- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 14-10-2021

- The Aussie climbs on the back of broad US dollar weakness.

- The market sentiment is mixed, as Asian equity futures seesaw between gainers and losers.

- AUD/USD: Downward pressured, as the 200-DMA remains above the spot price.

The AUD/USD begins the Asian session on the right foot, climbs 0.05%, trading at 0.7419, during the day at the time of writing.

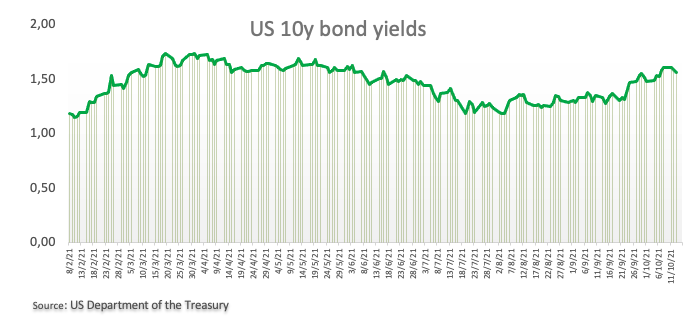

The market sentiment was upbeat on Thursday, as portrayed by European and American stock indexes, finishing in the green. The US Dollar weakened across the board, slid 0.11% to end at 93.97, underpinned by falling US T-bond yields, with the 10-year benchmark note coupon, down three basis points, finished at 1.516%.

As the Asian session starts, the current mood, as witnessed by Asian equity futures, is split between gainers and losers. Meanwhile, the S&P/ASX Australian Stock Exchange and the Nikkei 225 are rising 0.60% and 1.46%, respectively.

AUD/USD Price Forecast: Technical outlook

Daily chart

The AUD/USD is trading below the 200-day moving average (DMA), indicating the pair is in a downtrend. The 50-DMA is well below the price action, whereas the 100-DMA at 0.7410, while underneath, is near the spot price. Momentum indicators like the Relative Strength Index (RSI) at 64 supports the upward trend, but a daily close above the 100-DMA could open the door for further gains.

In that outcome, the first resistance for the AUD/USD pair would be the September 3 high at 0.7477, immediately followed by 0.7500. A breach of that area would expose the 200-DMA at 0.7567.

On the other hand, failure at the 100-DMA would resume the downward trend, pressuring the pair towards the October 13 low at 0.7322. A clear break below the latter would expose key support levels, like the 50-DMA at 0.7304, followed by the October 6 low at 0.7225.

AUD/USD: KEY ADDITIONAL LEVELS TO WATCH

The Governor of the Bank of Canada, Tiff Macklem, said global supply chain bottlenecks are not easing as quickly as expected, meaning inflation in Canada and among IMF members will probably take a little longer to come down.

"These bottlenecks are not easing as quickly as expected. And there was certainly a strong consensus these issues warrant continued attention and they are going to take some time to work through," said Macklem of his talks with IMF central bankers.

"What this all means, in all our countries, is that inflation - measures of inflation - are probably going to take a little longer to come back down," he added.

Macklem also said that while the supply chain hiccups are looking a bit more persistent, they continue to be viewed as transitory.

USD/CAD implications

The Canadian dollar has been the strongest of those on the Currency Strength Indicators since 30 Sep when the US dollar started to slide. The commodity complex is hot and CAD is propped up by sky-high oil prices:

-637698519265595451.png)

- USD/CHF edges higher on the last trading day of the week.

- Lower US Treasury yields undermine the demand for the US dollar.

- Fed tapering, inflationary concerns, and job data influence traders decision.

The USD/CHF pair accumulates mild gains on Friday in the early Asian session. After testing the low near 0.9194 after the US PPI data, the pair managed to bounce back near 0.9250. At the time of writing, USD/CHF is trading at 0.9235, up 0.05% for the day.

The US benchmark 10-year Treasury yields trade at 1.51% on softer US Producer Price Index (PPI) readings. The PPI rises 0.5% in September, below the market expectations of 0.6%. Further, the Initial Jobless Claims falls to a new pandemic low at 293,000 much below the market consensus of 318,000. The greenback follows the US bond yields and remains pressured below 94.00. It is worth noting that, S&P 500 Futures is trading at 4,434, up 0.12% for the day.

In addition to that, the President and CEO of the Federal Reserve Bank of Philadelphia said he is not expecting rate hikes until late 2022, or early 2023.

On the other hand, the Swiss franc loses momentum on higher inflation data. Switzerland’s producer and import prices jump 4.5% in September on a YoY basis.

As for now, traders are looking for the US Retails Sales data to take fresh trading insight.

USD/CHF additional levels

- A positive market sentiment hurt safe-haven currencies on Thursday, but the greenback versus the Japanese Yen appreciated.

- The US 10-year Treasury yield dipped three basis points, finished at 1.516%.

- Fed’s Bullard and Bostic, among others, coincide that inflationary pressures are stickier than expected.

The USD/JPY begins on the right foot in the Asian session, advances 0.01% is trading at 113.70 during the day at the time of writing.

On Thursday, financial markets witnessed appetite towards riskier assets, depicted by US equity indexes, finishing in the green, following European stocks footprints. In the Forex Market, the greenback weakened in tandem with safe-haven currencies, while the US 10-year T-bond yield fell three basis points, to end at 1.516%. Despite all those factors, the greenback gained traction against the Japanese Yen, reversing the Wednesday price action when the USD/JPY pair threatened to break under the 113.00 figure.

Also, some Fed speakers crossed the wires. The St. Louis Fed President James Bullard said that there is no strong case that inflationary pressures will dissipate over the next six months. In the same tone, the Atlanta Fed President Raphael Bostic said that inflation appears to last longer attributed to supply chains and labor disruptions.

Furthermore, the US Initial Jobless Claims decreased to 293K better than the 319K foreseen by analysts, increasing the chances of a Fed’s bond taper announcement in the November meeting. Additionally, the US Producer Price Index (PPI) rose by 8.6%, lower than the 8.7% estimated, while the PPI excluding food and energy, the so-called Core, increased by 6.8%, lower than the 7.1%.

On Friday, the Japanese economic docket will feature the Tertiary Industry Index for August on a monthly basis is expected at 0%.

Meanwhile, in the US, Retail Sales and the University of Michigan Consumer Sentiment Index will be unveiled on Friday. Investors expect a decrease of 0.2% in Retail Sales for September, whereas the UoM Consumer Sentiment Index for October estimates around 73.1 better than the September 72.8.

USD/JPY: KEY ADDITIONAL LEVELS TO WATCH

- EUR/USD is stalling just below the daily 20 EMA.

- A period of sideways accumulation could be on the cards for the near term.

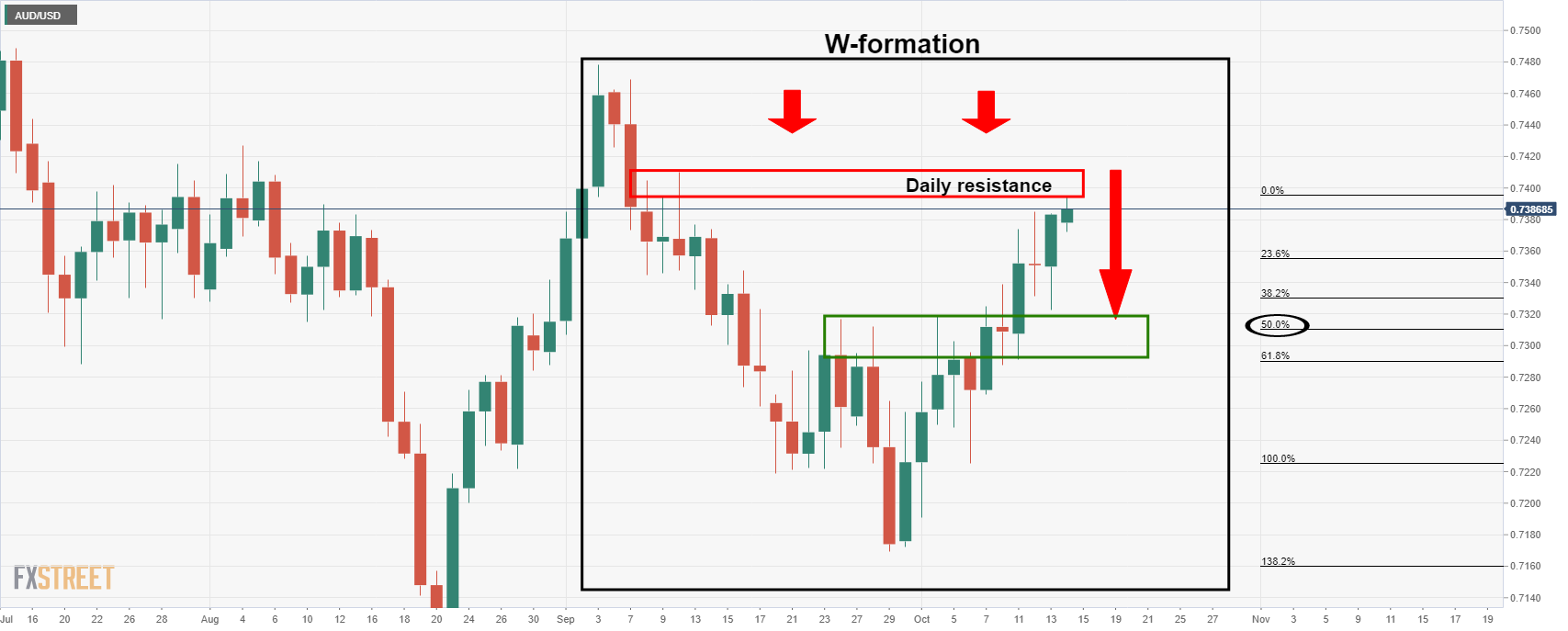

EUR/USD has shot higher in the last few sessions but the rally has stalled and left a doji topping candle on the daily chart. The following is an analysis of both the daily and hourly chart that illustrates a downside bias for the meanwhile.

