- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 17-12-2021

- The US Dollar Index ended the week above the 96.50 threshold.

- The US 10-year Treasury yield finished down, at 1.412%.

- DXY Technical outlook: Breaks above the ascending triangle, USD bulls target 98.00.

The US Dollar Index, also known as DXY, which measures the greenback’s performance against a basket of six rivals, rallies 0.72%, sitting at 96.68 during the day as the New York session wanes at the time of writing. The market sentiment was downbeat as the Wall Street session closed, with major US equities finishing in the red, following European stock indices footsteps.

In the US bond market, Treasury yields in the short-maturity of the curve rise with 2s, and 5s, up between 1 and 2.5 basis points, ended at 0.6457% and 1.1815%, each. In the mid to long maturity of the yield curve, yields fell between 1-4 basis points, with 10s, the 20s, and 30s, finishing at 1.412%, 1,8623%, and 1.82%, respectively.

In the week, the main event for the US dollar was the Federal Reserve monetary policy decision. The US central bank kept their interest rates unchanged at the 0 to 0.25% range while increasing the speed of the bond taper, from the $15 Billion agreed initially up to $30 Billion, beginning in mid-January of 2022.

Additionally, it released its Summary of Economic Projections, also known as SEP. Inside of that report lies the “famous” dot-plot, which displays the 18 Federal Reserve Board members’ projections for the Federal Fund Rates (FFR) in the current year, and subsequent ones. In this report, the US central bank policymakers expect three rate hikes by the end of 2022, projecting the FFR at 0.90%.

The market initially reacted as if the event was a “buy the rumor sell the fact.” Nevertheless, Friday’s price action is more aligned to the hawkish switch by the Fed.

US Dollar Index (DXY) Price Forecast: Technical outlook

The US Dollar Index finished the week above the 96.00 figure for the third week in a row. The DXY is in a clear uptrend, and through the last couple of weeks, price action consolidated around the 95.50-96.50 range, forming an ascending triangle in an uptrend.

On Wednesday, the DXY broke the top-trendline, reaching a daily high at 96.91, falling inside the ascending triangle after the Fed monetary policy decision. Nevertheless, the downward move was not strong enough to overcome the bottom-trendline that forms the ascending triangle.

At press time, the DXY broke for the second time above the downslope top-trendline of the ascending triangle, leaving as the first resistance the 97.00 figure. A breach of the latter would expose the June 30 high at 97.80, followed by the ascending triangle target at 98.00.

-637753755355683480.png)

- The shared currency gave back Thursday’s gains, down some 0.85%.

- The US central bank doubles its QE reduction to $30 bln, eyes three rate hikes in 2022.

- The ECB announced a “hawkish” hold, PEPP to end in March as scheduled.

- EUR/USD Technical Outlook: Neutral-bearish, as long as it remains below 1.1385.

On Friday, the EUR/USD plunges during the New York session, trading at 1.1237, down some 0.85% at the time of writing. The market sentiment is downbeat, spurred by monetary policy decisions by three of the most important central banks, as investors assess those decisions and rebalance their portfolios.

Fed increases taper speed eyes three hikes, and the ECB follow its footsteps at a slower rate

On Wednesday, the Federal Reserve announced its monetary policy decision. The US central bank kept their interest rates unchanged at the 0 to 0.25% range while increasing the speed of the bond taper, from the $15 Billion agreed initially up to $30 Billion, beginning in mid-January of 2022. Additionally, it released its Summary of Economic Projections, also known as SEP. Inside of that report lies the “famous” dot-plot, which displays the 18 Federal Reserve Board members’ projections for the Federal Fund Rates (FFR) in the current year, and subsequent ones. In this report, the US central bank policymakers expect three rate hikes by the end of 2022, projecting the FFR at 0.90%.

The market initially reacted as if the event was a “buy the rumor sell the fact.” Nevertheless, Friday’s price action is more aligned to the hawkish switch by the Fed.

Concerning the European Central Bank (ECB), the ECB kept rates unchanged and announced that the Pandemic Emergency Purchase Programme (PEPP) wound end in March as expected. Nevertheless, the ECB will boost the APP program to a pace of €40 Billion per month in Q2, from €20 Billion currently, meaning that the actual taper would be in the amount of €40 Billion, as the PEPP purchases accounted for €60 Billion. Regarding adjusting interest rates, ECB’s President Christine Lagarde said that it was “very unlikely” that the ECB will hike rates in 2022.

The European economic docket reported the PPI for Germany and the December IFO business survey. The PPI rose by 19.2% on a yearly basis, lower than the 20% estimated, suggesting further upside pressures on CPI on the subsequent releases. In the meantime, the IFO came at 94.7 lower than the 95.3 foreseen.

EUR/USD Price Forecast: Technical outlook

After peaking around 1.1350, the EUR/USD tumbled towards 1.1238, approaching the December 15 swing low at 1.1221. The EUR/USD is neutral from a market structure perspective, as it has failed to break below/above the 1.1200/1.1385 in the last couple of weeks. Nevertheless, as long as the daily moving averages (DMAs) remain above the spot price, the EUR/USD has a bearish bias.

On the downside, the first support would be December 12 low at 1.1221, immediately followed by 1.1200. A breach of the latter would expose the YTD low at 1.1186, which in the event of being broken, would send the pair tumbling to the 1.1100 figure.

- AUD/USD has continued to decline in recent trade and is now in the 0.7130s, down 0.7%, after hawkish Fed rhetoric.

- Fed’s Waller said the whole point of the Fed’s QE acceleration was to make the March meeting live for lift-off.

Recent downside momentum in AUD/USD has continued throughout US trading hours spurred primarily by a broad pick up in USD strength in wake of hawkish Fed commentary. The pair is now trading in the 0.7130s, down about 50 pips or 0.7% on the session and now down about 1.2% from earlier weekly highs hit in the 0.7220s on Thursday after the Fed’s monetary policy announcement.

Influential Fed board member Christopher Waller said that the "whole point" of the Fed's decision to accelerate the pace of its QE taper was to make the March Fed meeting "live" for a first rate hike. A hike in March, he said, was now his base case, although he could see the hike pushed out to May. According to the CME Fed Watch, markets are now pricing a roughly 50% chance that the Fed hikes rates by 25bps to 0.25-0.50% from 0.0-0.25% in March.

The comments come after the Fed doubled the pace of its QE taper earlier in the week, the new dot plot showed consensus expectations on the FOMC was for three rate hikes in 2022 and Chair Jerome Powell outlined a bullish view on the economy and labour market. Waller and other Fed speakers who have appeared (Mary Daly) since the Fed meeting stuck to this bullish economic view, but Waller was much more explicit on the potential timing of future Fed policy moves.

The Aussie’s losses on Friday, which have also been compounded by a broadly risk-averse market mood, have taken AUD/USD back to roughly in line with its pre-Fed meeting levels. Bears will likely be eyeing a potential test of this week’s lows under 0.7100 if the dollar can continue to strengthen into next week on hawkish Fed vibes and if risk appetite remains ropey.

- GBP/JPY slipped back to pre-BoE levels in the mid-150.00s on Friday as risk appetite deteriorates, boosting the yen.

- That marks a 1.3% pullback from post-surprise rate hike highs above 152.50, but GBP/JPY is still positive on the week.

Though the pair has stabilises in more recent trade as FX markets volumes drop off ahead of the weekend, GBP/JPY still trades with losses of about 0.45% on the session ad has pretty much unwound all of its post-surprise BoE rate hike gains. At present, the pair is trading in the 150.60s, having bounced at 150.50 at the retest of a previous downtrend that was broken around the mid-point of the week. Despite the sharp more than 1.0% pullback from Thursday highs above 152.50, a key area of resistance going all the way back to September, GBP/JPY is still set to close the week out with gains of about 0.2%.

If it can hold to the north of the downtrend it broke above around the middle of the week, then it may be able to edge higher next week. But trading conditions next week are likely to be subdued given the proximity to Christmas Day (next Saturday), so any meaningful recovery back to the 152.50 area may have to wait until the new year. Such a recovery would rely on an improvement in risk appetite and greater confidence that the BoE hiking cycle is going to continue at a reasonable pace in 2022.

Indeed, poor risk appetite on Friday seems to be the primary factor as to why GBP/JPY pulled back from the 151.50 area, a move driven by yen outperformance on safe-haven demand. There isn't exactly one theme driving the caution, but traders/market participants continue to fret about themes such as the rapidly accelerating global spread of Omicron as well as the increasingly hawkish shift of tone/policy at major central banks. Recall that, as well as the surprise BoE hike, the Fed doubled its QE taper speed and indicated as many as three rate hikes in 2022 and the ECB laid out its plans to taper its pandemic era bond-buying programme.

- USD/CAD is approaching 1.2900 after hawkish comments from Fed member Waller, who said that March meeting was live.

- A break above 1.2900 would likely open the door to a test of the initial post-Fed meeting highs near 1.2940.

Some had thought that this week’s rollercoaster ride in FX markets might have been over by the midpoint of the US session but hawkish rhetoric from influential Fed board member Christopher Waller has injected a dose of dollar strength that has accelerated USD/CAD’s upwards trajectory. Waller said that the "whole point" of the Fed's decision to accelerate the pace of its QE taper was to make the March Fed meeting "live" for a first rate hike. A hike in March, he said, was now his base case, although he could see the hike pushed out to May.

