- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 13-10-2021

- The USD/CAD slides for the second day in a row clings to 1.2450.

- Western Texas Intermediate (WTI) crude oil rises again above $80.00, lifts the CAD.

- USD/CAD: Moving averages and the Relative Strenght Index (RSI) suggest that the pair is a downtrend.

The USD/CAD begins the Asian session on the wrong foot slides 0.01%, is trading at 1.2441 during the day at the time of writing.

The market sentiment is a mixed bag, as witnessed by Asian equity futures, seesawing around gainers and losers. On Wednesday, a higher US inflation reading spurred a rally in the US bond market, which triggered a fall in US T-bond yields, ultimately underpinned the greenback, with the US Dollar Index falling 0.50%, finished at 94.00.

Higher crude oil prices boost the Canadian dollar. Western Texas Intermediate (WTI) advances 0.05%, is trading at $80.0, weighs on the USD/CAD pair.

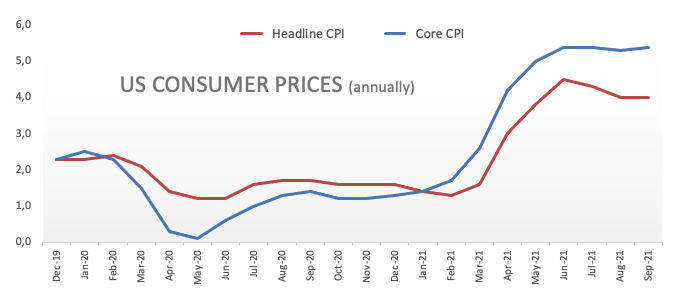

On Wednesday, the US Bureau of Labor Statistics (BLS) released inflation numbers. The Consumer Price Index for September rose by 5.4%, more than 5.3% estimated by analysts. Furthermore, the Core Consumer Price Index, which excludes food and energy costs, increased by 4%, according to estimations.

USD/CAD Price Forecast: Technical outlook

Daily chart

The USD/CAD pair is trading just below the daily moving averages, suggesting that the pair is in a downtrend. Momentum indicators like the Relative Strenght Index (RSI) at 34 indicate the pair has a downward bias.

For sellers to resume the downward trend, they will need a daily close below 1.2421. In that outcome, the first support would be 1.2302. A breach of the latter could tumble the USD/CAD towards 1.2006, but it will find some hurdles on the way south, like the May 27 high at 1.2140

On the flip side, a daily close above the confluence of the 200-DMA and the psychological around the 1.2500-05 area could open the door for further gains for buyers. In that outcome, the following resistance would be the 50-DMA at 1.2619.

KEY ADDITIONAL LEVELS TO WATCH

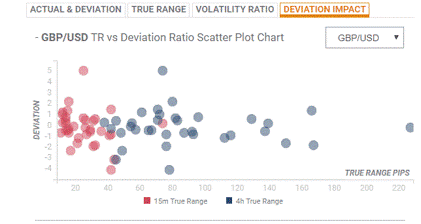

- GBP/USD extends the previous session’s gains on Thursday in the initial Asian session.

- Lower US T-yields undermine the demand for the US dollar.

- Brexit led-woes, worker shortage, weaker domestic data keep a check on sterling.

The GBP/USD pair extends gains on Thursday. The pair touched a high of 1.3667 in the previous session composed of nearly 100-pips movement. At the time of writing, GBP/USD is trading at 1.3667, up 0.03% for the day.

The US benchmark 10-year Treasury yields recovered to trade at 1.58% before falling to 1.54% on Wednesday following the higher September inflation data and FOMC minutes. The US Consumer Price Index (CPI) was upwardly revised to 5.4% on yearly basis from a previous estimate of 5.3%. Minutes from the Federal Open Market Committee’s September meeting showed the Fed could begin a “ gradual tapering process” by as soon as mid-November. The greenback pared its initial gains and traded lower near 94.00 with fresh losses.

On the other hand, the British pound gains on the USD broad-based selling amid the UK Chancellor, Rishi Suank remarks on supply chain issues during his visit to the US to address G-20 finance ministers. Furthermore, the European Union (EU) offered an “ Express Lane” proposal to solve Northern Ireland Brexit row, which aided the sterling recent gains.

As for now, traders keep their focus on the Bank of England (BOE) Credit Condition Survey, and US Initial Jobless Claims to gauge market sentiment.

GBP/USD additional levels

- NZD/USD snaps two days’ losses on Thursday in the early Asian session.

- US Dollar Index falls below the one-year high near 94.50 to trade negatively.

- Kiwi gains amid mixed play of COVID-19, risk-on sentiment, and inflationary pressures.

NZD/USD prints daily gain on Thursday in the Asian session. The selling pressure in the US dollar pushes NZD/USD higher. After testing the lows near 0.6911, the pair jumbled nearly 60-pips in the US session to give the highest closing in the past five-session. At the time of writing, NZD/USD is trading at 0.6960, up 0.10% for the day,

The US Dollar Index (DXY), which measures the greenback performance against its six major rivals, trades at 94.00, down 0.54% as investors digest the recent inflation readings and FOMC minutes. The US Core Price Index (CPI) jumped 5.4% in September from 5.3% in August whereas the FOMC minutes showed that the Fed is close to starting tapering, possibly in mid-November.

Furthermore, the risk-on sentiment helped the kiwi to gain momentum. It is worth noting that, S&P 500 Futures is trading at 4,358, up 0.08%. The disappointing economic data restricted the gains for the NZD. The ANZ Business Outlook Index in New Zealand fell -8.6 in October.

On the pandemic side, new 55 cases are recorded and Northland and Waikato will remain in alert level 3 for another five days.

As for now, all eyes are on the US Initial Jobless Claims to take fresh trading impetus.

NZD/USD additional levels

- EUR/USD begins the Asian session on the right foot, barely up 0.04%.

- Higher inflationary pressures weakened the US dollar, strengthened the euro and precious metals.

- US CPI annually base rose by 5.4%, higher than the 5.3% foreseen.

The EUR/USD advances as the Asian session begins trading at 1.1597, barely up 0.04% during the day at the time of writing. On Wednesday, the single currency dipped to the daily low at 1.1524 but bounced off the lows, courtesy of a higher US CPI reading, and finished around the 1.1590’s.

The market sentiment is upbeat, depicted by US equity indices, which rose between 0% and 0.77%, whereas Asian equity futures seesaw between gainers and losers as the Asian session kicks in.

On Wednesday, the US Bureau of Labor Statistics (BLS) released inflation numbers. The Consumer Price Index for September increased by 5.4%, higher than 5.3% estimated by analysts, suggesting that American citizens are struggling with higher prices. Further, the Core Consumer Price Index, which excludes food and energy costs, rose by 4%, unchanged.

The EUR/USD reaction to the news initially was towards a strong US dollar, but it seems that the market had already priced in the increase, selling off the greenback afterward, thus strengthening the euro.

EUR/USD Price Forecast: Technical outlook

Daily chart

The single currency is trading well below the daily moving averages, remains in a downtrend. Wednesday’s price action created a bullish-engulfing candle, meaning prices could be headed north, but strong resistance at the psychological 1.1600 needs to be reclaimed. Also, the October 4 high at 1.1639 adds another strong resistance layer for EUR/USD buyers to account for it.

In the case of a daily close above 1.1600, the first supply level would be the abovementioned 1.1639. A break of the latter could expose the 50-day moving average (DMA) at 1.1719 as the next resistance area.

On the flip side, a mover towards the downside is on the cards, supported by momentum indicators like the Relative Strength Index (RSI), which is at 41 below the 50-midline. Failure at 1.1600 would expose the 2021 year low at 1.1524. A break beneath that level could pave the way towards the July 16 low at 1.1370.

KEY ADDITIONAL LEVELS TO WATCH

- AUD/USD continues its northerly trajectory supported by higher energy and covid vaccinations optimism.

- China remains a significant risk to Australia's export-dependent economy.

AUD/USD is second to only the Canadian dollar on Wednesday in New York closing in the cunt down to Thursday's Asian session's key event that will reveal Australia's jobs data for September. At the closing bell on Wall Street, AUD/USD was 0.45% higher on the day at 0.7380 after travelling from a low of 0.7323 to a high of 0.7381. The pair is just 24 pips off a 38.2% Fibonacci retracement of the 2021 uninterrupted monthly bearish trend. See below for more on the technical picture.

Meanwhile, AUD is picking up a bid as investors seek out commodities as a hedge against inflation and prospects for rising prices in Iron Ore, and even higher LNG and other energy-related exports such as coal are going to serve the nation's surplus balance and currency well.

Additionally, news flow has the potential to be constructive as markets focus on reopening and on high energy costs. However, analysts at Credit Suisse argued that, ultimately, ''the bar for an improvement in the data sufficient to move the dial in a meaningful way on RBA policy is quite high, especially with the Reserve Bank of Australia outlook already priced fairly hawkish, and the likely outcome on the China front still far from clear.''

AUD/USD short squeeze has room to go

On the other hand, it is worth noting that over the course of the past month, net AUD positioning has collapsed to 2015 levels. That leaves the market vulnerable for a continued squeeze on short positioning, especially if unexpected changes in external drivers come about. For instance, Australia is highly dependent on China's business in iron ore.