EUR/USD daily chart

The W0formaiton is a reversion pattern that has a high completion rate. The price would be expected to retest the neckline of the formation from where it might find enough demand in buyers accumulating the euro at a discount. In doing so, that would be expected to lead to a higher high in a fresh daily impulse to the upside.

EUR/USD 1-hour chart

However, from a lower time frame perspective, the hourly chart is forming a bearish head and shoulders, so there are prospects of a downside continuation below the daily 38.2% Fibo target which suggests that the market will remain in a period of sideways accumulation for somewhile longer.

The Financial Times has released an article that will likely make sterling investors nervous as Brussels has been urged to prepare a contingency plan for the UK trade war. The ''EU countries want European Commission to be ready if Britain suspends key part of Brexit deal,'' the Financial Times explained.

''Leading EU member states are pressing Brussels to draw up tough retaliatory measures should the UK carry out its threat to suspend trading arrangements for Northern Ireland enshrined in the Brexit deal.

Representatives of five member states on Monday met European Commission vice-president Maros Sefcovic, the EU Brexit negotiator, to demand he come up with contingency plans for a possible trade war, diplomats have told the Financial Times.''

As bilateral discussions start again in earnest over the Northern Ireland Protocol, there's definite potential for things to get a lot messier which is going to be a headwind for the pound.

UK Brexit Minister Lord Frost’s demand to rewrite the Protocol to at least dilute the role of the European Court of Justice (ECJ) in overseeing the rules. If Lord Frost does not back down on this, an EU official said it will be “a very big gap between the ideas we are putting on the table today and what the UK Government is asking for.''

GBP/USD weekly chart

From a weekly perspective, considering the price dropped below all of the support structures which it is now testing again as resistance, the bias remains bearish. A correction to the trendline resistance and a 61.8% Fibonacci is underway, but bears are likely lurking at these levels.

- S&P 500 SPX gained 74.35 points, or 1.70%.

- Nasdaq Composite IXIC gained 248.97 points, or 1.71%.

- The DJI rose 532.21 points, ending up 1.55%.

US stocks charged higher on Thursday on strong earnings from companies including Morgan Stanley and UnitedHealth. Additionally, US data came in contrary to the inflation theme as well, cooling fears of stagflation.

As for the performance of the benchmarks, the S&P 500 added 74.35 points, or 1.70%, to end at 4,438.15 points, while the Nasdaq Composite climbed 248.97 points, or 1.71%, to 14,824.90. The Dow Jones Industrial Average DJI gained 532.21 points, or 1.55%, to 34,910.02. As for industry performaces, the technology sector was the strongest in the S&P with giants Microsoft Corp MSFT and Apple Inc AAPL climbing. Individual shares in the financial bloc, Citigroup C, Bank of America Corp BAC and Morgan Stanley MS were firmer following results that were released that topped quarterly earnings estimates.

US data dials down inflation nerves

Meanwhile, US data showed the number of Americans filing new claims for unemployment benefits last week fell close to a 19-month low, and a separate report showed producer prices eased in September to the lowest level this year as airline passenger service costs plunged. The seasonally adjusted PPI rose 0.5%, compared with a 0.7% gain in August, the Bureau of Labor Statistics said Thursday. The latest print was the lowest since December.

- The GBP/USD pair stalls at the 50-DMA retrace below 1.3700.

- Risk-on market sentiment boosts the GBP undermines the greenback.

- GBP/USD: The Relative Strength Index above 50, aiming higher, indicates that there could be a leg-up near 1.3800.

The GBP/USD retreats from the daily high around 1.3733, advances 0.20% during the New York session, trading at 1.3688 at the time of writing. The British pound could not hold to the 1.3700 level, broke the latter in a counter-trend move, which in 4-hours witnessed a 60 pip drop.

Risk-on market sentiment drives the market, portrayed by US equity indexes, posting gains between 1.47% and 1.82%. Risk-sensitive currencies, like the AUD and the GBP, are greatly favored. Additionally, the British pound had a boost over the weekend when Bank of England’s members expressed their interest in tackling rising inflation by hiking interest rates.

The greenback has been under selling pressure across the board, with the US Dollar Index that measures the buck’s performance against a basket of six currencies, slides 0.11%, clings to 93.97. Nevertheless, despite those factors, the US dollar trimmed some of its losses against the Sterling.

GBP/USD Price Forecast: Technical outlook

Daily chart

Despite the broad US dollar weakness, the Sterling advance stalled at the 50-day moving average, around 1.3716. The subsequent price action exerted downward pressure on the pair. Momentum indicators like the Relative Strenght Index (RSI) at 52 indicate that the GBP/USD pair might print another leg-up before resuming the downward trend, but firstly the pair will need a daily close above the 50-DMA.

In that outcome, the following leg-up could reach the 1.3800 figure, which confluences with the 78.6% Fibo retracements (from the September 14 pivot high to the September 29 pivot low), before resuming to the downside.

On the flip side, failure at 1.3700, could see the pair sliding towards the 1.3600 figure, followed immediately by the lows of the last five days, around 1.3570.

KEY ADDITIONAL LEVELS TO WATCH

What you need to know on Friday, October 15:

As Treasury yields held at the lower end of the weekly range, the dollar remained weak. The yield on the 10-year US Treasury note bottomed at 1.507%, ending the day nearby. As for the greenback, it managed to post a modest intraday advance against the EUR and the CHF.

Wall Street rallied on the back of better than expected earnings reports from big names, including banks such as Morgan Stanley, Bank of America and Citigroup.

Upbeat US data provided additional support to the market’s mood. The September Producer Price Index was up 0.5% MoM and 8.6% YoY, higher than the August readings although below the market’s expectations,while Initial Jobless Claims for the week ended October 8 printed at 293K, much better than the 319K expected.

EUR/USD lost the 1.1600 threshold, ending the day a few pips below the level. GBP/USD settled at 1.3860, while commodity-linked currencies were the best performers. AUD/USD regained the 0.7400 mark, while USD/CAD fell to 1.2354, a fresh multi-week low.

Oil prices were up. The International Energy Agency said that record natural gas prices would boost demand for oil and top oil producer Saudi Arabia dismissed calls for additional OPEC+ supply. WTI settled at $81.40 a barrel. Gold flirted with $1,800 a troy ounce, ending the day just below the level.

Friday will bring US Retail Sales and the Michigan Consumer Sentiment Index.

Ethereum Classic price will tap $280 by early 2022

Like this article? Help us with some feedback by answering this survey:

- Bulls have broken the weekly trendline resistance but face a critical level.

- AUD/USD eyes a run to 0.7480 as the last defence for a full-on bullish breakout.

- Commodity currencies are bid on the inflation theme and rising prices.

AUD/USD is up some 0.5% on the day and the pair have travelled from a low of 0.7372 to a high of 0.7426 as the commodity currencies continue to top the forex leader boards on a daily basis. Commodities are strong with the CRB index moving to fresh cycle highs on the day in what has been a monumental rally since April 2020. AUD, in particular, is enjoying a comeback in iron ore prices with a fresh corrective high made at the start of the week.

Evergrande remains a dark cloud for AUD

However, the Evergrande crisis is a dark cloud hanging over the Australian economy and its reliance on its biggest export, iron ore. Prices sat just over $US120 ($164) per tonne of 62 per cent at the end of last week, well below the prices reached in mid-July this year, when they topped $US200 per tonne. Considering the Chinese property shake-out, the fastest and largest iron ore crash in history would be expected to resume its southerly trajectory. UBS estimates there are 10 developers with potentially risky positions with combined contract sales of 1.86tn yuan – or 2.7 times Evergrande’s size. In other words, Evergrande is only the tip of the iceberg.

Chinese construction is likely to fall over the next year and that would be expected to equate to hundreds of millions of tonnes of less steel that will be needed. This would equate to hundreds of million tonnes of iron ore equivalent also. This puts iron ore on track to fall below $100 a tonne and perhaps to even match its 2015 price crash to somewhere below $50 in the near future and weigh heavily on AUD.

USD profit-taking in play

Meanwhile, the US dollar edged down against major peers on Thursday, touching a 10-day low as rising risk appetite and profit-taking ensued at the same time. Producer price growth slowed in September to the lowest level this year as airline passenger service costs plunged. The seasonally adjusted producer price index rose 0.5%, compared with a 0.7% gain in August, the Bureau of Labor Statistics said Thursday. The latest print was the lowest since December and came in line with the consensus on Econoday.