According to the CME Fed Watch, markets are now pricing a roughly 50% chance that the Fed hikes rates by 25bps to 0.25-0.50% from 0.0-0.25% in March. The hawkish repricing in USD Short-Term Interest Rate (STIR) markets has helped to push USD/CAD above the 1.2850 level and the pair is now eyeing a test of the 1.2900 level. At current levels in the 1.2880 area, the pair is trading with gains of about 0.85% on the day and is one of the worst-performing G10 currencies alongside NZD and SEK, weighed amid a sharp drop in crude oil prices.

A break above 1.2900 would likely open the door to a test of the initial post-Fed meeting highs near 1.2940. To recap the Fed’s meeting quickly, the Fed doubled its QE taper speed and indicated as many as three rate hikes in 2022. In the post-Fed press conference, Fed Chair Jerome Powell avoided being as explicit about the timing of rate hikes as Waller.

Notably, Waller has been ahead of the curve regarding the Fed’s shifting stance in recent months and was calling for a faster QE taper and earlier rate hikes (alongside FOMC member James Bullard) long before this become the consensus view of the committee. In that regard, he is one to watch out for at the Fed as a potential “thought leader”. A March hike would likely position the Fed as implementing their first rate hike ahead of the BoC, who have indicated lift-off could occur in the middle quarters of 2022 (i.e. no earlier than April). That means USD/CAD could be vulnerable to further hawkish Fed induces upside.

UK Brexit Minister Lord David Frost said on Friday that "we have not made enough progress on the Northern Ireland Protocol" in an FT op-ed cited by Reuters. Frost added that burdensome customs arrangements and the way EU rules are applied need to be changed drastically.

Market Reaction

GBP does not seem to have reacted to the latest Brexit news. GBP/USD continues to move lower, though this is more a dollar-driven move than anything else in wake of hawkish commentary from Fed's Waller, who said the March meeting was live for a first rate hike.

- The yellow-metal climbs for the third consecutive day, up some 0.15%.

- The US 10-year Treasury yield falls below the 1.40% threshold, underpins gold.

- XAU/USD Technical Outlook: Neutral-bullish, as long as it remains above $1,792.95.

Gold (XAU/USD) advances for the third successive day, aiming towards ending the week on a higher note, trading around $1,805 during the New York session. At the time of writing, the market sentiment is downbeat, as shown by US equity indices posting losses between 0.22% and 1.18%. Meanwhile, US bond yields extend their fall, with the 10-year benchmark note falling three basis points, down to 1.392%, a tailwind for the non-yielding metal.

After the bulk of central banks hosting monetary policy decisions, the yellow metal finally broke the $1,800 barrier, as investors assess the “hawkish” pivot in the Fed, the Bank of England (BoE), and the European Central Bank (ECB).

An absent macroeconomic US docket would keep XAU/USD trading within familiar levels. The “hawkish” pivot by Jerome Powell did its work as Fedspeakers cross the wires.

In the last couple of hours, Fed’s Governor Christopher Waller said that the US economy is “closing in” on maximum employment and backed the Fed’s decision to accelerate the pace of the QE taper. He noted that inflation “is alarmingly high, persistent and has broadened.”

At the same time, San Francisco’s Federal Reserve President Mary Daily said that it expects unemployment to fall below 4% in 2022, adding that she is bullish on the US economy. Regarding elevated prices, Daly said that “persistence in above-2% inflation is a positive outcome,” as it helps achieve the central’s bank target. Furthermore, she added that she foresees 2-3 rate hikes, but it would depend on how the US economy evolves.

Apart from this, investors’ focus is on the US macroeconomic docket next week. On Wednesday, US GDP (Q3), Consumer Confidence (December), and Personal Consumption Expenditures Prices (PCE) for the Q3 would entertain participants. On Thursday, Durable Goods (Nov), Initial Jobless Claims (Dec. 17), New Home Sales (Nov), and Michigan Consumer Sentiment (Dec) would offer additional clues on the status of the US economy.

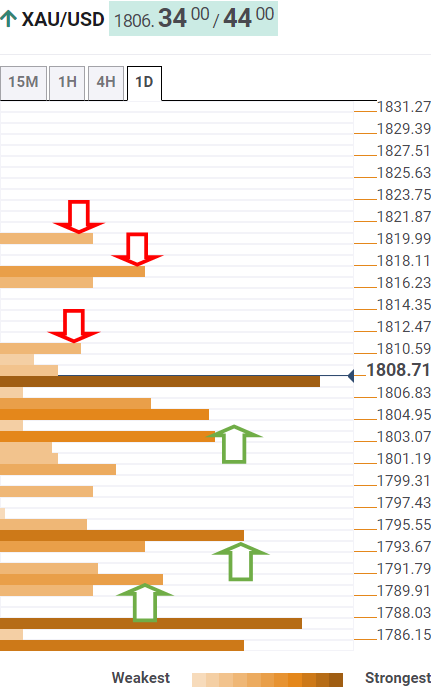

XAU/USD Price Forecast: Technical outlook

Gold (XAU/USD) has a neutral bias, despite trading above the daily moving averages (DMAs). However, once reclaimed the $1792.95 price level, that might open the door for further upside, though there would be some strong resistance levels to face. The first resistance would be November 26 swing high at $1,815.37. A breach of the latter would expose the September 3 high at $1,834, followed by the November 16 pivot high at $1,877.

On the flip side, supports would be found around the DMAs. The first would be the 50-DMA at $1,797.85, then the 200-DMA at $1,794.52, and the 100-DMA at $1,788.35.

.

Fed Board of Governors member Christopher Waller said on Friday that the "whole point" of the Fed's decision to accelerate the pace of its QE taper was to make the March Fed meeting "live" for a first rate hike. Under his base case scenario, a first rate hike in March is very likely, though it could be pushed back to May.

Additional remarks:

“There is no reason to delay the adjustment of balance sheet.”

“The balance sheet around 20% of GDP seems reasonable, compared to current around 35%... can go sooner and faster this time.”

“Could allow some run off of balance sheet perhaps in a meeting or two after liftoff.”

“Can go faster on balance sheet given flow of on RRP facility.”

“Would like to achieve maximum employment but will have to make a trade-off if inflation continues high.”

"Fed could hike a couple of time then see how inflation behaves, at this point, members do not expect it to come down."

"Does not think it remotely possible that the economy would be thrown into a recession by three rate increases in 2022."

"Expects unemployment rate could be as low as 3.7% by March, with all pre-pandemic jobs recovered once accounting for retirements."

“Three hikes in combination with falling inflation means real rates will be tightening.”

“Switch in dots reflected "amazing" realignment of views among policymakers.”

“Balance sheet runoff by summer would also help remove accommodation, ease need of further rate increases.”

Market Reaction

Waller's hawkish comments appear to be lending some support to the dollar, with the DXY pushing to session highs above 96.50 in recent trade, though to be fair, the dollar had already been on the front foot even prior to the remarks.

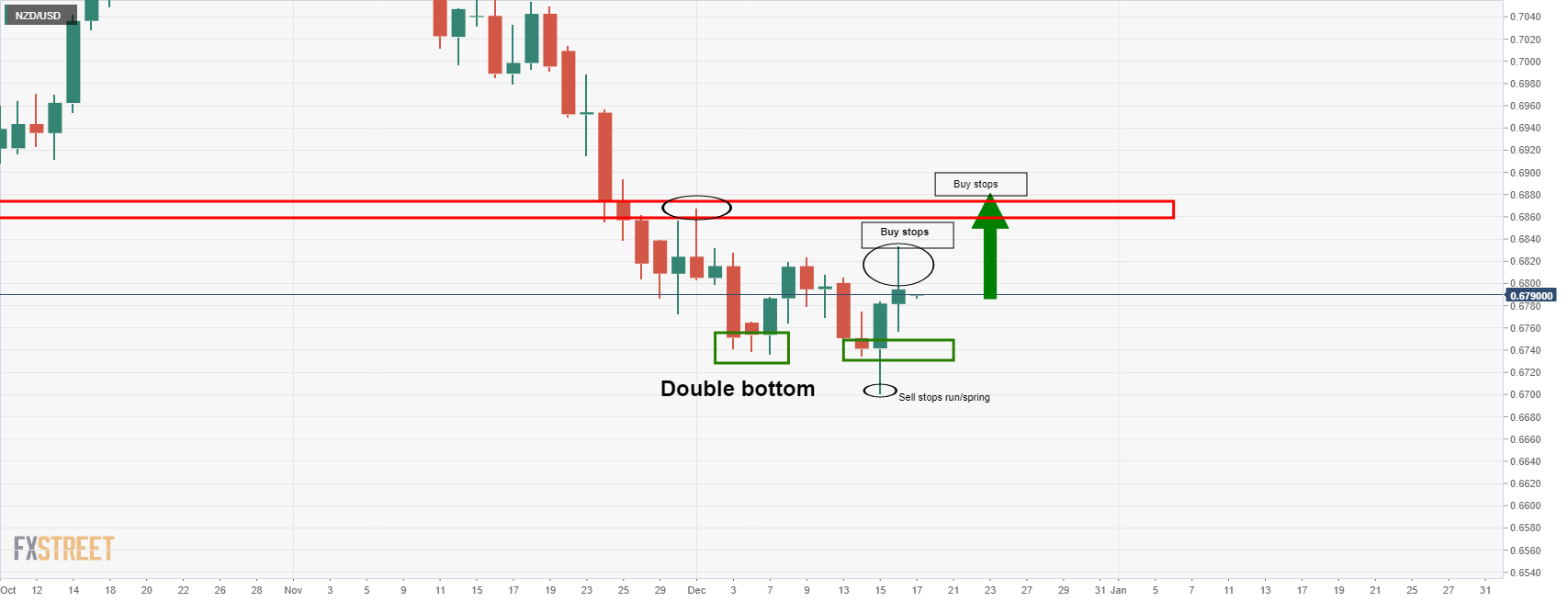

- NZD/USD fell sharply on Friday, falling back under 0.6750 amid kiwi underperformance.

