- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 09-10-2015

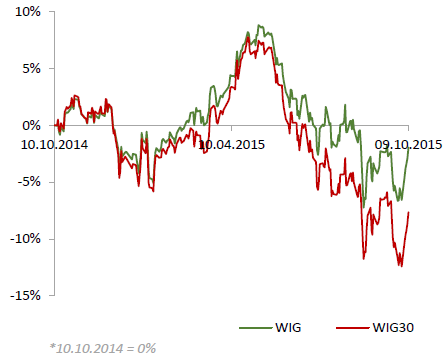

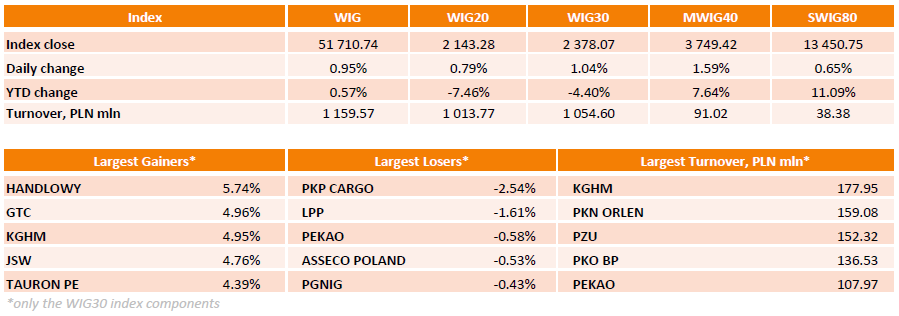

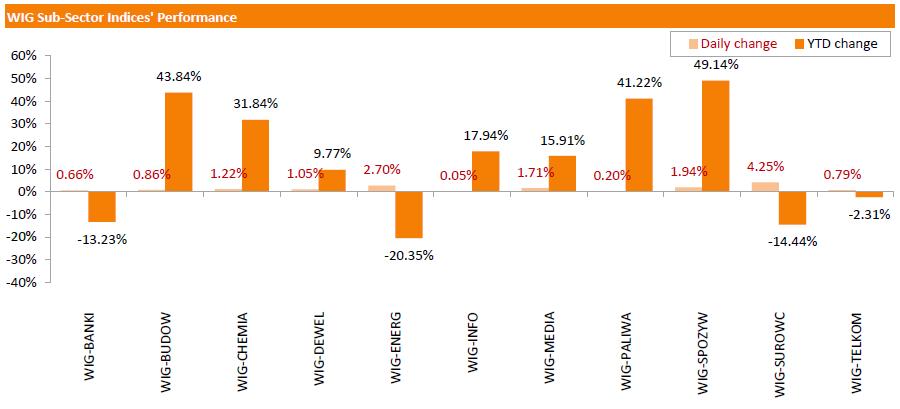

Polish equity market continued to surge on Friday. The broad market measure, the WIG index, added 0.95%. All sectors in the WIG generated positive returns, with materials (+4.25%) and utilities (+2.70%) outperforming.

The large-cap stocks' measure, the WIG30 Index, rose by 1.04%. Only seven out of the index's 30 constituents generated losses. PKP CARGO (WSE: PKP) and LPP (WSE: LPP) were the biggest laggards, slumping by 2.54% and 1.61% respectively. On the plus side, HANDLOWY (WSE: BHW) was the index's strongest advancer, climbing by 5.74%. It was followed by GTC (WSE: GTC), KGHM (WSE: KGH), JSW (WSE: JSW) and TAURON PE (WSE: TPE), jumping by 4.39%-4.96%.

Stock indices closed higher as yesterday's Fed minutes added to the speculation that the Fed may not raise its interest rates this year. FOMC members noted that the U.S. labour market continued to improve, while the inflation remained at low levels.

"After assessing the outlook for economic activity, the labour market, and inflation and weighing the uncertainties associated with the outlook, all but one member concluded that, although the U.S. economy had strengthened and labour underutilization had diminished, economic conditions did not warrant an increase in the target range for the federal funds rate at this meeting," the minutes said.

European Central Bank (ECB) President Mario Draghi said on Friday that the central bank is ready to adjust "the size, composition and duration of the asset-purchase program", adding that the central bank is closely monitoring all relevant incoming information.

He also said that the slowdown in in emerging economies is a risk to the Eurozone's economy.

Meanwhile, the economic data from the Eurozone was positive. The French statistical office Insee its industrial production figures on Friday. Industrial production in France climbed 1.6% in August, exceeding expectations for a 0.5% rise, after a 1.1% drop in July. It was the biggest increase since April 2013.

The increase was driven by a rise in manufacturing output. Manufacturing output was up 2.2% in August, while construction output increased 0.6%.

On a yearly basis, the French industrial production rose 0.6% in August, after a 0.7% gain in July.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £11.15 billion in August from £12.20 billion in July. July's figure was revised up from a deficit of £11.08 billion.

Exports of goods climbed 3.5% in August, while imports declined 0.7%.

The total trade deficit, including services, narrowed to £3.27 billion in August from £4.4 billion in July. July's figure was revised up from a deficit of £3.37 billion.

