- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 18-11-2022

- Federal Reserve officials’ hawkish commentary bolstered the US Dollar, except against the New Zealand Dollar.

- US Existing Home Sales tanked, flashing an upcoming recession in the United States.

- Reserve Bank of New Zealand’s upcoming monetary policy meeting would determine NZDUSD direction

The New Zealand Dollar (NZD) regained composure and finished the week up by 0.50% against the US Dollar (USD), albeit hawkish commentary by Federal Reserve (Fed) officials bolstered the US Dollar (USD). Additionally, an upbeat market sentiment strengthened risk-perceived assets in the FX markets, the New Zealand Dollar. Hence, the NZDUSD is trading at 0.6150, above its opening price by 0.39%.

Federal Reserve officials warranted that further rate hikes are coming

During the week, Federal Reserve officials remained hawkish after the Consumer Price Index (CPI) and the Producer Price Index (PPI) reports for the United States (US) were softer than expected, meaning that inflation is cooling down. That said, US equities rallied, while US Treasury bond yields and the US Dollar plunged due to growing speculations that the Fed could pivot sooner than expected.

Nevertheless, policymakers led by the St. Louis Fed President James Bullard, who said that interest rates are not “sufficiently restrictive” and added that would be if the Federal Funds rate (FFR) hit the 5% to 5.25% area. Echoing his comments was Minnesota’s Fed President Neil Kashkari, stating that one-month data can’t over-persuade the Fed, as it needs to keep at it until they’re sure that inflation has stopped climbing. On Friday, the Boston Fed President Susan Collins noted that the Federal Reserve needs to continue hiking rates, adding that rates will need to keep high for some time.

US Existing Home Sales plummet, weakens the US Dollar

Data-wise, US Existing Home Sales for October plunged a staggering 5.9%, below a 4.17% increase estimated by analysts. Home sales have fallen since February of 2022 due to the Federal Reserve’s tightening monetary conditions as they try to curb stubbornly high inflation, which peaked around 9%. Following the release, the NZDUSD edged slightly up, though it retraced below 0.6180, to finish the day around current exchange rates.

New Zealand Dollar traders focused on RBNZ’s policy decision

An absent New Zealand’s economic calendar left the NZD adrift to USD dynamics and market sentiment. During the Asian session, China’s Covid-19 outbreak and geopolitical risk put a lid on the earlier NZDUSD rally, which could not decisively crack the 0.6200 psychological level. The week ahead, the New Zealand docket will feature the Balance of Trade for October, Retail Sales, and the Reserve Bank of New Zealand (RBNZ) monetary policy meeting, with analysts expecting a 75 bps rate hike.

On the US front, the economic calendar for the United States will feature the Chicago Fed National Activity Index, Durable Good Orders, housing data, and Initial Jobless Claims. Also, further Federal Reserve officials would cross newswires.

NZDUSD Price Analysis: Technical outlook

The New Zealand Dollar (NZD) ended the week almost flat after hitting a weekly high of 0.6203. Failure to crack the latter keeps the NZD exposed to selling pressure. Notably, the 0.6200 figure was tested three times, and with the Relative Strength Index (RSI) exiting overbought conditions, aiming slightly lower, a fall toward the 100-day Exponential Moving Average (EMA) at 0.6015 is on the cards.

NZDUSD key support levels lie at 0.6100, followed by the downslope top-trendline of a descending channel around 0.6065, followed by the 100-day EMA at 0.6015. On the flip side, the NZDUSD’s first resistance would be the 0.6200 mark, followed by the August 25 daily high at 0.6251, ahead of the 200-day EMA at 0.6308.

- USDJPY prepares to finish the week with gains of more than 1%.

- Even though the USDJPY plunged towards 137.50s, the bias remains upward.

- USDJPY Price Analysis: Break below 137.50, a fall to the 200-DMA is on the cards; otherwise, the 100-DMA is eyed.

The USDJPY is set to finish the week almost flat, dropping in the last week from around 147.00 to 138.46, after the release of a soft inflation report in the United States (US), sparking speculations that the Federal Reserve (Fed) might stop from rising rates. However, in the present week, the USDJPY is staging a recovery. At the time of writing, the USDJPY is trading at 140.37.

USDJPY Price Analysis: Technical outlook

Albeit tumbling in the last week close to 5%, the USDJPY remains upward biased. At the time of typing, the USDJPY sits comfortably above 140.00. Nevertheless, the USDJPY could not crack the 100-day Exponential Moving Average (EMA) at 140.95, which could have exacerbated a rally toward the November 11 daily high at 142.48. It should be noted that the Relative Strength Index (RSI) exited from oversold territory, suggesting that USDJPY buyers are outpacing sellers.

On the downside, the USDJPY key support levels are the September 22 swing low at 140.34, followed by this week’s low, November 15 at 137.65. Upwards, the USDJPY key resistance levels lie at the 100-day EMA at 140.95, followed by 142.48, followed by the 50-day EMA at 145.08.

,

USDJPY Key Technical Levels

- The USDCHF is set to end the week with gains of more than 1%, but the bias is bearish.

- Short term, the USDCHF bottomed around 0.9350-0.9450, with buyers eyeing 0.9600.

The USDCHF advances for the fifth straight day after tumbling in the last week by more than 5% after a softer-than-expected US inflation report. However, hawkish commentary by Federal Reserve (Fed) officials throughout the week bolstered the US Dollar (USD) to the detriment of the Swiss Franc (CHF). At the time of writing, the USDCHF is trading at 0.9536, above its opening price by 0.26%.

USDCHF Price Analysis: Technical outlook

The USDCHF daily chart portrays the pair as downward biased. Based on last week’s price action, the USDCHF plunged below the 50, 100, and 200-day Exponential Moving Averages (EMAs), while the Relative Strength Index (RSI) pushed all the way down toward oversold conditions.

Once the USDCHF reached a fresh multi-month low of around 0.9356, price action formed a candlestick hammer, and since then, the major rallied towards the current exchange rate. Nevertheless, the bias remains intact, as the RSI exited from oversold conditions but remains at bearish territory.

Short term, the USDCHF 4-hour chart displays the major bottom around the 0.9350-0.9480 area. On Thursday, the USDCHF broke upwards, reaching a weekly high of 0.9557, but the major is consolidating around the 0.9500-0.9559 area. If the USDCHF clears the top, the next resistance would be 0.9600, followed by the November 11 daily high at 0.9681, ahead of 0.9700.

USDCHF Key support levels lie at the psychological 0.9500 figure. A breach of the latter would expose the November 17 daily low at 0.9432, followed by the November monthly low around 0.9356.

USDCHF Key Technical Levels

- The Australian Dollar would finish the week with losses of 0.50%.

- Existing Home Sales in the United States tanked sharply, though they were ignored as the US Dollar remained strong.

- AUDUSD Price Analysis: The inverted head-and-shoulders is still in play, though the major is undergoing a correction.

The Australian Dollar (AUD) prepares to finish the week negative, dropping against the US Dollar (USD), as sentiment shifted sour, amidst the lack of a catalyst, except for Federal Reserve policymakers continuing its hawkish campaign. Also, US Treasury yields moderately advanced, underpinning the USD. At the time of writing, the AUDUSD is trading at 0.6675.

US housing data feel the pain of higher interest rates

The United States economic calendar revealed Existing Home Sales for October, which plummeted 5.9%, below a 4.17% expansion expected by economists. It should be said that home sales have fallen since February 2022, as the Fed continued its tightening cycle as they fight elevated inflation levels. In the meantime, a slew of Federal Reserve officials reiterated that inflation is high, that October inflation figures, although encouraging it’s only one positive reading in eleven months and added that they would continue to hike rates.

Despite Fed officials’ efforts to push back against a Fed pivot, it required that St. Louis Fed President James Bullard said that rates are not “sufficiently restrictive” and added that rates would need to go as high as the 5% to 5.25% range. US equities tumbled on those remarks, later echoed by Minnesota’s Fed President Neil Kashkari, commenting that one-month data can’t over-persuade the Fed, as it needs to keep at it until they are sure that inflation has stopped climbing.

During the Asian session, the Australian Dollar took the backseat as the US Dollar gathered strength. The lack of economic data in Australia’s calendar kept traders focused on the last Australian jobs report, which surprised market analysts. However, the Reserve Bank of Australia’s (RBA) expectations for further tightening were unchanged. As of today, money market futures have priced in an 88% chance for a 25 bps hike on the December 5 meeting.

AUDUSD Price Analysis: Technical outlook

After hitting a weekly high above 0.6800, the AUDUSD erased those gains, extending its losses beneath the 100-day Exponential Moving Average (EMA) at 0.6699. Albeit the inverted head-and-shoulders chart pattern formed in the AUDUSD daily chart is still in play, the sudden reversal could be seen as AUD buyers booking profits and taking a breather before assaulting the 0.6800 psychological level.

Hence, the AUDUSD might pull back to the 50% to 61.8% Fibonacci retracement levels around the 0.6545-0.6594 area before rallying towards 0.6800 and beyond to the head-and-shoulders target around 0.6870.