- The pair’s mid-week post-Fed rally above 0.6800 appears looks to have been nothing more than a dead cat bounce.

NZD/USD’s mid-week post-Fed rally appears looks to have been nothing more than a dead cat bounce. After running out of upwards momentum just shy of its 21-day moving average at 0.6840 (at the time, it's now dropped to just above 0.6820), NZD/USD has dropped all the way back to roughly in line with its pre-Fed levels and below the 0.6750 mark. On the day, that means it is now down about 0.75%, making it the second-worst performing G109 currency after SEK.

While a deterioration in the New Zealand NBNZ Business Outlook index to -23.2 in December from 16.4 in November and in the NBNZ Own Activity index to 11.8 from 15.0 may be behind the kiwi’s underperformance on the day versus of AUD and CAD, the main driver of the downside for NZD/USD on Friday has been a downturn in the market’s broader appetite for risk. US equities are lower with underperformance seen in cyclical stocks, US yields are lower, crude oil is lower. All typical of risk-off conditions.

There isn't exactly one theme driving the caution, but traders/market participants continue to fret about themes such as the rapidly accelerating global spread of Omicron as well as the increasingly hawkish shift of tone/policy at major central banks. Recall that the Fed doubled its QE taper speed and indicated as many as three rate hikes in 2022, the BoE actually did hike rate by 15bps (to everyone surprise!) and the ECB laid out its plans to taper its pandemic era bond-buying programme.

Federal Reserve Bank of San Francisco President Mary Daly said on Friday that the best way to create sustainable recovery is not to accommodate as much, according to Reuters.

Additional Takeaways:

“We are nearing the level of maximum employment that's achievable today.”

“The job of the Fed is to balance its employment, inflation goals.”

“We are not behind the curve on inflation.”

“Policy is in a good place.”

“The Fed will have optionality to raise rates faster or slower than current fed policymaker forecast.”

“We are in a balancing act.”

“Raising rates doesn't mean we are declaring victory on full employment… We still expect more workers to come back to labor force.”

Federal Reserve Bank of San Francisco President Mary Daly said on Friday that she expects above-trend GDP growth in 2022 and for inflation to moderate, according to Reuters citing Daly's comments in a WSJ interview.

Additional Takeaways:

“Expects unemployment rate to fall below 4% next year.”

“Is bullish on the US economy.”

“Keep an open mind about how many rate increases next year.”

“Expect to complete bond buys by March, prepared to respond to whatever economy brings us.”

“If the economy slows, may not need 2-3 rate hikes... if the economy speeds as expected, 2-3 rate hikes next year would be appropriate.”

“Even with 2-3 rate hikes, still a very accommodative policy.”

“As the economy gets stronger, the Fed will do less to support it.”

“Persistence in above-2% inflation is a positive outcome, helps fed achieve 2% inflation on average.”

“We understand inflation is problematic… we have to respond to that.”

“Very encouraged by the rise in the participation rate and decline in unemployment rate for disadvantaged groups.”

Fed Board of Governors Member Christopher Waller said on Friday that the US economy is "closing in" on maximum employment and, thus, he strongly supported the Fed's decision to accelerate the pace of the QE taper, according to Reuters.

Additional Takeaways:

“Faster taper gives increased flexibility to adjust policy as early as spring.”

“The US economy is set to continue growing strongly at least through 1h 2022.”

“The Omicron variant is 'big uncertainty' for outlook.”

“Inflation is alarmingly high, persistent, and has broadened.”

“The baseline outlook is for inflation to moderate next year; watching expectations closely.”

“Omicron could slow recovery or exacerbate inflation… the Fed has to be ready 'in the coming weeks' to adjust as needed.”

“Rate hike will be warranted shortly after bond buys end.”

- The USD/CHF trims some of Thursday’s losses, up some 0.47%.

- A downbeat market sentiment boosts the US Dollar prospects, the CHF weakened.

- USD/CHF Technical Outlook: Upward bias, though a break above 0.9300 would open the door for 0.9400.

The greenback recovers some of Thursday’s losses against the Swiss franc, climbs above the 100, and the 50-day moving averages (DMAs) trading at 0.9227 during the New York session at the time of writing. Financial markets risk-aversion favors the greenback safe-haven status, to the detriment of the Swiss franc.

In the bond market, US T-bond yields extend their losses, with the 10-year Treasury yield falling four basis points, sitting at 1.382%. However, the greenback has offset the downfall, with the US Dollar Index, which tracks the buck’s performance against a basket of six rivals, advances 0.35%, up to 96.39, near December 16 daily tops.

USD/CHF Price Forecast: Technical outlook

From the technical perspective, as shown by the daily moving averages (DMAs) located below the spot price, the USD/CHF pair has an upward bias. In fact, in the overnight session, the USD/CHF dipped as low as the 200-DMA at 0.9174, then rebounded near the December 16 tops around 0.9232.

To the upside, the first resistance would be the December 16 high at 0.9233. The breach of the latter would allow USD bulls to resume the uptrend towards the 50% Fibonacci retracement at 0.9265. A clear break above that level would send the pair rallying towards the confluence of a downslope trendline and the 61.8% Fibonacci retracement around the 0.9280-0.9300 area.

On the other hand, the USD/CHF first support would be the 50-DMA at 0.9213, followed by the 100-DMA at 0.9204. A break beneath the latter would open the door for a retest of the 200-DMA at 0.9174.

-637753587199322541.png)

Analysts at Danske Bank forecast the USD/JPY pair at 113 in one month, 112 in three months, 111 in six and 109 in 12 months. They warn that a significant change in risk sentiment could take USD/JPY quicker towards 100.

Key Quotes:

“Upside risks to USD/JPY primarily comes from the global economy moving back in reflation mode if COVID-19 and labour market issues are solved and growth beats expectations. Significant change in risk sentiment causing US yields and commodities to decrease significantly could take USD/JPY quicker towards 100.”

“USD/JPY has moved higher driven by particularly higher US yields. Increasing inflation and strong growth on a global scale has been a fruitful environment for USD/JPY but factories have reached production limits on a global scale while goods demand continues to be strong. We see an increasing risk that central banks are forced to tighten significantly to bring demand down while fiscal stimulus wanes, which will move the global economy in to a period with slower growth and less inflation. That will result in flatter yield curves and less pressure on commodity prices including oil. If we add that speculators are still stretched short JPY, although to a smaller extent, it leaves USD/JPY more sensitive to downbeat economic news.”

- The S&P 500 was down 0.1%, the Nasdaq 100 up 0.4% and the Dow down 0.8%.

- US equity markets experienced choppy trading conditions on Friday amid “quad witching”.

US equity markets remain choppy on the final trading day of the week as traders and market participants weigh up this week’s main macro narratives, including the Fed’s hawkish pivot and a continued rise in global Omicron Covid-19 variant infections. The S&P 500 was last down 0.1%, though it bounced from earlier session lows in the 4600 area after finding support at prior weekly lows and recently managed to recover back above the 4650 level.

The Dow was down about 0.8%, though also mustered a modest recovery from earlier session lows in the 35.2K area to back above 35.5K, which means it still trades about 1.5% below Thursday’s highs at 36.2K. Long-term US bond yields fell on Friday, weighing on the appeal of cyclical stocks (i.e. stocks that trade based on expectations for economic growth). The 10-year fell below 1.40% to nearly hit two-week lows and is still down about 30bps since pre-Omicron highs close to 1.70%.

Weakness in yields has helped the growth/duration-sensitive Nasdaq 100 outperform, with the index actually now up about 0.4% on the day, having reversed from earlier session losses of as much as 1.3%. Recall that the valuation of many stocks in the Nasdaq 100 is more cased on expectations for future earnings growth rather than on actual earnings being reported today, leaving their valuation exposed to an increase in opportunity costs. A rise in long-term government bond yields is a proxy for this. Elsewhere, the CBOE S&P 500 Volatility Index was up half a point to the 21.00 area.

Trading conditions were also unpredictable/choppy on Friday, and are likely to remain like this for the remainder of the session, given that Friday was “quad witching” day. This is the simultaneous expiration of stock options, stock index futures and index options contracts, which happens once per quarter.

- The white-metal extends its gains for three days, up some 0.22%.

- Falling yields and risk-aversion boost the precious metal’s prospects and weaken the buck.

- XAG/USD Technical Outlook: Slightly tilted to the upside but needs to reclaim the $23.50 region.

Silver (XAG/USD) barely advances during the New York session, though it extends its gains for the third consecutive day, trading at $22.53 at the time of writing. The market sentiment is downbeat as portrayed by global equity indices falling, while US T-bond yields continue their post-Fed free fall, with the 10-year Treasury yield down three basis points, sitting under 1.40%.

In the meantime, the US Dollar Index, which measures the greenback’s performance against a basket of six peers, is up 0.28%, currently at 96.32.