Nevertheless, there are expectations that the US Federal Reserve is going to tighten monetary policy more quickly than previously expected amid an improving economy and surging inflation that had fuelled a rise in the greenback since early September. The minutes of the Fed's September meeting was more hawkish than expected and have confirmed the tapering of stimulus is likely to start as soon as November. The dollar index is back to being flat at the time of writing at 93.999. However, it had met its lowest since Oct 5 at 93.759. On Tuesday this week, it had reached a one-year high at 94.563.

AUD/USD technical analysis

The price is meeting a familiar level on the weekly chart of Sep 2020 which could prove to as resistance and send the pair back to test what is now a counter trendline. A break of the highs, however, will bring in the Sep tweezer top near 0.7480 which guards a full-on breakout to the upside. The market will otherwise be bearish below 0.7220.

- The euro resumes its downtrend to hit 19-month lows at 0.8450.

- The pound remains bid on BoE hike expectations.

- A sustained move below 0.8437 would accelerate the downtrend – Credit Suisse.

The euro has resumed its negative trend against the British pound on Thursday, hitting prices below 0.8470 for the first time since last August, to test 19 month-lows at 0.8450, which so far has resisted the pressure.

The pound remains firm on BoE tightening expectations

The British pound maintains a firm tone, buoyed by market expectations of a BoE rate hike early next year, and probably further tightening to follow to tackle inflationary pressures. Surging energy prices have pushed yearly inflation to levels almost twice the Bank of England’s target for price stability which has prompted some Bank officials to admit the possibility of accelerating the monetary policy normalization plan.

Furthermore, the European Union’s proposal to scrap custom checks for products arriving in Northern Ireland from Britain has eased fears about another stand-off with the Union, which has increased demand for the pound.

EUR/GBP: Breach of 0.8437 would accelerate the downtrend – Credit Suisse

According to the Credit Suisse's FX Analysis team expect the 0.8449/37 support area to hols although, they warn about the possibility of downward acceleration if such level is broken: “Whilst we would again look for a fresh hold at 0.8449/37 and swing higher in the channel, a sustained move below 0.8437 would mark an acceleration in the downtrend, then exposing the key lows of 2019 and 2020 at 0.8281/39.”

Technical levels to watch

- USD/CHF recovers from a 120 pip drop from the European session.

- Lower US T-bond yields capped the recovery of the USD/CHF pair.

- USD/CHF: A daily close above the Wednesday low increases the odds for another leg-up.

The USD/CHF trims Thursday’s losses barely declines 0.09%, trading at 0.9234 during the New York session at the time of writing. The Swiss franc strengthened against the greenback earlier in the European session, sending the pair tumbling towards Thursday’s daily low at 0.9198. However, despite still below the day’s open, the buck is staging a comeback and jumped almost 120 pips from the daily lows.

Meanwhile, the US Dollar Index, which measures the greenback’s performance against a basket of its peers, is slumping 0.05%, at 93.97, underpinned by the US T-bond 10-year yield struggling to hold to the 1.5’% threshold, sits at 1.519%, down three basis points.

USD/CHF Price Forecast: Technical outlook

Daily chart

The USD/CHF is in an uptrend, depicted by the daily chart, showing the daily moving averages (DMA’s) located below the spot price, acting as dynamic support levels. In fact, Thursday’s price action briefly broke below the 50-DMA, which lies at 0.9215 but bounced off, approaching Wednesday’s low of 0.9235.

For dollar buyers to resume the upward trend, they need a daily close above the Wednesday low. In that outcome, the USD/CHF will find its first resistance at 0.9300. A breach of the latter could push the pair towards the confluence of the March 9 and the September 30 highs around the 0.9375-0.9368 area, which was unsuccessfully tested two times.

On the other hand, failure at the Wednesday low could send the pair tumbling towards the 50-DMA. A sustained break below that level could push the USD/CHF towards the 100 and the 200-DMA, at 0.9166 and 0.9132, respectively.

The Relative Strenght Index (RSI) is at 47, edging slightly low, indicating that USD/CHF could have another leg down.

KEY ADDITIONAL LEVELS TO WATCH

- NZD/USD holds in positive territory as the US dollar slides.

- Inflation risks are supporting the currency complex and the NZ dollar.

- US PPI does not meet the consensus but inflation concerns are rampant.

At the time of writing, NZD/USD is trading at 0.7025 and up almost 1% on the day after rising from a low of 0.6958 to a high of 0.7040. The US dollar continues to underperform despite the strong US Consumer Price Index data and hawkish Federal Reserve minutes which outlined more detail around the central bank's intentions to start to taper, perhaps as soon as November. The greenback was touching a 10-day low as rising risk appetite put a brake on the safe-haven currency's recent rally, while the Aussie and Kiwi dollars gained.

US dollar sinks further on profit-taking

Expectations that the US Federal Reserve would tighten monetary policy more quickly than previously expected amid an improving economy and surging inflation had fuelled a rise in the greenback since early September. Profit-taking has ensued and improved risk sentiment has also dented the greenback.

Additionally, Producer price growth slowed in September to the lowest level this year as airline passenger service costs plunged. The seasonally adjusted producer price index rose 0.5%, compared with a 0.7% gain in August, the Bureau of Labor Statistics said Thursday. The latest print was the lowest since December and came in line with the consensus on Econoday.

In other data, a Labor Department report showed US Consumer Prices rose solidly in September, and they are likely to rise further amid a surge in energy prices, potentially pressuring the Fed to act sooner to normalise policy. The Fed's September meeting minutes yesterday also showed that a growing number of policymakers were worried that high inflation could persist. The dollar index is flat at the time of writing on the day at 93.999 but met its lowest since Oct 5 at 93.759. On Tuesday this week, it had reached a one-year high at 94.563.

Commodity currencies bid on the inflation hedge

The markets are concerned about the nature of the global inflation cycle and its persistence. With these global factors dominating, commodity currencies can benefit from the inflation hedge. In this regard, next week’s NZ CPI data will be a key domestic event.

NZD/USD technical analysis

The price on the weekly chart is on the verge of a fresh bullish impulse but the flag's resistance is not far off. A break there could lead to a significant rally while, otherwise, the will be prospects of a lower low to the channel's support.

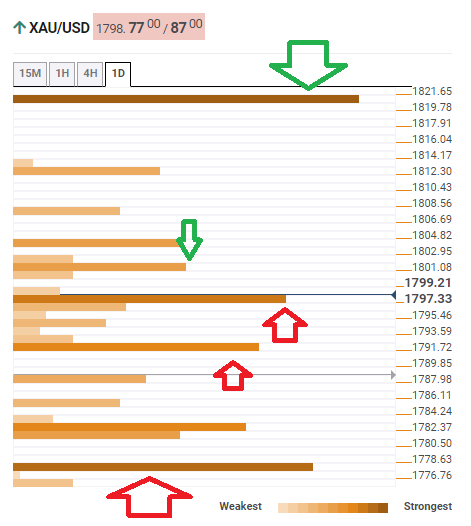

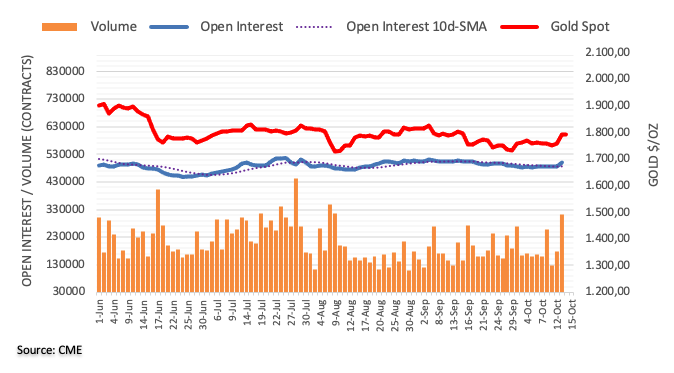

- Bullion prices reach fresh one-month highs at $1,800.

- US dollar weakness and inflation concerns boost gold's rally.

- XAU/USD: Next targets might be $1,807 and $1,830.

Gold futures’ appreciated for the third consecutive day on Thursday, favored by a somewhat softer dollar, to reach fresh one-month highs at $1,800 before consolidating above $1,790.

Gold rallies further as the USD loses ground

Bullion ticked up about $1 to it $1,800 for the first time since mid-September, on the back of a retreating US dollar, weighed by a flattening US yields curve. Long Term Treasury yields have retreated sharply over the last three days, with the yield of the 10-year note down to 1.52% after peaking above 1.60% earlier this week, while shorter-term yields surge to multi-month lows amid expectations that the Fed will soon announce the end of its QE program.

Furthermore, increasing concerns about the growing inflationary pressures are starting to translate into higher demand for gold, a traditional inflation hedge. Chinese producer prices surged to a 26-year high in September with a 10.7% increase year-on-year, which has reactivated concerns about the risks of stagflation. Earlier this week, US Consumer Prices accelerated to a 13-year high, confirming persistent consumer inflation and increasing pressure on the Federal Reserve to start normalizing its monetary policy.

XAU/USD, aimed to $1,807 on track to $1,830

From a technical perspective, gold prices have regained bullish momentum to attempt an assault to $1,807 (Sept. 15 high) ahead of $1.830 July and September's peak. If that level is surpassed, the next potential target might be June 8 and 11 highs at $1,905.

On the downside, the pair remains supported above previous weeks’ highs at $1,70, with next potential support areas at $1,745 (October 6 low) and below here, a key support area at $1,725 (September 29, 30 low).

