- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 20-10-2015

(pare/closed(GMT +3)/change, %)

EUR/USD $ 1,1346 +0,16%

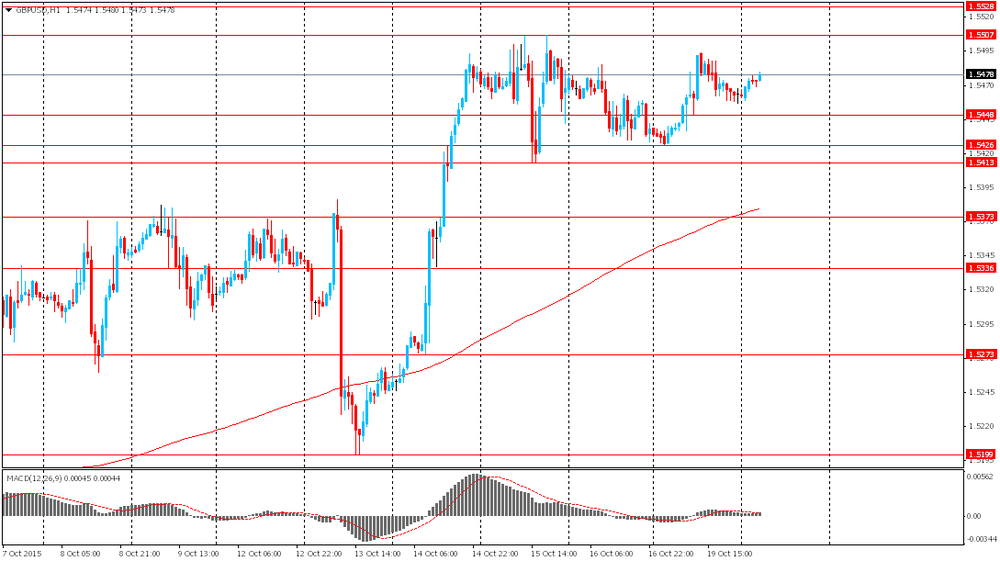

GBP/USD $1,5443 -0,14%

USD/CHF Chf0,956 -0,02%

USD/JPY Y119,86 +0,33%

EUR/JPY Y135,99 +0,49%

GBP/JPY Y185,09 +0,20%

AUD/USD $0,7260 +0,25%

NZD/USD $0,6747 -0,65%

USD/CAD C$1,2984 -0,22%

(time / country / index / period / previous value / forecast)

04:30 Japan All Industry Activity Index, m/m August 0.2%

08:30 United Kingdom PSNB, bln September -11.31 -9.4

11:00 U.S. MBA Mortgage Applications October -27.6%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories October 7.562

15:15 Canada BOC Press Conference

17:30 U.S. FOMC Member Jerome Powell Speaks

22:45 Australia RBA Assist Gov Edey Speaks

New York Fed President William Dudley said on Tuesday that the Treasury markets is a key for the implementation of monetary policy.

"The Treasury market plays a unique and crucial role in our economy, and in global financial markets more broadly. Treasury securities serve as a liquid investment and hedging vehicle for global investors, a ready source of collateral for many financial transactions and serve as a risk-free benchmark for other financial instruments. The Treasury market is important for the Federal Reserve's implementation of monetary policy," he said.

EUR/USD: $1.1300-10(E787mn), $1.1500(1.63bn)

USD/JPY: Y119.00($420mn), Y119.96($250mn)

GBP/USD: $1.5400(Gbp171mn), $1.5540(Gbp193mn)

AUD/USD: $0.7300(A$508mn)

USD/CAD: C$1.2800($395mn), C$1.2915-25($595mn), C$1.3000($1.49bn), C$1.3260-70($371mn)

The Bank of England's (BoE) Monetary Policy Committee Member Ian McCafferty said at Bloomberg LP on Tuesday that the central bank should start raising its interest rates if it wants to gradually hike its interest rates later.

"If we on the MPC are to achieve our ambition of raising rates only gradually, so as to minimize the disruption to households and businesses of a normalization of policy after a long period in which interest rates have been at historic lows, we need to avoid getting behind the curve," he said.

McCafferty was only one member who voted to hike interest rate by 0.25% in October.

The Italian statistical office Istat released its construction output data on Friday. Construction production in Italy was down at on a seasonally adjusted rate of 0.3% in August, after a 0.8% rise in July.

On a yearly basis, construction output declined at a calendar-adjusted rate of 4.6% in August, after a flat reading in July.

