- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 15-10-2015

(raw materials / closing price /% change)

Oil 46.86 +1.03%

Gold 1,183.00 -0.38%

(index / closing price / change items /% change)

Nikkei 225 18,096.9 +205.90 +1.15 %

Hang Seng 22,888.17 +448.26 +2.00 %

S&P/ASX 200 5,230.05 +32.79 +0.63 %

Shanghai Composite 3,338.27 +75.83 +2.32 %

FTSE 100 6,338.67 +69.06 +1.10 %

CAC 40 4,675.29 +66.26 +1.44 %

Xetra DAX 10,064.8 +148.95 +1.50 %

S&P 500 2,023.86 +29.62 +1.49 %

NASDAQ Composite 4,870.1 +87.25 +1.82 %

Dow Jones 17,141.75 +217.00 +1.28 %

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1378 -0,91%

GBP/USD $1,5468 -0,07%

USD/CHF Chf0,951 +0,20%

USD/JPY Y118,87 +0,10%

EUR/JPY Y135,25 -0,80%

GBP/JPY Y183,86 +0,02%

AUD/USD $0,7333 +0,38%

NZD/USD $0,6863 +0,92%

USD/CAD C$1,2862 -0,50%

(time / country / index / period / previous value / forecast)

00:30 Australia RBA Financial Stability Review

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

09:00 Eurozone Trade balance unadjusted August 31.4

09:00 Eurozone Harmonized CPI September 0.0% 0.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) September 0.1% -0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) September 0.9% 0.9%

12:30 Canada Manufacturing Shipments (MoM) August 1.7% -1%

12:30 Canada Foreign Securities Purchases August -10.12

13:15 U.S. Capacity Utilization September 77.6% 77.4%

13:15 U.S. Industrial Production (MoM) September -0.4% -0.2%

13:15 U.S. Industrial Production YoY September 0.9%

14:00 U.S. NAHB Housing Market Index October 62

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) October 87.2 89

14:00 U.S. JOLTs Job Openings August 5.753 5.625

20:00 U.S. Net Long-term TIC Flows August 7.7

20:00 U.S. Total Net TIC Flows August 141.9

The October rebound in global equities resumed, with U.S. stocks rising to a eight-week high amid bank earnings and growing speculation the Federal Reserve will delay raising interest rates until 2016. Treasuries fell and gold erased its loss for the year.

The Standard & Poor's 500 Index jumped the most in 10 days with gains in the nation's largest financial firms leading equities higher after two days of declines. Economic data from Group of 10 nations are missing analysts' estimates by the most in four months, fueling bets the Fed will delay raising interest rates until next year.

The probability of a Fed interest rate increase by the December policy meeting has dropped to 30 percent, down from 70 percent at the start of August, according to futures data compiled by Bloomberg. The slide worsened even after a gauge of U.S. core consumer prices advanced more than projected in September, while hiring data provided evidence of labor-market resiliency

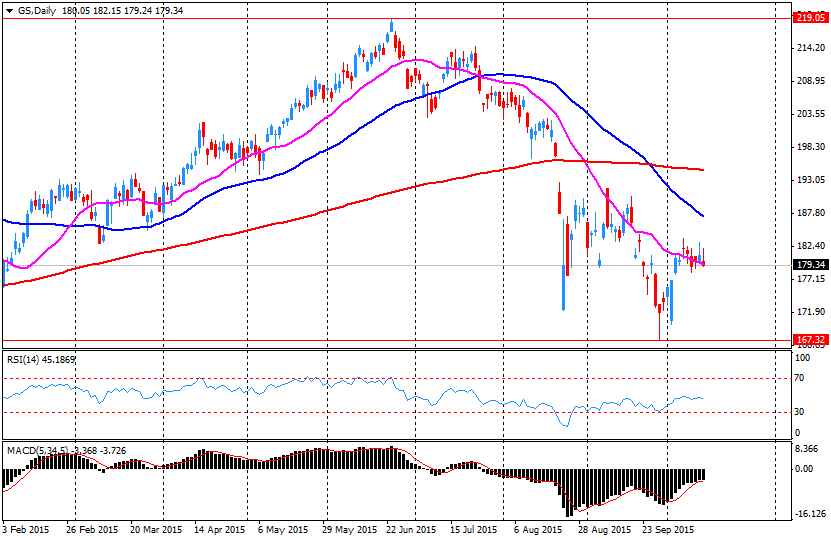

Financial shares paced gains with a 2.3 percent rally. Goldman Sachs Group Inc. added 3 percent even as third-quarter profit missed analysts' estimates as the global market turmoil took a bigger toll on its trading revenue than at rivals. Citigroup Inc. gained 4.4 percent as profit beat estimates.

The S&P 500 has jumped 8.4 percent from the depths of its August selloff, though it remains 5 percent below its all-time high set in May. The gauge has rallied as a weakening dollar bolsters the prospects for American companies that do business overseas, while speculation intensifies that rates will remain lower for longer.

