- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 22-11-2022

- USD/CHF stays depressed after snapping six-day uptrend the previous day.

- Clear break of one-week-old bearish channel, downbeat MACD signals favor sellers.

- 50-SMA, previous resistance line from November 03 challenge immediate downside.

USD/CHF holds lower ground near 0.9515 following the first daily negative in seven.

The Swiss Franc (CHF) pair broke a one-week-old bullish channel the previous day and welcomed the bears. While adding strength to the downside bias are the recently bearish signals from the Moving Average Convergence and Divergence (MACD) indicator.

However, the 50-SMA level surrounding 0.9495 precedes the resistance-turned-support line from November 03, close to 0.9430 by the press time, to challenge the USD/CHF pair’s immediate declines.

Following that, the 0.9400 round figure and the monthly low surrounding 0.9355 should gain the market’s attention.

On the flip side, the aforementioned channel’s support line acts as an immediate resistance around 0.9530, a break of which could escalate the corrective bounce towards the channel’s top, near 0.9630.

Should the USD/CHF bulls manage to keep the reins, the November 11 swing high surrounding the 0.9900 threshold will be important to watch for the pair’s further upside momentum. If the pair remains firmer past 0.9900, the odds of its run-up towards the monthly high near 1.0150 can’t be ruled out.

Overall, USD/CHF is likely to refresh the monthly low unless rising back beyond the 0.9900 mark.

USD/CHF: Four-hour chart

Trend: Further downside expected

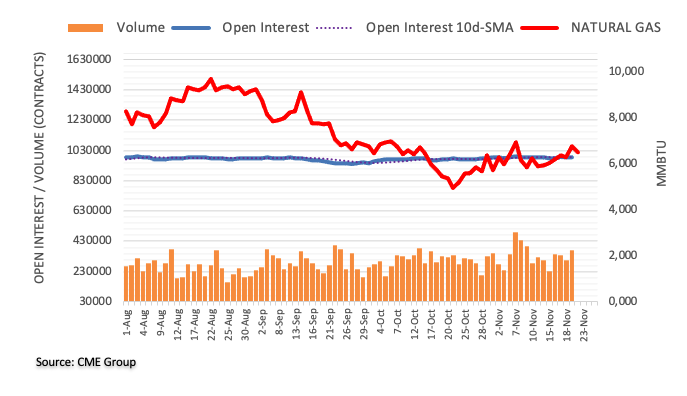

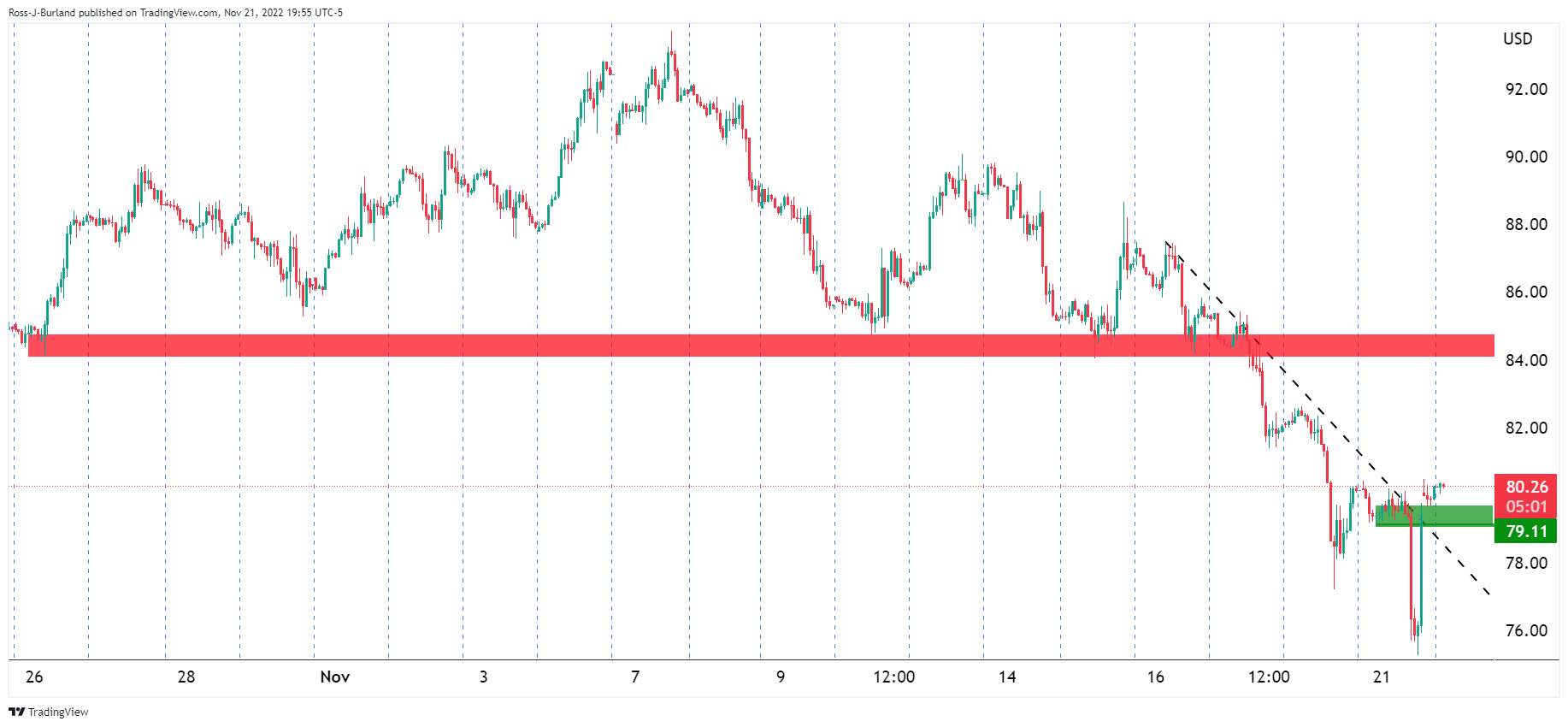

- WTI picks up bids to extend the previous day’s rebound from 10-month low.

- G7 discusses price cap level on Russian oil, Moscow threatens gas supply cut to EU.

- Talks of OPEC+ output increase, a reduction in energy demand due to China’s Covid conditions challenge WTI bulls.

- Preliminary PMIs for November, EIA Crude Oil Stocks Change will be eyed for fresh impulse.

WTI crude oil defends the previous day’s recovery while picking up bids to $81.10 during early Wednesday. The black gold’s latest run-up could be linked to the headlines surrounding the Group of Seven (G7) nations’ discussions on the oil price cap on Russian exports, as well as the inventory draw conveyed by the industry source.

Weekly prints of the American Petroleum Institute’s (API) Crude Oil Stock data marked the draw of 4.8 million barrels versus -5.835M prior for the week ended on November 18.

Elsewhere, Reuters mentioned that the G7, including the United States, along with the EU and Australia are slated to implement the price cap on sea-borne exports of Russian oil on Dec. 5, as part of sanctions intended to punish Moscow for its invasion of Ukraine. The news also quotes a Senior US Official as saying, “The G7 should soon announce the price cap on Russian oil exports and the coalition will probably adjust the level a few times a year rather than monthly.”

Previous, the Wall Street Journal (WSJ) quoted Saudi Arabia as denying a production increase plan due to unease with public discussion of the group's decision-making before an agreement with Russia had been struck.

It’s worth noting, however, that the Covid woes in China and fears of economic slowdown in major economies challenge the energy demand. On the same line could be the rate hikes by the key central banks.

Looking forward, the official weekly oil inventory data from the Energy Information Administration (EIA) for the week ended on November 18, expected at 0.115M versus -5.4M prior, will be important for the oil traders to watch for clear directions. However, major attention will be given to the preliminary readings of November’s monthly activity data and Minutes of the Fed’s latest minutes. Additionally, headlines surrounding the OPEC+ and Russian oil price cap will also be crucial for a clear guide.

Technical analysis

WTI recovery remains elusive unless crossing a three-week-old descending resistance line, around $87.10 by the press time.

- AUD/NZD is poised both and bullish and bearish depending on the time frame.

- The RBNZ will be the deciding factor for the day ahead.

Ahead of teh Reserve Bank of New Zealand today, AUD/NZD Bears are lined up on the long-term charts for a downside continuation but the bulls have committed to the test of recent lows on the lower time frames so there is no bias either way, at least for the short term and within 100 pips or structure as the following will illustrate.

AUD/NZD daily chart

While on the front side of the trend, the bias on the longer-term time frame is lower with a run to 1.0620 on the cards.

AUD/NZD H4 chart

The 4-hour time frame offers support structure on the way there with 12.0750/20 and then space to 1.0620.

More to come...

Reuters reported that the Group of Seven nations should soon announce the price cap on Russian oil exports and the coalition will probably adjust the level a few times a year rather than monthly, a senior US Treasury official said on Tuesday.

Key notes

The G7, including the United States, along with the EU and Australia are slated to implement the price cap on sea-borne exports of Russian oil on Dec. 5, as part of sanctions intended to punish Moscow for its invasion of Ukraine.

