area (interim resistance at 1823$). A close clearly above 1830$ would suggest more gains ahead for the metal. On the flip side, a slide under 1800$ should increase the bearish pressure, targeting 1790$.

The move higher has been driven by an improvement in risk sentiment and also by a broad-base US dollar decline during the American session. The DXY reversed from weekly highs and is now slightly above 96.00, down 0.15% for the day.

Economic data from the US came in below expectation with the December ISM Manufacturing Index at 58.7 below the 60.2 expected and under the 61.1 of the previous months. On Wednesday, the ADP employment report is due and also the Fed will release the minutes from its latest FOMC meeting. The key event will be n Friday with the Non-farm Payroll report.

Technical levels

- The British pound pares Monday’s losses, up some 0.40%.

- The US Dollar Index advances for the second consecutive day of 2022 but fails to boost the greenback vs. cable.

- US T-bond yields march firmly towards the 1.70% threshold.

- GBP/USD is tilted to the downside and will face strong resistance around the 1.3550-70 area.

The British pound advances for the first time of the week, trading at 1.3525 at the time of writing. European stock indices and US equity futures portrayed an upbeat market mood, Covid-19 Omicron variant woes wane, while investors assess US central bank tightening in the year, as shown by money market futures expecting three rate hikes in 2022.

In the overnight session, the GBP/USD dipped as low as 1.3460, immediately bouncing off Tuesday’s daily low and pushing through the 1.3500 figure, stalling the upward move around the R1 daily pivot point at 1.3531.

In the meantime, the US Dollar Index, which tracks the greenback’s performance against a basket of its rivals, advances 0.11% sits at 96.32. That happens on the back of rising US 10-year Treasury yields, closing to the 1.67% threshold, underpinning the greenback, whereas the GBP/USD pair pares Monday’s losses on the back of risk appetite, and probably the US hitting a million of Covid-19 cases on Monday, as the country gets struck by the Omicron variant wave.

During the European session, the UK economic docket featured the Markit/CIPS Manufacturing PMI for December, which came at 57.9, lower than the 57.6 estimated by analysts.

Some minutes ago, in the US economic docket, the Institute of Supply Manufacturing reported that the Manufacturing PMI for December in its final reading came at 58.7, lower than the 60 estimated by analysts. At the same time, the JOLTS Job Openings came at 10.562M, lower than the 11.075M.

The market reacted to the upside at the data, jumping some 11 pips, short of the confluence of the 50-DMA and a downslope bearish trendline.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is in a downtrend, as depicted by the daily chart, though the trend paused slightly. At press time, the pair is trapped within the 50 and the 100-day moving averages (DMAs) with the shortest time-frame one below the longer time frame. In fact, the 100-DMA intersects with a downslope trendline drawn from May 2021 cycle highs, which lies around 1.3558, which would be a difficult resistance area to overcome.

In the event of breaking above the aforementioned, the following line of defense for USD bulls would be 1.3600. A break above that level would expose the November 4 daily high at 1.3698, followed by the 200-DMA at 1.3743.

On the flip side, the first support would be 1.3500. The breach of the latter could pave the way for further downside action, with the January 3 daily low at 1.3431, followed by the 50-DMA as the first support at 1.3408.

- EUR/USD slips back to the 1.1270 area on Tuesday.

- Higher yields support another bullish move in the dollar.

- US ISM Manufacturing came at 58.7 in December.

The European currency remains under pressure and drags EUR/USD to fresh multi-day lows in the 1.1275/70 band on Tuesday.

EUR/USD weaker on US yields, wait for data

EUR/USD is down for the second straight session and extends the pessimism seen at the beginning of the week/year, always on the back of the strong resumption in the preference for the greenback.

Indeed, the dollar regained upside momentum in response to the acute rebound in US yields across the curve, where the 10y benchmark note manages to approach the 1.70% barrier and the 30y bond trades well above the 2.00% yardstick.

In the calendar, German Retail Sales expanded at a monthly 0.6% in November and contracted 0.2% over the last twelve months, while the Unemployment Change dropped by 23K people and the jobless rate ticked lower to 5.2, all for the month of December.

In the US docket, the ISM Manufacturing surprised to the downside at 58.7 last month.

EUR/USD levels to watch

So far, spot is losing 0.08% at 1.1285 and faces the next up barrier at 1.1386 (monthly high November 30) followed by 1.1464 (weekly high Nov.15) and finally 1.1520 (200-week SMA). On the other hand, a break below 1.1272 (weekly low Jan.4) would target 1.1221 (weekly low Dec.15) en route to 1.1186 (2021 low Nov.24).