Technical levels to watch

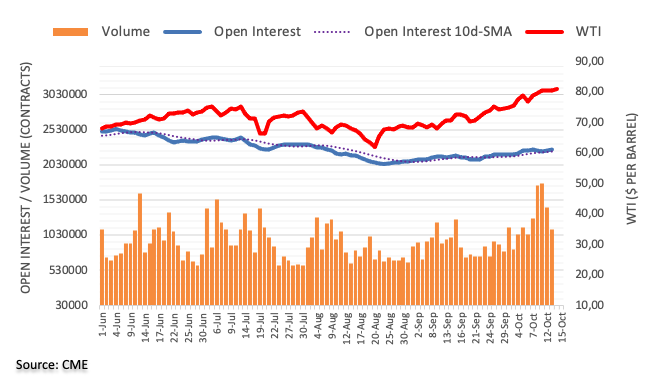

- USD/CAD suffers another drop on Thursday as USD sinks to a 10-day low.

- The global energy crisis supports CAD as oil prices rise.

USD/CAD is trading at 1.2370 and down some 0.57% after falling from a high of 1.2445 to a low of 1.2354 on Thursday so far. The Canadian dollar has strengthened to its highest level in more than three months against its US counterpart, as the energy crisis underpins the nation's biggest exporting industry, oil.

Rising energy prices support CAD

The price of oil, one of Canada's major exports, rose after the International Energy Agency said that record natural gas prices would boost demand for oil and top oil producer Saudi Arabia dismissed calls for additional OPEC+ supply. IEA said the OPEC+ group is undersupplying the market by 700,000 barrels per day as it sticks to its schedule of monthly supply increases even as shortages of natural gas, LNG and coal boost oil demand

In its Monthly Oil Market report, the IEA said natural gas and coal shortages in Asia and Europe are raising oil demand by up to half a million barrels per day, while OPEC+ adds just 400,000 barrels per day monthly and US producers refrain from new drilling, pushing oil prices to seven-year highs. West Texas Intermediate crude was last seen up 0.91% to US$81.25 per barrel.

"The surge in prices has swept through the entire global energy chain, fueled by robust economic growth as the world emerges from the pandemic. Record coal and gas prices, as well as rolling black-outs, are prompting the power sector and energy-intensive industries to turn to oil to keep the lights on and operations humming. The higher energy prices are also adding to inflationary pressures that, along with power outages, could lead to lower industrial activity and a slowdown in the economic recovery," the agency noted.

Meanwhile, in what was other welcomed news today, domestic manufacturing data added to evidence that economic activity picked up in the third quarter. Canadian factory sales rose 0.5% in August from July, on higher sales of petroleum and coal, chemicals and primary metals, Statistics Canada said.

US dollar pushed to a 10-day low

As for the US dollar, the DXY index that measures the greenback vs. a number of major rival currencies is down for the second straight day and trading back below 94. US rates are edging lower despite the firm Consumer Price Index print and the FOMC minutes showing imminent tapering. This is priced into the greenback which has suffered at the hands of lower yields and profit-taking as well as rising risk appetite. The DXY was touching a 10-day low on the day while the Aussie, CAD and Kiwi dollars gain in the inflation hedge.

- GBP/JPY's rally extends to fresh five-month highs at 155.70.

- The pound remains bid on BoE hike expectations.

- GBP/JPY could reach 159.80 – Credit Suisse.

The British pound has appreciated for the sixth consecutive day on Thursday, breaching the 155.00 level to approach three-year highs right above 156.00. The remains bid against an ailing Japanese yen on Thursday, after having gained nearly 4% so far in October.

BoE rate hike expectations are supporting the GBP rally

The sterling remains trading on a firm tone, with the investors pricing an interest rate hike by the Bank of England early next year. Surging energy prices have pushed yearly inflation to levels almost twice the BoE’s target for price stability in the UK, and some Bank officials are starting to suggest the possibility of accelerating the monetary policy normalization plan.

Furthermore, a somewhat higher appetite for risk on Thursday has weighed safe assets, like the Japanese yen, favoring riskier currencies such as the GBP. The world’s major stock markets are posting substantial advances, with the US indexes trading well above 1% at the time of writing.

The Dow Jones trades 1.49% up, while the S&P and Dow Jones Indexes advance 1.62% and 1.68% respectively with upbeat quarterly results offsetting concerns about inflationary pressures and supply chain bottlenecks thwarting the economic recovery.

GBP/JPY might extend its rally towards 159.80 – Credit Suisse

From a technical point of view, the pair seems ready to extend its rally to levels near 160.00, according to the FX analysis team at Credit Suisse: “With a major base already seen established in February 2021, we look for a break above 156.62 to further reinforce the positive outlook, with resistance seen next at 159.80.”

Technical levels to watch

- EUR/USD failure at 1.1600 threatens to push the single currency to new yearly lows.

- Risk-on market sentiment weighs on safe-haven currencies, like the US dollar.

- ECB members coincide with inflation upside pressures as “transitory.”

- Fed’s Bostic: Inflation appears to be the last longer because of supply chains.

- Fed’s Daly: Bottlenecks are the leading cause of rising prices.

The EUR/USD slumps during the New York session, trading at 1.1588, down 0.04% at the time of writing. Earlier in the Asian session, the single currency rose to a fresh weekly high at 1.1624, reclaiming the 1.1600 thresholds. However, as European traders got to their desks, the euro slid aggressively, with sellers pushing the pair beneath the 1.1600 figure.

Risk-on market sentiment has kept safe-haven currencies like the US dollar downward pressured. Riskier currencies like the AUD, the CAD, and the NZD outperform the greenback. Nevertheless, ongoing central bank divergences between the European Central Bank and a Federal Reserve ready to start the bond taper weigh on the shared currency.

During the European session, some ECB members crossed the wires. Klass Knot said that the inflation outlook for the Eurozone is back on track. In the same tone, Christine Lagarde, President of the European Central Bank, said that they continue to view inflation upswing as being largely driver by temporary factors.

That said, most ECB policymakers seem to adhere to the “transitory” narrative, contrarily to what Federal Reserve members have been vocal about recently.

Across the pond, on Thursday, Atlanta’s Federal Reserve President Raphael Bostic said that inflation appears to be the last longing because of supply chain and labor shortages. In the same tone, and at the same time, San Francisco President, Mary Duly, said that bottlenecks are the leading cause of rising prices. She added that inflation would subside as the COVID-19 crisis improved.

US Initial Jobless Claims rose to 293K better than the 319K expected

In the European economic docket, there is nothing to report. Concerning the US, the Initial Jobless Claims rose to 293K better than the 319K foreseen by analysts, delivering positive news regarding the labor market. Further, the US Producer Price Index increased by 8.6% less than the 8.7% estimated, while excluding food and energy, expanded 6.8% lower than the 7.1% expected.

KEY ADDITIONAL LEVELS TO WATCH

WTI futures capped at $81.61, remains steady above $80.00.

OPEC forecasts, US stocks weigh on oil prices.

US Oil prices consolidate between $79.45 and $81.60.

Front-month WTI futures have been rejected at $81.61 session high earlier today, and prices have retreated moderately during Thursday’s US trading session. Oil prices, however, remain fairly steady, consolidating at long-term highs, with downside attempts contained above the psychological $80 level.

OPEC, higher US stocks weigh on oil prices

The rally of the West Texas Intermediate was paused on Wednesday, after climbing above $80. The OPEC+ released a downward revision of its oil demand growth estimations for 2021, which might have eased upside pressure on crude prices.

Furthermore, The US Energy Information Administration (EIA) has reported on Thursday a much higher than expected increment on oil stocks, weighing prices further. Commercial crude oil inventories increased by 6 million barrels in the week of October 8 in the US, according to the EIA, well beyond the 0.7 million build-up anticipated by the market.

WTI prices remain capped below $81.60

Crude prices have remained trading rangebound over the last two days, trapped between $79.40 and $81.60 after peaking above $82.00 last Monday. On the upside, WTI futures need to confirm above the mentioned $81.60 (Oct.12 high) and $82.15 (Oct, 11 high) to set its focus on the $90.00 area (78.6% Fibonacci retracement of the 2014-2016 decline).

On the downside, below the $80.00 (psychological level and $79.45 (Oct. 12, 13 lows) the WTI might lose its upside momentum and extend its reversal towards $78.65 (Oct. 8, 10 lows).

Technical levels to watch

- The dollar fails to break above 113.70, remains trading near three-year highs.

- The Japanese yen weakens in a risk-on session.

- USD/JPY might extend its rally beyond 114.00 – UOB.

US dollar’s bullish attempt seen on the early US trading session has hit resistance again at the 113.70 area, and the pair retreated to the mid-range of 113.00. The USD remains strong against a weaker yen, trading right below three-year highs at 113.80 following a 3.3% rally over the last four weeks.

The yen suffers on higher risk appetite

The Japanese yen is trading lower against its main peers with a positive market sentiment hurting safe-havens in favor of riskier assets. The world’s major stock indexes are posting significant gains on Thursday, as concerns about surging inflation and supply chain bottlenecks have taken a backseat.

On the macroeconomic domain, Japanese industrial output contracted at a 3,2% pace in August, with automotive production plunging on the back of the global chip shortage.

