- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 06-10-2015

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1268 +0,75%

GBP/USD $1,5233 +0,56%

USD/CHF Chf0,9671 -0,91%

USD/JPY Y120,21 -0,22%

EUR/JPY Y135,46 +0,54%

GBP/JPY Y183,12 +0,35%

AUD/USD $0,7160 +1,09%

NZD/USD $0,6545 +0,92%

USD/CAD C$1,3035 -0,35%

(time / country / index / period / previous value / forecast)

00:00 Australia HIA New Home Sales, m/m August -0.4%

00:00 China Bank holiday

03:00 Japan BoJ Interest Rate Decision 0%

03:00 Japan Bank of Japan Monetary Base Target 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Coincident Index (Preliminary) August 113.1

05:00 Japan Leading Economic Index (Preliminary) August 105

06:00 Germany Industrial Production s.a. (MoM) August 0.7% 0.2%

06:00 Germany Industrial Production (YoY) August 0.5%

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln August -3.3 -3.5

07:00 Switzerland Foreign Currency Reserves September 540

08:30 United Kingdom Industrial Production (MoM) August -0.4% 0.3%

08:30 United Kingdom Industrial Production (YoY) August 0.8% 1.2%

08:30 United Kingdom Manufacturing Production (MoM) August -0.8% 0.3%

08:30 United Kingdom Manufacturing Production (YoY) August -0.5% -0.1%

11:00 U.S. MBA Mortgage Applications October -6.7%

12:30 Canada Building Permits (MoM) August -0.6%

14:00 United Kingdom NIESR GDP Estimate September 0.5%

14:30 U.S. Crude Oil Inventories October 3.955

19:00 U.S. Consumer Credit August 19.1 19

23:50 Japan Current Account, bln August 1808.6 1221.1

23:50 Japan Core Machinery Orders September -3.6% 3.2%

23:50 Japan Core Machinery Orders, y/y August 2.8% 4.2%

The International Monetary Fund (IMF) released its World Economic Outlook on Tuesday. The IMF lowered its global economic growth forecasts due to a weaker growth in advanced economies and the slowdown in emerging economies.

The global economy will expand 3.1% in 2015, down from the previous forecast of 3.3%, and 3.6% in 2016, down from the previous forecast of 3.8%, according to the IMF.

"Six years after the world economy emerged from its broadest and deepest postwar recession, the holy grail of robust and synchronized global expansion remains elusive," Maurice Obstfeld, the IMF Economic Counsellor and Director of the Research Department, said.

The IMF cut its growth forecasts in advanced economies to 2.0% in 2015, down from 2.1%, and to 2.2% in 2016, down from 2.4%, while emerging markets expected to expand 4.0% in 2015, down from 4.2%.

The lender kept unchanged its growth forecast for the Eurozone for 2015 at 1.5%, while upgraded to 1.6% for next year from 1.5%.

The U.S. economy is expected to grow at 2.6% in 2015 and 2.8% in 2016.

Canada's seasonally adjusted Ivey purchasing managers' index plunged to 53.7 in September from 58.0 in August. Analysts had expected the index to decrease to 54.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was up 49.8 in September from 48.2 in August, while employment index climbed to 57.1 from 56.3.

The prices index was fell to 64.4 in September from 66.3 in August, while inventories increased to 52.1 from 42.4.

The U.S. Commerce Department released the trade data on Tuesday. The U.S. trade deficit widened to $48.33 billion in August from $41.81 billion in July, missing expectations for a rise to $47.4 billion. July's figure was revised down from a deficit of $41.90 billion.

The rise of a deficit was driven by a rise in imports and a decline in exports. Exports declined 2% in August, while imports increased 1.2%.

Statistics Canada released the trade data on Tuesday. Canada's trade deficit widened to C$2.53 billion in August from a deficit of C$0.82 billion in July. July's figure was revised up from a deficit of C$0.59 billion.

Analysts had expected a trade deficit of C$1.2 billion.

The increase in deficit was driven by a drop in exports. Exports slid 3.6% in August.

