- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 04-11-2015

(time / country / index / period / previous value / forecast)

00:30 U.S. FED Vice Chairman Stanley Fischer Speaks

01:00 Australia RBA Assist Gov Lowe Speaks

07:00 Germany Factory Orders s.a. (MoM) September -1.8% 1%

08:00 United Kingdom Halifax house price index October -0.9% 0.6%

08:00 United Kingdom Halifax house price index 3m Y/Y October 8.6% 9.5%

08:15 Switzerland Consumer Price Index (MoM) October 0.1% 0%

08:15 Switzerland Consumer Price Index (YoY) October -1.4% -1.4%

09:00 Eurozone ECB Economic Bulletin

10:00 Eurozone Retail Sales (MoM) September 0.0% 0.2%

10:00 Eurozone Retail Sales (YoY) September 2.3% 3%

10:00 Eurozone European Commission Economic Growth Forecasts

10:45 Eurozone ECB President Mario Draghi Speaks

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom MPC Rate Statement

12:00 United Kingdom Asset Purchase Facility 375 375

12:45 United Kingdom BOE Gov Mark Carney Speaks

13:30 U.S. Continuing Jobless Claims October 2144 2144

13:30 U.S. Initial Jobless Claims October 260 262

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter III -1.4% 2.3%

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter III 3.3% -0.2%

13:30 U.S. FOMC Member Dudley Speak

14:10 U.S. FED Vice Chairman Stanley Fischer Speaks

15:00 Canada Ivey Purchasing Managers Index October 53.7 54

18:30 FOMC Member Dennis Lockhart Speaks

22:30 Australia AiG Performance of Construction Index October 51.9

Stock indices closed mixed on company news. Volkswagen's shares dropped as the company said that the carbon dioxide emission levels of 800 000 cars were incorrectly specified.

Shares of the commodity company Glencore rose as the company said that it was on track to reduce its debt and boost liquidity.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.3% in September, beating expectations for a 0.4% drop, after a 0.8% decrease in August.

On a yearly basis, Eurozone's producer price index dropped 3.1% in September, beating expectations for a 3.3% decrease, after a 2.6% fall in August.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in September.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) increased to 54.1 in October from 53.7 in September, down from the preliminary reading of 54.2.

The index was driven by rises in new business, backlogs of work and employment.

Eurozone's final composite output index rose to 53.9 in October from 53.6 in September, down from the preliminary reading of 54.0.

"The final PMI data confirm the steady but still somewhat lacklustre economic growth recorded in the euro area at the start of the fourth quarter. The survey suggests that the region's quarterly growth rate remains constrained at around 0.4%," Chief Economist at Markit Chris Williamson said.

Germany's final services purchasing managers' index (PMI) rose to 54.5 in October from 54.1 in September, down from the preliminary reading of 55.2.

France's final services purchasing managers' index (PMI) increased to 52.7 in October from 51.9 in September, up from the preliminary reading of 52.3.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 54.9 in October from 53.3 in September, exceeding expectations for a rise to 54.5.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in business activity and stronger job creation.

"The survey data point to GDP rising at a quarterly rate of 0.6% at the start of the fourth quarter, up from 0.5% in the third quarter. Such an improvement, together with the revival in hiring signalled by the three surveys, with job creation hitting an eight-month high in October, may coax more policymakers into raising interest rates before the end of the year," the Chief Economist at Markit Chris Williamson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,412.88 +29.27 +0.46 %

DAX 10,845.24 -105.91 -0.97 %

CAC 40 4,948.29 +12.11 +0.25 %

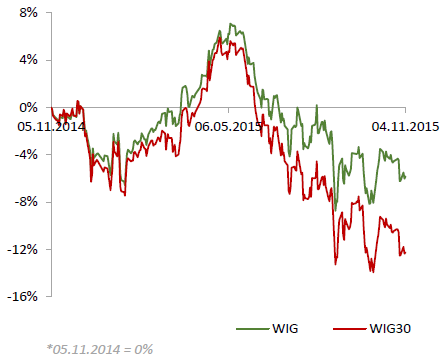

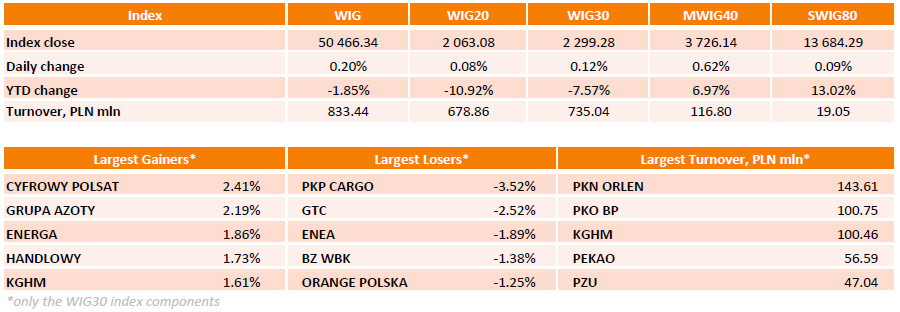

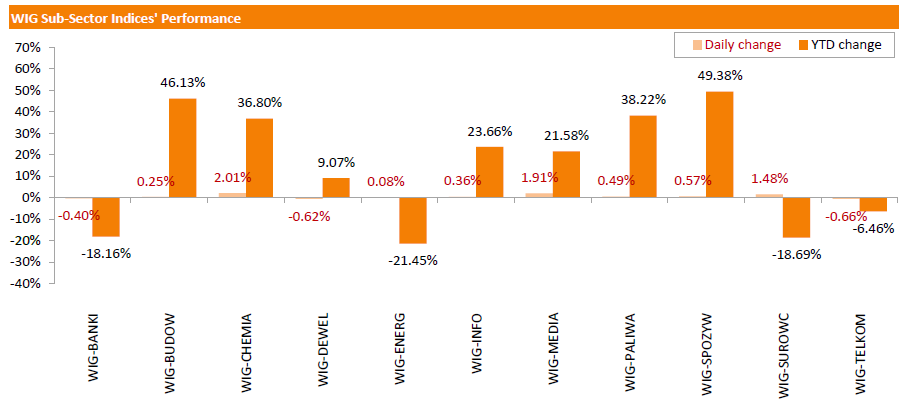

Polish equity market closed higher on Wednesday. The market broad measure, the WIG Index, added 0.20%. Sector-wise, chemical sector stocks (+2.01%) were the growth leaders in the WIG, while telecommunication sector names (-0.66%) were the poorest performers.