The US dollar strengthened against the major currencies after data on inflation and the US labor market. The report submitted by the Ministry of Labour showed that consumer prices in September fell slightly compared to August, but remained unchanged in annual terms.

According to the data, the seasonally adjusted consumer price index fell 0.2% in September. Meanwhile, the core index, which excludes prices of food and energy categories, rose 0.2%. Economists had expected overall prices decreased by 0.2% and the core index increased only 0.1%. In annual terms, prices have not changed, but the core index rose by 1.9%. It forecasts a decline of 0.1% and growth of 1.8%, respectively.

The Labor Department reported that, as in previous months, the decline in oil prices had the greatest pressure on inflation in September. The economic slowdown in China and emerging markets, coupled with the expectation of the Fed raising interest rates, as did the US dollar is stronger, leading to cheaper imports.

The report also showed that the index of energy prices fell by 4.7% in September, the head of which stood a reduction in the cost of gasoline (by 9% to a seasonally adjusted). Over the past year energy prices fell by 18.4%, and gasoline prices have fallen by 29.6%. Meanwhile, the cost of food rose in September by 0.4% MoM and 1.6% per annum. Housing costs rose by 3.2% per annum, and the cost of public services, excluding energy rose 2.7%.

Too low inflation has become a major problem for Fed officials to discuss when to begin raising interest rates, which remain unchanged from 2008. Fed Chairman Yellen and other officials said they are waiting for clear signs of inflation to start raising rates.

In addition, the US Department of Labor said the number of Americans who first applied for unemployment benefits, sharply decreased last week, while reaching the lowest level in more than 40 years.

According to the report for the week ended October 10, the number of initial applications for unemployment benefits fell by 7,000 (seasonally adjusted) and reached 255 000, which is the lowest since November 1973. Economists had expected 270,000 new claims. The figure for the previous week was revised downward - to 262 000 to 263 000. It is worth emphasizing the number of calls remained below the psychological threshold of 300 000 for 32 th consecutive week, which is the longest series in more than 40 years. Also, the Labor Department said that there were no special factors influencing the latest weekly data.

Meanwhile, it became known that the moving average for 4 weeks, which smooths the volatile weekly figures, dropped to 2250 - up to 265 000 (the lowest figure since December 1973). Meanwhile, the number of people who continue to receive unemployment benefits fell by 50,000 to 2.158 million. For the week ended October 3rd. Recall data on re-treatment come with a week delay

The euro earlier fell sharply against the US dollar, the main pressure exerted statements by the European Central Bank Ewald Nowotny. He noted that the ECB does not hold out much to the inflation target, in connection with which the regulator requires a new set of tools. "It is clear that we need additional tools," - said Nowotny, stressing that the basic inflation indicators are also below the target mark, so that new instruments should include structural measures. Recall that in September, consumer prices fell by 0.1% per annum. The decrease in prices occurred for the first time since March, when the ECB began a program of asset purchases, which gave rise to speculation about a possible continuation or increase in the program.

According to the latest forecasts of the ECB at the end of 2015 inflation will be at 0.1 percent and will rise to 1.1 percent next year. "Thus, we are clearly not up to the target value. The main reason for low inflation is the sharp fall in oil prices and raw materials - said Nowotny. - It is obvious that in this situation need a strong economic growth, which should help reduce the unemployment rate and bring inflation to the target level. "

Major U.S. stock-indexes higher on Thursday, after two days of losses, as investors assessed economic data and earnings reports from major banks. As the reporting season gathers steam, investors will be parsing quarterly results to gauge the impact of a slowing global economy on U.S. companies. Global stocks rebounded from two days of losses as investors bet the Federal Reserve will not raise interest rates until 2016. The Fed has said it will pull the trigger only if it sees signs of a sustainable economic recovery. Data released on Thursday painted contrasting pictures of the state of the U.S. economy. While consumer prices posted their biggest drop in eight months in September, unemployment benefit claims fell in the last week.

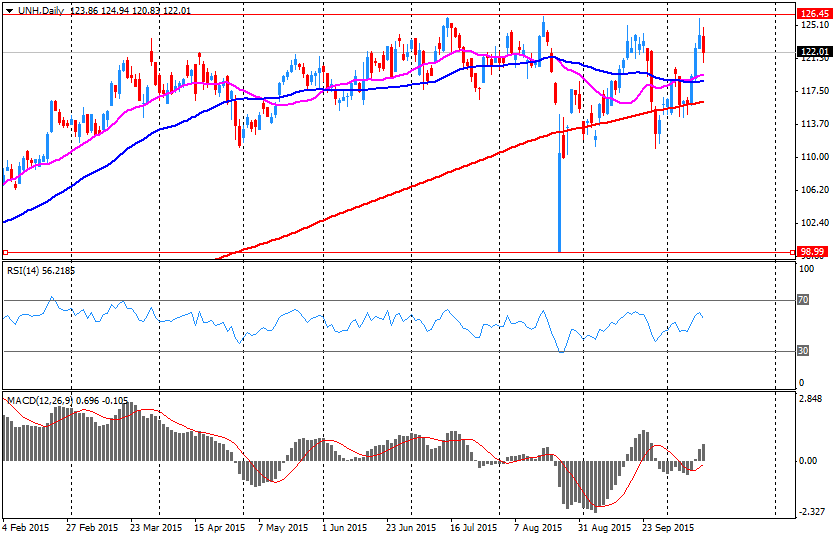

Most of Dow stocks in positive area (18 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -2.57%). Top gainer - NIKE, Inc. (NKE, +2.39%).

