- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 10-05-2022

- USD/JPY remains sidelined amid mixed concerns, anxiety ahead of the key US data.

- Fed’s Mester renewed 75 rate hike calls, yields probe the bulls.

- Headlines from China, Russia and Fedspeak can offer intermediate clues ahead of the US CPI for April.

- Expectations of easing inflation could propel USD in case of a stronger outcome.

USD/JPY fades bounces off the weekly low, steady around 130.30 heading into Wednesday’s Tokyo open. The yen pair’s latest weakness could be linked to the market’s cautious mood ahead of the key US Consumer Price Index (CPI) data, as well as mixed concerns surrounding China’s covid conditions and the Russia-Ukraine crisis.

The risk-barometer pair improved the previous day as the US dollar regained its mojo, after initially stepping back, on comments from Cleveland Fed President and FOMC member Loretta Mester who recalled the bears by saying that the Fed policymakers don't rule out a 75 basis points rate hike forever.

Also likely to have underpinned the greenback were fears of economic stagnation as rigid lockdowns in the world’s largest industrial player China and the geopolitical tensions between Moscow and Kyiv challenge the global supply chain and fuel price pressure.

Additionally, the monetary policy divergence between the Fed and the Bank of Japan (BOJ) and China’s readiness to tame the covid are some extra catalysts that allowed USD/JPY to print mild gains the previous day.

Against this backdrop, the Wall Street benchmark closed mixed after an initially positive start while the US 10-year Treasury yields also eased to 2.99% by the day’s end.

Looking forward, Fedspeak may entertain USD/JPY traders and so do the aforementioned risk catalysts but the US inflation numbers for April, expected 8.1% YoY versus 8.5% prior, will be crucial to watch. The reason is the market’s hope for softer prints and strong chatters over the Fed’s 75 basis points (bps) of rate hikes.

Also read: US CPI Preview: Hard core inflation to propel dollar to new highs, and two other scenarios

Technical analysis

A two-week-old ascending triangle formation restricts short-term USD/JPY moves between 130.00 and 131.35. Overbought RSI (14), however, signals a bumpy road for the bulls.

- AUD/NZD is teeing up for a bullish continuation on the daily chart.

- H1 is currently bearish, but bulls await a break of the lower highs.

AUD/NZD bulls are in anticipation of an onward bullish continuation on the daily chart and the following illustrates the current market structure and challenges for the bulls for the meantime.

AUD/NZD daily chart

The price has corrected a significant portion of the prior daily bullish impose. There are now prospects, so long as the bulls stay committed, for bullish continuation to play out over the foreseeable future on the daily chart.

AUD/NZD H1 chart

The bearish divergence is a potential meanwhile hindrance for the bulls. However, a break of the lower highs within the bear trend could be the green light needed to encourage buyers, ultimately leading to the start of a fresh daily sure to the upside.

- Silver remains on the back foot after breaking seven-month-old horizontal support.

- Bearish MACD signals, downbeat RSI keep sellers hopeful.

- September 2019 peak appears a tough nut to crack for sellers, corrective pullback needs validation from $22.00.

Silver (XAG/USD) licks its wounds around a recently flashed two-year low, sidelined near $21.30 during Wednesday’s initial Asian session.

The bright metal slumped to the lowest levels since June 2020 the previous day on breaking horizontal support stretched from October 2021.

With the RSI and MACD conditions joining the latest support break, silver prices are likely to witness further downside.

That said, the 200-week SMA level surrounding $20.20 appears immediate level on the bear’s radar.

Following that, the $20.00 psychological magnet and September 2019 peak of $19.65 will challenge the further downside.

Alternatively, recovery moves beyond the support-turned-resistance around $21.45 need validation from a 17-month-long horizontal area near $22.00 to convince buyers.

Silver: Weekly chart

Trend: Bearish

- EUR/JPY oscillates in a 48-pips range as investors see Germany's HICP stable at 7.8%.

- The ECB may accelerate its interest rates after concluding the APP.

- The BOJ will keep on deploying liquidity to spurt aggregate demand.

The EUR/JPY pair is displaying back and forth moves in a narrow range of 137.03-137.51 in the Asian session. On a broader note, the cross is oscillating in a tad wide range of 136.59-138.32 over the last two weeks. It looks like the market participants are waiting for a potential trigger that could bring a meaningful move in the asset.

The euro bulls are awaiting the speech from European Central Bank (ECB)’s President Christine Lagarde, which will provide some clues over the interest rate decision by the ECB next month. It seems that ECB Lagarde will dictate over concluding the Asset Purchase Program (APP) this year. The ECB could elevate its interest rate only after concluding its APP program. The central bank needs to deploy all quantitative measures to address galloping inflation. Also, the comments from ECB’s Lagarde over the chances of stagflation due to the Ukraine crisis will be important to look after.

Apart from ECB’s Lagarde speech, Germany’s Harmonized Index of Consumer Prices (HICP) will remain in focus. The yearly HICP is expected to land at 7.8%, in line with the prior figure. A higher-than-expected figure could weaken the shared currency bulls.

On the Japanese front, commitment to an ultra-loose monetary policy is still haunting the yen bulls. Japan’s economy has yet not reached its pre-pandemic levels. Therefore, the Bank of Japan (BOJ) will keep on deploying stimulus to spurt the aggregate demand.

Early Wednesday morning in Asia, the UK’s think tank National Institute of Economic and Social Research (NIESR) crossed wires via the Financial Times (FT) by saying, “The Bank of England will need to raise interest rates to 2.5% and keep them there until the middle of the decade in order to bring soaring inflation under control.”

The news also quotes NIESR Deputy Director Stephen Millard saying that the BoE could be overestimating how far demand headwinds will curb inflation.

Additional quotes

We expect inflation to come down fairly quickly, and so do the bank, but on higher interest rates than are in the BoE forecasts.

Despite the projection that higher rates would be necessary to contain inflation, NIESR said the central bank would have to navigate carefully the ‘treacherous waters’ caused by a tension between ‘allowing inflation expectations to anchor and . . . plunging the economy into a deep recession’.

Since we closed the forecast we had results which indicate that consumer confidence has plummeted quite a bit. This might be associated with a rise in ‘precautionary saving’ which could mean that ‘consumption isn’t going to be as strong as we predict’.

While we expect consumption to grow overall due to households using their pandemic savings, aggregates can hide what’s happening at the disaggregate level.

GBP/USD remains pressured

GBP/USD stays directed towards the yearly low surrounding 1.2260 following the news, on the back foot around 1.2315 by the press time.

Read: GBP/USD steadies around 1.2300 as investors await US CPI, Brexit NIP jitters

“The US GDP will increase by 2.6% this year,” said Atlanta Fed President Raphael Bostic. The policymaker also mentioned that the economy is strong, and demand is high.

Watch here: Atlanta Fed President Bostic speaking at The Financial Markets Conference

Additional comments

Fed policy must be robust, vigilant, and adaptive.

Market implications

Following the comments, EUR/USD remains defensive around 1.0530, keeping the two-week-old trading range intact, as market players await the key US inflation data.

Also read: US April CPI Preview: Has inflation peaked?

- On Tuesday, the GBP/JPY recorded minimal gains of 0.01%.

- As the Asian session begins, the market mood remains mixed, so beware of sudden JPY strength, despite the Bank of Japan’s commitment to ultra-loose monetary policy.

- GBP/JPY Price Forecast: The confirmation of a head-and-shoulders chart pattern would send the pair tumbling toward 152.00.

The GBP/JPY pares some of Monday’s losses though formed a doji in the daily chart, as traders remain undecided to push prices below the 160.00 mark or upwards to the 20-day moving average (DMA) at 163.16 in the Asian session. At the time of writing, the GBP/JPY is trading at 160.51.

Sentiment remains mixed as Asian equity futures fluctuate before the Sydney open. Fed speakers favored 50-bps rate hikes in the Federal Funds Rate (FFR) in the US session as inflation figures to be released on Wednesday loom. Also, higher US Treasury yields and China’s coronavirus crisis restrictions threaten to disrupt the global economic recovery.

That said, in the overnight session, the GBP/JPY opened near the 160.59 area and dipped near the daily lows around 160.00. nevertheless, during the European session, the cross-currency pair reached a daily high at 161.51, depicting a 150-pip range in the day. However, at the end of the trading session, a doji in the daily chart depicts that buying and selling pressure is at equilibrium.

GBP/JPY Price Forecast: Technical outlook

Despite the aforementioned in the paragraph above, a head-and-shoulders chart pattern looms. The Relative Strength Index (RSI), around 43.77, is in bearish territory, but the GBP/JPY remains range-bound.

If that scenario plays out, and the GBP/JPY breaks below the neckline, around 160.20-30, the first support would be the 100-day moving average (DMA) at 157.83. Breach of the latter would expose the 200-DMA at 155.09, followed by the head-and-shoulders chart pattern target around 152.00.

Key Technical Levels

- GBP/USD is stuck around 1.2300 as upcoming US CPI data has soaked volatility from the FX domain.

- The yearly US core CPI could slip to 6% while inflation may edge lower to 8.1%.

- Next week, UK’s Employment data and CPI numbers will remain in focus.

The GBP/USD pair is continued to oscillate in a range of 1.2292-1.2377 ahead of the release of the US Consumer Price Index (CPI). The whole FX domain has stuck in a limited range but it looks like the cable tops the list.

The spree of major economic events from the past week starting with the interest rate announcement by the Federal Reserve (Fed) to the disclosure of the US Nonfarm Payrolls (NFP) and now the US inflation numbers have resulted in an extremely volatile trading environment. Investors are seeing the yearly US inflation at 8.1%, lower than the prior print of 8.5%, and core CPI excluding food and energy prices at 6%, significantly down from the former figure of 6.5%. However, the odds of a jumbo rate hike by the Fed in June’s monetary policy are still rock solid.

On the UK front, no decision-making over the Northern Ireland Protocol (NIP) has worsened the situation further. The spokesperson from the UK administration said Johnson urged them to deliver for the people of Northern Ireland. "We want to fix some of the underlying challenges" regarding the NIP, the spokesperson added.

Meanwhile, signs of recession in the sterling area are also denting the demand for pound against the greenback. Higher energy bills and the inability of the UK corporate to generate more jobs are pushing the economy towards recession. This week UK calendar will remain light while the next week investors will focus on the Employment data and the UK inflation.

