- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 16-10-2015

The Reserve Bank of Australia (RBA) said in its Financial Stability Review that risks to financial stability in Australia continued to revolve around some local property markets.

Focus shifted from Greece to China and other emerging market economies, the central bank said. The RBA added that "global factors have not had a material impact on Australia's financial system".

European Central Bank (ECB) Executive Board Member Benoit Coeure said at a conference in Berlin on Friday that the banking union in the Eurozone should be completed as fast as possible for better reaction to the possible shocks.

"I would like to stress the urgency of completing the banking union," he said.

The Thomson Reuters/University of Michigan preliminary consumer sentiment index climbed to 92.1 in October from a final reading of 87.2 in September, missing expectations for an increase to 89.0.

"The rebound in confidence signifies that consumers have concluded that the fears expressed on Wall Street did not extend to Main Street. Importantly, the renewed confidence did not simply represent a relief rally, but instead reflected renewed optimism," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

He added that the consumption is expected to climb 2.9% during 2016.

The rise in the index was driven by increases in the index of current economic conditions and the index of consumer expectations.

The index of current economic conditions increased to 106.7 in October from 101.2 in September, while the index of consumer expectations rose to 82.7 from 78.2.

The one-year inflation expectations fell to 2.7% in October from 2.8% in September.

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Friday. Job openings dropped to 5.370 million in August from 5.668 million in July. July's figure was revised down from 5.753 million.

The number of job openings declined for total private (4.878 million) and for government (493,000) in August.

The hires rate was 3.6% in August.

Total separations rose to 4.846 million in August from 4.796 million in July.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production fell 0.2% in September, in line with expectations, after a 0.1% decline in August. August's figure was revised up from a 0.4% drop.

The drop was mainly driven by a fall in the mining output, which plunged by 2.0% in September.

Manufacturing output was down 0.1% in September, while utilities production increased 1.3%.

Capacity utilisation rate decreased to 77.5% in September from 77.8% in August, beating expectations for a decline to 77.4%. August's figure was revised up from 77.6%.

USD/JPY 118.50 (USD 640m) 118.65-75 (560m) 120.00 (1.2bln)

EUR/USD 1.1300 (EUR 579m) 1.1400 (1bln) 1.1425 (543m) 1.1500 (1bln)

USD/CHF 0.9675 (USD 223m)

USD/CAD 1.2775 (USD 538m) 1.3000 (300m)

AUD/USD 0.7200 (AUD 437m) 0.7300 (301m) 0.7400 (683m)

NZD/USD 0.6850 (NZD 220m)

Statistics Canada released foreign investment figures on Friday. Foreign investors added C$3. 1 billion of Canadian securities in August, after a divestment of C$10.09 billion in July.

July's figure was revised down from a sale of C$10.12 billion.

Canadian investors purchased C$8.7 billion of foreign securities in August, mainly US securities.

Statistics Canada released manufacturing shipments on Friday. Canadian manufacturing shipments fell 0.2% in August, beating forecasts of a 1.0% decrease, after a 1.7% gain in July.

The decline was driven by falls in the petroleum and coal product, motor vehicle parts, and aerospace product and parts industries.

Sales of petroleum and coal products dropped 5.2% in August, sales of motor vehicle parts fell 4.4%, output in the aerospace product and parts industries declined 3.5%, while sales in the motor vehicle assembly industry increased 6.7%.

Inventories rose 0.5% in August.

Sales decreased in 8 of 21 categories.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Financial Stability Review

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

09:00 Eurozone Trade balance unadjusted August 31.4 11.2

09:00 Eurozone Harmonized CPI September 0.0% 0.2% 0.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) September 0.1% -0.1% -0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) September 0.9% 0.9% 0.9%

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data. The U.S. industrial production is expected to decline 0.2% in September, after a 0.4% drop in August.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to rise to 89.0 in October from a final reading of 87.2 in September.

