- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 15-12-2021

November month employment statistics from the Australian Bureau of Statistics, up for publishing at 00:30 GMT on Thursday, will be the immediate catalyst for the AUD/USD pair traders.

The jobs figures become more important after the Reserve Bank of Australia (RBA) expected the economy to return to its pre-Delta path in the first half of 2022 versus H2 2022 in the November forecasts. Also, recent comments from RBA Governor Philip Lowe highlights today’s employment data as he said, “QE outlook depends on inflation data, labor market, the strength of consumer spending.” Adding to the importance were the receding virus-led activity controls during the October-November period.

Market consensus favors Employment Change to jump from -46.3K previous readouts to +200K on a seasonally adjusted basis whereas the Unemployment Rate is likely to drop to 5.0% from 5.2%. Further, the Participation Rate may also rise from 64.7% to 65.5%.

Ahead of the event, analysts at Westpac said,

Solid momentum through October, as indicated by the lift in payrolls, suggests a robust gain for employment in November (Westpac f/c: 220k, market 200k); but higher participation may see a lift in the unemployment rate (Westpac f/c: 5.3%).

How could the data affect AUD/USD?

AUD/USD seesaws around 0.7170 after positing the biggest daily gains in over a week. The Aussie pair’s previous gains could be linked to the market’s ‘buy the rumors, sell the fact’ action following the US Federal Reserve (Fed) meeting. However, recently downbeat comments from RBA Governor Lowe challenge the pair buyers ahead of the event.

It’s worth noting that the RBA’s optimism has recently waned due to the virus resurgence and the latest comments from Governor Lowe seem to weigh on the data’s importance. Even so, firmer jobs report will help the AUD/USD prices to keep the upside momentum targeting a confirmation of the inverse head-and-shoulders bullish chart pattern with successful trading above 0.7170.

On the contrary, downbeat data will asset recently dovish comments from RBA’s Lowe and can drag the quote back to the monthly horizontal support near 0.7090.

Key Notes

AUD/USD bulls stampeed despite hawkish Fed, Aussie jobs eyed

Australian Employment Preview: Rebound from Delta lockdowns may not be enough for the aussie

About the Employment Change

The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

About the Unemployment Rate

The Unemployment Rate released by the Australian Bureau of Statistics is the number of unemployed workers divided by the total civilian labor force. If the rate hikes, indicates a lack of expansion within the Australian labor market. As a result, a rise leads to weaken the Australian economy. A decrease of the figure is seen as positive (or bullish) for the AUD, while an increase is seen as negative (or bearish).

Reserve Bank of Australia Governor, Phillip Lowe, is speaking and addressing the CPA Australia Riverina Business Conference.

The title of the speech is, ‘the RBA and the Australian Economy.’

Key comments

He has said the conditions for a rate hike will not be met next year.

Lowe expects conditions for rate hike will not be met next year.

Lowe says "still a fair way" from a hike, board is prepared to be patient.

Lowe says board discussed tapering bond-buying from Feb and ending in May.

Lowe says could end bond buying in Feb if economic progress better than expected.

Lowe says could review bond-buying again in may if data disappoint.

QE outlook depends on inflation data, labour market, strength of consumer spending.

Lowe says will consider actions of other central banks, effects of the omicron variant.

Lowe says the omicron outbreak represents a downside risk.

Lowe expects positive momentum in economy to be maintained through the summer.

Underlying inflation expected to rise to 2.5% over 2023.

Lowe says inflation outlook in Australia very different than in US.

Lowe estimates total extra savings by households during pandemic at more than A$200 bln.

Lowe says additional savings will support strong growth in consumption.

Lowe notes sharp rise in job ads, reports firms finding it difficult to find workers.

Lowe says it is not our mandate to target house prices, higher rates not the solution.

AUD/USD impact

AUD/USD is stable and has not reacted to the comments.

Early Thursday morning in Asia, Reuters quoted anonymous sources to confirm the Chinese government’s rush to control the firms holding key data.

“The Chinese government has been expanding its practice of taking minority stakes in private companies beyond those specializing in online news and content to firms possessing large amounts of key data,” said the news.

The news also said that the government has already made a de facto special management stake or "golden share" arrangement with Full Truck Alliance Co Ltd, a Chinese platform arranging trucking services.

Reuters also mentioned that a third source with direct knowledge of the matter said, “Didi Global Inc has also been in talks about a golden share for its core ride-hailing business.”

Key quotes

Seeking influence, Beijing began taking golden shares in private online media companies - usually about 1% of a firm - some five years ago.

The stakes are bought by government-backed funds or companies which gain a board seat and/or veto rights for key business decisions.

A separate source said a golden share had been taken in a data-rich company very recently but declined to disclose which one.

Reuters was not able to ascertain how many other data-rich firms authorities were seeking to take a golden share in.

Fx implications

The news is negative for the market’s risk appetite but failed to stop the S&P 500 Futures from tracking the Wall Street benchmarks, up 0.20% intraday around 4,720 by the press time.

Read: Forex Today: Fed delivered as expected, stocks rallied on relief

- As the Asian session begins, silver advances some 0.14%.

- Fed announces a faster bond taper, and its policymakers project three interest rates hikes by 2022.

- The US central bank projects a 4.0% growth next year, up from September’s 3.8% projections.

- XAG/USD Technical Outlook: Has an upward bias, but faces strong resistance at the 200-hour SMA.

Silver (XAG/USD) advances sharply during the day as the New York session winds down, up some %, trading at $22.02 at the time of writing. On Wednesday, the Federal Reserve announced a faster bond-taper beginning in January of 2022 and, according to the dot-plot, could hike three times in 2022, fulfilling the market’s expectations.

The Federal Reserve revealed an increase in the pace of reducing its bond purchasing program by $30 Billion, double the amount initially agreed at the November meeting. Additionally, it dropped the word “transitory” from its monetary policy statement, referring to inflation as exceeding the bank’s 2% target “for some time.”

Fed’s Chair Jerome Powell press conference remarks

Jerome Powell held his traditional press conference after the Fed released its monetary policy statement. He said that “the economy no longer needs increasing amounts of policy support.” He commented that the pace of inflation is “uncomfortably high” and expressed that the Fed is making fast progress towards achieving maximum employment in his point of view.

The Summary of Economic Projections (SEP) was released in addition to the monetary policy statement. Fed policymakers expect inflation to run at a 2.6% pace in 2022, an increase over 2.2%, projected in September, but then fall to 2.3% in 2023 and 2.1% in 2024. Concerning the labor market, the Unemployment Rate is projected to fall to 3.5% in 2022.

Regarding the Federal Fund Rate (FFR), the Federal Reserve Board members expect it to end at 0.90% in 2022, meaning the US central bank would hike three times. By 2023, they expect the FFR at 1.6%, and in 2024 at 2.1%.

Concerning the US economic Outlook, Fed policymakers projected a 4% growth in 2022, up from the 3.8% in September.

Market reaction

XAG/USD initially reacted downwards, reaching a daily low at $21.40. However, the move was faded, bouncing off and rallying towards the 100-hourly simple moving average (SMA) at $22.00, a jump of $0.66 despite the hawkish pivot by the Fed.

XAG/USD Price Forecast: Technical outlook

At press time, silver is trading above the 50 and 100-hour simple moving averages (SMAs). In the near term, the bias is bullish, but a break above the 200-hour SMA at $22.21 might clear the way for an upward move towards the December 13 high at $22.40, followed by the December 6 high at $22.59.

On the flip side, failure at the 200-hour SMA could lead to further losses. The first support would be the 50-hour SMA at $21.98, followed by the daily pivot point at $21.64 and the S1 daily pivot at $21.58.

-637752072736938220.png)

- AUD/JPY seesaws around monthly top after rising the most in over a week.

- Firmer Momentum line, sustained break of previous resistance lines keep buyers hopeful.

- 200-DMA adds to the upside filters, 50% Fibonacci retracement level limits immediate declines.

AUD/JPY takes rounds to 81.75 following the break of a descending resistance line from early November, now support.

The cross-currency pair’s recently sidelined performance could be linked to traders’ wait for November’s Australia jobs report, as well as failures to cross the 100-DMA.

Read: Australian Employment Preview: Rebound from Delta lockdowns may not be enough for the aussie

It should be noted, however, that a successful break of the previous resistance lines from November and firmer Momentum line favor the AUD/JPY pair’s further upside.

Even so, November 19 swing low around 82.15 and the 200-DMA level of 82.75 challenge the pair buyers.

Also acting as an upside filter is the 61.8% Fibonacci retracement (Fibo.) of AUD/JPY downside from late October to December 03, at 83.40 by the press time.

Alternatively, a U-turn from the 100-DMA level near 81.80 will retest the resistance-turned-support lines around 81.15 and 80.80 before directing AUD/JPY sellers towards the 23.6% Fibonacci retracement level of 80.55.

In a case where AUD/JPY prices remain weak past 80.55, the 80.00 threshold and the monthly low near 78.80 will lure the pair sellers.

AUD/JPY: Daily chart

Trend: Further upside expected

- EUR/USD grinds higher around short-term key hurdle after reversing Fed-inspired losses.

- Fed announced faster tapering, hints three rate hikes in 2022 as expected.

- Powell accepted Omicron fears, backing the ‘buy the rumor sell the fact’ market move.

- ECB is likely signaling the end of PEPP but virus woes keep the case interesting.

Following a quick response to the hawkish Fed, EUR/USD bulls retake controls to poke the 1.1300 threshold during early Thursday morning in Asia.

The currency major pair dropped to 1.1221 after the US Federal Reserve (Fed) matched market forecasts for faster tapering and signaling rate hikes in 2022. However, comments from Fed Chair Jerome Powell seemed to have trigged the recent rally ahead of the key European Central Bank (ECB) monetary policy meeting.

Fed doubled monthly bond tapering to $30 billion and the dot-plot also mentioned three rate hikes in 2022, matching wide market expectations. However, Powell’s comments like “the Omicron variant poses risks to the outlook”, as well as refrain from rate hikes until the tapering is completed, recalled the EUR/USD pair buyers.

It’s worth noting that stimulus hopes from the US and a run-up in the equities, weighing down the US Treasury yields, also underpinned the currency pair’s advances.

In addition to the Fed-inspired move, the year-end consolidation and the pre-ECB preparations are likely extra arguments that support the latest EUR/USD run-up.

Moving on, the pair traders are likely to witness lackluster trading heading into the ECB meeting. However, preliminary readings of December month’s PMIs for Germany and the Eurozone may offer intermediate moves.

