- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 03-01-2022

- AUD/USD holds off from breaking below 0.7180 ahead of key data events.

- Chinese Manufacturing is coming up today while traders await critical US data as well.

AUD/USD has been in the hands of the bears to start the year as the US dollar firms along with US yields. For Tuesday, the price is holding above critical support near 0.7180 while bears step off the gas ahead of key data events that start today in China's Caixin Manufacturing PMI for December.

China data in focus

Based on a survey of 430 industrial businesses In China, the Caixin Manufacturing PMI Purchasing Managers' Index evaluates the efficiency of the manufacturing sector. This data is often regarded as a leading indicator for global growth. The Aussie is a high beta currency and would be expected to react to such data. Moreover, China is Australia's largest trading partner.

- China: Four reasons why growth could be better than expected in 2022 – Morgan Stanley

However, the data could be ignored in part as traders look ahead to the positive implications of the action that Chinese policymakers have already taken to help improve prospects for growth in 2022 and beyond.

The Chinese have ''hit pause on their deleveraging efforts and have already started to ease both monetary and fiscal policies in the last few weeks,'' analysts at Morgan Stanley explained.

“China’s zero-Covid approach has prevented disruptions to factory production and even led to a rise in its share of global exports.”

“A favourable global backdrop should further drive strong trade growth.”

Nonetheless, there will be no surprises if we see some expansion moderating the data today. ''In Nov all country PMIs were in expansion but rising Omicron concerns could weigh on sentiment in Dec. While we expect further expansion, some moderation is likely,'' analysts at TD Securities argued.

US data eyed

Looking elsewhere, the US calendar kicks off this week as well. The highlight will be Friday's jobs data in the form of Nonfarm Payrolls. ''The late-December COVID surge likely came too late to prevent a pickup in US payrolls after the gain in November (210k) appeared to be held down by an overly aggressive seasonal factor,'' analysts at TD Securities said.

meanwhile, the Federal Open market Committee minutes will also be a key event. ''Following the FOMC's decision to double the pace of QE tapering and the projection of a significantly more hawkish dot plot, focus will now turn to the elements that led to the evolution of views among policymakers (including on "maximum employment") after the November meeting,'' the analysts at TDS explained.

AUD/USD technical analysis

AUD/USD Price Analysis: A fast trip to 0.7150 is on the cards on a break of 0.7180

The bears have backed off from key support at this important juncture of the bearish impulse. However, if 0.7180 should give, then this could lead to a breakout and opens risk towards 0.7155 in mitigation of the price imbalance between here and there as illustrated above.

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, rose to the highest since November 24 while flashing a 2.60% level by the end of Monday’s North American session, per the FRED website.

Given the firmer inflation expectations backing fears of the Fed’s early rate hike, the US Treasury yields remain firmer and help the US dollar at the latest.

That said, US 10-year Treasury yields rallied the most in three months the previous day, firmer around 1.62% at the latest.

In addition to the strong inflation expectations, rapidly spreading coronavirus also weighs on the market sentiment and propels the US Treasury yields, as well as the US dollar.

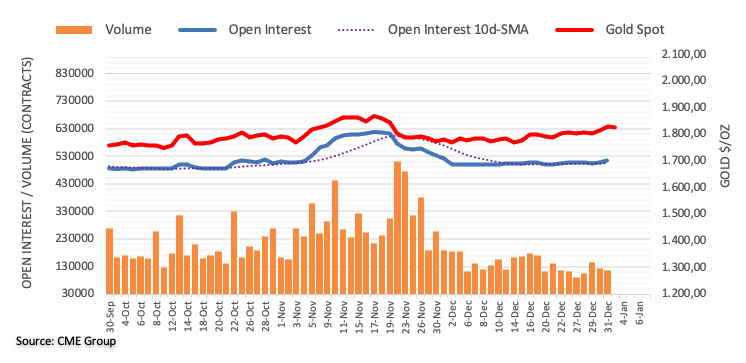

With the firmer US dollar, the commodities remain on the back foot, mainly the gold prices ahead of today’s US ISM Manufacturing PMI.

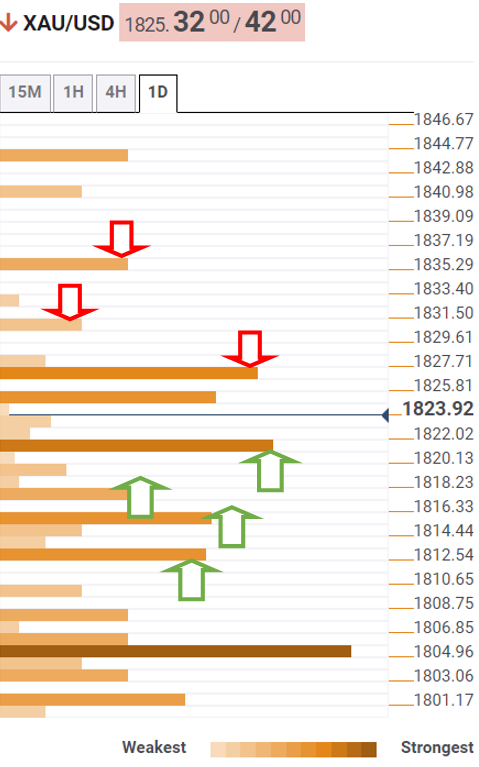

Read: Gold Price Forecast: XAU/USD sellers attack $1,800 as coronavirus fuels yields, US ISM PMI eyed

- Gold remains pressured after the biggest daily fall in six weeks.

- US T-Bond Yields rallied to multi-day high as virus cases rally, Fed rate-hike concerns gain momentum.

- US ISM Manufacturing PMI can offer immediate direction, FOMC Minutes, NFP will be the key.

- Gold Price Forecast: Defying the 1,800 threshold on dollar’s demand

Gold (XAU/USD) stays defensive at around $1,800 after printing the biggest daily losses since November 22. That said, the yellow metal seesaws near the short-term support line amid a lack of fresh catalysts during the early Asian session on Tuesday.

Firmer US Treasury bond yields drowned commodities and propelled the US Dollar Index (DXY) the previous day. Even so, equities had a nice start in 2022.

That said, the DXY rose around 0.60% daily, around 96.00 at the latest, rising the most since mid-December on Monday. On the other hand, the US Treasury yields jumped to the six-week top for 30-year, 20-year, 10-year and 5-year notes.

The worsening coronavirus conditions raise challenges for the market sentiment and policymakers who previously expected the South African covid variant, namely Omicron, to be less severe than the previous virus variant. The risk-off mood also takes clues from the rising hopes of faster Fed rate-hikes in 2022. Both these catalysts weigh bond prices and fuel yields.

“COVID worries have been front and center once again for investors since the start of the holiday season. The number of new COVID-19 cases has doubled in the last seven days to an average of 418,000 a day, mostly attributed to the highly transmissible but milder Omicron variant,” according to a Reuters tally.

The US inflation expectations, as per the 10-Year Breakeven Inflation Rate numbers from the Federal Reserve Bank of St. Louis (FRED), jumped to a fresh high in six weeks to portray further prices pressure ahead, allowing Fed hawks to keep controls.

It’s worth noting that the softer prints of US Markit Manufacturing PMI for December, final reading failed to have a notable market impact as gold traders are more interested in today’s US ISM Manufacturing PMI for the said month, expected 60.2 versus 61.1.

Other than the US PMI, virus updates and Fed chatters will also direct short-term gold price moves. However, Wednesday’s Federal Open Market Committee (FOMC) Meeting Minutes and Friday’s US Nonfarm Payrolls (NFP) will be crucial to watch for clear direction.

Read: ISM Manufacturing PMI Preview: Low expectations in three figures open door to dollar upswing

Technical analysis

Gold’s pullback from 61.8% Fibonacci retracement of (Fibo.) of November 16 to mid-December downside takes clues from bearish MACD signals and descending RSI line, not oversold, to keep sellers hopeful.

Even so, an ascending support line from December 15, near the $1,800 threshold, quickly followed by the 100-SMA level surrounding $1,797, challenges the gold sellers.

Adding to the downside filter is the monthly horizontal area near $1,793-91, a break of which should give a free hand to the gold bears targeting the last monthly low near $1,753.

On the flip side, a convergence of weekly resistance line and tops marked in July, as well as in September, restricts short-term recovery moves of gold, in addition to the 61.8% Fibo. level surrounding $1,830.

Following that, a run-up towards $1,850 and $1,870 can’t be ruled out before directing gold buyers to November’s peak of $1,877.

Gold: Four-hour chart

Trend: Further weakness expected

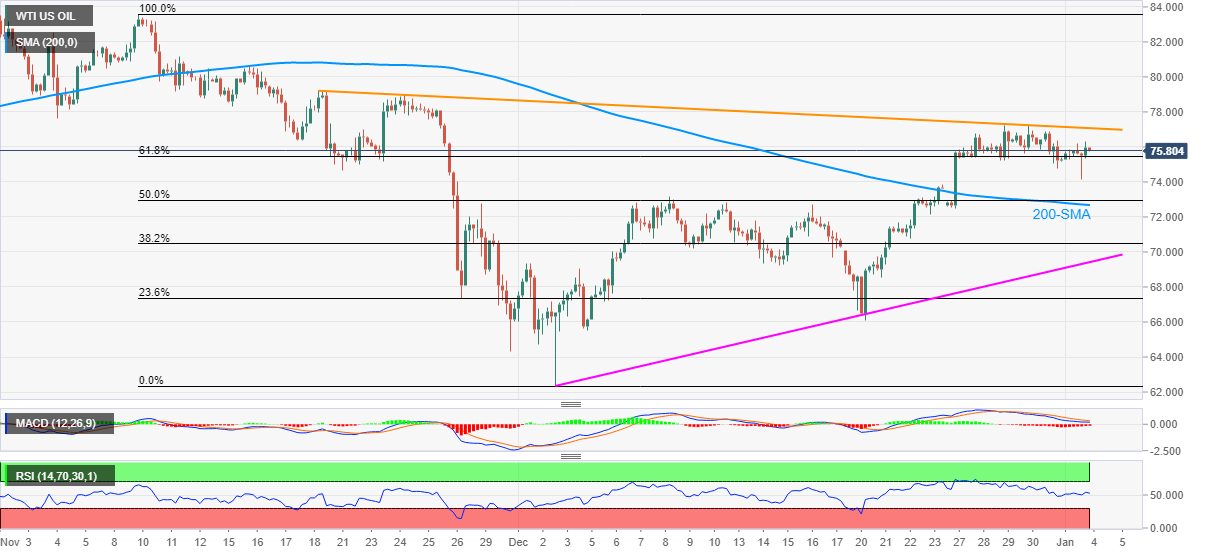

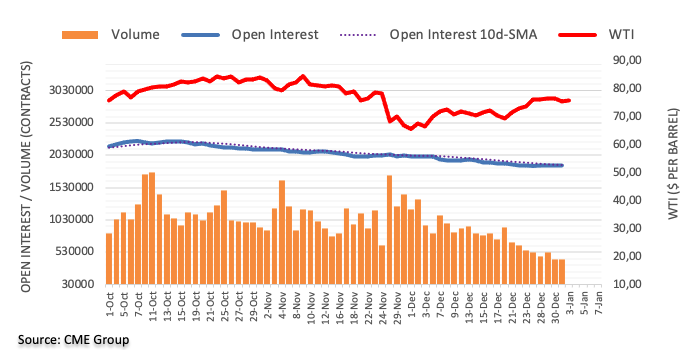

- WTI remains sidelined after bouncing off two-week low.

- Steady RSI, sustained trading beyond 61.8% Fibonacci retracement keeps buyers hopeful.

- Six-week-old resistance line guards immediate upside, 200-SMA adds to the downside filter.

WTI takes rounds of $75.85 during the early Asian session on Tuesday, after a volatile day that initially refreshed a fortnight low before flashing mild gains.

The 61.8% Fibonacci retracement (Fibo.) of November-December downside defended the black gold the previous day amid a steady RSI line and receding bearish bias of the MACD.

With this, oil prices can portray another attempt to cross a descending trend line resistance from November 19, around $77.10.

Following that, the monthly high near $77.25 may act as an extra filter to the north before directing the oil buyers towards the late November tops surrounding $79.00 and $79.20.

Meanwhile, pullback moves need a clear downside break of the 61.8% Fibo. level, around $75.50, to challenge the 200-SMA around $72.70.

