- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 07-10-2015

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1237 -0,28%

GBP/USD $1,5315 +0,54%

USD/CHF Chf0,9734 +0,65%

USD/JPY Y119,98 -0,19%

EUR/JPY Y134,83 -0,47%

GBP/JPY Y183,75 +0,34%

AUD/USD $0,7200 +0,56%

NZD/USD $0,6613 +1,03%

USD/CAD C$1,3065 +0,23%

(time / country / index / period / previous value / forecast)

05:00 Japan Eco Watchers Survey: Current September 49.3

05:00 Japan Eco Watchers Survey: Outlook September 48.2

05:45 Switzerland Unemployment Rate (non s.a.) September 3.2% 3.3%

06:00 Germany Current Account August 23.4

06:00 Germany Trade Balance August 25.0

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Bank of England Minutes

11:00 United Kingdom Asset Purchase Facility 375

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada New Housing Price Index, MoM August 0.1% 0.2%

12:30 U.S. Continuing Jobless Claims September 2191 2205

12:30 U.S. Initial Jobless Claims October 277 274

13:10 U.S. FOMC Member Dennis Lockhart Speaks

17:30 U.S. FOMC Member Charles Evans Speaks

18:00 United Kingdom BOE Gov Mark Carney Speaks

18:00 U.S. FOMC meeting minutes

19:30 U.S. FOMC Member Williams Speaks

The ratings agency Moody's affirmed the U.S. credit rating at "Aaa" on Wednesday. The outlook is "stable".

Moody's warned that there could be uncertainty "from the contentiousness of the political process".

"On a positive note, the process has introduced an element of spending restraint which has contributed to deficit reduction ahead of our expectations in recent years," Moody's Senior Vice President Steven Hess said.

"The Aaa rating is buttressed by a large and diverse economy, a strong record of GDP and productivity growth, and the status of the dollar and the US Treasury bond as global reserve currency and benchmark, respectively," Moody's concluded.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.5% in three months to September, after a 0.6% growth in three months to August.

"This slight softening in the third quarter is expected to be temporary. It is consistent with our latest forecast for the year as a whole," the NIESR said.

The NIESR expects the U.K. economy to expand 2.5% in 2015 and 2.4% in 2016, according to its August forecasts.

The think tank expects the Bank of England to raise its interest rate in the first half of 2016.

According to a Greek draft budget submitted to the Greek parliament on Monday, the Greek economy will contract this and next year. The Greek economy is expected to contract 2.3% in 2015 and 1.3% in 2016.

The primary budget target is expected to be a deficit of 0.25% of gross domestic product in 2015 and a surplus of 0.5% in 2016, according to a draft budget.

The Greek unemployment rate is seen to rise to 25.8% in 2016 from 25.4% this year.

The World Bank released its forecast for economic growth in developing countries in East Asia and Pacific on Monday. Developing East Asia will expand 6.5% in 2015, down from its April estimate of a 6.7% growth.

The downgrade was driven by a slowdown in the Chinese economy and the expected interest rate hike by the Fed.

China is expected to grow 6.9% in 2015, 6.7% in 2016 and 6.5% in 2017.

"Growth in developing East Asia Pacific continues to be solid, but the moderating trend suggests policy makers in the region must remain focused on structural reforms that lay the foundation for sustainable, long-term and inclusive growth," the World Bank East Asia and Pacific Regional Vice President, Axel van Trotsenburg, said.

EUR/USD: $1.1150/60(E310mn), $1.1300(E250mn)

USD/JPY: Y120.00($1.375bn),Y121.00($1.5bn), Y122.00($1.5bnn)

USD/CAD: Cad1.3000($5.7bn), Cad1.3300($4.6bn)

USD/CHF: Chf0.9505($458mn)

AUD/USD: $0.7000(A$1.6bn), $0.7200(A$6.0bn), $0.7250(A$1.6bn)

GBP/USD: $1.5195(stg200mn), $1.5400(stg300mn)

NZD/USD: $0.6500(NZ$867mn)

The Swiss National Bank's foreign exchange reserves increased to 541.540 billion Swiss francs in September from 540.031 billion francs in August.

August's figure was revised down from 540.416 billion francs.

French Finance Minister Michel Sapin said on Wednesday that the government will not revise its growth targets despite the downgrade of the global growth forecasts by the International Monetary Fund (IMF).

"I don't think this will jeopardise the European economic growth or jeopardise our growth targets," he said.

Sapin noted that the government expects the French economy to expand 1% this year and 1.5% in 2016.

