- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 30-12-2021

- GBP/USD grinds higher at multi-day top, bulls taking a breather after two-day uptrend.

- UK’s Sefcovic said, “London has breached great deal of trust.”

- Britain aims for ‘surge hubs’ as virus cases refresh record top.

- New Year’s Eve, light calendar to restrict market performance during the last of 2021.

GBP/USD takes rounds to 1.3500 during Friday’s Asian session, after refreshing the 10-week high the previous day. In doing so, the cable buyers pause following two consecutive days of run-up amid lackluster markets and no major catalysts, not to forget the year-end liquidity crunch.

Although the UK continues to suffer from the South African covid variant, namely Omicron, the government’s active response and medical studies taming fears of the virus strain keep GBP/USD buyers hopeful. Also helping the bulls could be the US dollar’s struggle, or preparations for the Fed rate hike in 2022, after a stellar 2021.

That said, Britain’s National Health Services (NHS) unveiled plans for “surge hubs” on Thursday. The so-called temporary medical housing facility became needed after the UK reported 189,213 cases.

The UK isn’t the only one suffering from the virus and has to control some of the year-end celebrations, the US and Europe are also in the line. That said, global policymakers advise people to stay cautious while cheering for 2022. Among them was World Health Organization Director-General Tedros Adhanom Ghebreyesus who urged people, per Reuters, “It's better to cancel now and celebrate later, than to celebrate now and grieve later.”

On a different page, European Commission vice-president Maros Sefcovic conveyed his dislike, for the UK’s Article 16 threats, via German news website Der Spiegel. Even so, the policymaker was sounding cautiously optimistic over finding a Brexit solution. It should be noted that the post-Brexit border checks take effect from January and increase the pessimism on the matter, which in turn should have the GBP/USD prices.

Elsewhere, the US policymakers remain hopeful of reaching an agreement over the Build Back Better (BBB) plan while also trying to placate fears over the Omicron. Talking about data, the US Initial Jobless Claims eased to 198K versus 208K expected during the week ended on December 24. Further, Chicago Purchasing Managers’ Index rose past 62.0 forecast to 63.1 for December.

It’s worth noting that the Wall Street benchmarks posted mild losses whereas the US 10-year Treasury yields consolidated the heaviest daily jump in three weeks, posted the previous day. That said, the S&P 500 Futures remain lackluster around 4,775 at the latest.

Moving on, GBP/USD prices are likely to remain sidelined amid a lack of major data/events and the year-end thin liquidity conditions.

Technical analysis

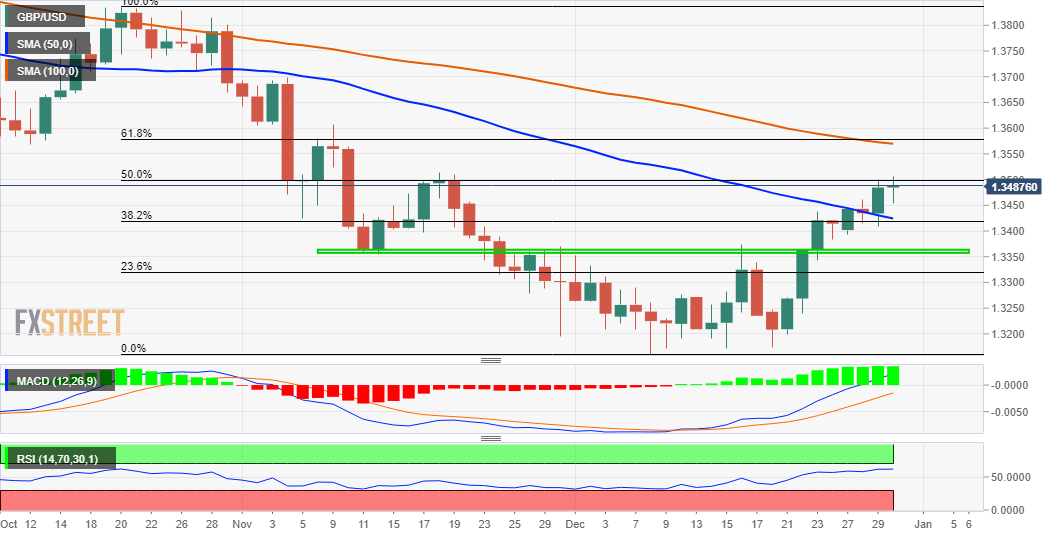

50% Fibonacci retracement of October-November downside, around 1.3500, restricts immediate moves of the GBP/USD pair. However, a clear upside break of the 50-DMA, at 1.3420 by the press time, keeps buyers hopeful.

Late Thursday, US President Joe Biden and his Russian counterpart Vladimir Putin held a telephonic conversation over the Russia- Ukraine tussles.

“U.S. President Joe Biden and his Russian counterpart Vladimir Putin on Thursday warned each other that an escalation of tensions over Ukraine could rupture relations between the two countries, U.S. and Russian officials said,” per Reuters.

The news also quotes White House press secretary Jen Psaki’s statement saying, “He (Biden) made clear that the United States and its allies and partners will respond decisively if Russia further invades Ukraine.”

On the other hand, Kremlin said, per the news, “Putin told Biden that any sanctions could rupture ties between Russia and the United States and would be a big mistake.”

It was also mentioned in the news that, “But Kremlin aide Yuri Ushakov said Russia was satisfied with their phone conversation, which he said centered on security guarantees that Moscow wants from the West amid a build-up of Russian forces close to the Ukrainian border.”

FX implications

Although the news hints at further challenges to the market sentiment, the year-end liquidity crunch and New Year’s Eve in major Asia-Pacific nations restrict the reaction to the news update. That said, the risk barometer pair AUD/USD remains pressured 0.7245 by the press time.

Read: AUD/USD: Gravestone Doji at monthly top probe bulls below 0.7300, China PMI eyed

- EUR/USD fades bounce off 100-SMA, dropped the most in two weeks the previous day.

- Steady RSI, sluggish MACD hints at extended grind between 100-SMA and monthly resistance line.

- Mid-November tops add to the upside filters, five-week-old rising trend line acts as additional support.

EUR/USD consolidates the heaviest daily loss in a fortnight with a choppy range above 1.1300 during Friday’s initial Asian session. That said, the quote seesaws near 1.1325 by the press time.

In doing so, the major currency pair struggles to keep the bounce off 100-SMA after taking a U-turn from the monthly high on Wednesday.

Although EUR/USD buyers keep returning from the 100-SMA, sluggish oscillators, namely the MACD and RSI, hints at another inactive daily performance by the pair as it approaches 2022.

That said, a downside break of the 100-SMA level of 1.1300 will have another support to watch, namely a two-week-old ascending trend line near 1.1280.

Also challenging the EUR/USD bears is an upward sloping support line from November 30, near 1.1245.

Meanwhile, an upside clearance of the monthly horizontal hurdle around 1.1360 will need validation from the November 16 peak of 1.1385 to convince the EUR/USD bulls.

Following that, a run-up toward the tops marked during June and March of 2020, respectively near 1.1425 and 1.1500, can’t be ruled out.

EUR/USD: Four-hour chart

Trend: Sideways

- AUD/USD seesaws after forming bearish candlestick near monthly high.

- Market sentiment dwindles as New Year approaches, Omicron cases rise.

- Aussie PM Morrison refrained from any major activity restrictions after snap National Cabinet Meeting.

- Key markets in Asia-Pacific are off due to New Year’s Eve, China’s official PMI for December will be eyed.

AUD/USD struggles around the monthly top, taking rounds to 0.7250-60 during early Friday morning in Asia.

The Aussie bulls again faced rejection near 0.7275 the previous day, while forming a bearish candlestick chart at the monthly top as mixed sentiment and a light calendar joins thin end-of-year liquidity conditions.

The pair’s latest performance portrayed the market’s inactive status during the final days of 2021, even as the South African covid variant named Omicron continues to hurt the sentiment with a jump in cases.

After witnessing a rally in the daily covid infections at home and abroad, the Australian Prime Minister decided to alter the definition of ‘close contact’ with the infected during the emergency National Cabinet Meeting. “We need to reset how we think about the pandemic, and how we manage ourselves and the things we need to do as governments,” said Aussie PM Morrison.

That said, Australia’s populous state New South Wales (NSW) again reports a jump in the COVID-19 figures while Victoria also prints an all-time high of 5,919 cases and seven virus-linked death per ABC News. “NSW's daily COVID-19 case tally has nearly doubled for the second time in three days, with 21,151 infections and six deaths recorded,” said ABC News.