In a case where WTI crude oil prices stay beneath the 200-SMA, a monthly support line near $69.45, will be in focus.

To sum up, oil prices grind higher and defend short-term supports amid steady oscillators, which in turn suggest further upside momentum.

WTI: Four-hour chart

Trend: Further recovery expected

“A wall of maturing debt and a surge in seasonal demand for cash will test China’s financial markets this month, putting pressure on the central bank to ensure sufficient liquidity,” said Bloomberg News Wire during early Tuesday morning in Asia.

Key quotes (from Bloomberg)

Demand for liquidity may total about 4.5 trillion yuan ($708 billion) in January, 18% more than the amount seen last year, according to calculations by Bloomberg based on official data and analysts’ estimates.

An increase in the amount of policy loans coming due and demand for cash to be spent during the Lunar New Year, which takes place earlier in 2022, are drivers.

A recent reduction in the reserve requirement ratio for banks could provide relief but some market watchers predict the central bank could ease again to avoid a liquidity crunch. That comes after policymakers indicated a shift from deleveraging the economy to supporting growth.

Further policy easing will be a double-edged sword for the People’s Bank of China. While such a move could soothe concerns about higher funding costs and prevent a liquidity squeeze, it may also fuel asset bubbles that Beijing wants to avoid.

Ahead of the Lunar New Year in 2019 and 2020, the authorities lowered the reserve ratio to pump in cash. However, they avoided supplying extra funds last year, stoking fears about a tighter policy stance and sending short-term funding costs soaring.

FX reaction

AUD/USD can seek solace in the news considering the sign of further liquidity from the biggest customer. That said, the pair consolidates recent losses around 0.7190, the lowest level in two days at the latest. It's worth noting that the virus-led partial lockdown in Ningbo is impacting operations of the world's largest port weighed on the market sentiment and AUD/USD prices.

Read: AUD/USD Price Analysis: A fast trip to 0.7150 is on the cards on a break of 0.7180

- USD/CAD grinds higher following a notable bounce off monthly bottom.

- US T-bond yields jumped the most in three months on covid fears, Fed rate-hike concerns.

- Oil prices are seesawed amid virus fears, OPEC+ headlines and firmer USD.

- US, Canada PMIs will decorate calendar, risk catalysts in focus.

USD/CAD hovers around 1.2750, after the biggest daily rise in a fortnight, during the early Tuesday morning in Asia. The Loonie pair portrayed the broad US dollar strength, backed by the surge in the US Treasury bond yields. That said, the volatile prices of Canada’s main export item, WTI crude oil, failed to contribute to the latest moves.

Fears of the South African covid variant, namely Omicron, fuelled the US bond yields at the start of 2022. The virus strain has spread faster than initially feared and pushes some of the global medical systems again on the brink of a breakdown even as policymakers stay hopeful to overcome the pandemic with optimistic studies.

“COVID worries have been front and center once again for investors since the start of the holiday season. The number of new COVID-19 cases has doubled in the last seven days to an average of 418,000 a day, mostly attributed to the highly transmissible but milder Omicron variant,” according to a Reuters tally.

Not only the virus woes but firmer hopes of faster rate hikes by the US Federal Reserve (Fed) in 2022 also propelled the US Treasury yields and the US dollar across the board. The US inflation expectations, as per the 10-Year Breakeven Inflation Rate numbers from the Federal Reserve Bank of St. Louis (FRED), jumped to a fresh high in six weeks to portray further prices pressure ahead, allowing Fed hawks to keep controls.

That said, softer prints of US Markit Manufacturing PMI for December, final reading, joined Construction Spending for November to flash lower than previous readouts and couldn’t affect the US dollar.

Amid these plays, Wall Street benchmarks closed higher and the US Treasury yields jumped to the six-week top for 30-year, 20-year, 10-year and 5-year notes.

It’s worth noting that sustained output increase by OPEC+ and fears of virus weighing on the oil demand challenged the WTI crude oil prices. Even so, the black gold ended Monday’s trading with mild gains of around $75.85.

Moving on, Canadian Markit Manufacturing PMI for December and the US ISM Manufacturing PMI for the said month, expected 57.5 and 60.2 versus 57.2 and 61.1 in that order, will entertain the USD/CAD traders. Given the recently high yields and firmer USD, backed by the COVID-19 fears, the pair is likely to remain firmer heading into Friday’s key jobs report.

Technical analysis

USD/CAD needs to overcome a two-week-old resistance line, near 1.2765 by the press time, to justify the bounce off the 100-DMA level of 1.2630. That said, bearish MACD signals and a steady RSI line keep sellers hopeful.

- USD/JPY bulls are moving in hard on a critical level of resistance.

- The week ahead will be a busy one with full markets returning and eager for volatility around critical events.

Monday marked the final day of the holiday season for all markets. The rest of the week will be supercharged on both volumes returning and high stake calendar events which could make for a wild ride. USD/JPY is going to be a major focus on forex given its ascent through 115.

At the time of writing, USD/JPY rallied from a low of 114.94 to a high of 115.36, extending the holiday drift to the upside. The moves in USD/JPY has dovetailed with the rally in stocks. The performance of global equities will be key at this juncture and more of the same could see the pair overcome 115.52, the high of November.

Bonds maintain a corrective tone after long end yields surged in late December and the Federal Open Market Committee minutes and Nonfarm Payrolls will be key this week in that respect.

''Following the FOMC's decision to double the pace of QE tapering and the projection of a significantly more hawkish dot plot, the focus will now turn to the elements that led to the evolution of views among policymakers (including on "maximum employment") after the November meeting,'' analysts at TD Securities said.

As for the main event of the week, the analysts explained that ''the late-December COVID surge likely came too late to prevent a pickup in US payrolls after the gain in November (210k) appeared to be held down by an overly aggressive seasonal factor.''

USD/JPY technical analysis

USD/JPY is attempting to break into a key area on the monthly chart. If it breaches the 116 figure, then there are real prospects of mitigation between here and 118.60 for the first quarter of the year.

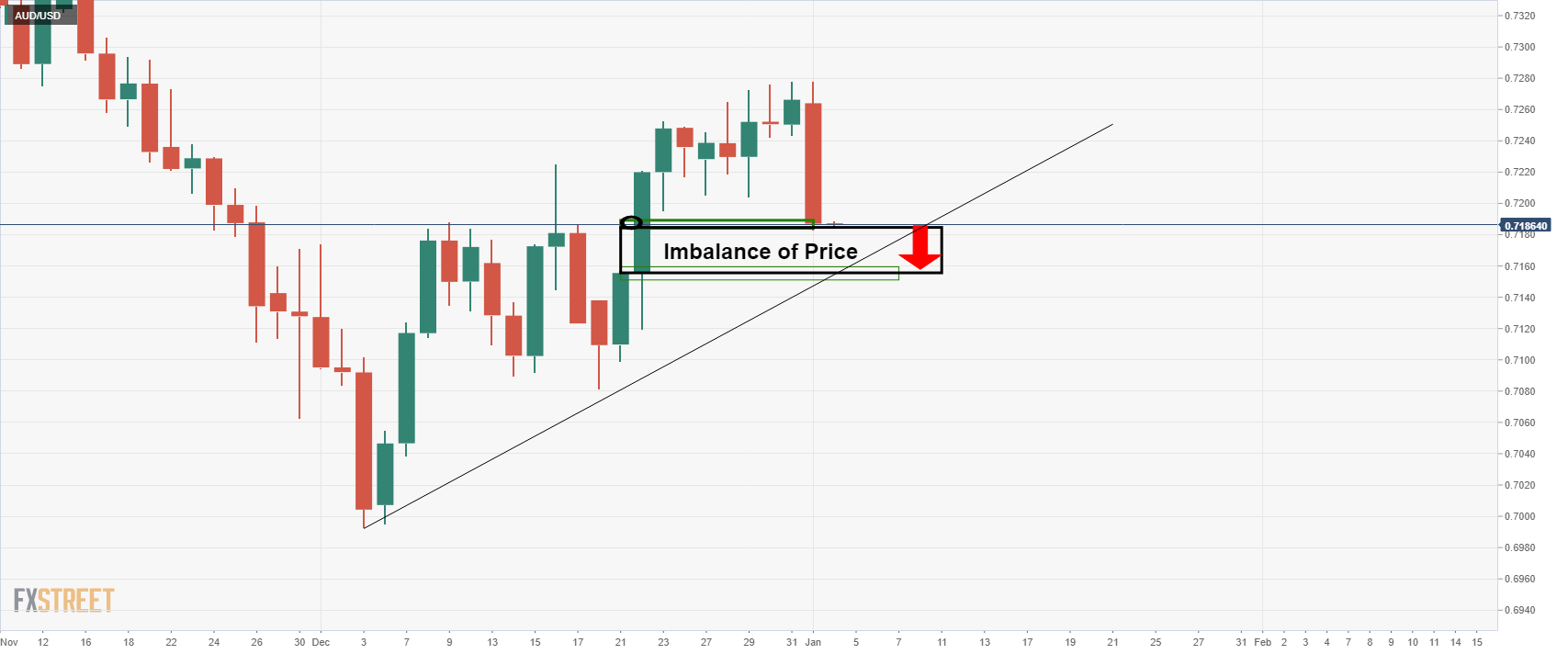

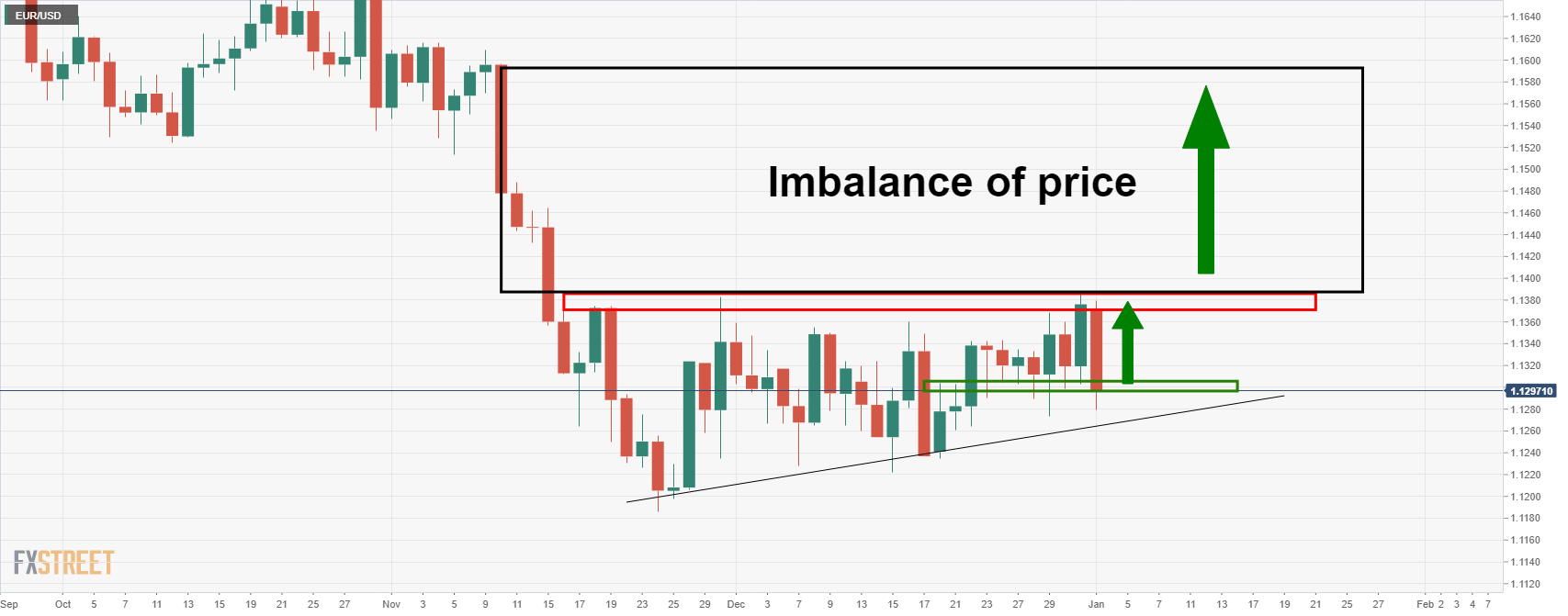

- AUD/USD bears in control and they target the imbalance of price.

- Support at this juncture near 0.7180 is critical in guarding against 0.7150.

AUD/USD has been n the hands of the bears to start the year. The greenback has picked up a strong bid while many markets have been closed.