The IMF lowered its global economic growth forecasts on Tuesday due to a weaker growth in advanced economies and the slowdown in emerging economies. The global economy will expand 3.1% in 2015, down from the previous forecast of 3.3%, and 3.6% in 2016, down from the previous forecast of 3.8%, according to the IMF.

Statistics Canada released housing market data on Wednesday. Building permits in Canada fell 3.7% in August, missing expectations for a 0.8% rise, after a 0.7% gain in July. July's figure was revised up from a 0.6% decrease.

The decline was driven by lower construction intentions in the non-residential and residential sector.

Building permits for non-residential construction declined 1.3% in August, while permits in the residential sector slid 5.1%.

The Bank of Greece said on Wednesday that the European Central Bank (ECB) lowered the amount of emergency funding (ELA) to Greek banks to €87.9 billion from €88.9 billion as the liquidity of Greek banks improved.

"The reduction by 1.0 billion euros of the ceiling reflects an improvement in the liquidity of Greek banks," the Bank of Greece said.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Coincident Index (Preliminary) August 113.1 112.5

05:00 Japan Leading Economic Index (Preliminary) August 105 103.5

06:00 Germany Industrial Production s.a. (MoM) August 1.2% Revised From 0.7% 0.2% -1.2%

06:00 Germany Industrial Production (YoY) August 0.8% Revised From 0.5% 2.3%

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln August -3.2 Revised From -3.3 -3.5 -2.98

07:00 Switzerland Foreign Currency Reserves September 540 541.5

08:30 United Kingdom Industrial Production (MoM) August -0.3% Revised From -0.4% 0.3% 1.0%

08:30 United Kingdom Industrial Production (YoY) August 0.7% Revised From 0.8% 1.2% 1.9%

08:30 United Kingdom Manufacturing Production (MoM) August -0.7% Revised From -0.8% 0.3% 0.5%

08:30 United Kingdom Manufacturing Production (YoY) August -1.2% Revised From -0.5% -0.1% -0.8%

11:00 U.S. MBA Mortgage Applications October -6.7% 25.5%

The U.S. dollar traded lower against the most major currencies in the absence of any major economic reports from the U.S. today.

The euro traded higher against the U.S. dollar despite the negative industrial production data from Germany. Destatis released its industrial production data for Germany on Wednesday. German industrial production slid 1.2% in August, missing expectations for a 0.2% gain, after a 1.2% rise in July. July's figure was revised up from a 0.7% increase.

The output of capital goods decreased 2.1% in August, energy output dropped 1.4%, and the production in the construction sector was down 1.3%, while the production of intermediate goods was flat.

The output of consumer goods decreased 0.4%.

German industrial production excluding energy and construction fell by 1.1% in August.

The British pound traded higher against the U.S. dollar after the positive industrial data from the U.K. The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. rose 0.5% in August, exceeding expectations for a 0.3% gain, after a 0.7% decrease in July. July's figure was revised up from a 0.8% drop.

Manufacturing output was driven by a rise in the vehicle production.

On a yearly basis, manufacturing production in the U.K. decreased 0.8% in August, missing forecast of a 0.1% fall, after a 1.2% drop in July. July's figure was revised down from a 0.5% decrease.

Industrial production in the U.K. climbed 1.0% in August, beating forecasts of a 0.3% rise, after a 0.3% fall in July. July's figure was revised up from a 0.4% decline.

On a yearly basis, industrial production in the U.K. gained 1.9% in August, exceeding expectations for a 1.2% rise, after a 0.7% increase in July. July's figure was revised down from a 0.8% rise.

The increase was driven by adjustments in the ONS calculations. The extraction industry in the British North Sea was working at full capacity after shutdowns and maintenance work in July. A small increase in gas production also supported the industrial production.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the building permits data from Canada. The Canadian building permits are expected to rise 0.8% in August, after a 0.6% decline in July.

