- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 08-09-2015

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1202 +0,31%

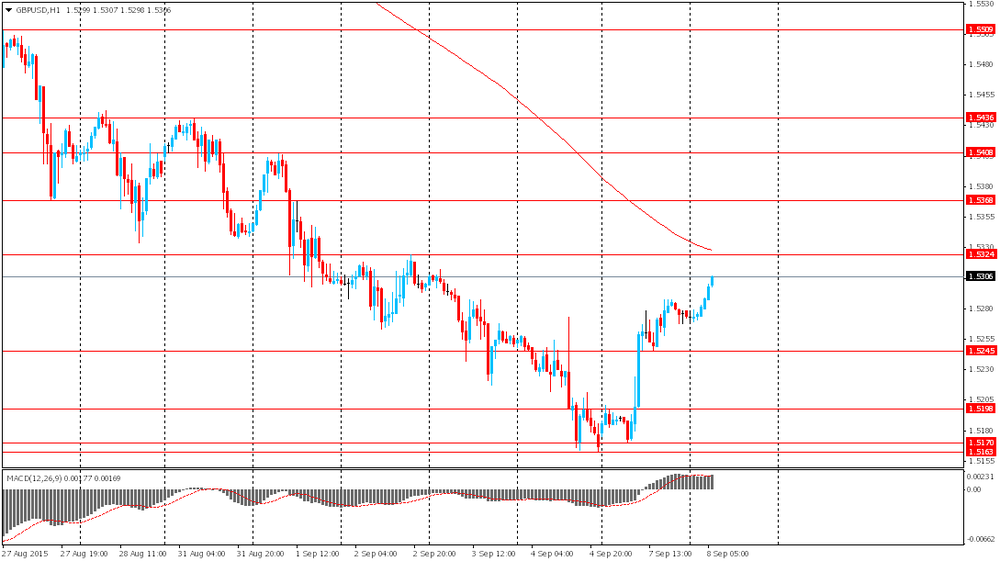

GBP/USD $1,5389 +0,75%

USD/CHF Chf0,9785 +0,36%

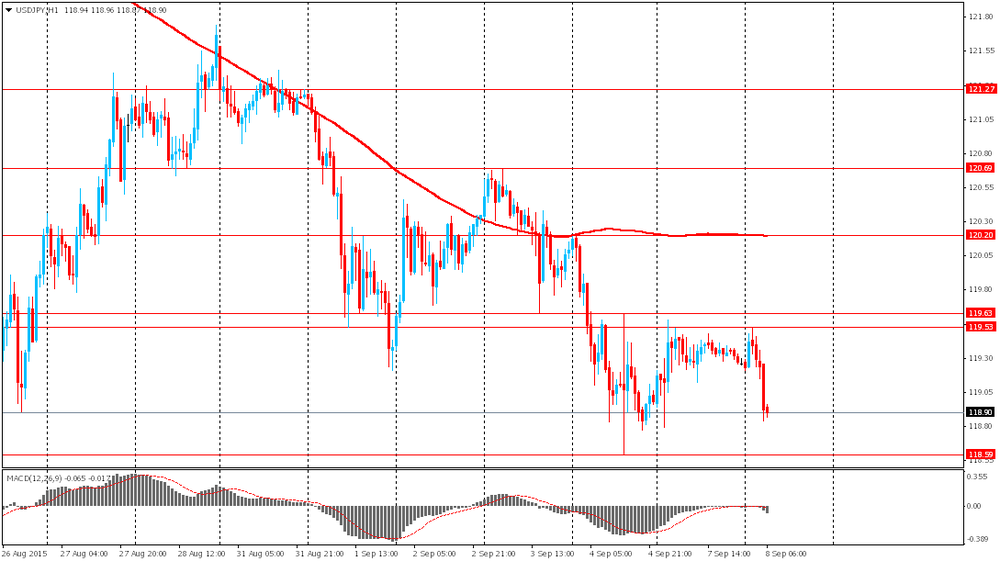

USD/JPY Y119,88 +0,52%

EUR/JPY Y134,30 +0,83%

GBP/JPY Y184,49 +1,27%

AUD/USD $0,7019 +1,30%

NZD/USD $0,6339 +1,10%

USD/CAD C$1,3209 -0,72%

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence September 7.8%

01:30 Australia Home Loans July 4.4% 0.8%

02:00 Australia RBA Assist Gov Lowe Speaks

05:00 Japan Consumer Confidence August 40.3

06:00 Japan Prelim Machine Tool Orders, y/y August 1.6%

08:30 United Kingdom Industrial Production (MoM) July -0.4% 0.1%

08:30 United Kingdom Industrial Production (YoY) July 1.5% 1.4%

08:30 United Kingdom Manufacturing Production (MoM) July 0.2% 0.2%

08:30 United Kingdom Manufacturing Production (YoY) July 0.5% 0.5%

08:30 United Kingdom Total Trade Balance July -1.6

09:00 Australia RBA Assist Gov Debelle Speaks

11:00 U.S. MBA Mortgage Applications September 11.3%

12:15 Canada Housing Starts August 193 190

12:30 Canada Building Permits (MoM) July 14.8% -5%

14:00 United Kingdom NIESR GDP Estimate Quarter III 0.7%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:00 U.S. JOLTs Job Openings July 5.249 5.288

21:00 New Zealand RBNZ Interest Rate Decision 3% 2.75%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:50 Japan Core Machinery Orders August -7.9% 3.7%

23:50 Japan Core Machinery Orders, y/y August 16.6% 10.5%

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index increased to 95.9 in August from 95.4 in July.

The increase was partly driven by a rise in job openings and earnings trends.

5 of 10 subindexes rose last month, while three fell and two were unchanged.

The NFIB surveyed 656 small business owners.

Bank of France expects the French economy to expand 0.3% in the third quarter

The Bank of France released its monthly report on Tuesday. The central bank expects the French economy to expand 0.3% in the third quarter.

The Bank of France noted that industrial activity increased slightly in August due to weak performance of chemicals and metalworking sectors.

The activity in the services sector rose in August due to a rise in temporary work and transport services.