The Evergrande Gray Rhino event has shaven the prices of Australia's number one export in what was already in a downtrend amidst trade tensions between the two nations. Iron ore prices sat just over $US120 ($164) per tonne of 62 per cent iron ore at the end of last week, well below the prices reached in mid-July this year, when they topped $US200 per tonne. However, they have started to recover from the Sep lows of $106, but considering the Chinese property shake-out, the fastest and largest iron ore crash in history would be expected to resume its southerly trajectory.

UBS estimates there are 10 developers with potentially risky positions with combined contract sales of 1.86tn yuan – or 2.7 times Evergrande’s size. In other words, Evergrande is only the tip of the iceberg. As things stand, Chinese construction is likely to fall over the next year and that would be expected to equate to hundreds of millions of tonnes of less steel that will be needed.

This would equate to hundreds of million tonnes of iron ore equivalent also. This puts iron ore on track to fall below $100 a tonne and perhaps to even match its 2015 price crash to somewhere below $50 in the near future. If prices were to somehow not fall further and continue to recover significantly higher, then AUD would become even more attractive that has so far been protected by the unexpected energy crisis that has driven coal and LNG prices wild in Asia.

However, China has already commissioned oodles of new coal mines to resolve the issue by the northern Spring. So, if the reopening of the economy in Australia is already priced in and should we see a continuation of the route in iron ore prices followed by falling coal and LNG prices, as well as domestic housing collapse, then AUD could be in for a very rough ride. With respect to housing, Chinese investment is expected to drop out at the same time that the Reserve Bank of Australia and APRA are tightening credit availability for its property market.

All of this means that the risk to reward to being short could start to be attractive again from a fundamental basis, while technically, as the analysis below will show, there could still be room left in this correction yet to go.

Aussie jobs data coming up

Meanwhile, the Australian Employment data is the key focus in Asia today.''We expect employment will have fallen -120k in August, which is slightly below consensus. But we expect the unemployment rate will only rise to 4.7%,'' analysts at ANZ Bank said. We also see China’s Consumer Price Index later in the day.

AUD/USD technical analysis

AUD/USD has started to correct five months of an uninterrupted bearish trend and the price is en-route to the 38.2% Fibonacci retracement of the impulse as illustrated above, near 0.7410. However, it may not be long before the bears re-engage once the positioning equilibrium levels out and the price starts to look rich again. On the other hand, that may not be for a while and until the April lows are tested again near to a 61.8% Fibo retracement near 0.7600.

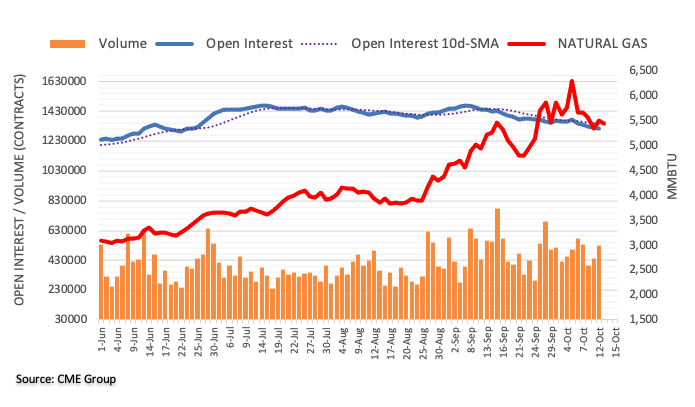

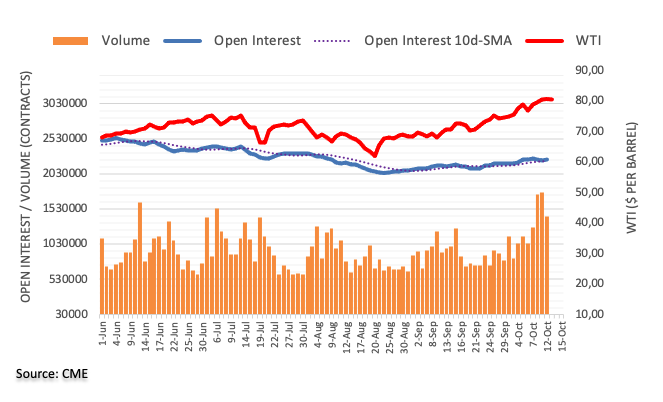

- WTI barely advances, courtesy of the OPEC+ which lowered its estimates for the rest of 2021.

- The US Dollar Index is down, bracing to 94.00.

- As US stock indexes rise, the market sentiment is upbeat towards the end of the New York session.

Western Texas Intermediate (WTI) US crude oil benchmark barely advances 0.05%, is trading at $79.94 during the New York session at the time of writing. The market sentiment has improved through the American session, as depicted by US equity indexes rising between 0.01% and 0.65%. Meanwhile, the US Dollar Index, which influences the price of crude oil, is declining 0.51%, clinging to 94.00

WTI sluggish advance on Wednesday lies on the back of the OPEC+, which revised lower its estimate for 2021 global oil consumption in its monthly report. Furthermore, the group added that the spike in natural gas prices could boost crude oil use like power generation, but it could curb the demand in other areas such as refining.

Oil has surged due to the rebound in activity from the pandemic, which has increased consumption, depleting inventories. Also, shortages in natural gas and coal have driven demand for the so-called black gold.

WTI Price Forecast: Technical outlook

Daily chart

WTI is trading around the week tops but retreated under $80.00, testing the close of Tuesday’s price action. The daily moving averages are located below the price, indicating that crude oil is in an uptrend. Momentum indicators like the Relative Strength Index (RSI) above 70, in oversold levels, means that WTI could be headed for a correction lower before resuming the upward bias.

In case of a WTI’s correction lower, the first demand zone would be the October 6 high at $79.53. A breach of the latter, WTI could tumble towards the October 7 low at $76.60.

On the flip side, a daily close above $80.00 indicates that oil prices might be headed for consolidation, awaiting for RSI to exit oversold levels before resuming the uptrend.

KEY ADDITIONAL LEVELS TO WATCH

What you need to know on Thursday, October 14:

The dollar sold-off on Wednesday dragged lower by falling US Treasury yields. The market mood was dismal throughout most of the day, with Asian indexes closing in the red after a mixed Chinese Trade Balance, which posted a surplus off $66.76 billion, much better than anticipated. Exports were sharply up, although imports contracted.

Yields were weaker ever since the day started, but accelerated their slump following the release of US inflation data. The September Consumer Price Index was upwardly revised to 5.4% YoY from a previous estimate of 5.3%, while the core annual reading was confirmed at 4%.

The US Federal Reserve published the Minutes of its latest meeting. As expected, the document showed that policymakers are ready to kick-start tapering, a gradual reduction in the pace of asset purchases, aiming to end it in mid-2022.

Wall Street once again struggled to advance, with the three majors indexes closing mixed around their opening levels. JP Morgan announced upbeat third-quarter earnings, reporting profits of $11.7 billion.

The EU announced a series of proposals that would reduce the burden on Irish Sea trade created by Brexit’s Northern Ireland Protocol. Meanwhile, BOE’s Governor Andrew Bailey reiterated his hawkish message.

The EUR/USD pair trades near the 1.1600 figures near fresh weekly highs, while GBP/USD hovers around 1.3660. Commodity-linked currencies resumed their advances with USD/CAD trading at 1.2430 a fresh multi-month low, and the AUD/USD approaching 0.7400 ahead of the release of Australian employment figures.

Gold benefited the most from the broad dollar’s weakness, now trading at $1,791 a troy ounce. Crude oil prices remain steady, with WTI at around $80.50 a barrel.

Top 3 Price Prediction Bitcoin Ethereum Ripple: Crypto market bound for a brief correction

Like this article? Help us with some feedback by answering this survey:

''Finance leaders from the G20 major economies on Wednesday endorsed a global deal to revamp corporate taxation and pledged to avoid premature withdrawal of fiscal support while keeping a close eye on inflationary pressures,'' according to a final draft communique seen by Reuters.

''The G20 finance ministers and central bank governors also called on the International Monetary Fund to establish a new trust fund to channel a $650 billion issuance of IMF monetary reserves to a broader range of vulnerable countries.''

G20 finance leaders endorse OECD pact to adopt 15% global minimum corporate tax, reallocate taxing rights for large multinationals.

G20 finance leaders reaffirm resolve to use 'all available tools for as long as required' to address covid-19 and its impact.

G20 finance leaders pledge to sustain economic recovery, avoid any premature withdrawal of support measures.

G20 finance leaders say central banks will act as needed to ensure price stability while looking through inflation pressures where they are transitory.

G20 finance leaders say support IMF to secure additional donor contributions to CCRT funds to provide debt service relief for poor countries

G20 finance leaders call for further contributions to expand IMF's poverty reduction and growth trust -draft

G20 finance leaders call on IMF to establish new resilience and sustainability trust to channel reserve assets to a broader range of vulnerable countries-draft.

G20 finance leaders call for early engagement of borrower countries, private creditors in common framework debt restructuring process

G20 finance leaders urge Chad's private creditors to act swiftly on common framework debt restructuring process.

G20 finance leaders say look forward to 'ambitious' replenishment of world bank IDA fund for poor countries by December 2021.

G20 finance leaders say committed to strengthening resilience of non-bank financial intermediation sector.

G20 finance leaders reiterate that no 'global stablecoins' should start operations until all legal, regulatory and oversight requirements addressed.