All S&P index sectors in positive area. Top gainer - Healthcare (+1,1%).

At the moment:

Dow 16909.00 +87.00 +0.52%

S&P 500 1998.50 +14.50 +0.73%

Nasdaq 100 4368.25 +41.75 +0.96%

10 Year yield 2,02% +0,04

Oil 46.08 -0.56 -1.20%

Gold 1187.90 +8.10 +0.69%

Stock indices traded higher on corporate earnings.

Comments by the European Central Bank (ECB) Governing Council Member Ewald Nowotny also supported stock markets. He said on Thursday that further stimulus measures are needed as the central bank's inflation target will be missed.

"In my view, it's quite obvious that additional sets of instruments are necessary," Nowotny said.

He added that additional instruments should include structural reforms and measures to stimulate demand.

The central bank's inflation target is 2%. The ECB expects the inflation to be 0.1% this year.

The ECB Vice President Vitor Constancio said in a speech in Hong Kong on Thursday that the exit from the zero interest rate policy may have spillover on other countries in the short terms.

"We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates," he said.

Constancio added that the spillover from US monetary policy is larger than those from the Eurozone, due to "the dominance of the US dollar in global financial markets".

Indexes on the close:

Name Price Change Change %

FTSE 100 6,338.67 +69.06 +1.10 %

DAX 10,064.8 +148.95 +1.50 %

CAC 40 4,675.29 +66.26 +1.44 %

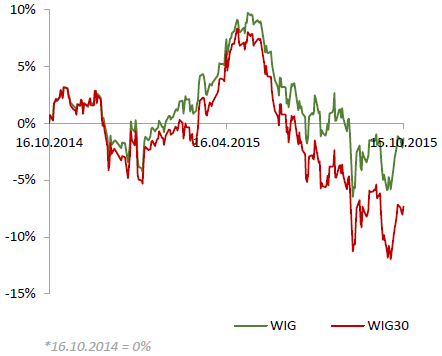

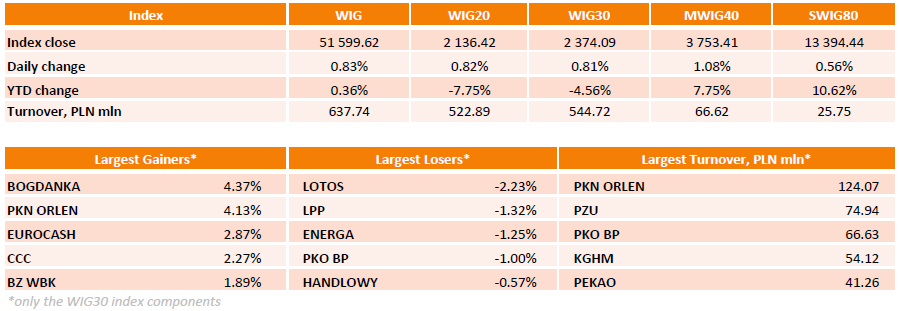

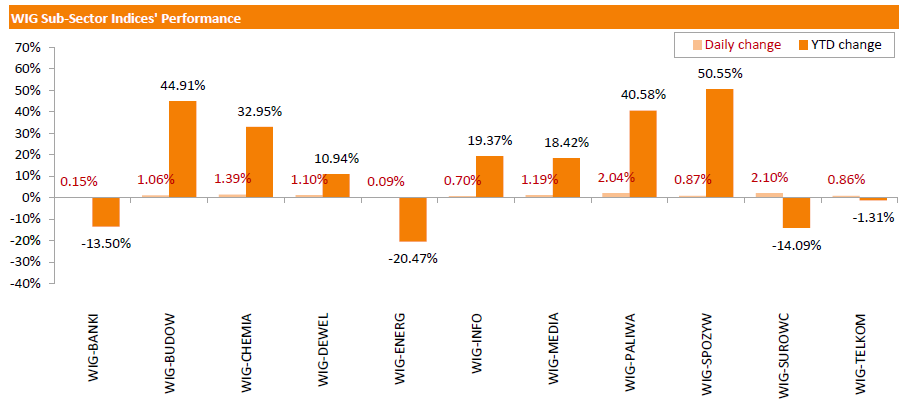

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, surged by 0.83%. All sectors in the WIG gained, with materials (+2.1%) and oil and gas sector (+2.04%) outperforming.