Job openings in the U.S. are expected to decline to 5.625 million in August from 5.753 million in July.

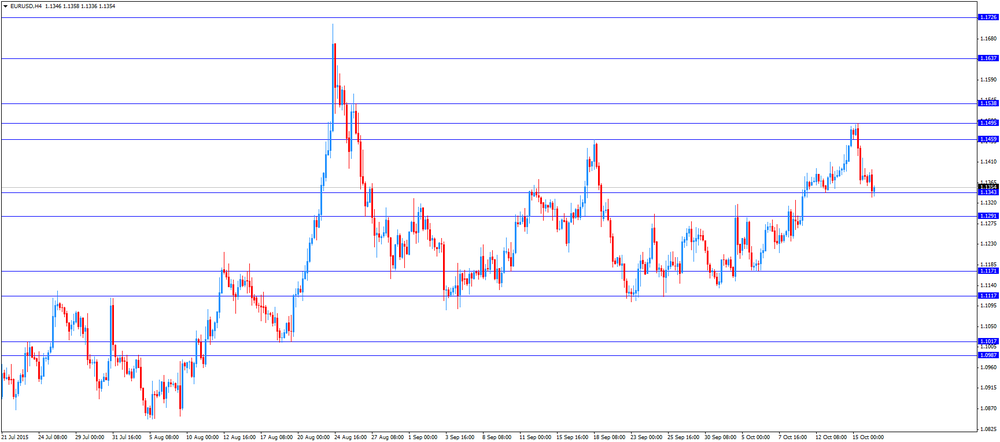

The euro traded lower against the U.S. dollar on the weak economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index rose 0.2% in September, in line with the preliminary reading, after a flat reading in August.

On a yearly basis, Eurozone's final consumer price inflation fell to -0.1% in September from 0.1% in August, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in September, vegetables prices rose by 0.11%, tobacco prices gained 0.08%, fuel prices for transport declined by 0.71%, heating oil prices decreased by 0.25%, while milk, cheese and eggs prices were down by 0.06%.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in September, in line with the preliminary reading.

Eurozone's unadjusted trade surplus dropped to €11.12 billion in August from €31.4 billion in July.

Exports rose at an annual rate of 6.0% in August, while imports increased by 3.0%.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian economic data. Canada's manufacturing shipments are expected to decrease 1.0% in August, after a 1.7% gain in July.

EUR/USD: the currency pair fell to $1.1333

GBP/USD: the currency pair decreased to $1.5433

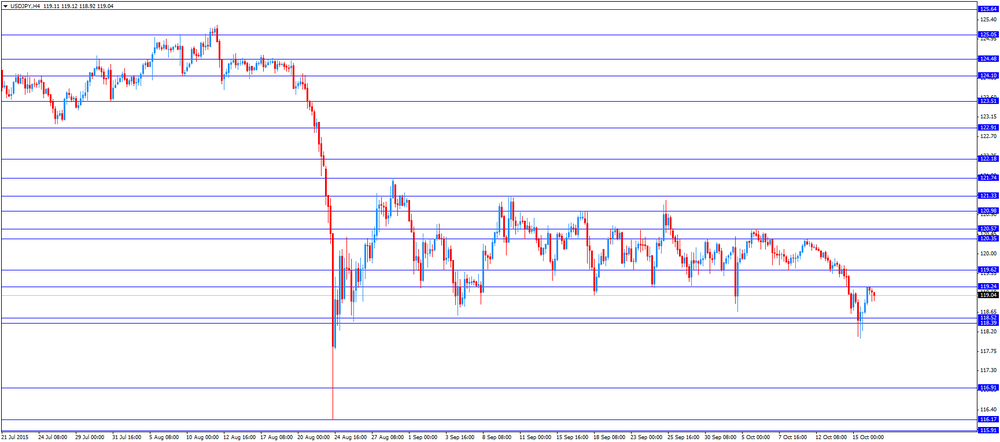

USD/JPY: the currency pair declined to Y118.92

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) August 1.7% -1%

12:30 Canada Foreign Securities Purchases August -10.12

13:15 U.S. Capacity Utilization September 77.6% 77.4%

13:15 U.S. Industrial Production (MoM) September -0.4% -0.2%

13:15 U.S. Industrial Production YoY September 0.9%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) October 87.2 89