However, with full volumes coming back into play, the question is whether the ranges can be broken in a continuation of the dominant trends that have formed in some forex pairs. The following illustrates the bearish bias in AUD/USD for the sessions ahead on a break of critical support.

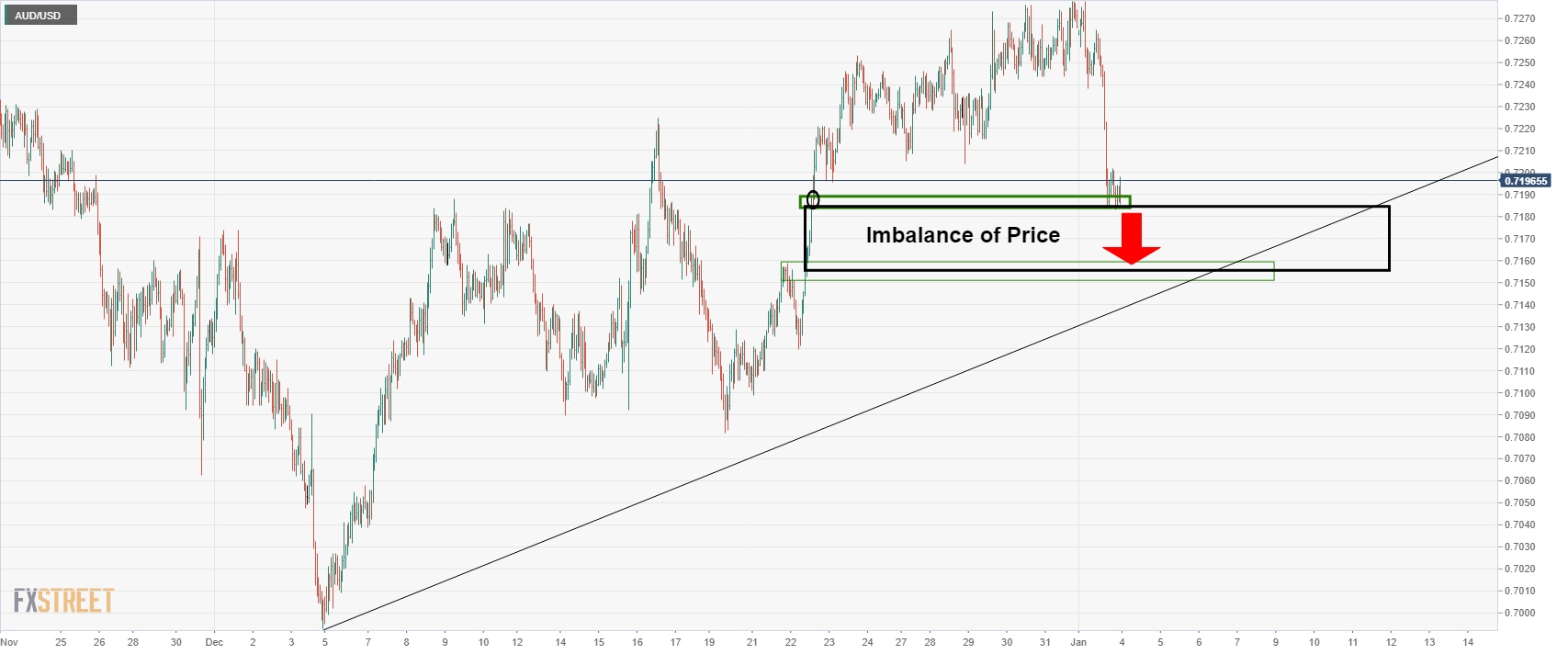

AUD/USD H1 chart

The bears are taking on the support at this important juncture of the bearish impulse. This could lead to a breakout and opens risk towards 0/.7155 in mitigation of the price imbalance between here and there as illustrated above.

This is also illustrated on the following daily chart:

- AUD/JPY dropped 1.0% to back under the 83.00 level on Monday despite as safe-haven currencies like the yen outperformed.

- The more defensive FX market bias contradicted the risk-on mood in global equity and bond markets.

- Support at key moving averages around 82.70 and in the 82.50 zone may be seen as a near-term buy opportunity.

Despite gains in strongly risk-on market conditions in global equity, bond and commodity markets, risk-sensitive currencies in the G10 suffered on the first trading day of 2022, whilst the safe-haven US dollar and yen benefitted. Given AUD’s status as one of the more risk-sensitive G10 currencies, AUD/JPY had a rough time on Monday, pulling back sharply from the six-week highs it printed during Asia Pacific trade in the 0.8380s to nearly 100 pips lower in the 82.90 area. At current levels underneath 83.00, the pair is trading lower by about 1.0% on the day, the worst one-day performance in one month.

As it gradually advanced in the 83.00s over the course of last week and early on Monday’s session, AUD/JPY had been testing an uptrend that has been capping the price action since early December. Failure to break above this uptrend ultimately seems to have been taken as a bearish signal by technicians, who have on Monday forced the pair back towards its 50 and 200-day moving averages, both of which sit around 82.70. A break below here would bring in focus a test of the key 82.50 level, which acted as strong resistance and then support in December.

The mismatch between FX (which has been more risk-off) and equities, bonds and commodities (where conditions have been more risk-on) provoked some head-scratching on Monday. Should US equities and bond markets continue to price in a more positive 2022 outlook in the coming days, it's hard to see how this could result in further AUD/JPY weakness. Bulls may well view the pair at current levels as a good short-term buy-the-dip opportunity, especially if the pair drops further to 82.50. But bulls will be wary of concerns about the Omicron outbreak in Australia, which has really been accelerating and could explain why the pair faired worse than its NZD and CAD peers on Monday.

- In a choppy start to the year, GBP/JPY fell back from near-156.00 to 155.00 before bouncing to 155.50.

- If risk-on conditions continue, the pair may well retest 156.00, but does risk entering overbought conditions according to the RSI.

Things were bumpy for GBP/JPY on the first trading day of 2022. Despite a resolutely risk-on market bias (when looking at moves in global equity and bond markets, anyway), FX markets have been more mixed. The US dollar outperformed amid a surge in yields, but the yen also performed well while more risk-sensitive currencies faired badly, amid an apparent shift from risk into safe-havens. Analysts said that with many market participants in Europe and the Asia Pacific region still on holiday amid multiple market closures, traders shouldn’t read too much into Monday’s out-of-synch FX market moves.

Nonetheless, the safe-haven bid that support the yen at one point sent GBP/JPY below 155.00 from earlier highs near 156.00. The yen bid has eased somewhat in recent trade, enabling GBP/JPY to recover back towards the 155.50 mark, where it trades lower on the day by about 0.2% versus earlier losses of more than 0.5%. Monday’s price action confirms the 155.00 level as an important area of near-term support, having acted as a good intra-day buy level now for three successive sessions. If stocks and yields can keep on pushing higher as market participants express a sunnier take on the 2022 outlook as Omicron worries subside, short-term GBP/JPY bulls could push the pair back to 156.00.

Medium-term bulls should beware that any push past 156.00 could tip GBP/JPY into overbought territory. The 14-day Relative Strength Index (RSI) is currently at 66, close to the 70 level above which currency pairs are often viewed as overbought. Indeed, over the course of the last two weeks, the pair has rallied more than 4.0% (from under 150.00). Some consolidation might, thus, be in order, before the pair has a run at last year’s 158.00 highs. But with the BoJ as dovish as ever and the BoE likely to implement multiple further rate hikes in 2022, the risks this year are to the upside.

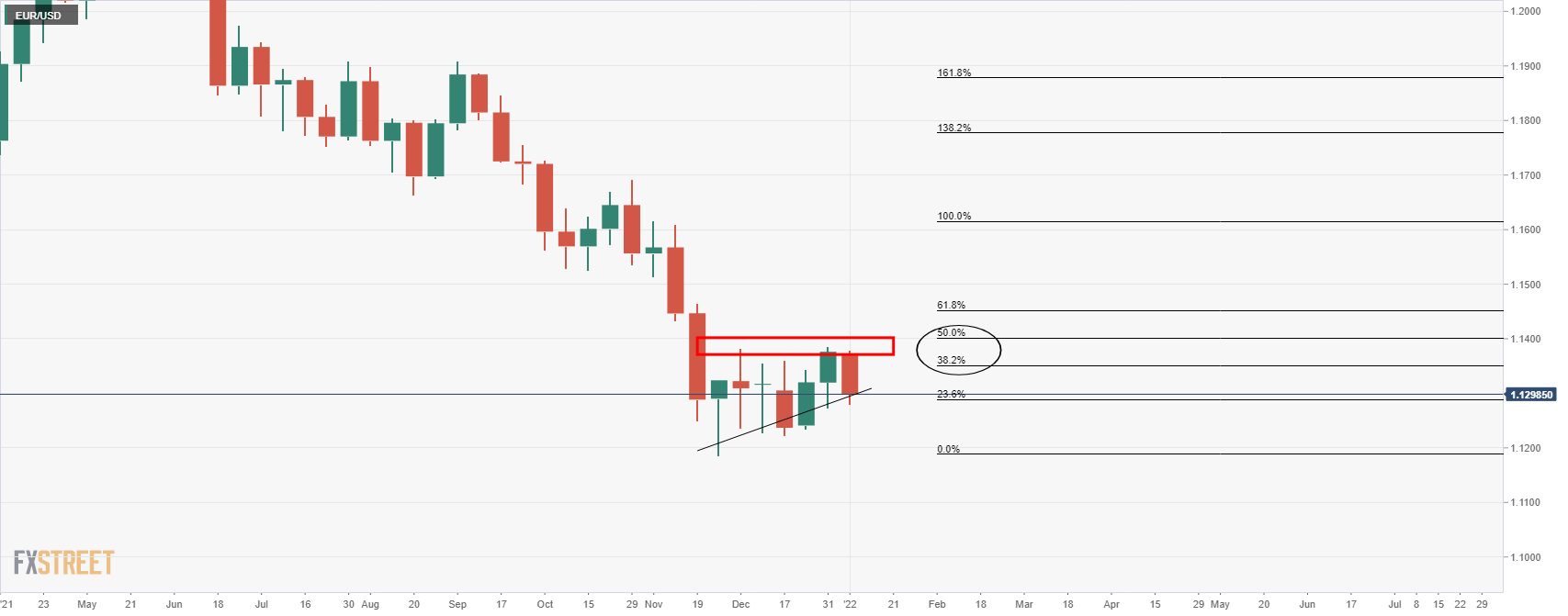

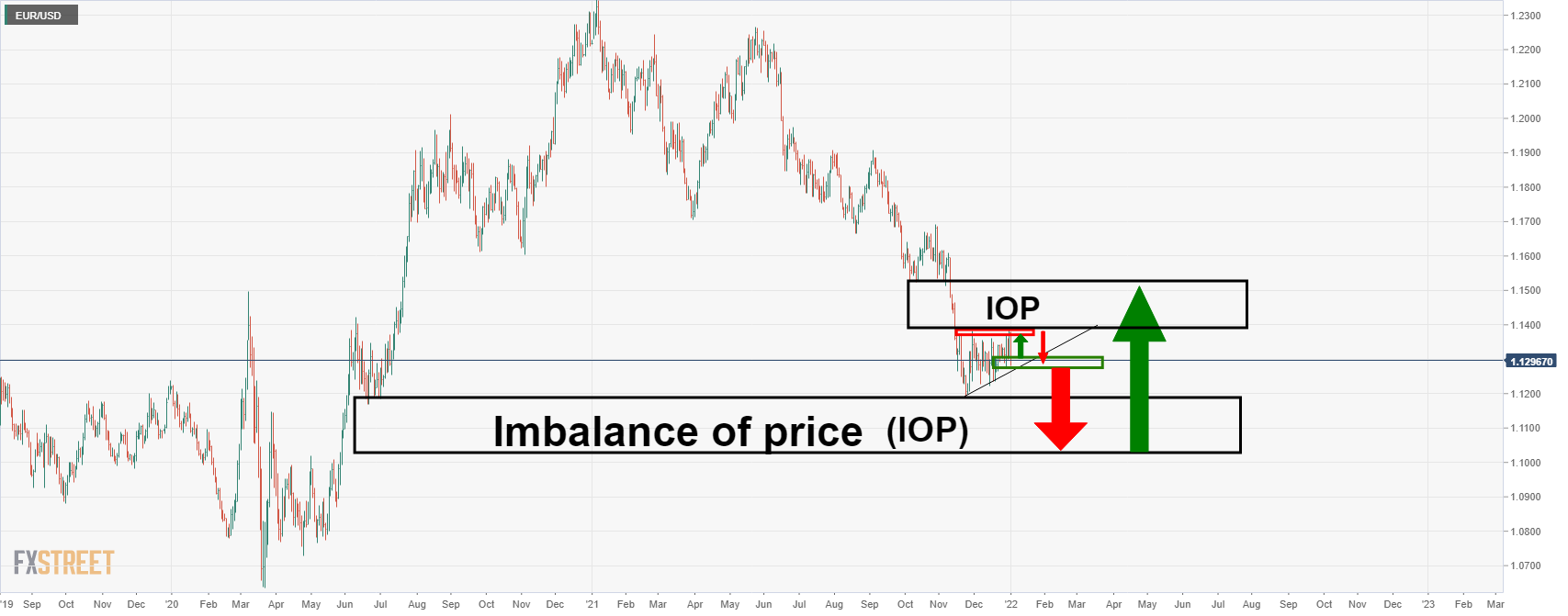

- EUR/USD bears eye a run towards the imbalance of price all the way down to 1.10 the figure.