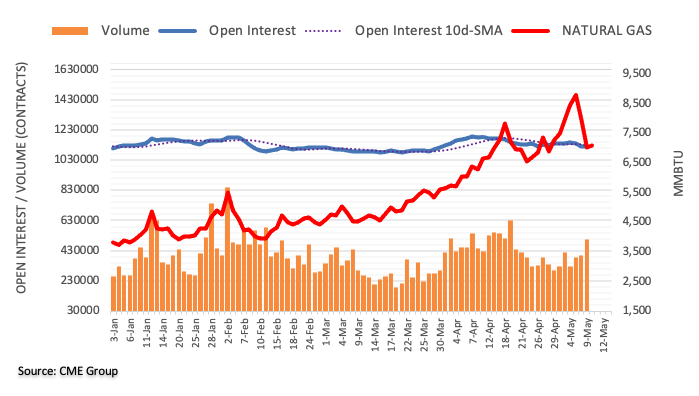

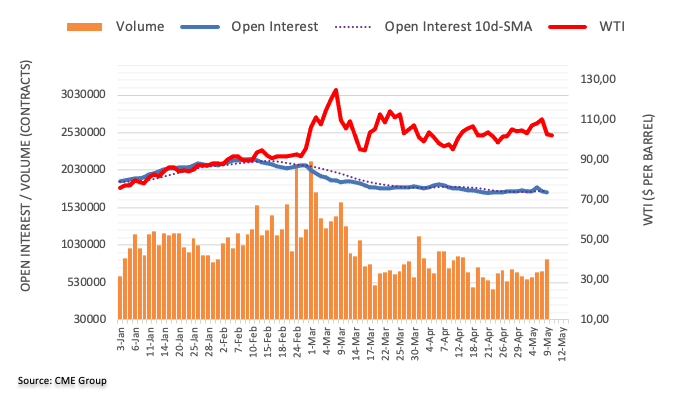

- WTI crude oil stays defensive after declining to two-week low on API stockpile data.

- Private oil inventories rose 1.618M versus -3.479M prior, Weekly EIA Crude Oil Stocks Change expected to print a draw.

- Trouble for European gas, Russia-Ukraine crisis fail to recall energy bulls as inflation woes join China’s “zero covid tolerance” policy.

WTI crude oil prices drop to a two-week low following weekly private oil inventory data, before bouncing off $98.00 during the initial Asian session on Wednesday. The energy benchmark’s latest rebound to $98.40, however, remains doubtful amid sour sentiment and anxiety ahead of the key data releases.

That said, the weekly prints of the American Petroleum Institute’s (API) Crude Oil Stock data for the period ended on May 6 flashed an addition of 1.618M barrels versus the previous contraction of 3.479M.

Among the key challenges to the oil buyers are ongoing covid-led lockdowns in China and the growth fears due to a jump in the inflation, as well as the global oil producers’ resistance to inflate output. On the contrary, the hardships for European energy supplies due to the ongoing Russia-Ukraine war should have favored the black gold, but could not of late.

China sticks to its “Zero Covid Tolerance” policy despite the World Health Organization’s (WHO) push to ease the rigid activity restrictions in Shanghai and Beijing. The lockdowns in the world’s largest industrial players pose a serious threat to the global supply chain and the oil prices.

Elsewhere, fears of global economic slowdown gradually spread as the major central bankers dial back easy money. On Tuesday, multiple Fed policymakers crossed wires to convey their take on the US central bank’s next moves. Most of them, including Federal Reserve Bank of Richmond President Thomas Barkin and NY Fed President John Williams, backed a 50 bps rate hike. However, comments from Cleveland Fed President and FOMC member Loretta Mester recalled the bears as she said, “They don't rule out a 75 basis points rate hike forever”.

Alternatively, a need for diversion into the European gas supplies, previous through Ukraine, joins the bloc’s oil embargo on Russian imports to keep the buyers hopeful. However, the risk-off mood underpins the US dollar and fails to entertain buyers.

Moving on, April month Consumer Price Index (CPI) and Producer Price Index (PPI) for China, expected 1.8% and 7.7% YoY respectively versus 1.5% and 8.3% previous readouts in that order, will offer immediate direction to the black gold. Following that, the US CPI data will be crucial amid hopes of the first softer inflation reading, 8.1% YoY versus 8.5% prior, in many years.

Read: US April CPI Preview: Has inflation peaked?

It should be noted that the weekly official oil inventory data, released from the Energy Information Administration (EIA), expected -1.2M versus 1.302M prior, will also direct short-term WTI moves.

Technical analysis

Although the monthly support line restricts WTI crude oil’s immediate downside around $98.00, the 21-DMA around $103.10 joins bearish MACD signals and downbeat RSI (14) to challenge corrective pullback.

- AUD/USD fades bounce off yearly low, remains depressed after four-day downtrend.

- Fed’s Mester, mixed headlines from China and Russia kept traders recalled the bears.

- US/China scheduled for April inflation release, Aussie Westpac Consumer Confidence up for publishing too.

- Pre-Inflation anxiety could restrict market moves, risk catalysts are important for fresh impulses.

AUD/USD prices hold onto the four-day-old downward trajectory, taking rounds to the yearly low of 0.6910 flashed before a few hours during Wednesday’s initial Asian session. In doing so, the risk-barometer pair portrays the market’s cautious mood ahead of the key inflation data from China and the US, as well as Australia’s Westpac Consumer Confidence.

The Aussie pair’s latest south-run could be linked to the increasing chatters surrounding the Fed’s 75 basis points (bps) rate hike, as well as China’s covid-linked lockdowns and “Zero Covid Tolerance” policy. Also weighing on the quote are the tales of the Russia-Ukraine war and likely negative implications of the same.

On Tuesday, multiple Fed policymakers crossed wires to convey their take on the US central bank’s next moves. Most of them, including Federal Reserve Bank of Richmond President Thomas Barkin and NY Fed President John Williams, backed a 50 bps rate hike. However, comments from Cleveland Fed President and FOMC member Loretta Mester recalled the bears as she said, “They don't rule out a 75 basis points rate hike forever”.

Elsewhere, China’s resistance to ease activity restrictions due to the covid outbreak and little leeway over the zero-tolerance policy challenged the global supply chain matrix, which in turn negatively affects the risk appetite and the AUD/USD prices. Also weighing on the market’s mood, as well as the pair prices, are headlines concerning Russia and Ukraine where the war becomes a stalemate, per the US Defense Agency.

Amid these plays, the US 10-year Treasury yields stretched the week-start pullback from a two-year high whereas the Wall Street benchmarks closed mixed, began the day on a positive side before losing the charm and then regained some.

Looking forward, Australia’s Westpac Consumer Confidence for May, prior -0.9%, appears as the first key data of the day, followed by April month Consumer Price Index (CPI) and Producer Price Index (PPI) for China, expected 1.8% and 7.7% YoY respectively versus 1.5% and 8.3% previous readouts in that order. However, major attention will be given to the US CPI data as markets expect the first softer inflation reading, 8.1% YoY versus 8.5% prior, in many years to push back the reflation and growth fears. Hence, any disappointment from the key inflation numbers will be another boost to the market’s risk-off mood, which could open the door for the AUD/USD pair’s further downside, mainly due to the pair’s risk-barometer status and the USD’s safe-haven appeal.

Also read: US CPI Preview: Hard core inflation to propel dollar to new highs, and two other scenarios

Technical analysis

January 2022 low surrounding 0.6965-70 restricts any corrective pullback of AUD/USD prices, which in turn join bearish MACD signals to suggest further downside of the quote towards mid-June 2020 low surrounding 0.6775.

- A time correction in the asset price will resume its upside rally after a potential trigger.

- The formation of Rising Wedge is advocating an upside break considering the broader context.

- The RSI (14) is oscillating in a bullish range of 60.00-80.00

The USD/CHF pair is hovering around Tuesday’s closing price at 0.9954 and is expected to continue its four-day winning streak led by a strong broader context. The asset has delivered a vertical upside move since the first trading session of April.

Despite the formation of a Rising Wedge chart pattern on a four-hour scale, the price action is not displaying any sign of exhaustion. Usually, a Rising Wedge depicts a bearish reversal on a downside break. However, the juggernaut move is betting over a resumption of the bullish momentum after a mild time correction.

The 20- and 50-period Exponential Moving Averages (EMAs) at 0.9906 and 0.9828 respectively are scaling sharply higher, which adds to the upside filters.

The Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which signals more upside ahead.

Should the asset oversteps Tuesday’s high at 0.9975, the greenback bulls will send the asset towards the psychological resistance of 1.0000. A breach of the latter will drive the asset towards the 3 October 2019 at 1.0028.

On the flip side, a slippage below Monday’s low at 0.9890 will drag the asset towards the 4 May high at 0.9853, followed by the 50-EMA at 0.9828.

USD/CHF four-hour chart

-637878183372665798.png)

- The AUD/JPY recovered some ground vs. the Japanese yen, though it remains below the 50-DMA.

- A mixed market mood in the Asian session could increase appetite for safe-haven peers, in this case, the JPY.

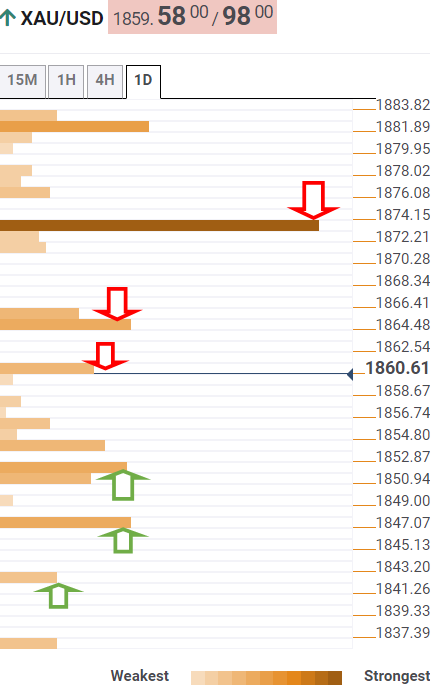

- AUD/JPY Price Forecast: Threatening to push beyond the 90.00 mark, though Tuesday’s price action shows indecision, as a doji formed.

The Australian dollar stops the bleeding vs. the Japanese yen and clings to minimal gains of 0.01% amidst a mixed market mood as portrayed by US equities trading in the green, except for the Russell 2000, down some 0.19%. At the time of writing, the AUD/JPY is trading at 90.47, just shy of the 50-day moving average (DMA) at 90.66.

Asian stock futures point to a mixed open, portraying a mixed market mood. Sentiment drivers like China’s coronavirus restrictions and Russia’s invasion of Ukraine loom the global economic growth.

Late in the Asian session, AUD/JPY traders would take cues from the Australian Consumer Confidence and the Japanese Foreign Exchange Reserves. Alongside the events mentioned above in the calendar, the Chinese inflation rate and the Producer Price Index could shed some light and shift the market mood, as the second-largest economy and Australia’s biggest trading partner is about to hit an uptick in inflation.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is consolidating around the 90.00 mark; psychological support briefly pierced during the Asian session on Tuesday. However, AUD/JPY bulls reclaimed the level and achieved a daily close above it. From a daily chart perspective, the AUD/JPY remains upward biased, though a break below the 50-DMA might send the pair towards the confluence of the October 21 cycle high and the 100-DMA around the 86.25-63 area.