Analysts at MUFG Bank, point out that external drivers are more supportive of the New Zealand Dollar and the Swedish Krona ahead of the Reserve Bank of New Zealand (RBNZ) and Riksbank meetings.

Key Quotes:

“NZD has benefitted from recent easing of global hard landing fears & relatively hawkish repricing of RBNZ rate hike expectations.”

“The NZD and SEK should both continue to benefit from the recent improvement in global investor risk sentiment. The SEK would benefit more if the Riksbank signalled as well that rates will have to peak much higher than 2.50%.”

“The RBNZ (Wed) and Riksbank (Thurs) will be the latest G10 central banks to update their monetary policies in the week ahead. The RBNZ are expected to deliver a sixth consecutive 50bps rate hike lifting the key policy rate up to 4.00%. Market participants are pricing in around a 40% probability that the RBNZ could even deliver a larger 75bps hike following much stronger inflation and wage growth in Q3. The RBNZ’s next policy meeting is not until 22nd February which could encourage the RBNZ to deliver a larger, more-front loaded hike in the week ahead. The Riksbank has been lagging other G10 central banks in tightening policy and is now playing catch up after delivering a 100bp hike in September. The Riksbank is expected to deliver a 75bps hike on Thursday while another 100bps hike can’t be ruled out.”

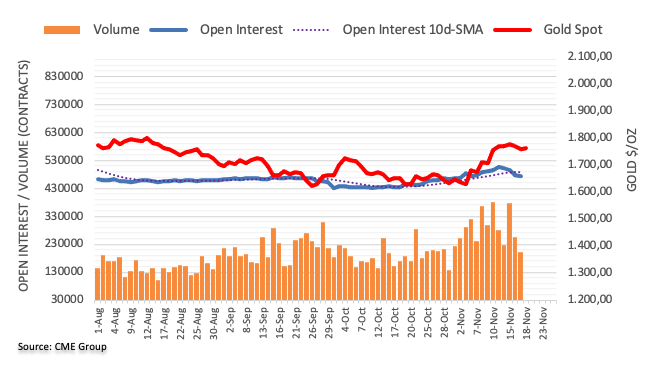

- Gold Price is set to finish the week with losses of almost 1%.

- US Existing Home Sales plunged severely as the Federal Reserve continued to tighten monetary conditions.

- XAUUSD consolidates around $1750, awaiting a fresh catalyst.

Gold Price tumbled across the board, courtesy of a risk-off impulse, as European equities turned negatively, while Wall Street is mixed. Additional Federal Reserve (Fed) officials are crossing wires, emphasizing the need for higher interest rates after two soft October inflation reports. At the time of writing, XAUUSD is trading at $1755, below its opening price by 0.24%.

US Existing Home Sales plummeted due to Federal Reserve’s monetary policy

The US National Association of Realtors reported that Existing Home Sales for October plunged a staggering 5.9%, below a 4.17% increase estimated by analysts. Home sales have fallen since February of 2022 due to the Federal Reserve’s tightening monetary conditions as they try to curb stubbornly high inflation, which peaked around 9%. However, market sentiment remains positive throughout the session on the back of soft CPI, and PPI October reports.

In the meantime, Fed policymakers reiterated their commitment to taming inflation down. St. Louis Fed President James Bullard said that interest rates are not “sufficiently restrictive” and added that would be if the Federal Funds rate (FFR) hit the 5% to 5.25% area. On Thursday, Minnesota’s Fed President Neil Kashkari commented that one-month data can’t over-persuade the Fed, as it needs to keep at it until they’re sure that inflation has stopped climbing.

Regarding price action, the US Dollar Index, a gauge of the buck’s value against a basket of six currencies, turned red, down by a minuscule 0.07%, at 106.621, capping XAUUSD fall, which threatened to extend below $1750. US Treasury bond yields, namely the 10-year benchmark note rate, rise two bps, yielding 3.795%, putting a lid on Gold Price.

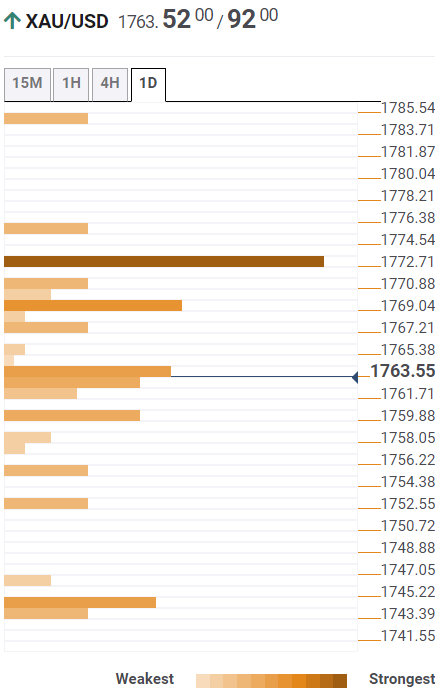

Gold (XAUUSD) Price Analysis: Technical outlook

The XAUUSD is extending its losses to three consecutive days, turning negative in the week, losing 0.85%. After climbing to a fresh three-month high at $1786.53, the non-yielding metal is retracing, set to finish the week around the $1750 area. Even though it’s an important milestone, XAUUSD could not capitalize on US Dollar (USD) weakness. However, the Relative Strength Index (RSI) slope is turning south, suggesting that consolidation in the mid $1700-$1800 is likely, as buyers regain momentum, to challenge the $1800 psychological level.

XAUUSD’s key resistance levels lie at $1786, followed by $1800, and the 200-day Exponential Moving Average (EMA) at $1802. On the other hand, XAUUSD support levels, the August 22 swing low at $1727.90, followed by the $1700 figure.

- US Dollar spikes and retreats during the American session, moving without clear direction.

- EURUSD up for the week, far from the top.

- The 200-day SMA at 1.0415 holds the key to more gains.

The EURUSD fell during the American session to 1.0325 and then rose quickly back to the 1.0350 area, on a calm session across FX markets. The greenback spiked higher amid a deterioration in market sentiment that did not last much.

A quiet Friday

The US Dollar gained momentum during the American session as US stocks trimmed losses and crude oil price tumbled. FX volatility remained limited with prices not far from the previous daily close.

Economic data released on Friday showed Home Sales in the US dropped for the ninth consecutive month in October. The annual rate fell from 4.71M to 4.43M, above the 4.38M of market consensus. The numbers did not impact markets. The DXY is posting modest weekly gains after more signs of a slowdown in inflation and better-than-expected retail sales numbers.

Next week key events include the FOMC minutes on Tuesday. US markets will not open on Thursday due to Thanksgiving Day. November Flash PMIs are due on Wednesday. The European Central Bank will release the minutes of the latest meeting on Thursday.

A not so positive week for EUR

The EURUSD is about to end the week with small gains and far from the top. It peaked at 1.0480 on Tuesday, the highest level since July 1 and the pulled back sharply. Euro’s rally was capped by the 200-day Simple Moving Average (currently at 1.0415) and pulled back to as low as 1.0303.

“The EURUSD pair has lost its long-term bullish strength, but nothing is said and done yet. The weekly chart shows that EURUSD held at the upper end of the previous week’s range while posting a higher high. The 20 Simple Moving Average (SMA) remains flat at around 1.0030, barely above a critical Fibonacci level, the 61.8% retracement of the November rally at around parity. The 100 SMA crosses below the 200 SMA, both gaining bearish traction far above the current level, not a good sign for Euro bulls”, says Valeria Bednarik, Chief Analysts in the latest report.

Technical levels

Gold rallied amid a weaker USD. Nonetheless, strategists at ANZ Bank expect the yellow metal to remain under pressure until the first quarter of next year.

Rising real rates in the US continue to be a key headwind

“Gold is getting renewed support from the weakening US Dollar. However, rising real rates in the US continue to be a key headwind for non-yielding Gold.”

“Inflation is still well above the Fed’s target range of 2%, and the USD’s direction could reverse on a hawkish comment by the central bank.

“We expect Gold prices to remain under pressure until Q1 2023.”

Economists at Credit Suisse no longer see a compelling reason for USDCAD to reach their 1.4100 target in Q4: they now lower it to 1.3500 and reset their target range from 1.3250-1.4300 to 1.3000-1.3650 for the remainder of the quarter.

CAD is vulnerable to deteriorating global growth outlook

“We now see fewer compelling reasons for USDCAD to reach our 1.4100 target in Q4 compared to at the time of our Q4 outlook, other than via a broad USD rally that takes all USD-crosses higher. The risks of disappointing hopeful expectations, which underpins our still bearish view on AUD, are simply less asymmetric in CAD.”

“We lower our end-Q4 USDCAD target from 1.4100 to 1.3500 and reset our target range for the pair from 1.3250-1.4300 to 1.3000-1.3650 for the remainder of the quarter. This leaves us with a minor pro-USD bias, as we continue to see CAD as vulnerable to deteriorating global growth outlook.”

Gold price struggled to build on the previous week's impressive gains. XAUUSD needs to clear $1,780 to stretch higher, FXStreet’s Eren Sengezer reports.

200-day SMA at $1,800 aligns as significant resistance

“The Relative Strength Index (RSI) indicator on the daily chart retreated modestly after having climbed above 70 earlier in the week, suggesting that the latest decline is a technical correction rather than the beginning of a bearish trend.”

