- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 02-11-2015

(raw materials / closing price /% change)

Oil 46.26 +0.26%

Gold 1,133.60 -0.20%

(index / closing price / change items /% change)

Nikkei 225 18,683.24 -399.86 -2.10 %

Hang Seng 22,370.04 -270.00 -1.19 %

Shanghai Composite 3,325.08 -57.48 -1.70 %

FTSE 100 6,361.8 +0.71 +0.01 %

CAC 40 4,916.21 +18.55 +0.38 %

Xetra DAX 10,950.67 +100.53 +0.93 %

S&P 500 2,104.05 +24.69 +1.19 %

NASDAQ Composite 5,127.15 +73.40 +1.45 %

Dow Jones 17,828.76 +165.22 +0.94 %

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1015 +0,09%

GBP/USD $1,5415 -0,07%

USD/CHF Chf0,9862 -0,14%

USD/JPY Y120,75 +0,12%

EUR/JPY Y133,00 +0,20%

GBP/JPY Y186,12 +0,03%

AUD/USD $0,7144 +0,13%

NZD/USD $0,6743 -0,49%

USD/CAD C$1,3093 +0,14%

(time / country / index / period / previous value / forecast)

03:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction October 59.9 58.8

15:00 U.S. Factory Orders September -1.7% -0.9%

19:00 Eurozone ECB President Mario Draghi Speaks

20:30 U.S. Total Vehicle Sales, mln October 18.2 17.7

21:45 New Zealand Employment Change, q/q Quarter III 0.3%

21:45 New Zealand Unemployment Rate Quarter III 5.9%

22:30 Australia AIG Services Index October 52.3

Major U.S. stock-indexes rose on Monday as PMI data in key countries pointed to slowing but stabilizing manufacturing activity globally, and as healthcare stocks rose to their highest in a week. U.S. factory activity slowed in October. But, while the Institute for Supply Management's national manufacturing index slipped to 50.1, it was ahead of the expected reading of 50.0.

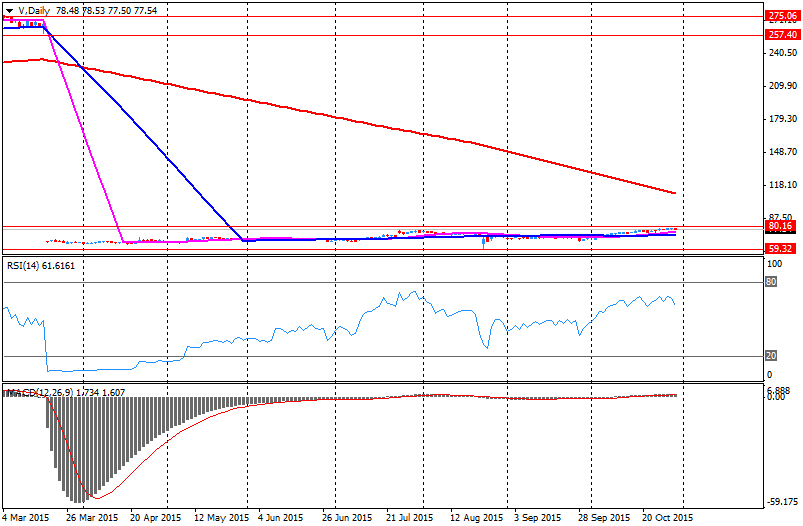

Most of Dow stocks in positive area (21 of 30). Top looser - Visa Inc. (V, -3.27%). Top gainer - Pfizer Inc. (PFE, +3.59%).

Most of S&P index sectors in positive area. Top gainer - Healthcare (+1,7%). Top looser - Utilities (-0.5%).

At the moment:

Dow 17670.00 +76.00 +0.43%

S&P 500 2086.50 +12.75 +0.61%

Nasdaq 100 4677.00 +33.75 +0.73%

Oil 46.23 -0.36 -0.77%

Gold 1135.30 -6.10 -0.53%

U.S. 10yr 2.18 +0.03

Stock indices closed higher on the better-than-expected manufacturing purchasing managers' index (PMI) from the Eurozone. Markit Economics released its final manufacturing PMI for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.3 in October from 52.0 in September, up from the preliminary reading of 52.0.

"The eurozone manufacturing recovery remains disappointingly insipid. The October survey is signalling factory output growth of only 2% per annum, a lacklustre performance given the amount of central bank stimulus in place," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) declined to 52.1 in September from 52.3 in September, up from the preliminary reading of 51.6.

The decline was driven by a slower production and employment growth.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) remains at 50.6 in October, down from the preliminary reading of 50.7.

Output and new orders increased, while employment declined at the fastest pace since December 2014.

European Central Bank (ECB) Governing Council member Ewald Nowotny said in an interview with the Austrian newspaper Kleine Zeitung newspaper on Monday that the central bank should add further stimulus measures to boost the inflation in the Eurozone. But he added that there has been made no decision by the ECB.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. climbed to 55.5 in October from 51.8 in September, beating expectations for a fall to 51.3. September's figure was revised up from 51.5.

A reading above 50 indicates expansion.

The increase was driven by rises in output and new orders.