G20 finance leaders say encourage concerted efforts to reform the world trade organization.

G20 finance leaders say will strive to address bottlenecks of covid-19 tools in low and middle-income countries in coming months.

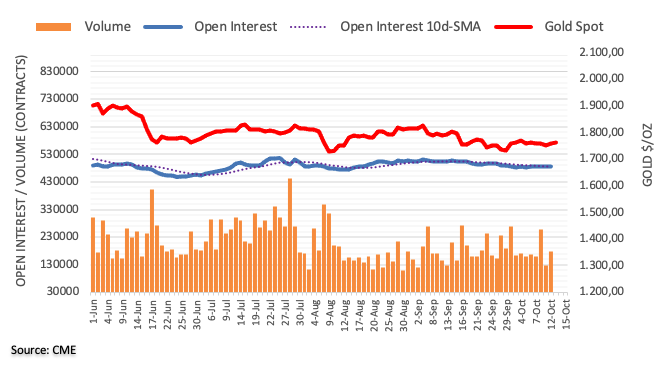

- Gold bulls bust through bearish commitments and prints fresh highs for October.

- US dollar gives back significant ground as 30-year US Treasury yields drop heavily.

- Stagflation theme gains traction in markets are cold energy sapping winter-time approaches.

The price of gold on Wednesday has rallied into key resistance territory where it has printed the highest levels since the weekly bar from the 13 Sep. At the time of writing, gold is trading at $1,792.50 and 1.85% higher. The price has travelled from a low of $1,757.89 to a high of $1,796.24 where it tests the 200-day EMA.

In key data today, US inflation data showed prices rose solidly in September, stoking expectations the Federal Reserve will announce a tapering of stimulus next month, with the potential for rate hikes by mid-2022. The Consumer Price Index rose 0.4% last month, versus a 0.3% rise expected by economists polled by Reuters.

In the 12 months through September, the CPI increased 5.4%, up from a 5.3% year-on-year advance in August, Reuters reported. ''Excluding the volatile food and energy components, the so-called core CPI climbed 0.2% last month, up from 0.1% in August.''

In more recent trade, the Federal Reserve released the minutes from its September meeting which gave the signs for a November announcement for tapering of the central bank's bond-buying stimulus. More on this in the link below:

FOMC Minutes: ''A gradual tapering process would likely be appropriate''

Nonetheless, the greenback has fallen into the fourth position on the Currency Strength Indexes behind GBP and the commodity currencies, AUD and CAD. The move does not tally with the foresight with regards to timings of a US rate hike lift-off though. The market had been pricing in a rate hike for December of next year, but since the CPI data and hawkish Minutes, it is now eyeing September.

However, given how far the US dollar index has come in just a couple of weeks, rising some 1.7% and running into a wall of resistance as per the Sep 2020 highs, a correction is of no surprise, only the timing of it remains the head-scratcher. What is evident, however, is that yield differentials are playing their part, with the 10 and 30-year Treasury yields down 1.5% and 2.5% respectively on the day. ''If the sell-off in rates continues, differentials may start to play a larger role in FX outcomes,'' analysts at ANZ Bank argued.

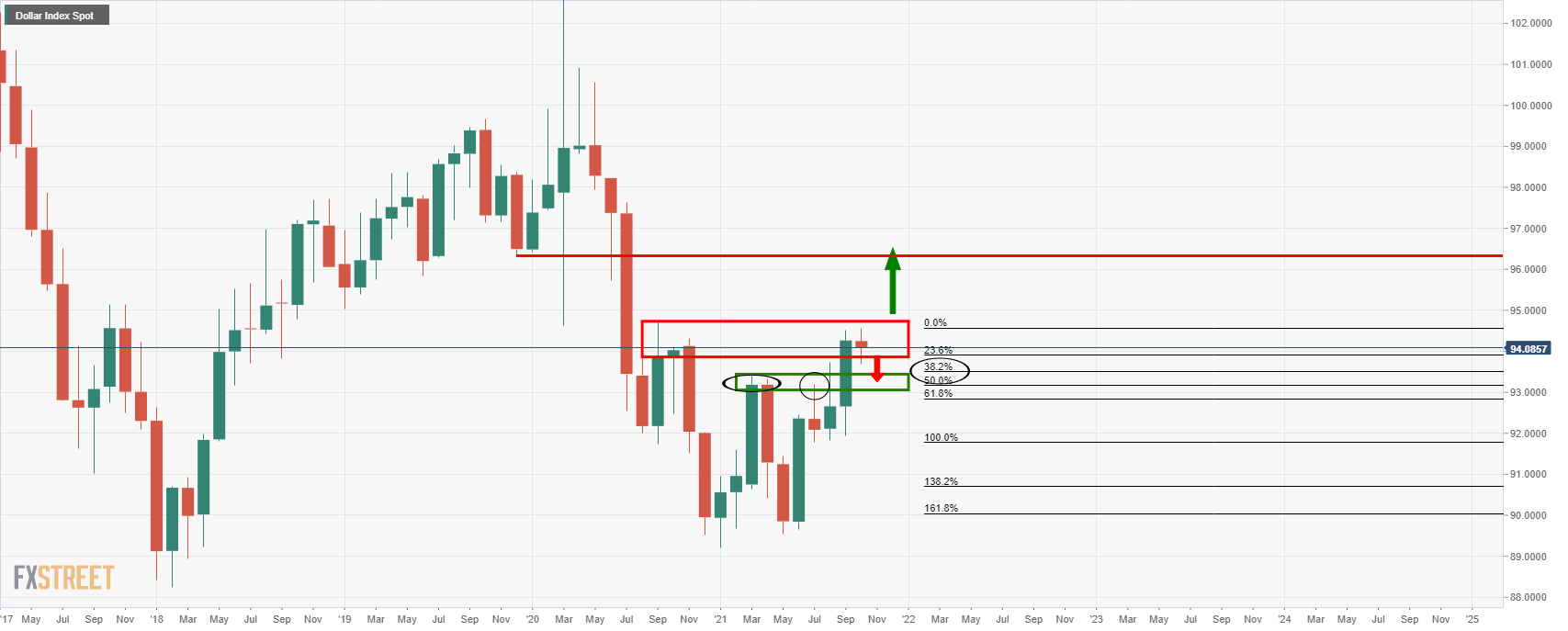

US dollar index, monthly chart

At this juncture, the 38.2% and 50% Fibonacci retracements levels align with the old market structure between March and August 2021 between 93.18 and 93.50.

Gold's fat right tail

Meanwhile, a fundamental and strongly bullish case for gold has been made today by analysts at TD Securities as follows:

Although stagflation has captured share of mind, it has yet to translate into additional gold demand. However, as the global energy crisis intensifies, reasons to own the yellow metal are also growing more compelling. A cold winter could send energy prices astronomically higher, asymmetrically fueling stagflationary winds. This translates into a fat right tail in gold prices. With a low bar for short covering, CTA trend follower purchases could be a potential catalyst.

The price of Brent crude, the worlds global benchmark for oil has steadied on the day but remain near to the highest levels since Oct 2018:

Gold technical analysis

- Gold Chart of the Week: XAU/USD bulls step in

As illustrated on the chart above in analysis at the Asian open this week, from a 4-hour perspective, the target area was between 1,790/1,800 which has been met in today's rally.

On Tuesday, as the chart below shows, the bears had been testing the grit of the bulls and the price had moved sideways along horizontal support and pushing dynamic support further out along the trend as follows:

However, the price broke the dynamic resistance which led to the bullish breakout towards the daily 200 MA near 1,800, a move that was illustrated in the daily chart from Tuesday's analysis as follows:

Gold live market, 4-hour chart

Gold live market, daily chart

At this juncture, the price would be expected to stall as traders take profit and assess the landscape of current market themes awaiting the next major catalyst. With that being said, a correction to at least a 38.2% Fibonacci retracement would be expected in the near future. Currently, that level comes in near to $1,780.

- Pound's rally is capped again right below 155.00.

- BoE rate hike expectations are fuelling sterling's rally.

- GBP/JPY is expected to reach 159.80 area – Credit Suisse.

The British pound appreciated for the fifth consecutive day against a weaker Japanese yen on Wednesday, although the pair has been unable to breach the resistance area at 154.80/90.

The pound remains bid on BoE hike expectations

The sterling remains firm across the board, which has reflected in the 3.2% GBP/JPY rally witnessed over the last two weeks. Investors are anticipating that the Bank of England will be the first major central bank to start hiking interest rates following the COVID-19 crisis. The surging energy prices have boosted yearly inflation well beyond the Bank of England’s 2% target for price stability, which has prompted some BoE officials to openly suggest the possibility of accelerating rate hikes, therefore increasing GBP’s attractiveness for investors.

On the other end, the Japanese yen, particularly sensitive to monetary policy differentials is suffering against the GBP and the USD. With the Bank of Japan discarding the possibility of any rate hike for the foreseeable future, and with the yield curve under control, the JPY remains vulnerable against monetary tightening expectations in the rest of the world’s major economies.

GBP/JPY expected to keep rallying towards – 159.80

In a bigger picture, the FX Analysis team at Credit Suisse expect the pound to continue appreciating in the coming weeks, heading to levels near 160.00: “With a major base already seen established in February 2021, we look for a break above 156.62 to further reinforce the positive outlook, with resistance seen next at 159.80.”