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. climbed 6.5% to 1.206 million annualized rate in September from a 1,132 million pace in August, exceeding expectations for an increase to 1.150 million.

August's figure was revised up from 1.126 million units.

The increase was driven by rises in starts of single-family and multifamily homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. declined 5.0% to 1.103 million annualized rate in September from a 1.161 million pace in August.

Analysts had expected building permits to climb to 1.164 million units.

Starts of single-family homes increased 0.3% in September. Building permits for single-family homes were down 0.3%.

Starts of multifamily buildings jumped 18.3% in September. Permits for multi-family housing slid 12.1%.

Statistics Canada released wholesale sales figures on Tuesday. Wholesale sales fell 0.1% in August, missing expectations for a 0.2% gain, after a 0.1% decline in July. July's figure was revised down from a flat reading.

Sales of automobiles and parts were down 1.2% in August.

Sales in the machinery, equipment and supplies subsector declined 2.4% in August, while sales in the food, beverage and tobacco subsector decreased 0.4%.

Inventories climbed by 0.6% in August.

The Hellenic Statistical Authority released its industrial turnover data for Greece on Tuesday. Greek overall turnover index slid 18.3% year-on-year in August, after 15.4% drop in July.

Domestic market turnover fell at an annual rate of 18.2% in August, while foreign market turnover plunged by 18.5%.

Turnover in the manufacturing sector declined at an annual rate of 18.4% in August, while mining and quarrying turnover dropped by 12.8%.

The Bank of Italy released its current account data on Tuesday. Italy's current account surplus declined to €1.39 billion in August from €1.53 billion in August last year.

The goods trade surplus decreased to €2.53 billion in August from €2.67 billion in August last year. The services trade balance turned to a surplus of €194 million from a deficit of €3.00 million.

The capital account surplus turned to a deficit of €59 million in August from a surplus of €157 million last year, while the financial account surplus rose to €4.42 billion from €4.09 billion.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Meeting's Minutes

06:00 Germany Producer Price Index (MoM) September -0.5% -0.1% -0.4%

06:00 Germany Producer Price Index (YoY) September -1.7% -1.8% -2.1%

06:00 Switzerland Trade Balance September 2.86 Revised From 2.87 2.51 3.05

08:00 Eurozone Current account, unadjusted, bln August 37.9 Revised From 33.8 13.7

09:45 United Kingdom MPC Member McCafferty Speaks

10:00 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the U.S. housing market data. Housing starts in the U.S. are expected to rise to 1.150 million units in September from 1.126 million units in August.

The number of building permits is expected to increase to 1.164 million units in September from 1.161 million units in August.

The FOMC member Dudley will speak at 13:00 GMT, the FOMC member Powell will speak at 13:15 GMT, while the Fed Chairwoman Janet Yellen will speak at 15:00 GMT.

The euro traded higher against the U.S. dollar on speculation that the European Central Bank (ECB) will expand its asset-buying programme. The ECB Governing Council Member Luis Maria Linde said on Tuesday that the central bank could adjust its asset-buying programme if needed.

The ECB could extend the asset-buying programme's size or modify its composition, he said.

Linde noted that the inflation in the Eurozone is well below the ECB's 2% target, and it is a cause for concern.

Meanwhile, the economic data from the Eurozone was negative. The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus fell to a seasonally adjusted €17.7 billion in August from €25.6 billion in July. July's figure was revised up from a surplus of €22.6 billion.

The trade surplus declined to €21.2 billion in August from €28.2 billion in July.

The surplus on services rose to €4.3 billion in August from €3.8 billion in July.

The secondary income deficit increased by €11.6 billion in August, while the primary income surplus decreased by €3.8 billion.

Eurozone's unadjusted current account surplus dropped to €13.7 billion in August from EUR 37.9 billion in July. July's figure was revised up from a surplus of €33.8 billion.

Destatis released its producer price index (PPI) for Germany on Tuesday. German PPI producer prices declined 0.4% in September, missing expectations for a 0.1% fall, after a 0.5% drop in August.

On a yearly basis, German PPI dropped 2.1% in September, missing expectations for a 1.8% decrease, after a 1.7% fall in August.

PPI excluding energy sector fell by 0.6% year-on-year in September.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Bank of England's (BoE) Monetary Policy Committee Member Ian McCafferty said on Tuesday that the central bank should start raising its interest rates if it wants to gradually hike its interest rates later.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the wholesale sales data from Canada. Wholesales sales in Canada are expected to rise 0.2% in August, after a flat reading in July.