“On the upside, $1,780 (Fibonacci 38.2% retracement of the March-November downtrend) aligns as initial resistance. With a daily close above that level, XAUUSD is likely to face strong resistance at $1,800 (200-day SMA) before targeting $1,830 (Fibonacci 50% retracement).”

“Interim support seems to have formed at $1,750. In case XAUUSD falls below that level and starts using that level as resistance, it could extend its downward correction toward $1,720 (100-day SMA, Fibonacci 23.6% retracement) and $1,700 (psychological level, 20-day SMA).”

March 2023 will be especially volatile for USDJPY. Economists at ING believe that the pair could be trading at 130 by the end of next year.

1Q23 will be a crucial quarter

“The default view is that the perma-dovish BoJ Governor, Haruhiko Kuroda, will not be moved. However, the end of Governor Kuroda’s term on 8 April 2023 will no doubt lead to frenzied speculation on his replacement and whether a less dovish candidate emerges”

“The first quarter of 2023 will see huge focus on the Japanese wage round, where a rise in wages is a prerequisite for the BoJ to tighten policy. This period will also see the Fed release its dot plots (22 March), which may be the first real chance for the Fed to acknowledge a turn in the inflation profile. As such, this period (March/April) could see a big reversal lower in USDJPY.”

“Unless we end up with 6%+ policy rates in the US next year, we would expect USDJPY to be ending 2023 nearer 130.”

- Canadian dollar among worst performers of the American session.

- USDCAD with a bullish tone, about to break 1.3400.

- Crude Oil tumbles by more than 4%.

The USDCAD is rising sharply during Friday’s American session. It recently hit a fresh daily high at 1.3398 and then pulled back modestly. It is looking at the 1.3400 area, with a bullish tone as Crude Oil tumbles and the US Dollar recovers.

Context favors the US Dollar

Data released in Canada showed the Industrial Product Price Index rose by 2.4% in October above the 0.4% expected. The Raw Material Price Index increased 1.3%, against expectations of a flat reading. The numbers, however, did not help the Canadian Dollar.

Equity prices in Wall Street are trimming gains as Crude Oil prices tumble by more than 4%. At the same time, the US Dollar is strengthening as market sentiment deteriorates and as US yields remain in positive territory.

The context is boosting USDCAD that is testing the 1.3400 area that capped the upside on Thursday. A break higher could open the doors to the next resistance level seen at 1.3460. If the Dollar fails here, a slide back to 1.3300 over the next sessions seems likely. Interim resistance is located at 1.3355.

The USDCAD is about to end the week with a gain of more than 100 pips, ending a five-week negative streak. Prices rebounded from the lowest level in months and also from the 20-week Simple Moving Average. A weekly close below 1.3250 should point to more declines.

Technical levels

- The GBPUSD clings to gains of 0.24% as the North American session begins.

- Federal Reserve hawkish commentary continued, though market sentiment is upbeat.

- Retail Sales in the United Kingdom climbed above estimates, a tailwind for the GBP.

- Traders eye US Existing Home Sales and Fed speak.

The British Pound (GBP) edges north of 1.1880 amidst a risk-on impulse, as shown by equity futures in the United States climbing with no fundamental reason after a slew of Federal Reserve (Fed) officials signaled rates would continue to rise. At the time of writing, the GBPUSD is trading at 1.1882, above its opening price by 0.35%, capitalizing on broad US Dollar (USD) weakness.

Sentiment turned positive as North American traders waited for US economic data on Existing Home Sales. Given that the last two inflation reports in the United States, namely the Consumer Price Index (CPI) and the Producer Price Index (PPI) propelled an improvement in market sentiment, Fed policymakers pushed against a possible Fed pivot. St. Louis Fed President James Bullard said that interest rates are not “sufficiently restrictive” and added that would be if the Federal Funds rate (FFR) hit the 5% to 5.25% area.

Echoing his comments, Minnesota’s Fed President Neil Kashkari says that one-month data can’t over-persuade the Fed, as it needs to keep at it until they’re sure that inflation has stopped climbing. On Friday, the Boston Fed President Susan Collins noted that the Federal Reserve needs to continue hiking rates, adding that rates will need to keep high for some time.

Earlier in the European session, the United Kingdom (UK) calendar featured Retail Sales, which surprisingly were above forecasts, even though the Bank of England (BoE) acknowledged the UK economy entered a recession. Retail Sales for October rose by 0.6% MoM against 0.3% estimates, while excluding volatile items, grew by 0.3% MoM, less than 0.6% forecasts. On an annual pace, both readings contracted less than estimates but remained negative.

Meanwhile, traders continue to asses a 4-decade high inflation level reached in the UK. The Consumer Price Index (CPI) expanded by 11.1% YoY in October, and above the Bank of England projections that inflation would peak at around 10.9%. As shown by STIRs, money market futures estimates an 82% chance that the Bank of England would hike 50 bps to 3..50%.

Furthermore, the UK Finance Minister Jeremy Hunt announced a £55 billion budget, plagued by tax rises and spending cuts. The budget is split between £30 billion in spending cuts and £25 billion in tax rises. However, most spending cuts are penciled in after the next election, due on January 2025.

GBPUSD Key Technical Levels

USDBRL’s bounce has stalled after retesting July peak of 5.51. Analysts at Société Générale note that the pair needs to break beyond one of the 5.01-5.62/64 bands to affirm a trending move.

Initial pullback expected towards 5.24/5.20

“An initial pullback is expected towards the bullish gap of last week near 5.24/5.20.”

“It is worth noting that the pair has been witnessing crisscross moves around important Moving Averages which denotes a clear direction is lacking; the price action could remain broadly within limits of 5.01 and multi-year channel at 5.62/5.64. A break beyond one of these bands is essential to affirm a trending move.”

- The index trades within a tight range near 106.80.

- US yields reverse course and now slip back to the red territory.

- CB Leading Index, housing data next of note in the NA session.

The greenback exchanges gains with losses in the 106.70 region when gauged by the USD Index (DXY) amidst the generalized lack of direction in the global markets on Friday.

USD Index now focuses on data

Despite the current vacillating price action, the index remains en route to close the week with small gains following the sharp retracement seen in the previous one

Most of the change in the direction of the dollar in the last couple of sessions comes in response to hawkish comments from St. Louis Fed J.Bullard on Thursday, which dialed down the potential discussion of a pivot in the Fed’s policy at the December event.

In the US calendar, the CB’s Leading Index comes next seconded by Existing Home Sales and the speech by Boston Fed S.Collins.

What to look for around USD

Price action around the dollar remains mixed and relegates the index to keep navigating the area around 106.50, all amidst a broad-based consolidative theme.

In the meantime, the greenback is expected to remain under the microscope amidst persistent investors’ repricing of a probable slower pace of the Fed’s rate path in the upcoming months.

Key events in the US this week: CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: US midterm elections. Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.11% at 106.81 and is expected to meet the next up barrier at 109.15 (100-day SMA) seconded by 110.76 (55-day SMA) and then 113.14 (monthly high November 3). On the other direction, the breakdown of 105.34 (monthly low November 15) would open the door to 105.05 (200-day SMA) and finally 104.63 (monthly low August 10).

In early November, USDMXN slipped below the 19.50 mark. However, economists at Commerzbank believe that risks are now skewed to the upside.

Banxico and the Fed

“The market is likely to keep an eye on whether and if so to what extent Banxico changes the speed of monetary policy tightening and whether it is therefore able to decouple from the Fed.”

“In view of key rate levels already reached on the one hand and the strong Peso on the other hand we consider upside risks to dominate in USDMXN.”