14:00 U.S. JOLTs Job Openings August 5.753 5.625

20:00 U.S. Net Long-term TIC Flows August 7.7

20:00 U.S. Total Net TIC Flows August 141.9

EUR/USD

Offers 1.1400 1.1425-30 1.1455-60 1.14 85 1.1500 1.1520 1.1535 1.1550

Bids 1.1355-60 1.1330 1.1300 1.1285 1.1265 1.1250 1.1230 1.1200

GBP/USD

Offers 1.5500-10 1.5530 1.5550 1.5565 1.5585 1.5600 1.5625-30 1.5650

Bids 1.5460 1.5425-30 1.5400 1.5380 1.5350 1.5330 1.5300

EUR/GBP

Offers 0.7360 0.7380 0.7400 0.7425-30 0.7450 0.7475-80 0.7500

Bids 0.7330-35 0.7300 0.7285 0.7265 0.7250 0.7230 0.7200

EUR/JPY

Offers 135.75 136.00 136.50136.75 137.00 137.25 137.50

Bids 135.20 135.00 134.80 134.50 134.30 134.00 133.75 133.50

USD/JPY

Offers 119.25 119.50 119.80-85 120.00 120.20 120.35 120.50

Bids 119.00 118.85 118.65-70 118.50 118.30 118.00 117.85 117.50

AUD/USD

Offers 0.7300 0.7325 0.7335 0.7350 0.7375 0.7400 0.7425 0.7450

Bids 0.7280 0.7260 0.7240 0.7220 0.7200 0.7185 0.7150

Bank of Japan Governor Haruhiko Kuroda said on Friday that the consumer price inflation trend was improving, adding that the consumer price inflation excluding fresh food and energy increased more than 1%.

"The overall price trend is improving, and consumer prices are expected to accelerate toward our 2 percent inflation target," he said.

Kuroda noted that "domestic demand is on track to strengthen".

Bank of Japan governor also said that a slowdown in emerging economies weighed on exports and factory production.

In general, Kuroda's comments could mean that the central bank will not add further stimulus measures at its meeting on October 30.

The Italian statistical office Istat released its trade data for Italy on Friday. Italy' trade surplus fell to €1.85 billion in August from €8.07 billion in July.

Exports increased 1.0% year-on-year in August, while imports climbed 2.1%.

The trade surplus with the EU was €467 million in August, while the trade surplus with non-EU countries was €1.38 billion.

Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index rose 0.2% in September, in line with the preliminary reading, after a flat reading in August.

On a yearly basis, Eurozone's final consumer price inflation fell to -0.1% in September from 0.1% in August, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in September, vegetables prices rose by 0.11%, tobacco prices gained 0.08%, fuel prices for transport declined by 0.71%, heating oil prices decreased by 0.25%, while milk, cheese and eggs prices were down by 0.06%.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in September, in line with the preliminary reading.

Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus dropped to €11.12 billion in August from €31.4 billion in July.

Exports rose at an annual rate of 6.0% in August, while imports increased by 3.0%.

USD/JPY 118.50 (USD 640m) 118.65-75 (560m) 120.00 (1.2bln)

EUR/USD 1.1300 (EUR 579m) 1.1400 (1bln) 1.1425 (543m) 1.1500 (1bln)

USD/CHF 0.9675 (USD 223m)

USD/CAD 1.2775 (USD 538m) 1.3000 (300m)

AUD/USD 0.7200 (AUD 437m) 0.7300 (301m) 0.7400 (683m)

NZD/USD 0.6850 (NZD 220m)

Federal Reserve Bank of New York President William Dudley said on Thursday that the Fed should raise its interest rates this year if growth, employment and inflation will meet their targets.

