- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 11-09-2015

The Bank of England's (BoE) Monetary Policy Committee (MPC) Member Kristin Forbes said in Cardiff on Friday that the central bank may have to raise its interest rate sooner than expected if the strong pound has less of an impact on inflation than thought.

"Perhaps most important for monetary policy today, this approach also suggests that sterling's recent appreciation could create less drag on import prices and inflation than we might have expected if the levels of pass-through seen after the crisis persisted. If this plays out, monetary policy would need to be tightened sooner than based on older models," she said.

The Thomson Reuters/University of Michigan preliminary consumer sentiment index slid to 85.7 in September from a final reading of 91.9 in August, missing expectations for a decrease to 91.2. It was the lowest level since September 2014.

"Consumers still anticipate a weaker domestic economy due to the global slowdown and are less optimistic about future growth in jobs and wages than they were a few months ago," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

The decline in the index was mainly driven by falls in the index of current economic conditions and the index of consumer expectations.

The index of current economic conditions declined to 100.3 in September from 105.1 in August, while the index of consumer expectations decreased to 76.4 from 83.4.

The one-year inflation expectations rose to 2.9% in September from 2.8% in August.

EUR/USD: $1.1100(E1.55bn), $1.1150(E800mn), $1.1200(E1.08bn), $1.1300(E910mn), $1.1310(E532mn), $1.1350(E1.08bn)

USD/JPY: Y120.50($700mn), Y120.70-75($548mn), Y121.00-05($690mn), Y121.50($300mn), Y122.00($379mn)

EUR/JPY: Y138.00(E398mn)

GBP/USD: $1.5362-70(GBP262mn)

EUR/GBP: GBP0.7300(E542mn)

AUD/USD: $0.7100(E358mn), $0.7150(A$850mn);

NZD/USD: $0.6300(NZ897mn), $0.6450(NZ$395mn), $0.6500(NZ$626mn)

AUD/NZD: NZ$1.1170(A$653mn), NZ$1.1500(A$826mn)

USD/CAD: C$1.3000($446mn), C$1.3150($230mn), C$1.3200($282mn), C$1.3300($411mn), C$1.3325($604mn)

The Central Bank of Russia (CBR) kept its interest rate unchanged at 11.0% on Friday. This decision was widely expected by analysts.

This decision was driven by risks of higher inflation and an economic slowdown.

"August saw a serious deterioration in foreign economic conditions. Inflation and inflation expectations were showing a clear upward trend, impacted by the exchange rate dynamics. The depreciated ruble will continue to put pressure on prices in the next few months," the CBR said.

The central bank cut its interest rate five times in 2015.

The central bank noted that further interest rate decisions will depend on the risks of inflation and a slowdown in the economy.

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index was flat in August, beating expectations for a 0.1% decline, after a 0.2% rise in July.

On a yearly basis, the producer price index decreased 0.8% in August, beating forecasts of a 0.9% decline, after a 0.8% fall in July.

A stronger U.S. dollar and low oil prices still weigh on inflation.

Services prices were up 0.4% in August, while prices for goods declined 0.6%.

Food prices increased by 0.3% in August, driven by a rise in wholesale egg prices, which jumped 23.2%.

Energy sales declined 3.3% in August.

The producer price index excluding food and energy climbed 0.3% in August, exceeding expectations for a 0.1% gain, after a 0.3% increase in July.

On a yearly basis, the producer price index excluding food and energy climbed 0.9% in August, beating forecasts of a 0.7% increase, after a 0.6% rise in July.

German Finance Minister Wolfgang Schaeuble said on Friday that a high amount of liquidity can lead to price bubbles.

"If you look at what's going on [on] a global level, this increasing public and private liquidity on the financial markets, it's by sure that we are moving to the next bubble," he said.

Schaeuble added that structural reforms should be implemented.

"It should not serve as a way out of, or to neglect, what is necessary -- that is structural reforms," he said.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany CPI, m/m (Finally) August 0.2% 0% 0.0%

06:00 Germany CPI, y/y (Finally) August 0.2% 0.2% 0.2%

09:00 Eurozone ECOFIN Meetings

11:30 United Kingdom MPC Member Forbes Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data. The U.S. PPI is expected to decrease 0.1% in August, after a 0.2% rise in July.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in August, after a 0.3 gain in July.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to fall to 91.2 in September from a final reading of 91.9 in August.

The euro traded lower against the U.S. dollar after the mostly negative economic data from the Eurozone. Destatis released its final consumer price data for Germany on Friday. German final consumer price index was flat in August, in line with the preliminary estimate, after a 0.2% rise in July.