The large-cap stocks' measure, the WIG30 Index, added 0.81%. Within the index components, BOGDANKA (WSE: LWB) and PKN ORLEN (WSE: PKN) fared the best, advancing 4.37% and 4.13% respectively. EUROCASH (WSE: EUR) and CCC (WSE: CCC) were also noteworthy performers, gaining 2.87% and 2.27% respectively. On the other side of the ledger, LOTOS (WSE: LTS) was the weakest name, dropping 2.23% on worries that the local tax office's tax claims would affect the company's third-quarter profit. It was followed by LPP (WSE: LPP), ENERGA (WSE: ENG) and PKO BP (WSE: PKO), declining 1.23%, 1.25% and 1% respectively.

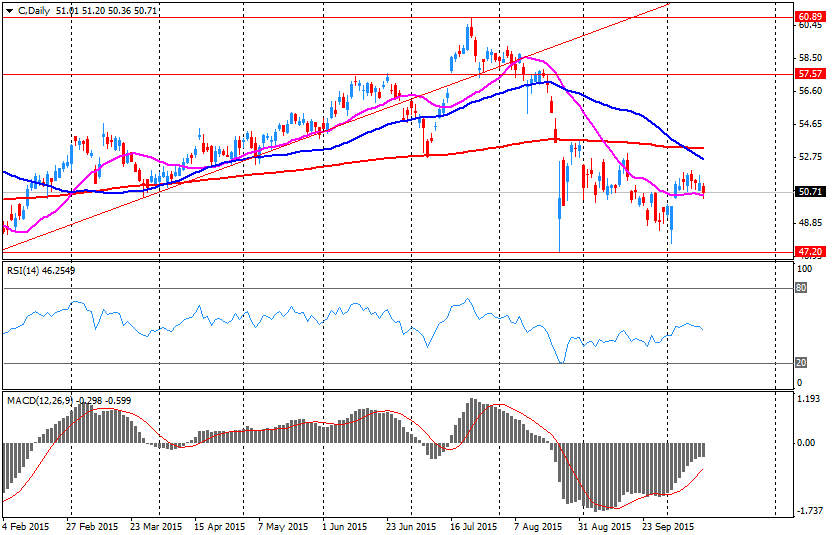

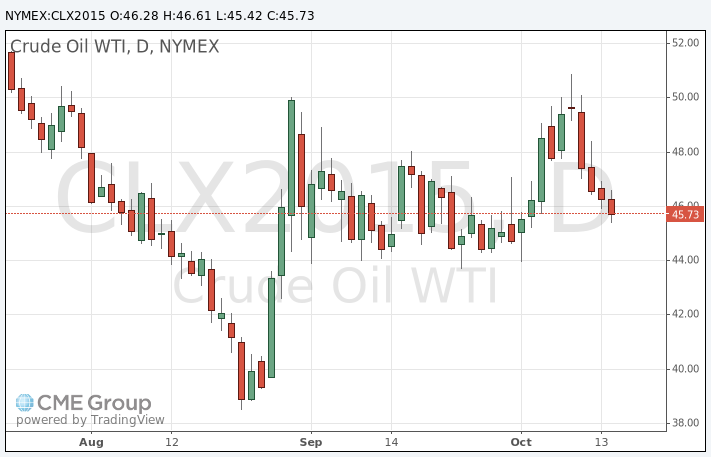

Oil prices decreased on the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories increased by 7.56 million barrels to 468.6 million in the week to October 09. It was the third consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 2.5 million barrels.

Gasoline inventories decreased by 2.6 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 1.125 million barrels.

U.S. crude oil imports climbed by 247,000 barrels per day.

Refineries in the U.S. were running at 86.0% of capacity, down from 87.5% the previous week.

WTI crude oil for November delivery declined to $45.42 a barrel on the New York Mercantile Exchange.

Brent crude oil for November decreased to $49.23 a barrel on ICE Futures Europe.

Gold price fell on a stronger U.S. dollar. The greenback rose against other currencies after the release of the U.S. consumer price inflation data. The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation fell 0.2% in September, in line with expectations, after a 0.1% fall in August.

The decrease was partly driven by lower gasoline prices. Gasoline prices dropped 9.0% in September. It was the biggest decline since January.

On a yearly basis, the U.S. consumer price index declined to 0.0% in September from 0.2% in August, beating expectations for a drop to -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in September, exceeding expectations for a 0.1% rise, after a 0.1% increase in August.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 1.9% in September from 1.8% in August. Analysts had expected the inflation to remain unchanged at 1.8%.

It is unclear if this mixed inflation data will be enough for the Fed's interest rate hike. Fed Governors Lael Brainard and Daniel Tarullo said this week that they would like to see clear signals that the inflation was accelerating toward the 2% target.

December futures for gold on the COMEX today declined to 1173.90 dollars per ounce.

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories increased by 7.56 million barrels to 468.6 million in the week to October 09. It was the third consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 2.5 million barrels.

Gasoline inventories decreased by 2.6 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 1.125 million barrels.

U.S. crude oil imports climbed by 247,000 barrels per day.