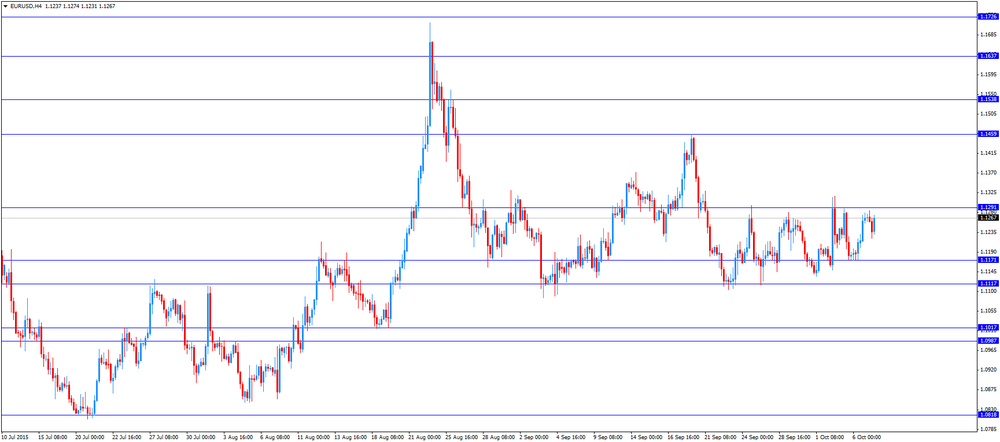

EUR/USD: the currency pair increased to $1.1274

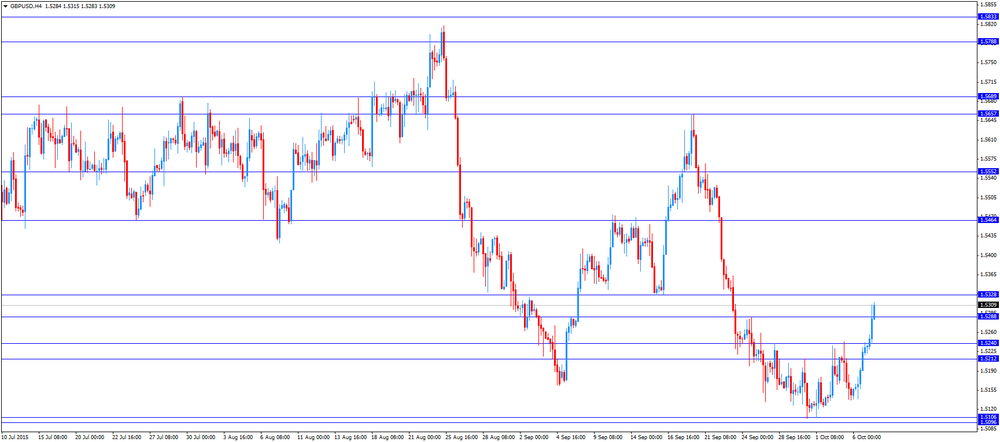

GBP/USD: the currency pair rose to $1.5315

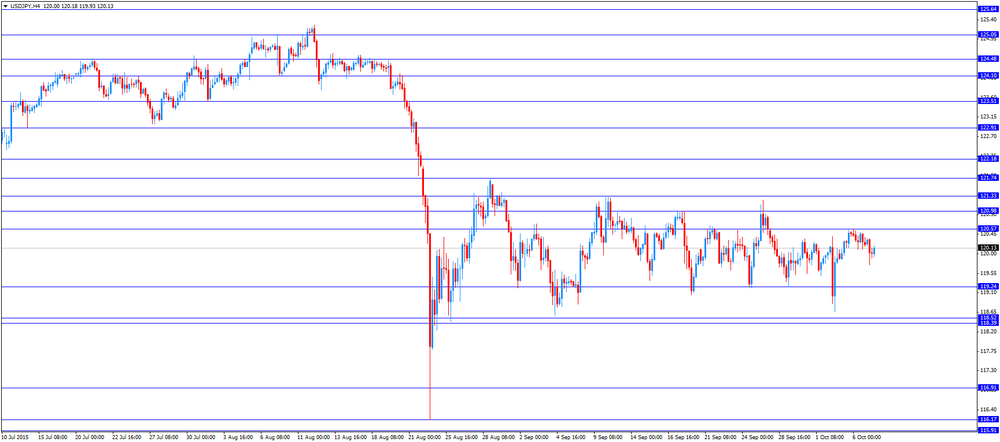

USD/JPY: the currency pair climbed to Y120.18

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) August -0.6% 0.8%

14:00 United Kingdom NIESR GDP Estimate September 0.5%

23:50 Japan Core Machinery Orders September -3.6% 3.2%

23:50 Japan Core Machinery Orders, y/y August 2.8% 4.2%

EUR/USD

Offers 1.1265 1.1280-85 1.1300 1.1330 1.1350 1.1365 1.1380 1.1400

Bids 1.1220-25 1.1200 1.1180-85 1.1155-60 1.1135 1.1120-25 1.1100

GBP/USD

Offers 1.5280 1.5300-10 1.5325-30 1.5350 1.5380 1.5400

Bids 1.5240 1.5220 1.5200 1.5185 1.5150 1.5130-35 1.5115 1.5100EUR/GBP

Offers 0.7375-80 0.7400 0.7405-10 0.7420 0.7435 0.7450

Bids 0.7350 0.7330-35 0.7300 0.7285 0.7265 0.7250

EUR/JPY

Offers 135.00 135.25 135.50 135.85 136.00 136.30 136.50

Bids 134.70 134.40 134.25 134.00 133.75 133.50 133.30 133.00

USD/JPY

Offers 120.20-25 120.50 120.65 120.85 121.00 121.30 121.50

Bids 119.80-85 119.65 119.40 119.25 119.10 119.00 118.85 118.50

AUD/USD

Offers 0.7200 0.7225-30 0.7250 0.7275 0.7300 0.7330 0.7350

Bids 0.7170 0.7150 0.7125-30 0.7100 0.7080-85 0.7060 0.7040 0.7020-25

San Francisco Fed President John Williams said on Tuesday that he expects the Fed to start raising its interest rates this year despite the weak U.S. labour market in September.

"Things are looking up, and if they stay on track, I see this as the year we start the process of monetary policy normalization," he said.

Spanish statistical office INE released its industrial production figures for Spain on Wednesday. Industrial production in Spain was down 1.4% in August, after a 0.7% gain in July.

On a yearly basis, industrial production in Spain climbed at adjusted 2.7% in August, after a 5.2% increase in July.

Output of capital goods jumped at seasonally adjusted 8.6% year-on-year in August, output of intermediate goods climbed 2.5%, energy production was up 1.1%, while consumer goods output rose 0.3%.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a press conference on Wednesday that the central bank will not cut its deposit rate in the "near future".

"I am not considering lowering the excess-reserve rate, and there will be no change in my views in the near future," he said.

Kuroda pointed out that the inflation is on track to reach the central bank's 2% target.

"Consumer prices are expected to stay around zero percent from a year earlier because of falling energy prices, but I think prices will gain upward momentum toward a 2 percent target once the impact of falling energy prices disappear," he said.

EUR/USD: $1.1150/60(E310mn), $1.1300(E250mn)