Technical levels to watch

- Silver advances on the back of lower US T-bond yields, despite high inflationary pressures.

- FOMC’s September meeting minutes showed that half of its members expect an interest rate hike by 2022.

- Further, the Fed minutes revealed that the pace of the QE reduction would be in the amount of US $15 billion.

Silver (XAG/USD) climbs during the New York session, trading at $23.09, up almost 2.35% at the time of writing. Factors like the August US higher inflation reading with the Consumer Price Index, rising 5.4% (YoY), the energy crisis in Asia and Europe, and falling US T-bond yields boosts the white metal.

Moreover, on Tuesday, Federal Reserve members, across the wires, expressed that they would like to start the QE’s reduction by the November meeting. Additionally, FOMC last meeting minutes just released revealed that half of its members expect an interest rate hike by the end of 2022. Further, the pace of monthly asset purchases will be reduced by $15 billion, with $10 billion in the case of Treasury securities and $5 billion In the case of mortgage-backed securities (MBS).

The market sentiment is slightly upbeat, as depicted by US stock indexes rising between 0.20% and 0.65%, except for the Dow Jones Industrial, which is falling 0.07%.

The US Dollar Index that tracks the greenback’s performance against a basket of peers is down 0.41%, sits at 94.13, underpinned by the slump in the US T-bond 10-year benchmark note rate sliding three basis points to sit at 1.549%, lifting the prospects of higher non-yield metal prices.

XAG/USD Price Forecast: Technical outlook

Daily chart

Silver (XAG/USD) approaches the 50-day moving average (DMA) around $23.28. The longer time frame daily moving averages are located above the spot price, indicating that the white metal is in a downtrend. The Relative Strength Index, known as RSI, a momentum indicator, is at 54, with an upslope, suggesting that silver has some buying pressure.

A daily close above the 50-DMA could open the way for another leg up, towards $24.85, but it would find some hurdles on the way up. The first resistance would be $23.94. A breach of the latter coupled with a break above $24.00. could accelerate the upward trend towards the next supply zone at $24.28 before reaching $24.85.

KEY ADDITIONAL LEVELS TO WATCH

- Kiwi's rebound from 0.6910 stalls below 0.6970/80 resistance area.

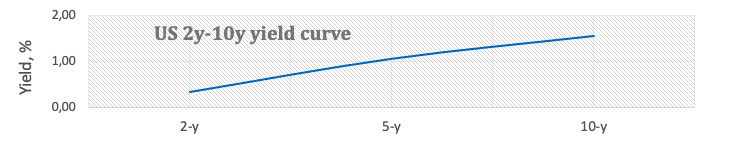

- The dollar loses ground with the US yield curve flattening.

- The FOMC minutes confirm QE tapering before the end of the year.

New Zealand's dollar has bounced up from session lows at 0.6910 on Wednesday to erase Tuesday’s losses, favoured by a somewhat softer US dollar. The pair however has stalled below the top of the last week’s trading range at 0.6970/80

The USD treads water as the US yield curve flattens

The kiwi has been favored by a moderate USD weakness on Wednesday with the flattening US yields’ curve weighing on the US dollar. The yield of the US 10-year note has dropped to 1.54% on Wednesday from 5-month highs at 1.61% on Tuesday while the 2-year yield surged to 18-month highs.

The economic calendar has failed to offer support to the dollar. The minutes of Federal Reserve’s September’s meeting have supported the idea that QE tapering might be officially announced next month, stating that “a gradual tapering process that concluded around the middle of next year would likely be appropriate”

Beyond that, some participants have acknowledged that inflation pressures might remain for a longer than expected period and have suggested the possibility of start hiking interest rates by the end of next year.

Previously, the US CPI confirmed market expectations that high inflation remains looming over the post-pandemic recovery, which bears into question Fed Powell’s theory of “temporary” inflation. Consumer prices accelerated to a 0.4% monthly pace in September, from 0.3% in August, with the yearly inflation increasing to 5.4% from 5.3% on the previous month.

Technical levels to watch

The Fed released its minutes of the September monetary policy meeting.

Key points coming through:

Participants reaffirmed that the committee's "substantial further progress" standard regarding its asset purchases was distinct from the criteria given in its forward guidance on the federal funds rate.

The committee had articulated a different, and more stringent, test concerning the conditions that would need to be met before it started raising the target range for the federal funds rate

Participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate

Various participants stressed that economic conditions were likely to justify keeping the rate at or near its lower bound over the next couple of years

Participants noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December.

A number of participants raised the possibility of beginning to increase the target range by the end of next year because they expected the labour market and inflation outcomes specified in the committee's guidance to be met by then.

Some of these participants saw inflation as likely to remain elevated in 2022 with risks to the upside.

Participants cited upside risks that inflation would continue for longer than expected, especially if labour and other supply shortages proved more persistent than currently anticipated.

Most participants remarked that the standard of "substantial further progress" had been met with regard to the committee's price-stability goal or that it was likely to be met soon.

Several participants expressed concern that the high degree of accommodation being provided by monetary policy, including through continued asset purchases, could increase risks to financial stability.

A number of participants assessed that the standard of substantial further progress toward the goal of maximum employment had not yet been attained but that, if the economy proceeded roughly as they anticipated, it may soon be reached.

A number of other participants indicated that they believed that the test of "substantial further progress" toward maximum employment had been met.

Some of these participants also suggested that labour supply constraints were the main impediments to further improvement in labour market conditions rather than lack of demand.

All participants agreed that it would be appropriate for the current meeting's postmeeting statement to relay that, if progress continued broadly as expected, a moderation in the pace of asset purchases may soon be warranted.

Participants generally commented that the "illustrative path" of taper developed by Fed staff provided a straightforward, appropriate template that policymakers might follow.

Participants noted that uncertainty remained high.

Participants judged that the current stance of monetary policy remained appropriate to promote maximum employment as well as to achieve inflation that averages 2% over time and longer-term inflation expectations that are well anchored at 2%.

The illustrative path encompassed monthly reductions of $10 bln in treasuries and $5 bln of MBS.

Most participants saw inflation risks as weighted to the upside.

A couple of participants observed that giving advance notice to the general public of a plan along these lines may reduce the risk of an adverse market reaction to moderation in asset purchases.

Several participants indicated that they preferred to proceed with a more rapid moderation of purchases than described in the illustrative examples.

Many participants noted the substantial rise in one- and three-year measures of inflation expectations in the New York Fed's survey of consumer expectations or in the one-year measure in the university of Michigan survey.

Participants observed that the inflation rate was elevated, and they expected that it would likely remain so in the coming months before moderating.

Participants marked up their inflation projections and some expressed concerns that elevated rates of inflation could feed through into longer-term inflation expectations of households and businesses.

Several participants indicated that a rise in the labour force participation rate might lag the improvements in other indicators such as the unemployment rate - a pattern consistent with past business cycle recoveries.

Various participants suggested that a complete return to pre-pandemic labour market conditions was unlikely.

Several other participants suggested that the upward pressure on prices would abate as the covid-related demand and supply imbalances subsided.

Members agreed post-meeting statement was an appropriate means of acknowledging that, in the near future, the committee would likely assess that the standard for reducing the pace of net asset purchases had been met.

A number of others assessed that once the covid-related concerns that were currently weighing on labour force participation passed, the participation rate and the EPOP ratio could return to, or even exceed the pre-pandemic levels.

A few participants noted that there was not yet evidence that robust wage growth was exerting upward pressure on prices to a significant degree, but also that the possibility merited close monitoring.

Market implications

The greenback is rising marginally from the lows of the day on the release. Prior to the minutes, the US dollar had eased back from a one-year high as longer-dated Treasury yields fell after US inflation data, despite it showing that prices rose solidly in September, advancing expectations for Federal Reserve tightening. However, the greenback has been ripe for bearish pickings considering how far it has come in just a couple of weeks, rising some 1.7% and running into a wall of resistance as per the Sep 2020 highs.

US dollar monthly chart

Meanwhile, the Fed funds futures indicate > 95% chance for Dec 22, ~70% chance for a Nov 22 rate hike. That's a big increase vs. last week.

- The euro extends recovery from 1.15.25 lows to levels near 1.1600.

- The US dollar loses ground with all eyes on the FOMC minutes.

- EUR/USD remains bearish, targeting 1.1000 – Credit Suisse.

The euro has continued regaining lost ground against a somewhat softer dollar on Wednesday with the investors awaiting the release of the minutes of the last FOMC meeting. The pair has bounced up from year-to-date lows at 1.1525 to appreciate about 0.5% returning to levels a few pips shy of 1.1600.

The dollar loses ground ahead of the FOMC minutes

The greenback is extending losses on Wednesday, with the market bracing for the release of the last Fed’s meeting minutes The market looking for clues on the possibility that the Bank will announce the tapering of its QE program in November and possibly suggest the timing of the first interest rate hike.

Beyond that, the flattening US bond yield curve has added negative pressure on the USD on Wednesday as the benchmark 10-year note has pulled back to 1.57% from levels past 1.6% on Tuesday. On the macroeconomic calendar, US Consumer Prices Index figures have confirmed the inflationary trend observed over the previous months, adding pressure on the US central bank to normalize its monetary policy.