The large-cap stocks' benchmark, the WIG30 Index, rose 0.12%. Within the index components, CYFROWY POLSAT (WSE: CPS) and GRUPA AZOTY (WSE: ATT) generated the biggest advances, up 2.41% and 2.19% respectively. Other noticeable gainers included ENERGA (WSE: ENG), HANDLOWY (WSE: BHW) and KGHM (WSE: KGH), climbing 1.61%-1.86%. On the other side of the ledger, PKP CARGO (WSE: PKP) led the decliners with a 3.52% drop, followed by GTC (WSE: GTC) and ENEA (WSE: ENA), sliding 2.52% and 1.89% respectively.

The European Central Bank (ECB) President Mario Draghi said on Wednesday that similar protection scheme of deposits across the Eurozone is needed.

"Deposits, which are the most widespread form of money, have to inspire the same level of confidence wherever they are located. To ensure that deposits are truly as safe everywhere across the euro area, the likelihood that a bank fails has to be independent of the jurisdiction where it is established. Resolution has to follow the same process in the event that a bank fails," he said.

Oil prices dropped on U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 2.85 million barrels to 482.8 million in the week to October 30. It was the sixth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 2.8 million barrels.

Gasoline inventories decreased by 3.3 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, fell by 0.2 million barrels.

U.S. crude oil imports dropped by 89,000 barrels per day.

Refineries in the U.S. were running at 88.7% of capacity, up from 87.6% the previous week.

Oil prices yesterday rose sharply on concerns over oil supply from Libya and Brazil. Oil workers on Sunday began a strike at state-owned oil producer Petroleo Brasileiro. Libya's oil company National Oil Corp. declared force majeure and suspended deliveries from the port of Zueitina.

WTI crude oil for December delivery declined to $46.41 a barrel on the New York Mercantile Exchange.

Brent crude oil for December fell to $48.84 a barrel on ICE Futures Europe.

Gold price fell on a stronger U.S. dollar. The U.S. dollar rose against other currencies on comments by the Fed Chairwoman Janet Yellen. She said that the interest rate hike this year is still possible, adding that the decision has not been made yet. Yellen pointed out that the Fed's decision will be depend on the incoming economic data. The Fed chairwoman noted that the U.S. economy is performing well.

Market participants eyed the U.S. economic data. Private sector in the U.S. added 182,000 jobs in October, according the ADP report on Wednesday. September's figure was revised down to 190,000 jobs from a previous reading of 200,000 jobs. Analysts expected the private sector to add 180,000 jobs.

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index climbed to 59.1 in October from 56.9 in September, beating expectations for a decrease to 56.5.

Market participants are awaiting the release of the U.S. labour market data on Friday. The U.S. unemployment rate is expected to remain unchanged at 5.1% in October. The U.S. economy is expected to add 180,000 jobs in October, after adding 142,000 jobs in September.

December futures for gold on the COMEX today declined to 1113.50 dollars per ounce.

The Fed Chairwoman Janet Yelllen testified before the House Financial Services Committee on Wednesday. She said that the interest rate hike this year is still possible, adding that the decision has not been made yet. Yellen pointed out that the Fed's decision will be depend on the incoming economic data.

The Fed chairwoman noted that the U.S. economy is performing well.

"Domestic spending has been growing at a solid pace," she said.

Yellen said the U.S. inflation is still well below the Fed's 2% target due to the low energy prices.

Major U.S. stock-indezes slightly lower on Wednesday, after two days of gains, fueled by a rally in energy stocks, pushed the three main indexes to within touching distance of their record highs. A report showing the private sector added more jobs than expected last month gave investors some optimism about the health of the labor market ahead of Friday's nonfarm payrolls data.

Dow stocks mixed (16 in negative area, 14 in positive area). Top looser - UnitedHealth Group Incorporated (UNH, -2.35%). Top gainer - Caterpillar Inc. (CAT, +0.83%).

S&P index sectors also mixed. Top gainer Industrial goods (+0,3%). Top looser - Conglomerates (-1.0%).

At the moment:

Dow 17806.00 -35.00 -0.20%

S&P 500 2097.50 -5.50 -0.26%

Nasdaq 100 4699.75 -12.25 -0.26%

Oil 47.04 -0.86 -1.80%

Gold 1112.80 -1.30 -0.12%

U.S. 10yr 2.23 +0.01

The European Central Bank (ECB) said in its economic bulletin that the direct impact of the slowdown in the Chinese economy on the economic growth in the Eurozone is modest.

"While trade spillovers from a continued slowdown of economic activity in China are likely to have only a modest impact on euro area GDP, other spillover channels can potentially be important," the central bank said.

The ECB noted that the global uncertainty due to the slowdown in the Chinese economy could have a negative impact on the economy in the Eurozone.

"A rise in global uncertainty could directly affect the confidence of euro area households and firms, hampering consumption and delaying investment decisions. Therefore, the impact on the euro area of a potential further slowdown in China ultimately hinges on the extent to which this slowdown spills over to other emerging markets more generally, and the degree to which the resulting loss of confidence affects global financial markets as well as global trade," the ECB noted.

European Central Bank Vice President Vitor Constancio said at a conference on Wednesday that there is no overvaluation of asset prices in the Eurozone. He added that the central bank's monetary policy should not combat bubles.

"There are pockets where assets are perhaps a little bit overvalued," Constancio said.

The ECB vice president noted that the ECB closely monitor these assets.

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 2.85 million barrels to 482.8 million in the week to October 30. It was the sixth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 2.8 million barrels.

Gasoline inventories decreased by 3.3 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, fell by 0.2 million barrels.