"The start of the final quarter saw UK manufacturing spring back into life and record its best month of factory output growth since June 2014. The revival provides a tentative suggestion that the manufacturers are pulling out of their recent funk, having been dogged by recession since the start of the year, and may help boost economic growth in the fourth quarter," Markit's Senior Economist Rob Dobson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,361.8 +0.71 +0.01 %

DAX 10,950.67 +100.53 +0.93 %

CAC 40 4,916.21 +18.55 +0.38 %

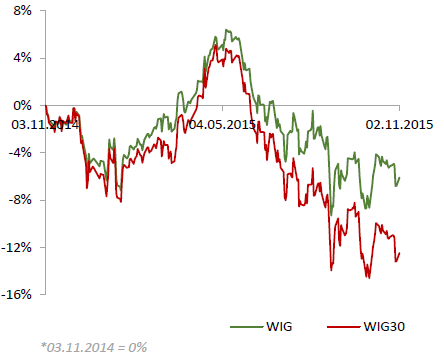

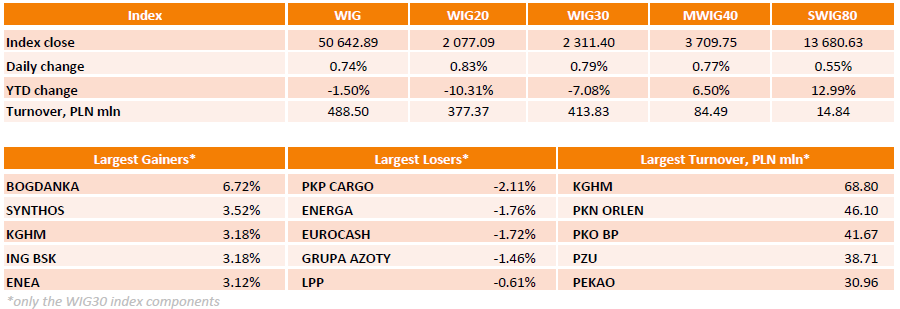

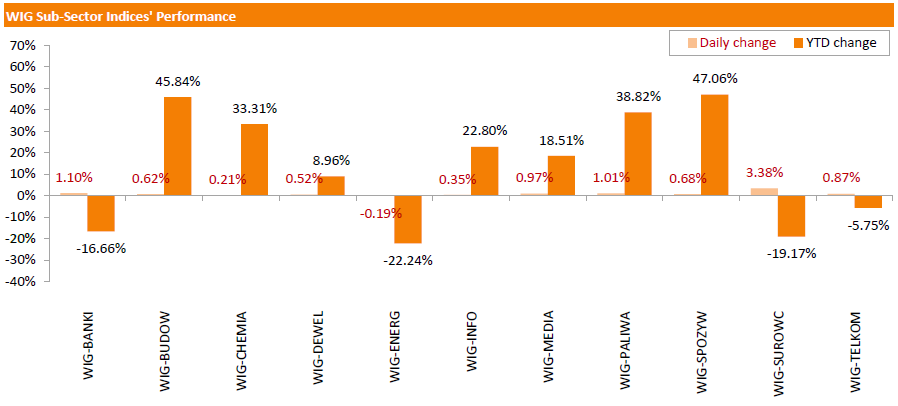

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, rose by 0.74%. All sectors, but for utilities (-0.19%), did well with materials names (+3.38%) outperforming.

Large-cap stocks benchmark, the WIG30 Index, added 0.79%. In the index basket, BOGDANKA (WSE: LWB) led the way up with a 6.72% gain, rebounding from the previous week's sharp decline. It was followed by SYNTHOS (WSE: SNS), ING BSK (WSE: ING), KGHM (WSE: KGH) and ENEA (WSE: ENA), advancing 3.12%-3.52%. On the other side of the ledger, PKP CARGO (WSE: PKP) was the weakest name, plunging by 2.11%. Other major underperformers were ENERGA (WSE: ENG), EUROCASH (WSE: EUR) and GRUPA AZOTY (WSE: ATT), declining by 1.46%-1.76%.

The Australian Bureau of Statistics released its building permits data on Monday. Building permits in Australia rose 2.2% in September, exceeding expectations for a 2.0% gain, after a 9.5% drop in August. August's figure was revised down from a 6.9% decrease.

Building permits for private sector houses declined 1.9% in September, while building permits for private sector dwellings excluding houses jumped 6.1%.

The seasonally adjusted estimate of the value of total building approved was down 2.1% in September.

On a yearly basis, building permits climbed 21.4% in September, after a 5.1% increase in August.

Oil prices fell on the Chinese economic data and on oil output data from Russia. Russia produced 10.78 million barrels per day in October. The country tries to defend its market share.

The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) rose to 48.3 in October from 47.2 in September, exceeding expectations for a rise to 47.5. A reading below 50 indicates contraction of activity. The index was driven by a slower contraction of new business.

Market participants also eyed the U.S. rigs data. The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 16 rigs to 578 last week. It was the ninth consecutive decrease and the lowest level since June 18, 2010. Combined oil and gas rigs declined by 12 to 775. It was the lowest level since April 2002.

WTI crude oil for December delivery decreased to $46.04 a barrel on the New York Mercantile Exchange.