- There were 10.562M job openings in November, less than the 11.075M expected.

- The weaker number seemed to weigh on the dollar a tad at the time.

The number of job openings on the last business day of November fell to 10.562 million, the US Bureau of Labor Statistics announced in its latest Job Openings and Labor Turnover Summary (JOLTS) on Tuesday. This reading came in below market expectations for 11.075 million and was lower versus October's 11.091 million reading, which had been revised up from 11.033 million.

Market Reaction

The DXY saw some negative ticks in the wake of the headline misses in the ISM manufacturing and JOLTs reports.

- ISM PMI fell to 58.7 in December from 61.1 in November, below the expected 60.0, its lowest since January 2021.

- The price paid subindex saw its largest drop since March 2020 to 68.2 from 82.4.

According to a survey compiled by the Institute of Supply Management, US Manufacturing PMI fell to 58.7 in December from 61.1 in November. That was lower than the expected reading of 60.0 and was the lowest reading since January 2021, when it also came in at 58.7.

In terms of the sub-indices, in a good omen for Friday's official December labour market report, the employment subindex rose to 54.2 from 53.3, which is its highest reading since April 2021. The new orders index eased slightly to 60.4 from 61.5 in November. The prices paid subindex, in a sign of easing supply chain snags, slumped to 68.2 from 82.4. That marked the lowest prices paid index reading since November 2020 and was the largest MoM drop in the index since March 2020.

Market Reaction

The DXY seems to have slipped a tad after the headline ISM and JOLTs numbers missed, but also given the sharp decline in inflationary pressures as indicated by the large drop in the ISM prices paid index. It still trades in the 96.20s and slightly higher on the day.

- EUR/JPY has rallied above 131.00 on Tuesday as Eurozone/Japan rate differentials widen amid Omicron-optimism.

- Should risk-on market conditions continue, a continued push towards Q4 2021 highs in the mid-133.00s is likely.

Amid broad yen weakness following a recent widening in G10/Japan rate differentials, EUR/JPY has rallied on Tuesday to its highest levels since mid-November above the 131.00 mark. At current levels close to 131.20, the pair is up about 0.7% on the session, its best such on-the-day gain since early December. Yields in Europe have rallied this week in tandem with yields in the US as market participants broadly price in a stronger outlook for the global economy in 2022 and beyond as Omicron-related fears subside. Omicron seems to be decisively “weaker” than delta, which it seems likely to replace as the dominant Covid-19 strain, and is three times less likely to result in hospitalisation. Moreover, these hospitalisations seem significantly less severe, something the UK vaccine minister recently said.

The 10-year German yield is above -0.15% and eyeing a test of post-pandemic highs above -0.10%, meaning it is up about 4bps on the week and over 25bps since the December lows. Japan 10-year yields, meanwhile, are only up 2bps on the week and about 6bps from the December lows, given that (as ever) they remain pinned close to 0.0% by the BoJ’s ongoing Yield Curve Control (YCC) programme. The recent approximate 20bps upwards shift in German/Japan rate differentials since mid-December as a result of the market’s surge in risk appetite in recent weeks has been a key driver of EUR/JPY’s rally from last month’s lows in the 127.50 area.

At current levels above 131.00, the pair is up more than 3.0% versus these recent lows. If optimism about the global economic outlook this year continues to grow, EUR/JPY may soon look to challenge its Q4 2021 high in the mid-133.00s, or perhaps even the 2021 highs just above 134.00. Though the ECB remains a long way from hiking interest rates, its rate of monthly QE buying is set to decline substantially in 2022 versus no change expected to the BoJ’s flagship YCC QE programme. QE policy divergence could well offer EUR/JPY longer-term support.

EUR/USD is trading back under 1.13. In the view of economists at Scotiabank, Italian politics is set to weigh on the common currency.

The 1.1275/85 zone to stand as intermediate support

“The Italian lower house announced today that voting on a new Italian president will start on January 24th, with Draghi possibly pulled away from the PM office. Political uncertainty in Italy has widened the spread of Italian over German 10-yr yields to around its highest since November 2020 and is set to weigh on the EUR for the next few weeks, at least, while the ECB/Fed divergence backdrop continues to pull the currency lower over the medium-term.”

“The 1.1275/85 zone will stand as intermediate support ahead of 1.1220/35 that stands before a test of the 1.12 zone.”

“EUR/USD now faces resistance in the mid-1.13s with ~1.1365 and ~1.1385 following (50-day MA at 1.1369 is the mark to beat on a closing basis).”