That said, the regional central bank is up for closing the Pandemic Emergency Purchase Program (PEPP) but questions over Asset Purchase Program (APP) and economic forecasts will be crucial for the pair traders to watch for fresh impulse.

“The ECB has made it clear that it is “very unlikely” that they would hike rates in 2022, insisting that higher inflation will likely be temporary. Nevertheless, market participants are expecting an upward revision to inflation projections, for this year and the next ones. Growth, on the other hand, can suffer a downward revision as the region is currently struggling with restrictions due to the rapid spread of Omicron. The scenario should be overall bearish for the shared currency,” said FXStreet’s Valeria Bednarik ahead of the meeting.

Read: European Central Bank Preview: More recalibration or actual tightening?

Technical analysis

Although an ascending support line from November 24 defends intraday bulls around 1.1260, EUR/USD needs to cross a seven-week-old descending resistance line, close to 1.1325 at the latest, to convince the buyers. Even so, the monthly horizontal resistance near 1.1380-85 and 100-DMA level surrounding 1.1445 will challenge the upside momentum.

Alternatively, a yearly low of 1.1186 offers an additional downside filter. Following that, the 61.8% Fibonacci Expansion (FE) level of October 28 to November moves, near 1.1120, will be in focus.

- AUD/USD bulls take charge despite hawkish Fed.

- AUD/USD traders await the Aussie jobs data for more volatility.

AUD/USD at 0.7173, is ending the day around 0.95% higher after travelling from 0.7092 and 0.7177 over the build-up and around the Federal Reserve event.

The AUD ended a choppy session firm despite an uber hawkish Fed. Treasury yields rose across the curve after the Fed announced an acceleration of tapering and a dot plot showing a more aggressive rate hike outlook. ''Expect this selling pressure to flow through to local rates markets at open before attention turns to RBA’s Lowe later this morning,'' analysts at ANZ Bank explained.

The hawkish message from a faster taper was amplified by significant upward revisions to the dot plot. However, much of what was announced had already been priced in and the US dollar turned on a dime and ended the day lower. For instance, the removal of “transitory” and the doubling of the taper had already been fully expected. What was unexpected, the dots were particularly striking. The median dot signals that there is expected to be three hikes next year, one more than previously indicated.

Meanwhile, investors moved back over toward risk-on assets after the Fed announcement, with US stocks reversing earlier losses to touch a session high. This supported the Aussie, setting it up for a positive start for what could be another busy day. Markets have become more optimistic that Omicron will not impede the global economic recovery.

Additionally, analysts at ANZ bank explained that ''pledges from China to support economic growth also helped alleviate some of the fears. Markets now expect further monetary policy easing in China after the People’s Bank of China said it will reduce bank reserve requirements.''

Meanwhile, traders are waiting for the Reserve Bank of Australia, Governor Phillip Lowe, will speak. Also, we will have the Aussie jobs data. A big gain in employment seems inevitable in November, analysts at ANZ bank said.

''Just how big is the question.''

''We expect a rise of 240k but the range of forecasts is wide. The impact on the unemployment rate will depend on how quickly participation picks up compared with employment. Our pick is 5.0%, down from 5.2% in October, but it could go either way.''

- NZD/USD is on the verge of confirming a bullish chart pattern after New Zealand GDP.

- NZ GDP contracted, but below expectations, in Q3.

- MACD turns most bullish in a week, favoring the bulls to aim for the key SMAs.

- Descending trend line from March acts as important support.

NZD/USD cheers softer-than-expected fall in New Zealand (NZ) Q3 GDP as bulls knock on the door around 0.6780 during early Thursday morning in Asia. In doing so, the kiwi pair is about to confirm a bullish chart pattern named falling wedge, backed by upbeat MACD signals and RSI line.

Read: New Zealand GDP Q3: Better than expected data could keep the bird flying high

The 100-SMA level of 0.6800 will act as an additional upside filter, other than the immediate 0.6790 hurdle, before welcoming the NZD/USD buyers. Following that, a run-up towards the 200-SMA level of 0.6933 can’t be ruled out.

It’s worth noting that a month-old descending trend line, around 0.6860, will precede the late November swing high close to 0.6960 to act as additional upside filters.

Meanwhile, pullback moves will be tested by the lower line of the stated wedge formation, near 0.6725, a break of which will recall the 0.6700 threshold on the chart, which also comprises a descending support line from March.

In a case where NZD/USD bears keep the reins past 0.6700, a downward trajectory towards late 2020 bottom near 0.6590 can’t be ruled out.

NZD/USD: Four-hour chart

Trend: Further upside expected

The Gross Domestic Product (GDP), released by Statistics New Zealand, has been released as follows:

New Zealand GDP SA (QoQ) Q3: -3.7% (exp -4.1%; prev 2.8%) - GDP (YoY) Q3: -0.3% (exp -1.4%; prev 17.4%).

NZD/USD implicaitons

The US dollar was pressured in the aftermath of the hawkish Federal reserve outcome, potentially due to irregular flows in holiday market conditions as traders square up for the year.

The kiwi, as a consequence, flew to a high of 0.6787. The better than expected GDP should help to underpin the kiwi for the day ahead. However, it has failed to move the needle so far as traders are only just coming through the door in Asia and the spreads are unreliable at this time of the day.

Why it matters to traders?

The Gross Domestic Product (GDP), released by Statistics New Zealand, highlights the overall economic performance on a quarterly basis. The gauge has a significant influence on the Reserve Bank of New Zealand’s (RBNZ) monetary policy decision, in turn affecting the New Zealand dollar. A rise in the GDP rate signifies improvement in the economic conditions, which calls for tighter monetary policy, while a drop suggests deterioration in the activity. An above-forecast GDP reading is seen as NZD bullish.

- NZD/USD reached a year-to-date low at 0.6700, as the Fed decided to increase the speed of the bond taper.

- The Federal Reserve Board members eye three rate hikes in 2022 and three in 2023.

- NZD/USD Technical Outlook: Bullish in the short-term, but downside risks remain.

After reaching a new year-to-date low once the Fed announced a faster bond taper and the dot-plot showed that the median of the Fed policymakers eye three interest rates hikes in 2023, the NZD/USD recovers during the New York session, trading at 0.6782 at the time of writing.

Further, the Fed’s last Summary of Economic Projections (SEP) showed that the median of the Federal Reserve Board members view the Fed Fund Rates at 0.9% by the end of 2022, 1.6% in 2023, and 2.1% by the end 0f 2024.

US bond yields are rising in the bond market, with the US 10-year Treasury yield advancing two basis points, sitting at 1.46%, while the US Dollar Index rises some 0.11%, at 96.68.

Key summaries of the Federal Reserve monetary policy statement

On Wednesday, in their last monetary policy meeting of the year, the Fed decided the bond-taper based on “inflation developments and the further improvement in the labor market.” Moreover, it announced the adjustment of its bond purchasing program, kicking in by January, with purchases of $40 Billion in US Treasuries and $20 Billion in mortgage-backed securities (MBS).

Despite the adjustment to the bond taper, the Fed left the door open for further adjustments as needed to the QE’s reduction pace. Concerning the Omicron newly discovered strain, the Fed said that “risks to the economic outlook remain, including from new variants of the virus.”

NZD/USD Price Forecast: Technical outlook

The New Zealand dollar advances sharply against the buck, despite the hawkish rhetoric of the Fed. At press time, the pair pierced the December 14 high at 0.6770, and it is closing fast towards the December 13 swing high at 0.6800.

In the event of a clear break above the latter, it would expose key resistance levels. The first resistance would be the December 9 high at 0.6823, followed by the December 1 pivot high at 0.6867, and then the figure at 0.6900.

-637751991804932262.png)

What you need to know on Thursday, December 16:

Markets participants held their breath ahead of the US Federal Reserve monetary policy decision, with the greenback firming up but without breaking any relevant level. The US central bank confirmed it will accelerate the pace of tapering, starting in January 2022. As expected, the central bank decided to leave rates on hold, and trim bond-buying by $30 billion per month.

US Federal Reserve Chair Jerome Powell noted that economic activity is on tact to expand at a robust pace this year, adding, however, that the Omicron variant poses risks to the outlook. On employment, he said that all officials think the labor market will reach maximum employment next year. About inflation, the focus remains on bottlenecks and supply constraints, although it is expected to decline closer to 2% by the end of 2022. As the presser developed, stocks found the strength to turn green, pushing the dollar back down.

The American dollar initially rallied with the headline, but turned south within Chair Powell’s press conference, ending the day lower against most of its major rivals. Powell noted that it would not hike rates before ending up tapering, cooling down speculative expectations. Stocks rallied on relief, pressuring the American currency.

The EUR/USD approached the 1.1300 level but remains below it ahead of the ECB. The European Central Bank will announce its decision on monetary policy and is widely anticipated to maintain its current policy on hold. In the previous week, there were market talks pointing out a possible extension of the financial support, despite President Christine Lagarde having repeated the Pandemic Emergency Purchase Program will end in March 2022.

The GBP/USD peaked at 1.3282 and currently trades at 1.3260. The high was reached following the release of UK inflation data, which jumped to a record of 5.1% YoY in November.

The Australian dollar appreciated the most, now trading around 0.7170 vs the dollar, and heading into the release of Australian employment data. USD/CAD retreated to 1.2840.

Gold posted a fresh multi-month low of 1,752, recovering afterwards to settle at around 1,778. Crude oil prices advanced alongside stocks, with WTI now trading at around $71.50 a barrel.

Cardano could more than double if ADA holds support

Like this article? Help us with some feedback by answering this survey:

- The S&P 500 surged back above 4700 despite the Fed signalling that it expects to hike three times in 2022.

- Stocks enjoyed a “sell the rumour, buy the fact” reaction to the policy announcement and the Fed’s bullish 2022 outlook.

- Some said with the last major US risk event of the year concluded the “Santa rally” could start.

US equities rallied in wake of the latest Fed policy announcement and post-meeting press conference with Fed Chair Jerome Powell. The S&P 500 gained more than 1.6% to close back above 4700, only a whisker away from record closing levels. Meanwhile, the Nasdaq 100 index was up more than 2.0% and pushed easily back above the 16K level to near 16.3K, while the Dow gained over 1.0% and nearly recovered back to the 36K level. The VIX dropped nearly three points to just above 19.0.

On balance, Wednesday’s Fed meeting was a hawkish affair. While the bank left rates unchanged at 0.0-0.25%, it doubled the pace of QE taper in January to $30B per month as expected and its dot-plot showed that the median expectation amongst Fed policymakers is for three rate hikes in 2022. This was at the hawkish end of expectations (some had expected the dot-plot to indicate two hikes next year). In the press conference, Powell talked about how the economy was very strong and how rate hikes would be appropriate to maintain price stability, which would prolong the expansion and ensure a more durable return to pre-pandemic labour market conditions.