Brent crude oil for December fell to $48.83 a barrel on ICE Futures Europe.

Gold price decline on speculation that the Fed will start raising its interest rate this year. The Fed released its interest rate decision last Wednesday. The Fed kept its interest rate unchanged at 0.00%-0.25%. This decision was widely expected by analysts.

The Fed pointed out that an interest rate hike in December is still on the table.

Market participants eyed the U.S. economic data. The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 50.1 in October from 50.2 in September, beating expectations for a fall to 50.0. It was the lowest level since May of 2013.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. final manufacturing purchasing managers' index (PMI) increased to 54.1 in October from 53.1 in September, up from the previous estimate of 54.0.

December futures for gold on the COMEX today declined to 1134.80 dollars per ounce.

European Central Bank (ECB) President Mario Draghi said in an interview with the Italian newspaper the Italian daily Il Sole 24 Ore published on Saturday that the central bank is ready to expand its stimulus measures if there will be a risk to its medium-term inflation target.

"If we are convinced that our medium-term inflation target is at risk, we will take the necessary actions," he said.

Draghi noted that the inflation in the Eurozone is likely to remain close to zero until the beginning of next year.

The ECB president pointed out that there are risks to the Eurozone's growth from the slowdown in emerging economies.

"Global growth forecasts have been revised downwards. This slowdown is probably not temporary," Draghi said.

The European Central Bank (ECB) purchased €10.57 billion of government and agency bonds under its quantitative-easing program last week.

The European Central Bank's (ECB) President Mario Draghi said at a press conference in October that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €3.01 billion of covered bonds, while holdings of asset-backed securities fell by €88 million.

The U.S. Commerce Department released construction spending data on Monday. Construction spending in the U.S. rose 0.6% in September, exceeding expectations for a 0.5% gain, after a 0.7% increase in August.

The increase was mainly driven by a rise in private residential construction. Spending on private residential construction climbed 1.9% in September.

Spending on private non-residential construction projects decreased 0.1% in September, while public construction spending increased 0.7%.

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 50.1 in October from 50.2 in September, beating expectations for a fall to 50.0. It was the lowest level since May of 2013.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in production. The employment index was down to 47.6 in October from 50.5 in September.

The production index increased to 52.9 in October from 51.8 in September.

The new orders index rose to 52.9 in October from 50.1 in September.

The price index was up to 39.0 in October from 38.0 in September.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. final manufacturing purchasing managers' index (PMI) increased to 54.1 in October from 53.1 in September, up from the previous estimate of 54.0.

A reading above 50 indicates expansion in economic activity.

The index was driven by rises in output, new orders and employment levels.

"With inflationary pressures remaining very subdued and signs of the slowdown persisting into the fourth quarter in the larger service sector, the policy outlook is by no means certain and debate about whether the economy yet needs higher interest rates will no doubt remain intense," Markit's Chief Economist Chris Williamson said.

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 18,683.24 -399.86 -2.10%

Hang Seng 22,370.04 -270.00 -1.19%

Shanghai Composite 3,326.49 -56.08 -1.66%

FTSE 6,343.15 -17.94 -0.28%

CAC 4,912.58 +14.92 +0.30%

DAX 10,930.43 +80.29 +0.74%

Crude oil $45.87 (-1.55%)

Gold $1137.80 (-0.32%)

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland climbed to 50.7 in October from 49.5 in September, exceeding expectations for an increase to 50.2.

A reading above 50 indicates contraction.

The increase was largely driven by a rise in production. The production increased to 53.7 in October from 49.1 in September.

Purchase prices increased to 36.1 in October from 35.1 in September, while the backlog of orders sub-index fell to 51.2 from 51.5.

Employment rose to 44.0 in October from 43.6 in September.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Greece on Monday. Greece's manufacturing purchasing managers' index (PMI) climbed to 47.3 in October from 43.3 in September.

The contraction of production eased in October, while job shedding also eased.

"Overall, the lack of capital circulating through the economy continued to take its toll on operating conditions at Greek manufacturers. However, the economic decline appears to be slowing to a more stable pace," Markit economist Samuel Agass said.

(company / ticker / price / change, % / volume)