Factors like a risk-off environment and falling US T-bond yields underpinned the non-yielding metal. Silver bulls are eyeing a break above the December 6 swing high at $22.59. Once decisively broken, it could send XAG/USD rallying towards the confluence of the 50 and the 100-day moving averages (DMAs) around $23.45-50. However, they would face medium resistance around the $23.00 threshold.

The Relative Strength Index (RSI), a momentum indicator around 45, aims to the upside, would support a bullish bias; nevertheless, caution is warranted as RSI remains below the 50-midline, failing to trigger a bullish signal.

On the other hand, failure at $23.00 could send XAG/USD tumbling. The first demand zone would be the December 16 swing low at $21.90. The breach of the latter would expose crucial support levels, as the December 15 low at $21.40, followed by the YTD low on September 30 at $21.33.

Daily chart

-637753547586524837.png)

In light of recent events, analysts at Danske Bank revised to the upside their forecasts for the USD/CAD for the next quarters. They do not see a rate hike in Canada before April.

Key Quotes:

“Bank of Canada has ended its QE program and continues to guide towards the first rate hike in the “middle quarters” of 2022. Meanwhile, market are priced much more aggressively and not only price a full hike in Q1 2022 but also an accumulative 5 hikes over the coming year. In our view, that looks slightly overdone and our base case remains that the first rate hike will not come before April.”

“Fundamentally, we still like to treat USD/CAD as a low beta version of USD/NOK, which is due to the CAD’s closer connection to USD and lower sensitivity to oil than NOK. We still favour more topside to USD/CAD – albeit less topside than in USD/NOK – and in light of the recent rise in the cross we adjust our forecast profile to 1.28 in 1M (from 1.26), 1.30 in 3M (from 1.29), 1.32 in 6M (from 1.31) and 1.33 in 12M (unchanged).”

The message from the Federal Reserve was hawkish but failed to out-hawk market pricing, explained analysts at MUFG Bank. They still expect the dollar to advance although they warn that renewed gains may now materialise until the new year.

Key Quotes:

“So the dollar has weakened by about 1.0% from the high on Wednesday with the move helped no doubt by the surprise decision by the BoE to hike. The ECB also laid out a QE plan for 2022 that was more modest than some had expected while Norges Bank hiked as expected and the BoJ today announced the end of some covid support measures. We still expect the dollar to advance although renewed gains may now materialise until the new year.”

“EUR has a strong seasonal bias to appreciate in December as can be seen below. Valuation is also likely to play a role in slowing USD strength going forward. Based on our own PPP analysis across G10, the dollar is overvalued by 10% or more versus 6 of the 9 other G10 currencies. EUR/USD is about 14% below fair-value with USD/JPY 17% over-valued. It is one reason why we assume the window for USD strength is set to close between Q1 and Q2 and allow for some renewed modest USD weakness in the second half of the year.”

“The fundamental backdrop points to further modest strength for the dollar but that may not become evident until normal trading conditions resume in January.”

Analysts at Danske Bank forecast the EUR/USD pair at 1.13 in a one-month period, at 1.12 in 3M and at 1.10 in 12M. They see downside risks to these forecasts.

Key Quotes:

“Fed focuses on starting rate hikes and asset purchases will finish by Q1. This will continue to shift the market’s attention towards USD on a theme of monetary divergence vis-à-vis EU. Such upside risk is amplified by the dollar rising from low levels.”

“We keep our EUR/USD forecast at 1.10 in 12M and see downside risks to this. This reflects our view that market themes are increasingly pro dollar. The manufacturing cycle is clearly slowing but central banks need to tighten to catch-up with inflation pressures and this is quite negative for EUR/USD, especially at current levels.”

“The key risk to see EUR/USD above 1.20 is seeing global inflation pressures to fade. However, ‘transitory’ has substantially lost credibility and we are likely to see a further EUR-negative environment as manufacturing growth slows down. The risk to take EUR/USD below 1.10 is a scenario where central banks tighten further amid a cyclical slowdown, akin a scenario like seen in early 80’s.”

Downside risks for the Australian dollar have eased in the near term, point out analysts at MUFG Bank. They warn is still too early to build long positions.

Key Quotes:

“The recent turnaround in fortunes for the AUD has been driven both by positive domestic and external factors. On the external side, the AUD has derived support from the easing back of initial fears over potential disruption to the global economy from the new Omicron variant. Market participants appear to making the assumption that economic disruption will prove short-lived as the new variant spreads more rapidly and is potentially less severe. At the same time, the AUD has derived support from the recent policy shift in China which has helped to ease concerns over the risk of a sharper slowdown from weakness in the real estate sector.”

“Domestic developments have also been favourable for the AUD. It has been revealed that GDP contracted less than expected in Q3 in response to the lockdowns, and the economy is now bouncing back strongly. The unemployment rate had already dropped back sharply in November to a low of just 4.6% and is well below pre-pandemic levels. It has further reinforced speculation that the RBA will speed up plans for tightening policy at their next meeting in February. The release next week of the minutes from this month’s RBA meeting could provide greater clarity over whether the RBA will even end QE immediately in February.”

“We believe that downside risks have eased for the AUD in the near-term. However, it is still premature to start building long AUD positions given downside risks are still posed by Omicron and the China real estate slowdown.”

- USD/MXN keeps falling even as Wall Street extends slide.

- Mexican peso among top weekly performers.

- Banxico surprises with an interest rate hike of 50bps.

The USD/MXN is falling for the third day in a row and not even risk aversion is avoiding the Mexican peso to add to weekly gains. The cross trades at 20.71, the lowest level in a month.

The Mexican peso is among the top performers of the week. It was already strong and Banxico’s decision on Thursday to raise the key interest rate by 50 bps, above the 25 bp increase of market consensus, boosted MXN even further.

Also, technical factors contribute to the decline. USD/MXN broke the strong support area around 20.90 and now it looks poised to test the 20.65 area. Below the next support might be seen at 20.45/50 followed by a key long-term trendline around 20.15.

On Friday, the Dow Jones is falling 1.65% and the Nasdaq 1%. The slide in equity prices, neither the Turkish lira crisis, is affecting so far the Mexican peso that together with the South African rand are the biggest gainers.

USD/MXN weekly chart

-637753511152689819.png)

- GBP/USD falls back to pre-surprise BoE rate hike levels underneath 1.3300

- Since losing its grip on the 1.3300 level, GBP/USD has been ebbing lower and is now trading in the 1.3270s.

- The pair is now back to its pre-surprise BoE rate hike levels.

Since losing its grip on the 1.3300 level, GBP/USD has continued to gradually ebb lower and, trading in the 1.3270s, is now all the way back to its pre-BoE policy announcement levels. Recall that the bank surprised markets with a 15bps rate hike on Thursday, sending GBP surging at the time (GBP/USD hit highs in the 1.3370s). Markets had expected the bank to hold off on rate hikes until February of next year given dovish rhetoric from BoE members earlier in the month/at the end of November about Omicron uncertainty.

On the week, GBP/USD is set to close roughly flat, with the pair one again bouncing from support at the 38.2% retracement back from the post-pandemic high (at 1.4250) to the post-pandemic low (at 1.4113), which sits close to 1.3170. It was not just a surprise BoE rate hike that came to GBP/USD’s rescue and prevented a break below the key Fibonnaci level and collapse towards the 50% Fib in the 1.2800s. Markets sold the US dollar in wake of the latest Fed policy announcement on Wednesday, which also gave GBP/USD a lift, despite the bank doubling the pace of its QE taper and indicating three hikes in 2022.

Looking back over the last few weeks, the 1.3370 area has been an important zone of support/now resistance and GBP bears appear to have taken the opportunity here to reload on shorts. If the dollar can continue to nurse a recovery in quiet, low volume pre-Christmas holiday trade next week and if the UK Omicron situation continues to deteriorate, there is no reason why GBP/USD can’t return to 1.3200 or under.