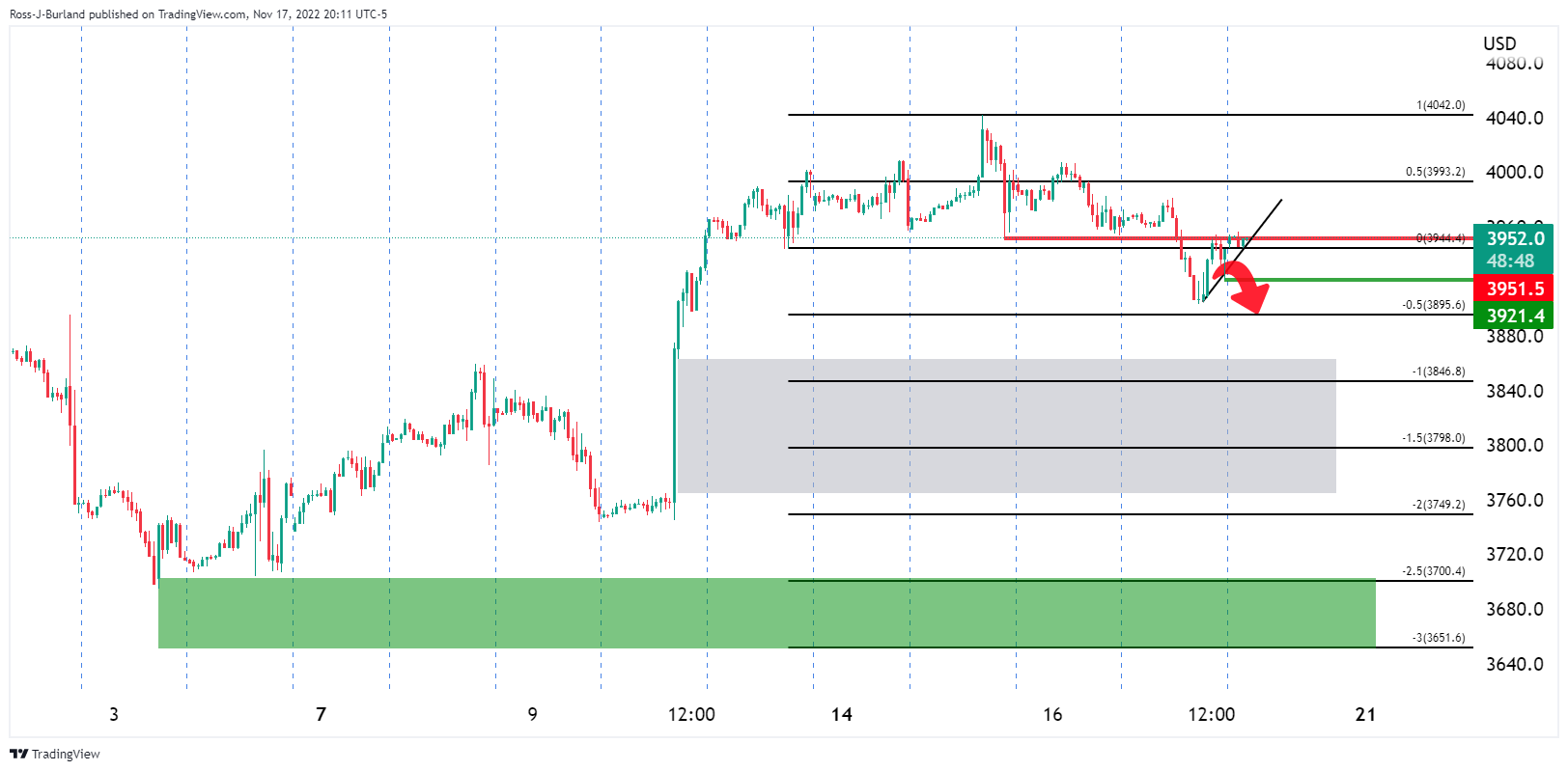

S&P 500 eventually defended the lows of June near 3630 which resulted in a phase of a rebound. Economists at Société Générale expect the index to inch toward the 200-Day Moving Average at 4070/4120.

Defending 3815 is crucial for continuation in ongoing rebound

“It is worth noting that monthly RSI has so far defended its lower end of the range since 2010.”

“Ongoing bounce could persist towards 200DMA of 4070/4120 and a weekly gap near 4218. It is worth noting that the index has consistently struggled to reclaim this Moving Average since April; these could be important resistance levels near term.”

“Defending short-term ascending channel near 3815 would be crucial for continuation in ongoing rebound. Break can result in a revisit of graphical levels near 3700/3630.”

The US Federal Reserve (Fed) has more work to do to bring inflation down, Federal Reserve Bank of Boston President Susan Collins said on Friday, as reported by Reuters.

"Restoring price stability remains the current imperative and it is clear that there is more work to do,” Collins explained. "I expect this will require additional increases in the federal funds rate, followed by a period of holding rates at a sufficiently restrictive level for some time."

Market reaction

These comments failed to trigger a noticeable market reaction and the US Dollar Index was last seen losing 0.06% on the day at 106.63.

- USDJPY remains on the defensive on Friday and is pressured by a combination of factors.

- Stronger domestic inflation figures underpin the JPY and offer some support to the pair.

- Subdued USD demand also acts as a headwind, though the downside remains cushioned.

The USDJPY pair comes under some selling pressure on Friday and reverses a part of the previous day's positive move back closer to the weekly peak. The pair remains on the defensive through the early European session and is currently trading around the 140.00 psychological mark, down less than 0.15% for the day.

The US Dollar continues with its struggle to register any meaningful recovery from the post-US CPI slump to a three-month low touched on Tuesday and acts as a headwind for the USDJPY pair. The Japanese Yen, on the other hand, is drawing some support from Friday's release of stronger domestic consumer inflation data, which showed that the core CPI accelerated to a 40-year high in October. This exerts additional downward pressure on the major, though any meaningful downside still seems elusive, at least for the time being.

The recent hawkish remarks by a slew of US central bank officials suggest that more interest rate hikes were on the way. This, in turn, pushes the US Treasury bond yields higher and should lend some support to the USD. In contrast, the Bank of Japan that the central bank will stick to its monetary easing to support the economy and achieve the 2% inflation target in a sustained, stable fashion. This marks a big divergence in the monetary policy stance adopted by the two major central banks, which could weigh on the JPY.

Apart from this, the risk-on impulse - as depicted by the upbeat mood around the equity markets - could further undermine the safe-haven JPY and offer support to the USDJPY pair. Even from a technical perspective, spot prices have been oscillating in a familiar trading range since the beginning of this week. This points to indecision over the near-term trajectory for the major. That said, repeated failures ahead of the 100-day SMA support breakpoint, around the 141.00 mark, suggest that the bearish trend might still be far from over.

Technical levels to watch

- EURUSD attempts some consolidation near 1.0400.

- Further upside targets the 200-day SMA at 1.0411.

EURUSD remains choppy and manages to pick up some pace and leave behind Thursday’s downtick.

The continuation of the recovery hinges on a breakout of the key 200-day SMA, today at 1.0411. Once cleared, the pair could then challenge the November top at 1.0481 (November 15).

North from here emerges the round level at 1.0500 prior to the weekly peak at 1.0614 (June 27).

EURUSD daily chart

Senior Economist at UOB Group Julia Goh and Economist Loke Siew Ting assess the recent BSP event.

Key Takeaways

“Bangko Sentral ng Pilipinas (BSP) raised its policy rates by 75bps today (17 Nov), as pre-announced by BSP Governor Felipe Medalla on 3 Nov. With effect from tomorrow (18 Nov), the overnight reverse repurchase (RRP) rate will be raised to 5.00%, the overnight deposit rate will be hiked to 4.50%, and the overnight lending rate will be raised to 5.50%, marking the highest level since Feb 2009.”

“The central bank stated that this outsized interest rate hike is necessary given the increased likelihood of further second-round effects, persistent inflationary pressures, and the predominance of upside risks to the inflation outlook. Recognizing the upside risks, BSP tweaked its headline inflation projections higher over the policy horizon -- 5.8% for 2022 (from 5.6% previously, UOB est: 5.5%), 4.3% for 2023 (from 4.1% previously, UOB est: 4.5%), and 3.1% for 2024 (from 3.00% previously, UOB est: 3.5%).”

“In today’s monetary policy statement, BSP also reiterated its primary mandate of keeping price and financial stability. It will continue to take all necessary actions to bring inflation back within the target band over the medium term. This indicates that BSP still stays in a rate hike mode. Moreover, we believe that the US Fed’s rate hike trajectory also matters to BSP in deciding its own monetary policy stance over the next couple of months. We reiterate our call for a 50bps hike in the RRP rate to 5.50% next month (on 15 Dec), followed by a 25bps rate increase each in Feb and Mar next year. This will bring the RRP rate to 6.00% by 1Q23 and holding at this 6.00% terminal rate thereafter until the end of 2023.”

"As the stance of monetary policy tightens further, it will become more likely that the pace of increases will slow," European Central Bank (ECB) policymaker Klaas Knot said on Friday.

"I expect us to reach broadly neutral territory at next month’s policy meeting," Knot added and argued that it would not be consistent to keep a large balance sheet to compress the term premium while tightening policy rates above neutral.

Market reaction

EURUSD edged slightly higher after these comments and was last seen rising 0.2% on the day at 1.0380.

Gold seems poised to end in the red for the first time in three weeks. Strategists at TD Securities expect another leg of short covering in the yellow metal.

Next major buying program rests just north of $1,815

“Another leg of short covering in gold markets is expected, with current prices supportive of another CTA buying program.”

“While the scale of buying flow expected at current prices is marginal, this reflects that positioning risks still remain skewed to the upside for the yellow metal with a low margin of safety before price action catalyzes subsequent buying flow from the largest money manager cohort trading gold. However, the next major buying program rests just north of the $1,815 mark.”

- Gold price fails to preserve modest intraday gains and retreats closer to the weekly low.

- More hawkish signals from Federal Reserve officials act as a headwind for the XAUUSD.

- An uptick in the US Treasury bond yields, a positive risk tone further weighs on the metal.

- Subdued US Dollar demand turns out to be the only factor offering support to Gold price.

Gold price struggles to capitalize on its modest intraday gains and retreats to the lower end of its daily range during the early North American session. Currently placed around the $1,760 level, the XAUUSD remains well within the striking distance of the weekly low and seems poised to end in the red for the first time in three weeks.