- For the meanwhile, the dynamic support is holding up the bears.

EUR/USD has been in a long-term downtrend since the middle of 2021. For the weeks ahead, there is a bias towards 1.10 and the following illustrates this in a top-down analysis.

The weekly chart has made a significant retracement to test the vicinity of 50% mean reversion. This leaves the focus on the downside in accordance with the dominant bearish trend.

EUR/USD weekly chart

However, there is still an imbalance of price that could yet be mitigated prior to further downside.

EUR/USD daily charts

Should the bulls break the resistance on the daily chart, then there will be prospects of a continuation to mitigate some of, if not all of, the imbalance of price as illustrated above.

On the other hand, considering the bearish trend, a break of both horizontal and dynamic support would reveal the downside imbalance as follows:

In any case, both areas of imbalance will be filled eventually:

The higher probability is to trade with the trend. In the above scenario, a bearish breakout of the dynamic support opens risk towards 1.10 the figure for the weeks ahead.

What you need to know on Tuesday, January 4:

The greenback is the best performer on Monday, appreciating against all of its major rivals on the back of soaring US government bond yields. The yield on the 10-year US Treasury note kick-started the day at 1.53%, jumping to 1.635% mid-US afternoon, holding nearby as the day comes to an end.

Coronavirus-related concerns dampened the market’s mood as the Omicron variant is indeed a tsunami of contagions as the WHO anticipated a couple of weeks ago, affecting not only the northern hemisphere. So far, governments have avoided imposing restrictions, but the situation may worsen if the health systems begin to stress.

US stock advanced despite the dismal mood, with the DJIA adding over 100 points.

The EUR/USD pair trades a few pips below the 1.1300 level, while GBP/US lost the 1.3500 threshold. Commodity-linked currencies edged lower vs the greenback, with AUD/USD trading around 0.7190 and USD/CAD currently at 1.2754.

The dollar appreciated even against safe-haven assets, with USD/JPY trading above 115.00.

Gold plunged to 1,798.29, ending the day at around $1,802. Crude oil prices were little changed on a daily basis, recovering from an intraday dip. WTI settled at around $76.00 a barrel.

Shiba Inu, MATIC, Terra and Solana top the list of cryptocurrencies offering high returns

Like this article? Help us with some feedback by answering this survey:

- Spot gold prices have fallen back sharply on Monday from around $1830 to the $1800 area as yields rise sharply.

- Upside has been most pronounced in the long-end for both real and nominal yields, as Omicron-worries are priced out.

A sharp rise in long-term US real and nominal bond yields has triggered heavy selling pressure in spot gold (XAU/USD), with prices slumping back from Asia Pacific levels around $1830 to current levels over 1.5% lower at $1800. For now, spot prices Whilst the short-end of the US yield curve is enjoying solid gains with 2s up about 4bps to post-pandemic highs near 0.80% as traders bet more confidently on near-term Fed hawkishness, the real action is occurring at the long-end. 5s are up over 10bps to 1.36%, 7s are up 12bps to 1.55%, 10s are up 13bps to 1.63%, as are 30s which have moved above 2.0% for the first time since November.

More important for gold given its negative correlation to real yields, 10-year TIPS are up nearly 10bps and probing the -1.0% level again. Recall that when real yields rise, the opportunity cost of holding non-yielding gold also rises, dimming its appeal. The surge in yields appears to have its roots in a surge in confidence about the long-term outlook for the US economic recovery, despite the ongoing risks presented by Omicron.

Market participants have ignored negative headlines about schools in the US delaying post-Christmas holiday restarts and are focusing on the fact that the number of deaths and hospitalisations, despite record infection rates in the US, Europe and UK, remain low. As a result, governments seem more reluctant than in the past to reimpose lockdowns. All of this optimism is not only hurting gold’s appeal from the yield standpoint, but also as a safe-haven asset.

The move higher in US bond yields essentially marks a return to pre-Omicron emergence levels. Whilst short-end rates are at post-pandemic highs on Fed rate hike expectations, 10s and 30s still have some way to go (the former hit 1.77% last March and the latter surpassed 2.50%). Markets are in a very optimistic mood on Monday as the new year gets underway, with US equities near-record highs as the likes of Tesla and Apple surge (the latter the first company to hit the $3T market capitalisation mark). Should yields continue to rise as Omicron worries subside, gold could be in trouble.

Bank views

Given the new year is just getting underway, it's worth taking some time to assess the outlook of some banks for gold. BNP Paribas “remain bearish on gold prices in 2022, given the rising U.S. rates environment”. “While the price could rise further in the near term”, the bank adds, “we forecast it to fall to $1,800 per ounce by the end of the first quarter, $1,650 by the end of 2022 and $1,600 by the end of 2023”. Citi is also bearish, seeing the precious metal “averaging about $1,685 throughout 2022, driven by a combination of dollar strength and higher U.S. real yields”.

Goldman Sachs warns that “gold may fare better if inflation concerns build further and central banks are perceived to be accommodating more of that shock, particularly since positions appear to have been materially reduced”. TD Securities agree, saying they “think gold continues to do well, mainly because we expect inflation to be quite elevated and we continue to expect significant monetary accommodation for the foreseeable future, which will result in highly negative real rates across much of the yield curve”.

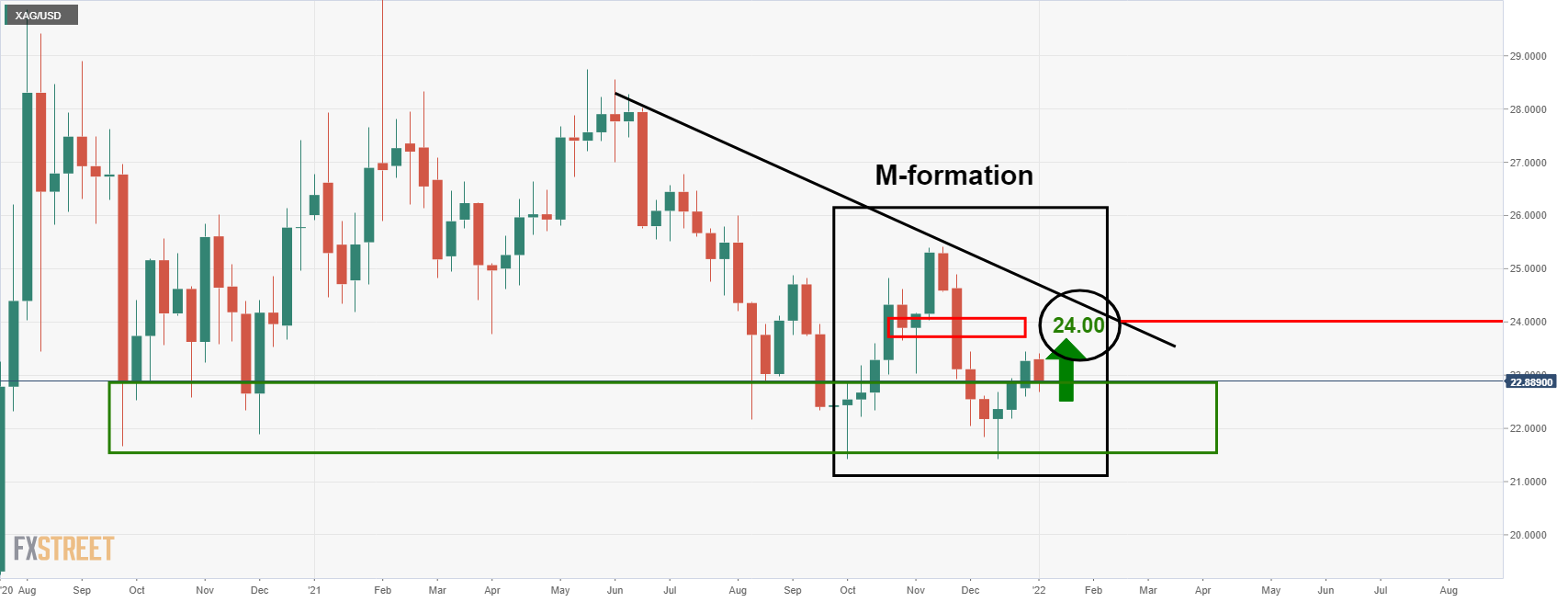

- XAG/USD bulls are moving in on following a sharp sell-off.

- The weekly M-formation is compelling as with eyes on 24 the figure.

Silver is rising in a corrective phase. The weekly M-formation is drawing the bulls in towards the neckline near 23.89. However, we have seen a sharp weekly rejection to the downside near 23.50.

Silver weekly chart

The bulls will need to step up at this juncture as the price heads towards a dynamic support area on the lower time frames as follows:

Silver H4 chart

As illustrated, the price is climbing within a bullish channel. The 22.60s is offering support and bulls need to now tale control beyond the 23.40s.

Silver, H1 chart

Froman hourly perspective, the price is taking on the 200 EMA following a sharp move into the end of December order block near the lows of the day. A break of the 200 EMA will leave the bulls in good stead to take back control with the broader corrective trend. A break of the resistance will open risk to the M-formation's neckline as illustrated above. Bulls can target 24.00:

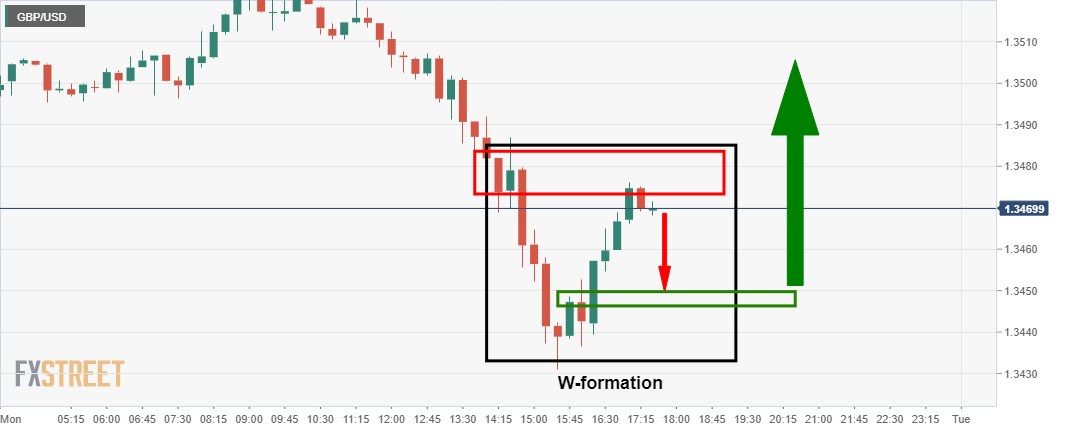

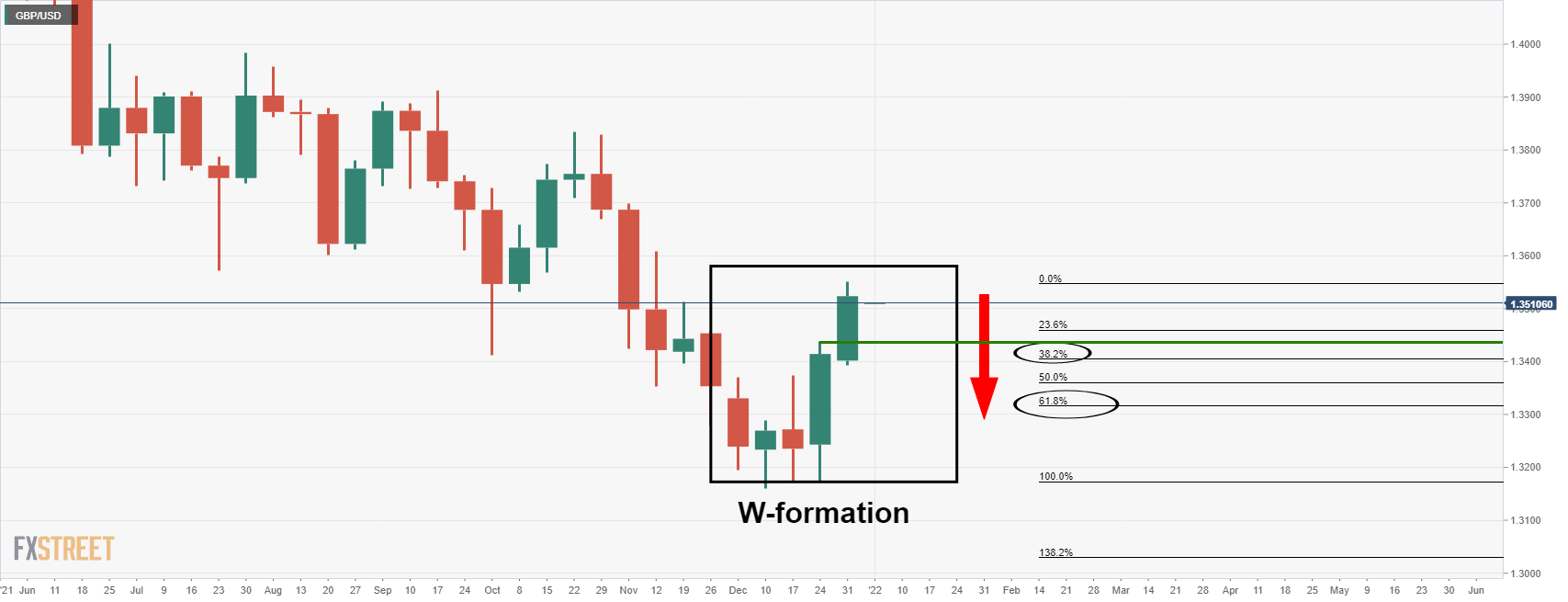

- GBP/USD is on the backfoot as the BoE expectations are dialled dback.

- Covid, Brexit and UK politics are in focus and weight for the pound.

- Technically, the pound has broken below a critical support line.

GBP/USD has started out the week on the backfoot. The pair is currently down some 0.44% but off the lows of the day located at 1.3430. The price has recovered to near 1.3470 after falling from 1.3535 earlier on the day.

There are prospects of a deeper run towards 1.34 the figure for the sessions ahead although a run on 1.35 the figure and nearby liquidity are still on the table for the meantime. This is illustrated below under technical analysis.

Meanwhile, from a fundamental perspective, full markets will not return until Tuesday with much of the world's banks on holidays still observing New Year's day that fell on a weekend. Volumes are therefore thin and true economic drivers will not kick in until Tuesday.

In this regard, the greenback remains rangebound with many markets remaining on holiday. DXY is up by some 0.65% and now trading above 96 after rallying within the 95.625/327 range. The index stays in the middle of the 95-97 trading range that has largely held since mid-November.

BoE hike expectations dialled back

The British pound has therefore run out of steam near 1.3550 as Bank of England tightening expectations have fallen back a bit. Coronavirus, domestic politics and Brexit are a risk to growth prospects.

Brexit will come roaring back into the headlines this week. A senior French official said that “At the start of January, January 4 to be precise, we will have meetings with the EU commissioners to define the process and the measures that need to be taken. Between January 4 and January 6, there are very important meetings to begin the legal process against the UK”

As for covid, so far plans are unchanged but social distancing is already happening voluntarly and hospitals and under pressure. The BBC reports that ''Prime Minister Boris Johnson said that England will continue with its Plan B Covid measures amid growing pressures on the NHS. He said it would be "folly" to think the pandemic was over and warned that pressure on hospitals would be "considerable" over the coming weeks.''

GBP/USD technical analysis

The bias is for a move to the upside in a correction of the recent bearish impulse followed by a downside continuation to test 1.34 the figure.

However, the 15-min chart is offering a bearish reversion pattern and the price is meeting 15-min resistance:

GBP/USD 15-min chart

As illustrated above, the price could be destined for a meanwhile move to the downside prior to further upside as follows:

GBP/USD H4 chart

The M-formation is a bullish reversal pattern seen on the 4-hour chart.

GBP/USD H1 chart

The hourly chart's bearish impulse could be where the trade is. The bears will be keen to see a discount from this juncture into the liquidity zone around 1.35 the figure. A discount will be on the table for a downside continuation towards a test of 1.34 the figure.

Having said that, the price has already corrected a significant length of the bearish impulse and has reached a 38.2% Fibonacci retracement level as follows:

Bears are already engaging, therefore, there are prospects of a downside continuation already and a retest of 1.35 liquidity and the counter-trendline may not be seen so soon.

- NZD/USD has dropped back sharply in recent trade, falling under 0.6800 as the dollar broadly picked up.

- The main drivers this week will be the key US December jobs report, as well as the December ISM surveys.

NZD/USD has stabilised in recent trade after pulling back sharply from Asia Pacific/early European session highs in the 0.6840 area to current levels in the 0.6780s. The 21-day moving average at 0.6786 seems to be offering some support where last week’s lows at 0.6790 failed. FX markets have been choppy and difficult to make sense of on Monday, with the dollar and yen seemingly gaining ground amid a safe-haven bid, but typically more risk-off resilient currencies like CHF and EUR suffering alongside the more risk-sensitive currencies like NZD, AUD and CAD.

Liquidity conditions remain thin/somewhat impaired amid the absence of many Asia Pacific and European market participants. Markets in the UK, Australia, New Zealand, Canada, Japan and China were all closed on Monday. A break below support around current levels for NZD/USD would likely signal continued drop back towards December lows around 0.6700. NZD/USD’s failure to break above trendline resistance last week in the mid-0.6800s seems to have been taken as a bearish signal. The main drivers of the pair and FX markets more broadly this week will be the key US December jobs report, as well as the December ISM surveys.

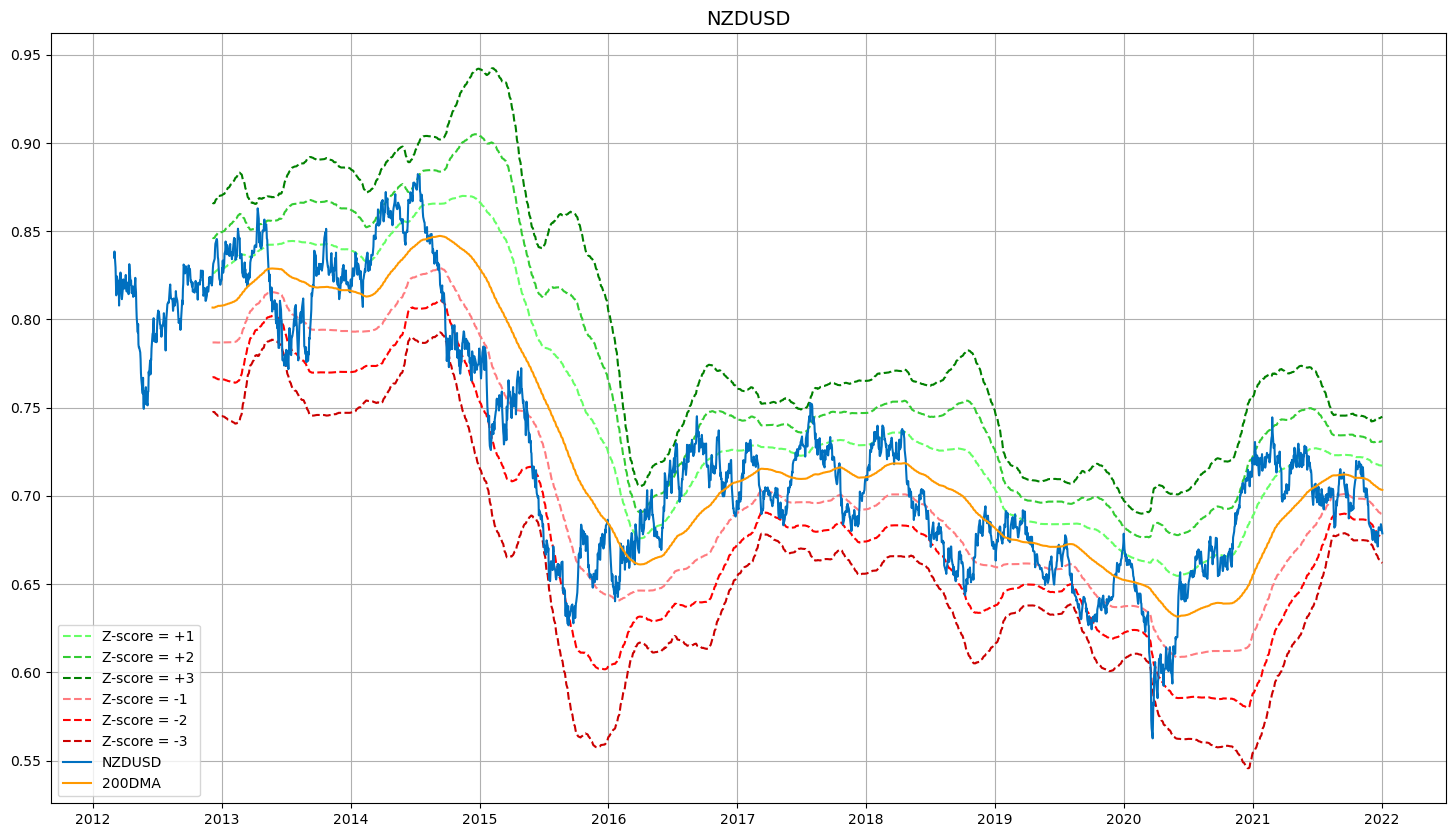

At current levels, NZD/USD’s Z-score to 200DMA is roughly -1.8, meaning it trades about 1.8 standard deviations below its 200DMA. As recently as mid-December, the pair’s Z-score was closer to -3.0. Looking back at the last five or so year, apart from during times when FX markets were undergoing violent repricing (such as during the March 2020 Covid-19 panic), a Z-score near or below -2.0 has been an indicator that conditions have become oversold and, at the very least, some consolidation lays ahead.

And consolidation has been just what NZD/USD has seen over the past few weeks. Whether this can continue into early 2022 is another question as the Fed primes itself for a potential rate hike as soon as March. NZD/USD’s Relative Strength Index score of close to 43 suggests there is plenty of room for some further selling pressure. But the RBNZ is ahead of the Fed when it comes to policy normalisation and looks set to extend its lead, a fact that seems to have e been neglected by FX markets as of late. Perhaps the NZD isn’t as vulnerable to the dollar’s advances as say the euro, yen and Swiss franc, central banks are decisively more dovish.

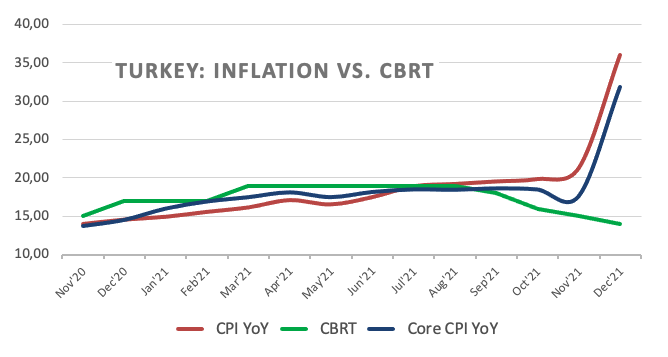

Turkish President Recep Erdogan said on Monday that he was saddened by the high level of inflation in 2021, but noted that he had brought down inflation in the past and would do so again. Erdogan added that he would investigate the exorbitant price hikes and blamed the high inflation on rising commodity prices and the weaker exchange rate. Erdogan added that he would add additional support to civil servant wages.