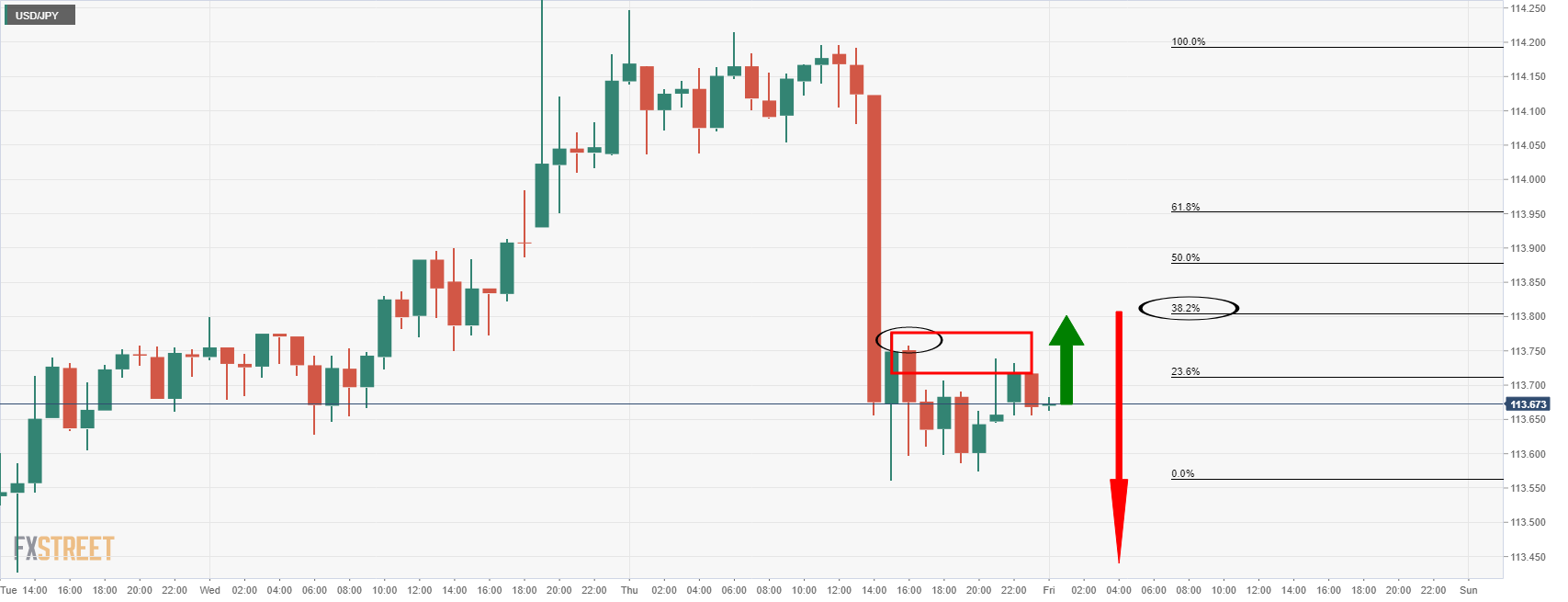

- The USD/JPY falls some 0.25% as the New York session begins.

- The Bank of Japan kept interest rates unchanged, though scaling back some of the pandemic stimulus.

- USD/JPY Technical Outlook: Despite the last two-day downward move, it has an upward bias.

After three of the most influential central banks delivered “hawkish” monetary policy decisions, the USD/JPY slides during the New York session trading at 113.36 at the time of writing. As witnessed by European and US equities dropping, the market sentiment is downbeat as investors assess monetary policy shift on the Fed, BoE, and ECB as the year-end looms.

Earlier in the Asian session, the Bank of Japan decided to slightly scale back the pandemic stimulus, though it kept rates unchanged at -0.10%. Additionally, it extended its pandemic-relief scheme by six months, ensuring that commercial banks keep funds flowing towards small branches.

According to Bank of Japan Governor Kuroda, he said that inflation remains well below the 2% target of the central bank, and it may “perk up next year,” mainly caused by high energy prices. However, he does not foresee it would reach the level seen in Western economies, so he emphasized that there is no need to tighten monetary policy.

In the meantime, the US 10-year Treasury yield, which strongly correlates with the USD/JPY currency pair, falls four basis points, sitting at 1.378%, below the 1.40% threshold, a headwind for the USD vs. the JPY. Contrarily, the US Dollar Index, a measurement of the greenback’s value against six peers, rises some 0.15%, up to 96.19.

USD/JPY Price Forecast: Technical outlook

The USD/JPY failure at the 50-day moving average (DMA) exerted downward pressure on the pair, which slumped towards the confluence of an upslope trendline and the October 28 cycle low at 113.25, a support level that put a lid on the fall, as USD buyers, defended the aforementioned level. Furthermore, as long as the longer time-frame DMAs remain below the spot price, the USD/JPY has an upward bias, but the move appears to be spurred by falling US bond yields.

On the downside, the October 28 pivot low at 113.25 is the first support level for the USDY/JPY. A breach of the latter would expose essential support levels, like the 113.00 figure, followed by the November 30 swing low at 112.53.

To the upside, the USD/JPY first resistance level would be the 50-DMA at 113.81. A break above that level would open the door for further upside. The next resistance would be 114.00, followed by the October 20 high at 114.70.

- WTI has dipped back from Thursday’s test of weekly highs at $73.00 to the low $71.00s.

- Risk appetite has faded as traders mull this week’s hawkish central bank events and the evolving Omicron situation.

Oil prices are under pressure on Friday amid a downturn in the market’s broader appetite for risk as traders mull this week’s hawkish turn from many G10 central banks and a continued rise in Omicron infection rates across the world. After matching early weekly highs just under $73.00 on Thursday, front-month WTI futures have since dipped all the way back to test the $71.00 level. At current levels in the low-$71.00s, WTI is set to end the week lower by about 50 cents or 0.8% and close to the centre of this week’s $69.40-$73.00ish range.

Major G10 central banks are becoming more hawkish, with the Fed doubling its QE taper pace and indicating three hikes in 2022, while sounding bullish on the economic outlook for 2022 despite Omicron. Meanwhile, the BoE actually implemented a surprise 15bps hike and the ECB laid out its QE taper plans for 2022, with the PEPP to end as planned in March. Some saw this as a vote of confidence in the durability of the global recovery, which perhaps aided crude oil markets at the time, though on Friday, focus has returned to a worsening Omicron picture.

Cases are at record highs in the UK, Denmark and South Africa and surges in the EU and US are expected next. Further pandemic curbs are likely as authorities scramble to slow transmission, though the most important uncertainty right now is whether the surge in infection rates will translate into a surge in hospitalisations and ultimately fatalities. Uncertainty about this is likely to keep oil market participants in two minds until the end of the year, meaning WTI may well remain trapped within recent ranges.

Goldman bullish on oil demand

Damien Courvalin, Goldman's head of energy research, said on Thursday that the Omicron variant hadn’t had much of an impact on mobility or oil demand as of yet according to high-frequency data. Moreover, oil demand in 2022 was expected to be strong amid rising global capital expenditure and infrastructure construction, he added. As a result, Courvalin said that Goldman sees average daily oil demand hitting fresh record highs in 2022 and 2023. Thereafter, Goldman expects steady growth in oil demand until the end of the decade until demand peaks at about 106M barrels per day, amid a gradual energy transition.

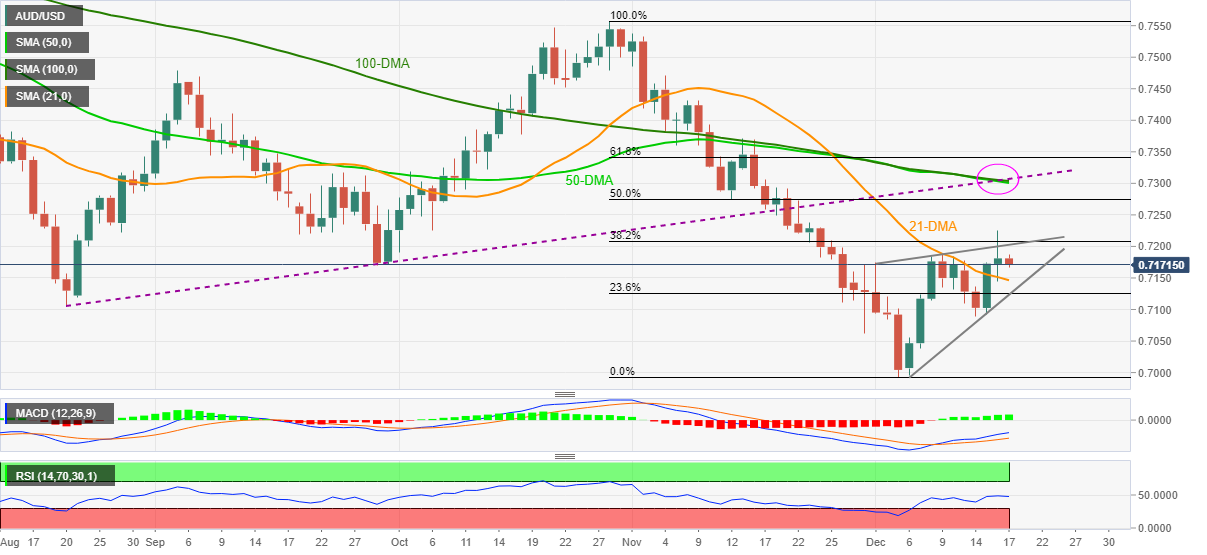

- AUD/USD has been ebbing lower on Friday though has found support at it 21DMA close to 0.7150.

- The pair has been choppy in recent days after the Fed policy announcement and Aussie jobs.

- But FX market trading conditions are expected to remain quiet for the rest of session.

AUD/USD has been ebbing lower in recent trade with markets set to end the week on a risk-averse note, though the pair’s losses are for now being cushioned by the 21-day moving average at 0.7151 and as trading volumes ebb. At present, the pair is trading in the 0.7160s, down about 0.2% on the session. Market participants are exhausted after an unusually busy week that saw six G10 central banks announce monetary policy as well as a number of key G10 data releases. In wake of all that and with the weekend fast approaching, trading volumes have declined substantially and, amid an empty economic calendar for the remainder of the day, FX market trading conditions are likely to remain highly subdued.

As far as AUD/USD was concerned, the most important events this week was Wednesday’s Fed policy announcement and Thursday’s Australian November jobs report. In wake of the Fed announcement, the US dollar was hit, pushing AUD/USD from weekly lows under 0.7100 to fresh weekly highs above 0.7200 on Thursday, despite the confirming expectations for a doubling of the QE taper pace and indicating three hikes in 2022. Whilst the Fed was hawkish on the face of it, Jerome Powell made clear in the press conference that monetary tightening at the indicated pace was dependant on the economy progressing as expected. The Fed is bullish on the US economy in 2022, but Powell’s reassurance that if things don’t go quite as well, the bank can delay rate hikes, seemed to be taken as dovish, sending the dollar lower.