| Pfizer Inc | PFE | 34.15 | 0.98% | 30.6K |

| Twitter, Inc., NYSE | TWTR | 28.69 | 0.81% | 42.0K |

| Walt Disney Co | DIS | 114.25 | 0.45% | 0.6K |

| Starbucks Corporation, NASDAQ | SBUX | 62.80 | 0.37% | 5.2K |

| International Paper Company | IP | 42.80 | 0.26% | 1.0K |

| Apple Inc. | AAPL | 119.80 | 0.25% | 114.7K |

| ALCOA INC. | AA | 8.95 | 0.22% | 11.0K |

| Microsoft Corp | MSFT | 52.75 | 0.21% | 3.5K |

| Facebook, Inc. | FB | 102.15 | 0.18% | 34.1K |

| Merck & Co Inc | MRK | 54.75 | 0.16% | 0.3K |

| Johnson & Johnson | JNJ | 101.14 | 0.11% | 1.1K |

| General Electric Co | GE | 28.95 | 0.10% | 5.7K |

| Google Inc. | GOOG | 711.18 | 0.05% | 0.2K |

| Amazon.com Inc., NASDAQ | AMZN | 626.18 | 0.04% | 8.0K |

| Verizon Communications Inc | VZ | 46.88 | 0.00% | 2.2K |

| Deere & Company, NYSE | DE | 78.00 | 0.00% | 2.5K |

| Tesla Motors, Inc., NASDAQ | TSLA | 206.90 | -0.01% | 3.2K |

| Citigroup Inc., NYSE | C | 53.16 | -0.02% | 1.0K |

| Wal-Mart Stores Inc | WMT | 57.21 | -0.05% | 2.7K |

| Caterpillar Inc | CAT | 72.90 | -0.12% | 1.4K |

| Barrick Gold Corporation, NYSE | ABX | 7.68 | -0.13% | 10.6K |

| Yahoo! Inc., NASDAQ | YHOO | 35.52 | -0.28% | 1.4K |

| Exxon Mobil Corp | XOM | 82.30 | -0.53% | 9.0K |

| Intel Corp | INTC | 33.62 | -0.71% | 17.8K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.68 | -0.76% | 2.6K |

| Visa | V | 76.25 | -1.71% | 154.9K |

| Yandex N.V., NASDAQ | YNDX | 15.80 | -1.86% | 1.2K |

| Hewlett-Packard Co. | HPQ | 12.30 | -54.38% | 1.7K |

Upgrades:

Downgrades:

Other:

Hewlett-Packard (HPQ) target lowered to $13 from $35 at RBC Capital Mkts

Hewlett-Packard (HPQ) initiated with a Outperform at Credit Suisse; target $19

Hewlett-Packard (HPQ) initiated with a Buy at Needham; target $14.50

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Spain on Monday. Spain's manufacturing purchasing managers' index (PMI) declined to 51.3 in October from 51.7 in September. It was the lowest level since December 2013.

The decline was driven by a slower pace of production growth and a decline in input prices.

"It's looking like a low key end to the year for the Spanish manufacturing sector as growth rates for output, new orders and employment have all slowed to a crawl in recent months. The forthcoming election is likely resulting in some caution among firms and clients alike as they wait to see the outcome of the December vote," a senior economist at Markit Andrew Harker said.

USD/JPY 120.00 (USD 1.14bln) 120.50 (777m) 121.00 (228m)

EUR/USD 1.1000 (EUR 1.3bln) 1.1130 (1.15bln)

GBP/USD nothing of note

USD/CHF 0.9770 (USD 254m) 0.9950 (300m)

USD/CAD 1.3110 (260m) 1.3210 (208m)

AUD/USD 0.7200 (AUD 1.56bln)

NZD/USD 0.6800 (NZD 250m)

EUR/JPY 133.00 (EUR 642m)

AUD/JPY 86.67 (AUD 218m)

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Italy on Monday. Italy's manufacturing purchasing managers' index (PMI) climbed to 54.1 in October from 52.7 in September.

The increase was driven by rises in output and new orders.

"Latest PMI data showed the upturn in the manufacturing sector regain some momentum at the start of the fourth quarter, with October seeing stronger rises in output, new orders and employment. Encouragingly, according to panel member reports sources of growth were both domestic and international, boding well for the sustainability of the recovery," Markit economist Phil Smith said.

November 2

Before the Open:

Visa (V). Consensus EPS $0.63, Consensus Revenue $3562.94

After the Close:

American Intl (AIG). Consensus EPS $1.01, Consensus Revenue $14314.00

November 3

After the Close:

Tesla Motors (TSLA). Consensus EPS $-0.60, Consensus Revenue $1253.10

November 4

After the Close:

Facebook (FB). Consensus EPS $0.52, Consensus Revenue $4369.16

November 5

After the Close:

Walt Disney (DIS). Consensus EPS $1.14, Consensus Revenue $13526.76

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Building Permits, m/m September -9.5% Revised From -6.9% 2% 2.2%

01:35 Japan Manufacturing PMI (Finally) October 52.5 Revised From 51.0 52.5 52.4

01:45 China Markit/Caixin Manufacturing PMI October 47.2 47.5 48.3

08:15 Switzerland Retail Sales (MoM) September 0.5% 0.1%

08:15 Switzerland Retail Sales Y/Y September -0.6% Revised From -0.3% 0.2%

08:30 Switzerland Manufacturing PMI October 49.5 50.2 50.7

08:50 France Manufacturing PMI (Finally) October 50.6 50.7 50.6

08:55 Germany Manufacturing PMI (Finally) October 52.3 51.6 52.1

09:00 Eurozone Manufacturing PMI (Finally) October 52 52.0 52.3

09:30 United Kingdom Purchasing Manager Index Manufacturing October 51.8 Revised From 51.5 51.3 55.5

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The final manufacturing purchasing managers' index is expected to rise to 54.0 in October from 53.1 in September.

The ISM manufacturing purchasing managers' index is expected to fall to 50.0 in October from 50.2 in September.