The central bank expects the economy to grow 1.2% in 2015, 1.8% in 2016 and 1.9% in 2017.

The Federal Reserve Bank of San Francisco President John Williams said in an interview with The Wall Street Journal on Friday that the U.S. economic outlook was better than he expected. But he added that "there are some pretty significant headwinds".

"All of the data that we have had up until now has been, I think, encouraging. It has been about as good, or better, than I was expecting, in terms of the U.S. economy," Williams said.

The San Francisco president noted that he wouldn't say whether the interest rate hike by the Fed in September is now in order.

Williams is a voting member of the Federal Open Market Committee this year.

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator fell to 100.0 in July from 100.1 in June.

"Stable growth momentum confirmed in the OECD area but the outlook deteriorates in most major emerging economies," the OECD said.

It signalled stable growth in the Eurozone, particularly in Germany and Italy.

There were signs of firming growth in France and India.

The index for the U.S., the U.K. and Canada pointed to a moderate growth.

The index for China pointed to a loss of growth momentum.

The index for Russia showed signs of slowing growth momentum.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence August 4 1

02:00 China Trade Balance, bln August 43.03 48.2 60.24

05:00 Japan Eco Watchers Survey: Current August 51.6 49.3

05:00 Japan Eco Watchers Survey: Outlook August 51.9 48.2

05:45 Switzerland Unemployment Rate (non s.a.) August 3.1% 3.1% 3.2%

06:00 Germany Current Account July 24.4 23.4

06:00 Germany Trade Balance July 24.2 Revised From 24.1 25.0

06:45 France Trade Balance, bln July -2.76 Revised From -2.7 -3.3

09:00 Eurozone GDP (QoQ) (Revised) Quarter II 0.5% Revised From 0.4% 0.3% 0.4%

09:00 Eurozone GDP (YoY) (Revised) Quarter II 1.0% 1.2% 1.5%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

The situation regarding the interest rate hike by the Fed remained unclear. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 173,000 jobs in August, missing expectations for a rise of 220,000 jobs, after a gain of 245,000 jobs in July. July's figure was revised up from a rise of 215,000 jobs.