If that scenario plays out, the AUD/JPY first support would be the 90.00 mark. Break below would expose the March 22 at 88.29, followed by March 18 daily low at 87.33 and then the aforementioned confluence around 86.25-63.

If the cross-currency holds above the 50-DMA, the AUD/JPY’s first resistance would be May 10 daily high at 91.15. A breach of the latter would expose May 9 daily high at 92.31, followed by a fifteen-day-old downslope trendline around 93.25-50.

Key Technical Levels

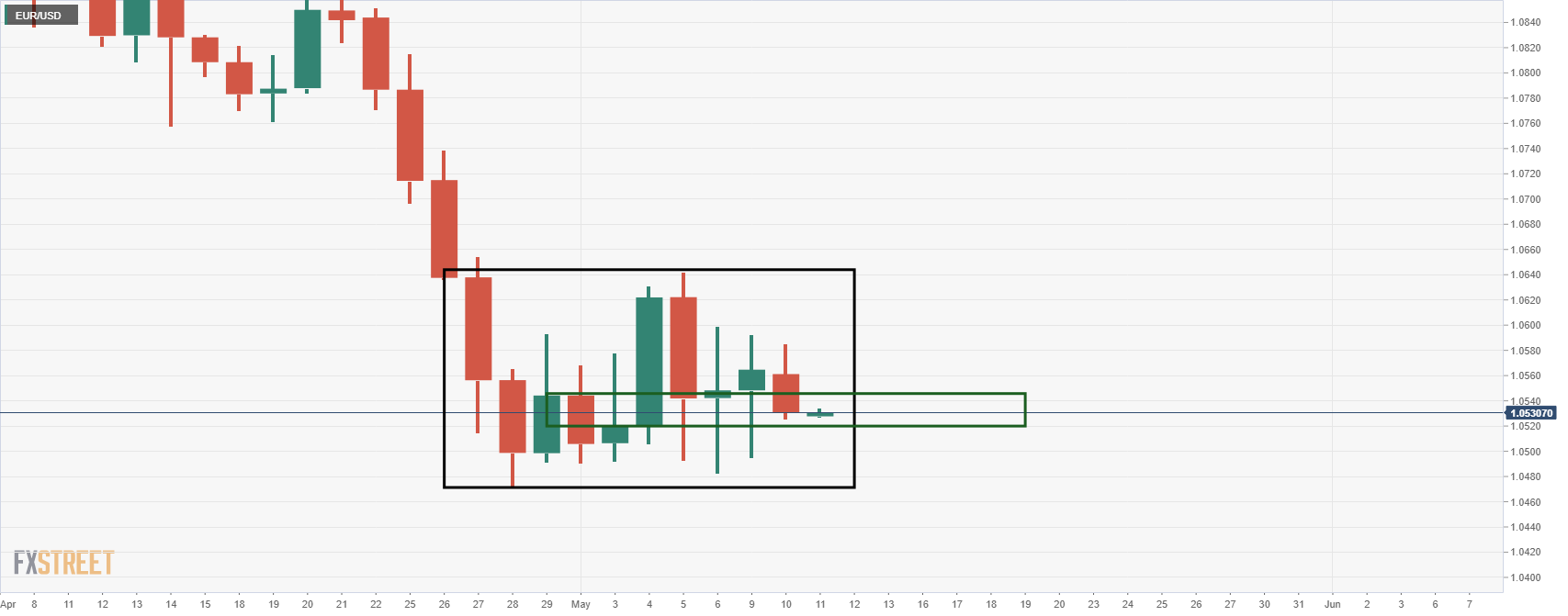

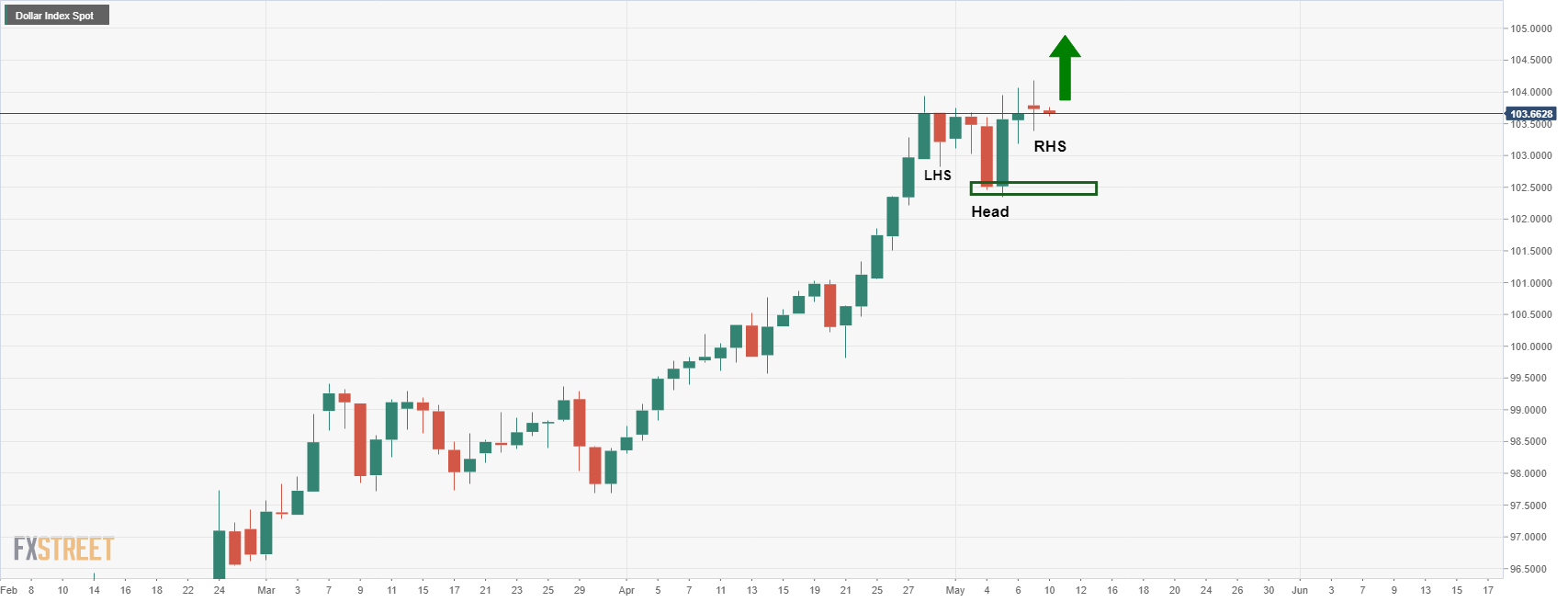

- EUR/USD bears remain in charge according to the weekly outlook.

- The daily chart's consolidation could be a phase of redistribution.

As per the prior analysis, EUR/USD Price Analysis: Accumulation kicking in, or just a respite on the way to test 1.0340, EUR/USD remains in a consolidation phase and it is yet to be seen if this is just a respite or accumulation.

EUR/USD daily chart

From a daily perspective, the price continues to be drawn to the midpoint of the consolidation range. With a break, either way, traders are left with the range to trade and nothing more conclusive. A strong bearish close will be needed in order to paint a bearish head and shoulders on the chart.

EUR/USD weekly chart

From a weekly perspective, the price is still very much in a bear trend and leaves the bias bearish for the foreseeable future. The bears can target the 2017 lows initially, 1.0340. A break there will open the risk of a move below parity.

- USD/CAD is stating above 1.3000 amid uncertainty over the release of the US CPI and core CPI.

- The yearly US inflation is seen at 8.1% while the core CPI may edge lower to 6%.

- Falling oil prices are hurting the cash inflows for Canada and henceforth the demand of loonie.

The USD/CAD pair has renewed its fresh yearly high at 1.3052 and is balancing above the psychological resistance of 1.3000. The asset managed to continue its winning streak by turning positive on Tuesday and is likely to advance further amid uncertainty over the release of the US Consumer Price Index (CPI) in the New York session.

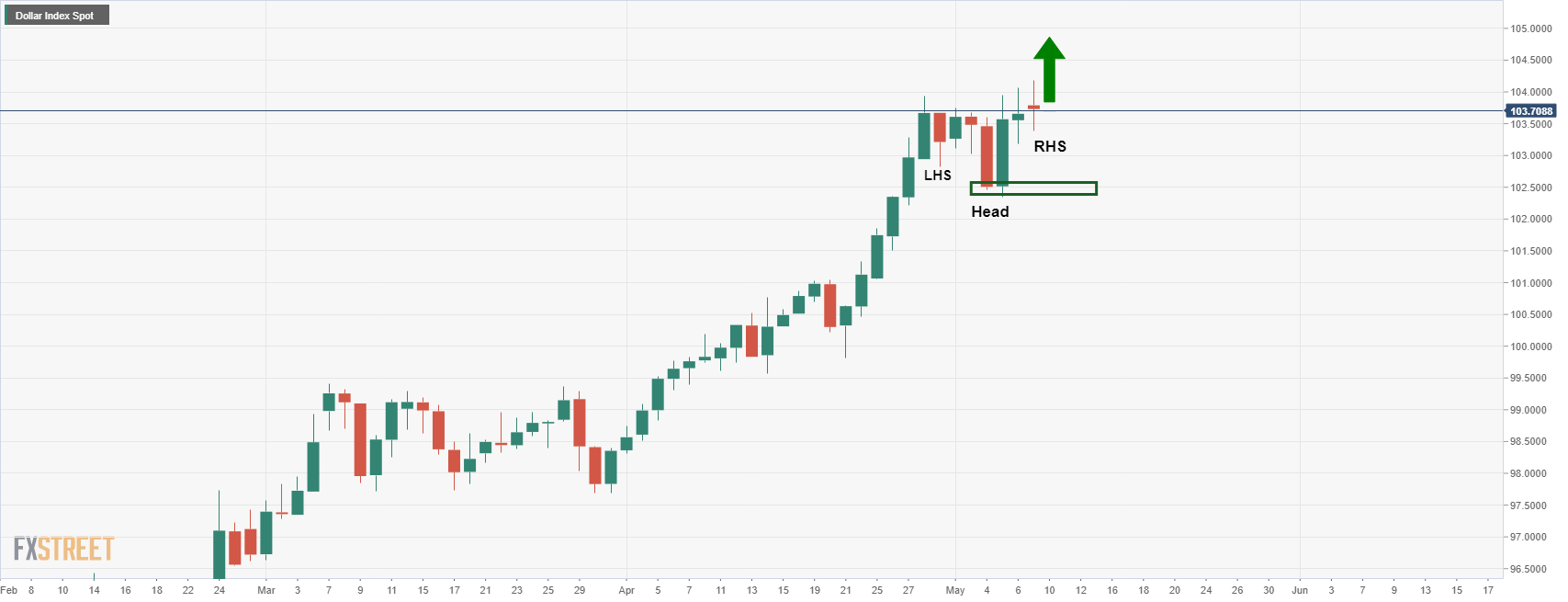

The greenback has been performing strongly against loonie as investors are expecting that a figure of US inflation above 8% would bolster the odds of a 75 basis point (bps) interest rate hike by the Federal Reserve (Fed) in June. The yearly US CPI is likely to edge lower to 8.1% against the multi-decade high figure of 8.5%. While the Core CPI, which doesn’t include food and energy prices, is expected to shift lower to 6% from the prior print of 6.5%. This may ease out the aggressive stance from the Fed a little but a jumbo rate hike announcement will remain on the cards. The US dollar index (DXY) is likely to recapture its 19-year high at 104.19 ahead of the US inflation.