According to IHS Markit, Canadian Manufacturing PMI fell slightly to 56.5 in December from 57.2 in November. That was less than the expected decline to 57.5.

IHS Markit comments:

"Canadian manufacturers closed 2021 with a robust expansion in operating conditions as the sector continues to reap the benefits of strong domestic and international demand. Moreover, anticipation of greater customer orders encouraged firms to stockpile at record rates during December."

"Whilst on the whole latest data are positive, it is difficult to ignore the impacts of the pandemic on the sector. Over the last year or so, material shortages have been prominent, and whilst production has continued to expand, the latest uptick was the softest for ten months. In addition, another marked rise in backlogs suggests persisting skill shortages."

"News of the Omicron variant paired with sustained supply shortages has been a cause for concern among some Canadian manufacturers. The impacts of the new variant are still unknown, but policy-makers remain committed to containing the virus."

Market Reaction

USD/CAD did not see any notable reaction to the latest PMI survey result.

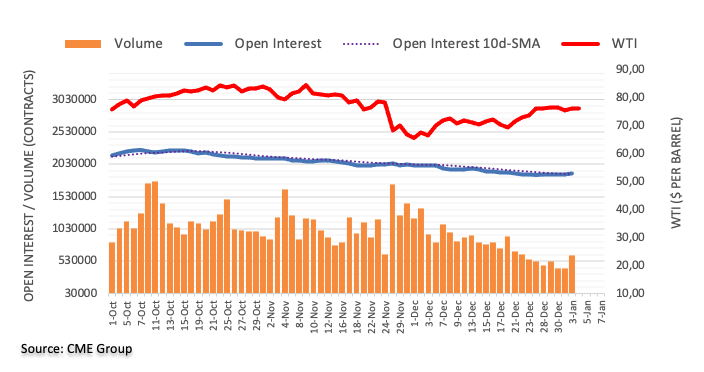

- USD/TRY fades Monday’s negative session and regains 13.00.

- The lira remains under pressure following CPI results.

- Attention gyrates to the CBRT event later in the month.

The lira gives away part of Monday’s gains and resumes the downside, motivating USD/TRY to advance further north of the 13.00 hurdle on turnaround Tuesday.

USD/TRY: Upside looks limited around 14.00

USD/TRY started the year on a negative note despite the rebound in the dollar and higher-than-expected inflation figures in Turkey published on Monday. Indeed, Turkish headline consumer prices rose 36.08% in the year to December, way above estimates, and along with an also larger-than-forecast rise in Producer Prices.

The post-CPI knee-jerk in the lira was, however, short-lived as the currency managed to regain ground afterwards and end the session with decent gains vs. the buck.

However, Tuesday contemplates a more familiar scenario for the beleaguered currency, which resumes the downward path amidst persistent dollar strength and its impact on the risk complex and the EM FX space.

Tuesday’s depreciation of the lira comes pari passu with the move higher in yields of the 10y reference bond, which hovers past the 23.00% region.

What to look for around TRY

The lira resumed the downtrend while market participants continue to digest the recent inflation figures and the government measures to promote the shift from dollars to the domestic currency. The reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation are forecast to keep the lira under intense pressure. That said, another visit to the all-time high north of the 18.00 mark in USD/TRY should not be ruled out just yet.

Eminent issues on the back boiler: Progress (or lack of it) of the new scheme oriented to support the lira. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges.

USD/TRY key levels

So far, the pair is gaining 2.55% at 13.3536 and a drop below 12.9953 (weekly low Jan.3) would pave the way for a test of 11.7343 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.8967 (weekly high Jan.3) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

- NZD/USD has failed to reclaim 0.6800 ahead of US data, with the 21DMA at 0.6788 acting as a magnet.

- The pair risks incurring further losses if optimism about the US economic outlook/prospect of Fed tightening continues to build.

NZD/USD’s failure to reclaim the 0.6800 despite multiple attempts during Asia Pacific and early European trading hours seems to have been taken as a bad omen and the pair dipped as low as the 0.6760s in recent hours. Ahead of the release of the key US ISM Manufacturing PMI for December and JOLTS Job Opening report for November at 1500GMT, the pair is in consolidation mode close to 0.6780, where it trades broadly flat on the day. That follow’s Monday’s US yield surge-fuelled tumble that saw the pair drop back from the mid-0.6800s, a 0.9% decline at the time, which was the pair’s worst performance since 17 December.