USD/JPY: Y120.00($1.375bn),Y121.00($1.5bn), Y122.00($1.5bnn)

USD/CAD: Cad1.3000($5.7bn), Cad1.3300($4.6bn)

USD/CHF: Chf0.9505($458mn)

AUD/USD: $0.7000(A$1.6bn), $0.7200(A$6.0bn), $0.7250(A$1.6bn)

GBP/USD: $1.5195(stg200mn), $1.5400(stg300mn)

NZD/USD: $0.6500(NZ$867mn)

The Bank of Japan (BoJ) released its interest rate decision on Wednesday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The BoJ board members voted 8-1 to keep monetary policy unchanged.

The BoJ noted that the country's economy continued to recover moderately, "although exports and production are affected by the slowdown in emerging economies".

The central bank said that the annual inflation in Japan was flat, but inflation expectations seems to be rising.

The BoJ expect the inflation to be about 0% "for the time being", due to low energy prices.

According to the French Customs, France's trade deficit narrowed to €2.98 billion in August from €3.2 billion in July. July's figure was revised up from a deficit of €3.3 billion.

The decline in deficit was driven by a drop in imports.

Destatis released its industrial production data for Germany on Wednesday. German industrial production slid 1.2% in August, missing expectations for a 0.2% gain, after a 1.2% rise in July. July's figure was revised up from a 0.7% increase.

The output of capital goods decreased 2.1% in August, energy output dropped 1.4%, and the production in the construction sector was down 1.3%, while the production of intermediate goods was flat.

The output of consumer goods decreased 0.4%.

German industrial production excluding energy and construction fell by 1.1% in August.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. rose 0.5% in August, exceeding expectations for a 0.3% gain, after a 0.7% decrease in July. July's figure was revised up from a 0.8% drop.

Manufacturing output was driven by a rise in the vehicle production.

On a yearly basis, manufacturing production in the U.K. decreased 0.8% in August, missing forecast of a 0.1% fall, after a 1.2% drop in July. July's figure was revised down from a 0.5% decrease.

Industrial production in the U.K. climbed 1.0% in August, beating forecasts of a 0.3% rise, after a 0.3% fall in July. July's figure was revised up from a 0.4% decline.

On a yearly basis, industrial production in the U.K. gained 1.9% in August, exceeding expectations for a 1.2% rise, after a 0.7% increase in July. July's figure was revised down from a 0.8% rise.

The increase was driven by adjustments in the ONS calculations. The extraction industry in the British North Sea was working at full capacity after shutdowns and maintenance work in July. A small increase in gas production also supported the industrial production.