The aim is to reduce Russia's petroleum revenues funding its war machine while maintaining flows of its oil to global markets to prevent price spikes. A cap on exports of Russian oil products is slated to begin on Feb. 5.

The coalition has agreed to set a fixed price on Russian oil rather than a floating rate, discounted to an oil price index.

The coalition worried that a floating price pegged below an oil benchmark might enable Russian President Vladimir Putin to easily game the mechanism by reducing supply, from Russia.

A US official said Washington does not expect Russia to retaliate by withholding oil exports as such a move could send global oil prices higher, but risks damaging Russian oil fields.

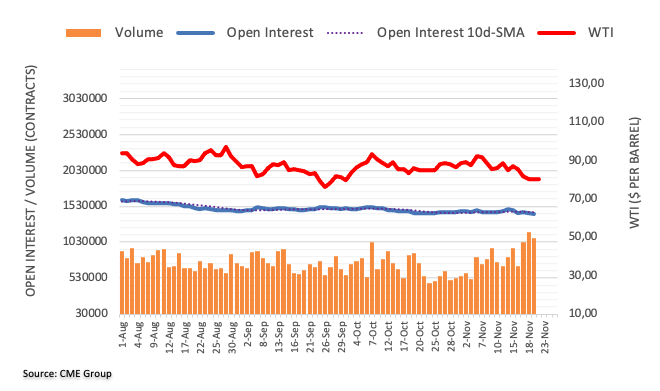

- Gold price remains sidelined after snapping four-day downtrend.

- Firmer sentiment downbeat yields weigh on the US Dollar but pre-event anxiety challenges the XAU/USD bulls.

- More evidences for Fed’s 50 bps rate hike could favor the Gold buyers.

Gold price (XAU/USD) steadies around $1,740 after pushing back the bears the previous day. In doing so, the yellow metal portrays the typical pre-event anxiety while keeping the buyers positive amid softer US Dollar and Treasury yields.

The chatters surrounding the Federal Reserve’s (Fed) easy rate hikes and firmer prints of equities joined the alleged stockpiling of Gold by China to underpin the XAU/USD’s run-up the previous day. However, Covid woes from the dragon nation challenged the bullion buyers.

That said, Richmond Fed Manufacturing Index improved to -9 for November versus -10 prior while Kansas City Federal Reserve President Esther George recently said, “(We) could well take a higher interest rate for some time to convince households to hold on to savings.”

It’s worth noting that Nikkei Asia quotes the World Gold Council (WGC) data to spot increasing Gold buying from China. The news also mentioned the unloading of the US Treasury bonds by Beijing, which in turn favored the XAU/USD buyers.

Alternatively, seven-month high coronavirus numbers and multiple activity restrictions in the key states of the world’s second-largest economy challenged the Gold bulls.

Amid these plays, stocks in Europe and the UK, as well as Wall Street, closed positively whereas the US 10-year Treasury yields dropped six basis points (bps) to 3.76%.

Looking forward, the Gold price may witness a lackluster day ahead of the European session amid a cautious mood before the preliminary readings of November’s PMIs. Also important will be the Federal Open Market Committee (FOMC) Meeting Minutes and the US Durable Goods Orders for October.

Market players will look for clues of more confirmatory signals for the economic transition and the Fed’s 50 basis points (bps) worth of rate hike in December to continue with the risk-on mood and favor the gold buyers.

Technical analysis

Although sustained trading below the 50-SMA and observance of a one-week-old descending trend line keeps Gold sellers hopeful, an upwards-sloping trend line from November 09, around $1,737 by the press time, challenges the XAU/USD bears.

It’s worth noting that the RSI (14) and MACD conditions are showing sellers’ exhaustion and hence an upside clearance of the immediate resistance line, close to $1,746, could quickly propel the quote towards the 50-SMA hurdle of $1,761.

Following that, the monthly high surrounding $1,787 and the $1,800 threshold will be on the Gold buyer’s radar.

Alternatively, a downside break of the fortnight-old support line, near $1,737, may drop to the $1,720 level before targeting the $1,700 round figure.

However, the bullion’s downside past $1,700 needs validation from the 61.8% Fibonacci retracement level of November 03-15 upside, close to $1,681.

Overall, Gold price is likely to improve further but a clear break of the 50-SMA appears necessary to convince the bulls.

Gold: Four-hour chart

Trend: Further recovery expected

- EUR/JPY daily chart portrays the formation of a rising wedge with bearish implications.

- The EUR/JPY price action recoiled as the cross approached 146.00, suggesting a breakout is about to happen.

The EUR/JPY continues to consolidate within a rising wedge, though finished with minuscule losses of 0.04% on Tuesday, on a risk-on sentiment. As the Asian session begins, the EUR/JPY is trading at 145.48, barely gaining 0.01%.

EUR/JPY Price Analysis: Technical outlook

As above-mentioned, a rising wedge formed in the EUR/JPY daily chart, with most daily lows tracking the 50-day Exponential Moving Average (EMA) as a dynamic support. Although the cross continues to advance steadily, price action shrank during the last four trading days. That would mean the EUR/JPY is consolidating or a breakout is about to happen.

If the EUR/JPY clears 146.00, it could exacerbate a rally toward the year-to-day (YTD) highs around 148.40, but on its way north, buyers need to surpass some resistance levels. The first one would be the ascending-wedge top trendline around 146.50, followed by the November 9 daily high at 147.11. Once cleared, the psychological 148.00 is next.

Otherwise, if the EUR/JPY breaks below the rising wedge, the first support would be the 50-day EMA at 144.12. A breach of the latter will expose the 143.00 figure, followed by the November 11 swing low around 142.54.

EUR/JPY Key Technical Levels

- NZD/USD seesaws inside a one-week-old trading range ahead of the key event.

- Recently increasing odds of the RBNZ’s 75 bps rate hike, risk-on mood keeps buyers hopeful.

- OCR peak, Governor Orr’s press conference will be crucial, US PMIs, Fed Minutes will entertain the traders afterward.

NZD/USD treads water around the mid-0.6100s amid the final nail-biting hours to the key Reserve Bank of New Zealand (RBNZ) Interest Rate Decision on Wednesday. The Kiwi pair gained the previous day as firmer sentiment joined hopes of 75 basis points (bps) of a rate increase by New Zealand’s central bank.

Stocks in Europe and the UK, as well as Wall Street, closed positively whereas the US 10-year Treasury yields dropped six basis points (bps) to 3.76%. At home, NZX 50 remained dicey as traders feared higher rates, as well as take negative notes from China’s Covid conditions.

That said, Fed policymakers’ failure to defend the previous hawkish expectations and mildly positive data also appeared to have favored NZD/USD buyers the previous day. It should be noted that the Kiwi pair ignored downbeat New Zealand trade numbers for October to print the gains.

Richmond Fed Manufacturing Index improved to -9 for November versus -10 prior while Kansas City Federal Reserve President Esther George recently said, “(We) could well take a higher interest rate for some time to convince households to hold on to savings.”

On the other hand, New Zealand Trade Balance flashed -2,129M MoM figures for October versus $-1,353M market forecasts and $-1,696M prior. Further, the Exports increased to $6.14B versus $5.94B prior whereas the Imports rose to $8.27B versus $7.63B prior.

Looking forward, the market’s high hopes of witnessing a 0.75% rate increase challenge the NZD/USD buyers as the Fed hawks appear to run out of steam. Even so, the latest inflation-linked data from Auckland have been positive and hence the hopes of witnessing a strong rate lift are high and can keep the bulls hopeful.

In addition to RBNZ’s verdict on the rates, forecasts concerning the Official Cash Rate (OCR) peak will be important as well.

Following that, the preliminary readings of November’s monthly activity data and Minutes of the Fed’s latest minutes will be closely observed to confirm the chatters surrounding the economic transition and the 50 bps rate hike chatters from the Fed.

Also read: RBNZ Interest Rate Decision Preview: NZD/USD – Buy the rumor, sell the fact on a 75 bps hike

Technical analysis

A clear break of the recent trading range between 0.6060 and 0.6200 appears necessary for clear directions. That said, a convergence of the 200-EMA and ascending trend line from October 13, around 0.5940, appears an additional important support to watch during the quote’s surprise downside.

- AUD/USD is expected to deliver more gains above 0.6650 amid a cheerful market mood.

- Aussie Manufacturing and Services PMI have dropped to 52.4 and 49.1 respectively.

- Going forward, FOMC minutes and US Durable Goods Orders will be of significant importance.

The AUD/USD pair is hovering around the critical hurdle of 0.6650 in the early Asian session. The asset is expected to extend its gains above the aforementioned hurdle despite a decline in Aussie S&P PMI data.

The S&P Global Manufacturing PMI has dropped to 52.4 against the former release of 52.7 and the Services PMI has declined to 49.1 in comparison with 49.3, the prior release. A decline in PMI numbers could have a harsh impact on the Aussie dollar but may add to the slowdown filters for inflation.

The economic activities could have been impacted due to a fall in consumer spending led by rising inflation and accelerating interest rates. This may force goods and services providers to favor a decline in price growth ahead.

Meanwhile, a significant recovery in the risk-on profile as investors have shrugged off uncertainty amid rising Covid-19 infections in China has supported the antipodean. However, the US dollar index (DXY) has witnessed the termination of the three-day winning streak. The mighty DXY has dropped below 107.20 and is expected to remain on tenterhooks ahead amid uncertainty over the release of the Fed Open Market Committee minutes (FOMC), which will release on Thursday.