His remarks come after data on Monday revealed inflation in Turkey topping 30% YoY in December 2021. Inflation in Turkey surged last month due primarily to a massive near 30% MoM drop in the value of the lira versus the US dollar over the course of the month that took the lira's Q4 2021 losses to more than 35%. Turkey has faced a crisis of confidence in its currency in recent months as investors flee the country after the CBRT axed rates from 19.0% in September to 14.0% in December despite surging inflation.

This has sent real yields in Turkey into deeply negative territory, hence the capital flight that has pressured the exchange rate. The lira was offered some respite after the Turkish government introduced a new policy to compensate Turkish savers against losses as a result of lira depreciation, which some analysts saw as a sort of semi-alternative to rate hikes. This allowed USD/TRY to fall back from above its December record highs above 18.00. The currency pair now trades around 13.00, but the prospect of further decline is limited so long as the CBRT rate remains so far under inflation.

Market Reaction

The lira ignored Erdogan's comments. No one is expecting the Turkish President to lose faith in his "new economic programme" of pressuring the CBRT to cut rates despite high inflation just yet.

- US dollar jumps as US 10-year yield hits 1.60% and the 30-year 1.99%.

- USD/JPY rises for the fourth day in a row, eyes 115.35/50.

The USD/JPY continues to move to the upside, and it has reached a strong resistance area located between 115.35 and 115.50. It printed a fresh five-week high at 115.36, slightly above the previous top boosted by a stronger rally across the board.

The DXY is up 0.60% so far on Monday, trading above 96.20. Equity prices are modestly higher in Wall Street. The relevant moves at the beginning of the year come from the bond market as Treasuries slide. The US-30 year is at 1.999%, the highest in a month, while the 10-year rose above 1.61%. The 2-year stands above 0.80%, at the highest since March 2020.

Economic data from the US on Monday showed no surprises on Monday. The Markit Manufacturing PMI (final) came in at 57.7 in December, below the flash reading of 57.8. On Wednesday, the ADP employment report is due and on Friday the non-farm payroll. “The recent COVID surge likely came too late to prevent a strong and above-consensus reading for payrolls in this week's report for December”, argue analysts at TD Securities. They forecast an increase in payrolls of 500K.

Looking at recent highs

The USD/JPY peaked in November at 115.51, a multi-year high. From the current level to the mentioned high, resistance is expected to emerge. With the pair around 115.30, the positive momentum remains intact.

On the contrary, a slide under 115.00 would clear the way for a correction, with support levels seen at 114.75 and 114.60.

Technical levels

- USD/CAD has surged back to the north of the 1.2750 mark, its biggest one-day gain since November.

- The dollar is strengthening amid a surge in US yields that is weighing most heavily on risk-sensitive currencies like CAD.

It’s been a choppy, mixed start to the year in global financial markets, with equities higher in the US and Europe, oil prices swinging between gains and losses, whilst other commodities are hammered by a significantly stronger US dollar. The US dollar seems to be being driven by a safe haven bid that seems concentrated purely in FX markets (otherwise stocks would be lower), and this has also seen the yen supported (hence why they are the two best performing G10 currencies). Commodity and risk-sensitive currencies such as the Canadian, Australian and New Zealand dollar’s have all been getting hit hard and are each down 1.0-1.2% on the day versus the buck.

There isn’t one specific news event/fundamental catalyst behind Monday’s indecisive, mixed market tone. Notably, for FX markets, US bond yields are surging, with the 10-year up 10bps on the day to 1.60%. Unusually, this doesn’t seem to be having an effect on the outperforming yen (which is typically highly vulnerable to higher US yields), but it seems to be weighing on the rest of the G10. With Canadian, Australian and New Zealand bond markets shut on Monday for belated New Year’s Day holiday, CAD, AUD and NZD have all been robbed of the protection of a move higher in their own respective government bond yields that might have shielded the currencies from the dollar’s US yield rally-driven advances.

As to why US yields are surging, analysts at TD Securities said “it appears the sell-off today is being driven by the market viewing the Federal Reserve as still being likely to hike by mid-2022 despite the surge in COVID cases”. It's worth adding “that it's still early in the New Year and most of the world is off for the holiday, so thinner liquidity may certainly be exacerbating market moves” the analyst said.

In the last few hours, USD/CAD has surged back to the north of the 1.2750 level, having started 2022 underneath 1.2650. That amounts to an on-the-day gain of about 1.0%, which marks the pair’s best one-day performance since 26 November, the day the world first panicked about Omicron. The pair is likely to find some resistance in the 1.2800 area, given this area coincides with the 21-day moving average and has been an important balance area in the past. In the grand scheme of things, Monday’s move isn't significant, as it leaves USD/CAD trading close to the centre of December’s 1.2600-1.2950ish ranges.

- US dollar gains momentum during the American session as US yields rise.

- Cable trims last week gains moves further away from monthly highs.

The GBP/USD pair failed to hold above 1.3500 and tumbled, reaching 1.3428, the lowest level since last Wednesday. Cable remains near the daily low, under pressure amid a stronger US dollar across the board.

After a three-day rally, GBP/USD is falling sharply trimming last week gains. From the highest level in almost two months, it hit last week at 1.3551, cable is now under pressure, back under the 55-day simple moving average. The 1.3400/05 zone is the next support to consider.

The decline of GBP/USD took place amid a rally of the US dollar. The greenback benefited from higher US yields. The 10-year rose to 1.60%, the highest since November 26, the 30-year stands at 1.97% at the highest in a month. The 2-year Treasury yield reached the highest since March 2020.

Economic data released in the US showed no surprises. The final Markit Manufacturing PMI came in at 57.7, below the flash reading of 57.8. On Wednesday the ADP employment report is due and on Friday the non-farm payroll.

Technical levels

- The S&P 500 is trading a tad higher on the first session of the year, having seen choppy trade post-open.

- Most banks are bullish on the index for 2022.

US equities saw a choppy start to first trading session of 2022, with the S&P 500 index swinging between 4795 highs and sub-4760 lows in a matter of minutes in wake of the 1430GMT equity cash open. Those lows under the 4760 level were the lowest such levels that the index has traded at in one week. However, at current levels around 4780, the index is trading with modest on-the-day gains of about 0.3%. That means the index is only about 0.7% below the record levels near-4810 it printed last week, indicative of the fact that US equity market sentiment remains very strong at the beginning of the new year.

To the downside, S&P 500 bulls may jump on any dip back to support in the 4750 as a buying opportunity, though the true dip-buying has happened at the 21-day moving average in recent weeks. It proved a great entry point for short-term bulls twice in December. In terms of the other major US bourses, the Nasdaq 100 has been choppy within a 16.3K to 16.5K range and is about 0.4% higher on the day, whilst the Dow is attempting to poke back above 36.5K and trades higher by about 0.25%. The S&P 500 CBOE volatility index, often referred to as Wall Street’s “fear gauge”, is trading subdued just above recent lows in the 17.00 area, only a few points above 2021 lows in the 14.00-15.00 region and well below recent Omicron-uncertainty induced highs in the mid-30s.

Bank views

Given the turn of the year, banks have been releasing their views on how the S&P 500 will perform in the year ahead. Many banks are bullish. BNP Paribas say they “expect to see some compression of price/earnings ratio multiples for the S&P 500 as rates rise... However, strong earnings growth could still translate into about a 10% total return, in our view”. As such, the bank year-end forecast for the S&P 500 is 5,100.

BNY Mellon say “while the kind of returns we’ve seen in the past three years may not be repeated in 2022, we still believe equity markets can deliver another solid year – especially if economies and earnings continue to grow, without inflation becoming a longer-lasting problem”. Their year-end target for the S&P 500 is 4900-5100, which translates to a gain of about 5-10%.

JP Morgan target 5050 by the end of 2022. “This represents a smaller percentage appreciation compared to our 2021 forecast; however, we do think international equities, emerging markets and cyclical market segments will significantly outperform and deliver two- to three-times higher returns” the bank says. “Increasing interest rates and marginally tighter monetary policy should be a headwind for high-multiple markets such as the Nasdaq”.

Unicredit expect the S&P 500 to end 2022 at around 5100. “This would be around 9% above current levels” the bank says and “should be mainly driven by three important sectors in the U.S.: tech, financials and health care. Apart from solid earnings growth estimates, these sectors are highly likely to benefit from a high volume of share-buybacks in 2022”.

Not all banks agree, however. Morgan Stanley Wealth see the S&P 500 dropping to 4400 by the end of the year. “The core of our cautious 2022 view on the S&P 500 is our belief that during a midcycle transition, price-earnings ratios typically compress” the bank says. “As the market’s price-earnings ratio reverts to a more normal 18 from the current 22.5… If that is correct, the S&P 500 will be 3% lower a year from now even with an expected 14% gain in earnings”.

- Final Markit Manufacturing PMI fell to 57.7 in December from 58.3 in November.

- That was slightly below the flash reading of 57.8.

According to IHS Markit, final December Manufacturing PMI for the US was 57.7. That marked a slight downwards revision from the flash estimate of 57.8 and was below October's 57.8 reading.

Comments from Siân Jones, Senior Economist at IHS Markit:

“December saw another subdued increase in US manufacturing output as material shortages and supplier delays dragged on. Although some reprieve was seen as supply chains deteriorated to the smallest extent since May, the impact of substantially longer lead times for inputs thwarted firms’ ability to produce finished goods yet again."

“While shortages remained significant, the end of the year brought with it some signs that cost pressures have eased. The uptick in input prices was the slowest for six months, and firms recorded softer increases in selling prices amid efforts to entice customer spending.”

Market Reaction

The S&P 500 plunged at the time of the release, however, this seems to have more to do with volatility shortly after the first US equity open of 2022, rather than being to do with the latest PMI report.

- EUR/USD slips back to the 1.1300 zone, or new daily lows.

- The greenback gains on higher US yields across the curve.

- US Manufacturing PMI eased a tad to 57.7 in December.

Further improvement in the US dollar keeps the risk appetite subdued and sends EUR/USD to the area of daily lows around 1.1300 at the beginning of the week.

EUR/USD weaker on dollar strength

EUR/USD extends the rejection from recent tops in the 1.1380/90 band and slowly approaches the 1.1300 neighbourhood, where the 20-day SMA also coincides.

The deep knee-jerk in spot came on the back of persistent dollar upside, which is in turn sustained by the move higher in US yields.

Earlier in the euro docket, Markit’s final Manufacturing PMI in Germany came at 57.4 in December and 58.0 in the broader Euroland. Across the pond, the Manufacturing PMI dropped marginally to 57.7 in the same period ahead of November’s Construction Spending.

EUR/USD levels to watch

So far, spot is losing 0.67% at 1.1306 and faces the next up barrier at 1.1386 (monthly high November 30) followed by 1.1464 (weekly high Nov.15) and finally 1.1520 (200-week SMA). On the other hand, a break below 1.1273 (weekly low Dec.29) would target 1.1221 (weekly low Dec.15) en route to 1.1186 (2021 low Nov.24).

- AUD/USD has been under pressure in recent trade as risk-sensitive currencies are sold and safe-havens (including USD) are bought.

- Volumes were light with Australian and UK markets shut but are picking up now the US session gets underway.

AUD/USD has seen quite a sharp pullback in recent trade, dropping from Asia Pacific levels near 0.7250 to current levels underneath 0.7220 upon the arrival of US market participants ahead of the US open. Volumes during the Asia Pacific and early European sessions were much lower than normal and roughly in line with that seen during last week’s thinned holiday trade given the closure of Australian and UK financial markets on Monday. Thus, as trading volumes have started to pick up for the US session, markets seem to have found a little conviction, with the conviction in FX markets on Monday being a preference towards a stronger dollar.

This has weighed on the Aussie, which looks on course to test the key 0.7200 level shortly. At current levels, AUD/USD is trading about 0.7% lower on the session and is the worst performer amongst its G10 peers, with downside in the prices of key Australian metal exports (Copper -1.5%, Gold -1.0%) not helping. With the pair having dropped under short-term trendline support, more selling may well be in store.

The Aussie’s performance is broadly in fitting with G10 FX markets adopting a more defensive/risk-off bias on Monday, with the safe-haven dollar and yen outperforming despite stocks in Europe and the US (in pre-markets, at least) trading higher. There isn't any one theme or new developments that can be pointed at as to why FX markets are in a more risk-off mood, but traders may be taking some profit on risk-sensitive currencies after their recent run of strength.