Refineries in the U.S. were running at 86.0% of capacity, down from 87.5% the previous week.

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index increased to -4.5 in October from -6.0 in September, missing expectations for a rise to -1.0.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"For the second consecutive month, regional manufacturers reported declines in overall activity. Indexes for new orders, shipments, employment, and average work hours all dipped into negative territory this month," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index was down -6.1 in October from 14.8 in September.

The new orders index increased to 10.6 in October from 9.4 in September.

The prices paid index slid to -0.1 in October from 0.5 in September, while the prices received index increased to 1.3 from -5.0.

The number of employees index dropped to -1.7 in October from 10.2 last month.

According to the report, the future general activity index was down to 36.7 in October from 44.0 in September.

Fitch Ratings said on Thursday that New Zealand's budget surplus "underscores the positive outlook on the sovereign's 'AA' rating".

The New Zealand government reached its budget surplus in the fiscal year ending June 30. It was the first budget surplus since 2008. The budget surplus was driven by stronger-than-expected tax revenue.

"Fitch believes that some of the improvement in revenue may be sustained into FY16. But the outlook for the dairy sector, and the implications for the wider economy, will be an important determinant of revenue growth," the agency said in its statement.

USD/JPY 119.00 (USD 268m) 120.00 (501m) 120.35 (300m)

EUR/USD 1.1300 (EUR 312m) 1.1365 (324m)

USD/CAD 1.3000 (USD 595m) 1.3050 (466m) 1.3100 (785m)

AUD/USD 0.7200 (AUD 537m) 0.7250 (391m) 0.7300 (1bln)

U.S. stock-index futures climbed.

Global Stocks:

Nikkei 18,096.9 +205.90 +1.15%

Hang Seng 22,888.17 +448.26 +2.00%

Shanghai Composite 3,338.27 +75.83 +2.32%

FTSE 6,333.45 +63.84 +1.02%

CAC 4,662.81 +53.78 +1.17%

DAX 10,057.48 +141.63 +1.43 %

Crude oil $46.21 (-0.92%)

Gold $1185.50 (+0.48%)

The New York Federal Reserve released its survey on Thursday. The NY Fed Empire State manufacturing index rose to -11.36 in October from -14.67 in September, missing expectations for an increase to -8.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

The new orders index decreased to -18.91 in October from -12.90 in September, while the shipments index climbed to -13.61 from -7.9.

The general business conditions expectations index for the next six months increased to 23.6 in October from 23.2 in September.

The price-paid index decreased to 0.94 in October from 4.1 in September.

The index for the number of employees fell to -8.5 in October from -6.2 last month.

The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation fell 0.2% in September, in line with expectations, after a 0.1% fall in August.

The decrease was partly driven by lower gasoline prices. Gasoline prices dropped 9.0% in September. It was the biggest decline since January.

Food prices increased 0.4% in September. It was the largest rise since May 2014.

On a yearly basis, the U.S. consumer price index declined to 0.0% in September from 0.2% in August, beating expectations for a drop to -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in September, exceeding expectations for a 0.1% rise, after a 0.1% increase in August.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 1.9% in September from 1.8% in August. Analysts had expected the inflation to remain unchanged at 1.8%.

The inflation remains low due to a weak wage growth and a stronger U.S. dollar.

It is unclear if this mixed inflation data will be enough for the Fed's interest rate hike. Fed Governors Lael Brainard and Daniel Tarullo said this week that they would like to see clear signals that the inflation was accelerating toward the 2% target.

(company / ticker / price / change, % / volume)

| Citigroup Inc., NYSE | C | 52.34 | 3.19% | 361.2K |

| Ford Motor Co. | F | 15.26 | 1.67% | 147.6K |

| American Express Co | AXP | 76.99 | 1.08% | 0.3K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.20 | 1.07% | 0.8K |