In the US, weekly jobless claims have dropped below the 300,000 new claims for the first time in the last 19 months while, on Wednesday, the Federal Reserve offered new hints suggesting that the official announcement of QE tapering might take place at its November’s meeting. The impact on the USD however, has been limited, with the greenback trading lower against most majors on Thursday.

USD/JPY might be about to move above 114.00 – UOB

In a bigger picture, the pair remains steady near recent highs, and, according to the FX Analysis team at UOB, a further rally should not be discarded: “On Tuesday (12 Oct, spot at 113.40), we highlighted that the impulsive surge suggests that further USD strength would not be surprising and that the next resistance is at 114.20. There is no change in our view for now even though overbought shorter-term conditions could lead to a couple of days of consolidation first. The USD strength is deemed intact as long as it does not breach 112.80 (‘strong support’ level was at 112.65 yesterday).”

Technical levels to watch

- XAG/USD threatens to trade above the $24.00 threshold.

- Falling US T-bond yields underpin the US Dollar, which is weaker across the board.

- September’s FOMC minutes reinforce the beginning of a bond taper process, which could be announced by the November meeting.

Silver (XAG/USD) is advancing during the New York session, up more than one a half percent, trading at $23.46 at the time of writing. The white metal is trading at fresh monthly highs, courtesy of falling US Treasury Bond Yields, with the 10-year benchmark note rate slumping three and a half basis points, sitting at 1.514%, short of breaking the 1.50% threshold.

At the same time, the US Dollar Index, which follows the buck’s performance versus six peers, is down 0.03%, at 93.99, despite positive US macroeconomic data across the docket.

On Wednesday, September’s Federal Reserve minutes showed that the committee agreed that a gradual tapering process that concluded around the middle of next year would likely be appropriate due to the ongoing economic recovery. Furthermore, most members agreed that the bond taper process could commence by mid-November or mid-December.

XAG/USD Price Forecast: Technical outlook

Daily chart

Silver is trading above the 50-day moving average (DMA), which lies at $23.29, above the September 13 low at $23.37, which was previous support that turned resistance. Furthermore, momentum indicators like the Relative Strenght Index (RSI) at 58, aiming higher, indicate an upside bias.

For silver buyers to resume the upward trend, they will need a daily close above the latter to confirm the range’s break, opening the door for further upside. In that outcome, the first resistance would be $24.00. A breach above that level could send XAG/USD rallying towards the September 3 high at $24.86, immediately followed by $25.00.

KEY ADDITIONAL LEVELS TO WATCH

- Pound's rally hits resistance at 1.3730 and pulls back below 1.3700.

- The sterling remains positive against a weaker US dollar.

- GBP/USD biased higher while above 1.3595.

The British pound is giving away gains on Thursday’s US trading session, with the pair dropping back to levels below 1.3700 after having peaked at a three-week high at 1.3730. On daily charts, however, cable remains positive, above the top of the recent trading range, at 1.3650/70.

The pound remains supported by hawkish BoE

The sterling has been showing strength over the last two weeks, as the market is pricing an interest rate hike by the Bank of England early next year. With inflation accelerating at levels almost twice the Bank’s target for price stability, BoE officials are starting to openly suggest the possibility of accelerating the monetary policy normalization plan.

Beyond that, the recent European Union's proposal to slash custom checks on British Products to Northern Ireland has eased concerns about another UK-EU dispute on the NI border, which has provided a fresh impulse to the sterling.

On the other end, the US dollar is trading softer amid a higher appetite for risk on Thursday. The decline in US weekly jobless claims, which have dropped below the 300,000 new claims for the first time in the last 19 months, has been overlooked by the market as it was the confirmation on Wednesday the Federal Reserve is set to start rolling back its bonds purchasing program over the next month, suggested by the minutes of the last FOMC meeting, released on Wednesday.

GBP/USD biased higher while above 1.3595 – UOB

From a broader perspective, the FX analysis team at UOB remains positive on the pound, as long as the pair remains above 1.3595: “We have expected GBP to trade within a 1.3500/1.3680 range since early this week (see annotations in the chart below).GBP rose strongly yesterday and the advance has gathered momentum. From here, GBP is likely to head higher to 1.3715. A break of 1.3715 would shift the focus to 1.3750. Only a break of the ‘strong support’ (currently at 1.3595) would indicate that GBP is not ready to head higher.”

Technical levels to watch

- AUD/USD breaks above 0.7400 for the first time in a month.

- Risk-on market sentiment turn investors towards riskier assets boosts the AUD.

- US Initial Jobless Claims dropped below the 300K mark.

The Australian dollar climbs 0.58% is trading at 0.7423 during the New York session at the time of writing. The market sentiment is upbeat, portrayed by European and US equity indexes in the green. Positive US macroeconomic data concerning the labor market and prices paid for US producers boost the investors’ risk appetite.

DXY breaks below 94.00, underpinned by falling US T-bond yields

The US Dollar Index that measures the greenback’s performance against a basket of six rivals is sliding 0.03%, at 93.99, while the US T-bond 10-year yield struggles to hold to previous day levels, sits at 1.526%, down almost two and a half basis points.

Data-wise, the Australian economic docket featured the employment report, which showed that the economy droped worse-than-expected 138K jobs in September, while the Unemployment Rate rose to 4.6%.

On the US front, the US Initial Jobless Claims came at 293K better than the 319K foreseen by analysts, delivering positive news regarding the labor market while increasing the chances of the Federal Reserve reduction to the pace of the Quantitative Easing. Further, the US Producer Price Index rose by 8.6% less than the 8.7% estimated, while excluding food and energy, expanded 6.8% lower than the 7.1% expected.

That said, positive news during the day benefited risk-sensitive currencies, like the Aussie, which reclaimed the 0.7400 thresholds. However, seesawing market sentiment due to changing economic conditions could put a lid on the AUD/USD.

AUD/USD Price Forecast: Technical outlook

Daily chart

The AUD/USD is trading above the 100-daily moving average (DMA) at 0.7416, whereas the 200-DMA is above the spot price, indicating the major trend is tilted to the downside. However, momentum indicators with the Relative Strength Index (RSI) at 64, pointing higher, suggests that the near-term trend is tilted to the upside.

For AUD/USD buyers to resume the upward trend, they need a daily close above the 100-DMA. In that outcome, the first resistance would be the September 3 high at 0.7478. A breach of the latter could expose crucial support levels, the July 6 at 0.7599 and then the psychological 0.7700.

Commercial crude oil inventories in the US increased by 6 million barrels in the week ending October 8, the weekly report published by the US Energy Information Administration (EIA) revealed on Thursday. This reading came in much higher than the market expectation for an inventory build of 0.7 million barrels.

Market reaction

The barrel of West Texas Intermediate (WTI( edged lower from daily highs after this report and was last seen trading at $80.90, where it was up 0.4% on the day.

Additional takeaways

"Total motor gasoline inventories decreased by 2.0 million barrels last week and are about 2% below the five year average for this time of year."

"US crude oil imports averaged 6.0 million barrels per day last week, decreased by 1.0 million barrels per day from the previous week."

"Total products supplied over the last four-week period averaged 20.7 million barrels a day, up by 12.5% from the same period last year."

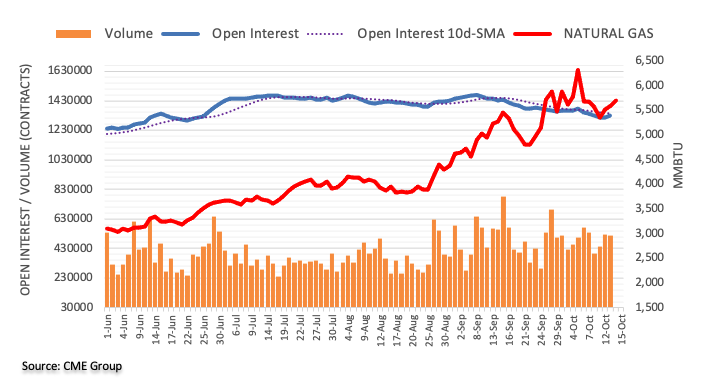

The weekly report published by the US Energy Information Administration (EIA) showed that the working gas in storage was 3,369 billion cubic feet (Bcf) as of Friday, October 8, representing a net increase of 81 Bcf from the previous week.

This reading came in lower than the market expectation of 94 Bcf.

"Stocks were 501 Bcf less than last year at this time and 174 Bcf below the five-year average of 3,543 Bcf," the publication further read.

Market reaction

US Natural Gas (spot) prices rose sharply after this report and were last seen rising nearly 4% on the day 6.015.

Atlanta Federal Reserve President Raphael Bostic said on Thursday that they are not seeing changes in the longer-run inflation expectations but added that they will be monitoring the situation, as reported by Reuters.

Additional takeaways

"There is a commitment across the system to promote diversity in the Fed leadership positions."

"Inflation is appearing to last longer because of supply chain and labour disruptions caused by the pandemic."

"Inflation right now is tied to the episode of the pandemic and those forces will recede."

Market reaction

The US Dollar Index largely ignored these comments and continues to fluctuate below 94.00.

- Wall Street's main indexes are posting strong gains.

- All major sectors of the S&P 500 trade in the positive territory.

After closing in the positive territory on Wednesday, major equity indexes in the US opened decisively higher as risk flows continue to dominate financial markets. Reflecting the upbeat market mood, the CBOE Volatility Index is down 6% at 17.50.