U.S. crude oil imports dropped by 89,000 barrels per day.

Refineries in the U.S. were running at 88.7% of capacity, up from 87.6% the previous week.

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index climbed to 59.1 in October from 56.9 in September, beating expectations for a decrease to 56.5.

A reading above 50 indicates a growth in the service sector.

The increase was mainly driven by a rise in new orders sub-index. The ISM's new orders index increased to 62.0 in October from 56.7 in September.

The business activity/production index rose to 63.0 in October from 60.2 in September.

The ISM's employment index was up to 59.2 in October from 58.3 in September.

The prices index climbed to 49.1 in October from 48.4 in September.

Markit/ADACI's services purchasing managers' index (PMI) for Italy rose to 53.4 in October from 53.3 in September.

A reading above 50 indicates expansion in the sector.

The increase was driven by a stronger rise in new business.

"Italy's service sector continues to expand at a steady pace, with the headline PMI in October broadly in line with that seen in September and for the third quarter as a whole. Growth in new business strengthened to a six-month high, showing that demand continues to build," an economist at Markit Phil Smith said.

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan increased to 52.2 in October from 51.4 in September.

A reading below 50 indicates contraction of activity.

The increase was driven by a stronger rise in new orders.

"Growth of the Japanese service sector improved at a faster rate in October, underpinned by a sharper rise in new orders. Despite this, employment levels declined at the fastest rate since December 2011, although this led consequently to an accumulation in volumes of unfinished work," economist at Markit, Amy Brownbill, said.

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Wednesday. Final U.S. services purchasing managers' index (PMI) declined to 54.8 in October from 55.1 in September, up from the preliminary reading of 54.6.

The decline was partly driven by a weaker rise in business activity and new business.

"The surveys nevertheless signal ongoing moderate growth of business activity and employment in the manufacturing and service sectors, which will keep alive the possibility that policymakers could be persuaded into raising interest rates before the year is over. However, the survey data also reinforce strong arguments - notably a continued absence of inflationary pressures - that there is no rush to tighten policy," Chief Economist at Markit Chris Williamson said.

Markit Economics released final services purchasing managers' index (PMI) for Spain on Wednesday. Spain's final services purchasing managers' index (PMI) increased to 55.9 in October from 55.1 in September.

The index was driven by an increase in activity and new business.

"The slight pick-up in growth rates of activity and new business was a positive from the latest services PMI survey as it broke the recent momentum of slowing rates of expansion, and provides optimism that solid increases can be recorded during the remainder of the year," Senior Economist at Markit Andrew Harker said.

U.S. stock-index futures rose.

Global Stocks:

Nikkei 18,926.91 +243.67 +1.30%

Hang Seng 23,053.57 +485.14 +2.15%

Shanghai Composite 3,458.86 +142.17 +4.29%

FTSE 6,450.22 +66.61 +1.04%

CAC 4,984.27 +48.09 +0.97%

DAX 10,928.65 -22.50 -0.21 %

Crude oil $47.86 (-0.17%)

Gold $1117.80 (+0.33%)

The Australian Industry Group (AiG) released its services purchasing managers' index (PMI) for Australia on the late Tuesday evening. The index slid to 48.9 in October from 52.3 in September.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Only two of the five activity sub-indexes were above 50 points in October.

Main contributor to the drop was the sales sub-index, which slid by 7.8 points.

(company / ticker / price / change, % / volume)

| AMERICAN INTERNATIONAL GROUP | AIG | 60.97 | +0.02% | 9.3K |

| E. I. du Pont de Nemours and Co | DD | 64.03 | +0.03% | 0.1K |

| Home Depot Inc | HD | 125.70 | +0.03% | 0.2K |

| International Business Machines Co... | IBM | 141.98 | +0.07% | 0.1K |

| McDonald's Corp | MCD | 112.18 | +0.09% | 1.3K |

| Microsoft Corp | MSFT | 54.20 | +0.09% | 26.1K |

| General Electric Co | GE | 29.63 | +0.14% | 22.1K |

| Exxon Mobil Corp | XOM | 87.00 | +0.17% | 5.4K |

| Ford Motor Co. | F | 14.84 | +0.20% | 7.4K |

| Nike | NKE | 131.70 | +0.23% | 2.0K |

| Chevron Corp | CVX | 98.40 | +0.26% | 1K |

| UnitedHealth Group Inc | UNH | 118.00 | +0.29% | 2.8K |

| Cisco Systems Inc | CSCO | 28.70 | +0.31% | 1K |

| JPMorgan Chase and Co | JPM | 65.99 | +0.32% | 1.8K |

| Citigroup Inc., NYSE | C | 54.35 | +0.35% | 0.2K |

| Barrick Gold Corporation, NYSE | ABX | 7.87 | +0.38% | 18.3K |

| AT&T Inc | T | 33.76 | +0.39% | 5.6K |

| Google Inc. | GOOG | 725.00 | +0.39% | 1.4K |

| Goldman Sachs | GS | 191.48 | +0.41% | 0.2K |

| Amazon.com Inc., NASDAQ | AMZN | 627.98 | +0.43% | 3.6K |

| Starbucks Corporation, NASDAQ | SBUX | 63.09 | +0.46% | 7.2K |

| Pfizer Inc | PFE | 34.86 | +0.49% | 9.2K |

| Procter & Gamble Co | PG | 77.48 | +0.56% | 0.6K |

| Wal-Mart Stores Inc | WMT | 58.45 | +0.59% | 3.6K |

| Facebook, Inc. | FB | 103.19 | +0.59% | 172.7K |

| Apple Inc. | AAPL | 123.30 | +0.60% | 273.1K |

| Caterpillar Inc | CAT | 75.25 | +0.67% | 4.0K |

| Visa | V | 78.45 | +0.71% | 3.1K |

| Twitter, Inc., NYSE | TWTR | 29.35 | +0.76% | 46.6K |

| Yahoo! Inc., NASDAQ | YHOO | 34.99 | +0.78% | 1.8K |

| Walt Disney Co | DIS | 116.45 | +0.79% | 16.3K |

| Intel Corp | INTC | 34.45 | +1.12% | 48.4K |

| ALCOA INC. | AA | 9.47 | +1.28% | 9.0K |

| United Technologies Corp | UTX | 101.85 | +1.85% | 0.3K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.68 | +2.18% | 38.9K |

| Tesla Motors, Inc., NASDAQ | TSLA | 225.00 | +7.99% | 167.1K |

| Verizon Communications Inc | VZ | 46.45 | 0.00% | 5.5K |

| General Motors Company, NYSE | GM | 35.78 | 0.00% | 0.1K |

| Hewlett-Packard Co. | HPQ | 14.19 | -0.70% | 3.1K

|

The U.S. Commerce Department released the trade data on Wednesday. The U.S. trade deficit narrowed to $40.81 billion in September from a deficit of $48.02 billion in August. August's figure was revised up from a deficit of $43.30 billion.