"If the economy performs in line with my forecast, I would favour lifting off later this year. But it's a forecast. It's not a commitment," he said.

Dudley added that the recent U.S. economic data pointed to the slower growth in the U.S. economy. But he noted that he sees that the U.S. economy expands above trend.

"When I put it all together, I still see an economy that's growing a bit above trend. And if that is the case, we should see greater pressure over time on resources. And if that is the case, then we should be able to begin to normalize monetary policy," Federal Reserve Bank of New York president said.

Cleveland Fed President Loretta Mester said on Thursday that the U.S. economy can handle interest rate hike.

"I believe the economy can handle an increase in the fed funds rate and that it is appropriate for monetary policy to take a step back from the emergency measure of zero interest rates," she said.

Mester added that the U.S. economy needs to add between 70,000 and 120,000 jobs per month to keep the unemployment rate steady at the current level of 5.1%.

U.S. Treasury Secretary Jacob Lew said on Thursday that the U.S. government will run out of cash if the federal borrowing limit will not be raised because emergency cash-management measures will be exhausted by November 03.

"We do not foresee any reasonable scenario in which it would last for an extended period of time," he said in a letter to U.S. Congress.

The emergency measures currently total $18.1 trillion.

The U.S. Treasury Department released its federal budget data on Thursday. The budget deficit turned to a surplus of $91.0 billion in September, up from a deficit of $64.4 billion in August.

In the fiscal year 2015, which ends at September this year, the budget deficit totalled $439 billion, down $44 million from 2014. It was the lowest level since 2007.

The deficit totalled 2.5% of gross domestic product (GDP).

Spending rose 5% in the fiscal year 2015, while individual income-tax receipts jumped by 11%, and corporate tax revenues climbed by 7.2%.

The Reserve Bank of New Zealand (RBNZ) released its consumer price inflation data on late Thursday evening. Consumer prices in New Zealand rose 0.3% in the third quarter, beating expectations for a 0.2% gain, after a 0.4% increase in the second quarter.

The increase in consumer price inflation was driven by higher housing-related prices, and higher vegetable and package holiday prices.

On a yearly basis, consumer price inflation increased 0.4% in the third quarter, beating forecasts of the 0.3% rise, after a 0.4% gain in the second quarter.

The annual increase in consumer price inflation was driven by higher housing-related prices.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 45.2 in in the week ended October 11 from 44.8 the prior week. The increase was driven by a better sentiment among part-time workers.

The measure of views of the economy rose to 35.6 from 35.4. It was the highest reading since early May.

The buying climate index fell to 39.5 from 39.6.

The personal finances index was up to 60.5 from 59.3.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1510 (2295)

$1.1467 (1082)

$1.1438 (1049)

Price at time of writing this review: $1.1384

Support levels (open interest**, contracts):

$1.1326 (246)

$1.1284 (2032)

$1.1227 (1858)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 36197 contracts, with the maximum number of contracts with strike price $1,1500 (3114);

- Overall open interest on the PUT options with the expiration date November, 6 is 45877 contracts, with the maximum number of contracts with strike price $1,1100 (4823);

- The ratio of PUT/CALL was 1.27 versus 1.34 from the previous trading day according to data from October, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.5704 (869)

$1.5607 (961)

$1.5511 (1896)

Price at time of writing this review: $1.5474

Support levels (open interest**, contracts):

$1.5393 (568)

$1.5296 (2298)

$1.5198 (2310)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 19178 contracts, with the maximum number of contracts with strike price $1,5350 (2600);

- Overall open interest on the PUT options with the expiration date November, 6 is 18944 contracts, with the maximum number of contracts with strike price $1,5300 (2310);

- The ratio of PUT/CALL was 0.99 versus 1.01 from the previous trading day according to data from October, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.