As of writing, the S&P 500 Index was rising 1% at 4,405, the Dow Jones Industrial Average was up 1.05% at 34,726 and the Nasdaq Composite was gaining 1.1% at 14,732.

All major sectors of the S&P 500 push higher after the opening bell with the Healthcare Index leading the rally with a daily gain of 1.65%. On the flip side, the Financials Index is up only 0.4% as US Treasury bond yields remain on the back foot.

S&P 500 chart (daily)

- DXY bounces off lows and approaches the 94.00 barrier.

- US 10-year yields remain depressed around the 1.53% area.

- US weekly Claims rose by 293K, bettering consensus.

After bottoming out around 93.75 during early trade, the greenback has managed to attract some buying interest and now pushes the US Dollar Index (DXY) back to the 94.00 neighbourhood.

US Dollar Index looks supported near 93.70

The index dropped and rebounded from multi-day lows in the 93.80/75 band on Thursday, always trading on the defensive against the backdrop of the improved mood in the risk complex and declining US yields.

Indeed, yields in the belly of the curve retreated to the sub-1.53% region while the longer end managed to bounce to the 2.07% area and reverse part of the recent moderate retracement.

In the docket, weekly Claims rose less than expected by 293K in the week to October 8, while Producer Prices surprised to the downside in September: up 8.6% YoY and 6.8% when it comes to the Core reading.

In addition, St. Louis Fed J.Bullard said he bets 50% on chances of elevated inflation persisting. He also expressed doubts in that inflation will fully disappear over the next 6 months.

US Dollar Index relevant levels

Now, the index is losing 0.05% at 93.95 and a break above 94.56 (2021 high Oct.12) would open the door to 94.74 (monthly high Sep.25 2020) and then 94.76 (200-week SMA). On the flip side, the next down barrier emerges at 93.77 (20-day SMA) followed by 93.67 (monthly low Oct.4) and finally 92.98 (weekly low Sep.23).

- XAU/USD has hit $1,800, the highest in a month.

- The Confluence Detector is showing is that gold's next big upside target is $1,820.

- Gold is not a dream risk-off hedge, nor is Bitcoin [Video]

Falling yields have always been good for gold – and this time, the precious metal seems to have found its feet regardless of the Treausiries. Tuesday's slide in returns on 10-year bonds sent XAU/USD shooting higher, and it stayed there also after yields crept up once again.

One of the explanations for the recent rise is the hint from the Fed that the pace of bond-buying will be reduced only gradually – 15 billion fewer dollars worth of buys every month rather than $20 billion.

How is XAU/USD technically positioned?

The Technical Confluences Detector is showing that gold faces some resistance at $1,802, which is the convergence of the 100-day Simple Moving Average, the Bollinger Band 15min-Upper, and the previous 4h-high.

The more significant line is $1,820, which is where the Pivot Point one-month Resistance 1 and the PP one-day R2 meet up.

Immediate support awaits at $1,797, which is the confluence of the 200-day SMA and the PP one-week Resistance 2.

The next line to watch is $1,791, which is a juncture of indicators including the Fibonacci 61.8% one-month and the SMA 100-15m.

Lower, strong support awaits at $1,777, which is where the PP one-week, the 50-day SMA, and the SMA 50-1h all converge.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence

In an interview with CNN on Thursday, San Francisco Federal Reserve Bank President Mary Daly said they are at a point where they feel they can taper bond purchases, as reported by Reuters.

Additional takeaways

"It is premature to start talking about rate increases."

"Price increases will last as long as COVID is with us; as covid subsides, pressures will ease."

"Bottlenecks causing price rises are related to COVID."

"If Fed pulls back on accommodation, I bet won't solve the supply-chain problem."

"Near-term inflation outlook won't be affected by decisions on infrastructure spending."

Market reaction

The greenback remains on the back foot following these comments and the US Dollar Index was last seen posting small daily losses at 93.92.

Citing a draft document, Reuters reported the International Monetary Fund (IMF) will say in its communique that inflation dynamics require close monitoring and policymakers need to be ready to take decisive actions to maintain price stability.

Additional takeaways

"Inflation surge still assessed as driven by temporary factors such as supply chain disruptions, higher commodity prices."

"Inflation now appears less transitory than previously expected, upside risks to inflation increasing."

"Steps need to be taken to make supply chains more resilient in the future, accelerate the adoption of new and green technologies."

"Delicate balancing act needed to underpin recovery, restore macroeconomic stability."

"New resilence and sustainability trust should not depart from existing IMF model, sees less scope for channelling SDR reserve through multilateral development banks."

"Need to build confidence in G20 common framework on debt restructuring among creditors and borrowers."

Market reaction

The market mood remains upbeat following these remarks with US stock index futures rising around 1% minutes ahead of Wall Street's opening bell.

St. Louis Fed President James Bullard said on Thursday that there is not a strong case that inflation will definitely dissipate over the next six months, as reported by Reuters.

Additional takeaways

"My outlook for the US economy is pretty bullish."

"Labor markets are very tight."

"I think by the end of tapering next spring, the unemployment rate will be 3.5% or better."

"Many US workers have retired."

"High level of Core PCE inflation is concerning."

"Would put 50% chance on high levels of inflation persisting."

Market reaction

These comments don't seem to be having a significant impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was down 0.07% on the day at 93.93.

- Manufacturing Sales in Canada rose modestly in August.

- USD/CAD trades in the negative territory below 1.2400.

Manufacturing Sales in Canada increased by 0.5% on a monthly basis in August to C$60.3 billion, the data published by Statistics Canada revealed on Thursday. This reading followed July's decrease of 1.2% and came in line with the market expectation.

"Sales in constant dollars increased 0.6% in August, indicating that the monthly gain resulted entirely from higher sales volume," the publication further read. "The Industrial Product Price Index decreased 0.3% month over month, while the Raw Materials Price Index decreased 2.4%, the first decline since September 2020."

Market reaction

The USD/CAD pair remains on the back foot after this report and was last seen losing 0.45% on a daily basis at 1.2386.

- USD/TRY clinched new all-time peaks near 9.2000.

- President Erdogan dismissed three members of the CBRT.

- The next target of note for the pair comes at the 10.0000 mark.

The Turkish lira depreciated to new all-time lows vs. the dollar and pushed USD/TRY well beyond the 9.000 barrier on Thursday.

USD/TRY now targets… the moon?

USD/TRY quickly climbed to new all-time highs in the 9.1800 area on Thursday after market participants aggressively sold the lira in response to another spark of mistrust in the already complicated relationship (if any at all) between President Erdogan’s administration and the Turkish central bank (CBRT) (still) led by S.Kavcioglu.

Indeed, the lira collapsed to record lows after President Erdogan sacked on Thursday two deputy governors of the CBRT and a committee member, all of them having disagreed with the rate cut by the central bank at its September meeting. It is worth recalling that the CBRT reduced the One-Week Repo Rate by an unexpected 100 bps to 18% last month, catching everybody off guard as the consensus was largely tilted to an “on hold” stance.

Investors’ shift has now gyrated to the upcoming CBRT event on October 21, while the door to another rate cut looks wide open no matter what consensus expects or rationality calls for.

USD/TRY key levels

So far, the pair is gaining 0.85% at 9.1546 and a drop below 8.9510 (10-day SMA) would aim for 8.8585 (20-day SMA) and finally 8.8297 (monthly low Oct.1). On the other hand, the next up barrier lines up at 9.1835 (all-time high Oct.14) followed by 10.0000 (round level) and then… ?

European Central Bank (ECB) policymaker Klaas Knot said on Thursday that the inflation outlook for the euro area is back on track, as reported by Reuters.

Additional takeaways

"Risks for headline inflation are tilted to the upside."

"Upside inflation risks are mainly linked to more persistent supply-side bottlenecks and stronger domestic wage-price dynamics."

"Welcoming rise in market-based inflation expectations."

"Current baseline projections consistent with ending the Pandemic Emergency Purchase Programme (PEPP) in March 2022."

"Confident that the pre-pandemic inflation gap in our macroeconomic projections will close by the end of this year."

"ECB weighing options to ease the transition out of the PEPP."

Market reaction

The EUR/USD pair showed no immediate reaction to these comments and was last seen posting small daily gains at 1.1600.

- Weekly Initial Jobless Claims in US declined by 36,000.

- US Dollar Index stays relatively quiet below 94.00.

There were 293,000 initial claims for unemployment benefits in the US during the week ending October 9, the data published by the US Department of Labor (DOL) revealed on Thursday. This reading followed the previous print of 329,000 (revised from 326,000) and came in better than the market expectation of 319,000.

Market reaction

Investors largely ignored these figures and the US Dollar Index was last seen losing 0.06% on the day at 93.93.

Additional takeaways

"The 4-week moving average was 334,250, a decrease of 10,500 from the previous week's revised average."

"The advance seasonally adjusted insured unemployment rate was 1.9% for the week ending October 2."

"The advance number for seasonally adjusted insured unemployment during the week ending October 2 was 2,593,000, a decrease of 134,000 from the previous week's revised level."

- Annual PPI in US continued to increase in September.

- US Dollar Index stays below 94.00 after the data.

The Producer Price Index (PPI) in the US for final demand rose to 8.6% on a yearly basis in September from 8.3% in August, the US Bureau of Labor Statistics announced on Thursday. This reading came in slightly lower than the market expectation of 8.6%.