Hawkish Fed signals act as a headwind for Gold price

The recent comments by a slow of US central bank officials suggest that more interest rate hikes were on the way, which, in turn, is seen acting as a headwind for the non-yielding Gold. Most recently, St. Louis Federal Reserve President James Bullard said on Thursday that the policy is not yet in a range estimated to be sufficiently restrictive to reduce inflation. Bullard added that the benchmark rate may need to rise as high as 7% to put downward pressure on inflation.

An uptick in US Treasury bond yields further weigh on XAUUSD

Furthermore, the better-than-expected release of the Retail Sales figures from the United States cast doubts on the peak inflation narrative. This suggests that the Federal Reserve might still be far from pausing its rate-hiking cycle, which offers some support to the US Treasury bond yields. Apart from this, a goodish recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - is also weighing on the safe-haven Gold price.

Subdued US Dollar demand offers some support to Gold price

The US Dollar, meanwhile, struggles to gain any meaningful traction and oscillates in a narrow range, despite an uptick in the US bond yields. The subdued USD price action offers some support to the Dollar-denominated Gold price and should help limit the downside, at least for the time being. Hence, it will be prudent to wait for strong follow-through selling below the $1,754-$1,753 region, or the weekly low, before positioning for a deeper corrective pullback for the XAUUSD.

Gold price technical outlook

From a technical perspective, sustained weakness below the $1,754-$1,753 area will set the stage for an extension of this week's retracement from the highest level since mid-August. The subsequent selling has the potential to drag Gold price to the $1,734-$1,732 strong horizontal resistance breakpoint, now turned support. The latter should act as a pivotal point, which if broken decisively will negate any near-term positive outlook and shift the bias in favour of bearish traders.

On the flip side, the $1,767-$1,770 region now seems to act as an immediate strong barrier for Gold price. The next relevant resistance is pegged near the $1,785-$1,786 zone, or the multi-month peak. A sustained strength beyond should allow the XAUSD bulls to challenge a technically significant 200-day Simple Moving Average (SMA), currently around the $1,800 psychological mark.

Key levels to watch

- DXY keeps the choppiness well and sound so far this week.

- The loss of the 200-day SMA near 105.00 could accelerate losses.

DXY trades in an inconclusive fashion above the 106.00 mark at the end of the week.

The index appears to have moved into a consolidative phase so far this week. That said, a drop below the November low at 105.34 (November 15) could pave the way for a probable visit to the critical 200-day SMA, today at 105.05.

The loss of this important region should shift the dollar’s outlook to negative, with the immediate support at the August low at 104.63 (August 10).

DXY daily chart

European Central Bank (ECB) policymaker and Germany’s central bank head Joachim Nagel said on Friday that the ECB policy rate is still in expansionary territory and added that they have to move it into restrictive territory, as reported by Reuters.

"We must resolutely raise our key rates further and adopt a restrictive stance," Nagel said. "We cannot stop here. Further decisive steps are necessary."

Regarding the balance sheet reduction, "we should start reducing the size of our bond holdings at the beginning of next year by no longer fully reinvesting all maturing bonds," Nagel said.

Market reaction

EURUSD showed no immediate reaction to these comments and was last seen posting small daily gains at 1.0365.

The US Dollar Index stopped just short of testing the 200-Day Moving Average at 105. Rebound towards 108.30 could follow, economists at Société Générale report.

Failure to hold 200DMA at 105/104.60 would denote an extended down move

“Daily MACD is within deep negative territory denoting an overstretched move.”

“An initial bounce is not ruled out towards 108.30, the 38.2% retracement from the high achieved in November.”

“The lower band of previous consolidation at 110.00 is likely to remain an important hurdle.”

“In case the index fails to hold 200DMA at 105/104.60, this would denote an extended down move. Next potential supports would be at 2020 peak of 103 and 101.90/101.30, the 50% retracement from 2021.”

UOB Group’s Economist Enrico Tanuwidjaja comments on the latest interest rate decision by the Bank Indonesia (BI).

Key Takeaways

“Bank Indonesia (BI) delivered its third series of a 50bps rate hike in Nov MPC meeting, in line with market expectation, to 5.25%.”

“BI said that the decision is a front-loaded, preemptive, and forward-looking step to anticipate and mitigate the risk of rising inflation and anchor inflation expectations to remain within the 2-4% range in 1H23.”

“Going forward, we revised and brought forward our BI rate forecast to 5.50% (previously 5.25%) by the end of 2022 and revised higher the terminal rate to 6.00% (previously 5.75%) that is likely to occur in Feb 23. This will give a reasonably comfortable yet historically tighter spread of circa 100bps with the expected terminal rate of the Fed funds rate of 5.00% by 1Q23.”

- EURJPY reverses two daily advances in a row on Friday.

- Further upside is still expected to meet resistance around 147.00.

EURJPY gives away some ground following an earlier bullish attempt to the 145.50 region at the end of the week.

If the corrective bounce becomes more serious, then the cross should face initial resistance at the so far November high at 147.11 (November 9). The surpass of this level could open the door to a more meaningful move to the 2022 peak at 148.40 (October 21).

In the meantime, further gains look in store in the near term as long as the cross navigates above the 3-month support line near 141.20. This area of contention is also propped up by the October lows in the 141.00 region.

In the longer run, while above the key 200-day SMA at 138.40, the constructive outlook is expected to remain unchanged.

EURJPY daily chart

outlook for 2023 next week. In the opinion of strategists at Commerzbank, the Platinum price should gain some ground, as the WPIC is likely to predict a smaller supply surplus in 2023.

Tighter Platinum market will probably be predicted for 2023

“Following the expectation of a supply surplus of just shy of 1 million ounces this year, a good half of which is attributable to the substantial outflows from the Platinum ETFs, a tighter Platinum market will probably be predicted for 2023.”

“For one thing, investor interest appears to have shifted. Most financial investors – at least those with a short-term horizon – are optimistic again. Long-term investors are likely to follow suit, reducing the pressure on investment demand.”

“And for another thing, mining supply in South Africa could decrease. Against this backdrop, the Platinum price should gain ground again after having lagged somewhat behind Gold of late.”

USDJPY has experienced a deeper pullback after breaking below graphical levels of 145.00. Break of 137.80 can extend the downtrend, economists at Société Générale report.

Bounce likely but resistance at 143.50

“An initial rebound is not ruled out however 143.50 and the lower limit of previous range at 145 are likely to be short-term resistance levels.”

“Holding below 143.50, there would be a risk of one more leg of decline.”

“Violation of 137.80 can result in extension in down move towards 200-DMA near 134 and 132.50.”

At its last meeting in early November, Norges Bank surprised with a smaller rate step of only 25 bps. Chances of a 50 bps hike next month has increased, but the Norwegian Krone needs hawkish comments from the central bank to be able to strengthen, economists at Commerzbank report.

Increasing speculation that Norges Bank might implement a bigger rate hike step in December

“There seems to be increasing speculation that Norges Bank might implement a bigger rate hike step in December. However, so far, the NOK was unable to benefit from this speculation.”

“Perhaps what is required is some support from Norges Bank in the shape of hawkish comments. Until we get these, Krone is likely to struggle for now.”

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the recently published trade balance results in Malaysia for the month of October.

Key Takeaways

“Malaysia’s export growth came off for the second straight month and hit the lowest in 15 months at 15.0% y/y in Oct (Sep: +30.1%). It also undershot our estimate (+27.5%) and Bloomberg consensus (+24.7%). The same goes for import growth which decelerated to a six-month low of 29.2% (Sep: +32.8%). This pulled trade surplus down significantly to MYR18.1bn last month from a fresh record high of MYR31.8bn in Sep.”

“All but energy related products saw weaker demand during Oct, led by electrical & electronics (E&E) products, palm oil & related products, as well as manufactures of metal. Shipments to almost all trading partners also recorded slower increases, with exports to the US, EU and China logging just a single-digit rise.”

“Recent external trade growth outturns in Sep-Oct suggest that Malaysia’s merchandise trade activity has entered a soft patch in tandem with weakening global demand. Volatile commodity prices and exchange rates were also factors weighing on the trade growth momentum amid global tech down cycle. Moreover, other global leading indicators continue to point to rising recession risk going into 2023, sparked by prolonged Russia-Ukraine war, tighter global monetary and financial conditions, as well as China’s COVID-19 Zero policy. Hence, we maintain our cautious outlook on Malaysia’s exports with a marginal gain of 1.5% for 2023 versus an estimated 26.0% expansion for 2022.”

The Dollar has stabilised after the big correction. Economists at ING expect the greenback to re-appreciate into the end of the year.

Bearish sentiment cooling off

“We think this consolidation phase in the Dollar may extend for a little longer, before a re-appreciation of the greenback into the end of the year.”

“With the dovish pivot narrative softening, we expect some re-appreciation of the Dollar in the near term, but that is a trend that could only start from next week or the one after.”

“DXY may stay around 106/107 today.”

Economist at UOB Group Lee Sue Ann reviews the latest labour market report in the Australian economy.