Despite the Fed’s hawkishness, stocks rallied, with the driver of this rally unclear. Some cited a sell the rumour, buy the fact reaction. That is to say, traders were positioning themselves cautiously in the run-up to the Fed meeting and, once the risk event was out of the way (even though it was a tad more hawkish than anticipated), markets got the green light to rally. Some said that, with the final major US risk event now out of the way for 2021, the typical December “Santa rally” can properly kick into gear.

Another factor that could have been bullish for markets was the Fed maintaining its stance that, despite the risks posed by Omicron, the Fed remains very bullish on the US economy for 2021 (instilling confidence in forecasts for earnings growth). Meanwhile, Powell noted how if growth did slow, the pace of rate hikes could also be slowed as the Fed responds to changing economic conditions. That was a comforting message to investors, some of whom have become fearful that the Fed would not be there to support a weakening economy if inflation remained elevated.

- Despite the hawkish Fed, USD/CAD drops into the abyss.

- Commodities turning around and FX follows the weaker US dollar.

Despite a seismic shift in the Federal Reserve's dot plot and language with regards to inflation, the US dollar was unable to capitalise on the hawkish outcome. Instead, the greenback is worse off since the release of the statement and has sunk to the lowest levels since the start of the New York session.

However, the commodity complex remains on the backfoot, as measured by the Thomson CRB index that reads -0.23% at the time of writing. Nevertheless, USD/CAD is now in the red for the first time this session and trades at 1.2857 following a post-Fed low of 1.2845.

Fed key takeaways

- FOMC monthly taper pace $30 billion vs $15 billion prior.

- ''In assessing monetary policy, will continue to monitor incoming information for the economic outlook.''

- ''Prepared to adjust stance of monetary policy as appropriate if risks emerge that impede its goals.''

- ''Job gains have been solid in recent months, and the Unemployment Rate has declined substantially.''

- The median forecast is now showing three hikes in 2022 and 2023. In the September Dots, the median saw only one hike by end-2022 (0.375%).

See also: Summary of Economic Projections

ECB in focus

Meanwhile, the outcome of the Fed was hawkish, more than expected when taking into account the dot plot, much of the market's thinking may have already been priced in. The US dollar has rallied by almost 4% since the start of November on the back of the Fed's tapering communications. However, the risk now comes with the European Central Bank and traders may not wish to be too long of the greenback going into Thursday's meeting. Reports suggest the upcoming ECB forecasts will show inflation remaining below the 2% target in both 2023 and 2024 and that should underpin the greenback.

US dollar sinks

USD/CAD drops 100 pips

Fed Chair Jerome Powell said in his post-Fed meeting press conference that it will be appropriate for interest rate hikes in this economy.

Additional Takeaways:

"I don't think Fed is behind the curve."

"We can now take steps in a thoughtful manner to address issues including too high inflation."

"We are in a highly accommodative stance."

"The extent to which end of the taper, rate hikes will be separated in time will be discussed in coming meetings."

"We are very, very well placed for interest rates with inflation and a strong economy."

"Not at all likely that there will be the same length of time between the end of taper and rate hikes as in the last cycle."

"It will be appropriate for interest rate hikes in this economy."

"Had the first discussion of balance sheet issues today; did not make any decisions today."

"Have not made any decisions on when balance sheet would shrink."

"Will turn to those discussions in coming meetings."

Fed Chair Jerome Powell said in his post-Fed meeting press conference that with inflation so far above the Fed's 2.0% target, we can't wait too long to get back to maximum employment.

Additional Takeaways:

"Inflation that we've got is not at all what we were looking for in our framework."

"This is not the inflation we were looking for."

"Wages are one thing to look at when assessing full employment."

"Quits rate is also a good signal of full employment goal."

"High quits rate suggests a very tight labor market."

"We have to make policy in real-time."

"The labor market is hotter than it ever ran in last expansion."

"The labor market is so many measures hotter than it was in the last expansion."

"Shock to labor force participation is not unwinding as quickly as had been expected."

"For so many reasons, labor force participation shock is not unwinding as many expected and much of it is voluntary."

"In some cases, it will abate once the pandemic recedes from view and participation rate will rise."

"The economy does not lack stimulus."

"The problem is a supply-side problem on labor and that will take time to work itself out."

"If the pandemic were under control, then we'd fully know what labor market can really look like, but that's not coming any time soon."

"We can only try and create conditions for a tight but stable labor market."

"High inflation is a threat to full employment as we need to maintain a long expansion."

- USD/JPY edges higher after the Fed announced a faster QE reduction.

- Per dot-plot, Fed members eye three-rate hikes in 2022.

- On his press conference, Fed’s Powell said that the Fed could raise rates despite not achieving the full-employment goal.

The USD/JPY reclaims the 114.00 figure as the Fed decided to keep rates at the 0 to 0.25% range while increasing the bond-taper speed. Additionally, according to the dot-plot, the median estimates at least three hikes in 2022, in line with market expectations.

According to the Summary of Economic Projections (SEP), the Federal Reserve Board members, the median view of the Federal Fund Rates in 2022 is at 0.9%, in 2023 at 1.6%, and by 2024 at 2.1%.

US bond yields are rising in the bond market, with the US 10-year Treasury yield advancing two basis points, sitting at 1.46%, while the US Dollar Index rises some 0.11%, at 96.68.

Key summaries of the Federal Reserve monetary policy statement

Adding to the abovementioned, the Federal Reserve decided the bond-taper based on “inflation developments and the further improvement in the labor market.” Also announced that the reduction will begin by January, with purchases of $40 Billion in US Treasuries and $20 Billion in mortgage-backed securities (MBS). Moreover, in line with the November FOMC monetary policy statement, it left the door open for further adjustments at the QE’s reduction pace.

Regarding the Omicron newly discovered strain, the Fed said that “risks to the economic outlook remain, including from new variants of the virus.”

At press time, Federal Reserve Chairman Jerome Powell is crossing the wires. He said that “Balancing of our goals means we could possibly raise interest rates before full employment is met, due to high inflation.”

Markets reaction

The USD/JPY reached a daily high near the 114.30s. However, the upward move was faded, as Federal Reserve Chairman Jerome Powell is crossing the wires.

To the upside, the next resistance would be the October 20 high at 114.70, followed by 115.00.

On the downside, the first support would be 50-DMA at 113.75, followed by the December 10 low at 113.21.

Fed Chair Jerome Powell said in his post-Fed meeting press conference that if the economy were to slow, that would slow the pace of rate increases.

Additional Takeaways:

"We've been adapting our policy."

"I did wonder if we should increase our taper at the november meeting."

"I decided in last month that we needed to look at speeding up the taper."

"Higher inflation and much faster progress on jobs is what made me decide on speeding taper."

"Unemployment rate seems to be catching up with other readings of a tight labor market."

"My thoughts were widely supported by the committee."

"If real wages were persistently above productivity growth that puts pressure on firms."

"Recent hot labor market readings mean we are watching this carefully; rents are another thing."

"If economy turns out not to be as strong, we will adapt policy accordingly."

"If economy were to slow, then that would slow rate increases."

Fed Chair Jerome Powell said in his post-Fed meeting press conference that the US economy is strong enough for the Fed to press ahead with its bond taper plans even amid the spread of Omicron.

Additional Takeaways:

"A lot of uncertainty on Omicron."

"Effect of omicron on the economy will depend on its effect on demand and supply."

"People are learning to live with variants."

"As more people are vaccinated, the less the economic effect."

"Delta hurt global supply chains getting worked out."

"We'll know a whole lot more about omicron in a few weeks."

"Given the strength of demand in the economy, it's appropriate to move forward the taper. Omicron doesn't have much to do with that."

Fed Chair Jerome Powell said in his post-Fed meeting press conference that it feels likely that a return to a higher participation rate is going to take longer and that the Fed needs to focus on making policy for current economic conditions.

Additional Takeaways:

"We are not going back to the pre-pandemic economy."

"Post-pandemic labor market will be different as will full employment."

"Unemployment rate consistent with max employment evolves over time."

"Labor force participation rate has been disappointing."

"I had thought that rate would significantly surge."

"We have to make policy now and inflation is well above target."

"Reality is we don't have a strong labor force participation yet and may not have for some time; inflation well above target and we need to make policy now."

"Balancing of our goals means we could possibly raise interest rates before full employment is met due to high inflation."

"We are making rapid progress on full employment; may not have to invoke the need to raise rates before that test is met."

Fed Chair Jerome Powell said in his post-Fed meeting press conference that its not appropriate to raise rates while taper is ongoing.

Additional takeaways:

"We have learned regards balance sheet is best to adjust methodically due to market sensitivity."

"We talked today about the balance sheet

"Have not taken a position on whether should pause between the end of the taper and first rate hike."

"We discussed the sequence of events regarding balance sheet runoff last time."

Fed Chair Jerome Powell said in his post-Fed meeting press conference that in my view, we are making rapid progress to maximum employment.

Additional Takeaways:

"Maximum employment is something we assess through broad range of indicators."

"Those include labor force participation rate and demographic groups assessments."

"Maximum employment is a judgment call."

Fed Chair Jerome Powell said in his post-Fed meeting press conference that inflation will run above the Fed's 2.0% goal well into next year.

Additional Takeaways:

"Bottlenecks, supply constraints have been larger, longer-lasting than anticipated."

"Price increases are now broader."

"Wage growth thus far not a major contributor to elevated inflation."

"Expect inflation to decline closer to 2% by end of 2022."

"We continue to expect inflation closer to the 2% goal by end of next year."

"We understand high inflation is a hardship."

"We are committed to our price stability goal."

"We will use our tools to support labor market, and prevent higher inflation from becoming entrenched."

"We will watch carefully to see if economy moving in line with expectations."

"We think full employment will be met next year."

"Expect to leave rates at zero until reach maximum employment."

"Expect a gradual pace of policy firming."

- The British pound dipped to 1.3170s, then bounced back near 1.3200.

- Fed’s dot plot is far more hawkish, with three rate hikes in 2022 and 2023.

The GBP/USD edged lower during the New York session after the Fed decided to keep interest rates unchanged at the 0-0.25% range. Further, it decided that a faster bond taper is needed, reducing its bond purchases by $30 Billion, in line with the market’s expectations. Also, the dot-plot witnessed that most of the board members feel comfortable hiking at least three times in 2022, followed by three times in 2023 and three times in 2024.