Elsewhere, Reuters tally for the US coronavirus numbers suggests a record number of newly reported cases, based on the seven-day average, while printing above 290,000 figures for the second consecutive day. “In Europe, where almost one million people have died of coronavirus over the past 12 months, traditional concerts and firework displays that typically draw thousands of people onto the streets were canceled in most major cities, including London, Paris, Zurich, Brussels, Warsaw and Rome,” said Reuters.

Talking about data, the US Initial Jobless Claims eased to 198K versus 208K expected during the week ended on December 24. Further, Chicago Purchasing Managers’ Index rose past 62.0 forecast to 63.1 for December.

While portraying the market mood, the Wall Street benchmarks posted mild losses whereas the US 10-year Treasury yields consolidated the heaviest daily jump in three weeks, posted the previous day.

It’s worth noting that the firmer US data and Omicron fears underpinned the US dollar’s safe-haven demand but cautious optimism of the global policymakers joined the year-end lacklustre moves to restrict the AUD/USD moves.

Given the holiday at home, as well as the light calendar, AUD/USD prices may remain sluggish. However, China’s official PMIs for December will be important to watch. That said, the headline NBS Manufacturing PMI is expected to remain unchanged at 50.1 while Non-Manufacturing PMI may improve to 53.1 versus 52.3, which in turn can help the Aussie pair to overcome the immediate hurdle on firmer readings.

Technical analysis

AUD/USD formed “Gravestone Doji” bearish candlestick near 0.7275 key hurdles comprising monthly rising wedge’s resistance line and 50% Fibonacci retracement (Fibo.) of October-December downside.

Adding to the upside filters is the 100-DMA level of 0.7290 that will act as a validation point for the further rally towards the mid-November swing high of 0.7371.

Alternatively, pullback moves can retest 38.2% Fibo. level surrounding 0.7200 but a three-month-old horizontal area near 0.7175-70 will restrict any further downside.

- Spot gold has been pressing higher in recent trade and look to be on course to test Tuesday’s $1820 highs.

- XAU/USD has been taking its cue on Thursday from falling real yields and rising inflation expectations.

- Traders and analysts have been warning against reading too much into any market moves this week given year-end illiquidity.

Spot gold prices (XAU/USD) have been pressing higher in recent trade and look to be on course to test Tuesday’s $1820 highs. At current levels close just above $1815, spot gold is on course to close out the session about $13 or roughly 0.7% higher. A strong weekly US jobless claims report, that showed initial claims dropping back under 200K (below pre-pandemic levels) and continued claims falling to just above 1.7M (in line with pre-pandemic levels) does not seem to have weighed on the precious metal.

Typically, strong labour market data would weigh on gold as it would be interpreted as having hawkish implications for Fed policy. But the Fed has gone to great lengths in recent weeks, including at its latest meeting, to acknowledge the tightness of the current US labour market, so Thursday’s data does little to surprise the bank or change this narrative. Instead, spot gold has been taking its cue on Thursday from falling real yields and rising inflation expectations.

The 5-year TIPS yields dropped under -1.63% in recent trade, its lowest level since 9 December and is down nearly 10bps on the day. That has not been accompanied by a fall in the nominal 5-year yield of equal magnitude, thus pushing 5-year break-even inflation expectations higher. 5-year breakevens moved above 2.90% on Thursday and look on course to test the early December highs at 2.92%. Remember that lower real yields is a positive for non-yielding gold as its lowers the “opportunity cost” of holding the precious metal, while higher inflation expectations increase the demand for inflation protection, which gold is seen as offering.

It's not clear why the demand for inflation protection in the form of TIPS has surged this week (hence pushing real yields lower). Traders and analysts have been warning against reading too much into any market moves this week, which are said to be exacerbated by low liquidity/volumes given many market participants are away for year-end holidays. Volumes and conviction are set to return next week and at the start of the new year, with plenty of US data to also give markets some direction/provide talking points.

- Spot silver prices have been choppy over the last few days, swinging between an 80 cents $22.60 to $23.40ish range.

- XAG/USD has recovered back above $23.00 on Thursday, putting on course for a 1.0% monthly gain but 12% annual loss.

- XAG/USD traders should keep their eyes on inflation expectations and real yields in 2022 as the Fed pivots hawkishly.

Spot silver (XAG/USD) prices have been choppy over the last few days, swinging between an 80 cents $22.60 to $23.40ish range in low liquidity/volume trading conditions. Right now, spot prices are trading slightly to the north of the $23.00 level again for an on-the-day gain of just over 1.0%. That means XAG/USD should end the month also about 1.0% higher, having recovered more than 7.5% from early monthly lows in the $21.50 area after spot prices found strong support at the late September (and annual) lows. On the year and with one trading session to go, spot silver prices are on course to post losses of slightly more than 12.0%.

Back to spot silver’s price action over the past few days; the confusing moves seem to have taken their cue from bond market developments. Real yields have been falling throughout the week, with 5-year TIPS now under -1.60% having begun the week above -1.50%, which has ultimately offer spot silver and other precious metals support. But nominal yields have been choppy, with the 5-year jumping as high as 1.31% on Wednesday from beginning the week under 1.25%, which coincided with silver prices pulling back from Tuesday’s $23.40 highs to Wednesday’s $22.60 lows. Nominal yields have since backed off, with the 5-year back around 1.27% and this has helped silver recover to current levels above $23.00.

The divergence between nominal (rising on the week) and real yields (falling sharply on the week) has seen break-even inflation expectations surge. 5-year breakevens began the week around 2.75% but have surged to close to 2.90%, the highest since 9 December. Whether this translates into a more lasting upturn and a challenge of November highs in the 3.30% area over the course of Q1 2022 remains to be seen, but could be a source of support for precious metals like silver which are seen as an inflation hedge.

With it seeming increasingly likely that the Fed is going to start its rate hiking cycle in March or, at the latest, May, this may be enough to keep inflation expectations in check, so long as markets believe a proactive Fed will squash inflation. If inflation expectations do fall back from current levels and perhaps head back towards Q2/3 2021 lows in the 2.40% area, this could put upwards pressure on real yields. Given the negative correlation between real yields (seen as a proxy for “opportunity cost”) and non-yielding precious metals, this would present an important headwind. Spot silver’s major patter in 2021 was lower highs followed by lower lows and it seems likely this will continue into 2022, which could see XAG/USD drop under key support in the $21.00s zone.

What you need to know on Friday, December 31:

Major pairs held within familiar levels on Thursday, trading choppily amid thinned market conditions. Most financial markets will be closed on Friday, amid the New Year’s Eve holiday. Wall Street will operate normally, while the bonds markets will close earlier. Market’s are likely to remain choppy.

The macroeconomic calendar will remain empty through all Friday, although China will publish the December official PMIs.

Coronavirus contagions continue escalating to record cases. Italy reported 126K new contagions, Spain 161K.

The EUR/USD pair is trading a few pips above the 1.1300 level, while GBP/USD managed to reach a fresh monthly high of 1.3521. The Canadian dollar was the strongest, as USD/CAD fell to the 1.2740 price zone. The AUD/USD pair, on the other hand, met sellers for a second consecutive day around 0.7275. USD/JPY maintained a positive tone, trading at around 115.10.

Crude oil consolidate gains, while gold prices ticked higher, with both holding within familiar levels.

Wall Street edged higher, with the S&P reaching record highs. US Treasury yields held near Thursday’s high, with the yield on the 10-year note currently at 1.52%.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Time to squeeze out the last gains for 2021

Like this article? Help us with some feedback by answering this survey:

- USD/CAD hit more than two-week lows under 1.2750 on Thursday as risk appetite and crude oil prices remains buoyant.

- Trading conditions will be subdued on Friday, which is New Year’s Eve, but will pick up next week.

USD/CAD broke below key support in the 1.2760s to hit its lowest level in over two on Thursday just under the 1.2750 mark. That translates into on the day losses of around 0.3%. Trade has been tentative this week with FX markets largely in holiday mode with many participants in Canada, the US, Europe and elsewhere away for Christmas and New Year’s celebrations. But that hasn’t stopped the loonie from benefitting from a recent drastic improvement in the market's appetite for risk, which has helped push US equity benchmarks to record levels and pushed oil prices to monthly highs around their pre-Omicron levels.