On the oil front, lower fossil fuel prices are also underpinning the greenback against the Canadian dollar. Oil prices settled below the psychological support of $100.00 on Tuesday as higher interest rates will absorb liquidity from the economy, which may result in lower aggregate demand. It is worth noting that Canada is the biggest exporter of oil to the US and lower oil prices result in lower cash inflows for Canada. Also, the Covid-19 restrictions in China are hurting the oil demand due to restrictions on the movement of men, materials, and machines.

President Biden declared that fighting inflation is his top domestic priority and said he understands Americans' frustration over high prices.

The Washington Post reported that ''Biden used a speech from the White House to address an issue that has become a major political liability for him. At the same time, he sought to draw contrasts with his Republican critics, noting the economic policies he is pushing while arguing that Republicans have no viable plan on inflation.''

Biden said he was looking at the possibility to drop some of the tariffs imposed against Chinese imports in order to lower US consumer price inflation.

On Wednesday, the US will report the CPI data. It is expected to rise by 0.5% MoM in April and headline to rise by 0.3%, as food and energy prices eased, analysts at ANZ Bank said.

''Inflation has probably peaked on a YoY basis, but monthly inflation trends remain stubbornly high and above rates consistent with 2%. Fed Chair Powell wants to reduce the excessive demand in the labour market by achieving a reduction in job openings without unemployment rising. Navigating that path will be challenging.''

The dollar has been choppy on Tuesday, fluctuating between modest gains as traders get set for Wednesday's big event in the US Consumer Price Index which could give clues on the likely path of the Federal Reserve's monetary policy.

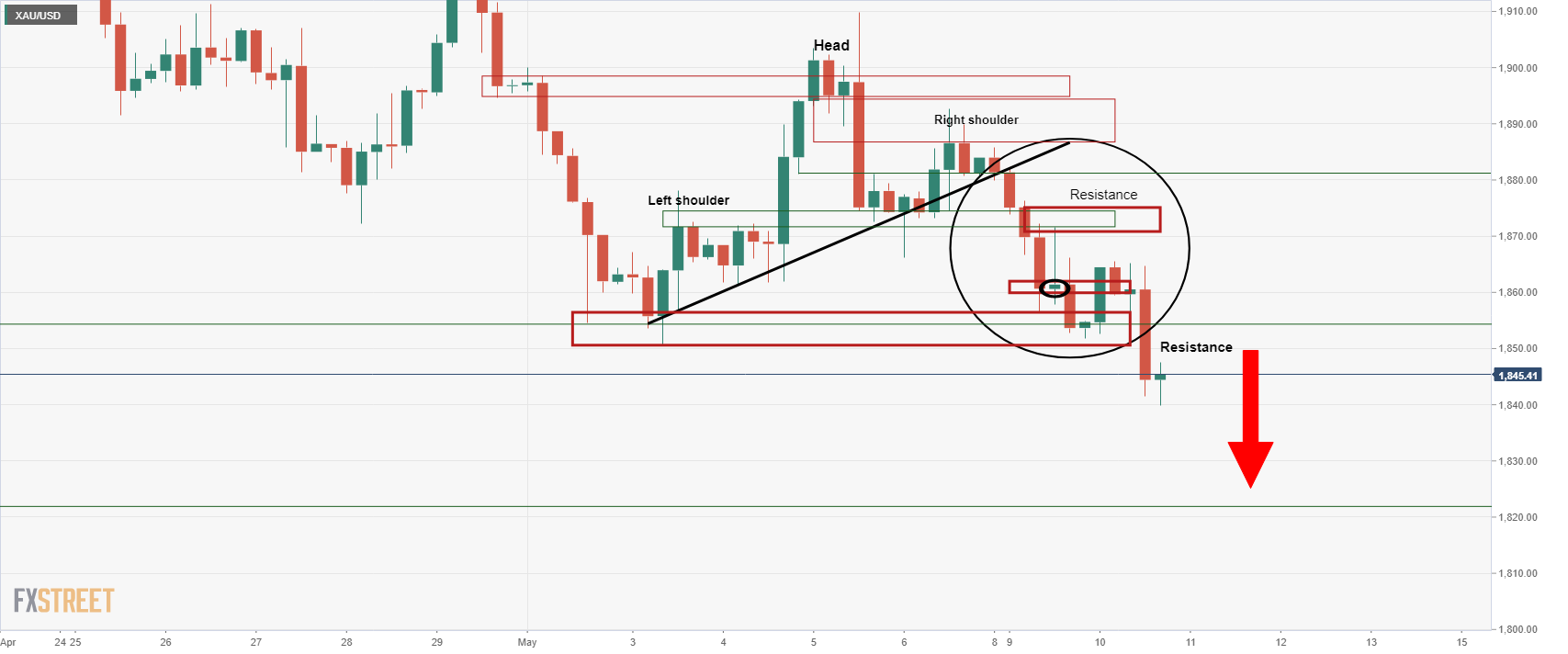

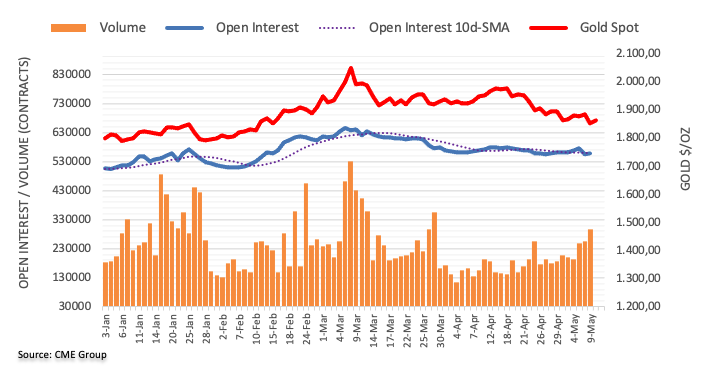

- Gold spot drops in the day and is losing 0.89%.

- An upbeat market mood weighed on the non-yielding metal, despite that US Treasury yields finished the session with losses.

- Gold Price Forecast (XAU/USD): A daily close below the 200-DMA would send Gold Price tumbling towards $1800.

Gold spot (XAU/USD) continues tumbling in the day and briefly pierced the 200-day moving average (DMA) at $1835.31 a troy ounce, amidst an upbeat market mood as illustrated by US equities recording gains between 0.20% and 1.30%. At the time of writing, XAU/USD is trading at $1837.94.

The Fed tightening risks that could spur a recession, China’s Covid-19 zero-tolerance restrictions, which halted factory production, triggered a slowing in exports, and the Ukraine-Russia conflict, are sentiment factors that, even though traders ignored in the session, they need to be aware of them.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, is rallying 0.68%, up at 103.911 as the New York session winds down. The US 10-year Treasury yield approaches the 3% threshold, recovering some ground after reaching a daily low at 2.942%.

Gold Price Forecast (XAU/USD): Technical outlook

In what appears to be a technical move, XAU/USD moved from around $1850 a troy ounce, below the S1 daily pivot point at $1841.73, and pierced the 200-DMA briefly as the New York session finished. It is worth noting that a daily close below the previously mentioned 200-DMA would exacerbate a fall toward $1800.

If that scenario plays out, the XAU/USD first support would be a four-year-old upslope trendline near the $1815-25 region. Once cleared, the XAU/USD’s bears’ next target would be $1800, followed by the YTD low at $1780.18.

Key Technical Levels

- NZD/USD bears remain in town despite a consolidating US dollar.

- All eyes will turn to the US inflation data on Wednesday.

NZD/USD is under pressure by some 0.5% into the closing hours of the North American sessions. The kiwi has fallen from a high of 0.6347 to a low of 0.6276 so far. The US dollar is in a sideways consolidation which is giving the bird some relief ahead of key US inflation data on Wednesday.

''NZ considerations are being all but ignored by markets and this is the USD show, and it’s benefiting from a flight-to-safety bid amid softness in commodities and risk assets,'' analysts at ANZ Bank said, adding that the US Consumer Price Index data tonight poses binary risks. ''As we noted on Monday, while a softer result (as the street is expecting) will be mildly relieving, a rise in inflation has the potential to trigger another wave of risk aversion (likely at the expense of the Kiwi).''

Meanwhile,m a number of Fed officials on Tuesday advocated the need for 50 basis point hikes at the next meetings. Cleveland Federal Reserve Bank President Loretta Mester argued that raising interest rates in half-point increments "makes perfect sense" for the next couple of Fed meetings. New York Fed President John Williams said that Chair Jerome Powell's indication the central bank will hike by half a percentage point at the next two polict meetings is sensible.

Eyes on US CPI

Tomorrow's CPI is expected to rise by 0.5% MoM in April and headline to rise by 0.3%, as food and energy prices eased, analysts at ANZ Bank said.

''Inflation has probably peaked on a YoY basis, but monthly inflation trends remain stubbornly high and above rates consistent with 2%. Fed Chair Powell wants to reduce the excessive demand in the labour market by achieving a reduction in job openings without unemployment rising. Navigating that path will be challenging.''