But before that, US Durable Goods Orders data will be of utmost importance. The economic data is seen as stable at 0.4%. An improvement in demand for durable goods could dampen the efforts of the Fed chair Jerome Powell who is working hard to slow down consumer spending.

On the Aussie front, mixed commentary from the Reserve Bank of Australia (RBA) Governor Philip Lowe on the interest rate guidance has created ambiguity in the minds of investors. While delivering a speech titled "Price Stability, the Supply Side, and Prosperity" at the Annual Committee for Economic Development, RBA Governor cited the absence of a pre-set path and stated that the central bank could return to a 50 bps rate hike or keep policy stance ‘unchanged’ for a period of time.

- GBP/JPY hit a two-week high but trimmed some gains, back below 168.00.

- The daily chart suggests the GBP/JPY is neutral-upward biased, but a head-and-shoulders pattern remains in play.

- GBP/JPY Price Analysis: Failure to crack 168.00 exacerbated a fall toward 167.50.

On Tuesday, the GBP/JPY retraces after hitting a two-week high around 168.30, amid upbeat sentiment, as shown by Wall Street, registering gains between 1.18% and 1.36%. However, the head-and-shoulders chart pattern remains in play as long as the right shoulder, around 169.08, is not surpassed. That said, the GBP/JPY is trading at 167.75, below its opening price by 0.46%.

GBP/JPY Price Analysis: Technical outlook

In the long term, the GBP/JPY remains neutral to upward biased, though a head-and-shoulders pattern emerging in the daily chart opened the door for a fall to 158.40. However, during the last week, the cross-registered gains of 2%, exchanging hands 300 pips above the neckline. If British Pound (GBP) buyers reclaim 169.00, that would invalidate the pattern and might exacerbate a rally toward the YTD highs of 172.13.

Short term, the GBP/JPY 4-hour chart illustrates the pair as neutral, slightly upward biased. GBP/JPY price action registered successive series of higher highs/lows, advancing steadily from around 163.03. On its way north, the GBP/JPY hurdled the 50, 200, and 100-Exponential Moving Averages (EMAs), suggesting buyers gathered momentum. But the Relative Strength Index (RSI), aiming downwards, could open the door for a pullback.

Therefore, the GBP/JPY first support would be the S1 daily pivot point at 167.33. Break below will expose the confluence of the 100 and the 200-EMAs around 166.81/93, followed by the 50-EMA at 166.02. Otherwise, the GBP/JPY key resistance levels lie at the R1 daily pivot at 168.29, followed b the R2 pivot level at 168.78, followed by the November 7 daily high at 169.00.

GBP/JPY Key Technical Levels

- EUR/USD fades corrective bounce from one-week low ahead of key data/events.

- Market sentiment improved despite no major positives, equities stayed firmer, yields eased.

- Eurozone Consumer Confidence, US Richmond Fed Manufacturing Index improved.

- Preliminary activity data for November will precede US Durable Goods Orders for October and Fed Minutes to entertain traders.

EUR/USD buyers take a breather ahead of an eventful day, steady around 1.0300 during Wednesday’s Asian session after snapping three-day downtrend the previous day. That said, a firmer risk profile allowed the pair buyers to battle against the sellers the previous day. However, a slew of data/events are up for publishing today and hence cautious mood probe the momentum traders of late.

European Central Bank (ECB) policymaker Robert Holzmann supported calls for a third straight 75 basis points (bps) rate increase for the December monetary policy meeting In an interview with the Financial Times (FT). However, European Central Bank board member and Bank of Portugal Governor Mario Centeno mentioned that there are many conditions for the rates increase to be less than 75 bps.

On the other hand, Kansas City Federal Reserve President Esther George recently said, “(We) could well take a higher interest rate for some time to convince households to hold on to savings.”

It’s worth noting that an improvement in the market’s sentiment despite the looming Covid woes from China and mixed concerns surrounding the US-China ties helped the EUR/USD pair to register the first daily gain in four on Tuesday. While portraying the mood, stocks in Europe and the UK, as well as Wall Street, closed positively whereas the US 10-year Treasury yields dropped six basis points (bps) to 3.76%.

With the recently upbeat market sentiment and softer US Treasury yields, the US Dollar Index (DXY) also marked broad losses ahead of crucial catalysts scheduled for publication today. The reason could well be linked to the market’s expectations of softer rate hikes from the Federal Reserve (Fed).

Moving on, global markets may witness a volatile day as multiple central bank events and data are likely to entertain the momentum traders. Among them, the preliminary readings of November’s monthly activity data and Minutes of the Fed’s latest minutes will be closely observed to confirm the chatters surrounding the economic transition and the 50 bps rate hike chatters from the Fed. Additionally, talks surrounding the gas price cap from the Group of Seven (G7) will also be important to watch for clear directions.

Also read: FOMC Meeting Minutes Preview: Three reasons to expect a US Dollar downer

Technical analysis

Despite the latest rebound the EUR/USD pair’s failure to cross the previous support line from November 04 and the 10-Day Moving Average (DMA), currently around 1.0340 and 1.0320 in the order, keeps teasing the bears.

- GBP/USD is looking to reclaim the 1.1900 hurdle amid positive market sentiment.

- Investors are awaiting the FOMC minutes release to get a detailed explanation behind the bigger rate hike.

- A decline in UK PMI numbers could be the outcome of a slowdown in consumer spending.

The GBP/USD pair is aiming to recapture the immediate hurdle of 1.1900 sooner as the market mood has turned extremely cheerful. Investors have shrugged off China’s Covid-19 worries and have started pouring funds into risk-perceived assets. Also, the rising expectation of a slowdown in the rate hike pace by the Federal Reserve (Fed) has shifted traction in the favor of risk appetite theme.

A three-day winning spell of the US dollar index (DXY) halted on Tuesday after an improvement in investors’ risk appetite. The DXY is declining towards the critical support of 107.00. S&P500 witnessed a significant buying interest as a slowdown in the rate hike pace by the Fed will trigger economic projections. Meanwhile, the 10-year US Treasury yields have dropped to near 3.76%.

Going forward, the Cable will keep an eye on the release of the Fed Open Market Committee (FOMC) minutes. The minutes will provide a detailed explanation behind the announcement of the fourth consecutive 75 basis points (bps) rate hike. Also, it will provide cues indicating the chances of a bigger rate hike continuation.

Apart from the interest rate guidance, the economic and financial conditions of the US will be of utmost importance.

On the UK front, the release of the S&P PMI numbers will be significant for the market participants. The Manufacturing PMI is seen lower at 45.8 vs. the prior release of 46.2. And, the Services PMI is expected to decline to 46.2 from the former release of 46.5. A decline in PMI numbers could be crucial for bringing price stability as lower consumer spending would support a decline in price growth by the manufacturers and service providers.

- US Dollar is on the backfoot and bears are lurking at key resistance.

- A break of 106.00 could seal the deal for the bears.

The US Dollar retreated across the board on Tuesday with investors looking past worries about China's COVID flare-ups ahead of Wednesday's Federal Open Market Committee Minutes.

A day after fresh COVID-19 curbs in China fuelled a risk-off tone to start the week, risk appetite reversed. Equities and high-beta currencies were favored, putting the US Dollar into a downward spiral. The DXY index, that measure the greenback vs. a basket of currencies was last seen down by over 0.5% near the lows of the day at 107.121.

The ebbs and flows of the market see the currency respecting technical structures and targets with the 38.2% Fibonacci retracement level acting as a relatively firm resistance near 107.50/70s. Meanwhile, there are prospects of a pivot from the Federal Reserve due to recent cooler-than-expected inflationary data within economic releases, notably the last US Consumer Price Index.

Focus on the Fed

Investors will be parsing minutes from the Fed's November meeting, due on Wednesday, for any hints about the December meeting and the outlook for interest rates thereafter with respect to the terminal rate. WIRP suggests a 50 bp hike on December 14 is still fully priced in, but the swaps are starting to gain price in around 30% odds of a terminal rate near 5.25%, according to analysts at Brown Brothers Harriman. ''Those odds will surely change after we get core PCE December 1, jobs data December 2, PPI December 9, and CPI December 13. However, it’s worth noting that the US economy continues to grow above trend in Q4 and the market should not underestimate the Fed’s need to tighten further.''

Analysts at TD Securities see the minutes shedding light on the FOMC's deliberations regarding the expected downshift in the pace of rate increases. ''With that said, policymakers will also emphasize that the terminal rate is likely edging higher vs prior expectations as the labor market remains overly tight.''

US Dollar technical analysis

On the back side of the counter-trendline, (bearish), bears are lurking at a 50% mean reversion but the price may already have found a ceiling at the round 107.50/70s.

The W-formation is seeing the price revert into the neckline and towards the 38.2% Fibonacci of the prior bullish impulse. A break of 106 could seal the deal for the bears.

- The NZD/USD is pairing Monday’s losses, up by 0.84%.

- From a daily chart perspective, the NZD/USD is neutral-upward biased, though it needs to clear 0.6200.