Analysts had expected a trade deficit of $41.1 billion.

The decline of a deficit was driven by a rise in exports. Exports climbed by 1.6% in September, while imports decreased by 1.8%.

Exports to Canada, China and the European Union increased in September, while exports to Japan declined by 13.8%, the lowest level since April 2010.

Imports from China climbed 3.8% in September.

Upgrades:

HP Inc.(HPQ) upgraded to Equal Weight from Underweight at Barclays

Downgrades:

HP Inc.(HPQ) downgraded to Neutral from Overweight at JP Morgan

Other:

HP Inc.(HPQ) initiated with a Neutral at UBS

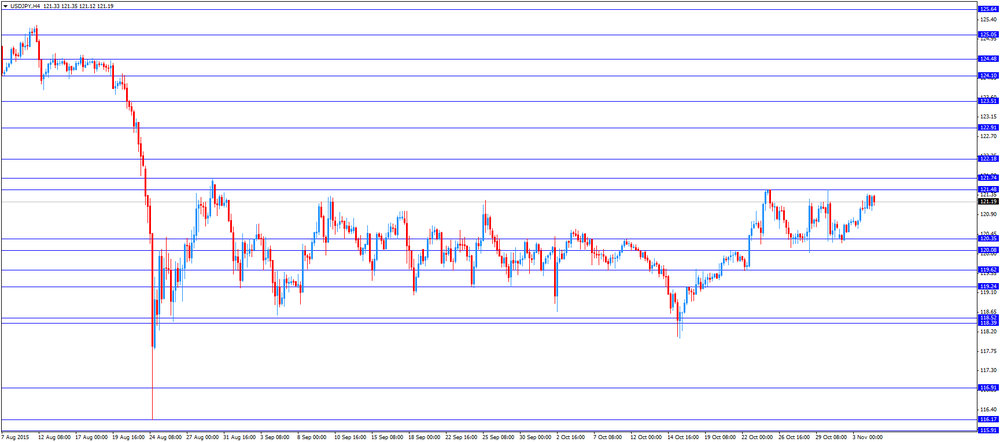

USDJPY 120.00 (USD 450m) 121.00 (699m) 122.00 (556m)

EURUSD 1.0925 (EUR 300m) 1.0950 (EUR 247m) 1.0995-1.10000 (550m)

USDCHF 1.0000 (USD 240m)

USDCAD 1.3225-30 (USD 490m) 1.3250 (467m)

AUDUSD 0.7110 (AUD 506m) 0.7150-60 (775m) 0.7420 (1.5bln)

Statistics Canada released the trade data on Wednesday. Canada's trade deficit narrowed to C$1.73 billion in September from a deficit of C$2.66 billion in August. August's figure was revised down from a deficit of C$2.53 billion.

Analysts had expected a trade deficit of C$1.9 billion.

The decrease in deficit was driven by a drop in imports. Imports fell 1.2% in September.

Imports of basic and industrial chemical, plastic and rubber products declined by 5.2% in September, and imports of metal and non-metallic mineral products dropped 14.3%, while imports of energy products slid 12.3%.

Exports increased 0.7% in September.

Exports of energy products rose by 3.7% in September, exports of consumer goods jumped by 4.3%, exports of motor vehicles and parts dropped by 3.7%, while exports of metal and non-metallic mineral product were up 3.2%.

Private sector in the U.S. added 182,000 jobs in October, according the ADP report on Wednesday. September's figure was revised down to 190,000 jobs from a previous reading of 200,000 jobs.

Analysts expected the private sector to add 180,000 jobs.

Services sector added 158,000 jobs in October, while goods-producing sector added 24,000 jobs.

The manufacturing sector lost 2,000 jobs in October. It was second consecutive monthly loss.

"Job growth as measured by the ADP Research Institute is not slowing meaningfully in contrast with the recent slowdown in the government's data. The economy is creating close to 200,000 jobs per month," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.1% in October. The U.S. economy is expected to add 180,000 jobs in October, after adding 142,000 jobs in September.

Japan's Cabinet Office released its consumer confidence index on Wednesday. The consumer confidence index rose to 41.5 in October from 40.6 in September, exceeding expectations for a gain to 41.4.

The increase was driven by rises in all sub-indexes. The overall livelihood sub-index increased to39.6 in October from 38.8 in September, the income growth sub-index was up to 40.0 from 39.4, the employment sub-index climbed to 45.9 from 44.9, while the willingness to buy durable goods sub-index rose to 40.3 from 39.1.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail Sales, M/M September 0.4% 0.4% 0.4%

00:30 Australia Trade Balance September -2.71 Revised From -3.1 -3 -2.32

01:45 China Markit/Caixin Services PMI October 50.5 50.8 52.0

05:00 Japan Consumer Confidence October 40.6 41.4 41.5

08:00 Eurozone ECB President Mario Draghi Speaks

08:50 France Services PMI (Finally) October 51.9 52.3 52.7

08:55 Germany Services PMI (Finally) October 54.1 55.2 54.5

09:00 Eurozone Services PMI (Finally) October 53.7 54.2 54.1

09:30 United Kingdom Purchasing Manager Index Services October 53.3 54.5 54.9

10:00 Eurozone Producer Price Index, MoM September -0.8% -0.4% -0.3%

10:00 Eurozone Producer Price Index (YoY) September -2.6% -3.3% -3.1%

10:30 U.S. FOMC Member Brainard Speaks

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data. According to the ADP employment report, the U.S. economy is expected to add 180,000 jobs in October.