EUR/USD remains bearish, targeting 1.1000 – Credit Suisse

The current euro recovery, however, is seen as a mere correction by Credit Suisse’s FX Analysis team. In a bigger picture, the pair remains heading lower: “EUR/USD is probing the weekly Ichimoku cloud and is close to the peak of March 2020 at 1.1495. Defending this can result in a rebound, however, 1.1665 could cap (…) Below 1.1495, next support could be at 1.1450 and projections of 1.1380 (…) “Whilst we would expect a fresh hold at 1.1290, we continue to see the broader risks skewed to the downside, with support seen next at 1.1020/00.”

Technical levels to watch

- EUR/GBP holding steady s US dollar drives the forex flows.

- Both EUR and GBP are up significantly as the US dollar corrects lower ahead of FOMC Minutes.

In US dollar volatility, EUR/GBP is sidelined as both the pound and euro rally on falling long-dated US Treasury yields and a weaker US dollar. The US dollar is driving the forex space. Despite higher wages in today's inflation data and firmer rate hike expectations in the US, the greenback has tumbled from near a one-year high on Wednesday.

At the time of writing, EUR/GBP is trading at 0.8485 and flat on the day having travelled between a narrow 0.8472 - 0.8495 range. However, from Brexit developments and UK data to the Federal Reserve minutes at the top of the hour, there is enough happening in the background across the US and UK to keep traders of the pair on their toes.

US interest rate rises eyed

Firstly, US inflation data showed prices rose solidly in September, stoking expectations the Federal Reserve will announce a tapering of stimulus next month, with the potential for rate hikes by mid-2022. The Consumer Price Index rose 0.4% last month, versus a 0.3% rise expected by economists polled by Reuters.

In the 12 months through September, the CPI increased 5.4%, up from a 5.3% year-on-year advance in August, Reuters reported. ''Excluding the volatile food and energy components, the so-called core CPI climbed 0.2% last month, up from 0.1% in August.'' Coming up, the Fed will release the minutes from its September meeting later on Wednesday and they will be parsed for signs of a November announcement that the central bank will announce a tapering of its bond-buying stimulus.

BoE tipped to be the first to raise rates

Meanwhile, the pound has edged higher on the Currency Strength Index, moving into third place behind the Aussie and Canadian dollar, commodity currencies that are stronger on the inflation hedge. Earlier, traders assessed data showing the British economy grew slightly below consensus in August. However, the sentiment is that was not enough to dent expectations the Bank of England (BoE) will increase rates. Britain's economy grew 0.4% in August, leaving it just 0.8% smaller than it was in February 2020, the Office for National Statistics said. Economists polled by Reuters had forecast monthly gross domestic product growth of 0.5% for August.

One of the major driving forces behind the pound is the expectation that the BoE will be the first major central bank to raise interest rates since the beginning of the pandemic. Investors are betting on a rise to 0.15% by December. GBP/USD had rallied to a two-week high of 1.3674 on Monday due to weekend headlines that quoted key members of the BoE, including the governor of the central bank, Andrew Bailey, and fellow policymaker, Michael Saunders, who both warned of inflationary risks and the need to act. Sanders warned that households must brace for "significantly earlier" interest rate rises. Bailey stressed the need to prevent inflation from becoming permanently embedded.

Brexit turns a significant corner

In other positive news for the pound, Brexit headlines have been coming in on Wednesday with updates from Brussels that plans to dramatically reduce checks on goods entering the region in a bid to end nearly two years of wrangling.

However, one key sticking point remains – UK Brexit Minister Lord Frost’s demand to rewrite the Protocol to at least dilute the role of the European Court of Justice (ECJ) in overseeing the rules. If Lord Frost does not back down on this, an EU official said it will be “a very big gap between the ideas we are putting on the table today and what the UK Government is asking for.''

- The US dollar dives for the second day in a row to test support at 1.2425.

- Oil prices, BoC rate hike expectations buoy the CAD.

- USD/CAD: A bearish H&S might push the pair to 1.2303 - DBS Bank.

The US dollar is trading lower against its Canadian counterpart for the second consecutive day on Wednesday. The pair’s recovery attempt seen on the early US trading session has been capped at 1.2470 and the greenback has pulled back again following the release of US Consumer Prices Index data.

Lower US yields, BoC supporting the CAD

On a broader picture, the USD/CAD has depreciated about 2.5% so far in October, with the Canadian dollar going through a steady upside trend, boosted by higher oil prices and market expectations the Bank of Canada will be forced to hike rates early next year to tackle inflation pressures. Beyond that, the flattening US yield curve, with the 10-year note down to 1.57 from five-month highs at 1.61% on Tuesday, has increased bearish pressure on the USD.

Furthermore, US macroeconomic data has failed to provide support to the US dollar. The higher than expected US consumer prices, with September's CPI accelerating to a 0.3% monthly rate and 5.4% year on year in September, have confirmed the inflationary pressures looming over the post-pandemic recovery, adding pressure to the Fed to start rolling back its massive bond-buying program.

The dollar has posted a moderately negative reaction to the data, while the investors await the release of the last FOMC meeting’s minutes to assess the possibilities that the bank will start tapering QE in November and the pace of the Bank’s monetary policy normalization plan.

USD/CAD: A bearish H&S might push the pair towards 1.2303 – DBS Bank

From a technical perspective, Benjamin Wong, Strategist at DBS bank, warns about the potential impact of a bearish H&S figure: “In the term, USD/CAD is pushing lower off a bearish head-and-shoulders reversal. A cursory look suggests this pattern should guide USD/CAD lower as its neckline around 1.2594 has clearly crated, validating the pattern (…) Having a calibrated target should give us a measuring rod, as USD/CAD is teasing the weekly charts’ Kijun support at 1.2478. A textbook scenario can see USD/CAD head towards 1.2303. Concurrently, USD/CAD is also framing a triangle break.”

Technical levels to watch

- GBP/USD climbs around this week’s tops 1.3670’s area, on broad US dollar selling pressure.

- Inflationary pressures threaten to derail the economic recovery.

- UK GDP for August increased by 6.9%, better than expected.

- US CPI rose to 5.4%, the highest gain since 2008.

During the New York session, the British pound advances almost half percent, trading at 1.3651 at the time of writing. The market sentiment is mixed, as US equity indexes seesaw between gains and losses.

Higher US inflation September reading than estimated, coupled with slower growth, threatens to derail the economic recovery. Furthermore, an ongoing energy crunch in Asia and Europe spurred the perception in consumers that companies with higher electricity prices could pass on those costs to them without harming the business.

US Consumer Price Index at higher readings since 2008, overshadowed the UK GDP figure

The UK economic docket featured the Gross Domestic Product for August annually, which rose by 6.9%, two ticks higher than the 6.7% estimated by economists. Despite being a positive figure, investors’ focus was on the United States Consumer Price Index. The GBP/USD barely blinked on the news.

Meanwhile, on the US front, the Consumer Price Index rose by 5.4%, more than the 5.3% YoY reading expected by analysts. The reading is the highest annual gain since 2008. The Core Consumer Price Index, which excludes food and energy, increases by 4% annually, according to estimations. The GBP/USD initial reaction was to the downside, reaching 1.3587, but bounced off the lows and printed a daily high around 1.3646, at the time being.

GBP/USD Price Forecast: Technical outlook

Daily chart

The GBP/USD is approaching the top of the week around 1.3670’s area. However, the daily moving averages (DMA’s) are still above the spot price, maintaining the downtrend on the pair. Also, the momentum indicator like the Relative Strenght Index (RSI) at 49 broke below the 50-midline, suggesting that downward pressure is mounting on the GBP/USD pair.

Failure to break above the 1.3700 figure could tumble the pair towards 1.3411, but it would find some hurdles on the way down. The first support level would be the October 12 low at 1.3567, followed by the September 28 low at 1.3520, and then the September 29 low at 1.3411.

KEY ADDITIONAL LEVELS TO WATCH

- USD/CHF retreats from 0.9300 to test trendline support at 0.9265.

- Below 0.9265, the pair might head towards 0.9215 and 0.9150.

- On the upside, the pair faces an important resistance at 0.9300/10.

The US dollar has been rejected again at 0.9300 resistance area, before losing momentum and drop 0.4% on the day so far, to test trendline support from early August lows, now around 0.9265.

The dollar is losing ground against its main peers on Wednesday, weighed by the flattening US yield curve, with the 10-year note dropping to 1.57%, from five-month highs at 1.61 on Tuesday.

USD/CHF daily chart

The daily chart, shows the pair below the 20-day SMA, testing the mentioned trendline at 0.9365. A confirmation below here will cancel the near-term uptrend and might empower bears to push the pair towards 0.9215 (September 22, 23 lows, and 50-day SMA) before testing 0.9150 (September 10 low)

On the upside, immediate resistance remains at 0.9300/10 (October 6, 8, and 12 highs). Above here, the pair might attempt another attack to multi-month high 0.9380 (Sept. 30 high, 78,6% Fib. Retracement of the March-June decline) and 0.9435 (Apr. 5 high).

Technical levels to watch

- The Aussie dollar breaks above 0.7350 on a higher US CPI reading.

- A mixed market sentiment put a lid on the AUD gains.

- AUD/USD: A daily close above 0.7400 opens the door for a test of the 100-DMA.

The AUD/USD is rising during the New York session, is trading at 0.7373, up 0.30% at the time of writing.