According to the Summary of Economic Projections (SEP), the Federal Reserve Board members, the median view of the Federal Fund Rates in 2022 is at 0.9%, in 2023 at 1.6%, and by 2024 at 2.1%.

Summarize the Federal Reserve monetary policy statement.

Adding to the abovementioned, the Federal Reserve decided the bond-taper based on “inflation developments and the further improvement in the labor market.” Also announced that the reduction will begin by January, with purchases of $40 Billion in US Treasuries and $20 Billion in mortgage-backed securities (MBS). Moreover, in line with the November FOMC monetary policy statement, it left the door open for further adjustments at the QE’s reduction pace.

Markets reaction

The British pound plunged towards 1.3176 and found strong support around that area, and it is threatening to reclaim the 1.3200 figure. It appears that it was a “buy the rumor-sell the fact” event, as it came in line with expectations.

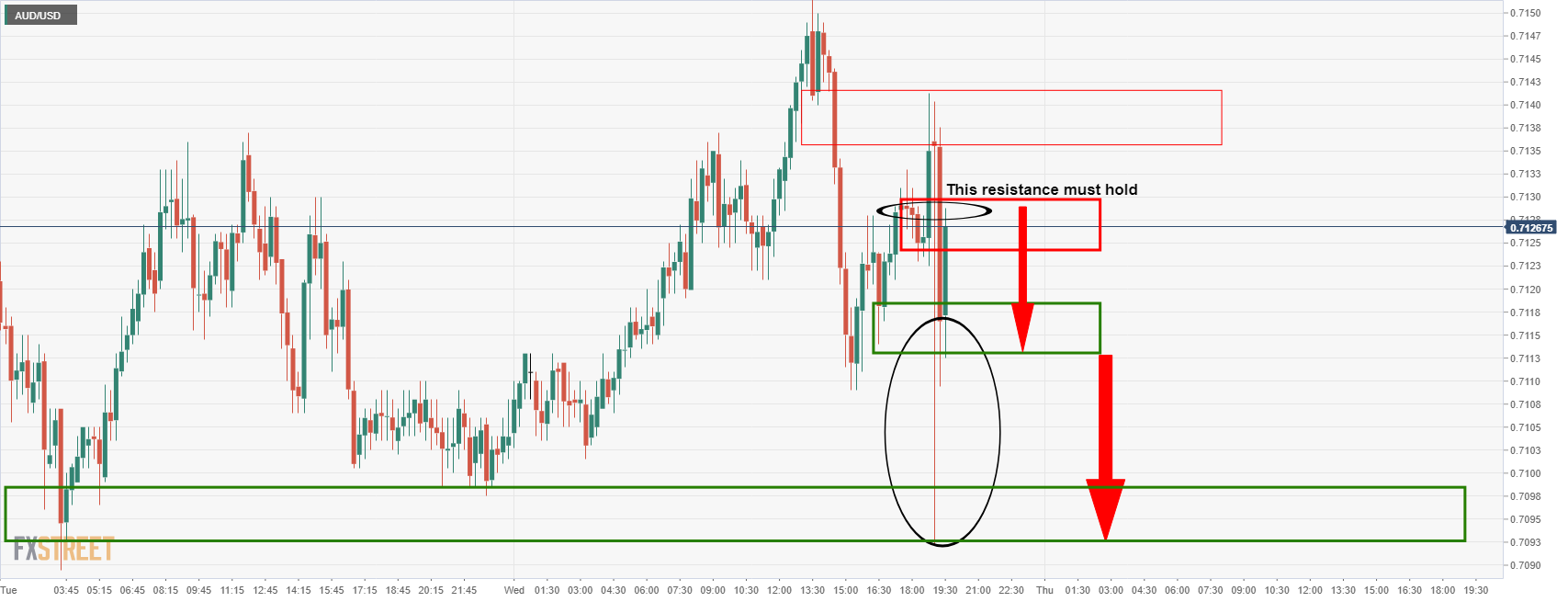

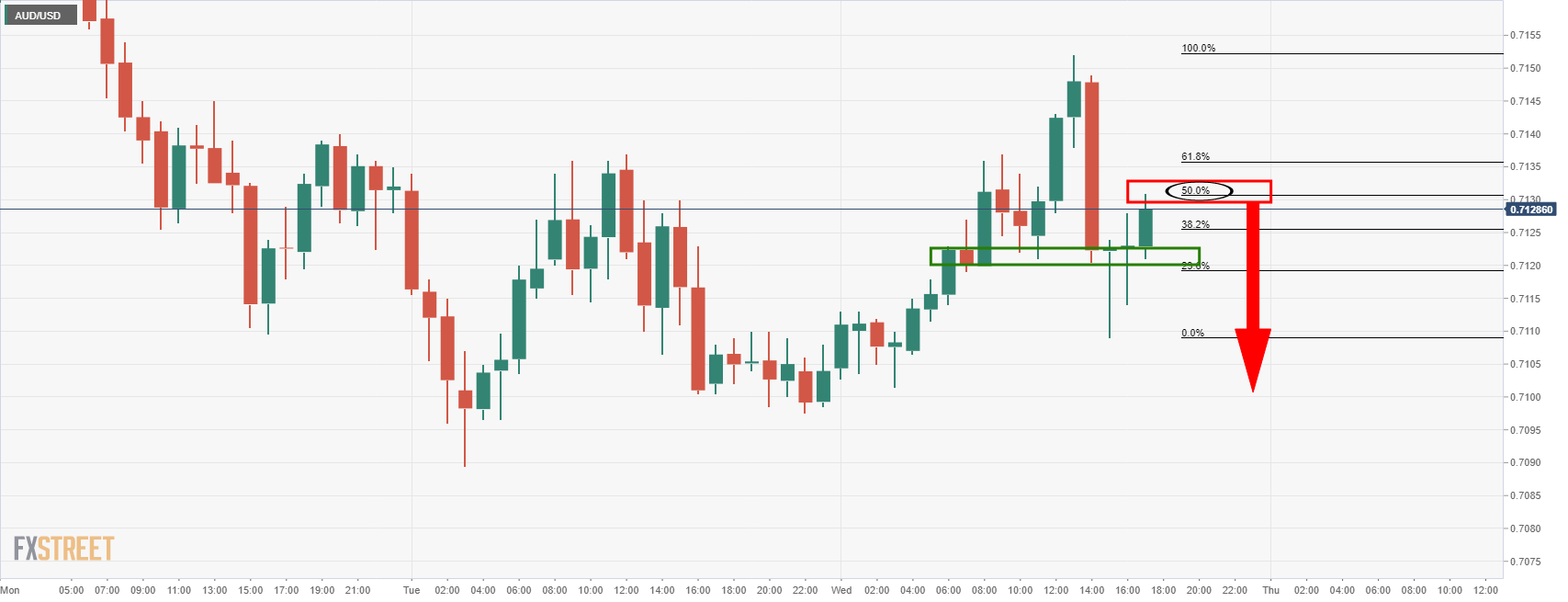

- Fed is hawkish and that is a bearish factor for AUD/USD.

- Fed's Powell is speaking and maintains the hawkish language that could impact the US dollar to the upside.

Federal Reserve's chair, Jerome Powell, has noted that inflation will run above goal well into 2022 in the presser. This leaves the downside in play for AUD/USD as follows:

AUD/USD daily chart

The daily chart is bearish while below 0.7150.

AUD/USD H1 chart

The bear wick could be targetted on a hawkish and bullish Fed's Powell. The US dollar would be expected to strengthen and this will expose the downside below 0.7090 towards 0.7050 and then 0.7030 as per the prior structure.

AUD/USD M15 chart

From a lower-term time frame, the 15-min chart shows that the price is mitigating the imbalance of the initial sell-off. However, should the key resistance hold, near 0.7130/40, now that the majority of the imbalance has been mitigated, then the prospects of the downside will intensify and leave 0.71 the figure vulnerable again.

Update: AUD/USD bulls step in

The spike to the upside has invalidated the downside case, for now. The old resistance would now be expected to act as support. However, the daily outlook for the sessions ahead remains intact while the price is below 0.7150. However, a break of 0.7180 would be the nail in the coffin for the bears.

Fed Chair Jerome Powell, speaking in his usual post-Fed meeting press conference, said that economic developments and the outlook warranted a faster pace of bond taper.

Additional Takeaways:

"Economic activity on track to expand at a robust pace this year."

"Demand remains very strong."

"Rising covid cases in recent weeks and omicron pose risks to the outlook."

"Omicron variant poses risks to outlook."

"We still see rapid economic growth."

"Amid improving jobs market conditions, the economy has been making rapid progress to jobs goal."

"Recent improvement in the labor market has narrowed difference across economic and racial groups."

"Some who would otherwise be seeking work are still out of labor force due to pandemic."

"Employers are having difficulties filling jobs, and wages rising at the fastest pace in many years."

"Employers having difficulty filling jobs, wages rising at the fastest pace in years."

"We think the labor market will continue to improve."

EUR/USD broke below a key uptrend that has been in play since November and fell to fresh one-month lows in the 1.1220s in response to the latest Fed policy announcement. The dollar was bought across the board in response to the Fed’s new dot plot showing that the median expectation of policymakers is for three interest rate hikes in 2022, a more hawkish showing than some had anticipated. The hawkish dot plot was the main surprise.

Otherwise, the Fed left rates at 0.0-0.25%, doubled the pace of its QE taper to $30B a month from January (though maintaining flexibility to adjust at a later date) and lifted its 2022 inflation forecast all as expected. Markets will now be watching what Fed Chair Jerome Powell has to say at his usual post-meeting press conference, which kicks off at 1930GMT.

Back to EUR/USD; now that the pair has broken to the south of the aforementioned key downtrend and prior monthly lows, the door is open for an extension of the downside towards the November lows under 1.1200. Powell will need to maintain a hawkish tone in the press conference for this to happen. One theme to watch might be his rhetoric on what constitutes the greater threat to the Fed’s mandate for full employment. In the past the Fed has emphasised the need to keep policy accommodative to reach this goal, but Fed rhetoric has recently shifted recently to noting that high inflation is the greater threat.

- Gold is feeling the pressure on a much more hawkish Fed, but much was priced in already.

- US dollar has rallied 30 points in the DXY on an uber hawkish Fed but is stalling.

- Fed's dot plot is far more hawkish with 3 rate hikes in 2022 and 2023. The taper has been doubled.

Gold, XAU/USD has extended the day's losses on an uber hawkish Federal Reserve statement and announcements of a doubling of its tapering of QE and a seismic shift in the dot plot. The median forecast is now showing three hikes in 2022 and 2023.