The U.S. unemployment rate dropped to 5.1% in August from 5.3% in July, exceeding expectations for a decline to 5.2%. It was the lowest level since April 2008.

Average hourly earnings rose 0.3% in August, beating forecasts of a 0.2% gain, after a 0.2% increase in July.

The euro traded lower against the U.S. dollar despite the mostly positive economic data from the Eurozone. Destatis released its trade data for Germany on Tuesday. Germany's seasonally adjusted trade surplus climbed to €22.8 billion in July from 22.1 in June.

Exports increased at a seasonally and calendar-adjusted 2.4% in July, while imports rose 2.2%. These were the highest seasonally adjusted monthly readings ever calculated both for exports and for imports, according to Destatis.

Germany's current account surplus was at €23.4 billion in July, down from €24.4 billion in June.

Eurostat released its revised GDP data today. Eurozone's revised gross domestic product (GDP) rose 0.4% in second quarter, up from the preliminary reading of a 0.3% increase, after a 0.5% gain in the first quarter. The first quarter's reading was revised up from a 0.4% rise.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in second quarter, up from the preliminary reading of a 1.2% gain, after a 1.0% rise in the first quarter.

Exports climbed to 1.6% in the second quarter, while imports rose to 1.0%.

According to the French Customs, France's trade deficit widened to €3.3 billion in July from €2.76 billion in June.

The rise in deficit was driven by lower exports and imports.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar after the labour market data from Switzerland. The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in August.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.2% in August from 3.1% in July.

The number of unemployed people in Switzerland rose to 136,983 in August from 133,754 in July.