The Swiss franc traded higher against the U.S. dollar after the release of the positive trade data from Switzerland. The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus rose to CHF3.05 billion in September from CHF2.86 billion in the previous month. August's figure was revised down from a surplus of CHF2.87 billion.

Exports dropped 2.9% year-on-year in September, while imports were down 3.8% year-on-year.

The Swiss trade surplus climbed to CHF9.42 billion in the third quarter from CHF9.37 billion in the second quarter.

Exports slid 5.1% in the third quarter, while imports fell 2.5%.

EUR/USD: the currency pair rose to $1.1386

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y119.77

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m August 0.0% 0.2%

12:30 U.S. Building Permits September 1161 1164

12:30 U.S. Housing Starts September 1126 1150

13:00 U.S. FOMC Member Dudley Speak

13:15 U.S. FOMC Member Jerome Powell Speaks

15:00 U.S. Fed Chairman Janet Yellen Speaks

23:50 Japan Trade Balance Total, bln September -569.6 84.4

EUR/USD

Offers 1.1350-55 1.1375-80 1.1400 1.1425-30 1.1455-60 1.1485 1.1500

Bids 1.1325-30 1.1300 1.1285 1.1265 1.1250 1.1230 1.1200

GBP/USD

Offers 1.5510 1.5525-30 1.5550 1.5565 1.5585 1.5600 1.5620

Bids 1.5480 1.5460 1.5445-50 1.5425-30 1.5400 1.5380 1.5350 1.5330 1.5300

EUR/GBP

Offers 0.7330-35 0.7350 0.7375-80 0.7400 0.7425-30 0.7450 0.7475-80 0.7500

Bids 0.7300 0.7285 0.7265 0.7250 0.7230 0.7200

EUR/JPY

Offers 136.00 136.50136.75 137.00 137.25 137.50

Bids 135.50 135.25-30 135.00 134.80 134.50 134.30 134.00 133.75 133.50

USD/JPY

Offers 119.80-85 120.00 120.20 120.35 120.50 120.80 121.00

Bids 119.50 119.25-30 119.00 118.85 118.65-70 118.50 118.30 118.00

AUD/USD

Offers 0.7300 0.7325 0.7335 0.7350 0.7375 0.7400 0.7425 0.7450

Bids 0.7270 0.7255-60 0.7235 0.7220 0.7200 0.7185 0.7150

San Francisco Fed President John Williams said in an interview with Bloomberg Television on Monday that the timing of the interest rate hike by the Fed is nearing.

"I do see the time to start raising rates in the near future, from my perspective," he said.

Williams noted that the U.S. economy continues to strengthen.

"My own view is that the economy is still on a good trajectory," San Francisco Fed president said.

The European Central Bank (ECB) Governing Council Member Luis Maria Linde said on Tuesday that the central bank could adjust its asset-buying programme if needed.

The ECB could extend the asset-buying programme's size or modify its composition, he said.

Linde noted that the inflation in the Eurozone is well below the ECB's 2% target, and it is a cause for concern.

EUR/USD: $1.1300-10(E787mn), $1.1500(1.63bn)

USD/JPY: Y119.00($420mn), Y119.96($250mn)

GBP/USD: $1.5400(Gbp171mn), $1.5540(Gbp193mn)

AUD/USD: $0.7300(A$508mn)

USD/CAD: C$1.2800($395mn), C$1.2915-25($595mn), C$1.3000($1.49bn), C$1.3260-70($371mn)

The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus rose to CHF3.05 billion in September from CHF2.86 billion in the previous month. August's figure was revised down from a surplus of CHF2.87 billion.

Exports dropped 2.9% year-on-year in September, while imports were down 3.8% year-on-year.

The Swiss trade surplus climbed to CHF9.42 billion in the third quarter from CHF9.37 billion in the second quarter.

Exports slid 5.1% in the third quarter, while imports fell 2.5%.

Destatis released its producer price index (PPI) for Germany on Tuesday. German PPI producer prices declined 0.4% in September, missing expectations for a 0.1% fall, after a 0.5% drop in August.

On a yearly basis, German PPI dropped 2.1% in September, missing expectations for a 1.8% decrease, after a 1.7% fall in August.

PPI excluding energy sector fell by 0.6% year-on-year in September.

Energy prices were down 6.1% year-on-year in September.