- An ascending channel in the NZD/USD 4-hour chart will exacerbate a rally towards 0.6300.

The New Zealand Dollar (NZD) trims Monday’s losses and rises back above the 0.6100 figure due to overall US Dollar (USD) weakness, as market sentiment improved, though it remains fragile. Therefore, the NZD/USD is trading at 0.6148, above its opening price by 0.80%, after hitting a daily low of 0.6094.

NZD/USD Price Analysis: Technical outlook

From a daily chart perspective, the NZD/USD is neutral-to-upward biased, consolidated for the last six days, within the 0.6100 – 0.6200 range. Of note, the NZD/USD exited from a descending channel six days ago, a solid breakout, meaning that the major might rally toward higher prices. Nevertheless, although in bullish territory, the Relative Strength Index (RSI) aims downwards, meaning buyers are losing momentum or getting a respite ahead of challenging the 200-day Exponential Moving Average (EMA) at 0.6303.

Short term, the NZD/USD 4-hour chart suggests an ascending channel is forming, which, once broken to the upside, would expose key resistance levels. Nevertheless, the NZD/USD is struggling to clear the R1 daily pivot at 0.6150, which, once cleared, could open the door toward 0.6200, followed by the August 24 swing high at 0.6251, ahead of the 0.6300 psychological level.

NZD/USD Key Technical Levels

Kansas City Federal Reserve President Esther George said US house prices remain above the pre-pandemic trend and one can argue it is in part due to quantitative easing.

She added that the distributional effects of this are at the expense of first-time homebuyers.

Key comments

US house prices remain above pre-pandemic trend and one can argue it is in part due to quantitative easing.

The distributional effects of this is at the expense of first-time homebuyers.

As we tighten policy, dynamics of excess savings is going to be key factor for the economic outlook.

.

Higher savings could provide further impetus to consumption

Could well take a higher interest rate for some time to convince households to hold on to savings.

Current data suggests savings is elevated across the spectrum.

But lower income households are running down their buffers more quickly.

Reduced inflation will mean we have to incentivize saving over consumption.

Wage growth remains strong.

Understanding wage growth important to tracking overall path of inflation.

Workers who switch jobs are seeing greater wage growth.

A calmer labor market with less churn could reduce inflationary pressures.

Many of my contacts report problems with low worker engagement, a drag on productivity.

US Dollar update

The dollar retreated across the board on Tuesday, as investors looked past worries about China's COVID flare-ups and ahead of Wednesday's Federal Open Market Committee Minutes. Analysts at TD Securities see the minutes shedding light on the FOMC's deliberations regarding the expected downshift in the pace of rate increases. ''With that said, policymakers will also emphasize that the terminal rate is likely edging higher vs prior expectations as the labor market remains overly tight.''

What you need to take care of on Wednesday, November 23:

The greenback edged lower on Tuesday amid the better performance of global equities and weaker US Treasury yields. Activity, however, was limited ahead of the FOMC Meeting Minutes and US Durable Goods Orders to be out on Wednesday.

Asian and European indexes closed in the green, while Wall Street posted substantial gains, adding the most in the final hours of trading. On the other hand, US Treasury yields edged lower with the 10-year note yield down 7 bps to hover around 3.75%, and the 2-year offering 4.51% barely down for the day.

Different European Central Bank officials were on the wires, most of them paving the way for another 75 bps rate hike at the December meeting, but the EUR showed little reaction to the news. Robert Holzmann, head of the National Bank of Australia, to back a third consecutive aggressive rate hike. The move would raise the deposit rate to 2.25%. Also, Finnish ECB policymaker Olli Rehn said the ECB would continue to raise interest rates, and the pace of its hikes will be determined by the rate of inflation and the overall economic situation.

Federal Reserve representatives also had some things to say. Cleveland Federal Reserve President Loretta Mester noted that expectations for longer-term inflation are reasonably anchored, although wage growth lags below inflation in most sectors. Finally, she added that labor demand outpaces worker supply.

At the end of the day, the market focus was on the European energy crisis, as the G7 and the EU are once again discussing a cap on Russian oil prices.

EUR/USD recovered some ground but could not regain the 1.0300 threshold, holding nearby at the end of the US session.

Earlier in the day, market talks made the rounds about United Kingdom Finance Minister Jeremy Hunt pushing privately for Britain to have closer ties with the European Union, somehow generating tensions in the new UK Prime Minister Rishi Sunak's government. GBP/USD settled at around 1.1880 amid the broad dollar’s weakness.

USD/CAD is down 1.3385 after a batch of mixed Canadian data. Retail Sales declined by less than anticipated, while the October New Housing Price Index declined in October. Also, Bank of Canada Senior Deputy Governor Rogers hit the wires and said that higher interest rates are starting to slow the economy and contain inflation. The AUD/USD trades around 0.6640, marginally higher on the day, while USD/JPY hovers around 141.20.

Gold trimmed early gains and finished the day little changed at around $1,738 a troy ounce. Crude oil prices ticked higher, with WTI trading at $81.10 a barrel.

During Asian trading hours, investors will be looking at the Reserve Bank of New Zealand monetary policy decision.

The focus now shifts to the FOMC Meeting Minutes. The US Federal Reserve hiked rates by 75 bps for a fifth consecutive meeting earlier in the month, and market players were hoping for a hint on pivoting. The document released alongside the meeting could be understood as a potential easing in the pace of quantitative tightening, although chief Jerome Powell’s words surprised with a hawkish tone. The FOMC Meeting Minutes may shed some light on whatever the Fed may do in December, and market players will likely rush to price it in.

Binance CEO CZ seeks money for industry recovery fund from Abu Dhabi investors after FTX collapse

Like this article? Help us with some feedback by answering this survey:

- Gold Price registers minuscule gains of 0.03%, around $1738.

- Federal Reserve speaker begin to price a 50 bps increase to the Federal Funds rate.

- The US Dollar edges lower, weighed by falling US Treasury bond yields.

Gold Price is almost flat on Tuesday’s North American session, capitalizing on a soft US Dollar (USD) still off the daily highs as Federal Reserve (Fed) officials continued to express the US central bank needs to tighten monetary conditions. Also, sentiment remains fragile due to Covid-19 cases in China. At the time of writing, the XAU/USD is trading at $1737.49, unchanged.

XAU/USD capitalize on weak US Dollar amid falling US bond yields

Sentiment improved throughout the day. Federal Reserve policymakers grabbed investors’ attention as the US central bank prepared to slow down borrowing costs. Loretta Mester, Cleveland Fed President, said, “Maintaining price stability is a critical objective that will be accomplished using all available means.” On Monday, Mester commented that she Is open to moderate rate hikes, though she emphasized that a pause is off the table. She echoed some of San Francisco Fed President Mary Daly’s comments, which added that the Federal Funds rate (FFR) needs to peak at around 5%.

In the meantime, Covid-19 cases in China peaked at around 28K on Monday, the most significant increase since April 2022. Beijing increased restrictions, and arrivals had to take three PCR tests within the first three days. Some schools switched to online learning, while some districts in Beijing asked citizens to stay at home for at least five days.

Elsewhere, the US Dollar Index (DXY), which tracks the greenback value against six currencies, slashes 0.50% down to 107.200. US Treasury yields are also dropping, led by the 10-year benchmark note rate yielding 3.750%, eight bps down compared to Monday’s close, a headwind for the greenback.

All that said, Gold trader’s focus turns to further Fed speaking, with Esther George and James Bullard crossing news wires, ahead of the release of the Federal Reserve Open Market Committee (FOMC) last meeting minutes.

Gold (XAU/USD) Price Analysis: Technical outlook

The XAU/USD daily chart portrays the yellow metal as neutral-biased. Even though the Gold Price sits above the 50 and 100-day Exponential Moving Averages (EMAs), four days of consecutive losses and failure to crack the 200-day EMA at $1801 exacerbated a fall toward current prices. Therefore, XAU/USD might consolidate in the $1730-50 range.

Upwards, the XAU/USD key resistance levels are $1750, followed by the November high of $1786.53 and $1800. On the flip side, the XAU/USD first support would be the August 22 swing low of $1727, followed by the $1700 figure.

- EUR/USD resistance in the 1.0300s would be expected to be an area where distribution will start to take shape.

- A change of character below 1.0270 again could be a defining moment for the pair.

At 1.0295, EUR/USD is 0.53% higher in late trade in North American trade as the US Dollar retreated across the board on Tuesday while investors look past worries about China's COVID flare-ups, boosting demand for more risky currencies. While investors will be parsing minutes from the Fed's November meeting, due on Wednesday, for any hints about the outlook for interest rates, the technicals point to a downside continuation given the break of recent daily structure 1.0270 as the following analysis will illustrate:

EUR/USD daily chart

The price dropped below the higher lows which made for a change in character. Nevertheless, the bulls have moved in and are retesting an area of price imbalance and the neckline of the M-formation. Should the bears commit, then a downside continuation could be in order for the remainder of the week.

EUR/USD H1 charts

The price is on the back side of the trend and the highs have potentially been locked in. Resistance could serve as the last stop for the correction into the peak formations of the prior bullish trend.