On a monthly basis, the PPI edged lower to 0.5% from 0.7%. Further details of the publication revealed that the annual Core PPI ticked up to 6.8%, compared to analysts' estimate of 7.1%.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen posting small daily losses at 93.93.

- USD/CAD is falling for the third straight day on Thursday.

- US Dollar Index remains on the back foot ahead of US data.

- WTI trades in the positive territory above $81.00.

The USD/CAD pair extended its slide during the European trading hours and touched its lowest level since early July at 1.2373. As of writing, the pair was down 0.45% on a daily basis at 1.2384.

WTI reclaims $81 on Thursday

The broad-based dollar weakness allows the pair to push lower while rising crude oil prices provide a boost to the CAD as well on Thursday.

Pressured by the ongoing decline in the US Treasury bond yields, the US Dollar Index (DXY) is losing 0.15% on the day at 93.85. The benchmark 10-year US T-bond yield, which fell nearly 6% in the previous two trading days, is down 0.7% at 1.527%. Later in the session, the US Department of Labor's weekly Initial Jobless Claims data and September Producer Price Index (PPI) figures will be looked upon for fresh impetus.

On the other hand, the barrel of West Texas Intermediate (WTI) is up nearly 1% on the day at $81.40 as investors await the weekly crude oil and gas inventory data published by the US Energy Information Administration (EIA). The upbeat market mood seems to be the primary driver behind crude oil prices.

Meanwhile, August Manufacturing Sales will be featured in the Canadian economic docket but this report is unlikely to have a noticeable impact on the loonie's performance against its rivals.

Technical levels to watch for

- EUR/USD adds to recent gains and surpasses 1.1600.

- Further up is located the monthly high at 1.1640.

EUR/USD advances for the second straight session and leaves behind the key 1.1600 barrier on Thursday.

Further recovery is expected to meet the interim hurdle at the 20-day SMA at 1.1631 ahead of the monthly peak at 1.1640 (October 4). The break above this area should meet the next target at the 55-day SMA, today at 1.1732 followed by the late-September tops in the mid-1.1700s.

In the meantime, the near-term outlook for EUR/USD is seen on the negative side below the key 200-day SMA, today at 1.1932.

EUR/USD daily chart

EUR/CHF is testing below support at 1.0696. If sustained into the close, would mark an important breakdown with next support at 1.0660, the Credit Suisse analyst team reports.

See – EUR/CHF: Sluggish recovery in the eurozone to drag down the pair – Rabobank

Resistance stays seen at 1.0742/53 initially

“If confirmed, the break below 1.0707/1.0696 would suggest further weakness is likely, with support seen next at the 1.0660 low from November 2020, then retracement support at 1.0642, before another prominent price low at 1.0605/00. Ultimately, the magnitude of the potential breakdown suggests we could even move beyond here over the medium-term.”

“Resistance stays seen at 1.0742/53 initially, with a move above the cluster of resistances at 1.0797/0810, which includes the 55-day average, then needed to confirm a floor is in place.”

EUR/GBP has started to pierce trend support from late 2019 at 0.8473/72. Analysts at Credit Suisse expect the pair to retest the YTD low and channel bottom at 0.8449/37.

Resistance at 0.8520/28 to cap for an eventual break lower

“Beneath 0.8472 should clear the way for a move beneath for a move back to the YTD low and lower end of the gentle seven-month downtrend channel at 0.8449/37.

Whilst we would again look for a fresh hold at 0.8449/37 and swing higher in the channel, a sustained move below 0.8437 would mark an acceleration in the downtrend, then exposing the key lows of 2019 and 2020 at 0.8281/39.”

“Resistance moves to 0.8500/02 initially. Above 0.8528 can see a recovery back to 0.8542/47, potentially a retest of the 200-day average at 0.8620/25.”

The medium-term inflation expectations in the eurozone have increased to around 1.9%, which is in line with the European Central Bank’s strategy, ECB Governing Council Member Olli Rehn said on Thursday, per Reuters.

"Due to persistent production bottlenecks, it is possible that an increase in energy prices has a longer-lasting impact on consumer prices," Rehn added. "We analyse this development carefully at the Governing Council and at the Bank of Finland."

Market reaction

The EUR/USD pair showed no immediate reaction to these comments and was last seen posting modest daily gains at 1.1612.

EUR/USD is seen at risk of a near-term rebound. Nonetheless, strength is still viewed as corrective ahead of a move to 1.1495/93 in due course, economists at Credit Suisse report.

Resistance moves to 1.1614, then 1.1663/71

“The strong rebound has seen a minor base complete and with a bullish RSI momentum divergence also in place we see scope for a corrective move higher. Saying this, a close above the 13-day exponential average and price resistance at 1.1602/14 is needed to add weight to this view with resistance then seen at 1.1641 ahead of the 38.2% retracement of the September/October fall and price resistance at 1.1663/71.”

“Our bias would be for a fresh cap at 1.1663/71 and a resumption of the core downtrend. Above 1.1671 can see a deeper recovery to 1.1695, potentially the 55-day average at 1.1733.”

“Failure to clear 1.1614 will leave the recovery in doubt with support seen at 1.1566 initially, with a break below 1.1529/24 curtailing thoughts of a rebound for a fall to our first objective at 1.1495/93 – the key March 2020 ‘point-of-breakout’ high and the 50% retracement of the rally from the 2020 low.”

- DXY recedes further and breaches the 94.00 support.

- There is expected to emerge decent contention in the mid-93.00s.

DXY loses the grip further and drops to new multi-day lows in the vicinity of 93.70 on Thursday.

So far, the continuation of this corrective decline could extend further in the near term. That said, the is a decent contention area near 93.50, where is located the pre-FOMC high (September 22). Further south from here comes the 55-day SMA just above 93.00 the figure.

Looking at the broader picture, the constructive stance on the index is seen unchanged above the 200-day SMA at 91.76.

DXY daily chart

EUR/CHF this week fell to its lowest level since Nov 2020, extending a downtrend that has been in place since late September. Concerns about slowing growth in the eurozone have led economists at Rabobank to downgrade their EUR/CHF one and three-month forecast to 1.07.

Fears that the eurozone economy is losing momentum provide more scope for flows back to the safe haven CHF

“In view of the slowdown in eurozone growth we have revised down our one-month and three-month EUR/CHF forecasts to 1.07.”

“On the assumption that the eurozone recovery remains in place, we expect a move back to 1.10 on a six-month view.”

“The November 2020 low around EUR/CHF 1.0660 will likely provide some support for the currency pair.”

Following Wednesday's impressive upsurge, gold preserved its bullish momentum in the first half of the day Thursday and touched $1,800 for the first time since mid-September.

At the time of press, the XAU/USD pair was up 0.4% on the day at $1,800.15.

Falling US Treasury bond yields seem to be fueling gold's rally in the second half of the week. After bond markets returned to action on Tuesday, the benchmark 10-year US Treasury bond yield lost nearly 6% and was last seen falling 0.9% on the day at 1.525%.

Moreover, the poor performance of US Treasury yields continues to weigh on the greenback with the US Dollar Index dropping to fresh 10-day lows near 93.80.

Later in the session, the weekly Initial Jobless Claims and September Producer Price Index data will be featured in the US economic docket.

Gold Price Forecast: XAU/USD to see further gains on a daily close above 200-DMA.

Gold 15-min chart

Technical levels to watch for

- EUR/JPY advances well past the 131.00 mark on Thursday.

- Extra gains now seen testing 132.00 and beyond.

EUR/JPY extends the sharp recovery for yet another session and this time further north of the 131.00 hurdle.

The intense move higher in the cross has been exacerbated following the recent breakout of the key 200-day SMA and now targets the round level at 132.00 ahead of minor obstacles at the July 1 high at 132.43 and the June 23 high at 132.69, all prior to another Fibo level at 132.79.

In the broader scenario, while above the 200-day SMA at 129.85, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Christine Lagarde, President of the Europen Central Bank (ECB), said on Thursday that they continue to view the inflation upswing as being largely driven by temporary factors, as reported by Reuters.

Additional takeaways

"The rebound phase of the euro area economy is increasingly advanced."

"We see the risks surrounding the euro area growth outlook as being broadly balanced."

"Price pressures could become more persistent if supply bottlenecks last longer or wages rise more than is currently anticipated."

"There is no evidence of significant second-round effects through wages."

"The governing council regularly recalibrates the net purchases under the Pandemic Emergency Purchase Programme (PEPP) based on a joint assessment of financing conditions and the inflation outlook."

Market reaction

The EUR/USD pair edged slightly lower from session tops after these comments and was last seen gaining 0.14% on the day at 1.1608.

- USD/JPY struggled to capitalize on its modest intraday uptick amid renewed USD selling bias.

- The risk-on impulse undermined the safe-haven JPY and might help limit any further losses.

- Slight overbought RSI could trigger some long-unwinding trade and deeper corrective slide.

The USD/JPY pair erased a major part of its intraday gains to the 113.60 region and was last seen hovering just a few pips above daily lows, around the 113.30-35 region.

The US dollar came under some renewed selling pressure during the early part of the European session and extended the previous day's retracement slide from 13-month tops. This, in turn, was seen as a key factor that acted as a headwind for the USD/JPY pair, though the risk-on impulse undermined the safe-haven Japanese yen and helped limit any deeper losses.