On a yearly basis, German final consumer price index remained unchanged at 0.2% in August, in line with the preliminary estimate.

The decline was driven by falling energy prices, which dropped 7.6% year-on-year in August.

German wholesale prices fell 0.8% in August, after a 0.1% increase in July.

On a yearly basis, wholesale prices in Germany dropped 1.1% in August, after a 0.5% decline in July. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 14.7% decline in the wholesale prices of solid fuels and related products.

The Bank of France released its current account data on Friday. France's current account surplus turned to a deficit of €0.4 billion in July from a surplus of €0.8 billion in June. June's figure was revised down from a surplus of €1.0 billion.

The deficit in the trade of goods was down to €0.9 billion in July from €1.0 billion in the previous month, while the surplus on services dropped to €0.3 billion from €1.7 billion.

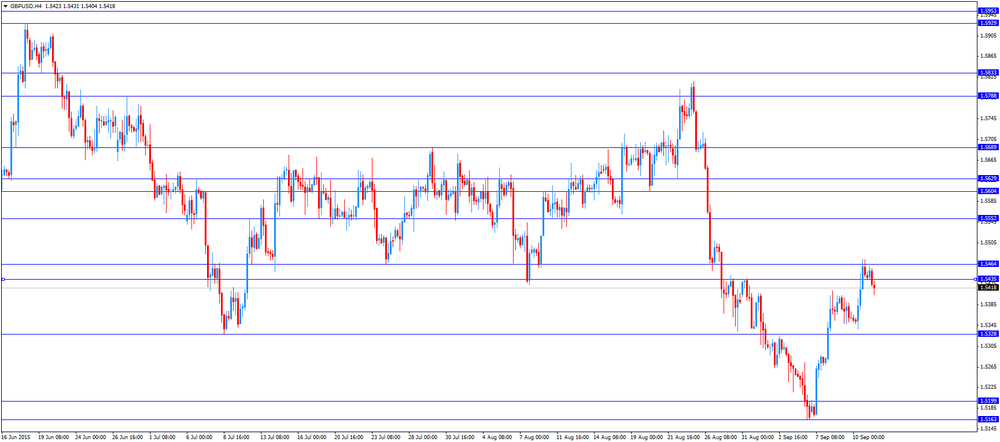

The British pound traded lower against the U.S. dollar after the release of the weak construction output data from the U.K. The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 1.0% in July, after a 0.9% rise in June.

The decline was driven by a drop in new work, which plunged 1.5% in July.

On a yearly basis, construction output decreased 0.7% in July. It was the first decline since May 2013.