EUR/USD M15 chart

Down on the 15-minute charts, the 1.0300s would be expected to be an area where distribution will start to take shape, and a break of the trendline supports will be eyed. A change of character below 1.0270 again could be a defining moment for the pair as it will likely lead to a downside breakout.

An exchange of letters between the governor of the Bank of England and the UK's Chancellor on the asset purchase facility has shown that there will be a cut of the maximum size of the Asset Purchasing Facility, APF.

The maximum size of the APF authorized has been cut to GBP871 bln, of which GBP16.4 bln can be corporate bonds.

Meanwhile, the BoE had confirmed its plan to continue with the gilt sales operation from Nov 1 onward, analysts at TD Securities explained. ''However, for Q422 APF sales operations will be distributed evenly only across the short and medium-maturity sectors, with the pace and frequency of sales in line with its original plans. The maturity split of gilt sales for subsequent quarters will be considered ahead of Q1 2023. The detailed auction calendar will be released on Oct 20.''

GBP/USD update

GBPUSD rose on Tuesday in a risk-on day after falling in the previous session, as the dollar retreated following three days of gains. Cable has rallied sharply in recent weeks after touching a record low of 1.0327 in September when the government unveiled plans for large unfunded tax cuts. At the time of writing, GBP/USD is trading at 1.1880 and up some 0.5%.

- USD/CAD has been range bound in North American trade as the US Dollar slides.

- Bears are in control as domestic data beats expectations and oil rebounds.

USD/CAD has been a two-way business in the US session, trading between 1.3383 and 1.3453 on the day so far. At 1.3397, the pair is down by some 0.4% as the US Dollar retreated across the board while investors look past worries about China's COVID flare-ups.

A risk on theme came onto the scene in Asia on Monday that supported high beta currencies such as the commodity complex. The Canadian dollar rose on firm preliminary domestic data as well that showed Retail Sales beat expectations -0.5 to -0.7.

Meanwhile, speculators’ net short CAD positions increased modestly though they remain below their recent highs, analysts at Rabobank explained. ''Focus recently has been on the oil price but also on the broad-based direction of the USD.''

Oil rebounds

As for oil, prices there have also gained ground early on Tuesday. A report that OPEC+ planned to raise production sent prices to the lowest since January, only to recover after Saudi Arabia and other members firmly denied the group was planning the move, Reuters reported. A further drop in prices could lead OPEC+ to cut production further.

Elsewhere, Canadian government bond yields were lower across a more deeply inverted curve, tracking the move in US Treasuries as traders get set for the Federal Open Market Committee minutes. The 10-year eased 2.9 basis points to 3.058%, while it fell 2.3 basis points further below the 2-year rate to a gap of about 88 basis points.

FOMC minutes eyed

Analysts at TD Securities see the minutes shedding light on the FOMC's deliberations regarding the expected downshift in the pace of rate increases. ''With that said, policymakers will also emphasize that the terminal rate is likely edging higher vs prior expectations as the labor market remains overly tight.''

- The British Pound extended its gains amidst a risk-on impulse.

- Federal Reserve officials see a dual threat of over and under-tightening.

- GBP/USD Price Analysis: Range-bound around 1.1800-1.1900 amidst the lack of catalyst.

The Pound Sterling (GBP) climbed in the North American session, albeit Federal Reserve (Fed) hawkish commentary continued, though officials expressed the likelihood of moderating the pace. Another factor, China’s Covid-19 outbreak, sparked investors’ fears, though they waned as Wall Street is trading in the green. At the time of writing, the GBP/USD is trading at 1.1872, above its opening price by 0.40%.

On Monday, San Francisco Fed President Mary Daly said she’s worried about overtightening, and she foresees rates initially at 5%, and from there, rates could go higher, depending on data. The Cleveland Fed President Loretta Mester said that slowing the pace of interest rates in the next month is possible. Mester commented that pausing is not an option and agreed with Daly, expecting rates at around 5%.

The US Dollar Index (DXY), a gauge of the buck’s value against a basket of peers, drops 0.37%, down from 107.747 to 107.381, a tailwind for the Pound Sterling.

Meanwhile, the ongoing Covid-19 crisis in China shifted market sentiment sour on Monday, though it waned, as Chinese authorities had not reimposed stricter lockdowns. Some of the newest measures suggested that some schools are back to online learning, while some districts in Beijing asked citizens to stay home for at least five days.

On the United Kingdom (UK) side, the British Pound is underpinned by expectations that the Bank of England (BoE) would raise borrowing costs as they scramble to control 40-years high inflation. Regarding the Autumn Budget presented by Chancellor Jeremy Hunt was well received by investors, with some analysts saying that it is a deflationary budget.

Nevertheless, a gloomy economic outlook in the UK favors further GBP/USD downside. Even though recession fears increased in the US, the interest rate differential between the Federal Reserve and the Bank of England would bolster the US Dollar (USD), so the GBP/USD might be headed downwards.

GBP/USD Price Analysis: Technical outlook

The GBP/USD is consolidated around the 1.1800-1.1900 area after bouncing from weekly lows around 1.1750. In the European session, the GBP/USD hit a daily high above 1.1900, though it retreated on Federal Reserve’s hawkish commentary. Also, the Relative Strength Index (RSI) is almost horizontal in bullish territory, meaning buying pressure is losing momentum.

If the GBP/USD clears 1.1900, the next resistance would be the November 17 high of 1.1957, followed by the 1.2000 psychological level. On the flip side, the GBP/USD first support would be 1.1800, followed by the last week’s low on November 17 low, 1.1762.

Reuters reported that Senior Deputy Governor Carolyn Rogers said in a speech at the University of Ottawa that higher interest rates are starting to slow the Canadian economy, putting pressure on households with elevated debt.

"It will take time to get back to solid growth with low inflation but we will get there," she said.

Key notes

Rogers said the bank was monitoring how a combination of high home prices and high household debt - both longstanding economic vulnerabilities in Canada - could affect the stability of the financial system.

"The risk of a trigger that may affect financial stability has increased" as rates have gone up, she said. "But there are good reasons to believe the system as a whole will be able to weather this period of stress and remain resilient," she added, citing reforms taken since the global financial crisis to shore up the system.

USD/CAD update

USD/CAD has been a two-way business in the US session, trading between 1.3383 and 1.3453 on the day so far. At 1.3397, the pair is down by some 0.4% as the US Dollar retreated across the board while investors look past worries about China's COVID flare-ups.

Data released on Tuesday showed retail sales in Canada dropped in September by 0.5%. Analysts at CIBC point out the biggest decline comes from gasoline and is linked to lower prices during the month, making sales fared a little better in volume terms with a 0.1% decline. They add the advance estimate for October shows a healthy bounce back of 1.5%, suggesting that consumer spending on goods is still fairly robust.

Key Quotes:

“The third quarter may have represented a modest giveback of prior strength in terms of retail sales volumes, but with spending on services continuing to recover the consumer is still expected to have been a positive contributor to overall GDP growth in Q3.”

“The advance estimates for October retail, wholesale and manufacturing suggest that the fourth quarter has started with a little more momentum than we previously anticipated, and placing some upside pressure on ours and the Bank of Canada's GDP forecast (+0.5% annualized) for Q4. However, it is early days, and the impact of past interest rate hikes on consumer spending will only grow in the coming months and quarters.”

- Mexican peso gains versus US dollar after three days.

- USD/MXN finds resistance at the 20-day SMA before 19.60.

- Interim support at 19.40, key level at 19.30.

The USD/MXN is falling on Tuesday after rising during three consecutive days, on a quiet session for financial markets. The rebound from monthly lows found resistance near the 19.60 barrier. The pair reversed its course after reaching the 20-day Simple Moving Average.

The ongoing retreat could extend toward the interim support area of 19.40. A break lower would expose the critical 19.25/30 zone that capped the downside last week. Below that area, the next target is seen at 19.00/05 (intermediate resistance at 19.15).

Technical indicators area mixed. Momentum is still moving to the upside but the RISE is starting to turn south. Price holds below key moving averages. A consolidation between 19.30 and 19.60 over the next sessions seems likely.

If the Dollar breaks and holds above 19.60 it would gain strength and could rise to the next barrier at 19.80.

USDMXN daily chart

-638047310855291572.png)

US Dollar Index (DXY) has experienced a quick decline toward the 200-Day Moving Average at 105/104.60 which is also the low of August. A break below here would open up next potential supports at 103 and 101.90/30, analysts at Société Générale report.

110.00 is likely to remain an important hurdle

“Daily MACD is within deep negative territory denoting an overstretched move. An initial bounce is not ruled out towards 108.30, the 38.2% retracement from the high achieved in November.”

“The lower band of previous consolidation at 110.00 is likely to remain an important hurdle.”

“In case the index fails to hold 200DMA at 105/104.60, this would denote an extended down move. Next potential supports would be at 2020 peak of 103 and 101.90/101.30, the 50% retracement from 2021.”

- Swiss Franc outperforms during the American session.

- USD/CHF ends a positive streak with a sharp decline.

- DXY holds onto losses, on a quiet trading session.

The USD/CHF is losing more than 50 pips on Tuesday ending a positive streak for the US Dollar. The pair printed a fresh two-day low at 0.9508 during the American session on the back of a decline of the DXY and a stronger Swiss Franc.