The U.S. trade deficit is expected to narrow to $41.1 billion in September from $48.33 billion in August.

The ISM non-manufacturing purchasing managers' index is expected to decline to 56.5 in October from 56.9 in September.

Fed Chairwoman Janet Yellen will speak at 15:00 GMT.

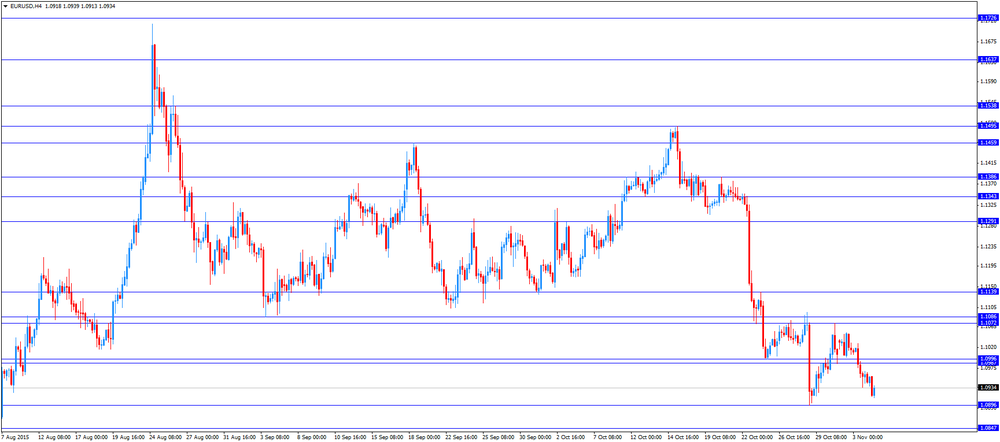

The euro traded lower against the U.S. dollar on comments by the European Central Bank's (ECB) President Mario Draghi. He said on Tuesday that the central bank will review the volume of its asset-buying programme at the monetary policy meeting in December.

Draghi pointed out that the ECB will add further stimulus measures if needed.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.3% in September, beating expectations for a 0.4% drop, after a 0.8% decrease in August.

On a yearly basis, Eurozone's producer price index dropped 3.1% in September, beating expectations for a 3.3% decrease, after a 2.6% fall in August.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in September.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) increased to 54.1 in October from 53.7 in September, down from the preliminary reading of 54.2.

The index was driven by rises in new business, backlogs of work and employment.

Eurozone's final composite output index rose to 53.9 in October from 53.6 in September, down from the preliminary reading of 54.0.

"The final PMI data confirm the steady but still somewhat lacklustre economic growth recorded in the euro area at the start of the fourth quarter. The survey suggests that the region's quarterly growth rate remains constrained at around 0.4%," Chief Economist at Markit Chris Williamson said.

Germany's final services purchasing managers' index (PMI) rose to 54.5 in October from 54.1 in September, down from the preliminary reading of 55.2.

France's final services purchasing managers' index (PMI) increased to 52.7 in October from 51.9 in September, up from the preliminary reading of 52.3.

The British pound traded lower against the U.S. dollar despite the better-than-expected PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 54.9 in October from 53.3 in September, exceeding expectations for a rise to 54.5.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in business activity and stronger job creation.

"The survey data point to GDP rising at a quarterly rate of 0.6% at the start of the fourth quarter, up from 0.5% in the third quarter. Such an improvement, together with the revival in hiring signalled by the three surveys, with job creation hitting an eight-month high in October, may coax more policymakers into raising interest rates before the end of the year," the Chief Economist at Markit Chris Williamson said.

The Canadian dollar traded mixed against the U.S. dollar ahead the Canadian trade data. The Canadian trade deficit is expected to narrow to C$1.9 billion in September from C$2.53 billion in August.

EUR/USD: the currency pair fell to $1.0913

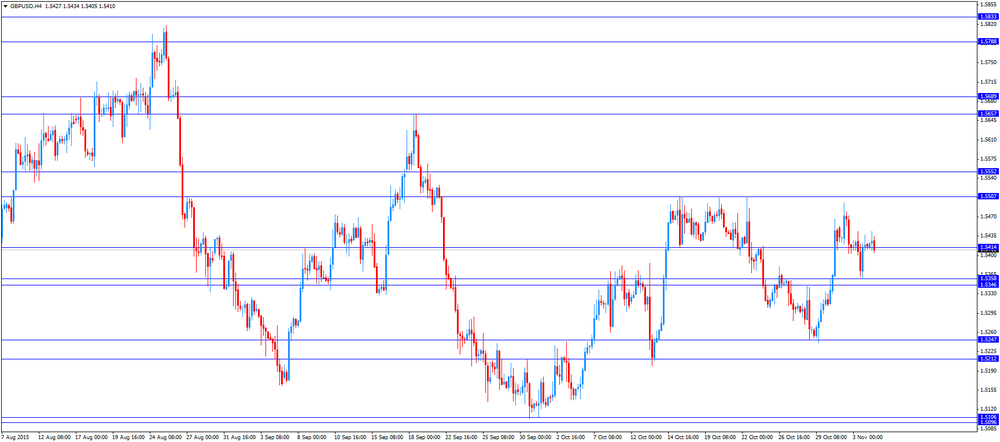

GBP/USD: the currency pair was down to $1.5405

USD/JPY: the currency pair increased to Y121.35

The most important news that are expected (GMT0):

13:15 U.S. ADP Employment Report October 200 180

13:30 Canada Trade balance, billions September -2.53 -1.9

13:30 U.S. International Trade, bln September -48.33 -41.1

14:45 U.S. Services PMI (Finally) October 55.1 54.6

15:00 U.S. ISM Non-Manufacturing October 56.9 56.5

15:00 U.S. Fed Chairman Janet Yellen Speaks

15:30 U.S. Crude Oil Inventories October 3.376 2.8

19:30 U.S. FOMC Member Dudley Speak

22:25 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Monetary Policy Meeting Minutes

Stock indices traded mixed on company news. Volkswagen's shares dropped as the company said that the carbon dioxide emission levels of 800 000 cars were incorrectly specified.