Construction output in the U.K. dropped 4.3% in August, after a 1.0% drop in July. It was the largest decline since December 2012.

The ONS said that the drop may have been driven by bad weather.

On a yearly basis, construction output fell 1.4% in August, after a 2.0% increase in July. July's figure was revised up from a 0.7% decrease.

Construction makes up 6% of UK's economy.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,416.16 +41.34 +0.65 %

DAX 10,096.6 +103.53 +1.04 %

CAC 40 4,701.39 +25.48 +0.54 %

Major U.S. stock-indexes eked out small gains on Friday, with the S&P 500 on track for its best week since December, as investors bet the Federal Reserve will keep interest rates at near-zero levels this year. Minutes of the Fed's September meeting, released on Thursday, indicated further signs of dovishness and concerns among policy-makers about a global economic slowdown weighing on the economy, even before weak September jobs data.

Dow stocks mixed (17 in negative area, 13 in positive). Top looser - Chevron Corporation (CVX, -1.15%). Top gainer - UnitedHealth Group Incorporated (UNH, +2.09%).

Most of S&P index sectors in positive area. Top looser - Financial (-0.2%). Top gainer - Conglomerates (+1,1%).

At the moment:

Dow 16977.00 +11.00 +0.06%

S&P 500 2006.75 +0.25 +0.01%

Nasdaq 100 4354.75 +10.00 +0.23%

10 Year yield 2,11% +0,00

Oil 49.84 +0.41 +0.83%

Gold 1157.90 +13.60 +1.19%

Oil prices traded mixed on profit taking.

Earlier, oil prices rose on a weaker U.S. dollar. The U.S. dollar declined on the latest Fed's minutes. The minutes added to the speculation that the Fed may not raise its interest rates this year. FOMC members noted that the U.S. labour market continued to improve, while the inflation remained at low levels.

"After assessing the outlook for economic activity, the labour market, and inflation and weighing the uncertainties associated with the outlook, all but one member concluded that, although the U.S. economy had strengthened and labour underutilization had diminished, economic conditions did not warrant an increase in the target range for the federal funds rate at this meeting," the minutes said.

Concerns over the escalation of the situation in Syria also supported oil prices. Russia continued its air strikes against Islamic State (IS) jihadists in Syria.

Market participants are awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 26 rigs to 614 last week. It was the fifth consecutive decrease and the biggest weekly fall since the week ending April 24, 2015.

WTI crude oil for November delivery rose to $49.53 a barrel on the New York Mercantile Exchange.

Brent crude oil for November declined to $51.50 a barrel on ICE Futures Europe.

Gold price increased on a weaker U.S. dollar. The U.S. dollar declined on the latest Fed's minutes. The minutes added to the speculation that the Fed may not raise its interest rates this year. FOMC members noted that the U.S. labour market continued to improve, while the inflation remained at low levels.

"After assessing the outlook for economic activity, the labour market, and inflation and weighing the uncertainties associated with the outlook, all but one member concluded that, although the U.S. economy had strengthened and labour underutilization had diminished, economic conditions did not warrant an increase in the target range for the federal funds rate at this meeting," the minutes said.

But Atlanta Fed President Dennis Lockhart reiterated on Friday that the interest rate hike by the Fed this year is still possible.

"I see a lift-off decision later this year at the October or December FOMC meetings as likely appropriate," he said.

Market participants eyed the U.S. import price index. According to the U.S. Labor Department's data on Friday, the U.S. import price index fell by 0.1% in September, beating expectations for a 0.5% decrease, after a 1.6% decline in August. August's figure was revised down from a 1.8% drop.

The decline was mainly driven by lower prices on foods, capital goods and nonfuel industrial supplies.

A stronger U.S. currency lowers the price of imported goods.

December futures for gold on the COMEX today rose to 1157.00 dollars per ounce.

The Bank of Canada released its Business Outlook Survey on Friday. The survey showed that business sentiment in Canada remains tepid overall, but "forward-looking indicators of business activity improved".

Future business expectations were supported by the positive outlook for the U.S. economy and a weaker Canadian dollar.

The outlook for many companies tied both directly and indirectly to the resource sector remained weak, due to lower commodity prices.

The Australian Bureau of Statistics released its home loans data on Friday. Home loans in Australia increased 2.9% in August, missing expectations for a 5.0% gain, after 0.3% decline in July. July's figure was revised down from 0.3% gain.

The value of home loans rose 6.1% in August, investment lending decreased 0.4%, while the number of loans for the construction of dwellings declined 0.5%.

Atlanta Fed President Dennis Lockhart reiterated on Friday that the interest rate hike by the Fed this year is still possible.

"I see a lift-off decision later this year at the October or December FOMC meetings as likely appropriate," he said.

But he added that "the data are giving off varied signals, and there is more ambiguity in the current moment than a few weeks ago".

Lockhart pointed out that consumer spending data will be important "over coming months".

The U.S. Commerce Department released wholesale inventories on Friday. Wholesale inventories in the U.S. rose 0.1% in August, beating expectations for a flat reading, after a 0.3% decrease in July. July's figure was revised down from a 0.1% fall.