A much stronger than expected November labour market report out of Australia contributed to the upside into Thursday’s session that saw AUD/USD reach as high as the 0.7220s. Recall that a record 366.1K jobs were created in Australia last month, pushing the unemployment rate to 4.6% and boosting the case for the RBA to end its QE outright next February. According to analysts at ANZ, "with the labour market data coming in much stronger than the RBA expected and a revision in other forecasts likely, an end to QE altogether in February is the most likely option in our view”.

AUD/USD looks set to close out the week flat and close to the centre of a 0.7090-0.7220ish range. While a potential hawkish pivot from the RBA next year may be one reason to bet on an improvement in the Aussie fortunes, Omicron continues to pose a threat via the fact that it could still severely dent macro risk appetite (hurting risk-sensitive AUD) and also given it is fast spreading in Australia. Daily reported infections in the most populous state New South Wales spiked to record highs above 2K on Thursday up from under 300 at the start of the month and look set to go higher.

NY Fed President and Fed Board of Governors member John Williams said on CNBC on Friday that inflation in the US at present is too high and it thus makes sense to accelerate the pace of the bank's QE taper, according to Reuters.

Additional Takeaways:

“Don’t see any real benefit to speeding taper up further.”

“It's really about creating optionality for next year.”

“Decisions on interest rates will depend on economic data.”

“He is optimistic fed will see really strong improvements in the labor market.”

“He expects the unemployment rate to come down to 3.5% by end of 2022 and above-trend growth.”

“Baseline outlook for next year is a very good one.”

“Raising interest rates would be a positive sign about where we are in the economic cycle but will be driven by data.”

“Fed is focused on both dual mandate goals.”

“Inflation may be one factor in whether Fed raises rates more quickly over time.”

“Fed wants to keep an eye on real interest rates.”

“Fed will be moving real interest rates back to what they think of as neutral, but there is still a question of where that is.”

“Fed has shown it can accomplish both maximum employment and price stability.”

- Weaker oil prices undermined the loonie and assisted USD/CAD to regain positive traction.

- The risk-off impulse drove some haven flows towards the USD and remained supportive.

- The fundamental backdrop favours bullish traders and supports prospects for further gains.

The USD/CAD pair built on its steady intraday ascent and shot to a fresh daily high, around the 1.2825 region during the early North American session.

The pair attracted fresh buying on Friday and for now, seems to have stalled this week's post-FOMC retracement slide from the 1.2935 region, or the highest level since August 20. This marked the first day of a positive move for the USD/CAD pair in the previous three sessions and was sponsored by a combination of factors.

The rapid spread of the Omicron coronavirus variant has been fueling worries that the imposition of fresh restrictions could dent the fuel demand. This, in turn, led to a fresh leg down in crude oil prices, now down over 2%, which undermined the commodity-linked loonie and assisted the USD/CAD pair to regain positive traction.

Meanwhile, the economic risks emerging from the new strain continued weighing on investors' sentiment. This was evident from a generally weaker tone around the equity markets, which assisted the safe-haven US dollar to reverse an intraday dip to a one-week low. This was seen as another factor that provided a modest lift to the USD/CAD pair.

The greenback was further supported by a more hawkish outlook from the Fed. It is worth recalling that the Fed on Wednesday announced that it would double the pace of tapering to $30 billion per month. Moreover, the so-called dot plot showed that officials expect to raise the fed funds rate at least three times next year.

The fundamental backdrop remained supportive of the emergence of some dip-buying and allowed the USD/CAD pair to recover a major part of the overnight losses. In the absence of any major market-moving economic releases, the US/oil price dynamics will be looked upon to grab some short-term trading opportunities.

Technical levels to watch

- EUR/USD ebbs lower towards 1.1300 after reversing lower from a test of the top of December 1.1230-1.1360ish ranges.

- As market participants continue to digest this week’s Fed and ECB meeting, conditions will likely be rangebound into the year-end.

After a choppy two sessions on Wednesday and Thursday in wake of monetary policy announcements from first the Fed and then the ECB, a sense of calm has returned to EUR/USD. The pair has been ebbing lower from monthly highs printed on Thursday at 1.1360 and currently trades in the 1.1310s, with traders likely eyeing a test of the 1.1300 level.

Whilst conditions over the last few days have been choppy, EUR/USD has largely stuck within 1.1230-1.1360ish ranges that had already been estabilished prior to the start of the week earlier on in the month of December. Amid a lack of any further key macro narrative alternating economic events or data releases in either the Eurozone or US between now and January, rangebound conditions will likely prevail into the year-end.

In terms of what that macro narrative actually is, strategists might surmise things like this; amid elevated inflationary pressures in both the US and Eurozone, the Fed and ECB are moving away from pandemic era emergency stimulus. The Fed has already begun its QE taper, which is set to accelerate from January and be swiftly followed up by as many as three rate hikes in 2022, whilst the ECB’s first major step towards monetary normalisation will come as the PEPP ends in March, though rate hikes are unlikely before 2023.

The consensus narrative about how that translates into FX markets has been that, amid comparatively higher US inflationary pressures, as well as a stronger labour market and economic recovery, the Fed’s more hawkish stance versus the ECB has been EUR/USD negative. Many expect this trend to continue into next year.

But narratives can quickly shift and market participants are keeping an eye on the rapid spread of the Omicron Covid-19 variant. Fed Chair Jerome Powell explicitly said on Wednesday that Fed monetary normalisation was not on autopilot and if the economy did drastically slow, the Fed could delay its plans. Some think the spread of Omicron could present such a risk. Infection rates are expected to surge in the US in the coming weeks/in Q1 2022 and may lift EUR/USD is Fed tightening plans are thrown off course.

- GBP/USD witnessed some selling on Friday and moved further away from the post-BoE high.

- COVID-19 woes turned out to be a key factor that acted as a headwind for the British pound.

- The risk-off mood benefitted the safe-haven USD and contributed to the intraday selling bias.

The GBP/USD pair traded with a negative bias heading into the North American session and was last seen hovering near the daily low, just below the 1.3300 mark.

Following an early uptick to the 1.3335-40 region, the GBP/USD pair witnessed some selling on Friday and extended the previous day's retracement slide from the 1.3375 area or a fresh monthly high. As investors looked past the Bank of England's surprise rate hike on Thursday, the worsening COVID-19 situations in the UK turned out to be a key factor that undermined the British pound.

Meanwhile, worries about the economic risks emerging from the rapid spread of the new Omicron variant of the coronavirus continued weighing on investors sentiment. This was evident from a generally weaker tone around the equity markets, which assisted the safe-haven US dollar to reverse an intraday dip to a one-week low. This was seen as another factor that exerted pressure on the GBP/USD pair.

Apart from this, the Fed's hawkish outlook, indicating at least three rate hikes next year, further acted as a tailwind for the greenback. As investors digest the latest monetary policy updates by key central banks, the broader market risk sentiment will drive the USD demand. This, in turn, should provide some impetus to the GBP/USD pair amid absent relevant market moving economic releases.

Technical levels to watch

The Central Bank of Russia announced on Friday that it raised its policy rate by 100 basis points to 8.5% from 7.5%. This decision came in line with the market expectation.

Key takeaways from policy statement

"If the situation develops in line with the baseline forecast, the Bank of Russia holds open the prospect of further key rate increase at its upcoming meetings."

"Key rate decisions will take into account actual and expected inflation movements relative to the target and economic."

"Developments over the forecast horizon, as well as risks posed by domestic and external conditions and the reaction."

"Based on the Bank of Russia’s forecast, given the monetary policy stance, annual inflation will edge down to 4.0–4.5% by late 2022 and will remain close to 4% further on."

"Inflation is developing above the Bank of Russia’s October forecast."

"The contribution of persistent factors to inflation remains considerable on the back of faster growth in demand relative to output expansion capacity."

"In this environment, given rising inflation expectations, the balance of risks for inflation is markedly tilted to the upside."

"This may bring about a more substantial and prolonged upward deviation of inflation from the target."

Market reaction

The USD/RUB pair showed no immediate reaction to the rate decision and was last seen trading at 73.7805, where it was virtually unchanged on a daily basis.

- USD/TRY blows past another record high, surges to the 17.00 neighbourhood on Friday.

- The recent CBRT rate cuts, soaring inflation continues to weigh heavily on Turkish lira.

The Turkish lira crashed to another record low on Friday and shot to the 16.85-90 region against its American counterpart during the first half of the European session.

The strong move up over the past two days or so comes after President Recep Tayyip Erdogan announced on Thursday to raise the minimum wage by 50% starting next year. Erdogan also said that the government would abolish income and stamp tax on the minimum wage. This was followed by a 100 bps rate cut by the Central Bank of the Republic of Turkey (CBRT) on Thursday.

Turkey's official inflation rate topped 21% in November – more than four times the target set by CBRT. The central bank, however, has not been given a free hand, instead is forced to adopt President's belief that high-interest rates cause inflation and delivered the fifth cut since September. With the latest leg down, the lira has lost over 50% of its value against the USD year to date.

Meanwhile, the latest leg of a sharp spike since the early European session could further be attributed to some technical factors on a sustained break through the 16.00 mark. That said, extremely overstretched technical indicators could hold back traders from placing fresh bets and cap the USD/TRY near the 17.00 round figure, at least for the time being.

- A combination of factors dragged USD/CHF to a near two-week low on Friday.