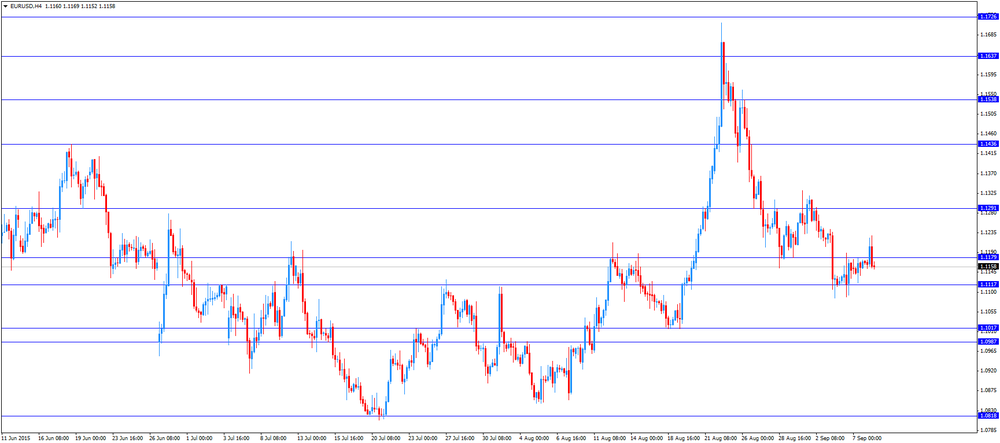

EUR/USD: the currency pair fell to $1.1152

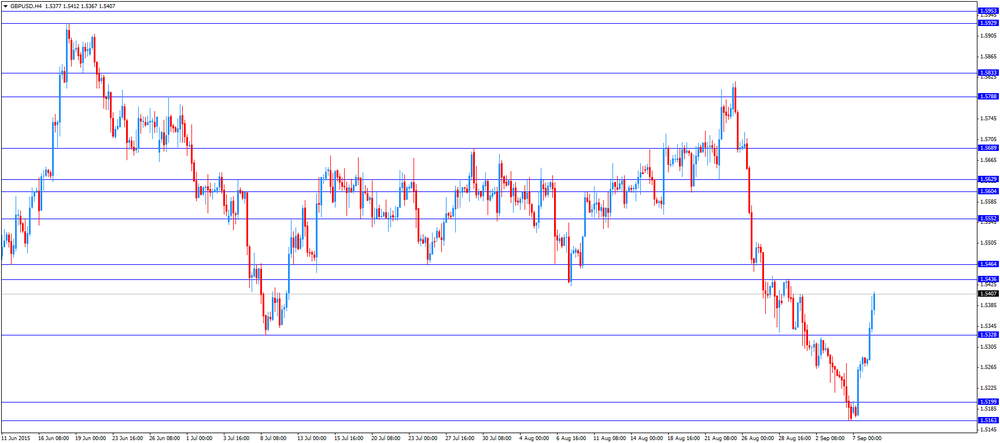

GBP/USD: the currency pair rose to $1.5412

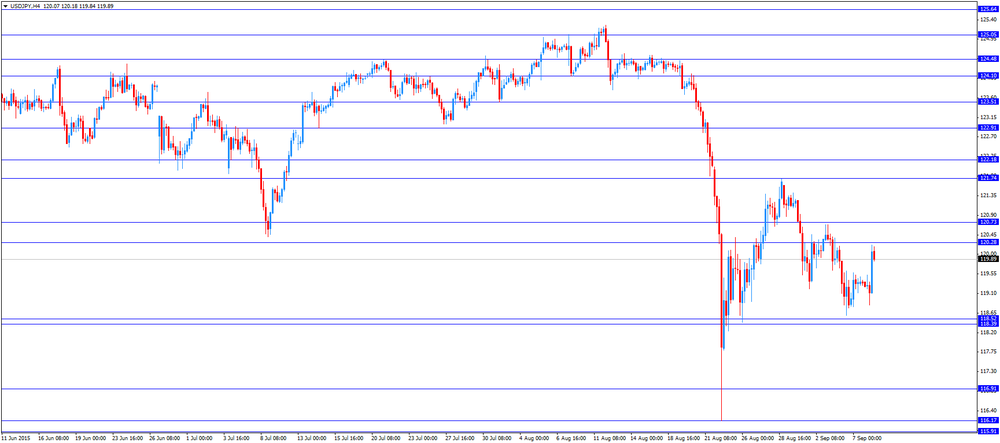

USD/JPY: the currency pair increased to Y120.22

The most important news that are expected (GMT0):

14:00 U.S. Labor Market Conditions Index August 1.1

19:00 U.S. Consumer Credit July 20.74 18.5

The German statistical office Destatis relased its labour costs data for the second quarter on Tuesday. Labour costs per hour worked rose 0.9% in the second quarter on a seasonally and calendar adjusted basis, after a 0.8% increase in the first quarter.

On a yearly basis, labour costs per hour worked increased 3.1% in the second quarter on a calendar adjusted basis, after a 2.8% gain in the first quarter.

The costs of gross earnings climbed 3.4% year-on-year in the second quarter, while non-wage costs were up 2.0% in calendar adjusted terms.

Destatis released its manufacturing turnover data for Germany on Tuesday. Manufacturing turnover rose on seasonally adjusted and on adjusted for working days basis by 1.9% in July, after a 1.9% drop in June.

Meanwhile, domestic turnover increased slightly by 0.2% in July, while the business with foreign customers jumped 3.7%.

Sales to euro area countries rose 2.4% in July, while sales to other countries climbed 4.7%.

On a yearly basis, manufacturing turnover in Germany was up on seasonally adjusted and on adjusted for working days basis by 2.5% in July, after a 1.6% gain in June.

Eurozone's revised gross domestic product (GDP) rose 0.4% in second quarter, up from the preliminary reading of a 0.3% increase, after a 0.5% gain in the first quarter. The first quarter's reading was revised up from a 0.4% rise.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in second quarter, up from the preliminary reading of a 1.2% gain, after a 1.0% rise in the first quarter.

Household spending gained 0.4% in the second quarter, while gross fixed capital formation was down 0.5%.

Exports climbed to 1.6% in the second quarter, while imports rose to 1.0%.