The Federal Reserve statement acknowledges that job gains have been solid and it has dropped the transitory language with respect to upside inflation pressures.

Fed futures printing in a 100% chance of a Fed hike as soon as May and 50% for a March rise, with 90% for April.

Key takeaways from the Fed statement

- FOMC monthly taper pace $30 billion vs $15 billion prior.

- ''In assessing monetary policy, will continue to monitor incoming information for the economic outlook.''

- ''Prepared to adjust stance of monetary policy as appropriate if risks emerge that impede its goals.''

- ''Job gains have been solid in recent months, and the Unemployment Rate has declined substantially.''

See also: Summary of Economic Projections

Watch live: Fed's Powell coming up, top of hour

Federal Reserve Chairman Jerome Powell holds a news conference after Federal Open Market Committee concluded its two-day meeting.

This shift to three rate hikes in 2022 will very much support the notion of the Fed moving into tightening mode. Therefore, there will be plenty of interest as to how the Fed now refers to inflation - after Powell said its description as transitory should be 'retired. This will be the key theme during the presser and the price of gold will be determined by it.

''Certainly, while the above suggests a hawkish tone from the Fed, the market is already pricing an aggressive tapering and the first hike in May 2022,'' analysts at TD Securities argued.

''This leaves a balance of risks tilted towards the upside for the near-term precious metals outlook, particularly as our macro strategists expect enough slowing in inflation and growth to delay rate the start of the hiking cycle.''

Gold technical analysis

However, from a technical perspective, while the price is being supported, the wick is going to be a target for the bears for the sessions ahead. A break of $1,750 will open the risk of a far deeper move to the downside and $1,700 could come under pressure over the coming weeks.

This will depend on the US dollar's trajectory. The initial move was a strong bid but it has since settled as follows:

- The Fed left interest rates unchanged at 0.0-0.25% and doubled the pace of QE taper in January, as expected.

- The bank's new dot plot showed Fed members expect three rate hikes in 2022, more hawkish than some had expected.

- As a result, the US dollar was supported and the DXY lurched towards 97.00.

The US Federal Reserve announced on Wednesday that the FOMC had agreed to leave the Federal Funds target range unchanged at 0.0-0.25%, in line with expectations. Moreover, the pace of the taper of the bank’s bond-buying programme will be doubled from mid-January to $30B per month, with a similar pace of taper likely appropriate in the months thereafter, though the pace of taper could be adjusted if warranted by a change in economic conditions. If the Fed does reduce its bond-buying by $30B per month until the programme is fully unwound, net asset purchases will fall to zero before the end of March 2022.

According to the new dot plot, the median view of the Fed Funds rate at the end of 2022 was lifted to 0.9% (indicating three rate hikes are expected in 2022) from 0.3%. The median view of the Fed Funds rate at the end of 2023 and was lifted to 1.6% from 1.0% and at the end of 2024 was lifted to 2.1% from 1.8%. The Fed’s view of where interest rates will sit in the long-run was left unchanged at 2.5%. Five of the 18 Fed members see the policy rate at or above 2.5% by the end of 2024.

In its statement on monetary policy, the Fed said that, with inflation having exceeded 2.0% for some time, its expects it to be appropriate to keep interest rates at the current level until labour market conditions hit levels consistent with full employment. The Fed added that supply and demand imbalances related to the pandemic and economic reopening continue to contribute to elevated levels of inflation and that risks to the economic outlook remains, including new variants of Covid-19. Job gains have been solid in recent months, the Fed said, and the unemployment rate has declined substantially, though sectors most adversely affected by the pandemic have improved in recent months, though continue to be affected by the pandemic.

The Fed also released new economic forecasts, where it sees Core PCE averaging 2.7% in 2022, up from 2.3% in the last forecast, before falling back to 2.3% in 2023 and then to 2.1% in 2024. The GDP growth forecast for 2022 was revised slightly higher to 4.0% from 3.8%, and was left unchanged at 2.2% for 2023 and 2.0% for 2024. The long-run expectation for growth was left unchanged at 1.8%.

Market Reaction

The DXY initially spiked higher from the 96.60s to as high as 96.90 in response to the Fed's policy announcement but has since retraced lower to the 96.70 area. USD/JPY broke above 1.1400, taking it to fresh one-month highs. EUR/USD fell sharply under 1.1250 and to fresh one-month lows in the 1.1220s.

The dot plot seems to have been a little more hawkish than expected, with three rate hikes indicated in 2022 (some market participants had expected the Fed to signal two hikes in 2022). As traders continue to digest the announcement, FX market focus now turns to the post meeting press conference with Fed Chair Jerome Powell, which kicks off at 1930GMT.

The Canadian government on Wednesday said that there is community transmission of the Omicron Covid-19 variant all over the country. As a result, the government will be sending booster doses and rapid tests to provinces so that they can ramp up vaccinations in response to the outbreak of the new variant. The government pledged to increase testing capacity at the border and urged people to avoid non-essential international travel.

Market Reaction

The loonie has not reacted to the latest government warnings, with FX markets focused on the imminent monetary policy announcement from the Fed (at 1900GMT).

- The USD/CHF edges up during the New York session, gaining 0.26%.

- USD/CHF Technical Outlook: It has a bullish bias; if the Fed maintains its hawkish rhetoric, it could challenge the 78.6% Fibonacci at 0.9326

The USD/CHF continues its rally in the week, up for the third day in a row, trading at 0.9268 during the New York session at the time of writing. The market sentiment is calm as market participants wait for the Federal Reserve’s last 2021 monetary policy decision.

Market participants seem to have fully priced at least two interest rate hikes, by the US central bank in 2022, with the possibility of three. Further, in the bond purchasing program, investors expect an increase of the reduction of purchases at least by $30 Billion.

In the overnight session, the USD/CHF remained subdued. However, as shown by the hourly chart, the pair bounced off the confluence of the 50, 100, and 200-hourly simple moving averages (SMAs), breaking the December 14 pivot high at 0.9245, peaking around 0.9270, some 30 minutes away of the Federal Reserve, decision.

That said, the bias of the USD/CHF is tilted to the upside and would challenge the 0.9300 figure if the Fed’s hawkish rhetoric remains.

In the meantime, US bond yields are almost flat. The US 10-year Treasury yield sits at 1.446%, unchanged, while the US Dollar Index edges up 0.03%, at 96.60.

USD/CHF Price Forecast: Technical outlook

Fed evens usually carry much volatility in the markets. At press time, the USD/CHF is trading near the 50% Fibonacci retracement from the November 24 swing high to the November 30 swing low.

That said, to the upside, the first resistance would be the December 7 high at 0.9274, followed by the 61.8% Fibonacci retracement at 0.9291 and then the 78.6% Fibonacci retracement at 0.9326

On the other hand, the key support levels would be the 38.2% Fibonacci retracement at 0.9239, the 50-DMA at 0.9217, and the figure at 0.9200.

-637751905109490323.png)

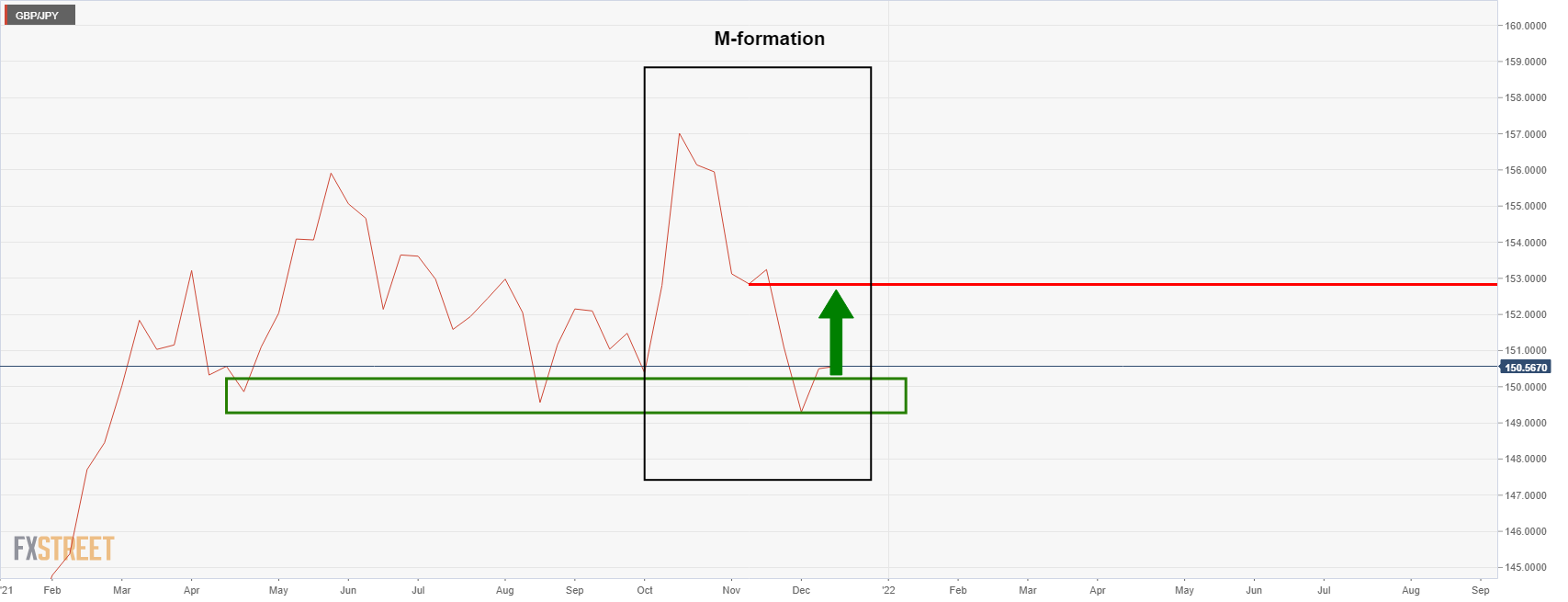

- GBP/JPy bulls are taking control and eye a breakout.

- The daily and weekly market structures offer prospects for 152.20 and then 153.20

GBP/JPY is moving higher in a phase of accumulation. The bulls can target the 61.8% ratio near 152.50 to mitigate the imbalance of the prior bearish impulse ahead of weekly resistance near 153.20.

GBP/JPY weekly chart

The M-formation on the weekly chart is a reversion pattern that would be expected to pull in the bulls to the neckline located near 153.20. However, there is some work to do on the daily chart first with levels to break as follows.