The market sentiment seesaws between risk-on/off mood, depicted by European stock indexes rising between 0.17% and 0.75%, while across the pond, American equity indexes are losing in the range of 0.25% and 0.52%, except for the Nasdaq Composite, which is in the green.

Factors like the higher US CPI reading, rising energy prices, and the possibility of slower growth dampen the market sentiment throughout the New York session. In the meantime, the US Dollar Index, which measures the greenback’s performance against a basket of six rivals, losses ground as US T-bond yields fall, declines 0.31%, sits at 94.18.

Iron ore is falling 6.20%, trading at $120.00 per metric tonne, putting a lid on the Australian dollar upside move.

On the Australian economic docket, the Westpac Consumer Confidence Change shrank to 1.5% worse than the 2% increase estimated by investors.

On the US front, the Consumer Price Index, on an annual basis, rose 5.4% in September, from a year earlier, a tick higher than the August reading. Meanwhile, the Core Consumer Price Index, which excludes the volatile food and energy prices, climbed 4%, unchanged from a year earlier.

Later on the day, the Federal Open Market Committee’s (FOMC) last meeting minutes will be unveiled at 18:00 GMT.

AUD/USD Price Forecast: Technical outlook

Dail chart

The Aussie dollar is approaching the top of the week. The 50-day moving average (DMA) at 0.7302 is the first support level, whereas the 100 and the 200-DMA remain above the spot price, acting as resistance levels.

Momentum indicator like the Relative Strength Index (RSI) at 59, aiming slightly up, supports the upward trend, but a daily close above 0.7400 could motivate AUD/USD buyers in their attempt to push the pair higher. In that outcome, the first resistance level would be the 100-DMA at 0.7416. A breach of that level could move the pair towards the September 3 high at 0.7477, immediately followed by 0.7500.

KEY ADDITIONAL LEVELS TO WATCH

- The dollar remains near three-year highs at 113.80, supported above 113.00.

- The Japanese yen edges up after a four-day downtrend.

- USD/JPY's rally is heading to 120.00 – ING.

The US dollar is regaining some ground against the Japanese yen on Wednesday’s US trading session. The pair’s reversal from three-year highs at 113.80 has found support at 113.25, before ticking up to 113.45.

The yen edges up against a softer US dollar

The Japanese yen appreciated earlier on Wednesday, supported by a somewhat weaker dollar, on the back of a flattening US yield curve. The 10-year bond yield has dropped to 1.57% after having peaked at 1.61 on Tuesday, while the 2-year yield has surged to 18-month highs at 0.36%

Furthermore, the US macroeconomic calendar has confirmed the inflationary pressures threatening economic recovery. US consumer prices accelerated at a 0.4% monthly pace and 5.4% year-on-year in September, from 0.3% and 5.3% respectively in September.

These figures bring into question Fed Powell’s theory of a “transitory” high inflation and bolster expectations the Federal Reserve may announce the rolling back of its massive monetary stimulus program in November.

USD/JPY: Seen rallying towards 120.00 – ING

According to the FX Analysis team at ING, however, USD’s rally is far from being finished. They expect the pair to reach prices at 120.00: “Pressure is building for a topside break out in USD/JPY. We think the US macro/Fed story will be a positive one for the dollar over the next 15 months (USD/JPY to trade to 120), while home-grown developments look slightly JPY bearish.”

Technical levels to watch

- The euro ticks up against a weaker USD and returns to 1.1580.

- The greenback pulls back as the US bond yields' curve flattens.

- EUR/USD remains negative, heading towards 1.1000 – Credit Suisse.

The euro is taking advantage of a somewhat softer dollar on Wednesday to regain lost ground. The pair has bottomed at year-to-date lows at 1.1525 to appreciate about 0.4% on the day, reaching session highs near 1.1580 so far.

The dollar loses ground as the US yield curve flattens

The greenback is trading lower against its main peers on Wednesday, weighed by a flattening US bond yield curve. The benchmark 10-year note has pulled back to 1.57% from levels above 1.6% on Tuesday, while shorter-term yields are building up. The yield of the 2-year Treasury bond has climbed to 0.35%, its highest level in 18 months.

On the macroeconomic calendar, US Consumer Prices have confirmed the inflationary trend observed over the previous months. Consumer inflation accelerated at a 0.4% pace in September, from 0.3% in the previous month while the yearly inflation increased by 5.4%, from 5.3% in August.

These figures cast doubt on Fed Powell’s theory of “temporary” high inflation pressures, adding pressure on the US central bank to announce QE tapering in November.

EUR/USD remains bearish, targeting 1.1000 – Credit Suisse

The current euro recovery, however, is seen as a mere correction by Credit Suisse’s FX Analysis team. In a bigger picture, the pair remains heading lower: “EUR/USD is probing the weekly Ichimoku cloud and is close to the peak of March 2020 at 1.1495. Defending this can result in a rebound, however, 1.1665 could cap (…) Below 1.1495, next support could be at 1.1450 and projections of 1.1380 (…) “Whilst we would expect a fresh hold at 1.1290, we continue to see the broader risks skewed to the downside, with support seen next at 1.1020/00.”

Technical levels to watch

- XAU/USD rallies above $1,780 on a higher than expected US CPI reading.

- Fed policymakers across the wires agreed to begin the bond taper by the FOMC November meeting.

- Silver rises in tandem with gold, almost 3% in the day.

Gold (XAU/USD) surges during the New York session, trading at $1,793, up almost 1.86% at the time of writing. Factors like the August US higher inflation reading with its Core component, rising 0.2% (MoM), the ongoing energy crunch in Europe and Asia, and falling US 10-year Treasury yield boosts the non-yielding metal.

Furthermore, on Tuesday, Federal Reserve members, across the wires, expressed that they would like to start the QE’s reduction by the November meeting, propelling investors towards safe-haven assets like gold and silver (XAG/USD), which is advancing almost 3%, around $23.20.

The market sentiment is mixed as depicted by European equity indexes rise between 0.12% and 0.55%, while across the pond, more significant stock indices fall between 0.21% and 0.48%, except for the tech-heavy Nasdaq Composite, which is rising 0.42%.

The US Dollar Index that tracks the greenback’s performance against a basket of peers is down 0.28%, sits at 94.25, underpinned by the slump in the US T-bond 10-year benchmark note rate slumping four basis points to sit at 1.533%, lifting the prospects of higher yellow-metal prices.

US Consumer Price Index rose above 5.4%, a tick higher than expected

Data-wise, the US Bureau of Labor Statistics (BLS) released inflationary numbers for August. The Consumer Price Index increased by 5.4%, higher than the 5.3%, whereas the Core Consumer Price Index, which excludes food and energy prices, remained unchanged at 4%, both readings on an annual basis.

Later on, the Federal Reserve will unveil the last FOMC meeting minutes at 18:00 GMT.

XAU/USD Price Forecast: Technical outlook

Daily chart

Gold (XAU/USD) tests the 200-day moving average (DMA) at around $1,799. A daily close above the latter would change the downward bias in the non-yielding metal, as the 200-DMA is the barometer of a long-term trade in the financial markets. But, besides the 200-DMA, the 100-DMA and a downward slope trendline could exert intense selling pressure around the $1,795 - $1,805 area.

For XAU/USD buyers, a daily close above that zone could pave the way for further gains. The first supply level would be the September 3 high at $1,833. A breach above that level could expose the June 11 high at $1,902.

Momentum indicators like the Relative Strength Index (RSI) is at 59, is aiming aggressively to the upside, suggesting that gold is under intense buying pressure as it remains below oversold levels.

XAU/USD KEY ADDITIONAL LEVELS TO WATCH

- DXY comes under pressure and retreats to the 94.20 region.

- US headline CPI rose 5.4% YoY in September, above consensus.

- The FOMC Minutes are due later in the NA session.

The US Dollar Index (DXY), which gauges the greenback vs. a basket of its main competitors, keeps the selling bias unchanged around the 94.30/20 band midweek.

US Dollar Index now looks to FOMC

Sellers have returned to the market and now drag the index to the negative territory for the first time after two consecutive daily advances, including new 2021 tops at 94.56 recorded on Tuesday.

The move lower in the buck tracks the retracement in US yields, where the 10-year reference hovers around the 1.57% region while the front-end of the curve trades near the 0.34% zone.

The index briefly leapt to the mid-94.00s soon after inflation figures tracked by the CPI rose at an annualized 5.4% in September (vs. 5.3% exp), while the Core print matched estimates at 4.0% YoY. However, the bullish attempt ran out of steam and returned to the 94.30/20 region soon afterwards.

US Dollar Index relevant levels

Now, the index is losing 0.25% at 94.27 and a break above 94.56 (2021 high Oct.12) would open the door to 94.74 (monthly high Sep.25 2020) and then 94.76 (200-week SMA). On the flip side, the next down barrier emerges at 93.77 (20-day SMA) followed by 93.67 (monthly low Oct.4) and finally 92.98 (weekly low Sep.23).

- Wall Street's main indexes are pushing higher on Wednesday.

- Technology shares push higher on improving market sentiment.

- Investors don't seem to be concerned about the September inflation data.

Major equity indexes in the US opened higher after closing the previous two sessions in the negative territory. As of writing, the S&P 500 was up 0.33% on the day at 4,365, the Dow Jones Industrial Average was rising 0.2% at 34,447 and the Nasdaq Composite was gaining 0.6% at 14,552.

Reflecting the improving market mood, the CBOE Volatility Index (VIX) is down nearly 3% at 19.36.