More weakness in USD/CHF would expose the critical short-term support at 0.9495/0.9500. On the upside, immediate resistance is seen at 0.9560 followed by the 0.9600 area.

Dollar drops, Swiss Franc outperforms

The US Dollar Index is losing 0.40% on Tuesday, after rising during the previous three trading days. At the same time, equity prices in Wall Street are posting gains on a quiet session.

Regarding economic data, the US released the Richmond Fed Manufacturing Index which rose in November from -10 to -9. On Wednesday, global PMIs are due and the Federal Reserve will release the minutes of its latest meeting.

The Swiss Franc gained momentum during the American session. The EUR/CHF cross broke below 0.9800 and dropped to 0.9762, hitting the lowest since November 16. The GBP/CHF turned negative hitting levels under 1.1300 and rose to the highest level in a week above 148.60.

Technical levels

Gold price dropped to a 10-day low near $1,730 on Monday. Economists at Commerzbank do not expect the yellow metal to stage a lasting recovery until the first quarter of next year.

Gold under pressure again due to firmer USD

“Gold price has dropped sharply again since the US Dollar ended its phase of weakness. Though the latest cooling of US inflation has dampened fears of rampant inflation and thus ever more pronounced rate hikes by the US Federal Reserve, it is still clear that the central bank has not yet finished tightening its monetary policy. After all, at 7.7% inflation is still a long way off its 2% target.

“The latest surge in the Gold price was largely attributable to short covering. This price-driving factor has now evaporated, as the most recent CFTC data for the last reporting week revealed a shift to speculative net long positions.”

“We are sticking with our assessment that the Gold price will only recover lastingly once an end to the rate hikes is in sight. This is likely to be the case in the first quarter of 2023.”

- Federal Reserve officials hawkish commentary failed to underpin the US Dollard.

- Sentiment turned positive, although China’s Covid-19 cases peaked nearby 28,000.

- Reserve Bank of Australia Governor Lowe puts back 50 bps on the table if needed.

The Australian Dollar (AUD) is recovering some ground in the North American session, after hitting a daily low beneath 0.6600, amid an improvement in sentiment. Factors like Federal Reserve (Fed) officials’ hawkish commentary and China’s Covid-19 outbreak were not an excuse for the AUD to rise against the US Dollar (USD). At the time of writing, the AUD/USD is trading at 0.6629.

Positive sentiment underpins the Australian Dollar

Wall Street is opening in the green. On Monday, a slew of US central bank policymakers. San Francisco Fed President Mary Daly said she’s worried about overtightening, and she foresees rates initially at 5%, and from there, rates could go higher, depending on data. Later, the Cleveland Fed President Loretta Mester said that slowing the pace of interest rates in the next month is possible. Mester commented that pausing is not an option and agreed with Daly, expecting rates at around 5%.

Aside from this, China’s Covid-19 outbreak is grabbing the headlines after the disease caused three deaths in the last three days. Beijing increased restrictions, and arrivals had to take three PCR tests within the first three days. Some schools switched to online learning, while some districts in Beijing asked citizens to stay at home for at least five days.

In the Asian session, the Reserve Bank of Australia (RBA) Governor Philip Lowe said that if salaries go up, that will keep inflation in Australia at around “Seven percent, plus or minus (a bit),” adding that a wage spiral in the ‘70s, ‘80s, turned out to be a disaster. Lowe sympathized with workers who can’t accept their wages falling behind, though he added that inflation would get to the RBA’s target if the country can ride through this period. He expects to raise rates further and even put 50 bps increases on the table.

What to watch

The Australian economic calendar will feature S&P Global PMIs for November. On the US front, the Fed parade will continue, with Loretta Mester, Esther George, and James Bullard, crossing the wires.

AUD/USD Key Technical Levels

Economists at Wells Fargo still forecast renewed strength in the trade-weighted US Dollar through until Q1-2023. However, they now expect a more extended period of greenback weakness beyond that.

The trade-weighted US Dollar could have already reached its cyclical high

“With inflation nearing its peak, we believe the US Dollar could quite possibly have already reached its cyclical peak as well.”

“In the near term, the resilience of the US economy (in contrast to recession in Europe) and a still hawkish Fed should see renewed greenback gains. However, over the longer term, growth and interest rate trends should swing sharply against the Dollar, as the US falls into recession from the middle of next year, and the Fed cuts rates aggressively in 2024.”

“We see a moderate 3.5% gain in the trade-weighted Dollar through early 2023, followed by an extended 12.5% decline thereafter.”

- The index remains unable to reverse Tuesday’s pessimism so far.

- US yields give away part of the recent advance.

- The Richmond Fed index and Fedspeak come next in the docket.

The USD Index (DXY), which gauges the greenback vs. a basket of its main competitors, keeps trading on the defensive near 107.50 on Tuesday.

USD Index looks at Fedspeak, FOMC Minutes

The recent upside momentum in the dollar appears somewhat dented in the first half of the week following Monday’s unsuccessful attempt to surpass the 108.00 hurdle.

The daily correction in the buck also comes in tandem with the small decline in US yields across the curve, all amidst a generalized improved mood in the risk-associated universe.

Later in the NA session, the only release of note will be the Richmond Fed Manufacturing Index. In addition, Cleveland Fed L.Mester (voter, hawk), Kansas City Fed E.George (voter, hawk) and St. Louis Fed J.Bullard (voter, hawk) are also due to speak.

What to look for around USD

The dollar faltered just ahead of the 108.00 barrier at the beginning of the week, sparking a corrective move soon afterwards pari passu with the recovery in the risk-linked galaxy.

While hawkish Fedspeak maintains the Fed’s pivot narrative in the freezer, upcoming results in US fundamentals would likely play a key role in determining the chances of a slower pace of the Fed’s normalization process in the short term.

Key events in the US this week: MBA Mortgages Applications, Building Permits, Durable Goods Orders, Initial Jobless Claims, Flash Manufacturing/Services PMIs, Final Michigan Consumer Sentiment, New Home Sales, FOMC Minutes (Wednesday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.24% at 107.50 and the breakdown of 105.34 (monthly low November 15) would open the door to 105.17 (200-day SMA) and finally 104.63 (monthly low August 10). On the other hand, the next up barrier comes at 107.99 (weekly high November 21) followed by 109.19 (100-day SMA) and then 110.68 (55-day SMA).

EUR/USD returns to positive territory on Tuesday. As Kit Juckes, Chief Global FX Strategist at Société Générale notes, the pace of European capital outflows continues to slow – which helps support the Euro.

Good news for Europe (at the margin)

“September saw the smallest net outflow of long-term capital from the Eurozone (EUR 80bn) since 2020. European investors have been net sellers of foreign debt for 7 months in a row, which is convenient, as the ECB pulls back and European Governments issue bonds to finance support for energy consumers. This is good for growth and, at the margin, for the currency – if European investors buy local debt instead of foreign debt, that helps the overall balance of payments. This isn’t unadulterated good news, if only because the current account is in deficit, but it’s an improvement. As is the relative shift in direction of ECB and Fed travel, and the shift in relative growth expectations.”

“The huge elephant in the room – that a prolonged European gas shortage slows growth and raises inflation far more in Europe than it does in other areas (particularly the US), is just one reason why the Euro’s revival (and the Dollar’s turn lower) won’t be in a straight line. But we’ll take the positive of an improving balance of payment as what it is – good news at the margin.”

USD/CAD staged a solid rejection of key resistance at 1.3495 yesterday. Economists at Scotiabank expect the pair to extend its fall towards 1.3290 in the near term.

Clear reversal from the upper 1.34s

“Short-term price patterns imply a clear reversal from the upper 1.34s, with the USD extending losses under minor support (rising channel on the intraday chart) at 1.3410/15 (now intraday resistance). Losses should extend towards 1.3290/00 in the short run from here.”

“The overall pattern of trade keeps the USD on track for a retest of the 1.32 area and, eventually, a drop to the measured move target derived from the Head and Shoulders of 1.3025.”

- USD/CAD comes under renewed selling pressure and is weighed down by a combination of factors.

- An uptick in oil prices underpins the Loonie and exerts pressure amid broad-based USD weakness.

- The mixed technical indicators warrant some caution before placing aggressive directional bets.

The USD/CAD pair meets with a fresh supply on Tuesday and extends the previous day's pullback from the vicinity of the 1.3500 psychological mark, or over a one-week high. The pair remain depressed through the early North American session and is currently trading around the 1.3400 round figure, just a few pips above the daily low.

The US Dollar comes under renewed selling pressure and stalls its recovery momentum from a three-month low, which, in turn, acts as a headwind for the USD/CAD pair. Rising bets for smaller interest rate hikes by the Fed drag the US Treasury bond yields lower, which, along with a positive risk tone, weighs on the safe-haven greenback.

Apart from this, an intraday pickup in crude oil prices underpins the commodity-linked Loonie and also contributes to the offered tone surrounding the USD/CAD pair. That said, worries about the worsening COVID-19 situation in China should keep a lid on any optimism in the markets. This should limit further losses for the USD and the major.

From a technical perspective, the overnight failure near a horizontal support breakpoint now turned resistance, and the subsequent fall favours bearish traders. Moreover, oscillators on the daily chart have been struggling to gain any meaningful positive traction. That said, bullish resilience below the 1.3400 mark warrants some caution.