The increase was driven by a rise in inventories of durable goods. Inventories of non-durable goods declined 0.2% in August as computer equipment jumped 1.9%, while inventories of durable goods gained 0.3%.

Wholesale sales fell by 1.0% in August, after a 0.3% decrease in July.

European Central Bank (ECB) President Mario Draghi said on Friday that the central bank is ready to adjust "the size, composition and duration of the asset-purchase program", adding that the central bank is closely monitoring all relevant incoming information.

He also said that the slowdown in in emerging economies is a risk to the Eurozone's economy.

"Developments surrounding the slower growth in emerging-market economies are posing renewed risks to the euro-area outlook," Draghi said.

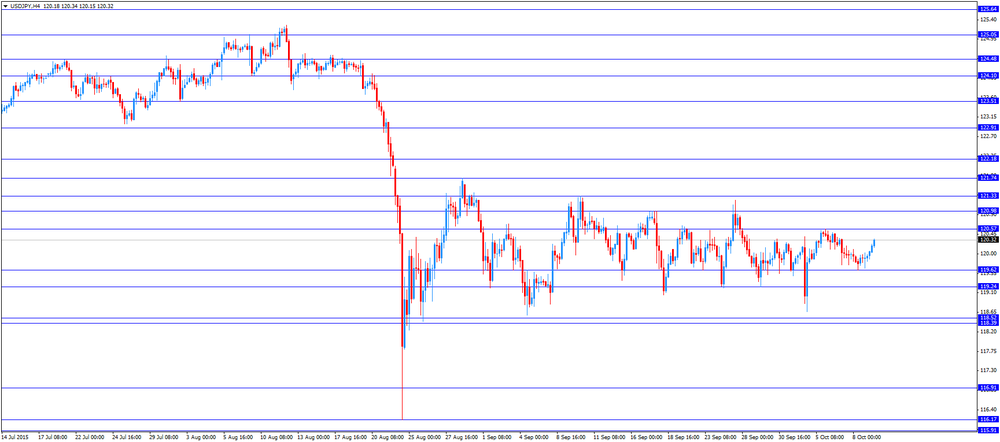

USD/JPY 120.00 (USD 1.1bln)

EUR/USD 1.1200 (EUR 530m) 1.1300 (537m)

USD/CAD 1.3200 (USD 500m)

AUD/USD 0.7100 (AUD 1bln) 0.7125 (400m) 0.7200 (720m) 0.7250 (376m)

NZD/USD 0.6500 (NZD 1bln)

AUD/JPY 85.20 (AUD 1bln)

EUR/JPY 133.00 (EUR 1.23bln) 134.50 (1.25bln)

U.S. stock-index futures futures were little changed, suppressed by disappointing results from Alcoa Inc.

Nikkei 18,438.67 +297.50 +1.64%

Hang Seng 22,458.8 +103.89 +0.46%

Shanghai Composite 3,183.52 +40.16 +1.28%

FTSE 6,442.07 +67.25 +1.05%

CAC 4,726.94 +51.03 +1.09%

DAX 10,122.56 +129.49 +1.30%

Crude oil $50.17 (+1.50%)

Gold $1153.30 (+0.78%)

The U.S. Labor Department released its import and export prices data on Friday. The U.S. import price index fell by 0.1% in September, beating expectations for a 0.5% decrease, after a 1.6% decline in August. August's figure was revised down from a 1.8% drop.

The decline was mainly driven by lower prices on foods, capital goods and nonfuel industrial supplies.

A stronger U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.7% in September, after a 1.4% fall in August.

(company / ticker / price / change, % / volume)