Exports of energy products dropped by 14.7% in August, exports of consumer goods dropped 8.0%, exports of motor vehicles and parts rose 3.1%, while exports of metal ores and non-metallic minerals were up 15.7%.

Imports climbed 0.2% in August.

Imports of aircraft and other transportation equipment and parts plunged by 14.4% in August, imports of metal and non-metallic mineral products climbed 6.0%, while imports of electronic and electrical equipment and parts declined 7.9%.

Markit Economics released construction purchasing managers' index (PMI) for Germany on Tuesday. Germany's construction purchasing managers' index (PMI) climbed to 52.4 in September from 50.3 in August.

A reading above 50 indicates expansion in the sector.

The index was driven by a rise in work on residential building projects.

Employment and purchasing activity also rose in September.

"Output rose at the strongest rate in six months, largely a result of sustained growth in residential building activity. Encouragingly, firms also reported a pick-up in purchasing activity, suggesting that companies are likely to remain busy in coming months," an economist at Markit, Oliver Kolodseike, said.

EUR/USD: $1.1170(E200mn), $1.1225(E200mn)

USD/JPY: Y119.90($250mn),Y120.00($1.1bn), Y120.05($250mn)

USD/CAD: Cad1.3150/65($425mn)

USD/CHF: Chf1.000(520mn)

AUD/USD: $0.6900(A$636mn), $0.7200(A$350mn)

EUR/JPY: Y132.50(E440mn)

NZD/USD: $0.6640(NZ$602mn)