Evidence, in the form of independent studies and real-time data, increasingly points to the Omicron Covid-19 variant being substantially milder than prior strains and the US last week also approved two highly effective at-home Covid-19 treatment pills for at-risk patients. Meanwhile, nations in Europe (the UK, France and Spain) are holding off on locking down to curb the rapid transmission of Omicron with health care systems currently a long way off being at risk of being overwhelmed. This, as well as positive seasonality that typically supports US equities in the final days of the year, has been a key driver the recent upturn in risk appetite. To recap, WTI fell as low as $66.00 last Monday, coinciding with USD/CAD spiking above 1.2950, but has since rallied to the $76.00s, coinciding with USD/CAD dropping over 1.5% to current levels under 1.2750.

Recent selling pressure in USD/CAD has seen the pair relinquish the 21-day moving average in the 1.2800 area which had been acting as a magnet to the price action for most of the last week. Trading conditions will be subdued on Friday given most European markets will be shut or closing shop early for New Year’s Eve and though US and Canadian markets will be open as usual, many market participants will in North America will likely also be exiting early. But in the new year, so long as risk appetite remains healthy and as long as markets continue to bet that the BoC will kick off its rate hike cycle by the end of Q1 2022, USD/CAD might be headed back towards December lows around 1.2600.

- The S&P 500 printed a fresh record high at 4808 and looks on course for a fresh record closing high.

- The index is on course for a monthly gain of about 5.0% and an annual gain of nearly 28%.

The S&P 500 hit a fresh intra-day record high on Thursday at 4808, but for the most part has traded within the ranges established over the last three sessions, where the index has mostly traded between the 4775 and 4805 levels. Right now, the index trades almost bang on the 4800 level and with modest gains of about 0.1% on the session. If it can close at current levels, that would mark a new record closing high.

Trading volumes remain incredibly low, as is typical of the final trading week of the year given the high proportion of market participants away for Christmas/New Year’s celebrations, which goes some way to explain the lack of volatility/trading opportunities. In that regard, things will get a lot more interesting next week with a much busier economic calendar and amid the return of most market participants from holidays.

The S&P 500 is up about 1.5% on the week and an impressive near-6.0% higher versus last week’s sub-4530 lows, supported by a fading of concerns about the impact of Omicron on the global economy and earnings, as well as strong US data that has solidified confidence in the US economic health. Indeed, the latest weekly report that was stronger than expected, with initial claims dropping back under 200K, continued claims falling to a fresh post-pandemic low at 1.716M, putting it broadly back in line with pre-pandemic levels, while the insured unemployment rate dropped to 1.3% from 1.4%. If the S&P 500 can close out the session around 4800, that puts it on course for monthly gains of about 5.0% and annual gains of close to 28%.

Seasonality is another factor being cited by equity analysts as behind recent strength/ongoing support. Analysts noted earlier in the week that the final five days of each calendar year and then the first two of the next are typically associated with gains of about 1.3% in the S&P 500. In terms of the other major indices, the Nasdaq 100 index is on course to gain about 0.3% on the session and after moving back above 16.5K, though remains within the trading 16.4-16.6K trading range established over the last three sessions.

The Dow, meanwhile, managed to pip Wednesday’s peaks and print a fresh intra-day record high above 36.6K for the first time. The index has since slipped back to trade flat on the day around 36.5K. The CBOE S&P 500 volatility index, meanwhile, continues to trade with a negative bias and is back below 17.00 and approaching the mid-November lows just above 16.0.

- NZD/USD has backed off from earlier session highs above 0.6850 and is currently trading in the 0.6830s.

- Some see USD resuming its upwards trajectory in 2022, which would leave NZD/USD vulnerable to a drop back to 0.6700.

NZD/USD has backed off from earlier session highs to the north of the 0.6850 level after failing to mount a test of its early monthly highs in the 0.6860s and is currently trading in the 0.6830s, where it now trades roughly flat on the day. Since the start of last week, the pair has risen substantially in tandem with a drastic improvement in the market’s general appetite for risk that has seen global equities surge amid easing Omicron variant concerns. But for the most part this week, trade has been more subdued. To the downside, the pair has been supported by dip-buying interest every time it crossed under 0.6800 and neared its 21-day moving average at 0.6783, while the pair has struggled to hold above last week’s highs in the 0.6840s.

These trading conditions are typical of the final trading week of the year, which is typically marred by low liquidity/volumes amid a lack of market participants, many of whom in the Americas and Europe are on holiday for Christmas/New Year. That suggests things are unlikely to get substantially more interesting until next week. Indeed, next week sees the usual start of the month blockbuster data releases out of the US that includes the latest labour market report and ISM PMI surveys.

All indications are that the US economy has continued to fire on all cyclinders in December, with the spread of Omicron only really picking up in the latter stages of the month. That might be a downside risk for the January data, but the December data should all justify the Fed’s recent hawkish shift. Indeed, the latest weekly report that was stronger than expected, with initial claims dropping back under 200K, continued claims falling to a fresh post-pandemic low at 1.716M, putting it broadly back in line with pre-pandemic levels, while the insured unemployment rate dropped to 1.3% from 1.4%.

This is in fitting with the rapid progress towards full employment noted by Fed Chair Jerome Powell at this month’s Fed meeting. As a result, some FX strategists see the dollar resuming its upwards trajectory as 2022 begins and a potential first rate hike from the Fed in March nears. NZD/USD’s failure to push beyond early December highs (unlike AUD/USD and GBP/USD) suggests, from a technical perspective, that the pair is at risk of a gradual retracement back towards December lows in 0.6700 area.

- Mexican peso extends monthly gains versus US dollar.

- USD/MXN breaks uptrend line, tests 100-day moving average.

The USD/MXN is falling again on Thursday and is testing the 20.45/50 support area. It reached the lowest level since mid-November. Now the 20.58 level has become the immediate resistance.

The area around 20.50 also contains the 100-day simple moving average. A daily close below would be the first one since September.

Technical indicators point to the downside. The daily RSI is not yet at oversold levels, suggesting the decline could continue in the short term, particularly if the 20.45 support is broken. The next critical support is located at 20.30.

A recovery above 20.60 should alleviate the bearish pressure. While the next resistance stands at 20.70. A level that should favor a retreat if reached in the short term. The 20.90 area is critical: if the dollar rises above it could negate the current negative bias, favoring a consolidation. Only above 21.30 the greenback would start looking stronger.

USD/MXN daily chart

-637764792888292666.png)

- AUD/USD is currently probing fresh monthly higher above 0.7250, though is finding some technical resistance.

- The pair has remained resilient this week to surging Covid-19 infection rates in Australia.

AUD/USD is currently probing monthly highs in the 0.7260 area and set for a second consecutive day of gains as the pair continues to derive support from buoyant risk appetite in global equity and commodity markets. For now, the pair seems to be finding resistance in the form of its 50-day moving average at 0.7265 and has been unable to break above an uptrend that has been capping the price action going back to the end of November.

AUD/USD didn’t see much of a reaction to the latest US weekly jobless claims report that was stronger than expected. For reference, initial claims dropped back under 200K, continued claims fall to a fresh post-pandemic low at 1.716M, which puts it broadly back in line with pre-pandemic levels and the insured unemployment rate dropped to 1.3% from 1.4%.

AUD has remained resilient this week to surging Covid-19 infection rates in Australia as the country’s high vaccination rate and new emphasis on living with the virus (as opposed to the previous zero Covid-19 strategy) renders fresh lockdowns unlikely. Indeed, the Australian government is expected to narrow the definition of “close contact” with a Covid-19 positive person in order to reduce the number of people being forced to self-isolate at any given time, in line with new guidelines in the US and elsewhere.

On the eve of New Year’s Eve, the Aussie looks on course to close out what has been a fairly rough year on a positive note. The Australian dollar has shed roughly 5.6% of its value versus the US dollar this year but is up roughly 2.0% this month. Risk appetite has recovered substantially in the latter parts of the month after a shaky start to the month as concerns about the global economic impact of the Omicron variant have subsided. Meanwhile, strong Australian economic data on the back of a phased ending of lockdowns in October, coupled with hawkish shifts in central banks elsewhere, has got market participants betting that the RBA will pivot policy guidance in a hawkish direction in the coming months to put the RBA’s monetary policy tightening timeline more in line with the Fed’s.

- Weaker US dollar and a EUR/GBP gives cable a boost.

- GBP/USD rebounds at 1.3480 and climbs to fresh highs.

- A positive tone across fanatical markets also helps the upside.

The GBP/USD rebounded at 1.3480 and rose to 1.3521, reaching a new monthly high. It remains near the top, still unable to confirm levels above 1.3515/20 but with the bullish momentum intact.

The decline of EUR/GBP to the 0.8380 zone (2021 lows) is helping the overall tone of the pound that is also being favored by higher equity prices. In Wall Street, the Dow Jones gains 0.16% and the Nasdaq 0.53%.