Among the 11 major S&P 500 sectors, the risk-sensitive Technology Index and the Communication Services Index both rise around 0.7% on a daily basis. On the flip side, the Energy Index is down 0.85%.

Earlier in the day, the data published by the US Bureau of Labor Statistics showed that the annual Consumer Price Index edged higher to 5.4% in September from 5.3% in August. Nevertheless, this reading doesn't seem to be impacting the risk sentiment.

S&P 500 chart (daily)

- EUR/USD bounces off Tuesday’s YTD low near 1.1520.

- Further south comes the round level at 1.1500.

EUR/USD reverses two consecutive daily pullbacks, including new 2021 lows in the proximity of the 1.1520 level.

Prospects for the continuation of the downtrend remains well in place, and a break below 1.1524 is expected to put a visit to the 1.1500 neighbourhood back on the radar in the relatively short-term horizon.

In the meantime, the near-term outlook for EUR/USD is seen on the negative side below the key 200-day SMA, today at 1.1935.

EUR/USD daily chart

Gold continues to hold over the 78.6% retracement at $1722. Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, expects the yellow metal to move back lower from the $1834 resistance level.

See – Gold Price Forecast: XAU/USD to hit $1850 before tanking through next year and beyond – ANZ

Resistance at $1834 to be tough

“The bounce has yet to clear moving average resistance at $1795/$1800 and we have extensive resistance from $1784 to $1834 (55, 200-day moving averages and highs since July) and we look for rallies to struggle on moves into this band. The 55-week ma also is found at $1817.”

“We are relatively neutral but downside risk remains. Below $1722, support is found at $1679.80/$1677.83, and is reinforced by the $1670 June 2020 low.”

“A close above $1834 is needed to retest the $1849 2020-2021 resistance line and $1856/57 4th June low. Above here lies the $1917 May 2021 peak.”

“Below $1670 would target the 2018-2021 uptrend at $1606.”

- GBP/USD reversed its direction after US inflation data.

- US Dollar Index edges higher toward 94.50 following earlier decline.

- Eyes on Brexit headlines, FOMC September Meeting Minutes.

The GBP/USD pair reversed its direction after climbing toward 1.3650 earlier in the day and retraced the majority of its daily advance. As of writing, the pair was up only 0.05% on the day at 1.3592.

DXY recovers on inflation data

Renewed dollar strength on US September inflation report seems to be weighing on GBP/USD at the beginning of the American session. The monthly report published by the US Bureau of Labor Statistics revealed that the annual Consumer Price Index (CPI) edged higher to 5.4% in September from 5.3% in August. Additionally, the Core CPI, which excludes volatile food and energy prices, stayed unchanged at 4% on a yearly basis.

Reflecting the positive impact of the CPI data on the greenback, the US Dollar Index (DXY) rebounded from the daily low it touched at 94.24 and was last seen losing 0.7% at 94.43.

Later in the day, investors will be keeping a close eye on the developments surrounding Brexit. Maroš Šefčovič, European Commission Vice President of Interinstitutional Relations and Foresight, will deliver the EU's proposal on the Northern Ireland Protocol at 1630 GMT.

Moreover, the FOMC will publish the minutes of its September meeting at 1800 GMT.

FOMC Minutes Preview: Fed to reiterate taper message, sending the dollar up, stocks down.

Technical levels to watch for

- DXY recedes from recent 2021 highs around 94.56.

- Intermittent dips are seen as buying opportunities.

DXY faces some selling pressure and corrects from Tuesday’s YTD highs in the 94.55/60 band.

The ongoing price action allows the index to keep the buying bias well in place and open the door to further upside in the not-so-distant future. That said, next target emerges at the September 2020 high at 94.74 and the 200-week SMA, today at 94.76. Further north should come the round level at 95.00.

Looking at the broader picture, the constructive stance on the index is seen unchanged above the 200-day SMA at 91.75.

DXY daily chart

- EUR/JPY’s sharp recovery surpasses the 131.00 mark on Wednesday.

- Further up comes the Fibo level at 131.75 ahead of 132.00.

EUR/JPY keeps pushing higher and now breaks above the key 131.00 barrier midweek.

The cross remains underpinned by the recent breakout of the key 200-day SMA and now shifts the attention to the next hurdle at 131.75, where a Fibo level of the June-August drop sits. The continuation of the move should target the round level at 132.00 the figure ahead of another Fibo level at 132.79.

In the broader scenario, while above the 200-day SMA at 129.83, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- EUR/USD pair lost its traction in the early American session.

- Annual CPI in US edged higher to 5.4% in September.

- US Dollar Index is staging a modest rebound after inflation report.

After rising to a fresh daily high of 1.1567 during the European trading hours, the EUR/USD pair came under renewed bearish pressure and was last seen trading at 1.1544, where it was down 0.15% on a daily basis.

Price pressures in US remain intact

The positive impact of the September US inflation report's on the greenback seems to be weighing on EUR/USD in the early American session.

The US Bureau of Labor Statistics announced on Wednesday that the Consumer Price Index (CPI) rose to 5.4% on a yearly basis from 5.3% in August. This reading came in slightly higher than the market consensus of 5.3%. Moreover, the annual Core CPI stayed unchanged at 4% as expected.

At the moment, the US Dollar Index, which touched a session low of 94.24, is down only 0.1% on the day at 94.42. Later in the session, the FOMC's September Meeting Minutes will be looked upon for fresh impetus.

FOMC Minutes Preview: Fed to reiterate taper message, sending the dollar up, stocks down.

Meanwhile, US stock index futures stay afloat in the positive territory, suggesting that the CPI is having little to effect on risk sentiment.

Technical levels to watch for

Inflation in the US, as measured by the Consumer Price Index (CPI), rose to 5.4% on a yearly basis in September from 5.3% in August, the US Bureau of Labor Statistics reported on Wednesday. This reading came in line with analysts' estimates. On a monthly basis, the CPI edged higher to 0.4% from 0.3%.

Further details of the publication revealed that the annual Core CPI, which excludes volatile food and energy prices, stayed unchanged at 4% as expected.

Market reaction

With the initial reaction, the US Dollar Index erased a portion of its daily losses and was last seen losing 0.13% on the day at 94.39.

Russian President Vladimir Putin reiterated on Wednesday that Russia is not using energy as a weapon and said that Russi supplied gas to Europe even during the Cold War, as reported by Reuters.

Additional takeaways

"European gas production will continue to decline."

"Russian gas production will only increase."

"Gazprom has increased gas supplies by around 10%."

"We are meeting requirements on gas supplies from Europe."

"We are increasing gas supplies to Europe, while other partners, including USA, cutting supplies."

"We are ready to increase gas supplies in line with what our partners request."

"Russia will increase gas transit via Ukraine this year."

"Europeans have not pumped sufficient volumes of gas into their storages."

Market reaction

These comments don't seem to be having a noticeable impact on market sentiment. As of writing, the UK's FTSE 100 Index was posting small daily losses at 7,123.

- Gold preserves its bullish momentum ahead of the American session.

- 10-year US Treasury bond yield stays in the negative territory.

- Dollar struggles to find demand ahead of US inflation data.

The XAU/USD pair struggled to make a decisive move in either direction in the first couple of days of the week but managed to gain traction ahead of US inflation data on Wednesday. The renewed USD weakness and falling US Treasury bond yields seem to be helping the pair push higher. As of writing, gold was up 0.7% on the day at $1,772.

In the absence of significant data releases and fundamental developments, the positive shift witnessed in market sentiment is making it difficult for the greenback to find demand. With the US stocks futures rising between 0.2% and 0.5%, the US Dollar Index is falling 0.25% on the day at 92.28 to punctuate the broad-based dollar weakness.

Meanwhile, the benchmark 10-year US Treasury bond yield, which fell 3.25% on Tuesday, is staying in the negative territory, providing an additional boost to XAU/USD.

Previewing the Consumer Price Index (CPI) data, "markets are keenly aware that price increases are again playing a part in Fed policy even if the rhetoric is muted," said FXStreet Senior Analyst Joseph Trevisani. "The credit markets tell the story. As inflation rises so should Treasury yields and the dollar. "

US Consumer Price Index September Preview: Inflation averaging, what inflation averaging?

Gold technical outlook

On the four-hour chart, gold is currently trading above the two-week-old trading range and a daily close above $1,770 could open the door for additional gains. However, the Relative Strength Index (RSI) indicator on the same chart is closing in on 70, suggesting that there could be a technical correction before the next leg up.

On the upside, the 200-period SMA acts as the first resistance at $1,775 ahead of $1,787 (September 22 high) and $1,800 (psychological level).

The initial support is now located at $1,770 (former resistance) before $1,760 (50-period SMA) and $1,755 (100-period SMA).

The aussie is moving around the mids 0.73. In the view of economists at ING, the cautious policy stance of the Reserve Bank of Australia (RBA) is not expected to send AUD/USD lower than 0.73 by year-end.

See: AUD/USD still seen lower at 0.72 on a three-month view – Rabobank

Aussie is slightly less vulnerable to external woes than before

“The market might have turned somewhat complacent to the wider implications of China’s real estate woes. More concerning developments in this sense are set to hit AUD harder than other pro-cyclicals, given its high exposure to Chinese sentiment.”

“AUD can count on some protection from rising energy prices and looks already significantly oversold.”