EUR/USD

Offers 1.1225-30 1.1250 1.1265 1.1280 1.1300 1.1330 1.1350

Bids 1.1180-85 1.1155-60 1.1135 1.1120-25 1.1100

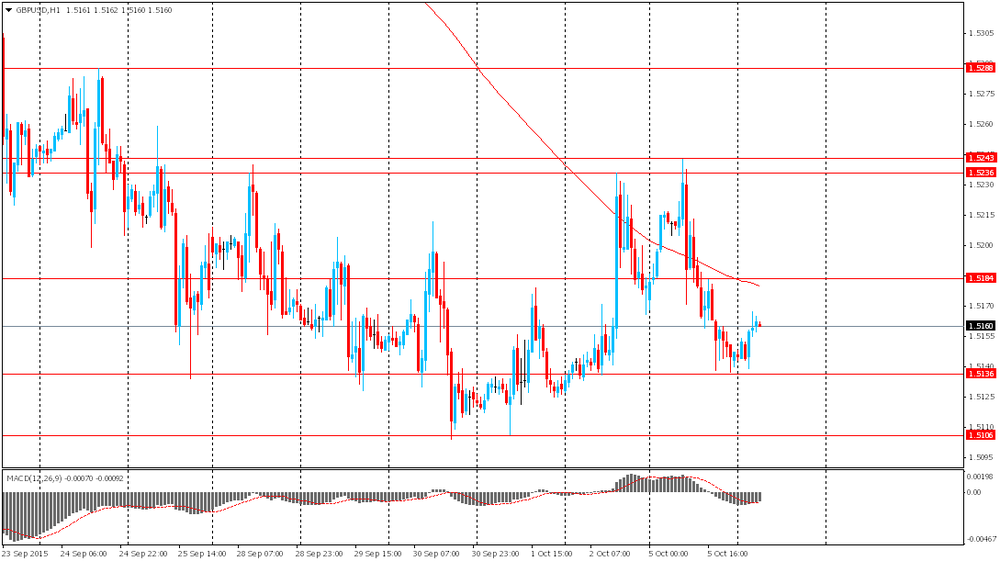

GBP/USD

Offers 1.5170 1.5185 1.5200 1.5235 1.5250 1.5265 1.5280 1.5300

Bids 1.5130-35 1.5115 1.5100 1.5080-85 1.5060 1.5030 1.5000

EUR/GBP

Offers 0.7400 0.7405-10 0.7420 0.7435 0.7450 0.7485 0.7500

Bids 0.7375-80 0.7360 0.7350 0.7330-35 0.7300

EUR/JPY

Offers 135.00 135.25 135.50 135.85 136.00 136.30 136.50

Bids 134.40 134.25 134.00 133.75 133.50 133.30 133.00

USD/JPY

Offers 120.50 120.65 120.85 121.00 121.30 121.50

Bids 120.00 119.80-85 119.65 119.40 119.25 119.10 119.00

AUD/USD

Offers 0.7135 0.7150 0.7185 0.7200 0.7225-30 0.7250

Bids 0.7100 0.7080-85 0.7060 0.7040 0.7020-25 0.7000 0.6980 0.6950

The Australian Bureau of Statistics released its trade data on Tuesday. Australia's trade deficit widened to A$3.1 billion in August from A$2.79 billion in July, missing expectations for a decline to a deficit of A$2.55 billion. July's figure was revised up from a deficit of A$2.46 billion.

Exports were flat in August, while imports rose 0.1%.

Halifax released its house prices data for the U.K. on Tuesday. House prices in the U.K. decreased 0.9% in September, after a 2.7% rise in August.

On a yearly basis, house prices climbed 8.6% in the three months to September, after a 9.0% increase in the three months to August.

"Housing demand has been strengthening recently, underpinned by economic growth, rising real earnings and very low mortgage rates. Increasing demand is combining with very low supply to drive robust underlying house price growth," Halifax's housing economist Martin Ellis said.

The Swiss Federal Statistics Office released its consumer inflation data on Friday. Switzerland's consumer price index rose 0.1% in September, in line with expectations, after a 0.2% drop in August.

The increase was driven by higher prices for clothing and vegetables. Prices for clothing and shoes rose 5.3% in September.

On a yearly basis, Switzerland's consumer price index remained unchanged at -1.4% in September, in line with forecasts. It was the biggest fall since July 1959.

Destatis released its factory orders data for Germany on Tuesday. German seasonal adjusted factory orders dropped 1.8% in August, missing expectations for a 0.5% increase, after a 2.2% fall in July. July's figure was revised down from a 1.4% decrease.

The decline was driven by a drop in foreign and domestic orders. Foreign orders decreased by 1.2% in August, while domestic orders fell by 2.6%.

New orders from the Eurozone rose 2.5% in August, while orders from other countries slid 3.7%.

Orders of the intermediate goods fell by 0.4% in August, capital goods orders were down 2.8%, while consumer goods orders decreased 1.5%.

EUR/USD: $1.1170(E200mn), $1.1225(E200mn)

USD/JPY: Y119.90($250mn),Y120.00($1.1bn), Y120.05($250mn)

USD/CAD: Cad1.3150/65($425mn)

USD/CHF: Chf1.000(520mn)

AUD/USD: $0.6900(A$636mn), $0.7200(A$350mn)

EUR/JPY: Y132.50(E440mn)

NZD/USD: $0.6640(NZ$602mn)

The Reserve Bank of Australia (RBA) kept unchanged its interest rate at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He noted that Australia's economy continued to expand moderately.

The RBA governor also said that there is a degree of spare capacity, and the Australian dollar is adjusting to lower commodity prices.

Stevens pointed out that "monetary policy needs to be accommodative", and it "will most effectively foster sustainable growth and inflation consistent with the target".

The central lowered its interest rate twice this year.

The New Zealand Institute of Economic Research (NZIER) released its Quarterly Survey of Business Opinion on late Monday evening. New Zealand's business confidence dropped to -14% in the third quarter from +5% in the second quarter, reaching its lowest level in more than four years.

"The drought and the slowing growth in China and the potential impact on the New Zealand economy - that has made a lot of business uneasy about what's going to be happening in the New Zealand economy in the coming months but as yet they haven't seen the effects in their business," NZIER senior economist Christina Leung said.

The International Monetary Fund (IMF) said on Monday that China can manage its economic slowdown. The IMF noted should implement effective governance.

"This will require, in particular, hardened budget constraints for both state-owned and private firms, and continued strengthening of the financial supervision framework," the lender said.

The IMF also said that a slowdown in the Chinese economy could have a negative impact on its neighbours.

"Spillovers have been magnified by forces that extend beyond China's border - including falling commodity prices and the prospect of an increase in U.S. interest rates - which could produce downward pressure on Asian neighbours," the lender said.