Higher US yields are not helping significantly the greenback on Thursday. US economic data came in above expectations with Initial Jobless Claims falling under 200K and the December Chicago PMI at 63.1 against expectations of 62. The DXY was unable to benefit from those figures.

If GBP/USD manages to break and holds above 1.3520 it would gain more strength. The next strong resistance could be seen at 1.3560. On the flip side, 1.3445 is the area of immediate support, followed by 1.3400.

The pound is on its way to the second weekly gain in a row, as it continues to recover from levels under 1.3200. The 20-week simple moving average awaits at 1.3555.

Technical levels

- WTI rebounded back above the $77.00 level on Thursday as oil continues to trade with a positive bias.

- OPEC+ is likely to stick to existing policy at the upcoming meeting, meaning another 400K BPD hike from February is likely.

Oil prices have spent Thursday trading within recent ranges, with front-month WTI futures in recent trade rebounding from a brief dip back under the $76.00 level to back above the $77.00 mark and eyeing a test of Wednesday’s post-bullish inventory monthly highs at $77.30. At present, WTI is trading just over 50 cents highs on the session, a continuation of the positive bias that has lifted the American crude oil benchmark from as low as $72.50 at the start of the week to current levels over $4.50 higher.

The main theme driving oil prices on Thursday continues to be the broadly upbeat mood in markets more broadly. US equities are currently trading at record levels with the S&P 500 close to 4800. Market participants have become substantially less pessimistic over the last week or so about how they view the Omicron Covid-19 variant impacting the global economy and crude oil demand – a succession of studies as well as real-time data all points to the fact that the new variant is substantially milder than anything that has come before it. Meanwhile, governments are for the most part not returning to the strict lockdowns seen in the past, as Omicron hasn’t shown much threat of overwhelming health care systems with sick patients (yet).

Should the positive Omicron vibes continue to support risk appetite into the new year, that points to continued upside risks for crude oil prices. In terms of other news being discussed by oil market participants on Thursday, China cut its first batch of 2022 crude oil imports to oil refiners by 11%. This has been framed by local analysts who are more “in the know” that this is a way to put pressure on small refineries to iron out inefficiencies rather than having any bearing on overall Chinese demand for oil imports. That could be why the news hasn’t had a lasting impact on prices.

Elsewhere, according to four sources speaking with Reuters, OPEC+ is likely to stick to existing policy at the upcoming 4 January 2022 meeting, which means hiking output by 400,000 barrels per day (BPD) from the start of February. The sources cited an easing of concerns about the impact that the spread of the Omicron variant of Covid-19 will have on demand and the recent recovery in prices as increasing the cartel's confidence that further output hikes remain appropriate. This is in line with market expectations (for no change in OPEC+ policy) and has thus not impacted crude oil prices.

According to four sources speaking with Reuters, OPEC+ is likely to stick to existing policy at the upcoming 4 January 2022 meeting, which means hiking output by 400,000 barrels per day (BPD) from the start of February. The sources cited an easing of concerns about the impact that the spread of the Omicron variant of Covid-19 will have on demand and the recent recovery in prices as increasing the cartel's confidence that further output hikes remain appropriate.

Market Reaction

This is in line with market expectations and has thus not impacted crude oil price action.

- EUR/GBP fell under 0.8400 on Thursday and is probing the annual lows in the 0.8380s.

- The pair has been under selling pressure since last Monday on better risk appetite and central bank divergence.

- Holiday-thinned trading conditions mean a sustained bearish break this week is unlikely, bears will be eyeing a break below 0.8380 in 2022.

Despite holiday-thinned liquidity conditions in global and European currency markets on the eve of New Year’s, EUR/GBP has slipped under 0.8400 to probe annual lows in the 0.8380s. That translates into on the day losses of about 0.3%. The pair has been under heavy selling pressure since hitting highs last week in the 0.8550 area and at current levels, trades nearly 2.0% lower from these peaks. A surge in risk appetite amid a rush to price out Omicron-related economic pessimism amid numerous studies showing the variant to be far milder than previous strains has aided the risk-sensitive GBP and weighed heavily on EUR/GBP.

Meanwhile, the fact that the UK health case system currently has not yet shown any signs of being overwhelmed despite rampant Omicron infection in the country means that, so far, UK policymakers have refrained from putting England back into lockdown. Prior to the recent surge in risk appetite, the UK had been viewed as the Omicron epicenter in Europe, a perception that had weighed on GBP at the time and contributed to EUR/GBP hitting highs near 0.8600 earlier in the month.

A subsiding of perceptions of the risk posed to the UK economy’s near-term outlook by the rapid spread of Omicron has given FX markets the green light to price in a more hawkish than expected BoE. Recall that earlier in the month, the bank surprised some market participants by hiking interest rates by 15bps and indicating that more is to come in 2022. At the time, GBP struggled to benefit as traders worried the BoE would fail to live up to expectations due to Omicron disrupting the UK recovery. But now pandemic risks are subsiding, central bank divergence may return as a key FX market driver in 2022.

As emphasised in characteristically hawkish commentary on Thursday from ECB policymaking hawk’s Klaas Knot (Dutch central bank head) and Robert Holzman (Austrian central bank head), there is a healthy debate going on at the ECB about its timeline for monetary policy normalisation. A growing throng of policymakers appear concerned about upside risks to the bank’s inflation forecast for 2023 and beyond (which currently sees inflation falling back under 2.0% in order to justify ongoing stimulus). Recall the bank decided it would temporarily increase the pace of QE purchases under the pre-pandemic APP in Q2 and Q3 to make up for the end of the PEPP at the end of Q1.

The bank said it would continue with APP purchases for as long as necessary, but if inflation continues to surprise to the upside in 2022, it seems likely these might be ended by the end of the year. A hot flash December inflation report out of Spain on Thursday raises the risk of an upside surprise from next week’s Eurozone aggregate flash December inflation estimate. This increases the likelihood of upside surprises in 2022.

The ECB is clearly on the road to monetary policy normalisation, as are other major central banks, but even if inflation surprises do force it to unwind stimulus at a faster pace, the bank remains well behind the BoE in this regard. Thus, any potential hawkish ECB pivot may struggle to result in lasting EUR/GBP strength. While holiday-thinned trading conditions mean that a sustained downside break of the annual lows in the 0.8380s seems unlikely on Thursday or Friday, the level is vulnerable to being broken in the new year.

European Central Bank governing council member and Dutch central bank head Klaas Knot said on Thursday that the bank could end its bond-buying programmes sooner if inflation continues to surprise on the upside. Knot added that it is now appropriate for the bank to prepare for gradual monetary policy normalisation and that the ECB is close to "mission accomplished" on inflation.

Market Reaction

Knot is a known hawk and it is known that he was one of the ECB members pushing for a greater acknowledgment of upside inflation risks at the last meeting, thus, the euro has not seen any reaction to the latest comments.

- A combination of supporting factors pushed USD/JPY to a fresh monthly high on Thursday.

- The risk-on mood continued undermining the safe-haven JPY and provided a goodish lift.

- Elevated US bond yields, upbeat US macro data benefitted the USD and remained supportive.

The USD/JPY pair maintained its bid tone through the early North American session and was last seen hovering near the monthly top, around the 115.15-20 region.

The optimism over signs that the Omicron variant might be less severe than feared and is unlikely to derail the economic recovery remained supportive of the underlying bullish sentiment. This was evident from an extension of the recent runup in the global equity markets, which undermined the safe-haven Japanese yen and pushed the USD/JPY pair higher.

This, along with a modest US dollar strength, contributed to the ongoing upward trajectory to the highest level since November 26. The greenback drew some support from elevated US Treasury bond yields and better-than-expected US Initial Jobless Claims data, though lacked bullish conviction amid thin end-of-year trading volumes.

Nevertheless, the USD/JPY pair has now rallied over 250 pips from the monthly swing low, around the 112.60 area touched on December 2, and seems poised to appreciate further. A sustained strength above the key 115.00 psychological mark, which coincided with an ascending channel resistance, adds credence to the constructive outlook.

Hence, a subsequent move back towards challenging the multi-year high, around mid-115.00s, remains a distinct possibility. Market participants now look forward to the release of the Chicago PMI for a fresh impetus. This, along with the broader market risk sentiment, would produce some trading opportunities around the USD/JPY pair.

Technical levels to watch

- Spot gold has stabilised in the $1800 area following a choppy few sessions.