“The firmly dovish RBA should not be of any help in the short-term, but we think AUD/USD can close the year around its current levels: 0.73.”

EUR/GBP has trended lower since the start of the month. Economists at Rabobank forecast the EUR/GBP pair at 0.85 over the next three months while GBP/USD is seen at 1.36.

See: EUR/GBP to move downward to 0.83 over next 12 months – Danske Bank

GBP investors fear headwinds to growth

“The backdrop of lagging economic growth in the UK combined with less monetary and fiscal accommodation is a concern for GBP investors.”

“We expect EUR/GBP to hold close to the 0.85 level in a three-month view.”

“We expect USD strength to keep cable in the 1.36 area on a three-month view.”

The South African rand has had a bad month hit by a stronger dollar. This dynamic is set to continue and economists at ING believe that the USD/ZAR pair could soar as high as 17.00 in 2022.

Trade surpluses to fade

“The SARB admits that the near 6% of GDP current account surplus will dissolve within a year and growth will slow sharply – from 5.3% expected this year to just 1.7% next year.”

“With higher US rates and a stronger dollar, USD/ZAR could be trading at 16 or even 17 next year.”

EUR/USD maintains its conclusive break below major support at 1.1703/1.1695, which finally confirmed a major top for the market. Economists at Credit Suisse believe the pair can free-fall to the 1.1020/00 region.

EUR/USD staying core bearish

“We look for a fall to the March 2020 high and 50% retracement at 1.1495/93 next, where we would expect a fresh pause. However, the size of the top suggests an eventual break lower will be seen, with support seen next at 1.1290.”

“Whilst we would expect a fresh hold at 1.1290, we continue to see the broader risks skewed to the downside, with support seen next at 1.1020/00.”

“Short-term resistance moves to 1.1643/63, which we now expect to cap the market to keep the market biased directly lower.”

The USD/CAD pair is seen trading higher over the coming years as economists at Danske Bank expect to see a stronger USD. Nonetheless, with the BoC set to hike rates, the CAD should limit its decline.

Forecast: 1.26 (1M), 1.29 (3M), 1.31 (6M), 1.33 (12M)

“In light of our expectations of a stronger USD and an eventual setback to reflation sensitive assets we therefore still pencil in a higher USD/CAD over the coming years.”

“Also with the latest move in relative rates we could see more support from markets pricing in forthcoming rate hikes from the Bank of Canada – which in turn should cap the topside. We expect the BoC to hike policy rates in Q3 2022 and deliver a subsequent additional 3 hikes by end 2023.”

“We forecast USD/CAD at 1.26 in 1M (from 1.27), 1.29 in 3M (unchanged), 1.31 in 6M (from 1.32) and 1.33 in 12M (unchanged).”

In its monthly report published on Wednesday, the Organization of the Petroleum Exporting Countries (OPEC) announced that it lowered the 2021 oil demand growth forecast to 5.82 million barrels per day (bpd) from 5.96 million bpd, per Reuters.

Additional takeaways

"OPEC keeps 2022 oil demand growth unchanged at 4.15 million bpd."

"OPEC sees rise in natural gas and thermal coal prices encouraging increased gas-to-oil switching."

"OPEC raises estimated demand for its crude in 2022 by 100,000 bpd to 28.8 million bpd."

"OPEC says its output rose 490,000 bpd to 27.33 million bpd in September."

Market reaction

Crude oil prices showed no immediate reaction to this report and the barrel of West Texas Intermediate was last seen trading at $80.10, where it was down 0.55% on a daily basis.

USD/JPY has set a 34-month high at 113.80. Economists at ING expect the pair to reach the 120.00 level as US yields lift off.

See: USD/JPY set to race higher towards 2017 highs at 118.62 – Credit Suisse

A new type of capitalism to hit the JPY?

“Pressure is building for a topside break out in USD/JPY. We think the US macro/Fed story will be a positive one for the dollar over the next 15 months (USD/JPY to trade to 120), while home-grown developments look slightly JPY bearish.”

“New PM Kishida is floating the idea of a ‘new type of capitalism’, where a capital gains tax could help in income redistribution. Japanese equities are worried.”

“With Japan still in deflation, the BoJ will be the last CB to hike.”

“USD/JPY still shows by far the highest daily correlation with 10-year US yields. Expect upside pressure on both into year-end.”

Strategists at Commerzbank suspect that palladium is in the throes of basing and needs to go back on the radar. A break above the 1046 January 2020 high would open up the 200-day moving average (DMA) at 1122.

Platinum has based at 900

“Platinum has at last managed to erode its 55-day ma at 1000 and introduce scope to test 1046 the 2020 high.”

“It is showing signs of reversal from the 200-week ma at 930.77. The market has traded through here but the new low of 901.68 was not confirmed by the daily RSI and we suspect has based – the market charted a key week reversal a couple of weeks ago.”

“The market will need to regain 1046 (January 2020 high) to reassert upside dominance. This would allow for a deeper recovery to the 55-week ma at 1076.58 and the 200-day ma at 1122.”

“Only below 900 would allow for losses to the 871.75 61.8% retracement and potentially the 825 September 2020 low.”

Despite much discussion of stagflation and the UK returning to the candle-powered 1970s, GBP is actually performing quite well. Yet economists at ING are uncertain whether the Bank of England will act as early as the market expects. Therefore, GBP/USD may plunge to the 1.32 level in a couple of months.

Market is convinced the BoE moves early

“Our team feel that the BoE will hike later than market pricing – warning of some downside risk to GBP. Look out for key speeches from BoE hawks – and whether they seek to correct expectations.”

“Cable could briefly see 1.32 in next two months if the BoE indeed rejects calls for early tightening. And USD should outperform.”

- USD/CAD is edging lower ahead of the American session.

- US Dollar Index continues to pull away from multi-month high set on Tuesday.

- WTI extends downward correction, tests critical $80 level.

The USD/CAD pair stays under modest bearish pressure during the European hours on Wednesday with the greenback struggling to find demand ahead of key events. As of writing, the pair was down 0.16% on a daily basis at 1.2445.

DXY turns south on Wednesday

Falling US Treasury bond yields seem to be weighing on the dollar on Wednesday. the benchmark 10-year US T-bond yield, which lost more than 3% on Tuesday, is currently losing 0.5% at 1.572%. Reflecting the USD's poor performance, the US Dollar Index (DXY) is falling 0.25%. Meanwhile, US stock index futures are rising between 0.15% and 0.5% on the day, making it difficult for the dollar to attract investors.

Later in the session, the US Bureau of Labor Statistics will release the September inflation report. Investors expect the Core Consumer Price Index (CPI) to stay unchanged at 4% on a yearly basis. A stronger-than-forecast inflation reading is likely to provide a boost to the greenback in the second half of the day.

In the late American session, the FOMC's September Meeting Minutes will be looked upon for fresh insights regarding the timing and the pace of reduction in asset purchases. Previewing this event, "FOMC Meeting Minutes from the bank's September decision will likely serve as a reminder that the Fed is about to taper in November – boosting the dollar," said FXStreet Analyst Yohay Elam.

FOMC Minutes Preview: Fed to reiterate taper message, sending the dollar up, stocks down.

On the other hand, the barrel of West Texas Intermediate (WTI) is trading in the negative territory near $80 and helping USD/CAD limit its losses for the time being.

Technical levels to watch for

- GBP/JPY gained strong positive traction for the fifth straight session on Wednesday.

- Encouraging Brexit headlines, hawkish BoE signals acted as a tailwind for the sterling.

- The recent widening of the UK-Japanese yield spread remained supportive of the move.

The GBP/JPY cross shot to the highest level since June 24 during the first half of the European session, with bulls now eyeing a move to reclaim the key 155.00 psychological mark.

The cross prolonged its recent strong bullish momentum from the 149.25-20 area, or monthly lows and continued scaling higher for the fifth consecutive session on Wednesday. This also marked the eighth day of a positive move in the previous nine and was supported by the emergence of fresh buying around the British pound.

Reports that the European Union's new proposals for the Northern Ireland Protocol will involve reduced checks on goods and medicines boosted the sterling. This comes amid the recent widening of the UK-Japanese 10-year yield differential, which weighed on the Japanese yen and contributed to the GBP/JPY pair's ongoing move up.

Over the weekend, the Bank of England (BoE) officials, including Governor Andrew Bailey, signalled an imminent interest rate hike later this year. The money market seems to have fully priced in a 25bps BoE rate hike in December and pushed the UK 10-year gilt yield to the highest level since May 2019, at 1.222% on Monday.

Conversely, the yield on the 10-year Japanese government bond remained near zero due to the Bank of Japan's yield curve control policy. Apart from this, a modest uptick in the equity markets undermined the safe-haven JPY and supports prospects for additional gains, though overbought conditions warrant some caution.

Hence, it will be prudent to wait for some near-term consolidation or a modest pullback before placing fresh bullish bets around the GBP/JPY cross and positioning for any further appreciating move.

Technical levels to watch

- A modest USD pullback assisted AUD/USD to attract some dip-buying on Wednesday.

- Traders now eye the US CPI report and FOMC minutes for a fresh directional impetus.

- A sustained move beyond multi-week tops is needed to confirm a fresh bullish break.

The intraday USD selling picked up pace in the last hour and pushed the AUD/USD pair to fresh daily tops, around the 0.7360 region.