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.10 | 4.75% | 232.5K |

| Barrick Gold Corporation, NYSE | ABX | 7.47 | 4.33% | 23.1K |

| Yandex N.V., NASDAQ | YNDX | 12.25 | 2.08% | 5.2K |

| Twitter, Inc., NYSE | TWTR | 30.78 | 1.52% | 52.2K |

| Exxon Mobil Corp | XOM | 80.83 | 1.00% | 7.3K |

| Chevron Corp | CVX | 90.70 | 0.88% | 1.7K |

| Walt Disney Co | DIS | 105.40 | 0.76% | 4.4K |

| Facebook, Inc. | FB | 93.12 | 0.70% | 57.8K |

| Nike | NKE | 125.75 | 0.67% | 4.5K |

| JPMorgan Chase and Co | JPM | 62.50 | 0.60% | 1.1K |

| Citigroup Inc., NYSE | C | 51.93 | 0.54% | 16.9K |

| Visa | V | 74.25 | 0.47% | 1K |

| Ford Motor Co. | F | 15.06 | 0.47% | 3.0K |

| Apple Inc. | AAPL | 110.00 | 0.46% | 131.9K |

| Wal-Mart Stores Inc | WMT | 67.15 | 0.40% | 0.4K |

| Johnson & Johnson | JNJ | 95.42 | 0.36% | 1.1K |

| Starbucks Corporation, NASDAQ | SBUX | 59.65 | 0.32% | 5.4K |

| Microsoft Corp | MSFT | 47.59 | 0.30% | 11.0K |

| General Motors Company, NYSE | GM | 33.53 | 0.30% | 2.1K |

| Caterpillar Inc | CAT | 72.03 | 0.26% | 0.8K |

| Cisco Systems Inc | CSCO | 27.98 | 0.25% | 3.1K |

| Intel Corp | INTC | 32.60 | 0.25% | 7.8K |

| Yahoo! Inc., NASDAQ | YHOO | 32.45 | 0.25% | 10.8K |

| Verizon Communications Inc | VZ | 44.33 | 0.23% | 0.9K |

| UnitedHealth Group Inc | UNH | 116.33 | 0.22% | 0.8K |

| Google Inc. | GOOG | 640.50 | 0.21% | 0.4K |

| Procter & Gamble Co | PG | 74.53 | 0.17% | 0.2K |

| International Business Machines Co... | IBM | 152.51 | 0.15% | 0.1K |

| Amazon.com Inc., NASDAQ | AMZN | 533.94 | 0.15% | 7.3K |

| ALTRIA GROUP INC. | MO | 56.45 | 0.14% | 258.6K |

| Deere & Company, NYSE | DE | 81.00 | 0.11% | 0.6K |

| Hewlett-Packard Co. | HPQ | 29.20 | 0.07% | 24.8K |

| McDonald's Corp | MCD | 102.95 | 0.00% | 0.3K |

| The Coca-Cola Co | KO | 41.98 | 0.00% | 1.7K |

| General Electric Co | GE | 27.98 | -0.18% | 15.5K |

| American Express Co | AXP | 77.00 | -0.23% | 0.2K |

| AT&T Inc | T | 33.32 | -0.24% | 2.6K |

| United Technologies Corp | UTX | 94.01 | -0.34% | 142.9K |

| Tesla Motors, Inc., NASDAQ | TSLA | 220.50 | -2.74% | 96.5K |

| ALCOA INC. | AA | 10.66 | -3.18% | 922.7K |

Statistics Canada released the labour market data on Friday. Canada's unemployment rate rose to 7.1% in September from 7.0% in August. It was the highest level since February 2014.

Analysts had expected the unemployment rate to decline 6.9%.

The increase was driven by higher labour participation. The labour participation rate remained unchanged at 65.9% in September, but the size of the labour force climbed.

The number of employed people climbed by 12,100 jobs in September, beating expectations for a decline of 10,000 jobs, after a 12,000 increase in August.

The increase was driven by a rise in part-time work. Full-time employment was down by 62,000 in September, while part-time employment increased by 74,000 jobs.

The Bank of Canada monitors closely the labour participation rate.

Upgrades:

Downgrades:

Tesla Motors (TSLA) downgraded to Underweight from Equal Weight at Barclays; target to $180 from $190

Other:

Alcoa (AA) reiterated at Buy at Stifel; target lowered to $15 from $18

Alcoa (AA) reiterated at Sector Perform at RBC Capital Mkts; target raised to $14 from $12

!YAHOO (YHOO) target lowered to $40 from $55 at Needham

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Friday. Greek industrial production climbed 4.1% in August.

On a yearly basis, industrial production in Greece jumped at an adjusted rate of 4.5% in August, after a 1.7% fall in July. July's figure was revised up from a 1.6% decrease.

Production in the manufacturing sector rose at an annual rate of 7.8% in August, output in the mining and quarrying sector slid 1.7%, while electricity production dropped by 2.7%.

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Friday. Greek consumer prices increased 1.8% in September, after the 0.4% drop in August.

On a yearly basis, the Greek consumer price index declined 1.7% in September, after a 1.5 fall in August. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 7.4% in September, transport costs dropped by 5.8%, clothing and footwear prices declined 4.9%, while household equipment prices were down 2.5%.

Prices of food and non-alcoholic beverages increased at an annual rate of 3.7% in September, while alcoholic beverages and tobacco prices climbed by 2.4%.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans August -0.3% Revised From 0.3% 5% 2.9%

06:45 France Industrial Production, m/m August -1.1% Revised From -0.8% 0.5% 1.6%

06:45 France Industrial Production, y/y August 0.7% 0.6%

08:30 United Kingdom Total Trade Balance August -4.4 Revised From -3.37 -3.27

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

Yesterday's minutes of the Fed's latest meeting weighed on the greenback. The Fed said that it wanted to have more time to see if the slowdown in the global economy will have a negative effect on the U.S. economy.

Most Federal Open Market Committee (FOMC) members expect the Fed to start raising its interest rate this year.

FOMC members noted that the U.S. labour market continued to improve, while the inflation remained at low levels.

The euro traded higher against the U.S. dollar after the positive industrial production data from France. The French statistical office Insee its industrial production figures on Friday. Industrial production in France climbed 1.6% in August, exceeding expectations for a 0.5% rise, after a 1.1% drop in July. It was the biggest increase since April 2013.

The increase was driven by a rise in manufacturing output. Manufacturing output was up 2.2% in August, while construction output increased 0.6%.

On a yearly basis, the French industrial production rose 0.6% in August, after a 0.7% gain in July.