GBP/JPY daily chart

From a daily perspective, support has been held and the bulls can home in on the 151.20s as per the order block eclipsed in the chart. A move towards the 61.8% golden ratio aligns particularly with the old support near 152.50. A break there opens risk to the M-formation's neckline, as illustrated in the weekly chart above.

A break of the daily support, however, opens the risk of a considerable move to the downside. 140/142.50 would be earmarked targets for the bears positioning for the downside in such a scenario, as per the following weekly chart:

- USD/CAD has pushed above 1.2900 in advance of the Fed and is eyeing a test of the 1.2950 annual high.

- CPI cooled in Canada in November and confirmation of this seemed to weigh on the loonie, which is underperforming currently.

USD/CAD has pushed above the psychologically important 1.2900 level on Tuesday and looks likely to stay there in the run-up to the Fed’s policy announcement (at 1900GMT). That means the pair is currently trading with gains of about 0.3%, having started the session closer to 1.2850.

The annual pace of Canadian Core Consumer Price Inflation in November saw a slight drop versus October's levels, which, though expected, cuts in the opposite direction to the building price pressures seen most recently out of the US, UK and EU. Thus, the data appeared to weigh on the loonie at the time as it eases (somewhat) the pressure on the BoC to tighten monetary policy settings.

Hawkish leaning commentary from BoC Governor Tiff Macklem more recently has not been enough to lift the loonie from near the bottom of Wednesday’s G10 performance table. For reference, Macklem said that the significant amount of slack that was in the Canadian economy is now substantially diminished, before adding that the time is coming closer when the bank will move away from its exceptional forward guidance. As a result, the loonie is one of the worst-performing G10 currencies ahead of the Fed meeting, though if the Fed does deliver some sort of surprise that alters risk appetite, the G10 rankings could quickly switch up.

In the case of a hawkish surprise (say the Fed hints at ending QE earlier than expected, or indicated sooner and faster than expected rate hikes), USD/CAD would likely continue Wednesday’s rally and test August highs around 1.2950. A more dovish outturn could see the pair drop back towards support around 1.2850.

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 19:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

Related articles

Fed Preview: Dollar hinges on 2022 rate hike dots, guide to trading the grand finale of 2021.

Fed Interest Rate Decision Preview: Can the FOMC satisfy and mollify the markets?

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

Bank of Canada Governor Tiff Macklem said on Wednesday that the significant amount of slack that was in the Canadian economy is now substantially diminished, according to Reuters. Earlier in the session, Macklem spoke about the longer-term outlook for BoC policy.

He said that lower neutral interest rates mean we are likely going to need exceptional forward guidance and QE more often and, with interest rates lower across the globe, the bank is likely to lower its policy rate to the effective lower bound (i.e. just above zero) more frequently in response to shocks.

Market Reaction

CAD has not seen a reaction to Macklem's latest remarks.

- The shared currency recovered some of its Tuesday’s losses, is up some 0.05%

- The EUR/USD is range-bound in familiar levels, waiting for the Fed.

- EUR/USD Technical Outlook: Bearish bias with the YTD low is at risk of being broken.

The EUR/USD barely advances during the New York session, trading at 1.1260 at the time of writing. A risk-off market mood spurred by Wednesday’s Federal Reserve monetary policy decision looms the financial markets. US equities are down in the day, while US bond yields rise, while the greenback is slightly up.

The EUR/USD pair remained subdued through the overnight session, in a familiar fashion, ahead of the Fed and could not break above the 50-hour simple moving average (SMA) around 1.1280. In fact, it dropped near the December 14 swing low at 1.1252, fading the downward move, settling at current levels.

Before the Wall Street opened, the US Commerce Department reported that Retail Sales for November rose by 0.3%, lower than the 0.8% foreseen. Meanwhile, excluding Autos, sales increased by 0.2%. The aforementioned was mainly ignored by investors, which in turn, on Tuesday’s witnessed the highest increase in 10-year of prices paid by producers, adding fuel to expectations of a faster Fed bond taper process, so expected by the markets.

What’s priced in?

The market expects that the Fed would accelerate the reduction of its QE, at least by double of the $15 Billion announced on November’s meeting. Additionally, the Summary of Economic Projections (SEP) with its “dot-plot” would be scrutinized, as market participants look for signals of rate hikes, how many, and in which time frame.

Money market futures expect at least two rate hikes by 2022, three in 2023, and two more in 2024, each one of 25 basis points, with rates closing almost to 2%.

In the meantime, US bond yields are almost flat. The US 10-year Treasury yield sits at 1.446%, unchanged, while the US Dollar Index edges up 0.03%, at 96.60.

EUR/USD Price Forecast: Technical outlook

The EUR/USD daily chart shows the pair has a downward bias, further confirmed by a descending triangle in a downtrend called a “pennant.” Additionally, the daily moving averages (DMAs) remain above the spot price, with the 50, 100, and 200-DMAs located at 1.1447, 1.1600, and 1.1788, respectively.

On the downside, a break below the December 7 pivot low at 1.1227 would expose the YTD low at 1.1186. The breach of the latter would push the pair towards the figure at 1.1100, followed by the pennant’s target at 1.1041.

To the upside, the first resistance would be 1.1300. In the event of the figure giving way for EUR bulls, that would expose the December 8 high at 1.1354, followed by a test of 1.1400.

-637751885505248747.png)

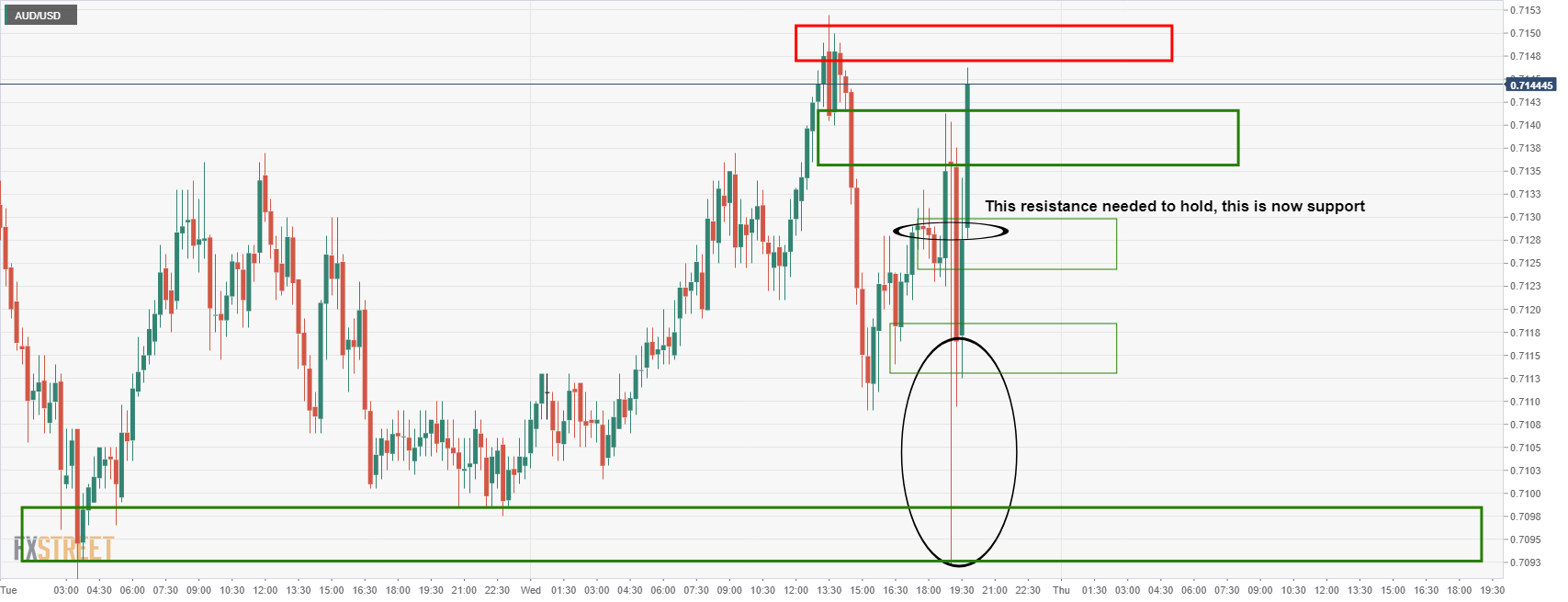

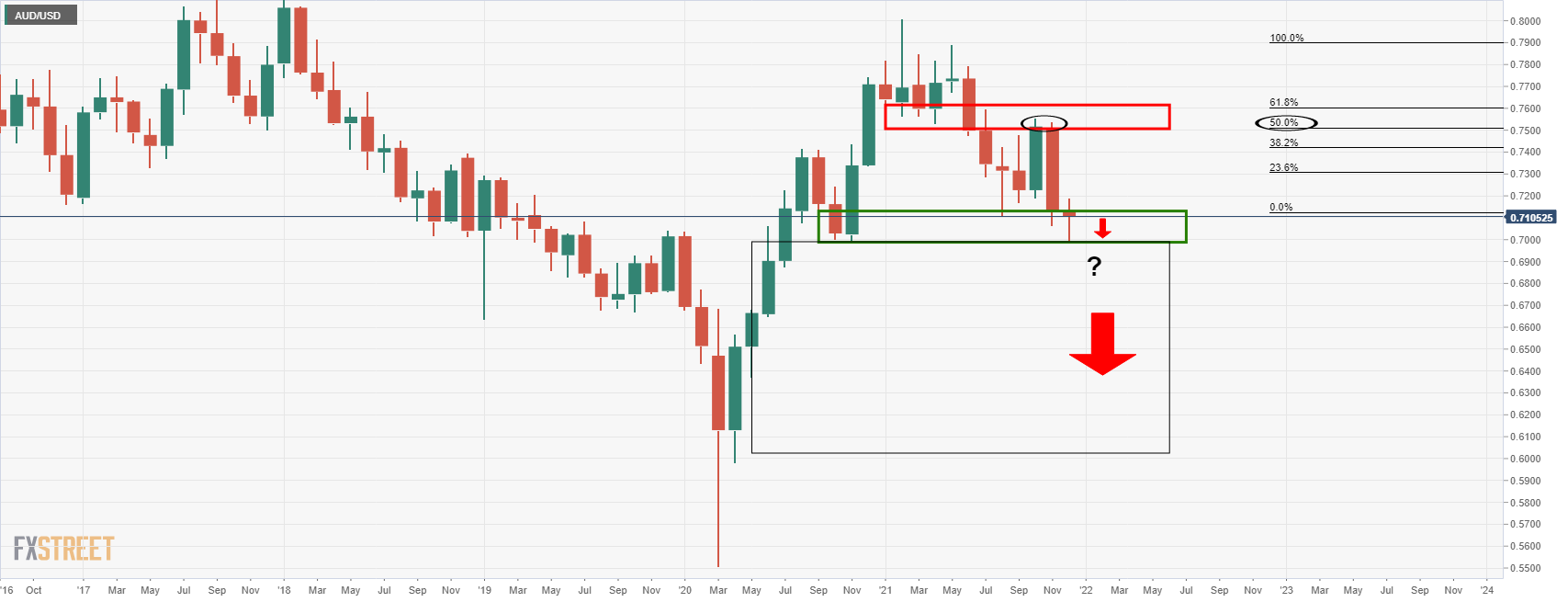

- AUD/USD traders await the Fed for clues with regards to the divergence between the RBA and Fed.