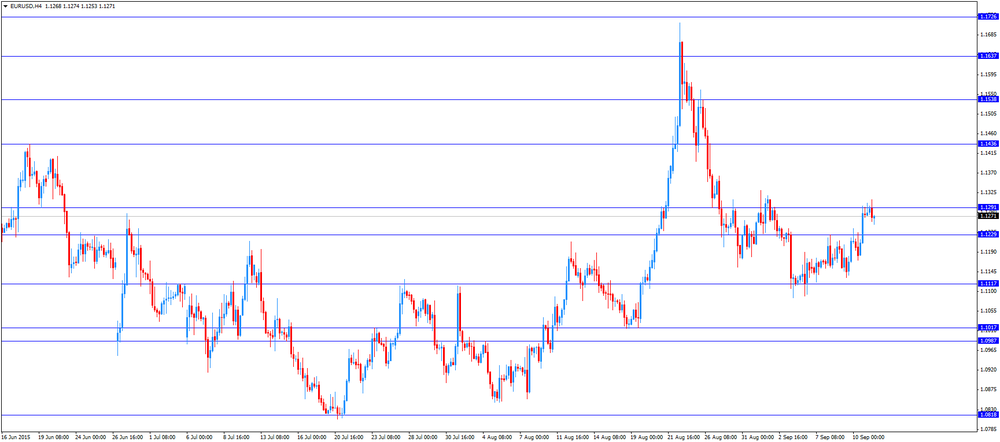

EUR/USD: the currency pair fell to $1.1253

GBP/USD: the currency pair declined to $1.5404

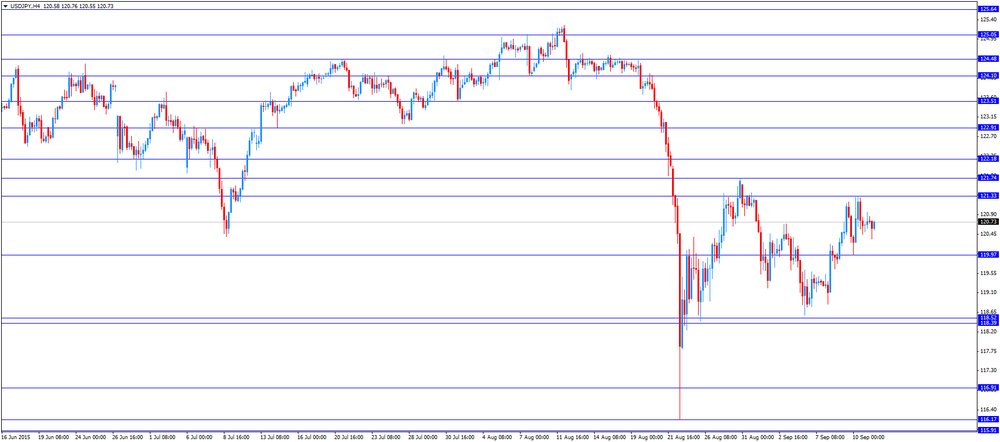

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. PPI, m/m August 0.2% -0.1%

12:30 U.S. PPI, y/y August -0.8% -0.9%

12:30 U.S. PPI excluding food and energy, m/m August 0.3% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y August 0.6% 0.7%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) September 91.9 91.2

18:00 U.S. Federal budget August -149.2 -81.5

EUR/USD

Offers 1.1320 1.1335 1.1350 1.1390-1.1400 1.1420 1.1450

Bids 1.1265-70 1.1250 1.1225 1.1200 1.1175-80 1.1160 1.1145-50

GBP/USD

Offers 1.5480 1.5500-10 1.5530 1.5550 1.5585 1.5600

Bids 1.5430 1.5400 1.5380 1.5350 1.5330 1.5320 1.5300

EUR/GBP

Offers 0.7325-30 0.7350 0.7380-85 0.7400 0.7425 0.7450

Bids 0.7295-0.7300 0.7280 0.7260-65 0.7250 0.7225-30 0.7200

EUR/JPY

Offers 136.35 136.50 136.80 137.00 137.50

Bids 136.00 135.80 135.50 135.00 134.80-85 134.65 134.50

USD/JPY

Offers 120.80 121.00 121.20 121.35 121.50 121.80 122.00

Bids 120.25 120.00 119.80-85 119.50 119.30 119.00

AUD/USD

Offers 0.7085 0.7100 0.0.7120-25 0.7150 0.7180 0.7200

Bids 0.7020 0.7000 0.6980-85 0.6965 0.6950

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 1.0% in July, after a 0.9% rise in June.

The decline was driven by a drop in new work, which plunged 1.5% in July.

On a yearly basis, construction output decreased 0.7% in July. It was the first decline since May 2013.

The Italian statistical office Istat released its industrial production data on Friday. Industrial production in Italy climbed at a seasonally-adjusted rate of 1.1% in July, after a 1.0% fall in June. June's figure was revised down from a 1.1% drop.

Consumer goods output rose 1.0% in July, intermediate goods output increased 0.6%, energy output jumped 7.1%, while production in the capital goods sector was up 0.3%.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 2.7% in July, after a 0.3% decrease in May.

The Bank of France released its current account data on Friday. France's current account surplus turned to a deficit of €0.4 billion in July from a surplus of €0.8 billion in June. June's figure was revised down from a surplus of €1.0 billion.

The deficit in the trade of goods was down to €0.9 billion in July from €1.0 billion in the previous month, while the surplus on services dropped to €0.3 billion from €1.7 billion.

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was down 0.3% in August, in line with preliminary reading, after a 0.9% drop in July.

On a yearly basis, consumer prices fell by 0.4% in August from a year ago, in line with preliminary reading, after a 0.1% rise in July.

The decline was mainly driven by the decline in the prices of fuels (gas and diesel oil) and electricity.

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices fell 0.8% in August, after a 0.1% increase in July.

On a yearly basis, wholesale prices in Germany dropped 1.1% in August, after a 0.5% decline in July. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 14.7% decline in the wholesale prices of solid fuels and related products.

Destatis released its final consumer price data for Germany on Friday. German final consumer price index was flat in August, in line with the preliminary estimate, after a 0.2% rise in July.

On a yearly basis, German final consumer price index remained unchanged at 0.2% in August, in line with the preliminary estimate.

The decline was driven by falling energy prices, which dropped 7.6% year-on-year in August.

Food prices climbed 0.8% year-on-year in August.