The British pound traded lower against the U.S. dollar after the mixed U.K. economic data. The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £11.15 billion in August from £12.20 billion in July. July's figure was revised up from a deficit of £11.08 billion.

Exports of goods climbed 3.5% in August, while imports declined 0.7%.

The total trade deficit, including services, narrowed to £3.27 billion in August from £4.4 billion in July. July's figure was revised up from a deficit of £3.37 billion.

Construction output in the U.K. dropped 4.3% in August, after a 1.0% drop in July. It was the largest decline since December 2012.

The ONS said that the drop may have been driven by bad weather.

On a yearly basis, construction output fell 1.4% in August, after a 2.0% increase in July. July's figure was revised up from a 0.7% decrease.

Construction makes up 6% of UK's economy.

The Canadian dollar traded higher against the U.S. dollar ahead the Canadian labour market data. The unemployment rate in Canada is expected to decline to 6.9% in September from 7.0% in August.

Canada's economy is expected to add 10,000 jobs in September.

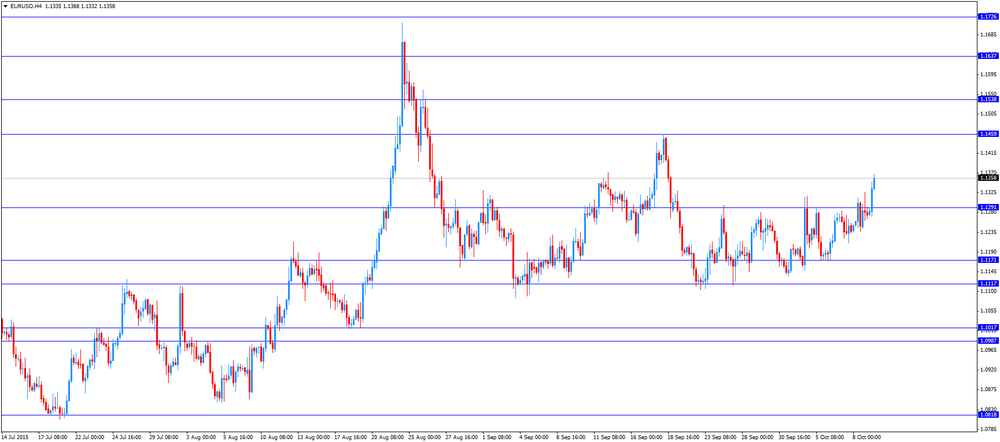

EUR/USD: the currency pair rose to $1.1368

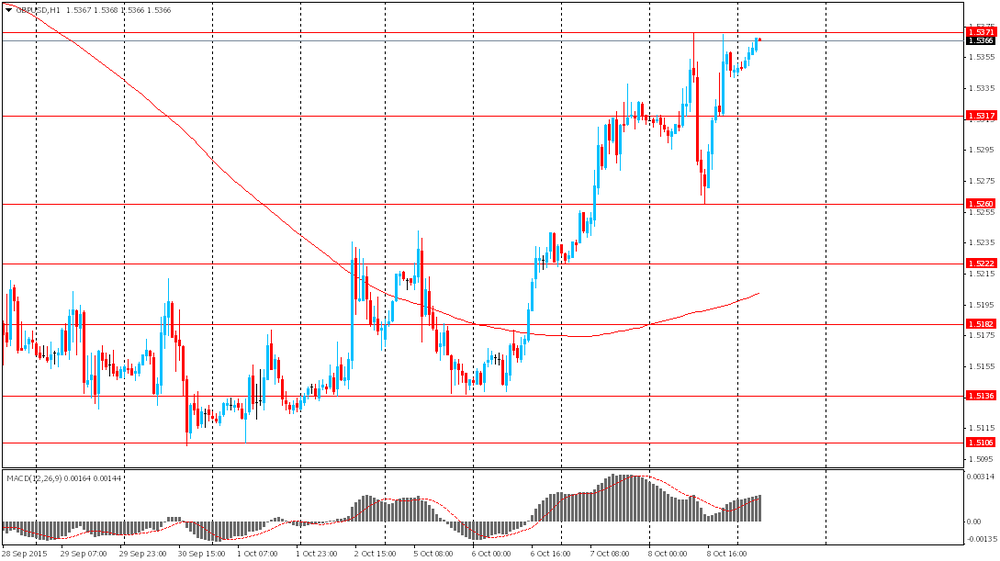

GBP/USD: the currency pair fell to $1.5321

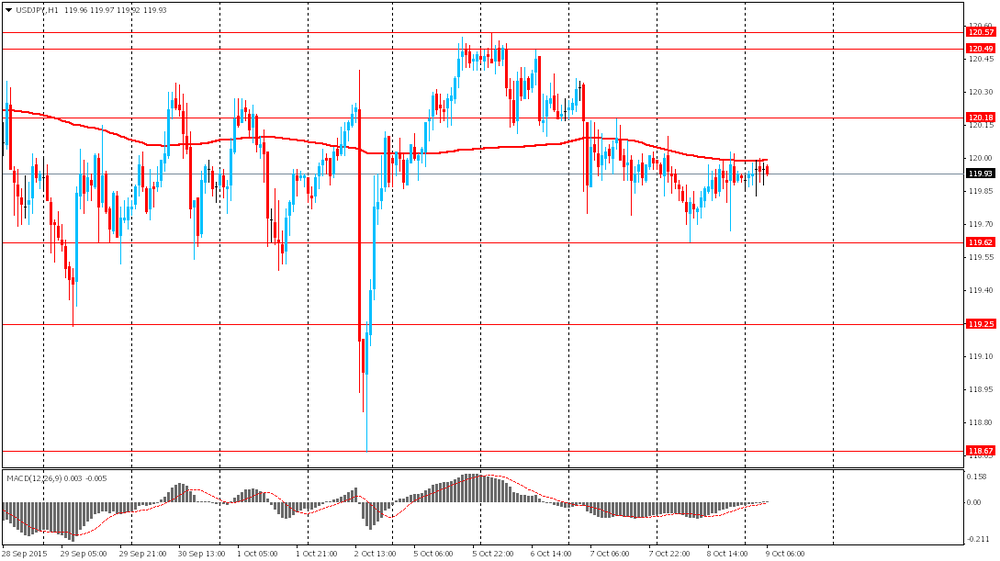

USD/JPY: the currency pair climbed to Y120.34

The most important news that are expected (GMT0):

12:30 Canada Unemployment rate September 7% 6.9%

12:30 Canada Employment September 12 10

13:10 U.S. FOMC Member Dennis Lockhart Speaks

14:00 U.S. Wholesale Inventories August -0.1% 0%

14:30 Canada Bank of Canada Business Outlook Survey

17:30 U.S. FOMC Member Charles Evans Speaks

EUR/USD

Offers 1.1350 1.1365 1.1380 1.1400 1.1430 1.1450

Bids 1.1300 1.1285 1.1270 1.1250 1.1235 1.1220 1.1200

GBP/USD

Offers 1.5385 1.5400-10 1.5425-30 1.5450 1.5480 1.5500-10

Bids 1.5350 1.5330-35 .5300 1.5280 1.5255-60 1.5240 1.5220 1.5200

EUR/GBP

Offers 0.7385 0.7400 0.7405-10 0.7420 0.7435 0.7450 0..7475 0.7500

Bids 0.7350 0.7330-35 0.7300 0.7285 0.7265 0.7250 0.7230 0.7200

EUR/JPY

Offers 136.50 136.75 137.00 137.50 137.80 138.00Bids 136.00 135.80 135.50 135.25 135.00 134.80 134.40 134.25 134.00

USD/JPY

Offers 120.00 20.20-25 120.50 120.65 120.85 121.00 121.30 121.50

Bids 119.50 119.25 119.10 119.00 118.85 118.50 118.30 118.00

AUD/USD

Offers 0.7300 0.7330 0.7350 0.7375 0.7400 0.7425 0.7450

Bids 0.7275 0.7260 0.7230 0.7200 0.7180 0.7150 0.7125-30 0.7100