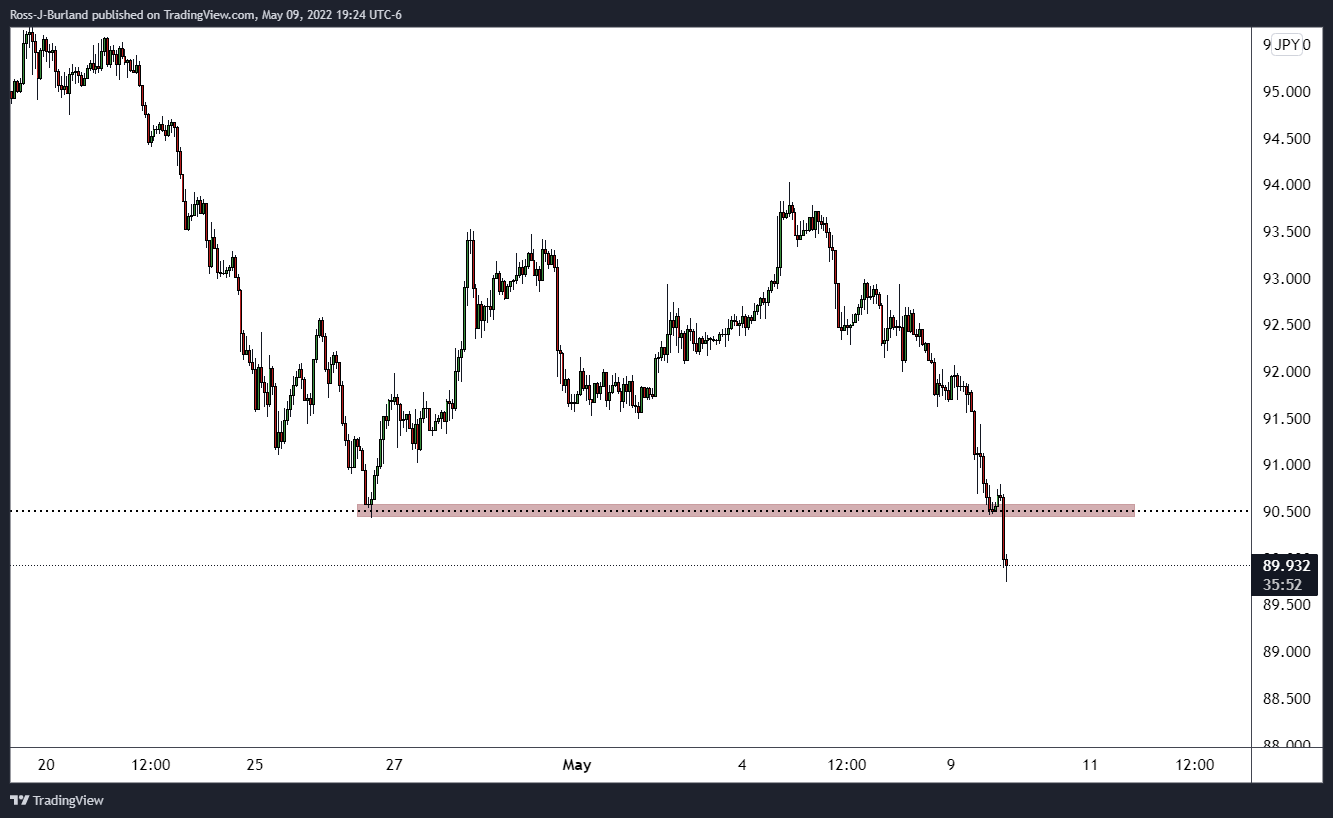

- It is make or break time for USD/JPY at this juncture.

- The price is meeting resistance despite the bullish flag.

USD/JPY is meeting an area of resistance on the hourly chart and has struggled to make a clean break out from the daily bull flag. Instead, the bears are targeting the W-formation's neckline and a break thereof will open the risk of a significant correction for the foreseeable future. The following illustrates this on a daily and weekly chart.

USD/JPY weekly chart

The price has made nine consecutive bullish weekly closes and a doji left on this week's candle could be the signal to the bears to keep the pressure on. A correction to the 38.2% Fibonacci level requires a break of the psychological 125 figure.

USD/JPY daily chart

The series of bullish flag patterns is a compelling feature on the chart but the price's breakout is not convincing at this juncture. Instead, the bears are putting up resistance and on closer inspection, the W-formation may be playing a role in the inability to breakout:

What you need to take care of on Wednesday, May 11:

Financial markets suffered once again from inflation and growth-related concerns. The American dollar shed some ground throughout the first half of the day but recovered its poise after Wall Street’s open amid a souring market mood. The catalyst for the latest round of risk aversion came from US Federal Reserve Cleveland President Loretta Mester, who said that a 75 bps rate hike is not out of the table “forever,” although adding that the current pace of hikes seems “about right.”

The EUR/USD pair is down within range, trading at around 1.0530 and weighed by the continued tensions between the continent and Russia. Another factor affecting the shared currency negatively was the German ZEW survey, which anticipated a further deterioration in the economic situation.

GBP/USD trades a handful of pips above the 1.2300 threshold. Demand for the British Pound was undermined by headlines, later denied, suggesting the UK would announce its intention to break the Northern Ireland treaty.

Commodity-linked currencies edged lower, following the lead of Wall Street, but were also affected by falling gold and oil prices. The bright metal settled just below $1,840 a troy ounce, while WTI fell below $100 a barrel.

The greenback kept advancing against the Swiss Franc but held unchanged against the Japanese yen.

US Treasury yields edged sharply lower, with that on the 10-year Treasury note settling at 2.95%.

Germany and the US will publish their latest inflation figures on Wednesday. German CPI is expected to be confirmed at 7.4% YoY, while the US reading is foreseen at 8.1%. An in-line or lower than anticipated reading may boost optimism, to the benefit of equities and to the detriment of the greenback.

Top 3 Price Prediction Bitcoin, Ethereum XRP: Why the bloodbath can lead to a new bull rally

Like this article? Help us with some feedback by answering this survey:

- The EUR/GBP gained almost 2% in the last week.

- The market mood shifted from mixed to upbeat as US equities regained composture and traded in the green.

- EUR/GBP Price Forecast: Shifted to upward biased once it broke a descending channel to the upside, opening the door for further gains.

The EUR/GBP retreats from weekly highs at around 0.8600 reached last week, though remains around the mid 0.85-0.86 range late in the New York session, amidst a mixed market mood. At 0.8550, the EUR/GBP shifted to an upward bias, following last week’s gains of 1.90%.

Sentiment has improved as the New York session progressed. US equities pared some earlier losses and record gains between 0.18% and 1.95%, despite factors like China’s Covid-19 zero-tolerance restrictions and the Ukraine-Russia war.

On Tuesday, during Asian and European sessions, the EUR/GBP opened around 0.8560s and fluctuated around the 0.8530-80 range throughout the day. Late in the North American session, the EUR/GBP settled around the daily pivot around 0.8550, shy of the 50-hour simple moving average (HSMA) at 0.8554, opening the door for a retest of the 100-HSMA around 0.8523.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP is upward biased and reached a fresh YTD high at around 0.8591. It is worth noting that a descending channel was broken to the upside, opening the door for further gains. That, alongside the 50-day moving average (DMA) at 0.8375, crossing over the 100-DMA, further cement the upward bias.

With that said, the EUR/GBP’s first resistance would be the YTD high at 0.8591. A breach of the latter would expose the September 29 daily high at 0.8658. Once cleared, the next resistance would be April 26 at 0.8719.

Cleveland Federal Reserve President Loretta Mester said on Tuesday that inflation will need to show a "compelling" slowdown before the Federal Reserve can consider pausing its interest rate increases, with the risks currently pointed towards a tougher fight to bring the pace of price increases under control.

"I would need to see monthly numbers coming down in a compelling way before I would want to conclude we could now rest," Mester said in an interview with Reuters on the sidelines of an Atlanta Federal Reserve bank conference.

Key notes

Will need to see a "compelling" slowdown of inflation before slowing fed rate increases.

Inflation risks skewed to the upside, an argument for doing more "upfront".

After half-point increases in June and July Fed will "have to see" what more is needed based on data in the meantime.

Expects PCE inflation might be back to around 2.5% in 2023.

Fed MBS sales could mean market losses for the central bank.

Losses would mean lower fed remittances to the treasury, though pose no "operational" problems for the fed itself.

Sales would help return the balance sheet to primary treasuries but could mean realizing losses depending on interest rates at the time.

Losses would also be a communications challenge for the Fed to explain why the benefits of the smaller balance sheet are Final size of the balance sheet will be determined by monitoring market developments as fed holdings decline.

Market implications

The US dollar was choppy on Tuesday, stuck below the 20-year highs made at the start of the week as yields start to consolidate while investors await tomorrow's April Consumer Price Index.

The data could give further signs of inflation that may be starting to cool, following last Friday's wage inflation data. Expectations are calling for a 8.1% annual increase compared to the 8.5% rise recorded in March.

- XAU/USD bears are moving in and taking on the daily support structure.

- US CPI will be a key driver for markets that are in wait and see mode.

- The US dollar is consolidating as US yields pull back giving relief to stocks.

The gold price continues to deteriorate despite some relief in the US dollar's advance. At the time of writing, XAU/USD is down some 0.46% at $1,845 while the DXY is trading at 103.85 and up just 0.1%.

The dollar has been choppy on Tuesday, fluctuating between modest gains as traders get set for Wednesday's big event in the US Consumer Price Index which could give clues on the likely path of the Federal Reserve's monetary policy.

Investors have been in a risk-on mood, as the yield on the benchmark US 10-year note eased back below the 3% psychological level and from the highest levels since 2018 at 3.20% scored on Monday. This has given some relief to US equity benchmarks that have been mixed in choppy trade. The Dow Jones Industrial Average has recovered to flat, with the S&P 500 up come 0.55%. The Nasdaq Composite is higher by some 1.9%.

However, the outlook is not so bullish for gold, according to analysts at TD Securities.

''Systematic trend followers are joining into the liquidation vacuum in gold. Finally, trend signals have sufficiently deteriorated to catalyze a substantial selling program in gold. With gold prices challenging the psychologically important $1850/oz range, the additional CTA flow could be sufficient to spark a breakdown in this technical level.''

Eyes on US CPI

Tomorrow's CPI is expected to rise by 0.5% MoM in April and headline to rise by 0.3%, as food and energy prices eased, according to analysts at ANZ bank. ''Inflation has probably peaked on a YoY basis, but monthly inflation trends remain stubbornly high and above rates consistent with 2%. Fed Chair Powell wants to reduce the excessive demand in the labour market by achieving a reduction in job openings without unemployment rising. Navigating that path will be challenging.''

Gold technical analysis

The price has fallen through the bottom of 4-hour support and is now testing daily support as follows with the focus now on $1,820 to the downside:

The M-formation is a reversion pattern so there could be a meanwhile bid at this juncture on failures to crack the daily support initially.

- The AUD/USD is dropping 0.30% in the day and 2.03% in the week.

- Sentiment remains negative, though the Australian dollar lifts from daily lows.

- AUD/USD Price Forecast: The major is in a downtrend, and a move towards 0.7000-50 might be an opportunity for bears, as they target 0.6500.

The Australian dollar is snapping three consecutive days of losses against the greenback despite being weighed by negative China’s economic data, which showed that exports slowed to their weakest in almost two years as the zero-tolerance policy halted factory production. At 0.6952, the AUD/USD is recovering some ground on Tuesday.

Late in the North American session, market sentiment shifted negative, except for the Nasdaq 100. The Federal Reserve tightening as it is struggling at inflation four times its target, China’s Covid-19 crisis, and the Ukraine-Russia war weigh on market mood, consequently affecting risk-sensitive currencies like the Australian dollar.

Fed speakers dominate Tuesday’s headlines

The Fed parade continued with New York Fed John Williams, Richmond’s Thomas Barkin and Cleveland’s Loretta Mester on Tuesday. They all agreed on 50-bps increases in the June and July meetings, while Mester added that the Fed would not rule out 75-bps hikes if needed.