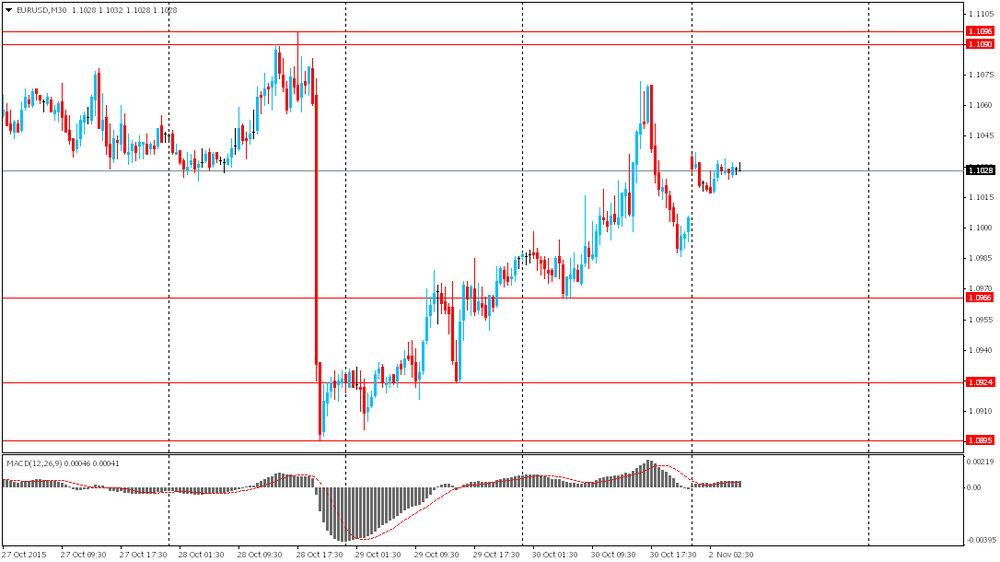

The euro traded mixed against the U.S. dollar after the release of the better-than-expected manufacturing purchasing managers' index (PMI) from the Eurozone. Markit Economics released its final manufacturing PMI for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.3 in October from 52.0 in September, up from the preliminary reading of 52.0.

"The Eurozone manufacturing recovery remains disappointingly insipid. The October survey is signalling factory output growth of only 2% per annum, a lacklustre performance given the amount of central bank stimulus in place," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) declined to 52.1 in September from 52.3 in September, up from the preliminary reading of 51.6.

The decline was driven by a slower production and employment growth.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) remains at 50.6 in October, down from the preliminary reading of 50.7.

Output and new orders increased, while employment declined at the fastest pace since December 2014.

European Central Bank (ECB) Governing Council member Ewald Nowotny said in an interview with the Austrian newspaper Kleine Zeitung newspaper on Monday that the central bank should add further stimulus measures to boost the inflation in the Eurozone. But he added that there has been made no decision by the ECB.

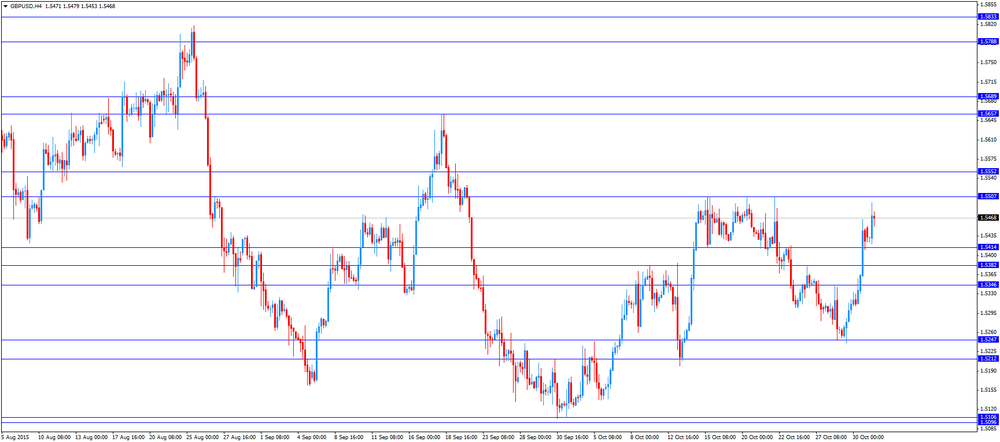

The British pound traded higher against the U.S. dollar after the better-than-expected manufacturing PMI data from the U.K. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. climbed to 55.5 in October from 51.8 in September, beating expectations for a fall to 51.3. September's figure was revised up from 51.5.

A reading above 50 indicates expansion.

The increase was driven by rises in output and new orders.

"The start of the final quarter saw UK manufacturing spring back into life and record its best month of factory output growth since June 2014. The revival provides a tentative suggestion that the manufacturers are pulling out of their recent funk, having been dogged by recession since the start of the year, and may help boost economic growth in the fourth quarter," Markit's Senior Economist Rob Dobson said.

The Swiss franc traded mixed against the U.S. dollar after of the release of the positive Swiss economic data. The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland were up at an annual rate of 0.2% in September, after a 0.6% drop in August. August's figure was revised down from a 0.3% fall.

On a monthly basis, retail sales increased by 0.1% in September.

Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland climbed to 50.7 in October from 49.5 in September, exceeding expectations for an increase to 50.2.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair was up to $1.5496

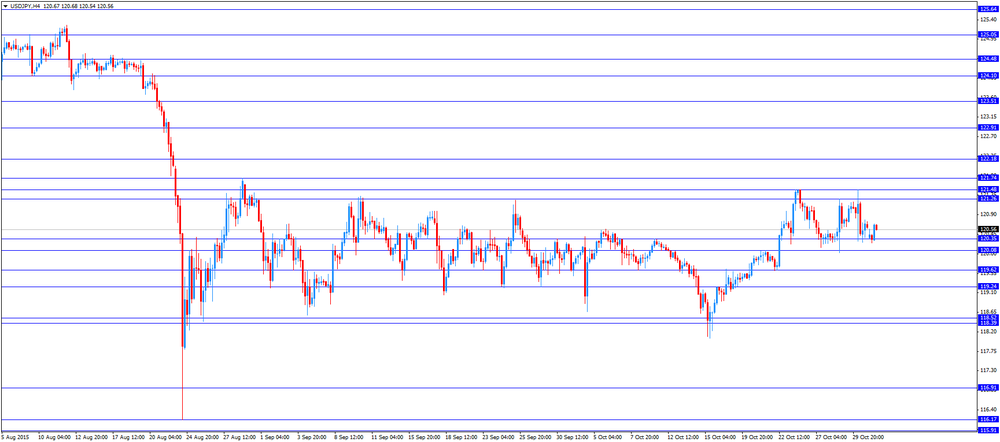

USD/JPY: the currency pair increased to Y120.69

The most important news that are expected (GMT0):

14:45 U.S. Manufacturing PMI (Finally) October 53.1 54

15:00 U.S. Construction Spending, m/m September 0.7% 0.5%

15:00 U.S. ISM Manufacturing October 50.2 50

17:00 U.S. FOMC Member Williams Speaks

EUR/USD

Offers 1.1050 1.1075-80 1.1100 1.1130 1.1150 1.1165 1.1180 1.1200

Bids 1.1020 1.1000 1.0980 1.0950 1.0920 1.0900 1.0885 1.0850

GBP/USD

Offers 1.5465 1.5480-85 1.5500-10 1.5530 1.5550

Bids 1.5400 1.5380 1.5350 1.5325-30 1.5300 1.52 85 1.5250

EUR/GBP

Offers 0.7170 0.7185 0.7200 0.7220-25 0.7250 0.7275-80 0.7300

Bids 0.7135-40 0.7120 0.7100 0.7085 0.7050 0.7030 0.7000

EUR/JPY

Offers 133.20 133.50-60 133.75-80 134.00 134.25 134.50 134.80 135.00

Bids 132.80 132.60 132.00 131.80 131.50 131.30 131.00

USD/JPY

Offers 120.75-80 121.00 121.20 121.35 121.50 121.80 122.00

Bids 120.40 120.20-25 120.00 119.80-85 119.50 119.25-30 119.00

AUD/USD

Offers 0.7160 0.7180 0.720 0.7220 0.7250 0.7265 0.7280-85 0.7300

Bids 0.7100-05 0.7080 0.7065 0.7050 0.7030 0.7000 0.6985 0.6960 0.6930 0.6900

Stock indices traded mixed on the better-than-expected manufacturing purchasing managers' index (PMI) from the Eurozone. Markit Economics released its final manufacturing PMI for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.3 in October from 52.0 in September, up from the preliminary reading of 52.0.

"The eurozone manufacturing recovery remains disappointingly insipid. The October survey is signalling factory output growth of only 2% per annum, a lacklustre performance given the amount of central bank stimulus in place," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) declined to 52.1 in September from 52.3 in September, up from the preliminary reading of 51.6.

The decline was driven by a slower production and employment growth.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) remains at 50.6 in October, down from the preliminary reading of 50.7.

Output and new orders increased, while employment declined at the fastest pace since December 2014.

European Central Bank (ECB) Governing Council member Ewald Nowotny said in an interview with the Austrian newspaper Kleine Zeitung newspaper on Monday that the central bank should add further stimulus measures to boost the inflation in the Eurozone. But he added that there has been made no decision by the ECB.

Earlier, stock markets fell on the Chinese economic data. The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) rose to 48.3 in October from 47.2 in September, exceeding expectations for a rise to 47.5.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. climbed to 55.5 in October from 51.8 in September, beating expectations for a fall to 51.3. September's figure was revised up from 51.5.

A reading above 50 indicates expansion.

The increase was driven by rises in output and new orders.

"The start of the final quarter saw UK manufacturing spring back into life and record its best month of factory output growth since June 2014. The revival provides a tentative suggestion that the manufacturers are pulling out of their recent funk, having been dogged by recession since the start of the year, and may help boost economic growth in the fourth quarter," Markit's Senior Economist Rob Dobson said.

Current figures:

Name Price Change Change %

FTSE 100 6,343.03 -18.06 -0.28 %

DAX 10,923.62 +73.48 +0.68 %

CAC 40 4,914.86 +17.20 +0.35 %

European Central Bank (ECB) Governing Council member Ewald Nowotny said in an interview with the Austrian newspaper Kleine Zeitung newspaper on Monday that the central bank should add further stimulus measures to boost the inflation in the Eurozone. But he added that there has been made no decision by the ECB.