The White House warned on Thursday that the budget battle could lead to another US government shut down. Rival lawmakers have time until October 1 to reach a deal.

"If Republican leaders maintain their insistence on trying to pass a budget along party lines, then we are going to be headed for a shut down," White House spokesman Josh Earnest said. Any shutdown could lead to an economic and financial turmoil on markets.

The last government shutdown happened in October 2013. The U.S. economy lost an estimated $24 billion during the last shutdown.

The European Central Bank's (ECB) Chief Economist Peter Praet said on Thursday that low interest rates were caused due to "economic malaise" in the Eurozone and across world.

"Low interest rates are ultimately a consequence of weak secular trends, coupled with the cyclical consequences of a complex debt crisis, exacerbated by a monetary union with institutional and structural flaw," he said.

Praet noted that the central bank will monitor closely risks to the risks to the inflation outlook, adding that it could adjust its asset buying programme.

According to the Royal Institution of Chartered Surveyors' (RICS), house prices in the U.K. are expected to rise 6% this year. RICS upgraded its forecasts from the previous estimate of a 3% growth due to the shortage of homes on the market and higher house prices.

"Given current market conditions, the latest data unsurprisingly shows house prices continuing to rise, and at an accelerating pace. And there is good reason for this trend to be sustained into next year, however uncomfortable that may be for those looking to enter the market," RICS Chief Economist, Simon Rubinsohn, said.

Japan's Ministry of Finance and the Cabinet Office released its quarterly survey on late Thursday evening. The business survey index (BSI) of manufacturers' sentiment rose to 11.0 in third quarter from -6.0 in the second quarter.

The sentiment is expected to decline to 10.5 in the three months to December, and to be 7.1 in the first quarter of 2016.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

06:00 Germany CPI, m/m (Finally) August 0.2% 0% 0.0%

06:00 Germany CPI, y/y (Finally) August 0.2% 0.2% 0.2%

The U.S. dollar traded with low volatility as declines in U.S. import prices had weighed on the greenback before the current session began. Lower import prices are likely to limit inflationary pressure further and justify more gradual tightening of Fed monetary policy. Market participants are waiting for producer price index data. A greater-than-expected decline in this index may weigh on the dollar in the short-term outlook. Economists expect a decline of 0.1% in August compared to an increase of 0.2% in the previous month.

The yen tends to decline against the greenback despite positive business sentiment data. The Business Sentiment Index, which is based on a survey of large Japanese manufacturers, rose to +11 in the third quarter from -6 reported previously. Japan economy minister Amari said that it is important for improvements in corporate sentiment to be reflected in capital expenditure.

The New Zealand dollar advanced slightly. The index of business activity in the industrial sector of the country's economy rose to 55.0 in August from 53.7 in July (revised from 53.5).

EUR/USD: the pair fluctuated within $1.1270-00 in Asian trade

USD/JPY: the pair traded within Y120.55-95

GBP/USD: the pair rose to $1.5460

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone ECOFIN Meetings

11:30 United Kingdom MPC Member Forbes Speaks

12:30 U.S. PPI, m/m August 0.2% -0.1%

12:30 U.S. PPI, y/y August -0.8% -0.9%

12:30 U.S. PPI excluding food and energy, m/m August 0.3% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y August 0.6% 0.7%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) September 91.9 91.2

18:00 U.S. Federal budget August -149.2 -81.5

EUR / USD

Resistance levels (open interest**, contracts)

$1.1451 (1562)

$1.1406 (1268)

$1.1359 (530)

Price at time of writing this review: $1.1291

Support levels (open interest**, contracts):

$1.1231 (518)

$1.1196 (797)

$1.1151 (1037)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 45859 contracts, with the maximum number of contracts with strike price $1,1500 (4624);

- Overall open interest on the PUT options with the expiration date October, 9 is 59683 contracts, with the maximum number of contracts with strike price $1,1000 (5657);

- The ratio of PUT/CALL was 1.30 versus 1.29 from the previous trading day according to data from September, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.5705 (1218)

$1.5608 (1300)

$1.5512 (2406)

Price at time of writing this review: $1.5453

Support levels (open interest**, contracts):

$1.5389 (899)

$1.5293 (830)

$1.5195 (2681)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 20797 contracts, with the maximum number of contracts with strike price $1,5500 (2406);

- Overall open interest on the PUT options with the expiration date October, 9 is 19014 contracts, with the maximum number of contracts with strike price $1,5200 (2681);

- The ratio of PUT/CALL was 0.91 versus 0.92 from the previous trading day according to data from September, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.