Some are fretting about record Omicron infection rates in the UK, US and elsewhere and a potential surge in hospitalisations. Elsewhere, some have suggested the surge in the dollar versus some of its G10 peers could be down to a large rise on the day in US bond yields (10s up 9bps to near 1.60% and 2s up roughly 6bps to just under 0.80%). If this was the case, one would expect that USD/JPY (the most sensitive G10 pair to movements in rate markets) would be surging, which at the moment it isn’t.

Tensions between Russia and Ukraine remain elevated into the new year. Yohay Elam, an Analyst at FXStreet, explains how a Russian-Ukranian clash would affect markets and create trading opportunities.

An outright war remains a remote scenario and could trigger a rush to safe havens

“How will the Russia-Ukraine conflict impact markets? Basically, geopolitical worries tend to boost the safe-haven dollar and yen. The Swiss franc could also gain ground but to a lesser extent.”

“Ukraine does not possess critical resources and Western countries are likely to intervene in a conflict between Russia and Ukraine. Sanctions could push oil prices higher in the longer term, but probably not more than that.”

“Overall, a Russian invasion of Ukraine could trigger a dollar-selling opportunity.”

- EUR/JPY met a tough nut to crack at the 131.00 level.

- Higher US yields sustains the selling bias in the Japanese yen.

- The stronger dollar puts the risk complex under pressure.

After another failed attempt to surpass the 131.00 level, EUR/JPY came under pressure and receded to the mid-130.00s, where some initial contention turned up so far on Monday.

EUR/JPY looks to risk trends

EUR/JPY enters the new year on the defensive around 131.00 following two consecutive weekly advances, all after bottoming out in the 127.50/40 region in the last part of 2021.

The renewed bid bias surrounding the greenback put the risk-linked galaxy under pressure on Monday, helped at the same time by soaring US yields as market participants slowly return to the normality after the festive period.

The cross, in the meantime, looks to leave behind the key 200-day SMA, today in the 130.50 zone, to facilitate extra gains in the short-term horizon.

Earlier in the euro docket, the German and EMU final Manufacturing PMI came at 57,4 and 58.0, respectively, for the month of December. Later in the NA session, the final Manufacturing PMI is due seconded by November’s Construction Spending.

EUR/JPY relevant levels

So far, the cross is retreating 0.33% at 130.58 and a surpass of 131.02 (monthly high Dec.31) would expose 131.15 (Fibo level) and then 132.17 (Fibo level). On the downside, the next support comes at 130.50 (200-day SMA) followed by 129.79 (100-day SMA) and finally 127.51 (low Dec.20).

- A combination of factors prompted aggressive selling around gold on Monday.

- The prevalent risk-on mood acted as a headwind for the safe-haven commodity.

- Rising US bond yields, resurgent USD demand contributed to the intraday selling.

Gold witnessed aggressive selling on the first trading day of the new year and stalled a near three-week-old uptrend around the $1,830-32 supply zone, or the highest level since November 22. The intraday selling pressure picked up pace during the early North American session and dragged spot prices to a fresh daily low, around the $1,805 region in the last hour.

Signs that the Omicron variant might be less severe than feared and is unlikely to derail the economic recovery overshadowed concerns about the continuous surge in new COVID-19 cases. The optimism was evident from an extension of the recent bullish run in the equity markets, which was seen as a key factor that acted as a headwind for the safe-haven gold.

Meanwhile, the risk-on mood, along with the Fed's hawkish outlook triggered a fresh leg up in the US Treasury bond yields and further drove flows away from the non-yielding yellow metal. In fact, the yield on the benchmark 10-year US government bond ended 2021 with the largest rise since 2013 and shot to back closer to 1.58%, or over a one-month high on Monday.

Moreover, the so-called dot plot indicated that the Fed officials expect to raise the fed funds rate at least three times in 2022. The combination of factors allowed the US dollar to regain positive traction and recover a major part of Friday's losses. This further undermined demand for the dollar-denominated gold and contributed to the intraday slide.

With the latest leg down, the XAU/USD has now reversed last week's positive move and a subsequent slide below the $1,800 mark will set the stage for further losses. That said, traders might refrain from placing aggressive bets amid quiet holiday trading and ahead of important US macro data scheduled at the beginning of a new month.

This week's US economic docket highlights the release of ISM PMIs and the ADP report. The market focus, however, will remain on the closely-watched US monthly jobs report (NFP) on Friday. Hence, it will be prudent to wait for a strong follow-through selling before confirming that gold has topped out and positioning for any further depreciating move.

Technical outlook

From a technical perspective, a sustained break below the $1,800 mark might prompt some technical selling and turn the XAU/USD vulnerable to slide further. The downward trajectory could drag spot prices further towards the $1,785 horizontal zone en-route the next relevant support near the $1,770 region and December swing low, around the $1,753 area.

On the flip side, the $1,830-32 region should continue to act as a key barrier, which if cleared decisively should push gold prices further towards the $1,850 region. The upward trajectory could further get extended towards November 2021 swing high, around the $1,877 with some intermediate hurdle near the $1,870 area.

Gold daily chart

Levels to watch

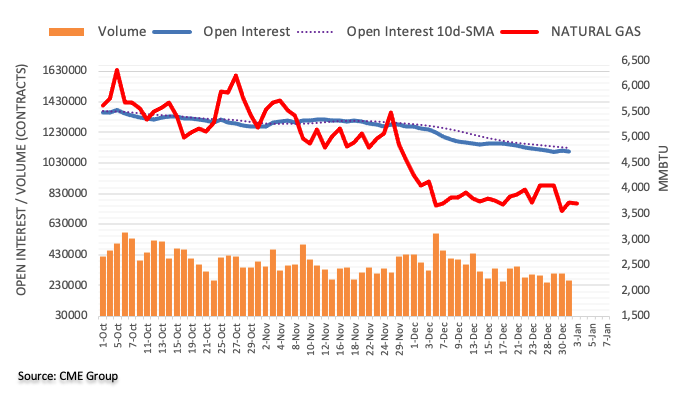

- WTI recently slipped under $75.00 to one-week lows, as traders fret over surging Omicron infections and a potential hospitalisation surge.

- Rising OPEC+ and US output also weakens the bull case, with OPEC+ expected to agree to higher output this week.

- The 50DMA may thus continue to act as a significant area of near-term resistance.

Early optimism in oil markets that saw front-month WTI future at one point surpassing the $76.00 during early European trade has given way upon the arrival of US markets participants, with WTI having dropped under $75.00 recently. The main benchmark for US light crude oil now trades at its lowest since last Monday’s surge below key resistance in the $75.00 area and is down about 75 cents on the day (roughly 1.0%). The $75.00 area has so far failed to offer support, implying that oil may see further (technically driven) selling as short-term bears look for a test of the $74.00 level.

In terms of the major themes being cited as driving oil market price action at the start of the week and the first trading session of 2022, there is some focus on surging Omicron infection rates. As cases hit record highs in the UK, Europe and US, investors are bracing for a surge in hospitalisations. Even though the scientific community seems to agree that Omicron is roughly three times less likely to result in hospitalisation (per infection), its high transmissibility means the risk of hospitals filling up again remains worth considering. UK PM Boris Johnson warned on Monday that UK hospitals face considerable pressure in the coming weeks and options (i.e. the potential for tougher restrictions) are being kept under review.

This could be weighing on prices this morning. In terms of oil-specific news, there was some focus on news of a 200K BPD outage in Libya, which will last one week, due to maintenance, but this hardly matters in the grand scheme of things, hence why it didn’t offer prices lasting support. Oil markets are not expected to be as tight as they were a few months ago as OPEC+ and the US continue to raise output. Regarding the former; more OPEC+ sources said the cartel will stick to its 40K barrel per day per month output hike plans when they meet this week, meaning 400K more barrels per day as of February. The group meets on Tuesday to discuss output policy, after agreeing on Monday to appoint Kuwait’s Haitham Al Ghais as its new secretary-general. This appointment isn’t expected to have any bearing on policy.

Meanwhile, last Friday’s Baker Hughes rig count showed US oil and gas firms adding rigs for a 17th consecutive month (a record), while an EIA report showed US output rising 6% to just under 11.5M barrels per day in October, as US output recovered from hurricane outages in September. With the large oil market deficits experienced in mid-2021 seemingly now a thing of the past the case for WTI to return to its October highs in the mid-$80s is weaker. For now, that means it may be a struggle for WTI to get above its 50DMA, which has been offering solid resistance over the last week or so.

- USD/CHF staged a goodish rebound from the 0.9100 mark on Monday, or a near two-month low.

- The prevalent risk-on mood undermined the safe-haven CHF and acted as a tailwind for the major.

- Rising US bond yields benefitted the USD, which contributed to the intraday short-covering move.

The USD/CHF pair trimmed a part of its intraday gains and was last seen trading around the 0.9135 region heading into the North American session.

A combination of supporting factors assisted the USD/CHF pair to defend and attract some buying around the 0.9100 mark on Monday. Despite the continuous surge in new COVID-19 cases, investors remain optimistic over signs that the Omicron variant might be less severe than feared and is unlikely to derail the economic recovery. This was evident from a generally positive tone around the equity markets, which undermined the safe-haven Swiss franc.

On the other hand, the US dollar drew some support from a fresh leg up in the US Treasury bond yields and reversed a major part of Friday's decline to the lowest level since November 30. In fact, the yield on the benchmark 10-year US government bond shot to 1.54%, back closer to a near one-month high touched last week. This, along with the Fed's hawkish outlook further acted as a tailwind for the greenback and provided a goodish lift to the USD/CHF pair.

The uptick, however, lacked bullish conviction and remained capped amid quiet holiday trading. Traders also seemed reluctant to place aggressive bets, rather preferred to wait on the sidelines ahead of important US macro data scheduled at the beginning of a new month. This week's US economic docket highlights the release of ISM PMIs and the ADP report. The market focus, however, will remain on the closely-watched US monthly jobs report (NFP) on Friday.

In the meantime, the US bond yields will play a key role in influencing the USD price dynamics and provide some impetus to the USD/CHF pair. Apart from this, traders will take cues from developments surrounding the coronavirus saga and the broader market risk sentiment to grab some short-term opportunities. Nevertheless, the pair, for now, seems to have stalled its recent downward trajectory, though any meaningful recovery still seems elusive.

Technical levels to watch

UK PM Boris Johnson said on Monday that the way forward is to continue on the same path (no explicit lockdowns), but also to keep everything (i.e. the potential for further restrictions) under review. Pressure on hospitals will be considerable over the next few weeks, Johnson added, saying that the majority of people in intensive care are either vaccinated or boosted. The mixture of things we are doing at the moment, he added, is the right one.

Market Reaction

FX markets have not seen any notable reaction to the latest comments from Johnson. If momentum/speculation of a tightening of curbs in the UK starts to build once again, this is a near-term downside risk for GBP.

- EUR/GBP is subdued at the start of 2022 close to 0.8400 and close to 22-month lows with UK markets shut.

- EUR/GBP was unresponsive to Monday’s final Eurozone manufacturing PMI and awaits further UK/Eurozone PMI surveys and Eurozone inflation this week.

EUR/GBP is starting the year in subdued fashion and meandering within recent ranges close to the 0.8400 level, which is not all too surprising given markets in London (Europe’s busiest FX trading hub) are closed for a UK bank holiday. To the upside, technicians will be eying last Friday’s 0.8415ish highs are resistance and to the downside, last Friday’s near two-year lows in the 0.8360s will offer support.

Markets have broadly been in a risk-on mood for most of the last 10 or so trading sessions, reflective of expectations that the comparatively milder Omicron Covid-19 variant will not wreak lasting economic damage on the global economy. This has helped GBP, which is more risk-sensitive than the euro, thus weighing on EUR/GBP, helping the pair hit 22-month lows at the end of last week under 0.8400. EUR/GBP has also benefitted from BoE/ECB policy divergence and this may well remain the case in 2022 with a few more rate hikes expected from the former but not the latter, as well as some potential quantitative tightening.

Economic data

Final Eurozone Manufacturing PMI figures out this morning offered little surprises with the headline Eurozone aggregative index coming in as expected at 58.0 showing sentiment in the sector remains strongly robust. EUR/GBP has thus not seen any reaction. The survey highlighted factories taking advantage of easing supply chain issues and reportedly buying raw materials at a record pace. Manufacturers expressed optimism that supply chain snags will ease further in 2022 and order books remain full, indicating the potential for strong output growth ahead. Euro traders will be more focused on a trickle of flash December HICP inflation estimates, with France reporting on Tuesday, Italy on Wednesday and Germany on Thursday ahead of the release of the aggregative numbers on Friday.