As of writing, Fed Governor Christopher Waller was crossing the wires and said that inflation is too high and it’s the Fed’s job to get it down. He favors front loading rates and emphasized that this is the time to hit it with rate increases because the economy can take it.

On Monday, reports from China showed that its exports decelerated to their weakest level in nearly two years, as Covid-19 related restrictions halted factory production and hurt domestic demand. Late in the week, the Chinese Inflation Rate and prices paid by producers will shed some light on a possible “stagflation” scenario in the second-largest economy in the world.

In the meantime, the Australian docket, featured in the Asian session, Retail Sales and Business Confidence, thought did not lift the AUD/USD above the 0.7000 figure. The former came in line with the 1.6% foreseen, while Business Confidence down ticked from 12 to 10. Later in the session, at around 12:30 GMT, the Westpac Consumer Confidence is estimated to fall from the previous month 95.7 to 94.7.

Meanwhile, the US economic docket would feature additional Fed speakers; Neil Kashkari, the next one crossing the wires. Data-wise, US inflation figures will be unveiled on Wednesday, followed by prices paid by producers on Thursday and Consumer Sentiment on Friday.

AUD/USD Price Forecast: Technical outlook

From a daily chart perspective, the AUD/USD remains downward pressured. The MACD is aiming downwards, further confirming the aforementioned, as AUD/USD bears target the 0.6500 price level.

The AUD/USD first support would be 0.6900. A breach of the latter would expose June 2020 swing low at around 0.6776. Once cleared, it would expose the May 2020 swing highs around 0.6616, followed by the 0.6500 mark.

Governor Christopher J. Waller is making comments and traders are looking for anything additional to his 'Reflections on Monetary Policy 2021' speech from last week that can give more clarity on the path ahead for 2022.

Waller has been an advocate of rate hikes, but famously said, ''we are not in a Volcker kind of moment," as he highlighted the difference between inflation that had been building for six of seven years compared to a surge in recent inflation that only began last year.

Key comments

Inflation is too high, my job is to get it down.

If we get some help from supply chain resolution, that's fantastic, but won't count on it.

Could put some downward pressure on labor markets.

Could pull back demand for labor and that would be a good thing.

We are trying to get job market back to equilibrium; right now it's out of whack.

We think we can raise interest rates and not have a big impact on unemployment.

Don't need to tank economy to bring down inflation.

This is the time to hit it with rate increases, because the economy can take it.

Do it now, front load it.

Market implications

The US dollar was choppy on Tuesday, stuck below the 20-year highs made at the start of the week as yields start to consolidate while investors await tomorrow's April Consumer Price Index. The data could give further signs of inflation that may be starting to cool, following last Friday's wage inflation data. Expectations are calling for a 8.1% annual increase compared to the 8.5% rise recorded in March.

- On Tuesday, the EUR/USD loses some 0.18% in the North American session.

- ECB’s Nagel: The ECB needs to hike rates in July if data shows it's needed.

- Fed rate-setters lay the ground for 50-bps increases as the Fed eyes CPI on Wednesday.

- EUR/USD Price Forecast: The major is neutral-downward biased, though it remains range-bound.

The shared currency continues to be unable to recover above the 1.0600 thresholds and remains trapped in the 1.0500s area for the third consecutive trading session. At 1.0538, the EUR/USD reflects the aforementioned amidst a mixed sentiment in the financial markets, portrayed by European equities rising while US stocks fluctuate.

Factors like the Fed tightening monetary policy, which threatens to “miss” a soft landing and spur a recession, alongside China’s zero-tolerance coronavirus restrictions, and the Ukraine-Russia war, loom the economic outlook.

Early in the week, reports from China showed that export growth slowed to its weakest in almost two years as Beijing’s Covid-19 restrictions halted factory production and crimped domestic demand. Also, the conflict between Ukraine – Russia seems to be at a dead end, with no advancement in hostilities and peace talks, as Russian President Vladimir Putin is preparing for a prolonged conflict, according to the Financial Times.

ECB’s Nagel insists on rate hikes as Fed rate-setters lay the ground for 50-bps increases

Aside from this, central bank speaking dominates the headlines on both sides of the Atlantic. In the European session, following a better than expected German ZEW, Economic sentiment in May, ECB member Joachim Nagel said that the bank should hike rates in July if incoming data suggests that inflation is too high. Meanwhile, ECB Francois Villeroy stated that the ECB would act to ensure price stability and reiterated that governments must tackle debt as rates rise.

Across the pond, Fed policymakers lay the ground for a series of three 50-bps increases, counting the May meeting, as expressed by New York Fed President John Williams, Richmond’s Fed Barkin, and Cleveland’s Fed Loretta Mester. The latter added that if inflation does not get under control, the Fed would need to go beyond neutral, and added that the board would not rule out 75-bps hikes, forever.

Elsewhere, the US economic docket would feature additional Fed speakers, with Neil Kashkari and Christopher Waller crossing the wires. Data-wise, US inflation figures will be unveiled on Wednesday, followed by prices paid by producers on Thursday and Consumer Sentiment on Friday.

EUR/USD Price Forecast: Technical outlook

The EUR/USD remains neutral-downward biased, unable to break beyond the 1.0500-1.0640 area boundaries. Even though the MACD-line is about to cross over the signal line, a leg-up would be capped by a confluence of resistance levels lying around 1.0600-40 area.

Upwards, the EUR/USD first resistance would be the 1.0600 figure. Break above would expose the 1.0640, top of the range above-mentioned, followed by a downslope trendline that passes near 1.0660-70. On the downside, the EUR/USD first support would be 1.0500. Latter’s breach would expose April’s 28 daily low at 1.0471, followed by January’s 2017 cycle lows at around 1.0340.

Analysts from Rabobank revised lower their one and three months forecast for the EUR/USD pair to 1.03, looking at a recovery later, with the possibility of climbing back to 1.10 on a twelve months perspective. They warn the benefit to the euro from the hawkish European Central Bank (ECB) may be short-lived.

Key Quotes:

“USD strength has already been a major factor in pushing EUR/USD back to levels last traded in 2017. Whether or not USD strength means that EUR/USD will move to parity in the coming months, remains to some extent dependent on the fundamental backdrop in the Eurozone and on EU policy.”

“The appearance of hawkish ECB rhetoric in the middle of last month raised the possibility of a rate hike as soon as July. That said, the benefit to the EUR from a hawkish ECB may be short-lived if investors are simultaneously concerned about recession risks in the Eurozone.”

“Although EUR/USD has pulled away from its recent lows today, the uncertainties about energy security and recession in the Eurozone suggest that the EUR is far from being out of the woods. Simultaneously, we expect safe haven flow to keep the USD well under-pinned. The aggressive pace of Fed policy tightening has underpinned the risks of a 2023 US recession. Previously we has anticipated that that would be sufficient to weaken the greenback significantly into the end of this year across the board. However, with the outlook for global growth also undermined by risks from slower growth in China and the Eurozone we anticipate that riskier currencies may remain on the back foot unless the Fed tightening cycle draws to a close. This suggests scope for the USD to remain on the front foot for some months to come.”

“We are revising lower our 1 and 3 month EUR/USD forecasts to 1.03 and see some scope for a move to 1.05 on a 6 month view with the USD only retreating back to 1.10 on a 12 month view.”

- US dollar strengthens again as Wall Street turns red again.

- GBP/USD heads for lowest daily close since June 2020.

- Data ahead: US inflation on Wednesday, UK Q1 GDP on Thursday.

The GBP/USD dropped to 1.2291 and printed a fresh daily low as the US dollar turned positive amid risk aversion. Stocks in Wall Street eared important gains as risk aversion prevails.

The Dow Jones is falling 0.74%, falling more than 500 points from the initial level and is headed toward the fourth decline in a row. The losing streak remains firm and supports the greenback even as US yields drop. The demand for safety continues to send yields lower. The US 10-year yield bottomed at 2.94% after hitting on Monday 3.20%. The DXY is up 0.10%, at 103.85.

Cable remains near multi-year lows, under pressure. The outlook about the global economy continues to weigh on market sentiment across financial markets.

Fed speakers on Tuesday continue to be on the hawkish side. US inflation data is due on Wednesday. In the UK the key report of the week will be on Thursday with Q1 GDP.

Analysts at Brown Brother Harriman point out that Bank of England tightening expectations have stalled. “WIRP (World Interest Rate Probability) suggests another 25 bp hike is fully priced in for the next meeting June 16, while the odds of a 50 bp move then are minimal. Looking ahead, the swaps market is pricing in 125-150 bp of total tightening over the next 12 months that would see the policy rate peak between 2.25-2.50%. There are no other BOE speakers scheduled this week and given last week’s communications disaster, that might not be a bad thing”.

The GBP/USD is about to post the lowest close since June 2020 although it remains near the intraday cycle low. The outlook keeps pointing to the downside with the 1.2300 area offering support at the moment. A close above 1.2400 could alleviate the bearish pressure.

Technical levels

- Mexican peso turns negative amid risk aversion.

- USD/MXN rebound and looks for a test of 20.45 and then 20.50.

- Key events ahead: US inflation on Wednesday and Banxico on Thursday.

The USD/MXN turned positive on Tuesday during the last hours as US stocks failed to hold into positive ground. The risk aversion environment weighs on Emerging market currencies, including the Mexican peso. Banxico will likely announce a 50bps rate hike on Thursday.

From a technical perspective, short-term bias points to the upside, particularly while above 20.25. The next resistance stands at 20.45. A daily close above 20.50 should clear the day to more gains in the short-term. The next strong barrier is seen at 20.70.

A slide under 20.25 would alleviate the bullish momentum. Then emerges the 20-day moving average at 20.17, and a close below should expose the May low at 19.99.

Risks still appear to be tilted to the upside in the short-term but USD/MXN needs to break above 20.50 to open the doors to more strength, while below gains seem limited.

USD/MXN daily chart

- Gold extends its losses to two-consecutive days, down some 0.39%.

- Fed speakers are “comfortable” with 50-bps rate hikes in the next couple of meetings.

- XAU/USD is accelerating towards the 200-DMA, which, once broken, might send gold prices towards $1800.

- Gold Price Forecast (XAU/USD): It is neutral-downward biased, and a break below the 200-DMA might push prices towards $1800.

Gold spot (XAU/USD) slides for the second straight, despite a shift to a favorable market mood, amidst increasing bets that Fed tightening could spur a recession. At the time of writing, the yellow metal is trading at $1847.05 a troy ounce in the North American session.

Global equities record gains, illustrating investors’ sentiment. The greenback is gaining, though it has not been able to weigh on the non-yielding metal, which is benefitting from falling US Treasury yields, led by the 10-year down eight basis points, back below the 3% threshold, sitting at 2.965%.