The United States, Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam reached a trade pact, which is known as the Trans-Pacific Partnership. The pact should boost trade between the countries. The countries account for 40% of world gross domestic product.

"This partnership levels the playing field for our farmers, ranchers, and manufacturers by eliminating more than 18,000 taxes that various countries put on our products," U.S. President Obama said in a statement on Monday.

Former Fed Chairman Ben Bernanke said in an interview with CNBC on Monday that there is no hurry to start raising interest rates.

"The goal post was 2 percent inflation. We're not there yet," he said.

"If you raised rates too early and kill the economy, that doesn't help you," he added.

Bernanke pointed out that slow productivity growth weighs on the U.S. economy.

Japanese investment bank Nomura lowered its GDP growth forecasts for China to 5.8% for next year on Monday, down from the previous estimate of a 6.7% growth. Yang Zhao, Nomura's economist, said that the Chinese economy slowed more sharply than anticipated. He added that the main reason is slowing property investment growth.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Trade Balance August -2.79 Revised From -2.46 -2.55 -3.1

03:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

03:30 Australia RBA Rate Statement

06:00 Germany Factory Orders s.a. (MoM) August -1.4% 0.5% -1.8%

The euro declined slightly against the U.S. dollar ahead of today's release of German industrial production data. Analysts expect the index to fall. Slower growth in China and the scandal around Volkswagen might have weighed on the country's exports.

Market participants are also waiting for ECB President Mario Draghi speech. Also today the International Monetary Fund will report on global economic outlook. If the IMF's report shows clear signs of slowing growth investors might take profits in stock markets. This could support the euro.

This week Portugal will hold elections. Prime Minister Pedro Passos Coelho, who supports austerity, is likely to win.

The Australian dollar rose sharply after the Reserve Bank of Australia left its benchmark rate unchanged at 2%. The central bank noted that the Australian economy continued to expand moderately and it still has spare capacity. Stock markets' volatility did not harm financial markets.

EUR/USD: the pair fell to $1.1170 in Asian trade

USD/JPY: the pair traded within Y120.35-55

GBP/USD: the pair rose to $1.5165

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:15 Switzerland Consumer Price Index (MoM) September -0.2% 0.1%

07:15 Switzerland Consumer Price Index (YoY) September -1.4% -1.4%

09:00 Eurozone ECOFIN Meetings

09:00 Eurozone Eurogroup Meetings

12:30 Canada Trade balance, billions August -0.59 -1.2

12:30 U.S. International Trade, bln August -41.86 -47.4

14:00 Canada Ivey Purchasing Managers Index September 58 54

17:00 Eurozone ECB President Mario Draghi Speaks

20:30 U.S. API Crude Oil Inventories September 4.6

21:30 U.S. FOMC Member Williams Speaks

22:30 Australia AiG Performance of Construction Index September 53.8

EUR / USD

Resistance levels (open interest**, contracts)

$1.1400 (5310)

$1.1314 (3243)

$1.1247 (2501)

Price at time of writing this review: $1.1182

Support levels (open interest**, contracts):

$1.1117 (1894)

$1.1081 (3293)

$1.1040 (3062)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 56701 contracts, with the maximum number of contracts with strike price $1,1400 (5310);

- Overall open interest on the PUT options with the expiration date October, 9 is 67169 contracts, with the maximum number of contracts with strike price $1,1000 (5757);

- The ratio of PUT/CALL was 1.18 versus 1.23 from the previous trading day according to data from October, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5400 (1469)

$1.5301 (737)

$1.5203 (1576)

Price at time of writing this review: $1.5154

Support levels (open interest**, contracts):

$1.5097 (2716)

$1.4999 (2105)

$1.4900 (1035)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 24967 contracts, with the maximum number of contracts with strike price $1,5500 (1686);

- Overall open interest on the PUT options with the expiration date October, 9 is 23752 contracts, with the maximum number of contracts with strike price $1,5100 (2716);

- The ratio of PUT/CALL was 0.95 versus 0.95 from the previous trading day according to data from October, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.