Last week’s Spanish numbers suggest upside risks to expectations (aggregative Eurozone inflation is seen slipping to 4.7% YoY from 4.9% in November). Final Eurozone service PMI numbers are unlikely to shift the dial, just as the final manufacturing survey results did on Monday. In terms of UK data, final PMI surveys will also be out this week and maybe slightly more interesting; the rapid spread of Omicron in the UK in the latter half of December means there may be negative revisions which could portend a big drop in sentiment in January. Indeed, there is generally a view data that doesn’t cover the period of rapid Omicron spread (like this week’s US and Eurozone data) is a little “out-of-date”, with traders more focused on January numbers to guage the near-term economic damage.

Whilst hot Eurozone inflation could offer the euro some short-term support, expectations of a continued large BoE/ECB policy divergence limit any potential upside. EUR/GBP is likely to be sensitive this week to Omicron news as cases rise in the UK, Europe and elsewhere. Any lockdown chatter in the UK could hurt sterling and see EUR/GBP rebound.

- EUR/USD erodes part of Friday’s advance to the proximity of 1.1390.

- Further north from that level comes the 1.1430 zone.

EUR/USD comes under selling pressure at the beginning of the year following new December’s top near 1.1390 recorded in the last session of the 2020.

There is a temporary hurdle signalled by the 55-day SMA, today at 1.1398, ahead of the 4-month resistance line around 1.1430. The surpass of the latter is expected to mitigate the downside bias and allow for extra gains in the short-term horizon.

The broader negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1751.

EUR/USD daily chart

- DXY partially reverses Friday’s pullback and approaches 96.00.

- Recent lows in the mid-95.00s should hold the downside for now.

The recent corrective downside in DXY seems to have met some decent contention in the 95.50 region so far.

A breach of the 95.50 zone should allow for an immediate test of the 55-day SMA at 95.39. On the other hand, if bulls manage to regain control, an attempt to the YTD high just below the 97.00 barrier (November 24) should not be ruled out.

In the meantime, while above the 4-month support line (off September’s low) around 94.80, the constructive view in DXY should remain unchanged. In addition, the broader positive stance stays underpinned by the 200-day SMA at 92.99.

DXY daily chart

- USD/JPY struggled to capitalize on its intraday positive move to an over one-month high.

- The risk-on mood undermined the safe-haven JPY and extended some support to the major.

- The USD drew some support from rallying US bond yields and further helped limit the slide.

The USD/JPY pair dropped to a fresh daily low during the mid-European session, with bears now awaiting a sustained break below the key 115.00 psychological mark.

The pair struggled to capitalize on its intraday positive move and witnessed a modest pullback from the 115.35 region, or the highest level since November 26 touched earlier this Monday. The intraday slide lacked any obvious fundamental catalyst and could be solely attributed to some profit-taking, especially after the recent strong runup of nearly 300 pips over the past one month or so. That said, a combination of factors should limit the downside for the USD/JPY pair.

The optimism over signs that the Omicron variant might be less severe than feared and is unlikely to derail the economic recovery helped offset worries about the continuous surge in new COVID-19 cases. This was evident from a generally positive tone around the equity markets, which should act as a headwind for the safe-haven Japanese yen. Apart from this, a modest US dollar strength and a fresh leg up in the US Treasury bond yields could extend support to the USD/JPY pair.

In fact, the yield on the benchmark 10-year US government bond shot back to 1.54% and might now be eyeing a near one-month high touched last week. This, along with the Fed's hawkish outlook, indicating at least three rate hikes in 2022, assisted the USD to regain positive traction and reverse a major part of Friday's slide. Despite the supporting factors, the USD/JPY pair lacked bullish conviction amid quiet holiday trading on the back of an extended weekend in the US.

Investors also seemed reluctant to place aggressive directional bets, instead preferred to lighten their bullish positions ahead of important US macro data scheduled at the beginning of a new month. This week's US economic docket highlights the release of ISM PMIs and the ADP report on private-sector employment. The focus, however, will remain on the closely-watched US monthly jobs report (NFP) on Friday, which should provide a fresh impetus to the USD/JPY pair.

Technical levels to watch

France's Finance Minister Bruno Le Maire announced on Monday that the government will widen the financial aid for companies hit by the coronavirus pandemic, as reported by Reuters.

La Maire further added that they will lower the threshold for companies to claim state support for turnover losses and noted that the additional cost of widening the aid will be in the range of "some hundred million euros."

Market reaction

This headline doesn't seem to be having a noticeable impact on the shared currency's performance against its rivals. As of writing, the EUR/USD pair was down 0.1% on the day at 1.1355.

- EUR/JPY corrects lower following Friday’s tops around 131.00.

- There is an interim hurdle at the Fibo level at 131.15.

EUR/JPY partially fades Friday’s strong advance after faltering once again around the 131.00 neighbourhood on Monday.

The recent breakout of the critical 200-day SMA (130.50) should prop up extra gains in the cross in the short-term horizon. That said, bulls now face the next minor barrier at the Fibo level (of the October-December drop) at 131.15. Further north is seen the 131.41 level (November 10) ahead of another Fibo level at 132.17.

While above the 200-day SMA, the outlook for EUR/JPY should point to extra gains.

EUR/JPY daily chart

Citing three sources familiar with the matter, Reuters reported on Monday that the Organization of the Petroleum Exporting Countries (OPEC) and its allies are expected to increase the oil output by 400,000 barrels per day in February as planned.

The group known as OPEC+ will have a meeting on Tuesday, January 4, to decide on the oil supply strategy.

Market reaction

This headline doesn't seem to be having a significant impact on crude oil prices. As of writing, the barrel of West Texas Intermediate (WTI) was trading at $76.25, gaining 1.2% on a daily basis.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the recently published results from the Exports sector in Malaysia.

Key Takeaways

“Exports expanded at a stronger pace of 32.4% y/y in Nov (Oct: 25.5%) which was in line with our forecasts but higher than Bloomberg consensus (30%). Imports gained 38% y/y (Oct: 27.9%) Higher imports over exports led to narrower trade surplus of MYR18.9bn (Oct: MYR26.3bn).”

“Overall exports in Nov were lifted by robust shipments of electrical and electronic (E&E) products (17.4% y/y), petroleum products (111.6%), palm oil and palm-oil based agriculture products (97.4%), and LNG (99.5%). Exports to key markets included ASEAN, China, USA, EU and Japan, which recorded double-digit growth.”

“With year-to-date (YTD) export growth of 25.7% y/y, this has surpassed our export target of 25%. Nevertheless, we expect a bumpy recovery in the coming months with a projected 2.0% export growth for 2022. The Omicron variant, ongoing supply-chain disruptions, and higher prices of traded goods could pose downside risks to the trade outlook. Domestically, worker shortages and the floods have dampened production in selected sectors and areas.”

- USD/TRY extends the rebound to the 14.00 area on Monday.

- Turkey headline CPI rose 13.58% MoM, 36.08% YoY in December.

- Turkey Manufacturing PMI improved a tad to 52.10 last month.

The Turkish lira extends the rout and pushes USD/TRY to fresh 2-week peaks in levels just shy of the 14.00 hurdle on Monday.

USD/TRY stronger on higher CPI

USD/TRY advances for the sixth consecutive session on Monday in response to the resumption of the buying interest in the greenback and further domestic headwinds facing the lira.

Indeed, TRY suffered another bout of selling pressure after Turkey’s inflation figures showed the CPI rose at a shocking 13.58% MoM in December and 36.08% from a year earlier, while the Core CPI gained 31.88% over the last twelve months.

In addition, the lira continues to give away part of the strong gains recorded soon after the government announced a plan aimed at preventing further dollarization of its economy in past days, as enthusiasm among Turks continues to fizzle out.

Extra results in the Turkish docket showed Producer Prices rose 19.08% on a monthly basis and 79.89% over the last twelve months and a slight improvement in the Manufacturing PMI to 52.10 in December.

What to look for around TRY

The lira resumed the downtrend in past sessions, as markets (and Turks) appear to have digested the recently announced measures by the government to promote the shift from dollars to the domestic currency. The reluctance of the CBRT to change (collision) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation are forecast to keep the lira under persistent pressure. That said, another visit to the all-time high north of the 18.00 mark in USD/JPY should not be ruled out just yet.

Key events in Turkey this week: December Inflation Rate, Producer Prices, Manufacturing PMI (Monday).

Eminent issues on the back boiler: Progress (or lack of it) of the new scheme oriented to support the lira. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges.

USD/TRY key levels

So far, the pair is gaining 1.15% at 13.3675 and a drop below 11.6665 (55-day SMA) would open the door to 10.2027 (monthly low Dec.23) and finally 9.3734 (200-day SMA). On the other hand, the next up barrier lines up at 18.2582 (all-time high Dec.20) followed by 19.0000 (round level).

- A strong pickup in the USD demand prompted some selling around GBP/USD on Monday.

- The risk-on mood capped the safe-haven USD and helped limit the downside for the pair.

- Investors now look forward to this week’s US macro data for a fresh directional impetus.

The GBP/USD pair remained on the defensive through the first half of the European session, albeit has managed to recover a few pips from the daily swing low. The pair was last seen trading around the 1.3515-20 region, down less than 0.10% for the day.

The US dollar made a solid comeback on the first trading day of the new year and failed to assist the GBP/USD pair to capitalize on its recent gains recorded over the past two weeks or so. The Fed's hawkish outlook, indicating at least three rate hikes in 2022, along with elevated US Treasury bond yields acted as a tailwind for the greenback.

It is worth recalling that the yield on the benchmark 10-year US government bond recorded the largest yearly increase since 2013 and ended 2021 above the 1.50% threshold. This, along with the worsening COVID-19 situation in the United Kingdom, further undermined the British pound and exerted some downward pressure around the GBP/USD pair.

Britain has been reporting a record number of new COVID-19 cases over the past few days, which could force the government to impose more restrictions. It is worth recalling that the UK Prime Minister Boris Johnson had said last week that ministers would keep the latest data under constant review to see if additional stricter measures are needed.

That said, the underlying bullish tone – as depicted by a generally positive tone around the equity markets – capped gains for the safe-haven greenback. This, in turn, assisted the GBP/USD pair to reverse an intraday slide to sub-1.3500 levels. The attempted recovery, however, lacked bullish conviction amid quiet holiday trading.

Nevertheless, the emergence of some dip-buying at lower levels supports prospects for an extension of the recent upward trajectory. Bulls, however, are likely to wait for a sustained strength beyond the 100-day SMA before placing aggressive bets ahead of this week's important US macro data, including the closely-watched NFP report.

Technical levels to watch

- Gold price pulls back from multi-week highs amid Fed rate hikes speculation.

- Risk-on sentiment at the start of 2022 also bodes ill for the bright metal.

- Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal.

Gold is feeling the pull of gravity on the first trading day of 2022, in what seems to be a correction from six-week highs of $1,832. Expectations that the upcoming US first-tier economic events, including the ISM PMIs and Nonfarm payrolls, will confirm a March Fed rate hike are keeping the bulls on the back foot. Additionally, the upbeat market mood is collaborating with the pullback in gold price.

Read: Gold Price Forecast: XAU/USD is down starting out 2022 but not out

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold price is trading below strong resistance of $1,827, where the Fibonacci 23.6% one-day coincides with the previous high four-hour and SMA10 one-hour.

The next topside hurdle is seen at the previous day’s high of $1,830, above which the multi-week top of $1,832 will be challenged once again.

The pivot point one-day R1 at $1,835 will be a tough nut to crack for gold bulls.

On the flip side, strong support is pegged at $1,821, the intersection of the Fibonacci 61.8% one-day, Fibonacci 23.6% one-week and previous low four-hour.

The next relevant cap is seen at 1,818, which is the pivot point one-day S1. Friday’s low of $1,815 will be next on sellers’ radars.

The convergence of the SMA100 one-hour and Fibonacci 23.6% one-month at $1,812 will be the line in the sand for gold buyers.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Barnabas Gan, Economist at UOB Group, assesses the latest inflation figures in Singapore.

Key Takeaways

“Singapore’s consumer prices rose at its fastest rate since February 2013 at 3.8% y/y (+1.0% m/m sa) in November 2021.”

“Similarly, Singapore’s core inflation accelerated to 1.6% in November 2021, the fastest gain since March 2019.”