- COVID-19 jitters benefitted the safe-haven CHF and exerted some pressure.

- The prevalent USD selling bias also contributed to the ongoing corrective slide.

The USD/CHF pair dropped to a near two-week low, around the 0.9175 region during the European session, with bears now awaiting a sustained break below the very important 200-day SMA.

The pair edged lower for the second successive day on Friday and extended its pullback from the 0.9300 neighbourhood, or monthly high touched in reaction to the Fed announcement on Wednesday. Worries about the economic risks emerging from the rapid spread of the Omicron coronavirus variant continued weighing on investors' sentiment. This was evident from a generally weaker tone around the equity markets, which benefitted the Swiss franc's relative safe-haven status.

Apart from this, the prevalent US dollar selling bias added to the selling bias surrounding the USD/CHF pair and contributed to the ongoing decline. That said, the Fed's hawkish outlook acted as a tailwind for the greenback and lend some support to the pair. The Fed announced that it would double the pace of tapering to $30 billion per month. Moreover, the so-called dot plot indicated that officials expect to raise the fed funds rate at least three times next year.

The fundamental backdrop supports prospects for the emergence of some dip-buying around the USD, warranting some caution for aggressive bearish traders. This makes it prudent to wait for a strong follow-through selling below the monthly swing low support, around the 0.9165-60 area, before confirming that the USD/CHF pair has topped out. In the absence of any relevant market-moving economic releases, this will set the stage for a further near-term depreciating move.

Technical levels to watch

- Gold price extends post-Fed gains beyond $1,800 on Friday.

- USD remains pressured alongside the yields, with year-end flows in play.

- Gold price awaits acceptance above $1,808 for additional upside.

Gold price is riding higher on the hawkish central banks’ decisions and year-end flows, having taken out the critical $1,800 mark. The US dollar and yields lick their wounds, lending support to the bright metal. The renewed upside in gold price, however, could remain capped by the expectations of a Santa rally io Wall Street. However, if gold price manages to sustain above the latter, then buyers are likely to remain hopeful for further upside.

Read: Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold is trying hard to overcome the $1,808 barrier, which is the convergence of the SMA200 four-hour, pivot point one-day R1 and Fibonacci 161.8% one-week.

If the latter is scaled, then gold bulls will test minor resistance at $1,811, close to the previous high four-hour. Further up, the rally could gain traction towards the confluence of the pivot point one-week R3 and pivot point one-day R2 at $1,818.

The level to beat for gold bulls is seen at $1,820, the Bollinger band one-day Upper.

Alternatively, strong support awaits at $1,804, the intersection of the SMA10 one-hour and Fibonacci 38.2% one-month.

Selling interest could accelerate below the last, opening floors towards the $1800 threshold, below which $1,794 will come to the rescue of gold bulls. At that point, the Fibonacci 23.6% one-day coincides with the pivot point one-week R1 and the previous week’s high.

The last line of defense for buyers is seen at $1,790, the meeting point of the Fibonacci 38.2% one-day and SMA100 one-day.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

In an interview with CNBC on Friday, Bank of England Chief Economist Huw Pill said domestically generated inflation pressures were likely to be more persistent. When asked about more rates hikes to come, "I think that's true," Pill responded, per Reuters.

Additional takeaways

"To ensure credibility of our inflation target, we felt time had come to act."

"We signalled in November that we were steering towards a rate increase because of tight labour market."

"Data we have seen has confirmed that labour market is tighter than we expected in November."

"Omicron has introduced new level of uncertainty."

"We need to move forward cautiously."

"We need to see if omicron leads to some reversal of labour market strength."

"We do see evidence of slowdown notably in consumer-facing sector."

"Omicron may weigh on activity in short term but we must be cautious about assuming it will be disinflationary over the medium term."

"Domestically generated inflation pressures must be contained."

"I am very uncomfortable about headline inflation prints but we must look at longer-term."

"We are very concerned about how our measures announced yesterday and what might be in future transmit through to the economy."

"We haven't used interest rate increases for quite a long time."

"Bond yields should rise as growth expectations recover."

"I don't think magnitude of rate hike yesterday will be transformative for housing market."

Market reaction

The GBP/USD pair showed no immediate reaction to these remarks and was last seen trading flat on the day near 1.3320.

The European Central Bank (ECB) Governing Council Member Olli Rehn said on Friday, “inflation forecasts are subject to very high uncertainty in the current exceptional circumstances.”

Last month, Rehn said that the Euro area inflation is expected to ease next year, adding that inflation is not showing up in wages yet.

Related reads

- EUR/USD remains confined in a range, below mid-1.1300s post-German IFO

- ECBs Muller: The central bank is prepared to tighten faster if inflation stays above 2%

- EUR/USD oscillated in a narrow trading band through the early part of the European session.

- The economic risks stemming from the Omicron variant acted as a headwind for the euro.

- The disappointing German IFO Business Climate Index did little to impress bullish traders.

The EUR/USD pair seesawed between tepid gains/minor losses and remained confined in a narrow trading band, below mid-1.1300s through the first half of the European session.

The European Central Bank (ECB) adopted a more hawkish stance on Thursday and announced that it will discontinue net asset purchases under the PEPP in March 2022. The ECB, however, warned about the uncertainty about the economic risk stemming from the rapid spread of the Omicron variant of the coronavirus and emphasized policy flexibility.

Apart from this, the disappointing release of the German IFO Business Climate Index, which fell to 94.7 in December from 96.6 previous, held back traders from placing bullish bets around the shared currency. That said, the post-FOMC US dollar selling bias continued lending some support to the EUR/USD pair and helped limit any meaningful slide.

The Fed on Wednesday announced that it would double the pace of tapering to $30 billion per month. Moreover, the so-called dot plot indicated that officials expect to raise the fed funds rate at least three times next year. The markets, however, had already priced in the prospects for a faster policy tightening, which, in turn, continued weighing on the USD.

Meanwhile, the EUR/USD pair's inability to gain any meaningful traction or capitalize on this week's goodish rebound from the 1.1220 area warrants some caution for aggressive bullish traders. This makes it prudent to wait for a strong follow-through buying before positioning for an extension of the recent bounce from the YTD low touched in November.

Technical levels to watch

Following the release of the German IFO Business Survey, the institute’s Economist Klaus Wohlrabe said that the “consumer-facing services like hospitality and tourism have seen falls in business.”

Additional quotes

Father Christmas has fewer gifts for Germany's economy this year, especially as not everything can be delivered.

Retail is seeing the impact from coronavirus, there are fewer shoppers.

Raw materials and input supply problems have got worse with 82% of industrial companies complaining.

Every second manufacturer is expecting price increases.

Industry export expectations down slightly.

EUR/USD remains below 1.1350

EUR/USD is keeping its range play intact around 1.1335, up 0.08% on a daily basis.

- German IFO Business Climate Index came in at 94.7 in December.

- IFO Current Economic Assessment fell to 96.9 this month.

- December German IFO Expectations Index arrived at 92.6, a miss.

The headline German IFO Business Climate Index fell further to 94.7 in December versus last month's 96.6 and the consensus estimates of 95.3.

Meanwhile, the Current Economic Assessment arrived at 96.9 points in the reported month as compared to last month's 99.0 and 97.5 anticipated.

The IFO Expectations Index – indicating firms’ projections for the next six months, fell to 92.6 in December from the previous month’s 94.2 reading and worse than the market expectations of 93.5.

Market reaction

EUR/USD is little change on the disappointing German IFO survey.

At the time of writing, the pair is up 0.04% on the day, trading at 1.1333.

About German IFO

The headline IFO business climate index was rebased and recalibrated in April after the IFO research Institute changed series from the base year of 2000 to the base year of 2005 as of May 2011 and then changed series to include services as of April 2018. The survey now includes 9,000 monthly survey responses from firms in the manufacturing, service sector, trade and construction.

The European Central Bank (ECB) is prepared to tighten faster if inflation stays above its 2% price target, Governing Council member Madis Muller said on Friday.

In the last hour, ECB policymaker Villeroy de Galhau said that the Eurozone economy was close to peak inflation.

EUR/USD reaction

EUR/USD is holding steady at 1.1332, moving back and forth in a narrow range ahead of the German IFO Survey.

- AUD/USD edged lower on Friday and moved further away from the monthly top set on Thursday.

- A generally softer risk tone turned out to be a key factor weighing on the perceived riskier aussie.

- The lack of any follow-through selling warrants caution before positioning for a further downfall.

The AUD/USD pair maintained its offered tone through the early part of the European session, albeit has managed to recover a few pips from the daily low. The pair was last seen trading around the 0.7170-75 region, down nearly 0.15% for the day.

The pair witnessed some selling on the last day of the week and extended the previous day's pullback from the monthly top, around the 0.7120-25 resistance zone. The worsening COVID-19 situation in Australia, along with a generally weaker risk tone turned out to be a key factor that drove flows away from the perceived riskier aussie.

In fact, Australia's largest state by population – New South Wales – has been reporting a sharp rise in new coronavirus cases over the past few days. Adding to this, worries about the economic risks stemming from the rapid spread of the new Omicron variant of the coronavirus continued weighing on investors' sentiment.

Meanwhile, the flight to safety assisted the US dollar to stall its post-FOMC retracement slide from the vicinity of a 16-month high. This was seen as another factor exerting pressure on the AUD/USD pair amid the Fed's hawkish outlook. It is worth mentioning that the so-called dot plot indicated at least three rate hikes next year.