Nevertheless, even though stocks are trading in the green, investors must be careful about China’s zero-tolerance Covid-19 restrictions, alongside Ukraine-Russia tussles, which would likely shift sentiment to negative, putting a lid on recent gains.

Fed members expect two 50-bps increases in back-to-back meetings

Meanwhile, after the Fed announced its monetary policy on Wednesday, the Fed parade of speakers continued. On Tuesday, the New York Fed President John Williams said that the Fed needs to be data-dependent and adjust policy according to those circumstances. He added that 50-bps rate hikes at the next two meetings “makes sense” as a base case. Late in the day, Richmond Fed President Thomas Barkin stated that 50-bps hikes are on the table and added that inflation is high, persistent, and broad-based. However, it emphasized that demand is strong and looks to remain robust, driven by healthy business and personal balance sheets.

Later, Cleveland’s Fed President Loretta Mester, a voter in 2022, said that the Fed needs to move rates up to at a pace to get inflation down while adding that she is comfortable with 50-bps increases in “a couple of meetings.” Mester said that if inflation does not get under control, the Fed would need to go beyond neutral, and added that the board would not rule out 75-bps hikes, forever.

On Tuesday, the US economic docket would feature additional Fed speakers, with Neil Kashkari and Christopher Waller crossing the wires. Data-wise, US inflation figures would be unveiled on Wednesday, followed by prices paid by producers on Thursday and Consumer Sentiment on Friday.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD’s still neutral biased, though the closer it gets to the 200-day moving average (DMA) at $1836.19, the possibilities to turn neutral-bearish increases. As of writing, the 50 and the 100-DMAs lie above the spot price, and once XAU/USD bears clear the $1890 support level, a move towards the 200-DMA and beyond is on the cards.

With that said, the XAU/USD’s first support would be May 3, a daily low at around $1850.34. Break below would expose the abovementioned 200-DMA at $1836.19, closely followed by a four-year-old upslope trendline near the $1815-25 region. Once cleared, XAU/USD’s bears’ next target would be $1800.

Cleveland Fed President Loretta Mester said on Tuesday that they don't rule out a 75 basis points rate hike forever, as reported by Reuters.

Additional takeaways

"Pace we are going right now seems about right."

"Aim is to use tools to get demand in better alignment with supply."

"But I don't want to rule anything out on hikes for the second half of the year."

"It all depends on inflation's path."

"We do need to be committed and resolute on curbing inflation."

"Fed's task is not going to be smooth, unemployment may have to rise in order to bring inflation down."

"I am very focused on inflation side of the equation."

"Given inflation, I think we'll have to move above neutral, not clear how far."

"We've got to see how the economy plays out in the second half of the year."

"We have to do what we can with our tools."

"Inflation is just way too high, longer it stays at that level, bigger risk inflation expectations will move up."

Market reaction

The US Dollar Index posts modet daily gains above 103.90 after these comments.

Chief of European Union Foreign Policy Enrique Mora is trading once again to Tehran to hold meetings on nuclear talks between the US, other Western powers, Russia and Iran, reported Reuters. Mora said he is to work on closing the remaining gaps as negotiations continue.

Talks, which are aimed at returning both the US and Iran to compliance with the 2015 JCPOA nuclear deal and removing sanctions on the Iranian economy (including on its oil exports), have been stagnant now for months.

Russia is not winning, Ukraine is not winning and the war in Ukraine is at a stalemate, Defense Intelligence Agency Chief Scott Berrier said on Tuesday. Berrier added that between eight and ten Russian generals have been killed in the war and that Russia has resorted to the use of indiscriminate and brutal methods in response to Ukraine's resistance. Berrier said that the US does not see Russia using tactical nuclear weapons at this time.

His comments come after Avril Haines, the Director of US National Intelligence, said that the next few months in Ukraine could see a "more unpredictable and potentially escalatory trajectory".

- Oil prices have stabilised on Tuesday after a sharp deterioration in global risk appetite on Monday triggered a steep sell-off.

- After dropping $8.0 on Monday, WTI has stabilised in the low $103.00s.

- Analysts suspect the scope for further downside is limited as the EU approaches a deal on a Russian oil embargo.

Oil prices have stabilised on Tuesday after a sharp deterioration in global risk appetite on Monday triggered a steep sell-off. After falling nearly $8.0 on Monday from above $110 per barrel, front-month WTI futures have on Tuesday found support above the psychologically important $100 mark and are currently trading roughly flat on the day in the mid-$102.00s.

Risk-off conditions on Monday that weighed on oil were a result of investors fretting about a combination of bearish factors, including; 1) worries about central bank tightening amid still sky-high inflation in the US, Europe and elsewhere, 2) worries about slowing global growth and continued inflationary risks emanating from the Russo-Ukraine war and lockdowns in China.

But “oil markets do look like they have more room to fall in the shorter term,” said a senior market analyst at OANDA on Tuesday, a sentiment shared by many other analysts. They cite the ongoing risks to Russian oil output posed by Western sanctions in response to the invasion of Ukraine.

EU 27 nations have not yet been able to agree on a plan for ending Russian oil purchases, with Hungary particularly reluctant to sign up to the embargo and some said this might also have weighed on crude prices this week. But various high-level EU officials/leaders, including European Commission President Ursula von der Leyen and French President Emmanuel Macron, have been in contact with Hungarian President Viktor Orban in recent days to try and get him on board.

French European Affairs Minister Clement Beaune said earlier on Tuesday that EU nations could reach a deal on the next round of Russian oil sanctions this week. Meanwhile, Japan has also said it will phase out Russian oil purchases.

Looking ahead, US crude oil inventory data will be in focus later in the day with the release of the weekly private API report at 2130BST, which are likely to show a fall in crude oil stocks according to a Reuters poll of analysts released on Monday. This might lend further support to WTI.

On Wednesday, focus will return to the global macro mood and how it reacts to the release of the April US Consumer Price Inflation report, which is expected to show a slight moderation in the pace of headline YoY price inflation. If confirmed, this could support sentiment by easing fears about Fed tightening, supporting a higher oil price.

Many traders will probably be eyeing a retest of earlier weekly highs above $110.00 later in the week should risk appetite hold up and the EU reach a deal on its proposed Russian oil embargo. But China lockdowns remain a key downside for traders to keep an eye on.

The US Bureau of Labor Statistics will release the April Consumer Price Index (CPI) data on Wednesday, May 11 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 12 major banks regarding the upcoming US inflation print.

On a yearly basis, CPI is expected to edge lower to 8.1% from 8.5% in March. The Core CPI, which excludes volatile food and energy prices, is forecast to fall sharply to 6% from 6.5%.

Commerzbank

“The US inflation rate is likely to have peaked at 8.5% in March. Although consumer prices probably rose quite strongly again in April, by 0.3% from March (consensus 0.2%). However, they had risen much more strongly in April 2021. As this increase now drops out of the year-on-year rate, the latter is likely to fall to 8.2%. A similar effect applies to the core rate, which excludes energy and food. Here we expect a decline from 6.5% to 6.1%.”

Nordea

“We expect the April CPI headline figure to show that inflation fell to c. 8.2 YoY and core inflation to fall to c. 6.2 YoY as we compare prices to last spring’s hefty price increases.”

ING

“Consumer price inflation should hopefully show inflation has passed the peak with the YoY rate slowing from 8.5% to 8.3%, and core inflation edging down to 6.1% from 6.5%. Lower gasoline prices will be a big help, as will a drop in second-hand car prices as heralded by data from the Mannheim car auctions. However, it will be a long slow descent to get to the 2% target. As such, the Fed will continue to hike rates swiftly with 50bp rate hikes expected in June, July and September.”

RBC Economics

“Torrid growth in the US inflation rate likely slowed in April to 8% YoY. This would mark the first decline in almost a year and come on the heels of price growth that soared to 8.5% YoY in March. Further risks to global supply chains from the Russian invasion and China’s lockdowns will continue to add tailwinds to global inflation pressures. With labour markets still exceptionally tight and inflation pressures exceptionally strong, the Fed is expected to continue to act quickly to move interest rates higher. We expect another 50bp hike in June to build on the 50 bps hike (and start of QT tightening) announced last week.”

TDS

“Core prices likely stayed strong in April, regaining momentum to 0.5% MoM after recording 0.3% in March. While used vehicles prices likely declined again, they probably fell less sharply than in the last report. We also look for renewed strength in shelter inflation. Our MoM forecasts imply 8.1%/6.1% YoY for total/core prices, likely confirming March was the peak of the cycle.”

NBF

“The food component likely remained very strong given severe supply constraints globally, but the increase in this segment may have been partially offset by lower gasoline prices. As a result, headline prices may have increased’“only’ 0.2% MoM, allowing the YoY rate to drop four ticks to 8.1%. Core prices, meanwhile, should have continued to be supported by rising rent prices and advanced 0.4%. Thanks to a strongly negative base effect, this healthy gain should still translate into a four-tick drop of the 12-month rate to 6.1%.”

SocGen

“Seasonally-adjusted gasoline prices are expected to have dropped roughly 5% in April. Home heating and electrical costs should dampen the overall energy price boost to the CPI, but the energy component is key to the 0.2% MoM forecast increase. If this is the case, the YoY measure would fall to 8% from 8.5% in March and raise hopes that the CPI peak pace was set last month. The unknowns regarding energy price pressures linger, however, so we are calling the peak at 8.5%, noting that conviction rests on oil and gas price developments. Core CPI is still expected up 0.4% MoM (5.9% YoY), as rent and shelter components contribute a large share of the index, and they are set for a 0.4% increase.”

CIBC

“With gasoline prices easing off in April, and strong year-ago prints from last year’s reopening being lapped, inflation is set to decelerate in April, while still remaining sky high. The 0.2% monthly advance expected for total CPI (8.1% YoY) would mask a strong gain in food prices, reflecting fresh supply chain issues linked to the war in Ukraine. That would also include an acceleration in monthly ex. food and energy prices to 0.4% (6.0% YoY), attributable to renewed supply chain disruptions for goods tied to widespread lockdowns in China, and continued upwards pressure from the cost of shelter and the tightening in the labor market. We are in line with the consensus which should limit any market reaction.”

Deutsche Bank

“We are expecting a 7.9% reading, down from the four-decade-high 8.5% print in March, not least due to base effects. From here it should all be about the pace of the declines as things like the extreme YoY prices in used cars roll out of the data. However, on the other side, it is important to see how prolonged the rise in rents is. Remember that rents make up a third of the CPI basket and 40% of core. Used cars only make up a few percentage points. A reminder that the day-by-day calendar of events is at the end as usual.”

Citibank

“US April CPI MoM – Citi: 0.1%, prior: 1.2%, CPI YoY – Citi: 8.0%, prior: 8.5%; CPI ex Food, Energy MoM – Citi: 0.4%, prior: 0.3%, CPI ex Food, Energy YoY – Citi: 6.0%, prior: 6.5%. After the softer 0.3% MoM rise in core CPI in March, there is discussion around whether US inflation has peaked. The next three months of data points – for April, May, and June – will likely show unfavorable base effects that may see the YoY reading decline from recent highs. However, underlying inflation is likely to remain strong and YoY prints could move higher again by July data.”