Key Takeaways

“Australia’s labour market remains tight. The seasonally adjusted unemployment rate fell to 3.4% in Oct, from 3.5% in Sep. Seasonally adjusted employment increased by 32,000 people (0.2%) in Oct, double the expectations for a gain of 15,000. But the outlook for labour demand is weakening. Labour supply, on the other hand, is increasing on the back of the rebound in migration. These factors will likely push up the unemployment rate higher in the coming months.”

“Further, real wages (adjusted for headline CPI inflation) have actually fallen 0.8% q/q, and 3.9% y/y lower, eroding consumer spending power. Indeed, we have seen a sharp decline in consumer confidence, suggesting that households’ cost-of-living pressures are increasing. Business conditions for Australian firms are also beginning to peak as the economy slows under the weight of high inflation and rising interest rates.”

“This is why we think the Reserve Bank of Australia (RBA) will soon pause in the current rate hiking cycle. The next RBA meeting is on 6 Dec, and that will be the final meeting of 2022. We are penciling in another 25bps hike, which will take the OCR to 3.10%. Thereafter, we look for a hold.”

EURNOK’s rebound have so far stalled near graphical levels of 10.68/10.71. A move beyond here would open up projections at 10.86 and 10.97, economists at Société Générale report.

Initial support aligns at 10.25

“Daily MACD is above its trigger and has entered positive territory denoting prevalence of upward momentum.”

“A retest of 10.68/10.71 is not ruled out. If a crossover materializes, EURNOK could unfold an extended up move towards 10.86 and projections of 10.97.”

“First support is at 10.25.”

See – EURNOK: Volatility will be the name of the game next year – ING

- NZDUSD catches fresh bids on Friday amid the emergence of some USD selling.

- A modest downtick in the US bond yields, a positive risk tone weigh on the buck.

- Spot prices remain on track to register strong gains for the fifth successive week.

The NZDUSD pair regains positive traction on Friday and builds on the previous day's late recovery from the 0.6065 region, or the weekly low. The pair climbs to the 0.6175-0.6180 area during the first half of the European session and remains well within the striking distance of its highest level since August 26 touched on Tuesday.

The US Dollar struggles to gain any meaningful traction on the last day of the week and turns out to be a key factor acting as a tailwind for the NZDUSD pair. A softer tone surrounding the US Treasury bond yields keeps the USD bulls on the defensive. Apart from this, a modest recovery in the equity markets further undermines the safe-haven buck and benefits the risk-sentiment Kiwi.

That said, growing worries about economic headwinds stemming from a new COVID-19 outbreak in China and persistent geopolitical risks might keep a lid on any optimism in the markets. Furthermore, investors seem convinced that the Fed will continue to hike interest rates, although at a slower pace, to curb inflation. This should act as a tailwind for the USD and cap the NZDUSD pair.

Moving ahead, traders now look forward to the release of the US Existing Home Sales data, due later during the early North American session. This, along with the US bond yields and the broader risk sentiment, will influence the USD and provide some impetus. Nevertheless, the NZDUSD pair remains on track to end in positive territory for the fifth successive week.

Technical levels to watch

The Pound survived the Autumn Statement, but downside risks persist in GBPUSD, economists at ING report.

EURGBP could rise to 0.89 by year-end

“The Pound survived the much-feared Autumn Statement by Chancellor Jeremy Hunt. Ultimately, the impact on next year's growth should not prove huge, especially compared to expectations. The tax hike will only affect high incomes and energy companies, and the National Insurance cut by the previous government has not been reversed.”

“We think it is too early to call for a prolonged stabilisation in the gilt market, and our debt team notes that there is still a lot of extra supply for private investors to absorb.”

“We continue to see downside risks for GBPUSD as the Dollar may start to recover into year-end, and target sub-1.15 levels in the near term. However, we forecast some outperformance in EURGBP (primarily due to EUR weakness), which could rise to 0.89 by year-end.”

- EURGBP comes under some renewed selling pressure and drops to a nearly two-week low.

- The formation of a rectangle pattern on short-term charts points to indecision among traders.

- Neutral technical indicators also warrant caution before placing aggressive directional bets.

The EURGBP cross hits a nearly two-week low during the first half of the European session on Friday, albeit continues to show some resilience below the 0.8700 mark.

The British Pound's relative outperformance comes amid growing acceptance that the Bank of England will lift borrowing costs further to combat stubbornly high inflation. Adding to this, mostly upbeat UK monthly Retail Sales figures offer additional support to the Sterling Pound and exert some downward pressure on the EURGBP cross.

That said, talks for a more aggressive policy tightening by the European Central Bank lends support to the shared currency. The bets were reaffirmed by ECB President Christine Lagarde's comments earlier this Friday. This, in turn, is holding back bearish traders from placing aggressive bets around the EURGBP cross and limiting further losses.

Looking at the broader picture, spot prices have been oscillating in a familiar trading band over the past two weeks or so. The range-bound price action constitutes the formation of a rectangle pattern on short-term charts, marking a consolidation phase and pointing to indecision over the next leg of a directional move for the EURGBP cross.

Moreover, neutral technical indicators on the daily chart haven't been supportive of a firm near-term direction. This makes it prudent to wait for a sustained breakout through the short-term range before confirming the near-term trajectory for the EURGBP cross and placing aggressive bets.

That said, some follow-through selling below the 0.8690 area will be seen as a fresh trigger for bearish traders and prompt some technical selling. The EURGBP cross might then accelerate the fall towards the 0.8635 intermediate support en route to the 100-day Simple Moving Average, currently pegged around the 0.8610-0.8600 region.

On the flip side, the 0.8775-0.8780 area now seems to have emerged as an immediate strong barrier. This is followed by the 0.8800 round-figure mark and the next relevant hurdle around the 0.8820-0.8825 region. A sustained strength beyond the latter will mark a bullish breakout and set the stage for a further near-term appreciating move.

The EURGBP cross might then accelerate the momentum towards the 0.8850-0.8860 resistance zone. The subsequent positive move should allow the bulls to reclaim the 0.8900 mark. Some follow-through buying has the potential to lift the EURGBP cross towards the 0.8945-0.8950 intermediate hurdle en route to the 0.9000 psychological mark.

EURGBP 4-hour chart

-638043639052930853.png)

Key levels to watch

Gold price stalls a two-day corrective decline on the final trading day of the week. Focus shifts toward the United States Existing Home Sales data. Disappointing figures could revive the uptrend in the yellow metal, FXStreet’s Dhwani Mehta reports.

End-of-the-week flows could keep Gold bulls on the edge

“Another sign of US housing market cooling could add to the latest leg down in the US Dollar. Friday will see the United States Existing Home Sales dropping in at 15:00 GMT, with a mild downtick to 4.38M expected in October when compared to the previous print of 4.71M.”

“Should the US data disappoint by a wide margin, it could reinforce expectations of a Federal Reserve slowdown in the tightening pace. The resultant US Dollar weakness could revive the uptrend in Gold price.”

“However, the end-of-the-week flows could play out and keep Gold bulls on the edge, with attention turning toward next week’s Federal Reserve meeting minutes.”

- Silver stages a goodish rebound from over a one-week low touched on Thursday.

- The overnight break and close below the 200-day SMA favours bearish traders.

- Any subsequent move up might confront stiff resistance near the $21.70 region.

Silver regains some positive traction on Friday and recovers a part of the previous day's heavy losses to a one-and-half-week low. The white metal sticks to its gains around the $21.20-$21.25 region through the first half of the European session and for now, seems to have snapped a three-day losing streak.

From a technical perspective, the overnight sustained weakness and a decisive close below the key 200-day SMA favours bearish traders. The said support breakpoint is currently pegged around the $21.40 area and should act as a pivotal point for intraday traders. A sustained strength beyond has the potential to lift the XAGUSD towards the $21.70 horizontal barrier.

The momentum could further get extended towards the $22.00 mark, which is followed by the multi-month peak, around the $22.25 region touched on Tuesday. Some follow-through buying will be seen as a fresh trigger for bulls and set the stage for further gains. Spot prices might then test the $22.50-$22.60 supply zone and eventually reclaim the $23.00 round figure.

On the flip side, the overnight swing low, around the $20.75 region, now seems to protect the immediate downside ahead of the $20.40-$20.35 support. The next relevant support is pegged near the $20.00 psychological mark. Failure to defend the latter will negate any near-term positive bias and make the XAGUSD vulnerable to extending the downward trajectory.

Silver daily chart

Key levels to watch

- EURUSD alternates gains with losses near 1.0370.

- The dollar also appears side-lined amidst flat yields.

- ECB Lagarde reiterated that extra rate hikes are in store.

The absence of a clear direction prevails around the European currency and prompts EURUSD to gyrate around the 1.0370 region at the end of the week.

EURUSD by-passes Lagarde’s comments

EUR/USD trades in an inconclusive fashion amidst the equally vacillating price action in the greenback and alternating risk appetite trends on Friday.

In what was the salient event in the euro area, Chairwoman C.Lagarde reiterated once again that the central bank plans to hike rate further, adding that the risks of a recession have increased. In addition, she suggested that fiscal policy needs to be temporary and targeted.

In the German debt market, the 10-year bund yields add to Thursday’s uptick and flirt with the 2.10% region, in line with the upside bias seen in their US peers.