Shares of the commodity company Glencore rose as the company said that it was on track to reduce its debt and boost liquidity.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.3% in September, beating expectations for a 0.4% drop, after a 0.8% decrease in August.

On a yearly basis, Eurozone's producer price index dropped 3.1% in September, beating expectations for a 3.3% decrease, after a 2.6% fall in August.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in September.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) increased to 54.1 in October from 53.7 in September, down from the preliminary reading of 54.2.

The index was driven by rises in new business, backlogs of work and employment.

Eurozone's final composite output index rose to 53.9 in October from 53.6 in September, down from the preliminary reading of 54.0.

"The final PMI data confirm the steady but still somewhat lacklustre economic growth recorded in the euro area at the start of the fourth quarter. The survey suggests that the region's quarterly growth rate remains constrained at around 0.4%," Chief Economist at Markit Chris Williamson said.

Germany's final services purchasing managers' index (PMI) rose to 54.5 in October from 54.1 in September, down from the preliminary reading of 55.2.

France's final services purchasing managers' index (PMI) increased to 52.7 in October from 51.9 in September, up from the preliminary reading of 52.3.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 54.9 in October from 53.3 in September, exceeding expectations for a rise to 54.5.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in business activity and stronger job creation.

"The survey data point to GDP rising at a quarterly rate of 0.6% at the start of the fourth quarter, up from 0.5% in the third quarter. Such an improvement, together with the revival in hiring signalled by the three surveys, with job creation hitting an eight-month high in October, may coax more policymakers into raising interest rates before the end of the year," the Chief Economist at Markit Chris Williamson said.

Current figures:

Name Price Change Change %

FTSE 100 6,446.65 +63.04 +0.99 %

DAX 10,936.49 -14.66 -0.13 %

CAC 40 4,982.98 +46.80 +0.95 %

The Australian Bureau of Statistics released its retail sales data on Wednesday. Retail sales in Australia rose 0.4% in September, in line with expectations, after a 0.4% gain in August.

The increase was mainly driven by higher household goods sales and cafes, restaurants and takeaway food services sales. Household goods sales were up 1.0% in September, while cafes, restaurants and takeaway food services sales increased 0.9%.

On a quarterly basis, retail sales rose 0.6% in the third quarter, after a 0.8% increase in the second quarter.

On a yearly basis, retail sales climbed 5.8% in September.

Markit Economics released final services purchasing managers' index (PMI) for France on Wednesday. France's final services purchasing managers' index (PMI) increased to 52.7 in October from 51.9 in September, up from the preliminary reading of 52.3.

The increase was driven by a stronger rise in new business and backlogs of work.

"The French service sector started the fourth quarter on a firmer footing, posting its strongest performance in four months. However, growth remains below-par compared with the survey's long-run trend and, although expansion has been sustained for nine successive months, the sector has thus far failed to generate more than a stuttering recovery," Senior Economist at Markit Jack Kennedy said.

Markit Economics released final services purchasing managers' index (PMI) for Germany on Wednesday. Germany's final services purchasing managers' index (PMI) rose to 54.5 in October from 54.1 in September, down from the preliminary reading of 55.2.

"Germany's service sector remained in good shape at the start of the fourth quarter, with growth of activity accelerating slightly since September. Moreover, the strongest rise in business outstanding since June 2011 and sharply increasing employment levels are supportive of hopes that growth can be sustained as we move towards the end of the year," an economist at Markit, Oliver Kolodseike, said.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) increased to 54.1 in October from 53.7 in September, down from the preliminary reading of 54.2.

The index was driven by rises in new business, backlogs of work and employment.

Eurozone's final composite output index rose to 53.9 in October from 53.6 in September, down from the preliminary reading of 54.0.

"The final PMI data confirm the steady but still somewhat lacklustre economic growth recorded in the euro area at the start of the fourth quarter. The survey suggests that the region's quarterly growth rate remains constrained at around 0.4%," Chief Economist at Markit Chris Williamson said.

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.3% in September, beating expectations for a 0.4% drop, after a 0.8% decrease in August.

Intermediate goods prices fell 0.5% in September, capital goods prices were flat, non-durable consumer goods prices climbed 0.1%, and durable consumer goods prices declined 0.1%, while energy prices decreased 0.8%.

On a yearly basis, Eurozone's producer price index dropped 3.1% in September, beating expectations for a 3.3% decrease, after a 2.6% fall in August.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in September. Energy prices dropped at an annual rate of 9.8%.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 54.9 in October from 53.3 in September, exceeding expectations for a rise to 54.5.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in business activity and stronger job creation.

"The survey data point to GDP rising at a quarterly rate of 0.6% at the start of the fourth quarter, up from 0.5% in the third quarter. Such an improvement, together with the revival in hiring signalled by the three surveys, with job creation hitting an eight-month high in October, may coax more policymakers into raising interest rates before the end of the year," the Chief Economist at Markit Chris Williamson said.

The Australian Bureau of Statistics released its trade data on Wednesday. Australia's trade deficit narrowed to A$2.32 billion in September from A$2.71 billion in August, beating expectations for a rise to a deficit of A$3.0 billion. August's figure was revised up from a deficit of A$3.1 billion.

Exports rose by 3.0% in September, while imports climbed by 2.0%.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China climbed to 52.0 in October from 50.5 in September, exceeding expectations for an increase to 50.8.

The index was driven by a further increase in total new business.

"The Caixin China Services PMI is 52.0 for October, up significantly from 50.5 the previous month. The Caixin Composite Output Index reached 49.9, also much higher than 48.0 in September, close to the neutral 50-point level. This shows that previous stimulus policies have begun to take effect, while the economic structure steadily improved," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

"The economy has started to show signs of stabilizing, reducing the need for a further stimulus. The government must be resolute and push forward the reform agenda in a well-rounded manner to release the long-term potential for sustainable economic growth," he added.