EUR/USD: $1.1100(E962mn), $1.1245-50(E360mn)

USD/JPY: Y119.00($544mn), Y120.15($350mn), Y120.40-45($1.1bn), Y121.50($502mn)

EUR/GBP: Gbp0.7300(E1.01bn)

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in August.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.2% in August from 3.1% in July.

The number of unemployed people in Switzerland rose to 136,983 in August from 133,754 in July.

The youth unemployment rate was up to 3.6% in August from 3.0% in July.

According to the French Customs, France's trade deficit widened to €3.3 billion in July from €2.76 billion in June.

The rise in deficit was driven by lower exports and imports.

Destatis released its trade data for Germany on Tuesday. Germany's seasonally adjusted trade surplus climbed to €22.8 billion in July from 22.1 in June.

Exports increased at a seasonally and calendar-adjusted 2.4% in July, while imports rose 2.2%. These were the highest seasonally adjusted monthly readings ever calculated both for exports and for imports, according to Destatis.

Germany's current account surplus was at €23.4 billion in July, down from €24.4 billion in June.

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus rose to $60.24 billion in August from $43.03 billion in July, beating expectations for a rise to a surplus of $48.20 billion.

Exports fell at an annual rate of 5.5% in August, while Imports slid at an annual rate of 13.8%, the tenth consecutive decline.

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Monday evening. Japan's GDP decreased by 0.3% in the second quarter, up from the preliminary reading of a 0.4% fall, after a 1.0% rise in the first quarter.

Business investment declined 0.9% in the second quarter, while inventories increased 0.3%. Household spending fell 0.7% in the second quarter.

On a yearly basis, Japan's economy contracted by 1.2% in the second quarter, up from the preliminary reading of a 1.8% rise, after a 4.5% increase in the first quarter. The first quarter's figure was revised up from a 3.9% gain.

The Organisation for Economic Cooperation and Development (OECD) Deputy Secretary-General Rintaro Tamaki said at a news conference in Tokyo on Monday that it is too early to say that the yuan devaluation was an attempt to boost exports.

"It's premature to think that action, taken to let the yuan move more in line with the market, was aimed at bringing China back to being an export-driven economy," he said.

Tamaki noted that it is important to monitor whether China can implement reforms to achieve stable and sustainable economic growth.

The head of the European Stability Mechanism (ESM) Klaus Regling said on Monday that he was confident the International Monetary Fund (IMF) would participate in the third Greek bailout program.

"It has not been defined to what extent the IMF will contribute but I'm confident that they will participate later this year," he said.

Regling also said that he was confident that there is no need for the full fiscal union.

"I don't think we need to go a lot further for a good functioning of the euro zone area," he said.

The International Monetary Fund (IMF) Managing Director Christine Lagarde urged the world's largest economies to implement structural reforms at the G20 summit on Saturday.

"Downside risks to the outlook have increased, particularly for emerging market economies. Against this backdrop, policy priorities have taken on even more urgency since we last met in April," she said.

Lagarde pointed out that growth remains too low, trade is too low, investment is too low and unemployment is too high.

The IMF managing director also said that the Fed should delay its interest rate hike until 2016 due to the global implications.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia National Australia Bank's Business Confidence August 4 1

02:00 China Trade Balance, bln August 43.03 48.2 60.24

05:00 Japan Eco Watchers Survey: Current August 51.6 49.3

05:00 Japan Eco Watchers Survey: Outlook August 51.9 48.2

05:45 Switzerland Unemployment Rate (non s.a.) August 3.1% 3.1% 3.2%

06:00 Germany Current Account July 24.4 23.4

06:00 Germany Trade Balance July 24.1 Revised From 24.0 25.0

The euro climbed ahead of today's eurozone GDP data. A median forecast suggests a revised reading of 1.2% y/y compared to 1.0% reported earlier.

The pound climbed ahead of Thursday's Bank of England meeting. Most analysts expect the BOE to keep interest rates unchanged. Minutes of the meeting might show whether policymakers are concerned about China's economic slowdown.

The yen advanced against the greenback amid revised GDP data. Japan GDP contracted by 1.2% in Q2 compared to a 1.6% contraction stated in a preliminary report published on August 17. Weaker exports resulted in slower economic activity.