| Facebook, Inc. | FB | 95.07 | 1.06% | 83.6K |

| Nike | NKE | 127.00 | 0.92% | 0.5K |

| Deere & Company, NYSE | DE | 76.95 | 0.88% | 2.4K |

| ALTRIA GROUP INC. | MO | 58.05 | 0.87% | 4.0K |

| Yahoo! Inc., NASDAQ | YHOO | 32.35 | 0.81% | 1.8K |

| Cisco Systems Inc | CSCO | 28.04 | 0.79% | 3.3K |

| Travelers Companies Inc | TRV | 103.58 | 0.79% | 26.3K |

| Home Depot Inc | HD | 121.20 | 0.77% | 1.1K |

| Walt Disney Co | DIS | 106.50 | 0.73% | 5.4K |

| United Technologies Corp | UTX | 92.83 | 0.72% | 0.1K |

| E. I. du Pont de Nemours and Co | DD | 56.80 | 0.71% | 0.3K |

| Johnson & Johnson | JNJ | 95.19 | 0.70% | 2.7K |

| JPMorgan Chase and Co | JPM | 60.40 | 0.68% | 0.2K |

| Amazon.com Inc., NASDAQ | AMZN | 548.50 | 0.67% | 4.7K |

| General Motors Company, NYSE | GM | 33.55 | 0.66% | 156.5K |

| Visa | V | 74.67 | 0.63% | 04K |

| Boeing Co | BA | 135.06 | 0.63% | 7.1K |

| Twitter, Inc., NYSE | TWTR | 29.56 | 0.61% | 1.9K |

| Merck & Co Inc | MRK | 49.83 | 0.59% | 0.1K |

| The Coca-Cola Co | KO | 41.92 | 0.58% | 1.0K |

| Starbucks Corporation, NASDAQ | SBUX | 59.15 | 0.56% | 1.3K |

| 3M Co | MMM | 149.12 | 0.54% | 27.9K |

| General Electric Co | GE | 27.75 | 0.54% | 17.6K |

| ALCOA INC. | AA | 10.00 | 0.50% | 12.5K |

| McDonald's Corp | MCD | 103.30 | 0.47% | 36.7K |

| Google Inc. | GOOG | 654.23 | 0.47% | 1.8K |

| Tesla Motors, Inc., NASDAQ | TSLA | 217.89 | 0.47% | 15.5K |

| International Business Machines Co... | IBM | 150.62 | 0.41% | 0.4K |

| Verizon Communications Inc | VZ | 44.17 | 0.41% | 1.3K |

| Apple Inc. | AAPL | 110.65 | 0.40% | 86.0K |

| Pfizer Inc | PFE | 33.17 | 0.39% | 13.5K |

| Procter & Gamble Co | PG | 74.50 | 0.39% | 3.7K |

| HONEYWELL INTERNATIONAL INC. | HON | 98.58 | 0.33% | 0.2K |

| Yandex N.V., NASDAQ | YNDX | 13.37 | 0.30% | 5.1K |

| Chevron Corp | CVX | 90.00 | 0.27% | 0.3K |

| Microsoft Corp | MSFT | 46.80 | 0.26% | 3.5K |

| Intel Corp | INTC | 32.85 | 0.15% | 38.5K |

| AT&T Inc | T | 33.30 | 0.09% | 2.6K |

| Exxon Mobil Corp | XOM | 80.20 | 0.05% | 2.3K |

| Caterpillar Inc | CAT | 70.67 | -0.06% | 2.9K |

| Hewlett-Packard Co. | HPQ | 29.35 | -0.24% | 0.1K |

| Barrick Gold Corporation, NYSE | ABX | 8.15 | -0.37% | 47.2K |

| Wal-Mart Stores Inc | WMT | 59.69 | -0.57% | 150.9K |

| UnitedHealth Group Inc | UNH | 120.55 | -1.25% | 7.0K |

| Goldman Sachs | GS | 177.00 | -1.40% | 94.2K |

Upgrades:

Facebook (FB) upgraded to Buy from Hold at Argus

Downgrades:

Wal-Mart (WMT) downgraded to Neutral from Outperform at Credit Suisse; target lowered to $62 from $85

Other:

Hewlett-Packard (HPQ) initiated with an Underweight at Barclays

IBM (IBM) initiated with an Underweight at Barclays

Apple (AAPL) initiated with an Overweight at Barclays

Cisco Systems (CSCO) initiated with an Overweight at Barclays

NIKE (NKE) target raised to $126 from $120 at FBR Capital

Deere (DE) initiated with a Market Outperform at Avondale; target $90

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending October 10 in the U.S. declined by 7,000 to 255,000 from 262,000 in the previous week. The previous week's figure was revised down from 263,000.

Analysts had expected the initial jobless claims to increase to 270,000.

Jobless claims remained below 300,000 the 32th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 50,000 to 2,158,000 in the week ended October 03. It was the lowest level since November 2000.

The People's Bank of China (PBoC) said on Thursday that bank lending in China rose to 1.05 trillion yuan ($165.5 billion) in September from CNY809.6 billion in August.

Total social financing climbed to 1.3 trillion yuan in September from 1.08 trillion yuan in August.

M2 money supply jumped 13.1% year-on-year in September, after a 13.3% gain in August.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation October 3.2% 3.5%

00:30 Australia New Motor Vehicle Sales (MoM) September -1.7% Revised From -1.6% 5.5%

00:30 Australia New Motor Vehicle Sales (YoY) September 2.6% Revised From 2.1% 7.7%

00:30 Australia Unemployment rate September 6.2% 6.3% 6.2%

00:30 Australia Changing the number of employed September 18 Revised From 17.4 5 -5.1

04:30 Japan Industrial Production (MoM) (Finally) August -0.8% -0.5% -1.2%

04:30 Japan Industrial Production (YoY) (Finally) August 0.0% 0.2% -0.4%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The U.S. consumer price inflation is expected to decline to -0.1% year-on-year in September from 0.2% in August.

The U.S. consumer price index excluding food and energy is expected to remain unchanged 1.8% year-on-year in September.

The number of initial jobless claims in the U.S. is expected to rise by 7,000 270,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to increase to -1.0 in October from -6.0 in September.