Absent releases in the euro area, the focus of attention should gyrate to the US docket, where the CB Leading Index and Existing Home Sales will take centre stage along with the speech by Boston Fed S.Collins.

What to look for around EUR

EURUSD trades within a narrow range amidst the broad-based indecision in the global markets, always below the 1.0400 mark and with the 200-day SMA at 1.0411 capping the upside so far.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. In addition, markets repricing of a potential pivot in the Fed’s policy has become the exclusive source of the sharp advance in the pair in recent sessions.

Back to the euro area, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – emerges as the main headwinds facing the euro in the short-term horizon.

Key events in the euro area this week: ECB C.Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EURUSD levels to watch

So far, the pair is gaining 0.10% at 1.0371 and faces the next hurdle at 1.0411 (200-day SMA) ahead of 1.0481 (monthly high November 15) and finally 1.0500 (round level). On the flip side, a breach of 1.0023 (100-day SMA) would target 0.9935 (low November 10) en route to 0.9730 (monthly low November 3).

Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group expect USDCNH to extend the consolidative theme within the 7.0600-7.2100 range in the near term.

Key Quotes

24-hour view: “Yesterday, we held the view that ‘there is room for USD to test 7.1200 first before the risk of a pullback increases’. However, USD blew past 7.1200 and soared to a high of 7.1787 before pulling back sharply. The pullback amid overbought conditions suggests USD is unlikely to advance further. For today, USD is more likely to trade sideways between 7.1200 and 7.1700.”

Next 1-3 weeks: “While we warned yesterday (17 Nov, spot at 7.1020) that downward momentum has waned and the chance of further USD weakness has diminished, we did not anticipate the strong surge to a high of 7.1787. Downward momentum has dissipated and USD has likely moved into a consolidation phase. In other words, USD is likely to trade sideways for now, expected to be between 7.0600 and 7.2100.”

EURUSD fell toward 1.0300 on Thursday but erased the majority of its daily losses before closing the day above 1.0350. Economists at ING expect the pair to trade under parity in the coming months.

EURUSD may stay in the 1.0350-1.0400 range into the weekend

“If the Fed remains the key driver for the Dollar, the ECB continues to have a rather marginal role for the Euro, which instead remains primarily tied to global risk sentiment and geopolitical/energy dynamics.”

“EURUSD may stay in the 1.0350-1.0400 trading range into the weekend and while we don’t exclude another short-term mini-rally, we think that the macro picture continues to point to sub-parity levels in the coming months.”

The Autumn Statement yesterday from Chancellor Hunt provided no fiscal surprises with a grim outlook confirmed. Therefore, economists at MUFG Bank expect the British Pound to remain under downside pressure.

UK current account deficit will remain over 5% of GDP in 2023-24

“The Autumn Statement again highlights the poor outlook and downside risks for the Pound.”

“The record current account deficit is forecast to improve (the OBR assumes GBP/USD at 1.1500 for the forecast period) but will remain elevated at 5.8% this fiscal year and 5.2% next fiscal year.”

“Expect GBP underperformance to persist.”

- GBPUSD gains some positive traction on Friday amid subdued USD price action.

- A combination of factors limits the USD downside and keeps a lid on the major.

- A bleak outlook for the UK economy contributes to capping the British Pound.

The GBPUSD pair sticks to its modest intraday gains through the early European session and is currently placed around the 1.1900 round-figure mark.

As investors look past a rather unimpressive UK government £55 billion fiscal plan, as outlined in the Autumn budget, a combination of factors assists the GBPUSD pair to regain positive traction on the last day of the week. Expectations that the Bank of England will continue raising rates to combat stubbornly high inflation act as a tailwind for the British Pound. Apart from this, the better-than-expected monthly UK Retail Sales data offers some support to spot prices amid subdued US Dollar price action.

The downside for the USD, however, remains cushioned amid the prevalent cautious mood. Concerns about economic headwinds stemming from a new COVID-19 outbreak in China, along with geopolitical tensions, continue to weigh on investors' sentiment. Apart from this, the overnight hawkish remarks by St. Louis Fed President James Bullard, saying that the policy is not yet in a range estimated to be sufficiently restrictive to reduce inflation, favour the USD bulls.

Apart from this, the gloomy outlook for the UK economy suggests that the path of least resistance for the GBPUSD pair is to the downside. In fact, the UK Office for Budget Responsibility (OBR) expects the UK GDP to slump by 1.4% next year as compared to its projections of growth of 1.8%, in March. Hence, any subsequent intraday positive move might still be seen as a selling opportunity and is likely to remain capped. Traders now look to speeches by external BoE MPC members - Catherine Mann and Jonathan Haskel - and the US Existing Homes Sales data for a fresh impetus.

Technical levels to watch

In Norway, mainland Gross Domestic Product data surprised on the upside. However, the Krone may not be able to benefit from the strong figures as the EURNOK’s path relies on calm markets, economists at ING report.

Strong domestic story may not matter

“Norwegian GDP data for the third quarter surprised on the upside, showing a rather strong 1.5% quarter-on-quarter growth. This is a testament to how the domestic story should remain largely supportive of NOK, also into the new year. Whether this will ultimately feed into a stronger Krone is another question, and mostly depends on whether markets will prove calm enough to allow fundamentals to play a role.”

“We really think volatility will be the name of the game for EURNOK next year, even though our base-case scenario is downward-sloping in 2023.”

“In the short run, a return to 10.60+ is a tangible possibility.”

European Central Bank (ECB) President Christine Lagarde is on the wires this Friday, via Reuters, speaking at the European Banking Congress, in Frankfurt.

Key quotes

ECB will ensure that a phase of high inflation does not feed into inflation expectations.

We expect to raise rates further to the levels needed to ensure that inflation returns to our 2% medium-term target in a timely manner.

Inflation in the euro area is far too high.

The risk of recession has increased.

Recession is unlikely to bring down inflation significantly.

We expect to raise rates further.

Interest rates are, and will remain, the main tool for adjusting our policy stance.

Interest rates remain the most effective tool for shaping our policy stance.

It is appropriate that the balance sheet is normalized in a measured and predictable way.

If governments cut investments, there is a risk that supply will not be rebuilt and constraints on growth will continue to bind.

Market reaction

The Euro is unimpressed by the comments from ECB Chief Lagarde, as EURUSD remains on the back near 1.0350 amid a renewed uptick in the US Dollar.

The UK Finance Minister Jeremy Hunt said on Friday, “I am confident we will be able to remove the vast majority of trade barriers with the European Union (EU) outside the single market.”

“We can find other ways to more than compensate for the advantages of being in the single market,” he added.

Furthermore, Hunt noted that “there is short-term disruption as we change our economic model but I believe there are long-term opportunities from Brexit.”

Earlier on, Hunt said: “It would be the wrong thing to make recession worse with public spending cuts now.”

Market reaction

At the time of writing, GBPUSD is paring back gains to near 1.1885, adding 0.25% on the day.

EURUSD idles below the 200-Day Moving Average at 1.0414. Therefore, the pair could struggle to extend its recent gains, economists at Société Générale report.

Upside could remain contained

“EURUSD is struggling to cross above its falling 200-DMA (around 1.0414) which denotes possibility of retraction in recent gains.”

“The low formed earlier this week at 1.0270 is crucial for continuation in bounce.”

“Next potential hurdles are at 1.0520 and March 2020 low of 1.0630/1.0690.”

See: EURUSD could be trading in a 0.95-1.05 range for most of 2023 – ING

- USDCAD is seen oscillating in a narrow trading band on the last day of the week.

- Bearish Crude Oil prices undermine the Loonie and offer support to the major.

- Softer US bond yields keep the USD bulls on the defensive and cap the upside.

The USDCAD pair struggles to gain any meaningful traction on Friday and oscillated in a narrow trading band, above the 1.3300 mark through the early European session.

Crude Oil prices languish near the monthly low amid concerns that a new COVID-19 outbreak in China will weaken fuel demand in the world's largest importer. This, in turn, undermines the commodity-linked Loonie and offers some support to the USDCAD pair, though subdued US DOllar demand acts as a headwind for spot prices.

A modest downtick in the US Treasury bond yields is seen as a key factor keeping the USD bulls on the defensive. That said, expectations that the Federal Reserve (Fed) will continue to hike interest rates, although at a slower pace, helps limit the downside for the buck. This, along with the cautious mood, favours the USD bulls.

The market sentiment remains fragile amid worries about economic headwinds stemming from China's COVID woes. Apart from this, geopolitical risks temper investors' appetite for perceived riskier assets. This is evident from a generally weaker tone around the equity markets, which could drive some haven flows towards the greenback.

Despite the supportive fundamental backdrop, the USDCAD pair, so far, has been struggling to attract any meaningful buying. Furthermore, the overnight failure near the 1.3400 round figure warrants some caution before positioning for any meaningful upside. Traders now look to the US Existing Home Sales data for a fresh impetus.

Technical levels to watch

Chancellor Jeremy Hunt did not cause a collapse of Sterling with his statement, but only damaged it. Bleak economic outlook dampens the prospects of the GBP, economists at Commerzbank report.