The fundamental backdrop seems tilted in favour of bearish traders, though the lack of a strong follow-through selling warrants caution. In the absence of any major market-moving economic releases from the US, the broader market risk sentiment and the USD price dynamics would be looked upon for some impetus around the AUD/USD pair.

Technical levels to watch

"The German economy will experience a setback in the final quarter of 2021 and the first quarter of 2022 on account of the pandemic, but is set to pick up significant momentum again in spring of next year," the country's central bank, Bundesbank, said in a biannual update of its economic forecasts on Friday.

Key takeaways

"While pandemic-related restrictions and supply bottlenecks for intermediate goods will stall growth in the final quarter of 2021 and the first quarter of 2022, ... private consumption is expected to rise substantially from spring onwards."

“See German GDP growth at 4.2% in 2022 vs 5.2% seen in June; 2023 seen at 3.2% vs 1.7%.”

“See German inflation at 3.6% in 2022 vs 1.8% seen in June.”

“Expect German inflation at 2.2% in both 2023 and 2024, above ECB target.”

Related reads

- ECB’s Villeroy: Probably relatively close to the inflation peak

- Forex Today: Dollar consolidates losses as investors assess central bank decisions

The European Central Bank (ECB) Governing Council member and Bank of France Head Francois Villeroy de Galhau made some comments on the inflation outlook on Friday.

He said that the Euro area is probably relatively close to the inflation peak.

- Silver edged higher for the third successive day and climbed to a near two-week high.

- Mixed oscillators on hourly/daily charts warrant caution for aggressive bullish traders.

- A sustained break below the $22.00 is needed to shift the bias back in favour of bears.

Silver built on the post-FOMC recovery from the $21.40 region, or the YTD low touched on Wednesday and edged higher for the third successive day on Friday. The uptick pushed the white metal to a nearly two-week high, around the $22.55-60 resistance zone during the early European session.

The mentioned barrier now coincides with the 100-period SMA on the 4-hour chart, which if cleared decisively would set the stage for a further near-term appreciating move. Oscillators on hourly charts have been gaining positive traction and support prospects for an eventual breakout.

That said, technical indicators on the daily chart – though have recovered from lower levels – are yet to confirm a bullish bias and warrant some caution. This makes it prudent to wait for some follow-through buying beyond positioning for an extension of the ongoing recovery move.

The XAG/USD might then accelerate the momentum towards an intermediate hurdle near the $22.80-85 area en-route the $23.00 round-figure mark. This is followed by resistance near the $23.30-35 region, above which bulls could aim to test the next relevant barrier near the mid-$23.00s.

On the flip side, immediate support is pegged near the $22.30 horizontal level. Any further decline is likely to attract some buying near the $22.00 mark, which if broken will negate the positive bias and turn the XAG/USD vulnerable to restest YTD lows support, around the $21.40 region.

Silver 4-hour chart

Levels to watch

Here is what you need to know on Friday, December 17:

The US Dollar Index (DXY) closed in the negative territory on Thursday as the British pound and the euro gathered strength on the back of the Bank of England's (BOE) and the European Central Bank (ECB) hawkish policy outlook. Ahead of the weekend, the greenback is consolidating its losses and investors await IFO sentiment data from Germany and the final revision to the euro area Consumer Price Index readings.

As expected, the ECB announced that it will end the Pandemic Emergency Purchase Programme (PEPP) in March. To continue to support the economy, the bank will increase the purchases under the Asset Purchase Programme to €40 billion from €20 billion in the second quarter before bringing them back down to €30 billion and €20 billion in the third and fourth quarters, respectively. The bank revised its inflation forecast for 2022 significantly higher as well. During the press conference, ECB President Lagarde said a rate hike in 2022 was very unlikely but didn't outright dismiss the possibility.

Following November's decision to keep its policy rate unchanged, the BOE opted for a 15 basis points rate hike in December, citing inflation concerns. The bank noted that the Omicron variant is expected to weigh on the economic activity in the near term while adding that the potential medium-term impact was unclear.

EUR/USD reached its highest level in more than two weeks at 1.1361 on Thursday but erased a portion of its daily losses before closing at 1.330. The pair is moving sideways near that level early Friday.

GBP/USD is virtually unchanged on the day a little above 1.3300. The data from the UK showed that Retail Sales rose by 4.7% on a yearly basis in November, after posting a 1.5% contraction in October, but investors showed no reaction to this reading.

USD/JPY reversed its direction after reaching a multi-week high of 114.28 earlier in the week and seems to have streaming around mid-113.00s. The Bank of Japan left its monetary policy settings unchanged after the December meeting and Governor Haruhiko Kuroda reiterated that they will ease the policy without hesitation if needed.

USD/TRY rose nearly 6% on Thursday after the Central Bank of the Republic of Turkey decided to cut its policy rate by 100 basis points. The pair reached a new all-time high above 16 early Friday and is up nearly 20% in December.

Gold gathered strength as central banks made it clear that they are increasingly concerned about inflation. XAU/USD is trading above $1,800 for the first time in December.

Bitcoin stays below the descending trend line coming from early November and trades around $47,000. Ethereum failed to hold above $4,000 after staging a decisive rebound on Wednesday and was last seen losing nearly 2% on the day at $3,890.

- GBP/USD struggled to gain any meaningful traction and remained confined in range.

- Upbeat UK Retail Sales data also did little to impress traders or provide any impetus.

- COVID-19 jitters and the risk-off mood held back bulls from placing aggressive bets.

The GBP/USD pair held steady around the 1.3320 region through the early European session and had a rather muted reaction to the UK macro data.

A combination of diverging forces failed to provide any meaningful impetus to the GBP/USD pair and led to a subdued/range-bound price move on the last trading day of the week. The Bank of England delivered a surprise rate hike on Thursday, which, in turn, was seen as a key factor that underpinned the British pound. Apart from this, better-than-expected UK Retail Sales data extended some support to the major amid the prevalent US dollar selling bias.

The UK Office for National Statistics reported that the total value of inflation-adjusted sales at the retail level increased 1.4% in November. This was well above consensus estimates for a reading of 0.8% and 1.1% rise reported in the previous month. That said, worries about the economic risks stemming from the Omicron outbreak held back bulls from placing aggressive bets and kept a lid on any further gains for the GBP/USD pair, at least for now.

Meanwhile, the USD prolonged the post-FOMC retracement slide from the vicinity of a 16-month high and remained on the defensive through the first half of the trading on Friday. This, in turn, acted as a tailwind for the GBP/USD pair. Meanwhile, the risk-off impulse in the markets and the Fed's hawkish outlook extended some support to the safe-haven greenback. This, in turn, warrants some caution before positioning for any further appreciating move.

It is worth recalling that the Fed on Wednesday announced that it would double the pace of tapering to $30 billion per month. Moreover, the so-called dot plot showed that officials expect to raise the fed funds rate at least three times next year. This, in turn, supports prospects for the emergence of some dip-buying around the greenback.

Technical levels to watch

- The UK Retail Sales came in at 1.4% MoM in November, a big beat.

- Core Retail Sales for the UK rose by 1.1% MoM in November.

- The cable trades better bid near 1.3325 on mixed UK Retail Sales.

The UK retail sales came in at 1.4% over the month in November vs. 0.8% expected and 1.1% previous. The core retail sales, stripping the auto motor fuel sales, stood at 1.1% MoM vs 0.8% expected and 2.0% previous.

On an annualized basis, the UK retail sales jumped by 4.7% in November versus 4.2% expected and -1.5% prior while the core retail sales rose by 2.7% in the reported month versus 2.4% expectations and -2.1% previous.

Main points (via ONS)

Non-food stores sales volumes rose by 2.0% in November 2021, because of growth in clothing stores (2.9%) and other non-food stores (2.8%) such as computer stores, toy stores and jewelry stores, with retailers noting strong trading related to Black Friday and in the lead up to Christmas.

Clothing stores sales volumes in November 2021 were above pre-coronavirus levels for the first time; 3.2% above their level in February 2020.

Automotive fuel sales volumes rose by 3.7% in November 2021 following some disruption to supplies in the previous two months; volumes were 1.9% below their February 2020 levels.

Food store sales volumes fell by 0.2% in November 2021; despite the fall in November, volumes were 3.2% above levels in February 2020.

FX implications

GBP/USD is retracing towards 1.3300, unable to sustain at higher levels. The spot was last seen trading at 1.3320, up 0.4% on the day.

- Gold refreshes monthly top, recently taking bids despite risk-off mood.

- Yields react to central bank actions, fears of delayed Fed rate hike despite firmer dot-plot.

- India proposes a cut in gold import duty to 4.0% from 7.5%.

- Virus updates, geopolitics in focus amid a light calendar to end the busy week.

Gold (XAU/USD) takes the bids to refresh the monthly high near $1,807, up 0.40% intraday to brace for the biggest weekly jump in six during early Friday morning in Europe.

The bullion prices cheer downbeat US Treasury yields and price-positive news from the biggest gold customer India. Also favoring gold buyers are the futures market data suggesting a delay in the Fed’s interest rate hike than what’s promised in the latest dot-plot.

That said, the US Treasury yields drop for the second consecutive day and weigh the US Dollar Index (DXY), down 0.05% on a day near 95.85.

Reuters shares the Indian Trade Ministry update, via NewsRise, suggesting the government’s proposal to cut basic import duty on gold from 7.5% to 4.0%.