The People's Bank of China (PBoC) said on Wednesday that the country's foreign-exchange reserves declined by $43.26 billion to $3.514 trillion in September from a month earlier.

China's foreign-exchange reserves dropped by $93.9 billion to $3.557 trillion in August after the yuan devaluation.

The European Central Bank (ECB) Governing Council member Erkki Liikanen said on Tuesday that the central should not adjust its asset-buying programme.

"Let's keep the tempo and let's stick to our plan. And if things change, we should not draw any hasty conclusions," he said.

Liikanen pointed out that a slowdown in the Chinese economy and low oil prices are the biggest risks to the Eurozone's economy.

The Australian Industry Group (AiG) released its construction data for Australia on late Tuesday evening. The Ai Group/HIA Australian Performance of Construction Index fell to 51.9 in September from 53.8 in August.

A reading above 50 indicates expansion in the sector.

The decline was driven by a drop in engineering, which slid by 9.3 point to 36.6 in September.

"Residential construction activity remains the cornerstone of the broader construction industry and will retain this role into at least the first half of 2016," HIA economist, Diwa Hopkins, said.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1401 (5343)

$1.1337 (3238)

$1.1300 (2551)

Price at time of writing this review: $1.1263

Support levels (open interest**, contracts):

$1.1220 (2850)

$1.1184 (5419)

$1.1142 (2064)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 57299 contracts, with the maximum number of contracts with strike price $1,1400 (5343);

- Overall open interest on the PUT options with the expiration date October, 9 is 68075 contracts, with the maximum number of contracts with strike price $1,1000 (5714);

- The ratio of PUT/CALL was 1.19 versus 1.18 from the previous trading day according to data from October, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.5500 (1686)

$1.5400 (1471)

$1.5302 (800)

Price at time of writing this review: $1.5243

Support levels (open interest**, contracts):

$1.5197 (2416)

$1.5099 (3241)

$1.5000 (2104)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 25469 contracts, with the maximum number of contracts with strike price $1,5500 (1686);

- Overall open interest on the PUT options with the expiration date October, 9 is 24246 contracts, with the maximum number of contracts with strike price $1,5100 (3241);

- The ratio of PUT/CALL was 0.95 versus 0.95 from the previous trading day according to data from October, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia HIA New Home Sales, m/m August -0.4%

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Coincident Index (Preliminary) August 113.1 112.5

05:00 Japan Leading Economic Index (Preliminary) August 105 103.5

06:00 Germany Industrial Production s.a. (MoM) August 0.7% 0.2% -1.2%

06:00 Germany Industrial Production (YoY) August 0.5% 3.4%

The Australian dollar rose amid gains in Asian stocks and a weaker U.S. dollar. However unfavorable data on business activity in Australia's construction sector limited growth of the AUD. AiG Performance of Construction Index came in at 51.9 in September compared to 53.8 reported previously. Nevertheless on the whole the construction sector rose for the second straight month. Construction of residential houses rose to an eleven-month high.

The yen rose against the greenback after release of results of today's Bank of Japan meeting and speech by LDP's Kozo Yamamoto. BOJ Board members voted 8 to 1 to keep monetary policy unchanged. Kozo Yamamoto spoke after the meeting. He sounded optimistic and said that the point of Abenomics is to ease monetary policy. The policymaker noted that the BOJ needs to buy more bonds. Yamamoto also said that there is no need to worry about public debt and that financial condition in the country is improving fast.

EUR/USD: the pair fluctuated within $1.1260-80 in Asian trade

USD/JPY: the pair fell to Y119.75

GBP/USD: the pair rose to $1.5255

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln August -3.3 -3.5

07:00 Switzerland Foreign Currency Reserves September 540

08:30 United Kingdom Industrial Production (MoM) August -0.4% 0.3%

08:30 United Kingdom Industrial Production (YoY) August 0.8% 1.2%

08:30 United Kingdom Manufacturing Production (MoM) August -0.8% 0.3%

08:30 United Kingdom Manufacturing Production (YoY) August -0.5% -0.1%

11:00 U.S. MBA Mortgage Applications October -6.7%

12:30 Canada Building Permits (MoM) August -0.6% 0.8%

14:00 United Kingdom NIESR GDP Estimate September 0.5%

14:30 U.S. Crude Oil Inventories October 3.955 2.0

19:00 U.S. Consumer Credit August 19.1 19

23:50 Japan Current Account, bln August 1808.6 1221.1

23:50 Japan Core Machinery Orders September -3.6% 3.2%

23:50 Japan Core Machinery Orders, y/y August 2.8% 4.2%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.