Looking at the technical picture, the recent strong positive momentum from the vicinity of the 109.00 level stalled near a resistance marked by the top boundary of an upward sloping channel. RSI on the daily chart is still holding in the overbought territory, which might trigger some long-unwinding trade and set the stage for a deeper pullback for the USD/JPY pair.

That said, the lack of any meaningful slide warrants some caution before confirming that the USD/JPY pair has topped out in the near term and positioning for any further depreciating move. From current levels, the 113.00 round-figure mark seems to act as immediate strong support, which if broken decisively should prompt aggressive technical selling.

The USD/JPY pair might then accelerate the downfall towards testing the next relevant support near the 112.25-20 horizontal zone. Any subsequent decline might still be seen as a buying opportunity and remain limited near the 112.00 round figure.

On the flip side, the 113.55-60 region now seems to have emerged as an immediate strong resistance, above which the USD/JPY pair could challenge the trend-channel barrier just ahead of the 114.00 mark. Some follow-through buying will be seen as a fresh trigger for bullish traders and pave the way for an extension of a multi-week-old bullish trend.

USD/JPY 4-hour chart

-637698032797640912.png)

Technical levels to watch

Japanese Prime Minister Fumio Kishida said on Thursday that new spending to aid domestic development and production of vaccines, drugs to treat COVID-19 patients will be included in the stimulus, as reported by Reuters.

Additional takeaways

"Will take steps to fix supply-demand balance to address sharp fall in domestic prices."

"Will extend to march special add-on subsidies to support jobs."

"Will start preparations to resume government travel discount programme in a re-modelled fashion."

"Will make bold hike in tax exemptions to firms that raise wages."

Market reaction

The USD/JPY pair showed no immediate reaction to these comments and was last seen posting small daily gains at 113.32.

- EUR/GBP prolonged its recent bearish trajectory and dropped to over two-month lows.

- Hawkish BoE signals, easing fears of a fresh Brexit-related spat underpinned the sterling.

- Weaker USD benefitted the shared currency and could extend some support to the cross.

The EUR/GBP cross extended its steady intraday descent and dropped to over two-month lows, around the 0.8460 region during the first half of the European session.

The cross struggled to capitalize on its modest intraday uptick, instead met with some fresh supply ahead of the key 0.8500 psychological mark and now seems vulnerable to slide further. The British pound's relative outperformance comes amid a positive development surrounding the Northern Ireland protocol of the Brexit agreement.

A team of EU negotiators on Wednesday delivered a plan that offered to reduce customs checks and paperwork on British products intended for Northern Ireland to avert a new post-Brexit spat. The UK said it would look at the proposals seriously and constructively and called on both sides to engage in intensive talks rapidly.

Apart from this, hawkish signals from the Bank of England (BoE) officials, including Governor Andrew Bailey, further acted as a tailwind for the sterling. In fact, the money market now seems to have fully priced in a 25bps BoE rate hike in December, which was seen as another factor that exerted pressure on the EUR/GBP cross.

On the other hand, the shared currency benefitted from the ongoing US dollar retracement slide from 13-year tops. This, however, did little to impress bullish traders, albeit might help limit any further losses for the EUR/GBP cross. Nevertheless, the fundamental backdrop favours bearish traders and supports prospects for further losses.

Technical levels to watch

Fed officials do not appear swayed from their QE tapering plans by the slowdown in jobs growth, keeping the US dollar on a solid footing. The US Dollar Index (DXY) is looking a little shaky into 94.5, but should retain the bulk of its recent gains, according to economists at Westpac.

Gas supply bottlenecks in Europe and power shortages in China to cast doubt on rebound prospects in the rest of the world

“US Q3 GDP projections continue to slip, the latest median estimate falling to 4.7% annualised. But it hasn’t dented the USD and further material growth downgrades seem unlikely in any case.”

“Power shortages in China and gas constraints in Europe likely extend well into the northern hemisphere winter, casting an ongoing cloud over global rebound prospects well into 2022.”

“Fed officials continue to signal a strong preference for moving ahead with a relatively brisk 6 to 9 month tapering of asset purchases, likely announced at their next meeting 4th November and starting before the year is out.”

“DXY looking a little shaky into 94.50 but should retain the bulk of its recent gains amid further signs the global rebound is losing steam and Fed QE tapering.”

“Raising interest rates to counter higher semi-conductor or energy prices would be 'self-defeating', if one-off,” said Bank of England (BOE) policymaker Silvana Tenreyro in an interview with Business Live on Thursday.

Additional comments

“There is a question about whether price changes are a one off.”

“We are also seeing temporary supply disruption from post-covid imbalances worldwide.”

“Inflation should be temporary.”

In its latest report, the German Economy Ministry said that it expected a significant GDP increase in the third quarter of this year, courtesy of the growth in the services sector.

Additional takeaways

“Economic development could proceed sideways in Q4.”

“Bottlenecks in raw material delivery may keep hurting the industry in coming months.”

Separately, the German economic institutes cut the 2021 growth forecast to 2.4% from the 3.7% previous estimate.

Meanwhile, the country’s highly influential institutes raised the 2022 GDP growth forecast from 3.9% to 4.8%.

Market reaction

EUR/USD is extending its recovery above 1.1600, as the US dollar accelerates its corrective pullback amid a negative turn in the Treasury yields across the curve.

The spot remains unfazed by the above headlines, as it trades at 1.1619, up 0.24% on the day, at the press time.

“Energy crisis has prompted a switch to oil that could boost demand by 500,000 barrels per day (bpd),” the International Energy Agency (IEA) said in its latest monthly oil market report released on Thursday.

Key takeaways

Natural gas, LNG and coal shortage could keep oil market in deficit to end of year at least.

Oil supply has resumed uptrend as OPEC+ unwinds production cuts, US recovers from hurricane Ida and maintenance winds down.

High energy prices could add to inflation that, along with power outages, lowers industrial activity and slows growth.

OECD commercial oil stocks fell by 23 mln barrels in September and are at their lowest since march 2015.

OPEC+ effective spare capacity could fall below 4 mln bpd by q2 2022 from 9 mln bpd in q1 2021.

Shrinking global spare capacity underscores need for increased investment to meet future demand.

Oil demand will exceed pre-pandemic levels in 2022, rising 3.3 mln bpd to 99.6 mln bpd.

Revises 2021 and 2022 oil demand forecast upwards by 170,000 bpd and 210,000 bpd respectively.

OPEC+ on track to pump 700,000 bpd below estimated demand for its crude in q4 2021.

Implied third-quarter refined product balances show the largest draw in eight years.

Market reaction

WTI is reacting positively to the IEA report, as it flirts with daily highs near $80.85. The US oil is higher by 1% on the day.

- USD/CHF witnessed heavy selling for the second straight session on Thursday.

- The ongoing USD corrective slide was seen as a key factor exerting pressure.

- The risk-on mood did little to undermine the safe-haven CHF or lend support.

The emergence of fresh selling around the USD dragged the USD/CHF pair to four-week lows, sub-0.9200 levels during the early part of the European session.

Despite a slightly stronger US CPI report, investors seem unconvinced about a sustained period of inflation. This was evident from a further decline in the longer-term US Treasury bond yields, which triggered a sharp US dollar corrective slide from 13-month tops. The pullback extended through the first half of the trading action on Thursday, which, in turn, dragged the USD/CHF pair lower for the second successive day.

Meanwhile, the minutes of the September FOMC monetary policy meeting revealed that the Fed remains on track to begin tapering its bond purchases in 2021. Moreover, a growing number of policymakers were worried about the continuous rise in inflationary pressure, forcing investors to bring forward the likely timing of a potential rate hike. This, however, did little to impress the USD bulls or lend any support to the USD/CHF pair.

Even the risk-on impulse in the equity markets, which tends to undermine demand for the traditional safe-haven Swiss franc, failed to ease the intraday bearish pressure around the USD/CHF pair. With the latest leg down, the pair has now reversed over 100 pips from levels just above the 0.9300 round-figure mark. A sustained break below the 0.9225-20 region might have already set the stage for an extension of the ongoing depreciating move.

Market participants now look forward to the US economic docket, featuring the release of the Producer Price Index (PPI) and the usual Weekly Initial Jobless Claims. This, along with the US bond yields and scheduled speeches by influential FOMC members, will influence the USD and provide a fresh impetus to the USD/CHF pair.

Technical levels to watch

A stronger USD plus local pandemic risks persisting have capped the kiwi recently, but NZ CPI is set to print at a 10-year high next week. Economists at Westpac are watching for a break of 0.6980, which would open up the 0.74 level by year-end.

NZ inflation will be highest since 2011

“NZD/USD has been rangebound inside 0.6860-0.6980, with few near-term directional clues. One possibility is that the downward correction since early September is complete, and a base is forming to launch a retest of 0.7200 multi week, and 0.7400 by year-end”.

“One argument for the NZD/USD to grind higher is the major commodity boom underway. Another argument is that RBNZ tightening will proceed as projected, despite adverse Covid developments recently.”

“Our economists expect Q3 CPI to rise by 1.5% QoQ, 4.2% YoY. That would be an increase from Q2’s 3.3% YoY, and the highest since 2011’s GST-related spike. Our forecast is slightly higher than the RBNZ’s.”