Statistics New Zealand released its labour market data on late Tuesday evening. The unemployment rate rose to 6.0% in the third quarter from 5.9% in the second quarter, in line with expectations.

Employment decreased 0.4% in the third quarter, after a 0.3% gain in the second quarter, missing expectations for a 0.4% rise.

The participation rate declined to 68.6% in the third quarter from 69.3% in the second quarter.

"Until recently, the labour market has been keeping pace with New Zealand's population growth, but in the past three months this has changed. This quarter also had the largest increase in the number of people outside the labour force since the March 2009 quarter," labour market and household statistics manager Diane Ramsay said.

According to the IBD/TIPP Poll, the U.S. IBD/TIPP Economic Optimism Index fell to 45.5 in November from 47.3 in October. A reading above 50 indicates optimism, a reading below 50 indicates pessimism.

The index consists of three main subindices. All subindices declined in November.

The European Central Bank's (ECB) President Mario Draghi said on Tuesday that the central bank will review the volume of its asset-buying programme at the monetary policy meeting in December.

He pointed out that the ECB will add further stimulus measures if needed.

"The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation," Draghi said.

The ECB president noted that there are "downside risks to the outlook for growth and inflation" from the slowdown in emerging economies.

The Swiss National Bank (SNB) President Thomas Jordan said on Tuesday that the Swiss franc remains overvalued, adding that the central bank intervened in the foreign exchange market.

Jordan also explained the central bank's monetary policy.

"Our current monetary policy is based on two pillars. The first pillar is the negative interest rate on sight deposits at the SNB. The second pillar is our willingness to intervene on the foreign exchange market as required," he said.

USDJPY 120.00 (USD 450m) 121.00 (699m) 122.00 (556m)

EURUSD 1.0925 (EUR 300m) 1.0950 (EUR 247m) 1.0995-1.10000 (550m)

USDCHF 1.0000 (USD 240m)

USDCAD 1.3225-30 (USD 490m) 1.3250 (467m)

AUDUSD 0.7110 (AUD 506m) 0.7150-60 (775m) 0.7420 (1.5bln)

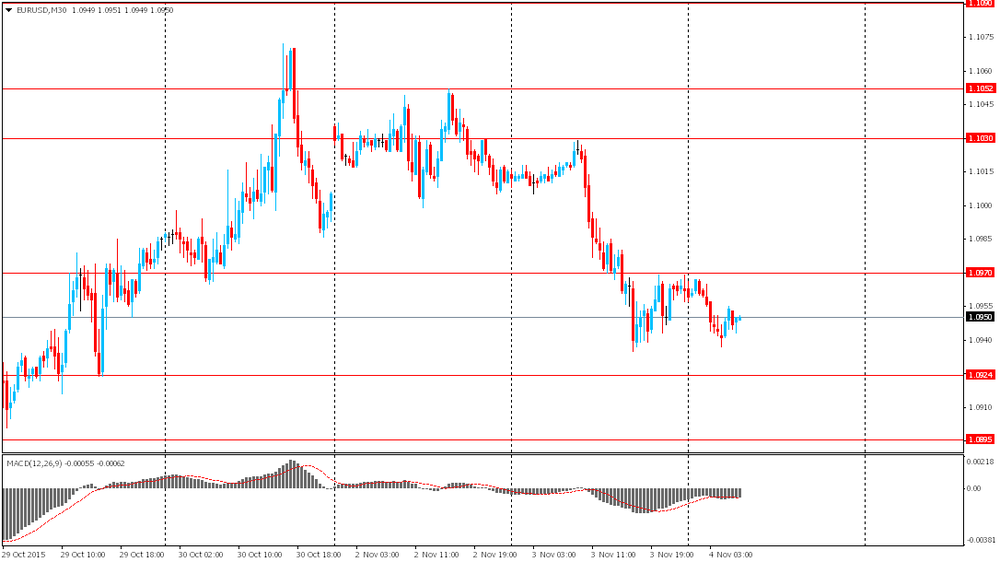

EUR / USD

Resistance levels (open interest**, contracts)

$1.1117 (4316)

$1.1079 (2234)

$1.1023 (1052)

Price at time of writing this review: $1.0933

Support levels (open interest**, contracts):

$1.0897 (2296)

$1.0866 (6922)

$1.0829 (1789)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 55219 contracts, with the maximum number of contracts with strike price $1,1200 (4549);

- Overall open interest on the PUT options with the expiration date November, 6 is 58483 contracts, with the maximum number of contracts with strike price $1,0900 (6922);

- The ratio of PUT/CALL was 1.06 versus 1.03 from the previous trading day according to data from November, 3

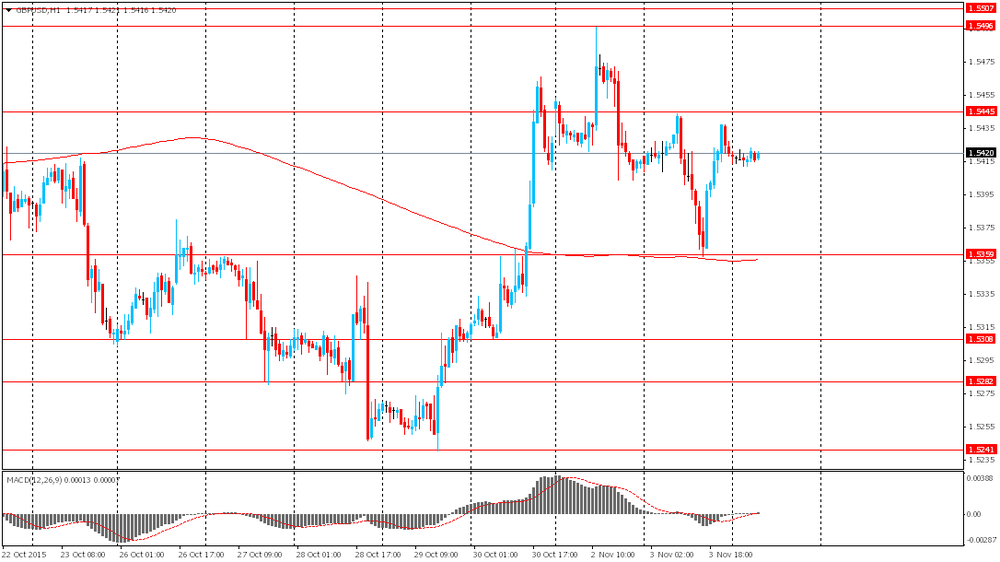

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (823)