As optimism about the US economic outlook in 2022 pushes equities and yields higher there and fuels expectations that the Fed will live up to or perhaps even exceed monetary tightening expectations this year, USD upside risks are growing. That could bode poorly for NZD/USD, even if the RBNZ is well ahead of the Fed when it comes to monetary tightening. The absence of notable New Zealand data this week to spur hawkish RBNZ repricing, versus an abundance of US releases and Fed speak means risk for the pair lay to the downside. Short-term bears may be eyeing an eventual push lower to support around 0.6700.

For now, though, the 21-day moving average at 0.6788 continues to act as a magnet. One notable risk to keep an eye on for NZD/USD is whether New Zealand follows in the footsteps of Australia and endures an Omicron-fuelled surge in Covid-19 cases in the coming weeks/months. Whilst in other parts of the world this hasn’t led to a surge in critical illness and lockdowns, the New Zealand government has a track record of enacting much more forceful measures. If there is a meaningful New Zealand outbreak, it will be interesting to see whether the kiwis follow in the footsteps of the Aussie by placing their faith in the fact that the country’s high vaccination rate will protect people rather than reverting to lockdowns.

According to four sources cited by Reuters, OPEC+ has agreed to stick to its existing plan and press ahead with a 400K barrel per day (BPD) output hike in February, as hinted by sources prior to the meeting and expected by analysts/markets.

Market Reaction

Given that the decision was widely expected, it has not provoked much of an oil market reaction. WTI experienced modest selling pressure and has dropped from close to $77.00 per barrel to the mid-$76.00s, but is still trading about 50 cents higher on the day at the time of writing.

US ISM Manufacturing PMI overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result, also known as the ISM Manufacturing PMI at 15:00 GMT this Tuesday. The index is anticipated to decline to 60.2 in December from 61.1 in the previous month. Given that the Fed looks more at the labour market and inflation than growth, investors will keep a close eye on the Employment and Prices Paid sub-component.

As Yohay Elam, Analyst at FXStreet, explains: “While the manufacturing sector is small in comparison to the services one, the release is not only the first for the new year but also the initial hint toward Friday's all-important Nonfarm Payrolls. The employment component and also the Prices Paid one – reflecting inflation expectations – are all of high importance.”

How could it affect EUR/USD?

Ahead of the key release, the US dollar continued drawing support from surging US Treasury bond yields and dragged the EUR/USD pair to a nearly two-week low. A stronger headline print will reaffirm hawkish Fed expectations and provide an additional boost to the greenback. Conversely, a weaker reading might do little to derail the Fed's expected policy path. This, in turn, suggests that the path of least resistance for the greenback is to the upside and down for the EUR/USD pair.

Meanwhile, Valeria Bednarik – Chief Analyst at FXStreet – offered a brief technical outlook for the major: "The daily chart shows that the pair stands below a flat 20 SMA, providing intraday dynamic resistance, while the longer ones keep heading lower far above it. Technical indicators head south around their midlines, failing to confirm, at this point, a bearish extension."

"In the near term, and according to the 4-hour chart, the bearish case is firmer. The pair has fallen below all of its moving averages, while technical indicators extend their declines within negative levels, maintaining their bearish slopes," Valeria added further.

Key Notes

• ISM Manufacturing PMI Preview: Low expectations in three figures open door to dollar upswing

• EUR/USD Forecast: Bears maintain the pressure on yields’ rally

• EUR/USD Price Analysis: Initial contention emerges near 1.1220

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

- AUD/USD is consolidating around the 0.7200 level aided by decent Asia PMIs as it awaits key US data reports.

- The pair is vulnerable to further selling from a technical perspective, with bears perhaps eyeing a test of 0.7100.

After Monday’s tumble as a result of broad USD strength, but also likely some technical selling pressure, AUD/USD has regained some composure on Tuesday and is pivoting either side of the 0.7200 level. Market commentators are citing strength in China coal prices (a key Australian export), as well as a positive Chinese Caixin Manufacturing PMI survey, which was better than expected at 50.9 in December versus 50.0 forecasts, as supportive of the Aussie. More broadly, ASEAN manufacturing PMI rose to 52.7 from 52.3 in November, indicate of broad economic strength in the region. With AUD/USD up 0.1% at current levels close to 0.7200, the currency is amongst the best performing G10 currencies on the day.

However, aside from a big drop in the yen to multi-year lows versus the US dollar amid catch up to the recent move higher in US (and global) yields), FX markets are tame on Tuesday. Currency traders are awaiting US ISM manufacturing PMI (Deceber) and JOLTS Job Openings (November) data at 1500GMT, ahead of the release of the ISM services PMI and official labour market report (also both for December) later in the week. Note that the Australian manufacturing PMI for December was also released during Asia Pacific hours, with the headline index easing to 57.7 from 59.2 in November.