The FOMC member Dudley will speak at 14:30 GMT.

The euro traded lower against the U.S. dollar on comments by the European Central Bank (ECB) Governing Council Member Ewald Nowotny. He said on Thursday that further stimulus measures are needed as the central bank's inflation target will be missed.

"In my view, it's quite obvious that additional sets of instruments are necessary," he said.

Nowotny added that additional instruments should include structural reforms and measures to stimulate demand.

The central bank's inflation target is 2%. The ECB expects the inflation to be 0.1% this year.

The ECB Vice President Vitor Constancio said in a speech in Hong Kong on Thursday that the exit from the zero interest rate policy may have spillover on other countries in the short terms.

"We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates," he said.

Constancio added that the spillover from US monetary policy is larger than those from the Eurozone, due to "the dominance of the US dollar in global financial markets".

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair fell to $1.1424

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y118.05

The most important news that are expected (GMT0):

12:30 U.S. NY Fed Empire State manufacturing index October -14.67 -8

12:30 U.S. Initial Jobless Claims October 263 270

12:30 U.S. CPI, m/m September -0.1% -0.2%

12:30 U.S. CPI, Y/Y September 0.2% -0.1%

12:30 U.S. CPI excluding food and energy, m/m September 0.1% 0.1%

12:30 U.S. CPI excluding food and energy, Y/Y September 1.8% 1.8%

14:00 U.S. Philadelphia Fed Manufacturing Survey October -6.0 -1

14:30 U.S. FOMC Member Dudley Speak

21:45 New Zealand CPI, q/q Quarter III 0.4% 0.2%

21:45 New Zealand CPI, y/y Quarter III 0.4% 0.3%

EUR/USD

Offers 1.1500 1.1520 1.1535 1.1550 1.1575 1.1600 1.1620 1.1650

Bids 1.1465 1.1440 1.1425 1.1400-10 1.1380-85 1.1355-60 1.1330 1.1300

GBP/USD

Offers 1.5500-10 1.5530 1.5550 1.5565 1.5585 1.5600 1.5625-30 1.5650

Bids 1.5460 1.5425-30 1.5400 1.5380 1.5350 1.5330 1.5300

EUR/GBP

Offers 0.7425-30 0.7450 0.7475-80 0.7500 0.7525-30 0.7550

Bids 0.7385-90 0.7365 0.7350 0.7330-35 0.7300

EUR/JPY

Offers 135.80 136.00 136.50 136.75 137.00 137.25 137.50

Bids 135.25 135.00 134.80 134.50 134.30 134.00 133.75 133.50

USD/JPY

Offers 119.00 119.20 119.50 119.80-85 120.00 120.20 120.35 120.50

Bids 118.65-70 118.50 118.30 118.00 117.85 117.50 117.30 117.00

AUD/USD

Offers 0.7350 0.7375 0.7400 0.7425 0.7450 0.7475 0.7500-10

Bids 0.7320 0.7300 0.7285 0.7260 0.7240 0.7220 0.7200 0.7185 0.7150

UnitedHealth reported Q3 earnings of $1.65 per share (+1.2% y/y) versus analysts' consensus of $1.64.

Its revenues amounted to $41.500 bln (+26.5% y/y), beating consensus of $40.262 bln.

The company reaffirmed its FY 2015 guidance with earnings expected to be within the range of $6.25 to $ 6.35 per share. The analysts' consensus forecast for the company's EPS FY 2015 stands at $6.35.

UNH rose to $123.50 (+1.17%) in pre-market trading.

Stock indices traded higher on speculation that the Fed will delay its interest rate hike due to the recent weak U.S. economic data. According to the U.S. Commerce Department, the U.S. retail sales climbed 0.1% in September, missing expectations for a 0.2% decrease, after a flat reading in August. Retail sales excluding automobiles decreased 0.3% in September, missing forecasts of a 0.1% decline, after a 0.1% fall in August.

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Thursday that further stimulus measures are needed as the central bank's inflation target will be missed.

"In my view, it's quite obvious that additional sets of instruments are necessary," he said.

Nowotny added that additional instruments should include structural reforms and measures to stimulate demand.

The central bank's inflation target is 2%. The ECB expects the inflation to be 0.1% this year.

The ECB Vice President Vitor Constancio said in a speech in Hong Kong on Thursday that the exit from the zero interest rate policy may have spillover on other countries in the short terms.

"We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates," he said.

Constancio added that the spillover from US monetary policy is larger than those from the Eurozone, due to "the dominance of the US dollar in global financial markets".

Current figures:

Name Price Change Change %

FTSE 100 6,325.36 +55.75 +0.89 %

DAX 10,042.42 +126.57 +1.28 %

CAC 40 4,659.59 +50.56 +1.10 %

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Thursday. Final industrial production in Japan declined 1.2% in August, down from the preliminary estimate of a 0.5% decrease, after a 0.8% drop in July.

On a yearly basis, Japan's industrial production was down 0.4% in August, down from the preliminary estimate of a 0.2% increase, after a flat reading in July.