- Bearish head & shoulders taking shape could leave 0.70 vulnerable to a test in the coming sessions.

AUD/USD started out the New York day better bid until an avalanche of demand came in for the greenback ahead of the Federal Open Market Committee event today. At the time of writing, AUD/UD is licking its wounds near 0.7125 and up by some 0.3% still. The price has traded between a range of 0.7097 and a high of 0.7151 where it peaked just ahead of the North American session.

AUD/USD dropped 40 pips in the Wall Street open when US stocks fell, with the Nasdaq Composite leading the charge, as investors expected the Federal Reserve to unveil in the next few hours an unwinding of its highly accommodative, pandemic era policies.

''A faster taper, a higher dot-plot and more hawkish forecasts should be the hallmarks of this meeting,'' analysts at TD Securities said. ''That should cast a long shadow over the other key central bank decisions this week, leaving the USD likely in firm standing overall.''

Fed/RBA divergence to pummle AUD/USD

The commodity complex and high beta FX will be put under pressure should we get the most hawkish of outcomes from the meeting with the Fed seeking to battle stickier inflation risks. The divergence between the Reserve Bank of Australia, especially, leaves the Aussie vulnerable as a consequence.

''We expect the monthly pace to be doubled to $30bn from $15bn, consistent with QE ending in mid-March instead of mid-June,'' the analysts at TDS said. ''Officials will likely also convey a more hawkish tone through changes to the statement, the economic projections, and the dot plot. We expect the median dot to show a 50bp increase in the funds rate in 2022.''

By contrast, while inflation is increasing globally, according to the RBA, in Australia it is of a different order. The RBA has stated that the labour market scarcity and “significant” wage growth have yet to emerge before higher inflation is considered sustainable. The RBA has also argued that there is still significant slack in the Australian labour market.

''We believe it will take at least a year before the required condition of “significant” wage growth set by the RBA is met,'' analysts at Rabobank argued. The analysts note that current levels of wage growth are still well below the historic average and have much catching up to do.

AUD/USD technical analysis

The daily chart is a compelling case for the downside following the recent correction that has met a 50% mean reversion of the prior bearish run from the 0.7370s to the 0.6990s. Should the market break those lows, then the next feasible target comes near to 0.6940.

We are also seeing a 50% mean reversion of the hourly chart as follows:

A rejection here would lead to the prospects of a bearish head & shoulders and leave 0.70 vulnerable to a test on the downside in the coming sessions.

- The New Zealand dollar extends its slide for three consecutive days, falling 0.14%.

- The market sentiment is mixed as investors prepare for the Fed.

- Market participants expect a faster bond taper and at least two rate hikes by 2022.

- NZD/USD Technical Outlook: It has a downward bias, though it could be an event of “buy the rumor, sell the fact.”

The NZD/USD slides for the third day in a row, trading at 0.6730 during the New York session at the time of writing. The market sentiment is mixed, as shown by European and US equities. In Europe, most indices fluctuate between gainers and losers, while in the US, all are in the red, ahead of the Fed.

As shown by the recent price action in the NZD/USD, investors are preparing for the Fed, except for Monday, when the pair dropped below the 0.6800 figure. In the last two days, the FX market has been calm, with the NZD/USD trading within familiar ranges, within 0.6700-0.6750.

In the overnight session, the NZD/USD pair peaked at around 0.6760, then fell towards the December 14 low at 0.6734, courtesy of greenback demand. However, the downward move was short-lived, bouncing back towards 0.6750s, though faced robust resistance, pushing the price towards the S1 daily pivot at 0.6726.

What’s priced in?

Market participants expect that the Fed would increase the pace of the bond taper to $30 Billion so that the US central bank could finish its stimulus by the end of March 2022. In addition, money market futures expect at least two hike rates by 2022, three in 2023, and two more in 2024, each one of 25 basis points, with rates closing almost to 2%.

In the meantime, US bond yields are almost flat. The US 10-year Treasury yield sits at 1.444%, while the US Dollar Index edges up 0.01%, at 96.58.

The US Economic docket featured Retail Sales for November, which rose by 0.3% on a monthly reading, lower than the 0.8% expected. However, market participants mainly ignored them, as they remained tuned into the Federal Reserve monetary policy decision.

NZD/USD Price Forecast: Technical outlook

The New Zealand dollar is under downward pressure as market participants prepare for the Fed. The pair is tilted to the downside, as shown by the daily moving averages (DMAs) residing above the spot price, with shorter time-frames below the longer ones. Further, the first line of defense for NZD bulls would be the psychological 0.6700, which, once broken, could give way for USD bulls towards October 2020 cycle lows, around 0.6550.

On the downside, the key levels to watch are 0.6700, followed by support provided by a downslope support trendline lying around 0.6680s, followed by 0.6650.

To the upside, the first resistance would be 0.6760, followed by December 14 high at 0.6770. A breach of the latter would expose the December 9 cycle high at 0.6822.

-637751838470850175.png)

- USD/JPY is trading subdued close to the 113.80 mark, but has been gradually ebbing higher all week into the Fed.

- The pair appears to have formed an ascending triangle and could soon see a bullish breakout.

USD/JPY continues to trade in subdued fashion, as has been the case for most of the week, if not with a slight positive bias, as the US dollar picks up in the run-up to the Fed’s policy announcement. The US data already released this week has by and large been dollar supportive, with Tuesday’s Producer Price Inflation report much hotter than expected and Wednesday’s Retail Sales not quite as strong as forecast but still at healthy levels, while the NY Fed Manufacturing survey indicated a strong start to the month for US industry.

Since bottoming out in the 113.20s at the start of the week, USD/JPY has gradually pushed higher, sticking fairly close to its 50-day moving average along the way, and now trades in the 113.80s. That translates into modest on-the-week gains of about 0.4%, with the price action for now being capped by the 21DMA (currently at 113.875). Last week’s near-114.00 highs are also providing some resistance, though it looks increasingly likely that USD/JPY is going to break out to the upside.

The pair appears to have formed an ascending triangle over the last few sessions, which technicians will note is typically indicative of a bullish breakout. A more hawkish than expected Fed could be just the catalyst that USD/JPY would need to break higher, so long as it spurred upside in long-term US government bond yields, to which the pair is most sensitive. From a technical perspective, a bullish breakout could open the door for USD/JPY to push on towards recent highs around 115.50.

The annual inflation rate in Canada remains at 4.7% in November. Analysts at RBC Capital Markets point out that inflation pressure continues to broaden; that combined with a stronger labour market will prompt a rate hike from the Bank of Canada during the second quarter of next year.

Key Quotes:

“Canada’s headline inflation rate was unchanged in November, at 4.7% year over year. Energy price growth inched higher again, backed by still elevated gasoline prices, which were 43.6% above levels in November 2020 and accounted for just under a quarter of the headline inflation rate. Growth in food prices also strengthened, to 4.4% or the highest since 2015.”

“Excluding food and energy products, CPI ticked slightly lower to 3.1% from year ago in November, or 2.7% on an annualized seasonally adjusted basis relative to the pre-shock February 2020 level.”

“Further disruptions to supply chains and energy markets from Omicron and the BC flood later in November are expected to add to price uncertainties in the near-term. But very firm demand growth means inflation rates will likely remain above pre-pandemic levels over the next year. And with labour markets also growing increasingly tight, we expect the bank of Canada to start hiking rates around the second quarter of 2022.”

Data released on Wednesday showed retail sales rose in the US below expectations in November, at the slowest pace in four months. Analysts at Wells Fargo point out that despite those numbers, holiday sales are still on track to post a record for the year, but with spending slowing in the final months, “it is not the finish retailers were hoping for.”

Key Quotes:

“Retail sales rose just 0.3% in November, which was less than half the consensus estimate that was calling for a 0.8% gain. The main story in the November is that higher prices for non-discretionary items, like food and gas, are forcing hard choices for consumers in other areas this holiday season. There is also reason to believe holiday sales were pulled forward to get ahead of supply chain snarls that left retailers worried and consumers frantic to secure their gifts in time for the holidays.”

“We would not rule out some giveback in December. With well-publicized supply-chain issues and aggressive messaging from retailers, shoppers have largely heeded the advice to shop early. The risk is that all that early shopping pulled forward trips that in other years would have happened in December, setting us up for a decline. It is not just pulled-forward demand either. If stores are out of key merchandise, holiday gift cards might take the place of gifts; since those get counted for retail sales when they are redeemed, that could push some spending into January.”

“The one thing everyone is getting this holiday season is inflation, our measure of real holiday sales showed a decline of 0.5% in November—which puts real holiday sales on track to rise roughly 10%. However once things shake out, the nominal year-over-year gain will likely be four to five percentage points higher thanks to inflation.”

The UK reported a record number of Covid-19 infections on Wednesday of 78.61K, a near 20K jump from Tuesday's 59.6K number. That was the highest daily count since the start of the pandemic, although it is worth noting that tests are more widespread and accessible in the UK than at any point in the pandemic thus far, and are much more accessible than most other developed countries.

There is particular attention on UK Covid-19 infection rates at the moment with the government warning that Omicron is spreading at a rapid pace in the country and in wake of the recent imposition of fresh Covid-19 curbs. Health officials have warned that Omicron's doubling time could now be under two days and there is speculation that the UK government might toughen restrictions even further in the weeks ahead in an attempt to prevent hospitals from being overwhelmed in the new year.

Infection rates will continue to surge, with the Omicron variant as much as four times more transmissible than the delta variant according to a study released by Japanese scientists last week. The key thing to watch will be the degree to which a surge in infections translates into a surge in hospitalisations (and sadly also mortality).

Market Reaction

Sterling did not react to the latest news, though will remain twitchy on Omicron headlines in the days/weeks ahead.

- Pound erases UK CPI gains, turns negative versus US dollar.

