- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Novosti i prognoe: devizno tržište od 23-04-2013

Euro fell against the dollar, reaching in this two-week low, helped by a weak presented a report on the euro area, which added speculation that the European Central Bank will cut interest rates to stimulate economic growth. It should be noted that the sharp drop in business activity in Germany has overshadowed the data output to ease the recession in France in April. As it became known, the PMI index for the services sector in the euro area rose to the level of April of 46.6, compared with 46.4 in March, below the 50 level that separates growth from contraction. Add that bad index for the euro area as a whole has coincided with a decrease in the index for German companies that make up the backbone of the economy in the eurozone. Meanwhile, studies have shown that the euro-zone companies are cutting jobs at a faster pace this month, after the March survey found that companies are firing employees at a slower pace. Economists note that at the moment clarity about the outlook completely absent, and as long as this situation remains, it will slow economic growth, and the decline will continue.

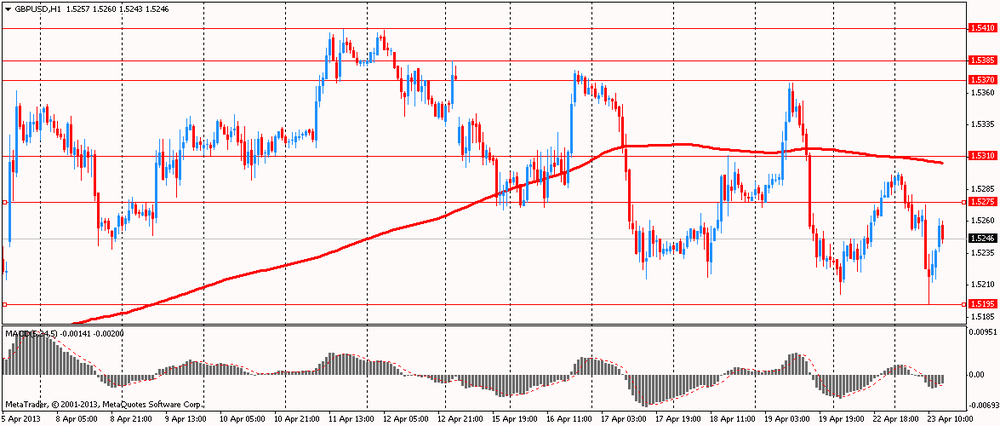

Sterling fell to a two-week low against the dollar, but later still managed to recover most of the losses after a report from the Confederation of British Industry showed that the balance of industrial orders declined significantly in April, reaching with its lowest level in half a year, in spite of Economists forecast a modest improvement, which was mainly due to the fall in domestic demand. According to the report, the balance of industrial orders fell in April to a level of -25, compared to -15 in March. Note that according to the average forecast of most economists, the value of this index would grow to -14. We add that the latest reading was the lowest since October 2010. In addition, the data presented today show that in the three months ended April, the number of new orders fell slightly, while the index, which measures expectations for the next quarter orders grew. Note also that the number of producers who expect to increase the total volume of new orders was 22%, while 28% expected a decrease of orders, against which the balance amounted to 6%. Note that the balance was much lower than the expected 14%, but remained above the long term average level to 3%.

The Canadian dollar traded at almost a six-week low against the U.S. dollar on the data from Europe and China, which indicate a slowdown in global economic growth, undermining demand for Canadian exports. Meanwhile, we observe the dynamics of trading was influenced by a report from Statistics Canada, which showed that retail sales in February rose at a faster pace than expected. In real terms, however, sales remained at the same level, which means that the February increase was driven mainly by higher prices, particularly for gasoline. Agency data showed that retail sales rose 0.8% to 39.55 billion Canadian dollars ($ 38.54 billion), which exceeded the expected 0.3%. Excluding the auto sector index rose by 0.7% m / m vs. 0.5% expected and revised January figure of 0.4%.

After

reporting a sharp drop in new home sales in the previous month, the Commerce

Department released a report on Tuesday showing a relatively modest rebound in

sales in the month of March.

The report

showed that new home sales rose 1.5 percent to an annual rate of

The monthly

increase in new home sales in March came after sales tumbled 7.6 percent in

February from a four-year high of

Canadian

retail sales climbed at a faster-than-expected pace in February, marking the

best back-to-back monthly performance since the fall of 2011, Statistics Canada

said Tuesday.

In volume

terms, however, sales were flat, which means the February advance was largely

due to higher prices, in particular for gasoline.