The output at factories and mines was revised down to 96.3 from the preliminary reading of 97.0.

Industrial shipments were downgraded to a 0.7% fall from the preliminary 0.5% decline, while inventories were revised down to a 0.3% rise from the preliminary 0.4% increase.

According to the Business NZ Survey published on late Wednesday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand rose to 55.4 in September from 55.1 in August. It was the highest level since February.

August's figure was revised up from 55.0.

A reading above 50 indicates expansion in the manufacturing sector.

The increase was mainly driven by a rise in the production and new orders.

"Production was at its highest level since December last year, while new orders continued to improve. Overall, this should flow through into healthy results for the last quarter of the year," Business NZ's executive director for manufacturing, Catherine Beard, said.

USD/JPY 119.00 (USD 268m) 120.00 (501m) 120.35 (300m)

EUR/USD 1.1300 (EUR 312m) 1.1365 (324m)

USD/CAD 1.3000 (USD 595m) 1.3050 (466m) 1.3100 (785m)

AUD/USD 0.7200 (AUD 537m) 0.7250 (391m) 0.7300 (1bln)

The European Central Bank (ECB) Vice President Vitor Constancio said in a speech in Hong Kong on Thursday that the exit from the zero interest rate policy may have spillover on other countries in the short terms.

"We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates," he said.

Constancio added that the spillover from US monetary policy is larger than those from the Eurozone, due to "the dominance of the US dollar in global financial markets".

"Global challenges require both domestic and global responses to ensure that the global financial system becomes more resilient," he concluded.

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Thursday that further stimulus measures are needed as the central bank's inflation target will be missed.

"In my view, it's quite obvious that additional sets of instruments are necessary," he said.

Nowotny added that additional instruments should include structural reforms and measures to stimulate demand.

The central bank's inflation target is 2%. The ECB expects the inflation to be 0.1% this year.

Richmond Federal Reserve President Jeffrey Lacker said in an interview with Fox Business Network on Wednesday that his outlook for the U.S. economy has not changed since September despite the recent weak economic data.

"My views haven't changed much since September," he said.

But he did not said if he will vote for the interest rate hike at the Fed's monetary policy meeting in October. Lacker was only one FOMC official who voted for the interest rate hike in September.

Richmond Federal Reserve president pointed out that interest rates should higher than they are now.

"The higher sustained growth we've seen in real consumer spending strongly suggests that real interest rates need to be higher than they are now," he said.

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economic activity continued to grow modestly from mid-August through early October, but a strong U.S. dollar and the slowdown in the Chinese economy weighed on the manufacturing sector in the U.S.

The New York, Philadelphia, Cleveland, Atlanta, Chicago, and St. Louis Districts expanded modestly, the Minneapolis, Dallas, and San Francisco Districts grew moderately, Boston's and Richmond's activity rose, while Kansas City' activity declined.

The Fed noted that labour markets tightened in most districts, but wage growth was mostly subdued.

UBS Group AG said on Tuesday that it expects central bank and sovereign wealth fund assets will decline by $1.2 trillion by the end of the year as China and oil-producing countries including Russia and Saudi Arabia use their foreign exchange reserves to boost the economic growth.

Massimiliano Castelli, head of global strategy at UBS Asset Management, said in a phone interview with Bloomberg on Tuesday that the decline in sovereign assets is likely to continue into next year.

UBS said that central banks and sovereign wealth funds totalled more than $18 trillion at the end of 2014.

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate remained unchanged at 6.2% in September, beating expectations for a rise to 6.3%. The number of employed people in Australia declined by 5,100 in September, missing forecast of a rise by 5,000, after a gain by 18,000 in August. August's figure was revised up from a rise by 17,400.

Full-time employment fell by 13,900 in September, while part-time employment climbed by 8,900.

The participation rate declined to 64.9% in September from 65.0% in August.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1579 (1892)

$1.1543 (2355)

$1.1519 (1322)

Price at time of writing this review: $1.1487

Support levels (open interest**, contracts):

$1.1443 (250)

$1.1409 (162)

$1.1360 (782)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 33663 contracts, with the maximum number of contracts with strike price $1,1500 (3016);

- Overall open interest on the PUT options with the expiration date November, 6 is 45126 contracts, with the maximum number of contracts with strike price $1,1200 (4624);

- The ratio of PUT/CALL was 1.34 versus 1.30 from the previous trading day according to data from October, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.5703 (508)

$1.5606 (977)

$1.5510 (1928)

Price at time of writing this review: $1.5486

Support levels (open interest**, contracts):

$1.5392 (552)

$1.5295 (2321)

$1.5197 (2069)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 18567 contracts, with the maximum number of contracts with strike price $1,5350 (2606);

- Overall open interest on the PUT options with the expiration date November, 6 is 18725 contracts, with the maximum number of contracts with strike price $1,5300 (2321);

- The ratio of PUT/CALL was 1.01 versus 1.00 from the previous trading day according to data from October, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.