Stock indices traded higher on yesterday's Fed minutes. The minutes added to the speculation that the Fed may not raise its interest rates this year. FOMC members noted that the U.S. labour market continued to improve, while the inflation remained at low levels.

"After assessing the outlook for economic activity, the labour market, and inflation and weighing the uncertainties associated with the outlook, all but one member concluded that, although the U.S. economy had strengthened and labour underutilization had diminished, economic conditions did not warrant an increase in the target range for the federal funds rate at this meeting," the minutes said.

Meanwhile, the economic data from the Eurozone was positive. The French statistical office Insee its industrial production figures on Friday. Industrial production in France climbed 1.6% in August, exceeding expectations for a 0.5% rise, after a 1.1% drop in July. It was the biggest increase since April 2013.

The increase was driven by a rise in manufacturing output. Manufacturing output was up 2.2% in August, while construction output increased 0.6%.

On a yearly basis, the French industrial production rose 0.6% in August, after a 0.7% gain in July.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £11.15 billion in August from £12.20 billion in July. July's figure was revised up from a deficit of £11.08 billion.

Exports of goods climbed 3.5% in August, while imports declined 0.7%.

The total trade deficit, including services, narrowed to £3.27 billion in August from £4.4 billion in July. July's figure was revised up from a deficit of £3.37 billion.

Construction output in the U.K. dropped 4.3% in August, after a 1.0% drop in July. It was the largest decline since December 2012.

The ONS said that the drop may have been driven by bad weather.

On a yearly basis, construction output fell 1.4% in August, after a 2.0% increase in July. July's figure was revised up from a 0.7% decrease.

Construction makes up 6% of UK's economy.

Current figures:

Name Price Change Change %

FTSE 100 6,416.85 +42.03 +0.66 %

DAX 10,106.4 +113.33 +1.13 %

CAC 40 4,718.42 +42.51 +0.91 %

Minneapolis Federal Reserve Bank President Narayana Kocherlakota repeated on Thursday that he was open to cut interest rate.

"I don't see raising the target range for the fed funds rate above its current low level in 2015 or 2016 as being consistent with the pursuit of the kind of labour market outcomes that we are charged with delivering. I would be open to the possibility of reducing the fed-funds target range even further, as a way of producing better labour market outcomes," he said.