Economically speaking things are not looking good for the UK

“Economically speaking things are not looking good for the UK. Hunt estimates that the economy is already in recession now and is therefore more pessimistic than the median of analysts. Hunt even expects a contraction of 1.4% in UK GDP (median of analysts: -0.5%). The island does not need a gas crisis to achieve that.”

“The fact that Sterling was able to stand up well also against the euro (good GBPUSD performance is not that difficult thanks to the collapse of the Dollar) might have been due to the fact that many thought a return to sensible fiscal policy might provide an additional boost for the UK currency. That did not happen though.”

“The market is clever enough to consider sensible fiscal policy to be a necessary condition for Sterling stability and to also consider the economic situation (and the results of the BoE’s monetary policy) for its GBP valuation.”

- The index fades Thursday’s uptick and remains near 106.50.

- US yields recede marginally following the recent recovery.

- Fedspeak, CB Leading Index, Existing Home Sales next on tap.

The greenback, in terms of the USD Index (DXY), returns to the negative territory following Thursday’s decent advance.

USD Index points to further consolidation in the near term

The index keeps the erratic performance so far this week and now gives away part of Thursday’s rebound to the area north of 107.00 the figure.

In the meantime, the lack of traction seems to have returned to the US money market following a firm bounce in yields in the previous session, all in response to hawkish comments from St. Louis Fed J.Bullard (voter, hawk).

On the latter, it is worth recalling that Bullard expects the minimum interest rate to be around 5.00%-5.25%, while he removed weigh from the recent lower-than-expected US inflation figures and motivated speculation of a Fed’s pivot to dwindle somewhat.

Later in the NA session, the CB Leading Index is due seconded by Existing Home Sales and the speech by Boston Fed S.Collins (voter, centrist).

What to look for around USD

Price action around the dollar remains mixed and relegates the index to keep navigating the area around 106.50, all amidst a broad-based consolidative theme.

In the meantime, the greenback is expected to remain under the microscope amidst persistent investors’ repricing of a probable slower pace of the Fed’s rate path in the upcoming months.

Key events in the US this week: CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: US midterm elections. Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.16% at 106.51 and the breakdown of 105.34 (monthly low November 15) would open the door to 105.05 (200-day SMA) and finally 104.63 (monthly low August 10). On the other hand, the next up barrier aligns at 109.15 (100-day SMA) seconded by 110.76 (55-day SMA) and then 113.14 (monthly high November 3).

NZDUSD briefly edged above 0.62 this week. In the view of economists at ANZ Bank, the Kiwi has already seen the lows.

USD’s safe haven premium to unwind

“While we are a touch cautious that US interest rates have gotten ahead of themselves, it is not just market expectations that the US policy cycle may be nearing a turn that is weighing on the USD.”

“We have also upgraded our China growth outlook (which should be good for commodities), and expect some of the USD’s safe haven premium to unwind following the Biden-Xi meeting in Bali, and as Europe copes with energy issues.”

“That all makes us more comfortable believing that we have likely seen the lows in the NZD.”

Here is what you need to know on Friday, November 18:

The US Dollar (USD) took advantage of the risk-averse market atmosphere on Thursday and the US Dollar Index ended up closing the day modestly higher. With the benchmark 10-year US Treasury bond yield edging lower and the market mood improving early Friday, the USD is having a difficult time preserving its strength. European Central Bank President Christine Lagarde is scheduled to deliver a speech at 1130 GMT. Later in the day, October Existing Home Sales data will be featured in the US economic docket. Ahead of the weekend, market participants will pay close attention to comments from central bankers.

On Thursday, the data from the US revealed that Housing Starts and Building Permits declined by 4.2% and 2.4% in October, respectively, reminding investors of the negative impact of the US Federal Reserve's (Fed) tightening on the housing market.

Meanwhile, St. Louis Federal Reserve President James Bullard said that the monetary policy was not yet sufficiently restrictive to reduce inflation. Commenting on the rate outlook, Minneapolis Federal Reserve Bank President Neel Kashkari noted that it was unclear how high the Fed will need to raise the policy rate to bring inflation down by restraining demand through higher borrowing costs. Although the 10-year US T-bond yield gained more than 2% on Thursday, it lost its traction and was last seen holding steady at around 3.75%.

EURUSD fell toward 1.0300 on Thursday but erased the majority of its daily losses before closing the day above 1.0350. The pair trades in a narrow range at around 1.0370 early Friday as investors await the next catalyst.

GBPUSD fell sharply during the European trading hours on Thursday and touched a daily low of 1.1764 before staging a decisive recovery later in the day. The pair currently trades slightly below 1.1900, posting modest daily gains. While presenting the Autumn Budget to parliament, British Chancellor Jeremy Hunt announced £55 billion in tax rises and spending cuts to fill a massive funding gap. "Today’s statement delivers a consolidation of £55 billion and means inflation and interest rates end up significantly lower," Hunt explained. In the meantime, the data published by the UK's Office for National Statistics revealed that Retail Sales rose by 0.6% in October.

The data from Japan showed on Friday that the National Consumer Price Index (CPI) jumped to 3.7% in October from 3% in September. This reading came in much higher than the market expectation of 2.7%. Commenting on the inflation report, "it is true that the CPI data shows significant price increases," Bank of Japan (BOJ) Governor Haruhiko Kuroda acknowledged. Regarding the policy outlook, however, Kuroda reiterated that they would maintain the easy monetary policy to support the economy. USDJPY edged lower during the Asian trading hours and was last seen trading in negative territory below 140.00.

Pressured by rising US T-bond yields, Gold price fell nearly 1% on Thursday and registered losses for the second straight day. With US yields holding steady early Friday, XAUUSD managed to turn positive on the day above $1,760.

Bitcoin continues to move up and down in a narrow channel above $16,000 for the third straight day on Friday. Ethereum lost more than 1% on Thursday but rebounded above $1,200 early Friday.

A bullish leap of faith on the Euro is too dangerous, in the opinion of economists at ING. They expect the EURUSD pair to be in the 0.95-1.05 range for most of the next year.

Market’s bromance with the Dollar will continue for a while yet

“We are bearish on EURUSD into the end of the first quarter of 2023.”

“Recession in Europe means that EURUSD could be trading in a 0.95-1.05 range for most of the year, where fears of another energy crisis in the winter of 2023 and uncertainty in Ukraine will hold the euro back.”

“The sufficient condition for a EURUSD turnaround is the state of affairs amongst trading partners. Are they attractive enough to draw funds away from USD cash deposits potentially paying 5%? That is a high bar and why we would favour the EURUSD 2023 recovery being very modest, rather than the ‘V’ shape some are talking about.”

“The case for a central bank pivot is stronger for the ECB than the Fed. We see the ECB tightening cycle stalling at 2.25% in February versus the near 3% currently priced by the market for 2023. Add in global merchandise trade barely growing above 1% next year plus the risk of tighter liquidity spilling into financial stability – all suggest the market’s bromance with the Dollar will continue for a while yet.”

USDJPY is expected to remain within the consolidative 138.50-142.50 range in the next weeks, comment Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “We expected USD to ‘trade within a range of 138.90/140.20’ yesterday. USD subsequently dropped to 138.86 before staging a surprisingly sharp advance to 140.74. The rapid rise appears to be running ahead of itself and USD is unlikely to advance much further. For today, USD is more likely to trade between 139.50 and 140.80.”

Next 1-3 weeks: “After USD dropped to 137.67 and rebounded, we highlighted on Wednesday (16 Nov, spot at 139.35) that further USD weakness is not ruled out, but the solid support at 137.60 may not come into view so soon, if at all. Yesterday, USD rebounded strongly to a high of 140.74. While our ‘strong resistance’ level at 140.80 is not breached, downward momentum has more or less dissipated. USD appears to have moved into a consolidation phase and is likely to trade within a range of 138.50/142.50 for the time being.”

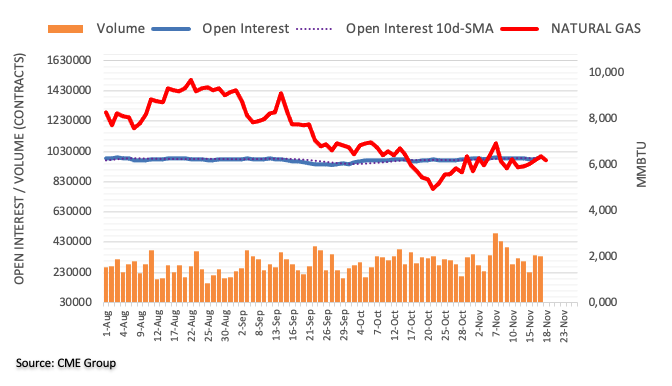

CME Group’s flash data for natural gas futures markets noted traders added around 9.2K contracts to their open interest positions on Thursday. Volume, instead, resumed the downtrend and shrank by nearly 9K contracts, partially offsetting the previous strong build.

Natural Gas: Next target comes at the 200-day SMA

Prices of the natural gas rose for the fourth consecutive session on Thursday. The move was in tandem with another uptick in open interest, which is supportive of the continuation of the leg higher in the very near term. Against that, the commodity could be in course to revisit the key hurdle at the 200-day SMA, today near $6.85 per MMBtu.