The data

agency said retail sales rose 0.8% to 39.55 billion Canadian dollars ($38.54

billion), which beat expectations for a 0.3% gain among traders, according to

economists at Royal Bank of

EUR/USD $1.2900, $1.2950, $1.3000,

$1.3030, $1.3050, $1.3065, $1.3100, $1.3135,

$1.3200

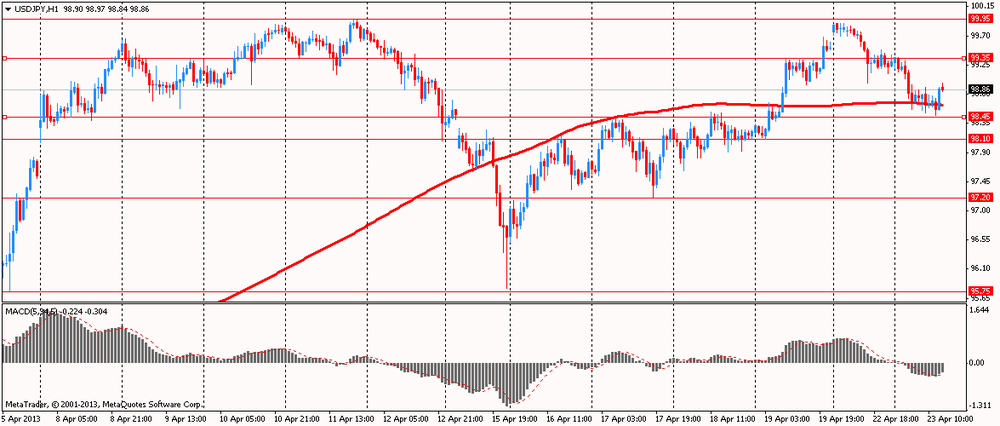

USD/JPY Y98.00, Y99.00, Y99.50, Y100.00, Y100.50, Y101.00

EUR/JPY Y122.25

GBP/USD $1.5140, $1.5200, $1.5250, $1.5260

AUD/USD $1.0250, $1.0260, $1.0300, $1.0320

EUR/AUD A$1.2640

USD/CAD C$1.0260

06:00 Switzerland Trade Balance March 2.10 1.73 1.9

07:00 France Manufacturing PMI (Preliminary) April 44.0 44.2 44.4

07:00 France Services PMI (Preliminary) April 41.3 42.3 44.1

07:30 Germany Manufacturing PMI (Preliminary) April 49.0 49.0 47.9

07:30 Germany Services PMI (Preliminary) April 50.9 51.1 49.2

08:00 Eurozone Manufacturing PMI (Preliminary) April 46.8 46.8 46.5

08:00 Eurozone Services PMI (Preliminary) April 46.4 46.7 46.6

08:30 United Kingdom PSNB, bln March 4.4 13.9 16.7

10:00 United Kingdom CBI industrial order books balance April -15 -14 -25

11:00 United Kingdom MPC Member McCafferty Speaks

The British pound during the session updated intraday lows against the dollar on record PSNB, but then stabilized and recovered somewhat. According to the Confederation of British Industry, the April CBI industrial orders index fell to -25 from the March level of the value -15. Analysts had expected a slight improvement to -14. In March, public sector net borrowing of Britain (PSNB) increased to 16,747 billion pounds, although analysts expect growth to 14.000 billion pounds. February's result was also revised to increase - from 4.356 billion pounds to 7.196 billion pounds.

The euro fell against the dollar on weak results PMI Germany. Activity in the private sector of the eurozone declined again in April. Such developments are likely to trigger the growth of appeals to the rejection of austerity measures in favor of the policy instruments that promote growth.

According to a survey of purchasing managers, active in German business confidence fell for the first time since November. Together with a similar report testifying to the slowdown in manufacturing activity in China, it has raised concern about the likely decline in global growth.

In April, a preliminary PMI index of manufacturing activity in the country has decreased to around 47.9 to 49 pips. in March. The result was weaker than the market forecast of 49. A similar index in the services sector also dropped from 50.9 pts. in March to 49.2, contrary to expectations of growth to 51. France reported that preliminary index of manufacturing activity PMI Markit rose to 44.4 in April, surpassing the forecast of 44.3 and 44.0 March result, while the same index in the service sector rose from 41.3 to 44.1, compared with an expected 42.0.

The disappointing news came today from China, where preliminary index of manufacturing activity in China HSBC PMI in March amounted to 50.5 (vs. 51.5). According to experts, these results have reinforced voiced over the weekend words of the head of the Central Bank of China that the country is going now to the "slower pace of sustainable growth." Market and leading institutions such as the IMF still predicts China's GDP growth this year at 8 +%.

EUR / USD: during the European session, the pair fell to $ 1.2971

GBP / USD: during the European session, the pair fell to $ 1.5195

USD / JPY: during the European session, the pair fell to Y98.47

At 12:30 GMT Canada will release the change in the volume of retail sales, the change in retail sales excluding auto sales for February. In the U.S., will be released at 13:00 GMT the index of business activity in the manufacturing sector in April, the 14:00 GMT - sales in the primary market in March, at 20:30 GMT - the change in volume of crude oil, according to API. At 21:00 GMT we will know the decision of the Reserve Bank of New Zealand's main interest rate and the accompanying statement will be made of the Reserve Bank of New Zealand.