Kocherlakota pointed out that the slow pace of the job creation is caused by the end of the Fed's asset-buying programme.

"We would typically expect that such a change in monetary policy should affect the economy with a lag of about 18 to 24 months. Viewed through this lens, the slow rate of labour market improvement in 2015 is not all that surprising," Minneapolis Federal Reserve Bank president said.

Kocherlakota is not a voting member of the monetary-policy-setting Federal Open Market Committee (FOMC) this year, and will leave his post at the end of the year.

San Francisco Fed President John Williams repeated on Thursday that he expects the Fed to raise its interest rates this year.

"I view the next appropriate step as gradually raising interest rates, most likely starting sometime later this year. Of course, that view is not immutable and will respond to economic developments over time," he said.

Williams added that the U.S. economy continued to strengthen.

Williams is a voting member of the monetary-policy-setting Federal Open Market Committee (FOMC) this year.

The Italian statistical office Istat released its industrial production data on Friday. Industrial production in Italy fell at a seasonally-adjusted rate of 0.5% in August, after a 1.1% rise in July.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 1.0% in August, after a 2.8% increase in July.

The French statistical office Insee its industrial production figures on Friday. Industrial production in France climbed 1.6% in August, exceeding expectations for a 0.5% rise, after a 1.1% drop in July. It was the biggest increase since April 2013.

June's figure was revised up from a 0.8% decline.

The increase was driven by a rise in manufacturing output. Manufacturing output was up 2.2% in August, while construction output increased 0.6%.

Output in mining and quarrying, energy, water supply and waste management declined 1.0% in August.

On a yearly basis, the French industrial production rose 0.6% in August, after a 0.7% gain in July.

USD/JPY 120.00 (USD 1.1bln)

EUR/USD 1.1200 (EUR 530m) 1.1300 (537m)

USD/CAD 1.3200 (USD 500m)

AUD/USD 0.7100 (AUD 1bln) 0.7125 (400m) 0.7200 (720m) 0.7250 (376m)

NZD/USD 0.6500 (NZD 1bln)

AUD/JPY 85.20 (AUD 1bln)

EUR/JPY 133.00 (EUR 1.23bln) 134.50 (1.25bln)

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. dropped 4.3% in August, after a 1.0% drop in July. It was the largest decline since December 2012.

The ONS said that the drop may have been driven by bad weather.

On a yearly basis, construction output fell 1.4% in August, after a 2.0% increase in July. July's figure was revised up from a 0.7% decrease.

Construction makes up 6% of UK's economy.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £11.15 billion in August from £12.20 billion in July. July's figure was revised up from a deficit of £11.08 billion.

Exports of goods climbed 3.5% in August, while imports declined 0.7%.

The total trade deficit, including services, narrowed to £3.27 billion in August from £4.4 billion in July. July's figure was revised up from a deficit of £3.37 billion.

The National Retail Federation (NRF) said on Thursday that it expects U.S. sales in November and December (excluding autos, gas and restaurant sales) to rise by 3.7% to $630.5 billion. Online sales are expected to climb between 6% and 8% to $105 billion.

"With several months of solid retail sales behind us, we're heading into the all-important holiday season fully expecting to see healthy growth," NRF President and CEO Matthew Shay said.

The International Monetary Fund (IMF) Managing Director Christine Lagarde said on Thursday that policymakers around the world have to upgrade its economic policies to boost the economy.

"My key message to global policymakers: they need to upgrade their policy recipes to reinvigorate growth and reduce global uncertainty," she said.

Lagarde also said that the global economy is stuck in a "new mediocre" growth pattern despite the massive asset-buying programmes around the world. She added that there is little room for error.

According to The Wall Street Journal's monthly survey, about 64% of respondents expect the Fed to raise its interest rates at the December meeting. 23% of respondents said that the Fed will hike its interest rates in March, while 5% of respondents expect the interest rate hike in June.

48% of respondents expect the second interest rate hike by the Fed in March, while 31% of respondents said it will happen in July.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 44.8 in in the week ended October 04 from 43.0 the prior week. The increase was driven by rises in all subindices.

The measure of views of the economy increased to 35.4 from 33.2. It was the highest level since May.

The buying climate index increased to 39.6 from 38.4. It was the highest level since May.

The personal finances index was up to 59.3 from 57.4. It was the highest level since April.

The Fed released its September monetary policy meeting minutes on Wednesday. The Fed said that it wanted to have more time to see if the slowdown in the global economy will have a negative effect on the U.S. economy.

"The Committee decided that it was prudent to wait for additional information confirming that the economic outlook had not deteriorated and bolstering members' confidence that inflation would gradually move up toward 2 percent over the medium term," the minutes said.

Most Federal Open Market Committee (FOMC) members expect the Fed to start raising its interest rate this year.

FOMC members noted that the U.S. labour market continued to improve, while the inflation remained at low levels.

"After assessing the outlook for economic activity, the labour market, and inflation and weighing the uncertainties associated with the outlook, all but one member concluded that, although the U.S. economy had strengthened and labour underutilization had diminished, economic conditions did not warrant an increase in the target range for the federal funds rate at this meeting," the minutes said.