Hence, it will be prudent to wait for strong follow-through selling before confirming that the recent bounce from the 100-day SMA support has run out of steam. In the meantime, any further fall is likely to find support near the 1.3330-1.3325 area ahead of the 1.3300 mark, which if broken decisively will shift the bias in favour of bearish traders.

On the flip side, daily wing high, around the 1.3455 region, now seems to act as an immediate hurdle. A sustained strength beyond should allow the USD/CAD pair to make a fresh attempt to conquer the 1.3500 round-figure mark. The momentum could then lift spot prices to the 50-day SMA resistance, currently around the 1.3550-1.3555 region.

USD/CAD daily chart

Key levels to watch

- EUR/USD reverses part of the recent retracement on Tuesday.

- A more intense rebound should meet the next hurdle at 1.0400.

EUR/USD returns to the positive territory and manages to climb as highas as the boundaries of the key 1.0300 region on Tuesday.

The continuation of the rebound should initially target the key 200-day SMA, today at 1.0400. The surpass of the latter is needed to dispute the so far November peak at 1.0481 (November 15).

EUR/USD daily chart

Enrico Tanuwidjaja, Economist at UOB Group, comments on the latest GDP figures in Thailand.

Key Takeaways

“The Thai economy rebounded by 4.5% y/y in 3Q22, accelerating from an average of 2.4% in 1H22. The economy accelerated by 1.2% q/q sa.”

“Growth in the last quarter was primarily driven by higher private consumption expenditures, investment, and most notably the export of services (tourism revenue). However, export of goods slowed down, while government expenditure, including its public investment decreased.”

“We keep our forecast for the Thai economy to grow by 3.2% for 2022, double the growth rate seen in 2021. For next year, we continue to remain sanguine and expect the Thai economy to grow circa 3.7% on expectations of higher and steadier tourism income that will continue to boost domestic trade activities coupled with stronger exports performance.”

- Retail Sales in Canada fell more than expected in September.

- USD/CAD continues to trade in negative territory at around 1.3400.

Retail Sales in Canada declined by 0.5% on a monthly basis in September, the data published by Statistics Canada revealed on Tuesday. This reading followed August's increase of 0.4% and came in slightly better than the market expectation for a decrease of 0.7%.

Further details of the publication revealed that Retail Sales ex-Autos fell by 0.7% in the same period, compared to analysts' estimate for a contraction of 0.4%.

Market reaction

USD/CAD showed no immediate reaction to these figures and it was last seen trading at 1.3405, where it was down 0.3% on a daily basis.

- USD/JPY comes under fresh selling pressure on Tuesday amid broad-based USD weakness.

- Bets for smaller rate hikes by the Fed, sliding US bond yields weigh heavily on the greenback.

- The Fed-BoJ policy divergence could undermine the JPY and help limit any meaningful slide.

The USD/JPY pair struggles to capitalize on the previous day's breakout momentum beyond the 100-day SMA and meets with a fresh supply on Tuesday. The pair remains depressed through the early North American session, albeit manages to rebound a few pips from the vicinity of the 141.00 mark, or the daily low.

The US Dollar comes under some renewed selling pressure and stalls its recent strong recovery from a three-month low, which, in turn, is exerting downward pressure on the USD/JPY pair. Investors now seem convinced that the Federal Reserve will slow the pace of its rate-hiking cycle and have been pricing in a greater chance of a relatively smaller 50 bps lift-off in December. This leads to a fresh leg down in the US Treasury bond yields and keeps the USD bulls on the defensive.

That said, the recent hawkish remarks by several Fed officials suggest that the US central bank will continue to tighten its monetary policy to curb inflation. In contrast, the Bank of Japan, so far, has shown no inclination to hike interest rates. In fact, BoJ Governor Haruhiko Kuroda reiterated on Friday that the central bank will stick to its monetary easing to support the economy and added that raising rates now would be inappropriate in light of current economic conditions.

This marks a big divergence in the monetary policy stance adopted by the two major central banks, which might continue to undermine the Japanese Yen. Apart from this, a slight recovery in the global risk sentiment, which tends to dent demand for traditional safe-haven currencies, including the JPY, might contribute to limiting losses for the USD/JPY pair. Investors might also prefer to wait for a fresh catalyst from the FOMC meeting minutes, due for release on Thursday.

Hence, it will be prudent to wait for strong follow-through selling before confirming that the recent bounce from the lowest level since August 29 has run out of steam. Next on tap is the release of the Richmond Manufacturing Index from the US. This, along with a scheduled speech by Cleveland Fed President Loretta Mester, might influence the USD price dynamics and allow traders to grab short-term opportunities around the USD/JPY pair.

Technical levels to watch

Gold price rebounded strongly from its key support of $1,620. However, strategists at ANZ Bank expect XAU/USD to fall below $1,700 again.

A short-lived price rise

“Prices settling above the $1,800 resistance will be crucial to confirm a bullish trend in Gold. With the Fed expected to hike in December by 50 bps and inflation staying well above the target range, we believe it would be difficult for XAU/USD to break this resistance before the end of this year.”

“We expect Gold to take support at $1,700, while prices could still test the downside of $1,620, which is a key support level in the near-term. A break of $1,620 could potentially open the door for prices to fall below $1,600.”

- DXY faces some downside pressure and recedes from 108.00.

- The index could accelerate gains once 108.00 is cleared.

DXY gives away part of the recent 3-day positive streak and revisits the 107.30 region on Tuesday.

Ideally, the index should leave behind recent highs near 108.00 to allow for the continuation of the rebound to, initially, the 100-day SMA, today at 109.19, prior to the resistance line around 109.70.

While above the key 200-day SMA at 105.17, the outlook for the index should remain constructive. This region is also reinforced by the November low at 105.34 (November 15).

DXY daily chart

The NZD is the top performer among the majors in the session ahead of the Reserve Bank of New Zealand (RBNZ) meeting. Hawkish guidance will lift NZD/USD to 0.6250, according to economists at Scotiabank.

The RBNZ is expected to hike rates

“Some 70% of the Bloomberg survey, and all the local banks who participate in the poll, expect the RBNZ to raise its Cash Rate 75 bps to 4.25%. OIS pricing is not fully onside, however; swaps are pricing in around 86% risk of a 3/4 point hike.”

“Hawkish guidance (markets are pricing in a Cash Rate near 5.25% by mid-2023) will lift the NZD to test key resistance at 0.6250.”

See – RBNZ Preview: Forecasts from seven major banks, going big on the OCR

The Reserve Bank of New Zealand (RBNZ) will announce its monetary policy decision on Wednesday, November 23 at 01:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of seven major banks.

RBNZ is expected to hike the Official Cash Rate (OCR) by 75 basis points (bps) to 4.25%, which would be the first super-sized rate hike after five consecutive 50 bps moves.

ANZ

“We expect the RBNZ will raise the OCR 75 bps to 4.25%. If there were to be a surprise, a 50 bps hike is more likely than +100 bps. We are forecasting the OCR to peak at 5%, via another 75 bps hike in February on a ‘let’s just get it done’ basis. If data cools more rapidly than expected the RBNZ could well slow the pace at that point. But regardless, we see upside risk to our forecast of a peak 5% OCR, given what’s looking like a well-entrenched wage-price spiral at this point.”

Westpac

“We expect the RBNZ to raise the OCR by 75 bps to 4.25%. Recent data has pointed to mounting inflation pressures, raising concerns that the Reserve Bank has fallen behind the pace despite its relatively early start to rate hikes. We expect the OCR to peak at 5% by early next year. And the RBNZ’s preferred ‘stitch in time’ approach means that it will be looking to head off the risk of an even higher peak.”

ING

“We expect the RBNZ to hike by 50 bps and signal a peak rate around 5.0%. The ongoing downturn in the housing market and worsening external conditions argue against a larger, 75 bps move. We are not fully convinced the RBNZ will ultimately deliver all its projected hikes, but a dovish pivot is unlikely on the cards at this stage.”

SocGen

“We are likely to see a 75 bps hike in RBNZ rates, to 4.25%.”

TDS

“The Bank appears to be drifting further from its remit as Q3 headline CPI surprised to the upside and private sector wages growth hit a record. RBNZ would have also been unpleasantly surprised by the rebound in ST inflation expectations. We will watch closely for RBNZ's new OCR track which may indicate a new terminal rate of 5%.”

NAB

“We have opted for 75 bps, which would take the OCR to 4.25%. But this is not with any strong conviction, and we could understand if the Bank suffices with a 50 bps move on the day. As for what November’s MPS will forecast as a peak on the OCR, we would guess something in the top half of the 4s.”

Citibank

“We expect the RBNZ MPC to steepen its pace of rate hikes in November and lift the OCR by 75 bps to 4.25%, cementing the RBNZ as one of the more hawkish central banks globally. This will take monetary policy well into restrictive territory (above the average neutral estimate of around 2%). The acceleration in rate hikes from 50 bps to 75 bps would come from a combination of a tight labor market, an acceleration in wages, and higher than expected inflation in Q3. We also expect large upward revisions to inflation forecasts in the November SMP. The team also pencils another 50 bps hike in February after which the RBNZ is likely to pause for the remainder of 2023, implying a terminal policy rate of 4.75%.”