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland were up at an annual rate of 0.2% in September, after a 0.6% drop in August. August's figure was revised down from a 0.3% fall.

Sales of food, beverages and tobacco climbed at an annual rate of 2.0% in September, while non-food sales rose 0.4%.

On a monthly basis, retail sales increased by 0.1% in September.

Sales of food, beverages and tobacco rose 1.0% in September, while non-food sales declined 0.4%.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) remains at 50.6 in October, down from the preliminary reading of 50.7.

Output and new orders increased, while employment declined at the fastest pace since December 2014.

"Although remaining inside expansion territory, growth continues to be fragile. The fact that employment fell at the sharpest rate in ten months suggests that firms are hardly gearing up for a sustained upturn," Markit Senior Economist Jack Kennedy said.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's final manufacturing purchasing managers' index (PMI) declined to 52.1 in September from 52.3 in September, up from the preliminary reading of 51.6.

The decline was driven by a slower production and employment growth.

"There are some warning signs in the data set. In particular, stocks of finished goods rose for the first time in a year, suggesting that a future rise in demand could be satisfied by using existing stock, rather than scaling up production levels," Markit economist Oliver Kolodseike said.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.3 in October from 52.0 in September, up from the preliminary reading of 52.0.

"The eurozone manufacturing recovery remains disappointingly insipid. The October survey is signalling factory output growth of only 2% per annum, a lacklustre performance given the amount of central bank stimulus in place," Chris Williamson, Chief Economist at Markit said.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. climbed to 55.5 in October from 51.8 in September, beating expectations for a fall to 51.3. September's figure was revised up from 51.5.

A reading above 50 indicates expansion.

The increase was driven by rises in output and new orders.

"The start of the final quarter saw UK manufacturing spring back into life and record its best month of factory output growth since June 2014. The revival provides a tentative suggestion that the manufacturers are pulling out of their recent funk, having been dogged by recession since the start of the year, and may help boost economic growth in the fourth quarter," Markit's Senior Economist Rob Dobson said.

The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) rose to 48.3 in October from 47.2 in September, exceeding expectations for a rise to 47.5.

A reading below 50 indicates contraction of activity.

The index was driven by a slower contraction of new business.

"The slight upswing shows the manufacturing industry's overall weakening has slowed down, indicating that previous stimulating measures have begun to take effect. Weak aggregate demand remained the biggest obstacle to economic growth, and the risk of deflation resulting from the continued fall in the prices of bulk commodities needs attention," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan increased to 52.4 in October from 51.0 in September, down from the preliminary reading of 52.5.

A reading below 50 indicates contraction of activity.

The index was driven by a rise in new orders.

"Operating conditions at Japanese manufacturers improved substantially at the start of the final quarter of 2015. Growth in production accelerated to the fastest since February, underpinned by a sharp rise in total new orders," economist at Markit, Amy Brownbill, said.

Ratings agency Standard & Poor's (S&P) on Friday lowered Saudi Arabia' credit rating to A+ from AA-. The outlook is negative.

The agency noted falling oil prices will lead to a wider government deficit. According to S&P, the country's deficit could rise to 16% of gross domestic product (GDP) this year from 1.5% in 2014.

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 16 rigs to 578 last week. It was the ninth consecutive decrease and the lowest level since June 18, 2010.

Combined oil and gas rigs declined by 12 to 775. It was the lowest level since April 2002.

According to The Wall Street Journal poll, 13 investment banks expect Brent crude oil price will average $58 a barrel and West Texas Intermediate (WTI) crude oil price will average $54 a barrel next year.

Many of these banks forecasted crude oil price above $70 a barrel a few months ago.

USD/JPY 120.00 (USD 1.14bln) 120.50 (777m) 121.00 (228m)

EUR/USD 1.1000 (EUR 1.3bln) 1.1130 (1.15bln)

GBP/USD nothing of note

USD/CHF 0.9770 (USD 254m) 0.9950 (300m)

USD/CAD 1.3110 (260m) 1.3210 (208m)

AUD/USD 0.7200 (AUD 1.56bln)

NZD/USD 0.6800 (NZD 250m)

EUR/JPY 133.00 (EUR 642m)

AUD/JPY 86.67 (AUD 218m)

West Texas Intermediate futures for December delivery fell to $46.40 (-0.41%), while Brent crude is currently at $49.62 (+0.06%). Oil prices weakened after a report on Chinese manufacturing showed that economic activity contracted in the sector in October although it still posted the best result in four months. The Markit/Caixin Manufacturing Purchasing Managers' Index came in at 48.3 in October compared to expectations for a 47.5 reading and 47.2 reported previously. China is the second-biggest oil consumer in the world, that's why weak manufacturing activity in this country suggests that it will not boost demand and global markets will remain oversupplied.

Barclays said that China's oil demand growth, adjusted for inventories, slowed to 226,500 barrels per day, or 2.1%, in September compared with the same month last year, much lower than the 6.3% gain recorded for the first three quarters of the year.