Consumer non-durable goods prices fell 1.0% year-on-year in September, intermediate goods sector prices decreased by 1.4%, while capital goods prices increased 0.7% and durable consumer goods sector prices rose 1.3%.

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus fell to a seasonally adjusted €17.7 billion in August from €25.6 billion in July. July's figure was revised up from a surplus of €22.6 billion.

The trade surplus declined to €21.2 billion in August from €28.2 billion in July.

The surplus on services rose to €4.3 billion in August from €3.8 billion in July.

The secondary income deficit increased by €11.6 billion in August, while the primary income surplus decreased by €3.8 billion.

Eurozone's unadjusted current account surplus dropped to €13.7 billion in August from EUR 37.9 billion in July. July's figure was revised up from a surplus of €33.8 billion.

The Reserve Bank of Australia (RBA) released its minutes from October monetary policy meeting on Tuesday. The RBA said that the accommodative monetary policy was appropriate, adding that the monetary policy decision will depend on the incoming economic data, both domestically and abroad.

The central bank noted that the GDP growth in the June quarter was weak, in line with expectations. Weak resource exports and a decline in mining investment weighed on the GDP growth.

According to the minutes, board members noted that the interest rate cut this year "continued to provide support to demand, particularly dwelling investment and household consumption".

Members also said that the labour market strengthened in the recent months, but "spare capacity remained in the economy".

Risks to financial stability and stability of the economy in Australia revolved around local property markets.

The RBA kept unchanged its interest rate at 2.00% in October.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1446 (2341)

$1.1403 (1243)

$1.1375 (611)

Price at time of writing this review: $1.1328

Support levels (open interest**, contracts):

$1.1263 (2005)

$1.1213 (1930)

$1.1148 (4432)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 37348 contracts, with the maximum number of contracts with strike price $1,1500 (3483);

- Overall open interest on the PUT options with the expiration date November, 6 is 46534 contracts, with the maximum number of contracts with strike price $1,1000 (4837);

- The ratio of PUT/CALL was 1.25 versus 1.28 from the previous trading day according to data from October, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.5703 (906)

$1.5605 (1095)

$1.5509 (1900)

Price at time of writing this review: $1.5470

Support levels (open interest**, contracts):

$1.5393 (551)

$1.5296 (2841)

$1.5198 (2605)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 20310 contracts, with the maximum number of contracts with strike price $1,5350 (2600);

- Overall open interest on the PUT options with the expiration date November, 6 is 20640 contracts, with the maximum number of contracts with strike price $1,5300 (2841);

- The ratio of PUT/CALL was 1.02 versus 1.04 from the previous trading day according to data from October, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

1:30 Australia RBA Meeting's Minutes

06:00 Germany Producer Price Index (MoM) September -0.5% -0.1% -0.4%

06:00 Germany Producer Price Index (YoY) September -1.7% -1.8% -2.1%

06:00 Switzerland Trade Balance September 2.87 2.51 3.05

The euro remains under pressure ahead of ECB meeting and press conference scheduled for Thursday. Experts say that officials may change the tone of their statements. The single currency is likely to remain under pressure till the end of the week. It's worth to remember that on Friday data showed that inflation turned negative in September in the euro zone (the first negative reading since the introduction of ECB's asset purchase program in March).

The Australian dollar rose amid minutes of the latest meeting of the Reserve Bank of Australia. Minutes suggest that the central bank does not intend to cut its benchmark rate. The rate has been at 2% since May. Minutes noted risks to financial stability from overheated housing market, although a weaker AUD contributes to balance in the economy. The RBA said that inflation will stay low for the coming year or two.

EUR/USD: the pair fluctuated within $1.1320-40 in Asian trade

USD/JPY: the pair traded within Y119.45-55

GBP/USD: the pair rose to $1.5480

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone Current account, unadjusted, bln August 33.8

09:45 United Kingdom MPC Member McCafferty Speaks

10:00 United Kingdom BOE Gov Mark Carney Speaks

12:30 Canada Wholesale Sales, m/m August 0.0% 0.2%

12:30 U.S. Building Permits September 1161 1164

12:30 U.S. Housing Starts September 1126 1150

13:00 U.S. FOMC Member Dudley Speak

13:15 U.S. FOMC Member Jerome Powell Speaks

15:00 U.S. Fed Chairman Janet Yellen Speaks

20:30 U.S. API Crude Oil Inventories October 9.3

22:45 New Zealand Visitor Arrivals September 7.4%

23:50 Japan Trade Balance Total, bln September -569.6 84.4

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.