- The precious metal swung as high as $1820 earlier in the week and as low as $1790 on Wednesday.

- Traders will be reluctant to read too much into recent moves given holiday-thinned liquidity conditions.

It’s been a choppy couple of sessions for spot gold (XAU/USD) prices, which slid back from earlier weekly highs at $1820 to underneath $1790 at one point on Wednesday but have since stabilised in the $1800 area on Thursday. Gold has been buffeted by choppiness in bond and FX markets in recent days, though traders have warned not to read too much into the recent price action given holiday-thinned liquidity conditions that will prevail until the end of the week. One thing that can be derived from the recent price action is that the 21-day moving average appears to have become a key level of support for spot gold

Real yields rallied on Wednesday, with the 10-year TIPS trying to push to the north of the -1.0% level having previously traded around -1.06% and this upside seemed to pressure gold at the time. Remember, gold has an inverse relationship to US real yields, given they are a proxy for “opportunity cost” - as real yields rise, so does the opportunity cost of holding non-yielding gold, thus demand for the precious metal is weakened.

The 10-year TIPS yield has since dropped back to the -1.06% area, allowing gold to recover back to the $1800 area. There didn’t seem to be anything behind the recent moves in real yields, with the initial upside spurred by a rally in the nominal 10-year yield, which broke above the 1.50% level for the first time in a few weeks and was carried briefly above 1.55% amid technical selling. Remember that higher bond yields reflect the fact that bond prices have fallen. So long as the 10-year TIPS remains subdued to the south of the $1800 level, spot gold has a decent shot of holding in the $1800 region.

Also helping gold recover from Wednesday’s dip has been a gradual weakening of the US dollar. The DXY dipped under 96.00 on Wednesday for the first time since mid-December after the latest US trade figures showed the country’s monthly trade deficit balloon to over $97B, well above expectations for a monthly deficit figure of $89B. The DXY has since been choppy but continues to trade in the 96.00 area, having seemingly failed to garner any impetus in wake of the latest strong weekly jobless claims report (initial claims fell back under 200K).

- Weekly Initial Jobless Claims fell to 198K in the week ending on 25 December.

- Markets haven't seen much of a reaction amid holiday-thinned trading conditions.

There were 198,000 initial claims for unemployment benefits in the US during the week ending December 25, data published by the US Department of Labor (DoL) revealed on Thursday. This reading followed last week's print of 206K (revised up from 205K) and came in below market expectations for 208K.

Continued jobless claims dropped sharply to 1.716M in the week ending December 18, the data showed, well below expectations for a small rise to 1.868M from 1.856M the week prior (which was revised down from 1.859M). The insured unemployment rate fell to 1.3% from 1.4% in the prior week.

Market Reaction

Markets do not seem to have reacted to the latest weekly jobless claims numbers, though the DXY has seen some positive ticks in recent trade and moved back to 96.00. Whether the latest strong labour statistics, which showed the insured unemployment rate falling to 1.3% from 1.4%, can translate into a sustained dollar rebound in holiday-thinned trading conditions remains to be seen.

- USD/CAD turned lower for the second successive day and dropped to a two-week low.

- The USD struggled to preserve its intraday gains and acted as a headwind for the pair.

- The ascending channel support might help limit losses amid retreating crude oil prices.

The USD/CAD pair edged lower through the mid-European session and dropped to a two-week low, around the 1.2770 region in the last hour.

Following an early uptick to the 1.2810-15 area, the USD/CAD pair met with a fresh supply on Thursday and turned lower for the second successive day. This also marked the third day of a negative move in the previous four sessions and was sponsored by the emergence of some US dollar selling at higher levels.

The underlying bullish sentiment continued to act as a headwind for the safe-haven greenback, which was further pressured by retreating US Treasury bond yields. Despite the continuous surge in new COVID-19 cases, investors remain optimistic amid signs that the Omicron variant might be less severe than feared.

This was evident from an extension of the recent bullish run in the equity markets. This helped offset weaker crude oil prices, which tend to undermine the commodity-linked loonie. The USD/CAD pair, however, has managed to defend ascending trend-channel support, warranting some caution for bearish traders.

Market participants now look forward to the US economic docket, featuring the releases of Weekly Initial Jobless Claims and Chicago PMI. This, along with the US bond yields, will influence the USD. Traders will take cues from oil price dynamics to grab some short-term opportunities around the USD/CAD pair.

Technical levels to watch

- EUR/USD has fallen back after hitting fresh monthly highs on Wednesday and is back to trading just above 1.1300.

- Amid holiday trading conditions, hot Spanish CPI and hawkish ECB rhetoric has not impacted euro trade much.

After hitting its highest levels of the month on Wednesday just under 1.1370 on Wednesday, EUR/USD has pulled back to within recent ranges. Earlier in the session, the pair tested its 21-day moving average at the 1.1300 level, but has since rebounded to around the 1.1330, where it trades lower by about 0.1% on the session. The pair’s failure to break above December’s 1.1240-1.1360ish ranges is not overly surprising given that markets have been very much on holiday mode this week. Indeed, for many European nations, Thursday is the final trading session of the year, whilst for most European nations that do see markets open on Friday, it is a half-day.

Most FX strategists had been expecting that trading conditions this week would be rangebound and the price action thus far has lived up to the bill. Things should get more exciting from next week with the release of the key December US labour market report and December US ISM PMIs surveys. Also out next week is the flash estimate of Eurozone Consumer Price Inflation in December. Ahead of the release of the Eurozone aggregate figures, individual countries will be reporting and the Spanish flash numbers are already out. Data released on Thursday morning showed that the YoY rate of CPI in Spain surged to 6.7% in this month from 5.5% a month earlier, well above expectations for a rise to 5.8%.

The data didn’t provoke much of a reaction in the euro at the time but is an early indication of upside risks to the market’s consensus forecast that next week’s Eurozone flash CPI number will drop to 4.7% this month from 4.9% in November. The euro also largely ignored hawkish commentary from the ECB’s Austrian central bank head Robert Holzmann, who on Thursday called for the bank to phase out negative interest rates and unconventional monetary policy in 2022. In terms of the rest of Thursday’s session, things will for the most part be quiet, though traders will be keeping an eye on the release of the weekly US jobless claims report at 1330GMT, followed by the Chicago PMI at 1445GMT.

- GBP/USD attracted some dip-buying on Thursday and recovered the early lost ground.

- The technical setup favours bullish trades and supports prospects for additional gains.

- A sustained break below the 1.3400 round figure is needed to negate the positive bias.

The GBP/USD pair recovered intraday losses and was last seen trading in the neutral territory, just below the key 1.3500 psychological mark, or the monthly high touched earlier this Thursday.

Looking at the broader picture, the recent strong recovery move from the YTD low paused near a hurdle marked by the 50% Fibonacci level of the 1.3834-1.3161 downfall. This coincides with the November 19 swing high and should act as a key pivotal point for short-term traders.

Given the recent move beyond the 1.3375-80 barrier, the overnight sustained breakthrough the 38.2% Fibo. and the 50-day SMA confluence favours bullish traders. This along with positive oscillators supports prospects for a further near-term appreciating move for the GBP/USD pair.

Hence, a subsequent strength towards the next relevant resistance, near the 1.3565 region, remains a distinct possibility. The mentioned area comprises 61.8% Fibo. level and the 100-day SMA, which if cleared decisively would be seen as a fresh trigger for bullish traders.

On the flip side, the daily swing low, around the 1.3455-50 region, now seems to protect the immediate downside. Any subsequent decline could be seen as a buying opportunity near the 38.2% Fibo. level/50-DMA confluence resistance breakpoint and remain limited near the 1.3400 mark.

Failure to defend the mentioned support levels, leading to a further slide below the 1.3385-75 region might shift the bias back in favour of bearish traders. The GBP/USD pair could then accelerate the fall towards testing the 23.6% Fibo. level, around the 1.3320 area.

GBP/USD daily chart

Levels to watch

- NZD/USD struggled to preserve early gains to a multi-week high amid resurgent USD demand.

- The prevalent risk-on environment helped limit any further slide for the perceived riskier kiwi.

- Investors now look forward to the US economic releases for some short-term opportunities.

The NZD/USD pair managed to rebound a few pips from the early European session low and was last seen hovering in the neutral territory, around the 0.6825-30 region.

The pair struggled to capitalize on its early positive move and witnessed a modest pullback from the vicinity of mid-0.6800s, or a four-week high touched earlier this Thursday. The intraday pullback was exclusively sponsored by resurgent US dollar demand, though the underlying bullish tone in the markets helped limit the downside for the NZD/USD pair.