"Fundamentals suggest moderate demand ahead, in our view," the bank said.

Gold is currently at $1,141.80 (+0.04%) near its open level after touching a four-week low earlier today. Expectations that the Federal Reserve can still raise interest rates till the end of the year continue weighing on this non-interest-paying asset. Higher rates would decrease demand for gold further. Gold had advanced last month on speculation that the general weakness in the global economy could persuade the central bank of the U.S. to delay the rate hike to next year, but the latest Fed monetary policy statement suggested that a rate hike in December was still possible.

Assets in SPDR Gold Trust, world's largest gold-backed exchange-traded fund, fell 0.3% to 692.26 tonnes on Friday. Physical demand remained weak.

U.S. stock indices edged down on Friday amid mixed earnings and some weaker-than-expected economic reports, but posted strong gains over the month.

The Dow Jones Industrial Average declined 92.26 points, or 0.5%, to 17663.54 (+0.1% over the week and +8.5% during October). The S&P 500 lost 10.05 points, or 0.5%, to 2079.36 (+0.2% over the week and +8.3% during October). The Nasdaq Composite fell 20.53 points, or 0.4%, to 5053.75 (+0.4% over the week and +9.4% during October).

Personal spending in the U.S. rose by 0.1% in September compared to a 0.4% increase in August and a 0.3% rise in July. Meanwhile personal income rose by 0.1%. Economists expected both indices to grow by 0.2%.

This morning in Asia Hong Kong Hang Seng fell 0.64%, or 144.39, to 22,495.65. China Shanghai Composite Index lost 0.13%, or 4.38, to 3.378.18. The Nikkei plunged 1.94%, or 370.43, to 18,712.67.

Asian indices declined after a report showed that economic activity in China's manufacturing sector contracted in October, although the pace of decline slowed down. Markit/Caixin Manufacturing Purchasing Managers' Index came in at 48.3 in October compared to expectations for a 47.5 reading and 47.2 reported previously. China's economy affects the global economy, that's why these data will influence currency markets as well.

Japanese stocks declined as many investors took profits after four consecutive sessions of gains.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Building Permits, m/m September -9.5% Revised From -6.9% 2% 2.2%

01:35 Japan Manufacturing PMI (Finally) October 52.5 Revised From 51.0 52.5 52.4

01:45 China Markit/Caixin Manufacturing PMI October 47.2 47.5 48.3

The yen rose against the U.S. dollar amid Bank of Japan monetary policy decision (board members voted 8 to 1 to leave policy unchanged) and after BOJ Governor Kuroda admitted that inflation target time frame was revised because of low oil prices. Now the 2% inflation target is expected to be reached in the second half of 2016.

The Australian and New Zealand dollars rose amid Chinese economic data. The National Bureau of Statistics reported that the Manufacturing PMI was unchanged at 49.8 in October. A reading below 50 suggests contraction. However the Markit/Caixin Manufacturing Purchasing Managers' Index came in at 48.3 in October exceeding expectations for a 47.5 reading and 47.2 reported previously. China's economy affects the global economy, that's why these data influence currency markets as well.

EUR/USD: the pair fluctuated within $1.1015-40 in Asian trade

USD/JPY: the pair fell to Y120.25

GBP/USD: the pair traded within $1.5425-55

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Retail Sales (MoM) September 0.5%

08:15 Switzerland Retail Sales Y/Y September -0.3%

08:30 Switzerland Manufacturing PMI October 49.5 50.2

08:50 France Manufacturing PMI (Finally) October 50.6 50.7

08:55 Germany Manufacturing PMI (Finally) October 52.3 51.6

09:00 Eurozone Manufacturing PMI (Finally) October 52 52.0

09:30 United Kingdom Purchasing Manager Index Manufacturing October 51.5 51.3

14:45 U.S. Manufacturing PMI (Finally) October 53.1 54

15:00 U.S. Construction Spending, m/m September 0.7% 0.5%

15:00 U.S. ISM Manufacturing October 50.2 50

17:00 U.S. FOMC Member Williams Speaks

EUR / USD

Resistance levels (open interest**, contracts)

$1.1211 (4570)

$1.1132 (3949)

$1.1074 (2071)

Price at time of writing this review: $1.1037

Support levels (open interest**, contracts):

$1.0935 (4611)

$1.0870 (5926)

$1.0830 (1626)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 53384 contracts, with the maximum number of contracts with strike price $1,1200 (4570);

- Overall open interest on the PUT options with the expiration date November, 6 is 56174 contracts, with the maximum number of contracts with strike price $1,0900 (5926);

- The ratio of PUT/CALL was 1.05 versus 1.07 from the previous trading day according to data from October, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.5701 (821)

$1.5601 (1221)

$1.5503 (2734)

Price at time of writing this review: $1.5435

Support levels (open interest**, contracts):

$1.5394 (570)

$1.5298 (2695)

$1.5199 (2865)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 21618 contracts, with the maximum number of contracts with strike price $1,5500 (2734);

- Overall open interest on the PUT options with the expiration date November, 6 is 21623 contracts, with the maximum number of contracts with strike price $1,5200 (2865);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from October, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.