FOMC members voted 9-1in September to keep interest rates unchanged. Only Richmond Fed President Jeffrey Lacker voted to raise interest rate by 0.25%.

West Texas Intermediate futures for November delivery rose to $50.26 (+1.68%), while Brent crude advanced to $53.76 (+1.34%) amid concerns that escalating tensions in Syria could harm oil supply from the region.

Syria is not a crude producing country and global supply remains ample, however market participants are concerned about longer term impact on supplies from the Middle East.

Rumors of possible cooperation between various oil producing countries have also supported prices. Investors will be looking for any signs that any producer is ready to start cutting output to support prices.

Gold climbed to $1,147.80 (+0.31%) as minutes of the latest Fed meeting showed that policymakers are hesitating to raise rates. Market participants generally expected the minutes to be dovish. Policymakers were mostly concerned about inflation. A delay in rate hikes could support non-interest-paying bullion, although uncertainty could weigh on prices in the near-term future.

U.S. stock indices rose on Thursday after dovish Fed meeting minutes were released.

Minutes showed that policy makers were concerned over low inflation, which had been below target level for more than three years. The Federal Reserve pursues two goals: a healthy labor market and stable inflation. Officials said that they had approached their full employment target, but they were not confident about inflation. The minutes said that that the future decision will depend on confidence in inflation.

Third quarter earnings season is expected to be weak. According to FactSet, analysts forecast that profits of S&P 500 companies fell by 4.9% in Q3. Alcoa Inc. released its report after markets closed on Thursday. The company's shares fell 5% in after-hours as earnings missed Wall Street expectations.

The Dow Jones Industrial Average rose 138.46 points, or 0.8%, to 17,050.75. The S&P 500 added 17.60, or 0.9%, to 2,013.43. The Nasdaq Composite Index climbed 19.64, or 0.4%, to 4,810.79.

This morning in Asia Hong Kong Hang Seng rose 1.72%, or 383.45, to 22,738.36. China Shanghai Composite Index added 0.70%, or 21.90, to 3.165.26. The Nikkei rose 1.34%, or 242.46, to 18,383.63.

Asian indices rose following gains in Wall Street.

Gains in Chinese stocks slowed down after yesterday's after-holiday rally. Japanese stocks traditionally followed the lead from U.S. markets.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1402 (5163)

$1.1356 (4252)

$1.1318 (3065)

Price at time of writing this review: $1.1287

Support levels (open interest**, contracts):

$1.1239 (3001)

$1.1197 (5333)

$1.1149 (1914)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 56505 contracts, with the maximum number of contracts with strike price $1,1500 (5313);

- Overall open interest on the PUT options with the expiration date October, 9 is 68537 contracts, with the maximum number of contracts with strike price $1,1000 (5743);

- The ratio of PUT/CALL was 1.21 versus 1.19 from the previous trading day according to data from October, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.5600 (1472)

$1.5500 (1682)

$1.5401 (1800)

Price at time of writing this review: $1.5374

Support levels (open interest**, contracts):

$1.5299 (1001)

$1.5200 (2364)

$1.5100 (3220)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 26107 contracts, with the maximum number of contracts with strike price $1,5200 (1800);

- Overall open interest on the PUT options with the expiration date October, 9 is 23682 contracts, with the maximum number of contracts with strike price $1,5100 (3220);

- The ratio of PUT/CALL was 0.91 versus 0.93 from the previous trading day according to data from October, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Home Loans August -0.3% Revised From 0.3% 5% 2.9%

The U.S. dollar little changed after release of minutes of the latest FOMC meeting. The minutes pointed to policymakers' concerns over inflation and the ability of the U.S. economy to handle higher rates in the coming months. Many members of the committee noted that their confidence in stable inflation had not grown. The Federal Reserve expects inflation to reach the 2% target level by the end of 2018.

The Australian dollar rose amid gains in Asian stocks and iron ore prices, which rose 0.7% to $54.80 yesterday as Chinese markets reopened after a holiday. This commodity is one of Australia's key export products and its price affects the country's budget and the AUD exchange rate. Meanwhile home loans data weighed on the currency. Data showed that home loans rose only by 2.9% in August compared with economists' expectations for a 5% rise. The previous reading was revised to -0.3% to 0.3%.

EUR/USD: the pair fluctuated within $1.1265-90 in Asian trade

USD/JPY: the pair traded within Y119.80-00

GBP/USD: the pair rose to $1.5370

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Industrial Production, m/m August -0.8% 0.5%

06:45 France Industrial Production, y/y August 0.7%

08:30 United Kingdom Total Trade Balance August -3.37

12:30 Canada Unemployment rate September 7% 6.9%

12:30 Canada Employment September 12 10

12:30 U.S. Import Price Index September -1.8% -0.5%

13:10 U.S. FOMC Member Dennis Lockhart Speaks

14:00 U.S. Wholesale Inventories August -0.1% 0%

14:30 Canada Bank of Canada Business Outlook Survey

17:30 U.S. FOMC Member Charles Evans Speaks

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.