The greenback made a solid comeback and reversed the previous day's slide back closer to the monthly low amid a fresh leg down in the European currencies. This, along with the overnight sharp spike in the US Treasury bond yields, acted as a tailwind for the greenback and prompted some selling around the NZD/USD pair at higher levels.

In fact, the yield on the benchmark 10-year US government bond shot to 1.56% for the first time since November 29 after a $56 billion auction of seven-year notes saw weak demand. This, along with the Fed's hawkish outlook, indicating at least three rate hikes next year, pushed the two-year yield to the highest since March 2020.

Meanwhile, the optimism led by signs that the Omicron variant might be less severe than feared helped offset worries about the economic impact of the continuous surge in new COVID-19 cases. This was evident from an extension of the recent bullish run in the equity markets, which, in turn, acted as a tailwind for the perceived riskier kiwi.

The mixed fundamental backdrop makes it prudent to wait for a strong follow-through selling before placing any aggressive bearish bets around the NZD/USD pair amid thin end-of-year trading volumes. Traders now look forward to the US macro data – Weekly Initial Jobless Claims and Chicago PMI – for some short-term opportunities.

Technical levels to watch

- USD/CAD bounces from nine-day lows to recapture the 1.2800 mark.

- The pair is rescued by the broad rebound in the US dollar amid light trading.

- Bulls remain hopeful while above this critical daily support line.

USD/CAD is staging a solid comeback from nine-day lows of 1.2770, helped by a sharp corrective upside in the US dollar and weaker oil prices.

The greenback is extending the recovery from monthly lows against its major peers, mainly driven by profit-taking ahead of the New Year Eve celebrations.

Meanwhile, a pullback in WTI prices from higher levels also collaborates with the renewed upside in the CAD pair.

Traders now look forward to the US Jobless Claims data for fresh trading impulse but the risk trends and year-end flows will remain the main market drivers.

Looking at USD/CAD’s daily chart, the price has recaptured the critical 21-Daily Moving Average (DMA) at 1.2802, although needs a daily closing above the latter to confirm a bullish reversal from weekly troughs.

If that happens, bulls will then flex their muscles towards the next upside barrier, located at 1.2850. Further up, a rally towards the 1.2900 round number cannot be ruled out.

The fact that the pair trades above all the major DMAs is supportive of the bullish potential. To add, the 14-day Relative Strength Index (RSI) is trading above the midline, pointing to more gains in the making.

USD/CAD: Daily chart

On the flip side, a sharp sell-off towards the December 13 lows of 1.2706 could kick in should the horizontal support line at 1.2770 gets breached on a daily candlestick closing basis.

Further south, the confluence of the upward-sloping 50-DMA and December 9 lows of 1.2648 will be a tough nut to crack for sellers.

USD/CAD: Additional levels to consider

- A combination of factors prompted a short-covering move around USD/CHF on Thursday.

- A strong pickup in the USD demand was seen as a key factor that provided a goodish lift.

- The risk-on mood undermined the safe-haven CHF and remained supportive of the move.

The USD/CHF pair added to its intraday gains and shot to a fresh daily high, around the 0.9180 region during the first half of the European session.

The pair witnessed a short-covering move on Thursday and moved away from the lowest level since November 10, around the 0.9145 region touched in the previous day. The recovery momentum lifted spot prices back above the very important 200-day SMA and was sponsored by a combination of supporting factors.

The underlying bullish tone in the markets undermined the safe-haven Swiss franc and provided a goodish lift to the USD/CHF pair amid resurgent US dollar demand. Despite the continuous surge in new COVID-19 cases, investors remain optimistic amid signs that the Omicron variant might be less severe than feared.

On the other hand, the greenback drew some support from the overnight spike in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond shot to 1.56% for the first time since November 29, while the two-year yield, which is sensitive to interest rate moves, rose to the highest since March 2020.

It, however, remains to be seen if the USD/CHF pair is able to capitalize on the move as investors might refrain from placing aggressive bets amid thin end-of-year trading volumes. Hence, it will be prudent to wait for a strong follow-through buying before confirming that the recent downtrend is over and placing fresh bullish bets.

Market participants now look forward to the US economic docket, featuring the releases of Weekly Initial Jobless Claims and Chicago PMI. This, along with the US bond yields, will influence the USD. Apart from this, traders might take cues from the broader market risk sentiment to grab some short-term opportunities around the USD/CHF pair.

Technical levels to watch

GBP/USD has turned south after testing 1.3500 on Wednesday. The technical outlook suggests that the cable could have a tough time regathering its strength but buyers could look to reclaim control as long as key support levels remain intact, FXStreet’s Eren Sengezer reports.

Buyers are likely to try to reclaim control as long as 1.3400 holds

“The 20-period SMA on the four-hour chart and the trend line form the initial support at 1.3440 and additional losses toward 1.3400 (psychological level, static level) could be witnessed if that level turns into resistance.”

“On the upside, 1.3500 (psychological level, daily high) aligns as initial resistance before 1.3550 (static level, former support).”

Making some comments on the inflation outlook, European Central Bank (ECB) policymaker Robert Holzmann said that “inflation to peak around the turn of the year and then slowly ease.”

He added that it “will be crucial in 2022 to gradually phase out negative interest rates and unconventional monetary policy.”

Earlier this morning, the central bank policymaker Klaas Knot said, inflation in the eurozone could very stay above the central bank's 2% target for the coming years.

Market reaction

EUR/USD keeps lows near 1.1310 on the above comments. The spot is down 0.30% on the day, trading at 1.1313, at the press time.

- Gold price remains depressed in a familiar range around the $1,800 mark.

- 10-year US Treasury yields are back above 1.50%, pressurizing gold price.

- Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal.

Amid thin-year end liquidity conditions, gold price continues to trade choppy within familiar levels, largely pivoting around the $1,800 mark. The downbeat sentiment around gold price could be attributed to a broad-based US dollar rebound, aided by the recent strength in the Treasury yields. The 10-year rates have recaptured the 1.50% key level, which warrants caution for gold bulls. Going forward the year-end repositioning in the greenback will continue to have a significant impact on gold while thin conditions could exaggerate the moves.

Read: Gold Price Forecast: Year-end flows to keep XAU/USD choppy around $1,800

Gold Price: Key levels to watch

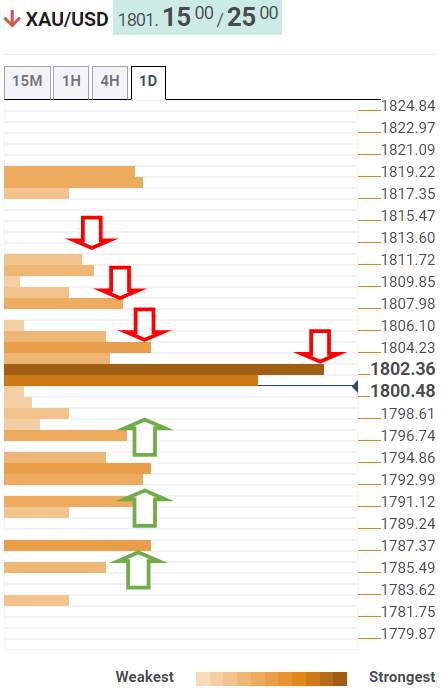

The Technical Confluences Detector shows that the gold price is struggling to recapture strong resistance at $1,803, which is the intersection of the Fibonacci 38.2% one-week, Fibonacci 61.8% one-day and SMA10 one-day.

The immediate upside will then be capped by the Fibonacci 38.2% one-month of $1,806. The previous day’s high of $1,808 will provide another roadblock to gold buyers.

Acceptance above the latter could fuel a renewed uptick towards the previous week’s high of $1,811, above which the December top of $1,820 will be on the bulls’ radars.

On the flip side, the Fibonacci 38.2% one-day at $1,796 will get tested on a sustained move below $1,800.

A dense cluster of healthy support levels is aligned around $1,793, which will be a powerful cap. That price zone comprises of the SMA100 four-hour, Fibonacci 23.6% one-day and pivot point one-week S1.

SMA100 one-day at $1,791 will be the next downside target, below which sellers will aim for the Fibonacci 23.6% one-month at $1,787.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- EUR/USD witnessed fresh selling on Thursday amid resurgent USD demand.

- The mixed technical setup warrants caution before placing fresh directional bets.

The EUR/USD pair dropped to the 1.1300 mark during the early part of the European session, reversing Wednesday's positive move to the highest level since November 30. The US dollar made a solid comeback from the vicinity of the monthly low and prompted fresh selling around the major amid thin end-of-year trading volumes on Thursday.