The Australian dollar felt pressure as investors assessed National Australia Bank's Business Confidence index. The index fell to 1 in August from 4 reported previously. Meanwhile China's trade balance report supported the AUD. The country's trade surplus came in at $60.24 billion beating expectations for $48.2 billion. Exports fell by 5.5% y/y compared to -8.3% reported previously and -6.0% expected. At the same time imports fell by 14.3% in August compared to -8.1% in July. Imports missed expectations too.

EUR/USD: the pair rose beyond $1.1200 in Asian trade

USD/JPY: the pair fell to Y118.85

GBP/USD: the pair rose beyond $1.5300

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Trade Balance, bln July -2.7

14:00 U.S. Labor Market Conditions Index August 1.1

19:00 U.S. Consumer Credit July 20.74 18.5

20:30 U.S. API Crude Oil Inventories August 7.6

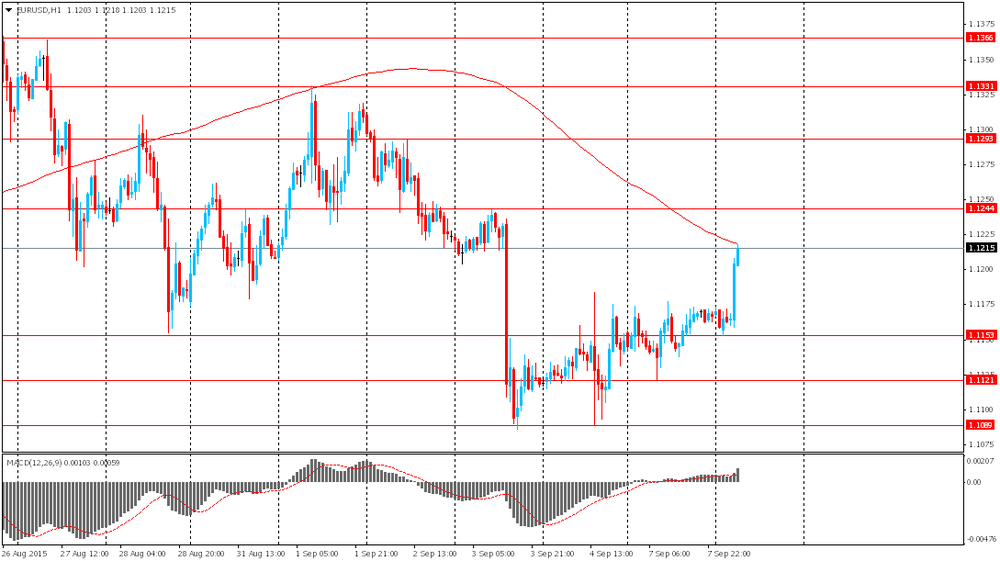

EUR / USD

Resistance levels (open interest**, contracts)

$1.1347 (1342)

$1.1300 (662)

$1.1247 (560)

Price at time of writing this review: $1.1215

Support levels (open interest**, contracts):

$1.1135 (277)

$1.1063 (942)

$1.1021 (2587)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 40777 contracts, with the maximum number of contracts with strike price $1,1500 (3650);

- Overall open interest on the PUT options with the expiration date October, 9 is 54459 contracts, with the maximum number of contracts with strike price $1,0700 (5751);

- The ratio of PUT/CALL was 1.34 versus 1.47 from the previous trading day according to data from September, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5602 (935)

$1.5504 (1294)

$1.5406 (583)

Price at time of writing this review: $1.5376

Support levels (open interest**, contracts):

$1.5279 (498)

$1.5185 (1790)

$1.5089 (1177)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 15297 contracts, with the maximum number of contracts with strike price $1,5500 (1294);

- Overall open interest on the PUT options with the expiration date October, 9 is 14774 contracts, with the maximum number of contracts with strike price $1,5200 (1790);

- The ratio of PUT/CALL was 0.97 versus 1.10 from the previous trading day according to data from September, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.