EUR/USD

Offers $1.3150/55, $1.3130, $1.3100, $1.3050, $1.3015/20

Bids $1.2970, $1.2950/40, $1.2920

GBP/USD

Offers $1.5330, $1.5300/10, $1.5250

Bids $1.5160/50, $1.5130/20, $1.5100/090

AUD/USD

Offers $1.0345/50, $1.0320, $1.0300, $1.0275/80

Bids $1.0220, $1.0200, $1.0185/80, $1.0155/50, $1.0120/15, $1.0100

EUR/GBP

Offers stg0.8630/40, stg0.8610/15, stg0.8600

Bids stg0.8500, stg0.8485/80, stg0.8460/50

EUR/JPY

Offers Y129.90/00, Y129.80/85, Y129.40/50, Y128.90/00, Y128.55/60

Bids Y127.55/50, Y127.10/00, Y126.80, Y126.55/50

USD/JPY

Offers Y99.70, Y99.30, Y99.10/20

Bids Y98.50, Y98.30, Y98.00

EUR/USD $1.2900, $1.2950, $1.3000, $1.3030, $1.3065, $1.3100, $1.3135, $1.3200

USD/JPY Y98.00, Y99.00, Y99.50, Y100.00, Y100.50, Y101.00

EUR/JPY Y122.25

GBP/USD $1.5140, $1.5200, $1.5250, $1.5260

AUD/USD $1.0250, $1.0260, $1.0300, $1.0320

EUR/CHF A$1.2640

USD/CAD C$1.0260

00:00 Australia Conference

Board Australia Leading Index February +0.2% +0.3%

01:45 China HSBC Manufacturing PMI (Preliminary) April 51.6 51.4 50.5

The euro slid before data projected to show services and manufacturing output in Europe shrank. A composite PMI for services and manufacturing industries was unchanged at 46.5 in April, London-based Markit Economics is predicted to say according to the median estimate of economists surveyed by Bloomberg before today's report. Readings below 50 indicates contraction.

The Ifo institute's business climate index for Germany, based on a survey of 7,000 executives, probably fell to 106.2 this month from 106.7, a separate poll showed before tomorrow's release.

The Australian and New Zealand currencies led losses versus the yen and dollar after the Purchasing Managers' Index for China by HSBC Holdings Plc and Markit Economics missed economists' forecasts. The preliminary PMI for China was 50.5 this month compared with a final 51.6 reading for March. The number was below the median 51.5 estimate in a Bloomberg News survey of analysts. A reading above 50 indicates expansion.

The yen rose versus all of its major peers after a private report signaled a slowdown in Chinese manufacturing, underscoring concern the largest Asian economy is faltering and boosting demand for refuge assets.

EUR / USD: during the Asian session the pair fell to $ 1.3030

GBP / USD: during the Asian session the pair fell to $ 1.5250.

USD / JPY: on Asian session the pair fell to Y98.55.

There is a full calendar Tuesday, including the release of the euro area flash manufacturing and service PMI numbers. The calendar gets underway with the release of the French April business climate indicator, including the April manufacturing and service sector sentiment indices, at 0645GMT. The release of the main flash PMI numbers starts at 0658GMT, with the release of the French flash numbers, followed at 0728GMT with the German numbers and the eurozone data at 0758GMT. That is followed at 0800GMT with the release of the Italian ISTAT April cоnsumer confidence numbers. Sovereign issuance in Europe sees Spain plan to tap 3-month Jul 19, 2013 Letra and tap 9-month Jan 24, 2014 Letra with indicative size to be announced on Monday, with expectations of between E3.5-E4.5bln.

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3061 +0,08%

GBP/USD $1,5287 +0,37%

USD/CHF Chf0,9341 +0,05%

USD/JPY Y99,30 -0,20%

EUR/JPY Y129,70 -0,15%

GBP/JPY Y151,78 +0,15%

AUD/USD $1,0271 -0,04%

NZD/USD $0,8425 +0,15%

USD/CAD C$1,0260 -0,04%00:00 Australia Conference Board Australia Leading Index February +0.2%

01:45 China HSBC Manufacturing PMI (Preliminary) April 51.6 51.4

06:00 Switzerland Trade Balance March 2.10 1.73

07:00 France Manufacturing PMI (Preliminary) April 44.0 44.2

07:00 France Services PMI (Preliminary) April 41.3 42.3

07:30 Germany Manufacturing PMI (Preliminary) April 49.0 49.0

07:30 Germany Services PMI (Preliminary) April 50.9 51.1

08:00 Eurozone Manufacturing PMI (Preliminary) April 46.8 46.8

08:00 Eurozone Services PMI (Preliminary) April 46.4 46.7

08:30 United Kingdom PSNB, bln March 4.4 13.9

10:00 United Kingdom CBI industrial order books balance April -15 -14

11:00 United Kingdom MPC Member McCafferty Speaks

12:30 Canada Retail Sales, m/m February +1.0% +0.3%

12:30 Canada Retail Sales ex Autos, m/m February +0.5% +0.5%

12:45 Canada BOC Gov Carney Speaks

12:45 Canada Gov Council Member Macklem Speaks

13:00 U.S. Manufacturing PMI (Preliminary) April 54.6 54.3

14:00 U.S. New Home Sales March 411 419

20:30 U.S. API Crude Oil Inventories April -6.7

21:00 New Zealand RBNZ Interest Rate Decision 2.50% 2.50%

21:00 New Zealand RBNZ Rate Statement© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.