From a technical perspective, the overnight strong intraday rally faltered just ahead of a resistance marked by the 38.2% Fibonacci level of the 1.1692-1.1186 downfall. The mentioned barrier, around the 1.1370-80 region, coincides with the late-November swing high and should now act as a key pivotal point for short-term traders.

Meanwhile, the EUR/USD pair was last seen hovering near the 23.6% Fibo. level, which is followed by the weekly low, around the 1.1275 region touched in the previous day. Some follow-through selling will be seen as a fresh trigger for bearish traders and drag spot prices to the 1.1200 mark en-route the YTD low, around the 1.1185 region.

On the flip side, bulls are likely to wait for a sustained strength beyond the 38.2% Fibo. level before placing fresh bets. The EUR/USD pair might then surpass the 1.1400 mark and test the next relevant resistance near the 1.1440-45 region. The momentum could further get extended towards the key 1.1500 psychological mark.

Meanwhile, neutral technical indicators on the daily chart haven't been supportive of a firm near-term direction, warranting some caution for aggressive traders. The mixed technical set-up suggests that the EUR/USD pair is more likely to extend its two-way price moves and remain confined in a range held since the beginning of this month.

EUR/USD daily chart

Technical levels to watch

- GBP/USD faced rejection near the 1.3500 mark and witnessed a modest pullback on Thursday.

- Resurgent USD demand exerted pressure amid the worsening COVID-19 situation in the UK.

- Britain reported a record number of cases amid an alarming spread of the Omicron variant.

The GBP/USD pair maintained its bid tone through the early European session and was last seen trading near the daily low, around the 1.3465-60 region.

The pair struggled to find acceptance above the key 1.3500 psychological mark and witnessed a modest pullback from the highest level since November 19 touched earlier this Thursday. The US dollar made a solid comeback and reversed a major part of the overnight losses back closer to the monthly low. This, along with the worsening COVID-19 situation in the United Kingdom, attracted some selling around the GBP/USD pair.

The greenback drew some support from the overnight spike in the US Treasury bond yields that followed soft demand for a $56 billion auction of seven-year notes. In fact, the yield on the benchmark 10-year US government bond shot to 1.56% for the first time since November 29. Adding to this, the Fed's hawkish outlook pushed the two-year yield to the highest since March 2020 and provided a goodish lift to the greenback.

Meanwhile, Britain reported a record 183,037 new COVID-19 cases on Wednesday, which could force the government to impose more restrictions. It is worth recalling that the UK Prime Minister Boris Johnson had said last week that ministers would keep the latest data under constant review to see if additional stricter measures are needed. This was seen as another factor that acted as a headwind for the British pound.

It, however, remains to be seen if the GBP/USD pair is able to attract some buying at lower levels or the downtick marks the end of the recent strong recovery from the YTD low touched earlier this month. There isn't any major market-moving economic data due for release from the UK. This warrants some caution for bearish traders makes it prudent to wait for some follow-through selling before confirming that the pair has topped out.

Market participants now look forward to the US economic docket – featuring the usual Weekly Initial Jobless Claims and Chicago PMI – for a fresh impetus. This, along with the US bond yields, will influence the USD price dynamics. Traders might also take cues from developments surrounding the coronavirus saga to grab some short-term opportunities around the GBP/USD pair amid thin end-of-year trading conditions.

Technical levels to watch

EUR/USD touched its highest level in a month at 1.1370 on Wednesday but struggled to preserve its bullish momentum. The pair was last seen edging lower toward 1.1300 as choppy action continues heading into new year, FXStreet’s Eren Sengezer reports.

Year-end flows could ramp up market volatility later in the session

“Later in the session, the US Department of Labor's weekly Initial Jobless Claims data will be featured in the US economic docket alongside the ISM-Chicago's PMI for December. These data are unlikely to trigger a noticeable market reaction but year-end flows toward the end of the European session could open the door to wild fluctuations.”

“On the downside, 1.1300 area, where the 100 and the 200-period SMA's on the four-hour chart are located, act as significant support. In case a four-hour candle closes below that level, additional losses toward 1.1270 (static support) could be witnessed.”

“Initial resistance aligns at 1.1340 (static level) before 1.1360 (post-ECB high). Although the pair managed to rise above that level on Wednesday, it retreated back below it before closing, punctuating the significance of that resistance.”

See: EUR/USD to edge lower amid double asymmetry between the US and the eurozone – Natixis

The double asymmetry (labour supply, central bank behaviour) between the US and the eurozone has complicated effects on asset allocation. Consequently, it is prudent to hedge the risk of euro depreciation against the dollar and it is also reasonable to overweight equities, private equity and real estate in the eur zone relative to those in the US, in the view of analysts at Natixis.

The labour market situation

“The COVID-19 crisis has driven down the labour supply in the US, but not in the eurozone. We should therefore expect stronger labour market pressures in the US than in the eurozone and, consequently, faster growth in wages and in unit labour costs in the US.”

The central banks’ behaviour

“The Fed wants to exit its highly expansionary monetary policy, albeit cautiously and partially. The ECB, meanwhile, apparently has no intention to exit its policy. Evidently, it wants to use a highly expansionary monetary policy to offset the loss of purchasing power caused by the rise in energy prices, boost the employment rate and facilitate the energy transition.”

So what to expect?

“Monetary policy is likely to be more expansionary for a long time in the eurozone than in the US. This can be expected to result in: Significant bond capital flows from the eurozone to the US and a significant depreciation of the euro against the dollar and a catch-up in eurozone asset valuations (equities, real estate, corporate value) with those in the US, given the eurozone’s more negative real long-term interest rates.”

There are two theories to determine a stock market index target. The fundamental approach and the portfolio rebalancing approach. Strategists at Natixis combine these two approaches to define an overall (fundamental and portfolio) approach to share prices.

Combining the two approaches

“The fundamentalist approach to determining share prices simply says that share prices must converge towards their fundamental value, which is the discounted sum of future dividends. If this approach is the only one that explains share prices, the equity risk premium is therefore expected to be relatively stable and does not vary according to the economic cycle, monetary policy, etc. However, high variability in the equity risk premium suggests there are determinants of share prices other than their fundamental value.”

“The idea of portfolio rebalancing approach to share prices is that savers desire a particular structure for their wealth between the various asset classes (money, bonds, equities, real estate). When monetary policy becomes expansionary, there is strong money creation and the proportion of money in wealth increases. Savers then rebalance the structure of their portfolios by using the excess money they hold to buy other assets. At equilibrium, this drives up the prices of other assets, increases the proportion of other assets in wealth and rebalances the structure of portfolios. Indeed, we can see that strong money creation is associated with a sharp rise in stock market indices.”

“When we combine both approaches, we find that the equity risk premium decreases as the proportion of money and bonds in wealth increases. The idea is simple: if the proportion of money in wealth increases, portfolio rebalancing leads share prices to rise above their fundamental value.”

- AUD/USD struggled to preserve its intraday gains amid resurgent USD demand.

- The risk-on mood continued lending some support to the perceived riskier aussie.

- Investors now look forward to the US economic data for some trading opportunities.

The AUD/USD pair surrendered its modest intraday gains and was last seen trading just a few pips above the daily low, around mid-0.7200s during the early European session.

The US dollar made a solid comeback on Thursday and reversed a major part of the overnight losses back closer to the monthly swing low. This, in turn, was seen as a key factor that acted as a headwind for the AUD/USD pair and attracted some selling near the 0.7265 region.

The greenback drew some support from the overnight spike in the US Treasury bond yields that followed soft demand for a $56 billion auction of seven-year notes. In fact, the yield on the benchmark 10-year US government bond shot to 1.56% for the first time since November 29.

Apart from this, the Fed's hawkish outlook, indicating at least three rate hikes next year, pushed the two-year yield to the highest since March 2020 and helped revive the USD demand. That said, the underlying bullish tone might cap the upside for the safe-haven greenback.

The global risk sentiment remained well supported by the optimism over signs that the Omicron variant might be less severe than feared. This was evident from an extension of the recent bullish run in the equity markets, which could further lend support to the perceived riskier aussie.

This warrants some caution before confirming that the AUD/USD pair's recent bounce from the key 0.7000 psychological mark, or the YTD low has lost steam amid thin year-end trading volumes. Market participants now look forward to the US macro data for a fresh impetus.

The US economic docket features the release of Weekly Initial Jobless Claims and Chicago PMI. This, along with the US bond yields, will influence the USD. Traders might also take cues from the broader market risk sentiment to grab some opportunities around the AUD/USD pair.