$1.5601 (1100)

$1.5503 (2974)

Price at time of writing this review: $1.5413

Support levels (open interest**, contracts):

$1.5298 (2721)

$1.5199 (2586)

$1.5100 (1915)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 21913 contracts, with the maximum number of contracts with strike price $1,5500 (2974);

- Overall open interest on the PUT options with the expiration date November, 6 is 21678 contracts, with the maximum number of contracts with strike price $1,5200 (2856);

- The ratio of PUT/CALL was 0.99 versus 1.02 from the previous trading day according to data from November, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Retail Sales, M/M September 0.4% 0.4% 0.4%

00:30 Australia Trade Balance September -2.71 Revised From -3.1 -3 -2.32

01:45 China Markit/Caixin Services PMI October 50.5 50.8 52.0

05:00 Japan Consumer Confidence October 40.6 41.4 41.5

The euro declined against the U.S. dollar after European Central Bank President Mario Draghi hinted to possibility of additional steps to stimulate the economy and inflation. "The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation," Draghi said. Berenberg chief economist Holger Schmieding said that considering the current inflation level there is a 60% chance of further easing in December. Meanwhile expectations for a rate hike by the Federal Reserve rose.

The Australian dollar rose on domestic economic data and data from China. The Markit/Caixin Services PMI for China rose to 52.0 in October from 50.5 reported previously. "This shows that previous stimulus policies have begun to take effect, while the economic structure steadily improved," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

Meanwhile Australia's seasonally-adjusted trade deficit came in at A$2.32 billion in September compared to a deficit of A$3.0 billion expected by economists and the A$2.71 billion deficit reported previously. The deficit contracted due to stronger exports. Exports rose by 3%, imports rose by 2%.

EUR/USD: the pair fell to $1.0935 in Asian trade

USD/JPY: the pair traded within Y121.05-35

GBP/USD: the pair traded within $1.5410-25

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:50 France Services PMI (Finally) October 51.9 52.3

08:55 Germany Services PMI (Finally) October 54.1 55.2

09:00 Eurozone Services PMI (Finally) October 53.7 54.2

09:00 Eurozone ECB President Mario Draghi Speaks

09:30 United Kingdom Purchasing Manager Index Services October 53.3 54.5

10:00 Eurozone Producer Price Index, MoM September -0.8% -0.4%

10:00 Eurozone Producer Price Index (YoY) September -2.6% -3.3%

10:30 U.S. FOMC Member Brainard Speaks

13:15 U.S. ADP Employment Report October 200 180

13:30 Canada Trade balance, billions September -2.53 -1.9

13:30 U.S. International Trade, bln September -48.33 -41.1

14:45 U.S. Services PMI (Finally) October 55.1 54.6

15:00 U.S. ISM Non-Manufacturing October 56.9 56.5

15:00 U.S. Fed Chairman Janet Yellen Speaks

15:30 U.S. Crude Oil Inventories October 3.376 2.8

19:30 U.S. FOMC Member Dudley Speak

22:25 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Monetary Policy Meeting Minutes

West Texas Intermediate futures for December delivery are currently at $47.88 (-0.04%), while Brent crude is at $50.50 (-0.08%). On Tuesday industry group the American Petroleum Institute said U.S. crude inventories rose by 2.8 million barrels in the week ending October 30. The Energy Information Administration will publish its official data later today. A buildup in crude stocks suggests softer demand and weighs on prices.

Meanwhile Bloomberg reported that Libya's Petroleum Facilities Guard halted crude shipments from Zueitina port because of the conflict between the nation's rival governments.

Gold slightly rebounded to $1,120.50 (+0.57%), but stayed under pressure amid speculation that the Federal Reserve could raise rates in December. Outflows from exchange-traded funds and gains in stock markets also weighed on the precious metal. Meanwhile weaker-than-expected reports on the U.S. economy failed to support gold.

Market participants are waiting for more data to assess strength of the U.S. economy and the probability of a data-dependant rate hike. That's why investors will focus on U.S. key jobs report due Friday.

U.S. stock indices rose on Tuesday. Energy stocks were the biggest positive contributors.

The Dow Jones Industrial Average rose 89.39 points, or 0.5%, to 17,918.15. The S&P 500 added 5.74 points, or 0.3%, to 2,109.79 (its energy sector rose 2.5%). The Nasdaq Composite Index gained 17.98 points, or 0.4%, to 5,145.13.

The Commerce Department reported that U.S. factory orders fell for the second straight month in September, while the manufacturing sector continued struggling with a strong dollar and energy companies' expenditure cuts. Factory orders fell by 1.0% after the 2.1% decline in August.

Meanwhile the index of U.S. economic optimism calculated by Investor's Business Daily and TechnoMetrica Institute of Policy and Politics declined to 45.5 in November from 47.3 in October. The latest reading is 2.5 points below the index's 12-month average (48.0 points) and 3.6 points below the average throughout the history of the index (49.1).

Investors are waiting for U.S. jobs data. A strong report could intensify expectations for a rate hike in December.

This morning in Asia Hong Kong Hang Seng rose 2.48%, or 559.70, to 23,128.13. China Shanghai Composite Index gained 2.70%, or 89.66, to 3.406.36. The Nikkei 225 rose 1.84%, or 344.09, to 19,027.33.

Asian indices advanced. Japanese stocks climbed on the biggest initial public offering in the country since 1998. Market participants are closely watching IPO of Japan Post ignoring other factors. Stocks of Japan Post Holdings Co. and its financial units jumped 14%.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.