- GBP/USD regains positive traction on Tuesday amid the emergence of fresh selling around the USD.

- Bets for smaller Fed rate hikes, sliding US bond yields, a positive risk tone undermine the greenback.

- A bleak outlook for the UK economy could act as a headwind for the British Pound and cap the pair.

The GBP/USD pair attracts fresh buying in the vicinity of the 1.1800 round-figure mark on Tuesday and reverses a major part of the overnight losses. The pair maintains its bid tone through the early North American session and is currently placed around the 1.1870 region, just a few pips below the daily top.

The US Dollar comes under some renewed selling pressure and stalled its recent strong bounce from the lowest level since August 12, which, in turn, offers support to the GBP/USD pair. Rising bets for relatively smaller interest rate hikes by the Federal Reserve seem to weigh on the US Treasury bond yields and keep the USD bulls on the defensive. Apart from this, a modest recovery in the global risk sentiment is further seen undermining the safe-haven greenback.

The British Pound, on the other hand, draws support from expectations that the Bank of England will continue raising borrowing costs to combat stubbornly high inflation. Apart from this, reports that the UK government privately discussed the possibility of a Swiss-style relationship with the European Union further underpins the Sterling. This, in turn, provides an additional boost to the GBP/USD pair, though a bleak outlook for the UK economy could cap any further gains.

In fact, the UK Office for Budget Responsibility (OBR) last week projected the UK GDP to slump by 1.4% next year as compared to a growth of 1.8% forecast in March. Apart from this, worries about economic headwinds stemming from a new COVID-19 outbreak in China and the imposition of fresh lockdowns should keep a lid on any optimism in the markets. This, along with the recent hawkish signals from several Fed officials, could limit the USD losses and cap the GBP/USD pair.

Hence, the market focus will remain glued to the release of the November FOMC monetary policy meeting minutes, due on Thursday. Investors will look for clues about the Fed's policy outlook and future rate hike path. This will influence the USD price dynamics and determine the near-term trajectory for the GBP/USD pair. In the meantime, traders on Tuesday will look to the release of the Richmond Manufacturing Index and Cleveland Fed President Loretta Mester's speech for some impetus.

Technical levels to watch

EUR/CHF has staged a steady rebound after forming a significant low near 0.9410 in September. The pair could extend its bounce while holding above the 0.9640/10 region, economists at Société Générale report.

Compression in 10y BTP/Bund underpins EUR/CHF

“Tightening of 10-year BTP/ Bund spread to 189 bps, lowest since July, supports higher EUR/CHF.”

“Daily MACD is anchored within a positive territory which denotes prevalence of upward momentum.”

“Defending daily Ichimoku cloud at 0.9640/0.9610 is essential for persistence in bounce.”

“Short-term hurdles are at 200-DMA near 0.9970/1.0010.”

- EUR/JPY comes under pressure and breaks below 145.00.

- The next hurdle of note still emerges around 147.00 near term.

EUR/JPY fades the optimism seen at the beginning of the week and puts 145.00 to the test on turnaround Tuesday.

So far, the corrective rebound looks well in place and the cross should face initial resistance at the so far November high at 147.11 (November 9). Above the latter, the door could open to a more meaningful move to the 2022 peak at 148.40 (October 21).

In the longer run, while above the key 200-day SMA at 138.54, the positive outlook is expected to remain unchanged.

EUR/JPY daily chart

Economist at UOB Group Enrico Tanuwidjaja reviews the latest current account figures in Indonesia.

Key Takeaways

“Indonesia’s 3Q22 CA position recorded a surplus of USD4.4bn (or an equivalent of 1.3% of GDP), higher than 2Q22's USD4bn (1.2% of GDP). However, the capital and financial account recorded a deficit of USD6.1bn (1.8% of GDP), increasing by more than five-fold from a deficit of USD1.2bn (0.3% of GDP) in 2Q22. Overall, Indonesia's balance of payments (BOP) position in 3Q22 remained generally resilient with a slight deficit of USD1.3bn.”

“Strong demand for exports from Indonesia’s key trading partners and high global commodity prices have resulted into a much-improved goods trade performance which has in turn underpinned an even stronger surplus in CA position in the last quarter. The performance of the capital and financial account in 3Q22 was supported by direct investment despite increasing uncertainty on global financial markets.”

“We expect Indonesia to record a CA surplus amounting to 0.8% of GDP in 2022 before waning commodity prices, higher imports, higher services deficit, and higher primary deficit turn the CA position into a deficit of circa 0.5% of GDP in 2023.”

The Pound outperformed G10/USD last week. Economists at Société Générale note that the GBP/USD pair could extend its race higher towards 1.2070.

EUR/GBP may have room to run towards next support around 0.8620

“GBP/USD has affirmed a short-term bounce after cross crossed above the trend line since February. The ongoing move could persist towards projections near 1.2070.”

“The 200-Day Moving Average at 1.2250/1.2300 is a crucial resistance zone.”

“Lower daily lows suggest EUR/GBP may have room to run towards next support around 0.8620 (GBP/EUR 1.16).”

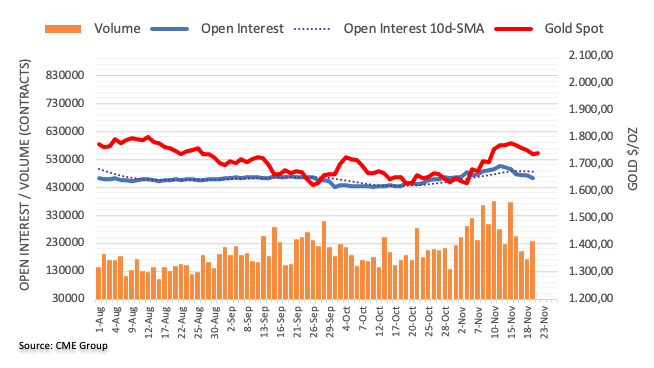

- Gold price catches fresh bids and snaps a four-day losing streak amid renewed US Dollar selling bias.

- Bets for smaller rate hikes by the Federal Reserve weigh on the US Treasury bond yields and the USD.

- A positive risk tone might turn out to be the only factor that could cap further upside for Gold price.

- Traders now await the November FOMC meeting minutes on Wednesday for a fresh directional impetus.

Gold price regains some positive traction on Tuesday and snaps a four-day losing streak to a one-and-half-week low touched the previous day. The XAU/USD sticks to gains just below the $1,750 level through the mid-European session and for now, seems to have stalled its recent corrective pullback from a three-month high.

Fresh US Dollar selling benefits Gold price

The US Dollar comes under some selling pressure and halts the recent bounce from its lowest level since August 12, which, in turn, is seen boosting the Dollar-denominated gold. Investors seem convinced that the Federal Reserve (Fed) will slow the pace of its rate-hiking cycle and have been pricing in a greater chance of a relatively smaller 50 bps lift-off at the December meeting. This is evident from a modest downtick in the US Treasury bond yields and weighs on the USD.

Hawkish signals by Federal Reserve officials seem to cap gains

That said, the recent hawkish signals from several Fed officials suggest that the US central bank will continue to tighten its monetary policy to combat stubbornly high inflation. This, in turn, should act as a tailwind for the US bond yields and help limit losses for the US Dollar, capping any further gains for the non-yielding Gold price. Hence, the focus will remain on the minutes of the Fed’s November meeting, due on Thursday, which will be looked upon for cues about future rate hikes.

A positive risk tone further warrants caution for XAU/USD bulls

In the meantime, worries about economic headwinds stemming from a new COVID-19 outbreak in China and the imposition of fresh lockdowns could benefit the greenback's status as the global reserve currency. Apart from this, signs of stability in the financial markets might also contribute to capping the upside for the safe-haven XAU/USD. This makes it prudent to wait for strong follow-through buying before traders start positioning for a further appreciating move for Gold price.

Next on tap is the release of the Richmond Manufacturing Index from the US. This, along with a scheduled speech by Cleveland Federal Reserve President Loretta Mester and the US bond yields, will influence the US Dollar price dynamics. Apart from this, traders will take cues from the broader risk sentiment to grab short-term opportunities around the Gold price.

Gold price technical outlook

From a technical perspective, any subsequent move up is likely to confront some resistance near the $1,755 region. A sustained strength beyond might trigger a short-covering rally towards the $1,765 area. The next relevant hurdle is pegged near the $1,770 level, above which Gold price could climb back to retest the multi-month high, around the $1,785 zone touched last week.

On the flip side, the weekly low, around the $1,733-$1,732 region, marks a previous strong resistance breakpoint and should continue to protect the immediate downside. That said, a convincing breakthrough might prompt aggressive technical selling and make the Gold price vulnerable to accelerate the fall to challenge the $1,700 round figure.

Key levels to watch

Gold price rose 3.9% in the week ending 15 November 2022 after the US Consumer Price Index report came softer than expected. This alleviated downside pressure on the yellow metal, strategists at Société Générale report.

Money managers turned net long

“One which showed spectacular activity was Gold, with a $7.4bn bullish flow. This was mainly driven by a $6.1bn short covering on the bullion’s future contracts, the largest seen for Gold since data started being aggregated in 2006.”