Wells Fargo

“In April, we expect CPI rose 0.4% MoM, which would lead the YoY rate to drop to 8.3%, the first decline since July 2021. We expect core CPI to advance 0.5% over the month in April and fall to 6.1% over the year (previously 6.5%).”

ANZ

“We expect US core CPI to have risen 0.5% MoM in April and headline CPI by 0.3%, as food and energy price rises eased. On a YoY basis, core and headline inflation should have eased to 6.1% and 8.2% respectively, suggesting annual inflation may have peaked. Has inflation peaked? It probably has on a YoY basis, but monthly inflation trends remain stubbornly high and above rates consistent with 2% saar.”

Bundesbank head and ECB governing council member Joachim Nagel said on Tuesday that the ECB should raise interest rates in July if incoming data confirms that inflation is too high, reported Reuters. The ECB should end its asset purchase programme at the end of June, Nagel continued, noting that the risk of acting too late is "increasing notably".

There is "disturbing evidence" that the increase in inflation is gaining momentum, he continued, noting that higher inflation is likely to prevail, meaning price growth expectations could become less anchored.

AUD/USD witnessed an intraday short-covering move from the fresh YTD low set earlier this Tuesday.

Retreating US bond yields, the risk-on impulse undermined the safe-haven USD and extended support.

The lack of any follow-through buying and acceptance below the 0.7000 mark favours bearish traders.

The AUD/USD pair staged a goodish recovery from its lowest level since June 2020 touched earlier this Tuesday and held on to its modest intraday gains through the early North American session. The pair was last seen trading around the 0.6970 region, up nearly 0.25% for the day.

The ongoing retracement slide in the US Treasury bond yields, along with the risk-on impulse, weighed on the safe-haven US dollar and benefitted the perceived riskier aussie. That said, any meaningful move up still seems elusive amid the prospects for a more aggressive policy tightening by the Fed, which should continue to act as a tailwind for the buck.

From a technical perspective, the overnight breakthrough the 0.7000 psychological mark and a subsequent slide below the previous YTD low, around the 0.6965 area, marked a fresh bearish breakpoint. Moreover, the AUD/USD pair's inability to capitalize on the intraday bounce suggests that a one-month-old bearish trend might still be far from being over.

The negative outlook is reinforced by the fact that technical indicators on the daily chart are holding deep in the bearish territory and are still far from being in the oversold zone. Hence, any further recovery might still be seen as a selling opportunity. That said, traders might refrain from placing fresh bets ahead of the US CPI report on Wednesday.

In the meantime, the 0.7000 mark now seems to act as an immediate resistance, above which a bout of short-covering could lift spot prices to the 0.7055-0.7060 horizontal zone. The latter should act as a strong barrier and cap the upside for the AUD/USD pair, at least for the time being.

On the flip side, immediate support is now pegged near the daily swing low, around the 0.6910 area. Some follow-through selling below the 0.6900 mark will reaffirm the near-term bearish bias and pave the way for additional losses. The AUD/USD pair might then accelerate the downward trajectory to the 0.6840-0.6835 intermediate support en-route the 0.6800 mark.

AUD/USD daily chart

-637877877755603135.png)

Key levels to watch

The next few months in Ukraine could see a "more unpredictable and potentially escalatory trajectory", said Avril Haines, the Director of US National Intelligence according to Reuters.

Cleveland Fed President and FOMC member Loretta Mester said in an interview on Tuesday with Yahoo Finance that she doesn't think the Fed is going to put the US economy into a sustained downturn, according to Reuters. Nonetheless, she added, the challenge for the Fed is a large one.

Unemployment may need to rise and there may be another negative GDP print, she continued. However, Mester said that there is a lot of positive momentum underneath the recent negative Q1 GDP print. It is important for the Fed to be raising interest rates to bring demand into balance with constrained supply, she said.

Ukraine and China both pose upside risks to inflation, she continued, adding that the US economy might see a couple of months where the unemployment rate rises, though this won't be sustained. Regarding recent stock market volatility, Mester called it "very uncomfortable" but necessary to get inflation down, and reiterated that the Fed needs to consider selling mortgage-backed securities. "We'll know more about the right size of the balance sheet as it shrinks," she added.

Cleveland Fed President Loretta Mester on Tuesday said that the Fed needs to move up rates as a pace to get inflation turning lower, according to an interview with Yahoo Finance cited by Reuters. Mester said she is comfortable with moving rates up in 50 bps intervals at another couple of meetings.

Additional Remarks:

"We will need evaluate if there is a need to speed rate hikes up, or go slower."

"I will need compelling evidence that inflation is moving down."

"So far, I have not seen compelling evidence."

The Fed needs to get its monetary policy to a more neutral stance, then evaluate how much further tightening is needed.

The neutral nominal rate of interest is about 2.5%.

"We may need to go above neutral to get inflation down."

"I think we will need to go beyond neutral."

"I am open to seeing how things evolve in second half of year and next."

- EUR/USD looks to extend the bounce to 1.0600 and beyond.

- The weekly high at 1.0641 emerges as the next target of note.

EUR/USD adds to the weekly recovery, although another test/surpass of the 1.0600 barrier remains elusive for the time being.

If the rebound picks up extra pace, then the pair should initially target the round level at 1.0600 prior to the more relevant weekly high at 1.0641 (May 5).

Above the 3-month line near 1.0930, the selling pressure is expected to alleviate somewhat. This area coincides, with the weekly high recorded on April 21.

EUR/USD daily chart

- USD/CHF witnessed modest intraday pullback from the fresh YTD high touched earlier this Tuesday.

- Retreating US bond yields kept the USD bulls on the defensive and prompted some profit-taking.

- The risk-on impulse to undermine the safe-haven CHF and limit losses amid hawkish Fed expectations.

The USD/CHF pair extended its intraday retracement slide from a three-year high and dropped to the 0.9900 neighbourhood during the early North American session.

The pair witnessed a turnaround from the 0.9975 region, or its highest level since May 2019 touched earlier this Tuesday and for now, seems to have snapped a three-day winning streak. The ongoing corrective slide in the US Treasury bond yields undermined the US dollar and prompted traders to lighten their bullish bets around the USD/CHF pair. Apart from this, the downtick lacked any obvious fundamental catalyst and is more likely to remain limited amid the prospects for a more aggressive policy tightening by the Fed.

Investors seem convinced that the Fed would need to take more drastic action to bring inflation under control. In fact, the markets are still pricing in a further 200 bps rate hike for the rest of 2022. Adding to this, concerns about rapidly rising consumer prices should act as a tailwind for the US bond yields. Hence, the focus remains glued to the release of the US CPI report on Wednesday. Nevertheless, the fundamental backdrop favours the USD bulls and supports prospects for the emergence of some dip-buying around the USD/CHF pair.

Furthermore, a generally positive tone around the equity markets, which tends to drive flows away from the safe-haven Swiss franc, validates the positive outlook for the USD/CHF pair. Hence, it will be prudent to wait for strong follow-through selling before traders start positioning for any meaningful corrective slide. In the absence of any major market-moving economic releases, the US bond yields will influence the USD demand. This, along with the broader market risk sentiment, should provide some trading impetus to the USD/CHF pair.

Technical levels to watch

50 bps rate hikes at the next two Fed meetings "makes sense" as a base case scenario, said NY Fed President and influential FOMC member John Williams on Tuesday, report Reuters. Williams said his view on the neutral rate in the US is for real interest rates to be about 0-0.5% with inflation running between 2-2.5% (suggesting a nominal neutral rate of 2.0-3.0%).

Additional Remarks:

If inflation is higher, an interest rate that adjusts for higher inflation is needed.

You can imagine circumstances where you don't need to go much above that, but that will be decided and we will learn along the way.

Williams said he has no reluctance to raise real interest rates above the neutral level if needed.

The Fed needs to anchor long-term inflation expectations at 2%.

Williams said he is confident inflation can be brought down.

As long as demand is very strong, it’s difficult to resolve supply chain issues.

Asked about the recent stock market rout, Williams said financial conditions haven’t overreacted.

Policy accommodation is being removed quickly via quantitative tightening.

Federal Reserve Bank of Richmond President Thomas Barkin said on Tuesday that once the Fed has gotten interest rates back to neutral, it can then decide whether it needs to put brakes on the economy (i.e. by further lifting interest rates into restrictive territory), depending on the level of inflation, reported Reuters. The Fed's policy path will not necessarily cause a recession, Barkin noted.

Barkin noted Fed Chair Jerome Powell's comments that 50 bps rate hikes are on the table for upcoming meetings and said that the Fed needs to get inflation under control, calling it high, persistent and broad-based. Getting inflation closer to the Fed's goal creates certainty that enables growth and supports maximum employment, he commented.

Demand in the US economy is strong and looks set to remain robust, he continued, driven by healthy business and personal balance sheets. Moreover, a number of pandemic-era inflation pressures will eventually settle, Barkin notes, adding that rising borrowing rates will dampen investment levels and spending on interest rate-sensitive items like houses and cars.

GBP/USD bounces off a test of 1.23 but the outlook remains negative. Economists at Scotiabank expect cable losses below 1.23 to extend as low as the May 2020 low of 1.2076.

1.2376 stands as resistance ahead of the figure area

“The 1.23 area provided support while gains peaked at 1.2376 that stands as resistance ahead of the figure area.”

“Losses below 1.23, which look to be in store given the GBP’s bearish trajectory, may find support at yesterday’s low of 1.2261.”

“The mid-figure area is the only noteworthy support point on the charts until 1.2076 (May 2020 low).”

EUR/USD is back to the mid-1.05s. Still, economists at Scotiabank expect the pair to finally see a break below 1.05 to open up the 2017 low of 1.0341.

The intraday high of 1.0585 is resistance

“Multiple breaks of 1.05 point to the area (with the high 1.04s) eventually giving way and opening EUR losses to the 2017 low of 1.0341. However, tests of the figure zone have been followed by relatively solid buying that then sees the EUR cap out at the next figure or in the high 1.05s.”

“The intraday high of 1.0585 is resistance followed by 1.0595/00 and 1.0640.”

“At 1.0536, the intraday low stands as support and then 1.0520 and the 1.05 area.”

Economists at TD Securities believe the Mexican peso may find space for some appreciation. They expect USD/MXN to tick down towards the 19.75/80 region over the coming months.

USD/MXN to return stably above the 20 mark in 2023

“We expect the MXN to experience some moderate strengthening against the dollar towards the 19.75/80 area in Q3/Q4.”

“In 2023, we expect USD/MXN to return stably above the 20 mark (H1 2023) and then the 21 mark (H2 2023), paring back the modest strength we anticipate for this year.”