Technical levels to watch

USD/CAD has reclaimed the 1.2800 level as defends two-month-old ascending trend-channel support. FXStreet’s Haresh Menghani expects the pair to advance towards mid-1.30s on a break above the 1.2835/50 resistance zone.

Convincing break below 1.2770/65 to open up 1.2640/35

“USD/CAD, so far, has managed to defend the lower boundary of an upward sloping channel extending from late October around the 1.2770/65 region, which should act as a key pivotal point for short-term traders. A convincing break below will set the stage for an extension of the recent retracement. The pair might then turn vulnerable to accelerate the fall towards the 1.2700 round-figure mark and extend the corrective slide further towards the next relevant support near the 1.2640/35 region.”

“The 1.2835/50 region now seems to have emerged as an immediate strong barrier. A sustained strength beyond will reaffirm the trend-channel support, which should allow the pair to aim back to reclaim the 1.2900 mark. The momentum could push USD/CAD further to the 1.2960/65 area, or the YTD top, en-route the key 1.3000 psychological mark and the ascending channel resistance, currently near mid-1.3000s.”

Gold keeps the red for the third day in the row amid quiet markets. Year-end flows are set to keep XAU/USD choppy around $1,800, according to FXStreet’s Dhwani Mehta.

Gold’s technical setup paints a bearish picture on the 4H chart

“Gold is extending the previous bearish momentum, as the Treasury yields hold the recent advance. Meanwhile, the market mood remains cautious, underpinning the dollar’s safe-haven demand at gold’s expense.”

“Gold price is extending the recent losses, with bears looking to retest the ascending 100-SMA support at $1,792. The next downside target is seen at the horizontal trendline support at $1,785.”

“On the upside, bulls need to recapture the 50 and 200-SMAs confluence area at $1,802 and $1,805 respectively, above which the 21-SMA at $1,807 will come into play. Recapturing the latter is critical to resuming the uptrend towards the monthly highs of $1,820. Ahead of that level, the previous stubborn resistance at $1,814 will challenge the bulls’ commitments once again.”

See – Gold Price Forecast: XAU/USD at risk of plunging below $1,500 – Credit Suisse

Here is what you need to know on Thursday, December 30:

The greenback faced selling pressure in the second half of the day on Wednesday but managed to limit its losses early Thursday with the US Dollar Index staying in the positive territory above 96.00. In the absence of high-tier data releases, the improving market mood made it difficult for the dollar to find demand but rising US Treasury bond yields are helping the currency show resilience against its rivals. The benchmark 10-year US Treasury bond yield rose nearly 5% on Wednesday and seems to have settled above 1.5%. Later in the session, the US Department of Labor's weekly Initial Jobless Claims report and the ISM Chicago's PMI for December will be the last data releases of the year. In the meantime, US stocks futures are trading flat in the early European session, reflecting a neutral risk sentiment so far.

EUR/USD touched its highest level in a month at 1.1370 on Wednesday but struggled to preserve its bullish momentum. The pair was last seen edging lower toward 1.1300.

GBP/USD climbed above 1.3500 for the first time in five weeks during the Asian trading hours but lost its traction. The pair is currently posting small daily losses near 1.3470.

USD/JPY capitalized on rising US Treasury bond yields and advanced beyond 115.00 in the early European session on Thursday.

Gold dropped below $1,790 pressured by the sharp upsurge witnessed in the 10-year US T-bond yield on Wednesday but managed to erase a large portion of its daily losses. Nevertheless, XAU/USD seems to be having a hard time reclaiming $1,800.

Bitcoin closed the second straight day in the negative territory on Wednesday and stays relatively quiet around $47,000 early Thursday. Ethereum touched its lowest level in three weeks at $3,585 before staging a technical correction toward $3,700.

- USD/JPY gained some follow-through traction on Thursday and jumped to a fresh monthly high.

- Resurgent USD demand remained supportive of the move amid the underlying bullish sentiment.

- A sustained move beyond the 115.00 mark might have already set the stage for additional gains.

The USD/JPY pair continued scaling higher heading into the European session and shot to a fresh monthly high, around the 115.15 region in the last hour.

A combination of supporting factors assisted the USD/JPY pair to prolong its uptrend witnessed since the beginning of this month and gain traction through the first half of the trading on Thursday. The underlying bullish sentiment in the financial markets continued undermining the safe-haven Japanese yen and acted as a tailwind for the USD/JPY pair.

The optimism led by signs that the Omicron variant might be less severe than feared helped offset worries about the economic impact of the continuous surge in new COVID-19 cases. This, in turn, boosted investors' appetite for perceived riskier assets, which was evident from an extension of the recent bullish run in the equity markets.

Bulls further took cues from the overnight spike in the US Treasury bond yields that followed soft demand for a $56 billion auction of seven-year notes. In fact, the yield on the benchmark 10-year US government bond shot back to 1.56% for the first time since November 29, while the two-year yield rose to the highest since March 2020.

This comes on the back of the Fed's hawkish outlook, indicating at least three rate hikes next year, and helped revive demand for the US dollar, which provided an additional boost to the USD/JPY pair. Apart from this, the momentum could further be attributed to some technical buying on a sustained strength beyond the key 115.00 psychological mark.

The mentioned handle coincided with a resistance marked by the top boundary of an upward sloping channel extending from the monthly swing low. A sustained strength beyond could be seen as a fresh trigger for bullish traders and might have already set the stage for a further near-term appreciating move amid thin end-of-year trading volumes.

Market participants now look forward to the US economic docket, featuring the releases of Weekly Initial Jobless Claims and Chicago PMI. This, along with the US bond yields, will influence the USD price dynamics. Apart from this, traders will take cues from the broader market risk sentiment to grab some short-term opportunities around the USD/JPY pair.

Technical levels to watch

One-month risk reversal (RR) of the USD/INR, a measure of the spread between call and put prices, not only drops for the first time in four days but also marks the heaviest fall since December 15, according to data source Reuters.

A call option gives the holder the right but not obligation to buy the underlying asset at a predetermined price on or before a specific date. A put option represents a right to sell.

That said, the daily difference between them slumps to -0.1000 versus the previous day’s reading of +0.013. It’s worth noting that the weekly RR drops for the third time in a line, to -0.013 at the latest.

Amid these plays, USD/INR consolidates losses around the lowest level since November 24, up 0.10% intraday near 74.56.

FX option expiries for December 30 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.1290 384m

- 1.1310 201m

- 1.1330 357m

- 1.1375 285m

- USD/JPY: USD amounts

- 115.25 300m

- USD/CHF: USD amounts

- 0.9350 280m

- USD/CAD: USD amounts

- 1.2500 255m

- 1.2870 250m

- EUR/GBP: EUR amounts

- 0.8375 531m

- 0.8635 575m

- USD/TRY refreshes weekly top, eases from intraday high at the latest.

- Clear break of 200-SMA, bullish MACD signals keep buyers hopeful.

- Fresh selling will wait for weekly support line break.

USD/TRY remains on the front foot for the fourth consecutive day, up 4.72% intraday despite a recent pullback to $13.28 ahead of Thursday’s European session.

In doing so, the Turkish lira (TRY) pair justifies the upside break of 200-SMA amid bullish MACD conditions, suggesting further advances of the quote. However, 100-SMA challenges the pair’s immediate upside at $13.55.

Although the USD/TRY prices are likely to ease before advancing further, the pullback moves will be worrisome if breaking the aforementioned weekly support line, near $12.40. That said, the 200-SMA level of $12.90 may restrict immediate declines.

In a case where the pair bears dominate past $12.40, the recently flashed multi-day low near $10.25 will be in focus.

Meanwhile, an upside clearance of the 100-SMA level of $13.55 will push the USD/TRY prices towards the $14.00 threshold and then to the December 21 swing high of $14.13.

Following that, the 61.8% Fibonacci retracement (Fibo.) level of December 20-23 declines near $15.35 should lure the pair buyers.

Overall, USD/TRY remains in the recovery mode but intermediate pullbacks can’t be ruled out.

USD/TRY: Four-hour chart

Trend: Gradual recovery expected

The European Central Bank (ECB) policymaker Klaas Knot said in an interview published on Thursday, inflation in the eurozone could very stay above the central bank's 2% target for the coming years.

"I have a different view, I think the chance we remain stuck above 2% is just as big. Not far above 2%, but still,” Knot said.

The ECB this month projected inflation in the monetary union to fall to 1.8% after 2022, although Knot said that “the outlook could prove to be too rosy.”