- GBP/USD key levels seen at 1.3300 and 1.3180.

- Traders await the FOMC statement, its projections and Powell.

The US Dollar gained momentum during the American session amid a decline in equity prices and also ahead of the FOMC statement. GBP/USD dropped from weekly highs near 1.3285 to 1.3205, turning negative for the day.

The pound lost momentum and erased the gains that followed the release of higher-than-expected UK inflation data on European hours. Now, market participants have their attention set on the Fed.

The GBP/USD is moving sideways facing a strong resistance below 1.3300 while on the downside support is seen around 1.3180. Those two levels will likely be challenged during the next sessions.

Fed today, BoE tomorrow

The Federal Reserve will announce its decision at 19:00 GMT. The central bank will issue the statement and economic projections. Thirty minutes later Jerome Powell will deliver a press conference.

What the FOMC decides, its projections and Powell’s comments will likely rock markets, including the US dollar.

On Thursday, market participants will learn about the decision of the Bank of England. Market consensus sees no change in rates but some speculate with a rate hike amid rising inflation and an improvement in the labor market in the UK, offset by the surge of COVID cases. “We expect the BoE to leave policy on hold, with a message of COVID uncertainty and data dependency providing few clues to a February hike either, though they likely keep the option on the table. QE will conclude as expected this month”, said analysts at TD Securities.

Technical levels

- Spot silver prices are on the back foot in advance of Wednesday’s key Fed meeting, recently dropping into the $21.50s.

- XAG/USD is at risk of further downside should the Fed surprise hawkishly, with a move towards $21.00 on the cards.

Spot silver prices (XAG/USD) have continued their downwards trajectory on Wednesday in the run up to Wednesday’s pivotal Fed policy announcement, with spot prices recently dropping into the $21.50s for the first time since the end of September. Broader market sentiment is subdued pre-Fed, as is typically the case, with a softer than expected US November Retail Sales report versus a stronger than expected December NY Fed survey having been ignored. But this hasn’t been enough to stop the rot in silver markets, with spot prices now down a further 1.7% on the day despite a flat US dollar and US yields curve. That takes the precious metal’s weekly losses to about 2.7%.

As such, silver bears will be eyeing the September lows in the $21.40s and XAG/USD may well get there in advance of 1900GMT (when the Fed’s rate decision and statement is announced). If the Fed is as hawkish as many strategists suspect they will be in doubling the pace of the QE taper and indicating multiple hikes in 2022, this could further add to silver’s woes. A break below $21.40 brings in sight the next key support in the form of the June highs around $21.15. If that level goes, it’s a clean run lower to the early September high just above $19.50.

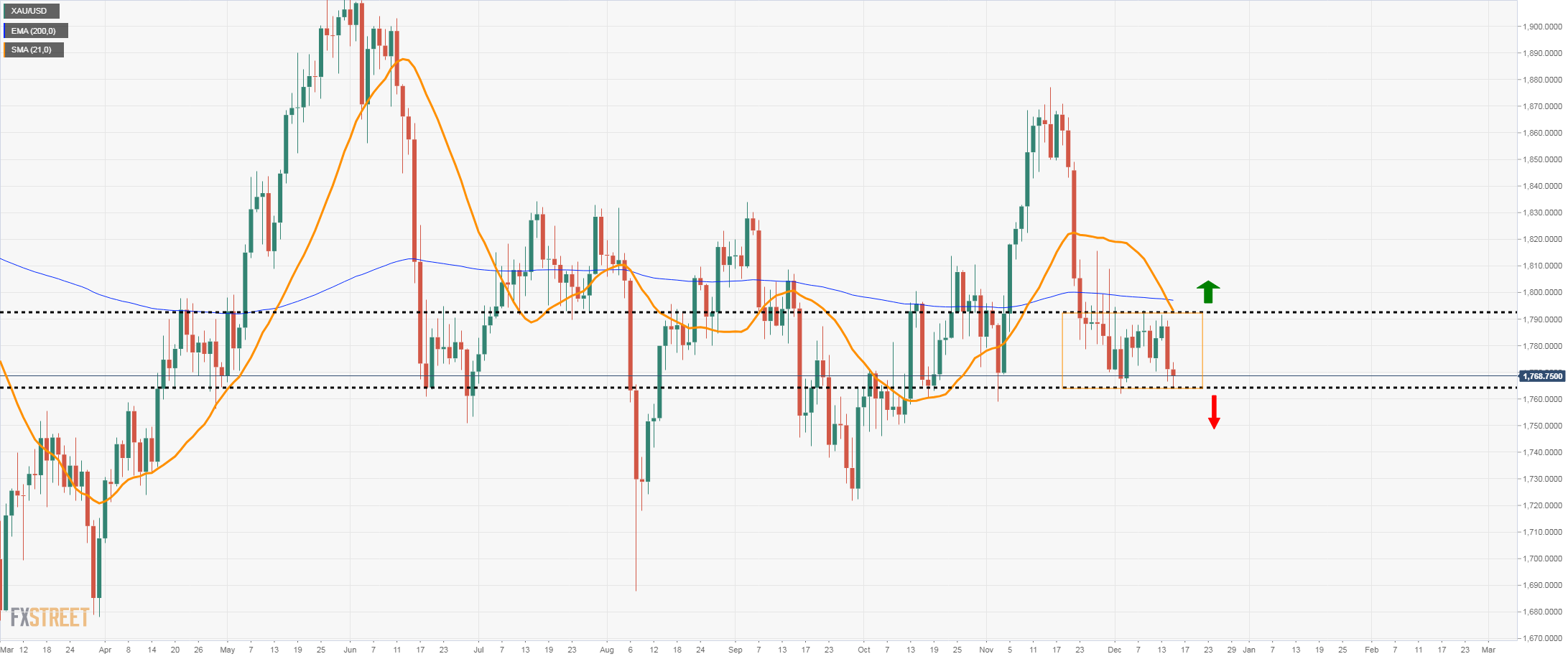

- Gold is moving sideways with a bearish bias ahead of the FOMC.

- Volatility likely to jump around Fed’s statement.

- XAU/USD looking at December lows, all can change dramatically.

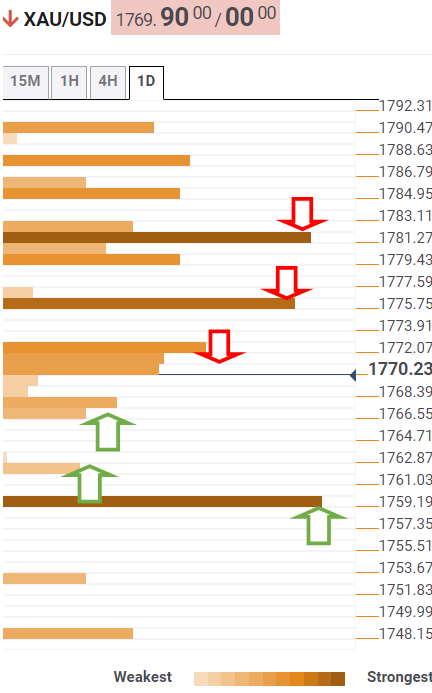

Gold is falling on Wednesday, before the decision of the Federal Reserve. Recently it bottomed at $1763m the lowest since December 3 and then rebounded toward $1770. Price is moving sideways with a bearish bias.

The US November retail sales report came in below expectations and boosted gold for a few minutes. After reaching $1774, it turned to the downside amid a stronger US dollar during the American session.

The risk aversion environment kept US yields under control and offered some support to gold. What the Fed decides and what Powell says will have a large impact on the Treasury market, hence in gold prices. The statement will be released at 19:00 GMT, including the projections of FOMC members.

Levels to look for after Fed

Gold had been moving sideways since December and is has established to critical levels. On the upside is the area around $1790/95, a horizontal line, and also near the 20 and 200-day moving averages. A firm break above and a confirmation should clear the way to more gains above $1800.

On the flip side, $1765 is a key level that should lead to more losses if broken on a sustained basis, targeting $1745/50. Below the next support stands at $1730.

Volatility and exaggerated moves are likely during the FOMC announcement and later during Powell’s press conference.

Technical levels

There were big moves in oil prices in 2021 as economic reopening and geopolitical pressures played out. Oversupply points to lower oil prices in 2022, with West Texas Intermediate (WTI) potentially trading below the $60 level, strategists at Deutsche Bank report.

Likely continued strong demand for oil

“We forecast WTI falling and potentially breaking $60/barrel next year on the back of a material rise in oil surpluses.”

“In supply, OPEC is set to add at least 2.1 mmb/d, slightly more than non-OPEC supply addition of +1.9 mmb/d dominated by the US (+900 kb/d) and the Former Soviet Union (+400 kb/d), all in Q4-22 over Q4-21 terms.”

“On the demand side, we forecast healthy growth (+3.4 mmb/d YoY) with oil demand back to pre-Covid 2019 levels by the end of next year, but we see downside risks, especially to jet fuel demand, on the back of new variant risks.”

“With OPEC adhering to its scheduled January supply increase, the risks to the $60/bbl WTI and $64/bbl Brent forecasts (Q2 to Q4-22) are skewed to the downside.”

Gold is historically problematic in periods of rising interest rates and had a rather mixed 2021. Strategists at Deutsche Bank expect the yellow metal to continue struggling throughout the next year and forecast XAU/USD at $1,750 by end-2022.

Gold still not responding to continuing inflation fears

“It was notable how higher inflation did not translate into higher gold prices, with gold perhaps no longer the obvious safe-haven for some investors.”

“Despite still high inflation, gold seems unlikely to have a good 2022: we forecast a price of $1,750/oz at end-December 2022.”

See – Gold Price Forecast: XAU/USD at risk of tanking to $1,561 on a breach of $1,691/77 – Credit Suisse

- The Turkish lira extends its slide as analysts prepare for another 100 bps rate cut on Thursday.

- CBRT’s current interest rate lies at 14%, as Turkey’s inflation rises by 20%.

- Turkey’s lira value has dropped almost half of its value since the beginning of 2021.

At the time of writing, as Wall Street opens, the USD/TRY prints a new year-to-date high at 14.8157. The market sentiment is mixed ahead of the Federal Reserve monetary policy decision. That, alongside unorthodox economic policies of Turkish President Recep Tayyip Erdoğan, keeps the lira at the risk of continuing its free fall amid the expectations of a 100 basis point rate cut by the CBRT that would leave rates at 13.00% by the end of the year.

Since the last month, the Turkish lira shed its value almost 30% -- half of its value in a year-- as policymakers linked to President Erdogan keeps slashing borrowing costs, despite soaring inflation levels, at 20%.